UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| x | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under Rule 14a-12 | |||

| MAC-GRAY CORPORATION | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| MOAB CAPITAL PARTNERS, LLC | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

PRELIMINARY VERSION

PROXY STATEMENT

This proxy statement is being furnished to holders of the common stock of Mac-Gray Corporation (“Mac-Gray” or the “Company”) in connection with the solicitation of proxies by Moab Capital Partners, LLC (“Moab Capital”), Moab Partners, L.P. (“Moab Partners”), and Michael M. Rothenberg, the Managing Director of Moab Capital (collectively with Moab Capital and Moab Partners, “Moab”), to be used at the Annual Meeting of Stockholders (the “Annual Meeting”) of the Company.

Time and Place of the Annual Meeting

The Annual Meeting is being held on Thursday, May 30, 2013, 10:00 a.m. local time at the Goodwin Procter LLP Conference Center, Second Floor, Exchange Place, 53 State Street, Boston, Massachusetts 02109.

All stockholders of the Company as of the close of business on April 25, 2013, the record date for the Annual Meeting, are entitled to notice of and to vote at the Annual Meeting or at any adjournment(s), postponement(s) or other delay(s) thereof.

Voting materials, which include this Proxy Statement and a BLUE proxy card, will be sent to some or all stockholders on or about May [ ], 2013. Stockholders who do not receive this statement and a BLUE proxy card but wish to receive them can contact Alliance Advisors, as indicated on the last page of this Proxy Statement.

If your shares are held in the name of a brokerage firm, bank or nominee, only that entity can vote such shares and only upon receipt of your specific instruction. Accordingly, we urge you to contact the person responsible for your account and instruct that person to execute the BLUE proxy card on your behalf.

This Proxy Statement does not constitute formal notice of the Annual Meeting. The Company will send formal notice of the Annual Meeting.

YOUR VOTE IS IMPORTANT. If you agree with the reasons for Moab’s solicitation set forth in this Proxy Statement and believe that the election of the Moab nominees to Mac-Gray’s Board of Directors (the “Board”) can make a difference, please vote for the election of the Moab nominees, no matter how many or how few shares you own. We also ask you to support the Moab positions on proposals 2 and 3 described below.

MOAB URGES YOU NOT TO SIGN ANY PROXY CARD THAT IS SENT TO YOU BY THE COMPANY, EVEN AS A FORM OF PROTEST – PLEASE READ OUR PROXY AND MAKE AN INFORMED VOTE ON THE BLUE PROXY CARD.

By executing the BLUE proxy card, you will authorize us to (a) vote FOR the election of James E. Hyman and Michael M. Rothenberg (the “Moab Nominees”) to the Board in Proposal 1 and AGAINST the election of the Company’s nominees, (b) vote FOR the amendment to the Company’s charter documents in Proposal 2, (c) vote AGAINST the executive compensation resolution in Proposal 3; and (d) ABSTAIN from ratifying the selection of McGladrey LLP as the Company’s independent auditor in Proposal 4, unless you instruct us otherwise. If you have already signed a proxy card sent to you by the Company, you may revoke that proxy at any time prior to the time a vote is taken by (i) giving written notice of such revocation to the Secretary of the Company, (ii) signing and duly delivering a proxy bearing a later date, or voting by telephone or via the Internet at a later date or (iii) attending the Annual Meeting and voting in person.

-2-

The persons and entities which constitute Moab are described below in the section entitled “Certain Information Regarding the Participants.” This Proxy Statement sometimes refers to Moab as “we,” “us,” “our” and variants of those words.

Why You Were Sent This Proxy Statement

You are receiving a Proxy Statement and proxy card from us because you owned shares of common stock of the Company on April 25, 2013, the record date for the Annual Meeting. This Proxy Statement describes important issues on which we would like you, as a stockholder, to vote. It also gives you information on these issues so you can make an informed decision.

When you sign the BLUE proxy card, you appoint Michael M. Rothenberg and Andrew Stotland as your representatives at the Annual Meeting. They will vote your shares, as you have instructed them on the BLUE proxy card, at the Annual Meeting. If you sign and return a BLUE proxy card without giving specific voting instructions, your shares will be voted FOR the election of the Moab Nominees in Proposal 1 and AGAINST the election of the Company’s nominees, FOR Proposal 2 and AGAINST Proposal 3, and will not be voted (i.e., will be ABSTENTIONS) with respect to the ratification of the selection of McGladrey LLP. If you plan to attend the Annual Meeting we recommend that you complete, sign, and return your BLUE proxy card in advance of the meeting just in case your plans change. This way, your shares will be voted whether or not you attend the Annual Meeting.

REASONS FOR THE SOLICITATION

Moab is proposing a slate of Class I directors for election to the Board for four principal reasons, the first of which is the Company’s history of dilutive acquisitions at what Moab considers to be excessive premiums. Since its IPO in 1997, Mac-Gray has made eight acquisitions for a total of $398.2 million. As shown in the table below, the largest acquisitions were valued at EV/EBITDA multiples significantly higher than where the Company traded at the time the deals were announced.

| Web | Web | |||||||||||||||||||||||||||||||

| Services- | Services- | Automatic | ||||||||||||||||||||||||||||||

| ($ in millions) | Intirion | Copico | Amerivend | East | West | Lundermac | Hof Service | Laundry | ||||||||||||||||||||||||

Closing Date | 3/12/1998 | 4/23/1998 | 4/27/1998 | 1/16/2004 | 1/10/2005 | 1/23/2006 | 8/9/2007 | 4/1/2008 | ||||||||||||||||||||||||

LTM Revenue | $ | 19.1 | $ | 7.1 | $ | 18.6 | $ | 29.9 | $ | 69.3 | $ | 8.0 | $ | 27.0 | $ | 65.9 | ||||||||||||||||

LTM EBITDA | $ | 2.0 | N/A | N/A | $ | 4.4 | $ | 12.7 | N/A | n/a | $ | 15.6 | ||||||||||||||||||||

EBITDA Margin | 10.3 | % | N/A | N/A | 14.7 | % | 18.4 | % | N/A | n/a | 23.6 | % | ||||||||||||||||||||

Purchase Price | $ | 30.6 | $ | 15.2 | $ | 26.7 | $ | 39.7 | $ | 109.2 | $ | 11.5 | $ | 43.0 | $ | 112.7 | ||||||||||||||||

EV/EBITDA Multiple Paid | 15.6x | N/A | N/A | 9.0x | 8.6x | N/A | n/a | 7.2x | ||||||||||||||||||||||||

Mac-Gray EV/EBITDA Multiple on Acquisition Date | 14.9x | 10.1x | 9.9x | 5.0x | 5.1x | 6.4x | 6.4x | 5.8x | ||||||||||||||||||||||||

The second reason for this solicitation is the Company’s financial results. Despite having paid multiples higher than Mac-Gray’s for each significant acquisition, the Company has not demonstrated that it is capable of leveraging its larger scale to enhance overall operating margins. For example, though the Company’s LTM revenue has grown from $79.2 million at the time of its 1997 IPO to $322.1 million as of December 31, 2012, its gross margin has contracted from 24.7% to 16.4%, its general and administrative expenses as a percentage of revenue have expanded from 6.1% to 6.7%, and the Company’s adjusted EBITDA margin has fallen from 22.8% to 21.2%. each in that same time period.

-3-

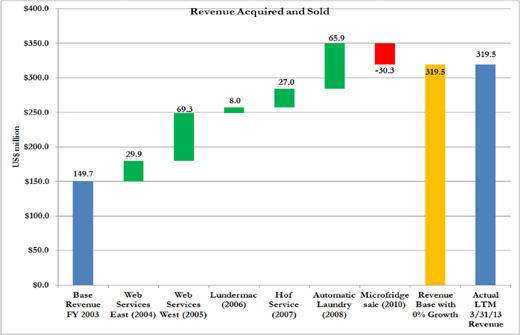

Mac-Gray has also failed to generate any organic revenue growth from December 31, 2003, the date of the most current reported financials prior to David Bryan’s election in March 2004, to December 31, 2012. In its SEC filings each year from 2004 through 2011 (with the exception of 2008), the Board reported increases in Company prices. Beginning in 2012, the Company changed the terminology in its SEC filings and began describing the impact of its “price management initiatives” on revenue. However, as shown by the following chart, the net revenue acquired (after the Microfridge divestiture) over this nine-year period ended December 31, 2012 is exactly equal to the Company’s reported revenue for the twelve months ended March 31, 2013. This implies that Mac-Gray has not generated a single dollar of organic revenue growth since the election of the incumbent Class I directors despite claiming to have implemented numerous price increases and “price management initiatives” in that same time frame. Furthermore, during the tenure of the incumbent Class I directors, organic revenue has actually declined by $27.6 million. Meanwhile, Stewart Gray MacDonald Jr. has been CEO during this same time frame, and has been handsomely rewarded by the Compensation Committee of the Board of Directors with significant salary increases, incentive plan payouts, and bonuses for such performance. For example, Mr. MacDonald’s total compensation increased from $468,237 in 2003 to $1,708,872 in 2012. Specifically, his salary increased from $314,596 in 2003 to $535,300 in 2012, and his combined bonus, non-equity/cash compensation, stock/options awards, and all other compensation has increased from $153,641 to $1,173,572 in that same time period. Class I director Mr. Bryan has been on the Compensation Committee since his election in March 2004 while Class I director Ms. Tocio has been on the Compensation Committee since her appointment to the Board in November 2006.

