Exhibit 15.1

Excerpt containing the pages and sections of the 2013 registration document that are incorporated by reference into the 2013 annual report on form 20-F(1)

(1) The following document contains certain pages and sections of the 2013 Registration Document which are being incorporated by reference into the 2013 Annual Report on Form 20-F of Orange. Where information within a subsection has been deleted, such deletion is indicated with a notation that such information has been redacted. |

2013 form 20-F /ORANGE –E-14

Orange is one of the world’s leading telecommunications operators with revenues of 41 billion euros in 2013 and 165,000 employees worldwide at December 31, 2013. Present in around 30 countries, the Group has a total customer base of more than 236 million customers at December 31, 2013. Orange is also a leading provider of telecommunication services to multinational companies, under the brand Orange Business Services.

Orange has been listed since 1997 on NYSE Euronext Paris (symbol: ORA) and on the New York Stock Exchange (symbol: ORAN).

History

Orange, formerly France Telecom, is France's incumbent telecommunications operator. The Group has its origins in the Ministry for Mail, Telegraphs and Telephone, later to become the General Directorate of Telecommunications, which in 1990 was accorded the status of independent public entity and, on January 1, 1991, renamed France Telecom. On December 31, 1996, France Telecom became a Société Anonyme (limited company) with the French State as its sole shareholder. In October 1997, France Telecom shares were listed on the Paris and New York stock exchanges allowing the French government to sell 25% of its shares to the public and Group employees. Subsequently, the government gradually reduced its holding to 53%. The Law of December 31, 2003 authorized the transfer of the Company to the private sector and between 2004 and 2008 the State sold a further 26% of the share capital. At December 31, 2013, the French State retained 26.94% of the shares, held either directly or jointly with Bpifrance.

Since the 1990s, France Telecom’s area of activity and its regulatory and competitive environment have undergone significant changes. In a context of increased deregulation and competition, between 1999 and 2002, the Group pursued a strategy of developing new services and accelerated its international growth with a number of strategic investments. These included, in particular, acquiring mobile operator Orange and the Orange brand, which had been created in 1994, and taking a stake in Poland's incumbent operator, Telekomunikacja Polska (renamed Orange Polska in 2013). Most of these investments could not be financed by share issues and therefore the Group’s debt substantially increased during this period.

At the end of 2002, France Telecom started a large-scale refinancing plan for its debt to reinforce its balance sheet, as well as an operational improvements program, the success of which has allowed the Group to develop a global integrated-operator strategy by anticipating changes in the telecommunications industry.

In 2005, France Telecom acquired 80% of Spanish mobile operator Amena, whose activities were then regrouped with the Group's fixed-line and internet operations in Spain into a single entity under the Orange brand. In 2008 and 2009, the Group acquired almost all the remaining capital of Orange España.

In parallel, the Group streamlined its asset portfolio by selling off non-strategic subsidiaries and holdings.

In 2006, Orange became the single brand of the Group for Internet, television and mobile services in most countries where the Group operates, and Orange Business Services the brand for services offered to businesses throughout the world.

Since 2007, Orange has pursued a selective acquisition policy mainly focused on emerging markets (in particular Africa and the Middle East), while attempting to grasp opportunities for consolidation in markets where the Group was already present. In 2010 this strategy notably led the Group to raise its stake in Egyptian operator ECMS (Mobinil) from 36% to 94%. It also resulted in the joint venture with Deutsche Telekom that combined UK business under the EE brand on April 1, 2010, as well as in the 2012 disposal of Orange Switzerland.

On July 1, 2013, the Company adopted the name Orange.

In July 2010, the Group launched a new strategic plan Conquest 2015. This initiative is simultaneously aimed at its employees, customers and shareholders, and more generally at the society in which the Company operates. For more information on Orange's strategy see Section 2.3 Orange’s Group strategy.

Business in 2013

(1) The EE customer base in the UK is 50% consolidated in the Orange customer base

ORANGE / 2013 REGISTRATION DOCUMENT - 6

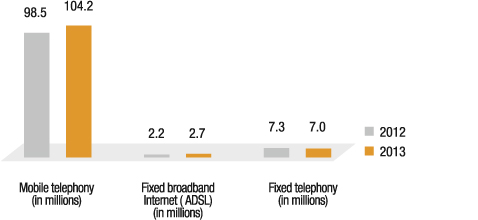

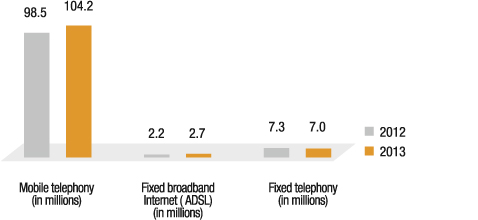

At the end of 2013, the Orange Group grew its worldwide customer base by 2.4% year-on-year to 236.3 million, adding an additional 5.6 million customers, including 178.5 million mobile customers (excluding MVNOs) (up 3.5%) and 15.5 million broadband customers (up 3.8%).

This increase reflects the continued strength of growth in mobile phone services in Africa and the Middle East, where numbers rose 7.9% to 88 million customers at December 31, 2013, (an additional 6.4 million cell phone customers). In Africa, the Orange Money application had 8.9 million customers, from 5.6 million in 2013 (up 59%).

In France, mobile contracts, which make up over three-quarters of the mobile customer base at December 31, 2013 (20.9 million customers) rose 5.9%, thanks to the success of offerings targeting specific customer segments: Sosh, Open, and Origami.

In other geographical regions mobile contracts also grew strongly, by 6.1% on the year to 34.5 million customers at December 31, 2013, most notably in Spain, the UK, Poland and Romania, and made up 54% of the mobile customer base at December 31, 2013.

2013 also saw rapid growth in 4G high capacity mobile broadband: in France, where the target of one million customers was met with a coverage of 50% of the population; in Spain, where 4G now has 530,000 customers and a coverage of 30% of the population; in Poland; and in the UK, where Everything Everywhere had more than two million customers at the start of January 2014.

Fixed broadband had 15.5 million customers at December 31, 2013, a 3.8% increase on the year, i.e. 559,000 additional customers, including 297,000 in Spain, 215,000 in France and 29,000 in Slovakia. Fixed broadband connections at December 31, 2013 include 382,000 fiber-optic connections, 319,000 of which are in France (+81%), 59,000 in Slovakia and nearly 3,000 in Moldova.

The Group’s consolidated revenues for the year were 40.98 billion euros, down 5.8%. Price reductions linked to regulatory measures remain significant. Excluding regulatory measures, the fall in revenues is limited to 2.6% overall, with a 4.8% decline in France linked to a fall in average revenues per user (ARPU), and a 5.3% decline in the enterprise segment linked to an economic environment that remains difficult. However, revenues grew by 4.4% in Spain and 4.7% in Africa-Middle East.

The Group adapted in 2013 by cutting costs by 929 million euros (mostly in France) which offset nearly 40% of its fall in revenues.

At the same time, Orange maintained its development capacity by pursuing its investments, notably in high capacity mobile and fixed broadband (4G, fiber-optic and VDSL), which doubled in comparison to 2012. Total investments amounted to 5.631 billion euros in 2013, i.e. a rate of investment of 13.7% of revenues.

Group footprint in 2013

ORANGE / 2013 REGISTRATION DOCUMENT - 7

The chart below shows the main operating subsidiaries and investments of Orange SA as of December 31, 2013 (the complete list is available on the website orange.com). The holding percentages shown for each entity are the percentage of interest along with the percentage of control when these differ (3):

(1)

Company operating under the Orange brand.

(2)

Orange controls the Strategy Committee, which makes recommendations to the Board of Directors.

(3)

For further information on subsidiaries, see Note 17 List of main consolidated companies to the consolidated financial statements (Section 4.1.1).

ORANGE / 2013 REGISTRATION DOCUMENT - 9

ORANGE / 2013 REGISTRATION DOCUMENT - 11

This chapter contains forward-looking statements, particularly in Section 2.3 Orange’s group strategy. These forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from the results anticipated in the forward-looking statements. The most significant risks are detailed in Section 2.4 Risk factors. Please also consult the information under the heading Forward-looking information at the start of this document.

There was a slight upturn in the global market for information and communications technology (ICT) during 2013, which grew faster than global GDP for the first time (Figure 2). However, growth in ICT remains modest (+3.3%) despite strong expansion by the sector’s leading players (Apple, Samsung, Google and Facebook). There is still a correlation between the expansion of ICT markets and economic growth but it is less marked than in the past. In addition, the digital sector, long considered more resilient in tough times than other parts of the economy, now seems to have lost some of its immunity.

Within ICT, which chiefly comprises the computing, audiovisual, multimedia, internet and telecommunications sectors, the global telecoms services market grew at the same pace in 2013 as in 2012 (+2.7%), lagging global GDP. The long economic crisis has hit telecoms services in mature countries particularly hard.

