UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | |

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box: ¨ Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ý Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to § 240.14a-12 |

Pioneer Natural Resources Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | |

Payment of Filing Fee (Check the appropriate box): ý No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

| | | | | |

NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS |

| |

To the Stockholders of Pioneer Natural Resources Company:

The Annual Meeting of Stockholders of Pioneer Natural Resources Company ("Pioneer" or the "Company") will be held on Wednesday, May 25, 2022, at 8:00 a.m., Central Time (the "Annual Meeting"). In light of the public health impact of the ongoing coronavirus, or COVID-19, outbreak and the continued uncertainty regarding the progression of the pandemic and the potential outbreak of new variants, Pioneer has determined that the Annual Meeting will be held in a virtual meeting format only, with log-in beginning at 7:45 a.m., Central Time. You may attend the Annual Meeting online, including to vote or submit questions, at the following website address www.virtualshareholdermeeting.com/PXD2022 by entering the company number and control number included on your Notice Regarding the Internet Availability of Proxy Materials (the "Notice of Availability"), on your proxy card or on the instructions that accompanied your proxy materials. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/PXD2022. The Annual Meeting is being held for the following purposes:

| | | | | | | | | | | | | | | | | |

| 1 | To elect the Company’s 12 director nominees named in this Proxy Statement, each for a term to expire at the 2023 Annual Meeting of Stockholders. | | | | |

| | DATE & TIME Wednesday, May 25, 2022, at 8:00 a.m. C.S.T. PLACE Via live webcast at www.virtualshareholdermeeting.com/PXD2022 RECORD DATE March 31, 2022 | |

| | | | |

| 2 | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2022. | | | |

| | | | |

| 3 | To approve on an advisory basis the Company’s named executive officer compensation. | | | |

| | | | |

| 4 | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. | | | |

| | | | |

| | | | |

| | | | |

These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting only if you were a stockholder of record at the close of business on March 31, 2022. If there are not sufficient votes represented for a quorum or to approve the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned or postponed in order to permit further solicitation of proxies. Beginning on or about April 14, 2022, the Company mailed the Notice of Availability to its stockholders containing instructions on how to access this Proxy Statement and vote online, and the Company made proxy materials available to the stockholders over the Internet. Instructions for requesting a paper copy of the proxy materials are contained in the Notice of Availability.

By Order of the Board of Directors, Akshar C. Patel Corporate Secretary Irving, Texas April 14, 2022 | | | |

| | | |

| | | |

| | YOUR VOTE IS IMPORTANT Please vote over the internet at www.proxyvote.com or by phone at 1-800-690-6903 promptly so that your shares may be voted properly. If you received a paper copy of the proxy materials (which includes the proxy card), you may also vote by completing, signing and returning the paper proxy card by mail. | |

| | | | | |

| Proxy Statement Summary | |

| |

| General Information | |

| |

| Proposal One: Election of Directors | |

| |

| Corporate Governance | |

| Corporate Governance Guidelines | |

| Board Leadership Structure | |

| CEO and Senior Management Succession Planning | |

| Director Independence | |

| Director Self-Evaluation Process, Onboarding and Education, and Board Refreshment | |

| Engagement with Stockholders | |

| Commitment to Sustainability | |

| Procedure for Directly Contacting the Board and Whistleblower Policy | |

| |

| |

| The Board, Its Committees and Its Compensation | |

| Meetings and Committees of the Board | |

| Board's Role in Oversight of Strategy and Risk Management | |

| Attendance at Annual Meetings | |

| Director Compensation | |

| Stock Ownership Guidelines for Non-Employee Directors | |

| |

| |

| Audit Committee Report | |

| |

| Compensation and Leadership Development Committee Report | |

| |

| Compensation Discussion and Analysis | |

| |

| | | | | | | | | | | | | | |

| 2 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

| | | | | |

| Executive Compensation Tables | |

| Summary Compensation Table | |

| 2021 Grants of Plan-Based Awards | |

| Narrative Disclosure for the 2021 Grants of Plan-Based Awards Table | |

| 2021 Outstanding Equity Awards at Fiscal Year End | |

| 2021 Option Exercises and Stock Vested | |

| Pension Benefits | |

| 2021 Non-Qualified Deferred Compensation | |

| Potential Payments upon Termination or Change in Control | |

| Ratio of the CEO's Compensation to the Median Compensation of the Company's Other Employees | |

| |

| |

| Compensation Programs and Risk Considerations | |

| |

| Security Ownership of Certain Beneficial Owners and Management | |

| |

| Transactions with Related Persons | |

| |

| Proposal Two: Ratification of Selection of Independent Registered Public Accounting Firm | |

| |

| Proposal Three: Advisory Vote to Approve Named Executive Officer Compensation | |

| |

| Stockholder Proposals; Identification of Director Candidates | |

| |

| General Information about the Annual Meeting | |

| |

| Stockholder List | |

| |

| Annual Report and Other Information | |

| |

| Internet and Phone Voting | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 3 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | The following section is only a summary of key elements of this Proxy Statement, and is intended to assist you in reviewing this Proxy Statement in advance of the Annual Meeting. This summary does not contain all of the information you should consider, and you are encouraged to read this entire Proxy Statement before submitting your votes. |

| DATE & TIME Wednesday, May 25, 2022, at 8:00 a.m. C.S.T. PLACE Via live webcast at www.virtualshareholdermeeting.com/PXD2022. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/PXD2022. RECORD DATE March 31, 2022 | | |

| | | Voting Matters and Board Recommendations |

| | | | | | | | | |

| | | PROPOSAL | DESCRIPTION | | | BOARD RECOMMENDATION | PAGE |

| | | | | | | | |

| | | 1 | Election of the Company's 12 director nominees named in this Proxy Statement | FOR each of the director nominees | |

| | | 2 | Ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2022 | FOR | |

| | | 3 | Approval, on an advisory basis, of the Company's named executive officer compensation | FOR | |

| | | |

| | | |

| | | |

| | | | | | | |

| HOW TO VOTE Internet At www.proxyvote.com until May 24, 2022 By Telephone 1-800-690-6903 until May 24, 2022 By Mail Complete, sign and return your proxy card before May 25, 2022 During the Meeting Go to www.virtualshareholdermeeting.com/PXD2022 | | | 2021 Business Highlights |

| | | | | | | | | |

| | | | | | |

| | |

| | | | DELIVERED STRONG CASH FLOW $6.1B Delivered strong cash flow from operating activities for the full year 2021. | | | RETURN OF CAPITAL TO SHAREHOLDERS $1.9B Returned capital to shareholders through base-plus-variable dividend program and opportunistic share repurchases. |

| | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| 4 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

Business Highlights (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| MAINTAINED A STRONG BALANCE SHEET $3.8B Ended 2021 with unrestricted cash on hand of $3.8 billion and net debt of $3.1 billion. The Company had $5.8 billion of liquidity as of December 31, 2021, comprising its unrestricted cash and a $2.0 billion unsecured credit facility (undrawn as of December 31, 2021). | | | | ESG FOCUS •Expanded responsibilities of the Sustainability and Climate Oversight Committee •Continued focus on Board refreshment with the addition of four new directors, two of whom are women and two of whom identify as individuals from underrepresented communities •Increased diversity of executive leadership to 47% •Increased weight of ESG & Health, Safety and Environment metrics in annual incentive compensation plan •Published inaugural Climate Risk Report outlining progress toward full implementation of Task Force on Climate-Related Financial Disclosures ("TCFD") principles | |

| | | | | | |

Enhanced Emissions and Water Usage Targets

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

REDUCE GHG EMISSIONS INTENSITY 50% The Company's updated target aims to reduce greenhouse gas ("GHG") emissions intensity 50% by the year 2030*. Previously, this target was 25% by 2030. *2019 baseline | | | | REDUCE METHANE EMISSIONS INTENSITY 75% The Company's updated target aims to reduce methane emissions intensity 75% by the year 2030*. Previously, this target was 40% by 2030. *2019 baseline | | | | | REDUCE FRESHWATER USED IN COMPLETIONS 25% The Company's updated target seeks to reduce freshwater usage in completions to 25% by 2026.

| |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 5 |

Nominees for Director

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | COMMITTEE MEMBERSHIPS(1) | OTHER CURRENT PUBLIC CO. BOARDS (#)(2) |

| NAME | AGE | DIRECTOR SINCE | PRIMARY OCCUPATION | INDEPENDENT(1) | AC | CLD | HSE | NCG | SCOC |

| | | | | | | | | | |

| | | | | | | | | | |

A.R.

