| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

AMENDMENT NO. 1 ON

FORM 10-K/A

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2002

| [ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

Commission File No.: 0-22693

| SysComm International Corporation (Exact name of registrant as specified in its charter) |

| Delaware (State or other jurisdiction of incorporation or organization) | 11-2889809 (I.R.S. Employer Identification No.) |

| 7 Kingsbridge Road, Fairfield New Jersey 07004 (Address of principal executive offices) (Zip Code) |

(973) 227-8772

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

| Common Stock, par value $.01 per share (Title of Class) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

The aggregate market value of our common stock held by non-affiliates of the registrant as of March 29, 2002 was $1,224,000. For purposes of this calculation only, directors, executive officers and the principal controlling shareholder of the registrant are deemed to be affiliates of the registrant.

The number of shares outstanding of each class of our common equity as of January 22, 2003 is as follows:

| Class of Common Equity Common Stock, par value $.01 | Number of Shares 4,895,998 |

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A amends the registrant’s Annual Report on Form 10-K for the year ended September 30, 2002 filed with the Securities and Exchange Commission on December 23, 2002. This amendment replaces the information previously incorporated by reference in Part III of the Form 10-K with the actual text for Part III of the Form 10-K.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES OF THE REGISTRANT

Our directors, executive officers and significant employees are as follows:

| Name | Age | Position | Position Held Since |

| Jerome C. Artigliere | 48 | Chairman of the Board of Directors | January 2002 |

| Kevin McLaughlin | 60 | President, Chief Executive Officer, Chief Operating | April 2002 |

| Officer, Secretary and Director | |||

| Scott R. Silverman | 38 | Director | January 2001 |

| Charles L. Doherty | 68 | Director | January 2001 |

| Anat Ebenstein | 39 | Director | December 2000 |

| J. Robert Patterson | 45 | Vice President, Chief Financial Officer and Treasurer | December 2000 |

| Sebastian Perez | 39 | General Manager | November 2001 |

Following is a summary of the background and business experience of the directors, executive officers and significant employees:

Jerome C. Artigliere:Mr. Artigliere, 48, was named our Chairman and appointed to the Board of Directors in January 2002 upon the resignation and retirement of Garrett A. Sullivan, our former Chairman. Mr. Artigliere is the Senior Vice President and Chief Operating Officer of Applied Digital Solutions, Inc. and has served in various other capacities for Applied Digital Solutions since January 1998. From 1996 to 1997, Mr. Artigliere was Regional Vice President at General Electric Capital Corporation in Portsmouth, New Hampshire, a commercial bank subsidiary of Peoples Heritage Bank of Portland, Maine. He earned an undergraduate degree in finance form Seton Hall University in 1977 and a Masters of Business Administration degree from Fairleigh Dickinson University in 1980.

Kevin McLaughlin: Mr. McLaughlin, 60, was appointed to the Board of Directors and named Chief Executive Officer on April 12, 2002. Previously Mr. McLaughlin served as Chief Executive Officer of Computer Equity Corporation, a subsidiary of Applied Digital Solutions. Prior to that Mr. McLaughlin served as a Vice President of Sales for Applied Digital Solutions, Inc. Mr. McLaughlin’s also served as the Vice President of Sales for SCB Computer Technology, Inc., a nationwide information technology consulting company, from 1995 to 2000.

Scott R. Silverman: Mr. Silverman, age 38, was appointed to the Board of Directors and to the Compensation Committee in January 2001. Since March 2002, Mr. Silverman has been President and Director of Applied Digital Solutions. From September 1999 through March 2002, Mr. Silverman operated his own private investment-banking firm and prior to that time, from October 1996 to September 1999, he served in various capacities for Applied Digital Solutions. Mr. Silverman’s positions at Applied Digital Solutions related to business development, corporate development and legal affairs. From July 1995 to September 1996, he served as President of ATI Communications, Inc. an Applied Digital Solutions subsidiary. He began his career as an attorney specializing in commercial litigation and communications law at the law firm of Cooper Perskie in Atlantic City, New Jersey, and Philadelphia, Pennsylvania. Mr. Silverman is a graduate of the University of Pennsylvania and Villanova University School of Law.

Charles L. Doherty:Mr. Doherty, 68, was appointed to the Board of Directors in January 2001 and currently serves as the only member of the Audit Committee. He works pro bono as a financial consultant to a variety of non profit organizations. From 1988 to 1995, he was Executive Vice President of Finance and Administration for Granada North America. Prior to that he served as a financial executive of entities subsequently acquired by Granada. Mr. Doherty earned both his Bachelor of Science degree in Accounting and his MBA in Finance from Boston College, Boston, MA.

1

Anat Ebenstein:Ms. Ebenstein, 39, was appointed to the Board of Directors in December 2000. Ms. Ebenstein is currently the only member of the Executive Committee. From December 2000 until July 2001, Ms. Ebenstein served as our President and Chief Operating Officer. From July 2001 to April 2002, Ms. Ebenstein acted as our President, Chief Executive Officer and Chief Operating Officer. From January 1999 to December 2000, Ms. Ebenstein served as President of Applied Digital Solutions’ Network Division, an IT services solutions provider comprised of computer hardware, system integration services and consulting firms. She served as President of InfoTech USA, Inc., acquired by us on December 14, 2000, from July 1992 to April 2002.

J. Robert Patterson - Vice President, Chief Financial Officer and Treasurer: Mr. Patterson, 45, joined us as Vice President, Chief Financial Officer and Treasurer in December 2000. Mr. Patterson served as Vice President of Finance for Applied Digital Solutions' Network Division, an IT services solutions provider comprised of computer hardware, system integration services and consulting firms. He has served as Controller of InfoTech USA, Inc., acquired by us on December 14, 2000, since 1990.

Sebastian Perez – General Manager:Mr. Perez, 39, joined us in 1992 as a project manager. During the past decade, he has managed our technical services, operations, and consulting services groups. In 1998, Mr. Perez was promoted to assistant to the Chief Executive Officer and was made responsible for our New York sales region. In November 2001, he was promoted to general manager. Prior to joining us, Mr. Perez spent six years with NYNEX Business Information Systems Co., as a systems engineer.

Directorships

Mr. Silverman is a director of Applied Digital Solutions, Inc. No other director holds directorships in any other company which has a class of securities registered pursuant to Section 12 of the Exchange Act, or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940.

Legal Proceedings and Indemnification

On October 22, 2002, Anat Ebenstein, our former President, Chief Executive Officer and Chief Operating Officer, filed a complaint against us, Applied Digital Solutions and certain officers and directors in connection with the termination of her employment. The complaint filed in the Superior Court of New Jersey, Mercer County, seeks compensatory and punitive damages of an unspecified amount arising from an alleged improper termination.

Our bylaws provide that we shall indemnify each director and such of our officers, employees and agents as the Board of Directors shall determine from time to time to the fullest extent provided by the laws of the State of Delaware.

We carry insurance providing for indemnification, under certain circumstances, to all of our directors and officers for claims against them by reason of, among other things, any act or failure to act in their capacities as directors or officers. To date, no sums have been paid to any past or present director or officer under this or any prior indemnification insurance policy.

Board Committees and Meetings

We have standing Executive, Audit and Compensation Committees of the Board of Directors. The Board of Directors does not have a nominating committee or a committee performing the functions of a nominating committee. The members of the committees are identified with the summary of background and business experience of the directors above.

