Exhibit 15.1

Excerpt containing the pages and sections of the 2018 registration document that are incorporated by reference into the 2018 annual report on form 20-F (1)

(1) The following document contains certain pages and sections of the 2018 Registration Document which are being incorporated by reference into the 2018 Annual Report on Form 20-F of Orange. Where information within a subsection has been deleted, such deletion is indicated with a notation that such information has been redacted.

[REDACTED SECTION: CERTAIN TEXT THAT FOLLOWS HAS BEEN REDACTED.]

1.1. Overview

Orange is one of the world’s leading telecommunications operators with revenue of 41 billion euros and 151,000 employees worldwide, including 92,000 in France, at December 31, 2018. The Group served 264 million customers at December 31, 2018, of which 204 million mobile customers and 20 million fixed broadband customers. The Group is present in 27 countries. Orange is also a leading provider of telecommunication services to multinational companies, under the brand Orange Business Services. In March 2015, the Group presented its strategic plan, Essentials2020, which focuses on its customers’ expectations to ensure that they experience the best of the digital world and the power of its very high-speed broadband networks.

Orange SA is the parent company of the Orange group and also carries the bulk of the Group’s activities in France. Orange has been listed since 1997 on Euronext Paris (symbol: ORA) and on the New York Stock Exchange (symbol: ORAN).

1.1.1. Company identification

Company name: Orange

Registration location and registration number:

Paris Trade and Companies Register (Registre du commerce et des sociétés - RCS) 380 129 866 APE (principal activity) code: 6110Z

Date of incorporation and term:

Orange was incorporated as a French société anonyme on December 31, 1996 for a 99-year term. Barring early liquidation or extension, the Company will expire on December 31, 2095.

Registered office:

78, rue Olivier de Serres, 75015 Paris, France Telephone: +33 (0)1 44 44 22 22

Branches: None

Legal form and legislation applicable:

Orange is governed by French corporate law subject to specific laws governing the Company, notably Act 90-568 of July 2, 1990 on the organization of public postal services and France Télécom, as amended.

The regulations applicable to Orange as a result of its operations are described in Section 1.7 Regulation of activities.

Company purpose:

The Company’s corporate purpose, in France and abroad, specifically pursuant to the French Postal & Electronic Communications Code, shall be:

-to provide all electronic communication services in internal and international relations;

-to carry out activities related to public service and, in particular, to provide, where applicable, a universal telecommunications service and other mandatory services;

-to establish, develop and operate all electronic communications networks open to the public necessary for providing said services and to interconnect the same with other French and foreign networks open to the public;

-to provide all other services, facilities, handset equipment, electronic communications networks, and to establish and operate all networks distributing audiovisual services, and especially radio, television and multimedia broadcasting services;

-to set up, acquire, rent or manage all real-estate or other assets and businesses, to lease, install and operate all structures, businesses, factories and workshops related to any of the purposes defined above;

-to obtain, acquire, operate or transfer all processes and patents related to any of the purposes defined above;

-to participate directly or indirectly in all transactions that may be related to any of the purposes defined above, through the creation of new companies or enterprises, the contribution, subscription or purchase of securities or corporate rights, acquisitions of interests, mergers, partnerships, or any other means;

-and more generally, all industrial, commercial and financial transactions, or transactions involving movable or fixed assets, that may be related directly or indirectly, in whole or in part, to any of the aforementioned corporate purposes, or to any similar or related purposes, or to any and all purposes that may enhance or develop the Company’s business.

1.1.2. History

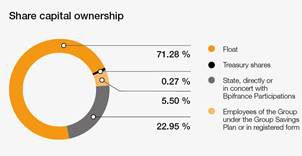

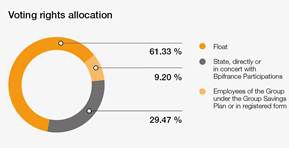

Orange, formerly France Télécom, is France’s incumbent telecommunications operator. The Group has its origins in the Ministry for Mail, Telegraphs and Telephone, later to become the General Directorate of Telecommunications, which in 1990 was accorded the status of independent public entity and, on January 1, 1991, renamed France Télécom. On December 31, 1996, France Télécom became a société anonyme (limited company). In October 1997, France Télécom shares were listed on the Paris and New York stock exchanges, allowing the French government the disposal of 25% of its shares to the public and Group employees. Subsequently, the public sector gradually reduced its holding to 53%. The law of December 31, 2003 authorized the transfer of the Company to the private sector and between 2004 and 2008 the public sector sold a further 26% of the capital, and then again 4% in 2014 and 2015. At December 31, 2018, the French State retained 22.95% of the share capital, held either directly or jointly with Bpifrance Participations.

France Télécom’s area of activity and its regulatory and competitive environment have undergone significant changes since the 1990s. In a context of increased deregulation and competition, between 1999 and 2002, the Group pursued a strategy of developing new services and accelerated its international growth with a number of strategic investments. These included, in particular, acquiring the mobile operator Orange Plc and the Orange brand, which had been created in 1994, and taking a controlling stake in Poland’s incumbent operator, Telekomunikacja Polska.

Since 2005, the Group has expanded strategically in Spain by acquiring the mobile operator Amena, then in 2015 the fixed-line operator Jazztel. Spain is the Group’s second largest market, accounting for nearly 13% of consolidated revenue in 2018.

In parallel, the Group streamlined its asset portfolio by selling off non-strategic subsidiaries and holdings.

Over the last twelve years, the Group has pursued a policy of selective, value-creating acquisitions by concentrating on the markets in which it is already present.

Mainly targeting the emerging markets of Africa and the Middle East where the Group is historically present (in particular Cameroon, Côte d’Ivoire, Guinea, Jordan, Mali and Senegal), this strategy was implemented through the acquisition of Mobinil in Egypt (2010) and of Méditel in Morocco (2015) and more recently by the acquisition of a number of African operators (in Liberia, Burkina Faso, Sierra Leone and the Democratic Republic of the Congo) (2016).

It also resulted in the joint venture with Deutsche Telekom that combined UK activities under the EE brand (2010) followed by the disposal of EE in 2016, as well as the disposal of Orange Suisse (2012), Orange Dominicana (2014), Orange Armenia (2015) and Telkom Kenya (2016).

As part of its Enterprise Services and since the acquisition of Equant in 2000, Orange has been pursuing its strategy of becoming a global player in digital transformation and has accelerated its shift to services through a number of targeted acquisitions, notably in the fields of cyber security and Cloud services, such as those of Business & Decision and Basefarm in 2018.

Business diversification is one of the major pillars of the Orange group’s Essentials2020 strategy. The acquisition of Groupama Banque, now Orange Bank, in 2016, which launched its new banking offer in November 2017, illustrates the goal of diversifying into the mobile financial services sector.

In 2006, Orange became the Group’s main brand for Internet, television and mobile telephony services in the majority of countries where it operated, most importantly France and Spain. In 2013, the Company adopted the Orange name, offering the full range of its telephony services in France under the Orange brand. This policy continued with the adoption of the Orange brand by Telekomunikacja Polska in 2013, by Mobinil in Egypt, Mobistar in Belgium and Méditel in Morocco in 2016, and by several of the Group’s subsidiaries in Africa in 2017. Enterprise services in the world are offered under the brand Orange Business Services.

For more information on Orange’s strategy and its business model, see Section 1.2 Market, strategy and business model.

1.2. Market, strategy and business model

1.2.1. The global digital services market

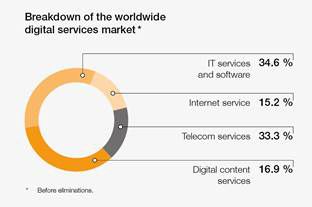

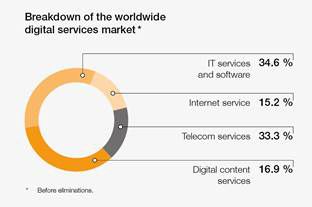

The digital services market is a subsector of the broader Information and Communication Technologies (ICT) sector. It combines IT services and software, telecoms services, TV and video services, and Internet services. On the other hand, it does not include network equipment (1) and devices which are intermediate goods that automatically form part of the added value. The digital services market is an essential component of economic growth and accounts for significant value creation via the distribution of new services and new uses.

