UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to Section 240.14a-12 |

Priority Healthcare Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

This filing consists of PowerPoint presentation slides and a transcript of a presentation by Express Scripts, Inc. recorded on DVD, which will be made available to be shown to all Priority Healthcare Corporation employees, on or after Wednesday, August 3, 2005, relating to the Agreement and Plan of Merger, dated as of July 21, 2005, by and among Express Scripts, Inc., Pony Acquisition Corporation, and Priority Healthcare Corporation.

The Model for Industry Leadership

George Paz

President & CEO Express Scripts

Dom Meffe

CEO, CuraScript

SVP Specialty Pharmacy, Express Scripts

2

Congratulations to Priority Healthcare

You’ve built one of the most respected healthcare service companies in the country.

3

Why We’re Here

To welcome you and to share with you:

Overview of Express Scripts/CuraScript Our vision for how Priority Healthcare will complement our value proposition Our culture Information about the acquisition process

4

Why Priority Healthcare

Specialty medications are the fastest growing segment of healthcare spend - our job is to help clients manage this spend

We can build one of the largest and most comprehensive platform for specialty pharmacy services by adding your expertise to our core offering

5

Express Scripts Overview

6

Our Value Proposition

We make the use of prescription drugs safer and more affordable…

7

Our Culture

People are our product…intelligence, diversity and passion

A “whatever it takes” service culture… internal commitment to teamwork and patient care

Uncompromising integrity

8

Our Clients

Managed care organizations

Commercial insurers

Self funded employers

Unions and Taft Hartley Funds

State and federal government programs

9

Our Products

Retail network management

Home delivery

Generic penetration programs

Formulary management

Step therapy programs

Specialty pharmacy services

10

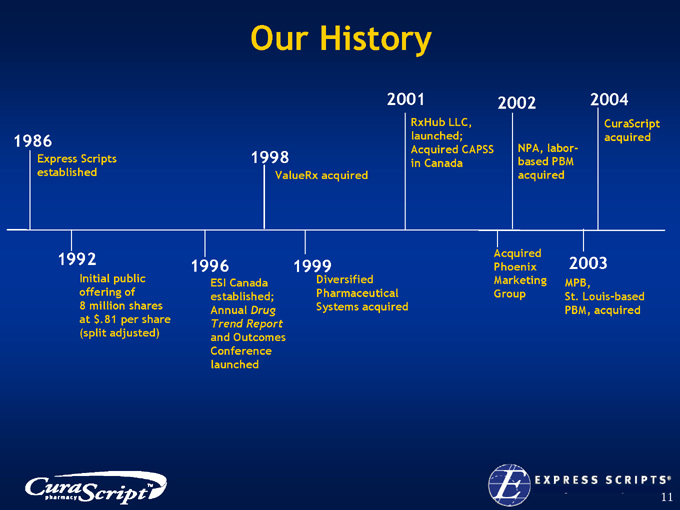

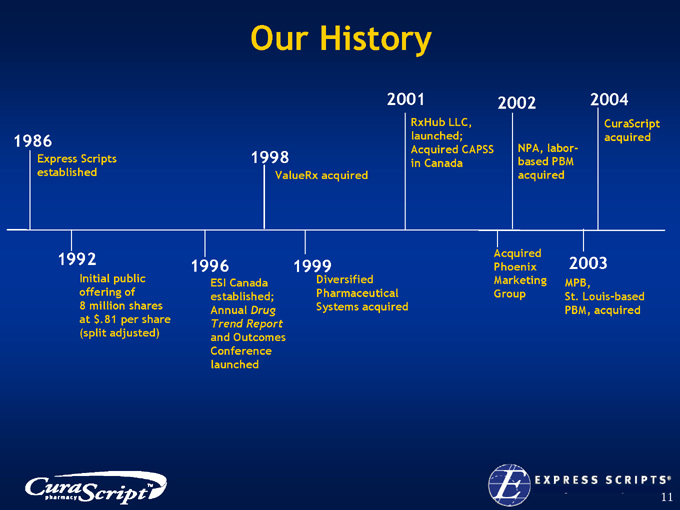

Our History

1986

Express Scripts established

1992

Initial public offering of 8 million shares at $.81 per share (split adjusted)

1996

ESI Canada established; Annual Drug Trend Report and Outcomes Conference launched

1998

ValueRx acquired

1999

Diversified Pharmaceutical Systems acquired

2001

RxHub LLC, launched; Acquired CAPSS in Canada

2002

NPA, labor-based PBM acquired

Acquired Phoenix Marketing Group

2003

MPB,

St. Louis-based PBM, acquired

2004

CuraScript acquired

11

Express Scripts at a Glance - 2004

We’re #137 on the Fortune 500

Revenues $15.1 Billion

Employees 11,000

12

Express Scripts With Priority Healthcare

Revenues $16.8 Billion

Employees 12,900

13

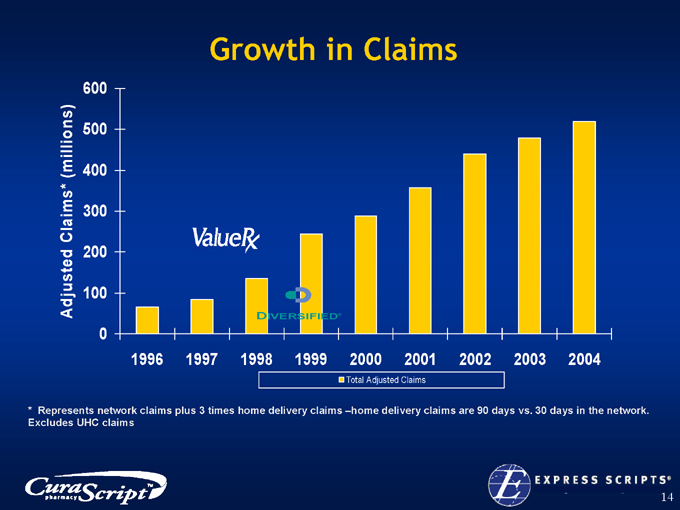

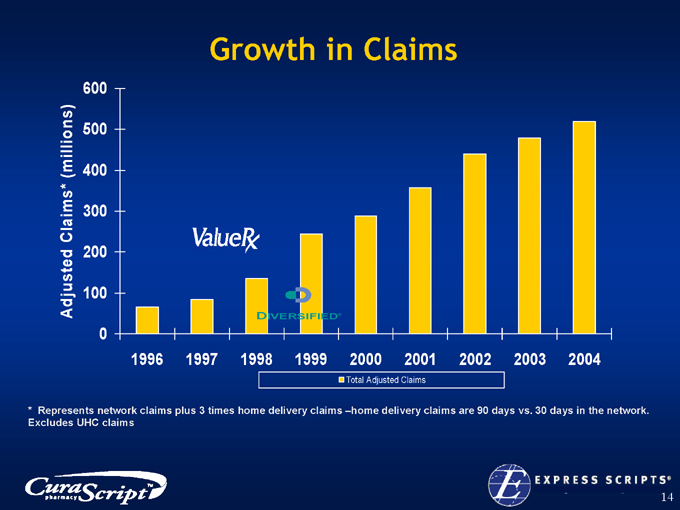

Growth in Claims

Adjusted Claims* (millions)

600 500 400 300 200 100 0

1996 1997 1998 1999 2000 2001 2002 2003 2004

DIVERSIFIED®

Total Adjusted Claims

* Represents network claims plus 3 times home delivery claims –home delivery claims are 90 days vs. 30 days in the network.