Along with approving acquisitions at valuations that implied higher EV/EBITDA multiples than Mac-Gray’s at the time, the Board has a history of not cooperating in the advancement of stockholder rights, one example being its failure to implement a successful shareholder proposal to declassify the Board. On May 25, 2012, ISS Proxy Advisory Services published a report in which it gave Mac-Gray a score of 0.0 out of a possible 100.0 for shareholder rights, highlighting the Board’s failure to implement a successful shareholder proposal to declassify the Board as one explanation for the score. ISS also suggests that the Board “appears to suffer from a chronic delusion that it has primacy in the shareholder-director principal-agent relationship”.

-4-

The Board also unanimously rejected two offers to acquire the Company at substantial premiums to Mac-Gray’s trading price at the time the offers were received. The first proposal came in December 2006 from Coinmach Services Corporation for $13.00 to $13.75 per share, a 21% to 28% premium to Mac-Gray’s trading price at the time. The second offer came in October 2011 from KP Capital for $17.50 per share, a 33% premium to Mac-Gray’s trading price at the time. In both instances, Mac-Gray did not allow the suitors to conduct due diligence. The Company also refused to disclose the names of the financial advisors used in evaluating the proposals and would not furnish a business plan detailing why the offer prices were inadequate. Both of the Class I directors voted to reject these two offers.

Another action that raises Moab’s concern is the Company’s use of corporate funds to purchase stock from a large shareholder that communicated to Moab its support of Moab’s slate in advance of the 2012 Annual Meeting. After Moab proposed its slate of directors for election at the Annual Meeting of the Company’s Stockholders in 2012 (the “2012 Annual Meeting”), representatives of the Company used its entire $2 million share repurchase authorization to negotiate a private purchase of stock at $15.03 per share from a large shareholder which Moab believes favored Moab’s slate. Despite the fact that the stock price traded down 27% from the average price of $15.03 paid per repurchased share as implied by 10-Q published for the period of March 31, 2012 ($2.0 million spent to repurchase 133,000 shares) to $10.92 on November 16, 2012, the Board failed to approve a new share repurchase program during that time. For whatever reason, the Board refuses to share much of Mac-Gray’s substantial free cash flow with stockholders. As illustrated in the table below, only 6.4% of the cash flow generated by the Company in the last five years has been paid as dividends.

| ($ in millions) | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||

Adjusted EBITDA from continuing operations | $ | 69.5 | $ | 71.5 | $ | 66.2 | $ | 65.2 | $ | 63.5 | ||||||||||

Plus: Non-cash stock compensation | 2.1 | 2.2 | 2.5 | 3.1 | 2.7 | |||||||||||||||

Plus: Extraordinary legal expenses | — | — | — | 1.7 | 2.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Moab Adjusted EBITDA | $ | 71.6 | $ | 73.7 | $ | 68.8 | $ | 69.9 | $ | 68.4 | ||||||||||

Minus: Capital expenditures | (24.3 | ) | (21.3 | ) | (26.6 | ) | (27.5 | ) | (29.6 | ) | ||||||||||

Minus: Cash interest paid | (20.9 | ) | (20.0 | ) | (17.2 | ) | (12.4 | ) | (11.8 | ) | ||||||||||

Minus: Cash income taxes paid | (0.2 | ) | (0.2 | ) | (0.2 | ) | (0.1 | ) | (0.2 | ) | ||||||||||

Plus/Minus: Decrease/Increase in net working capital | 5.0 | 3.7 | (0.2 | ) | (2.7 | ) | (6.7 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Recurring Free Cash Flow | $ | 31.2 | $ | 35.9 | $ | 24.5 | $ | 27.2 | $ | 20.1 | ||||||||||

Proceeds from exercise of stock options | 4.0 | 0.8 | 0.2 | 0.9 | 0.6 | |||||||||||||||

Proceeds from issuance of stock | 0.3 | 0.4 | 0.2 | 0.3 | 0.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted Free Cash Flow | $ | 35.5 | $ | 37.1 | $ | 25.0 | $ | 28.5 | $ | 21.0 | ||||||||||

Cash dividend paid | $ | 0.0 | $ | 0.0 | $ | 2.8 | $ | 3.1 | $ | 3.5 | ||||||||||

Cumulative Adjusted Free Cash Flow Generated | $ | 35.5 | $ | 72.6 | $ | 97.6 | $ | 126.0 | $ | 147.1 | ||||||||||

% paid as dividends | 0.0 | % | 0.0 | % | 2.8 | % | 4.7 | % | 6.4 | % | ||||||||||

Furthermore, while the Board’s announcement of a 45% increase to the dividend on February 25, 2013, appears substantial on a percentage basis, it is important to note that Mac-Gray’s dividend still only represents 17.7% of the adjusted after-tax free cash flow that Moab calculates the Company will generate in 2013 based on its public guidance.

-5-

| 2013 | ||||

| ($ in millions) | Estimate | |||

Adjusted EBITDA from continuing operations (1) | $ | 69.5 | (2) | |

Plus: Non-cash stock compensation (3) | 2.7 | |||

Plus: Extraordinary legal expenses | — | |||

|

| |||

Moab Adjusted EBITDA | $ | 72.2 | ||

Minus: Capital expenditures | (37.5 | ) (2) (4) | ||

Minus: Cash interest paid (5) | (5.7 | ) | ||

Minus: Cash income taxes paid (3) | (0.2 | ) | ||

Plus/Minus: Change in working capital | — | |||

|

| |||

Recurring Free Cash Flow | $ | 28.8 | ||

Proceeds from exercise of stock options | — | |||

Proceeds from issuance of stock | — | |||

|

| |||

Adjusted Free Cash Flow | $ | 28.8 | ||

New annual dividend | $ | 5.1 | ||

% paid as dividends | 17.7 | % | ||

| (1) | As defined by the Company in its Form 10-K |

| (2) | Midpoint of management’s 2013 guidance |

| (3) | Assumed flat with 2012 |

| (4) | Includes anticipated prepaid facilities management fees |

| (5) | Assumes average of $187 million outstanding on revolver at a rate of LIBOR+250 bps based on 5/2/2013 press release, plus unused facility fee |

Additionally, Moab believes that the Board’s Compensation Committee (the “Committee”) has established an inappropriate peer group for setting Mac-Gray’s executive compensation. As outlined in the Company’s annual proxy statements, this list of similarly situated companies consists of only fourteen companies, has an average market capitalization over five times greater than Mac-Gray’s, and contains companies that operate in far more sophisticated sectors such as pharmaceuticals, software, and laser-based manufacturing. Moab feels that the Small-cap Service Industry Comparables group, which consists of all US-listed companies with SIC Code Classification (Service: 7000-8999), per the US Department of Labor, and market capitalizations between $150 to $200 million, provides a more adequate benchmark for compensation analysis because it consists of twenty-four companies, has an average market capitalization nearly equal to Mac-Gray’s, and contains companies that operate in service industries like Mac-Gray.

