UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

Mac-Gray Corporation

(Name of Registrant as Specified In Its Charter)

Moab Partners, L.P. a Delaware limited partnership

Moab Capital Partners, LLC, a Delaware limited liability company

Michael M. Rothenberg

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

On May 8, 2013, Moab Capital Partners, LLC, on behalf of Moab Partners, L.P. (collectively, “Moab”), a shareholder of Mac-Gray Corporation (the “Company”), prepared the following PowerPoint presentation to be used in speaking with ISS Proxy Advisory Services (ISS) on May 9 in regards to Moab’s proxy solicitation for the election of its slate of nominees to the Company’s board of directors (the “Board”) prior to the filing of definitive proxy. This PowerPoint presentation may be regarded as expressing an intent to consider, among other actions, enhanced distributions by the Company, a change in capitalization or dividend policy, a greater willingness to consider acquisition proposals or a change in the Company’s charter by removing a staggered board.

On May 9, 2013, Moab’s managing member, Michael Rothenberg, and James Hyman, each a Moab nominee for director to the Company’s Board, participated in a conference call with ISS in which they presented the reasons in favor of their election to the Board and their plans for the Company in the event of their election. The text of the Mr. Rothenberg’s and Mr. Hyman’s discourse during the conference call with ISS is provided herein. This discourse contains the expression of opinions and viewpoints of Moab, Mr. Rothenberg and Mr. Hyman. Anyone reading the text of the discourse should understand that it was given and intended to be received in conjunction with the PowerPoint presentation which is also a part of this Schedule 14A filing.

Form of Presentation

| It's time for change at 9 May 2013 |

| MOAB CAPITAL PARTNERS, LLC ("MOAB CAPITAL") WILL FILE A PROXY STATEMENT REGARDING THE ELECTION OF DIRECTORS OF MAC-GRAY CORPORATION (THE "COMPANY") AT THE COMPANY'S 2013 ANNUAL MEETING OF STOCKHOLDERS. SECURITY HOLDERS ARE ADVISED TO READ THIS PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY MOAB PARTNERS, L.P. FROM THE STOCKHOLDERS OF MAC-GRAY CORPORATION FOR USE AT ITS 2013 ANNUAL MEETING WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, THIS DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE AVAILABLE TO STOCKHOLDERS OF MAC-GRAY CORPORATION AT NO CHARGE FROM THE PARTICIPANTS AND AT THE SECURITIES AND EXCHANGE COMMISSION'S WEBSITE AT WWW.SEC.GOV. THE FOLLOWING ARE, UNDER SEC RULES, PARTICIPANTS IN THE SOLICITATION OF PROXIES FROM THE COMPANY'S STOCKHOLDERS IN CONNECTION WITH THE UPCOMING ELECTION OF THE COMPANY'S BOARD OF DIRECTORS: (I) MOAB CAPITAL, (II) THE OFFICERS AND MANAGEMENT OF MOAB CAPITAL, INCLUDING MICHAEL ROTHENBERG, (III) MOAB PARTNERS, L.P. AND (IV), JAMES HYMAN, MICHAEL ROTHENBERG, THE INDIVIDUALS NOMINATED BY MOAB CAPITAL FOR DIRECTOR. INFORMATION REGARDING THE PARTICIPANTS AND THEIR INTERESTS MAY BE FOUND IN FILINGS BY MOAB CAPITAL WITH THE SEC ON MARCH 5, 2013. |

| Moab Capital Partners, LLC ("Moab") is an investment adviser to funds that are in the business of buying and selling securities and other financial instruments. Moab currently has a long position in Mac-Gray Corporation ("Mac-Gray" or the "Company") common stock. We do not own any options on Mac-Gray common stock (NYSE: TUC). Moab will profit if the trading price of Mac-Gray common stock increases and will lose money if the trading price of common stock of Mac-Gray decreases. Moab may change its views about or its investment positions in Mac-Gray at any time, for any reason or no reason. Moab may buy or sell or otherwise change the form or substance of its Mac-Gray investment. Moab disclaims any extraordinary obligation to notify the market of any such changes except as required by the United States securities laws or other law. The information and opinions expressed in this presentation (the "Presentation") are based on publicly available information about Mac-Gray. Moab recognizes that there may be non-public information in the possession of Mac-Gray or others that could lead Mac-Gray or others to disagree with Moab's analyses, conclusions and opinions. The Presentation may include forward-looking statements, estimates, projections and opinions prepared with respect to, among other things, certain legal and regulatory issues Mac-Gray faces and the potential impact of those issues on its future business, financial condition and results of operations, as well as, more generally, Mac-Gray's anticipated operating performance, access to capital markets, market conditions, assets and liabilities. Such statements, estimates, projections and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Moab's control. Although Moab believes the Presentation is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements therein not misleading, Moab makes no representation or warranty, express or implied, as to the accuracy or completeness of the Presentation or such communications (or any inaccuracies or omissions therein). Thus, shareholders and others should conduct their own independent investigation and analysis of the Presentation and of Mac-Gray. The Presentation is not investment advice or a recommendation or solicitation to buy or sell any securities. Except where otherwise indicated, the Presentation speaks as of the date hereof, and Moab undertakes no obligation to correct, update or revise the Presentation or to otherwise provide any additional materials. Moab also undertakes no commitment to take or refrain from taking any action with respect to Mac-Gray or any other company. As used herein, except to the extent the context otherwise requires, Moab includes its affiliates and its and their respective partners, directors, officers and employees. Disclaimer 2 |

| Subpar share price performance: Mac-Gray's share price has underperformed the Russell 2000 Index over 1-year and 3-year periods, which corresponds to the post-recession period. The stock is trading 24% below the rejected KP Capital's offer two years later. Failure to benefit from improved end-market fundamentals: Mac-Gray has failed to capitalize on improved end-market dynamics, where vacancy rates have dropped to the lowest level in over a decade. Since 2010, revenues are up by a meager 0.7% and Adjusted EBITDA has declined by 4.1%, while vacancy rates dropped from 8% in 1Q2010 to 4.3% in 1Q2013. Mac-Gray's competitors have done much better. Accelerated earnings deterioration: The 1Q2013 report released on May 2, 2013 demonstrated that Mac-Gray's business fundamentals are rapidly deteriorating. In the quarter revenue declined by 3.1% and gross profit by 6.7% over the same quarter last year. After excluding $2.2 million of litigation expense that was incurred in 1Q2012 (part of SG&A), Adjusted EBITDA declined 5.9% in the first quarter over the same period last year. The Company is now attributing deterioration in the core business to laundry becoming a "discretionary consumer purchase" even though its peers are thriving and previously it had blamed poor performance on low vacancy rates (which now are at decade low levels). History of overpriced, dilutive acquisitions: As long serving incumbent directors, Mary Tocio and David Bryan, must be held accountable for approving Mac-Gray's history of overpriced, dilutive acquisitions. Since 2003, Mac-Gray has spent $316 million on acquisitions for approx. $200 million in annualized revenue. The amount spent on acquisitions is 1.5x the current market capitalization of $194.4 million. As further evidence of the failed acquisition strategy, despite Mac-Gray's claim in it discussion of operations in almost every periodic SEC filing that it has implemented price increases, organic revenue has increased by ZERO since 2003. Disregard for shareholder rights: The incumbent directors have exhibited almost complete disregard for shareholder rights by ignoring shareholder approved proposals for two years, resulting in a ZERO governance score by Institutional Shareholder Services ("ISS") last year. It is only after the threat of another proxy contest emerged did the Board decide to reduce the threshold needed to amend bylaws but it continues to ignore stockholder approved proposals to declassify the Board. 3 Why Change is Needed |

| Share Performance and Operating Metrics |

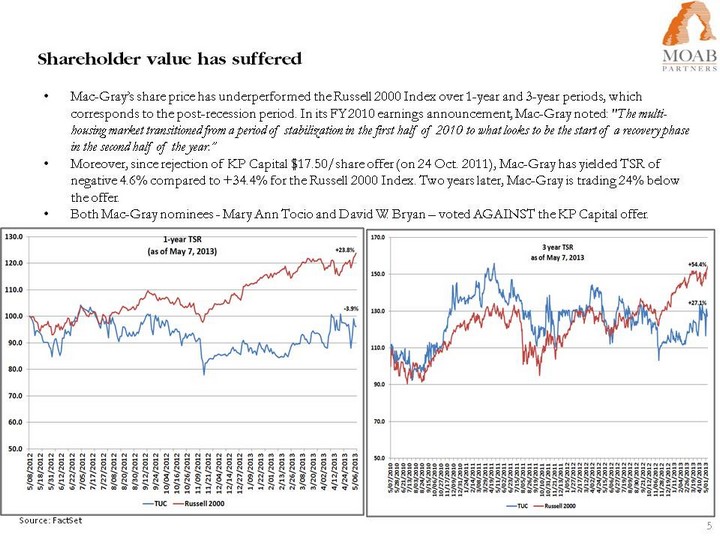

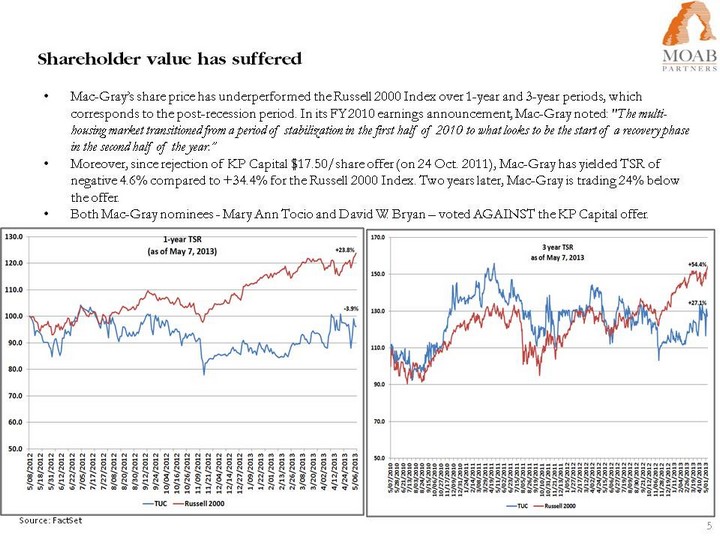

| Mac-Gray's share price has underperformed the Russell 2000 Index over 1-year and 3-year periods, which corresponds to the post-recession period. In its FY2010 earnings announcement, Mac-Gray noted: "The multi- housing market transitioned from a period of stabilization in the first half of 2010 to what looks to be the start of a recovery phase in the second half of the year." Moreover, since rejection of KP Capital $17.50/share offer (on 24 Oct. 2011), Mac-Gray has yielded TSR of negative 4.6% compared to +34.4% for the Russell 2000 Index. Two years later, Mac-Gray is trading 24% below the offer. Both Mac-Gray nominees - Mary Ann Tocio and David W. Bryan - voted AGAINST the KP Capital offer. 5 Shareholder value has suffered Source: FactSet |