With growth of 4.5% in 2018, the global digital services market amounts to €3,383 billion and is continuing to grow steadily. The growth of this market is driven by the dynamic Internet services sector (up 13.6% in 2018) and IT and digital content (up 5.6% each). Revenue from telecoms services was €1,187 billion. It experienced moderate growth of 1.1% in 2018 (2).

Source : Idate - Digiworld yearbook 2019.

Market growth by region (2)

North America remains the top region in the world in the digital services market with 37% of worldwide revenue, ahead of the Asia-Pacific region at 29%, driven by its economic and industrial development. Europe comes next with 24% of the market but is gradually weakening, whereas Latin America (5%) and Africa (4.6%) account for 10% of the worldwide market combined.

Digital services growth slowed in emerging markets owing to constraints on purchasing power, competitive pressure and, sometimes, the quality of service. The Asia-Pacific market suffered a decline in demand in India and a substantial slowdown in China. Growth in sub-Saharan Africa will likely not exceed 5%. While Africa will account for 25% of the world’s population in 2050, compared with 17% in 2020, the potential of the Africa Middle East region, where the Orange Group is very present, remains strong in both access infrastructure and equipment. The digital ecosystem is currently being built in the region. It is emerging and adapting to local conditions in order to integrate IT in all areas of the economy (trade, agriculture, government, mobile payments, etc.).

Key trends and changes in telecoms services

The development of very high-speed fixed broadband and mobile and the high penetration of smartphones worldwide, lead to a growing demand for bandwidth (2).

The return to growth of telecommunications services which began in 2017 remains weak in Europe. The weight of telecommunications services is, therefore, trending downward in Europe due to strong competition between operators and the development of OTT services. The American market has also been in decline for the past two years, but while it is of comparable size, it generates twice as much revenue, traffic and investment. Lastly, growth in the rest of the world remains steadier, although there is an observable slowdown in emerging markets.

Convergence of services and market consolidation

Convergence, which provides a competitive advantage to operators with both fixed and mobile network infrastructures, continues to grow, particularly in Europe. It led to the development of so-called quadruple play offers (voice, Internet, television, mobile), as well as the growing use of WiFi in mobile networks.

The convergence of telecommunications and content operators is a feature specific to the North American and UK markets. In the United States, the acquisition by AT&T of the Time Warner media group, owner of television chains HBO and CNN, announced in June 2018, was approved by the competition authorities.

In Europe, the consolidation trend has slowed following mergers between telecoms operators in 2014-2015 which addressed the need for convergence and a reduction in the number of mobile operators. However, the merger between mobile operators Tele2 and T-Mobile in the Netherlands was approved by the European Commission at the end of November 2018. With respect to fixed/mobile convergence transactions, the merger of Vodafone and Liberty Global in Germany, Hungary, the Czech Republic and Romania, which was announced in May 2018, is underway. The merger of Tele2 and Telecom Hem in Sweden was approved by the European Commission in October 2018. In addition, in 2018, Iliad and its founder took a majority stake in the operator Eir in Ireland.

Network development and growth in telecommunication uses worldwide

While in Africa and the Middle East, Internet access networks are developing primarily via the deployment of mobile networks, in Europe, investment in networks has focused on very high-speed broadband access with the development of fixed-line fiber, 4G mobile network performance improvements and the first 5G tests. Concurrently, operators are upgrading their networks to make them more flexible and simpler to manage (thanks to virtualization) and more open (thanks to APIs).

Usage is continuing to grow under the combined effect of the deployment of new networks, the increase in capacity of existing networks and growth in the penetration rate of smartphones. The explosion in usage is mainly driven by the development of video and Internet services accessible via a multitude of screens (computers, smartphones, tablets, connected TVs, connected watches). Furthermore, the development of long-distance radio network technologies to connect low-consumption devices (LPWA) and 5G will allow an increase in the number of connected devices which is currently still quite low.

Consumer and company expectations

Digital technologies continue to gradually permeate all areas of daily life: family, home, well-being, entertainment, work, and money. More and more industries are being affected: domotics, the automotive sector, health, financial services, energy and retail. The big Internet players generate revenue through the monetization of data, collected and analyzed thanks to Big Data and artificial intelligence techniques.

In this context, consumers have strong expectations on the quality and reliability of the communication networks, but also on the protection of their personal data and on having a trusted relationship with their operator. In order to ensure the protection of citizens’ right to privacy, in May 2018, the European Union implemented the General Data Protection Regulation (GDPR), a new legal framework to protect personal data in Member States (see section 1.7 Regulation of telecom activities).

The digitization of companies (IoT, Big Data) improves their performance and effectiveness through a better understanding and management of customer relationships and of their internal processes. Furthermore, in the face of the increased threats of cyber-attacks, cyber-security needs are increasing. Businesses therefore need to be assisted in this double aspect of their transformation process.

Artificial Intelligence (AI) on the rise

Big Data, advances in algorithms and access to processing power at very low cost, in addition to investments by American and Asian IT giants, have accelerated the performance of artificial intelligence. Major global players like Amazon and Google are positioned in the personal assistant voice market which is still little developed in Europe.

The emergence of AI should substantially change consumer services as well as processes within companies. AI opens up opportunities to create new value-added services such as the development of chatbot solutions (software robot that speaks to a user) in customer relationships. It can substantially improve operational efficiency in almost all major business lines: customer relationships, as well as IT, marketing, support functions, etc.

1.2.2. The Orange group strategy

Launched in 2015, the strategic plan, Essentials2020, focuses on Orange’s ambition for 2020 to "provide its customers with an unmatched customer experience" by being ever-present to "connect every individual to what is essential to them". This involves providing exemplary basic services, quality and reliable access, customer connections at any time and from anywhere they want, as well as even more personalized options for services and offers.

The implementation of its Essentials2020 strategy has enabled Orange to generate revenue and EBITDA growth again.

Orange serves every kind of customer: those who focus above all else on price and those who have a particularly high-level of service expectation, whether private individuals, very small companies or multinationals. The Group can rely on a series of key strengths for the mission that it has set out. With its brand and its 151,000 employees at end-2018, it is present in Europe, Africa and the Middle East on the residential market, and everywhere in the world on the Enterprise market.

Orange’s ambition breaks down into five main drivers:

1. offering enriched connectivity;

2. reinventing the customer relationship;

3. building a company model that is both digital and caring;

4. supporting the transformation of business customers;

5. diversifying by capitalizing on its assets.

Moreover, the strategic plan will be achieved within the framework of a company that is digital, efficient and responsible.

1. Offering enriched connectivity

The multiplication of screens, the generalization of video on the Internet and customers’ growing need for online services and content has led to an explosion in usage and in mobile data traffic. Moreover, the digital revolution has created new customer expectations and has changed their behavior, making connectivity even more important. Offering an efficient network to all customers is no longer enough; services must now be tailored to each individual consumer and to each moment. Orange would like to offer richer connectivity to all its customers, whether retail or business.

In order to achieve its ambition, the Group invested €7.4 billion in 2018 in line with the annual objective announced for 2018. Clear priority is given to investments in very high-speed broadband, in order to respond to the explosion in traffic and meet customer expectations. These will allow Orange to develop broadband services, whether fixed or mobile, as well as convergence services in Europe. Investments are being made in particular in the following areas:

Development of very high-speed fixed broadband and of convergence

Fiber To The Home (FFTH) is a source of value creation for Orange, through the recovery of market share, customer loyalty and the improvement of the average revenue per user (ARPU). At the end of 2018, very high-speed fixed broadband accounted for 6.3 million customers and was up by 33% year-on-year.

The Group accelerated fiber deployment in 2018. At the end of 2018, there were 32.5 million very high-speed broadband connectable households (an increase of 5.9 million year-on-year, up by 22.4%), including 13.8 million in Spain, 11.8 million in France and 6.4 million in the rest of Europe.