-6-

Small-cap Service Industry Comparables group data table with market capitalization of each company on March 5, 2013

Ticker | Name | Market Capitalization | 2011 CEO Salary | Bonus | Stock/ Options/ Other | Non-equity Compensation | Total 2011 CEO Compensation | |||||||||||||||||||

AMRI US Equity | Albany Molecular Research, Inc. | $ | 274.9 | $ | 400,000 | $ | 3,829,267 | $ | 4,229,267 | |||||||||||||||||

LOV US Equity | Sparks Networks, Inc. | $ | 154.7 | $ | 314,784 | $ | 360,054 | $ | 315,177 | $ | 990,015 | |||||||||||||||

EGAN US Equity | eGain Communications Corp | $ | 226.5 | $ | 24 | $ | 37,100 | $ | 37,125 | |||||||||||||||||

POWR US Equity | PowerSecure International Inc. | $ | 161.7 | $ | 550,000 | $ | 40,478 | $ | 676,042 | $ | 1,266,520 | |||||||||||||||

INSM US Equity | Insmed, Inc. | $ | 187.8 | $ | 425,000 | $ | 106,250 | $ | 1,665,853 | $ | 2,197,103 | |||||||||||||||

PRGX US Equity | PRGX Global, Inc. | $ | 182.2 | $ | 639,615 | $ | 1,288,288 | $ | 684,517 | $ | 2,612,420 | |||||||||||||||

AFAM US Equity | Almost Family, Inc. | $ | 194.1 | $ | 529,000 | $ | 536,666 | $ | 1,065,666 | |||||||||||||||||

MHGC US Equity | Morgans Hotel Group | $ | 152.8 | $ | 591,346 | $ | 972,250 | $ | 663,600 | $ | 2,227,196 | |||||||||||||||

MCRI US Equity | Monarch Casino & Resort, Inc. | $ | 153.3 | $ | 240,000 | $ | 25,000 | $ | 120,092 | $ | 385,092 | |||||||||||||||

RLH US Equity | Red Lion Hotels Corp | $ | 136.0 | $ | 321,612 | $ | 250,223 | $ | 571,835 | |||||||||||||||||

TRR US Equity | TRC Companies, Inc. | $ | 188.4 | $ | 465,000 | $ | 887,034 | $ | 465,000 | $ | 1,817,034 | |||||||||||||||

MCHX US Equity | Marchex, Inc. | $ | 146.5 | $ | 220,000 | $ | 940,126 | $ | 1,160,126 | |||||||||||||||||

UPIP US Equity | Unwired Planet Inc. | $ | 192.0 | $ | 450,000 | $ | 49,371 | $ | 499,371 | |||||||||||||||||

CCRN US Equity | Cross Country Healthcare, Inc. | $ | 179.5 | $ | 514,064 | $ | 305,241 | $ | 149,267 | $ | 968,572 | |||||||||||||||

INTX US Equity | Intersections Inc. | $ | 193.4 | $ | 420,000 | $ | 2,605,471 | $ | 3,025,471 | |||||||||||||||||

DTLK US Equity | Datalink Corp | $ | 194.8 | $ | 375,000 | $ | 691,313 | $ | 390,000 | $ | 1,456,313 | |||||||||||||||

DMRC US Equity | Digimarc Corp | $ | 170.4 | $ | 525,000 | $ | 3,459,161 | $ | 3,984,161 | |||||||||||||||||

FRM US Equity | Furmanite Corp | $ | 225.3 | $ | 439,583 | $ | 75,000 | $ | 160,592 | $ | 675,175 | |||||||||||||||

ACTC US Equity | Advanced Cell Technology, Inc. | $ | 157.8 | $ | 490,000 | $ | 649,359 | $ | 2,448,405 | $ | 3,587,764 | |||||||||||||||

MIND US Equity | Mitcham Industries, Inc. | $ | 200.3 | $ | 433,200 | $ | 154,079 | $ | 286,553 | $ | 873,832 | |||||||||||||||

CALD US Equity | Callidus Software | $ | 163.9 | $ | 400,000 | $ | 1,482,500 | $ | 46,033 | $ | 1,928,533 | |||||||||||||||

GLUU US Equity | Glu Mobile Inc. | $ | 152.3 | $ | 350,000 | $ | 796,255 | $ | 420,000 | $ | 1,566,255 | |||||||||||||||

BCOV US Equity | Brightcove Inc. | $ | 174.1 | $ | 256,250 | $ | 157,894 | $ | 414,144 | |||||||||||||||||

KBIO US Equity | KaloBios Pharmaceuticals, Inc. | $ | 159.0 | $ | 340,000 | $ | 30,340 | $ | 370,340 | |||||||||||||||||

TUC US Equity | Mac-Gray Corp | $ | 181.3 | $ | 520,000 | $ | 787,934 | $ | 359,300 | $ | 1,667,234 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||

Peer Median | $ | 176.8 | $ | 422,500 | $ | 1,213,323 | ||||||||||||||||||||

Mac-Gray vs Peer Median | +2.5 | % | +23.1 | % | +37.4 | % | ||||||||||||||||||||

While the Committee’s peer group selection makes CEO Stewart Gray MacDonald Jr.’s pay seem less excessive, the table below illustrates that, in 2011, his salary was 23.1% higher than the median CEO salary of the Small-cap Service Industry Comparables group, and his total compensation was 37.4% higher than the group’s median CEO total compensation.

| ($ in millions ) | Compensation Committee Comparables | Small-cap-Service Industry Comparables | Mac-Gray | |||||||||

Number of Companies | 14 | 24 | ||||||||||

Average Market Capitalization | $ | 980.1 | $ | 180.1 | $ | 181.3 | ||||||

Median 2011 CEO Salary | $ | 549,884 | $ | 422,500 | $ | 520,000 | ||||||

Median 2011 Total CEO Compensation | $ | 2,734,171 | $ | 1,213,323 | $ | 1,667,234 | ||||||

Average 2011 Stock Price Performance | 3.5 | % | 14.5 | % | (6.3 | %) | ||||||

Average 2012 Stock Price Performance | 6.5 | % | 6.2 | % | (7.2 | %) | ||||||

Note: Average Market Capitalizations shown as of 3/5/13

-7-

Moab also believes that the Compensation Committee has set performance targets too low. The following chart illustrates that little revenue or adjusted EBITDA growth was required by the Committee for executives to earn 100% of their target bonus. The chart also shows that only about 12% revenue or 14% adjusted EBITDA growth is needed for executives to earn 150% of their target bonus.

| 2009 Actual | 2010 Target | Growth Required | 2010 Actual | 2011 Target | Growth Required | 2011 Actual | 2012 Target | Growth Required | ||||||||||||||||||||||||||||

100% Target Bonus Level(1) | ||||||||||||||||||||||||||||||||||||

Revenue(2) | $ | 356.2 | $ | 325.9 | 0.0 | % | $ | 322.2 | $ | 326.6 | 2.1 | % | $ | 322.0 | $ | 327.8 | 1.8 | % | ||||||||||||||||||

Adjusted EBITDA(3) | $ | 71.1 | $ | 71.2 | 0.0 | % | $ | 64.8 | $ | 67.1 | 3.6 | % | $ | 66.1 | $ | 70.3 | 6.3 | % | ||||||||||||||||||

150% Target Bonus Level(1) | ||||||||||||||||||||||||||||||||||||

Revenue(2) | $ | 356.2 | $ | 358.5 | 10.0 | % | $ | 322.2 | $ | 359.3 | 12.3 | % | $ | 322.0 | $ | 360.6 | 12.0 | % | ||||||||||||||||||

Adjusted EBITDA(3) | $ | 71.1 | $ | 78.3 | 10.0 | % | $ | 64.8 | $ | 73.8 | 14.0 | % | $ | 66.1 | $ | 77.4 | 17.0 | % | ||||||||||||||||||

Interestingly, even when full targets are not met, partial bonuses are awarded equal to the percentage level of the target achieved. Therefore, bonuses are awarded when revenue and earnings decline. For example, the Company’s revenue in 2009, excluding Microfridge, was $325.9 million. For 2010, the Compensation Committee set the 100% Bonus Level Target for revenue at $325.9 million, implying that 0% year-over-year growth was needed for executives to achieve 100% of their target bonus. Mac-Gray’s actual revenue in 2010, excluding Microfridge, was $320.0 million, representing a year-over-year decline from 2009. However, because management achieved 98% of its 2010 revenue target, executives still received a bonus for their efforts. Additional bonuses and salary hikes were also awarded to the CEO after the closing of several acquisitions before the merits of those transactions could have been properly evaluated.

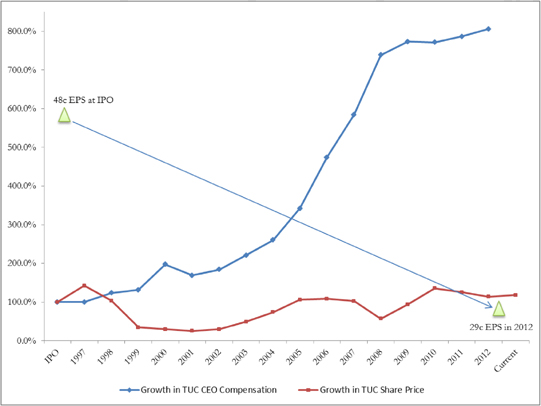

Through its investigation of Mac-Gray’s CEO compensation, Moab has concluded that the Company’s CEO compensation has completely decoupled from earnings and stock price performance. In the two years leading up to the announcement by Moab of its nomination of the Moab Nominees, from March 4, 2011 to March 5, 2013, the day before Moab announced it would nominate its slate, Mac-Gray’s stock declined by 20% from $15.66 to $12.50, while operating income declined from $7.1 million to $6.5 million in the corresponding quarters ended March 31, 2011 and March 31, 2013, respectively. Nevertheless, the Board’s Compensation Committee, including both Class I directors, rewarded the CEO with increased compensation each of those years, including significant non-equity incentives. As shown in the chart below, it appears as though the CEO’s compensation is not aligned with creating shareholder value. This is evidenced by the growth in the CEO’s compensation from $211,945 at the time of the IPO to $1,708,872 in 2012 while the EPS as reported in accordance with GAAP accounting declined from $0.48 to $0.29 in that same time frame.