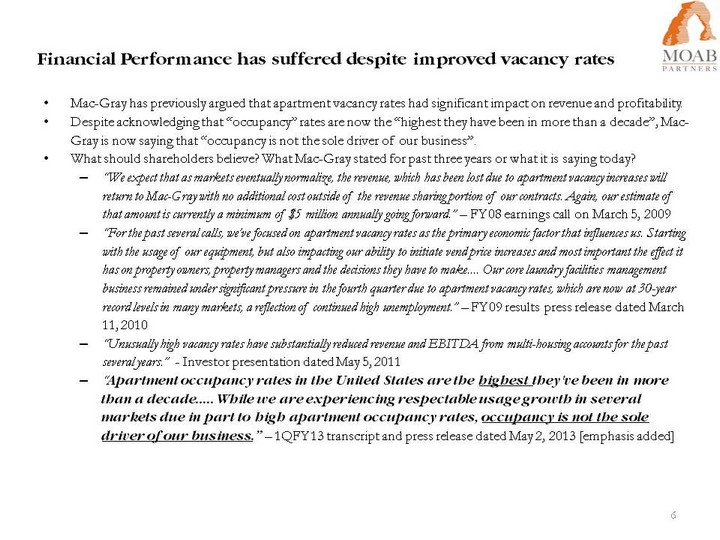

| Mac-Gray has previously argued that apartment vacancy rates had significant impact on revenue and profitability. Despite acknowledging that "occupancy" rates are now the "highest they have been in more than a decade", Mac- Gray is now saying that "occupancy is not the sole driver of our business". What should shareholders believe? What Mac-Gray stated for past three years or what it is saying today? "We expect that as markets eventually normalize, the revenue, which has been lost due to apartment vacancy increases will return to Mac-Gray with no additional cost outside of the revenue sharing portion of our contracts. Again, our estimate of that amount is currently a minimum of $5 million annually going forward." - FY08 earnings call on March 5, 2009 "For the past several calls, we've focused on apartment vacancy rates as the primary economic factor that influences us. Starting with the usage of our equipment, but also impacting our ability to initiate vend price increases and most important the effect it has on property owners, property managers and the decisions they have to make.... Our core laundry facilities management business remained under significant pressure in the fourth quarter due to apartment vacancy rates, which are now at 30-year record levels in many markets, a reflection of continued high unemployment." - FY09 results press release dated March 11, 2010 "Unusually high vacancy rates have substantially reduced revenue and EBITDA from multi-housing accounts for the past several years." - Investor presentation dated May 5, 2011 "Apartment occupancy rates in the United States are the highest they've been in more than a decade..... While we are experiencing respectable usage growth in several markets due in part to high apartment occupancy rates, occupancy is not the sole driver of our business." - 1QFY13 transcript and press release dated May 2, 2013 [emphasis added] 6 Financial Performance has suffered despite improved vacancy rates |

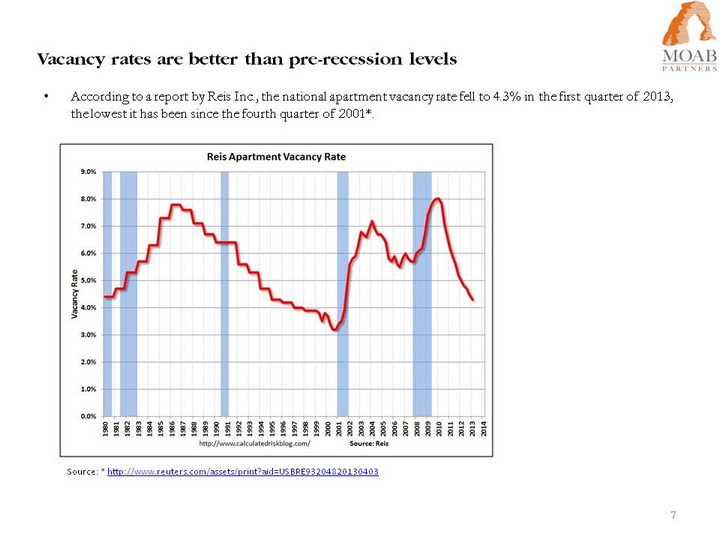

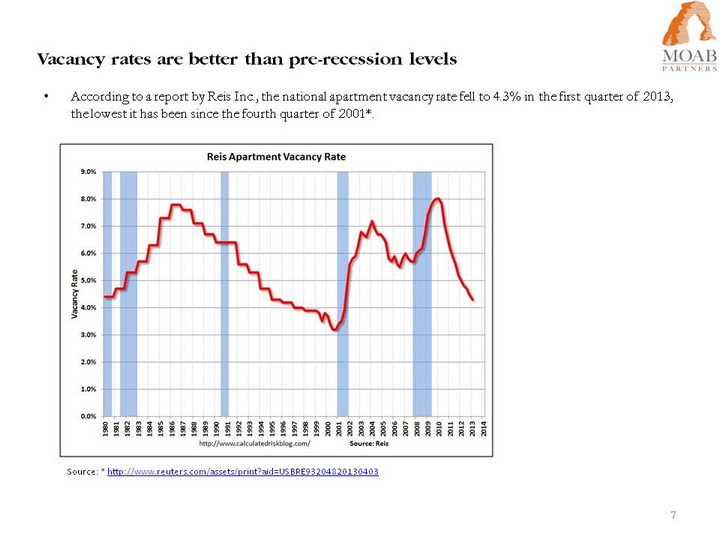

| According to a report by Reis Inc., the national apartment vacancy rate fell to 4.3% in the first quarter of 2013, the lowest it has been since the fourth quarter of 2001*. 7 Vacancy rates are better than pre-recession levels Source: * http://www.reuters.com/assets/print?aid=USBRE93204820130403 |

| In March 2009, Mac-Gray estimated the impact of high vacancy rates on revenue to be at least $5 million annually. Given current vacancy rates are now lower than that in 2008, Mac-Gray's revenue should be even higher than. $332 million (FY08 revenue of $327mn +$5mn of lost revenue) - without accounting for any organic growth - compared to the actual FY12 revenue of $322 million. Apartment vacancy rates have declined from 8% in 1Q2010 (6.6% in 4Q2010) to 4.3% currently. Despite such a massive improvement in end-market fundamentals, Mac-Gray's revenue increased by a meager $2.1 million or 0.7% during this period. 8 Despite improved end-market dynamics, Mac-Gray has stagnated Source: 10k |

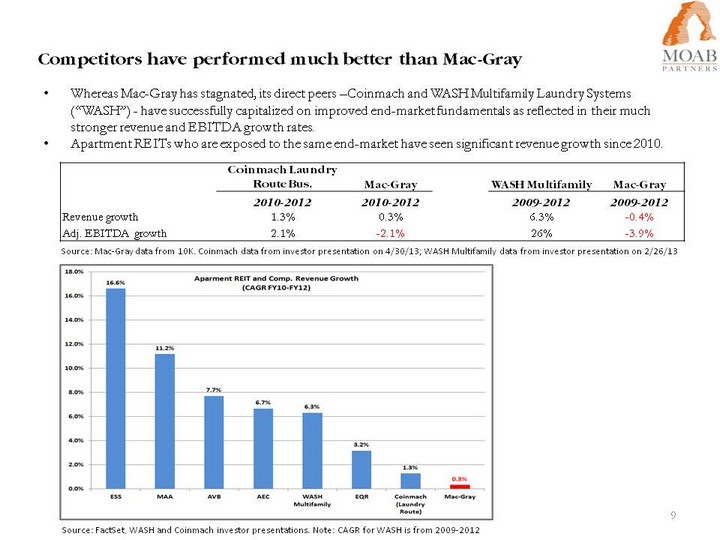

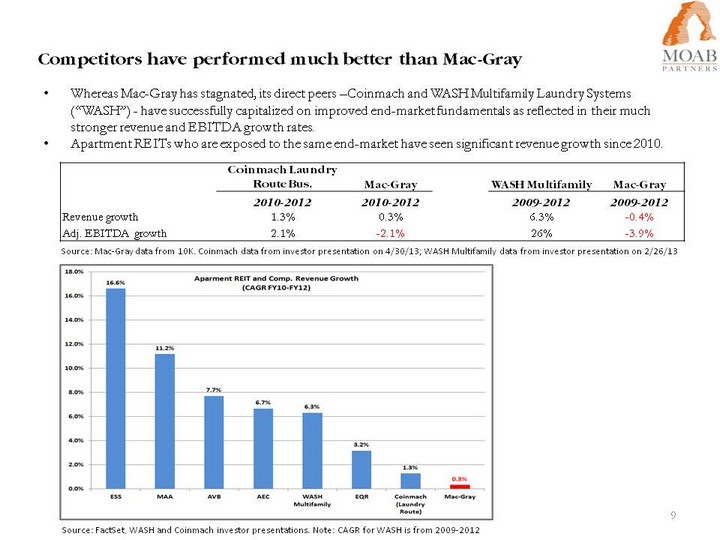

| Whereas Mac-Gray has stagnated, its direct peers -Coinmach and WASH Multifamily Laundry Systems ("WASH") - have successfully capitalized on improved end-market fundamentals as reflected in their much stronger revenue and EBITDA growth rates. Apartment REITs who are exposed to the same end-market have seen significant revenue growth since 2010. 9 Competitors have performed much better than Mac-Gray Source: Mac-Gray data from 10K. Coinmach data from investor presentation on 4/30/13; WASH Multifamily data from investor presentation on 2/26/13 Coinmach Laundry Route Bus. Mac-Gray WASH Multifamily Mac-Gray 2010-2012 2010-2012 2009-2012 2009-2012 Revenue growth 1.3% 0.3% 6.3% -0.4% Adj. EBITDA growth 2.1% -2.1% 26% -3.9% Source: FactSet, WASH and Coinmach investor presentations. Note: CAGR for WASH is from 2009-2012 |