The Executive Committee was established by the Board in January 2001. The Executive Committee possesses all of the powers of the Board except the power to issue stock, approve mergers with nonaffiliated corporations or declare dividends (except at a rate or in a periodic amount or within a price range established by the Board), and certain other powers specifically reserved by Delaware law to the Board. The Executive Committee held no meetings during the fiscal year ended September 30, 2002.

The function of the Audit Committee is to recommend annually to the Board of Directors the appointment of our independent accountants, discuss and review the scope and the fees of the prospective annual audit and review the results thereof with the independent accountants, review and approve non-audit services of the independent accountants, review compliance with our existing major accounting and financial policies and review management’s procedures and policies relative to the adequacy of our internal accounting controls. The Audit Committee held 4 meetings during the fiscal year ended September 30, 2002.

2

The function of the Compensation Committee is to make recommendations to the Board of Directors concerning salaries and incentive compensation for our executives and employees. The Compensation Committee held one meeting during the fiscal year ended September 30, 2002.

The Board of Directors held 5 meetings and acted by written consent 7 times during the fiscal year ended September 30, 2002. During the year, all Directors attended 75% or more of the Board of Directors’ meetings and the Board Committees to which they were assigned.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our officers and directors and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission and to furnish copies of all such reports to us. We believe that, based upon a review of filings with the Securities and Exchange Commission, each of our directors and executive officers were late in complying with the reporting requirements of Section 16(a) of the Exchange Act during the fiscal year 2002.

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth the compensation paid or accrued by us during each of the three fiscal years ended September 30, 2002 to our current chief executive officer, our former chief executive officer, one other executive officer whose total cash compensation for such periods exceeded $100,000 and one additional individual for whom disclosure would be required but for the fact that he was not serving as an executive officer as of September 30, 2002:

| Summary Compensation Table | |||||||||||||||

| Long-Term Compensation | |||||||||||||||

| Annual Compensation | Awards | Payouts | |||||||||||||

| Restricted | |||||||||||||||

| Other Annual | Stock | Options / | LTIP | All Other | |||||||||||

| Name and Principal | Salary | Compen- | Awards | SAR’s | Payouts | Compen- | |||||||||

| Position | Year | ($) | Bonus ($) | sation ($) | ($) | (#) | (#) | sation ($) | |||||||

| Kevin McLaughlin(1) | 2002 | $ | 75,000 | $ | 20,000 | $ -- | $ -- | -- | -- | $ -- | |||||

| Director, Chief Executive | 2001 | -- | -- | -- | -- | -- | -- | -- | |||||||

| Officer, Chief Operating Officer, | 2000 | -- | -- | -- | -- | -- | -- | -- | |||||||

| President & Secretary | |||||||||||||||

| J. Robert Patterson(2) | 2002 | 130,000 | 10,000 | 7,017 | (5) | -- | -- | -- | -- | ||||||

| Vice President, Chief Financial | 2001 | 101,042 | 16,335 | 4,703 | (5) | -- | -- | -- | -- | ||||||

| Officer & Treasurer | 2000 | -- | -- | -- | -- | -- | -- | -- | |||||||

| John C. Spielberger(3) | 2002 | 143,654 | -- | -- | -- | -- | -- | -- | |||||||

| Former Vice President, Sales & | 2001 | 260,600 | -- | -- | -- | -- | -- | -- | |||||||

| Marketing | 2000 | 143,506 | -- | -- | -- | -- | -- | -- | |||||||

| Anat Ebenstein(4) | 2002 | 135,417 | -- | 8,284 | (5) | -- | -- | -- | -- | ||||||

| Director & former President, | 2001 | 195,833 | 19,500 | 2,698 | (5) | -- | -- | -- | -- | ||||||

| Chief Executive Officer, | 2000 | -- | -- | -- | -- | -- | -- | -- | |||||||

| & Chief Operating Officer | |||||||||||||||

(1) | Joined us on April 12, 2002. Mr. McLaughlin's salary, bonus and other benefits are paid by Applied Digital Solutions. We reimburse Applied Digital Solutions for these payments as part of our financing arrangement with Applied Digital Solutions. See Item 13. Certain Relationships and Related Transactions below for additional information. |

(2) | Joined us on December 14, 2000. |

(3) | Appointed as our officer on December 14, 2000. Of the amounts included in salary for fiscal year ended September 30, 2002, 2001 and 2000 above are $109,194, $180,600 and $73,923, respectively, representing sales commissions paid by us to Mr. Spielberger. Mr. Spielberger resigned on February 8, 2002. |

(4) | Removed from office on April 12, 2002. |

(5) | Consists of expenses for a car. |

3

Option Grants in Last Fiscal Year

The following table contains information concerning the grant of stock options under our 1998 Stock Option Plan or 2001 Flexible Stock Plan to the named executive officers during 2002:

| Individual Grants | |||||||||||

| Name | Number of Securities Underlying Options Granted (#) (1) | % of Total Options Granted to Emloyees in 2002 (2) | Exercise Price ($/Sh) | Expiration Date | Grant Date Present Value ($) (3) | ||||||

| Kevin McLaughlin | 350,000 | 42% | $ 0.28 | 2010 | $ 94,500 | ||||||

| J. Robert Patterson | 100,000 | 12 | 0.28 | 2010 | 27,000 | ||||||

| John C. Spielberger | -- | -- | -- | -- | -- | ||||||

| Anat Ebenstein | -- | -- | -- | -- | -- | ||||||

(1) | Options granted under the 2001 Flexible Stock Plan and the 1998 Stock Option Plan were granted at an exercise price equal to the fair market value of our common shares on the grant date. The options were granted on June 28, 2002, become exercisable on June 28, 2003 and expire on June 28, 2010. |

(2) | In addition to the options granted to executive officers and described above, on June 28, 2002, the Board of Directors reserved 375,000 stock options for future issuance to employees. The authority to identify these employees and to determine the number of options to be granted to them has been delegated by the Board of Directors to our Chief Executive Officer. These reserved shares have been included in the denominator for purposes of calculating the Percentage of Total Options Granted to Employees in 2002 in the table above. |

(3) | Based on the grant date present value of $0.27 per option share which was derived using the Black-Scholes option pricing model in accordance with rules and regulations of the Securities Exchange Commission and not intended to forecast future appreciation of our common share price. The Black-Scholes model was used with the following assumptions: dividend yield of 0%; expected volatility of 16.9%; risk-free interest rate of 3.5%; and expected life of 4 years. |

Aggregate Option Exercises in Last Fiscal Year and Year-End Values

The following table sets forth information concerning the exercise of stock options by the named executive officers during the fiscal year ended September 30, 2002, the number of options owned by the named executive officers and the value of any in-the-money unexercised stock options as of September 30, 2002.

| Aggregated Fiscal Year-End Option Values | ||||||||||

| Value of Unexercised | ||||||||||

| Number of Unexercised | In-the-Money | |||||||||

| Options | Options at | |||||||||

| Shares Acquired | at Fiscal Year End (#) | Fiscal Year End ($) (1) | ||||||||

| Name | (on Exercise (#)) | Value Received ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||

| Kevin McLaughlin(2) | -- | $ -- | -- | 350,000 | $ -- | $ | 59,500 | |||

| J. Robert Patterson(3) | -- | -- | 100,000 | 100,000 | 11,000 | 17,000 | ||||

| John C. Spielberger(4) | -- | -- | -- | -- | -- | -- | ||||

| Anat Ebenstein(5) | -- | -- | 300,000 | -- | 33,000 | -- | ||||

(1) | The value of the unexercised in-the-money options at September 30, 2002 assumes a fair market value of $0.45 the closing price of our common stock as reported on the OTC Bulletin Board on September 30, 2002. The values shown are net of the option exercise price, but do not include deduction for taxes or other expenses associated with the exercise of the option or the sale of the underlying shares. |

(2) | Joined us on April 12, 2002. |

(3) | Joined us on December 14, 2000. |

(4) | Appointed as an officer on December 14, 2000 and resigned on February 8, 2002. |

(5) | Removed from office on April 12, 2002 |

Compensation of Directors

Our independent directors receive an annual fee of $1,000 payable quarterly in advance. In addition, each independent director receives $200 for attendance in person at each Board meeting and $100 for participation in each telephonic board meeting held. Directors who are also our officers or officers of Applied Digital Solutions, Inc. currently receive no cash compensation for serving on the Board of Directors, other than reimbursement of reasonable expenses incurred in attending meetings.