Alameddine | 74 | 2021 | Former Lead Director, Parsley Energy, Inc. | | | | | | | — |

| Lori G. Billingsley | 58 | 2021 | Retired Global Chief Diversity, Equity & Inclusion Officer, The Coca-Cola Company | | | | | | | — |

| Edison C. Buchanan | 67 | 2002 | Former Managing Director, Credit Suisse First Boston | | | | | | | — |

| Maria S. Dreyfus | 42 | 2021 | CEO, Ardinall Investment Management | | | | | | | 2 |

Matthew M.

Gallagher | 39 | 2021 | President of Greenlake Energy Ventures, LLC | | | | | | | 1 |

Phillip A.

Gobe | 69 | 2014 | Retired CEO, ProPetro Holding Corp. | | | | | | | 1 |

Stacy P.

Methvin | 65 | 2013 | Retired Vice President, Shell Oil Company | | | | | | | 1 |

Royce W.

Mitchell | 67 | 2014 | Executive Consultant | | | | | | | — |

Frank A.

Risch | 79 | 2005 | Retired Vice President and Treasurer, Exxon Mobil Corporation | | | | | | | — |

Scott D.

Sheffield | 69 | 1997 | Chief Executive Officer | | | | | | | 1 |

| J. Kenneth Thompson | 70 | 2011 | President and CEO, Pacific Star Energy LLC | | | | | | | 3 |

Phoebe A.

Wood | 69 | 2013 | Retired Vice Chairman and Chief Financial Officer, Brown-Forman Corporation | | | | | | | 3 |

(1) Definitions of abbreviations used in Nominees for Director table: | | | | | | | | | | | | | | |

| AC | Audit Committee | | | Chairperson |

| CLD | Compensation and Leadership Development Committee | | | Audit Committee Financial Expert |

| HSE | Health, Safety and Environment Committee | | | Independent Board Chair |

| NCG | Nominating and Corporate Governance Committee | | | |

| SCOC | Sustainability and Climate Oversight Committee | | | |

(2) Refers to a company with a class of securities registered pursuant to section 12 of the Securities Exchange Act of 1934.

| | | | | | | | | | | | | | |

| 6 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

Diversity and Composition Highlights of Director Nominees

•Independent Leadership: The Chairman of the Company's Board of Directors (the "Board"), J. Kenneth Thompson, is an independent director.

•Independence: The Board seeks to ensure that at least two-thirds of its members will be independent under applicable laws and regulations. 11 of the Board's 12 director nominees are independent, as defined by the rules of the New York Stock Exchange (the "NYSE").

•Board Refreshment: Over time, the Board refreshes its membership through a combination of adding or replacing directors to achieve the appropriate balance between maintaining longer-term directors with deep institutional knowledge of the Company and adding directors who bring a diversity of perspectives and experience. In 2021, four new directors were named to the Board, all of whom are non-employee directors, two of whom are women and two of whom identify as individuals from underrepresented communities.

•Diversity of Backgrounds, Skills and Experience; Rooney Rule: In assessing the composition of the Pioneer Board, the Board and its Nominating and Corporate Governance Committee strive to achieve an overall balance of diversity of backgrounds and experience at policy-making levels with a complementary mix of skills and professional experience in areas relevant to the Company's business and strategy. In the event that the Nominating and Corporate Governance Committee determines to recruit candidates from outside Pioneer as potential nominees to join the Pioneer Board, the committee will use its best efforts to include, and will instruct any third-party search firm the committee engages to assist it in seeking candidates for the Board to include, qualified candidates with a diversity of gender and race/ethnicity in the initial pool from which the committee selects director candidates. Among the twelve nominees for election to the Board, four self-identify as women, and two self-identify as individuals from underrepresented communities (meaning, an individual who self-identifies as Black, African American, Hispanic, Latino, Asian (including the Middle East), Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender).

The Board believes that the nominees for election offer a diverse range of backgrounds, skills and experience in relevant areas that contribute to overall effective leadership and exercise of oversight responsibilities by the Board:

| | | | | | | | | | | |

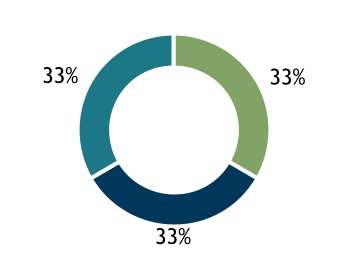

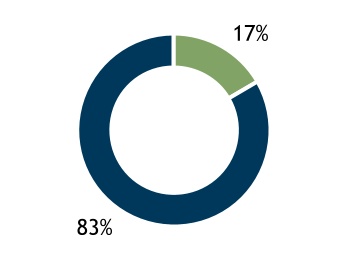

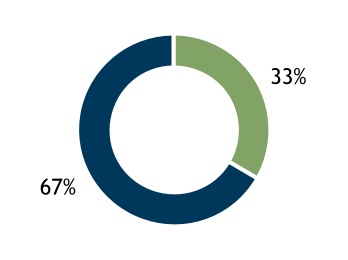

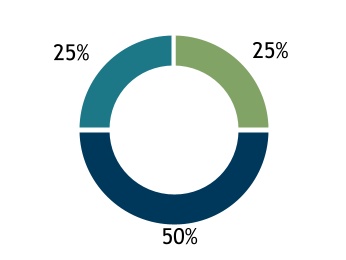

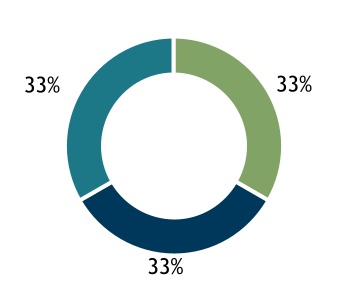

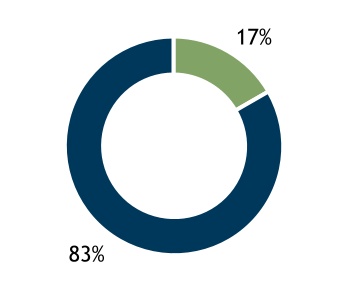

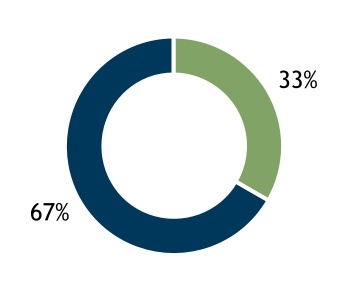

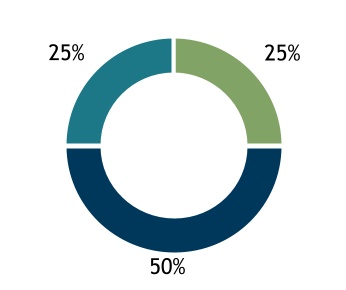

NON-EMPLOYEE DIRECTOR TENURE | RACIAL DIVERSITY | GENDER DIVERSITY | AGE DIVERSITY |

| | | | | | | | | | | |

l 0-5 Years l 6-10 Years l >10 Years | l Racially Diverse l Not Racially Diverse | l Female l Male | l <60 Years l 60-70 Years l 70+ Years |

| | | | | | | | | | | |

| 8 YEAR AVERAGE | 17% DIVERSE | 33% FEMALE | AVERAGE AGE: 64 |

| q | q | |

| AGGREGATE BOARD DIVERSITY: 42% | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 7 |