Excludes UHC claims

14

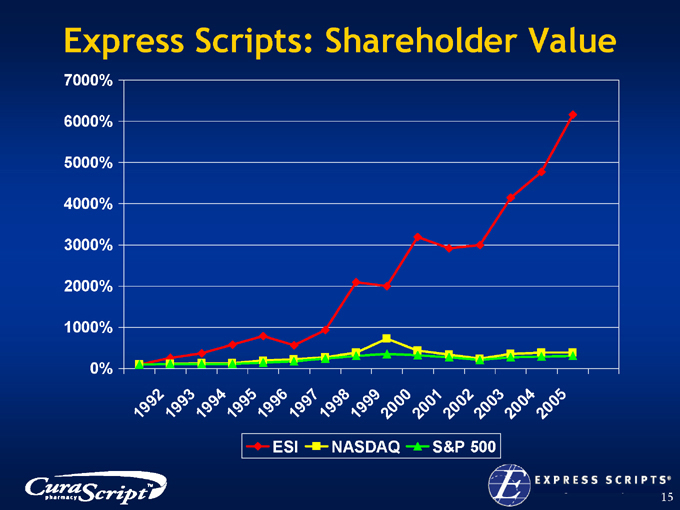

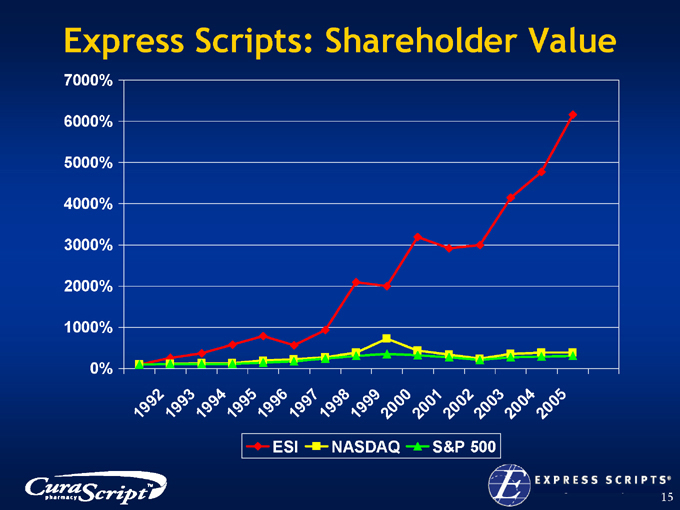

Express Scripts: Shareholder Value

7000% 6000% 5000% 4000% 3000% 2000% 1000% 0%

1992 1993

1994 1995 1996 1997 1998 1999 2000

2001 2002 2003 2004 2005

ESI

NASDAQ

S&P 500

15

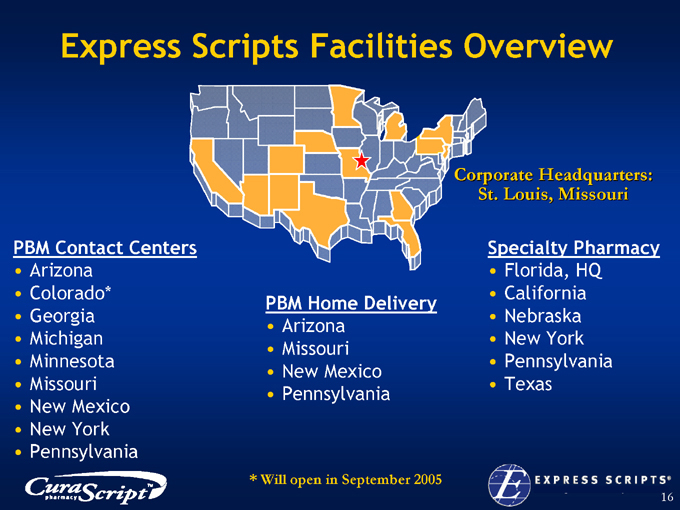

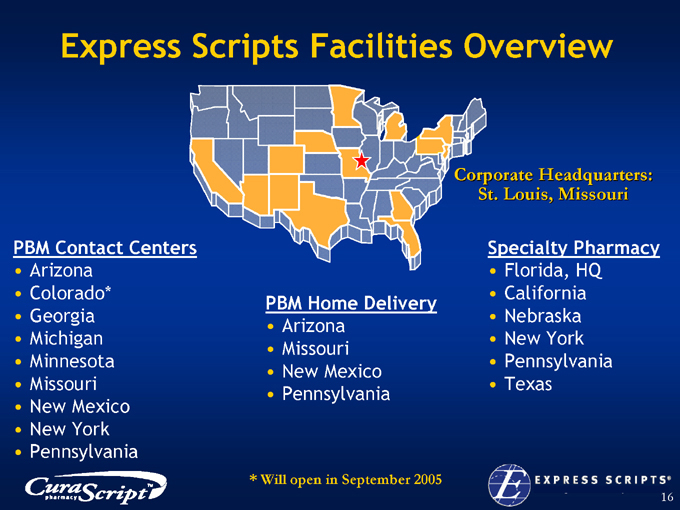

Express Scripts Facilities Overview

PBM Contact Centers

Arizona Colorado* Georgia Michigan Minnesota Missouri New Mexico New York Pennsylvania

PBM Home Delivery

Arizona Missouri New Mexico Pennsylvania

Corporate Headquarters: St. Louis, Missouri

Specialty Pharmacy

Florida, HQ California Nebraska New York Pennsylvania Texas

* Will open in September 2005

16

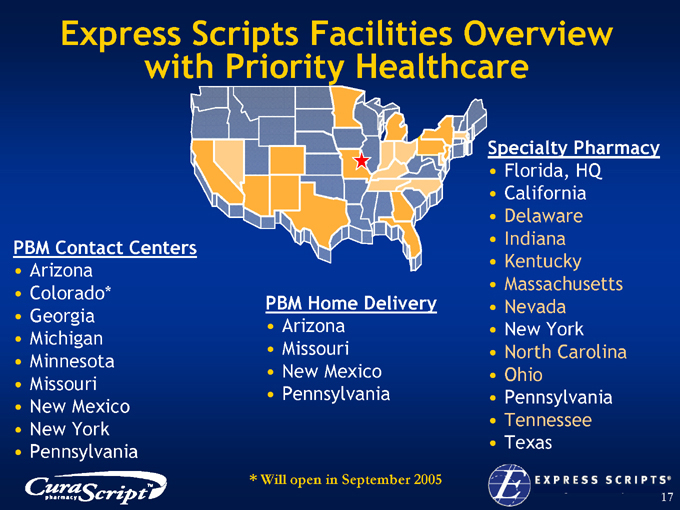

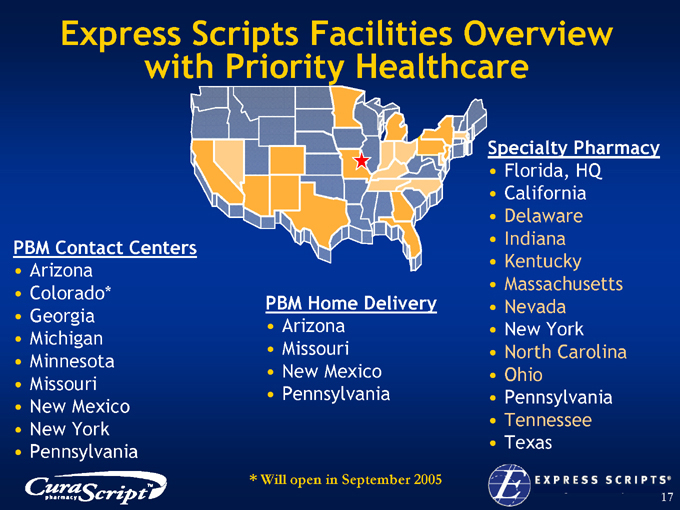

Express Scripts Facilities Overview with Priority Healthcare

PBM Contact Centers

Arizona Colorado* Georgia Michigan Minnesota Missouri New Mexico New York Pennsylvania

PBM Home Delivery

Arizona Missouri New Mexico Pennsylvania

Specialty Pharmacy

Florida, HQ California Delaware Indiana Kentucky Massachusetts Nevada New York North Carolina Ohio Pennsylvania Tennessee Texas

