United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Act of 1934

| | | | | | | | | | | |

| For the fiscal year ended | December 31, 2024 | Commission File Number | 1-13145 |

Jones Lang LaSalle Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Maryland | 36-4150422 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 200 East Randolph Drive | Chicago, | IL | | | 60601 | |

| (Address of principal executive offices) | | (Zip Code) | |

| Registrant's telephone number, including area code: | | (312) | 782-5800 | | | | |

| | | | | | | | | | | | | | |

| |

| | |

| | |

| |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 | | JLL | | The New York Stock Exchange |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth corporation (as defined in Rule 12b-2 of the Exchange Act).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant as of the close of business on June 30, 2024 was $9,675,058,454.

The number of shares outstanding of the registrant's common stock (par value $0.01) as of the close of business on February 13, 2025 was 47,391,812.

Portions of the Registrant's Proxy Statement for its 2025 Annual Meeting of Shareholders are incorporated by reference in Part III of this report.

JONES LANG LASALLE INCORPORATED

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

| | |

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

Jones Lang LaSalle Incorporated, incorporated in 1997, is a Maryland corporation. References to “JLL,” “the Company,” “we,” “us” and “our” refer to Jones Lang LaSalle Incorporated and include all of its consolidated subsidiaries, unless otherwise indicated or the context requires otherwise. Our common stock is listed on The New York Stock Exchange ("NYSE") under the symbol “JLL.”

For over 200 years, JLL, a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions. JLL is a Fortune 500® company with annual revenue of $23.4 billion, operations in over 80 countries and a global workforce of more than 112,000 as of December 31, 2024. We provide services for a broad range of clients who represent a wide variety of industries and are based in markets throughout the world. Our clients vary greatly in size and include for-profit and not-for-profit entities, public-private partnerships and governmental ("public sector") entities. Through LaSalle Investment Management, we invest for clients on a global basis in both private assets and publicly-traded real estate securities.

Our global platform and diverse service and product offerings position us to take advantage of the opportunities in a consolidating industry and to successfully navigate the dynamic and challenging markets in which we compete worldwide.

We use JLL as our principal trading name. Jones Lang LaSalle Incorporated remains our legal name. JLL is a registered trademark in the countries in which we do business, as is our logo. In addition, LaSalle Investment Management, which uses LaSalle as its principal trading name, is a wholly-owned subsidiary of Jones Lang LaSalle Incorporated. LaSalle is also a registered trademark in the countries in which we conduct business, as is our logo.

In September 2024, we announced an organizational change that will bring together all building operation groups to address client needs and the changing dynamics of the real estate industry. As a result of these changes, effective January 1, 2025, we will report our Property Management business (currently included in Markets Advisory) within our Work Dynamics segment. Also effective January 1, 2025, this segment will be renamed Real Estate Management Services, and our Markets Advisory segment will become Leasing Advisory. Concurrently, Capital Markets will be renamed Capital Markets Services, LaSalle will be renamed Investment Management and JLL Technologies will be renamed Software and Technology Solutions; there are no reporting changes within these three segments.

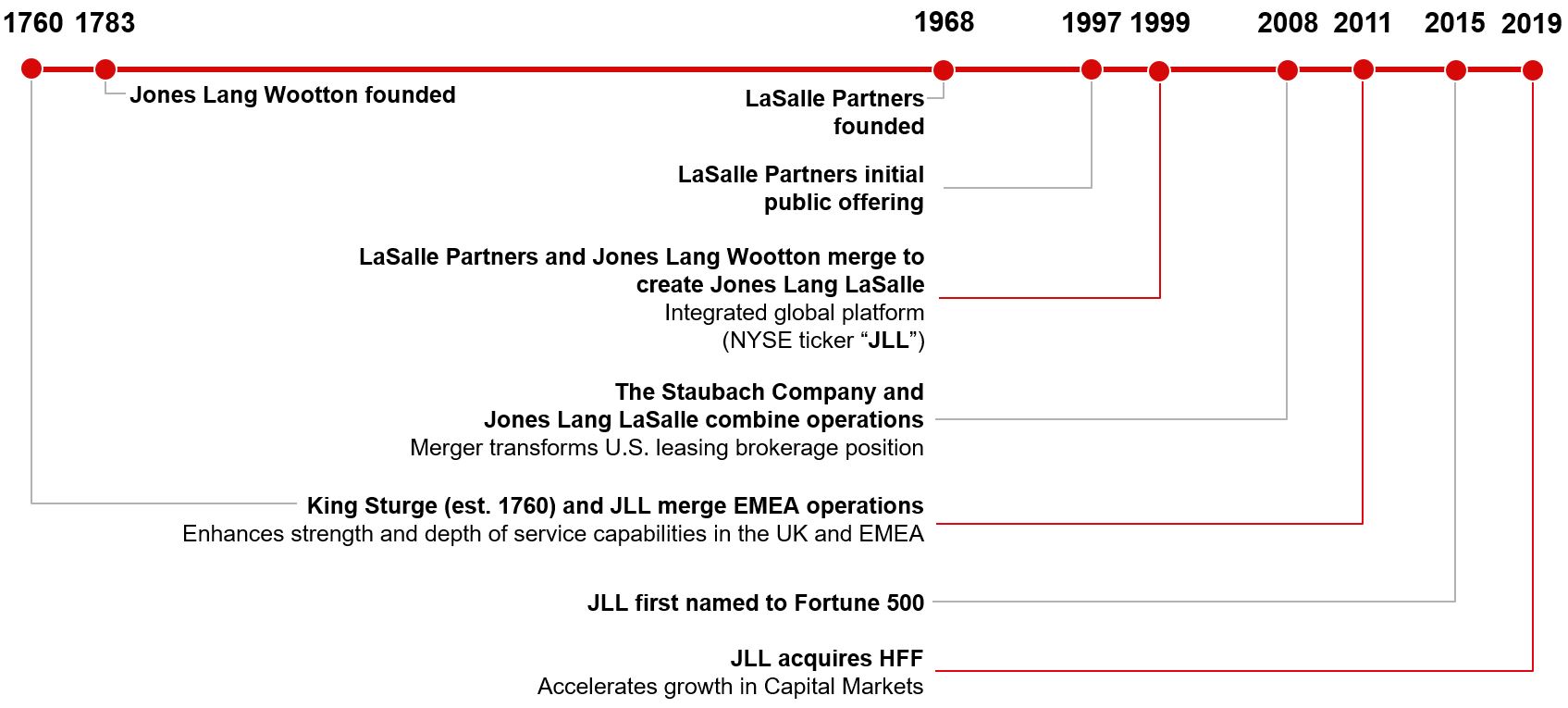

OUR HISTORY

While our roots trace back to 1783 with the founding of Jones Lang Wootton in England, we began to establish our global services platform through the 1999 merger with LaSalle Partners Incorporated ("LaSalle Partners," founded in the United States in 1968 and incorporated in 1997). The Company has grown by expanding our client base as well as service and product offerings, both organically and through mergers and acquisitions. Our extensive global reach and in-depth knowledge of local real estate markets enable us to serve as a single-source provider of solutions for the full spectrum of our clients' real estate needs. The mergers and acquisitions have given us additional share and scale in key geographical markets, expanded our capabilities in certain service offerings and further broadened the global platform we make available to our clients.

For information on recent acquisitions, refer to Note 4, Business Combinations, Goodwill and Other Intangible Assets, of the Notes to the Consolidated Financial Statements, included in Item 8.

A timeline of notable milestones in our history is illustrated below.

OUR SERVICES AND BUSINESS SEGMENTS

We are driven to shape the future of real estate for a better world. We do this by addressing the needs of real estate owners, occupiers and investors, leveraging our deep real estate expertise and experience to provide clients with a full range of services on a local, regional and global scale. For details on the range of services provided by each of the five segments, refer to the narrative starting on page 6.

We offer our real estate services locally, regionally and globally to real estate owners, occupiers, investors and developers for a variety of property types, including (ordered alphabetically):

| | | | | | | | |

| • Critical Environments and Data Centers | • Hotels and Hospitality Facilities | • Office (including Flex Space) |

| • Cultural Facilities | • Industrial and Warehouse | • Residential (Individual and Multifamily) |

| • Educational Facilities | • Infrastructure Projects | • Retail and Shopping Malls |

| • Government Facilities | • Logistics (Sort and Fulfillment) | • Sports Facilities |

| • Healthcare and Laboratory Facilities | • Military Housing and Other | • Transportation Centers |