| As noted earlier, Coinmach and WASH Multifamily have not only outperformed Mac-Gray in terms of revenue and Adj. EBITDA growth rate since the beginning of recovery in 2010, but are also operating more efficiently as indicated by their superior EBITDA margin. 10 Competitors have significantly higher profit margins Source: Coinmach investor presentation on 4/30/13 |

| Not only has Mac-Gray failed to benefit from improved apartment vacancy rates, but its profit margins have deteriorated to levels that are even below what the Company achieved during the recession period. Shareholders should remember that during its proxy contest in 2011, Mac-Gray laid out a strategy that included enhancing operational efficiency through Change Point Technology and taking advantage of attractive acquisition opportunities. Since 2011, no material acquisitions have been announced and operational efficiency has worsened as evidenced by the Company's declining EBITDA margins. Obviously, Change Point has not been a game changer, as promised by the Company. 11 Inability to grow revenue has resulted in failure to benefit from cost leverage Source: 10kK filing. Reported Adjusted EBITDA not adjusted for $2.2 million litigation expense incurred in 1Q2012 |

| In 1Q2013 revenue declined by 3.1% and gross profit by 6.7% over the same quarter last year. After excluding litigation expense from 1Q2012 SG&A, Adjusted EBITDA declined by 5.9% sequentially in the first quarter. While, 1Q2013 gross margin is slightly higher than for FY2012, it is worth noting that FY2012 gross margin was 220bps lower than in 1Q2012. This is primarily due to college related revenue stream. More importantly, gross margin in 1Q2013 was 69bps lower than in comparable period 1Q2012. As noted above, the reported year-over-year increase in 1Q2013 Adj. EBITDA margin is primarily due to the inclusion of a one-time litigation expense in 1Q2012 SG&A expense - and not due to any operational efficiency. Overall, 1Q2013 results indicate continued weakness in the core business and it appears that the pace of margin erosion is accelerating. 12 Deterioration in core business continued in 1Q2013 Adjusted EBITDA excludes one-time litigation expenses for 1Q2012. Note first quarter margins are seasonally higher than full year due to college occupancy. Source: 10k and 8k filing |

| Mac-Gray is suffering from deteriorating Cash ROIC and Cash ROE 13 |

| During 2004-2012, Mac-Gray spent $316 million on acquisitions for approx. $200 million in annualized revenue. The amount spent on acquisitions is 1.5x the current market capitalization of $194.4 million. Net revenue acquired (after MicroFridge divestiture) over this period is exactly equal to the company's reported revenue for the twelve months ended March 31, 2013. This implies that the Company generated ZERO organic revenue growth in the last 9 years despite numerous price increases during that time (see appendix for details). The two incumbent nominees have approved a failed acquisition strategy 14 Source: 10k filings and company press releases |

| Board approved transactions at multiples that were higher than Mac-Gray's at the time of each acquisition. Board's failure in creating value through acquisition is evidenced by the fact that Mac-Gray is currently trading at a significant discount to the multiples it paid at the time of acquisition. Incumbent nominees showed questionable understanding about acquisition valuations 15 EBITDA calculated as earnings before net interest expense, income tax expense, depreciation and amortization expense, stock compensation expense and extraordinary gains and losses Source: Factset, company press release |

| Management and the Board have failed in their efforts to expand Mac-Gray's addressable market MicroFridge (Intirion Corporation) "sells a proprietary line of appliances for small space living environments, primarily combination refrigerators/freezers/microwave ovens utilizing its Safe Plug(r) circuitry. The products are marketed throughout the United States to colleges, hotels and motels, and assisted living facilities, as well as to the federal government for military housing." Acquired in 1998 for $30.6 million (a). Divested in 2010 for $11.5 million Copico, Inc. "is the major provider of card- and coin-operated reprographics equipment and services to the academic and public library markets in New England, New York, and Florida." Acquired in 1998 for $15.1 million (b) In 2006 Mac-Gray takes an impairment charge to write-down a significant portion of the assets of its reprographics business Reprographics business described as "immaterial" in 2008 Form 10-K Includes 1.6 million shares and $1 million of cash representing $30.6 million of total value at the time of the transaction Includes 250,000 shares and $11 million of cash representing $15.1 million of total value at the time of the transaction 16 |

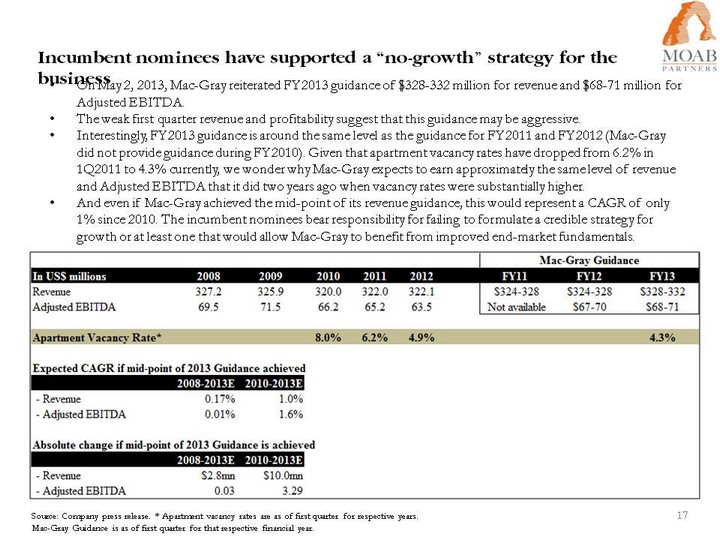

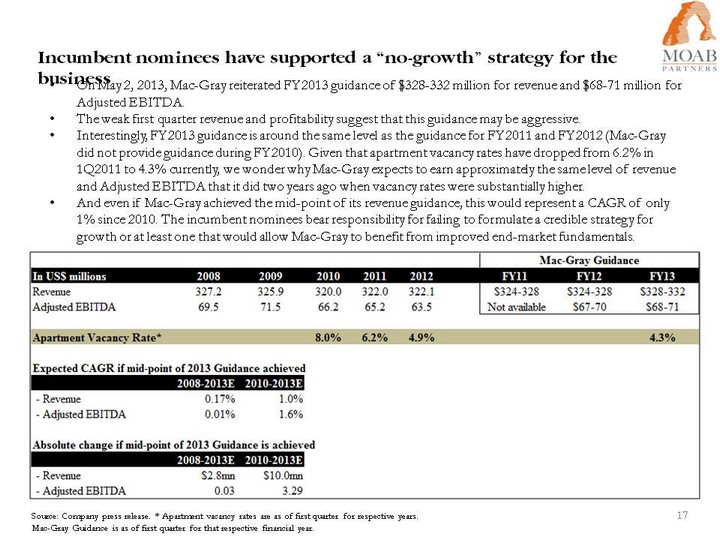

| On May 2, 2013, Mac-Gray reiterated FY2013 guidance of $328-332 million for revenue and $68-71 million for Adjusted EBITDA. The weak first quarter revenue and profitability suggest that this guidance may be aggressive. Interestingly, FY2013 guidance is around the same level as the guidance for FY2011 and FY2012 (Mac-Gray did not provide guidance during FY2010). Given that apartment vacancy rates have dropped from 6.2% in 1Q2011 to 4.3% currently, we wonder why Mac-Gray expects to earn approximately the same level of revenue and Adjusted EBITDA that it did two years ago when vacancy rates were substantially higher. And even if Mac-Gray achieved the mid-point of its revenue guidance, this would represent a CAGR of only 1% since 2010. The incumbent nominees bear responsibility for failing to formulate a credible strategy for growth or at least one that would allow Mac-Gray to benefit from improved end-market fundamentals. Incumbent nominees have supported a "no-growth" strategy for the business 17 Source: Company press release. * Apartment vacancy rates are as of first quarter for respective years. Mac-Gray Guidance is as of first quarter for that respective financial year. |

| 19 Results of Voting on Stockholder Proposals Source: Company 8-Ks dated 5/26/2010, 5/18/2011, and 6/13/2012 Date Stockholder Proposal % Needed for Approval For Against Abstain % For Result Implemented 5/6/2010 Declassify the Board of Directors 50.1% 7,088,802 6,009,404 39,716 53.8% Approved No 5/18/2011 Declassify the Board of Directors 50.1% 7,361,091 5,909,935 3,510 55.5% Approved No 6/7/2012 Amend the By-Laws of the Company 75.0% 7,503,813 5,246,804 9,404 58.8% Not approved [because of 75% vote requirement] Addressed in April. '13 after Moab nominations |

| Incumbent Directors have shown utter disregard for shareholder rights 20 "At last year's annual meeting, a shareholder proposal to declassify the Board received affirmative votes from a majority of the Company's shares outstanding. The Board has failed to act on this proposal; it does not discuss the result in this year's proxy... This is the third time in two years that the Company has failed to respond to a shareholder proposal and the second consecutive year in which it has ignored a successful proposal to declassify the Board...The Board's failure to take action demonstrates a lack of responsiveness to shareholder concerns. The Board appears to suffer from a chronic delusion that it has primacy in the shareholder-director principal- agent relationship." May 25, 2012 ISS Proxy Advisory Services Report on Mac-Gray Executive Summary (in its entirety): The Board failed to respond adequately to a shareholder proposal that received the support of a majority of the outstanding shares at last year's annual shareholder meeting. Eliminating the 75 percent vote requirement to amend bylaws would enhance shareholders' ability to make changes to the company's governing documents.. Mac-Gray scores 0.0 (High Concern) out of a possible 100.0 for Shareholder Rights The Board failed to implement a shareholder proposal supported by the majority of shares voted The Board is classified The Company has a poison pill in effect Shareholders may not call special meetings The Company's poison pill has not been approved by shareholders Shareholders may not act by written consent or such consent must be unanimous The Company requires a supermajority vote to approve amendments to the charter or bylaws |

| Incumbent directors are trying to take away shareholders right to vote on Board members 21 In stark contrast to past elections, the Board has elected to implement a heretofore ignored age limit in its nominations. This year, the Board has decided to retire Class I Director Edward F. McCauley, citing his age, and preclude shareholders from having a voice in electing his replacement, instead saying the size of the Board will be reduced. Because the size of the Board is determined by the Board itself, this Board retains its right to self-appoint an eighth director immediately following the Annual Meeting without a shareholder vote. This matter could have been addressed at the special meeting of the Board held on April 5, 2013, but no such disclosures have been made by the Company. By shrinking this year's slate to two directors, the Board has ensured that any new directors chosen by shareholders will be a minority in the boardroom for at least another year, thereby protecting the failed status quo. |