4

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

Scott R.Silverman, President of Applied Digital Solutions, is currently the only member of our Compensation Committee. See “Item 13. Certain Relationship and Related Transactions” for additional information.

Report of the Compensation Committee

The following Report of the Compensation Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent we specifically incorporate this Report by reference therein.

Compensation Committee of the Board

The Compensation Committee is composed of one non-employee member of the Board of Directors. It is the Compensation Committee’s responsibility to review, recommend and approve changes to our compensation policies and programs. It is also the Committee’s responsibility to review and approve all compensation actions for our executive officers and various other compensation policies and matters and administer our 1998 Stock Option Plan, including the review and approval of stock option grants to our executive officers, our 1999 Employee Stock Purchase Plan, our 2001 Flexible Stock Plan and our 401(k) Plan.

General Compensation Philosophy

The Committee focuses on compensating executives on a competitive basis with other comparably sized and managed companies, in a manner consistent and supportive of our overall objectives, and through a compensation plan which balances our long-term and short-term strategic initiatives. The Committee intends that our executive compensation program will:

1. |

| Reward executives for strategic management and enhancement of stockholder value; |

2. |

| Reflect each executive's success at resolving key operational issues; |

3. |

| Facilitate both the short-term and long-term planning process; and |

4. |

| Attract and retain key executives believed to be critical to our long-term success. |

Setting Executive Compensation

Our compensation program for executive officers generally consists of a fixed base salary, performance-related annual bonus awards and long-term incentive compensation in the form of stock options. In addition, our executives are able to participate in various benefit plans generally available to our other full-time employees.

In reviewing executives’ performances over the past fiscal year, the Committee took into consideration, among other things, the following performance factors in making its compensation recommendations: revenues, net income and cash flow. Our executive compensation programs are designed to enable us to attract, retain and motivate our executives. Our general compensation philosophy is that total cash compensation should vary with our performance in attaining financial and non-financial objectives and that any long-term incentive compensation should be closely aligned with the interests of stockholders. Total cash compensation for the majority of our employees, including its executive officers, includes a base salary and a cash bonus based on our profitability. Long-term incentive compensation is realized through the granting of stock options to most employees, at the discretion of the presidents of our divisions, as well as eligible executive officers.

Base Salary

Base salary for our executives is intended to provide competitive remuneration for services provided to us over a one-year period. Base salaries are set at levels designed to attract and retain the most appropriately qualified individuals for each of our key management level positions.

Short-Term Incentives

Short-term incentives are paid primarily to recognize specific operating performance achieved within the last fiscal year. Since such incentive payments are related to a specific year’s performance, the Committee understands and accepts that such payments may vary considerably from one year to the next. Our bonus program ties executive compensation directly back to the annual performance of both the individual executive and the company. Through this program, in the fiscal year ended September 30, 2002, the actual bonus payment paid to any of the named executive officers was derived from specific measures of company and individual performance.

5

Long-Term Incentives

We do not provide our executives with long-term incentive payments. Instead, we may, from time to time, grant our executive officers stock options in order to reward executive officers for company or individual achievements, to motive executive officers to improve company performance or to encourage ownership of our common stock. We believe that this long-term incentive strategy better aligns the interests of our executive officers with those of our stockholders. During 2002, we granted stock options to Kevin McLaughlin, our President, Chief Executive Officer, Chief Operating Officer and Secretary, and J. Robert Patterson, our Vice President, Chief Financial Officer and Treasurer.

Compensation Pursuant to Plans

1998 Stock Option Plan.

On February 24, 1998, the stockholders approved a stock option plan as a successor to the expiring 1988 Stock Option Plan. As of September 30, 2002, 295,000 options have been granted and remain outstanding under the 1998 Stock Option Plan. The 1998 Stock Option Plan had 1,000,000 shares of common stock reserved for issuance upon the exercise of options designated as either (i) incentive stock options or (ii) non-qualified stock options. Incentive stock options may be granted under the 1998 Stock Option Plan to our employees and officers. Non-qualified options may be granted to our consultants, directors (whether or not they are employees), employees or officers.

The purpose of the 1998 Stock Option Plan is to encourage stock ownership by certain of our directors, officers and employees and certain other persons instrumental to our success and to give them a greater personal interest in our success. The 1998 Stock Option Plan is administered by the Compensation Committee. The Committee, within the limitations of the plan, determines the persons to whom options will be granted, the number of shares to be covered by each option, whether the options granted are intended to be incentive stock options, the duration and rate of exercise of each option, the option purchase price per share and the manner of exercise, the time, manner and form of payment upon exercise of an option, and whether restrictions such as repurchase rights are to be imposed on the shares subject to options. Options granted under the 1998 Stock Option Plan may not be granted at a price less than the fair market value of the common stock on the date of the grant (or 110% of fair market value in the case of persons holding 10% or more of our voting stock). The aggregate fair market value of shares for which incentive stock options granted to any person and exercisable for the first time by such person during any calendar year (under all of our stock option plans and those of any related corporation) may not exceed $100,000. The 1998 Stock Option Plan will terminate in February, 2008; however, options granted under the plan will expire not more than 10 years from the date of grant. Options granted under the 1998 Stock Option Plan are not transferable during an optionee’s lifetime but are transferable at death by will or by the laws of descent and distribution.

1999 Employee Stock Purchase Plan.

On January 28, 1999, the stockholders approved the 1999 Employee Stock Purchase Plan. The 1999 Employee Stock Purchase Plan has 200,000 shares of common stock reserved for issuance upon purchase by our employees. The 1999 Employee Stock Purchase Plan provides our eligible employees with an opportunity to acquire an interest in our future.

The purpose of the 1999 Employee Stock Purchase Plan is to provide our employees with an opportunity to purchase common stock through accumulated payroll deductions, and give them a greater personal interest in our success. The 1999 Employee Stock Purchase Plan is administered by the Board of Directors, which, within the limitations set forth in the plan, determines the persons who may purchase shares of common stock, the number of shares to be sold, the time, manner and form of payment, and whether restrictions are to be imposed on the shares subject to purchase. The 1999 Employee Stock Purchase Plan provides eligible employees an opportunity to purchase shares of common stock through payroll deductions during two offering periods: October 1 through March 31 and April 1 through September 30. At the time a participant files his subscription agreement, he shall elect to have payroll deductions made on each pay day during the offering period in an amount not exceeding 10% of the compensation he receives each pay day during the offering period. All payroll deductions made for participants in the 1999 Employee Stock Purchase Plan are credited to the employee’s account under the plan and are withheld in whole percentages only. A participant may discontinue his participation in the plan under certain circumstances, or may increase or decrease the rate of his payroll deductions during the offering period. The purchase price per share is an amount equal to 85% of the fair market value of a share of common stock on the first or last day of the offering period, whichever is lower. The aggregate number of shares purchased by an employee may not exceed a number of shares determined by dividing $12,500 by the fair market value of a share of our common stock on the first day of the offering period. The 1999 Employee Stock Purchase Plan expires by its terms on December 17, 2008.

