Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Exhibit 99.3

[LOGO]

SILICON LABORATORIES

[GRAPHIC]

Expanding Market Leadership

Private Securities Litigation Reform Act of 1995

This presentation contains forward-looking statements based on Silicon Laboratories’ current expectations. These forward-looking statements involve risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. Silicon Laboratories believes that it is important to communicate the company’s future expectations to investors. However, there may be events in the future that Silicon Laboratories is not able to accurately predict or control. For a discussion of these and other factors which could impact Silicon Laboratories financial results and cause actual results to differ materially from those in the forward-looking statements, please refer to Silicon Laboratories recent filings with the SEC, particularly the Form 10-K filed January 22, 2003 and the Form 10-Q filed July 21, 2003. Unless otherwise required by law, Silicon Labs expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any result or change in expectations.

[LOGO]

Silicon Laboratories Confidential

2

Transaction Highlights

• Silicon Laboratories to acquire privately held Cygnal Integrated Products

• Transaction value = $60M at closing

• Earn-out capped at $65M

• Earn-out period will be based on Q2-04 through Q1-05 revenue

• Consideration in SLAB stock in a tax-free reorganization

• 1.2 million shares at closing

• 1.3 million additional shares subject to earn-out provision

• No stock price collars or re-pricing dates

• Expect to be accretive during 2005

• Close expected late Q4-03

3

Compelling Strategic Rationale

1. Large and attractive market opportunity

• Consistent with diversification strategy

• Broadens total addressable market

• Adds customer and product breadth

2. Synergistic products and engineering expertise

• Analog-intensive, mixed-signal

• Strong system selling opportunity

• Interesting development possibilities

3. Seamless integration

• Austin-based

• Strong engineering culture

• Same supply chain partners

4

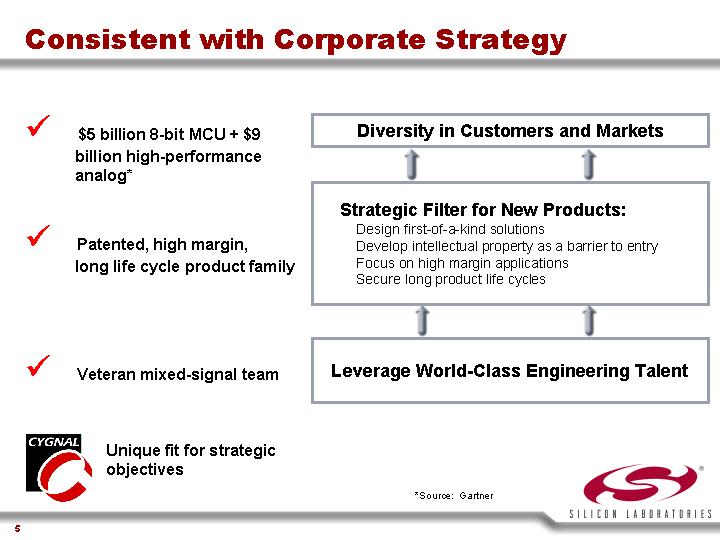

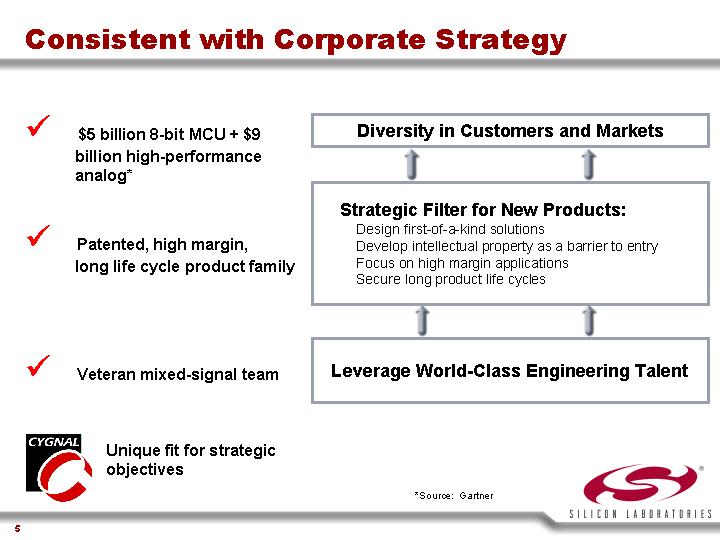

Consistent with Corporate Strategy

• | $5 billion 8-bit MCU + $9 billion high-performance analog* | | Diversity in Customers and Markets |