| Incumbent Directors voted to reject two premium offers December 2006: Board unanimously rejects $13.00-$13.75 per share offer from Coinmach Services Corporation to acquire the Company Coinmach's offer represents a 21% to 28% premium to Mac-Gray's trading price at the time of the proposal Over six years later, Mac-Gray is still trading within the range offered by Coinmach. Stephen R. Kerrigan, Chairman, CEO and President of Coinmach on December 4, 2006: "We are disappointed that Mac-Gray's Board of Directors is unwilling even to discuss our proposal." October 2011: Board rejects KP Capital's $17.50 per share offer to acquire the Company Offer represents a 33% premium to Mac-Gray's trading price at the time of the proposal Offer represents a 27% premium to Mac-Gray's trading price on May 3, 2013, more than 15 months later Despite Moab's repeated public and private requests, the Board refuses to: disclose names of financial advisors used in evaluating the proposal; disclose a business plan detailing why $17.50 per share was inadequate; disclose the nature of the internal discussions regarding the offer or the depth to which the KP Capital proposal was considered by the Board; disclose why KP Capital was not allowed to conduct due diligence 22 |

| After Moab proposed a slate of directors for election at the 2012 annual meeting, representatives of the Company used the Company's entire $2.0 million share repurchase authorization to negotiate a private purchase of stock from a stockholder who had indicated support for Moab's slate at approximately $15.00 per share. Since purchasing shares in 2012, the Board has to this day neglected to approve a new share repurchase authorization despite the stock price trading below where the Company repurchased shares from the one stockholder who was supportive of Moab's slate last year. In its definitive proxy statement filed on April 29, 2013, Mac-Gray increased its estimate of the costs of this proxy contest to $750,000 from $500,000 previously. This figure exceeds the costs of Moab's solicitation by $580,000, and is more than quadruple Moab's estimated costs. Furthermore, the estimated cost of this year's proxy contest is more than 2.5x of what Mac-Gray incurred during the 2011 proxy contest. 23 Incumbent Directors approved use of corporate funds to entrench the Board |

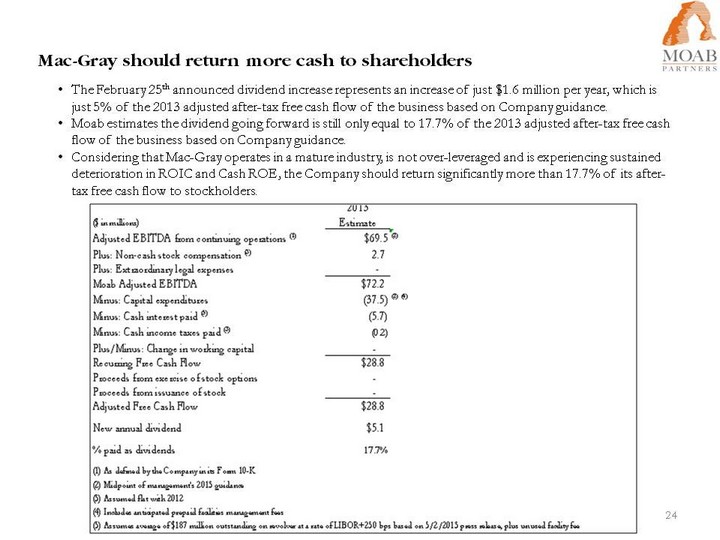

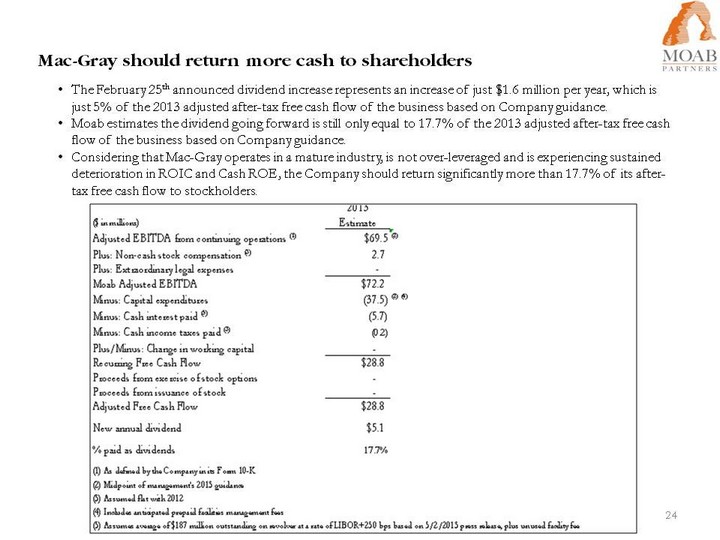

| Mac-Gray should return more cash to shareholders The February 25th announced dividend increase represents an increase of just $1.6 million per year, which is just 5% of the 2013 adjusted after-tax free cash flow of the business based on Company guidance. Moab estimates the dividend going forward is still only equal to 17.7% of the 2013 adjusted after-tax free cash flow of the business based on Company guidance. Considering that Mac-Gray operates in a mature industry, is not over-leveraged and is experiencing sustained deterioration in ROIC and Cash ROE, the Company should return significantly more than 17.7% of its after- tax free cash flow to stockholders. 24 |

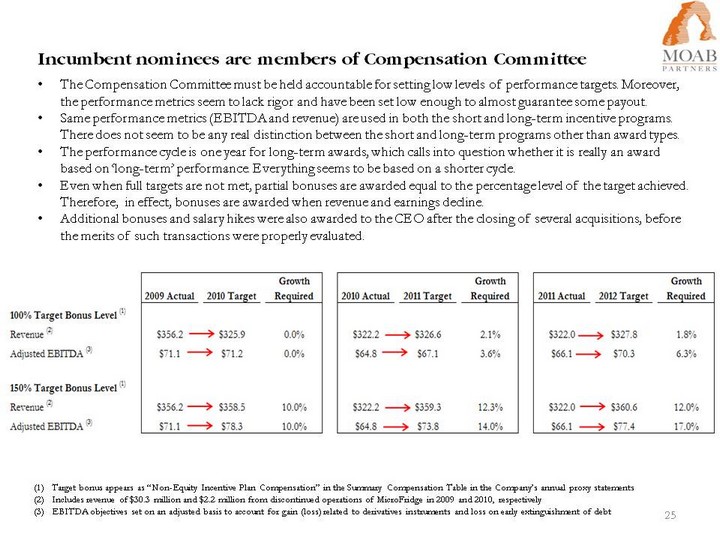

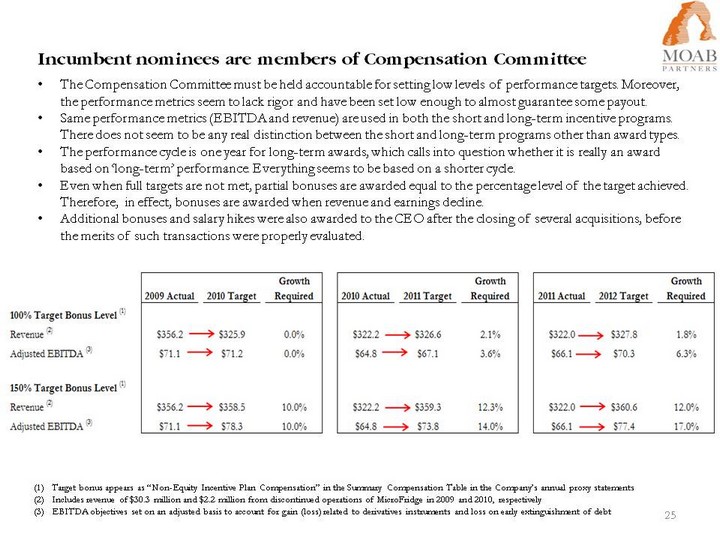

| The Compensation Committee must be held accountable for setting low levels of performance targets. Moreover, the performance metrics seem to lack rigor and have been set low enough to almost guarantee some payout. Same performance metrics (EBITDA and revenue) are used in both the short and long-term incentive programs. There does not seem to be any real distinction between the short and long-term programs other than award types. The performance cycle is one year for long-term awards, which calls into question whether it is really an award based on 'long-term' performance. Everything seems to be based on a shorter cycle. Even when full targets are not met, partial bonuses are awarded equal to the percentage level of the target achieved. Therefore, in effect, bonuses are awarded when revenue and earnings decline. Additional bonuses and salary hikes were also awarded to the CEO after the closing of several acquisitions, before the merits of such transactions were properly evaluated. Incumbent nominees are members of Compensation Committee Target bonus appears as "Non-Equity Incentive Plan Compensation" in the Summary Compensation Table in the Company's annual proxy statements Includes revenue of $30.3 million and $2.2 million from discontinued operations of MicroFridge in 2009 and 2010, respectively EBITDA objectives set on an adjusted basis to account for gain (loss) related to derivatives instruments and loss on early extinguishment of debt 25 |

| Is the CEO's compensation really aligned with creating stockholder value? See Exhibit D 26 (CHART) |

| Board Nominees: Background and Plan |

| Proposed nominee background 28 James E. Hyman (age 53) is the President and CEO of TestAmerica Inc., the nation's largest provider of environmental testing services, a role he has held since 2011. In addition to his role at TestAmerica, Mr. Hyman has served as a Board Member of Grosvenor Americas, an operating company of Grosvenor, a privately owned global property group with assets under management exceeding $18 billion, since 2011. At Grosvenor Americas, Mr. Hyman serves as Chairman of the Audit Committee and is a member of the Compensation Committee. Before his roles at TestAmerica and Grosvenor, Mr. Hyman was Chairman, President, CEO, and a Director of Houston-based Cornell Companies, Inc., a New York Stock Exchange traded provider of government services, from 2005 until its sale in 2010. Earlier in his career, Mr. Hyman held executive positions with Starwood Hotels & Resorts Worldwide, GE Capital Services, McKinsey & Company, and JP Morgan, among others. He chairs the non-profit Mega-Cities Project, focused on urban development issues in the world's largest cities. Mr. Hyman received an MBA with Distinction from Harvard Business School and an AB with honors from The University of Chicago. |