6

2001 Flexible Stock Plan

On March 29, 2001, the stockholders approved the 2001 Flexible Stock Plan. As of September 30, 2002, 3,725,000 options were granted and remain outstanding under the 2001 Flexible Stock Plan. The 2001 Flexible Stock Plan initially had 2,500,000 shares of common stock reserved for issuance. This number is subject to an annual increase of 25% of the number of outstanding shares of common stock as of January 1 of each year, but may not exceed 10,000,000 in the aggregate. As of January 22, 2003, 1,223,000 shares of common stock are available for future issuance under the 2001 Flexible Stock Plan. These shares may be issued in the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock, performance shares, cash awards, or other stock based awards.

The purpose of the 2001 Flexible Stock Plan is to attract, retain, motivate and reward employees and other individuals and to encourage ownership by employees and other individuals of our common stock. The 2001 Flexible Stock Plan is administered by the Compensation Committee. The Committee, within the limitations of the plan, has discretion to determine (i) when and to whom an award is granted and the type and amount of the award, and (ii) the terms, conditions and provisions of, and restrictions relating to, each award granted. The 2001 Flexible Stock Plan may be terminated at any time by the Board of Directors.

401(k) Plan

On January 1, 1994, we adopted a 401(k) savings plan for the benefit of all eligible employees. All employees as of the effective date of the 401(k) plan became eligible to participate. An employee who became employed after January 1, 1994 would become a participant after the completion of 6 months of service and attainment of 20 years of age. Under the 401(k) plan, participants may elect to contribute from their compensation any amount up to the maximum deferral allowed by the Internal Revenue Code. Our contributions are discretionary and we may make optional contributions for any plan year at our discretion. During the fiscal years ended September 30, 2002, 2001 and 2000, we recorded 401(k) administrative costs totaling $5,588, $4,950 and $7,796, respectively.

The Compensation Committee is pleased to submit this report to the stockholders with regard to the above matters.

| COMPENSATION COMMITTEE SCOTT R. SILVERMAN |

7

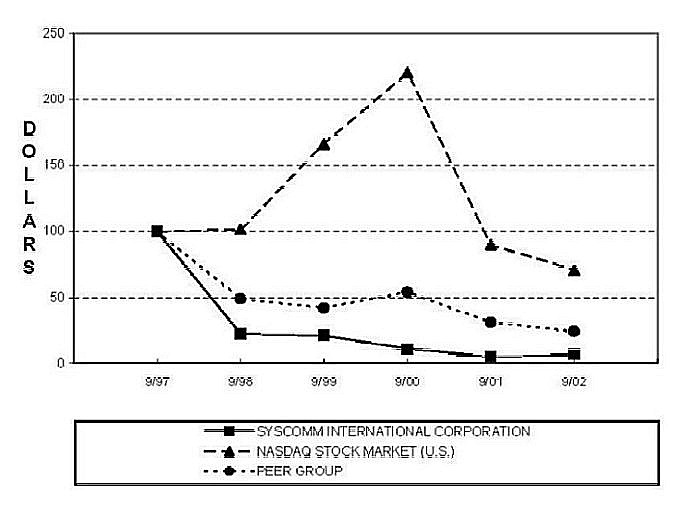

Performance Graph

The following Performance Graph does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent we specifically incorporate this Performance Graph by reference therein.

The Performance Graph compares the percentage change in the cumulative total stockholder return for the period beginning on September 30, 1997 and ending on September 30, 2002, based upon the market price of our common stock, the NASDAQ Stock Market Index for U.S. companies and a group consisting of our peer corporations on a line-of-business basis. The corporations making up the peer group are AlphaNet Solutions, Inc., En Pointe Technologies, Inc., Manchester Technologies, Inc., Micros to Mainframes, Inc. and Pomeroy Computer Resources, Inc. The graph assumes (i) the reinvestment of dividends, if any, and (ii) the investment of $100 on September 30, 1997 in our common stock, the NASDAQ Stock Market Index for U.S. companies, Standard & Poor’s 500 Index, the American Stock Exchange Index for U.S. Companies and the peer group index.

Cumulative Total Return

Based on Investment of $100

September 30, 1997 - September 30, 2002

| 30-Sep-97 | 30-Sep-98 | 30-Sep-99 | 30-Sep-00 | 30-Sep-01 | 30-Sep-02 | ||||||||||

| SysComm | $ 100.00 | $ 22.55 | $ 21.08 | $ 11.28 | $ 5.25 | $ 7.06 | |||||||||

| Nasdaq US | 100.00 | 101.58 | 165.95 | 220.33 | 90.05 | 70.89 | |||||||||

| Peer Group | 100.00 | 49.08 | 42.04 | 54.24 | 31.15 | 24.43 |

8

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Equity Compensation Plan Information

The following table sets forth information regarding our compensation plans (including individual compensation arrangements) under which shares of our common stock are authorized for issuance as of September 30, 2002:

| Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (a) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (b) | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column (a) | ||||

| Equity compensation plans approved by security holders | 4,020,000(1) | $0.413 | 1,928,000 | ||||

| Equity compensation plans not approved by securities holders | 1,250,000(2) | 0.537 | -- |

(1) | Represents 3,725,000 options which have previously been granted and which remain outstanding under our 2001 Flexible Stock Plan and 295,000 options which have previously been granted and which remain outstanding under our 1998 Stock Option Plan. Our 2001 Flexible Stock Plan initially had 2,500,000 shares of common stock reserved for issuance. This number is subject to an annual increase of 25% of the number of outstanding shares of commons stock as of January 1 of each year but may not exceed 10,000,000 in the aggregate. |

(2) | Represents (i) 650,000 options issued to consultants in connection with the provision of certain investment advisory services for us; (ii) 300,000 options issued in December 2000 to David A. Loppert, our former Chief Executive Officer, in connection with his employment with us and (iii) 300,000 warrants issued in December 2000 to John H. Spielberger, a former stockholder, in connection with the sale of his shares to Applied Digital Solutions. |

Ownership of Equity Securities

The following table sets forth information regarding beneficial ownership of our common stock by each director and by each named executive officer and by all the directors and named executive officers as a group as of January 22, 2003:

| Name | Aggregate Number of Shares Beneficially Owned (3) | Percent of Outstanding Shares | |||||

| Jerome C. Artigliere | -- | * | |||||

| Kevin McLaughlin (1) | -- | * | |||||

| Anat Ebenstein (2) | 300,000 | 6.1% | |||||

| Charles L. Doherty | 115,000 | 2.3% | |||||

| Scott R. Silverman | 100,000 | 2.0% | |||||

| J. Robert Patterson | 100,000 | 2.0% | |||||

| All Directors and Executive Officers as a | |||||||

| Group (6 persons) | 615,000 | 12.6% | |||||

* | Represents less than 1% of the issued and outstanding shares of our common stock. |

(1) | Appointed an officer and/or director on April 12, 2002. |

(2) | Appointed an officer and/or director on December 14, 2000 and removed from office on April 12, 2002. |

(3) | This table includes presently exercisable options and options which become exercisable within 60 days. The following directors and executive officers hold the number of options which are presently exercisable or are exercisable within 60 days set forth following their respective names: Jerome C. Artigliere - 0; Kevin McLaughlin - 0; Anat Ebenstein - 300,000; Charles L. Doherty - 100,000; Scott R. Silverman - 100,000; J. Robert Patterson - 100,000; and all directors and executive officers as a group - 600,000. |