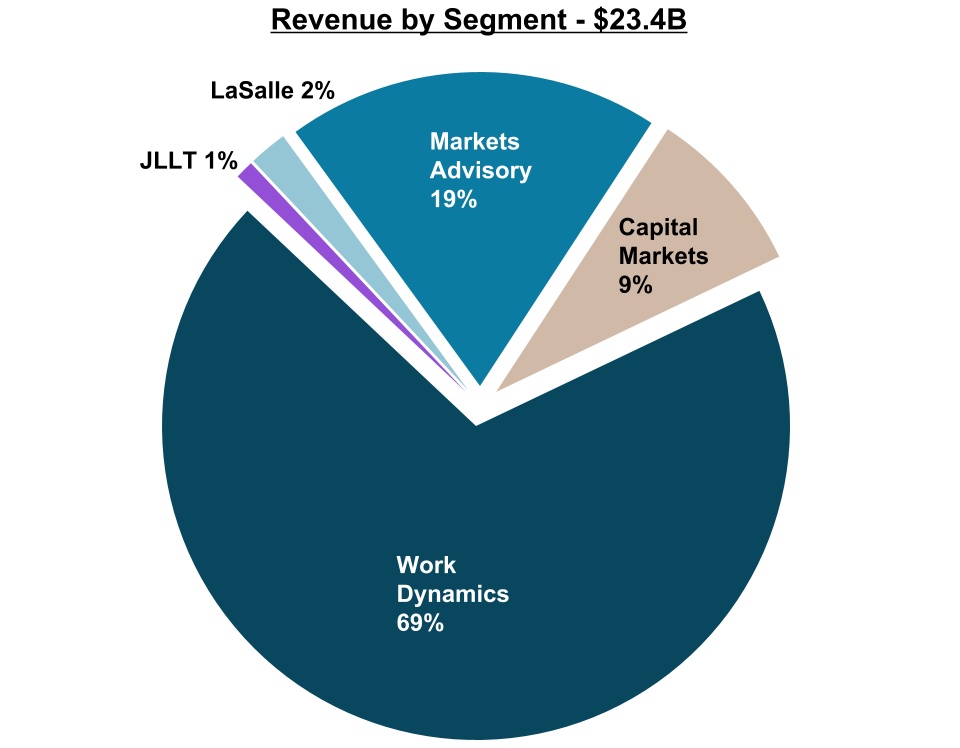

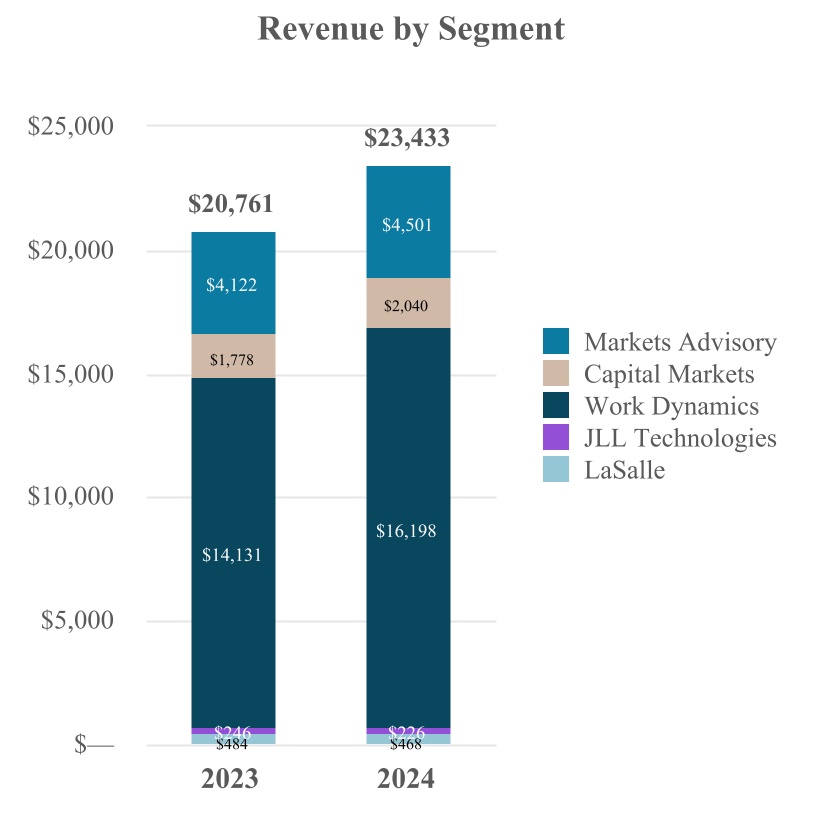

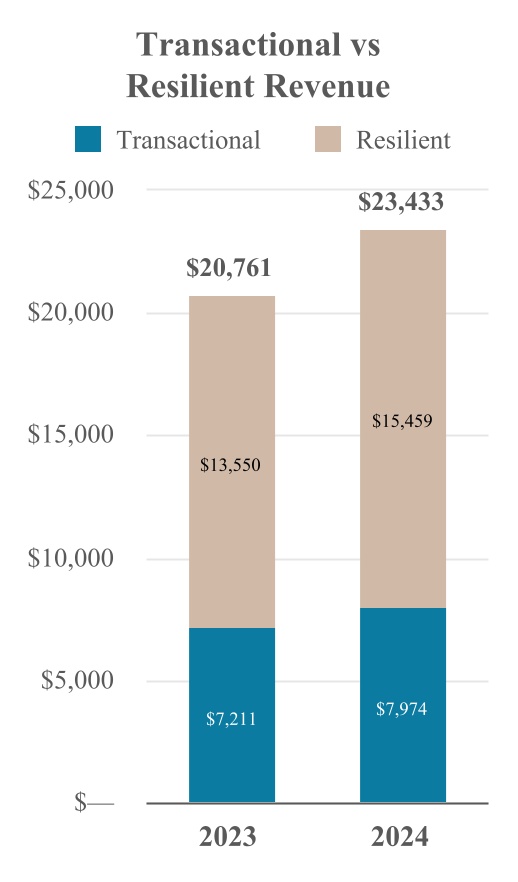

The following reflects our revenue by segment for the year ended December 31, 2024:

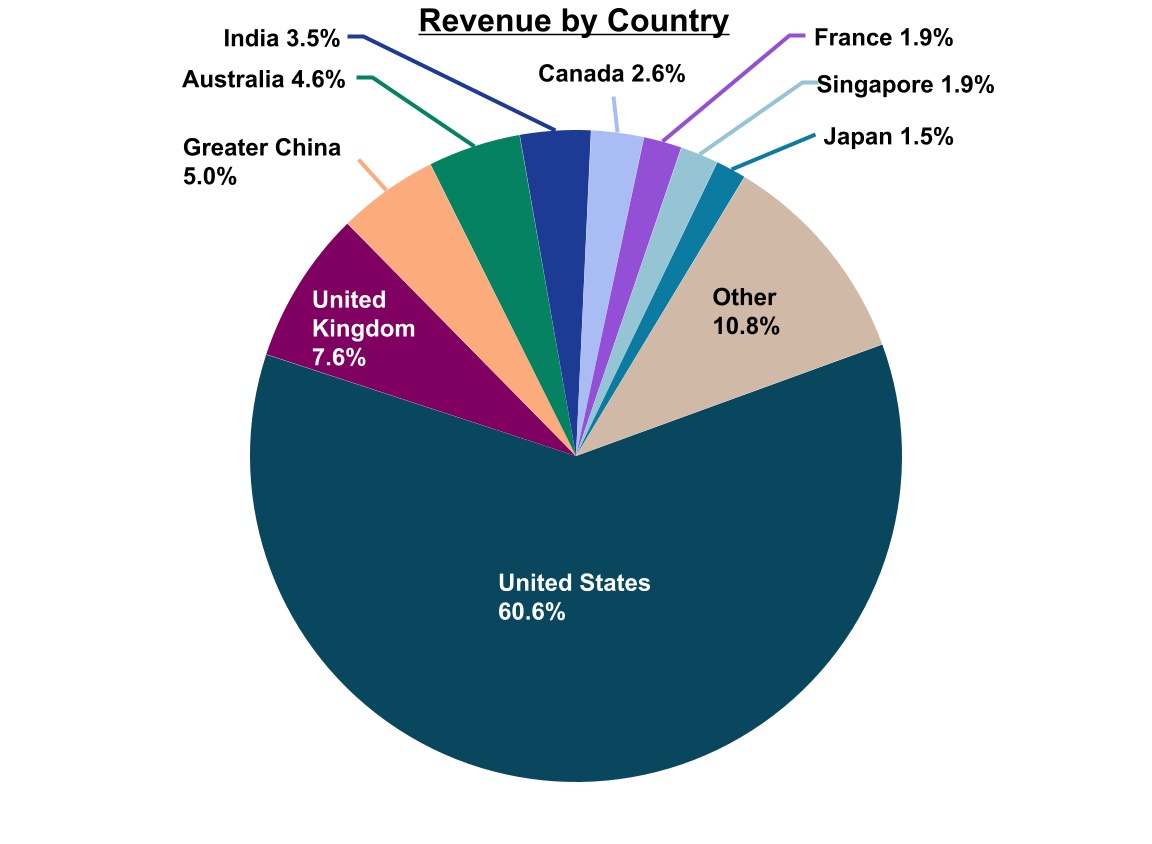

Our revenue was $23.4 billion for 2024, earned geographically as follows:

Note: Greater China is defined as China, Hong Kong, Macau and Taiwan.

As of December 31, 2024, our five segments, and the services we provide within them, included:

1. Markets Advisory

Markets Advisory offers local expertise across the globe covering a comprehensive range of services across asset types. We aggregate such services into three categories: Leasing, Property Management and Advisory, Consulting and Other.

Leasing

Agency Leasing executes marketing and leasing programs on behalf of property owners (including investors, developers, property-owning companies and public entities), including product positioning, target tenant identification and competitor analysis through to securing tenants and negotiating leases with terms that reflect our clients' best interests. In 2024, we completed approximately 18,300 agency leasing transactions representing 318 million square feet of space.