* Will open in September 2005

17

Express Scripts’ Commitment: Build the Premier Specialty Platform

Aligned interest with our clients and patients

Comprehensive disease state expertise

Multiple distribution capabilities

Further develop supply chain opportunities

Maintain the integrity of specialty as a stand-alone business unit

18

CuraScript Overview

19

Our Mission

Make specialty drug therapy more effective and affordable… one patient at a time

20

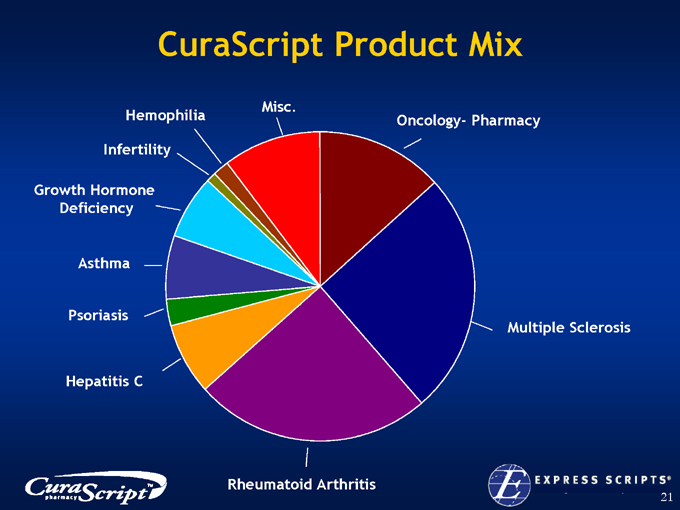

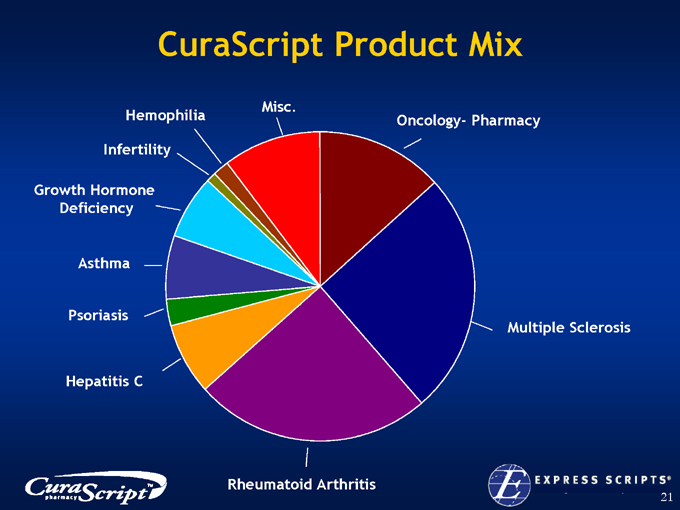

CuraScript Product Mix

Hepatitis C

Psoriasis

Asthma

Growth Hormone Deficiency

Infertility

Hemophilia

Misc.

Oncology- Pharmacy

Multiple Sclerosis

Rheumatoid Arthritis

21

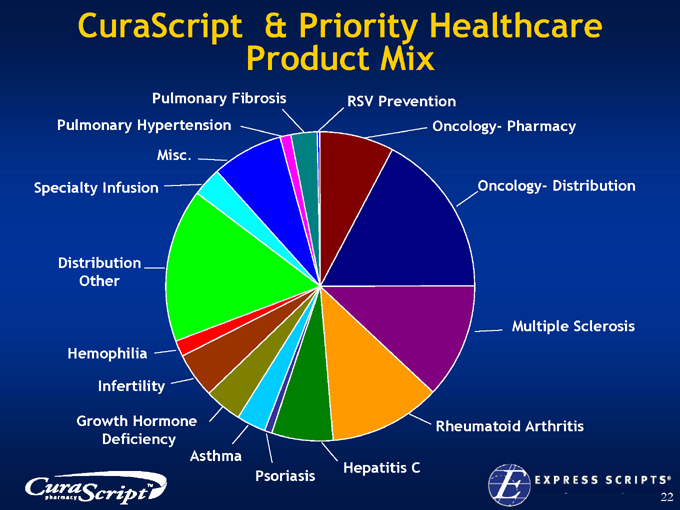

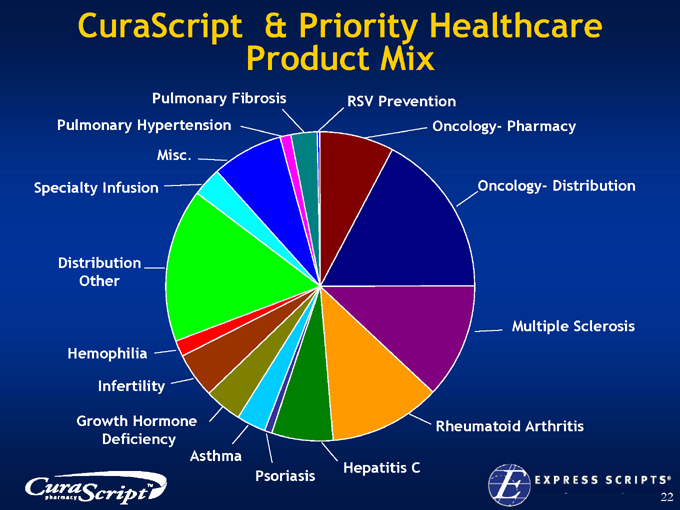

CuraScript & Priority Healthcare Product Mix

Psoriasis

Asthma

Growth Hormone Deficiency

Infertility

Hemophilia

Distribution Other

Specialty Infusion

Misc.

Pulmonary Hypertension

Pulmonary Fibrosis

RSV Prevention

Oncology- Pharmacy

Oncology- Distribution

Multiple Sclerosis

Rheumatoid Arthritis

Hepatitis C

22

Goals for Working Together

Maintain focus on patient care

Maintain client relationships

Leverage strengths and capabilities of the organizations

Maintain open and honest communications

23

Coming Together: Next Steps

Provide a forum for answering questions

Collaborate on integration planning

Continue the legal and regulatory work to close the transaction as anticipated during Q4 2005