9

Principal Stockholders

Set forth in the table below is information as of January 22, 2003 with respect to persons known to us (other than the directors and executive officers shown in the preceding table) to be the beneficial owners of more than 5% of our issued and outstanding common stock:

| Name and Address | Number of Shares Beneficially Owned | Percent of Class | |||||

| Applied Digital Solutions, Inc. 400 Royal Palm Way, Suite 410 Palm Beach, Florida 33480 | 2,570,000 (1) | 52.5% | |||||

| David A. Loppert 107 Pembroke Drive Palm Beach Gardens, Florida 33418 | 345,100 (2) | 7.0% | |||||

| Dominic and Dominic LLC 32 Old Slip New York, New York 10005 | 450,000 (3) | 9.2% | |||||

(1) | Based on Schedule 13D filed with the Securities and Exchange Commission on December 26, 2000. Applied Digital Solutions, Inc., a Missouri corporation, has sole voting and dispositive power as to 2,570,000 shares. |

(2) | Based on Schedule 13G filed with the Securities and Exchange Commission on January 31, 2002. Mr. Loppert has sole voting and dispositive power as to 345,100 shares. |

(3) | Represents 100,000 exercisable options granted on April 7, 1999 and 350,000 exercisable warrants granted on January 1, 2001 as compensation for services provided to us. Based on correspondence received from Dominic and Dominic, Roseann T. Cook, Chief Operating Officer of Dominic and Dominic, will possess sole voting and dispositive power as to the shares upon exercise of the options or warrants. |

Changes in Control

Applied Digital Solutions, Inc. has entered into a Term and Revolving Credit Agreement with IBM Credit Corporation, pursuant to which all of the shares of our common stock currently owned by Applied Digital Solutions, Inc. are pledged as collateral. The exercise by IBM Credit Corporation of its rights with respect to those shares upon an event of default could result in a change of control.

Except as mentioned above, there are no arrangements, known to us, the operation of which may at a subsequent date result in a change of control.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We have entered into a financial arrangement with Applied Digital Solutions whereby the salary, bonus and benefits for Kevin McLaughlin are paid by Applied Digital Solutions. We reimburse Applied Digital Solutions for all payroll and benefit-related expenses incurred as a result of such financial arrangement on a monthly basis. During fiscal years ending September 30, 2002 and 2001, we reimbursed Applied Digital Solutions approximately $166,000 and $100,000, respectively, for such business expenses. No such expenses were paid to Applied Digital Solutions during fiscal year ending September 30, 2000.

We have financing agreements with IBM Credit Corporation, through the Applied Digital Solutions’ credit facility, to finance inventory purchases up to $3.35 million. Borrowing for purchases is based upon 75% of all eligible receivables due within 90 days and up to 100% of all eligible inventories. Effective March 27, 2002, Applied Digital Solutions entered into a new credit agreement with IBM Credit Corporation. As part of the security for the Applied Digital Solutions’ credit agreement with IBM Credit Corporation, Applied Digital Solutions’ shares of our common stock are pledged as collateral for amounts outstanding under the credit agreement. Additionally, IBM Credit Corporation has a security interest in our receivables and inventories, up to the amount advanced from Applied Digital Solutions under the line of credit. Any amounts we owe to Applied Digital Solutions bear interest at the same rate as paid by Applied Digital Solutions to IBM Credit Corporation which is currently 17%, but will be increased to 25% if all amounts are not repaid by February 28, 2003 and to 35% if all amounts are not repaid by February 28, 2004. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” for additional information.

10

ITEM 14. CONTROLS AND PROCEDURES

It is the Chief Executive Officer’s and Chief Financial Officer’s responsibility to ensure we maintain disclosure controls and procedures designed to provide reasonable assurance that material information, both financial and non-financial, and other information required under the securities laws to be disclosed is identified and communicated to senior management on a timely basis. Our disclosure controls and procedures include mandatory communication of material events, automated accounting processing and reporting, management review of monthly and quarterly results and an established system of internal controls.

During the fourth quarter, management, including the Chief Executive Officer and Chief Financial Officer, conducted an evaluation of disclosure controls and procedures pursuant to Exchange Act Rule 13a-14. Based on that evaluation, the Chief Executive Officer and Chief Financial Officer have concluded the disclosure controls and procedures currently in place are adequate to ensure material information and other information requiring disclosure are identified and communicated in a timely fashion. There have been no significant changes in internal controls, or in factors that could significantly affect internal controls, subsequent to the date the Chief Executive Officer and Chief Financial Officer completed their evaluation.

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K

(a)(1) | The financial statements and financial statement schedules listed below are included in this report |

(a)(2) | Financial statement schedules have been included in Item 15(a)(1) above. |

(a)(3) | Exhibits |

(b) | Reports on Form 8-K |

| On August 2, 2002, we filed a Current Report on Form 8-K under Item 4 and 7 reporting a change in our accountants. On August 14, 2002, we filed a Current Report on Form 8-K under Item 7 disclosing the certifications made by our Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| On December 19, 2002, we filed a Current Report on Form 8-K/A under Item 4 and 7 amending the Current Report Form 8-K reporting a change in our accountants originally filed on August 2, 2002. |

(c) | Exhibits - Included in Item 15(a)(3) above. |

11

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Fairfield, State of New Jersey, on January 28, 2003.

| | SYSCOMM INTERNATIONAL CORPORATION (Registrant) | |

| By: | /s/ Kevin McLaughlin | |

| Kevin McLaughlin, Chief Executive Officer, Secretary, Assistant Treasurer and Director | ||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Signature | Title | Date |

| /s/ Jerome C. Artigliere | Chairman of the Board of | January 28, 2003 |

| (Jerome C. Artigliere) | Directors | |

| /s/ Kevin McLaughlin | Chief Executive Officer, Secretary, Assistant Treasurer and Director | January 28, 2003 |

| (Kevin McLaughlin) | (Principal Executive Officer) | |

| /s/ J. Robert Patterson | Vice President, Treasurer and Chief | January 28, 2003 |

| (J. Robert Patterson) | Financial Officer (Principal Financial Officer and Principal Accounting Officer) | |

| /s/ Charles L. Doherty | Director | January 28, 2003 |

| (Charles L. Doherty) | | |

| Director | ||

| (Scott Silverman) | | |

| | Director | |

| (Anat Ebenstein) | |

12

CERTIFICATIONS

I, Kevin McLaughlin, Chief Executive Officer of SysComm International Corporation (the "Registrant"), certify that:

1. I have reviewed this annual report on Form 10-K of the Registrant;

2. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report;

3. Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report;

4. The registrant's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act 13a-14 and 15d-14) for the registrant and we have:

a) Designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared; |

b) Evaluated the effectiveness of the registrant's disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the “Evaluation Date”); and |

c) Presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date; |

5. The registrant's other certifying officers and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent function):

a) All significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and |

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls; and |

6. The registrant's other certifying officers and I have indicated in this annual report whether or not there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

Date: January 28, 2003 | ||

| /s/ Kevin McLaughlin | ||

| Kevin McLaughlin, Chief Executive Officer |

I, J.Robert Patterson, Chief Financial Officer of SysComm International Corporation (the "Registrant"), certify that:

1. I have reviewed this annual report on Form 10-K of the Registrant;

2. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report;

3. Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report;