Across Europe, the deployment of very high-speed fixed broadband networks provides a competitive advantage over fixed-mobile convergence where the Group is the leader with 10.9 million convergent customers at end-2018, up by 5.5% year-on-year, including 6.1 million in France, 3.1 million in Spain and 1.6 million elsewhere in Europe.

The Group’s Love convergent offers are available everywhere in Europe. Convergence also allows better service to be provided to business customers.

Rollout of very high-speed broadband mobile networks (4G and 4G+)

The development of very high-speed mobile broadband is continuing in all regions in which the Group is present and Orange continues to make significant investments in geographical coverage. Investments in 4G and 4G+ mobile services continued to enjoy sustained growth in 2018. The deployment of 4G sites accelerated in France, Spain and in Africa and the Middle East, particularly in Mali, Morocco, Senegal and Côte d’Ivoire. The impact of the Group’s investments in mobile networks in France is reflected in the results of Arcep’s 2018 annual survey which ranked Orange as number one in network quality for the eighth consecutive year.

Continuation of network modernization

In anticipation of the future needs of its customers, the Group is upgrading its networks to make them more agile and automatically adaptable. Orange is thus continuing to drive the transition of its networks towards all-IP, the Cloud and the virtualization of networking functions, with the goal of being able to make them programmable in real time and dynamically, based on the evolution of traffic and needs. Orange has also begun using its expertise in artificial intelligence to improve the operational effectiveness of its networks and of its information system.

Orange is a world leader in the submarine cables market with a 450,000 kilometers network, i.e., 10 times the circumference of the Earth (either wholly-owned or held through international consortiums). The Internet and most international communications (over 99% of traffic) use these submarine cables. In 2018, Orange contributed to the deployment of the PEACE cable (Pakistan & East Africa Connecting Europe). It is 12,000 kilometers long and will connect Pakistan, Djibouti, Kenya, Egypt and France and later South Africa. It will strengthen the ties between the planet’s three most-populated continents.

The Group is also preparing for the arrival of 5G: it is well-suited to new mobile Internet uses and to the Internet of Things and will also enable the emergence of new economic models. In 2018, Orange carried out the first conclusive 5G technical tests in France and in Europe. The Group will launch a p-commercial phase in 2019 with the deployment of a 5G network in 17 cities in Europe: in France (Lille, Paris, Marseille and Nantes), Spain, Poland, Belgium, Luxembourg and Romania.

The Group’s ambitions for the future are to continue to lead in FTTH and its future developments and to be leader in 5G. It also wants to take advantage of new, related sales opportunities while continuing to optimize the cost of the core networks and their CO2 emissions.

For more information, see Sections 1.5.1 Orange’s networks and 1.6.1 Research and innovation.

An enriched content experience

The quality of the Group’s networks, particularly in very high-speed broadband, allows it to support the development of uses and respond to customer demands by offering a multi-screen experience. The development of uses is also based on access to quality content. In this area, the Group’s strategy involves strengthening its role as a distributor by focusing on content aggregation able to choose, highlight, package and offer attractive content meeting customer expectations in a simple and fluid manner.

In a context of increased competition in 2018 resulting, in particular, from the development and distribution of content via Internet (streamed content services consumed on TV screens) which no longer requires an operator TV decoder, Orange has continued its strategy of creating value through content.

For more information, see Section 1.4.6.2 Content activities.

2. Reinventing the customer relationship

The relationship with the customer is a key success factor, thanks to the direct link with the end-customer, especially when facing competition from OTT platforms. The Group aims therefore to have an impeccable relationship with its customers, thanks in particular to:

-the power of the Orange brand;

-the simplification of the customer journey by limiting the number of steps and intermediaries;

-the improvement of the customer experience.

Brand identity

Orange has a strong brand, ranked 65th in the Top 100 BrandZ ranking (source: Kantar Milwardbrown survey of the Top 100 Most Valuable Global Brands in 2018). The Orange brand fell three places compared to its 2017 ranking due to the strong growth of certain American and Chinese brands.

An optimized customer journey

With the development of very high-speed broadband and the rapid growth in smartphones offering customers autonomy, speed and continuous availability, mobile services are becoming essential to the customer relationship. The Group optimized its network of physical sales locations and rethought their role with the use of the smartphone which is increasingly becoming the key contact point, notably through the My Orange customer app. It enables customers to manage their Internet and mobile offerings from their smartphone, to contact Orange easily and to resolve problems. It currently has 18.5 million active users.

The physical stores now focus on more sophisticated customer reception and advice tasks, and on the most complex transactions. The concept is one of service excellence, provided in larger and more welcoming stores that are organized by theme (home, family, work, well-being and entertainment) and known as Smart Stores. Orange had 883 Smart Stores at the end of 2018. The Group thus offers an optimized customer journey combining Smart Stores and digital channels through its self-care solutions such as "My Orange" or e-commerce solutions.

The improvement of the customer experience

New customer relations management tools allow services to be better targeted based on customer uses. The purpose of these tools is to reconstruct the history of a customer’s relationship with Orange, regardless of their contact points, in order to better know the customer and propose customized solutions that correspond to his or her needs and expectations. According to Les Echos’ e-CAC 40 study published in October 2018, Orange is ranked 5th in digital maturity among large French companies.

Orange is increasingly using its renowned expertise in artificial intelligence. After integrating an artificial intelligence solution (IBM’s Watson) in its Mobile Banking offering, the Group announced that its Djingo smart speaker will be available in Orange stores in the spring of 2019. It will become the main interface for all Orange services. For more information, see Section 1.6.1 Research and Innovation.

A trusted operator

As part of its offers, Orange already secures its customers’ identities (Mobile Connect), health data (Orange Healthcare) and, for some people, their money (Orange Bank, Orange Money). In addition to its existing cyber-security and digital identity services, Orange intends to become a trusted operator which secures and facilitates the digital lives of its customers.

Unlike several Internet giants who highlight free access to their service, the Orange business model is not based on using the personal data of its customers but rather on a subscription (see Section 1.2.3 Business model). At the Show Hello event, Orange announced the creation of an Ethics Committee on data use with customer and employee representatives.

Orange deployed a broad-based project across the Group to prepare for the entry into force of the General Data Protection Regulation (GDPR), which took place in May 2018.

3. Building a company model that is both digital and caring

Orange wants to be a company to which all its employees, women and men, are proud to belong. In order to measure employee satisfaction, which is a guarantee of business performance, Orange introduced an employee satisfaction plan with a bi-annual survey in France and an annual survey outside of France.

The Group is continuing its internal transformation driven by the three priorities of its promise to be a people-oriented and digital employer:

-relying on committed employees;

-developing collective agility by encouraging initiative and being always more customer-focused;

-and securing the skills needed for the future by developing expertise in-house and attracting new talent. The strong and rapid change in business lines and skills is becoming a major societal challenge.

In December 2018, Orange confirmed its policy of being an ambitious employer by signing a new inter-generational agreement for the 2019-2021 period based on three major themes: integrating young, measures for senior employees and end-of-career management, and the transmission of know-how, particularly between generations.

Orange has been committed to achieving gender equality in the workplace for over ten years. It has focused on four main areas: women’s access to positions of responsibility and to every management level, balanced gender representation in all business areas including technical fields, equal pay, and private life/work life balance.

Orange is involved in the environmental and energy transition. In July 2018, it signed a new incentive agreement which, in particular, introduced a Corporate Social Responsibility indicator for energy management.

In order to develop the skills needed for the future, Orange Cyberdefense joined forces with Microsoft and ECE Paris to train future cyber-security experts at the heart of the digital transformation of companies.

A recognized policy of human resources development

In February 2019, for the fourth consecutive year, Orange received the Top Employer Global 2019 world certification, which rewards the best human resource policies and practices. Orange is one of the 14 employers in the world to be certified Top Employers Global 2019 and the only telecoms operator on the list.

On October 4, 2018, Orange also received the Top Employer Africa 2019 certification for the sixth consecutive year, placing it among the three first Top Employers on the continent.