| | | |

• | Patented, high margin, long life cycle product family | | Strategic Filter for New Products: Design first-of-a-kind solutions

Develop intellectual property as a barrier to entry

Focus on high margin applications

Secure long product life cycles |

| | | |

• | Veteran mixed-signal team | | Leverage World-Class Engineering Talent |

| | | |

[GRAPHIC]

Unique fit for strategic objectives

*Source: Gartner

5

Overview of Cygnal

world’s smallest mixed-signal microcontroller

[GRAPHIC]

• Private, founded in 1999

• Based in Austin, TX: 62 employees

• CY02 revenues $5.2M

• 13,000 development kits shipped

• Complete development tools

• 35 patents issued or pending

• Product focus:

• C8051F family of high-margin, general purpose 8-bit microcontrollers

• Integrates ADC/DAC, high-performance MCU, and programmable communications interfaces

• 50+ products

6

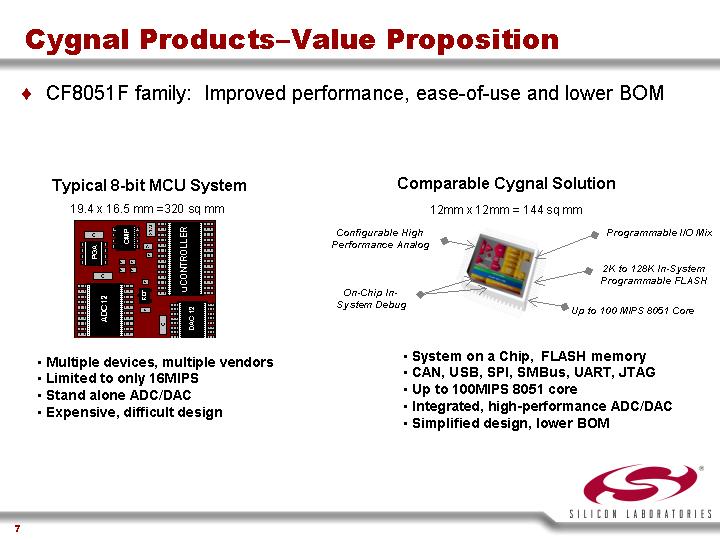

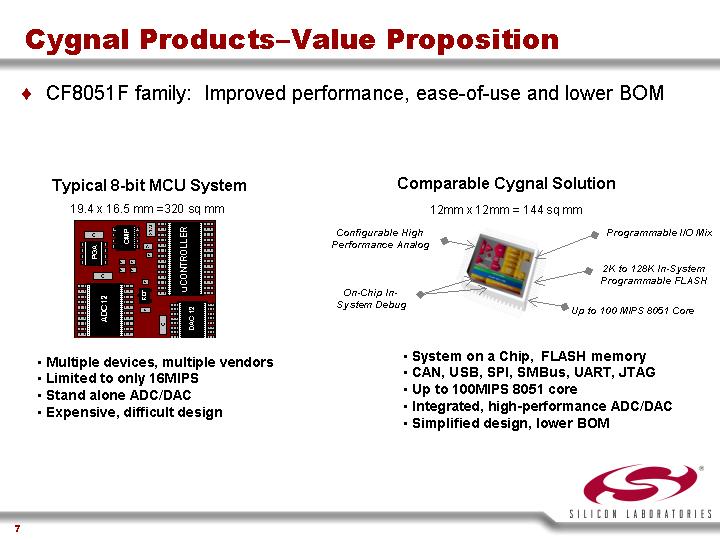

Cygnal Products–Value Proposition

• CF8051F family: Improved performance, ease-of-use and lower BOM

Typical 8-bit MCU System

19.4 x 16.5 mm =320 sq mm

[GRAPHIC]