24

Again, We Welcome Priority Healthcare

Q & A

25

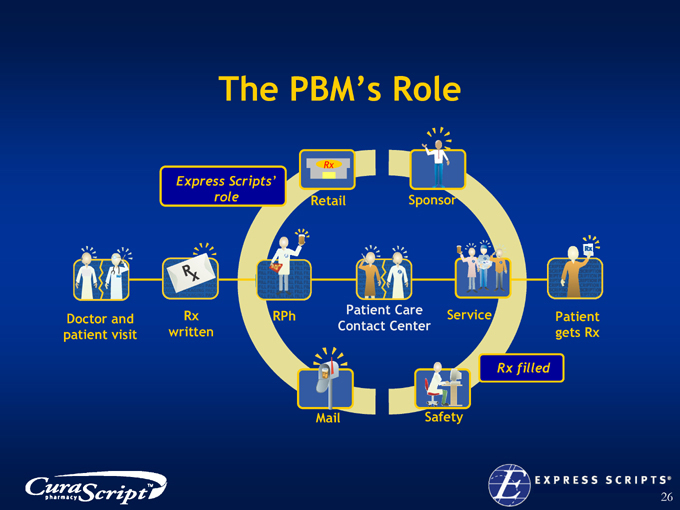

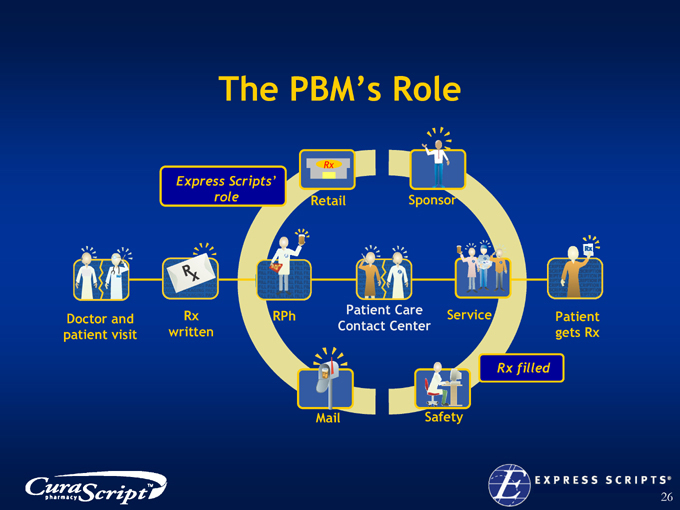

The PBM’s Role

Express Scripts’ role

Retail

Sponsor

Doctor and patient visit

Rx written

RPh

Patient Care Contact Center

Service

Patient gets Rx

Mail

Safety

Rx filled

26

Where to Find Additional Information

Priority plans to file with the Securities and Exchange Commission (the “SEC”) and mail to its shareholders a Proxy Statement in connection with the proposed transaction.Investors are urged to carefully read the Proxy Statement and any other relevant documents filed with the SEC when they become available, because they will contain important information about Priority, Express Scripts and the proposed merger. The Proxy Statement will be mailed to the shareholders of Priority prior to the shareholder meeting. In addition, investors and security holders will be able to obtain free copies of the Proxy Statement, when it becomes available, and other documents filed by Priority and Express Scripts with the SEC, at the Web site maintained by the SEC at www.sec.gov. These documents may also be accessed and downloaded for free from Priority’s Web site at www.priorityhealthcare.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Priority Healthcare Corporation, 250 Technology Park, Lake Mary, Florida 32746, (407) 804-6700. Copies of Express Scripts’ filings may be accessed and downloaded for free from Express Scripts’ Web site at www.expressscripts.com, or copies may be obtained, without charge, by directing a request to Investor Relations, Express Scripts, Inc., 13900 Riverport Dr., Maryland Heights, Missouri 63043, (314) 770-1666.

Participants in the Solicitation

Priority and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Priority in connection with the proposed transaction. Information regarding Priority’s directors and executive officers is contained in Priority’s proxy statement relating to its 2005 annual meeting of shareholders, which was filed with the SEC on April 8, 2005. Additional information regarding the interests of participants in the solicitation will be set forth in the Proxy Statement filed with the SEC in connection with the proposed transaction.

Steve Cosler: This is a very exciting day in the history of Priority Healthcare. Last night as most of you know, we announced our acquisition by Express Scripts, one of the largest PBM’s (Pharmacy Benefit Managers) in the industry and in the nation. And we are pleased to have with us today George Paz, President and Chief Executive Officer of Express Scripts, and Dom Meffe, Senior Vice President of Express Scripts and CEO of CuraScript, our neighbor and soon to be partner across town and Jeff Knudson is with us as well who was very integral in managing this last several months of discussions and negotiations and planning to bring us to this point. You’ll get a chance to hear from both George and Dom in a few minutes and get a chance to understand a little bit more, a lot more really, in more detail about Express Scripts and also get to see the phenomenal success in growth that they have had over the last decade. Very much like our company. So you’ve got two very successful, high growth companies coming together and that’s very exciting. My comments this morning will be brief, unlike the voice mail that I left you last night. I got done recording that and Cynthia says “You know it’s six minutes” and I said. “okay.”

But I had a lot that I wanted to say that was from the heart and I can get a little windy at times and it was very late and a couple of those words were mumbled and it was about 11:30 at night when we got totally wrapped up. As I said though, this is a very exciting day in the journey of Priority Healthcare. From the strip center in Altamonte Springs with the luggage shop squarely in the middle, pharmacy on one side, distribution on the other, (I see several people on the front row that knew that facility very, very well…lived and breathed with all of us there) to now over $2 billion in sales this year and becoming a part of one of the most successful and largest health care services companies in the industry, Express Scripts, is quite an achievement and accomplishment. And the people in this room made it happen. You all brought us to this point.

We are fortunate to work in a great industry, $35 billion of specialty type therapies in 2004 going to $70 billion in 2008, tremendous growth in the segment that we work in. Over 700 new therapies in the pipeline so it really assures this continuous growth, probably for years to come. Payers, physicians, patients, manufacturers all trying to manage the supply chain, trying to manage costs. On one hand we’ve got tremendous therapies that are being developed for patients that are suffering from chronic disease, debilitating disease, life threatening disease. On the other hand, these therapies are very, very expensive. And we stand in the middle and we’ve done that very successfully and in this combination we’ll be able to do it even better. But most of all, the most fortunate part that we have in our industry, as we have discussed many times, is that every day, regardless of how long the day is, how many times the phone rings, how long you’re on hold with somebody, maybe trying to get a script cleared with an insurance company, how many times the system may burp once or twice. Regardless of how tough the day is, we can go home every night and know that we made an impact on people that are suffering from debilitating chronic disease, we made a positive impact on their lives. And that is a rare privilege for people that work in the workplace day to day. We have that privilege, that’s what we do every day, and we take that very seriously and it’s a real privilege that we get to do that.

We’re in an industry though also where size and scale is very important. Purchasing, overall efficiencies of operations, clinical critical mass, we talked about that a

- 1 -

lot. The bigger we get, the more we know about the patients, and the therapies and the disease states. We’re taking that into our caring path our disease state management clinical management system so that we can provide better data back to the physician and the payer and the pharmaceutical manufacturer along the way so that they can get better at what they do. Critical mass, size and scale makes a difference and this combination will greatly enhance our critical mass along with building a lot of other capabilities that over the next few months you’re going to hear a lot more about. Very importantly, culturally and from a core values standpoint, Priority Healthcare and Express Scripts and CuraScript are on the same page. And that is very important in a combination like this. I’ve had the privilege of getting to know Dom Meffe and Donnie Howard who is a very important leader along with many others in CuraScript over the last several years. We are competitors but we’re friendly competitors. So we’ve gotten to know those guys extremely well, have great respect for what they’ve built as I know they have great respect for what we’ve built. And this combination is really going to strengthen both hands and make us a very, very powerful force in the marketplace.

I’ve also gotten to know George Paz and his team at Express Scripts. And again, I can tell you that they share the same commitments that we’ve got, the same core values, the cultures are very similar. And that’s important when you look at a combination of this significance. The combination will provide unprecedented opportunities for our customers and our employees and we’ll all be excited to hear more about that and a very exciting future. So enough from me. I want to again introduce George Paz, President and CEO of Express Scripts to tell you more about their outstanding company. George.

(chorus of applause)

George Paz:Well, first of all it is truly a great pleasure and an honor to be here this morning to address you. I — just give you a little bit about — I got to learn how to use this. There we go. That’s me. (chorus of laughter)

Just to give you a little bit of an idea of who George Paz is, to start with, I’ve been with Express Scripts since 1998. I’m a bit of an accounting nerd. I take pleasure in being a nerd. But I — so my specialty really is around putting companies together. And when I came to Express Scripts, Express Scripts was early in its life, it was a fairly small company. It had less revenue than Priority has today at over $2 billion. We had about $800 million. And we had about 800 employees back then. We were in a small little building. We had just started an operation down in Tempe, Arizona.

And the company was going — our whole industry, the PBM industry was going through a bit of a evolution if not revolution as people were trying to decide what scale and size really meant. And trying to compete against the large health plans. And so my boss at the time, Barrett Toan, who is now our chairman of our board, hired me to come and try to figure out what our strategy should be.

And what we came to the conclusion was you can’t really predict whether you’re going to be bought, sold or how the game gets played, what you have to do is be the best. And you have to have a very sound business model. So we went off to really work on improving service, improving patient care and relationships, client relationships. And when you do those things if you do them well the company grows and prospers.

Then what we realized is that by putting scale together you actually did get a lot.

