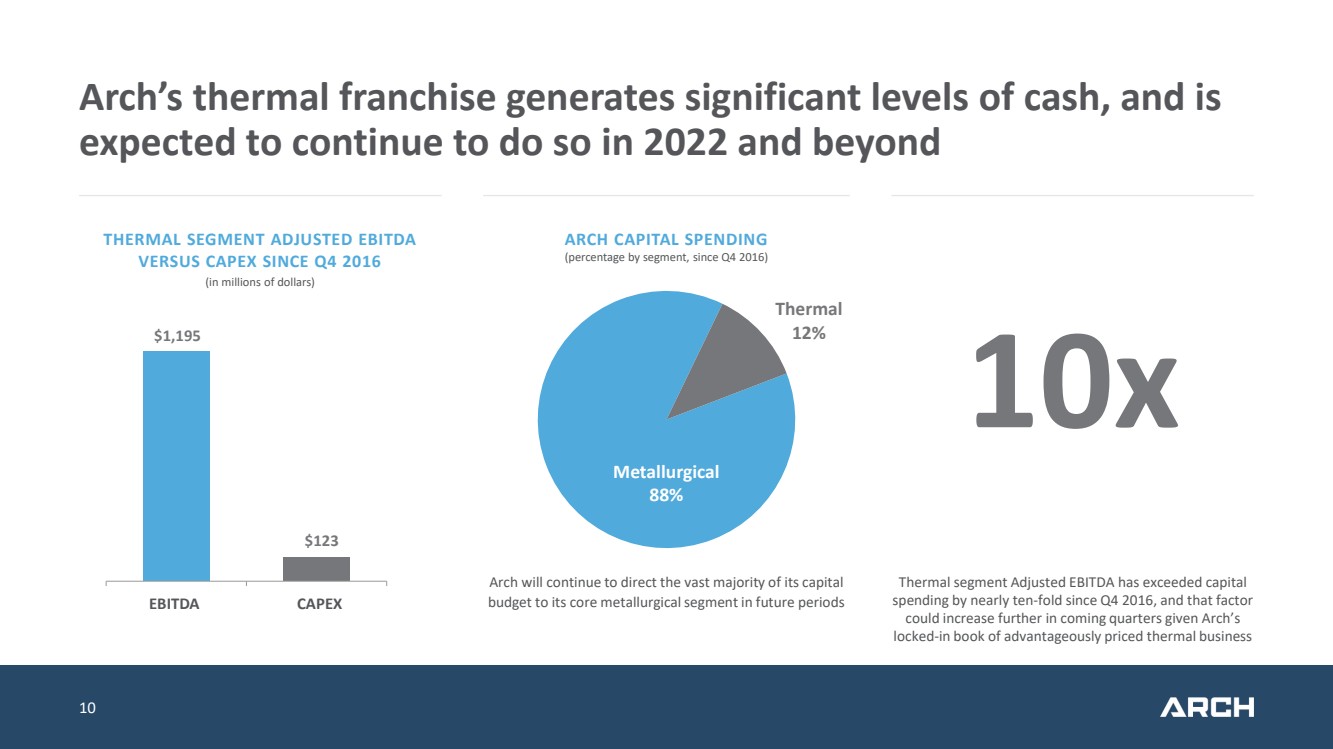

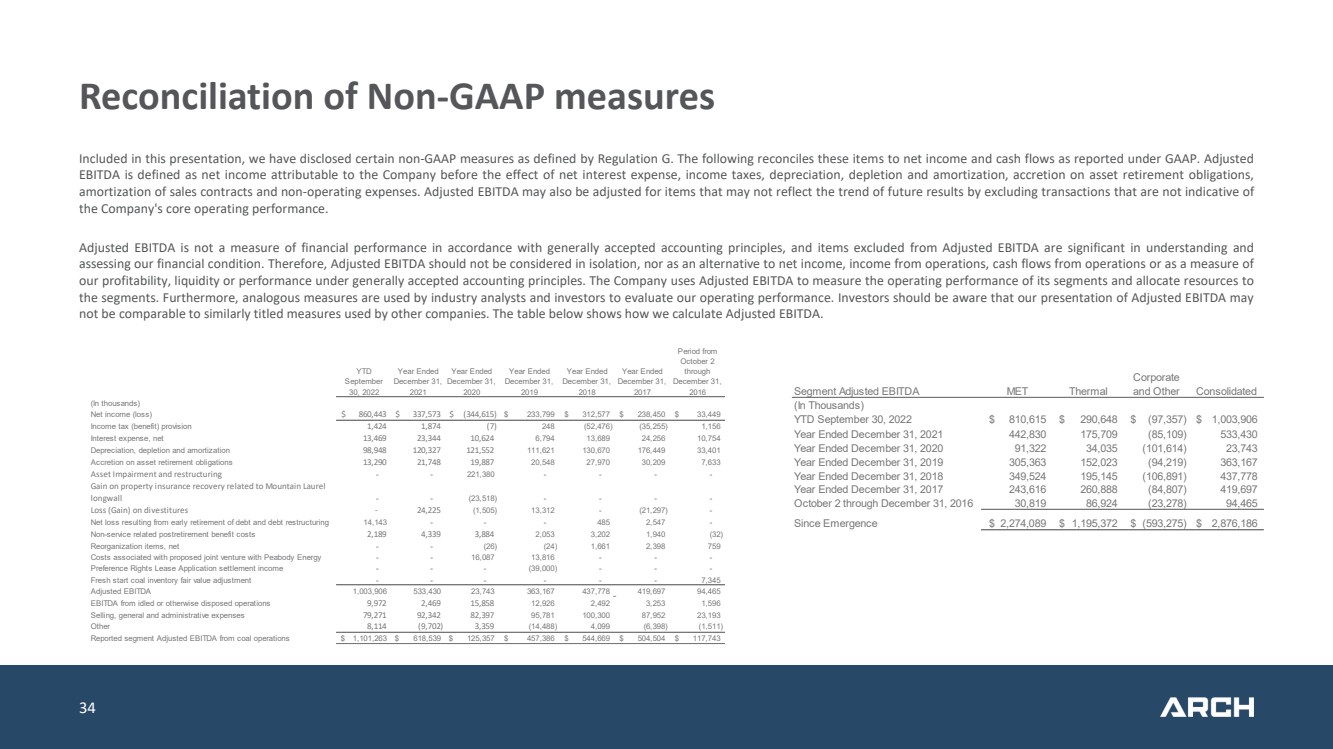

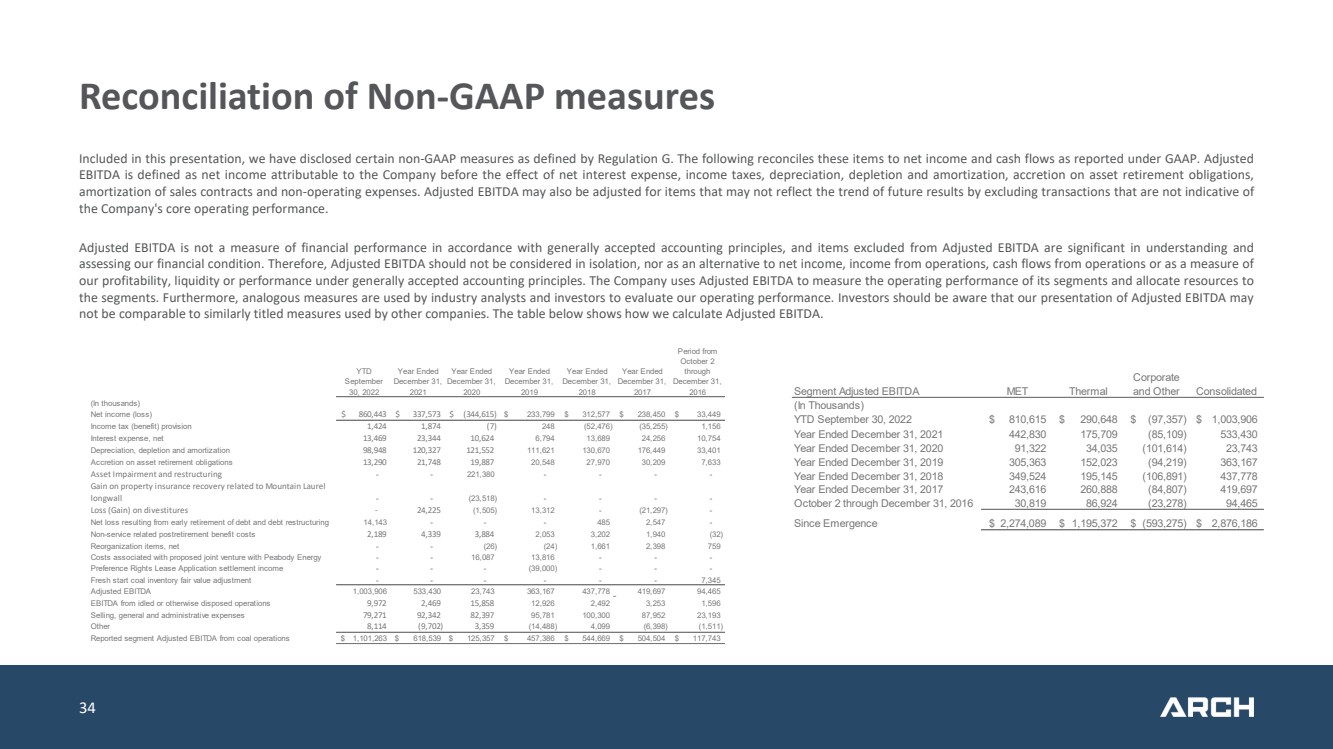

| 34 Reconciliation of Non - GAAP measures Included in this presentation, we have disclosed certain non - GAAP measures as defined by Regulation G .. The following reconciles these items to net income and cash flows as reported under GAAP .. Adjusted EBITDA is defined as net income attributable to the Company before the effect of net interest expense, income taxes, depreciation, depletion and amortization, accretion on asset retirement obligations, amortization of sales contracts and non - operating expenses .. Adjusted EBITDA may also be adjusted for items that may not reflect the trend of future results by excluding transactions that are not indicative of the Company's core operating performance .. Adjusted EBITDA is not a measure of financial performance in accordance with generally accepted accounting principles, and items excluded from Adjusted EBITDA are significant in understanding and assessing our financial condition .. Therefore, Adjusted EBITDA should not be considered in isolation, nor as an alternative to net income, income from operations, cash flows from operations or as a measure of our profitability, liquidity or performance under generally accepted accounting principles .. The Company uses Adjusted EBITDA to measure the