Source: Idate

ORANGE / 2013 REGISTRATION DOCUMENT - 12

Source: Idate - IMF

Market growth by region

Europe

The European telecoms services market, having been stable at around 33% of the ICT sector for several years (Figure 1), shrank slightly in 2013. Most European countries also experienced a squeeze on prices and on operator’s margins over and above the effects of the economic crisis. This was linked to several factors:

■

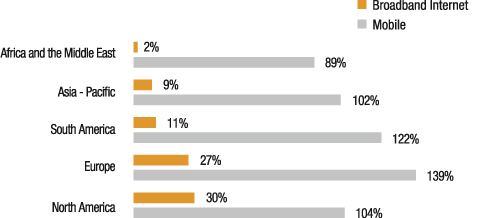

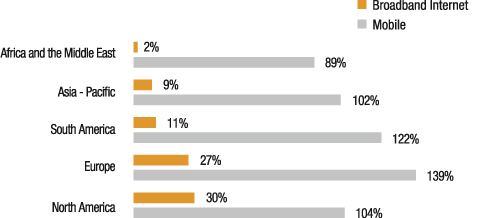

as internet access services have reached maturity volume growth has slowed. Mobile handset penetration in Europe is now 139%, the highest in the world (Figure 3);

■

despite an internal market of 510 million people, the European telecoms market is highly fragmented, split into 28 distinct markets with more than 150 fixed and mobile operators rather than the handful that dominate similar-sized Chinese and US markets. The European Commission estimates the cost of the lack of a single ICT market at 110 billion euros (source: EC, October 2013);

■

the wave of low-priced SIM-only offers, which gathered pace in Europe during 2013, has profoundly transformed the telecoms market, undermining the previous model of subsidized handsets and encouraging the emergence of new handset financing solutions. The rise of unlimited-use contracts and the success of IP applications (VoIP, instant messaging) have successfully generated volume growth but at the price of varying degrees of reduction in value.

The European telecoms market thus finds itself faced with slowing revenue growth at a time when it needs to invest in mobile and fixed infrastructure to keep pace with rising traffic and new technologies (building new generation networks - NGN). Average data transfer speeds in Europe are still only half those in the USA (source: Cisco VNI Forecast, 2013). Weaker revenues and margins among Europe’s operators are increasingly forcing them to rethink their business models and look at mergers, joint ventures and infrastructure sharing in particular.

USA

Telecoms services in the USA are still relatively dynamic. But despite a very mature market with high levels of consumption, their share of the overall ICT market is slightly smaller (28% in 2013) than elsewhere in the world (Figure 1).

Price pressures are less severe than in Europe and North American operators have managed to sustain margins while rolling out broadband. The TV component of multiplay offers is a particularly strong source of revenues. As a result, CAPEX is higher than in Europe and has given the Americans a lead in deploying 4G LTE networks, despite the United States having lagged behind Europe in the roll-out of 3G.

Rest of the World

Emerging markets (Asia Pacific, Africa, Middle East) have seen the growth rates of their economies slow, while still growing faster than mature markets, particularly in Europe. ICT markets, particularly the market for telecoms services, are growing faster than GDP albeit not at the double-digit rates of the mid-2000s (Figure 2). Telecoms services continue to take a high share of ICT spending as a whole in these markets (Figure 1).

Source: Idate

ORANGE / 2013 REGISTRATION DOCUMENT - 13

Key trends and developments

Fixed-line telephony

In developed countries, the migration of fixed-line toward all-IP networks and the replacement of fixed-line usage by mobile or instant messaging have driven a decline in traditional switched (PSTN) fixed-line telephony. Revenues from fixed-line telephony have been falling consistently for years as volumes and subscriptions fall.

For a number of years, the same trend has been seen in markets like China and India, which lost nearly 100 million fixed telephone lines between 2005 and 2012, around 25% of the installed base (source: Idate, July 2013). However, in most other emerging markets, such as African and Middle Eastern countries, the current installed capacity is holding steady or even growing.

Mobile broadband

Falling prices have helped make mobile telephony universally accessible. The ITU estimates that at end-2013 mobile networks had around 6.8 billion subscriptions, one for every person on the planet (source: ITU, 2013).

Driven by the explosion of data traffic to smartphones, tablets and other connected devices, itself related to the demand for video-heavy OTT applications, mobile broadband has become a major avenue of development, taking over from telephony. By the end of 2013, there were an estimated 2 billion subscriptions to mobile broadband, around 30% global penetration according to the ITU.

Fixed broadband

The number of households with internet access is rising across all regions of the world, but major disparities persist between mature and developing markets, reflecting the gap in IT equipment penetration. According to the ITU, at end-2012, nearly 80% of global households had a television, while 41% had a computer and 37% had internet access. At end-2013, nearly 40% of the world population, or close to 2.7 billion people, were connected to the internet including 31% of the population in developing markets (source: ITU, 2013). Idate estimates that the global penetration rate of fixed broadband was 11% at end-2013, around 30% in developed markets and around 7% in developing markets (Figure 3).

Access to high capacity broadband, meanwhile, varies by region. Europe has been slow to roll out fiber optic and average broadband speeds have therefore lagged behind the rest of the world, particularly Asia. In 2013, Asia and North America made up 82% of the market and are likely to retain this lead over the next few years. For instance, 58% of homes are fiber-connected in South Korea and 43% in Japan compared to just 5% in Europe (source: European Commission, October 2013).

A revolution in the value chain

The internet giants, which started life in the IT, handset or content sectors, and over-the-top (OTT) providers who deliver their services across the telecommunications network are revolutionizing the established business environment and value chains with which telecoms operators grew up. Value is now parceled out within a broader and increasingly open ecosystem where roles are split between telecoms operators, content providers, handset manufacturers and OTT service providers. OTT service providers have helped transform the reference offers, in many cases driving the market toward free or low-cost services, while the internet giants now offer the core services traditionally provided by telecoms operators, such as voice and messaging.

Outlook

According to Idate, the global telecom services market is set to grow at an annual average rate of 2.9% in 2013-2025. Growth in internet services over the next few years is likely to come mainly from the still relatively young video, social network and data transfer sectors. Specifically, video downloads and sharing, which demand exponentially increasing amounts of capacity, are expected to make up 69% of retail global internet traffic by 2017 (source: Cisco, VNI 2012). The already rapid convergence of different fixed and mobile services and of the communications infrastructures that support them is likely to gather pace. Finally, we can expect further redistribution within the ICT value chain. The slice taken by OTT services – 2.5% of Europe’s communication services revenues in 2012 – is expected to continue to grow and reach 6% by 2020 (source: Idate, December 2012).

ORANGE / 2013 REGISTRATION DOCUMENT - 14

Regulation of the telecommunications sector is largely harmonized in the EU member states where the Orange Group operates, with national regulatory authorities obliged to implement common EU rules at the national level, though some national differences remain.

This common regulatory framework is presented below with a detailed description for each major country in which the Orange Group operates.

For information concerning risks linked to the regulations of the telecommunications sector, see Section 2.4.2 Legal Risks.

The general EU legal framework for electronic communications consists of five main directives deriving from the 2002 Telecom Package.

■

Framework Directive 2002/21/EC of March 7, 2002, on a common regulatory framework for electronic communications networks and services;

■

Authorization Directive 2002/20/EC of March 7, 2002, on the authorization of electronic communications networks and services;

■

Access Directive 2002/19/EC of March 7, 2002, on access to, and interconnection of, electronic communications networks and associated facilities;

■

Universal Service Directive 2002/22/EC of March 7, 2002, on universal service and users’ rights relating to electronic communications networks and services;

■

Directive on Privacy and electronic communications 2002/58/EC of July 12, 2002, concerning the processing of personal data and the protection of privacy in the electronic communications sector.

The European Commission has identified the relevant markets for products and services which can be subject to ex ante regulation in a recommendation that is regularly updated. The latest version (recommendation 2007/879/EC of December 19, 2007) identifies seven relevant markets (1). This recommendation is currently under review. On January 24, 2014, the Commission published an amended draft recommendation, which proposed removing from the list of relevant markets the retail market for access to the public telephone network at a fixed location for residential and non-residential customers (M1) and the market for call origination on the public telephone network provided at a fixed location (M2). The Commission is also proposing to amend the definition of wholesale broadband access markets (M4 and M5) and the wholesale terminating segments of leased lines market (M6).

The wholesale fixed (M3) and mobile (M7) termination markets would be left unchanged. This recommendation is due to be adopted in the second half of 2014.

All five directives were reviewed in 2009 (2), with changes fully transposed by EU member states, and were subsequently placed under the oversight of the Body of European Regulators for Electronic Communications, BEREC (3).

This regulatory framework has been fleshed out with a number of additional texts.

Roaming

Regulation No. 531/2012, adopted on June 13, 2012 by the European Parliament and Council, on roaming on public mobile communications networks within the Union (Roaming III):

■

introduces, for the wholesale market, a regulated right of access to European roaming services for MVNOs and resellers;

■

extends the sliding cap on roaming rates to the retail data market;

■

introduces, as of July 1, 2014, two structural changes to increase competition in the retail market by separating domestic services and international roaming services;

■

expands, for customers using their cell phones outside the EU, pricing transparency requirements and bill shock prevention measures for European operators.

(1)

M1: access to the public telephone network at a fixed location for residential and non-residential customers.

M2: call origination on the public telephone network provided at fixed location.

M3: call termination on individual public telephone networks provided at fixed location.

M4: wholesale unbundled access.

M5: wholesale broadband access.

M6: wholesale terminating segments of leased lines.

M7: voice call termination on individual mobile networks.

(2)

Directive 2009/140/EC of the European Parliament and Council of November 25, 2009 amending the Framework, Access and Authorization Directives and Directive 2009/136/EC of November 25, 2009 amending the Universal Service and Privacy and Electronic Communications Directives.