| Proposed nominee background (continued) Michael M. Rothenberg (age 39) has spent the past 15 years in the investment management industry. In 2006, he co-founded Moab Capital Partners, LLC, a value-oriented event-driven money management firm. From 2003 to 2005, Mr. Rothenberg was a senior investment professional at Xerion Capital Partners, LLC, a $500 million hedge fund, where he was responsible for investing and trading a portfolio of distressed debt, bank debt, and event driven equities that peaked at $300 million. From 2002 to 2003, Mr. Rothenberg was the distressed debt Portfolio Manager at Troy Capital Management, LLC, an $80 million hedge fund where he was responsible for investing and trading a $25 million portfolio of distressed debt and event driven equities. From 2001 to 2002, Mr. Rothenberg was an investment analyst at Gracie Capital Partners, LLC, an event driven and distressed debt focused hedge fund. From 1998 to 2001, Mr. Rothenberg was an investment analyst at Perry Capital, LLC, an $11.5 billion hedge fund, where he focused on distressed debt, event driven equity, and private equity investments. Prior to entering the investment management industry, from 1995 to 1998, Mr. Rothenberg was an investment banking analyst at Peter J. Solomon Company, focusing on mergers and acquisitions. Mr. Rothenberg earned a B.S. in Economics in 1995 from The Wharton School at The University of Pennsylvania in Philadelphia, Pennsylvania, majoring in finance. 29 |

| Our Plan Business review Review market density across the country and address weakest markets with buy/divest/harvest mindset. Aggressively pursue accretive deals. Moab believes due to the utter failure of the company's past acquisitions that this board is stunted from evaluating the next deal. In a rapidly consolidating industry Mac-Gray has not announced a material acquisition or divestiture since 2008. For example Mac-Gray failed to pursue two acquisitions recently completed by peers in 2013. Coinamatic Canada by WASH and AIR- serv by Coinmach. Both transactions were done at attractive multiples in recent months. Seek to restructure incentive programs to pay more for growth and eliminate bonuses when revenue and earnings decline. The overall objective being to align incentives with long term growth in shareholder value. Evaluate if changes need to made in the management team. The current leadership has been in place for over 15 years and failed to deliver results. Double the newly increased dividend. This would still represent a payout ratio below 50% of free cash flow. Immediately implement a share repurchase authorization to use opportunistically. Depending on the stock price, we would implement a tender offer. Initiate a study to evaluate opening a facility to refurbish and reuse used washer/dryer parts to minimize replacement costs. Governance review Implement reasonable proposals supported by a majority of stockholders Declassify the Board Allow majority of stockholders to call special meetings 30 |

| Mac-Gray's share price has underperformed the Russell 2000 Index over 1-year and 3-year periods, which corresponds to the post-recession period. The stock is trading 24% below the rejected KP Capital's offer two years later. Both incumbent nominees are long serving Board members and must be held accountable for Mac-Gray's subpar TSR. Mac-Gray has failed to capitalize on improved end-market dynamics, where vacancy rates have dropped to the lowest level in over a decade. Since 2010, revenues are up by a meager 0.7% and Adjusted EBITDA has declined by 4.1%, while vacancy rates dropped from 8% in 1Q2010 to 4.3% in 1Q2013. Mac-Gray's competitors have done much better. Moreover, the deteriorating trend in financial performance continued in 1Q2013. Incumbent nominees must be held accountable for approving Mac-Gray's history of overpriced, dilutive acquisitions. Since 2003, Mac-Gray has spent $316 million on acquisitions for approx. $200 million in annualized revenue. The amount spend on acquisition is 1.5x the current market capitalization of $194.4 million. The incumbent nominees have exhibited complete disregard for shareholder rights by ignoring shareholder approved proposals for two years, resulting in a ZERO governance score by Institutional Shareholder Services ("ISS") last year. It is only after the threat of another proxy contest emerged, did the Board decide to reduce the threshold needed to amend bylaws. Vote FOR the BLUE card. 31 Conclusion |

Discourse of Moab Nominees to ISS

Thank you for your attention today. This is a very important meeting for us and we truly appreciate your time.

Michael Rothenberg:

My name is Michael Rothenberg. I founded Moab Capital Partners 7 years ago and our business has grown to manage $300 million in assets from insurance companies, high net worth individuals and families. We invest in credit and equity securities in North America with a value orientation. I have been a professional value investor for 15 years. I look for stable cash flow businesses, cash cows whose value I can ascertain, and I tend to avoid investing is highly volatile businesses.

We love the laundry business. Mac-Gray and its peers operate laundry rooms in apartment buildings and college dorms. The companies sign 7-8 year contracts with landlords. The operators provide the equipment and then provide the servicing and coin collection over the life of the contract. All the revenue from the laundry machines is split with the landlords. The business model has been proven for decades and we believe it will continue to work for many many years to come.

The laundry business throws off tons of cash. Management teams and boards decide whether to spend that cash on organic growth, acquisitions or if it should be returned to shareholders. Mac-Gray’s incumbent directors and management spent that cash flow and borrowed more to fund several acquisitions in the early 2000s. Since the great recession, that cash flow has been used to reduce debt. It is critical that all of us not mistake a great stable cash flow industry like laundry with a great management team or a great Board.

Unfortunately Mac-Gray’s Board and Management have made so many mistakes that they have destroyed significant shareholder value. Mac-Gray IPO’d in 1997 at $11 per share and trades near $13 today having only paid about 70c in cumulative dividends in nearly 16 years. Stewart MacDonald has been CEO the entire time and the two incumbent directors seeking reelection have sat on this Board for a long time: 9 years for Mr. Bryan and almost 7 years for Ms. Tocio but they have not taken corrective actions. Over the last 4 years, the incumbent directors paid Stewart MacDonald nearly $7 million and even if we achieve the high end of company guidance this year, Mac-Gray’s EBITDA will still be less than what it was 4 years ago.

In this presentation I will make the case that Mac-Gray’s extremely disappointing operational and stock price performance is the direct result of failures and mistakes made by the management team and the Board. And there is absolutely no plan today to right the ship, or hold anyone accountable.

CEO Stewart MacDonald inherited this business, along with his siblings from his parents. Stewart has been the CEO for more than 17 years. Though he is a large owner, he is handsomely compensated and no one could argue that he is independent. This Board, including the two directors seeking reelection who have served terms of more than nine and almost seven years, seem unwilling to hold Stewart accountable for anything. Perhaps this is because the Board as a whole owns less than 1% of the stock. Mr. Hyman and I plan to bring real change to Mac-Gray that can meaningfully improve the business and shareholder returns.

Moab has accumulated its position in Mac-Gray over more than 3 years and contrary to the Board’s recent claims, our exposure to Mac-Gray has gone virtually straight up from the day we bought our first share in early 2010. Today we own more shares than we’ve ever held, totaling 9.2% of Mac-Gray. Mac-Gray will make comments to you that Moab is conflicted and that this proxy contest is somehow our first step of a bigger plan to enhance Moab’s return at the expense of other shareholders. This is patently false. If elected Moab has agreed to vote its shares going forward with whatever the majority of shareholders chooses to pursue. Also, they claim we’ve put lines in our proxy disclaiming conflicts. These are mere legal precautions. Moab has absolutely no conflicts in this matter nor do we have any plans or proposals with respect to whatever Mac-Gray is addressing. If we prevail in this contest we will be still be a minority on the Board.

1

Flipping through the disclaimers, Page 3 lists some of the key highlights why we’ve decided to pursue this contest. We will go into more detail on each of these points throughout the presentation but to highlight:

First – Mac-Gray’s stock price has been a huge disappointment, underperforming the Russell 2000 Index in 1 and 3 year time periods and trading 24% below the 17.50 per share acquisition proposal rejected by this Board 2 years ago.

Second – Mac-Gray’s market has improved significantly in the last few years. On numerous occasions, management of Mac-Gray has highlighted vacancy rates as a key driver for laundry room usage. Well, today vacancy rates are at 10 year lows yet Mac-Gray’s financial performance has declined.

Third – Unfortunately the rate of decline at Mac-Gray is accelerating as evidenced by the Company’s dismal first quarter announced last week where they reported a 3.1% revenue decline, 6.7% gross profit decline and a 5.9% EBITDA decline adjusting for a 1x litigation expenses. Interestingly, now the company is backing off of its arguments that vacancy rate improvements would help their business and they’ve formulated a new argument that laundry has become a “consumer discretionary purchase”. We’ll show why this claim is completely false and should not be accepted by the Board.

Fourth – No one has been held accountable for the company’s string of overpriced dilutive acquisitions. Since the term of nominee David Bryan, Mac-Gray completed 5 acquisitions paying a total of $316 million. This represents 1.5x the entire market capitalization of the company today. Clearly that money would have been better spent if it were returned to shareholders. Furthermore, the acquisition strategy was flawed and the Company has actually reported ZERO organic revenue growth over the last 9 years despite raising laundry machine vend prices in all but one of those years.

Our fifth principal concern is this Board’s disregard for shareholder rights. After Moab’s proxy contest initiation last year, you graded this Board a score of 0.0 for shareholder rights. This Board has ignored majority-approved shareholder proposals at the last 3 annual meetings and only recently, under threat of our proxy contest, has the Board addressed any of these issues.

We need to point out that this is a staggered Board and the company’s two nominees have served for a very long time more than 9 years for Mr. Bryan and almost 7 years for Ms. Tocio. Keeping these failed directors in place means that a large shareholder like us would have to wait another 3 years to hold these two directors accountable for their failures and inactions. Their decisions and inactions have clearly destroyed value and the time to hold them accountable isright now.

On Page 5 we show the 1 and 3 year returns of Mac-Gray vs. the Russell 2000 index. We benchmark Mac-Gray to the Russell 2000 Index as this was the benchmark ISS used in its past reports and there are no other publicly traded laundry operators.

Our 1 year chart shows total shareholder return of -4% vs. positive 24% for the Russell.

Our 3 year chart begins in 2010 which is an important starting point as this is when management acknowledged the turnaround in vacancy rates which have provided a wind at their backs from which to increase revenue, profitability and shareholder return. Unfortunately in this time period Mac-Gray underperformed the Russell 2000 Index by 27%.

Also since the rejection of the $17.50 per share offer by KP Capital, Mac-Gray’s stock has delivered a total return of -4.6% vs. +34% for the Russell 2000 Index. Two years later, Mac-Gray is trading 24% below the offer price.