Director Nominee Skills Matrix

| | | | | | | | | | | |

| | Senior Exec Experience - serving in a senior leadership role at another organization | |

| | E&P Industry Ops - experience in the exploration and production industry and/or knowledgeable on the Company's position in the sector | |

| | Science / Tech / Eng / R&D - experience in research, innovation, or improvement on searching for or extracting raw materials | |

| | Accounting / Finance - knowledge of the financial markets, corporate finance, accounting regulations, and accounting and financial reporting processes | |

| | M&A / Commercial Transactions - experience in consolidation of companies or assets through various types of financial transactions | |

| | Strategic Planning / Risk Management - oversight of management’s development, implementation of strategic priorities, security, and risk management | |

| | Environmental / Safety / Health / Sustainability - experience in refining and establishing sustainable practices and/or safer working conditions | |

| | Marketing / Sales - experience executing corporate commercial and/or marketing strategies and initiatives | |

| | Global Business / International - experience in globalization and developing international business relationships in global markets | |

| | Legal / Government / Regulatory - experience in highly regulated businesses and/or familiar with legal practices | |

| | Human Resources - experience in human capital management and/or cultivating resources and communication channels throughout the company | |

| | Other Public Boards - experience on boards of other publicly traded companies | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Alameddine | l | l | l | | l | l | | | l | | l | l |

| Billingsley | l | | | | | l | l | | l | l | l | |

| Buchanan | l | | l | l | l | l | l | l | l | l | l | l |

| Dreyfus | l | | l | l | l | l | l | | l | l | l | l |

| Gallagher | l | l | l | l | l | l | l | | | l | l | l |

| Gobe | l | l | l | | l | l | l | | l | | l | l |

| Methvin | l | l | l | l | | l | l | l | l | l | l | l |

| Mitchell | l | l | | l | l | l | l | l | l | | l | l |

| Risch | l | l | | l | l | l | | l | l | l | l | l |

| Sheffield | l | l | l | l | l | l | l | l | l | l | l | l |

| Thompson | l | l | l | l | l | l | l | l | l | l | l | l |

| Wood | l | l | | l | l | l | | | l | l | l | l |

| | | | | | | | | | | | | | |

| 8 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

Governance Highlights

The Board believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duties to stockholders. The Board oversees the development and execution of the Company's strategy, including the oversight of risk. To foster the continuous improvement of governance practices and policies, the Board focuses on the following actions:

| | | | | |

| •The Board is led by the Company's independent Chairman of the Board whose robust duties are set forth in the Company's Corporate Governance Guidelines and include overseeing all activities of the Board and its various committees. See "Board Leadership Structure" on page 31. •The Board regularly oversees and reviews succession and development plans for senior management positions and the CEO. •The Company's non-employee directors meet in executive session during every quarterly Board meeting. •Board members regularly meet directly with members of senior management and continuously assess performance during meetings and other interactions. |

| •The Board and its committees conduct an extensive, thorough and candid annual self-evaluation. •Board members provide feedback on a wide array of topics including Board and committee effectiveness, composition, culture, risk oversight processes, continuing education, skills and expertise, among others. •The Board's self-evaluation and decisions are informed by the Company's stockholder engagement process. See "Engagement with Stockholders" on page 36. |

| •The Board is committed to continually assessing the composition of the Board and strives to achieve an overall balance of backgrounds and diversity of experience to achieve a complementary mix of skills and professional experience in areas relevant to the Company's business. As part of this effort, the Board is focused on regular renewal and refreshment. As a result, the Company has an experienced and diverse group of nominees. See “Directors and Nominees” on page 16. •The Board's extensive onboarding and continuing education processes augment the director recruitment and selection process to foster a complementary mix of skills and professional experience. See "Self-Evaluation Process and Board Composition" on page 33. |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 9 |

Through this comprehensive and robust corporate governance process, Pioneer's Board has adopted the following corporate governance best practices: | | | | | |

| CORPORATE GOVERNANCE BEST PRACTICES |

| The Board has an independent Chairman |

| 11 out of 12 director nominees are independent |

| Board refreshment: 6 out of 11 non-employee director nominees have tenures of eight or fewer years; 4 new directors added in 2021 |

| Board diversity: 42 percent of Pioneer's Board nominees are diverse; women chair 2 of the Board's 5 standing committees |

| Senior executive diversity: 47 percent of Pioneer's management committee is diverse |

| Board oversight of: •the Company's long-term strategy •risk management - annual review of enterprise risks, with a focus on specific risks during interim quarters |

| Annual Board and committee self-evaluations |

| Active stockholder engagement process, with participation by independent Board members |

| Stockholder proxy access |

| All directors stand for election annually |

| Majority voting for directors in uncontested elections |

| Independent audit, compensation and governance committees |

| Robust stock ownership policy for directors |

| All directors attended more than 75 percent of the meetings of the Board and committees on which they served during 2021 |

| Anti-hedging and pledging policies |

| Compensation clawback policy |

| No poison pill |

Commitment to Sustainability

The Board and senior management of the Company understand that in order to continue to provide value to the Company's stockholders, Pioneer must remain focused on its social license to operate and committed to environmental, social and governance ("ESG") issues.

Pioneer's annual Sustainability Report, and first annual Climate Risk Report, available on the Company's website, highlight Pioneer's commitment to ESG issues and the Board's oversight of risks related to climate change. These reports detail Pioneer's efforts to conduct the Company's operations safely and with respect for the environment, to provide its people the resources they need to be collaborative and successful in their careers, to help communities in which Pioneer operates share in the opportunities created by its investments and to position the Company to navigate the energy transition.

Board oversight - the Board is actively engaged in overseeing the Company's sustainability practices:

•The Board regularly considers the potential impacts of climate change policy and growing alternative energy sources on global fossil fuel demand and Pioneer's long-term business prospects. As part of the Company's strategic planning process, management periodically prepares and reviews with the Board long-term scenarios under varying assumptions to stress test the Company's business outlook in the face of these risks.

| | | | | | | | | | | | | | |

| 10 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

•The Health, Safety and Environment Committee reviews the Company's health, safety and environmental ("HSE") performance and the Company's management of current and emerging HSE and climate change-related issues, including trends in legislation and proposed regulations affecting the Company. This committee is also responsible for overseeing the Company's operational implementation and progress regarding certain environmental and climate-related targets, such as emissions-intensity and freshwater reduction targets.

•The Nominating and Corporate Governance Committee assists the Board in identifying, evaluating and monitoring social, governance, political, human rights and public policy trends, issues and concerns and other sustainability and corporate responsibility matters that could affect the Company's business and reputation, including climate change-related risks and opportunities.

•The Compensation and Leadership Development Committee oversees the Company's strategies, initiatives and programs with respect to Pioneer's culture, talent recruitment, development and retention, employee engagement and diversity and inclusion. The committee is also responsible for aligning executive compensation with company performance, including the incorporation of sustainability and climate-related goals established by the HSE Committee, such as emissions-intensity and freshwater reduction targets.

•The Sustainability and Climate Oversight Reporting Committee ("SCOC") oversees the Company's overall climate strategy and the preparation of its annual sustainability report, climate risk report and other significant disclosures regarding ESG matters.

Executive Compensation Highlights

Structure - the three main components of the executive compensation program, each of which generally is targeted at the median level of the Company's peer group, are:

•Base salary - fixed cash compensation component.

•Annual cash bonus incentive award - variable cash payout based on Company and individual performance for the year.

•Long-term incentive plan awards - 100 percent of the Chief Executive Officer's ("CEO") target value of long-term incentive plan awards is allocated to performance-based performance unit awards; the allocation to performance unit awards for the other executive officers is 60 percent; the payout is dependent on relative total stockholder return against industry peers and the S&P500 index over a three-year period; the remaining target value of long-term incentive plan awards is allocated to time-based awards that vest over three years.