(3)

Regulation (EC) No. 1211/2009 of the European Parliament and Council of November 25, 2009, creating BEREC.

ORANGE / 2013 REGISTRATION DOCUMENT - 15

Price caps (€ VAT excl.) | | Roaming III |

| July 1st, 2011 | July 1st, 2012 | July 1st, 2013 | July 1st, 2014 | July 1st, 2017 | July 1st, 2022 |

| Sent (retail) | 0.35 € | 0.29 € | 0.24 € | 0.19 € | withdrawal (1) |

Voice | Received (retail) | 0.11 € | 0.08 € | 0.07 € | 0.05 € | withdrawal (1) |

| Wholesale | 0.18 € | 0.14 € | 0.10 € | 0.05 € | withdrawal (1) |

| Sent (retail) | 0.11 € | 0.09 € | 0.08 € | 0.06 € | withdrawal (1) |

SMS | Received (retail) | 0.00 € | withdrawal (1) |

| Wholesale | 0.04 € | 0.03 € | 0.02 € | withdrawal (1) |

Data | Retail | | 0.70 € | 0.45 € | 0.20 € | withdrawal (1) |

| Wholesale | 0.50 € | 0.25 € | 0.15 € | 0.05 € | withdrawal (1) |

Voice: tariff per minute VAT excl. / sms: tariff per sms VAT excl. /data: tariff per Mb VAT excl. (1) Withdrawal subject to EC review in 2016 Source: Orange, based on data in EU regulation No. 531/2012 |

Call termination rates

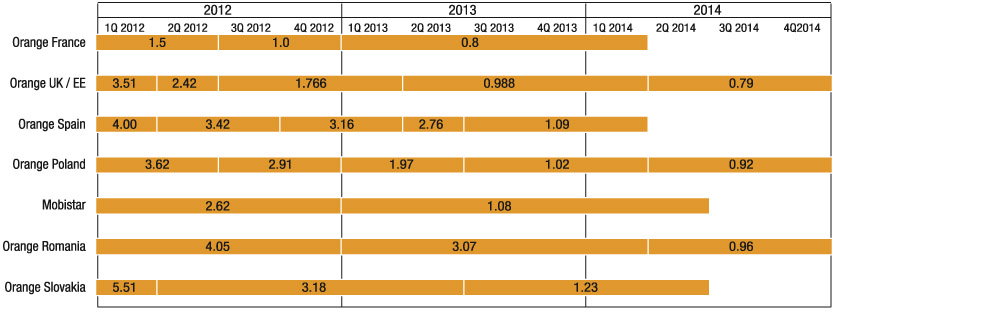

On May 7, 2009, the European Commission adopted a recommendation regulating fixed-line and mobile call termination rates in the EU (2009/396/EC).

The Commission recommends that national authorities should apply the following principles:

■

symmetry in each country between the various operators’ fixed voice call termination rates and also between their mobile call termination rates, with the option of allowing a four-year transitional asymmetry on fixed or mobile call termination rates to benefit a new entrant;

■

call termination rates geared towards the avoidable cost of this service for an efficient operator (i.e. about 1 euro cent per minute for voice MTRs and a lower rate for voice FTRs).

The recommendation has been implemented as follows in the countries where the Orange Group operates:

Country | Introduction of a termination rate costing model based on

the avoidable cost of termination for an efficient operator |

| Mobile | Fixed-line |

France | 01/01/2013 | 01/01/2013 |

Belgium | 01/01/2013 | Undecided |

UK | 04/01/2013 | 01/01/2014 |

Poland | 07/01/2013 | Undecided - proposed for 2014 |

Spain | 07/01/2013 | Depends on result of ongoing market analysis |

Slovakia | 08/01/2013 | Different model adopted |

Romania | Undecided – proposed for 2014 | Undecided – proposed for 2014 |

Source: Cullen International December 2013. Figures are December tariffs at local level

Currency exchange rates used in this table are the latest month average rate of the period

ORANGE / 2013 REGISTRATION DOCUMENT - 16

Source: Cullen International December 2013. Figures are December tariffs at local level

Currency exchange rates used in this table are the latest month average rate of the period

Protecting Personal Data

A general directive (1995/46/EC) encompasses the processing of personal data in the European Union. It was followed by a directive specific to the electronic communications sector (2002/58/EC).

On January 25, 2012 the European Commission unveiled a major plan for updating the existing framework with a proposed Regulation that would replace the 1995 directive and stand alongside the sectorial directive. The new rules would increase harmonization between member states and strengthen legal rights. The legislative process is still ongoing.

Jan. 2013 | Rollout of broadband communication networks Revised guidelines governing the use of state aid to support rapid deployment of broadband communication networks. |

March 2013 | Draft rules on measures designed to cut the cost of rolling out broadband infrastructure for electronic communications |

Feb. 2013 | Draft recommendation by the European Commission on universal service obligations |

| Launch of the Connected Continent project by the European Commission |

Sept. 2013 | Connected Continent draft rules Recommendation on non-discrimination obligations and consistent costing methodologies Statement specifying the guidelines for the creation of a single market for telecommunications, which it argues is urgently needed |

| Connecting Europe Facility |

Dec. 2013 | The European Parliament and Council voted 33.2 billion euros to help develop Europe’s infrastructure in 2014-2020 (the Connecting Europe Facility). 1.14 billion euros of this will go on the telecoms sector |

(1)

Method for benchmarking fixed call termination rates:

Average rate per minute (in euro cents):

at local level, i.e. at the lowest interconnection point (the equivalent of ICAA in France);

during “peak” minutes only (as off-peak periods are not homogeneous from one operator to another).

ORANGE / 2013 REGISTRATION DOCUMENT - 17

Rollout of broadband communication networks

Guidelines governing the use of state aid to support rapid deployment of broadband communication networks

To keep pace with fast-changing technology and meet the aims of the Digital Agenda, the European Commission published new guidelines on state aid to the broadband sector (EU Official Journal, January 15, 2013).

Key changes were as follows:

■

technological neutrality: the new guidelines take into account that high capacity broadband (new generation access or NGA) networks can run on different technological platforms;

■

ultra-fast networks: the new guidelines allow public funding of NGA networks capable of delivering more than 100 Mbps in urban areas but subject to strict conditions;

■

private operator commitments: any public authority empowered to grant aid must carry out a public consultation to check that no private investor is planning to build a similar network in the near future. It can require the private investor to commit to making significant progress in rolling out the network in a short time-frame. If the investor fails to meet these commitments, the authority can then step in with public intervention plans;

■

the threshold notion: any state aid must lead to a threshold being exceeded in terms of connectivity, capacity and speed. In other words, any infrastructure supported by public funds must provide a substantial improvement on existing networks;

■

role of National Regulatory Authorities (NRA): The guidelines take the view that NRAs are best placed to oversee public authorities wishing to provide aid and must be consulted to define eligible areas and set rates and the terms of wholesale access;

■

transparency: new rules requiring transparency on aid grants.

Draft regulationon measures designed to cut the cost of rolling out broadband infrastructure for electronic communications

The European Commission proposed a draft regulation on March 26, 2013, to help cut the costs of deploying high-capacity broadband infrastructure in the European Union. This would give electronic communications operators the right to access the physical infrastructure of other network industries (e.g. the electricity grid, water and sewage networks, transport network, etc.) to deploy broadband networks.

This has raised issues for MEPs and the European Council about subsidiarity, proportionality and the choice of legal instrument. The European Parliament’s ITRE Committee filed its amendments on November 28, 2013, notably including the suggestion that the proposal should take the form of a European Directive to give countries greater flexibility in its implementation.

Universal Service

In November 2011 the European Commission published a statement presenting the key results of the third revision of the scope of universal service. It concluded that there is no reason to extend the obligations of universal service to mobile services or broadband Internet connection.

The Commission’s draft recommendation of February 18, 2013 had expressed reservations about making broadband part of the universal service obligation. In its report adopted on October 24, 2013, the European Parliament asked the Commission to reconsider its position on the inclusion of broadband Internet in the scope of universal service. The draft recommendation has not yet been approved.

Launch of the ConnectedContinent project by the European Commission (Digital Single Market)

On September 11, 2013, the Commission adopted several regulatory proposals aimed at making the single market for telecommunications a reality, including: (i) the Connected Continent draft regulations, (ii) a recommendation on non-discrimination obligations and consistent costing methodologies and (iii) plans for the creation of a single market for telecommunications, which it argues is urgently needed.

Connected Continent draft regulations

The proposed regulations for a single market adopted by the European Commission, currently before the European Parliament, mainly address the following points:

■

simplification of existing EU regulations for telecommunications operators, notably through the creation of a single authorization allowing operators to conduct their business across all 28 member states;

■

abolition of roaming charges and international call premiums within Europe: incoming call charges while traveling in the EU would be banned and prices aligned with national rates;

■

net neutrality: rules to preserve the open Internet. Internet traffic must be managed in a non-discriminatory, proportionate and transparent way. Operators would still be allowed to differentiate their offers (by speed for instance) allowing them to compete on service quality without degrading the service quality of Internet access;

ORANGE / 2013 REGISTRATION DOCUMENT - 18

■

consumer protection: new rights and harmonization of existing consumer rights across the EU, covering information to customers, a framework for customer contracts, greater rights to switch provider or contract, right to terminate contracts that fail to meet advertised access speeds, etc.;

■

radio spectrum and 4G: increased coordination of the calendar, duration and other conditions under which radio frequencies are assigned;

■

simplification of wholesale access products: standardized terms and characteristics for wholesale access to fixed networks.