Tenant Representation establishes strategic alliances with occupier clients to define space requirements, identify suitable alternatives, recommend appropriate occupancy solutions, and negotiate lease and ownership terms with landlords. Our involvement helps our clients reduce real estate costs, minimize occupancy risk, improve occupancy control and flexibility, and create more productive office environments. In 2024, we completed approximately 23,000 tenant representation transactions representing 497 million square feet of space.

Our agency leasing and tenant representation advisory businesses anchor to the workplace of the future and helps owners and occupiers realize their sustainability commitments and goals. Both our agency leasing and tenant representation fees are typically based on a percentage of the value of the lease revenue commitment for executed leases, although in some cases they are based on a monetary amount per square foot leased.

Property Management

Property Management provides services to real estate owners for office, industrial and logistics, retail, multi-housing and specialty properties. We typically provide property management services through local teams, which are generally on-site for office and multi-housing properties, supported by regional supervisory teams and central resources in such areas as technology, training, environmental services, accounting, marketing, lease administration and human resources. We leverage our market share and buying power to deliver superior service and value to our clients, and our extended delivery team increasingly uses new technology and digital capabilities we deploy at the property. This allows clients to drive value, optimize operations, gain insights and elevate the tenant experience. Our work with clients also includes advisory, tenancy management and services focused strategically on reducing energy usage and carbon impact.

As of December 31, 2024, we provided property management services for properties totaling approximately 3.1 billion square feet.

We are generally compensated by either directly agreeing to a fixed fee or a cost plus fee model, or a fee based upon a percentage of cash collections we make on behalf of our clients, or based on square footage managed; in some cases, management agreements provide for incentive compensation relating to operating expense reductions, gross revenue or occupancy objectives, or tenant satisfaction levels. Consistent with industry norms, management contract terms typically range from one to three years, although some contracts can be terminated at will at any time following a short notice period, usually 30 to 120 days.

Advisory, Consulting and Other

Advisory and Consulting provides clients with specialized, value-add real estate consulting services in such areas as occupier portfolio strategy, workplace solutions, location advisory, mergers and acquisitions advisory, asset management, development advisory and master planning activities.

We typically negotiate compensation for Advisory and Consulting based on developed work plans that vary based on the scope and complexity of projects.

2. Capital Markets

Capital Markets is a full-service global provider of capital solutions creating a world of opportunity for investors and owners of real estate. As a leading provider of property sales, debt, value and risk advisory services, and hedging and derivatives, we combine the unique knowledge of our people with the power of collective insight and technology made possible by our fully-integrated capital markets platform. Our broad array of services includes (ordered alphabetically):

| | | | | | | | |

| ● Debt advisory | | | | ● Loan sales |

| ● Equity advisory (Equity and funds placement, M&A and corporate advisory) | | | | ● Loan servicing |

| ● Investment sales and advisory | | | | ● Value and risk advisory |

Investment Sales, Debt/Equity Advisory and Other

We provide brokerage and other services for real estate transactions, such as sales or loan originations and refinancing. M&A and corporate advisory services include sourcing capital, both equity and debt, and other traditional investment banking services designed to assist investor and corporate clients to maximize the value of their real estate interests. To meet client demands for selling and acquiring real estate assets domestically and internationally, our Capital Markets teams combine local market knowledge with our access to global capital sources to provide superior execution in raising capital for real estate transactions. By originating, developing and introducing innovative new financial products and strategies, Capital Markets is integral to the business development efforts of our other businesses. Most of our revenues are in the form of fees, derived from the value of transactions we complete or securities we place. In certain circumstances, we receive retainer fees for portfolio advisory or consulting services. For the year ended December 31, 2024, we provided capital markets services for approximately $186 billion of client transactions.

Value and Risk Advisory

Our Value and Risk Advisory professionals provide several services, including valuation, secured lending advisory, transaction support, data and analytics, development advisory, asset and infrastructure advisory, business valuation, property tax advisory, and restructuring. Our specialist risk advisory team provides environmental risk assessments to help asset owners reduce the carbon footprint of an asset. Our risk analytics services use artificial intelligence ("AI") and machine learning to identify risks from cash flow stability, climate change, location, regulatory and health and safety risks. Working closely with investors and lenders, we usually negotiate compensation for value and risk advisory services based on the scale and complexity of each assignment, and our fees typically relate in part to the value of the underlying assets.

Loan Servicing

In the U.S., we are a commercial multifamily lender and loan servicer approved by Freddie Mac, Fannie Mae and Housing and Urban Development/Ginnie Mae (the “Agencies”). In addition, we are one of only 25 Fannie Mae Delegated Underwriting and Servicing ("DUS") lenders. We service substantially all the loans we originate and sell to the Agencies, and service loans we did not originate but subsequently acquire the rights to service. We obtain a periodic fee for each loan we service based on a proportion of the cash collections. As of December 31, 2024, we serviced a loan portfolio of approximately $140 billion.

| | | | | |

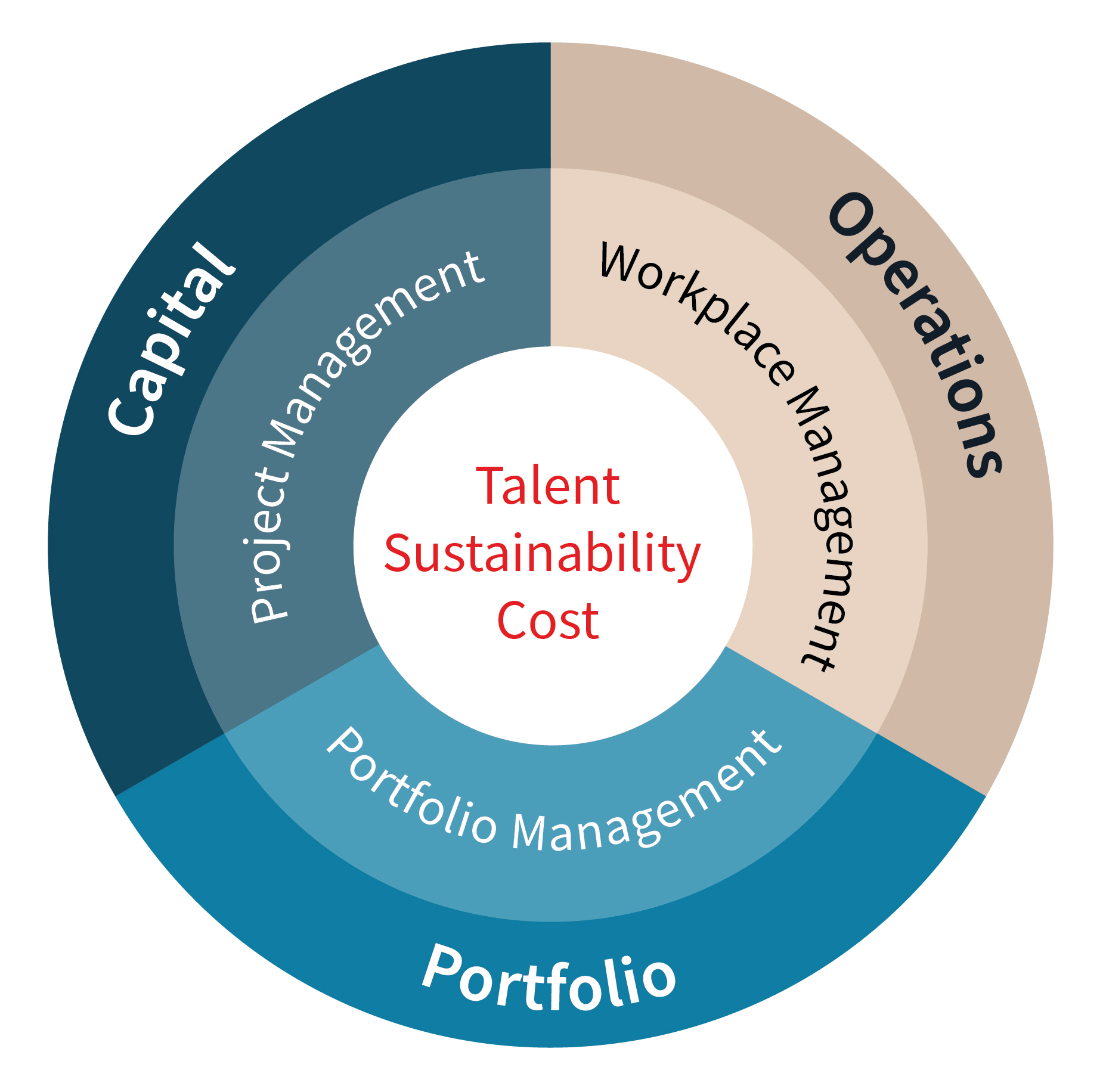

3. Work Dynamics Workplace Management As a strategic partner of clients with a multinational footprint, Work Dynamics offers a single, cohesive service-delivery team focused on three key value levers: (i) making informed, data-driven decisions and digital transformation, (ii) achieving operational excellence through improved productivity and financial performance and (iii) attracting and retaining talent through an enhanced user experience. Workplace Management provides comprehensive facility management services globally to corporations and institutions that outsource the management of the real estate they occupy, typically those with large multi-market portfolios of over one million square feet. Our Workplace Management offering leverages tech-enabled solutions and focuses on the work, worker and workplace to help clients manage costs, achieve sustainability goals, improve workplace service delivery and enhance end-user experience and performance. | |