-8-

* “TUC” is the trading symbol for Mac-Gray Corporation on the New York Stock Exchange. EPS values shown are as reported by Mac-Gray in accordance with GAAP accounting. The y-axis shows the indexed percentage change. The x-axis increases in one-year increments from the date of the Company’s IPO to March 5, 2013

The Board’s aforementioned actions have motivated other shareholders to engage the Company in a series of costly shareholder campaigns. In December 2007, stockholder Fairview Capital Investment Management, LLC (“Fairview”) voiced concerns regarding the Company’s growth and capital allocation strategy and urged the Company to consider a high dividend payout model or a sale of the Company. In 2009, Fairview ran a successful proxy contest against the Company and replaced Stewart MacDonald with Bruce Ginsberg on the Board. In April 2011, TUC Investor Value Group, LLC ran a proxy contest against the Company but failed to get any of its three independent directors elected. In February 2012, Moab nominated two directors for election to the Board at the 2012 Annual Meeting... The Company and Moab agreed to a settlement which resulted in the Company nominating Bruce Percelay, one of Moab’s initial two nominees, for election as a Class III director at the Company’s 2012 Annual Meeting. Bruce Percelay was successfully elected to replace Bruce Ginsberg. The Company reports spending nearly $2 million from 2009 to 2012 in relation to these proxy contests but, prior to Moab’s Board nominations on March 6, 2013, the Board failed to act on the stockholder-approved initiatives to amend the Company’s by-laws and remove the poison pill. While the Company has removed the poison pill and proposed to amend its by-laws, these actions were only taken after Moab announced its nominees for election as directors to the Board at the 2013 Annual Meeting. The Board has continued to ignore the initiative to declassify the Board which was approved by a majority vote at both of the past two annual meetings of stockholders.

-9-

The fourth and final reason for this solicitation is the Company’s disappointing stock price performance. As shown below, Mac-Gray shares have delivered a compounded annual return of just 0.83% per year since going public at $11.00 per share on October 16, 1997 through March 5, 2013 when the stock closed at $12.50.

| Enterprise Value at IPO | Enterprise Value at 3/5/13* | |||||||

Share Price | $ | 11.00 | $ | 12.50 | ||||

Shares Outstanding (millions) | 11.0 | 14.5 | ||||||

Market Capitalization | $ | 120.8 | $ | 181.3 | ||||

Net Debt | $ | 9.0 | $ | 177.80 | ||||

Total Enterprise Value | $ | 129.8 | $ | 362.9 | ||||

Total Enterprise Value/LTM EBITDA | 7.2x | 5.3x | ||||||

| * | Date Moab announced its plan for a proxy contest |

Moab believes that its nominees are seasoned executives that all possess significant operational, financial, and/or strategic expertise that would be extremely valuable assets to the Company’s Board of Directors. In addition to these attributes, Moab believes that Messrs. Hyman and Rothenberg would bring fresh perspectives to the Board that will help maximize value for stockholders. Mr. Hyman is a seasoned executive in the services sector with strong track records of implementing operational improvements. He has held directorships on numerous public and private company Boards of Directors. Furthermore, Mr. Rothenberg, as the General Partner of Moab Partners, would bring meaningful independent shareholder representation to the Board for the first time in Company history. The current Board collectively owns just 1% of the Company, a value of less than $2 million. Mr. Rothenberg has followed the Company and its industry closely for more than three years.

WHAT MOAB WANTS

We seek stockholder support to win this election for the Moab Nominees and replace the Company’s Class I directors.

In February 2012, Moab succeeded in getting one of its nominees, Bruce Percelay, placed on the Company’s proxy statement and subsequently elected as a Class III director at the 2012 Annual Meeting. We believe that Mr. Percelay has provided the Board with a breadth and depth of experience that is valuable and relevant to the business of Mac-Gray. Moab initially nominated Mr. Percelay for election to the Board due to his significant operational, financial and strategic experience with Mac-Gray’s core customer base—large apartment building owners. In addition, Mr. Percelay has brought to the Board many years of financial valuation, acquisition and divestiture experience, and skills we believe were sorely lacking on Mac-Gray’s Board at the time of Mr. Percelay’s election.

-10-

Moab believes the Company’s nominees have ignored stockholder-friendly initiatives passed by a majority of stockholders at the past three annual meetings of stockholders, have approved numerous overpriced dilutive acquisitions, have rejected two premium takeover offers to acquire the Company, and as members of the Compensation Committee have approved numerous salary increases to the Chief Executive Officer despite declining financial performance, and have set incentive program targets too low—rewarding key executives with cash incentives even when revenue and earnings decline.

Each of the Company’s nominees was a member of the Board when the Board rejected two separate, unsolicited proposals to acquire Mac-Gray at substantial premiums. The first offer was from Coinmach Services Corporation in 2006, and the second from KP Capital in 2011. In both cases, the suitors were denied the ability to conduct due diligence. The Company’s nominees also sat on the Board during the period in which it rewarded Mac-Gray’s CEO with salary increases and bonuses that appear unjustified given the Company’s poor financial and stock price performance over the past several years. Each of the nominees was a member of the Board’s Compensation Committee during this same time period.

In addition, Moab believes Mr. Bryan, a Board member for nine years and chairman of the Compensation Committee, has failed stockholders by setting incentive program targets too low and thereby rewarding key executives with cash incentives even when revenue and earnings decline, by ignoring stockholder-friendly initiatives passed by a majority of stockholders at the past three annual meetings of stockholders, by approving numerous overpriced and dilutive acquisitions, and by rejecting two premium takeover offers to acquire the Company without allowing either suitor to conduct due diligence.

Moab believes Ms. Tocio, a Board member for over six years and a member of the Compensation Committee, has also failed stockholders by setting incentive program targets too low and thereby rewarding key executives with cash incentives even when revenue and earnings decline, by ignoring stockholder-friendly initiatives passed by a majority of stockholders at the past three annual meetings of stockholders, by approving numerous overpriced and dilutive acquisitions, and by rejecting two premium takeover offers to acquire the Company without allowing either suitor to conduct due diligence.

Class I, the class of directors whose term expires at the Annual Meeting, currently has three directors. We initially notified the Board that we intended to nominate three candidates for election to the Board; subsequently, the Board announced in its proxy materials that it has reduced the number of Class I directors to two effective upon the retirement of director Edward McCauley. Accordingly, we have determined that we will be seeking your support for the election of only two nominees, Messrs. Hyman and Rothenberg. We are disappointed that the Board has chosen to reduce the number of directors to be elected, because it means that even if shareholders vote in favor of the non-incumbents we have nominated, the Board will continue to be controlled by incumbents who approved the actions we have described in this Proxy Statement, which we believe have not been in stockholders’ best interest. The decision to reduce the size of the Board after Moab named three persons to be nominated looks to us to be an attempt to entrench the criticized policies. Pursuant to the Company’s charter documents, the Board has this power but, in our view, to exercise it to keep stockholders from electing enough new directors to change the Company’s course of action is a clear attack on stockholder democracy. Moab is severely disappointed in the Board’s decision to reduce the number of directors of the Company and hopes other stockholders will express similar views to the Board. As noted, Moab believes this plan is designed to ensure that, even if stockholders support Moab’s effort, incumbents will continue to control the Board and Moab and other stockholders seeking to change the composition of the Board to improve stockholder participation in management will be forced to wait until the next annual meeting of the Company’s stockholders in 2014 to gain adequate representation on the Board. We strongly feel that any action taken by the Board to reduce the number of directors eligible for election by the stockholders is a reprehensible attempt to prevent a greater level of stockholder participation in the management of the Company and a further attempt to protect entrenched management and the incumbent Board.

-11-

Moab believes that the Moab Nominees, if elected to the Board of Directors, will bring fresh perspectives to the Board that will help maximize value for stockholders and be more responsive to stockholder interests, as evidenced by their efforts in this proxy to allow stockholders to express their views on the various matters described above and in the proposals below.