Recommendation “on non-discrimination obligations and consistent costing methodologies to promote competition and enhance the broadband investment environment”

The recommendation adopted by the European Commission on September 12, 2013, seeks to:

■

strengthen rules on non-discrimination to provide equivalent access on new networks, publication of performance indicators and the application of technical replicability tests;

■

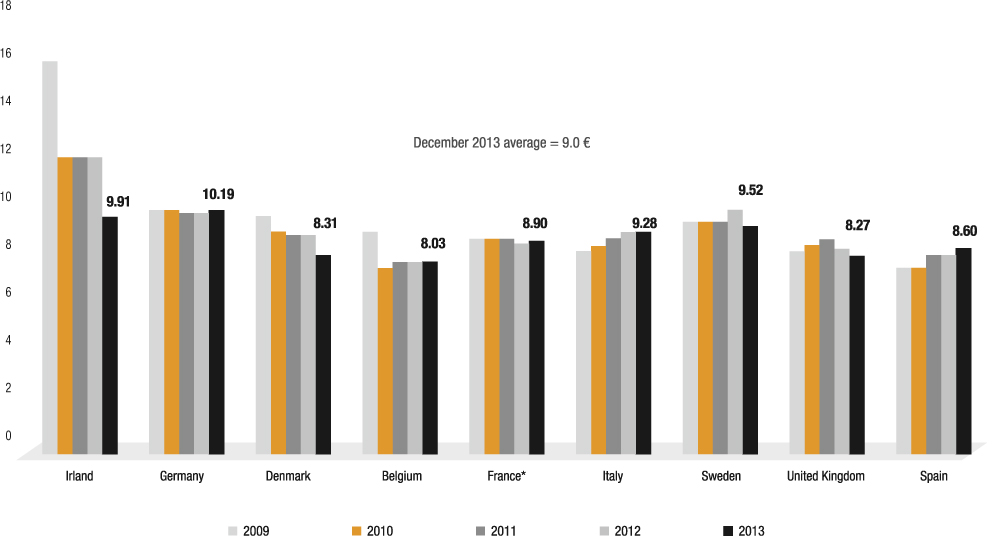

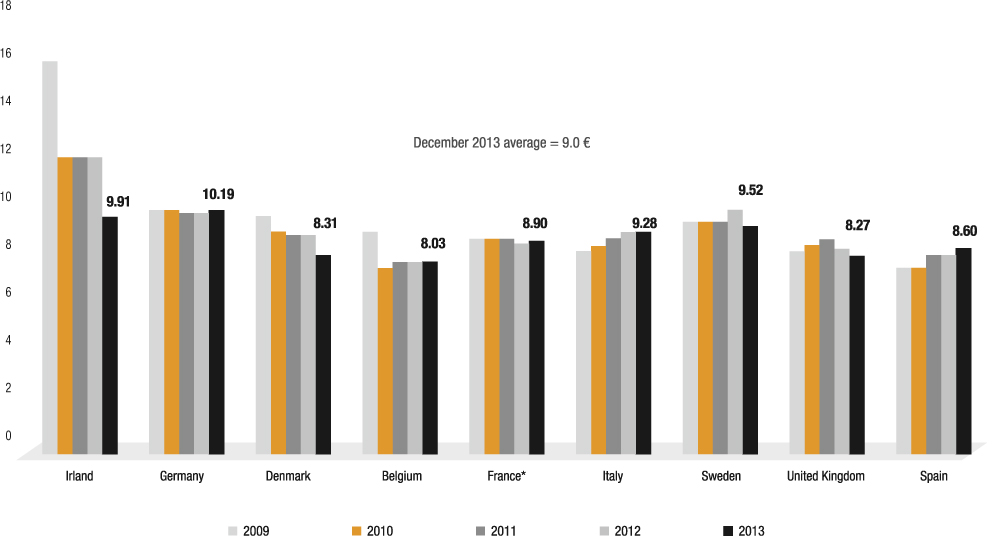

stabilize prices, at constant currency, for use of the copper network around the current average access price within the EU (8 to 10 euros at current rates excluding tax); and

■

allow greater flexibility in pricing high capacity broadband as national regulators have the option of not imposing a cost-based system where strengthened non-discrimination rules are in place and there is effective competition between platforms (copper, cable, mobile).

The European Parliament has voted in favor of the proposal for Regulation on April 3, 2014. A final agreement on the Regulation is expected from the European Commission before the end of 2014.

Source : Cullen International - December 2013. Figures are December tariffs at local level

Currency exchange rates used in this table are the latest month average rate of the period

* In France, rate of 9.02 euros as from February 1, 2014

ORANGE / 2013 REGISTRATION DOCUMENT - 19

Statement specifying the guidelines for the creation of a single market for telecommunications, which it argues is urgently needed

The statement issued by the Commission sets out policy guidelines for structuring issues not covered by the draft regulations or the recommendation. It stresses the challenges facing the EU, particularly the modernization of regulations, investment and the need to set rules that are fair to both operators and over-the-top (OTT) players.

Connecting Europe Facility

To help implement its Digital Agenda, the European Commission plans to invest up to 9.2 billion euros through its Connecting Europe Facility between 2014 and 2020 to expand broadband networks and set up pan-European digital services like cross-border online administration and e-health services. In December 2013, the European Parliament and Council allocated 1.14 billion euros to the telecommunications sector.

4G Frequency Band

The European Commission’s ambition for high-capacity broadband infrastructure, set out in its Connected Continent project, is a long way from being achieved. The Commission notes that the EU has lost time in rolling out 4G infrastructure due to the late and uncoordinated allocation of spectrum. It plans to take a firmer coordinating and harmonizing role on the timing and processes for allocating 4G spectrum.

First digital dividend: On May 6, 2010, the European Commission decided to allow the 800 MHz frequency band, previously used for terrestrial analog TV, to be repurposed for mobile communication services.

It also authorized the refarming of GSM spectrum for LTE use. In its decision 2009/766/EC of October 16, 2009, on the harmonization of the 900 MHz and 1,800 MHz frequency bands, amended on April 18, 2011, the European Commission asked member states to ensure these bands were technically neutral and so available for 4G services. In a complementary decision on November 5, 2012, the Commission required member states to introduce technological neutrality to the 2.1 GHz band (1,920-1,980 MHz/2,110-2,170 MHz) to allow the use of 4G (LTE) in this part of the spectrum before May 24, 2016.

Discussions are also underway to eventually create a second digital dividend in the 700 MHz band for mobile services. The World Radiocommunication Conference of 2012 decided in principle to open up the 700 MHz band in ITU region 1 (Europe and Africa) for mobile services. The next conference, to be held in late 2015, will lay down technical specifications and should then allocate bands for mobile services.

In preparation, the European Commissioner responsible for the Digital Agenda set up a high-level consultative group in January 2013, charged with reporting before July 2014 on how UHF (ultra high frequency) bandwidth can be best used to meet future needs.

Legal framework

The electronic communications sector is primarily governed by the French Postal and Electronic Communications Code (CPCE) as well as laws relating to e-commerce, the information society, consumer protection and data protection.

The French government transposed the European Telecoms Package, as amended in 2009, into national law via the Ministerial Order of August 24, 2011 and the Decree of March 12, 2012, implementing regulations.

The audiovisual communication services produced or distributed by the Orange Group come under the specific regulations governing this sector and are managed by the law of September 30, 1986.

For information concerning risks linked to the regulations of the telecommunications sector, see Section 2.4.2 Legal Risks.

Regulatory Authorities

The Postal and Electronic Communications Regulatory Authority (the Arcep) is an independent administrative body created by the law of July 26, 1996, and acts as French regulator for these sectors nationwide. The Arcep’s main missions in electronic communications are to set regulations (general or specific obligations) for operators within its jurisdiction. It has powers to sanction non-compliant operators and can rule on disputes between operators over technical and pricing conditions for network access and interconnection. The Arcep also allocates spectrum and numbering resources. Finally, it determines the size of contributions to fund the universal service obligation and oversees the mechanisms for delivering this funding.

On July 5, 2013, the Constitutional Court ruled that Article L. 36-11 of the CPCE, which grants the Arcep its powers of sanction, was unconstitutional. It found that the Arcep failed to separate its role as investigator and prosecutor of rule breaches from its role as judge of the same breaches. A law enabling the government to restore by Ministerial Order the Arcep’s powers of sanction in a way that was constitutional was passed on December 19, 2013. The Order was published in France’s Official Journal on March 14, 2014.

ORANGE / 2013 REGISTRATION DOCUMENT - 20

The French Competition Authority, established in March 2009 following the restructuring of the French Competition Council, is an independent government authority responsible for ensuring open market competition and compliance with public economic policy. It has jurisdiction over all business segments, including the electronic communications sector. It has sanction powers for anti-competitive practices, as well as consultative powers. It also specializes in overseeing mergers and acquisitions.