4. Supporting the transformation of business customers

Carrying opportunity, efficiency, and growth, the digital revolution deeply transforms the activities, organization, tools (customer and employee relations) and the processes of businesses. In this context, Orange is positioned as a trusted partner to support companies in their digital transformation. To this end, the Group is attentive to the needs and specifics of each of its customers’ industries, business lines and processes, and security constraints, from SMEs to multinationals. In addition to its traditional role as a supplier of connectivity wherever it is present, the Group focuses on four key areas:

-providing digital work solutions to allow employees to become more mobile, more connected and more collaborative;

-improving business line processes, particularly through applications and connected objects, which provide companies with new possibilities;

-providing multinationals with private and hybrid Cloud solutions;

-security solutions for the protection of all areas of companies’ vital activities, which represent an increasingly important challenge today.

In 2018, Orange Business Services pursued its strategy of becoming a global player in digital transformation and accelerated its growth in services. In addition, the diversification of its B2B activities continues with the structurally important acquisitions of Enovacom (a leading player in e-health), Business & Decision (an international consulting and systems integration group) and Basefarm Holding (a major player in infrastructure and management services of Cloud critical applications in Europe).

For more information, see Section 1.4.5. Enterprise.

5. Diversifying by capitalizing on its assets

Orange concentrates on fields in which it can capitalize on its assets and be a legitimate player in its customers’ eyes to develop new areas of growth: following on connected devices and mobile financial services, cyber defense has become a major challenge for companies and governments.

Connected objects and mobile financial services have fundamentally transformed customers’ daily life, and Orange believes it can provide a real value-added service in these areas. These services require enhanced connectivity and offer numerous synergies with the Group’s main assets: customer relationships, digital expertise, both physical and digital distribution power, capacity for innovation, brand strength (building confidence and trust with clients), networks and international presence.

Cyber-defense is another field in which the Group has all of the assets needed to offer the solutions of the future to its customers. The Group opened Orange Cyberdefense in Casablanca, Morocco in October 2018 to create the cyber-security leader in French-speaking Africa.

A new Group Executive Committee took office on May 2, 2018. The fifteen-member team, both diversified and more international, is tasked with ensuring the successful transformation of Orange into a multi-services operator by capitalizing on the progress achieved through the Essentials2020 plan, and notably through its voluntary involvement in the deployment of very high-speed broadband networks and improvement of the customer experience.

Connected objects

The Group wants to be present across the entire value chain of connected devices: the distribution of connected devices, the supply of related value-added services, and the management of data from the connected devices, in particular using Datavenue, its open intermediation platform.

Orange Business Services launched the LTE-M technology in November 2018, dedicated to IoT in France. It also initiated a developer challenge to stimulate the LTE-M ecosystem. LTE-M technology is already available in Belgium, was launched in Romania at the end of 2018 and will be released in Spain in 2019.

Mobile financial services

The growth prospects for mobile financial services are significant, not only in Europe but also in Africa, where the mobile penetration rate is much higher than the percentage of people with bank accounts in most concerned countries, and where customers want to make an increasing number of payments using mobile devices, in a simple and fluid manner thanks to the dissemination of smartphones.

Orange’s ambition in mobile financial services is to achieve the following by 2023:

-4 million Orange Bank customers and €500 million in net banking income in Europe;

-over €800 million in revenue and over 30 million active Orange Money customers in Africa and the Middle East.

For more information, see Section 1.3 Significant events.

A digital, efficient and responsible company

The Group wants to meet its objectives in respect of CSR performance by being an ethical company, respectful of the ecosystem and the environment in which it operates.

Corporate responsibility

In order to respond to the social and environmental challenges related to the increasing number of devices (smartphones, tablets, connected objects), as well as to the multiplication of energy-consuming uses, Orange has committed to two priorities: to reduce its CO2 emissions per customer use by 50% by 2020 (compared to 2006), and to promote the integration of circular economy principles within its organization and its processes. At the end of 2018, CO2 emissions per customer use had been reduced by 56.6% since 2006. In March 2018, Orange extended its solar energy access services to the residents of rural areas in five new countries, confirming its intent to become a key player in the energy transition in Africa.

For more information, see chapter 4 Non-financial performance.

For the 2018 Shareholders’ Meeting, Orange published its third Integrated Annual Report showing shareholders and all its audiences how its corporate project intends to create sustainable value shared by all.

Operational effectiveness

Orange continues to improve its operational effectiveness through the implementation of its Explore2020 program. Orange has achieved gross savings of €3.5 billion since 2015, thus exceeding the €3 billion of gross savings initially forecast for the 2015-2018 period.

Over the 2019-2020 period, Orange will continue its efforts using as main drivers digitization, simplification and sharing to achieve additional gross savings of one billion euros over this period.

Since 2018, the Group has also leveraged a Lean CAPEX program for the gradual reduction of unit costs, which will result in savings of up to one billion euros by the end of 2020. This will be partly reinvested, in accordance with the Group’s objectives.

Ambitions

Orange’s strategy, in its core and new business areas, aims to generate new growth while maintaining a healthy financial position. Concerning operations, the Group tracks several major indicators allowing it to assess the implementation of the Essentials2020 plan presented in March 2015:

Two global summary indicators reflect the core ambition of Essentials2020 concerning Orange customers’ digital experience:

-a leadership indicator in terms of customer recommendations (the Net Promoter Score or NPS), which encompasses all of the strategic plan’s drivers. Orange had set itself the goal of becoming number 1 in NPS among 75% of customers before 2018. It achieved very positive results in 2017, with 68% ranking it number 1. In 2018 however, this score fell to 57% due to strong competitive pressure on prices in several countries. The global target of 75% was therefore not met. However, the Group does hold the top position in 15 out of 23 countries (3), with a notably high score in France, where Orange is number 1 in all segments (4);

-an indicator which measures the power of the Orange brand: the Brand Power Index. Orange’s goal was to ensure ongoing improvement of this indicator in all of its markets by 2018. In 2018, compared with 2014, the Brand Power Index for fixed broadband and convergence increased in 7 countries out of 10 and the Brand Power Index for mobile increased in 15 countries out of 25.

Furthermore, Orange has one goal per driver:

-for the first driver on enhanced connectivity, Orange set itself the objective of tripling the average data speeds of its customers on its fixed and mobile networks by the end of 2018 compared with 2014. At the end of 2018, compared with 2014, the average data speed of the fixed network increased 7.6 times thanks to the deployment of fiber and the average data speed of the mobile network increased 3.1 times;

-for the second driver, on customer relationships, Orange was aiming for 50% digitization of interactions with its customers in Europe by 2018. In 2018, 52% of Orange’s customer interactions were via digital channels;

-for the third driver on the digital and caring employer model, Orange has chosen an indicator symmetrical to that chosen for its customers, based on recommendation. In 2018, 81% of employees recommended Orange as employer;

-for the fourth driver on the Enterprise market, Orange has chosen to measure the success of the transformation of its Enterprise business model towards IT services. The Group aims to raise the share of IT and integration services in the Orange Business Services revenue mix by 10 points by 2020. In 2018, revenue from IT and integration services accounted for 36% of OBS revenue on a like-for-like basis, i.e., an 8-point increase compared with 2014;

-finally, the selected indicator for the last driver measures the success of diversification into new services, notably connected devices and mobile financial services. The objective was for these new services to contribute more than one billion euros to the Group’s revenue in 2018. With 2018 revenue of €862 million, this objective was not achieved given that the connected devices market grew less than expected.

Financial objectives

As regards the financial component, see Sections 3.2.2 Outlook, and 6.3 Dividend distribution policy.

1.3. Significant events

In 2018, the Group continued to carry out its strategic plan, Essentials2020, which relies primarily on the quality of the Group’s networks resulting from targeted capital investments, the depth of its convergent and content products and the diversification into new services, particularly mobile financial services and connected devices. In the business segment, Orange Business Services made several acquisitions in 2018 to supplement its business customer digital transformation activities. The Group also continues to implement its operational efficiency and cost-control programs (with Explore2020) and investment programs (with Lean CAPEX).