operating performance of its segments and allocate resources to the segments .. Furthermore, analogous measures are used by industry analysts and investors to evaluate our operating performance .. Investors should be aware that our presentation of Adjusted EBITDA may not be comparable to similarly titled measures used by other companies .. The table below shows how we calculate Adjusted EBITDA .. YTD September 30, 2022 Year Ended December 31, 2021 Year Ended December 31, 2020 Year Ended December 31, 2019 Year Ended December 31, 2018 Year Ended December 31, 2017 Period from October 2 through December 31, 2016 (In thousands) Net income (loss) 860,443 $ 337,573 $ (344,615) $ 233,799 $ 312,577 $ 238,450 $ 33,449 $ Income tax (benefit) provision 1,424 1,874 (7) 248 (52,476) (35,255) 1,156 Interest expense, net 13,469 23,344 10,624 6,794 13,689 24,256 10,754 Depreciation, depletion and amortization 98,948 120,327 121,552 111,621 130,670 176,449 33,401 Accretion on asset retirement obligations 13,290 21,748 19,887 20,548 27,970 30,209 7,633 Asset Impairment and restructuring - - 221,380 - - - - Gain on property insurance recovery related to Mountain Laurel longwall - - (23,518) - - - - Loss (Gain) on divestitures - 24,225 (1,505) 13,312 - (21,297) - Net loss resulting from early retirement of debt and debt restructuring 14,143 - - - 485 2,547 - Non-service related