QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

|

|

Soliciting Material Under Rule 14a-12 |

MAC-GRAY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

MAC-GRAY CORPORATION

22 WATER STREET

CAMBRIDGE, MASSACHUSETTS 02141

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Mac-Gray Corporation (the "Company") to be held on Thursday, May 20, 2004 at 10:00 a.m., local time, at the Goodwin Procter LLP Conference Center, Second Floor, Exchange Place, Boston, Massachusetts 02109 (the "Annual Meeting").

The Annual Meeting has been called for the purpose of (i) electing two Directors to hold office until the annual meeting of stockholders to be held in 2007, and (ii) considering and acting upon such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

After the formal portion of the Annual Meeting, there will be an informal session for the purpose of presenting a brief report on the Company and responding to your questions.

The Board of Directors has fixed the close of business on March 31, 2004 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors of the Company recommends that you vote "FOR" the election of the two nominees as Directors of the Company.

MAC-GRAY CORPORATION

22 WATER STREET

CAMBRIDGE, MASSACHUSETTS 02141

(617) 492-4040

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, MAY 20, 2004

NOTICE IS HEREBY GIVEN that the 2004 Annual Meeting of Stockholders of Mac-Gray Corporation, a Delaware Corporation (the "Company"), will be held on Thursday, May 20, 2004 at 10:00 a.m., local time, at the Goodwin Procter LLP Conference Center, Second Floor, Exchange Place, Boston, Massachusetts 02109 (together with adjournments or postponements thereof, the "Annual Meeting") for the purpose of considering and voting upon:

- 1.

- The election of two Directors, each to hold office until the Company's annual meeting of stockholders to be held in 2007 and until such director's successor is duly elected and qualified; and

- 2.

- Such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on March 31, 2004 as the record date for determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. Only holders of common stock of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof.

In the event there are not sufficient votes with respect to the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

| | | By Order of the Board of Directors |

|

|

MICHAEL J. SHEA

Secretary |

Cambridge, Massachusetts

April 8, 2004 |

|

|

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE REQUESTED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY CARD.

ATTENDANCE AT THE ANNUAL MEETING WILL BE LIMITED TO STOCKHOLDERS AS OF THE RECORD DATE, THEIR AUTHORIZED REPRESENTATIVES AND GUESTS OF THE COMPANY. ADMISSION WILL BE BY PRESENTATION OF YOUR TICKET OR BROKERAGE STATEMENT AND PROPER IDENTIFICATION. IF YOU ARE A REGISTERED STOCKHOLDER (YOUR SHARES ARE HELD IN YOUR NAME) AND PLAN TO ATTEND THE MEETING, PLEASE VOTE YOUR PROXY, DETACH YOUR TICKET FROM THE TOP PORTION OF THE PROXY CARD AND BRING THAT TICKET AND A FORM OF PERSONAL IDENTIFICATION WITH YOU TO THE MEETING. IF YOU ARE A BENEFICIAL OWNER (YOUR SHARES ARE HELD IN THE NAME OF A BANK, BROKER OR OTHER HOLDER OF RECORD), AND PLAN TO ATTEND THE MEETING, YOU SHOULD BRING A RECENT BROKERAGE STATEMENT SHOWING YOUR OWNERSHIP OF SHARES AND A FORM OF PERSONAL IDENTIFICATION.

MAC-GRAY CORPORATION

22 WATER STREET

CAMBRIDGE, MASSACHUSETTS 02141

(617) 492-4040

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Thursday, May 20, 2004

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Mac-Gray Corporation, a Delaware corporation (the "Company" or "Mac-Gray"), for use at the Annual Meeting of Stockholders of the Company to be held on Thursday, May 20, 2004 at 10:00 a.m., local time, at the Goodwin Procter LLP, Conference Center, Second Floor, Exchange Place, Boston, Massachusetts 02109 (together with any adjournments or postponements thereof, the "Annual Meeting").

The Notice of the Annual Meeting, Proxy Statement and Proxy Card are first being mailed on or about April 8, 2004 to stockholders of record as of March 31, 2004. The Board of Directors has fixed the close of business on March 31, 2004 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting (the "Record Date"). Only holders of record of common stock, par value $.01 per share, of the Company ("Common Stock") at the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 12,637,421 shares of Common Stock outstanding and entitled to vote at the Annual Meeting and 966 stockholders of record. Each holder of Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held of record for each matter properly submitted at the Annual Meeting.

If your shares are held in "street name," your brokerage firm, under certain circumstances, may vote your shares for you if you do not return your proxy. Brokerage firms have authority under the rules of the New York Stock Exchange, or NYSE, to vote customers' unvoted shares on some routine matters, including the election of directors. If you do not give a proxy to your brokerage firm to vote your shares, your brokerage firm may either vote your shares on the election of directors or leave your shares unvoted. Shares held by brokers as to which voting instructions have not been received from the beneficial owners with respect to non-routine matters are referred to as "broker non-votes." We encourage you to provide voting instructions to your brokerage firm by returning your completed proxy. This ensures your shares will be voted at the meeting according to your instructions. You should receive directions from your brokerage firm about how to submit your proxy to them at the time you receive this proxy statement.

The presence, in person or by proxy, of a majority of the outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. A quorum being present, the affirmative vote of a plurality of the votes cast is necessary to elect a nominee as a Director of the Company. Shares that reflect abstentions or "broker non-votes" will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting. With respect to the election of Directors, votes may only be cast for or withheld from each nominee. Abstentions, broker non-votes or votes that are otherwise withheld will be excluded entirely from the votes and will have no effect on the election of Directors.

Stockholders of the Company are requested to complete, date, sign and return the accompanying Proxy Card in the enclosed envelope. Shares of Common Stock represented by properly executed proxies received by the Company and not revoked will be voted at the Annual Meeting in accordance with the instructions contained therein. If instructions are not given therein, properly executed proxies will be voted "FOR" the election of the two nominees for Director listed in this Proxy Statement. It is not anticipated that any other matters will be presented at the Annual Meeting. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders.

Attendance at the annual meeting will be limited to stockholders as of the record date, their authorized representatives and guests of the Company. Admission will be by presentation of your ticket or brokerage statement and proper identification. If you are a registered stockholder (your shares are held in your name) and plan to attend the meeting, please vote your proxy, detach your ticket from the top portion of the proxy card and bring that ticket and a form of personal identification with you to the meeting. If you are a beneficial owner (your shares are held in the name of a bank, broker or other holder of record), and plan to attend the meeting, you should bring a recent brokerage statement showing your ownership of shares and a form of personal identification.

Any properly completed proxy may be revoked at any time before it is voted on any matter (without, however, affecting any vote taken prior to such revocation) by giving written notice of such revocation to the Secretary of the Company, or by signing and duly delivering a proxy bearing a later date, or by attending the Annual Meeting and voting in person.

The Annual Report of the Company for the fiscal year ended December 31, 2003 (the "Annual Report") is being mailed to stockholders of the Company concurrently with this Proxy Statement. The Annual Report, however, is not a part of the proxy solicitation material.

PROPOSAL NUMBER 1

ELECTION OF DIRECTORS

Nominees

The Board of Directors of the Company consists of eight members and is divided into three classes, with four Directors in Class I, two Directors in Class II and two Directors in Class III currently. Directors serve for three-year terms with one class of Directors being elected by the Company's stockholders at each annual meeting of stockholders. Two new directors were recently elected by the Board as stated below and will stand for election by the shareholders as Class I Directors.

Two Class I directors, Wm. M. Crozier, Jr. and John P. Leydon, who are ineligible to stand for re-election due to the Board's age limit policy with respect to nominees, will not be standing for re-election at the Annual Meeting. At the Annual Meeting, two new Class I Directors will be elected to serve until the 2007 annual meeting of stockholders and until their respective successors are duly elected and qualified. The Board of Directors appointed Edward F. McCauley to the Board on March 10, 2004 and has nominated Mr. McCauley for election as a Class I Director. The Board of Directors appointed David W. Bryan to the Board on March 25, 2004 and has nominated Mr. Bryan for election as a Class I Director. Unless otherwise specified in the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election as Directors of the nominees. Mr. McCauley and Mr. Bryan have agreed to stand for election and to serve if elected as a Director. However, if either nominee fails to stand for re-election or is unable to serve, then proxies may be voted in favor of the election of such other nominee as the Board of Directors may recommend or the Board of Directors may reduce the number of Directors.