• Multiple devices, multiple vendors

• Limited to only 16MIPS

• Stand alone ADC/DAC

• Expensive, difficult design

Comparable Cygnal Solution

12mm x 12mm = 144 sq mm

[GRAPHIC]

• System on a Chip, FLASH memory

• CAN, USB, SPI, SMBus, UART, JTAG

• Up to 100MIPS 8051 core

• Integrated, high-performance ADC/DAC

• Simplified design, lower BOM

7

Cygnal–Differentiated Products

• Intelligent, mixed-signal 8051 architecture

• Industry leading performance

• Flexible, programmable

• Clear advantages in:

• CPU throughput

• A/D performance

• D/A conversion

• Serial connectivity

• Size

Attribute | | Cygnal

C8051F | | Competing

Solutions |

| | | | |

# FLASH MCUs | | 52 | | 45 |

CPU Throughput | | 20 --> 100MIPS | | 1 --> 16MIPS |

A/D Converter | | 8, 10, 12, 16-Bit | | 8, 10-Bit |

A/D Performance | | ý | | ý |

D/A Converter | | 10-Bit, 12-Bit | | NONE |

Serial Connectivity | | UART, SPI, SMBus,

USB2.0, CAN | | UART, SPI,

SMBus, CAN |

Low Power | | ý | | ý |

Smallest Package | | 11-Pin

9mm sq. | | 8 to 20-Pin

27-138 mm sq. |

8

Attractive Market Opportunity

• Broadened market reach: 8-bit MCU + high performance analog

• New vertical market opportunities

Worldwide General-Purpose 4- and 8-Bit MCU Revenue Forecast

[CHART]