In Mac-Gray’s presentation to you they choose a 5-year time frame which conveniently starts right after a 26% slide in their shares in the preceding 6 months while the S&P 500 was down 1% and the Russell 2000 Index was down 7%. The sharp slide is the result of reported results from the failed acquisition strategy. Their starting point on 12/31/2007 of $11.25 per share is just $0.25 above their 1997 IPO price a full decade later. If you look at the more recent 1- and 3-year relative performance, Mac-Gray has surely underperformed. Moreover, in their presentation, Mac-Gray arbitrarily ends their graph in December 2012, deceiving shareholders by completely ignoring the run-up in the broader markets this year.

Page 6: I’d like to read some of management’s public comments blaming everything but themselves for the company’s poor performance. Please notice their about face on the most recent quarterly earnings call.

2

| | • | | In March 2009 on an earnings call: “We expect that as markets eventually normalize, the revenue, which has been lost due to apartment vacancy increases will return to Mac-Gray with no additional cost outside of the revenue sharing portion of our contracts. Again, our estimate of that amount is currently a minimum of $5 million annually going forward.” |

| | • | | In March 2010 in a press release“For the past several calls, we’ve focused on apartment vacancy rates as the primary economic factor that influences us. Starting with the usage of our equipment, but also impacting our ability to initiate vend price increases and most important the effect it has on property owners, property managers and the decisions they have to make.... Our core laundry facilities management business remained under significant pressure in the fourth quarter due to apartment vacancy rates, which are now at 30-year record levels in many markets, a reflection of continued high unemployment.” |

| | • | | In their presentation to ISS in May 2011 “Unusually high vacancy rates have substantially reduced revenue and EBITDA from multi-housing accounts for the past several years.” |

| | • | | Now notice what they said just last week after reporting their worst quarter in years:“Apartment occupancy rates in the United States are thehighestthey’ve been in more than a decade..... While we are experiencing respectable usage growth in several markets due in part to high apartment occupancy rates,occupancy is not the sole driver of our business.” |

Mr. MacDonald goes on to claim that laundry has become a “consumer discretionary purchase”.

This about-face is shocking. Management can no longer make the case on vacancy rates. Those have plummeted to 10 year lows. Mac-Gray’s peers are privately held and it is likely that few shareholders have done the work to discredit management’s new preposterous claim. We have done the work and will prove that Mac-Gray’s peers are doing substantially better today.

We think Mr. MacDonald’s claim is laughable and we have the evidence to back it up. Really, more people are living in the same buildings but suddenly these consumers have started to re-wear their dirty clothes?

Page 7 shows the Reis industry data that highlights the sharp decline in vacancy rates across the country. Vacancy rates today are at 10-year lows.

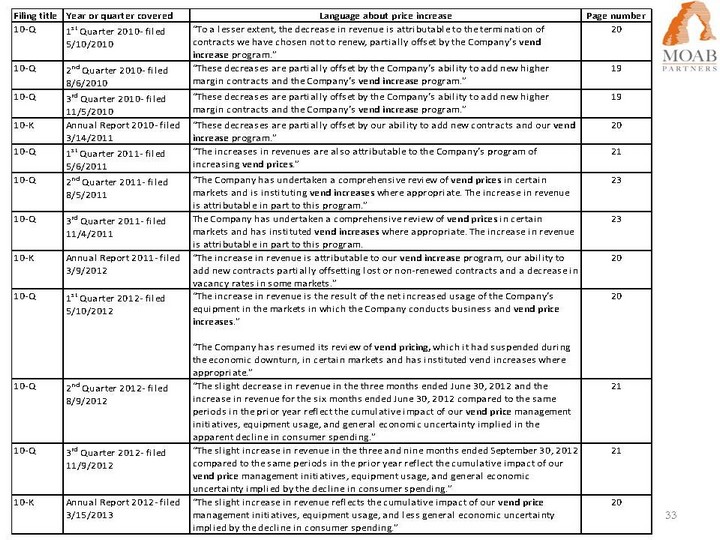

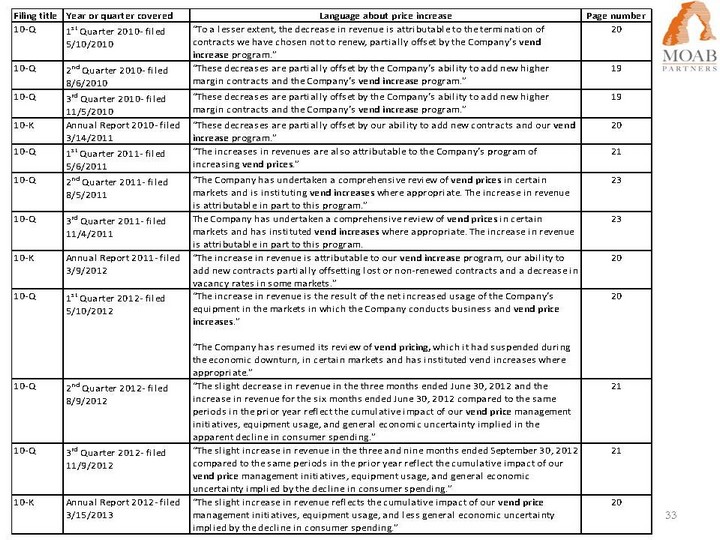

Page 8 provides a picture of Mac-Gray’s revenue from the recession through the rebound in the apartment market. As you can see, revenue has barely rebounded even though vacancy rates are at 10-year lows. Sadly even the 0.7% growth in revenue from 2010 to 2012 is stale. Updating for the recently reported first quarter of 2013, trailing twelve month revenue is now lower than 2010 revenue even though the company has reported raising prices in all three years. We have evidence of the company’s repeated price increases laid out in the appendix of this presentation and what we’ve discovered is that the company has raised prices every year since 2003 with the exception of 2008.

If we go back to Mr. MacDonald’s quote that at least $5 million of revenue was lost due to vacancy rates, revenue should be well over $332 million today but trailing 12-month revenue is actually just $319.5 million.

Page 9: On this slide we compare Mac-Gray’s non-existent growth during the economic rebound to the performance of its two largest peers, Coinmach and WASH Multifamily. As you can see, Mac-Gray is not growing its revenue, despite annual price increases, and it’s the only company in the space experiencing a decline in EBITDA.

On the bottom graph we’ve also shown the revenue growth of Apartment REITS which are exposed to the same end-market dynamics as Mac-Gray—that is, vacancy rates. As you can see, Mac-Gray is far behind in last place.

3

While the growth at WASH Multifamily is indicative of what a well-run laundry business should be experiencing, we want to point out why we believe Coinmach’s growth has also been sluggish, even though it is still growing revenue and earnings faster than Mac-Gray. Coinmach was acquired in a leverage buyout in 2007 during the peak of the credit bubble at an enormous valuation. The buyer burdened Coinmach with $1.2 billion of debt, roughly 8.2x EBITDA and interest rates were much higher than versus today. Coinmach went bankrupt in 2009 during the economic downturn and, up until a week ago, has been owned by the original banks who provided the financing. We believe Coinmach’s owners for the past three years have had a single mission of getting their debt repaid by running the business for cash flow. As a consequence, Coinmach, we believe, has not been actively pursuing growth initiatives for more than 3 years. Just last week the banks finally exited their investment in Coinmach and were made whole. Coinmach was acquired by Pamplona Capital Management in a billion-dollar leveraged buyout.

Page 10: This is a slide from Coinmach’s recent investor presentation. As you can see, Mac-Gray’s margins in 2012 aresignificantly trailing those of Coinmach and WASH Multifamily. And I should highlight that both of those businesses are growing revenue and margins faster than Mac-Gray. If we update figures for their recently reported first quarter, Mac-Gray’s margin would be 30 basis points lower.

This is a good time for me to point out how we believe efficiencies in the laundry business are critical in driving higher margins which ultimately result in faster growth as more efficient operators tend to win more business. The largest cost to a laundry operator is the network of field employees who are driving around collecting the quarters and handling the service calls. The key to driving efficiency is regional scale, that is, dense penetration in the markets you operate. Imagine serving 20,000 machines in one city or the same number spread out across the country. The operator who has big market share in a city or region can more easily win new business in that regionand more synergistically acquire smaller players in that region.

As you’ll see in our presentation, during the nearly seven and over nine year terms of the two incumbent directors up for reelection this year, Mac-Gray pursued a flawed national expansion strategy. We will show that they also overpaid for their acquisitions.

Lastly, because these transactions have destroyed so much value AND because thesame people are running the company and sitting on the Board today, the company appears to have taken itself out of the market for deals even though they articulated acquisitions as part of their business plan during their 2011 proxy contest. They have not announced an acquisition since 2011 while their competitors have been buying great businesses at cheaper valuations – including two big deals we’ll describe later that were just completed in the past few months.

You can see on Page 11 how gross margins and EBITDA margins have eroded. In the company’s last proxy contest during 2011, they argued to you that the rebound in vacancy rates, coupled with management’s business plan would drive increased profitability. Relating to their business plan, the company highlighted acquisition opportunities and Change Point technology—a credit card swiping device in the laundry room as plans they would employ to drive growth. Unfortunately, the company has not announced a single acquisition since 2011 and Change Point has not delivered. Margins are lower now and eroding at a rapid pace.

The data on the right side of the graph on Page 12 shows gross margin and EBITDA margin deterioration in the recently announced first quarter. Importantly, our figures for the first quarter of 2012 exclude $2.2 million of one-time litigation expenses related to a failed effort by Mac-Gray to sue a competitor. On a normalized basis the erosionaccelerated in the 1st quarter. As you can see on the table, revenue was down 3.1%, gross profit down 6.8% and EBITDA down 5.9%. Also note that Mac-Gray’s first quarter is generally the most important quarter of the year because it is a quarter with the highest college dorm occupancy.

Mac-Gray has somehow boasted in their presentation to you that the first quarter was “strong and stable”. This is an outrageous claim.

Turning to Page 13, here we show what the company has delivered in terms of ROIC and ROE. The picture is pretty grim with ROIC declining from 14.6% to 9% and ROE slashed in half. We just can’t understand how the Board is not taking action and instead increasing senior management’s compensation every year. Our best guess is that since laundry is such a great business, it’s easy to overlook the missteps unless you really do your homework.