If elected, the Moab Nominees recognize that they will owe fiduciary obligations to all stockholders. Mr. Hyman does not anticipate that he will have any conflicts of interest with respect to the Company, and has not sought and will not seek transactions with the Company. Mr. Rothenberg, as Managing Director of Moab Capital, cannot disclaim all potential conflicts of interest with respect to the Company or all interest in seeking a transaction with the Company because, while Moab has not sought and has no current arrangement or understanding with respect to any transactions with the Company, other than purchases and sales of the stock of the Company, Moab would be open to considering a proposal to participate in the acquisition of the Company if in the future a beneficial opportunity or invitation presented itself. In such a case, of course Mr. Rothenberg would abstain from participating and Moab would vote for such a transaction only if a majority of the other shareholders who voted approved it. Moab would also be open to considering an acquisition in which it is not involved. However, although Moab is aware of certain parties that from time to time have indicated a possible interest in acquiring Mac-Gray, Moab has no knowledge of any definitive plans or proposals and Moab believes that it is too early and too speculative at this time to consider if any plan or proposal might be favorable to stockholders. Moab also fully understands that, if it at any time accepted an opportunity or invitation to participate in an acquisition of the Company, the directors of Mac-Gray would act independently and be guided by independent parties in accordance with their fiduciary obligations to the Company and to all stockholders. None of the Moab Nominees has any contract, arrangement or understanding with the Company, or any other direct financial interest concerning the Company, other than through the beneficial ownership of stock of the Company by the Moab Nominees disclosed in this Proxy Statement and in filings with the Securities and Exchange Commission by Moab. All the Moab Nominees satisfy the independence criteria under the Securities and Exchange Commission (“SEC”) and New York Stock Exchange rules regarding board of directors’ independence.

PROPOSALS

We are soliciting your proxy to vote for the following proposals (the “Proposals”), which we intend to submit for approval at the Annual Meeting:

-12-

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, two Class I directors will be elected for terms expiring at the 2016 annual meetings of stockholders or until their respective successors are duly elected or appointed and qualified. Moab is seeking your support at the Annual Meeting to elect its nominees in opposition to Company’s nominees. Each of Moab’s nominees has consented to serve as a director of the Company if elected and each of the nominees has consented to being named in this Proxy Statement. Shares represented by BLUE proxies returned duly executed to Moab will be voted, unless otherwise specified, FOR the election of the nominees named below.

MOAB’S NOMINEES FOR DIRECTOR

James E. Hyman (age 52): Mr. Hyman is President and CEO of TestAmerica Inc., the nation’s largest provider of environmental testing services, a role he has held since 2011. In addition to his role at TestAmerica, Mr. Hyman has served as a Board Member of Grosvenor Americas, an operating company of Grosvenor, a privately owned global property group with assets under management exceeding $18 billion, since 2011. At Grosvenor Americas, Mr. Hyman serves as Chairman of the Audit Committee and is a member of the Compensation Committee. Before his roles at TestAmerica and Grosvenor, Mr. Hyman was Chairman, President, CEO, and a Director of Houston-based Cornell Companies, Inc., a New York Stock Exchange traded provider of government services, from 2005 until its sale in 2010. Earlier in his career, Mr. Hyman held executive positions with Starwood Hotels & Resorts Worldwide, GE Capital Services, McKinsey & Company, and JP Morgan, among others. He chairs the non-profit Mega-Cities Project, focused on urban development issues in the world’s largest cities. Mr. Hyman received an MBA with Distinction from Harvard Business School and an AB with honors from The University of Chicago.

Michael M. Rothenberg (age 39): Since 1998, Mr. Rothenberg has worked in the investment management industry. In 2006, he co-founded Moab Capital Partners, LLC, a value-oriented event-driven money management firm. From 2003 to 2005, Mr. Rothenberg was a senior investment professional at Xerion Capital Partners, LLC, a $500 million hedge fund, where he was responsible for investing and trading a portfolio of distressed debt, bank debt, and event driven equities that peaked at $300 million. From 2002 to 2003, Mr. Rothenberg was the distressed debt Portfolio Manager at Troy Capital Management, LLC, an $80 million hedge fund where he was responsible for investing and trading a $25 million portfolio of distressed debt and event driven equities. From 2001 to 2002, Mr. Rothenberg was an investment analyst at Gracie Capital Partners, LLC, an event driven and distressed debt focused hedge fund. From 1998 to 2001, Mr. Rothenberg was an investment analyst at Perry Capital, LLC, an $11.5 billion hedge fund, where he focused on distressed debt, event driven equity, and private equity investments. Prior to entering the investment management industry, from 1995 to 1998, Mr. Rothenberg was an investment banking analyst at Peter J. Solomon Company, focusing on mergers and acquisitions. Mr. Rothenberg earned a B.S. in Economics in 1995 from The Wharton School at The University of Pennsylvania in Philadelphia, Pennsylvania, majoring in finance.

The number of shares of the Company’s common stock beneficially owned by, and the percentage beneficial ownership of, each of the Moab Nominees as of the date of this Proxy Statement are set forth on Exhibit A to this Proxy Statement. Moab beneficially owns an aggregate of 1,338,127 shares of the Company’s total outstanding common stock as of the date of this Proxy Statement. Moab owns approximately 9.2% of the Company’s total outstanding common stock based on the Company’s statement in its proxy statement on Schedule 14A filed April 29, 2013 that there were 14,613,980 outstanding shares of common stock of the Company as of April 25, 2013.

-13-

If elected, the Moab Nominees would be responsible for managing the business and affairs of the Company. The Moab Nominees understand that, as directors of the Company, each of them has an obligation under Delaware law to scrupulously observe his duty of care and duty of loyalty to the Company and all of its stockholders, not just those nominating him.

WE STRONGLY RECOMMEND THAT YOU VOTE “FOR” THE ELECTION OF THE MOAB NOMINEES.

-14-

PROPOSAL 2

APPROVAL OF AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF MAC-GRAY CORPORATION

The Company’s proxy statement indicates that:

“The stockholders are being asked to approve an amendment (the ‘Charter Amendment’) to the Amended and Restated Certificate of Incorporation of Mac-Gray Corporation, as amended, to lower the vote required for stockholders to amend the By-laws of the Company. The Charter Amendment would amend Article VIII, Section 2 of the Certificate of Incorporation so that the By-laws of the Company may be amended or repealed at any annual meeting or special meeting of stockholders called for such purpose, by the affirmative vote of at least a majority of shares present in person or represented by proxy at such meeting and entitled to vote on such amendment or repeal, voting together as a single class. The current Certificate of Incorporation requires that, unless a By-law amendment is recommended by the Board, the affirmative vote of at least three-fourths of the shares present in person or represented by proxy at such meeting and entitled to vote on such amendment or repeal in order to amend or repeal the By-laws of the Company.”

Moab recommends a vote FOR Proposal 2.

Moab believes that amendment of the Company’s charter document is appropriate given that stockholders made a similar proposal, which related only to the bylaws, at the 2012 Annual Meeting. Moab further notes that, according to the Company’s Form 8-K filed with the SEC on June 13, 2012 to announce the voting results for the proposals at the 2012 Annual Meeting, holders of 7,503,813 shares of Mac-Gray common stock approved the proposal (58.8%), but not the 75% majority required to pass the proposal.

If Proposal 2 is approved, Moab and other holders would be more easily able to join other holders in other amendments to the bylaws.

-15-

PROPOSAL 3

NON-BINDING, ADVISORY VOTE ON THE COMPENSATION OF COMPANY’S NAMED EXECUTIVE OFFICERS

The Company intends to submit the following proposed resolution for stockholder vote at the Annual Meeting:

“RESOLVED, that the stockholders of Mac-Gray Corporation approve the overall compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, and described in the Compensation Discussion and Analysis, executive compensation tables and accompanying narrative disclosures in this proxy statement.”

Moab recommends a vote AGAINST Proposal 3.

Moab believes the executive compensation program of Mac-Gray is excessive given the past performance of the Company. Compared to the firms in the Small-cap Service Industry Comparables group, an appropriate peer group for the Company in terms of market capitalization and industry sector, as described in more detail above in “Reasons for this Solicitation,” the salary of Mac-Gray’s CEO was 26.8% higher than the median CEO salary of the Small-cap Service Industry Comparables group, and his total compensation was 49.8% higher than the group’s median CEO total compensation. Moab believes stockholders should encourage the Board and the Compensation Committee to review compensation by a vote AGAINST Proposal 3.

-16-

PROPOSAL 4

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

At the Annual Meeting a vote will be held to ratify the selection of McGladrey LLP (“McGladrey”) as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2013. The affirmative vote of a majority of the votes properly cast for and against each such matter is required to ratify McGladrey’s appointment. Abstentions are not included in the number of votes cast for and against the proposal and therefore have no effect on the vote on such proposal. The Company’s proxy statement indicates that “Stockholder ratification of the selection of McGladrey as the Company’s independent registered public accounting firm is not required by the Company’s By-laws or otherwise. However, the Board is submitting the selection of McGladrey to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain McGladrey. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.” While Moab believes that stockholders should carefully consider the issues and express their views relating to the selection of McGladrey, Moab will abstain from voting with respect to this proposal if no instruction is provided by a stockholder.