The Board of Directors of the Company recommends that the Company's stockholders vote "FOR" the election of the two nominees of the Board of Directors as Directors of the Company.

2

INFORMATION REGARDING DIRECTORS/NOMINEES

Set forth below is certain information regarding the Directors of the Company, including the Class I Directors who have been nominated for election at the Annual Meeting, based on information furnished by them to the Company.

Name

| | Age

| | Director Since

|

|---|

| Class I (Term expires 2004) | | | | |

| Edward F. McCauley* | | 64 | | 2004 |

| David W. Bryan* | | 58 | | 2004 |

| John P. Leydon + | | 71 | | 1997 |

| William M. Crozier, Jr. + | | 71 | | 1999 |

Class II (Term expires 2005) |

|

|

|

|

| Jerry A. Schiller | | 71 | | 1997 |

| Thomas E. Bullock | | 57 | | 2000 |

Class III (Term expires 2006) |

|

|

|

|

| Stewart G. MacDonald, Jr. | | 54 | | 1983 |

| Larry L. Mihalchik | | 57 | | 2002 |

- *

- Nominee for election

- +

- Retiring as of May 20, 2004

Stewart G. MacDonald, Jr. serves as Chairman of the Board and Chief Executive Officer and has served as a Director of the Company since 1983. Mr. MacDonald has served the Company as Chairman of the Board since 1992, and as Chief Executive Officer since 1996. Mr. MacDonald is the fourth member of the Company's founding families to lead the organization. He received his B.A. from the University of Wisconsin.

John P. Leydon has been a Director of the Company since April 1997. Mr. Leydon was a vice president and the Chief Financial Officer of Pacific Packaging Products, Inc. from December 1996 to December 2001, has served as a consultant since 2001, and was elected Director in 2003. From 1983 to 1996, Mr. Leydon was a partner at Leydon & Gallagher, a certified public accounting firm. Mr. Leydon is a Certified Public Accountant and received his B.S. in Business Administration from Boston College, his M.B.A. from Babson College and his M.S. in Taxation from Bentley College.

Jerry A. Schiller has been a Director of the Company since April 1997. Mr. Schiller has been a private investor and consultant since 1993. In October 1993, Mr. Schiller retired after 31 years of service with The Maytag Corporation. From 1985 until his retirement, Mr. Schiller served as the Executive Vice President and Chief Financial Officer, as well as a member of the board of directors of The Maytag Corporation. Mr. Schiller received his B.S. in Business Administration and Accounting from Augustana College and later obtained his CPA certification.

William M. Crozier, Jr. has been a Director of the Company since April 1999. From 1996 until 1997, Mr. Crozier was Chairman of the Board of BankBoston Corporation. From 1974 until 1996, Mr. Crozier was Chairman of the Board and Chief Executive Officer of BayBanks, Inc. Mr. Crozier received his B.A. in Economics from Yale University and his M.B.A. from Harvard Business School.

Thomas E. Bullock has been a Director of the Company since November 2000. From 1997 to 2000, Mr. Bullock was President and Chief Executive Officer of Ocean Spray Cranberries, Inc. From 1994 to 1997, Mr. Bullock was Executive Vice President and Chief Operating Officer of Ocean Spray. Mr. Bullock holds a B.S. from St. Joseph's College in Philadelphia, PA.

3

Larry L. Mihalchik has been a Director of the Company since August 2002. Mr. Mihalchik, currently a business consultant, had been Chief Executive Officer, President and a director of Clare, Inc., a provider of electronic components, from February 2001 until its acquisition by IXYS, Incorporated in June 2002. From 1999 until joining Clare, Inc., Mr. Mihalchik was Chief Executive Officer and a director of ICOMS Inc., an e-commerce provider. From 1996-1999, Mr. Mihalchik was Chief Executive Officer of Atex Media Solutions, a software development and integration company. Previously, Mr. Mihalchik served as Senior Vice President and Chief Financial Officer of MA/COM and Executive Vice President, Chief Financial Officer, and a director of The Timberland Company. Mr. Mihalchik received his B.S. in Business Administration from Westminster College, PA and later obtained his CPA certification.

Edward F. McCauley has been a Director of the Company since March 2004. Mr. McCauley is retired. Over a thirty-six year career at Deloitte & Touche, Mr. McCauley served as Lead Audit Partner or Advisory Partner for a wide variety ofFortune 500 companies, non-profit and regulated enterprises. He retired from Deloitte & Touche in 2001. His experience also includes involvement with acquisitions, mergers, and public offerings. Mr. McCauley holds a B.S. in Accounting from St. Joseph's University and is a CPA. He also serves as a Board member and Chairman of the Audit Committee of Harvard Pilgrim Healthcare, Inc.

David W. Bryan has been a Director of the Company since March 2004. Mr. Bryan is currently a consultant and was the CEO of Capzised, Inc., an Internet specialty retailer, from 1999-2001. Prior to that, he was CEO of Avedis Zildjian Company from 1995-1999. Mr. Bryan held senior managerial positions over eleven years at Sara Lee Corporation (1983-1994), including serving as President and CEO of the Aris Isotoner Division from 1993-1994. Mr. Bryan earned a B.A. in Economics from Colby College and an M.B.A. from Columbia University.

DIRECTOR COMPENSATION

Directors who are also employees of the Company do not receive compensation for their services on the Board of Directors or any committee thereof. Each Director who is not an employee of the Company receives (i) an annual fee of $12,000, paid in quarterly installments, 50% of which is paid in shares of Common Stock and the balance of which, at the discretion of the Director, is paid in cash, shares of the Company's Common Stock or any combination thereof; and (ii) an additional fee of $500 per Board of Directors and committee meeting attended in person and $250 per meeting attended by teleconference, except for Audit Committee members who receive $750 per meeting attended in person. In addition, the chairmen of each of the Governance/Nominating and Compensation committees are paid $1,000 per year for serving as chairmen of their respective committees. The Chairman of the Audit Committee is paid $2,000 per year. Under the Company's 1997 Stock Option and Incentive Plan, each newly elected non-employee Director receives an option to purchase 1,000 shares of Common Stock on the fifth business day after his or her election to the Board of Directors, and each non-employee Director who is serving as a Director on the fifth business day after each annual meeting of stockholders automatically receives an option to purchase 1,000 shares of Common Stock. All of such options granted to non-employee Directors are fully exercisable upon grant at an exercise price equal to the fair market value of the Company's Common Stock on the date of the grant and terminate upon the tenth anniversary of the date of grant. All Directors are reimbursed for significant travel expenses, if any, incurred in attending meetings of the Board of Directors and its committees.

4

CORPORATE GOVERNANCE

Board of Directors

The Company's Board of Directors, or the Board, currently has eight directors. NYSE rules require that a majority of the Board consist of members who are independent. The Board has affirmatively determined that each of Messrs. Bullock, Crozier, Leydon, McCauley, Mihalchik, Schiller, and Bryan is independent under applicable NYSE rules.

During the fiscal year ended December 31, 2003 ("Fiscal 2003"), the Board held five (5) meetings. During the periods that he served, each director attended at least 75% of each of: (1) the number of Board meetings held and (2) the number of meetings of all committees on which he served.

Directors are encouraged to attend the Company's annual meetings of stockholders. All six directors attended the 2003 Annual Meeting of Stockholders.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics applicable to all officers, employees and Board members. The Code of Business Conduct and Ethics is posted on Mac-Gray's website,www.macgray.com. The Code of Business Conduct and Ethics is located under the "Corporate Governance" caption of the "Investor Relations" tab. Any amendments to, or waivers of, the Code of Business Conduct and Ethics which applies to the Company's Chief Executive Officer, Chief Financial Officer, Corporate Controller or any person performing similar functions will be disclosed on the website promptly following the date of such amendment or waiver.