4

On the chart on Page 14 we have built a bridge starting with Mac-Gray’s 2003 revenue in the last twelve months before Class I Director David Bryan’s term began. Since he has sat on the board the company has announced 5 acquisitions. The purchase price of these deals combined equals 1.5 times the current market capitalization so these are important to analyze. Mary Ann Tocio joined the board almost seven years ago in 2006 and has overseen three of these 5 deals. Building from 2003 revenue of $149 million we’ve added the revenue acquired from each of Mac-Gray’s five announced acquisitions at the time the deals were consummated and then we subtracted the revenue sold when Mac-Gray divested Microfridge in 2010. This is the company’s only reported divestiture in this timeframe. Interestingly, the bridge gets to $319.5 million of revenue which is exactly equal to the company’s recently reported trailing twelve month revenue.

What this means is that, despite reported price increases in all but 1 of the last 9 years, Mac-Gray’s organic revenue has not grown at all. 0%. When we couple this information with the revenue performance of Mac-Gray’s competitors, the reported price increases and the improvement in vacancy rates, there is no way to explain Mac-Gray’s revenue stagnation over nine years other than lost market share. Specifically lost contracts to competition. We think this chart makes it very clear that the acquisitions have not been integrated well and revenue has been lost to competition.

We don’t see anyone being held accountable for these serious failures. Both Class I directors seeking reelection approved these deals and have not held management accountable.

I also want to highlight geographically what Mac-Gray did here. Remember this business’ origins are in New England, specifically Boston where it started, where Mac-Gray today maintains a very strong presence. Their first acquisition of Web Services East’s assets brought them to Florida. Web Services West’s assets acquired the next year brought them into the Southwest. Lundermac was actually in Massachusetts but it was tiny. Hof Service brought them into Maryland, DC and Virginia and then Automatic Laundry brought them to Denver, Phoenix Seattle and Dallas. This quest to grow a strong regional franchise into a rolled up national player was flawed and the results today, unfortunately, expose the mistakes of the two directors seeking reelection as well as those of senior management.

On Page 15 we focus on the prices paid for the acquisitions and the valuation ascribed to the deals where available. You can see on the far right that Mac-Gray has pretty consistently traded between 5 and 6x EBITDA. Yet moving to the middle of the page you can see that this Board approved the acquisitions at prices of 7-9x EBITDA. Prior to our proxy contest, Chief Financial Officer Mike Shea admitted to us that the Automatic Laundry acquisition, Mac-Gray’s largest acquisition, has not worked out anywhere near plan but we’ve never heard this type of disclosure publicly.

Summarizing the data on this page, you see that Mac-Gray trades at 22% and 29% discounts, respectively, on revenue and EBITDA multiples to what it paid for these deals.

On Page 16 we highlight management’s and the Board’s failed efforts to expand Mac-Gray’s addressable market. You can see Microfridge, which was acquired in 1998 for over $30 million, was divested in 2010 for $11.5 million. Somehow in their 2011 proxy contest presentation, management boasted that this divestiture was a value-enhancing event for stockholders. Microfridge was a flawed concept by the CEO from day 1. Microfridge was a seller and renter of small refrigerators—principally to students in college dormitories. Presumably Mr. MacDonald believed because Mac-Gray does the laundry routes on several college campuses that they could synergistically get into refrigerator rentals at colleges. But the business models are completely different. A refrigerator is marketed to an individual student and rarely requires servicing. A laundry room is contracted directly with the university and requires routine visits for coin collection and service. It’s really startling that management didn’t get this.

Next, we highlight Copico, a library coin reprographics business acquired in 1998 for $15 million in cash and stock. The only disclosures we’ve seen on this business in recent years was in their 2006 10-K when Mac-Gray wrote down a significant portion of their reprographics assets and then in their 2008 10-K when they just referred to the reprographics business as “immaterial”. Copico might have had a similar business model to Mac-Gray’s laundry route business but I guess nobody at Mac-Gray realized in 1998, as the dot-com boom was burgeoning, that photocopy machines in the library weren’t going to be an exciting growth engine.

Turning to Page 17, here we lay out company guidance, endorsed by the Board, which we refer to as the “no-growth” plan. As you can see in the table, even if Mac-Gray achieves the high end of this year’s guidance, which is highly unlikely given Q1’s declining results, Mac-Gray will still achieve EBITDA levels below what it earned in 2009. In this time period vacancy rates have plummeted to 10-year lows and the company has been raising prices.

5

We modeled the growth rates at the bottom of the page if the mid-point of guidance is achieved. As you can see, over 6 years this year’s guidance midpoint gets us to a revenue CAGR of 0.1% and an EBITDA CAGR of 0.01%.

It’s obvious that Mac-Gray has a company-specific problem and the Board should not accept management’s phony excuses or endorse no growth plans for this business. We feel the incumbent nominees bear responsibility for their failure in formulating a credible growth strategy or at least a plan that shows how Mac-Gray can benefit from the significant improvement in vacancy rates.

Now I’d like to turn the conversation to corporate governance. On Page 19 we show the results of shareholder sponsored votes at the last three annual meetings. As you can see the Board has ignored majority-approved shareholder proposals three years in a row. And we believe last month’s announcement, that the Board would remove the poison pill and super-majority voting requirement in its by-laws, was clearly a defensive move in direct response to our proxy contest, which was launched weeks before their board held this special meeting. Had we not taken extraordinary efforts to hold this Board accountable, surely the Board would have not held that special meeting and shareholders would continue to be ignored. We still have to question why won’t this Board listen to the shareholders who voted twice to declassify the Board. Mr. Hyman and I support a declassified board.

On Page 20 we highlight the points you made in your report last year on Mac-Gray. Obviously the score of 0.0 with the specific issues you laid out. Mac-Gray’s Board completely ignored your report for almost a year and implemented no corrective actions until last month—after Moab launched this proxy contest. Even then this Board only took two corrective actions—addressing the poison pill and the super-majority voting requirements, but ignoring the other items on your list. Mr. Hyman and I, if elected, would propose each item on this list in order to return a shareholder focus to this Board.

On Page 21 we highlight a not-so-shareholder-friendly action taken by this Board just last month. In stark contrast to past elections, this Board has decided to retire Mr. Ed McCauley citing an age limit in the by-laws—even though it has ignored this limit on numerous occasions in the past. Examples of recent instances where the 70-year old age limit policy was overlooked include the Board’s nomination of William F. Meagher Jr., when he was 71 in 2011 and the nomination of Mr. McCauley when he was 71 in 2010.

But the Board did not nominate a director to replace Mr. McCauley nor did it shrink the size of the Board from 8 to 7 directors. So the company has reduced its slate to two directors and only two directors will be seated after the votes are counted. So even if Mr. Hyman and I are seated, including Bruce Percelay whom we nominated last year, shareholder-appointed nominees will represent less than half of the Board. 3 out of 7 instead of 4 out of 8. They have successfully diluted the impact of this election

But importantly, this Board decided NOT to formally reduce the size of the Board from 8 to 7, thereby giving itself the opportunity to self-appoint an 8th director after the annual meeting which could reduce our nominees influence to 3 out of 8. If this occurs independent shareholders like Moab will have to wait longer and longer to re-focus this board.

On Page 22 we detail the two premium offers rejected by this Board including both Mr. Bryan and Ms. Tocio who are seeking reelection. Coinmach’s CEO after proposing to buy Mac-Gray seven years ago for a price still higher than where Mac-Gray trades today said publicly “We are disappointed that Mac-Gray’s Board of Directors is unwilling even to discuss our proposal”

Regarding the $17.50 proposal that was rejected in 2011. This offer represented a 33% premium to Mac-Gray’s trading price when it was announced and still represents a 27% premium to current trading levels.

This Board never attempted to discredit the proposal. All they’ve said publicly is that $17.50 was inadequate and that their business plan would deliver greater value. These actions outraged us. We converted to a 13D filer and sent a private letter to the Board imploring them to share with the public the reasons for turning down this offer—again not even allowing the buyer to conduct due diligence. Our request was rebuffed so we publicly asked the Board to disclose the names of their financial advisors, disclose a business plan detailing why $17.50 per share was inadequate, disclose the nature of discussions internally and with KP Capital and to disclose why KP Capital was not even allowed to conduct due diligence which might have led them to increase their bid. The Board ignored all of our requests.

6

So we criticized how a Board can reject $17.50 but not even have a share buyback authorization in place to possibly repurchase stock in the open market that was trading 30% cheaper. We exposed them and they actually authorized a tiny $2-million share repurchase plan. This is just 1% of the total market capitalization.

Then we launched our proxy contest last year and, in the middle of the contest, they privately negotiated a trade with a shareholder who had already informed Moab of their intention to support our slate last year. This trade was executed at $15 per share and the Board spent the full $2 million authorized on this one private trade. Mac-Gray’s stock traded 27% lower than $15 over the next six months and still trades nearly $2 per share cheaper today but this Board has not even implemented any additional share repurchase authorizations to this day.

Page 23 describes the use of funds to entrench the board. In addition to highlighting this nefarious $15 privately negotiated trade we also want to highlight the Board’s estimated costs for shareholders to bear in this year’s proxy contest. The company’s estimate of $750,000 is quadruple Moab’s estimated costs and more than 2 ½ times what Mac-Gray spent defending itself during their 2011 contest. With proxy contests initiated by shareholders in 4 of the last 5 years, these costs are sadly becoming a recurring expense of the business. In spite of all the efforts by shareholders, the trickery of this Board coupled with its staggered nature leave us today with an entirely insider-appointed Board with the exception of Bruce Percelay who Moab nominated last year.

Turning to slide 24, despite operating in a mature industry, the incumbents have been extremely reluctant in their dividend policy and even after the recently hyped 45% increase Mac-Gray is still only paying out 17.7% of the company’s recurring free cash flow.

I want to point out that Mac-Gray is just 2.5x leveraged today (that’s total net debt divided by EBITDA). If the company achieves its guidance and pays out the new dividend, it will be just 2x levered by the end of the year. As a contrast, Coinmach was acquired last week by Pamplona Capital Management and the financing for that deal, which takes advantage of today’s very attractive low rate environment, totals 4x EBITDA.

Mac-Gray’s other major competitor WASH is even more leveraged. They are owned by Code Hennessy—another prominent leverage buyout player.

If elected, we would propose a doubling of Mac-Gray’s current dividend, which would only get to a mere 35% payout ratio. Once we are comfortable with the management team in place, we would entertain taking on some debt to fund accretive acquisitions, special dividends or share buybacks.