Source: Gartner, January 2003

9

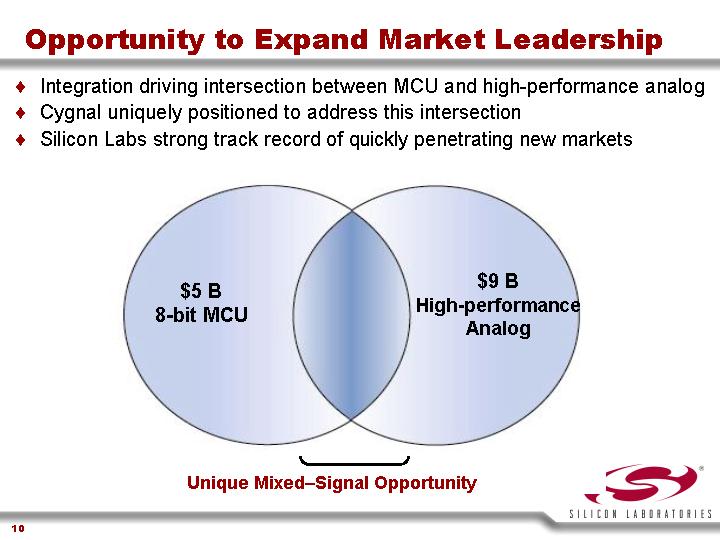

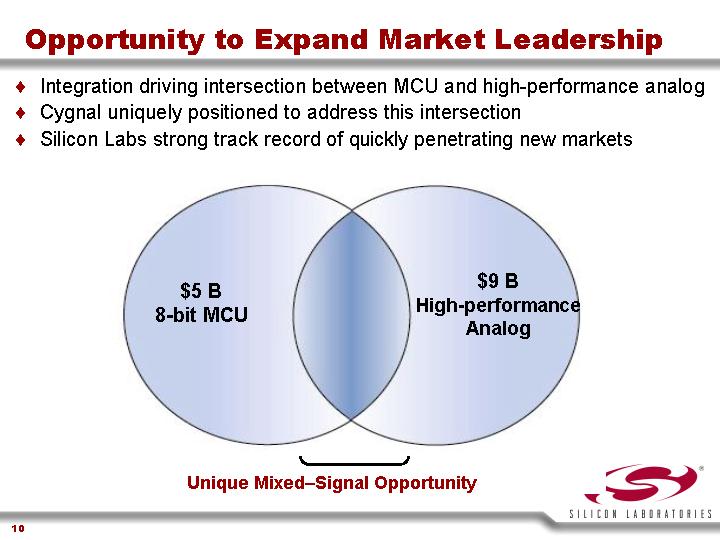

Opportunity to Expand Market Leadership

• Integration driving intersection between MCU and high-performance analog

• Cygnal uniquely positioned to address this intersection

• Silicon Labs strong track record of quickly penetrating new markets

[CHART]

Unique Mixed–Signal Opportunity

10

Immediate Opportunity to Expand Sales

• Cygnal execution

• Highly differentiated products

• Unique mixed-signal expertise

• Initial customer acceptance

• Silicon Labs sales leverage

• Access to global sales network

• Strong market position

• Large OEM relationships

One Chip Serves Multiple Applications

[GRAPHIC]

11

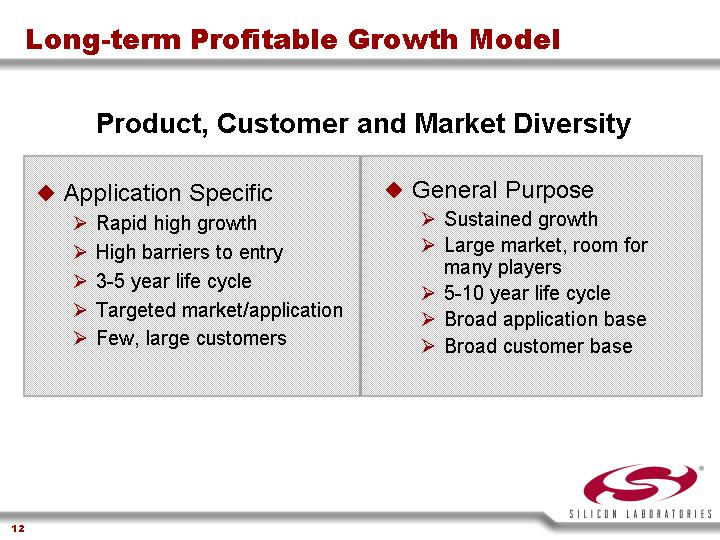

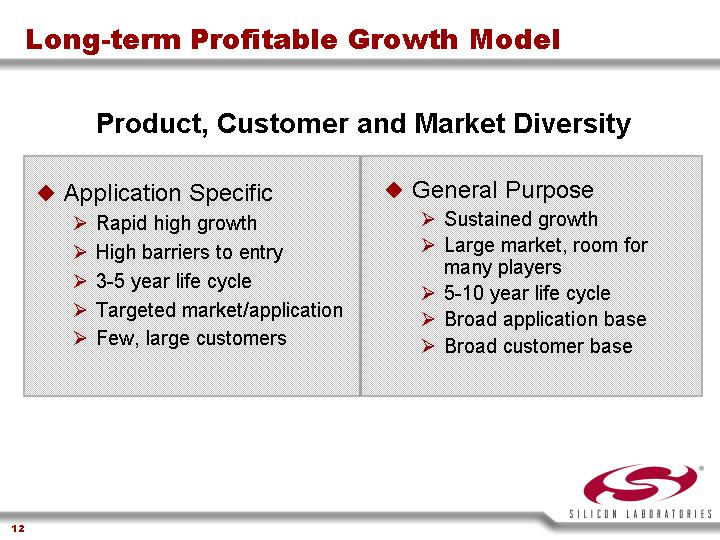

Long-term Profitable Growth Model

Product, Customer and Market Diversity

• | Application Specific | • | General Purpose |

| • | Rapid high growth | | • | Sustained growth |

| • | High barriers to entry | | • | Large market, room for many players |

| • | 3-5 year life cycle | | • | 5-10 year life cycle |

| • | Targeted market/application | | • | Broad application base |

| • | Few, large customers | | • | Broad customer base |

| | | | | | | |

12

Silicon Laboratories Mission

Global Leadership in High-Performance,

Analog-Intensive, Mixed-Signal IC Solutions

[GRAPHIC]