4. The registrant's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act 13a-14 and 15d-14) for the registrant and we have:

a) Designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared; |

b) Evaluated the effectiveness of the registrant's disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the “Evaluation Date”); and |

c) Presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date; |

5. The registrant's other certifying officers and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent function):

a) All significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and |

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls; and |

6. The registrant's other certifying officers and I have indicated in this annual report whether or not there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

Date: January 28, 2003 | ||

| /s/ J. Robert Patterson | ||

| J. Robert Patterson, Chief Financial Officer |

Certification Pursuant to

18 U.S.C. §1350,

As Adopted Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the Annual Report of SysComm International Corporation (the "Registrant") on Form 10-K for the year ending September 30, 2002, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Kevin McLaughlin, Chief Executive Officer of the Registrant, certify, to the best of my knowledge, pursuant to 18 U.S.C. §1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

(1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

(2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Registrant. |

| /s/ Kevin McLaughlin | |

| Kevin McLaughlin Chief Executive Officer SysComm International Corporation January 28, 2003 |

Certification Pursuant to

18 U.S.C. §1350,

As Adopted Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the Annual Report of SysComm International Corporation (the "Registrant") on Form 10-K for the year ending September 30, 2002, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, J. Robert Patterson, Chief Financial Officer of the Registrant, certify, to the best of my knowledge, pursuant to 18 U.S.C. §1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

(1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

(2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Registrant. |

| /s/ J. Robert Patterson | |

| J. Robert Patterson Chief Financial Officer SysComm International Corporation January 28, 2003 |

List Of Exhibits

(Item 14 (c))

| Exhibit Number |

|

2.1 | Stock Purchase Agreement by and between Applied Digital Solutions, Inc. and John H. Spielberger, Catherine Spielberger and Bearpen Limited Partnership, dated November 13, 2000 (incorporated herein by reference to Exhibit 2.1 to the Company's Current Report on Form 8-K filed with the Commission on December 22, 2000, as amended by the Company's Current Report on Form 8-K/A filed with the Commission on February 9, 2001). |

2.2 | Amendment No. 1 to Stock Purchase Agreement by and between Applied Digital Solutions, Inc. and John H. Spielberger, Catherine Spielberger and Bearpen Limited Partnership, dated December 14, 2000 (incorporated herein by reference to Exhibit 2.2 to the Company's Current Report on Form 8-K filed with the Commission on December 22, 2000, as amended by the Company's Current Report on Form 8-K/A filed with the Commission on February 9, 2001). |

2.3 | Stock Purchase Agreement by and between the Company and Applied Digital Solutions, Inc., dated November 13, 2000 (incorporated herein by reference to Exhibit 2.3 to the Company's Current Report on Form 8-K filed with the Commission on December 22, 2000, as amended by the Company's Current Report on Form 8-K/A filed with the Commission on February 9, 2001). |

2.4 | Addendum to Stock Purchase Agreement by and between the Company and Applied Digital Solutions, Inc., dated December 14, 2000 (incorporated herein by reference to Exhibit 2.4 to the Company's Current Report on Form 8-K filed with the Commission on December 22, 2000, as amended by the Company's Current Report on Form 8-K/A filed with the Commission on February 9, 2001). |

2.5 | Stock Purchase Agreement by and between the Company and Applied Digital Solutions, Inc., dated December 15, 2000 (incorporated herein by reference to Exhibit 2.5 to the Company's Current Report on Form 8-K filed with the Commission on December 22, 2000, as amended by the Company's Current Report on Form 8-K/A filed with the Commission on February 9, 2001). |

3.1 | Amended and Restated Certificate of Incorporation (incorporated herein by reference to Exhibit 3.1 to the Company's Registration Statement on Form S-1 (File No. 333-25593) filed with the Commission on April 22, 1997) |

3.2 | Amended and Restated By-Laws (incorporated herein by reference to Exhibit 3.2 to the Company's Registration Statement on Form S-1 (File No. 333-25593) filed with the Commission on April 22, 1997) |

4.1* | Non-Qualified Stock Option Award Granted to David A. Loppert dated January 1, 2001 |

10.1 | Agreement for Wholesale Financing (Security Agreement), dated November 27, 2000 between the Company's subsidiary, Information Technology Services, Inc., and IBM Credit Corporation (incorporated herein by reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q filed with the Commission on August 14, 2001) |

10.2 | Agreement for Wholesale Financing (Security Agreement), dated January 5, 2001, between the Company's subsidiary, Information Technology Services, Inc., and IBM Credit Corporation (incorporated herein by reference to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2001 filed with the Commission on August 13, 2001) |

10.3* | 1998 Incentive Stock Option Plan, as Amended (incorporated herein by reference to Exhibit 99 to the Company's definitive Proxy Statement filed with the Commission on December 27, 1999) |

10.4* | 1999 Employee Stock Purchase Plan (incorporated herein by reference to Exhibit A to the Company's definitive Proxy Statement filed with the Commission on December 28, 1998) |

10.5* | 2001 Flexible Stock Plan (incorporated herein by reference (incorporated herein by reference to Exhibit A to the Company's definitive Proxy Statement filed with the Commission on February 28, 2001) |

10.6 | Collateralized Guaranty dated May 23, 2001 between the Company, its subsidiaries, Information Technology Services, Inc. and Information Products Center, Inc., and IBM Credit Corporation (incorporated by reference to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2001 filed with the Commission on August 13, 2001) |

10.7 | Contract of Sale - Office, Commercial and Multi-Family Residential Premises by and between SysComm International Corporation and Parr Research and Marketing, Inc. (incorporated by reference to the Company's Current Report on Form 8-K dated January 28, 2002 filed with the Commission on February 12, 2002) |

10.8 | Third Amended and Restated Term Credit Agreement dated March 1, 2002 between Applied Digital Solutions, Inc., Digital Angel Share Trust and IBM Credit Corporation (incorporated by reference to Exhibit 10.2 to the Applied Digital Solutions, Inc.'s Current Report on Form 8-K filed with the Commission on March 8, 2002) |

10.9 | Letter dated August 13, 2002 from IBM Corporation discussing the waiver of certain existing defaults under the Third Amended and Restated Term Credit Agreement (incorporated by reference to Exhibit 10.2 to the Applied Digital Solutions, Inc. Quarterly Report on Form 10-Q for the Quarter Ended June 30, 2002 filed with the Commission on August 14, 2002). |

10.10 | Waiver Agreement from IBM Credit Corporation, waiving existing defaults under the Third Amended and Restated Term Credit Agreement as of June 30, 2002 (incorporated by reference to Exhibit 10.20 to Applied Digital Solutions, Inc. Registration Statement on Form S-1 (File No. 333-98799) filed with the Commission on August 27, 2002). |

10.11 | Amendment to the Third Amended And Restated Term Credit Agreement dated as of September 30, 2002 (incorporated by reference to Exhibit 10.21 to Applied Digital Solutions, Inc. Post-Effective Amendment No. 1 to Registration Statement on Form S-1 (File No. 333-98799) filed with the Commission on November 5, 2002). |

10.12 | Amendment to the Third Amended And Restated Term Credit Agreement dated as of November 1, 2002 (incorporated by reference to Exhibit 10.22 to Applied Digital Solutions, Inc. Post-Effective Amendment No. 1 to Registration Statement on Form S-1 (File No. 333-98799) filed with the Commission on November 5, 2002). |

10.13 | Sublease Agreement dated as of May 25, 2000 by and between Sungard Portfolio Solutions and Information Products Center, Inc. |

18.1 | Letter regarding change in certifying accountant (incorporated herein by reference to Exhibit 16 to the Company's Current Report on Form 8-K filed with the Commission on September 13, 2001). |