Communications with the Board

The Board welcomes the submission of any comments or concerns from stockholders and any interested parties. Communications should be addressed to Michael J. Shea, Secretary, Mac-Gray Corporation, 22 Water Street, Cambridge, MA 02141 and marked to the attention of the Board or any of its committees or individual directors.

Committees of the Board

The Board currently has three standing committees: an Audit Committee, a Compensation Committee and a Governance and Nominating Committee. Each committee is comprised solely of directors determined by the Board to be independent under the applicable NYSE and SEC rules. You may find copies of the charters of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee in the "Investor Relations" section of our website atwww.macgray.com.

Audit Committee. The Audit Committee, which consists of Jerry A. Schiller (Chairman), John P. Leydon, and Larry L. Mihalchik, held seven (7) meetings during 2003. The Board has made a determination that each of the members of the Audit Committee satisfies the independence and experience requirements of both the NYSE and SEC. In addition, the Board has determined that each of Messrs. Leydon, Mihalchik, and Schiller is an "audit committee financial expert," as defined by SEC rules. The Audit Committee assists the Board in its oversight of the integrity of the Company's financial statements, the Company's compliance with legal and regulatory requirements, the qualifications, independence and performance of the Company's independent auditors and the performance of the Company's internal control function. This includes the selection and evaluation of the independent auditors, the oversight of the Company's systems of internal accounting and financial controls, the review of the annual independent audit of the Company's financial statements, the establishment of "whistle-blowing" procedures, and the oversight of other compliance matters.

5

Compensation Committee. The Compensation Committee held four (4) meetings during 2003. The Compensation Committee consists of John P. Leydon (Chairman), Thomas E. Bullock, and Wm. M. Crozier, Jr. The Compensation Committee assists the Board in establishing compensation policies for the Board and the Company's executive officers, including reviewing and making recommendations to the Board, or in the case of the Chief Executive Officer, to the independent members of the Board, regarding executive officer compensation. The Committee also determines the number of options to be granted or shares of Common Stock to be issued to eligible persons under the Company's 1997 Stock Option and Incentive Plan (the "1997 Stock Option Plan"), prescribes the terms and provisions of each grant made under the 1997 Stock Option Plan, and administers and interprets the 1997 Stock Option Plan.

Governance and Nominating Committee. The Governance and Nominating Committee held four (4) meetings during 2003. Members of the committee are: Thomas E. Bullock (Chairman) and Larry L. Mihalchik. The Corporate Governance and Nominating Committee is responsible for identifying individuals qualified to become Board members, recommending to the Board the director nominees for election at the annual meeting of stockholders, developing and recommending to the Board a set of corporate governance guidelines, and playing a general leadership role in Mac-Gray's corporate governance.

The Governance and Nominating Committee will consider for nomination to the Board candidates recommended by stockholders. Recommendations should be sent to the Governance and Nominating Committee, c/o Michael J. Shea, Secretary, Mac-Gray Corporation, 22 Water Street, Cambridge, MA 02141. In order to be considered for inclusion as a nominee for director at the Company's 2005 Annual Meeting of Stockholders, a recommendation must be received no later than March 8, 2005. Recommendations must be in writing and must contain the information set forth in Article II, Section 3 of the Company's Bylaws. The minimum qualifications and specific qualities and skills required for directors are set forth in the Governance and Nominating Committee charter, which is available in the investor relations section of the Company's website atwww.macgray.com. In addition to considering candidates suggested by stockholders, the Governance and Nominating Committee may consider potential candidates suggested by current directors, company officers, employees, search firms and others. The Governance and Nominating Committee screens all potential candidates in the same manner regardless of the source of the recommendation. The Governance and Nominating Committee determines whether the candidate meets the Company's qualifications and specific qualities and skills for directors, and determines whether requesting additional information or an initial screening interview is appropriate.

Report of the Audit Committee

The Company's Audit Committee is entirely comprised of independent directors and financial experts as defined by the NYSE and SEC, and acts under a revised charter approved by the Board on December 4, 2002. The members of the Audit Committee in Fiscal 2003 were Jerry A. Schiller (Chairman), John P. Leydon, and Larry L. Mihalchik. The Audit Committee met seven (7) times during Fiscal 2003.

As more fully described in its charter, the Audit Committee is appointed by the Board to assist the Board in the general oversight and monitoring of management's and the independent auditor's execution and supervision of the Company's financial reporting process, the Company's procedures for compliance with legal and regulatory requirements, and the performance of the Company's internal audit function. The primary objective of the Audit Committee in fulfilling these responsibilities is to promote and preserve the integrity of the Company's financial statements and the independence and performance of both the Company's internal audit function and external independent auditor. In this context, the Audit Committee retained the firm of Ernst & Young to supplement the internal audit function at the Company beginning in 2003.

6

It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles ("GAAP"). That is the responsibility of the Company's independent auditors and management. In giving recommendations to the Board of Directors, the Audit Committee has relied on (i) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with GAAP, and (ii) the report of the Company's independent auditors with respect to such financial statements.

In this context, the Audit Committee has reviewed, and discussed with management and PricewaterhouseCoopers LLP ("PWC"), the Company's audited financial statements for the year ended December 31, 2003. The Audit Committee has discussed with PWC the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received from PWC the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with PWC their independence from the Company and its management. Further, the Audit Committee has considered whether PWC's provision of non-audit services to the Company is compatible with maintaining their independence.

In reliance on the reviews and discussions referred to above, the Audit Committee has recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the SEC.

Submitted by the members of the Audit Committee:

Jerry A. Schiller, Chairman

John P. Leydon

Larry L. Mihalchik

The aggregate fees billed by PricewaterhouseCoopers LLP in 2003 and 2002 for professional services rendered for audit, audit-related, tax and non-audit services were:

Type of Fees

| | 2003

| | 2002

|

|---|

| Audit Fees | | $ | 187,200 | | $ | 174,500 |

| Audit-Related Fees | | | 3,000 | | $ | 10,000 |

| Tax Fees | | $ | 20,000 | | $ | 0 |

| All Other Fees | | | | | | |

| | |

| |

|

| Total | | $ | 210,200 | | $ | 184,500 |

In the above table, in accordance with the definitions and rules of the SEC, "audit fees" are fees the Company paid PWC for professional services for the audit of the Company's annual financial statements, review of financial statements included in the Company's quarterly reports on Form 10-Q, and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements; "audit-related fees" are fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company's financial statements; "tax fees" are fees for tax compliance, tax advice and tax planning; and "all other fees" are fees for any services not included in any of the foregoing categories. During 2003, "audit-related fees" consisted of fees for the review of the sale of lease receivables and, during 2002 "audit-related fees" consisted of fees for the review of SFAS 142 implementation.

7

INFORMATION REGARDING EXECUTIVE OFFICERS

The names and ages of all executive officers of the Company and the principal occupation and business experience during at least the last five years for each are set forth below.

Name

| | Age

| | Position

|

|---|

| Stewart G. MacDonald, Jr. | | 54 | | Chairman and Chief Executive Officer |

| Neil F. MacLellan, III | | 44 | | Executive Vice President and Chief Operating Officer |

| Michael J. Shea. | | 54 | | Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

The biography of Mr. MacDonald is set forth above under Information Regarding Directors/Nominees.

Neil F. MacLellan, III has been with the Company since 1985 and has served as Executive Vice President since December 1995 and as Chief Operating Officer since November 1998. From January 1991 through December 1995, Mr. MacLellan served as the Company's Director of Finance and Administration and from March 1985 through January 1991, Mr. MacLellan served as Controller of the Company. Mr. MacLellan received his B.S. in Accounting from Bentley College.

Michael J. Shea has served as Executive Vice President, Chief Financial Officer and Treasurer of the Company since November 1998. In April 1999, Mr. Shea was elected Secretary of the Company. From April 1998 to November 1998, Mr. Shea served as Senior Vice President and Chief Financial Officer of Professional Dental Associates, Inc. From March 1997 through April 1998, Mr. Shea served as Chief Financial Officer of Auto Palace, Inc., currently a division of Auto Zone. Mr. Shea is a Certified Public Accountant and received his B.A. from Stonehill College and his M.B.A. from Babson College.