Our globally-integrated delivery team includes our own personnel as well as third-party vendors and subcontractors who meet clients' requirements by providing consistent service delivery worldwide and a single point of contact for their real estate service needs. Workplace Management solutions offered to clients range from mobile engineering at a single location to a full-service outsourcing, where we execute day-to-day operations management of client site locations, delivered through a globally-integrated platform with standardized processes. Facilities under management cover all real estate asset classes, including corporate headquarters, distribution facilities, hospitals, research and development facilities, data centers and industrial complexes. As of December 31, 2024, Workplace Management managed approximately 2.2 billion square feet of real estate for our clients. Workplace Management contracts are generally structured on a principal basis (a fixed fee, guaranteed maximum, or reimbursement-based pricing model) but may also be on an agency basis. Typically, our structures include a direct or indirect reimbursement for costs of client-dedicated personnel and third-party vendors and subcontractors in addition to a base fee and performance-based fees. Performance-based fees result from achieving quantitative and qualitative performance measures and/or target scores on recurring client satisfaction surveys. Workplace Management agreements are typically three to seven years in duration and, although most contracts can be terminated at will by the client upon a short notice period (usually 30 to 60 days), a transition period of six to twelve-months is more common in our industry. We typically experience a high renewal rate, with most clients renewing their contracts at least once; many of our largest contracts have been in place for more than a decade. |

Project Management Project Management provides consulting, design, management and build services to tenants of leased space, owners in self-occupied buildings and owners of real estate investments, leveraging technology to drive outstanding service delivery. We also provide services to public-sector clients, notably military and government entities, and educational institutions, primarily in the U.S. and to a growing extent in other countries. We bring a "life cycle" perspective to our clients, from consulting and capital management through design, construction and occupancy via our JLL brand, while we also provide fit-out, refurbishment and design services under the Tétris brand, predominantly in Europe. Our Project Management business is generally compensated on the basis of negotiated fees as well as reimbursement of costs when we are principal to a contract (or client). Individual projects are generally completed in less than one year, but client contracts may extend multiple years in duration and govern a number of discrete projects. |

|

|

Portfolio Services

Through the suite of services our Work Dynamics business provides to clients via our "One JLL" approach, we gain deep knowledge and extensive data about their corporate real estate footprints, business strategies and organizational priorities. This knowledge enables our consulting practice to effectively advise clients on how to optimize their workplace strategies and occupancy planning to improve utilization and ultimately enhance the productivity and well-being of those who use the space. More broadly, this advice may extend to our clients’ portfolio strategies, including location advisory, transaction management, lease administration, technology implementation and optimization, and options to add and integrate flexible space solutions. Our fee structures vary and are based on the point-in-time or over-time nature of services and deliverables provided to our clients.

4. JLL Technologies

JLL Technologies leverages its comprehensive technology portfolio of software platforms, apps, hardware and technology services, as well as innovations from venture-backed companies, to help organizations maximize their real estate experience.

Services and Software Solutions

We offer professional services including program and project management, implementation and support, managed services, and advisory/consulting services. We recognize the associated revenue at the time our performance obligation is satisfied, sometimes over the course of multiple years.

In addition, our cloud-based software solutions enable higher-quality insight and decision-making through improved data and analytics, creating opportunities to improve clients' financial and/or operating performance. These solutions are typically sold via subscription offerings and we recognize revenue over time, commensurate with the length and terms of the contract. Examples include:

•Building Engines, a comprehensive system that unites the technology and applications used to manage a building with simplified upstream and downstream user interactions;

•Corrigo, a mobile and desktop-integrated product that enables facility managers to efficiently manage work orders, centralize repairs and maintenance, and automate tasks, all on a scalable level; and

•Hank, a technology which uses machine learning and artificial intelligence to optimize building energy efficiency, maintenance costs and tenant comfort, facilitating improved property operating income.

JLL Spark - Investments in Proptech

We drive property technology (proptech) innovation across the real estate spectrum, supporting the development of an array of products and data analytics tools. One way we achieve this goal is through strategic investments in proptech funds and early to mid-stage proptech companies, including through our JLL Spark Global Ventures Funds.

We generally report these investments at fair value and include fair value adjustments in our Consolidated Statements of Comprehensive Income within Equity earnings. As of December 31, 2024, the fair value of such investments was $363.1 million.

5. LaSalle

LaSalle is a global real estate investment management firm that invests institutional and individual capital in real estate assets and securities with a strategic priority to meet client objectives and deliver superior risk-adjusted returns over market cycles.

LaSalle launched its first institutional investment fund in 1979, making us one of the most experienced real estate focused investment managers in the industry. We have invested, on behalf of our clients and ourselves, in real estate assets located in 25 countries around the globe, as well as in public real estate companies traded on all major stock exchanges. LaSalle provides clients with a broad range of real estate investment products and services, designed to meet the differing strategic, asset allocation, risk/return and liquidity requirements of our clients. The range of investment solutions are offered either through commingled or single investor strategies and include private and public equity investments and real estate debt strategies structured as private or public open-ended funds or private closed-end funds (commingled funds), separate accounts, joint ventures or co-investments.

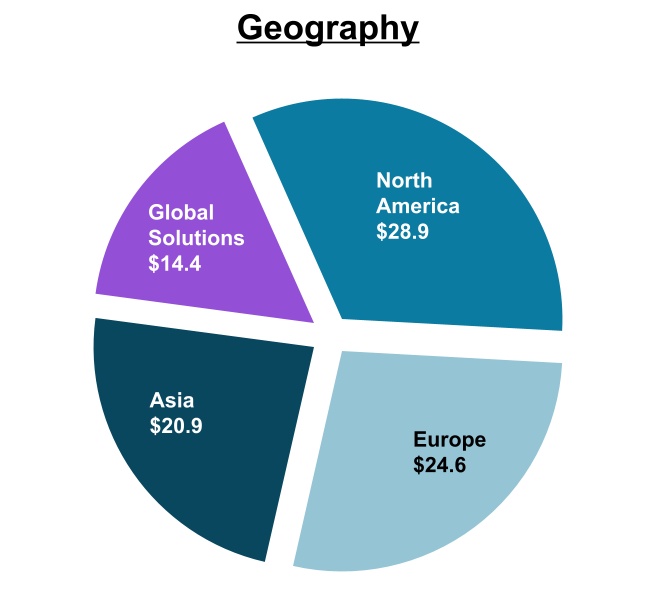

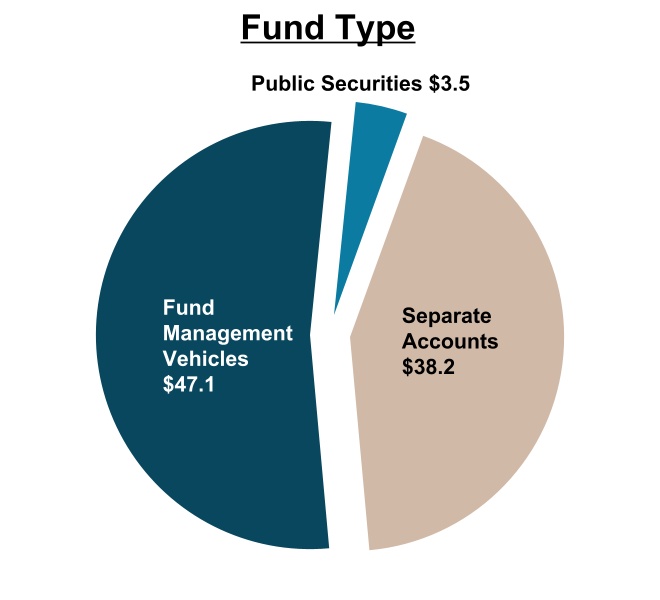

LaSalle's assets under management ("AUM") of $88.8 billion, as of December 31, 2024, by geographic distribution and fund type, is detailed in the following graphics ($ in billions).

We believe our ability to co-invest alongside our clients' funds aligns our interests and will continue to be an important differentiating factor in maintaining and improving our investment performance and attracting new capital to manage. As of December 31, 2024, we had a total of $406.1 million of co-investments, alongside our clients, in real estate ventures included in total AUM.

LaSalle is compensated for investment management services for private equity investments based on capital committed, capital deployed and managed (advisory fees), with additional fees tied to investment performance above specific hurdles (incentive fees). In some cases, LaSalle also receives fees tied to acquisitions, financings, and dispositions (transaction fees).

Our investment funds have various life spans, typically ranging between five and nine years, but in some cases are open ended. In 2024, open-ended funds represented approximately 32% of AUM as of December 31, 2024. Separate account advisory agreements generally have specific terms with "at will" termination provisions and include fee arrangements calculated on the mark to market value of the assets, plus, in some cases, incentive fees.

ORGANIZATIONAL PURPOSE

JLL’s organizational purpose is to shape the future of real estate for a better world. Staying true to this purpose in all that we do enables us to fully align with the best interests and ambitions of our clients and all our stakeholders. It exemplifies our commitment to the highest standards of environmental, social and corporate governance ("ESG"), and to a more sustainable and inclusive future.

