Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007 |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission File Number: 001-32715

INTERLEUKIN GENETICS, INC.

(Name of Registrant in its Charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 94-3123681

(I.R.S. Employer

Identification No.) |

135 Beaver Street, Waltham, MA

(Address of principal executive offices) |

|

02452

(Zip Code) |

Registrant's Telephone Number:(781) 398-0700 |

Securities registered pursuant to Section 12(b) of the Exchange Act: |

Common Stock, $0.001 par value

per share |

|

American Stock Exchange

and

Boston Stock Exchange |

Securities registered pursuant to Section 12(g) of the Exchange Act: |

Common Stock, $0.001 par value per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YESo NOý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YESo NOý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YESý NOo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-Ký.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YESo NOý

The aggregate market value of the registrant's voting and non-voting common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common stock was last sold as of the last business day of the registrant's most recently completed second fiscal quarter was $45,183,049.

As of March 27, 2008 there were 30,832,102 shares of the registrant's Common Stock and 5,000,000 shares of the registrant's Series A Preferred Stock, issued and outstanding.

Documents Incorporated By Reference

Portions of the registrant's Definitive Proxy Statement for the 2008 Annual Meeting of Shareholders to be held on or about June 12, 2008, are incorporated by reference in Part III hereof.

INTERLEUKIN GENETICS, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2007

Table of Contents

| PART I |

Item 1. |

|

Business |

|

3 |

Item 1A. |

|

Risk Factors |

|

20 |

Item 1B. |

|

Unresolved Staff Comments |

|

28 |

Item 2. |

|

Properties |

|

28 |

Item 3. |

|

Legal Proceedings |

|

28 |

Item 4. |

|

Submission of Matters to a Vote of Security Holders |

|

29 |

PART II |

Item 5. |

|

Market for Registrant's Common Equity and Related Stockholder Matters |

|

30 |

Item 6. |

|

Selected Consolidated Financial Data |

|

31 |

Item 7. |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

32 |

Item 7A. |

|

Quantitative and Qualitative Disclosure about Market Risk |

|

40 |

Item 8. |

|

Financial Statements and Supplementary Data |

|

40 |

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

71 |

Item 9A. |

|

Controls and Procedures |

|

71 |

Item 9A(T). |

|

Controls and Procedures |

|

73 |

Item 9B. |

|

Other Information |

|

73 |

PART III |

Item 10. |

|

Directors, Executive Officers and Corporate Governance |

|

74 |

Item 11. |

|

Executive Compensation |

|

74 |

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management |

|

74 |

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

74 |

Item 14. |

|

Principal Accountant Fees and Services |

|

74 |

PART IV |

Item 15. |

|

Exhibits and Financial Statement Schedules |

|

75 |

2

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K and, in particular, the description of our Business set forth in Item 1, the Risk Factors set forth in Item 1A and Management's Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7, and the documents incorporated by reference into this report contain or incorporate certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements contained in this report that are not statements of historical fact may be deemed to be forward-looking statements. Words or phrases such as "may," "will," "could," "should," "potential," "continue," "expect," "intend," "plan," "estimate," "anticipate," "believe," "project," "likely," "outlook," or similar words or expressions or the negatives of such words or expressions are intended to identify forward-looking statements. We base these statements on our beliefs as well as assumptions we made using information currently available to us. Such statements are subject to risks, uncertainties and assumptions, including those identified in Item 1A "Risk Factors" and elsewhere in this report, as well as other matters not yet known to us or not currently considered material by us. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Given these risks and uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements. Forward-looking statements do not guarantee future performance and should not be considered as statements of fact. All information set forth in this Form 10-K is as of the date of filing this Form 10-K and should not be relied upon as representing our estimate as of any subsequent date. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

Item 1. Business

Overview

Interleukin Genetics, Inc. is a genetics-focused personalized health company that develops preventive consumer products and genetic tests for sale to the emerging personalized health market. Our vision is to build a leading personalized health and wellness company using the science of applied genetics to empower consumers to personalize their health. We currently have two primary segments to our business. The first is a personalized health segment primarily focused on researching and developing genetic tests that leverage and target the role that genetically determined variations in the inflammatory response have on health and disease. Revenue is being generated from our Clinical Laboratory Improvement Act of 1988 (CLIA) certified lab and from sponsored research from partners (including Alticor, a related party see Note 4 to our consolidated financial statements, Item 8.). Our second segment, comprising the Interleukin brands consumer products business, focuses on developing, selling and marketing nutritional supplements and products into retail consumer channels. These two segments contribute toward our overall mission of developing tests and products that can help individuals improve and maintain their health through preventive measures. We plan to pursue improving personalized healthcare for patients by:

- •

- developing genetic risk assessment tests for use in multiple indications, countries and demographics;

- •

- processing genetic risk assessment tests in our CLIA-certified lab or in labs of sublicensees;

- •

- developing or acquiring nutritional products distributed in mass retail consumer channels, and expanding their distribution to multiple consumer channels; and

3

- •

- conducting research and development of personalized preventive and therapeutic botanicals based on individuals' genetic information.

We believe that by identifying individuals whose risk for certain chronic diseases is potentially increased due to variants in one or more genes and combining this knowledge with personalized interventions, we can help individuals improve their health outcomes. We have patents covering the influence of certain gene variations on risk for a number of common chronic diseases and conditions.

We believe that one of the great challenges confronting medicine today is to understand why some people are more prone than others to developing serious chronic diseases and why some people respond to treatments for those diseases differently than others. Until doctors are able to understand the underlying causes of such variability, the practice of medicine will remain largely constrained to the current approach of prescribing therapies based on broad recommendations in which genetically different individuals receive the same treatment.

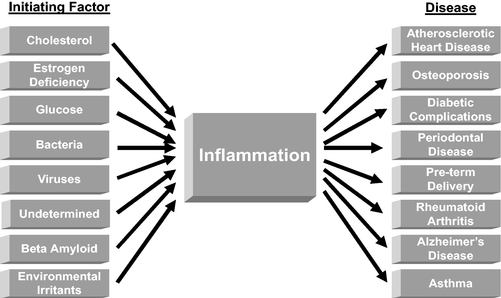

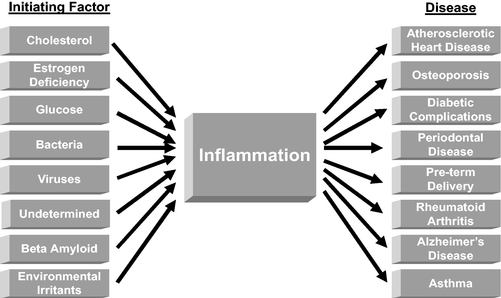

Until recently, scientific study of chronic diseases has largely focused on identifying factors that "cause" a disease. Common examples of such factors include high levels of cholesterol in the case of heart disease, bacteria in the case of periodontal disease and reduced estrogen levels in the case of osteoporosis. However, the mere presence of these initiating factors does not necessarily mean a person will develop a disease. Common diseases arise in part as a result of how our bodies respond to various environmental factors.