Each of the executive officers holds his respective office until the regular annual meeting of the Board of Directors following the annual meeting of stockholders and until his successor is duly elected and qualified or until his earlier resignation or removal.

EXECUTIVE COMPENSATION

The following sections of this Proxy Statement set forth and discuss the compensation paid or awarded during the last three fiscal years to the Company's Chief Executive Officer and the other executive officers of the Company, each of whom is named in the tables below (the "Named Executive Officers").

8

Summary Compensation Table

The following table shows for each of the last three fiscal years compensation paid by the Company to the Chief Executive Officer and the Named Executive Officers.

| |

| | Annual Compensation

| | Long-Term

Compensation

Awards

| |

|

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)(1)

| | Securities

Underlying

Options(#)

| | All other

Compensation

($)(2)

|

|---|

Stewart G. MacDonald, Jr.

Chairman and Chief Executive Officer | | 2003

2002

2001 | | 314,596

300,000

300,000 | | 145,000

83,000

55,000 | | —

—

110,000 | | 8,641

7,235

3,000 |

Neil F. MacLellan, III

Executive Vice President and Chief Operating Officer | | 2003

2002

2001 | | 209,733

200,000

200,000 | | 77,500

45,650

30,000 | | —

33,000

67,000 | | 6,182

5,369

9,001 |

Michael J. Shea

Executive Vice President, Chief Financial Officer, Treasurer and Secretary | | 2003

2002

2001 | | 209,733

200,000

200,000 | | 77,500

41,500

25,000 | | —

33,000

42,000 | | 6,915

3,552

3,000 |

- (1)

- Executive officers are eligible for annual cash bonuses. Such bonuses are based upon achievement of corporate and individual performance objectives determined by the Compensation Committee of the Board of Directors. Cash bonuses for the year ended December 31, 2003, or Fiscal 2003, are paid to executives in 2004.

- (2)

- Includes contributions made on the executive's behalf to the Company's retirement plan and premiums paid by the Company for insurance.

Option Grants in Last Fiscal Year

No stock options were granted in Fiscal 2003 to the Chief Executive Officer or any of the Named Executive Officers.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information concerning the exercise of stock options by the Named Executive Officers during Fiscal 2003 and the value of unexercised options as of December 31, 2003.

| |

| |

| | Number of Securities Underlying

Unexercised Options

at December 31, 2003

| | Value of Unexercised

In-the-Money Options

at December 31, 2003

|

|---|

Name

| | Shares Acquired

on Exercise (#)(1)

| | Value

Realized

($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Stewart G. MacDonald, Jr. | | -0- | | -0- | | 140,000 | | 20,000 | | $ | 153,000 | | $ | 34,000 |

| Neil F. MacLellan, III | | -0- | | -0- | | 64,000 | | 36,000 | | $ | 113,311 | | $ | 70,220 |

| Michael J. Shea | | -0- | | -0- | | 39,000 | | 36,000 | | $ | 70,810 | | $ | 70,220 |

- (1)

- None of the named Executive Officers exercised any options during Fiscal 2003.

9

Employment Agreements with Executive Officers

Although the Company is not a party to employment agreements with any of its three executive officers, on February 14, 2002, the Company entered into severance agreements with its three executive officers. Under certain circumstances involving a change of control of the Company and termination of the executive's employment for reasons other than cause, Mr. MacDonald, Mr. MacLellan and Mr. Shea would be entitled to an amount equal to two and ninety-nine one hundredths (2.99) times, two (2) times and two (2) times, respectively, the sum of (i) the executive's average annual base salary over the three (3) fiscal years immediately prior to the terminating event (or the executive's annual base salary in effect immediately prior to the change in control, if higher) and (ii) the executive's average annual bonus over the three (3) fiscal years immediately prior to the change in control (or the executive's annual bonus for the last fiscal year immediately prior to the change in control, if higher), payable in one lump-sum payment. Additionally, the Company would continue to provide to the executive certain benefits, including health, dental and life insurance on the same terms and conditions as though the executive had remained an active employee, for twenty-four (24) months.

Report of the Compensation Committee of the Board of Directors on Executive Compensation

The Compensation Committee, comprised of John P. Leydon, Chairman, Thomas E. Bullock and William M. Crozier, Jr. reviews and recommends to the Board of Directors the compensation arrangements for all directors and executive officers. The Compensation Committee administers and takes such other actions as may be required in connection with certain compensation and incentive plans of the Company.

In addition, the Compensation Committee determines the number of options to be granted or shares of Common Stock to be issued to eligible persons under the 1997 Stock Option Plan and prescribes the terms and provisions of each grant made under the 1997 Stock Option Plan. The Compensation Committee interprets the 1997 Stock Option Plan and grants thereunder and establishes, amends and revokes rules and regulations for administration of the 1997 Stock Option Plan.

General

The compensation arrangements of the Company reflect the philosophy that the Company and its shareholders are best served by running the business with a long-term perspective, while striving to deliver consistently good annual results. Compensation arrangements are therefore designed to provide competitive financial rewards for successfully meeting the Company's larger strategic as well as annual operating objectives. The Company rewards the creation of sustainable long-term shareholder value. The Compensation Committee recognizes that there are not a significant number of comparable publicly traded companies in the Company's industry segments and, accordingly, the committee reviews compensation structures necessarily broader in scope than the Company's industry segments. When last reviewed, the compensation of the Company's executives was in line with similarly situated executives in reasonably similar, like-size companies.

Compensation Policies for Executive Officers

The compensation of the Company's Chief Executive Officer and other executive officers is comprised of annual salary and cash and/or stock incentives based on annual and long-term performance of the Company.

10

Base Salary. The Compensation Committee, in its discretion, determines the annual base salary and base salary adjustments for executive officers. Generally, salary adjustments for executive officers are determined by evaluating:

- •

- competitive pay practices

- •

- the performance of the Company

- •

- the performance of the executive officer including any change in the responsibilities assumed by the executive officer.

The Compensation Committee believes that the base salaries are reasonable when compared with other companies.

Cash Bonuses. The Company maintains a short-term incentive plan known as the Senior Executive Incentive Plan (the "Plan") for the named executive officers of the Company that provides for the payment of cash bonuses to the executives when the financial, strategic and individual objectives are achieved. The 2003 Plan focused on the achievement of a combination of key financial performance indicators, such as earnings before interest, tax, depreciation and amortization (EBITDA) by business segments and non-financial goals. By implementing a compensation structure composed of salary and a performance-related bonus, a significant portion of each executive officer's annual total cash compensation is placed at risk in order to provide an incentive toward sustained high performance.

The Named Executive Officers' incentive bonuses vary in proportion to base salary, depending primarily on the level of responsibilities when the financial, strategic, and personal objectives are achieved. When such objectives are exceeded, bonuses are higher and when objectives are not met, the incentive bonuses are lower or nil, depending on the circumstances. Each key financial performance indicator and objective that makes up an individual's bonus carries a predetermined percentage weighting which is set at the beginning of the financial year. The total bonus paid to an individual is the sum of the financial results that make up the individual's predetermined financial targets, plus or minus adjustment for individual performance. The Compensation Committee considered the compensation that the executive officers received in the form of stock options in determining the appropriate cash bonus for each executive officer.

Stock Options. Stock option grants are designed to attract and retain employees who can make significant contributions to the Company's success, reward employees for such significant contributions, and give employees a longer-term incentive to increase shareholder value. Because an optionee will benefit only if the Company's stock price increases over time, options are considered to be an effective means of linking executive pay with the creation of shareholder wealth.

The size and frequency of stock option grants are determined by the Compensation Committee in its discretion, taking into account the optionee's level of responsibility, the achievement of objectives, the implementation of key strategies, and/or the potential for positively influencing future results. The Compensation Committee may impose specific performance measures on stock option grants. The Compensation Committee also may grant stock options for executive recruitment and retention purposes, in amounts that the Compensation Committee, in its discretion, deems necessary and appropriate.