The ANFr (AgenceNationale des Fréquences - French national agency for frequencies) is responsible for planning, managing and controlling the usage of radio frequencies and for coordinating the establishment of certain radio transmission facilities. The frequency spectrum is covered by 11 controlling authorities: government ministries, the Arcep and the French Broadcasting Authority (CSA). The Arcep and the CSA are in turn responsible for allotting to users the frequencies they control.

TheCSA is an independent administrative body created by the law of January 17, 1989, tasked with protecting freedom of audiovisual communication by means of any electronic communications technology as regards radio and television in accordance with the Law of September 30, 1986. In July, 2013, the CSA was partly reformed and a Commission for the modernization of audiovisual broadcasting should be created and be given responsibility for the radio spectrum. It is expected that a draft law extending the powers of the CSA to the Internet and connected television will be brought forward in 2014.

2.2.2.2 Regulation of mobile telephony

Frequency spectrum management

Main blocks assigned in the mobile services spectrum

(800 MHz, 900��MHz, 2.1 GHz and 2.6 GHz)

800 MHz | ■ Authorizations were given to Bouygues Telecom, Orange France and SFR in January 2012 for 10 MHz each in the ■ Free Mobile obtained roaming access rights on the SFR network. |

900 MHz | ■ 2G and 3G operators were authorized to refarm the 900 MHz band for 3G in February 2008. ■ 2 x 5 MHz were sold back to Free Mobile by Orange France and SFR on January 1, 2013 for high-density areas, and by Bouygues Telecom in July 2011 for the remaining parts of the country. |

2.1 GHz | ■ Free Mobile was awarded the fourth 3G license, with a 2.1 GHz channel, in January 2010. ■ SFR and Orange France were each awarded two other channels in May 2010. |

2.6 GHz | ■ Authorizations were given to Orange France and Free Mobile in October 2011 for 20 MHz each, and to Bouygues Telecom and SFR for 15 MHz each. |

Deployment obligations of 3G operators in continental France

| Orange | SFR | Bouygues Telecom | Free Mobile |

3G population coverage obligation | 91% at end-2010 98% at end-2011 | 88% at end-2010, 98% at end-2011 and 99.3% at end-2013 | 75% at end-2010 | 90% at end-2017 |

At end-December 2013, Orange’s 3G coverage was 98.7% of the population and 89.5% of country.

Deployment obligations of 4G operators in continental France

In % of population | 11/10/2015 | 17/01/2017 | 11/10/2019 | 17/01/2022 | 11/10/2023 | 17/01/2024 | 17/01/2027 |

Inside priority deployment area

(18% of population and 63% of territory) | | 40% (800 MHz) | | 90% (800 MHz) | | | |

In each county (department) | | | | | | 90% (800 MHz) | 95% (800 MHz) |

Throughout the metropolitan territory | 25% (2.6 GHz) | | 60% (2.6 GHz) | | 75% (2.6 GHz) | 98% (800 MHz) | 99.6% (800 MHz) |

Source: Arcep | | | | | | | |

The 800 MHz band was assigned to Bouygues Telecom, Orange France and SFR.

The 2.6 GHz band was assigned to Bouygues Telecom, Free Mobile, Orange France and SFR.

ORANGE / 2013 REGISTRATION DOCUMENT - 21

Significant events in 2013 and the start of 2014

| |

Jan. 2013 | MVNO Competition Authority Opinion No. 13-A-02 on the position of mobile virtual network operators (MVNOs) in the French mobile telephony market |

| Mobile network sharing |

March 2013 | Competition Authority Opinion No. 13-A-08 on the conditions for mobile network sharing and roaming |

Jan. 2014 | Network sharing agreement concluded between SFR and Bouygues Telecom on the deployment of a shared mobile network |

| 4G – Refarming 1,800 MHz |

March 2013 | Arcep Decision No. 2013-0363 authorizing Bouygues Telecom to use 4G in the 1,800 MHz band as from October 1, 2013. |

July 2013 | Second digital dividend: The Ministry for the Economy, the Arcep and the Directorate-General for Cultural Media and Industry (DGMIC) have carried out consultations on the timing for freeing up and selling off the 700 MHz band. |

March 2013 | Arcep Decision No.2013-0520 on the specification of mobile operators’ obligations to account for and report costs |

| Regulation of mobile call terminations |

May 2013 | New round of analysis for the wholesale fixed and mobile voice and SMS call termination markets for the 2014-2016 period |

MVNO

Competition Authority Opinion No. 13-A-02 of January 21, 2013 on the position of mobile virtual network operators (MVNOs) in the French mobile telephony market

Acting on a request by the Alternative Mobile association to investigate the conditions under which MVNOs can continue to compete in the fast-changing mobile telephony market, the Competition Authority noted that MVNOs had helped stimulate the market and diversify choice therein. It considered that in the context of a changing market, MVNOs could find it hard to match the new offers of network operators and expressed reservations over some of the technical and pricing conditions that were available to them on the wholesale market.

Mobile network sharing

Competition Authority Opinion No. 13-A-08 of March 11, 2013 on the conditions for mobile network sharing and roaming

After the French government called upon it to report on how operators could share networks without impairing competition and on the roaming terms that Free Mobile enjoys, the Competition Authority noted that 3G roaming was necessary even though it should remain limited in time and that it had explicitly advocated this approach in the past. On mobile network sharing, it began by emphasizing the primacy of competition via infrastructure and went on to analyze the feasibility and scope of each possible type of sharing.

Network sharing agreement between SFR and Bouygues Telecom on the deployment of a shared mobile network

In July 2013, SFR and Bouygues Telecom revealed they were in negotiations to roll out a shared mobile network. An agreement was then signed on January 31, 2014. The agreement would affect 57% of the population in continental France (everywhere except the 32 urban areas with over 200,000 inhabitants and the white zones) and is based on two principles: 1) a joint venture to manage the assets of shared sites and 2) Ran sharing (shared radio access) between the two operators on their 2G, 3G and 4G technologies. The Arcep, in consultation with the Competition Authority, announced it would be taking an in-depth look at the agreement and checking whether it met certain conditions (strategic and commercial autonomy of operators, no squeezing out of competitors from the market and improved services for users).

4G rollout and 1,800 MHz spectrum refarming

On March 12, 2013, the Arcep published guidelines for the introduction of technological neutrality in the 1 800 MHz band.

On March 14, 2013, the Arcep authorized Bouygues Telecom to refarm, as from October 1, 2013, the 1,800 MHz band for non-GSM technologies in exchange for relinquishing a number of frequencies. The fees for the right to use the 1,800 MHz band once it was freed from technological specifications were amended by Decree No. 2013-238 of March 22, 2013.

On June 3, 2013, Orange filed a request with the French Administrative Supreme Court (Conseil d’Etat) challenging the legality of this decision on the grounds that the date of authorization of the implementation of the refarming made it impossible to apply competition rules.

The French President decided in May 2013 to allocate the whole of the 700 MHz band to electronic communications. The timetable for the switchover in this spectrum has yet to be specified.

In July 2013, the Ministry for the Economy, the Arcep and the Directorate-General for Cultural Media and Industry (DGMIC) carried out consultations on the timing for freeing up and selling off the frequencies. So far, no decision has been taken.

ORANGE / 2013 REGISTRATION DOCUMENT - 22

Regulation on mobile call terminations

| Market analysis - 1st round | Market analysis - 2nd round | Market analysis - 3rd round |

| | | | 1st price cap | 2nd price cap (decision dec. 2008) (1) | (March 2011 and July 2012 decisions) |

(Cent €/min) | 2005 | 2006 | 2007 | Jan. 08-

Jun. 09 | Jul. 09-

Jun. 10 | Jul. 10-

Dec. 10 | Jan. 11-

Jun. 11 | Jul. 11-

Dec. 11 | Jan. 12-

Jun. 12 | Jul. 12 (2)-

Dec. 12 | Jan. 13

-Jun. 13 | Jul. 13-

Dec. 13 |

Orange France | 12.50 | 9.50 | 7.50 | 6.50 | 4.50 | 3.00 | 3.00 | 2.00 | 1.50 | 1.00 | 0.80 | 0.80 |

SFR | 12.50 | 9.50 | 7.50 | 6.50 | 4.50 | 3.00 | 3.00 | 2.00 | 1.50 | 1.00 | 0.80 | 0.80 |

Bouygues Télécom | 14.79 | 11.24 | 9.24 | 8.50 | 6.00 | 3.40 | 3.40 | 2.00 | 1.50 | 1.00 | 0.80 | 0.80 |

Free Mobile, full MVNOs (2) | | | | | | | | | 2.40 | 1.60 (3) | 1.10 (3) | 0.80 |

Asymmetry | 18% | 18% | 23% | 31% | 33% | 13% | 13% | 0% | 0% | 60% | 38% | 0% |

(1) For Bouygues Télécom, decision 2010-0211 of Feb 18, 2010 fixing the rate for 2H2010 at 3.40 € cents. (2) For Free Mobile and full MVNO’s Lycamobile et Oméa Telecom, decision of July 27,2012 with effect as of Aug. 2012 - maximum price for 1H 2012 (3) Excluding E1 connection Source: Orange, based on Arcep data |

On July 22, 2010, the Arcep adopted decision No. 2010-0898 on the analysis of wholesale markets for SMS call termination rates on French mobile networks, capping the price mobile operators could charge each other for SMS call termination:

Euro cents/SMS | 2009 | February 2010 | October 2010 | July 2011 | July 2012 |

Orange France | 3.00 | 2.00 | 2.00 | 1.50 | 1.00 |

SFR | 3.00 | 2.00 | 2.00 | 1.50 | 1.00 |

Bouygues | 3.50 | 2.17 | 2.17 | 1.50 | 1.00 |

The SMS termination rates paid by Free Mobile and full-MVNOs are governed by commercial agreements. |

Analysis of the wholesale mobile call termination markets

On May 28, 2013, the Arcep launched a public consultation beginning a new round of analysis of the wholesale fixed and mobile voice and SMS call termination markets in continental France and its overseas territories for the 2014-2016 period. The Authority decided that the 2014-2016 round should consider jointly the fixed-line voice call termination, mobile voice call termination and SMS termination markets.