In March 2018, Stéphane Richard, Chairman and Chief Executive Officer of Orange, announced a renewed Group Executive Committee, with a new, more diversified and international team of 15 members whose mission is to lead the transformation of Orange into a multi-services operator by capitalizing on the progress achieved through Essentials2020. The new Executive Committee started work on May 2, 2018 (see Section 5.1 Composition of management and supervisory bodies).

Investment in networks

In 2018, the investments in networks (besides telecommunication licenses) accounted for 62% of the Group’s CAPEX. In particular, the installation of networks providing broadband and very high-speed broadband Internet access is one of the five levers of the Essentials2020 strategic plan. In France, Orange invested 9 billion euros in the installation of networks between 2015 and 2018, 3 billion euros of which was on fiber optics.

Very high-speed fixed broadband networks

The Group is continuing the accelerated deployment of its very high-speed fixed broadband networks with 5.9 million new households connectable year-on-year. At December 31, 2018, Orange had 32.5 million very high-speed broadband connectable households throughout the world (up 22.4% year-on-year), including 13.8 million in Spain, 11.8 million in France and 6.4 million in the rest of Europe. In France, out of 11.8 million households and commercial premises in the available market for fiber at the end of 2018, Orange built 9.3 million fiber connections, using only equity capital. Orange has installed 69% of the fiber optic network in France (source: Arcep) and in 2018 signed six new agreements for operating the fiber optic networks of regional authorities (Bourgogne-Franche-Comté, Gironde, Vienne-Deux Sèvres, Orne and Var, plus a submarine cable in Guadeloupe, see below). Orange particularly made progress with installations in the less populated areas, with an increase of 40% in 2018 compared with 2017. In addition, in May 2018, Orange entered into commitments with the French government regarding the deployment of fiber optics in its «AMII» areas (areas covered by calls for expressions of investment intentions) (see Note 14.1 to the consolidated annual financial statements).

In April 2018, Orange also announced a commercial agreement with Eutelsat aiming to improve its satellite-based, very high-speed broadband Internet access services in the European countries where it operates in the retail market. This agreement will allow the Group to offer high quality access to digital services to all of its European customers, including in rural areas where it is sometimes difficult to introduce traditional very high-speed broadband networks.

Modernization of the fixed-line telephony network in France

In France, Orange has been gradually replacing the Public Switched Telephone Network (PSTN) technology installed in the 1970s in order to preserve fixed-line telephony service for years to come. IP (Internet Protocol) based technology, now an international communications standard, is already used by nearly 11 million Orange customers in France. It will gradually replace the old STN technology at Orange for all of its fixed-line telephony customers. Since November 15, 2018, Orange has only been marketing fixed-line telephony in metropolitan France using IP.

Very high-speed broadband mobile networks (4G/4G+/5G)

In 2018, Orange continued installing its 4G/4G+ networks. In France and in Spain, the investments made are mainly aimed at increasing the density of coverage outside of urban areas and at improving speeds in the major cities. At December 31, 2018, 4G coverage rates reached 98.6% of the population in France, 96.9% in Spain and 99.8% in Poland. In France, Orange will have converted nearly all of its 3G sites into 4G by the end of 2019. In addition, Orange’s 4G+ is already installed in dozens of cities to meet the growing usage needs of customers. In Africa and the Middle East, deployments are continuing, particularly in Mali, Morocco and Senegal. With these investments, Orange has 56.2 million 4G customers across the world at December 31, 2018 (an increase of 21.7% year-on-year), including 15 million in France, 9.8 million in Spain, 14.8 million in Europe and 16.7 million in Africa & Middle East (excluding associates and joint ventures).

In addition, against a background of strong growth in mobile Internet traffic, the Group is actively preparing for the arrival of 5G technology and has, in particular, decided to carry out new large-scale trials in Europe, as a joint development with its technology and innovation partners. 5G promises a higher-performance network, with speeds up to 10 times faster than 4G and an altogether new network for the Internet of Things, able to connect objects on a massive scale. In countries where there is very little fiber optic infrastructure, 5G will also be an alternative for accessing very high-speed. In 2018, Orange conducted the first conclusive technical experiments of 5G in France and in Europe. Rolled out at the existing 4G sites, 5G will be installed in 17 cities in Europe in 2019 and be ready for commercialization starting in 2020, when a sufficient number of 5G smartphones will be available.

Orange ranked no. 1 mobile network in France

For the eighth consecutive time, Orange confirmed its ranking as the number one mobile network in France according to the results of the annual survey of the quality of service of mobile operators in mainland France published by Arcep (Autorité de Régulation des Communications Electroniques et des Postes) in October 2018. Overall, Orange was first or tied for first on 181 of the 193 criteria measured.

This survey also bears out the Group’s continued efforts on mobile coverage for rural areas in France, by this year again ranking Orange in first place or tied for first place for voice services in communities with less than 10,000 residents. In January 2018, Orange and the other French mobile operators signed an agreement (called the «New Deal») with the French government, under the aegis of Arcep, on access by the French population to broadband in the whole country. The extension until 2031 of authorizations to use the 900 MHz, 1,800 MHz and 2,100 MHz frequencies expiring in 2021 will take place

without an increase in fees or financial auctions, in exchange for increased coverage obligations for operators from 2018. In this connection, Orange has agreed along with the other French mobile operators to cover at least 5,000 new areas throughout the nation.

Submarine cables

Through new partnerships, Orange has strengthened its position in the submarine cable market. The Group’s goal is to raise the quality of the services it offers on its global network, while optimizing costs, so as to handle the ever increasing volume of data exchanges.

In May 2018, Orange International Carriers announced the entry into service of a new land cable between Marseilles and Penmarch (two major geographic locations for submarine cables), which interconnects 15 submarine cables and thus improves connectivity between Asia, the Middle East and West Africa. In September 2018, Orange announced the improvement of its connectivity on the coast of West Africa due to its investment in the MainOne submarine cable. In October 2018, Orange also announced a partnership with Google as part of the Dunant Project, the first submarine cable to connect the United States and France in over 15 years. The 6,600 kilometer cable is set to go into service in late 2020. In addition, Orange and PCCW Global announced in October 2018 their partnership agreement to lay the new PEACE submarine cable (Pakistan & East Africa Connecting Europe). This cable, 12,000 kilometers long, is to connect Pakistan, Djibouti, Kenya, Egypt and France and should be operational in 2020. Finally, in January 2019, Orange inaugurated the Kanawa cable that connects French Guiana, Martinique and Guadeloupe. This cable, 1,750 kilometers long, was financed by Orange’s equity capital.

The multi-services and enhanced services strategy

Content, mobile financial services and connected devices are major areas of diversification for the Group, one of the five levers of its Essentials2020 strategic plan and a component of the broader strategy of developing enhanced services.

Mobile financial services (Orange Bank - Orange Money)

At the end of November 2018, Orange made known its goal of expanding in mobile financial services.

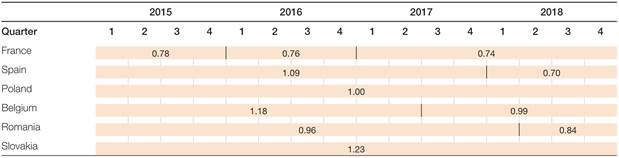

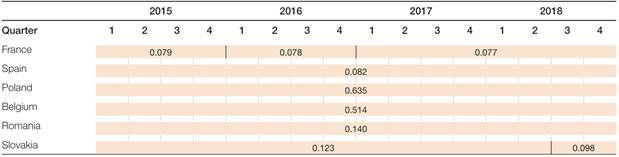

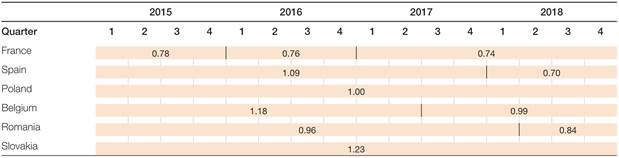

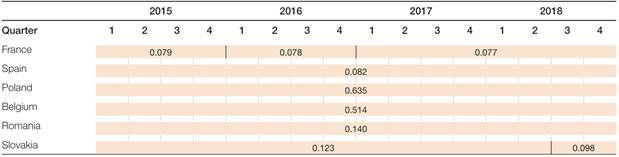

In terms of Europe, the Group’s goal is to roll out its mobile financial services in seven European countries by 2023 through its Orange Bank services (in France, Spain, Poland, Belgium and Slovakia) and enhanced services through its Orange Money service (in Romania and Moldova). The Group aims to have 4 million customers by that date. Orange Bank was launched in November 2017 in metropolitan France and had served 248,000 customers as of December 31, 2018. In March 2018, Orange Bank enhanced its line of banking products with a personal loans offering. In October 2018, its banking products were launched in the French overseas departments.