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 11 |

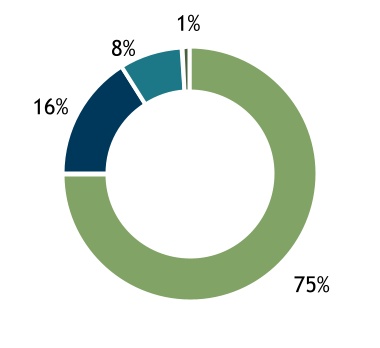

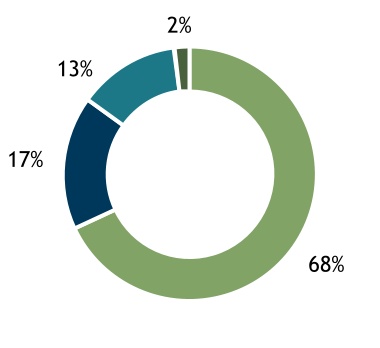

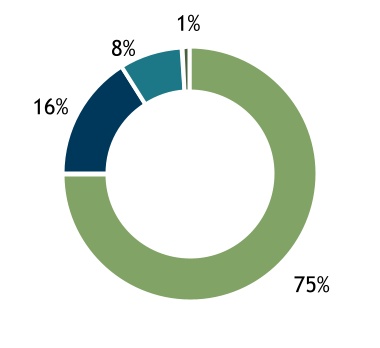

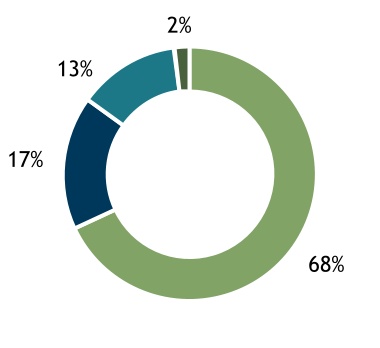

The following charts illustrate the various components of total 2021 annual compensation for the CEO and the other named executive officers as a group as reported in the Summary Compensation Table.

| | | | | |

l Long-Term Incentive l Annual Cash Bonus l Base Salary l Other Compensation | l Long-Term Incentive l Annual Cash Bonus l Base Salary l Other Compensation |

The Company's executive compensation and compensation-related governance policies and practices incorporate many best practices, including the following:

| | | | | |

| KEY COMPENSATION PRACTICES |

| Pay for performance - over 85 percent of target total compensation for the CEO comprises variable compensation |

| Emphasize long-term performance - over 75 percent of target total compensation for the CEO comprises performance units |

| Compensation clawback policy |

| Double-trigger payments in the event of a change in control |

| Independent Compensation and Leadership Development Committee with independent compensation consultant |

| Stockholding requirement of 6 times base salary for the CEO, 5 times base salary for the COO and 3 times base salary for other NEOs |

| Health, safety and environmental goals incorporated into the annual cash bonus incentive program |

| Annual advisory vote on executive compensation |

| No tax gross ups |

| No employment agreements |

| No hedging or pledging of Company common stock |

| No repricing of stock options or buying out underwater stock options |

| | | | | | | | | | | | | | |

| 12 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

Stockholder Outreach and Engagement

| | | | | | | | | | | | | | | | | | | | | | | |

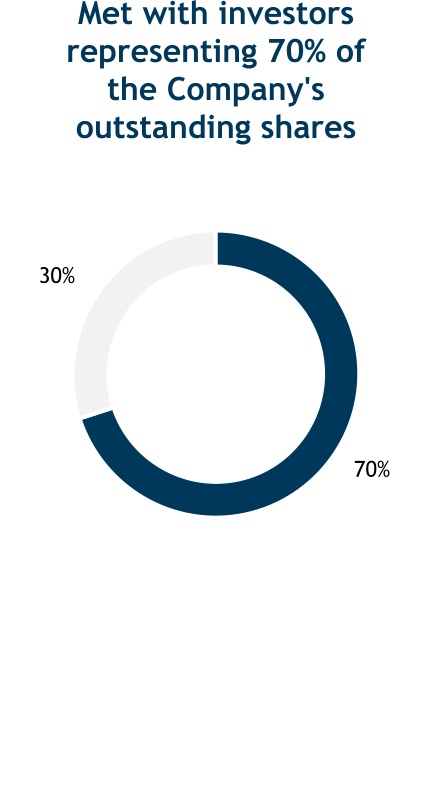

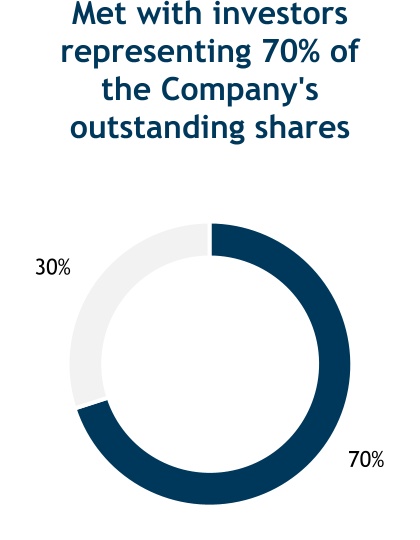

The Company regularly engages with its stockholders and other stakeholders and solicits feedback. The Company's practice is to regularly reach out to its largest stockholders, generally twice per year. Initial stockholder outreach occurs prior to the annual meeting to discuss any concerns stockholders may have, but particularly relating to matters to be voted on at the meeting. Following the annual meeting, additional stockholder outreach occurs to review a wider range of topics of concern, including strategic priorities, sustainability and environmental issues, corporate governance and executive compensation. As part of this annual engagement process, during 2021 and through the date of this Proxy Statement, Pioneer met with stockholders holding in the aggregate more than 70 percent of the Company's outstanding shares. The topics covered at the meetings included strategic priorities, sustainability and environmental issues, corporate governance, diversity, equity and inclusion efforts and executive compensation, among others. This process has led to a number of enhancements in the Company's governance, compensation and disclosure practices. For more information see "Engagement with Stockholders" on page 36. | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 13 |

| | | | | |

PROXY STATEMENT 2022 ANNUAL MEETING OF STOCKHOLDERS |

| |

General Information

This Proxy Statement provides information in connection with the solicitation of proxies by the Board of the Company for use at the Annual Meeting, which will be held online at www.virtualshareholdermeeting.com/PXD2022 on Wednesday, May 25, 2022, at 8:00 a.m., Central Time. You may attend the Annual Meeting online using the control number included in your Notice of Availability and vote your shares of the Company's common stock if you were a stockholder of record at the close of business on March 31, 2022. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/PXD2022. To be admitted and participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Availability, on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the stockholder of record may be voted electronically during the Annual Meeting. Shares for which you are the beneficial owner but not the shareholder of record also may be voted electronically during the Annual Meeting. However, even if you plan to attend the Annual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are not present at the Annual Meeting, your shares may be voted only by a person to whom you have given a proper Proxy. The Board is requesting your Proxy so that the persons named on the Proxy will be authorized to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting. You may revoke the Proxy in writing at any time before it is exercised at the Annual Meeting. See "General Information about the Annual Meeting - Voting and Quorum - Revoking a Proxy."

About the Annual Meeting

In light of the public health impact of the ongoing coronavirus, or COVID-19, outbreak and the continued uncertainty regarding the progression of the pandemic and the potential outbreak of new variants, Pioneer has determined that the Annual Meeting will be held in a virtual meeting format only. There will be no physical meeting location and the meeting will only be conducted via live webcast. You may submit questions for the meeting in advance at www.virtualshareholdermeeting.com/PXD2022. You may participate in the Annual Meeting, submit live questions and vote during the meeting at www.virtualshareholdermeeting.com/PXD2022 by entering the control number included on the Notice of Availability or the proxy card you received, or in the instructions that accompanied your proxy materials. Online check-in will begin at 7:45 a.m., Central Time. Please allow ample time for online check-in procedures. If you encounter any difficulties accessing the virtual meeting during check-in or during the course of the Annual Meeting, please call 844-986-0822 (U.S.) or 303-562-9302 (International).

This virtual stockholder meeting format uses technology designed to increase stockholder access and provide stockholders rights and opportunities to participate in the meeting similar to what they would have at an in-person meeting. In addition to online attendance, stockholders will be provided an opportunity to hear all portions of the official meeting, submit written questions and comments before and during the meeting, and vote online during the open poll portion of the meeting.

See "General Information about the Annual Meeting" for additional information relating to the Annual Meeting.