Since July 2008, except for retail offerings for fixed telephony under universal service, all of Orange’s regulatory obligations concerning retail fixed telephony (access and communication) on the consumer and business markets have been lifted. Ex ante regulation of Orange’s fixed-line services relates to retail offerings under the universal service and wholesale offerings that are regulated to ensure effective competition in the retail markets (call origination and termination, wholesale line rental, unbundling, bitstream).

Orange’s obligations regarding cost accounting and accounting separation in the fixed-line business

The Arcep’s decision No. 06-1007 of December 7, 2006 sets forth Orange’s obligations as to cost accounting and accounting separation in the wholesale and retail businesses. When the retail activities use network resources that correspond to wholesale services subject to a separate accounting obligation, these resources are valued in the separate accounts at wholesale rates and not at cost. These obligations were first implemented in 2007 in respect of FY2006. The fiscal year was deemed compliant by the Arcep and has been extended to every year since.

Regulation of fiber optic networks

Regulatory framework governing very high capacity broadband offers:

■

no ex ante regulation on retail prices;

■

asymmetric regulation of civil engineering infrastructure which allows alternative operators to deploy their horizontal networks on Orange’s infrastructure: non-discriminatory access at a rate that reflects costs;

ORANGE / 2013 REGISTRATION DOCUMENT - 23

■

principle that the terminating segment of networks are mutualized between operators;

■

no asymmetric access obligation (unbundling or bitstream) for fiber optic in high-density areas, confirmed by Arcep decisions of June 14, 2011 on the analysis of markets 4 and 5;

■

symmetric regulation of access to network terminating segments, including outside high-density areas: same obligations to offer passive access to the terminating segment of FTTH networks on reasonable and non-discriminatory terms apply to all operators cabling buildings anywhere in France. This access must be made available from a sharing point in a reasonable location (Arcep Decision No. 2009-1106 of January 17, 2010). Charges must be compatible with the principles of efficiency, relevance, objectivity and non-discrimination.

The “SuperfastBroadband Program”

In November 2012 the French government created a Superfast Broadband Program to plan a 10-year rollout of superfast broadband.

The program helped develop a roadmap whose main points were announced in February 2013.

The aim is to have 100% of the French population eligible for very high capacity broadband by 2022, with an interim target of covering half the population and companies by 2017. FTTH is seen as the main way of achieving this, although other technologies are also expected to contribute (higher speed on copper as a transitional solution, satellite, LTE). At the annual conference of France’s Superfast Broadband Plan, held on February 6, 2014, the main lines of the plan were confirmed.

A total 20 billion euros of private and public investment is estimated to be needed to meet the 2022 target. This breaks down into three parts:

■

one third of investment by private operators who expect to use their own capital to deliver FTTH to 57% of French homes by 2022;

■

the remaining 43% of homes will be covered by the other two-thirds of investment, provided by government authorities to fund publicly organized networks. Half these homes are seen as profitable enough for a public/private partnership to be viable;

■

the last third relates to the most rural areas and will be co-funded 50/50 by central and local government.

A steering body for the rollout of high capacity broadband networks has been set up, and its role is notably to encourage and organize the rollout by operators and help harmonize the initiatives undertaken by regional authorities. A new law is planned to create the public body to follow up on the Superfast Broadband Program in 2014.

The eventual closure of the copper local loop is a major part of the process. The government has appointed Paul Champsaur to set out the conditions and timetable for the elimination of copper. He is due to report before the end of 2014.

Significant events in 2013 and the start of 2014

| |

March 2013 | Net neutrality Arcep Decision No. 2013-0004 of January 29, 2013 and introduction of measurement and monitoring processes for the service quality of fixed-line Internet access |

| VDSL2 |

April 2013 | An independent committee of copper experts reported in favor of introducing VDSL2 technology on Orange’s local copper loop network |

| Regulation of fixed-line call terminations |

May 2013 | New analysis round for the wholesale fixed and mobile voice and SMS markets in 2014-2016 |

| Fixed number portability |

June 2013 | Arcep Decision No. 2013-0830 specifying the way fixed number portability is implemented |

| Universal Service |

Oct. 2013 | Orange is allocated the universal telephony service for three years |

| Analysis of the fixed broadband and superfast fixed broadband markets |

Nov. 2013 | Public consultation by the Arcep on its draft decisions on the analysis of fixed broadband and superfast broadband markets in 2014-2017 |

Dec. 2013 | Reform of IFER (flat rate tax on network companies) |

| Completion of the regulatory framework for the rollout of fiber optic networks |

Jan. 2014 | Arcep recommendation to encourage mutualization ofFTTH networks for small buildings in high-density areas Amendments to the list of districts in very high-density areas |

| Analysis of relevant fixed-line telephony markets |

Feb. 2014 | Public consultation by the Arcep to launch the fourth round of analysis of fixed-line telephony markets (2014-2017) |

ORANGE / 2013 REGISTRATION DOCUMENT - 24

Internet Neutrality

In 2012, the Arcep began monitoring the interconnection and routing of data traffic with a view to informing users on the service quality of Internet access in France.

The Arcep uses two methods to simultaneously monitor:

■

the changing architectures of data traffic interconnection and routing between Internet access providers and Internet players by compiling half-yearly data (Arcep Decision No. 2012-0366 of March 29, 2012);

■

the quality of fixed-line Internet access services through a half-yearly survey; the aim being to make clear to the Arcep and web users the consequences for users of each operator’s practices (Arcep Decision No. 2013-0004 of January 29, 2013).

Authorization of the introduction of VDSL2 technology

The copper experts committee arrived at a consensus opinion, on April 26, 2013, in favor of introducing VDSL2 to Orange’s local copper loop from October 1, 2013.

VDSL2 is a copper wire based technology that can significantly increase speed as compared to ADSL of lines less than 1 km in length. Around five million lines (16% of the total) to homes and workplaces could have access to faster broadband using this technology, mostly in areas that will not be getting FTTH in the short term.

Regulation of fixed-line voice call terminations

Cut in fixed-line termination rates (FTRs)

In July 2011 the Arcep published its latest decision following its third round of analysis of the fixed-line telephony markets for the period 2011-2014, according to which Orange has to apply call termination rates that reflect the long-term incremental costs of a generic efficient operator of a new generation network (NGN). As part of this new analysis, the asymmetry of Call Termination Rates enjoyed by Orange’s competitors has been eliminated.

Caps in euro cents per minute | Orange FTR | Alternative operators’ FTR | Level of asymmetry |

year 2007 | 0.5486 | 1.088 | 98% |

Q1-Q2-Q3 2008 Change | 0.4935 (10.0%) | 1.088 0.0% | 120% |

Oct. 1, 2008 Change | 0.45 (8.8%) | 0.9 (17.3%) | 100% |

Oct. 1, 2009 Change | 0.425 (5.6%) | 0.7 (22.2%) | 65% |

Oct. 1, 2010 Change | 0.4 (5.9%) | 0.5 (28.6%) | 25% |

Oct. 1, 2011 Change | 0.3 (25%) | 0.3 (40%) | 0% |

July 1, 2012 Change | 0.15 (50%) | 0.15% (50%) | 0% |

Jan. 1, 2013 Change | 0.08 (46.6%) | 0.08 (46.6%) | 0% |

Source: Orange, based on Arcep data |

Analysis of the wholesale call termination markets

On May 28, 2013, the Arcep launched a public consultation beginning a new round of analysis of the wholesale fixed and mobile voice and SMS call termination markets in continental France and its overseas territories for the 2014-2016 period. The Authority decided that the 2014-2016 round should consider jointly the fixed-line voice call termination, mobile voice call termination and SMS termination markets.

Universal service in electronic communications

Following the universal service (telephony) tendering process for 2013-2016, Orange was appointed by the Ministerial Order of October 31, 2013, as the operator responsible for providing the telephony access and services components of the universal service under Article L. 35-1, 1 of the French Postal and Electronic Communications Code (CPCE).

Orange was also appointed, by an Order on February 14, 2012, as the operator responsible for the public telephony component of the electronic communications universal service.

ORANGE / 2013 REGISTRATION DOCUMENT - 25

Analysis of the fixed broadband and superfast fixed broadband markets

Following publication in July 2013 of the results of the Review and Prospects consultation on markets 4, 5 and 6 and on the decisions on symmetrical regulation of fiber optic, the Arcep published its draft decisions on the fixed broadband and superfast fixed broadband markets on November 27, 2013.