With respect to Africa and the Middle East, the Group’s goal is to extend Orange Money into 19 countries and aims to have more than 30 million active customers in 2023. Launched in 2008, Orange Money today has 39 million customers, including 15 million who use the service every month, in 15 countries in Africa and the Middle East (excluding associates and joint ventures). Another of the Group’s goals is to launch, with partners, additional banking services (credit, saving and insurance products) in four African nations (Côte d’Ivoire, Senegal, Mali and Burkina Faso) through the launch of Orange Bank Africa, assuming the necessary authorizations can be obtained. Moreover, Orange and MTN, two of the largest mobile money operators on the African continent, announced in November 2018 the creation of Mowali, a joint operation that will enable interoperable mobile payments throughout the continent.

Content

Orange’s content strategy will give priority to the broadest possible distribution of the best content offerings on the market, and to invest in movies and series via Orange Studio and OCS. It has been confirmed through a series of new agreements signed in 2018:

-in January and March 2018 respectively, Orange renewed distribution agreements with the M6 Group and TF1 Group channels as well as non-linear services associated with these channels. These agreements allow Orange TV customers to enjoy enhanced services and features for the two groups’ programming. At December 31, 2018, Orange had 9.6 million IPTV and satellite TV customers (of which 7.0 million customers in France), a 6.1% increase year-on-year;

-in 2018, Orange extended its agreement with organizations in the film industry to invest in French and European movie productions via OCS, committing 125 million euros over the next three years (2019-2021);

-in April 2018, Orange and Fnac Darty announced the strengthening of their digital reading strategic partnership with the launch of a new audiobook offering, promoting the dissemination of new methods of digital reading. Following on from the «ePresse» (digital press) and «izneo by Fnac» (digital comics) services launched at the beginning of October 2017, since May 2018 Orange customers have been able to access 100,000 audiobooks and 3 million e-books, through the «Kobo by Fnac» audiobook service;

-in April 2018, Orange and Vivendi announced that they had signed a partnership with the CanalOlympia movie theater network, the leading movie theater and show network managed by Vivendi in Central and West Africa, with several dozen theaters planned in the coming years.

Internet of Things (IoT)

To support the explosion of the Internet of Things (IoT) market, Orange Business Services announced in November 2018 the introduction of LTE-M technology (Long-Term Evolution for Machines) in France. This is the first technology dedicated to connected devices on a mobile network in France. Installed on the Orange 4G network, this technology facilitates exchanges of enriched data (Data, Voice, Messaging) with devices that are in motion, in buildings or underground locations, and also is needed for logistical tracking, telesurveillance and medical remote assistance, and vehicle fleet management. At year-end 2018, over 98% of the population was covered. Starting in 2019, international roaming and other new features specific to LTE-M technology will be available.

This end-to-end technology supplements the existing IoT dedicated network products such as LoRa®, which remains the network of choice for connecting devices with very low energy consumption. The LoRa® (Long Range) network now covers over 30,000 towns and cities and 95% of the population of metropolitan France.

In April 2018, Orange Business Services also announced the launch, in France and in Europe, of the Datavenue Market web portal, putting the suppliers of connected devices in contact with companies or developers wishing to test and validate an IoT project, in a completely independent manner and at lower cost.

Lastly, Orange and Groupama announced in January 2019 their agreement to create a joint company called Protectline, operating in the property telesurveillance space. This company will be 51% owned by Orange and 49% by Groupama. Orange will introduce its property telesurveillance products for fixed and mobile retail customers in France in the spring of 2019.

Digital transformation of business customers

As part of the Essentials2020 strategic plan, Orange is positioning itself as a partner of companies in their digital transformation. To that end, Orange has added to its activities through acquisitions and creating a joint company.

Following the takeover in June 2018 and additional acquisitions in second half of 2018, Orange acquired 88.2% of the capital of Business & Decision, a company specializing in data and digital technology, operating in business intelligence (structured analysis of business data) and customer relationship management (CRM), for a total amount of 36 million euros, net of the cash acquired. In addition, Orange benefits from mutually-binding options on the remaining 4.9% of the capital (see Note 3.2 to the consolidated annual financial statements).

In August 2018, Orange also acquired 100% of Baseform Holding, a European company active in infrastructure, Cloud services, the management of critical applications and data analysis, for a total of 230 million euros net of the cash acquired (see Note 3.2 to the consolidated annual financial statements). Henceforth, with 2,200 employees expert in the Cloud, more than half of whom work outside France, Orange Business Services plans to generate over half of its revenue in the Cloud internationally and is aiming at annual growth of 25% through 2022.

In February 2018, Orange also acquired Enovacom, which operates in the e-health sector. This acquisition forms part of the strategy of Orange Healthcare, its healthcare subsidiary, to be the leading partner in the digital transformation of health organizations and stakeholders in France and internationally.

Lastly, in February 2019, Orange announced the acquisition of the SecureData group and its subsidiary SensePost. SecureData is the largest independent provider of cyber security services in the United Kingdom, which is the largest market in Europe (see Note 17 to the consolidated annual financial statements).

Orange, a people-oriented and digital employer

Building a people-oriented and digital employer model by securing the skills needed for tomorrow, developing collective agility, and fostering individual commitment is one of the priorities of the Essentials2020 strategic plan.

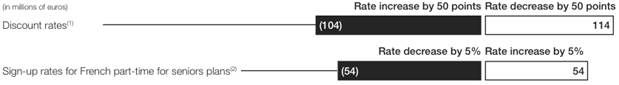

In December 2018, Orange signed a new intergenerational agreement with three French trade unions, covering the integration of young people, assistance with and preparation for retirement and knowledge transfer. This agreement, effective January 1, 2019, covers the years 2019, 2020 and 2021. Under this agreement, Orange has agreed that the Group in France will host an average of 4,000 young people on work-study and 2,400 interns at all times. Once they are trained, the Group further agrees to hire at least 2,000 from work-study or internships on permanent contracts. Lastly, Orange has given a three-year extension to the French «Part-Time for Seniors» plan of 2015, allowing employees to tailor their schedules during the three years preceding their retirement. The estimated number of beneficiaries of the extension of this plan is 6,000 employees (see Note 6 to the consolidated annual financial statements).

In June and December 2018, Orange announced that it had, in the context of its share Buyback program, acquired 6.9 million treasury shares for the amount of 101 million euros (see Note 13.2 to the consolidated annual financial statements). Those purchases were made in order to fulfill obligations related to (i) the «Orange Vision 2020» free share award plan covering 9.1 million shares and (ii) the plan for performance share awards as part of executives’ multi-year variable compensation (Long Term Incentive Plan, LTIP 2018 - 2020). These plans were established with the objective of involving all Group employees and executives (subject to continued employment and performance conditions) in the success of the Essentials2020 strategic plan (see Note 6.3 to the consolidated annual financial statements).

Furthermore, in December 2018, Orange announced the payment of an extraordinary «solidarity bonus» for 20,000 of the lowest-income employees as a commitment to the issue of people’s purchasing power.

Operational effectiveness (Explore2020)

In 2018, Orange continued its operational effectiveness (Explore2020) program. The objective, which was reviewed in December 2017, was to exceed the 3 billion euros of gross savings initially projected for 2015-2018, thereby contributing to controlling the expected increase in operating expenses.

