UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

x | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

|

MAC-GRAY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

Contacts:

Michael J. Shea | Scott Solomon |

Chief Financial Officer | Vice President |

Mac-Gray Corporation | Sharon Merrill |

781-487-7610 | 617-542-5300 |

Email: mshea@macgray.com | Email: tuc@investorrelations.com |

Mac-Gray Corporation’s Board of Directors Issues Letter to Shareholders

Urges Shareholders to Vote their WHITE Proxy Card for the Two Highly Qualified

Independent Directors the Board has Nominated for Re-election

WALTHAM, MA, May 15, 2013 – The Board of Directors of Mac-Gray Corporation (NYSE: TUC), the nation’s premier provider of laundry facilities management services to multi-family housing, today issued the following letter to shareholders urging them to vote their WHITE proxy card for the two highly qualified independent directors the Board has nominated for re-election. The full text reads as follows:

Dear Shareholders:

By now, you likely have received Moab Capital Partners’ most recent communications recommending that you vote for the Moab nominees at Mac-Gray’s upcoming Annual Meeting. We strongly urge you to reject this dissident slate.

PLEASE VOTE THE ENCLOSED WHITE PROXY CARD TODAY!

Despite the challenging economic climate of the past four years, your Board has taken numerous steps to manage through a difficult economy, strengthen the Company’s balance sheet, return value to shareholders, and position Mac-Gray to be able to take advantage of eventual improvements in the economic climate.

· Since 2004, Mac-Gray has eliminated approximately $185 million of debt, strategically lowering its debt leverage from 3.8x in 2008 to 2.8x in 2012

· Your Board has approved double-digit dividend increases for three consecutive years, including a 45% increase announced in February 2013

· Mac-Gray has channeled capital and resources into markets with the highest potential to enhance long-term profitable growth

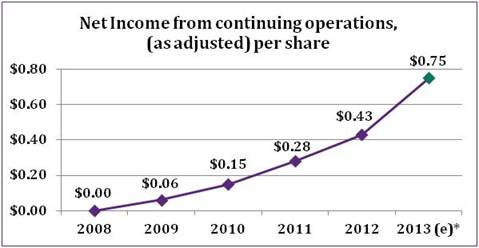

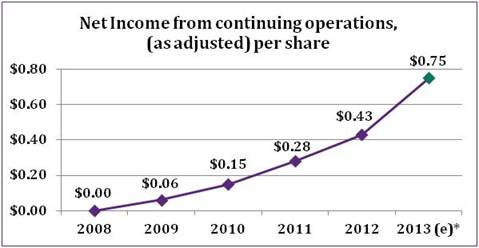

· Management and the Board are executing a multi-pronged strategy that has resulted in adjusted EPS increasing from $0.06 per share in 2009 to $0.43 per share in 2012

*Mid-point of 2013 guidance

FIRST MOAB’S CO-FOUNDER SAYS HE MIGHT BE INTERESTED IN

PARTICIPATING IN AN ACQUISITION OF MAC-GRAY;

NOW HE TELLS YOU MOAB HAS NO PLAN TO SELL THE COMPANY.

WHICH IS IT?

· In its first proxy filing, on April 26, 2013, Moab stated that it “would be inclined to consider a proposal to participate in the acquisition of the Company.” Moab Co-Founder Michael Rothenberg goes on to acknowledge that he cannot disclaim “potential conflicts of interest with respect to the Company” or an “interest in seeking a transaction with the Company.”

· After the Company pointed out that Mr. Rothenberg had admitted to the conflict of interest between his being a director of the Company and participating in buying the Company, Mr. Rothenberg stated that his conflict of interest language was a “standard legal disclaimer” and that “Our plan is not to consider selling the business.”

So what does Moab really want? Given these contradictory statements, can you count on Mr. Rothenberg to protect the interests of all shareholders?

MAC-GRAY HAS BEEN CONSISTENTLY OPEN TO APPOINTING STRONG, INDEPENDENT DIRECTORS

Your Board consists solely of independent directors who are highly qualified for their roles and fully dedicated to enhancing the Company’s value for its shareholders. Maintaining an independent and motivated Board and enhancing Mac-Gray’s corporate governance are important to our current directors, as is clear from our Board’s efforts over the past 18 months:

· In 2011, the Board extended an offer to one of Moab’s current nominees, James A. Hyman, who declined the offer

· In January 2012, the Board elected Paul R. Daoust —a recognized leader in human resources, operations and supply chain management

· In June 2012, the Board nominated, and Mac-Gray stockholders elected, Bruce A. Percelay — a candidate introduced by Moab

· In April 2013, the Board terminated Mac-Gray’s shareholder rights plan and recommended to shareholders an amendment to the Company’s charter that would reduce the vote required to amend the Company’s By-laws from 75% to a majority of the shares present

Does this sound like a Board that is entrenched?

Our Board has nominated Mary Ann Tocio and David W. Bryan, two highly qualified incumbent candidates for re-election — nominees who are part of an experienced, independent, highly qualified and committed Board. Compare our candidates to Mr. Rothenberg, a 39 year old hedge fund manager, who has never had a job working for an operating company and who has never served on a public company Board.