18.2 | Letter regarding change in certifying accountant (incorporated herein by reference to Exhibit 16 to the Company's Current Report on Form 8-K filed with the Commission on August 2, 2002). |

18.3 | Letter regarding change in certifying accountant (incorporated herein by reference to Exhibit 16 to the Company's Current Report on Form 8-K/A filed with the Commission on December 19, 2002). |

21.1 | List of Subsidiaries** |

| |

* | Management contract or compensatory plan. |

** | Previously filed. |

| Contents | |||

| | |||

| | Reports of Independent Public Accountants | F-2/4 | |

| | Financial Statements | ||

| | Consolidated Balance Sheets September 30, 2002 and 2001 | F-5 | |

| | Consolidated Statements Of Operations Years ended September 30, 2002, 2001 and 2000 | F-6 | |

| | Consolidated Statements Of Stockholders' Equity Years ended September 30, 2002, 2001 and 2000 | F-7 | |

| | Consolidated Statements Of Cash Flows Years ended September 30, 2002, 2001 and 2000 | F-8 | |

| | Notes To Consolidated Financial Statements | F-9/26 | |

| | Schedule II - Valuation and Qualifying Accounts Years ended September 30, 2002, 2001 and 2000 | S-1 |

F-1

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS

Board of Directors and Stockholders

SysComm International Corporation

Fairfield, New Jersey

We have audited the accompanying consolidated balance sheet of SysComm International Corporation and Subsidiaries as of September 30, 2002, and the related consolidated statements of operations, stockholders' equity and cash flows for the year then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of SysComm International Corporation and Subsidiaries as of September 30, 2002, and their results of operations and cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Our audit referred to above included the information in Schedule II, which presents fairly, in all material respects, when read in conjunction with the consolidated financial statements, the information required to be set forth therein.

/s/ J. H. Cohn LLP

Roseland, New Jersey

October 30, 2002

F-2

INDEPENDENT AUDITORS' REPORT

Board of Directors and Stockholders

SysComm International Corporation

Fairfield, New Jersey

We have audited the accompanying consolidated balance sheet of SysComm International Corporation and subsidiaries as of September 30, 2001, and the related consolidated statements of operations, stockholders' equity and cash flows for the year then ended. Our audit also included the consolidated financial statement schedule listed in the Index at Item 15. These consolidated financial statements and consolidated financial statement schedule are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements and consolidated financial statement schedule based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of SysComm International Corporation and subsidiaries as of September 30, 2001 and its results of operations and cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America, and the supporting schedule presents fairly the information required to be set forth therein.

The Company is controlled by its majority shareholder, Applied Digital Solutions, Inc. (ADS). The Company relies on financing from ADS to meet its liquidity needs. As further discussed in Note 7 to the financial statements, availability of future loans from ADS are uncertain. The Company's plan for providing adequate liquidity during the next fiscal year is set forth in Note 7 to the financial statements.

/s/ RUBIN, BROWN, GORNSTEIN & CO., LLP

Saint Louis, Missouri

November 7, 2001

F-3

INDEPENDENT AUDITORS’ REPORT

To the Board of Directors

SysComm International Corporation and Subsidiary

Shirley, New York

We have audited the accompanying consolidated statements of operations, stockholders’ equity, and cash flows for the year ended September 30, 2000. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly in all material respects, the consolidated financial position of SysComm International Corporation and Subsidiary as of September 30, 2000 and the results of its operations and its cash flows for the year ended September 30, 2000, in conformity with accounting principles generally accepted in the United States of America.

/s/ ALBRECHT, VIGGIANO, ZURECK & COMPANY, P.C.

Hauppauge, New York

December 15, 2000

F-4

| SYSCOMM INTERNATIONAL CORPORATION |

| AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS (In thousands, except par value) |

Assets | ||

September 30, | ||

| 2002 | 2001 | |

| Current Assets | ||

| Cash and cash equivalents | $ 3,398 | $ 1,811 |

| Accounts receivable (net of allowance for doubtful accounts | ||

| of $208 in 2002 and $414 in 2001) | 1,913 | 9,409 |

| Inventories | 91 | 495 |

| Deferred tax assets | 42 | 171 |

| Other current assets | 135 | 589 |

| Total Current Assets | 5,579 | 12,475 |

| Property, equipment and improvements, net | 524 | 3,177 |

| Goodwill, net | 2,154 | 2,154 |

| Other assets | 1,500 | 1,265 |

| Total Assets | $ 9,757 | $ 19,071 |

Liabilities And Stockholders' Equity | ||

| Current Liabilities | ||

| Current maturities of long-term debt and capital lease obligations | $ 21 | $ 1,007 |

| Amounts due to Parent Company | 127 | 947 |

| Accounts payable | 190 | 4,850 |

| Accrued expenses and other liabilities | 1,160 | 1,177 |

| Total Current Liabilities | 1,498 | 7,981 |

| Note payable – Parent Company | – | 2,398 |

| Long-term debt and capital lease obligations | 21 | 42 |

| Total Liabilities | 1,519 | 10,421 |

| Commitments and contingencies | ||

| Stockholders' Equity | ||

| Preferred shares: | ||

| Authorized 5,000 shares, no par value: none issued | – | – |

| Common shares: | ||

| Authorized 80,000 shares of $.01 par value; 5,757 shares | ||

| issued; 4,896 shares outstanding | 58 | 58 |

| Additional paid-in capital | 6,653 | 6,653 |

| Retained earnings | 2,445 | 2,857 |

| Treasury stock (861 shares, carried at cost) | (918) | (918) |

| Total Stockholders' Equity | 8,238 | 8,650 |

| Total Liabilities and Stockholders' Equity | $ 9,757 | $ 19,071 |

See the accompanying notes to consolidated financial statements.

F-5

| SYSCOMM INTERNATIONAL CORPORATION |

| AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except share and per share data) |

| For The Years Ended September 30, | |||

| 2002 | 2001 | 2000 | |

| Revenue | |||

| Product revenue | $22,266 | $ 32,773 | $ 40,690 |

| Service revenue | 2,916 | 3,488 | – |

| Total revenue | 25,182 | 36,261 | 40,690 |

| Cost of sales | |||

| Cost of products sold | 19,203 | 28,583 | 36,117 |

| Cost of services sold | 1,562 | 1,493 | – |

| Total cost of products and services sold | 20,765 | 30,076 | 36,117 |

| Gross profit | 4,417 | 6,185 | 4,573 |

| Selling, general and administrative expenses | 4,179 | 6,249 | 6,411 |

| Depreciation and amortization | 268 | 535 | 308 |

| Asset impairment | – | 95 | – |

| Loss from operations | (30) | (694) | (2,146) |

| Other (income) expense: | |||

| Other (income) expense | 223 | (102) | (102) |

| Interest expense | 274 | 272 | 147 |

| Loss before income tax benefit | (527) | (864) | (2,191) |

| Income tax benefit | (115) | (159) | (231) |

| Net Loss Applicable To Common Stockholders | $ (412) | $ (705) | $ (1,960) |

| Net Loss Per Common Share – Basic | $ (0.08) | $ (0.15) | $ (0.42) |

| Weighted Average Number Of Common Shares | |||

| Outstanding - Basic | 4,896 | 4,823 | 4,694 |

See the accompanying notes to consolidated financial statements.