If you sign and return a BLUE proxy card but do not indicate how your shares should be voted, your shares will not be voted (i.e., will be ABSTENTIONS) with respect to the ratification of the selection of McGladrey.

-17-

BACKGROUND OF THIS SOLICITATION

Moab Capital is the investment advisor to Moab Partners which has been a shareholder of Mac-Gray since March 2010, and beneficially owns 1,338,127 shares, or approximately 9.2% of the Company’s outstanding shares of common stock, as of the date of this Proxy Statement.

On October 24, 2011, the Company announced via press release that its Board of Directors (the “Board”) had unanimously rejected an offer from KP Capital, LLC (“KP Capital”) to acquire the Company for $17.50 in cash per share.

On November 10, 2011, Moab sent a letter to the Company expressing its concern over the Board’s decision to reject KP Capital’s proposal, and requested that the Company disseminate certain information regarding the Board’s decision. The requested information included the names of the financial advisors used to evaluate the offer, justification of the Board’s decision to not grant shareholders the right to vote on the proposed acquisition, as well as an updated business plan that would justify why the Board felt $17.50 per share was an inadequate price.

On November 21, 2011, Mr. Rothenberg had a telephone conversation with Thomas Bullock, the Chairman of the Board, and Linda Serafini, the General Counsel and Secretary of the Company, regarding the Board’s rejection of KP Capital’s offer and other concerns expressed in the November 10, 2011 letter.

On December 5, 2011, Moab sent a letter to the Company declaring that, after its conversation with Mr. Bullock, it deemed the Company’s response to the November 10, 2011 letter unacceptable. Moab suggested the Board consider a share repurchase program, and also indicated its intent to nominate candidates for election to the Board at the 2012 Annual Meeting.

On December 21, 2011, the Company announced that its Board had authorized a $2 million share repurchase program under which the Company is authorized to purchase up to an aggregate of that amount of the Company’s outstanding common stock.

On January 17, 2012, the Company announced that its Board had approved at 10% increase to the quarterly common stock dividend from $0.055 per share to $0.0605 per share, an increase that amounted to approximately $300,000 per year.

On February 16, 2012, Moab notified the Company via written letter that it was nominating Bruce A. Percelay and Jonathan G. Davis for election to the Board at the 2012 Annual Meeting.

On February 17, 2012, Moab issued a press release announcing that it was nominating Messrs. Percelay and Davis for election to the Board at the 2012 Annual Meeting. In the press release, Moab also stated that, while the Board’s recently announced share repurchase authorization and dividend increase were directionally appropriate, they were immaterial when considered in aggregate as they represented an immaterial portion of the Company’s after tax free cash flow. On February 17, 2012, Moab filed an amendment to the 2011 Schedule 13D and filed a Schedule 14A with the SEC.

On an unspecified date in the first quarter of 2012, representatives of the Company used the Company’s entire $2 million share repurchase authorization to negotiate a private purchase of stock from a dissident shareholder supportive of Moab’s slate at $15.00 per share.

-18-

On March 23, 2012 and April 5, 2012, representatives from Moab had telephone conversations with Mac-Gray representatives with respect to its nomination of Messrs. Percelay and Davis for election to the Board. The Company interviewed both Moab nominees following the initial conversation and subsequently informed the representatives of Moab of the Board’s proposed compromise to Moab’s solicitation for its nominees, which included nominating Mr. Percelay, but not Mr. Davis, for election to the Board at the 2012 Annual Meeting. Moab rejected this compromise and proposed that the Board nominate Mr. Davis as well.

On April 23, 2012, Moab sent a letter to the Board confirming that it had withdrawn its proxy statement and intended to support the slate of directors nominated by the Board at the 2012 Annual Meeting.

On June 7, 2012, the Company issued a press release detailing the results of the 2012 Annual Meeting, including Mr. Percelay’s election as a Class III director to the Board.

On March 6, 2013, Moab notified the Company via written letter that it was nominating Mark L. Bromberg, James E. Hyman, and Michael M. Rothenberg for election to the Board at the 2013 Annual Meeting. Moab sent a letter to the Board providing a copy of the presentation Moab intends to use in meetings with proxy advisory firms and a limited number of investors in connection with its nomination of a slate of directors to the Board at the 2013 Annual Meeting. Moab issued a press release announcing its decision to nominate three independent directors to the Board. Moab filed a Schedule 13D (the “2013 Schedule 13D”) and Schedule 14A with the SEC that included copies of the letters to the Company and Board, the press release, and presentation.

On March 20, 2013, Moab sent a letter to the Company demanding that it provide certain documents, including, but not limited to, the Company’s stock ledger and a complete record of holders and beneficial owners of the Company’s common stock, that Moab could use in its proxy solicitation process.

On April 8, 2013, the Company filed its preliminary proxy statement on Schedule 14A in respect of the 2013 Annual Meeting and issued a press release announcing, among other things, that its Board had approved the termination of the Company’s Shareholder Rights Plan, and that the Board recommends to stockholders an amendment to the Company’s charter that would remove the supermajority requisite for amendments to the Company’s By-Laws. We believe that these latest measures would not have been considered or approved by the Board if not for this proxy solicitation by Moab and pressure from other large stockholders of Mac-Gray. These measures, in our opinion, are too little too late, particularly in light of the Board’s poor performance history, poor financial execution, and numerous acts to entrench itself and reject stockholder-friendly initiatives. Moab believes that meaningful independent shareholder representation on the Board is necessary to revitalize Mac-Gray’s value for stockholders.

On April 22, 2013, Moab issued a press release soliciting support for its slate of nominees for election as directors to the Company’s Board of Directors at the 2013 Annual Meeting and explaining its reasons for the solicitation.

On April 29, 2013, the Company filed its definitive proxy statement on Schedule 14A in respect of the 2013 Annual Meeting. The Board in the proxy materials indicated that it has determined to nominate only two of the three current Class I directors for re-election and will reduce the number of directors on the Board to seven members. We strongly feel that by effectively preventing the election of a third independent candidate for election as a Class I director, the Board is engaging in anti-stockholder tactics to entrench the control of its incumbent members and prevent a greater level of independent stockholder participation in the management of the Company.

-19-

PARTICIPANTS

The following are, under SEC rules, participants in this solicitation of proxies from the Company’s stockholders in connection with the upcoming election of the Company’s Board of Directors: Moab Capital Partners, LLC, Moab Partners, L.P., Michael R. Rothenberg and each of the other Moab Nominees. The business addresses and ownership of Company securities with respect to each of the participants is provided in Exhibit A hereto. Transactions in Company securities by the participants are described on Exhibit B hereto. Other than as set forth in this Proxy Statement, including the exhibits hereto, none of the participants have any substantial interest, direct or indirect, in the matters to be voted on at the Annual Meeting.

VOTING INFORMATION AND PROCEDURES

Who Can Vote at the Annual Meeting

The record date for determining stockholders entitled to notice of and to vote at the Annual Meeting is April 25, 2013 (the “Record Date”). Stockholders of the Company as of the Record Date are entitled to one vote at the Annual Meeting for each share of common stock of the Company, $0. 01 par value per share (the “Common Stock”), held on the Record Date. The Company stated in its proxy statement on Schedule 14A filed April 29, 2013 that there were 14,613,980 outstanding shares of common stock of the Company as of April 25, 2013. There are no cumulative voting rights.

How to Vote

You may vote by mail or by telephone.

You may vote by mail by signing your BLUE proxy card and returning it in the enclosed, prepaid and addressed envelope. If you mark your voting instructions on the proxy card, your shares will be voted as you instruct. If you sign and return a BLUE proxy card but do not make any specific choices, your shares will be voted FOR the election of the Moab Nominees, FOR Proposal 2, AGAINST Proposal 3 and will not be voted (i.e., will be ABSTENTIONS) with respect to Proposal 4.

You may also vote by telephone by following the instructions on your BLUE proxy card.

You may vote in person at the meeting.

We will ask the Company to pass out written ballots to anyone who wants to vote at the meeting. If you hold your shares in street name, you must request a legal proxy from your stockbroker in order to vote at the meeting. Holding shares in “street name” means your shares of stock are held in an account by your stockbroker, bank, or other nominee, and the stock certificates and record ownership are not in your name. If your shares are held in “street name” and you wish to attend the Annual Meeting, you must notify your broker, bank, or other nominee and obtain the proper documentation to vote your shares at the Annual Meeting.

If any of your shares are held in the name of a brokerage firm, bank, bank nominee or other institution on the record date, only that entity can vote your shares and only upon its receipt of your specific instructions. Accordingly, please contact the person responsible for your account at such entity and instruct that person to execute and return our proxy card on your behalf indicating a vote FOR the election of the Moab Nominees in Proposal 1, FOR Proposal 2, and AGAINST Proposal 3. If you do not indicate to the person responsible for your account how to vote with respect to Proposal 4, your shares will not be voted (i.e., will be ABSTENTIONS) with respect to the ratification of the selection of McGladrey LLP as the Company’s independent auditors. You should also sign, date and mail the voting instruction form your broker or banker sends you when you receive it (or, if applicable, vote by following the instructions supplied to you by your bank or brokerage firm, including voting by telephone or via the Internet). Please do this for each account you maintain to ensure that all of your shares are voted.