This core organizational purpose is fully aligned with our "One JLL" philosophy which supports our corporate values of teamwork, ethics and excellence. This philosophy formalizes how our teams engage with each other and enables us to deliver the best capabilities to our clients. Ultimate responsibility for promoting awareness and ensuring adherence to our values and purpose across the enterprise is held by the JLL Global Executive Board ("GEB") and is endorsed by our Board of Directors. Our purpose guides our strategic growth vision and informs our response to the long-term macro trends which maintain prevalence in the real estate industry at all points in the economic cycle. These trends and our strategic framework are summarized below.

INDUSTRY TRENDS

Informing our long-term growth strategy, we see five major macro trends influencing the continued expansion and evolution of the real estate sector. These macro trends are:

(1) Urban Development Update - World Bank, April 2023.

Growth in corporate outsourcing

Corporate outsourcing of real estate services began in the early 1990s with U.S.-based corporations, and evolved into a global trend, embraced by owners and occupiers, with a strong growth trajectory. By focusing their own resources on core competencies and partnering with dedicated service providers like JLL to manage real estate strategy and activities, organizations are better positioned to advance their goals of financial and operational performance, talent attraction, customer experience, employee productivity and environmental sustainability.

Considering the impact of the pandemic, an evolving technology backdrop (e.g., artificial intelligence) and other macro factors on workforce productivity, creativity, well-being and culture, corporate management and boards around the world have a growing focus on reimagining workplaces and concepts for the future of work. With our deep expertise and specialist experience and resources in these areas across industries, we are positioned to provide our clients highly adaptive and relevant solutions and advisory services. With an under-penetrated market opportunity, we see a long runway for further growth in the trend for organizations to outsource real estate services as our clients increasingly seek strategic advice on reimagining their workspaces and workstyles to reinforce culture, attract talent and drive cost efficiencies.

Rising investment allocations and globalization of capital flows to real estate

In the years following the 2008 Global Financial Crisis, as investors reassessed investment allocations and priorities, real estate emerged from its previous "alternative investment" classification to become a major defined asset class of its own. This began a sustained long-term trend of rising investment allocations to the real estate sector with allocations increasing approximately 200 basis points since 2015, according to Cornell University's Baker Program in Real Estate and Hodes Weill & Associates, LP. While major global and market events can have significant near-term impacts on real estate investment transaction volumes, this deeply engrained long-term trend remains prevalent, as investors focus on real estate's relative returns and distinctive investment characteristics.

Complementing this, as investment volumes return, we anticipate increased capital flows across borders, creating new opportunities for advisors and investment managers equipped to source and facilitate these capital flows and execute cross-border transactions. Our real estate investment expertise and differentiated platform capabilities, linked seamlessly across the world's major markets, is ideally placed to support our clients' investment ambitions.

Urbanization

The concentration of people, culture, diversity, opportunity, facilities and creative expression supports the long-term global trend of migration into the world's major cities. While work patterns and preferences will continue to evolve, driven in part by new possibilities created by technology and the widespread adoption of flexible working, cities will thrive as they deliver on people's lifestyle and economic ambitions, characterized by vibrant and reimagined office, cultural, retail and residential profiles alongside an increasing focus on sustainability initiatives.

According to the World Bank's Urban Development update in April 2023, over 80% of global GDP is generated from cities, with the population in cities expected to increase 1.5 times by 2045. These trends support increasing demand for global real estate services and advice. JLL has well-established global research exploring this and associated trends in more depth, including related dynamics in the way the world’s major cities are growing, adapting and evolving.

Fourth Industrial Revolution

The World Economic Forum defines the Fourth Industrial Revolution as the wave of change being driven through advances in technology, data and artificial intelligence. The real estate industry is affected in many ways including, for example, (1) the transition to flexible and hybrid office working models, (2) new data-driven understanding of how all forms of real estate can be more efficient, sustainable and productive, (3) the rise of experiential and online retail, (4) new asset management technologies and (5) the growth of the logistics sector.

While there is currently no single technology disruptor positioned to dominate the real estate industry, there are thousands of start-ups, applications and concepts vying to transform the marketplace, collectively known as proptech. The challenge to innovate and maximize the current and future benefits of proptech is constant. At the heart of our Beyond strategy (discussed below) and supported by ongoing investments and innovations, we are widely-recognized as a leading user of technology and data in real estate.

Sustainability

Addressing climate change and the finite nature of global resources are recognized ESG risks for our industry. According to the International Energy Agency, real estate and the built environment account for nearly 40% of total global direct and indirect CO₂ emissions. At the same time, stakeholders are demanding greater focus on ESG from businesses and organizations in all areas of society. These and other factors, including heightened awareness of the importance of promoting health and well-being, coalesce into strong rising demand for sustainability services, decarbonization planning and advice across the real estate industry. JLL has identified meeting this demand as a growth opportunity and priority, aligning with our purpose to shape the future of real estate for a better world.

Refer to our annual ESG Performance Report, available on our website, for further information.

STRATEGIC FRAMEWORK

Our GEB has set out the Beyond strategic vision and framework to deliver long-term sustainable and profitable global growth. This framework comprises broad strategic priorities grouped into five pillars – Clients, Brand, Technology, People & Values, and Sustainability – which collectively support and drive our ambitious long-term growth trajectory.

Beyond: Our Strategic Vision for Long-Term Sustainable and Profitable Growth

After launching our Beyond strategic plan in 2017, we embarked on a multi-year transformation program to build a fully-integrated global organization and enable our "One JLL" philosophy across all of our business lines and functions. This allows us to provide seamless and consistent services to our clients across the world, as well as smoothly and rapidly deploy innovations, best practices and new technologies, ultimately enhancing growth prospects and operating efficiencies.

Clients

We deliver advisory-led services to maximize client outcomes, leveraging data, expertise and collaboration to convert insights into solutions. Our “One JLL” philosophy formalizes how our teams engage with each other and enables us to seamlessly serve clients across business lines and geographies. We focus on attracting clients in growth industries who value our global scale, differentiated platform and data-driven insights.

We continue to enhance our comprehensive service offerings to create real value for our clients. Guided by our Beyond strategy, we are making continued investments in our people and platform, ensuring our multidisciplinary teams are well positioned to provide tailored services and improve client outcomes.

Brand

We are recognized across our industry for our global presence, market-specific knowledge, actionable intelligence and sector specialization. Our company continues to emphasize its capability to provide tailored solutions for complex client challenges by aligning real estate strategies with clients' business growth objectives. Our industry-leading research capabilities, data intelligence and world-renowned expertise equip JLL's people to SEE A BRIGHTER WAY forward for our clients.

Our clients perceive the JLL brand to be trustworthy and ethical, in line with our recent recognition by Ethisphere as one of the World's Most Ethical Companies for the 17th consecutive year. Our heritage of over 250 years and strong global network reinforce this perception. While clients value our global connectivity, they also value our service quality and proactiveness. This is reflected by numerous local recognition awards and client-awarded supplier excellence awards.

Increasingly, our clients place importance on our ability to deliver integrated insights with the latest technology, and we continue to demonstrate our leadership in technology to transform data into actionable insight. Our industry-recognized commitment to technology earned JLL a place in Fast Company's Next Big Things in Tech. Additionally, Fortune named us one of the World's Most Admired Companies for the eighth consecutive year.

Our company continues to expand brand awareness beyond the traditional real estate sector while strengthening executive relationships to position real estate as a solution for various business challenges. As a strategic partner of the World Economic Forum, we play an active role in Real Estate and Investment industry groups, supporting global priorities such as sustainability. This involvement includes participation in events like New York Climate Week.

Technology

Technology is core to our growth strategy and essential to our purpose to shape the future of real estate for a better world. Through technology, JLL helps organizations transform the way they acquire, manage, operate and experience space. With a comprehensive portfolio of purpose-built solutions, unparalleled industry expertise and leading-edge, venture-backed companies, JLL enables organizations to achieve exceptional building performance, accelerate the path to net zero and optimize spaces for the future of work.

JLL is a global leader in proptech, expanding and refining our technology capabilities to deliver significant competitive advantages and value for our company and our clients, across all business lines. The technology and data solutions we provide include multiple cloud-based software products and AI-powered platforms. These technologies generate value for occupiers and investors by leveraging data and analytics to improve the quality of decision making, deliver unique insights and reduce operating costs.

Additionally, we remain committed to the JLL Spark Global Ventures Funds, the offerings of which are further discussed in Our Services and Business Segments. Visit our website at www.jll.com to see our full portfolio of technology services.

People & Values

People are at the heart of our business. We are dedicated to helping our people SEE A BRIGHTER WAY by enabling them to explore new opportunities, build expertise, create long-term careers, and draw inspiration through working with talented colleagues and clients.

In the world's major markets across most industries, declining working-age populations and long-term economic growth continue to drive competition for talent, resulting in highly fluid and competitive recruitment markets. A successful enterprise-wide people strategy is central to our company's success and complements our promise to our people where we commit to empowering them to shape a brighter way forward. This promise ensures JLL is positioned as an employer of choice for top talent, achieving and sustaining an inclusive and collaborative culture that strongly appeals to our people and our clients alike.

Sustainability

Our sustainability program is rooted in our purpose to shape the future of real estate for a better world. Staying true to this purpose enables us to align with the interests and ambitions of our clients and stakeholders. It exemplifies our commitment to the highest standards of ESG, and to a more sustainable and inclusive future.