- 2 -

When — you know, in those days as I said earlier we were a fairly small shop and today we have over 11,000 employees. And we’ll get a little bit into that in a few minutes. But really an acquisition — you know, when you read about banking deals or you read about life insurance deals or property and casualty insurance deals you’re looking at companies that don’t have a lot of growth rate.

And the reason big companies get together is because they need the scale not because there’s a lot of new business opportunities because they need to take their fixed costs and spread it over a whole bunch of new business or their business. That’s not our industry. Our industry is an industry of growth and opportunity. And with that comes more growth and more opportunity the bigger you get. So our job is not really to shrink the base but to grow the base. And truly, you’ve heard this many times probably before but when you put two companies together they talk about one and one is three, well, to be honest with you one and one can be four, five or even six. And so that’s what we’re really going to do.

That’s what we — that’s why Priority was so appealing to us because of the commonality of cultures. The commonality of patient care and our approach to the marketplace fit quite nicely and we believe gives us a tremendous opportunity to grow our business. So again, just to kickoff what we’re going to be talking about this morning is I do want to give you a bit of an idea of what Express Scripts and CuraScript is.

Our vision for Priority Healthcare and how it will come into our business and our culture. I would like to spend some time talking about Express Scripts culture. Every company has a culture. We, similar to you, have many satellite operations in a lot different states. And each of those different sites has its own culture, quite frankly, but we do have an overall culture and that’s what I would like to talk to you about. And then I’ll give you a little bit of information about the acquisition.

What really appeals to us, quite frankly, is the specialty marketplace. As we said earlier this market is going to grow from $32 billion in 2004 to $70 billion by 2008. But the story isn’t just about economics and growth. I mean, that’s great. Shareholders demand it. We’ve got to deliver it. But it’s also about the impact we can have on people’s lives. Everything I’ve heard about you and I haven’t had the luxury of being in here with you before, but certainly it’s the way we administer our programs through CuraScript and through our PBM offering is the one to really understand that that patient is going through a significant amount of trial and tribulation. And to the extent we can make that better for that person, make their life a little easier that’s really what it’s about. That’s the way you ultimately grow shareholder value.

We can sit here and talk about growing earnings. We can talk about cash flow collections. We can talk about all those things. My view, even as an ex-CFO, is really not to focus on that as much as to focus on delivering quality product at a fair price with a very patient caring model. And when you do those things the economics, in fact, do come about.

Just give you a little bit of an overview of Express Scripts. What is Express Scripts — you know, a lot of companies have tag lines or mottos and — what our view is that we make the use of prescription drugs safer and more affordable. That’s what we believe our job is. And you’re seeing a little something missing there because you got the three little dots and we didn’t clutter up the screen. But it really is about making it safer,

- 3 -

more affordable so it can get to the patient. And then delivering a caring model, which enforces the patient experience. So that’s what we’re all about at Express Scripts. And we spend a lot of time trying to hone and refine that model.

Talking briefly about our culture. I believe there’s three really important components to a business. And the first is always the people. At the end of the day unless you’re selling widgets and the widgets is your product people are what makes a company work. The better the workforce, the more the workforce is tied to the model we’re trying to deliver, the better the product and the more success we will all achieve.

We spent as much time as possible trying to educate and communicate with our individuals. As you get to know me over the next several years you’ll know that I am one that believes in communications. I would rather have you be over communicated with than under. It sounds like based on the voice mail you got last night that comes from somewhat of a shared philosophy. (chorus of laughter)

But I really do believe that that is important. That you really should understand what’s going on with your business. You should take pride in all the different offerings and services we have to offer and be part of it. So people are an incredibly important component. In addition to that it really is a model of service. And the words up here are whatever it takes. And I truly do believe that. Our IT people, our operations people, people throughout the organization really have a customer focus, a member focus. Know that without that member and without that customer we don’t have a business and then we don’t get paid.

So our motto is really to do what we can do to help that patient. Especially when you consider that we’re not mailing sweaters, we’re mailing life sustaining drugs. And it’s of utmost importance in what we do to make that members life as comfortable as possible. In addition to that it has to be about integrity. Profits and growth and all that stuff means nothing, means not a thing if we don’t conduct ourselves in an ethical fashion. So for me it is all about integrity.

I can forgive almost any mistake. I can forgive almost any situation. But what we can’t forgive, none of us in this room, can forgive is unethical behavior. And so our company truly is based on our people, our commitment to service and our ethical approach to the marketplace.

Just quickly talk about our clients. Who do we serve? Over the years as we’ve put together the PBM industry through multiple acquisitions we’ve structured ourselves to be in every different division. You know, there’s a lot of consolidation going on in managed care. So to safeguard against that we go directly to the large employer groups. We work with the unions and we work with the state and federal governments. We have many states as our clients. We do the department of defense contract out our Tempe site. Where we mail prescriptions in big boxes to a distribution point because they don’t want the people to know where these people are at for security reasons. But it’s a great business where we take a lot of pride in helping the department of defense with what they do. And we are the vendor both on the retail side — I negotiating with the pharmacies as well as on the mail order side. So it’s a very strong business model.

We have many accounts besides the DOD. We have large accounts like Great West, Blue Cross Blue Shield of Massachusetts. In addition to that we have Fortune 500 companies such as Goodyear Tire and Rubber. We do business with Citigroup. We’ve

- 4 -

got many, many very large clients that we service so it’s — and then on the state side we do the State of Georgia, State of Missouri, New Mexico, on an on and on. So many, many clients.

What do we do? We have a whole host of products. In the PBM itself, and you probably know this, when you go to the pharmacy you carry a card when you walk in. We are the card — the people behind that card for about one out of every five employees in the United States. So we represent about 20 percent of all the working public in this country. We’ve grown quite large. We have about 55 million members in the United States and 5 million more members up in Canada. We are the largest PBM in Canada and we’re the third largest PBM in the United States. And now combined we are the largest specialty business in the United States, which I think is something we should be all very proud of.

In addition to the retail we offer home delivery. Home delivery is a very important component of our business. And this is more the oral solids and the specialty side of the business. As a matter of fact, we tried to move all the specialty out of home delivery or mail order into specialty because the patient care model that’s in place on the specialty side.

On the home delivery side, this is probably the fastest growing piece of our business. It offers a nice alternative to retail and gives members a chance to save through their co-pays and gives the plans an opportunity to save about a ten — ten percentage points off the cost of the drugs. Generics. You’ll hear a lot about it as you grow into the Express Scripts family. It’s not big in the specialty side but generics are really where we make our money.

Our model is based on client alignment. We want to make more money as we save our plans money. So where we make our most money is in home delivery and generics. So if we can move people into those two products that’s where we maximize profits. That’s why I believe, and I’ll show you a table here in a minute on growth, why we’ve grown and why we’ve prospered over the years is because when we do our jobs right and we’re making more and more money people aren’t looking at our margins, instead they’re looking at how much we’ve saved them. So our model is built on saving money to make money. And that seemed to work very well for us.

Of course the big one is specialty and the reason we’re here today. We bought CuraScript about 18 months ago and they had $300 million in revenues. Quite a bit smaller than you. Today they passed a billion dollars on a run rate. This — the specialty business is a very much needed component of our business model and why putting our two companies together makes it such an appealing opportunity to both our clients, our members and our shareholders.

Just real quickly. Express Scripts we were formed in 1986 as a mail order company for New York Life, which owned a small HMO. In 1992 the company basically had one client, which was New York Life (imagine that) and we went public. We went public on a split adjusted basis at about 82 cents a share. In 1996 we moved into Canada and became the first US company to have a PBM operation in Canada. Then in 1998 we did our first major acquisition, which was the purchase of Value RX and in effect, doubled the size of Express Scripts.

Exactly one year later in 1999 we bought Diversified Pharmaceutical Companies

- 5 -

from Smith-Kline and doubled our size again. So by this point we had quadrupled. In 2001 we did an acquisition in Canada to further our presence in the Canadian market and that actually took us to be — to come the largest PBM in Canada.