-20-

A large number of banks and brokerage firms are participating in a program that allows eligible stockholders to vote by telephone or via the Internet. If your bank or brokerage firm is participating in the telephone voting program or Internet voting program, then such bank or brokerage firm will provide you with instructions for voting by telephone or the Internet on the voting form. Telephone and Internet voting procedures, if available through your bank or brokerage firm, are designed to authenticate your identity to allow you to give your voting instructions and to confirm that your instructions have been properly recorded to vote FOR the election of the Moab Nominees in Proposal 1, FOR Proposal 2, and AGAINST Proposal 3. If you do not indicate by telephone or via the Internet how to vote with respect to Proposal 4, your shares will not be voted (i.e., will be ABSTENTIONS) with respect to the ratification of the selection of McGladrey LLP as the Company’s independent auditors. Stockholders voting via the Internet should understand that there might be costs that they must bear associated with electronic access, such as usage charges from Internet access providers and telephone companies.

If your bank or brokerage firm does not provide you with a voting form, but you instead receive our proxy card, you should mark the proxy card to indicate a vote FOR the election of the Moab Nominees in Proposal 1, FOR Proposal 2, and AGAINST Proposal 3, date it and sign it, and return it in the provided envelope. If you do not indicate on our proxy card how to vote with respect to Proposal 4, your shares will not be voted (i.e., will be ABSTENTIONS) with respect to the ratification of the selection of McGladrey LLP as the Company’s independent auditors.

Revocability of Proxies

Any proxy may be revoked by you at any time prior to the time a vote is taken by delivering to the Secretary of the Company a notice of revocation bearing a later date, by delivering a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person.

Holders who used Internet or telephone voting procedures can follow the revocation procedures specified on the Internet voting site or via the telephone voting program. Holders whose shares are held through a broker in “street name” can instruct the broker to change or revoke any instructions previously given for voting their shares. Holders who wish assistance in contacting the Company or their broker can contact Alliance Advisors, LLC (“Alliance Advisors”) at (888) 991-1298 (toll free) or (973) 873-7721 (collect).

Only holders of record as of the close of business on the Record Date will be entitled to vote at the Annual Meeting. If you were a stockholder of record on the Record Date, you will retain your voting rights for the Annual Meeting even if you sell your shares after the Record Date. Accordingly, it is important that you vote the shares held by you on the Record Date, or grant a proxy to vote such shares, even if you sell such shares after the Record Date.

ALTHOUGH YOU MAY VOTE MORE THAN ONCE, ONLY ONE PROXY WILL BE COUNTED AT THE ANNUAL MEETING, AND THAT WILL BE YOUR LATEST-DATED, VALIDLY EXECUTED PROXY.

-21-

Quorum Requirement

The presence, in person or by proxy, of a majority of the shares of Common Stock outstanding entitled to vote as of the Record Date at the Annual Meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting or withhold your votes. Broker non-votes also will be counted for purposes for determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

Required Vote

With respect to Proposal 1 and assuming a quorum is present, two nominees, whether nominated by Mac-Gray or Moab, who receive the greatest number of affirmative votes cast in the election will be elected to the Board as Class I directors. Abstentions and broker non-votes will not be counted as votes cast and therefore will have no effect on the outcome of election.

With respect to Proposal 2 and assuming a quorum is present, approval of the amendment to the Company’s charter document will require the affirmative vote of a majority of the outstanding shares entitled to vote on such amendment. Abstentions and broker non-votes will be treated as votes against Proposal 2.

With respect to Proposal 3 and assuming a quorum is present, approval of the executive compensation resolution will require the affirmative vote of a majority of the votes cast in person or by proxy at the Annual Meeting. Abstentions and broker non-votes will not be deemed to count either for or against Proposal 3 and therefore will have no effect on the outcome of Proposal 3.

With respect to Proposal 4 and assuming a quorum is present, ratification of the selection of McGladrey LLP as the Company’s independent auditors will require the affirmative vote of a majority of the votes cast in person or by proxy at the Annual Meeting. Abstentions and broker non-votes will not be deemed to count either for or against Proposal 4 and therefore will have no effect on the outcome of Proposal 4.

Appraisal Rights

The Company’s stockholders have no appraisal rights under Delaware General Corporation Law in connection with the Annual Meeting.

Solicitation

The entire expense of preparing and mailing this Proxy Statement and any other soliciting material and the total expenditures relating to the solicitation of proxies (including, without limitation, costs, if any, related to advertising, printing, fees of attorneys, financial advisors, solicitors, accountants, public relations, transportation and litigation) will be borne by Moab. In addition to the use of the mails, proxies may be solicited by Moab, other Participants and/or their employees by telephone, telegram, and personal solicitation, for which no additional compensation will be paid to those persons engaged in such solicitation. Moab has also retained Alliance Advisors as information agent.

Moab estimates that its total expenditures relating to the solicitation of proxies will be approximately $170,000 (including, without limitation, costs, if any, related to advertising, printing, fees of attorneys, accountants, public relations, transportation, and litigation). Total cash expenditures to date relating to this solicitation have been approximately $60,000. Moab currently intends to seek reimbursement from the Company for its actual expenses in connection with this solicitation.

-22-

ADDITIONAL INFORMATION ABOUT PARTICIPANTS

None of the Moab Nominees is employed by the Company. All of the Moab Nominees are citizens of the United States. All the Moab Nominees satisfy the independence requirements of Item 407 of Regulation S-K.

None of Moab, any of the persons participating in this proxy solicitation on behalf of Moab or any of its nominees within the past ten years (i) has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting activities subject to, federal or state securities laws, or finding any violation with respect to such laws; (iii) was a party to a civil proceeding which ultimately mandated activities that were subject to federal securities laws.

Except as set forth in this Proxy Statement or in the annexes hereto, none of Moab, any of the persons participating in this proxy solicitation on behalf of Moab, the Moab Nominees or, with respect to items (i), (vii) and (viii) of this paragraph, any associate (within the meaning of Rule 14a-1 of the Securities Exchange Act of 1934) of the foregoing persons (i) owns beneficially, directly or indirectly, any securities of the Company, (ii) owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company, (iii) owns any securities of the Company of record but not beneficially, (iv) has purchased or sold any securities of the Company within the past two years, (v) has incurred indebtedness for the purpose of acquiring or holding securities of the Company, (vi) is or has within the past year been a party to any contract, arrangement or understanding with respect to any securities of the Company, (vii) since the beginning of the Company’s last fiscal year has been indebted to the Company or any of its subsidiaries in excess of $120,000 or (viii) has any arrangement or understanding with respect to future employment by the Company or with respect to any future transactions to which the Company or any of its affiliates will or may be a party. In addition, except as set forth in this Proxy Statement or in the annexes hereto, none of Moab, any of the persons participating in this proxy solicitation on behalf of Moab, the Moab Nominees and any associates of the foregoing persons, has had or is to have a direct or indirect material interest in any transaction or proposed transaction with the Company in which the amount involved exceeds $120,000, since the beginning of the Company’s last fiscal year.

Except as set forth in this Proxy Statement or in the annexes hereto, none of the Moab nominees, since the beginning of the Company’s last fiscal year, has been affiliated with (i) any entity that made or received, or during the Company’s current fiscal year proposes to make or receive, payments to or from the Company or its subsidiaries for property or services in excess of five percent (5%) of either the Company’s or such entity’s consolidated gross revenues for its last full fiscal year, or (ii) any entity to which the Company or its subsidiaries were indebted at the end of the Company’s last full fiscal year in an aggregate amount exceeding five percent (5%) of the Company’s total consolidated assets at the end of such year. None of the Moab Nominees is, or during the Company’s last fiscal year has been, affiliated with any law or investment banking firm that has performed or proposes to perform services for the Company.

Except as set forth in this Proxy Statement, none of the corporations or organizations in which the Moab Nominees have conducted their principal occupation or employment was a parent, subsidiary or other affiliate of the Company, and the Moab Nominees do not hold any position or office with the Company or have any family relationship with any executive officer or director of the Company or have been involved in any proceedings, legal or otherwise, of the type required to be disclosed by the rules governing this solicitation.

-23-

We have no reason to believe that any of the Moab Nominees will be disqualified or unwilling or unable to serve if elected. Moab reserves the right to nominate substitute persons if the Company makes or announces any changes to its bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any of the Moab Nominees. In such event the Company may claim a substitution is not proper under its charter and bylaws. In addition, if any additional directorships are to be voted upon at the Annual Meeting, Moab reserves the right to nominate additional persons to fill the added positions and will appropriately amend this Proxy Statement. In such case, shares represented by proxies given to us will be voted for any substitute or additional nominees of Moab.