postretirement benefit costs 2,189 4,339 3,884 2,053 3,202 1,940 (32) Reorganization items, net - - (26) (24) 1,661 2,398 759 Costs associated with proposed joint venture with Peabody Energy - - 16,087 13,816 - - - Preference Rights Lease Application settlement income - - - (39,000) - - - Fresh start coal inventory fair value adjustment - - - - - - 7,345 Adjusted EBITDA 1,003,906 533,430 23,743 363,167 437,778 419,697 94,465 EBITDA from idled or otherwise disposed operations 9,972 2,469 15,858 12,926 2,492 3,253 1,596 Selling, general and administrative expenses 79,271 92,342 82,397 95,781 100,300 87,952 23,193 Other 8,114 (9,702) 3,359 (14,488) 4,099 (6,398) (1,511) Reported segment Adjusted EBITDA from coal operations 1,101,263 $ 618,539 $ 125,357 $ 457,386 $ 544,669 $ 504,504 $ 117,743 $ Segment Adjusted EBITDA MET Thermal Corporate and Other Consolidated (In Thousands) YTD September 30, 2022 810,615 $ 290,648 $ (97,357) $ 1,003,906 $ Year Ended December 31, 2021 442,830 175,709 (85,109) 533,430 Year Ended December 31, 2020 91,322 34,035 (101,614) 23,743 Year Ended December 31, 2019 305,363 152,023 (94,219) 363,167 Year Ended December 31, 2018 349,524 195,145 (106,891) 437,778 Year Ended December 31, 2017 243,616 260,888 (84,807) 419,697 October 2 through December 31, 2016 30,819 86,924 (23,278) 94,465 Since Emergence 2,274,089 $ 1,195,372 $ (593,275) $ 2,876,186 $ |