References in the Proxy Materials to the "Annual Meeting" also refer to any adjournments, postponements or changes in location of the Annual Meeting, to the extent applicable.

| | | | | | | | | | | | | | |

| 14 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

Electronic Availability of Proxy Statement and Annual Report

As permitted under the rules of the Securities and Exchange Commission (the "SEC"), the Company is making this Proxy Statement and its Annual Report available to its stockholders electronically via the internet. The Company is sending the Notice of Availability on or about April 14, 2022, to its stockholders of record as of the close of business on March 31, 2022. The Notice of Availability includes:

•instructions on how to access the Company's proxy materials electronically;

•the date, time and location of the Annual Meeting;

•a description of the matters intended to be acted upon at the Annual Meeting;

•a list of the materials being made available electronically;

•instructions on how a stockholder can request paper or e-mail copies of the Company's proxy materials;

•any control/identification numbers that a stockholder needs to access the Proxy and the online Annual Meeting; and

•information about attending online the Annual Meeting and voting online during the Annual Meeting.

Voting Matters and Board Recommendations

The following table sets forth the items currently on the agenda for the Annual Meeting, along with the Board's recommendations.

| | | | | | | | | | | |

| PROPOSAL | DESCRIPTION | BOARD RECOMMENDATION | PAGE |

| | | |

| 1 | Election of the Company's 12 director nominees named in this Proxy Statement | FOR each of the director nominees | |

| 2 | Ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2022 | FOR | |

| 3 | Approval, on an advisory basis, of the Company's named executive officer compensation | FOR | |

| | | |

For additional information about the Annual Meeting, including what vote is required for each item, how a Proxy that is properly completed and submitted will be voted, and what is the quorum required for the meeting, please see "General Information about the Annual Meeting."

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 15 |

| | | | | |

PROPOSAL ONE ELECTION OF DIRECTORS |

| |

| | | | | | | | | | | | | | |

Directors and Nominees Upon recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the 12 individuals named below for election as directors at the Annual Meeting, each of whom is currently serving as a director of the Company. The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the Company's directors will be reduced or the persons acting under the Proxy will vote for the election of a substitute nominee that the Board recommends. The Board considers each director's relevant experience, qualifications, skills and other factors in the course of its annual self-evaluation. In addition, with regard to the overall composition of the Board, the Nominating and Corporate Governance Committee and the Board seek to achieve an overall balance of backgrounds and diversity of experience with a complementary mix of skills and professional experience in areas relevant to the Company's business and strategy. The biographies of each of the nominees set forth below contain certain information about his or her principal occupation and business experience and also highlight certain of the nominee's particular attributes that the Board believes the nominee brings to the Board. Required Vote The Company's Amended and Restated Certificate of Incorporation, as amended (the "Certificate of Incorporation"), provides that all directors are to be elected annually. The Company's Sixth Amended and Restated Bylaws (the "Bylaws") provide for the election of directors by the majority vote of stockholders in uncontested elections. This means the number of votes cast "For" must exceed the number of votes cast "Against" such nominee's election in order for him or her to be elected to the Board. As a condition to being nominated, each nominee for director is required to submit an irrevocable letter of resignation that becomes effective if the nominee does not receive a majority of the votes cast in an uncontested election and the Board decides to accept the resignation. If a nominee who is currently serving as a director does not receive a majority of the votes cast for his or her election, the Board will act on the tendered resignation within 90 days after the date of the certification of the election results. If the resignation is not accepted, the Board will publicly disclose its decision and its primary rationale, and the director will continue to serve as a director until his or her successor is elected and qualified or until his or her earlier resignation or removal. If the Board accepts the resignation, the Board may fill the vacancy in accordance with the Company's Bylaws or may decrease the size of the Board. | |

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW.

The Board considers each director’s relevant experience, qualifications, skills and other factors in the course of the Board’s annual self-evaluation.

The Company’s Amended and Restated Certificate of Incorporation provides that all directors are to be elected annually by the majority vote of stockholders in uncontested elections. |

| | | | | | | | | | | | | | |

| 16 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

| | | | | | | | | | | |

| | A.R. ALAMEDDINE | |

| | |

| Mr. A.R. Alameddine joined the Board in connection with Pioneer’s acquisition of Parsley Energy, Inc. ("Parsley"). Prior to joining Pioneer's Board, Mr. Alameddine served on Parsley's board of directors from December 2013 until Parsley was acquired by the Company in January 2021, including service as Parsley's Lead Director from February 2016. Prior to his retirement in 2008, Mr. Alameddine held a number of positions in the oil and gas industry, including serving as Executive Vice President of Worldwide Negotiation Execution and Implementation at Pioneer from 2005 until his retirement in 2008. Before joining Pioneer in 1997, Mr. Alameddine spent 26 years with Mobil Exploration & Producing Company, a subsidiary of Exxon Mobil Corporation, in various engineering and planning positions in the United States. In addition, he worked in Norway for three years on various North Sea projects. Mr. Alameddine's extensive experience in the exploration and production ("E&P") industry, including in senior executive roles in operational and technical positions with a major international energy company, brings to the Board significant senior executive experience, and experience in and knowledge of the E&P industry and its operations. Education: Bachelor of Science degree in Petroleum Engineering, Louisiana State University Pioneer Committees: Compensation and Leadership Development Nominating and Corporate Governance Current Public Company Directorships: None Prior Public Company Directorships (within last five years): Parsley Energy, Inc. Current Non-Public Company Board or Other Service: None | |

| | |

Age: 74 Director Since: 2021 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 17 |

| | | | | | | | | | | |

| | LORI G. BILLINGSLEY | |

| | |

| Lori G. Billingsley became a Director of the Company in June 2021. She most recently served as the Global Chief Diversity, Equity and Inclusion ("DEI") Officer for The Coca-Cola Company ("Coca-Cola") until March 2022. In this role, she led the company’s DEI Center of Excellence. Ms. Billingsley spent 20 years with Coca-Cola, having spent most of her time in a variety of roles with increasing responsibility within Public Affairs and Communications. Prior to her role as Global Chief DEI Officer, she served as the Vice President of Community and Stakeholder Relations, North America. Prior to joining Coca-Cola, Ms. Billingsley led her own public relations consultancy, LG Communications, was a vice president at Porter/Novelli, a leading public relations firm where she co-founded their Multicultural Communications and Alliance Building practices, and was a senior public affairs specialist for the District of Columbia Government's Office of Human Rights and Minority Business. Ms. Billingsley's more than 30 years of public affairs, issues communications, community and stakeholder relations, and diversity, equity and inclusion experience, brings to the Board significant senior executive experience in employee development, building diverse workforces and stakeholder and community engagement. Education: Bachelor of Arts in Public Relations, Howard University Master of Arts in Public Communications, American University Pioneer Committees: Compensation and Leadership Development Health, Safety and Environment Current Public Company Directorships: None Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: NAACP Foundation ColorComm | |

| | |

Age: 58 Director Since: 2021 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 18 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

| | | | | | | | | | | |

| | EDISON C. BUCHANAN | |

| | |

| Mr. Buchanan was a Managing Director of various groups in the Investment Banking Division of Dean Witter Reynolds in their New York and Dallas offices from 1981 to 1997. In 1997, Mr. Buchanan joined Morgan Stanley Dean Witter as a Managing Director in the Real Estate Investment Banking group. During 2000, Mr. Buchanan served as Managing Director and head of the domestic Real Estate Investment Banking Group of Credit Suisse First Boston. Mr. Buchanan's more than 20 years in investment banking and finance, including in senior executive roles, brings to the Board significant senior executive experience and extensive experience in corporate finance, mergers and acquisitions and commercial transactions, strategic planning and human resources. Education: Bachelor of Science degree in Civil Engineering, Tulane University Master of Business Administration in Finance and International Business, Columbia University Pioneer Committees: Compensation and Leadership Development Nominating and Corporate Governance Current Public Company Directorships: None Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Commonweal Conservancy (Chair) | |

| | |

Age: 67 Director Since: 2002 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 19 |

| | | | | | | | | | | |

| | MARIA S. DREYFUS | |

| | |

| Maria S. Dreyfus became a Director of Pioneer in September 2021. She is the CEO and Founder of Ardinall Investment Management, a New York based independent investment firm established in 2017. Ardinall Investment Management has an ESG-based investment approach and focuses on climate change and sustainable investments. Prior to Ardinall Investment Management, Ms. Dreyfus spent 15 years at Goldman Sachs, most recently serving as Portfolio Manager and Managing Director in the Goldman Sachs Investment Partners group, where she focused on energy, industrials, transportation and infrastructure investments in both public and private markets. Ms. Dreyfus's extensive experience in investment banking and finance, including significant expertise in the areas of environmental, social and governance issues and sustainable energy investments, brings to the Board significant knowledge of and insight into environmental policy, renewable energy matters and matters related to the energy transition. Education: Bachelor of Science in Economics and Management Science, Massachusetts Institute of Technology (MIT) Pioneer Committees: Audit Health, Safety and Environment Sustainability and Climate Oversight Current Public Company Directorships: Macquarie Infrastructure Corporation Nabors Energy Transition Corp. Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Caisse de dépôt et placement du Québec (CDPQ)