With 40% of global carbon emissions emanating from the built environment according to the International Energy Agency, the real estate sector has a collective responsibility to set and achieve transformational sustainability targets. JLL is a leader in addressing this challenge - from setting aggressive sustainability targets for our own operations, through providing industry-leading sustainability services, products and advice for our corporate and investor clients, to partnering with civil society and industry bodies.

In 2021, we became the first real estate services company to align its climate ambitions with climate science when our net zero target was certified by the Science Based Targets initiative (SBTi) to its Net-Zero Standard. Within this overall target, JLL has committed to:

1.A near-term target to reduce absolute Scope 1, 2 and 3 emissions by 51% by 2030 from a 2018 baseline (including 100% of Scope 1 and 2 emissions from JLL-occupied buildings)

2.A long-term target to reduce absolute Scope 1, 2 and 3 emissions by 95% by 2040 from a 2018 baseline

We further discuss our ESG and sustainability focus areas in the next section, Sustaining Our Enterprise: A Business Model That Considers All Aspects of Stakeholder Value.

Growth

Our Beyond priorities, strategic vision and the macro trends discussed above provide a basis for enhancing productivity, optimizing sustainable and profitable long-term growth, and creating value for all our stakeholders. We embrace our opportunity to play a leading role in understanding and guiding the future of work, workplaces and cities, while enabling clients and communities to deliver on their sustainability targets and ambitions. JLL recognizes the vital role innovations in data capabilities and technology will play in the real estate sector. We continue to strategically invest in our platform, products and people to lead this wave of change.

The commercial real estate industry is consolidating, with the large players gaining market share both organically and through mergers and acquisitions. Our strong investment grade balance sheet provides flexibility to augment our organic growth with selective inorganic opportunities, enhancing our competitive position in this evolving landscape.

Our growth strategy and strategic vision includes creating an environment were all employees feel valued and can contribute their unique strengths to our collective success, ensuring we attract and retain a talented global workforce to meet our clients' evolving needs.

SUSTAINING OUR ENTERPRISE: A BUSINESS MODEL THAT CONSIDERS ALL ASPECTS OF STAKEHOLDER VALUE

As referenced above, the built environment is estimated to account for over one-third of global final energy consumption and nearly 40% of total direct and indirect CO2 emissions, meaning JLL can have a significant impact through the work we do with our clients, as well as efforts in our own workplaces and communities. | | | | | |

| Our Global Sustainability Program | |

Our sustainability program focuses on three areas that align to our purpose and JLL's corporate strategy. Each area is supported by targets and delivered by global business lines and corporate functions. •Climate action for sustainable real estate: We support action that accelerates the transition to net zero, enhances performance and mitigates risks. •Healthy spaces for all people: We create safe and healthy spaces that promote productivity, well-being and sustainability. •Inclusive places for thriving communities: We provide fair and inclusive places that support equal opportunities and thriving communities. |

Four principles underpin our program and demonstrate how we deliver a positive impact for our stakeholders and lead our sector on sustainability.

1.Being a responsible business and leading by example, giving us the credibility to talk to our clients and advance industry action on sustainability

2.Harnessing the power of our people, giving them the opportunity, knowledge and tools to own their success and valuing what makes them unique

3.Driving change through client solutions to maximize impact, collaborating to transform and transition toward more sustainable outcomes

4.Advocating for a better real estate sector by driving demand for sustainability, demonstrating thought leadership and engaging the industry, governments and society on the issues that matter most

Our approach is informed by a "double materiality" assessment aligned with the European Sustainability Reporting Standards (ESRS). Through a process of market evaluation and direct stakeholder input, we have identified the most important ESG impacts, risks and opportunities to inform our decision making for impact and value creation beyond our already ambitious net zero commitment.

A description of these issues, along with an account of our approach and performance in 2024, is covered in our annual ESG Performance Report, due for publication in the second quarter of 2025, available on our website.

Creating Sustainable Value for Clients, Shareholders and Employees

We have designed our business model to (i) create value for all our stakeholders, (ii) establish high-quality relationships with the suppliers we engage and the communities in which we operate and (iii) respond to macroeconomic trends impacting the real estate sector.

We strive to create a healthy and dynamic balance between activities that will produce short-term value and returns for our stakeholders through effective management of current transactions and business activities, and investments in people (such as new hires), acquisitions, technologies and systems designed to produce sustainable returns over the long term.

Increasingly, our clients require innovative and consistent sustainability solutions across all geographies in which they operate. Through industry-leading sustainability services powered by a suite of sustainability technology solutions, we deliver an end-to-end approach that enables clients to achieve their goals.

We have over 1,000 sustainability professionals located around the world who are responsible for developing industry-leading sustainability and decarbonization solutions. Partnering for an end-to-end journey, we ensure clients have a clear plan, take the necessary action, and manage critical data to disclose against sustainability goals and deliver a return through risk mitigation and value creation.

We provide a programmatic approach to drive outcomes and deliver value across all types of real estate portfolios:

•Plan - to help clients develop carbon baselines and actionable sustainability strategies;

•Act - to execute sustainability initiatives that drive outcomes on goals; and

•Manage - to optimize implemented projects and programs, and measure and monitor critical data to support continued progress in reducing emissions and compliance reporting.

JLL's sustainability program is aligned with our purpose to shape the future of real estate for a better world and our corporate strategy to create long-term value for our stakeholders, including shareholders, clients, employees and communities. Through this, we help our clients manage their real estate more effectively and efficiently, promote employment and create value for our shareholders and employees.

COMPETITION

We operate across a wide variety of highly-competitive business lines within the commercial real estate industry globally. Our significant growth over the last decade, and our ability to take advantage of the consolidation which has taken place in our industry, have made us one of the largest commercial real estate services and investment management providers on a global basis, though the industry remains fragmented.

As we provide a broad range of commercial real estate and investment management services across many geographies, we face competition at international, regional and local levels. Increasingly, we also see companies who may not traditionally be considered real estate service providers, including investment banking firms, investment managers, accounting firms, technology firms, software-as-a-service companies, firms providing co-working space, firms providing outsourcing services of various types (including technology, food service and building products) and companies that self-perform their real estate services with in-house capabilities, entering the market. Some of our primary competitors include large national or global firms including CBRE Group Inc., Cushman & Wakefield plc, Colliers International Group Inc., Savills plc and Newmark Group Inc.

DISTINGUISHING ATTRIBUTES AND COMPETITIVE DIFFERENTIATORS

We deliver exceptional strategic, fully-integrated services, best practices and innovative solutions for real estate owners, occupiers, investors and developers worldwide through an integrated global platform. We invest in technology and data capabilities that provide our people and our clients with the best insights, driving productivity and client results. These characteristics, among others, distinguish us from our competitors, drive service excellence and customer loyalty, and demonstrate our commitment to a sustainable future.

While we face formidable competition in individual markets, the following are key attributes differentiating JLL for clients seeking real estate and investment management services across the globe.

| | | | | | | | |

Client Relationship Management Our client-driven focus enables us to develop, sustain and grow long-term client relationships that generate repeat business and create repeat revenue opportunities. Our clients are the center of our business model, and we enable superior service delivery through ongoing investments in the people, processes and tools that support client relationship management. Our client experience management platform allows us to gather, understand and act on our clients' feedback. Our goal is to provide a holistic understanding of our clients' needs across our business, curate a customized experience and identify the right management approach for our clients to drive accountability and bring the best of JLL. We achieve superior client service through best practices in client relationship management, seeking and acting on regular client feedback, and recognizing each client's own specific definition of excellence. We also invest in developing the highest caliber talent dedicated to managing our client relationships through an employee compensation and evaluation system aligned with our global career framework and designed to reward client relationship building, teamwork and quality performance. | |

| Globally Integrated Business Model and "One JLL" Through the combination of a wide range of high-quality, complementary services, we develop and implement real estate strategies that meet the increasingly complex and far-reaching needs of our clients. With operations spanning the globe, our in-depth knowledge of local, regional and international markets along with our "One JLL" approach - leveraging the ability and connectivity of our people - can provide services which address the entire life cycle of real estate around the world. "One JLL" enables cross-selling opportunities across geographies and service offerings that we expect will continue to develop new revenue sources and growth. |