In March 2003, we entered into a broad strategic alliance with Alticor. Alticor has a long history of manufacturing and distributing nutritional supplements and skin care products to a worldwide market.

In August 2006, we acquired the assets and business of the Alan James Group, which develops, markets and sells nutritional products into retail consumer channels. As part of the acquisition, we acquired a portfolio of branded nutritional supplements, some of which are leaders in market share, that are distributed at leading discount retailers, drugstores, grocery stores and warehouse clubs in the United States. The Alan James Group maintains an efficient operational infrastructure, highlighted by relationships with key manufacturing, logistics, and technology partners, and an experienced marketing and product development team, who are based in Boca Raton, Florida. Future expansion in the areas of product and channel development offers us opportunities to expand and enhance its product portfolio.

The Role of Inflammation in our Genetic Test Products

One of the many benefits from the sequencing of the human genome is a new understanding of the role of genetic variations, such as single nucleotide polymorphisms (SNP) and haplotypes. Once used as a tool to help scientists decipher the human genome, SNP and haplotype analysis now is an important tool used to study the relevance of genetic variations to human health. A common SNP may cause a gene to make a different amount of a protein or to make a variant protein, both of which may lead to a discernible physiological impact. We have focused on the SNP variations associated with inflammation and have over the years conducted clinical studies involving over 20,000 individuals. During the last decade we have worked with the University of Sheffield in the United Kingdom, to identify several SNPs that influence the body's inflammatory response. We have concluded our research collaboration with the University of Sheffield, but the ten-year collaboration helped us generate several patents and the principal investigator, Dr. Gordon Duff, continues to serve as a member of our scientific advisory board. In addition, we have conducted clinical studies throughout the world to make these research findings clinically useful. Some of our clinical research collaborations include studies at the Mayo Clinic; Brigham & Women's Hospital (Harvard Medical College); University of California at San Francisco; University of California at San Diego; New York University Medical Center; University

4

of Sheffield, UK; Yonsei University Medical Center, Seoul Korea; Tongji Medical College, Wuhan China; and Tuft's University Medical Center.

Inflammation is one of the body's most ancient protective mechanisms. Over the last dozen years, understanding of the role of inflammation in several diseases has increased. It is now accepted that many chronic diseases begin with a challenge to the tissues of the body and that the inflammatory response system of an individual mediates the clinical manifestation of the disease. The following diagram reflects some of the diseases that are thought to be significantly influenced by inflammation. It is now thought that SNP variations in the genes that influence the inflammatory process can have an important impact on a person's risk/trajectory of a disease.

Inflammation is the first organized response to any injurious challenge to the body, such as a bacterial infection. It is a well-defined process that involves the migration and activation of leukocytes from the blood to the site of challenge. The objective of inflammation is to localize and destroy the deleterious agent. If the deleterious agent cannot be cleared, the inflammation becomes chronic.

There are classic inflammatory diseases, such as rheumatoid arthritis, but in recent years inflammation has been found to affect several other major diseases. For example, it is now known that chronic inflammation can influence the process that leads to acute heart attacks. If an individual has a strong inflammatory response, he or she may be more successful in clearing a bacterial infection than an individual with a less robust response. However, an individual with a strong response may actually be at increased risk for a more severe course in one or more of the chronic diseases of mid to later life, such as cardiovascular disease, osteoporosis, and Alzheimer's disease.

Historical Development

In the early 1990s, as we were beginning to focus on the importance of interleukin-1 (IL-1), Dr. Gordon Duff in the United Kingdom identified the first SNPs in the IL-1 and tumor necrosis factor alpha (TNFa) genes, and he and other investigators demonstrated that individuals with some of those variations produced higher levels of IL-1 and TNFa proteins. In 1993, we initiated research collaborations with Dr. Duff, and in 1994, we initiated a collaboration with the University of Sheffield to investigate and patent the clinical use of variations in the genes that control inflammation. We have concluded our research collaboration with the University of Sheffield, but the ten-year collaboration

5

helped us generate several patents and the principal investigator, Dr. Duff, continues to serve as a member of our scientific advisory board.

Studies by us and others have now shown that individuals who have certain IL-1 gene variations or patterns of variations tend to have increased levels of IL-1 proteins and also tend to have increased levels of other inflammatory mediators that are produced downstream of IL-1 proteins.

Individuals with another specific genotype pattern tend to have lower levels of inflammatory mediators. It is also important to note that the IL-1 gene variations on which we are focused are highly prevalent in the population, with 8-10% of the Caucasian population being homozygous (having two copies) for the less frequent variant and an estimated 30% of the Caucasian population having one copy of the gene variant. Also, up to 59% of the Caucasian population will test positive for some of the various IL-1 high-risk patterns.

Our Approach to Test Development

Our intellectual property is focused on the discoveries that link genetic variations in key inflammation genes to risk for disease. We have concentrated our efforts on variations in the genes for IL-1, since the IL-1 gene appears to be one of the strongest control points for the development and severity of inflammation. We have patents issued on single SNPs and SNP patterns in the IL-1 gene cluster as they relate to use for identifying individuals on a rapid path to chronic disease complications and use for guiding selection of preventive and therapeutic agents. Groups of IL-1 SNPs are often inherited together as patterns called haplotypes. We have a U.S. patent issued on haplotypes in the IL-1 gene cluster and their biological and clinical significance. We believe these patents are controlling relative to IL-1 SNP and haplotype patterns that would be used for genetic risk assessment tests.

Multiple genes and complex gene interactions with environmental factors determine the risk for the common diseases for which we are developing tests. We will develop a test based on our proprietary genetic factors if: a) clinical studies show that their effect has a critical and unique influence on the clinical expression of disease, or b) our genetic factors guide the development or use of preventive or therapeutic agents that modulate the specific actions of those genetic factors. In the former application, the risk effects of our genetic factors must be sufficiently powerful such that these genetic factors cannot be excluded from a test panel without substantially reducing the practical clinical usefulness of the test. For example, in patients with a history of heart disease, higher levels of inflammation (as measured by C-reactive protein) are as predictive of future heart attacks as higher levels of LDL cholesterol. We believe that our proprietary genetic variations identify healthy individuals who have a lifelong tendency to experience elevated inflammation and therefore to have higher risk for heart disease.

There are gene families that influence other non-inflammatory biological mechanisms involved in cardiovascular disease such as the genetic factors involved in cholesterol metabolism. For each targeted clinical disease area that meets our criteria, we are developing, or plan to develop, proprietary risk assessment tests that are anchored by our intellectual property plus additional candidate genes that have been validated and shown to be of value in assessing risk. Other genes to be added to a test panel may be in-licensed or may be available from the public domain. Since knowledge about the genes involved in health risks will continue to evolve over many years, we may introduce test panels that initially have our proprietary genetic factors with successive versions of additional genes. The heart health risk assessment panel introduced in the Alticor channel in 2006 involves three SNPs in two genes covered by our intellectual property. The osteoporosis risk assessment panel we are developing includes multiple SNPs covered by our intellectual property plus additional in-licensed genes that have been validated as risk factors for osteoporosis.