In 2002 we bought NPA, which was a labor based PBM. 2003 we bought a small PBM from Cardinal Health Company. And then in 2004 we acquired CuraScript. During this period our stock has been rewarded quite nicely as we’ve successfully integrated those acquisitions. Give you some idea how big we are, we are the number 137 on the Fortune 500 list. With your addition you will see us jump significantly next year, which is a very nice testament.

Revenues. Last year we had $15 billion in revenues. And we have currently about 11,000 employees. That message isn’t complete until we put on top Priority. A very important component of this — of our acquisition. And part of our now — our family. Revenues will be $16.8 billion on a pro forma basis. That means it doesn’t consider the growth, which will occur through the course of the year.

In addition to that we’ll up to almost 13, 000 employees. If you look at Express Scripts itself, we use something called claim counts, which are the prescriptions that people get, and you can see our growth from 1996 at under 100 million to today we’re approaching 600 million prescriptions processed every year.

This is probably the slide that tells the whole story. It’s a little confusing. If you look back at 1992 we assume every — both S&P 500, the NASDAQ and ESI stock has a value of 1. So you just look at those things and assume at 1 how have they grown. The — although the stock market looks like it’s flat because there’s virtually no growth there, the reason it looks that way is because there is actually 300 percent growth in the stock market over that period. The reason the line looks flat is because we had to adjust the scale to show how Express Scripts has performed, which is a 42 percent compounded annual growth rate or a 6000 percent increase in value over the period of time. So it’s a platform that works. It’s a platform that’s focused on patient care and saving money and delivering the best service and products. And that’s how we get the returns that we’ve been able to accomplish.

Again, looking at the footprint of the company, this is prior to the Priority acquisition. You can see that we have what we call contact centers, which are call centers located in various states trying to get geographic coverage across the entire United States. We have four home delivery sites where we dispense the oral solids. In addition to that the CuraScript specialty pharmacy presence. So you kind keep — remember what that map looks like, now look what happens when we add Priority. The model gets much more robust and big and I think this is what we have to offer to our clients. We will be, again, the leading specialty company in the United States. And I can’t say enough about how excited I am about that opportunity.

Just in closing before I turn it over to Dom, I want to just talk a little bit here about what our commitment is and how we’re going to go about our business. We really do lead. And you hear me say often that we make money when we save money. I can’t say that enough. You know, when you go to buy a car they always try to up sell you into, you know, get this thing, that thing, bigger tires, a steering wheel, a radio, something. You know, they’re always trying to sell you something to add — enhance the value and all those things add costs. Our model is the opposite of that.

- 6 -

As we take costs down and our revenue line down we make more money. And that’s why the model has worked. And that’s why you see the returns we’ve been able to accomplish. And that model should continue to work. When you save people money, you make money that’s hard to beat. So we really have a culture that’s vested in alignment. Aligning our interest with those of our clients, our members and I think that works. We also have a very strong competency in disease state expertise. CuraScript brought that to us but let me tell you, you round it out and add to it very nicely.

Steve and all of you have done a very nice job of building a tremendous company here. And that added together makes one and one closer to three or four than it does to two. The distribution channels again — your wholesaling and your infusion business I believe are tremendous opportunities for our growth in the future. When you look at the — what the oncology marketplace and the need for infusion as the market changes from more and more biotechs coming — biotech products coming to market. Having those capabilities strengthens our business significantly in the future.

So again, I think that our challenge here is to really build a world class specialty company. We also believe that specialty is kind of a unique business in that it not only augments and supplements our pharmacy business but it also is a stand alone business. One of the nice things that Dom and his team has done is been able to sell specialty to clients where we then come on back and later can sell the PBM services. And we do that vice versa. So again, giving a much broader product offering and expertise should allow that model to even grow and prosper even more.

So at this point I would like to turn it over to Dom.

Dom Meffe: Sure. Thanks. Well, I owe you guys one. When Steve introduced me and said “CuraScript” nobody hissed and booed. (chorus of laughter)

Let me get that off my chest now. Yes. It’s a bit weird to be here. It’s weird because we’ve been competitors. And everybody knows — most everybody knows the CuraScript name. We certainly know the Priority name. You guys have built one of the most respected companies in the space — you know, help found the industry, Steve so you have a lot to be proud of. You know, what’s neat, we’ve been competitors for a long time. And Steve and I have known each other for a while. We’ve played a bunch of golf. We try to beat each other’s brains in on the golf course. But we’ve never been enemies. You know, there’s a big difference between competitors and enemies out there. And I think we share the same mutual enemy and to me that’s inappropriate patient care. And that’s what you all were founded on and that’s what we were all founded on here.

And I’m not a very much of a slide guy. I haven’t been ‘corporatized’ yet by Express completely. So I probably have one slide. Eighteen months ago I was in the exact same seat that y’all were in. And whenever — George wasn’t there. But Barrett Toan, who was the CEO of Express Scripts came down and announced the acquisition of CuraScript. And I’m sitting here listening to all of this and I’m kind of thinking don’t they know that we really don’t like PBMs all that much. I mean, I work a referral all day long and I got to go through all the prior authorization, I got to wait on hold for a long time and then at the end of the day you have a patient crying on the phone. Oh, no. It has to go mail order, right, for five bucks for a 90 day supply. Or maybe they block you out of the network. So Steve and I we kind of — we were always worried about PBMs. And

- 7 -

here they are kind of being our friend. And they want to buy us and they want us to be part of us.

In the process what they went through to learn about the specialty business was really, really unique. Because they talk in their language. They kept asking about how many members did you have, how many lives did you have, how many scripts did you fill. And you know, that we all talked about patients, right. We’re all in the same business together. And Barrett Toan I remember with a bunch of the really smart analytical people, they’re trying to understand our forecast. And they’re asking question after question. Like, “Well, if you have one patient how long are they going to be on therapy.” And y’all know the answer, “it depends” right. It depends on the genotype and how long they’re going to be on the different therapies. And everybody here knows that business.

And we kept saying well it depends, and it depends, and it depends. And they started getting aggravated. And we’re in our boardroom in Orlando. And they go, “It depends on what?” And I said, “You know what, Barrett, it depends on if the patient dies.” And the room got dead silent. And he said, “This meeting is done.” Took all his people out. And he took me in the hall and I go, “Now, I just blew it.” (chorus of laughter) “There goes my new car.” (chorus of laughter) You know, I have this old beat up Honda Civic out there. And he put his arm around me and he said, “Son we’re going to leave you alone.” And that’s the message I have to give you today. Express Scripts as big as they are and as wildly successful as they are — and you’re going to love meeting all the people from Express because how bright they are and they make a ton of money. They were smart enough to know that they didn’t know anything about the specialty pharmacy business.

And once they were lucky enough to — we were lucky enough to be acquired by them, we set it up to be a separate entity. And I want you to know that’s — you have to know that your parent company understands that specialty is unique. Specialty is very, very different. It’s a different type of patient experience. Now here’s a neat thing about Express Script. When they got there they didn’t used to call them patient contact centers, they used to call them call centers. They saw us calling them patients, they say that’s cool. We’ll call them patient contact centers. They don’t call them members anymore at Express Script, they talk about them in terms of patients.

It’s been an amazing transformation as they’ve looked at us — and whenever you hear someone from Express say we’re going to identify best practices that’s not a bunch a corporate crap from someone up here in a suit and tie, they mean it. When they looked at CuraScript, and we were a small little company there, they started calling them patients, they started adopted the things. I’m part of George’s senior staff and we have a large say in what they’re doing. This is a very unique culture and a very unique company.

Now, one word on culture. We’ve known each other as competitors for awhile and I’m very — I’m pretty versed on your culture. I love hearing Steve tell the story about some little building he started in and we did the same thing. We started in Omaha, Nebraska. You know, in a room about as big as this corner over here. We had about 17 employees back in 1997. So that’s probably close to yours there, Steve, out there. But you got to know one thing of the culture and how we started.