To ensure that high levels of performance occur over the long term, stock options granted to executives typically have a life of ten years, generally vest over a period of up to three years, and have an exercise price equal to 100% of the fair market value of the Common Stock on the grant date. Any value received by an executive officer from a stock option grant depends entirely on increases in the price of the Common Stock.

In addition to the executive officers, one hundred forty nine (149) other managers and employees of the Company had options outstanding as of December 31, 2003.

11

Other Compensation. The Company provides executive officers and management with health, retirement and other benefits under plans that are generally available to the Company's employees.

Compensation of the Chief Executive Officer. In setting the compensation package for Stewart G. MacDonald, Jr., Chief Executive Officer ("CEO"), the Compensation Committee uses the same factors it considers in establishing the compensation levels of other executive officers. Financial and individual award targets are established for the year in line with overall compensation philosophy. These include, but are not limited to, the Company's achievement of financial goals as well as leadership and other individual performance goals.

For Fiscal 2003 Stewart G. MacDonald's base salary was increased 5 percent (5%) to $315,000 and he was awarded a cash bonus of $145,000 pursuant to the Senior Executive Compensation Plan. The Compensation Committee reviewed the Company's financial results as well as the established goals for Fiscal 2003 and Mr. MacDonald's role in achieving those results. Mr. MacDonald led the Company through considerable progress over the past year in achieving strategic priorities including: managing the largest acquisition in the history of the Company; improving shareholder relations; achieving a higher price for the Company's stock; developing and deploying technologies that differentiate Mac-Gray from its competitors; and building a strong leadership team. At the same time, Mr. MacDonald has continued to emphasize the Company's values—integrity, quality and accountability.

The Compensation Committee exercised a degree of subjectivity and discretion in determining the level of each element of compensation, individually and in the aggregate, for the CEO for 2003. The Committee considers the CEO's level of compensation appropriate in view of his performance and leadership of the Company during 2003.

Submitted by the members of the Compensation Committee:

John P. Leydon, Chairman

Thomas E. Bullock

William M. Crozier, Jr.

Compensation Committee Interlocks and Insider Participation

None of the company's Compensation Committee is a current or former officer or employee of the Company.

Report of the Governance and Nominating Committee

The Company's Governance and Nominating Committee (the "Committee") is comprised of independent directors as defined by the NYSE and SEC, and acts under a charter approved by the Board on May 22, 2003, a copy of which is attached to this Proxy Statement asAppendix A. The members of the Corporate Governance and Nominating Committee in Fiscal 2003 were Thomas E. Bullock (Chairman) and Larry L. Mihalchik. The Corporate Governance and Nominating Committee met four (4) times during Fiscal 2003.

As more fully described in its charter, the Corporate Governance and Nominating Committee reviews and reports to the Board on matters of corporate governance, identifies individuals qualified to become board members, and recommends individuals to the Board for nomination, election, or appointment as members of the Board and its committees. Other duties and responsibilities of the Committee are to: review and make recommendations regarding the structure, size, composition, and operational procedures of the Board and its committees; review periodically the membership of each committee and make recommendations regarding assignments; evaluate the standards applied by the Board in determining Director independence; identify emerging governance trends and issues; develop

12

and recommend a set of Corporate Governance Guidelines to meet the requirements of regulatory bodies; review and monitor Board compliance in areas of governance and make appropriate recommendations; assure that the Company is communicating relevant governance matters to management, employees, and others; and report annually to the Board regarding the performance and effectiveness of the Board and its committees, including a self-evaluation of the Governance and Nominating Committee.

During 2003, the Committee identified and interviewed candidates for election to the Board of Directors. The result of these efforts was the election to the Board in March of two new Directors, Edward F. McCauley and David W. Bryan who are nominated for election by the shareholders for three-year terms. Each brings significant experience and expertise to the Board.

The Committee prepared and presented a set of Corporate Governance Principles to the Board at the December 11, 2003 meeting. The Board unanimously approved the document.

Submitted by the members of the Governance and Nominating Committee:

Thomas E. Bullock, Chairman

Larry L. Mihalchik

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

13

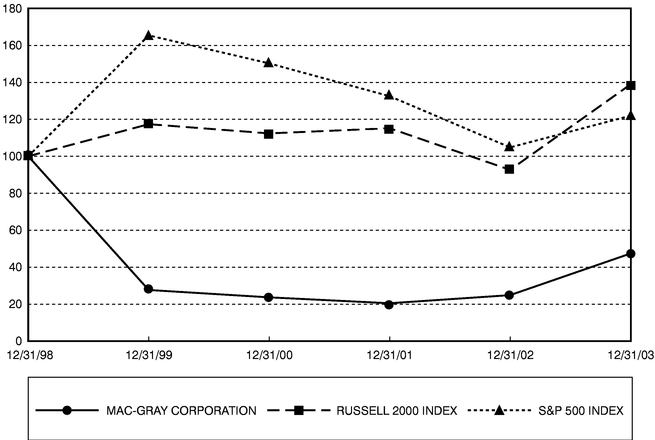

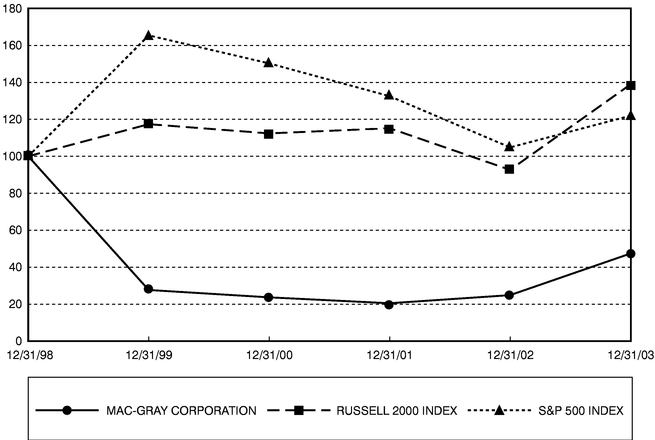

Stockholder Return Performance Graph

Set forth below is a line graph comparing the percentage change in the cumulative total stockholder return on the Company's Common Stock from December 31, 1999 through December 31, 2003, based on the market price of the Company's Common Stock and assuming reinvestment of dividends, with the total return of the S&P 500 Index and the Russell 2000 Index. The calculation of total cumulative return assumes a $100 investment in the Company's Common Stock, the S&P 500 Index and the Russell 2000 Index on December 31, 1999. The comparisons in this line graph are historical and are not intended to forecast or be indicative of possible future performance of the Common Stock of the Company.

| | Cumulative Total Return

|

|---|

| | At December 31,

|

|---|

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

|---|

| Mac-Gray Corporation | | 100 | | 27.48 | | 23.42 | | 20.25 | | 24.67 | | 47.21 |

| Russell 2000 Index(1) | | 100 | | 117.51 | | 112.44 | | 115.23 | | 92.62 | | 139.00 |

| S&P 500 Index | | 100 | | 165.64 | | 150.55 | | 132.62 | | 104.85 | | 122.00 |

- (1)

- Because the Company does not believe it can reasonably identify a peer group, the Company has selected the Russell 2000 Index as a broad equity market index that includes companies whose equity securities are of a more comparable market capitalization than the S&P 500 Stock Index.

14

Certain Relationships and Related Transactions

Pursuant to a Stockholders' Agreement by and among the Company and certain of its stockholders dated June 26, 1997 (the "Stockholders' Agreement"), (i) each of Mr. Stewart G. MacDonald, Jr. ("Mr. S. MacDonald"), Ms. Sandra E. MacDonald ("Ms. S. MacDonald"), Mr. Daniel W. MacDonald ("Mr. D. MacDonald," and collectively, the "MacDonalds") (and any assignees or trusts created by them or under which they are beneficiaries) received "piggy-back" and demand registration rights, (ii) each of the MacDonalds granted to and received rights of first offer to purchase shares of the Company's Common Stock offered for sale by another stockholder who is a party thereto and (iii) the MacDonalds granted to the Company rights of second offer to purchase such shares.