In the past few years, genome-wide association (GWA) studies have become possible as one approach to identify the association of many genes with specific health risks. These studies are now

6

practical due to the commercial availability of genome-wide array technologies. Most of the GWA studies are being conducted through government-funded consortia. We have access to GWA technologies and expertise through some of our collaborators. In diseases/conditions for which GWA technologies are being used in large government-funded studies, we may in-license or access publicly available SNPs for our panels. In diseases/conditions for which other GWA studies are not available, we may choose to employ GWA technologies either internally or through external collaborations to add value to our test panels. All of these technologies are dependent on high quality clinical databases, which we are collecting throughout the world for selected health risks. The use of GWA approaches to health risks is new, and data coming out of the first studies may take many years to validate.

In the past few years, the use of haplotypes has become a standard approach to genetic risk assessment for complex diseases. Haplotypes are blocks of SNPs that are inherited together from one parent and in some cases the specific block of SNPs has functional significance beyond the biological functions attributable to the individual SNPs. As recently reported studies support, the same SNP may have very different effects on gene function in different individuals depending on the haplotype context. We believe that we have expertise, experience and intellectual property related to the use of haplotypes in assessing genetic risk for complex diseases. We have recently reported that the same SNP may have very different effects on gene function in different individuals depending on the haplotype context.

We have in-licensed international rights to the use of gene variations, or genotypes, that regulate one important mechanism involved in fat metabolism. U.S. patents have been filed to cover the use of these genetic factors. When an individual consumes more calories than he or she burns, the excess energy is stored in fat cells as lipid droplets. One of the key chemicals that regulates the mobilization of fat from the lipid droplet to be burned as energy is called perilipin. Investigators at Tufts University Medical School and Tufts Human Nutrition and Research Center have identified variations in the perilipin gene that appear to regulate fat metabolism and body weight. Studies have been completed on several hundred individuals showing that women with one specific perilipin genotype weigh an average of 22 pounds more than women with another perilipin genotype. Seven clinical studies were published from 2004 through 2007 on the influence of perilipin genotypes on weight and related biological parameters. This research was conducted under the direction of Dr. Jose Ordovas, an international expert on the genetics of cardiovascular disease and on the interactions of genetics and nutrition. We have licensed rights to the use of this genetic test for weight management and for the use of this genetic information to develop nutritional products to facilitate weight management in individuals who have certain perilipin gene variations. Our collaborators have completed research which indicates that the perilipin genetic variations could be used for the medical guidance of weight management. We plan to conduct a significant amount of additional research which may lead to the development of genetic tests for this use.

In some cases, we have and may continue to develop genetic test panels that have limited or no exclusive intellectual property but meet specific needs of Alticor, our distribution partner. The general nutrition panel launched in the U.S. and under development internationally, as described below, is an example of such a test panel.

Business Strategy

Our strategy is to develop products and perform services and commercialize such products and services through strategic alliances. In the near term, we plan to build out the direct-to-consumer marketing strategy and launch new products in new channels, including in-licensing products. Our genetic testing business will continue to explore high potential markets such as weight management, osteoporosis, and arthritis. Our research and development initiatives will continue to enhance our intellectual property position, ensure commercial and technical success of our products, and develop formulary solutions that enable our partners to offer prevention and intervention therapeutics in a consumer and/or medical segment.

7

In March 2003, we entered into a broad strategic alliance with Alticor to develop and market novel genetic risk assessment tests and nutritional and skin care products. The alliance utilizes our intellectual property and expertise in genetics to develop risk assessment tests and aids Alticor in its effort to develop personalized consumer products. The alliance has included loans, equity investments, multi-year research and development agreements, the deferment of outstanding loan repayment and the refinancing of bridge financing obligations. A licensing agreement includes sales of selected genetic tests to Alticor for distribution within their channel. In addition, we receive minimal royalties on marketed Alticor nutritional products that are linked to the genetic tests.

We expect that this alliance will open our products and services to our partner's proven marketing and distribution channels (including in Asia). We believe that Alticor shares our belief that the future of personalized nutritional supplements and skin care will be based on an individual's genetic makeup. This alliance is currently focused on developing genetic risk assessment tests to determine a genetic profile of an individual and developing nutritional supplements and skin care products that will benefit individuals of that genetic profile. Our activities in the skin care field are in the planning stage.

8

Product Development Focus

We expect our revenue model to consist of: 1) fees for processing genetic risk assessment tests; 2) royalties or profit sharing from sales of genetic test products developed with and marketed by a partner; 3) fees for contract research; 4) sales of consumer products, including those acquired in our August 2006 acquisition of the business and assets of the Alan James Group; and 5) royalties from sales of supplement products licensed to commercial partners.

Products Available for Sale

Gensona Genetic Tests

We have research agreements with Alticor to develop certain genetic tests, which Alticor will market to consumers through its channels under Alticor's GENSONA® brand. In 2006, we provided two genetic risk assessment tests through Alticor. The GENSONA® Heart Health Genetic Test uses SNP testing of two genes to identify persons who may have an over-expression of inflammation and therefore may be at increased risk for cardiovascular disease. The GENSONA® General Nutrition Genetic Test identifies SNPs of potential importance in two genes that affect vitamin B metabolism and four genes involved in responding to oxidative stress. The GENSONA® tests are marketed solely through the Alticor business channel.

Nutritional Supplements

We currently market and sell a line of branded nutritional supplements, most of which have been in the market for longer than 10 years, to major discount retailers, drugstores, grocery stores and warehouse clubs in the United States. Our portfolio includes items in multiple segments, including Energy, Memory, Leg Vein Health, and Heart Health. Recognizable brand names include Ginsana®, Ginkoba®, Venastat®, Ginsana Gold Multiplex®, Optiform SAM-e® and Cransana®, which are company-owned, and Kyolic®, which is marketed under a distribution agreement with Wakunaga. In addition, we market a line of private label skincare products on an exclusive basis to General Nutrition Centers (GNC).

We maintain an efficient operational infrastructure, in which we leverage strategic relationships with contract manufacturers, logistics companies and technology partners, enabling us to source and distribute products on a competitive basis, and maintain excellent service levels with our customers. We also maintain relationships with key sales brokers, who in conjunction with our sales and support personnel, can effectively manage the product related and promotional initiatives needed to support and grow the business.

Our objectives are to increase sales, improve our operating efficiencies, and enhance our position in the market through the following key initiatives:

- •

- Increase Sales of our Existing Nutritional Supplement Products We expect to maintain and strengthen our supplement sales through a combination of targeted promotional activities at both the store and consumer levels. Specifically, we use print advertising in selected periodicals that effectively reach our target consumer, to emphasize product attributes and benefits. In addition, by using in store promotional activities, such as temporary price reductions, to coincide with our marketing initiatives, we can further enhance the value proposition offered to our consumers, stimulating both repeat purchase, and attracting new customers into our franchise.