| |

| | |

Age: 42 Director Since: 2021 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 20 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

| | | | | | | | | | | |

| | MATTHEW M. GALLAGHER | |

| | |

| Mr. Gallagher joined the Board in connection with Pioneer's acquisition of Parsley. He is currently serving as President of Greenlake Energy Ventures, LLC and a Venture Partner at NGP Energy Capital Management, LLC Prior to joining Pioneer's Board, Mr. Gallagher had served as Parsley's President and Chief Executive Officer since January 2019. Mr. Gallagher previously served as Parsley's President and Chief Operating Officer from January 2017 until October 2018 and as Parsley's President from October 2018 until January 2019, when pursuant to Parsley's succession plan, he was appointed President and Chief Executive Officer. Mr. Gallagher also served as a director of Parsley from January 2018 until Pioneer's acquisition of Parsley. Prior to being named Parsley's President, Mr. Gallagher served in a number of roles at Parsley since joining that company in 2010, including as Vice President—Chief Operating Officer from May 2014 through January 2017 and Vice President—Engineering and Geoscience from December 2013 to April 2014. Prior to joining Parsley, Mr. Gallagher worked in a number of positions at Pioneer from 2005 to 2010, including a variety of engineering roles with Pioneer. Mr. Gallagher's extensive experience in various roles with energy companies, including more than six years in a Chief Operating or Chief Executive role, brings to the Board significant senior executive experience and experience in and knowledge of the E&P industry and its operations and related technology matters, as well as experience in HSE matters and human resources. Education: Bachelor of Science in Petroleum Engineering, the Colorado School of Mines Pioneer Committees: Health, Safety and Environment Current Public Company Directorships: Chesapeake Energy Corporation Prior Public Company Directorships (within last five years): Parsley Energy, Inc. Current Non-Public Company Board or Other Service: None | |

| | |

Age: 39 Director Since: 2021 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 21 |

| | | | | | | | | | | |

| | PHILLIP A. GOBE | |

| | |

| Mr. Gobe has served as the Chairman of the Board of Directors of ProPetro Holding Corp. ("ProPetro") since July 2019. He was appointed as ProPetro's Executive Chairman in October 2019 and chief executive officer in March 2020, and served as chief executive officer through August 2021, at which point he continued as ProPetro’s Executive Chairman. In March 2022, he transitioned back to non-executive Chairman of the Board of Directors of ProPetro. Previously, he had served as Chief Operating Officer of Energy Partners, Ltd. from December 2004, and President from May 2005 until his retirement in September 2007. Mr. Gobe also served as a director of Energy Partners, Ltd. from November 2005 until May 2008. Prior to that, Mr. Gobe had served as Chief Operating Officer of Nuevo Energy Company from February 2001 until its acquisition by Plains Exploration & Production Company in May 2004, and prior to that time, he held numerous operations and human resources positions with Vastar Resources, Inc. and Atlantic Richfield Company ("ARCO") and its subsidiaries. Mr. Gobe's extensive experience in various roles with energy companies, including a major international energy company, which included more than nine years in a Chief Operating role, brings to the Board significant senior executive experience and experience in and knowledge of the E&P industry and its operations and related technology matters, as well as experience in commercial transactions, HSE matters and human resources. Education: Bachelor of Arts, the University of Texas Master of Business Administration, the University of Louisiana in Lafayette Pioneer Committees: Health, Safety and Environment (Chair) Sustainability and Climate Oversight Current Public Company Directorships: ProPetro Holding Corp. Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Pantheon Resources PLC | |

| | |

Age: 69 Director Since: 2014 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 22 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

| | | | | | | | | | | |

| | STACY P. METHVIN | |

| | |

| Ms. Methvin was Vice President, Refining Margin Optimization of Shell Oil Company ("Shell") from 2011 until her retirement in 2012, and from 2009 until 2010, she was Vice President, Global Distribution of Shell. Ms. Methvin also held various other operational and management roles in the upstream, downstream and chemical businesses during her tenure at Shell and its subsidiaries that began in 1979, including President, Shell Louisiana E&P Company, President, Shell Deer Park Refining Company, President, Shell Pipeline Company LP, President, Shell Chemical LP, and Vice President, Strategy and Portfolio for the downstream business. With more than 15 years of senior executive service in operational and management roles in the upstream, downstream and chemical business segments of a major international energy company, Ms. Methvin brings to the Board significant senior executive experience, experience in and knowledge of the E&P industry and its operations, strategic planning and risk management, HSE matters, marketing transactions, international operations, regulatory compliance and human resources. Education: Bachelor of Arts in Geological and Geophysical Sciences, Princeton University Pioneer Committees: Compensation and Leadership Development (Chair) Health, Safety and Environment Sustainability and Climate Oversight Current Public Company Directorships: Magellan Midstream Partners, LP Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Oiltanking GmbH (Chair) xF Technologies Inc. Louisiana Governor's Advisory Commission on Coastal Protection, Restoration and Conservation Memorial Hermann Healthcare System (Chair-elect) The Houston Zoo (Chair) | |

| | |

Age: 65 Director Since: 2013 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 23 |

| | | | | | | | | | | |

| | ROYCE W. MITCHELL | |

| | |

| Mr. Mitchell has been an executive consultant, focusing on advising management teams and board audit committees of E&P companies, since January 2005, except for the period from April 2008 through December 2008 when he served as Chief Financial Officer of Frac Tech Services, Ltd. Mr. Mitchell served as Executive Vice President, Chief Financial Officer and Chief Accounting Officer of Key Energy Services, Inc. from January 2002 to January 2005. Before joining Key Energy Services, Inc., he was a partner with KPMG LLP from April 1986 through December 2001 specializing in the oil and gas industry. With more than 25 years with a major accounting firm, including 15 years as a partner, and significant experience as a chief financial officer and consultant for energy companies, Mr. Mitchell brings to the Board extensive experience and knowledge in accounting, corporate finance, mergers and acquisitions, risk management and commercial transactions, including significant experience in the E&P industry. Mr. Mitchell has been determined by the Board to meet the SEC's definition of audit committee financial expert. Education: Bachelor of Business Administration, Texas Tech University Pioneer Committees: Audit (Chair) Health, Safety and Environment Sustainability and Climate Oversight Current Public Company Directorships: None Prior Public Company Directorships (within last five years): ProPetro Holding Corp. Current Non-Public Company Board or Other Service: None | |

| | |

Age: 67 Director Since: 2014 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 24 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

| | | | | | | | | | | |

| | FRANK A. RISCH | |

| | |

| Mr. Risch retired in 2004 as Vice President and Treasurer (and Principal Financial Officer) of Exxon Mobil Corporation following a 38 year international career in finance, strategic planning and general management with Exxon and its operating affiliates in the U.S. and abroad. In 1990, he began a two year assignment in Dallas as Executive Assistant to the Chairman of the Board and CEO of Exxon Corporation. He became Assistant Controller of the corporation in 1992, Assistant Treasurer in 1994 and Vice President and Treasurer of the corporation on January 1, 1999. Mr. Risch's extensive executive experience as a financial officer at a major international energy company brings to the Board extensive senior executive experience, and extensive knowledge and experience in accounting, finance, capital markets, strategic planning, risk management, mergers and acquisitions and commercial transactions. Mr. Risch has been determined by the Board to meet the SEC's definition of audit committee financial expert. Education: Bachelor of Science in Business Administration, Pennsylvania State University Master of Science in Industrial Administration, Carnegie Mellon University Pioneer Committees: Audit Nominating and Corporate Governance Current Public Company Directorships: None Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Carnegie Mellon University Tepper School of Business, Business Board of Advisors (Emeritus Member) Financial Executives International The Dallas Theater Center (Life Trustee) The Dallas Holocaust and Human Rights Museum (Immediate Past Board Chair) HIAS International Dallas CASA (Court Appointed Special Advocates) (Emeritus Director) | |