We urge you to vote for your Board’s candidates on the enclosed WHITE proxy card and, we urge you not to vote for Moab’s nominees. If you receive a color proxy card from Moab, we kindly ask you to disregard and discard it.

Please sign, date and return the enclosed WHITE proxy card by mailing it in the enclosed pre-addressed, stamped envelope, or follow the instructions on the enclosed WHITE proxy card to vote by Internet or telephone.

Your vote is important to us. Regardless of how many Mac-Gray shares you may own, we encourage you to make your shares count. If you have any questions or need any assistance voting your shares, please contact MacKenzie Partners, Inc., which is assisting the Company in this matter, toll-free at (800) 322-2885 or proxy@mackenziepartners.com.

On behalf of Mac-Gray’s Board of Directors, we thank you for your continued support and confidence in us. We remain committed to rewarding your trust and continuing to build value for all shareholders.

Sincerely,

/s/ Thomas E. Bullock | |

Thomas E. Bullock | |

Chairman of the Board | |

About Mac-Gray Corporation

Founded in 1927, Mac-Gray derives its revenue principally through the contracting of debit-card and coin-operated laundry facilities in multi-unit housing facilities, such as apartment buildings, college and university residence halls, condominiums and public housing complexes. Mac-Gray manages laundry rooms located in 43 states and the District of Columbia. Mac-Gray also sells and services commercial laundry equipment to retail laundromats and other customers through its product sales division. To learn more about Mac-Gray, visit the Company’s website at www.macgray.com.

Important Shareholder Information

The Company will hold its 2013 Annual Meeting of Stockholders on May 30, 2013. On April 29, 2013, the Company filed with the U.S. Securities and Exchange Commission (the “SEC”) and mailed to its shareholders a definitive proxy statement in connection with the Annual Meeting and the solicitation of proxies (the “2013 Proxy Statement”). The 2013 Proxy Statement contains important information about Mac-Gray, the Annual Meeting and related matters.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE 2013 PROXY STATEMENT AND ANY OTHER RELEVANT SOLICITATION MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THESE DOCUMENTS CONTAIN IMPORTANT INFORMATION.

The 2013 Proxy Statement and other relevant solicitation materials (when they become available), and any and all documents filed by the Company with the SEC, may be obtained by investors and security holders free of charge at the SEC’s web site at www.sec.gov. In addition, Mac-Gray’s filings with the SEC, including the 2013 Proxy Statement and other relevant solicitation materials (when they become available), may be obtained, without charge, from Mac-Gray by directing a request to the Company at 404 Wyman Street, Suite 400, Waltham, Massachusetts 02451, Attention: Secretary. Such materials are also available at www.macgray.com/proxy.

Mac-Gray and its directors and executive officers are deemed to be participants in the solicitation of proxies from Mac-Gray’s shareholders in connection with the Annual Meeting. Information regarding Mac-Gray’s directors and executive officers, including a description of their direct and indirect interests by security holdings, is contained in the 2013 Proxy Statement and in Mac-Gray’s 2012 Annual Report on Form 10-K filed with the SEC on March 15, 2013 (the “2012 Annual Report”).

Cautionary Statements

This letter contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements regarding Mac-Gray’s upcoming 2013 Annual Meeting; Mac-Gray’s corporate governance measures and other statements regarding the future operation, direction and success

of the Company’s business. Certain factors which could cause actual results to differ materially from the forward-looking statements include, but are not limited to, general economic conditions, changes in multi-housing vacancy rates, Mac-Gray’s ability to renew long-term customer contracts, and those risks set forth in the 2012 Annual Report under “Risk Factors” and in other reports subsequently filed with the SEC. Mac-Gray undertakes no obligation to update any forward-looking statements, which speak only as of the date of this letter.

Mac-Gray reports net income, as adjusted results, which is a non-GAAP financial measure, as a complement to results provided in accordance with accounting principles generally accepted in the United States (GAAP). Net income, as adjusted excludes certain gains and losses from the comparable GAAP net income, is an indication of our baseline performance before gains, losses or other charges that are considered by management to be outside of our core operating results. These non-GAAP results are among the primary indicators management uses as a basis for evaluating the Company’s financial performance as well as for forecasting future periods. Management establishes performance targets, annual budgets and makes critical operating decisions based upon these metrics. Accordingly, disclosure of these non-GAAP measures provides investors with the same information that management uses to understand the Company’s true economic performance year over year. See Appendix 1 and 2 to the ISS Presentation for definitions of and information regarding the non-GAAP financial measures contained in this news release, together with a reconciliation of such non-GAAP measures to GAAP measures.

If you have any questions, require assistance with voting your WHITE proxy card, or need additional copies of the proxy materials, please contact:

MacKenzie Partners, Inc.

105 Madison Avenue

New York, NY 10016

proxy@mackenziepartners.com

(212) 929-5500 (Call Collect)

Or

TOLL-FREE (800) 322-2885