- •

- Introduce New Products Given the dynamic nature of demand for consumer products, and the continued emphasis on vitamins, minerals, and nutritional supplements in the context of promoting health and well being, we actively seek opportunities to introduce innovative products, that have unique attributes and can establish a competitive position in the marketplace. We

9

PST® Genetic Tests

We currently out-license sales and marketing of our Periodontal Susceptibility Test (PST®) to national and international commercial partners. PST® is a genetic test that analyzes two IL-1 genes for variations that identify an individual's predisposition for over-expression of inflammation and risk for periodontal disease. We expect to review a number of business development strategies in 2008 to increase sales of PST® tests.

Product Development

Our current plan is to develop products in three categories:

Our genetic test development efforts are focused on the following programs:

- •

- IL-1 Cardiovascular Genetic Test — Asian populations and validation studies in Caucasians

- •

- Weight Management Genetic Test — North America and International populations

- •

- Obesity (from Perilipin) Genetic Test — Caucasian populations

- •

- Gastric Cancer and Atrophic Gastritis Genetic Test — In Asian populations including Japan

- •

- Osteoporosis Genetic Test — North America and International populations

- •

- Osteoarthritis Genetic Test — North America populations

10

IL-1 Cardiovascular Genetic Test

In the last decade, studies in men and women have shown that inflammation is an important risk factor for cardiovascular disease. Cardiovascular disease is the leading cause of death in North America. Recent scientific discoveries indicate that some of the risk for cardiovascular disease, including heart attacks, is due to variations in the genes that we inherit. Just as with conventional cardiovascular risk factors such as high cholesterol, smoking and diabetes, the presence of one or more of these DNA variations does not mean that an individual will develop cardiovascular disease. However, using knowledge about genetic risk factors to make informed choices about diet and lifestyle may reduce the risk of developing cardiovascular disease in the future.

Coronary artery disease (CAD) is a disease in which plaque builds up inside the coronary arteries. These arteries supply your heart muscle with oxygen-rich blood. Plaque is made up of fat, cholesterol, and other substances found in the blood. When plaque builds up in the arteries, the condition is called atherosclerosis. Over time, CAD can weaken the heart muscle and lead to heart failure and arrhythmias. CAD is the most common type of heart disease and it is the leading cause of death in the United States for both men and women. Lifestyle changes, medicines, and/or medical procedures can effectively prevent or treat CAD in most people. Over 105 million American adults have total blood cholesterol values of 200 mg/dL and higher, and 36.6 million American adults have levels of 240 or above. Doctors consider total cholesterol levels of 240 mg/dL or greater high in adults and levels from 200 to 239 mg/dL borderline-high.

Recent studies have shown that excess inflammation is as powerful a predictor of heart attacks as high LDL cholesterol levels. Our heart health genetic test analyzes two IL-1 genes for variations that identify an individual's predisposition for over-expression of inflammation and which may cause an increased risk for cardiovascular disease. This test is not intended to and does not diagnose an existing disease but rather is intended for healthy individuals to help assess their risk for future disease. The IL-1 cardiovascular genetic test is based on data from genetic association studies obtained through collaborations with experts in cardiovascular disease at leading academic institutions. This genetic test provides risk information independent of traditional risk factors, including family history, hypertension and smoking, in assessing risk for heart disease. This test panel was introduced in the Alticor North American channel in the first quarter of 2006. To date, we have determined that the high-risk patterns are commonly found in all major ethnic populations and thus far have been demonstrated to correlate strongly to disease in Caucasian populations. Other population studies are planned or in process. We have genetic association studies on cardiovascular disease in progress in Korea and China to determine how the risk assessment test will translate into other ethnic groups in specific environments.

In March 2007, results of a genetic variation study on CAD that we conducted in collaboration with the Mayo Clinic and investigators at the University of California at San Diego were presented at the American Cardiology Conference by Drs. Joseph Witztum and Sotiros Tsimikas. The results showed that in Caucasian patients with identified genetic variations as measured by the IL-1 genetic test there was a significantly increased risk of acute myocardial infarction (MI) or CAD, which is considered to be at least a fifty percent blockage of at least one vessel. Increasing levels of oxidized low-density lipoprotein (oxLDL) or lipoprotein a (Lp (a)) showed increasing risk. In patients without this genetic pattern risk remained constant over all oxLDL and Lp (a) levels. In patients within the top quartile of oxLDL the odds ratio for risk of CAD was 6.92 (p<0.00001). Confirmatory studies and studies in other ethnic populations are planned. We expect to complete these validation studies for risk of CAD in Caucasian populations in 2008.

General Nutrition Genetic Test

To function properly, cells depend on the action of a vast number of genes. Our general nutrition genetic test analyzes variations in several genes that influence how the body uses certain vitamins and

11

micronutrients. The test identifies individuals who may have altered B vitamin dependent metabolism or reduced response to oxidative stress. It analyzes two genes important to B vitamin utilization and four genes that are important in managing oxidative stress. This test, which is not proprietary, may be able to identify individuals who may benefit from particular nutritional supplements, and who may be at increased likelihood for health complications. This test is not intended to and does not diagnose a specific disease or assess a specific health condition. It is intended to provide information to individuals who are interested in knowledge that may help them make choices about the consumption of certain vitamins and anti-oxidants.

- •

- B Vitamin Genes: The genes analyzed related to B vitamin metabolism are 5-10-methylenetetrahydrofolate reductase (MTHFR) gene and the transcobalamin 2 (TCN2) gene. The variant of the MTHFR gene that was tested has been associated with less efficient activity of certain enzymes that depend on B vitamins for optimal function. The variant of the TCN2 gene that was tested has been associated with affecting the body's need for vitamin B-12 and how effectively it reaches cells.

- •

- Oxidative Stress Genes: The genes analyzed related to oxidative stress are manganese superoxide dismutase 2 (SOD2) gene, glutathione s-transferase M1 (GSTM1) gene, paroxanase 1 (PON1) gene, and x-ray repair cross complementing (XRCC1) gene. In some studies, individuals with these genetic variations have a different response to oxidative stress. Knowing genetic variations associated with nutrient and vitamin metabolism may help guide decisions about use of vitamins and anti-oxidants.

Weight Management Genetic Test — North America and International

According to the 1999-2003 National Health and Nutrition Examination Survey, an estimated 65% of adults in the U.S. are overweight (Body Mass Index >25). Overweight and obese (Body Mass Index >30) individuals are at increased risk for many diseases including heart disease, type II diabetes, and some types of cancer. Our objective is to develop a test that offers information about how specific individuals gain and maintain weight. We have developed the basic elements of a genetic test panel that identifies genetically-determined metabolic differences that may contribute to weight management. This test panel will guide nutritional and exercise choices to enhance an individual's efforts to maintain a desirable weight.