In 1977, the Company entered into an arrangement with the Company's co-founder and then Chief Executive Officer that provided his wife, Ms. Evelyn C. MacDonald ("Ms. E. MacDonald"), with an annual payment following his death. The Company, through its subsidiary, Mac-Gray Services, pays Ms. E. MacDonald, the mother of Mr. S. MacDonald, the Company's Chairman and Chief Executive Officer, a fixed amount of $104,000 per year pursuant to this arrangement, which is not evidenced by a comprehensive written agreement, and will continue to make such payments for the remainder of Ms. E. MacDonald's life.

PRINCIPAL AND MANAGEMENT STOCKHOLDERS

The following table sets forth certain information with respect to the beneficial ownership of the Company's Common Stock as of March 31, 2004 by (i) each person known by the Company to own beneficially five percent or more of the outstanding shares of the Company's Common Stock, (ii) each director of the Company, the Chief Executive Officer and each of the executive officers, and (iii) all directors and executive officers of the Company as a group. Except as otherwise indicated, the Company believes that the beneficial owners of the Company's Common Stock listed below, based on

15

information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable.

Name of Beneficial Owner(1)

| | Shares Beneficially

Owned(2)

| | Percentage of Shares

Beneficially Owned

| |

|---|

| Stewart G. MacDonald, Jr. (3)(4)(5) | | 2,250,300 | | 17.81 | % |

| Sandra E. MacDonald (3)(4)(6) | | 3,092,200 | | 24.47 | % |

| Daniel W. MacDonald (3)(4)(7) | | 2,022,600 | | 16.00 | % |

| Peter C. Bennett (3)(4)(8) | | 1,700,000 | | 13.45 | % |

| R. Robert Woodburn, Jr. (3)(4)(9) | | 1,700,000 | | 13.46 | % |

| Cynthia V. Doggett (3)(10) | | 2,250,300 | | 17.81 | % |

| Richard G. MacDonald (3)(11) | | 3,092,200 | | 24.47 | % |

| Gilbert M. Roddy, Jr. (3)(12) | | 493,533 | | 3.91 | % |

| Myron M. Kaplan (13) | | 1,494,900 | | 11.83 | % |

| Dimensional Fund Advisors Inc. (14) | | 882,600 | | 6.98 | % |

| Web Services Company, Inc. (15) | | 1,048,600 | | 8.30 | % |

| William M. Crozier, Jr. (16) | | 23,829 | | * | |

| John P. Leydon (16) | | 23,856 | | * | |

| Edward F. McCauley (16) | | 1,000 | | * | |

| Larry L. Mihalchik (16) | | 9,389 | | * | |

| Jerry A. Schiller (16) | | 19,806 | | * | |

| Thomas E. Bullock (16) | | 24,959 | | * | |

| Neil F. MacLellan, III (16) | | 81,558 | | * | |

| Michael J. Shea (16) | | 62,934 | | * | |

| All executive officers and directors as a group (9 persons) | | 2,497,631 | | 19.76 | % |

- *

- less than 1%

- (1)

- Unless otherwise indicated by footnote, the mailing address for each stockholder and director is c/o Mac-Gray Corporation, 22 Water Street, Cambridge, MA 02141.

- (2)

- Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number and percentage of shares of the Company's Common Stock beneficially owned by a person, shares of the Company's Common Stock subject to options and warrants held by that person that are currently exercisable or exercisable within 60 days of March 31, 2004 are deemed outstanding, but are not deemed to be outstanding for purposes of computing the percentage for any other person. As of March 31, 2004, a total of 12,637,421 shares of the Company's Common Stock were issued and outstanding.

- (3)

- The Company and certain stockholders of the Company, including The Evelyn C. MacDonald Family Trust for the benefit of Stewart G. MacDonald, Jr., The Evelyn C. MacDonald Family Trust for the benefit of Sandra E. MacDonald, The Evelyn C. MacDonald Family Trust for the benefit of Daniel W. MacDonald (each of these sub-trusts under The Evelyn C. MacDonald Family Trusts is referred to herein as a "Sub-Trust" and collectively as "Sub-Trusts"), Mr. S. MacDonald, Ms. S. MacDonald, Mr. D. MacDonald, The Stewart G. MacDonald, 1984 Trust (the "SGM Trust"), The Daniel W. MacDonald Trust 1988 (the "DWM Trust"), the New Century Trust, The Whitney E. MacDonald GST Trust-1997, The Jonathan S. MacDonald GST Trust-1997, The Robert C. MacDonald GST Trust-1997, The Whitney E. MacDonald Gift Trust, The Jonathan S. MacDonald Gift Trust, The Robert C. MacDonald Gift Trust, and Cynthia V. Doggett are parties to the Stockholders' Agreement. The Stockholders' Agreement gives the parties thereto rights of first offer to purchase shares offered for sale by another stockholder who is a party thereto, as well as providing the Company with rights of second offer to purchase such shares. As a result of the

16

Stockholders' Agreement, each of the parties thereto may be deemed to beneficially own all of the issued and outstanding shares of the Company's Common Stock owned by the other parties thereto, although such beneficial ownership is not reflected in the table of shares beneficially owned.

- (4)

- A total of 1,700,000 shares of the Company's Common Stock are held in trust pursuant to The Evelyn C. MacDonald Family Trusts (the "ECM Trust"), the grantor of which is Ms. E. MacDonald. The independent trustees (the "Independent Trustees") of the ECM Trust are Peter C. Bennett ("Mr. Bennett") and R. Robert Woodburn, Jr. ("Mr. Woodburn"). In addition, each of Mr. S. MacDonald, Ms. S. MacDonald and Mr. D. MacDonald are trustees of the individual Sub-Trust under the ECM Trust of which such individual is a beneficiary. 566,667 shares of the Company's Common Stock held by the ECM Trust are held in a Sub-Trust for the benefit of Mr. S. MacDonald, 566,667 shares of the Company's Common Stock held by the ECM Trust are held in a Sub-Trust for the benefit of Ms. S. MacDonald, and 566,667 shares of the Company's Common Stock held by the ECM Trust are held in a Sub-Trust for the benefit of Mr. D. MacDonald. The Independent Trustees have voting power over the shares held by the ECM Trust and the Sub-Trusts, and may be deemed to have beneficial ownership of such shares of the Company's Common Stock. The three trustees of each Sub-Trust (including each of Mr. S. MacDonald, Ms. S. MacDonald and Mr. D. MacDonald as to their own respective Sub-Trust) generally have the shared power to dispose of the shares of the Company's Common Stock attributed to such Sub-Trust and, therefore, may be deemed to have beneficial ownership of the shares of the Company's Common Stock held by such Sub-Trust.

- (5)

- Includes (i) 626,608 shares of the Company's Common Stock held by the SGM Trust, of which Mr. S. MacDonald serves as co-trustee and is sole beneficiary, (ii) 493,533 shares of the Company's Common Stock held by the New Century Trust, of which Mr. S. MacDonald is the grantor, (iii) 566,667 shares of the Company's Common Stock held by the ECM Trust for the benefit of Mr. S. MacDonald, of which Mr. S. MacDonald serves as co-trustee and is the beneficiary, (iv) 145,102 shares of the Company's Common Stock held by the wife of Mr. S. MacDonald, and (v) 126,096 shares of the Company's Common Stock held by the minor children of Mr. S. MacDonald. Mr. S. MacDonald may replace the shares of the Company's Common Stock held by the New Century Trust at any time with property of equivalent value and therefore may be deemed to beneficially own all such shares of the Company's Common Stock. Mr. S. MacDonald disclaims beneficial ownership of such shares of the Company's Common Stock as well as the shares of the Company's Common Stock held by the wife and minor children of Mr. S. MacDonald. Mr. S. MacDonald holds options to purchase up to 160,000 shares of the Company's Common Stock, 160,000 of which are exercisable within 60 days and included in shares of the Company's Common Stock beneficially owned.