| | |

Age: 79 Director Since: 2005 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 25 |

| | | | | | | | | | | |

| | SCOTT D. SHEFFIELD | |

| | |

| Mr. Sheffield was appointed the Company's Chief Executive Officer in February 2019 and also served as the Company's President from February 2019 through December 2020. He served as Chairman of the Board of the Company from 1999 through February 2019. Previously, he had served as Chief Executive Officer of the Company from 1997 through December 31, 2016, and then as the Executive Chairman until December 31, 2017. Mr. Sheffield was the Chairman of the Board of Directors and Chief Executive Officer of Parker & Parsley Petroleum Company, a predecessor of the Company (together with its predecessor companies, "Parker & Parsley"), from January 1989 until Pioneer was formed in August 1997. Mr. Sheffield joined Parker & Parsley as a petroleum engineer in 1979, was promoted to Vice President - Engineering in September 1981, was elected President and a Director in April 1985. Before joining Parker & Parsley, Mr. Sheffield was employed as a production and reservoir engineer for Amoco Production Company. Mr. Sheffield's severance agreement provides that his failure to be re-elected constitutes "good reason" under his severance agreement whether or not his resignation is accepted by the Board, which would entitle him to terminate his employment and receive the benefits described in the section below entitled "Executive Compensation Tables - Potential Payments upon Termination or Change in Control." Mr. Sheffield's more than 30 years' experience as CEO of the Company or its predecessor, and his extensive experience in petroleum engineering, brings to the Board extensive senior executive experience, experience in and knowledge of the E&P industry, its operations and related technology matters, corporate finance, capital markets and mergers and acquisitions, strategic planning, marketing and hedging transactions, international business matters, governmental and regulatory matters and human resources. In addition, his service on the Advisory Board of the Center for Global Energy Policy at Columbia University, which conducts research and convenes policy experts and industry leaders on a range of energy-relevant matters, brings to the Board knowledge of and insight into environmental policy and renewable energy matters. Education: Bachelor of Science in Petroleum Engineering, the University of Texas Pioneer Committees: None Current Public Company Directorships: The Williams Companies, Inc. Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: The Center for Global Energy Policy at Columbia University Advisory Board CSL Capital Management, LLC | |

| | |

Age: 69 Director Since: 1997 Independent: No | | |

| | |

| | | | | | | | | | | | | | |

| 26 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

| | | | | | | | | | | |

| | J. KENNETH THOMPSON | |

| | |

| Mr. Thompson has served as the Board's independent Chairman since February 2019, and prior to that time, had served as Lead Independent Director since May 2015. Mr. Thompson has served as the President and Chief Executive Officer of Pacific Star Energy LLC, a privately held firm that is a passive holder of oil lease royalties in Alaska, since September 2000. He served as Managing Director of Alaska Venture Capital Group LLC, a privately held oil and gas exploration company in which Pacific Star Energy LLC owns an interest, from December 2004 to December 2012. Mr. Thompson's experience includes serving as Executive Vice President of ARCO's Asia Pacific oil and gas operating companies in Alaska, California, Indonesia, China and Singapore from 1998 to 2000, and President and Chief Executive Officer of ARCO Alaska, Inc., the parent company's oil and gas producing subsidiary based in Anchorage, from June 1994 to January 1998. He also served in various technical and management roles at ARCO from 1974 to 1998, including as executive head of ARCO's oil and gas research and technology center from 1993 to 1994, which included research and technology application in various geoscience disciplines, engineering technologies and environmental sciences. When head of ARCO's Research & Technology Center, he also had oversight of the Information Technology department, the computing center and IT security. Mr. Thompson's extensive experience as a CEO of an oil and gas exploration company and as a senior executive in operational and technical roles with a major international energy company brings to the Board significant senior executive experience, experience in and knowledge of the E&P industry and its operations, technology and research and development, strategic planning and risk management, HSE matters, international operations, and human resources. In addition, his experience as executive head of ARCO's oil and gas environmental research and technology initiatives and Chair of the environmental, health, safety and social responsibility committee of Coeur Mining, Inc. brings to the Board significant knowledge of and insight into environmental matters. In 2019, Mr. Thompson was selected as one of the 100 most influential corporate directors by the National Association of Corporate Directors. Education: Bachelor of Science degree in Petroleum Engineering, Missouri University of Science & Technology Pioneer Committees: Compensation and Leadership Development Nominating and Corporate Governance Sustainability and Climate Oversight (Chair) Current Public Company Directorships: Alaska Air Group, Inc. Coeur Mining, Inc. Tetra Tech, Inc. Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: CDF Capital (Chair) | |

| | |

Age: 70 Director Since: 2011 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 27 |

| | | | | | | | | | | |

| | PHOEBE A. WOOD | |

| | |

| Ms. Wood has been a principal at CompaniesWood, a consulting firm specializing in advising and investing in early stage investments, since 2008. She was Executive Vice President and Chief Financial Officer of Brown-Forman Corporation, a diversified consumer products manufacturer, from 2001 to 2006, and Vice Chairman and Chief Financial Officer from 2006 to 2008, where she was responsible for the financial operations of the company, including corporate development, controllership, treasury, investor relations, tax, information technology and internal audit. Prior to Brown-Forman Corporation, Ms. Wood was Vice President, Chief Financial Officer and a Director of Propel Corporation (a subsidiary of Motorola) from 2000 to 2001. Previously, Ms. Wood served in various capacities during her tenure at ARCO from 1976 to 2000, including as divisional CFO in Alaska and England. Ms. Wood's extensive senior executive experience as a financial officer in diverse industries, including a major international energy company, and Chair of the audit committees of two other public companies, bring to the Board extensive senior executive experience, and deep knowledge and experience in accounting, finance, capital markets, strategic planning, risk management, corporate governance, mergers and acquisitions and commercial transactions. In 2018, Ms. Wood was selected as one of the 100 most influential corporate directors by the National Association of Corporate Directors. Education: A.B. degree, Smith College Master of Business Administration, the University of California Los Angeles Pioneer Committees: Compensation and Leadership Development Nominating and Corporate Governance (Chair) Sustainability and Climate Oversight Current Public Company Directorships: Invesco Ltd. Leggett & Platt, Incorporated PPL Corporation Prior Public Company Directorships (within last five years): Coca-Cola Enterprises Inc. Current Non-Public Company Board or Other Service: The Gheens Foundation Board of Trustees American Printing House for the Blind Board of Trustees | |

| | |

Age: 69 Director Since: 2013 Independent: Yes | | |

| | |

| | | | | | | | | | | | | | |

| 28 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

Board Composition; the Directors' Experiences, Qualifications, Attributes and Skills; Rooney Rule

The Board endeavors to achieve an overall balance of backgrounds and diversity of experience at policy-making levels with a complementary mix of skills and professional experience in areas relevant to the Company's business and strategy, while also ensuring that the size of the Board is appropriate to function effectively and efficiently. Accordingly, the Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board's overall composition and the Company's current and future needs.

In considering whether an incumbent director should be nominated for reelection, the Board considers the results of its self-evaluation process. See "Corporate Governance - Director Self-Evaluation Process, Onboarding and Education and Board Refreshment" below for more detail about this process. In identifying potential director candidates for addition to the Board, the Nominating and Corporate Governance Committee will rely on any source available for the identification and recommendation of candidates, including its directors, officers and stockholders. In the event that the Nominating and Corporate Governance Committee determines to recruit candidates from outside Pioneer as potential nominees to join the Pioneer Board, the committee will use its best efforts to include, and will instruct any third-party search firm the committee engages to assist it in seeking candidates for the Pioneer Board to include, qualified candidates with a diversity of gender and race/ethnicity in the initial pool from which the committee selects director candidates.

As set out in the Company's Corporate Governance Guidelines, all directors are expected to possess the highest personal values and integrity; exhibit sound judgment, intelligence, personal character, and the ability to make independent analytical inquiries; be willing to devote adequate time to Board duties; strive for a collegial atmosphere showing mutual respect for all Directors and opinions; and be able to serve on the Board for a sustained period.