Obesity Genetic Test — North America

Obesity is the second leading cause of preventable death in the U.S. Approximately, 127 million adults in the U.S. are overweight, 60 million are obese (Body Mass Index >30) and 9 million are extremely obese (BMI >40). 65% of the people over age 20 are overweight and 30.5% are obese. The estimated annual costs of the overweight and obese population in the U.S. are $123 billion. This includes direct costs related to health care for prevention, diagnostic and treatment services of an estimated $64 billion. Indirect costs related to obesity include, among others, the value of wages lost by people unable to work because of obesity-driven illness or disability, as well as the value of future earning lost by premature death. Genetic factors play a significant role in the predisposition of individuals to developing obesity and potentially, to the successful outcome of current therapies. Obesity is a complex disease and can be attributed to both monogenic (involving a single gene) and polygenic (involving multiple genes) causes. There have been numerous reports on the association between genes and obesity phenotype, however, very few have been associated with resistance to weight loss on a low calorie diet. The perilipin gene is, therefore, unique in that specific polymorphisms in this gene have been associated with resistance to weight loss on calorie-restricted diets. Perilipin is a phosphoprotein that is found in the periphery of lipid droplets within adipocytes and plays a key role in regulating the storage and release of triglycerides. Evidence that perilipin is a candidate gene in the pathogenesis in polygenic obesity comes from both animal and clinical research. The perilipin knockout

12

mouse is lean and demonstrates resistance to the adipogenic effects of a high-fat diet. In humans, the perilipin gene is located on chromosome 15q26 which is a linkage locus for diabetes, hypertriglyceridemia and obesity. Perilipin polymorphisms have been found to be associated with anthropometric measures, risks of obesity and resistance to weight loss. Our program in obesity seeks to confirm and extend previous studies to provide information about the inherited tendencies of individuals' to dietary energy restriction and other metabolic risk parameters. Treatment or dietary strategies could be tailored to individuals, if predictive information about the response to these strategies were available.

Gastric Cancer Genetic Test — International

Gastric cancer (GC) continues to be the second most deadly cancer worldwide. It is most prevalent in East Asia, including Japan. In the high-risk geographies it is the number one or two cause of cancer deaths. In 2002, new cases of gastric cancer were estimated at 934 thousand worldwide compared to 1.2 million new cases of breast cancer. Five-year survival rates from GC are approximately 20%. The U.S. gastric cancer rate per 100,000 adult males is 8.4, compared to 62.1 in Japan, and 41.4 in China.Helicobacter pylori (HP) the primary risk factor for GC, infects approximately 70-80% of the Japanese population over age 50. Despite increased efforts at early screening, the incidence remains unacceptably high. Though there is some indication that eradication of HP with antibiotics may decrease the incidence of GC, such measures are not practical in parts of Asia where the infection rate is as high as 80% of the adult population. Screening for GC is laborious, inconvenient, and expensive. There is a need to stratify GC risk among HP positive patients, so informed decisions can be made regarding HP eradication and GC screening frequency and intensity. While lifestyle issues such as diet and cigarette smoking are environmental risk factors for GC, inflammation is a major GC risk factor. IL-1 genetic variations have been shown to be a major determinant of precancerous changes (atrophic gastritis) and GC in Caucasian populations. In the Japanese population, IL-1 genetic variations are associated with atrophic gastritis but their association with GC is less certain. Our program in gastric cancer genetics seeks to identify the key genetic determinants of GC to identify individuals at high risk for developing atrophic gastritis and GC, enabling physicians to target these patients for intensive HP eradication and/or GC screening.

Osteoporosis Genetic Test — North America and International

Osteoporosis, the most common age-related bone disease, results in a decrease in the strength of the bone that leaves the affected individual more susceptible to fractures. According to the National Institute of Health, 10 million Americans suffer from the disease and another 34 million have low bone mass, placing them at increased risk for the disease. Although osteoporosis occurs in both men and women, it begins earlier and progresses more rapidly in women after menopause. The consequences of osteoporosis can be both physical and financial. Hip and vertebral fractures, which are commonly associated with osteoporosis, have a profound impact on quality of life. We have conducted research projects with major osteoporosis centers. Results of these studies have indicated that a number of small variations in the IL-1 gene cluster, referred to as polymorphisms, are associated with a more rapid rate of bone loss and an increased risk of vertebral fracture in post-menopausal Caucasian women. A genetic risk assessment test could identify women at elevated risk for developing osteoporosis-related vertebral fracture comparatively early in the course of the disease and allow these women and their physicians to pursue risk reduction practices. This would enable nutritional or therapeutic intervention or recommendations for changes in lifestyle or diet at an early stage, so that bone loss and fractures are minimized or prevented.

We are developing an osteoporosis risk assessment test that combines the IL-1 SNPs with SNPs in other genes known to be associated with bone loss to form a test panel. This test panel has been evaluated in one of the largest clinical databases of fractures caused by osteoporosis, the Study of

13

Osteoporotic Fractures (SOF), directed out of the University of California at San Francisco. The IL-1 SNPs are proprietary to us, and other genes in the panel are either public domain or will be in-licensed as needed. Efforts to develop the osteoporosis risk assessment test and the marketing have been driven in part by our research agreement with Alticor. We have completed a genetic association study on bone changes related to osteoporosis in Japan and have studies on osteoporosis in progress in Korea to determine how the risk assessment test will translate into other ethnic groups in specific environments.

Osteoarthritis Genetic Test

Osteoarthritis (OA) is the most common adult joint disease, increasing in frequency and severity in all aging populations. The estimated U.S. prevalence is 20-40 million patients or 5 times that of rheumatoid arthritis. OA involvement of the hand, knee, hip and spine is common, with total knee replacements numbering over 250,000/yr and total hip replacements numbering over 150,000/yr in the U.S. alone. OA may involve a single joint or multiple joints in the same individual, with current therapy focused on pain relief, as there is no FDA-approved therapy that arrests or reverses the joint deterioration. The etiology of OA is multifactorial involving both mechanical and biochemical factors. OA progression is associated with accelerated cartilage degradation leading to joint space narrowing (JSN), painful joint disruption, and functional compromise. The pattern of manifestation of OA in many ways mimics that of osteoporosis in that it is more common in women than in men, and it appears to be related to postmenopausal changes with hormone replacement therapy suppressing cartilage degradation. OA disease progression is characterized by a proinflammatory gene expression pattern in cartilage and in joint synovium, with a reactive increase in bone density in the subchondral bone. Large amounts of data provide support for a central role of IL-1 in the pathogenesis of OA including animal susceptibility models, models of IL-1-targeted therapy, genetic association studies, and elevated IL-1 gene expression in patients with generalized OA. Genetic variations in the IL-1 gene cluster have been previously determined to be associated with multiple clinical phenotypes in OA. Our OA program plans to investigate if IL-1 gene variation together with several other inflammatory gene variations is associated with the occurrence of multijoint OA for the development of a genetic risk assessment test.

Research with Alticor

On February 28, 2008, we announced a new research collaboration with Access Business Group International LLC (ABG), a subsidiary of Alticor Inc. The research agreement encompasses four primary areas; osteoporosis, cardiovascular disease, nutrigenomics, and dermagenomics. We will be conducting various clinical studies, which will be fully funded by Alticor. Studies will look to correlate SNP gene variations to the risk of osteoporosis or cardiovascular disease in Asian populations. Other studies will seek to identify genetic factors that influence athletic performance and skin appearance (e.g., wrinkles, elasticity, aging) for the purpose of developing products to enhance healthy aging. Under the terms of the agreement, ABG will pay us $1.2 million during 2008 for this contract research. In addition, we will recognize approximately $800 thousand of deferred receipts, which were unused from prior research agreements with Alticor.