- (6)

- Includes (i) 148,800 shares of the Company's Common Stock held by The Whitney E. MacDonald GST Trust-1997, (ii) 148,800 shares of the Company's Common Stock held by The Jonathan S. MacDonald GST Trust-1997, (iii) 148,800 shares of the Company's Common Stock held by The Robert C. MacDonald GST Trust-1997, (iv) 16,050 shares of the Company's Common Stock held by The Whitney E. MacDonald Gift Trust, (v) 16,050 shares of the Company's Common Stock held by The Jonathan S. MacDonald Gift Trust, (vi) 16,050 shares of the Company's Common Stock held by The Robert C. MacDonald Gift Trust, (vii) 566,667 shares held by the ECM Trust for the benefit of Ms. S. MacDonald, of which Ms. S. MacDonald serves as co-trustee and is the beneficiary, (viii) 500,000 shares of the Company's Common Stock held by The MacDonald Annuity Trust, of which Ms. S. MacDonald serves as trustee and settlor with right to replace property, and (ix) 1,000,000 shares of the Company's Common Stock held by the DWM Trust, of which Ms. S. MacDonald serves as co-trustee. Richard G. MacDonald ("Mr. R. MacDonald") is the sole trustee of each of the aforementioned trusts (other than the ECM Trust, The MacDonald

17

Annuity Trust and the DWM Trust) and may be deemed to beneficially own all of such shares of the Company's Common Stock. The shares held by each of The Whitney E. MacDonald GST Trust-1997, The Jonathan S. MacDonald GST Trust-1997 and The Robert C. MacDonald GST Trust-1997 (collectively, the "GST Trusts") and The Robert C. MacDonald Gift Trust, The Whitney E. MacDonald Gift Trust and The Jonathan S. MacDonald Gift Trust (collectively, the "Gift Trusts") may be replaced at any time by Ms. S. MacDonald, the grantor of such trusts, with property of equivalent value and, therefore, Ms. S. MacDonald may be deemed to beneficially own all such shares of the Company's Common Stock. Ms. S. MacDonald disclaims beneficial ownership of the shares of the Company's Common Stock held by the GST Trusts, the DWM Trust, The MacDonald Annuity Trust and the Gift Trusts.

- (7)

- On a Form 4 filed with the Securities and Exchange Commission by Daniel W. MacDonald on August 18, 2003, Mr. MacDonald reported beneficial ownership inclusive of (i) 1,000,000 shares of the Company's Common Stock held by the DWM Trust, of which Mr. D. MacDonald is co-trustee and sole beneficiary, and (ii) 566,667 shares of the Company's Common Stock held by the ECM Trust for the benefit of Daniel W. MacDonald, of which Mr. D. MacDonald serves as co-trustee and is the beneficiary. Mr. MacDonald holds 455,933 shares directly.

- (8)

- Includes 1,700,000 shares of the Company's Common Stock held by the ECM Trust for which Mr. Bennett serves as co-trustee and shares voting and dispositive power over the shares of the Company's Common Stock. Mr. Bennett disclaims beneficial ownership of the shares of the Company's Common Stock held by the ECM Trust. Mr. Bennett's mailing address is 111 Cushing Street, Hingham, Massachusetts 02043.

- (9)

- Includes 1,700,000 shares of the Company's Common Stock held by the ECM Trust for which Mr. Woodburn serves as co-trustee and shares voting and dispositive power over the shares of the Company's Common Stock. Mr. Woodburn disclaims beneficial ownership of the shares of the Company's Common Stock held by the ECM Trust. Mr. Woodburn's mailing address is c /o Palmer & Dodge LLP, One Beacon Street, Boston, Massachusetts 02108.

- (10)

- Includes (i) 626,608 shares of the Company's Common Stock held by the SGM Trust, of which Ms. Doggett serves as co-trustee, (ii) 493,533 shares of the Company's Common Stock held by the New Century Trust, of which Ms. Doggett serves as co-trustee, (iii) 566,667 shares of the Company's Common Stock held by the ECM Trust for the benefit of the husband of Ms. Doggett, of which the husband of Ms. Doggett serves as co-trustee and is the beneficiary, (iv) 132,298 shares of the Company's Common Stock held by the husband of Ms. Doggett, and (v) 126,096 shares of the Company's Common Stock held by the minor children of the husband of Ms. Doggett. The shares of the Company's Common Stock held in the New Century Trust may be replaced at any time by the grantor, Mr. S. MacDonald, with property of equivalent value. The SGM Trust is revocable by the grantor, Mr. S. MacDonald. Ms. Doggett disclaims beneficial ownership of all of shares of the Company's Common Stock held by such trusts as well as the husband and minor children of Ms. Doggett.

- (11)

- Includes (i) 148,800 shares of the Company's Common Stock held by The Whitney E. MacDonald GST Trust-1997, (ii) 148,800 shares of the Company's Common Stock held by The Jonathan S. MacDonald GST Trust-1997, (iii) 148,800 shares of the Company's Common Stock held by The Robert C. MacDonald GST Trust-1997, (iv) 16,050 shares of the Company's Common Stock held by The Whitney E. MacDonald Gift Trust, (v) 16,050 shares of the Company's Common Stock held by The Jonathan S. MacDonald Gift Trust, (vi) 16,050 shares of the Company's Common Stock held by The Robert C. MacDonald Gift Trust, (vii) 566,667 shares held by the ECM Trust for the benefit of by the wife of Richard G. MacDonald ("Mr. R. MacDonald"), of which by the wife of Mr. R. MacDonald serves as co-trustee and is the beneficiary, (viii) 500,000 shares of the Company's Common Stock held by The MacDonald Annuity Trust, of which the wife of Mr. R.

18

MacDonald serves as trustee and settlor with right to replace property, (ix) 1,100,000 shares of the Company's Common Stock held by the DWM Trust, of which the wife of Mr. R. MacDonald serves as co-trustee, and (x) 552,983 shares of the Company's Common Stock held by the wife of Mr. R. MacDonald. The shares held by each of the GST and Gift Trusts may be replaced at any time by Ms. S. MacDonald, the grantor of such trusts, with property of equivalent value and, therefore, Ms. S. MacDonald may be deemed to beneficially own all such shares of the Company's Common Stock. Mr. R. MacDonald is the sole trustee of each of the aforementioned trusts (other than the ECM Trust, The MacDonald Annuity Trust and the DWM Trust) and may be deemed to beneficially own all of such shares of the Company's Common Stock. Mr. R. MacDonald disclaims beneficial ownership of the 3,214,200 shares of the Company's Common Stock listed above.

- (12)

- Includes 493,533 shares of the Company's Common Stock held by the New Century Trust, of which Mr. Roddy serves as co-trustee. The shares of the Company's Common Stock held by the New Century Trust may be replaced at any time by Mr. S. MacDonald, the grantor, with property of equivalent value, of which all 493,533 shares of the Company's Common Stock Mr. Roddy disclaims beneficial ownership. Mr. Roddy's mailing address is c/o Loring, Wolcott & Coolidge, 230 Congress Street, Boston, Massachusetts 02110.

- (13)

- On a Form 4 filed with the Securities and Exchange Commission by Myron M. Kaplan ("Mr. Kaplan") on April 2, 2004, Mr. Kaplan reported his beneficial ownership of 1,494,900 shares of the Company's Common Stock, and a mailing address of P.O. Box 385, Leonia, New Jersey 07605.

- (14)

- On a Schedule 13G filed with the Securities and Exchange Commission by Dimensional Fund Advisors Inc. ("Dimensional") on February 10, 2004, Dimensional reported its beneficial ownership of 882,600 shares of the Company's Common Stock. Dimensional Fund Advisors Inc., with an address of 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401, is an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts (the "Funds"). In its role as investment adviser or manager, Dimensional possesses voting and/or investment power over the securities reported herein that are owned by the Funds. All securities reported herein are owned by the Funds. Dimensional disclaims beneficial ownership of such securities.

- (15)

- On a Schedule 13G filed with the Securities and Exchange Commission by Web Service Company, Inc. ("Web") on February 6, 2004, Web reported its beneficial ownership of 1,048,600 shares of the Company's Common Stock, and a mailing address of 3690 Redondo Beach Avenue, Redondo Beach, CA 90278.