Section 16(a) Beneficial Ownership Reporting Compliance

No Moab Nominee has failed to file any reports related to the Company that are required by Section 16(a) of the Securities Exchange Act of 1934, as amended.

STOCKHOLDER PROPOSALS

Any stockholder of the Company meeting certain notice and information requirements may present a proposal to be included in the Company’s proxy statement for action at the annual meeting of stockholders to be held in 2014 (the “2014 Annual Meeting”) pursuant to Rule 14a-8 of the Exchange Act. Such stockholder must deliver such proposal to the Company’s corporate secretary at Mac-Gray Corporation, 404 Wyman Street, Suite 400, Waltham, MA 02451, not later than the 90th day and not earlier than the 120th day prior to the first anniversary of the Company’s 2013 annual meeting of stockholders. When the Company releases its definitive proxy statement, it will contain the specific date of its 2013 annual meeting of stockholders (the “2013 Annual Meeting”).

Stockholder proposals to be presented at the Company’s 2014 Annual Meeting that are not to be included in the Company’s proxy statement, including nominees for the Company’s Board of Directors, must be received by the Company no earlier than January 30, 2014 and no later than March 1, 2014, which dates may change if the date of the 2013 annual meeting of stockholders (the “2013 Annual Meeting”) is changed for any reason. In the event that the Company’s 2014 Annual Meeting is more than 30 days before the anniversary date of the 2013 Annual Meeting or more than 60 days after the anniversary date of the 2013 Annual Meeting, stockholder proposals must be received by the Company not later than (i) the 90th day prior to the 2014 Annual Meeting or (ii) the 10th day following the initial public announcement of the 2014 Annual Meeting date, whichever occurs later.

Where You Can Find More Information

The Company files annual, quarterly and special reports, proxy statements, and other information with the SEC. You may read and copy any reports, statements, or other information the Company files with the SEC at the SEC’s public reference room at Station Place, 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. These SEC filings are also available to the public from commercial document retrieval services and at the Internet World Wide Web site maintained by the SEC at http://www.sec.gov by selecting “More Search Options” at the top right and then typing “Digirad” into the box asking for the Company Name.

-24-

OTHER MATTERS

As of the date of this Proxy Statement, we are not aware of any other matter that will be presented for consideration at the Annual Meeting. However, we do not set the agenda, and the Company may submit additional matters.

Even if you have already returned a proxy card to management, you have every right to revoke your earlier vote by signing, dating and mailing a BLUE proxy card today.

-25-

REMEMBER . . . ONLY YOUR LATEST DATED PROXY COUNTS.

LET’S MAKE THE STOCKHOLDERS A PRIORITY AT MAC-GRAY CORPORATION.

SUPPORT OUR EFFORTS TO MAXIMIZE STOCKHOLDER VALUE.

VOTE THE BLUE PROXY CARD TODAY!

YOUR VOTE IS IMPORTANT—PLEASE CALL IF YOU HAVE QUESTIONS

We have retained Alliance Advisors to act as information agent in connection with this proxy solicitation. If you have any questions or require any assistance, including regarding online access to Moab’s proxy materials, please contact Alliance Advisors, at the following address and telephone number:

If you have any questions, require assistance in voting your shares, or need additional copies of Moab’s proxy materials, please call Alliance Advisors at the phone numbers or email address listed below.

Alliance Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

(973) 873-7721 (call collect)

Or

TOLL-FREE (888) 991-1298

IT IS IMPORTANT THAT YOU RETURN YOUR PROXY PROMPTLY. PLEASE SIGN AND DATE THE ACCOMPANYING BLUE PROXY CARD AFTER INDICATING A VOTE FOR OUR NOMINEES IN PROPOSAL 1, FOR PROPOSAL 2 AND AGAINST PROPOSAL 3 AND PROMPTLY RETURN YOUR PROXY USING THE ENCLOSED POSTAGE-PAID ENVELOPE. ABSENT STOCKHOLDER INSTRUCTIONS, WE INTEND TO ABSTAIN FROM VOTING ON PROPOSAL 4. WE URGE YOU TO CONSIDER CAREFULLY YOUR VOTE ON THE RATIFICATION OF THE SELECTION OF MCGLADREY LLP AS THE COMPANY’S INDEPENDENT AUDITOR.

-26-

EXHIBIT A

INFORMATION ABOUT THE PARTICIPANTS

IN THIS SOLICITATION OF PROXIES

NAME AND ADDRESS | NUMBER OF SHARES DIRECTLY OWNED | NUMBER OF SHARES BENEFICIALLY OWNED | PERCENT OF CLASS BENEFICIALLY OWNED (1) | |||||||||

Moab Capital Partners, LLC (2)(3) | 0 | 1,338,127 | 9.2 | % | ||||||||

Moab Partners, L.P. (2)(4) | 200 | 1,338,127 | 9.2 | % | ||||||||

Michael Rothenberg (2)(3) | 0 | 1,338,127 | 9.2 | % | ||||||||

James E. Hyman TestAmerica Laboratories, Inc. 19 Old Kings Highway South Suite 100 Darien, CT 06820 | 0 | 0 | 0 | |||||||||

| (1) | Based on 14,613,980 shares of common stock of the Company outstanding on April 25, 2013, as reported in the Company’s proxy statement on Schedule 14A filed April 29, 2013. |

| (2) | The business address for each of Moab Capital, Moab Partners and Mr. Rothenberg is: 15 East 62nd Street, New York, NY 10065 |

| (3) | The shares reported as beneficially owned by Moab Capital and Mr. Rothenberg are those owned by Moab Partners. |

| (4) | Moab Partners effects transactions in securities primarily through margin accounts maintained with JP Morgan Securities Corp., which may extend margin credit to Moab Partners as and when required to open or carry positions in the margin accounts, subject to applicable federal margin regulations, stock exchange rules and the firm’s credit policies. In such instances, the positions held in the margin accounts are pledged as collateral security for the repayment of debit balances in the account. |

A-1

EXHIBIT B

TRANSACTIONS WITHIN THE PAST TWO YEARS BY THE PARTICIPANTS

IN THIS SOLICITATION OF PROXIES

Moab has made the following purchases and sales of the Company’s securities in the past two years:

Trade Date | U.S. Dollar Amount | Quantity of Shares | Party to the Transaction | |||

PURCHASES | ||||||

1/5/11 | $1,790 | 122 | Moab Partners, L.P. | |||

1/6/11 | $14,695 | 1,000 | Moab Partners, L.P. | |||

1/19/11 | $58,748 | 4,000 | Moab Partners, L.P. | |||

1/20/11 | $4,989 | 339 | Moab Partners, L.P. | |||

1/20/11 | $50,618 | 3,420 | Moab Partners, L.P. | |||

1/21/11 | $188,559 | 13,000 | Moab Partners, L.P. | |||

1/21/11 | $8,703 | 600 | Moab Partners, L.P. | |||

1/21/11 | $14,598 | 1,007 | Moab Partners, L.P. | |||

1/24/11 | $56,622 | 3,850 | Moab Partners, L.P. | |||

1/26/11 | $65,305 | 4,429 | Moab Partners, L.P. | |||

1/28/11 | $32,333 | 2,220 | Moab Partners, L.P. | |||

1/31/11 | $65,203 | 4,459 | Moab Partners, L.P. | |||

2/4/11 | $50,656 | 3,429 | Moab Partners, L.P. | |||

2/4/11 | $2,977 | 200 | Moab Partners, L.P. | |||

2/8/11 | $65,550 | 4,452 | Moab Partners, L.P. | |||

2/9/11 | $72,605 | 4,897 | Moab Partners, L.P. | |||

2/28/11 | $238,892 | 15,085 | Moab Partners, L.P. | |||

3/1/11 | $15,714 | 1,000 | Moab Partners, L.P. | |||

3/2/11 | $40,328 | 2,600 | Moab Partners, L.P. | |||

3/3/11 | $261,694 | 16,700 | Moab Partners, L.P. | |||

3/7/11 | $23,627 | 1,519 | Moab Partners, L.P. | |||

3/10/11 | $197,618 | 13,300 | Moab Partners, L.P. | |||

3/11/11 | $32,720 | 2,259 | Moab Partners, L.P. | |||

3/14/11 | $34,345 | 2,378 | Moab Partners, L.P. | |||

3/15/11 | $86,022 | 6,027 | Moab Partners, L.P. | |||

3/16/11 | $128,609 | 9,007 | Moab Partners, L.P. | |||

3/17/11 | $180,512 | 12,567 | Moab Partners, L.P. | |||