Skin care products comprise several different treatments to manage the appearance of the skin. The worldwide skin care products market is expected to reach more than $7 billion by 2010. Anti-aging products are expected to retain double-digit growth rates in the next several years, while sales of moisturizers and cleansers are also expected to experience good growth. Worldwide sales of products in this category were $5.8 billion in 2006.

Retail sales of sports nutritional products are expected to exceed $12.7 billion by 2011. Posting a 23% growth rate between 2005 and 2006 from $4.5 billion to $5.5 billion, the market sector is being driven by the continued trend for health and wellness and balanced eating amongst serious athletes and

14

the baby boomer generation. Sports beverages are said to be leading the sector, followed by bars, gels and supplements.

Laboratory Testing Procedure

To conduct a genetic risk assessment test, the consumer collects cells from inside the cheek on a brush and submits it by mail to our laboratory. Samples are only processed with a requisition signed from a physician. Our clinical laboratory then performs the test following our specific protocol and informs the consumer and, depending on the regulations in the particular state or (in Canada) province, his designated health care provider, of the results.

During 2004, we completed the construction of our genetic testing laboratory (for which we obtained registration under CLIA in 2005) to process the test samples. The regulatory requirements associated with a clinical laboratory are addressed under the section titled "Government Regulation." In early 2007 we obtained a clinical laboratory permit from the State of New York for our IL-1 Cardiovascular Genetic Test.

Marketing and Distribution Strategy

We market and distribute our genetic tests under the GENSONA® brand through our strategic partnership with Alticor. We market and distribute our nutritional products through major retailers. We market and distribute our PST® tests through sales and marketing partners directly to dentists and periodontists.

We intend to develop tests for partners in the pharmaceutical, biotechnology and other industries. Once tests are developed and launched, reimbursement may come from various sources including insurance, partners or directly from consumers. Under our distribution agreement with Alticor, Alticor pays us directly for the processed tests. If in the future we develop products that are sold through the medical channel, our ability to successfully commercialize these products may depend on obtaining adequate reimbursement from third-party payers.

Partnerships with Academic Researchers

We have (or have had) research collaborations at the University of Sheffield (UK), Tufts University, New York University, Harvard University, the Mayo Clinic, California Pacific Medical Center, Boston University, the University of Arkansas, Tongji Medical College (China) and Yonsei University (Korea). Through these collaborations, we have been able to take advantage of research conducted by these third parties in connection with the development of our genetic risk assessment tests and other possible products.

Intellectual Property

Our intellectual property and proprietary technology are subject to numerous risks, which we discuss in the section entitled "Risk Factors" of this report. Our commercial success may depend at least in part on our ability to obtain appropriate patent protection on our therapeutic and diagnostic products and methods. We currently own rights in twenty issued U.S. patents, which have expiration dates between 2015 and 2020, and have twenty-one additional U.S. patent applications pending, which are based on novel genes or novel associations between particular gene sequences and certain inflammatory diseases, and disorders. Of the twenty issued U.S. patents, sixteen relate to genetic tests for periodontal disease, osteoporosis, asthma, coronary artery disease, sepsis and other diseases associated with IL-1 inflammatory haplotypes.

We have been granted a number of corresponding foreign patents and have a number of foreign counterparts of our U.S. patents and patent applications pending.

15

In addition, through our Alan James Group subsidiary, which we acquired in August 2006, we own a portfolio of nutritional products brands, including Ginkoba®, Ginsana®, and Venastat®. We have received trademark protection for PST®, our periodontal genetic risk assessment test.

Competition

The competition in the field of personalized health is defined, but the markets and customer base are not well established. There are a number of companies involved in identifying and commercializing genetic markers. The companies differ in product end points and target customers. The companies in the industry break down into four sectors, including, 1) predictive medicine companies, 2) SNP discovery companies, 3) personalized health companies, and 4) technology platform companies.

Our potential competitors in the United States and abroad are numerous and include, among others, major pharmaceutical and diagnostic companies, specialized biotechnology firms, universities and other research institutions. Many of our potential competitors have considerably greater financial, technical, marketing and other resources than we have, which may allow these competitors to discover important genes or successfully commercialize these discoveries before us. If we do not discover genes that are linked to a health risk, characterize their functions, develop genetic tests and related information services based on such discoveries, obtain regulatory and other approvals, and launch these services or products before competitors, we could be adversely affected. Additionally, some of our competitors receive data and funding from government agencies. To the extent our competitors receive data and funding from those agencies at no cost to them, they may have a competitive advantage over us.

In the case of newly introduced products requiring "change of behavior" (such as genetic risk assessment tests), the presence of multiple competitors may accelerate market acceptance and penetration through increasing awareness. Moreover, two different genetic risk assessment tests for the same disease may in fact test or measure different components, and thus, actually be complementary when given in parallel as an overall assessment of risk, rather than being competitive with each other.

Furthermore, the primary focus of most companies in the field is performing gene-identification research for pharmaceutical companies for therapeutic purposes, with genetic risk assessment testing being a secondary goal. In contrast, our primary business focus is developing and commercializing genetic risk assessment tests for health risks and forward-integrating these tests with additional products and services.

The business of manufacturing, distributing and marketing nutritional supplements is highly competitive. Many of our competitors are substantially larger and have greater financial resources with which to manufacture and market their products. The barriers to competition are low in the nutritional products markets because the products are generally not protected by patents. In particular, the retail segment is highly competitive. In many cases, competitors are able to offer price incentives for retail purchasers and establish frequent buyer programs for consumers. Some retail competitors also manufacture their own products and therefore they have the ability and financial incentive to promote sales of their own products. Our ability to remain competitive depends on the successful introduction and addition of new offerings to our product line. We will also continue to focus on increased sales and marketing of our current products.

Government Regulation

The genetic risk assessment tests that we are developing and our current and future nutritional supplements will be subject to regulation by governmental entities.

16

Genetic Testing

CLIA

CLIA provides for the regulation of clinical laboratories by the United States Department of Health and Human Services. CLIA requires the certification of clinical laboratories that perform tests on human specimens and imposes specific conditions for certification. CLIA is intended to ensure the accuracy, reliability and timeliness of patient test results performed in clinical laboratories in the United States by mandating specific standards in the areas of, among other things, personnel qualification, administration participation in proficiency testing, patient test management, quality control, quality assurance and inspections. CLIA contains guidelines for the qualification, responsibilities, training, working conditions and oversight of clinical laboratory employees. In addition, specific standards are imposed for each type of test that is performed in a laboratory. The categorization of commercially marketedin vitro diagnostic tests marketed under CLIA is the responsibility of the FDA. The FDA will assign commercially marketed test systems into one of three CLIA regulatory categories based on their potential risk to human health. Tests will be designated as waived, of moderate complexity or of high complexity. CLIA and the regulations promulgated there under are enforced through quality inspections of test methods, equipment, instrumentation, materials and supplies on a periodic basis. Our commercial laboratory is CLIA-certified for high complexity tests, such as genetic tests.