These relate to the wholesale physical network infrastructure access (market 4), the wholesale broadband access market (market 5) and the wholesale terminating segments of leased lines market (market 6).

Reform of flat rate tax on network enterprises (IFER)

The 2010 Finance Law eliminated the professional tax and introduced new taxes payable to local authorities.

■

business property tax (CFE);

■

corporate value added tax (CVAT).

On top of these, there is a flat rate tax on network enterprises (IFER) levied on network companies (energy, rail, telecommunications), paid to local authorities and levied on certain categories of assets, as follows:

■

tax on copper wires, making up around 20% of the total;

■

two taxes on switching equipment making up around 80% of the total.

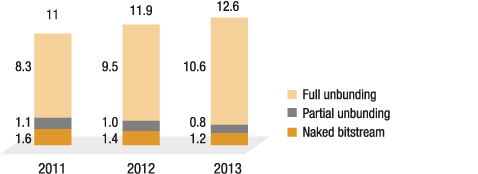

IFER was reformed by Amended Finance Law No. 2013-1279 of December 29, 2013. In four years the components levied on switching equipment, which fall exclusively on Orange, will be transferred to the copper wires and so be shared among all operators via the wholesale offerings (mainly unbundling).

Completion of the regulatory framework for the rollout of fiber optic networks

On January 21, 2014, the Arcep adopted a recommendation on FTTH access for buildings with fewer than 12 residential or business premises in high-density areas, and outside low-density pockets. This expands on an earlier recommendation, issued June 14, 2011, and provides for the installation of concentration points of 100 single fiber lines to serve buildings of fewer than 12 homes, outside low-density pockets. To provide complete coverage, the Arcep recommends a prior consultation system is put in place to bring together all stakeholders, including local authorities.

Moreover, the Arcep’s decision of January 27, 2014 reduced the number of districts classed as in high-density areas from 148 to 106 districts. This decision was the subject of a public consultation from October 21 to November 18, 2013, and was then approved by the Minister responsible for electronic communications and published in the French Republic’s Official Journal of January 26, 2014.

New analysis of fixed-line telephony markets: fourth round of analysis on the 2014-2017 period:

In February 2014, the Arcep launched a public consultation to begin the fourth round of analysis of the fixed telephony market (2014-2017), covering the relevant markets access to the public telephone network at a fixed location for residential customers (market 1) and call origination on the public telephone network provided at a fixed location (market 2). As part of this consultation, the Arcep is submitting the following proposals to all stakeholders:

■

a gradual migration from straight carrier selection offers to wholesale line rental, VGAST offers;

■

lifting the asymmetrical regulation imposed on Orange in the call origination market for calls to value-added service (VAS) numbers, instead relying exclusively on the symmetrical framework established by Decision No. 2007-0213;

■

definitive withdrawal of the flat rate interconnection scheme for narrowband Internet access.

Regulation of fixed-line services wholesale offers

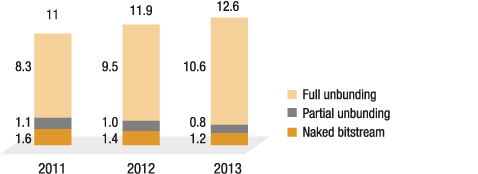

Rate changes for wholesale offerings subject to cost orientation (unbundling, analog and digital wholesale line rental, and call origination)

In 2013, Orange published new rates that include higher rates for unbundling and wholesale line rental, and lower rates for bitstream access.

For 2014, Orange announced another rise in full unbundling rates in accordance with the European Commission’s recommendation on non-discrimination obligations and consistent costing methodology, issued on September 12, 2013, as well as a rise in bitstream rates.

| | 2013 rates | 2014 rates |

Unbundling | Full | 8.90 € | 9.02 € |

| Partial | 1.64 € | 1.64 € |

Wholesale line rental | Analog WLR | 12.21 € | 12.19 € |

| Digital WLR | 18.61 € | 18.35 € |

Bitstream | DSL access | 4.09 € | 4.39 € |

| Naked DSL access | 12.21 € | 12.41 € |

ORANGE / 2013 REGISTRATION DOCUMENT - 26

Legal framework

The 2002 European Telecom Package was transposed into Spanish law by the general Telecommunications Act (law No. 32/2003 of November 3, 2003), Royal Decree No. 2296/2004 of December 10, 2004 on the electronic communications markets, network access and numbering, and Royal Decree No. 424/2005 of April 15, 2005 on the supply of electronic communications services, universal service obligations and user rights.

The 2009 Telecom Package was transposed into Spanish law by Royal Decree No. 726/2011 on universal service provision in May 2011 and royal decree No. 13/2012 of March 31, 2012.

The telecommunications sector is also covered by law No. 15/2007 of July 3, 2007 relating to the implementation of competition rules.

Law No. 34/2002 of July 11, 2002 relating to the information society and electronic commerce specifies the obligations and limits of responsibility applicable to service providers in the information society.

The regulatory framework applicable to data protection in Spain is based around law No. 15/1999 of December 13, 1999, relating to personal data protection and order No. 999/1999 relating to security measures. In the field of intellectual property rights protection, law No. 23/2006 of July 7, 2006 amends law No. 1/1996 of April 12, 1996 and transposes European directive 2001/29/EC relating to the harmonization of certain aspects of copyright and related rights in the information society.

Regulatory Authorities

Following government reforms begun in 2012, the telecommunications sector came under the responsibility of a number of different institutions in 2013:

■

Until the new authorities took over in October, the sector was overseen by the Secretariat of State for Telecommunications and the Information Society (Secretaría de Estado de Telecomunicaciones y para la Sociedad de la Información – SETSI), the Telecommunications Market Commission (Comisión del Mercado de las Telecomunicaciones – CMT) and the National Competition Commission (ComisiónNacional de la Competencia – CNC), charged with enforcing competition law in coordination with the sector authorities;

■

Since October 2013, the regulators for all the various sectors of the economy, including telecommunications, have been brought together under a new cross-industry entity, the National Commission for Markets and Competition (ComisiónNacional de los Mercados y la Competencia), set up by law No. 3/2013 of June 4, 2013, which also has responsibility for competition issues.

As a result the telecom industry is now overseen by both the new multi-industry regulator and Setsi as follows:

■

Setsi handles authorizations, spectrum attributions, telephone numbering, universal service cost approvals, service quality, and disputes between consumers and non-dominant operators;

■

the National Commission for Markets and Competition (ComisiónNacional de los Mercados y la Competencia – CNMC), conducts market analysis and handles disputes involving operators with significant market power.

Mobile call termination rates

Following a consultation in December 2011 on the wholesale mobile call termination market (market 7), the CMT issued a decision on May 10, 2012 proposing a gradual decrease of mobile call termination caps, reaching rate symmetry in July 2013. The proposed caps are as follows:

(In euro cents/minute) | 04/16/12-10/15/12 | 10/16/12-02/29/13 | 03/01/13-06/30/13 | From July 2013 |

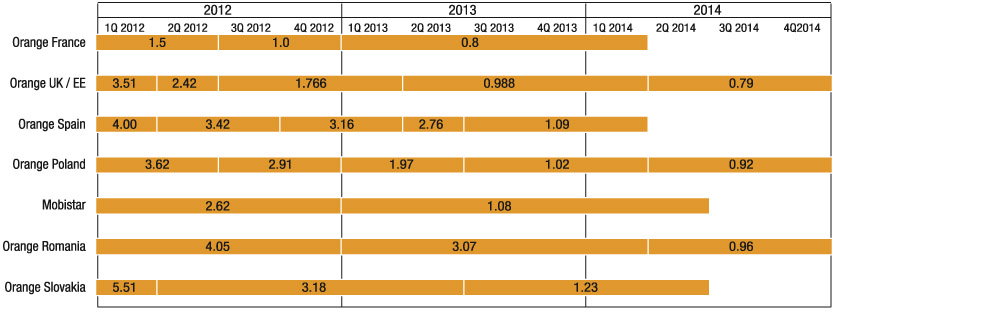

Movistar, Vodafone, and Orange | 3.42 | 3.16 | 2.76 | 1.09 |

Yoigo | 4.07 | 3.36 | 2.86 | 1.09 |

Significant events in 2013 and the start of 2014

July 2013 | Extension of Orange licenses to 2030 (800 MHz and 1,800 MHz) |

August 2013 | Telefónica and Yoigo agreement |

ORANGE / 2013 REGISTRATION DOCUMENT - 27

Spectrum

In May 2011, the Spanish authorities allocated a 5 MHz duplex block in the 900 MHz spectrum to Orange Spain. The license, granted under the principle of technological neutrality, is valid until December 2030.

In July 2011, the Spanish authorities auctioned the 800 MHz, 900 MHz and 2.6 GHz frequency bands. The 800 MHz licenses, awarded in 2011, only become available from 2015. The same is true for the 900 MHz block allotted to Telefónica.

In July 2013, Orange Spain’s license for the 900 MHz band was extended from 2025 to 2030 and its 1,800 MHz license from 2023 to 2030.