- (16)

- Mr. Crozier holds options to purchase up to 6,000 shares of the Company's Common Stock, all of which are exercisable within 60 days and included in the shares of the Company's Common Stock beneficially owned. Mr. Leydon holds options to purchase up to 6,000 shares of the Company's Common Stock, all of which are exercisable within 60 days and included in the shares of the Company's Common Stock beneficially owned. Mr. McCauley holds an option to purchase up to 1,000 shares of the Company's Common Stock, all of which are exercisable within 60 days and included in the shares of the Company's Common Stock beneficially owned. Mr. Mihalchik holds options to purchase up to 2,000 shares of the Company's Common Stock, all of which are exercisable within 60 days and included in the shares of the Company's Common Stock beneficially owned. Mr. Schiller holds options to purchase up to 6,000 shares of the Company's Common Stock, all of which are exercisable within 60 days and included in the shares of the Company's Common Stock beneficially owned. Mr. Bullock holds options to purchase up to 4,000 shares of the Company's Common Stock, all of which are exercisable within 60 days and included in the

19

shares of the Company's Common Stock beneficially owned. Mr. MacLellan holds options to purchase up to 100,000 shares of the Company's Common Stock, 78,000 of which are exercisable within 60 days and included in the shares of the Company's Common Stock beneficially owned. Mr. Shea holds options to purchase up to 75,000 shares of the Company's Common Stock, 53,000 of which are exercisable within 60 days and included in the shares of the Company's Common Stock beneficially owned.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

The Company's executive officers and directors and beneficial owners of more than 10% of its Common Stock are required under Section 16(a) of the Exchange Act to file reports of ownership and changes in ownership with the SEC. Copies of those reports must also be furnished to the Company. Based on a review of the copies of reports furnished to the Company, and written representations that no other reports were required, the Company believes that during Fiscal 2003 all directors, officers or beneficial owners of greater than 10% of the Company's Common Stock filed on a timely basis all reports required by Section 16(a), except for Myron M. Kaplan who did not timely file his Form 4 in connection with his disposition of stock in November and December 2003.

EXPENSES OF SOLICITATION

The Company will pay the entire expense of soliciting proxies for the Annual Meeting. In addition to solicitations by mail, certain directors, officers and regular employees of the Company (who will receive no compensation for their services other than their regular compensation) may solicit proxies by telephone, telegram or personal interview. Banks, brokerage houses, custodians, nominees and other fiduciaries have been requested to forward proxy materials to the beneficial owners of shares held of record by them and such custodians will be reimbursed for their expenses. All costs incurred with respect to the Annual Meeting will be borne by the Company.

SUBMISSION OF STOCKHOLDER PROPOSALS FOR 2005 ANNUAL MEETING

Any stockholder proposals submitted pursuant to Exchange Act Rule 14a-8 and intended to be presented at the 2005 annual meeting must be received by the Company on or before December 29, 2004 to be eligible for inclusion in the Company's proxy statement and form of proxy to be distributed by the Board of Directors in connection with that meeting. Any such proposal should be mailed to: Secretary, Mac-Gray Corporation, 22 Water Street, Cambridge, Massachusetts 02141.

Any stockholder proposals (including recommendations of nominees for election to the Board of Directors) intended to be presented at the Company's 2005 annual meeting, other than a stockholder proposal submitted pursuant to Exchange Act Rule 14a-8, must be received in writing at the principal executive office of the Company no later than March 8, 2005, nor prior to January 24, 2005, together with all supporting documentation required by the Company's By-laws. Proxies solicited by the Board of Directors will confer discretionary voting authority with respect to these proposals, subject to SEC rules governing the exercise of this authority.

INDEPENDENT ACCOUNTANTS

The firm of PricewaterhouseCoopers LLP served as the Company's independent public accountants for Fiscal 2003 and will serve in such capacity for the year ending December 31, 2004. A representative of PricewaterhouseCoopers LLP will be present at the Annual Meeting and will be given the opportunity to make a statement if he or she so desires. The representative will be available to respond to appropriate questions.

20

OTHER MATTERS

The Board of Directors does not know of any matters other than those described in this Proxy Statement which will be presented for action at the Annual Meeting. If other matters are duly presented, proxies will be voted in accordance with the best judgment of the proxy holders.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE REQUESTED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE BY INTERNET PURSUANT TO THE INSTRUCTIONS ON THE PROXY CARD. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU PREVIOUSLY RETURNED YOUR PROXY CARD.

21

APPENDIX A

MAC-GRAY CORPORATION

GOVERNANCE AND NOMINATING COMMITTEE

CHARTER

The Board of Directors of Mac-Gray Corporation (the "Company") has constituted and established a Governance and Nominating Committee (the "Committee").

I. General Statement of Purpose

The purpose of the Committee is to review and report to the Company's Board of Directors (the "Board") periodically on matters of corporate governance, to identify individuals qualified to become board members and to recommend individuals to the Board for nomination, election, or appointment as members of the Board and its committees. The Committee is also responsible for developing and recommending to the Board a set of corporate governance guidelines applicable to the Company and periodically reviewing such guidelines and recommending any changes thereto.

In addition, the Committee is responsible for providing assistance to the Board on the evaluation of the overall effectiveness of the Board, and taking a leadership role in shaping the corporate governance of the Company, including Board committees and their function.

II. Committee Membership

The number of individuals serving on the Committee shall be fixed by the Board from time to time, but shall have no fewer than two members, all of whom shall meet the independence requirements set forth in Section 303A of the New York Stock Exchange Listed Company Manual.

III. Committee Structure

The Board shall appoint the members of the Committee on an annual basis at its first meeting following the Annual Meeting of Shareholders. The Board, taking into account the views of the Chairman of the Board, shall designate a chairman of the Committee.

The Board may replace or remove committee members at any time with or without cause. Resignation or removal of a director from the Board, for whatever reason, shall automatically constitute resignation or removal, as applicable, from the Committee. Vacancies occurring on the Committee, for whatever reason, may be filled by the Board.

IV. Meetings

The Committee shall meet in person or by conference telephone at least quarterly, or more frequently as circumstances require. Each meeting will have on its agenda the provision for an executive session, and the Committee shall meet in executive session, without management, at least once a year. A majority of the members of the Committee shall constitute a quorum for purposes of holding a meeting and the Committee may act by a vote of a majority of members present at such meeting. In lieu of a meeting, the Committee may act by unanimous written consent. The Committee may invite to its meetings any director, officer of the Company or such other person as it deems appropriate in order to assist it in performing its responsibilities. The Committee shall have the authority to retain independent consultants or advisors, to be paid by the Company, that are necessary to perform its duties.

A-1

V. Duties and Responsibilities of the Committee

The responsibilities of the Committee shall be:

- 1.

- Develop a Board that provides management with experienced and seasoned advisors in fields related to current and future business directions of the Company.

- 2.

- Identify qualified individuals for Board membership and, after appropriate consideration, make recommendation to the Board regarding all nominees for proposed election (including at each annual meeting of shareholders), whether for shareholder vote, by appointment by the Board to fill interim vacancies, including a vacancy created by an expansion of the size of the Board. In considering possible candidates for board membership, the Committee shall be guided by the following principles:

- a)

- each candidate should be an individual of the highest character and integrity, possessing business and financial acumen, demonstrated business ethics, and tenure and breadth of experience in a significant leadership capacity;

- b)

- each candidate should provide the desired mix of characteristics, qualifications, and diverse experiences, perspectives, and skills appropriate for a corporation such as the Company;

- c)

- each candidate's past or anticipated contributions to the Board and its committees should be clear;

- d)

- each candidate should have sufficient time to devote to the affairs of the Company;

- e)

- each candidate should represent the interests of the stockholders as a whole.

The Committee will also provide the Board with both an assessment as to whether a candidate would meet the independence requirements set forth in Section 303A of the New York Stock Exchange Listed Company Manual at the time of consideration by the Board and a recommendation as to the class of director in which the nominee should serve.

- 3.