Other Laboratory Regulations

CLIA does not preempt state laws that are more stringent than federal law. Some states independently regulate clinical laboratories and impose standards and requirements in addition to or more stringent than the CLIA regulations. Moreover, some states impose regulations on out-of-state laboratories that conduct tests on their residents. Finally, some foreign jurisdictions may also impose regulations on how we process tests for their residents. We are required to comply with all applicable laboratory regulations.

Food and Drug Administration

The FDA regulates the sale and distribution of medical devices, including in vitro diagnostic test kits, in interstate commerce. The information that must be submitted to the FDA in order to obtain clearance or approval to market a new medical device varies depending on how the medical device is classified by the FDA and its intended use. Medical devices are classified into one of three classes on the basis of the controls deemed by the FDA to be necessary to reasonably ensure their safety and effectiveness. Class I devices are subject to general controls, including labeling, pre-market notification and adherence to FDA's quality system regulations, which are device-specific good manufacturing practices. Class II devices are subject to general controls and special controls, including performance standards and post-market surveillance. Class III devices are subject to most of the previously identified requirements and to pre-market approval. Most in vitro diagnostic kits are regulated as Class I or II devices. Entities that fail to comply with FDA requirements may be subject to enforcement actions, such as recalls, detentions, orders to cease manufacturing and restrictions on labeling and promotion or approval or clearance of new products. In addition, those entities may be subject to criminal and civil penalties.

The FDA presently requires clearance or approval of most diagnostic test kits that are sold to labs, hospitals and doctors, because those kits are considered to be medical devices. However, diagnostic tests that are developed and performed by a CLIA-certified reference laboratory, also known as "home-brew," "in-house" or "laboratory-developed" tests, generally have been considered clinical laboratory services.

17

The FDA has consistently claimed that it has the regulatory authority to regulate laboratory-developed tests that are validated by the developing laboratory. However, it has generally exercised enforcement discretion in not otherwise regulating most tests developed by CLIA-certified laboratories. Recently, the FDA indicated that it was reviewing the regulatory requirements that will apply to laboratory-developed tests, and in September 2006, it published a draft guidance document, which it revised in July 2007, or the Draft Guidance, that may be relevant to tests developed by us. The Draft Guidance describes the FDA's current thinking about potential regulation ofIn Vitro Diagnostic Multivariate Index Assays, or IVDMIAs, and the revision provided additional examples of the types that would be subject to the Draft Guidance. An IVDMIA is defined by the FDA as a device that combines the values of multiple variables using an interpretation function to yield a single patient-specific result intended for use in the diagnosis of a disease or other condition or is used in the cure, mitigation, treatment, or prevention of disease, and provides a result whose derivation is non-transparent and cannot be independently derived or verified by the end user. The FDA has indicated that it believes that most IVDMIAs will be either Class II or III devices.

The first version of the Draft Guidance and related discussions about IVDMIAs have attracted the attention of the U.S. Congress and in March 2007, the Laboratory Test Improvement Act was introduced in the U.S. Senate. The Bill, if enacted into law, would mandate that all providers of laboratory-developed tests provide evidence to the FDA that verifies the analytical validity of such tests. It would also require the development of a mechanism for the enhanced reimbursement of cleared and approved in vitro diagnostic products and laboratory-developed tests. The Bill was referred to committee and no further action has been taken as of the date of this annual report.

Although we are not currently offering or developing IVDMIAs, the FDA's interest in or actual regulation of laboratory-developed tests or increased regulation of the medical devices used in laboratory-developed testing could lead to periodic inquiry letters from the FDA and increased costs and delays in introducing new tests, including genetic tests. It is possible that a changing regulatory climate could someday require regulatory clearance or approval prior to the launch of genetic risk assessment tests, which could have a material adverse effect on our business.

HIPAA Compliance and Privacy Protection

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) established for the first time comprehensive federal protection for the privacy and security of health information. The HIPAA standards apply to three types of organizations ("Covered Entities"): health plans, health care clearing houses, and health care providers who conduct certain health care transactions electronically. Covered Entities must have in place administrative, physical and technical standards to guard against the misuse of individually identifiable health information. Additionally, some state laws impose privacy protections more stringent than those of HIPAA. There are also international privacy laws, such as the European Data Directive, that impose restrictions on the access, use, and disclosure of health information. Any of these laws may impact our business. We are not currently a Covered Entity subject to the HIPAA privacy and security standard. It is possible that in the future we will become a Covered Entity (for example if any of the tests that we perform become reimbursable by insurers). Regardless of our own Covered Entity status, HIPAA may apply to our customers.

Dietary Supplements

The manufacturing, processing, formulation, packaging, labeling and advertising of our nutritional products are subject to regulation by a number of federal agencies, including the FDA and the Federal Trade Commission (FTC). Our activities are also regulated by various state and local agencies where our products are sold.

18

FDA

The FDA is primarily responsible for the regulation of the manufacturing, labeling and sale of our nutritional products as "dietary supplements." The Dietary Supplement Health and Education Act of 1994 (DSHEA) amended the Federal Food, Drug and Cosmetic Act by defining dietary supplements, which include vitamins, minerals, nutritional supplements and herbs, and by providing a regulatory framework to ensure safe, quality dietary supplements and the dissemination of accurate information about such products. Dietary supplements are regulated as foods under DSHEA and the FDA is generally prohibited from regulating the active ingredients in dietary supplements as food additives, or as drugs unless product claims trigger drug status. Generally, dietary ingredients not used in dietary supplements marketed before October 15, 1994, the date of DSHEA's enactment, require pre-market submission to the FDA of evidence of a history of their safe use, or other evidence establishing that they are reasonably expected to be safe. There can be no assurance that the FDA will accept the evidence of safety for any new dietary ingredient that we may decide to use. FDA's refusal to accept such evidence could result in regulation of such dietary ingredients as food additives, requiring FDA approval based on newly conducted, costly safety testing.

DSHEA provides for specific nutritional labeling requirements for dietary supplements and permits substantiated, truthful and non-misleading statements of nutritional support to be made in labeling, such as statements describing general well being from consumption of a dietary ingredient or the role of a nutrient or dietary ingredient in affecting or maintaining structure or function of the body. There can be no assurance that the FDA will not consider particular labeling statements used by us to be drug claims rather than acceptable statements of nutritional support, necessitating the preparation and submission by us of a costly new drug application. It is also possible that the FDA could allege false statements were submitted to it if structure/function claim notifications were either non-existent or so lacking in scientific support as to be plainly false.

In addition, the DSHEA authorizes the FDA to promulgate current good manufacturing practices (cGMPs) specific to the manufacture of dietary supplements, to be modeled after food cGMPs. We currently use a third-party manufacturer for our dietary supplement products, which manufacturer must comply with food cGMPs.

Dietary supplements are also subject to the Nutrition, Labeling and Education Act (NLEA), which regulates health claims, ingredient labeling and nutrient content claims characterizing the level of a nutrient in a product. NLEA prohibits the use of any health claim for dietary supplements unless the health claim is supported by significant scientific agreement and is pre-approved by the FDA.