On an aggregate basis for fiscal years 2015 to 2018, the objective was reached, with 3.5 billion euros of gross savings over the period (953 million euros in 2015, 758 million euros in 2016, 934 million euros in 2017 and 893 million euros in 2018), thus surpassing the original goal by 18%. In 2018, this amount related to both operating expenses included in the adjusted EBITDA calculation, of 681 million euros, and in CAPEX, of 211 million euros.

Over the 2019-2020 period, Orange will continue its efforts on costs using as the main drivers digitization, simplification and sharing to achieve additional gross savings of one billion euros over the period 2019-2020. On investments, Orange will rely on Lean CAPEX, a program with the goal of gradually reducing unit costs by 15%, resulting in one billion euros in gross savings in 2020 (which will be partially reinvested in line with the Group’s objectives).

1.4. Operating activities

Orange provides consumers, businesses and other telecommunications operators with a wide range of services including fixed telephony and mobile telecommunications, data transmission and other value-added services, including mobile financial services. The Group operates in 27 countries (including two in which it holds a minority interest). The Group’s business is presented in this section under the following segments: France, Spain, Europe, Africa & Middle East, Enterprise, International Carriers & Shared Services, Orange Bank (see Section 3.3.1 Note 1 Segment information).

The results of Orange’s activities in 2018 and its principal operating indicators in its various business segments are detailed in Section 3.1 Analysis of the Group’s financial position and earnings.

Unless otherwise indicated, the market shares indicated in this chapter correspond to market shares in terms of volume, and the data related to customers does not include SIM cards dedicated to connected objects (Machine to Machine).

1.4.1. France

Orange is France’s incumbent telecommunications operator (see Section 1.1 Overview). The bulk of its business is carried by Orange SA, which is also the parent company of the Orange group.

The France operating segment includes all fixed and mobile communication services to consumers and companies with less than 50 employees (5) in France (6), as well as services for carriers. Activities developed for companies with more than 50 employees, as well as content activities and those of Orange Bank are covered respectively in Sections 1.4.5, 1.4.6.2 and 1.4.7 of this document.

In 2018, the France operating segment generated 42.6% of the Group’s consolidated revenue.

The market

At September 30, 2018, the revenue of French telecommunications operators declined by 1.1% on a sliding 12-month basis (source: Arcep, 3rd quarter 2018). While fixed narrowband telephony revenue continued its downward trend as a result of the steady decline in the number of lines, fixed broadband revenue continued its growth due to the increasing number of accesses. Despite intense competition, mobile services revenue rose driven by a sustained growth in access numbers.

The French broadband and very high-speed broadband Internet market is dominated by four main operators that account for over 99% of broadband customers. With a 40.3% market share, down 0.1 point compared with end-2017, Orange is the market leader on this market ahead of Free, Altice-SFR and Bouygues Telecom (nos. 2, 3 and 4, respectively, in number of customers). (7)

The French mobile market is dominated by the same four operators as the fixed market, which account for 89% of mobile customers (excluding M2M). With a market share of 32.5% in 2018 compared with 32.9% in 2017, Orange also remains the leader in this market ahead of its competitors Altice-SFR, Free Mobile and Bouygues Telecom (respectively nos. 2, 3 and 4 in number of mobile customers excluding M2M) and all of the MVNOs. (7)

Orange’s business activities

Orange France’s core business involves the provision of fixed-line, broadband and very high-speed broadband Internet and mobile telephony services for the Retail and Pro-SME markets. This strategy is underpinned by convergence, very high-speed fixed and mobile broadband and the Group’s "unmatched" customer experience (see Section 1.2.2 The Orange group strategy).

In the Retail mobile market, Orange has segmented its offers into four main categories: 2h 100 MB or 2h 5 GB for customers looking for basic communication and Internet connectivity; 10 GB which offers a combination of enhanced Internet connectivity and increased communication possibilities; 50 GB adapted to meet the needs of heavier Internet users; and 100 GB and 150 GB for customers wanting the best smartphones and who have extremely intense connectivity needs both in France and abroad.

Orange is present in all market segments, including the entry-level market, with four types of mobile contract marketed under the Sosh brand at affordable prices that are available only on the Internet, with no commitment and no handset. At the end of December 2018, Sosh had 3.8 million mobile clients.

Since 2015, Orange has only marketed 4G offers, including entry-level packages.

Orange pressed ahead with its family-based strategy through its flagship Open offer with the development of multi-line contracts. Open mobile offers are available in the same ranges as traditional mobile offers and include the same levels of service.

The strategy of segmenting offers on the Retail and Pro-SME markets allows Orange to continue to grow its subscriber base while the decline in prepaid offers continues.

At the same time, the MVNO customer base hosted on Orange’s network has remained stable on a sliding 12-month basis.

In the Retail broadband Internet market, Orange has segmented its offers into two main categories: Livebox designed for customers looking for basic Internet and TV services, and Livebox Up which meets the needs of customers who want the highest speeds and a premium TV experience. Regarding equipment, in October 2018 Orange launched a new HDTV decoder.

Sosh has also been present on the broadband Internet market since the end of August 2018, with affordable offers, available exclusively online and without commitment.

Orange’s and Sosh’s broadband Internet access offers are marketed with FTTH technology in eligible areas, or alternatively, with ADSL. Orange is the leader in terms of FTTH access sold, with a portfolio of nearly 2.6 million subscribers at the end of 2018.

Since the telecommunications market was opened to competition, Orange has been the operator responsible for part of the universal provision of services. These include a minimal set of basic services available to all citizens who request them, including connection to a fixed network open to the public, and the provision of quality telephone service at an affordable rate. See section 1.7.1.2.3 Regulation of fixed-line telephony, broadband and very high-speed broadband Internet.

Furthermore, Orange offers services to carriers, an activity which includes the interconnection of competing operators, as well as unbundling and wholesale services (ADSL and fiber optic), regulated by Arcep, and construction and marketing services for very high-speed fiber optic networks. Unbundling services saw a decrease in their price regulated by Arcep on January 1, 2018.

With the steady growth in full unbundling, as well as the wholesale of ADSL contracts and naked ADSL access to third-party Internet service providers, the decline in revenue generated by the traditional telephony service business continues.

Orange is also pursuing advertising activities via its websites, which are available in multi-screen web, mobile and tablet format with more than 27 million unique visitors per month. The most frequently visited French website on a daily basis, Orange.fr ranks 6th behind Google, Facebook, YouTube, Amazon and Wikipedia, with 8.8 million unique visitors per day. On mobile screens, Orange attracts 16.8 million mobile users as well as 4.1 million tablet users each month (source: Médiamétrie and Médiamétrie//NetRatings - Audience Internet Global - November 2018).

Against a backdrop of fierce competition and market restructuring, Orange has also continued to innovate, notably with the continuous development of mobile financial services (see Section 1.4.7 Orange Bank).

Distribution

Orange is pressing ahead with its digital development strategy with a 100% digital customer experience in Orange online stores (available on Orange.fr) and Sosh (via Sosh.fr), with Sosh offers available only on the digital channel. In 2018, the latter accounted for 26.4% of sales actions, up 5.5 points year-on-year. Digital technologies can address the growing needs of customers for autonomy and immediacy. Orange’s contract management app My Orange, attracted 5.0 million unique visitors in December 2018.

The dedicated customer centers, based on the type of services marketed, accounted for 19.2% of sales actions, a decline of 1.4 point year-on-year. The development of the digital channel is thus continuing to relieve the pressure on call centers and reduces the use of outsourcing.

The network of retail stores spread across France continues to roll out the Smart Store concept launched in 2015. At end-2018, this network, which consisted of 394 stores owned by Orange (including 16 Megastores and 180 Smart Stores), and 201 Générale de Téléphone Stores (including 78 Smart Stores), accounted for 50.4% of sales actions, down 2.7 points year-on-year.

Lastly, the other channels, which include direct marketing, door-to-door and the multi-operator network, accounted for 4% of sales actions, a decline of 1.3 point year-on-year.

The Network

Orange’s commercial leadership is partly based on its leadership in fixed and mobile networks.