Technology Leadership Technology is transforming commercial real estate and CRE technology strategy is top of mind for our clients. JLL’s technology strategy is to build, acquire, license and invest to curate a portfolio of the most impactful technology products. We drive adoption of these products to empower our people and generate value for our clients. We make significant investments in technology to empower our people and clients to achieve success. For example, our acquisition of Raise Commercial Real Estate and the resulting LeasingOS platform is a cloud-based application that helps JLL deliver greater value throughout the leasing lifecycle by providing a digital one-stop place for brokers and clients to collaborate. We are a leader in the development and deployment of Artificial Intelligence (AI) to transform CRE: •Our purpose-built JLL Falcon platform provides a cutting-edge set of AI-enabled software services that combines JLL’s vast and comprehensive proprietary data with generative AI models to deliver timely, revenue-generating and cost-saving insights and maximized returns. •JLL Azara, powered by JLL Falcon, is a data analysis application designed to transform how business leaders interact with corporate real estate and facilities management data. •JLL GPT is a generative AI assistant, purpose-built for the CRE industry, used by thousands of our employees to increase efficiency and deliver customized solutions for clients. Through our JLL Technologies business, we offer a comprehensive set of products along with services for investor and occupier clients. Corrigo, for example, helps improve client outcomes and drive cost efficiency for our Work Dynamics business. JLL Spark Global Ventures has invested in more than 50 proptech start-ups focused on technology such as IoT sensors, AI space planning and visualization, AI analytics for builders, investment platforms and more. Our globally-coordinated investments in research, technology, data and analytics, people, quality control and innovation provide a foundation for us to develop, share and continually evaluate best practices across our global organization. Our investments are focused on both platform and client-facing technology. Further, we will continue to develop and deploy technology to support our marketing and client development activities and to make our products and services increasingly accessible. | |

| | | | | | | | |

| Brand The combined strength of our JLL and LaSalle brands represents a significant advantage when we pursue new business opportunities, and is also a major motivator for talented people to join our global organization. Large corporations, institutional investors and occupiers of real estate recognize our ability to create value reliably in changing market conditions, based on (i) evidence provided by brand perception surveys we have commissioned, (ii) extensive coverage we receive in top-tier business publications, (iii) awards we receive in real estate, sustainability, innovation, data/technology and ethics, as well as (iv) our significant, long-standing client relationships. Our reputation derives from our deep industry knowledge providing actionable intelligence, global provision of high-quality professional real estate and investment management services, and our local expertise and sector specialization, ensuring that our clients receive a best-in-class service. We believe in uncompromising integrity and the highest ethical conduct, where our Board of Directors and senior management lead by example. We are proud of the global reputation we have earned, and are determined to protect and enhance it. The integrity our brand represents is one of our most valuable assets and a strong differentiator for JLL. In 2022, we unveiled our global brand idea, SEE A BRIGHTER WAY, which embodies our commitment to bring optimism, innovative ideas and unmatched intelligence in everything we do for our clients. This has helped us to increase the value of our brand, and continues to support our quest to shape the future of real estate for a better world. |

Employee Experience Our people are united by our purpose to shape the future of real estate for a better world. Our purpose, combined with our strategic focus areas, positions us for exciting business growth. Embedded in everything we do are our values: Teamwork, Ethics and Excellence. Driving the best people experience is imperative, enabling our employees to continue to grow with JLL while also feeling part of an inclusive and collaborative culture. We give employees the opportunity, knowledge and tools to own their success because we value what makes each of us unique. Our goal-setting framework uses four categories of goals (clients, platform, people and values, and brand) that align our people’s efforts with enterprise-wide strategy throughout all levels of the organization and builds focus and attention on our priorities. Ongoing employee feedback is important to the continued improvement of our organization and to harness this valuable feedback, we conduct an all-employee survey regularly, measuring key aspects such as engagement, leadership, inclusion and well-being. | |

| | | | | | | | |

| Financial Strength Our broad geographic reach and the range of our global service offerings diversify the sources of our revenue, reducing overall volatility in operating a real estate services business. This further differentiates JLL from firms with more limited service offerings, or that are only local/regional and must rely on fewer markets or services. Confidence in the financial strength of long-term service providers is important to our clients, who require this when they select real estate service providers. We focus on maintaining financial performance metrics, particularly our leverage and debt service coverage ratios, that support investment-grade financial ratings. We continue our long history of investment grade credit ratings from Moody’s Investors Service, Inc. ("Moody’s") and Standard & Poor’s Ratings Services ("S&P"). Our issuer and senior unsecured ratings as of December 31, 2024 are Baa1 from Moody’s and BBB+ from S&P. Accordingly, our ability to present a strong financial condition may distinguish us as we compete for business. We have ample capacity to fund our business. As of December 31, 2024, corporate liquidity was $3.6 billion, the sum of cash and cash equivalents and the available capacity on our unsecured credit facility (the "Facility"). The Facility is provided by an international syndicate of banks, which, as of December 31, 2024, had a maximum borrowing capacity of $3.3 billion and a maturity date in November 2028. In addition to our Facility, we established a commercial paper program in 2024, in which we may issue up to $2.5 billion of short-term, unsecured and unsubordinated commercial paper notes at any time. |

Focus on Sustainability Leading on sustainability is fundamental to both our purpose and our long-term growth strategy, with a strong correlation to the success of our business. Being a responsible corporate citizen is the right thing to do, and is what our clients and employees expect from us. Our ESG Performance Report provides information on our management approach and performance against the three issue areas that underpin our sustainability program, and additional ESG impacts identified through our sustainability materiality review. | |

| Industry-Leading Research and Data Capabilities We invest in and rely on comprehensive research to support and guide the development of real estate and investment strategy for our clients. With hundreds of research professionals who gather data and cover market and economic conditions around the world, we are a leading adviser within the commercial real estate industry. Research plays a key role in keeping colleagues and clients attuned to important trends and changing conditions in world markets. We continue to devise and invest in new approaches through data science techniques and other technology to make our research, services and property offerings more readily available to our people and clients. We believe our investments in research, technology, data science and analytics, people and thought leadership position JLL as a leading innovator in our industry. Our research initiatives investigate emerging trends to help us anticipate future conditions and shape new services to benefit our clients, which in turn help us secure and maintain profitable long-term relationships with the clients we target: the world's leading real estate owners, occupiers, investors and developers. |

| |

Awards

We won numerous awards and recognitions through January 2025 that reflect the quality of the services we provide to our clients, the integrity of our people and our desirability as a place to work. As examples, we were named:

•An Energy Star Sustained Excellence Award recipient, by the U.S. Environmental Protection Agency, every year since 2012

•One of the World's Most Ethical Companies by the Ethisphere Institute, every year since 2008

•A World's Most Admired Company by Fortune Magazine, every year since 2017

•To the Human Rights Campaign Foundation's Corporate Equality Index, a benchmarking survey on corporate policies and practices related to LGBTQ workplace equality, for the tenth consecutive year

•One of the Best Places to Work for Disability Inclusion by the Disability Equality Index, for the sixth consecutive year

•A member of Seramount’s Inclusion Index, recognizing our dedication and progress to creating an inclusive workplace for the third consecutive year

•One of America’s 100 Most Sustainable Companies by Barron’s, for the fifth consecutive year

•To the Wall Street Journal's Management Top 250 ranking, for the fifth consecutive year

•One of America’s Most JUST Companies by Forbes/JUST Capital, for the third consecutive year

•A Top Company for Executive Women by Seramount, for the second consecutive year

•One of U.S. News & World Report’s Best Companies to Work For

•One of America's Greatest Workplaces by Newsweek and Plant-A Insights Group

•One of The World's Best Companies by Time and Statista

•One of Forbes' Most Trusted Companies

INTEGRATED REPORTING

JLL was one of the first U.S. listed companies to participate in the International Integrated Reporting Council ("IIRC"), and we continue to support the general principles set forth by the <IR> Framework, which are designed to promote communications and integrated thinking about how an organization's strategy, governance, and financial and non-financial performance lead to the creation of value over the short, medium and long term.

Components of Our Integrated Reporting. This Annual Report on Form 10-K focuses on our business strategy and our financial performance, including an attempt to illustrate how being a sustainable enterprise is integral to our success. Our citizenship and sustainability efforts for ourselves and our clients are reflected primarily in our annual ESG Performance Report, available through our ESG and Sustainability Reporting Hub. Our governance and remuneration practices are reported primarily in the Proxy Statement for our Annual Meeting of Shareholders. The mechanisms we use to make our clients comfortable with respect to our transparency and fair dealing are summarized in our Ethics Everywhere Report. The behaviors and standards we expect of our employees and of the suppliers we engage for our own company and on behalf of clients are presented in our Code of Ethics and our Vendor Code of Conduct. We publish details of our ethics program and ethics statistics in our Ethics Everywhere Report to increase transparency and understanding of the types of concerns and issues raised through our reporting channels.

Responsibility for Integrated Reporting. Our Finance, Legal and Sustainability functions are primarily responsible for the integrity of our integrated reporting efforts, collaborating in the preparation and presentation of this report and engaging our organization's leadership.

SEASONALITY

Historically, we have reported a relatively smaller revenue and profit in the first quarter with both measures increasing during each of the following three quarters. This is a result of a general focus in the real estate industry on completing or documenting transactions by calendar year end and the fact that certain expenses are constant throughout the year. Our seasonality excludes the recognition of investment-generated performance fees and realized and unrealized investment equity earnings and losses. Specifically, in our LaSalle business, we recognize incentives fees when assets are sold or as a result of valuation increases in the portfolio, the timing of which may not be predictable or recurring. In addition, investment equity gains and losses are primarily dependent on underlying valuations, and the direction and magnitude of changes to such valuations are not predictable. Non-variable operating expenses, which we treat as expenses when incurred during the year, are relatively constant on a quarterly basis.

HUMAN CAPITAL

The following table details our global headcount for reimbursable and non-reimbursable employees.

| | | | | | | | |

| (in thousands) | December 31, 2024 | December 31, 2023 |

| Professional non-reimbursable employees | 58.2 | | 57.8 | |

| Directly reimbursable employees | 53.9 | | 48.3 | |

| Total employees | 112.1 | | 106.1 | |

The costs associated with directly reimbursable employees are fully reimbursed by clients, primarily in Work Dynamics but also within Markets Advisory. Specifically, reimbursable employees include many of our Workplace Management and Property Management professionals, inclusive of our building maintenance employees.

Our employees do not report being members of any labor unions, with the exception of approximately 3,800 building maintenance employees in the United States, over 77% of whom are reimbursable. As of both December 31, 2024 and December 31, 2023, approximately two-thirds of our employees were based in countries other than the United States.