This company was started when I lost a sister to cancer. And the care that she

- 8 -

received on her cancer treatment — the chemo was fine because you would go to the doc’s office for that. But all the adjunctive therapy she was taking back and the Procrits and the anti-emetics, it was horrible. And I felt completely helpless. Because we would get the pharmacy to try to get the Procrit. Epogen back then instead of Aranesp. Now they are with Epogen. And it was lousy. She had reactions to it. And in the middle of the night — you know you all talk to patients and there’s reactions. So the care was horrible.

So we committed ourselves, that very small group in Omaha, to build a patient care model that we didn’t really — back then we weren’t smart enough to figure out that the Ps. We didn’t figure out that the Payers might want to buy it and the Pharma might want to buy it. Or maybe a big company like Express Scripts could buy us for a lot of money some day. We just built a model that we would want our family member to use in case they became ill. And that’s the culture of CuraScript.

Now, do we do that all the time? Heck no. We make plenty of mistakes. Just like y’all probably make service errors. But in our heart you have to know the organization you’re getting together with our culture is about patient care and our desire to build the best patient care type of culture out there.

So what are we going to do together? We’re going to build the premiere specialty pharmacy platform in the United States. Every single piece of business that you is very, very important. Most people when they get combined they get in and go, “Oh, my gosh, what I do they don’t really like. Okay. I’m in the distribution business. Well, they’re a PBM, they won’t like distribution.” I’m telling you distribution is extremely important to our long term value proposition. The Pharma programs are extremely, all the therapies you do are extremely important.

In fact, here’s my corporate slide. Which one do you push? Is it the up, George?

George Paz: Be careful with that corporate —

(chorus of laughter)

Dom Meffe:Yeah. Which one? I’m completely incompetent with IT stuff so. Flip it a couple of more if you don’t — No. I think you’re going the wrong way. There you go. Which one are you clicking now? Yeah. One more.

Okay. This is us. CuraScript about a billion dollars a year. And these are the types of therapy — and I apologize if I’m in your way. But we do a lot of the same things you do. You do a lot of multiple sclerosis, rheumatoid arthritis. We do a decent amount of Hep C, not nearly as much as you. So this is kind of what we do. So what I did — now I apologize. This slide is awful busy up there with all these charts. But this is us combined together. You’re — let’s just call you $2 billion, let’s call us a billion just to use easy numbers, about $3 billion.

But what this slide shows is look how comprehensive this product offering is. Imagine if you were a salesperson going to a client and you now have a one stop shop for all these therapies. Every single therapy is going to be extremely critical. See we believe that clients — like if you went to a restaurant right now over to Olive Garden here, you wouldn’t order your appetizer at one restaurant, your drinks at another, your entrée at another and your dessert at Chili’s over there. If you’re a client you want to go to one restaurant to order all your food, under one roof, with one bill and have good service. We believe that’s how our clients look at the marketplace. So we’re going to leverage this broad product offering out here to take it to the market.

- 9 -

So goals for working to in this mean — in this transition period, we go through all this, please, stay focused on patient care. I mean, that’s what we’re pleading to our group down — we just left our group. Now, everybody gets all excited. At the end of the day you can make a difference in someone’s life by just focusing on the patient. We’re going to have to really work hard to maintain client relationships. Some clients may be concerned about what this means to me. If I’m a physician on the distribution side what does this mean to me. We’re going to have to work very, very hard at that.

I commit to you, we’re going to look for best practices as we put these organizations together. We’re not going to do things the Express Scripts way. We’re not going to do things the CuraScript way. And we’re not going to do things the Priority way. We’re going to do things the right way for the patient. That’s my commitment to you. We’re going to combine together to do the right thing for the patient.

And we’re going to open up a open and honest communications flow. Now, as you know, through integration we just don’t know all the answers yet. You know what’s the name going to be? Am I going to have a job? Who’s going to do this? What about that facility over there. We just started the integration process. We have a terrific team that’s going to be involved in the process together. David Lowenberg, who you’ll meet, is the chief operating officer of Express Script, terrific guy. He’s going to lead that process. He’s done all the acquisitions of Express Scripts. He and I have become very close. He and I will work together.

We’re going to integrate senior management from the Priority side. Together we’re going to make decisions on the right thing to do. This is not about consolidating and collapsing to save money. This is about finding one plus one equals five to grow this together. So that’s my commitment to you along the way.

I think that might be the end of my thoughts. I’m not sure. Oh, I think this next is designed for either George or I, but I’ll go ahead. What we want to do is we want to provide a forum for answering questions. So we want to open it up to any type of questions. We want to collaborate, work together on integration planning. And as you know, we just announced the signing of the acquisition, we haven’t closed the transaction yet. We think that’s going to be in the fourth quarter some time. There’s all these regulatory hurdles they have to go through so lawyers can make all their money out there. So we have to go through a lot of those steps through the process. So we think that will be done some time in the fourth quarter. But in the meantime, as — I’m sure Steve said this, we have to operate as separate organizations. We have to operate as separate companies out there. But we hope to work together as much as we can, as much as law allows us to be together to work together.

If you don’t see us and if we’re not part of integration that means that we’re not allowed to yet, it’s not because we don’t want to be. Because sometimes the lawyers say you can’t do that yet. So that’s my commitment to you.

But now, actually, I would like to open it up, I think. I’ll turn it over to Steve to open up the question.

Steve Cosler: We want to take your questions. I know this group isn’t bashful.

Female audience member: Eventually is this going to be an actual merger or is Priority — is it going to be a subsidiary of CuraScript?

- 10 -

George Paz: It’s a — legally it’s called a merger, that’s the form it has to take. The reality is, it’s an acquisition and it will become a subsidiary. But that has probably some negative connotations to it. My acquisition of Dom was also a merger legally followed by, you know, payment. So we bought them and it became a subsidiary. Dom’s point is the right point though. The world is too short — and I know GE is famous for buying a company, taking their management sticking down the organization, putting in their culture and putting a GE sign on the door. You know, that probably works for them but I don’t know that it works for many. When you look at our acquisitions it’s all about bringing the best and brightest to the table. It’s getting the best employees with the best patient centric model, people that care. And we will, you know —

My biggest job here, as I said earlier, I think shareholder value is created when you do the other things, not the other way around. And so if we put this together right and get best practices we’ll succeed and we’ll be successful. So it’s not about putting CuraScript outside on your front door or putting Express Scripts on your front door, it’s figuring out what’s the best answer.

Female audience member 2: How does this affect our non-compete?

Steve Cosler: How does it affect our non-compete?

Female audience member 2: The employee’s non-compete.

Steve Cosler: All employee agreements stay in effect.

George Paz: That’s right.

Female audience member 3: How does this affect Aetna, with the Aetna Specialty Pharmacy?

Steve Cosler:Yeah. Good question. Absolutely no affect on Aetna. Aetna — the specialty pharmacy at Aetna will obviously remain in the wonderful facility that we have out there and it will continue to do the things that it is doing. So really no impact whatsoever.

Female audience member 4:Since CuraScript is located in Orlando and Priority is in Lake Mary, kind of similar locations, do you foresee a time where we would have any kind of collaboration on location for all services?

George Paz: I can try that and I can also let Dom speak to it.

You know, one of the advantages of growth, I think that what I said earlier was that when we bought CuraScript they had $300 million in revenue and based on their last month they passed a billion dollars in revenue, that’s pretty good growth over an 18 month period. We’re looking to add another building outside of where Dom’s currently located. Again, it’s all about growth. I’m not going to sit here and tell you there won’t be some change at some time. And I can’t tell you what that is, that’s what we’ll figure out over the next several years. But the reality is, it should be about growing. If we continue to service our patients and our clients the business itself will grow.