On Page 25 we’ve laid out what I would describe as weak compensation targets set out by the Board and the two incumbents. Mr. Bryan is chair of the compensation committee and Ms. Tocio sits on the committee. As you can see on this slide, growth required to achieve 100% bonus targets has been minimal. 0% in 2010, 2-3% in 2011 and 2-6% in 2012.

What’s much more concerning is that these targets are for 100% bonus levels but the incentive plan rewards executives even when targeted earnings levels are achieved. This means that revenue and EBITDA declines justify cash bonuses to senior executives at Mac-Gray. For example, in order for management to not have earned a revenue-driven bonus in 2012, Mac-Gray’s revenue would have had to decline 4x faster than it did during the great recession. As another example, in 2011 management missed their targeted revenue because revenue declined—even though prices were raised. Nevertheless, senior management received 99% of their target bonuses. We don’t understand this plan—particularly when prices are raised nearly every year.

If Mr. Hyman and I were added to the Board, we would seek to significantly change management incentives. We would not reward revenue or earnings declines and perhaps we might increase rewards for growth. Most importantly, our compensation mechanism would be aligned with long term shareholder value creation. Paying bonuses for declining revenue—in years when prices are raised is just crazy in our view.

Page 26 illustrates the results of a completely failed compensation plan. Since the company’s IPO in 1997, CEO MacDonald’s compensation has increased 8 fold and the sharpest rise in his compensation began in 2004 when nominee Mr. Bryan was placed on the Board and on the compensation committee. We also point out that EPS has declined from $0.48 at the time of the IPO to $0.29 in 2012.

7

Now James and I would like to take a few moments to review our backgrounds and outline our plan for Mac-Gray. James go ahead.

James Hyman:

Thank you Michael. My name is James Hyman and Page 28 provides a quick overview of my background. I’ll spend a couple of minutes talking about my involvement with Mac-Gray, but, before I do, let me provide some additional information on myself and my relevance to the Mac-Gray board.

For the past 20 years, there are two common threads that have run through my career.

| | • | | First, I have spent my time at multi-location, common-process service businesses across industries ranging from equipment rental to hotels to prisons to my current role as CEO of TestAmerica, the largest environmental testing business in America. The common thread across that range of industries is that success requires establishing common processes for consistent service delivery to clients at multiple locations and across all elements of the business system, and a very tight focus on asset utilization. |

| | • | | The second common thread is that the companies where I had leadership positions, the businesses have all been positioned in mature industries, have lagged competitors for an extended period and have frustrated owners with poor equity returns. In each case, I have been part of the turnaround. |

As CEO at Cornell, a New York Stock Exchange-traded company that had lagged the performance of peers for years, we first right-sized the company and then refocused the organization on utilization and return on capital. In addition, I successfully negotiated two shareholder proxy contests while retaining confidence of the shareholder community to continue to manage the company. Over five years we grew top line by 8% CAGR, operating income by 37% CAGR and our 5-year total shareholder return outperformed sector benchmarks by 670bps according to Risk Metrics and 1210bps according to Glass Lewis.

At TestAmerica, where I am currently CEO, we’ve spent two years restructuring by creating a lean corporate overhead, refocusing the operations on client service, increasing operating density for leverage and increasing asset utilization. We aren’t complete, but we have the major work done and can now focus on profitably taking market share.

Turning to Mac-Gray, I first became involved in the fourth quarter of 2010 when I was approached by River Road Asset Management, a large long-term shareholder of Mac-Gray, about potentially joining the Board. River Road had been an investor in Cornell, and had benefited from the performance improvement delivered there. With Mac-Gray, River Road was frustrated with performance and thought I could add insight to the Board. Through early 2011, I met with Mac-Gray Board members and the CEO. They discussed with me their plans for business performance improvement. Unfortunately, they took so long to offer to nominate me to the Board in April 2011 that, by the time they did, I had already accepted other commitments and so declined.

In early 2013, River Road again discussed with me if I would have interest with Mac-Gray and suggested that I talk with Michael Rothenberg of Moab, which I did. I have followed the Mac-Gray story at a distance over the past two years and was perplexed by the lack of progress made on a number of fronts that the Board and CEO had discussed and the continued underperformance of the business relative to peers. For example:

| | • | | It perplexed me that the acquisitions don’t seem to be producing the return on equity to be accretive for shareholders. It’s not just acquiring footprint—it’s acquiring at the right price within the right strategy. At Cornell, I had seen the previous Board approving an acquisition strategy that chased EBITDA, for which management was compensated, without being accretive to shareholders. We shifted from chasing revenue to driving ROCE and aligned that with management compensation. |

| | • | | Another example, it perplexed me why overall margins were showing sustained decay. At both Cornell and TestAmerica, we used a market downturn to aggressively restructure so that with demand recovery and an emphasis on dynamic pricing, the company can achieve margin expansion. I expected to see this at Mac-Gray based on the discussions in 2010-11, but haven’t seen it in the public numbers and with the recovery in rental occupancy, it indicates that management may not be moving fast enough and the Board may not be pushing hard enough for speed of execution. |

8

Lastly, let me address my time commitment. Because we have completed much of the turnaround at TestAmerica and put a new management team in place, I now can commit the time to another outside obligation and agreed with Michael that Mac Grey would be it.

I believe I am uniquely qualified to serve as a Board member of Mac-Gray, both with my business background in analogous situations, a clear view of investor concerns of this company and a track record of collegially working with a Board to deliver change that enhances shareholder value.

Michael Rothenberg:

Thank you James. In terms of my background, I have been in the professional investing business for 15 years, building Moab Partners over the last 7. Prior to this, I worked as an investment banker focused on mergers and acquisitions for 3 years out of college. My area of expertise is business valuation. This is an area sorely lacking on Mac-Gray’s Board as evidenced by the high and dilutive prices the Board and both incumbents have agreed to pay for their largest acquisitions. I have also managed my own business from day 1 that has grown in an extremely competitive industry.

In response to Mac-gray’s assertion that I have little operating company and board experience, I want to point out, first, in terms of operating experience, that while at Perry Capital in the late 90s I spent nearly a year living in Chicago overseeing our largest investment which was FTD, the floral delivery business. I worked very closely with the CEO to separate FTD’s high growth internet assets into a newly formed public company and actually served as de-facto Chief Financial Officer of FTD.com during that time. As a professional investor, I have sat on numerous official creditor and steering committees through the complex bankruptcy process representing the interests of large classes of bond securities or bank lenders claims. Just to name a few over my career, I’ve sat on the official committees representing the bond investors and/or bank lenders in the restructurings of Solutia, Muzak, iPCS Communications and Grupo Iusacell.

Page 30 is critically important as it highlights the plan that James and I would seek to implement if elected to serve on this Board. If you’ll allow me to comment on each point. First, we would work with senior executives to review the business on a market-by-market basis, understanding as best we can Mac-Gray’s profitability, market share and key competitors in each region. We think substantial shareholder value could be created at Mac-Gray by selling break-even or money-losing markets to local operators. A leader can fold our contracts into their route network and take out significant cost and, therefore, could afford to pay Mac-Gray significantly more for the business than it is worth to us.

Second, we would seek to resume an intelligent acquisition program that focuses on route efficiency. Even though Mac-Gray highlighted acquisitions as a key element of their business plan in 2011, no deals have been announced till this day. We believe because the same Board and management are in place that made the bad deals, that they have taken themselves out of the market missing exciting opportunities. As evidence of this, earlier this year, WASH Multifamily acquired Coinamatic Canada—the largest laundry room operator in Canada. Based on comments made at a public investor presentation earlier this year, Coinamatic Canada was acquired by WASH at just over 5x EBITDA. Just last month Coinmach acquired AIR-serv, the nation’s largest operator of tire inflation vending equipment that you see in gas stations. Based on Coinmach’s recent investor presentation, they paid less than 5x EBITDA for the industry leader and they will fold their laundry quarter collectors in with the coin collectors of this business to extract enormous synergy. Regretfully, Mac-Gray’s board is missing these exciting opportunities.

Third, we would seek to restructure incentive programs to perhaps pay more for growth but certainly not reward revenue and earnings declines. Key in our plan would be to align incentives with long-term growth in shareholder value.

Fourth, we need to evaluate the senior management team. This team has been in place for more than 15 years with failed results. As outsiders today, our first step would be to interview first- and second-tier management to get their perspectives and search for talent inside the organization before making a final determination.

9

Fifth, as we’ve mentioned before, we think Mac-Gray can comfortably double the newly increased dividend.

Sixth, we see no reason not to implement a share repurchase authorization so that the Board can take advantage of mis-pricing opportunities that may arise. If we are secure with management, we would also consider more aggressive returns of capital to shareholders through possibly tender offers or special dividends.

Seventh, this is something we learned at the recent investor presentations by WASH and Coinmach—they work to reuse parts of their washers and dryers. Specifically, WASH has a dedicated facility and boasts that half the parts in their washers and dryers live a second life. Coinmach, on the other hand, focuses on reusing washer and dryer engines. To the best of our knowledge, Mac-Gray has failed in its refurbishment efforts and has gone the route of just selling their old machines for scrap metal value.

Moving to the governance side, we would seek to implement the key areas you highlighted in your report last year that have continued to be ignored by this Board and the incumbents. We would fight strongly to de-stagger the Board.

In conclusion, we’re pursuing this contest urgently because the Board has no apparent plan to grow this business or create shareholder value and no one seems to be held accountable for past failures.

We highlight on this final slide the underperforming stock price, particularly after a $17.50 per share proposal was rejected by the Board, a failure by this company to capitalize on improved end-market dynamics which is most evident in the company’s important and extremely disappointing first quarter, and the failure to hold anyone accountable for the flawed acquisition program. Both incumbent directors seeking reelection pursued this program and yet today revenue and profitability are in decline—just look at the decline in adjusted EBITDA on Page 30 of Mac-Gray’s own presentation to you. Clearly that $316 million was not well spent—our entire market capitalization today is $190 million. But all the same senior management remains in place as do the two directors seeking to extend their terms this year. And, lastly, the poor track record of corporate governance and your 0.0 score last year. This governance track record has led to 4 proxy contests in the last 5 years—all of which, to date, have unfortunately amounted to just 1 out of our 8 directors today nominated by an independent shareholder.

And this wraps up our presentation. Thank you again for your attention and please let us know if you have any other questions.

10

Important Additional Information