In certain markets, including the United States, claims made with respect to dietary supplements may change the regulatory status of our products. For example, in the United States, the FDA could possibly take the position that claims made for some of our products make those products new drugs requiring approval or compliance with a published FDA over the counter (OTC) monograph. If the FDA were to assert that our product claims cause them to be considered new drugs or fall within the scope of OTC regulations, we would be required to, file a new drug application, comply with the applicable monographs, or change the claims made in connection with those products.

The FTC regulates the marketing practices and advertising of all our products. In recent years, the FTC instituted enforcement actions against several dietary supplement companies for false and misleading marketing practices and advertising of certain products. These enforcement actions have resulted in consent decrees and monetary payments by the companies involved. Although the FTC has never threatened an enforcement action against us for the advertising of our products, there can be no assurance that the FTC will not question the advertising for our products in the future.

We believe that we are currently in compliance with all applicable government regulations. We cannot predict what new legislation or regulations governing our operations will be enacted by

19

legislative bodies or promulgated by agencies that regulate its activities or what changes in interpretations of existing regulations may be adopted by the FDA or the FTC.

Other Information

Our executive offices are located at 135 Beaver Street, Waltham, Massachusetts 02452, and our telephone number is (781) 398-0700. We were incorporated in Texas in 1986 and we re-incorporated in Delaware in March 2000. We maintain a website at www.ilgenetics.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to such reports are available to you free of charge through the Investor Relations Section of our website as soon as practicable after such materials have been electronically filed with, or furnished to, the Securities and Exchange Commission. The information contained on our website is not incorporated by reference into this Form 10-K. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Item 1A. Risk Factors

The market for personalized health generally and genetic risk assessment tests in particular is unproven.

Competition in the field of personalized health is defined, but the markets and customer base are not well established. Adoption of technologies in this emerging field requires substantial market development. Although our primary customer, Alticor, has begun to develop the direct-to-consumer marketing personalized health, the overall market is unproven and there can be no assurance that other channels for marketing our products can be developed. As a result, there can be no assurance that our products will be successful upon launch or that they can be sold at sufficient volumes to make them profitable. If our potential customers do not accept our products, or take a longer time to accept them than we anticipate, it will reduce our anticipated sales, resulting in additional losses to us.

The market for genetic risk assessment tests, as part of the field of personalized health, is at an early stage of development and may not continue to grow. The scientific community, including us, has only a limited understanding of the role of genes in predicting disease. When we identify a gene or genetic marker that may influence risk for disease, we conduct clinical trials to confirm the initial scientific discovery and to establish the scientific discovery's clinical utility in the marketplace. The results of these clinical trials could limit or delay our ability to bring a test to market, reduce a test's acceptance by our potential customers or cause us to cancel the program, any of which would limit or delay sales and cause additional losses to us. The marketplace may never accept our products, and we may never be able to sell our products at a profit. Further, we may not complete development of or commercialize our other genetic risk assessment tests.

The success of our genetic risk assessment tests will depend upon their acceptance as being medically useful and cost-effective by patients, physicians and other members of the medical community, as well as third-party payers, such as insurance companies and the government. Our efforts to commercialize our intellectual property have had little success outside of the Alticor channel to date. We can only achieve broad market acceptance with substantial education about the benefits and limitations of genetic risk assessment tests.

Technological changes may cause our tests to become obsolete.

We have to date focused our efforts on genetic tests based on a small number of candidate genes. It is now possible to use array technology to conduct whole genome association studies for risk assessment, which may make our technologies obsolete. To date, our tests have been developed on behalf of, and marketed to, our primary customer, Alticor. In order to develop new customers and markets for our genetic risk assessment tests, we will be required to invest substantial additional capital and other resources into further developing these tests.

20

We currently have only one customer for our genetic risk assessment tests and it is our largest shareholder and the sole distributor for our tests.

To date, we have had only one customer for our genetic risk assessment tests, Alticor, which is also our largest stockholder and the sole distributor for our tests. We have limited experience and capabilities with respect to distributing, marketing and selling genetic risk assessment tests. We have relied and plan to continue to rely significantly on our sales, marketing and distribution arrangements with Alticor, which seek to leverage Alticor's established marketing and distribution channels. If Alticor does not successfully market our products, sales will decrease and our losses will increase. We may attempt to negotiate marketing and distribution agreements with third parties, although there can be no assurances we will be able to do so. As a result of our dependence upon Alticor, in some cases, we have and may continue to dedicate our resources toward the development of genetic test panels that have limited or no exclusive intellectual property benefit to us, but meet specific needs of Alticor.

Our consumer products business is heavily concentrated in one customer.

We currently market and sell our line of branded nutritional supplements to major discount retailers, drugstores, grocery stores and warehouse clubs in the United States, but 47% of our revenues in this business segment is derived from sales to one customer. In addition, we market a line of private label skincare products on an exclusive basis to GNC. Since this business is dependent upon consumers, we rely on one customer to a large extent to assist us in our promotional and advertising materials, as well as placement of our products in its stores. We are challenged constantly to develop innovative ways to maintain the interest and attention of our existing consumers and attract new consumers, thereby enhancing our largest customer's interest in marketing and distributing our products. Further, we are reliant upon contract manufacturers, logistics companies and technology partners to source and distribute these nutritional products. In each case, problems with these third parties could result in manufacturing, logistical, sourcing and distribution problems that could have a material adverse effect on our consumer products business.

The profitability of our consumer products businesses may suffer if we are unable to establish and maintain close working relationships with our customers.

For the year ended December 31, 2007, approximately 71% of our revenues were derived from our consumer products business, which consists of developing, marketing and selling nutritional supplements and products into retail consumer channels. This business relies to a great extent on close working relationships with our customers, rather than long-term exclusive contractual arrangements. Customer concentration in this business is relatively high and one customer accounted for approximately 47% of our revenues in that business. In addition, customers of our branded and private label consumer products, generally large food, drug and mass retailers, purchase those products through purchase orders only and are not obligated to make future purchases. We therefore rely on our ability to deliver quality products on time in order to retain existing and generate new customers. If we fail to meet our customers' needs or expectations, whether due to manufacturing issues that affect quality or capacity issues that result in late shipments, we will harm our reputation and customer relationships and likely lose customers. Additionally, if we are unable to maintain close working relationships with our customers, sales of all of our products and our ability to successfully launch new products could suffer. The loss of a major customer and the failure to generate new accounts could significantly reduce our revenues or prevent us from achieving projected growth.

We have a history of operating losses and expect these losses to continue in the future.

We have experienced significant operating losses since our inception and expect these losses to continue for some time. We incurred losses from operations of $6.1 million in 2005, $6.5 million in 2006 and $5.9 million in 2007. As of December 31, 2007, our accumulated deficit was $74.4 million.

21

Our losses result primarily from research and development, selling, general and administrative expenses and amortization of intangible assets. Although we have recently begun to generate revenues from sales of our genetic risk assessment tests and nutritional products, these may not be sufficient to result in net income in the foreseeable future. We will need to generate significant revenue to continue our research and development programs and achieve profitability. We cannot predict when, if ever, we will achieve profitability.

We are subject to government regulation, which may significantly increase our costs and delay introduction of future products.