At JLL, our community of people is united by our shared purpose of shaping the future of real estate for a better world through our values of Teamwork, Ethics and Excellence. We hold true to our people promise of giving every employee the opportunity, knowledge and tools to own their success while celebrating what makes each person unique.

Employee Engagement

Our vibrant workplace culture is reflected in our annual People Survey results, where 86,000 (76%) employees across all levels and backgrounds shared their perspectives, resulting in an engagement score of 72—surpassing the high-performance organizations benchmark by 4 points.

We create a work environment that supports the growth and interests of our employees. Our programs provide a framework that recognizes and understands our colleagues’ distinct aspirations and needs throughout our company. This approach enables us to develop strategies that resonate with different groups, ensuring all employees can access resources that support their success.

Our Business Resource Groups are open to all employees, and continue to foster an environment where connections flourish, providing inclusive platforms for career learning and relationship-building across our global community. These groups strengthen our culture of belonging while creating pathways to enhance business acumen and professional development.

Training and Development

As our business has evolved, so too have our broader learning and development platform and products. We continue to upskill our workforce on future-focused skills, ensuring our employees worldwide have the development they need, whether for technical or professional development, leveraging our JLL Virtual Learning library. Nearly 90,000 employees annually have been able to learn, in seven different languages, through our virtual, on-demand offerings about topics such as, but not limited to, sustainability, technology and the future of work. Our learning platforms have resulted in nearly 2 million learning assets consumed to accelerate the development of our employees.

Using extensive internal and external research, we have redefined the core leadership behaviors that drive our near and long-term success. These behaviors are the foundation for leadership development, leadership performance and talent assessments, succession planning and other talent processes. Our award-winning development platform, Leading the Way, has been updated to reflect the refreshed leadership behaviors and our employees can self-assess against them to participate in programs.

Leading the Way is an end-to-end platform that helps our employees grow their leadership skills from frontline to executive. It has served over 15,000 employees worldwide with various programs including e-learning, live webinars, and top talent initiatives. These programs incorporate elements of coaching, mentorship and partnerships with a variety of business schools, ensuring comprehensive leadership development across all levels of our organization.

We're leading the industry in technological innovation by integrating AI tools into our goal-setting platform. This advancement empowers employees to set personalized, persona-driven goals that align with their individual career paths and skill development, creating an environment where everyone has access to growth opportunities.

Well-being

Our well-being framework, consisting of physical, mental, financial and inclusion pillars, fosters a culture of holistic care that empowers our approximately 112,000 employees to thrive both personally and professionally. Through our global well-being site, employees can access live and virtual resources on topics such as mental health, financial education and caregiver support. Our Well-being hub offers over 120 sessions globally, addressing all aspects of employee wellness. In 2024, the hub has been viewed over 56,000 times, with employees completing several hundred hours of courses throughout the year.

Health and Safety

Health and safety is at the forefront of JLL's operations. With over 1,000 health and safety professionals, we are committed to creating an environment that unequivocally protects our employees, clients and supply partners.

To effectively manage health and safety, our program is certified to the internationally recognized health and safety management standard ISO 45001. We implement global health and safety standards that ensure we apply a consistent approach to harm prevention and operate assurance programs to ensure legal compliance.

We recognize that successful health and safety programs are built on proactive individual and collective safe behaviors. Through our health and safety vision, "One team S.A.F.E.R together," we create a stronger culture of health and safety, underpinned by our S.A.F.E.R. behaviors: S – Speak about safety; A – Act safely; F – Focus on safety standards; E – Engage in safety initiatives; R – Recognize safe performance.

Through our safety vision and our awareness and education programs, like Global Safety Week, the strength of our program is realized in the low accident rates for the year 2024, compared with the U.S. Occupational Safety and Health Administration ("OSHA") industry average accident rates for our industry (NAICS Code 531: Real Estate). The following metrics are as of January 2025:

•Lost Time Incident Rate was 0.17 (OSHA industry average was 1.4): 12-month average of recordable illness and injuries per 100 JLL employees and JLL contractors that resulted in days away from work.

•Total Recordable Incident Rate was 0.36 (OSHA industry average was 2.1): 12-month average of recordable illness and injuries per 100 JLL employees and JLL contractors.

•Days Away, Restricted Duty and Transfer was 0.22 (OSHA industry average was 1.1): 12-month average of recordable illness and injuries per 100 full-time employees and JLL contractors that resulted in days away from work or restricted duties.

•There were zero JLL employee workplace fatalities reported in 2024.

JLL has developed a new standard for its offices, creating workplaces that are productive, healthy, sustainable and inclusive. These new standards use industry-leading practices and research-based improvements to raise the standard of our office spaces, directly affecting our employees and accelerating the transition to net zero carbon emissions.

INTELLECTUAL PROPERTY

We regard our technology and other intellectual property, including our brands, as a critical part of our business.

We hold various trademarks, trade dress and trade names and rely on a combination of patent, copyright, trademark, service mark and trade secret laws, as well as contractual restrictions to establish and protect our proprietary rights. We own numerous domain names, have registered numerous trademarks, and have filed applications for the registration of a number of our other trademarks and service marks in the United States and in foreign countries. We hold the "Jones Lang LaSalle," "JLL," "LaSalle Investment Management" and "LaSalle" trademarks and the related logos to conduct the material aspects of our business globally. We own the rights to use the ".jll" and ".lasalle" top level domain names.

Although we believe our intellectual property plays a role in maintaining our competitive position in a number of the markets we serve, we do not believe we would be materially adversely affected by the expiration or termination of our trademarks or trade names or the loss of any of our other intellectual property rights other than the "JLL," "Jones Lang LaSalle," "LaSalle," and "LaSalle Investment Management" names, and our Design (Three Circles) mark that is also trademarked. Our trademark registrations have to be renewed every ten years, which we expect to continue to renew, as necessary. Based on our most recent trademark registrations, the JLL mark will expire in 2034. The JLL Design (Three Circles) mark will expire in 2031. Our LaSalle and LaSalle Investment Management marks will expire in 2031.

In addition to our trademarks and trade names, we also have proprietary technologies for the provision of complex services and analysis. We also have a number of pending patent applications in the U.S. to further enable us to provide high levels of client service and operational excellence. We will continue to file additional patent applications on new inventions, as appropriate, demonstrating our commitment to technology and innovation.

CORPORATE GOVERNANCE; CODE OF BUSINESS ETHICS; CORPORATE ESG AND RELATED MATTERS

We are committed to the values of effective corporate governance, operating our business to the highest ethical standards and conducting ourselves in an environmentally and socially responsible manner. We believe these values promote the best long-term performance of JLL for the benefit of our shareholders, clients, staff and other constituencies.

Corporate Governance. We believe our policies and practices reflect corporate governance initiatives that comply with the listing requirements of the NYSE, the corporate governance requirements of the Sarbanes‑Oxley Act of 2002, U.S. Securities and Exchange Commission ("SEC") regulations, the Dodd-Frank Wall Street Reform and Consumer Protection Act, and the General Corporation Law of the State of Maryland, where we are incorporated.

Our Board of Directors ("the Board") regularly reviews corporate governance developments and modifies our Bylaws, Guidelines and Committee Charters accordingly. On December 11, 2023, our Board approved and adopted the Fourth Amended and Restated Bylaws of the Company which became effective as of such date and are available on our website.

We have adopted the following corporate governance policies and approaches considered to be best practices in corporate governance.

•Annual elections of all members of our Board

•Annual "say on pay" votes by shareholders with respect to executive compensation

•Right of shareholders owning 30% of the outstanding shares of our Common stock to call a special meeting of shareholders for any purpose

•Majority voting in Director elections

•Separation of Chairman and CEO roles, with the Chairman serving as Lead Independent Director

•Required approval by the Nominating, Governance and Sustainability Committee of any Director or Executive Officer related-party transactions

•Executive session among the Non-Executive Directors at each in-person meeting

•Annual self-assessment by the Board and each of its Committees

Code of Ethics. In 2022, we launched an updated version of our Code of Ethics which sets forth the ethics principles that guide our operations globally and applies to all employees of JLL and the members of our Board. The Code of Ethics is the cornerstone of our Ethics Everywhere Program, by which we establish the operating framework to communicate, monitor and enhance our ethical culture and maintain compliance with our Code. As we operate in a service industry, the integrity our brand represents is one of our most valuable assets. For 2023 and 2024, we received Compliance Leader Verification from Ethisphere, a leading organization dedicated to advancing best practices in ethics, compliance, corporate governance and citizenship. The Compliance Leader Verification process involves a rigorous review of an ethics and compliance program and corporate culture and is awarded to select organizations that demonstrate a high level of excellence. This honor supersedes Ethisphere's Ethics Inside Certification, which we held from 2008-2022. As previously noted, we have also earned Ethisphere's World's Most Ethical Companies® recognition every year since 2008 and, in 2022, we received an award for "Best Compliance and Ethics Program" by Corporate Secretary magazine.

Our Whistleblower and Non-Retaliation Policy and our Human Rights Policy also support our values and our commitment to ethical business practices. We support the principles of the United Nations Global Compact and the United Nations Principles of Responsible Investing. We are also a member of the Partnering Against Corruption Initiative sponsored by the World Economic Forum.