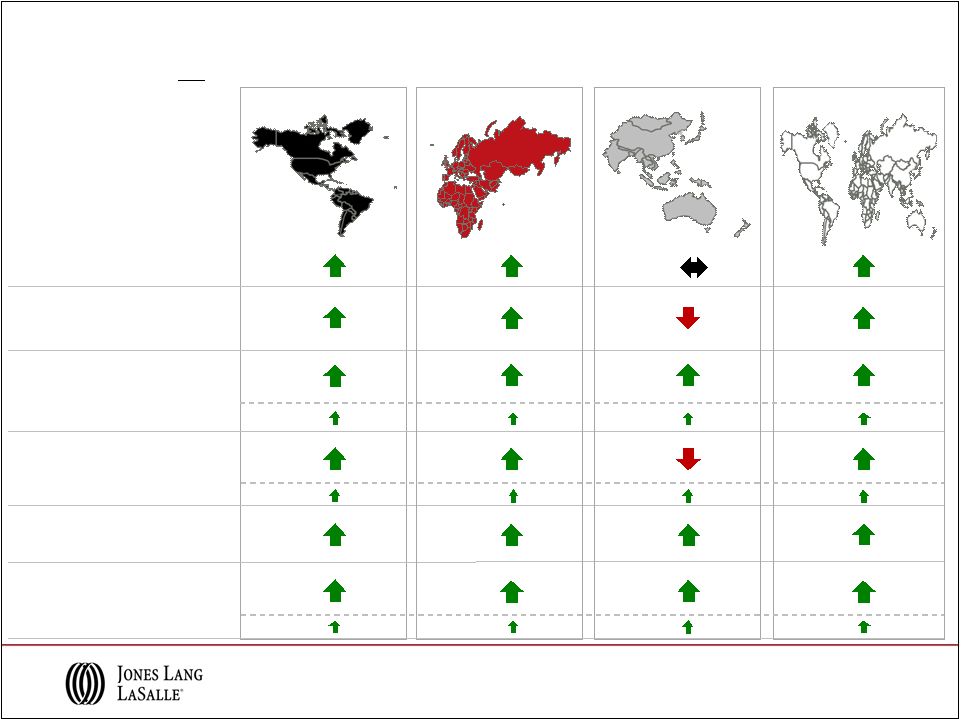

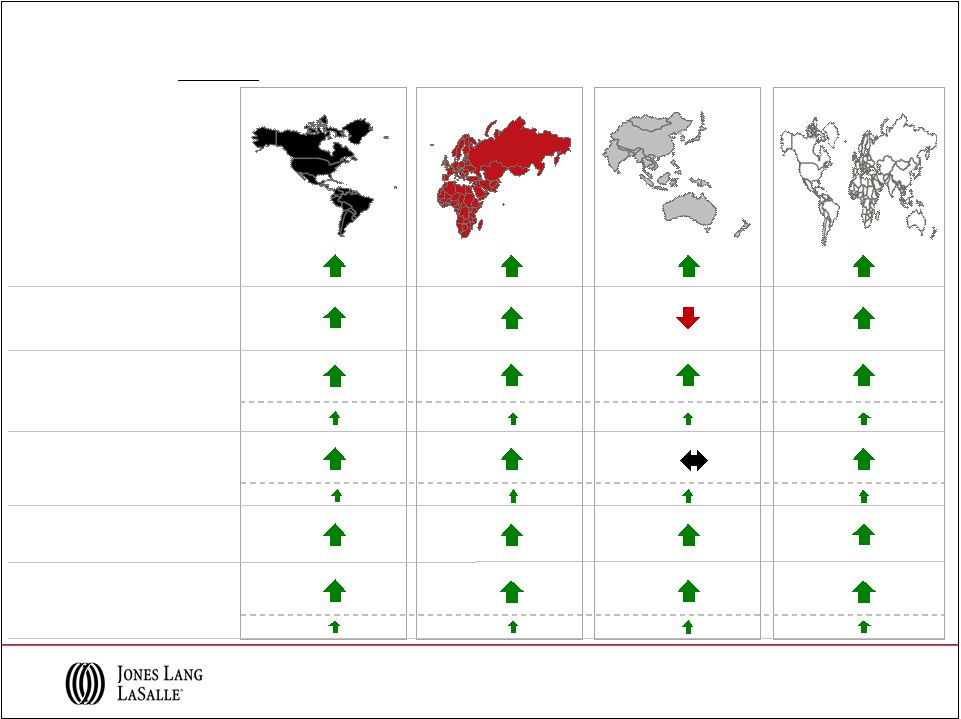

Fee Revenue / Expense Reconciliation • Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue and expense in JLL financial statements have been steadily increasing • Margins diluted as gross accounting requirements increase revenue and costs without corresponding profit • Business managed on a “fee” basis to focus on margin expansion in the base business 16 ($ in millions) 2012 2011 2012 2011 Consolidated Revenue 921.3 $ 845.3 $ 1,734.7 $ 1,533.1 $ Consolidated Operating Expenses 846.7 773.6 1,636.4 1,449.4 Adjusted Operating Income Margin 8.3% 8.7% 5.9% 5.6% Gross Contract Costs: Property & Facility Management 21.3 1.7 38.4 3.3 Project & Development Services 0.2 - 0.3 0.1 Total Gross Contract Costs 21.5 1.7 38.7 3.4 Property & Facility Management - - - - Project & Development Services 26.6 22.9 53.0 43.5 Total Gross Contract Costs 26.6 22.9 53.0 43.5 Property & Facility Management 18.1 19.9 40.3 38.6 Project & Development Services 2.9 5.5 5.6 11.4 Total Gross Contract Costs 21.0 25.4 45.9 50.0 Consolidated Fee Revenue 852.2 $ 795.3 $ 1,597.1 $ 1,436.2 $ Consolidated Fee-based Operating Expenses 777.6 $ 723.6 $ 1,498.8 $ 1,352.5 $ Adjusted Operating Income Margin ("fee"-based) 9.0% 9.2% 6.4% 5.9% YTD Asia Pacific Americas EMEA Q2 Note: Consolidated revenue and fee revenue exclude equity earnings (losses). Restructuring and acquisition charges are excluded from operating expenses. Restructuring and acquisition charges as well as intangible amortization related to the King Sturge acquisition are excluded from operating expenses when calculating adjusted operating income margin. |