And, you know, when we bought DPS and we bought Value, which were both located in Minneapolis, Minnesota — there is more employees working in that combined company today at Minneapolis than were when we bought them separately. So hopefully, this will be a growth platform. If we all do our jobs that’s what we will accomplish.

I don’t know if you have —

Dom Meffe:The biggest implication of us being in Orlando is the annual Christmas party is going to have be at the TD Waterhouse Center so. (chorus of laughter)

- 11 -

Dom Meffe: You know, we’re growing so fast down at — we’re hiring almost 15 employees a month. And we’re building 60,000 square feet out front. In our plan, forgetting the Priority add, it’s going to be full soon. So logic will tell you this is all about growth. We just — if you can make a difference in the company and help us grow this is — we need everybody to be part of this team together.

We have a lot of integration work to do. And we’ll be open and honest and tell you exactly where we are the whole way.

Male audience member: In specialty now where does Priority and CuraScript where do we rank?

Dom Meffe:I think we both ranked always Number 1. Yeah.

(chorus of laughter)

Male audience member:From the standpoint of revenues?

Dom Meffe:You know, it’s hard to tell. Because the two other big players — oh, I’m sorry. I just jumped in and started answering that.

You know, Caremark and Medco don’t necessarily report their specialty earnings separately so you can kind of guess. But with Medco buying Accredo their pretty close, what, a billion eight, I think Accredo in revenue. And they probably have about a billion running through. So let’s call them three, just to round it up. And that’s pretty much what we’ll be. I think — I would imagine Caremark is a little bit short of that. It’s all so hard to discern. I bet they’re close to 2 to 2.4. So a — but you got to remember 2 billion of ours is pharmacy and another billion is distribution. So Medco could probably fairly say they have 3 billion in pharmacy specialty revenue. So let’s give them that. I rather give them that and kick their butt later. (chorus of laughter)

Dom Meffe: So let’s we’re — we’ll probably be Number 2 in the pharmacy. You combine us together, we’re probably close to Number 1. But, man, no one has the platform. No one has — who is Number 1 in fertility? Well, we will be. Hepatitis. We will be. MS. We will be. Distribution. We will be.

They don’t have infusion. They don’t have a 3PL. They don’t have a logistic company. They don’t have the culture of Express Scripts and the nerds I talk — I mean, the strong team back at Express Scripts. (chorus of laughter)

Dom Meffe: — working with them. I’m very confident we will be Number 1 if we’re not when we start.

Male audience member 2: Two questions. From a distribution standpoint I think what we’ve done is great. Can I expect any changes with respect to management and the way that we’re running things now? What is your vision as far as growth in distribution? I did mention that there were wholesale out there and we do compete with some wholesaler or we, you know, we try to.

Also with respect to human resources and benefits where and how soon can we get a glimpse of what we can expect in 2006?

George Paz:You know, benefits — first of all let’s go back and revisit what the hold up is. Dom made a statement that over the next period of time the lawyers have to try to get the deal done. We have to go through what they call a — an FTC check, which is do we allow fair competition when you put the two companies together. Then we go through an SEC review of the documents. And that may or not get a review. So that may or may not take a long time. The tying of the benefits has to be to when the deal closes.

- 12 -

See, I’m really all about growing the company not shrinking the company. And so if we close this deal after you’ve already had open enrollment, we’ll think long and hard about changing that. By the same token, if we close the deal quick enough where we can affect open enrollment look at best practices again. See what’s best for the entire — think about today, what do you have, 500 employees. Seven-hundred employees. I’m sorry. And you — well, here in Orlando.

Steve Cosler: 500 or 600.

George Paz:Yeah. Now, all of a sudden think about our buying power and our ability to get, you know, better opportunities with the physicians and the hospitals in town. So we’re going to have to leverage all that. That’s what HR does for us. So, you know, it really depends on the timing of the close, quite honestly. Because we anticipate a fourth quarter close doesn’t mean that’s when it’s going to happen. It could happen as quick as 60 days and it could actually run until the end of the year. But that will have a direct tie to the benefits.

Again, we’re not here just to make change. I’ll tell you, I don’t believe in change for change sake. When I make a change it’s because it’s a better answer. You know, it may not be a better answer for your singularly but you as a group will hopefully be better off. So my idea for change is for the better. So anyway, before I give it to Dom on the wholesale side, let me just say, one of the values we have here is that we don’t have a wholesaler answer today. And so bringing you — your team onboard gives us that.

So I’ll let you speak to that.

Dom Meffe:We were quizzed pretty hard on the investor call this morning about what are you going to do with wholesale distribution and I’ll tell you the same thing I told them. If you take a step back, the overarching goal here is what Steve and George mentioned. You have a market that’s going from about 30 billion to 75 billion, let’s just call that the biotech market. And within that biotech market a large portion of those drugs are better suited administered in the physician office and they will never be for a pharmacy to ship directly to a patient. So if you want to be the biggest platform in the biotech market you have to have a distribution services.

So we’re going to have a broad platform of services that along the way we’ll take a piece of this supply chain and we’re going to appeal to different client groups. Now the one thing that we have to make sure we work through, sometimes oncologists don’t necessarily like the health plans out there. Because the health plans reduce the reimbursement right to the oncologists and some of the doctors. We’re going to have to work through that. Make sure the physicians that work through our distribution center see the value in what we can bring them.

So the changes you think you asked for, this company will grow. You’ve experienced growth. I mean, that’s the one overarching theme of your company is growth. You will see that consistently go forward out there. So we’re very excited about distribution. It’s a piece in the whole supply chain. And luckily we don’t know anything about so we need y’all to help us out there.

Male audience member 3: You talk a lot about best practices and doing what’s best for everybody. Me being in the IT department and knowing that you’re going to have to integrate the platforms that you’re using on your systems, how do you see moving forward with that?

- 13 -

Dom Meffe: I think that’s a great question.

George Paz: Before you answer. Let me just tell you what — to give you some idea what we did. When we bought Value RX in 1998 it was a consortium of acquisitions that the Value management had done. So they had bought about seven or eight companies. They were still running seven or eight platforms. They had seven or eight IT shops. And at Express Scripts we had our model, which we had spent a lot of money on in developing, and which was quite scalable. So quite honestly, what we did is we moved all those people the Value’s — into the Express Scripts’ shop.

When we bought DPS what we found out — one of the things is we bought DPS from a huge pharmaceutical manufacturer, which spent — they had a lot of money. I didn’t have a lot of money. They spent over $80 million just on the first phase of their adjudication platform. Their system was a lot better than ours. And what we did was we closed the deal, we went in and we looked at best practices and best systems and we decided they had a better system than ours.

And so what we did is we left and today at Express Scripts a lot of the IT on the PBM side now, not the specialty because Dom still got his own specialty shop IT department. The PBM piece is now up in Minneapolis. So I — you don’t know me. But I can assure you that we will do what’s right by the organization.

Dom Meffe: And a lot of that will be determined through the integration process. I’m not turning your question away, but to George’s point, we’ll choose one platform. We won’t operate in multiple platforms. You have a lot of different companies you’ve acquired successfully and we will put that on one platform.

You know, choosing a platform is a lot like raising a kids, you got to think for the long term. And every platform as they stand right now has the sniffles and the act up and you have to put in time-out a little bit.

(chorus of laughter)

Dom Meffe:You got to hang through that stuff and keep an eye on the future. You have to provide on the platform and the framework to be good people. So we will identify the platform that’s going to get us to where we need to be in three to five years. And there is — you guys are going through some Oracle redundant type system stuff, that’s tough stuff. But your leadership shows that that is the platform of the future so you have to go through a little pain. So we will identify one platform to go forward on.

Steve Cosler: Okay. We appreciate everybody taking some time to spend with us, there will be on myPHC.com additional Qs and As and an opportunity to submit questions along the way as well.

Thank you very much. Exciting day. And meeting adjourned.

(chorus of applause)

- 14 -