13

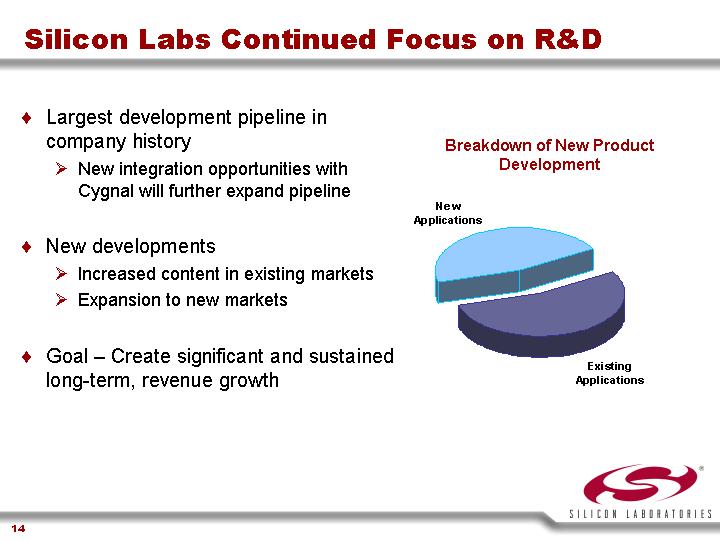

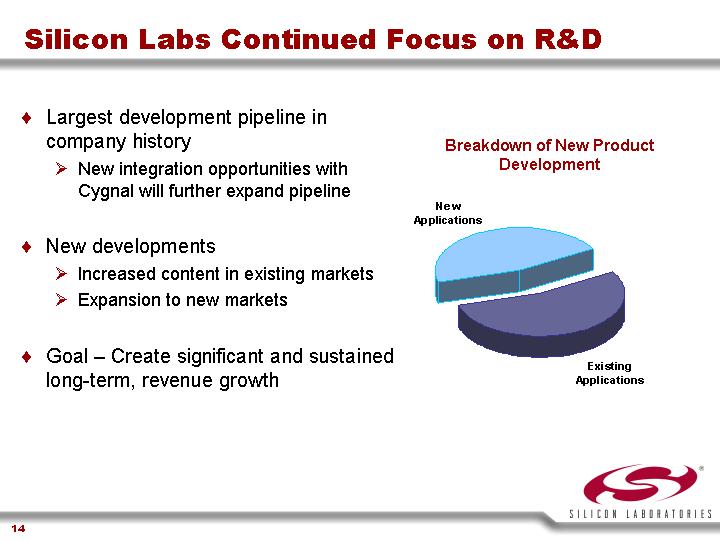

Silicon Labs Continued Focus on R&D

• Largest development pipeline in company history

• New integration opportunities with Cygnal will further expand pipeline

• New developments

• Increased content in existing markets

• Expansion to new markets

• Goal – Create significant and sustained long-term, revenue growth

Breakdown of New Product

Development

[CHART]

14

Compelling Strategic Rationale

1 Large and attractive market opportunity

• Consistent with diversification strategy

• Broadens total addressable market

• Adds customer and product breadth

2 Synergistic products and engineering expertise

• Analog-intensive, mixed-signal

• Strong system selling opportunity

• Interesting development possibilities

3 Seamless integration

• Austin-based

• Strong engineering culture

• Same supply chain partners

15

[LOGO]

www.silabs.com

www.cygnal.com