The table below summarizes certain key qualifications, skills and attributes that each director brings to the Board. The lack of a mark for a particular item does not mean the director does not possess that qualification or skill. However, a mark indicates a specific area of focus or expertise that the director brings to the Board. More details on each director's qualifications, skills and attributes are included in the director biographies on the previous pages.

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 29 |

| | | | | | | | | | | |

| | Senior Exec Experience - serving in a senior leadership role at another organization | |

| | E&P Industry Ops - experience in the exploration and production industry and/or knowledgeable on the Company's position in the sector | |

| | Science / Tech / Eng / R&D - experience in research, innovation, or improvement on searching for or extracting raw materials | |

| | Accounting / Finance - knowledge of the financial markets, corporate finance, accounting regulations, and accounting and financial reporting processes | |

| | M&A / Comm. Transactions- experience in consolidation of companies or assets through various types of financial transactions | |

| | Strategic Planning / Risk Management - oversight of management’s development, implementation of strategic priorities, security, and risk management | |

| | Environmental / Safety / Health / Sustainability - experience in refining and establishing sustainable practices and/or safer working conditions | |

| | Marketing / Sales - experience executing corporate commercial and/or marketing strategies and initiatives | |

| | Global Business / International - experience in globalization and developing international business relationships in global markets | |

| | Legal / Government / Regulatory - experience in highly regulated businesses and/or familiar with legal practices | |

| | Human Resources - experience in human capital management and/or cultivating resources and communication channels throughout the company | |

| | Other Public Boards - experience on boards of other publicly traded companies | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Alameddine | l | l | l | | l | l | | | l | | l | l |

| Billingsley | l | | | | | l | l | | l | l | l | |

| Buchanan | l | | l | l | l | l | l | l | l | l | l | l |

| Dreyfus | l | | l | l | l | l | l | | l | l | l | l |

| Gallagher | l | l | l | l | l | l | l | | | l | l | l |

| Gobe | l | l | l | | l | l | l | | l | | l | l |

| Grillot* | | l | l | l | | | l | | l | l | l | |

| Methvin | l | l | l | l | | l | l | l | l | l | l | l |

| Mitchell | l | l | | l | l | l | l | l | l | | l | l |

| Risch | l | l | | l | l | l | | l | l | l | l | l |

| Sheffield | l | l | l | l | l | l | l | l | l | l | l | l |

| Thompson | l | l | l | l | l | l | l | l | l | l | l | l |

| Wood | l | l | | l | l | l | | | l | l | l | l |

| Wortley* | l | | | l | l | l | l | | | l | l | l |

*Messrs. Grillot and Wortley will retire from the Board effective as of the Annual Meeting.

| | | | | | | | | | | | | | |

| 30 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |

Corporate Governance Guidelines

The Board believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duties to stockholders. The Company's Corporate Governance Guidelines cover the following principal subjects:

| | | | | | | | | | | | | | |

| | | | |

| •Role and functions of the Board •Qualifications and independence of directors •Size of the Board and director selection process •Committee functions and independence of committee members •Meetings of non-employee directors •Self-evaluation of the Board and its committees •Ethics and conflicts of interest (a copy of the current "Code of Business Conduct and Ethics" is posted on the Company's website at www.pxd.com/culture/governance) •Review and approval of related person transactions | | •Contacting the Board (including the Board's non-management or independent directors as a group), including reporting of concerns about the Company's accounting, internal controls or auditing matters •Compensation of the Board and stock ownership requirements •Succession planning and annual compensation review of senior management •Directors' access to senior management and to independent advisors •New director orientation •Continuing director education

| |

| | | | |

The Company's Corporate Governance Guidelines are posted on the Company's website at www.pxd.com/culture/governance. The Corporate Governance Guidelines are reviewed periodically and as necessary by the Company's Nominating and Corporate Governance Committee, and any proposed additions to or amendments of the Corporate Governance Guidelines are presented to the Board for its approval.

Board Leadership Structure

The Company's governing documents allow the roles of Chairman of the Board and CEO to be filled by the same or different individuals. This approach allows the Board flexibility to determine whether the two roles should be separate or combined based upon the Company's needs from time to time.

In February 2019, the Board appointed J. Kenneth Thompson, an independent member of the Board, to serve as Chairman of the Board concurrently with the appointment of Scott D. Sheffield to serve as the Company's President and Chief Executive Officer. Prior to his appointment to Board Chairman, Mr. Thompson had served as the Lead Director of the Board since May 2015, and has served as a member of the Board since 2011. The Board believes that Mr. Thompson's tenure as a director with the Company along with his extensive executive experience in the energy industry provides him deep knowledge of the Company, its history, its business and its industry, making him well suited to ensure that critical business issues are brought before the Board. In

| | | | | | | | | | | | | | |

| 2022 PROXY STATEMENT | | PIONEER NATURAL RESOURCES | | 31 |

addition, the Board believes that Mr. Thompson's service as an independent director of a number of other boards provides him invaluable insight and exposure to many of the major issues Pioneer faces as a publicly-traded company.

As the Board's independent Chairman, Mr. Thompson's duties include approving the agenda and meeting schedules for each meeting of the Board, in consultation with the CEO and the Corporate Secretary and taking into account suggestions of other directors, and presiding at meetings of the Board. All directors are encouraged to suggest the inclusion of agenda items and meeting materials, and any director is free to raise at any Board meeting items that are not on the agenda for that meeting. In addition, the Board's non-employee directors regularly meet in executive session without the presence of any members of management, and, in accordance with the Company's Corporate Governance Guidelines, the Board will hold at least one executive session with independent directors each year. Mr. Thompson presides at these executive sessions, following which he provides guidance and feedback to the Company's management team.

The Board regularly considers its leadership structure to ensure that the structure is appropriate in light of the needs of the Company's business, and the Board is open to different structures as circumstances may warrant. At the present time, the Board believes that the current arrangement of having Mr. Thompson, an independent director, serve as Chairman, best serves the interests of the Company and its stockholders.

CEO and Senior Management Succession Planning

The Board recognizes that management succession planning is a fundamental and ongoing part of its responsibilities. The full Board is responsible for overseeing CEO succession planning, and regularly reviews potential internal senior management candidates with the CEO and the Company's Senior Vice President, Human Resources, including the qualifications, experience, and development plans for these individuals. In addition, the Compensation and Leadership Development Committee regularly reviews potential successors to other senior officers within the organization with the CEO and the Company's Senior Vice President, Human Resources, including their qualifications, experience, and development plans. Directors engage with potential CEO and senior management successors at Board and committee meetings and in less formal settings to allow directors to personally assess candidates. Effective January 1, 2021, Pioneer appointed Richard P. Dealy, then serving as the Company's Executive Vice President and Chief Financial Officer, as the Company's President and Chief Operating Officer, and named Mr. Sheffield, then President and Chief Executive Officer, as Chief Executive Officer.

Director Independence

Assessment Process. Each year, the Board, with the assistance of the Nominating and Corporate Governance Committee, assesses the independence of the Company's directors. In making this assessment, the committee and the Board use the independence standards of the NYSE corporate governance rules for determining whether directors are independent, and additionally consider the rules of the SEC and the NYSE in determining independence for Audit Committee and Compensation and Leadership Development Committee members. A director cannot be considered independent unless the Board affirmatively determines that he or she does not have any relationship with management or the Company that may interfere with the exercise of his or her independent judgment, including any of the relationships that would disqualify the director from being independent under the rules of the NYSE and SEC. In addition, the Nominating and Corporate Governance Committee and the Board consider the tenure of each director and whether a long period of service could affect his or her objectivity and independence from management.

Independence of Pioneer's Directors. The Board has assessed the independence of each director under the independence standards of the NYSE and affirmatively determined that all of the Board's directors, other than Mr. Sheffield, are independent. In connection with its assessment of the directors' independence, the Board reviewed the facts and circumstances of certain of the directors' roles as independent directors of companies that have a business relationship as a vendor or service provider to the Company in the ordinary course of business.

| | | | | | | | | | | | | | |

| 32 | | PIONEER NATURAL RESOURCES | | 2022 PROXY STATEMENT |