F-6

| SYSCOMM INTERNATIONAL CORPORATION |

| AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY For The Years Ended September 30, 2002, 2001 and 2000 (In thousands) |

| Additional | Total | |||||

| Common Stock | Paid-In | Retained | Treasury | Stockholders' | ||

| Number | Amount | Capital | Earnings | Stock | Equity | |

| Balance – October 1, 1999 | 5,524 | $55 | $6,474 | $5,522 | $(844) | $11,207 |

| Net Loss | – | – | – | (1,960) | – | (1,960) |

| Common Stock Issued Pursuant to Stock Purchase Plan | 31 | 1 | 28 | – | – | 29 |

| Purchase Of Treasury Shares | – | – | – | – | (68) | (68) |

| Balance – September 30, 2000 | 5,555 | 56 | 6,502 | 3,562 | (912) | 9,208 |

| Net Loss | – | – | – | (705) | – | (705) |

| Compensatory Stock Options | ||||||

| Issued To Non-employees | – | – | 73 | – | – | 73 |

| Common Stock Issued Pursuant | ||||||

| To Stock Purchase Plan | 2 | – | – | – | – | – |

| Net Proceeds From Issuance of Common Stock | 200 | 2 | 78 | – | – | 80 |

| Purchase Of Treasury Shares | – | – | – | – | (6) | (6) |

| Balance – September 30, 2001 | 5,757 | 58 | 6,653 | 2,857 | (918) | 8,650 |

| Net Loss | – | – | – | (412) | – | (412) |

| Balance – September 30, 2002 | 5,757 | $ 58 | $ 6,653 | $ 2,445 | $ (918) | $ 8,238 |

See the accompanying notes to consolidated financial statements.

F-7

| SYSCOMM INTERNATIONAL CORPORATION |

| AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) |

| For The Years Ended September 30, | |||||

| 2002 | 2001 | 2000 | |||

| Cash flows from operating activities | |||||

| Net loss | $ (412) | $ (705) | $ (1,960) | ||

| Adjustments to reconcile net loss to net cash | |||||

| provided by (used in) operating activities: | |||||

| Depreciation and amortization | 268 | 535 | 308 | ||

| Compensatory stock options issued to non-employees | – | 73 | – | ||

| Deferred income taxes | (115) | (283) | (250) | ||

| (Gain) loss on disposition of property and equipment | – | (6) | 9 | ||

| Asset impairment | – | 95 | – | ||

| Changes in operating assets and liabilities: | |||||

| Decrease in accounts receivable | 7,496 | 4,493 | 2,911 | ||

| Decrease in inventories | 404 | 331 | 337 | ||

| (Increase) decrease in other current assets | 386 | (418) | (570) | ||

| Decrease in other assets | 15 | 29 | – | ||

| Decrease in accounts payable | |||||

| and accrued expenses | (4,677) | (909) | (1,243) | ||

| Net cash provided by (used in) operating activities | 3,365 | 3,235 | (458) | ||

| Cash flows from investing activities | |||||

| Payments received on note receivable | 68 | 31 | – | ||

| Capital expenditures | (56) | (97) | (305) | ||

| Payment for costs of business acquisitions (net of cash acquired) | – | (1,966) | – | ||

| Proceeds from disposition of property and equipment | 2,441 | 10 | 5 | ||

| Net increase (decrease) in cash surrender value of life insurance | (6) | 10 | – | ||

| Net cash provided by (used in) investing activities | 2,447 | (2,012) | (300) | ||

| Cash flows from financing activities | |||||

| Payments of long-term debt | (3,405) | (293) | (428) | ||

| Net payments on Parent Company line of credit | (820) | (232) | – | ||

| Net proceeds from issuance of common stock | – | 80 | 29 | ||

| Purchase of treasury stock | – | (6) | (68) | ||

| Net cash used in financing activities | (4,225) | (451) | (467) | ||

| Net increase (decrease) in cash and cash equivalents | 1,587 | 772 | (1,225) | ||

| Cash and cash equivalents – beginning of year | 1,811 | 1,039 | 2,264 | ||

| Cash and cash equivalents – end of year | $ 3,398 | $ 1,811 | $ 1,039 | ||

| Supplemental disclosure of cash flow information | |||||

| Income taxes paid | $ 74 | $ 32 | $ 29 | ||

| Interest paid | 321 | 224 | 147 | ||

See the accompanying notes to consolidated financial statements.

F-8

| SYSCOMM INTERNATIONAL CORPORATION |

| AND SUBSIDIARIES |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (In Thousands) |

Note 1 – Summary Of Significant Accounting Policies

Business Organization And Basis Of Presentation |

The Company, through its subsidiaries, conducts business in the New York City Metropolitan area and New Jersey. The Company is a supplier and systems integrator of a broad range of computer services and related products. The Company's customers are generally medium to large size entities. |

Change In Control |

Basis Of Consolidation |

Use Of Estimates |

| SYSCOMM INTERNATIONAL CORPORATION AND SUBSIDIARIES |

| Notes To Consolidated Financial Statements (Continued) |

Revenue Recognition |

The Company provides an allowance for doubtful accounts equal to the estimated collection losses based on historical experience coupled with a review of the current status of existing receivables. |

Inventories |

The Company reviews the movement of inventories on an item-by-item basis to determine the value of items which are slow moving. After considering the potential for near term product engineering changes and/or technological obsolescence and current realizability due to changes in returns and price protection policies, the Company determines the need for an inventory valuation allowance. The allowance was $78 and $115 as of September 30, 2002 and 2001, respectively. |

Property, Equipment And Improvements |

Depreciation and amortization are computed using straight-line and accelerated method over the following estimated useful lives: |

| | | Estimated Useful Life | |

| Vehicles | 1-5 years | ||

| Computer equipment | 5 years | ||

| Furniture and fixtures | 7 years | ||

| Leasehold improvements | 5 years |

F-10

| SYSCOMM INTERNATIONAL CORPORATION AND SUBSIDIARIES |

| Notes To Consolidated Financial Statements (Continued) |

Impairment losses on long-lived assets, such as equipment and improvements, are recognized when events or changes in circumstances indicate that the undiscounted cash flows estimated to be generated by such assets are less than their carrying value and, accordingly, all or a portion of such carrying value may not be recoverable. Impairment losses are then measured by comparing the fair value of assets to their carrying amounts. |

Goodwill |

Income Taxes |

Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. The income tax provision or credit is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities. |

Net Earnings (Loss) Per Common Share |

Since the Company had net losses in 2002, 2001 and 2000, the assumed effects of the exercise of employee stock options for the purchase of 344, 16 and 0 common shares outstanding at September 30, 2002, 2001 and 2000, respectively, would have been anti-dilutive. |

F-11

| SYSCOMM INTERNATIONAL CORPORATION AND SUBSIDIARIES |

| Notes To Consolidated Financial Statements (Continued) |

Cash And Cash Equivalents |

Fair Value Of Financial Instruments |

Impact Of Recently Issued Accounting Standards |

In June 2002, the Financial Accounting Standards Board issued Statement No. 146, "Accounting for Costs Associated With Exit or Disposal Activities" ("SFAS 146"). SFAS 146 nullifies the consensus in Emerging Issues Task Force Issue No. 94-3, "Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in Restructuring)," and requires that a liability for the cost associated with an exit or disposal activity be recognized when the liability is incurred, as opposed to the date of an entity's commitment to an exit plan. The provisions of SFAS 146 are effective for exit or disposal activities that are initiated after December 31, 2002. The Company does not expect the adoption of SFAS 146 to have a significant financial impact on its consolidated financial statements. |

Reclassifications |

F-12

| SYSCOMM INTERNATIONAL CORPORATION AND SUBSIDIARIES |

| Notes To Consolidated Financial Statements (Continued) |

Note 2 – Acquisition