In the fixed network, Orange continued to step up its very high-speed broadband program in 2018 with the installation of 2.7 million FTTH connections in one year (compared with 2.2 million in 2017), setting a new record in France. 69% of fiber optic installations were deployed by Orange in 2018 (source: Arcep, 3rd quarter 2018). At end-2018, Orange had 11.8 million FTTH-connections.

Actions to improve the fixed network speed with a view to significantly improving the Internet experience of households and professional customers in rural areas continued, with fiber deployment in town centers (subscriber connection node opticalization, fiber to sub-distribution frames), and participation in FTTH Public Initiative Networks (PIN) of local and regional authorities. Orange has enjoyed considerable success regarding its expertise in PIN deployment. Six new agreements relating to the operation of the fiber optic networks of local authorities (Bourgogne - Franche-Comté, Gironde, Vienne - Deux-Sèvres, Orne and Var, as well as a submarine cable in Guadeloupe) were signed in 2018.

As regards the mobile network, 2018 saw the continued deployment of 4G reaching a coverage rate of 98.6% of the French population (up 2,7 points compared with end-2017), which is still the best 4G coverage rate in France (8). At the end of 2018, Orange had deployed 19,053 4G sites in France (9) (source: ANFr, January 1, 2019).

This deployment involves the continued extension of coverage in tourist areas, stadiums, trains (LGV and TER), subways and the motorway network.

For the eighth consecutive year, the Orange mobile network was ranked no. 1 by Arcep in 2018 (source: Arcep, October 2018).

As regards the cluster, transmission, and transport network, Orange carried on with (i) the simplification of fixed-line broadband access engineering (vDSL and FTTH) to accommodate the high growth in traffic, and (ii) works aimed at the transition from traditional telephony services to IP telephony.

1.4.2. Spain

The Group has been present in Spain since the liberalization of the Telecom market in 1998. Initially present in the fixed-line telephony market, it acquired the mobile telephony operator Amena in 2005, and then adopted the Orange brand in 2006. The acquisition of the Jazztel fixed-line operator in 2015 enabled Orange to consolidate its position in terms of convergence thanks to Jazztel’s fiber coverage. The Group has also strengthened its presence in the low-cost market with the acquisitions of MVNO Simyo in 2012 and República Móvil in 2018, thereby consolidating its multi-brand strategy designed to cover all segments of the market.

In 2018, Orange generated 12.8% of its consolidated revenue in Spain, making it the second most important market for the Group.

The market

Since the beginning of market consolidation in 2014, four operators have dominated the telecoms market: Telefónica, the incumbent operator, which operates under the Movistar brand and which acquired D+ in 2014; Orange; Vodafone which acquired ONO in 2014; and MásMóvil Ibercom, initially an MVNO, which acquired Yoigo in 2016 and then signed a commercial agreement to access Orange’s fixed and mobile networks.

Together, the four convergent operators control more than 90% of the market, with Telefónica ranked first, followed by Orange, whose market share in 2018 reached 26.7% on broadband Internet and 25.8% on mobile, then Vodafone (8).

In addition to competing on the B2B and B2C segments through their main brands, these four operators also compete via other brands in the low-cost market: Orange with Jazztel, Amena, Simyo and República Móvil; Telefónica with Tuenti and O2; Vodafone with Lowi; and MásMóvil with Pepephone.

Orange’s activities in Spain

Orange is pursuing a multi-brand commercial strategy in Spain comprising a focus on convergent offers, the deployment of next-generation networks and prioritizing innovation in its services and business lines (X by Orange, wholesale, etc.). Its operating strategy combines the potential of its 4G and FTTH networks. In 2018, this strategy continued to be supported by the increased number of TV customers and the growing trend for convergence in the customer base.

In the mobile market, Orange has developed a wide range of 4G offers, both for convergent customers and for mobile-only customers. Orange’s strategy focuses on providing value-for-money, very high-quality services, including for low-cost offers, to meet the needs of all customer segments. In 2018, Orange improved its offerings to meet the growing demands of its customers for data and services.

Orange also offers quality, high definition and multi-device TV contents. In 2018, Orange significantly developed its TV platform, both at the technical level and in terms of content, by enhancing its offer through broadcasting soccer matches and other premium content, which allowed it to reach a TV penetration rate of more than 17% (10). Since August 2018, Orange has, with Movistar, been the only operator to offer its customers the entire soccer content available in Spain.

Orange is also a key player in the low-cost market with mobile-only and convergent offers available online under the brands Amena, Simyo and República Móvil.

On the fixed broadband market, Orange continued to be the leader in FTTH customer base growth.

On the B2B market, Orange launched X by Orange in 2018 to enable small offices and home offices (Sohos) and Small and Medium Enterprises (SMEs) to have access to high-end digital services. As a digital partner for large companies, Orange has developed cutting-edge technologies such as Big Data, the Internet of Things and cyber security services, enabling its key account clients to improve their operational efficiency and competitive position.

With the objective of differentiating itself from other operators, Orange launched several innovative solutions in 2018 such as Smart WiFi, which ensures an optimal wireless signal at home for its customers, and WiFi with me, which allows customers to access the Internet wherever they are. Orange was also the only operator in Spain to offer Google Home Assistant and was granted exclusivity for the launch of the Pixel 3 smartphone.

Orange has also innovated in the equipment market, offering the best smartphones, tablets, video game consoles and Smart TVs in a bundle with offers tailored to meet the needs of each customer.

The Network

Orange continued to deploy its FTTH network, with 1.9 million new connectable households in 2018. In 2018, Orange was able to offer very high-speed broadband connections to 13.8 million households through its own fiber optic network and thanks to the network sharing agreement signed with Vodafone and MásMóvil.

Orange is also pursuing the roll out of its 4G network which, in 2018, covered 96.9% of the population (10). Regarding 5G, Orange has launched a national testing program to develop real 5G usage scenarios and demonstrate the benefits of this technology to improve the customer experience.

1.4.3. Europe

Outside France and Spain, the Group is present in six countries in Europe, where it is implementing its convergence strategy through the deployment of very high-speed fixed and mobile broadband, and the launch of new offers. In 2018, Orange launched its Love convergence offers in all European countries. In each country, Orange develops its convergence strategy taking into account the local context and leveraging the strengths of its subsidiaries:

-in Poland where the Group is the incumbent operator, leader in fixed and number two in mobile;

-in Belgium and Luxembourg, where the Group launched its convergence offers via partnerships;

-and in other countries in Central Europe (Romania, Slovakia and Moldova) where the Group, leader in mobile, is a convergent player via the deployment of fiber optic, the use of 4G for the development of fixed via LTE, and its partnerships.

1.4.3.1. Poland

The Group has been present in Poland since 2000, the year it acquired an interest in the incumbent operator, Telekomunikacja Polska (renamed Orange Polska). In 2006, Orange became the single brand for mobile activities in accordance with the Group’s brand policy. In 2012, it also became the single brand for all fixed-line telephony services offered by the Group in Poland. Orange owns 50.67% of the shares of Orange Polska, which is listed on the Warsaw Stock Exchange. In 2018, the Group generated 6.2% of its consolidated revenue in Poland.

Poland has four main mobile telephony operators: Orange, T-Mobile (owned by Deutsche Telekom), Polkomtel (operating under the Plus brand, owned by the Cyfrowy Polsat Pay-TV by satellite group) and P4 (operating under the Play brand, controlled by Tollerton Investments Ltd and Novator Telecom Poland SARL). At the end of 2018, these four mobile telephony operators accounted for 98% of the total number of SIM cards in Poland, with Orange ranking second after Play with a market share of 27.9% at end-December 2018 (10).

In the broadband Internet market, Orange is the leading operator with a market share of 28.4% in the third quarter of 2018 (10). Its principal competitors are cable TV operators (mainly UPC Polska, Vectra and Multimedia Polska), as well as Netia, a traditional telecommunications operator. The telecommunications market is undergoing consolidation with Netia being acquired by the Cyfrowy Polsat group, followed by Vectra’s announcement in August 2018 of its acquisition of Multimedia Polska. While these developments underscore the validity of Orange’s convergent strategy in Poland, they are likely to boost competition.

Orange’s activities in Poland