Following these allocations, the Spanish spectrum is distributed as follows:

| 800 MHz | 900 MHz | 1,800 MHz | 2.1 GHz | 2.6 GHz |

| | | | FDD | TDD | FDD | TDD |

Orange | 2*10 MHz | 2*10 MHz | 2*20 MHz | 2*15 MHz | 5 MHz | 2*20 MHz | 10 MHz |

Vodafone | 2*10 MHz | 2*10 MHz | 2*20 MHz | 2*15 MHz | 5 MHz | 2*20 MHz | 20 MHz |

Telefónica | 2*10 MHz | 2*10 MHz | 2*20 MHz | 2*15 MHz | 5 MHz | 2*20 MHz | |

Yoigo | | | 2*15 MHz | 2*15 MHz | 5 MHz | | |

Telefónica and Yoigo agreement

In July 2013, Telefónica and Yoigo signed a deal allowing Telefónica to use Yoigo’s 4G frequencies and Yoigo to offer fixed and mobile convergence services across Telefónica’s broadband network.

Universal Service

The law on a sustainable economy approved in February 2011 stipulates that functional access to the Internet includes a 1 MB broadband connection. The new method for calculating the universal service cost was approved in December 2012 and includes broadband connections. Telefónica was again designated as the universal service provider beginning in January 2012.

The universal service net cost from 2006 to 2010 and Orange’s contribution are given in the following table:

(In millions of euros) | 2006 | 2007 | 2008 | 2009 | 2010 |

Universal service net cost | 75.34 | 71.09 | 74.85 | 46.78 | 43.57 |

Orange’s contribution | 8.03 | 7.46 | 7.61 | 4.7 | 4.75 |

Significant events in 2013 and the start of 2014

| |

February 2013 | Wholesale broadband market (markets 4 and 5/2007) Consultation on draft decisions on unbundling and bitstream offers |

| Orange and Vodafone agreement on FTTH |

March 2013 | Signature of a deal between Orange and Vodafone on the rollout of fiber optic |

| European Commission phase II investigation into fixed wholesale broadband offers |

June 2013 | The European Commission has challenged the draft decision of the CMT (pricing not strictly based on costs) |

| New pricing offer for local loop unbundling |

September 2013 | The CMT issued a decision in favor of increasing the full unbundling rate to 8.80 euros and reducing the partial unbundling rate to 1.30 euros |

| The European Commission asks for a new wholesale bitstream access offer |

October 2013 | The European Commission asked the CNMC to amend its wholesale offer for broadband access (NEBA) or withdraw its draft, taking account of cost-based pricing |

ORANGE / 2013 REGISTRATION DOCUMENT - 28

Wholesale broadband markets (markets 4 and 5/2007)

The CMT issued a decision on the wholesale broadband market in January 2009 that covers offers under 30 Mbps. A new round of analysis of this market began in 2013 and a decision is expected in 2014.

Following the consultation launched in February 2013 on unbundling and bitstream rates, and having taken account of comments by the European Commission and the BEREC, in September the CMT increased the full unbundling monthly rate from 8.32 euros to 8.60 euros and cut the partial unbundling tariff from 2.06 euros to 1.30 euros.

As regards bitstream rates, the CMT introduced provisional tariffs for new bitstream (NEBA) offers in July 2012, including a bitstream for fiber offer, which will eventually replace current technologies (GigADSL and ADSL-IP). These rates include an increased risk premium for wholesale superfast broadband offers.

In February 2013, the CMT proposed a new set of bitstream rates which the European Commission failed to approve. In June 2013, the Commission launched a phase II investigation and expressed serious doubts about these new offers, which were priced 50% above cost. At end-October 2013, at the conclusion of this procedure, the European Commission officially asked the CNMC to withdraw or amend its proposals to comply with cost-based pricing.

On January 30, 2014, the CNMC finally approved the following tariffs:

Bitstream Offers | Provisional monthly rates 2012 | Definitive rates 2014 |

Neba FTTH | 23.22 € | 19.93 € |

Neba DSL | 6.50 € | 6.48 € |

Naked DSL premium | 9.11 € | 8.60 € |

Aggregation offer (per Mbps) | 32.62 € | 14.56 € |

GigADSL and IP-ADSL (regional offer) at 10 Mbps | 12.50 € | 10.20 € |

IP-ADSL (national offer) at 10 Mbps | 16.67 € | 13.60 € |

Orange and Vodafone agreement to roll out fiber optic in Spain

In March 2013, Orange and Vodafone agreed to roll out fiber optic in more than 50 cities by 2017, giving coverage of around 40% of the population for an estimated total investment of 1 billion euros.

Under the agreement, which is open to any other operator wishing to co-invest, the vertical infrastructure will be shared pro-rata of costs incurred. Orange and Vodafone have opened a dispute resolution procedure before the regulator seeking to change the access conditions for the terminating segment of the fiber optic cable belonging to Telefónica. The agreement reached with Telefónica led the CMT to impose provisional measures in July 2013. As the tariff cuts obtained by the CMT were insufficient, Orange and Vodafone appealed the CMT’s decision seeking “reasonable” and non-discriminatory terms of access, particularly in light of the deal between Telefónica and Yoigo. The regulator’s final ruling is pending.

Changes to the procedure for reviewing Telefónica’s retail offers

In March 2013 the CMT notified the European Commission of its plans to modify the rules applicable to the method for the ex ante review of Telefónica’s retail offers for consumer customers purchasing telephone network and broadband (less than 30 Mbps) services. These changes introduce twice-yearly price squeeze tests per product line.

One-day fixed-line number portability

The CNMC confirmed that portability of a fixed-line number within a single working day would be effectively available as from November 11, 2013. This measure, originally planned for July 1, 2013, was pushed back to allow some players to make the necessary technical changes.

Legal framework

Orange Polska’s businesses are governed by the law of July 16, 2004 on telecommunications, transposing the 2002 European Telecom Package concerning electronic communications into Polish law, and by the law of February 16, 2007 concerning competition and consumer protection. The law of December 2012, transposing EU directives issued in 2009, came into force on January 21, 2013.

The law of May 7, 2010, on developing telecommunication networks and services, provides access to telecommunications and other technical infrastructures funded by public funds.

As regards e-commerce, the law of July 18, 2002 that governs provision of electronic services transposes European Directive 2000/31/EC concerning electronic commerce and defines electronic service supplier obligations.

ORANGE / 2013 REGISTRATION DOCUMENT - 29

The applicable framework concerning personal data protection is defined by the law of August 29, 1997 concerning personal data protection, as amended in 2002. The 2004 Telecommunications Act also defines certain rules applicable to data protection and storage.

For information concerning risks linked to the regulations of the telecommunications sector, see Section 2.4.2 Legal Risks.

Regulatory Authorities

The Ministry of Administration and Digitization, created in November 2011, is responsible for telecommunications.

The Office of Electronic Communications (UKE) is responsible, in particular, for telecommunications regulation and frequency management, as well as certain functions related to broadcasting services.

The Office of Competition and Consumer Protection (UOKiK) is responsible for the application of competition law, merger control and consumer protection.

Memorandum of Understanding between Orange Polska and the UKE

The MOU signed on October 22, 2009 between the UKE and Orange Polska on the creation of a stable telecommunications market included the following points: Orange Polska’s implementation of non-discrimination rules for alternative operators, major investments in broadband (1.2 million lines), the introduction of performance indicators and changing reference offers to commercial offers.

In January 2012, the UKE and Orange Polska extended the investment agreement until the end of March 2013, with a target of having 220,000 broadband lines (speeds of at least 30 Mbps) in place by that date.

The agreement duly expired at end-March 2013.

Significant events in 2013 and the start of 2014

March 2013 | Launch of a UOKiK investigation into alleged abuse by the three operators, Orange Polska, T-Mobile and Polkomtel, of their collectively dominant position in the retail mobile services market |

| Allocation of 1,800 MHz spectrum |

Feb. 2013 | Award of five national 2x5 MHz technology neutral licenses until December 31, 2027 |

| Allocation of 700 MHz spectrum |

July 2013 | Launch of a UKE consultation on whether to allocate the 700 MHz band to electronic communications |

| Allocation of 800 MHz and 2.6 GHz spectrum |

Dec. 2013 | Launch of UKE auction of 4G frequency band |

Mobile call termination rates

The UKE published seven decisions on December 14, 2012, ruling that Orange Polska, T-Mobile, Polkomtel, P4, CenterNet, Mobyland and Aero2 each had a dominant position in the mobile call termination market for the mobile numbers open to interconnection on their network (third round of market analysis). It also set symmetrical mobile voice call termination rates for all operators from January 1, 2013, and termination rates based on long run incremental costs as from July 1, 2013.

Date | January 1 to June 30, 2013 | July 1, 2013 (pure LRIC) |

Zlotys/min | 0.0826 | 0.0429 |

Euro cents/min | 1.94 | 1.01 |

Spectrum

In 2011, the UKE issued three decisions that introduce technological neutrality in the 900 MHz, 1,800 MHz, and 2,100 MHz frequency bands.

Orange Polska’s 1,800 MHz license, which expired in August 2012, was renewed in July 2012 for a further 15 years.

Also, five new 5 MHZ duplex blocks in the 1,800 MHz band were awarded to P4 and T-Mobile on February 13, 2013, for 15 years.

One new 5 MHz duplex block in the 800 MHz band was also awarded to Sferia on August 5, 2013, by the Ministry for Administration and Digitization.

In July 2013, the UKE published a consultation on whether to assign 700 MHz spectrum to electronic communications. No decision on this has yet been announced.

ORANGE / 2013 REGISTRATION DOCUMENT - 30