Exhibit 99.2

Building Better Value.

Important Information for ShareholdersThis communication shall not constitute an offer to sell, the solicitation of an offer to sell, the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed merger, Cornerstone will file a registration statement on Form S-4 with the Securities and Exchange Commission, which will contain the joint proxy statement/prospectus of SmartFinancial and Cornerstone. Shareholders of Cornerstone and SmartFinancial are encouraged to read the registration statement, including the joint proxy statement/prospectus that will be part of the registration statement, because it will contain important information about the merger, Cornerstone and SmartFinancial. After the registration statement is filed with the SEC, the joint proxy statement/prospectus and other relevant documents will be mailed to all Cornerstone and SmartFinancial shareholders and will be available for free on the SEC’s website (www.sec.gov). The joint proxy statement/prospectus will also be made available for free by contacting the President and CEO of SmartFinancial at (865) 868-0613 or the President and CEO of Cornerstone at (423) 385-3009. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Cornerstone, SmartFinancial and their respective directors, executive officers, and certain other members of management and employees of Cornerstone and SmartFinancial may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information concerning the interests of the persons who may be considered “participants” in the solicitation will be set forth in the joint proxy statement/prospectus relating to the merger and the other relevant documents filed with the SEC when they become available. Information about the directors and executive officers of Cornerstone is also set forth in Cornerstone’s proxy statement for its 2014 annual meeting of shareholders and its Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC. Forward-Looking Statements Certain of the statements made in this release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements, including statements regarding the intent, belief or current expectations of Cornerstone, SmartFinancial and their respective management regarding the companies’ strategic directions, prospects, future results and benefits of the merger, are subject to numerous risks and uncertainties. Certain factors may cause actual results to differ materially from those contained in the forward-looking statements, including economic and other conditions in the markets in which Cornerstone and SmartFinancial operate, governmental regulations, the ability to obtain regulatory and shareholder approval, the possibility that conditions to completion of the merger will not be satisfied, the ability to complete the merger in the expected timeframe, the companies’ competitive environment, cyclical and seasonal fluctuations in their operating results, and other risks.

FOR IMMEDIATE RELEASE SmartFinancial and Cornerstone Bancshares to MergePartnership Creates Premier Banking Franchise in Strong Southeastern Markets PIGEON FORGE, Tenn. and CHATTANOOGA, Tenn., December 8, 2014 SmartFinancial, Inc. (“SmartFinancial”), parent company of SmartBank, and Cornerstone Bancshares, Inc. (“Cornerstone”) (OTCBB: CSBQ, CSBQP), parent company of Cornerstone Community Bank, jointly announced today the signing of a definitive agreement to merge, creating a combined company that will operate under the name SmartFinancial, Inc. While the two holding companies will be combined, the banks will initially remain independent and continue to operate under their respective names in their respective markets. The company plans to merge the banks in the future, combining them under the SmartBank name. Headquartered in Pigeon Forge, TN, SmartBank operates seven branch locations throughout East Tennessee and Northwest Florida. Based in Chattanooga, TN, Cornerstone Community Bank currently has five branch locations throughout the Chattanooga MSA. On a pro forma basis, based on financial results as of September 30, 2014, the combined holding company would have approximately $945 million in total assets, $790 million in total deposits and $650 million in total loans, with 12 branch locations in the East Tennessee and the Florida Panhandle markets. After the banks are merged, the combined bank is expected to be the twelfth largest bank chartered in Tennessee. “I am very excited to announce this new partnership and merger of equals,” said Cornerstone’s Chairman Miller Welborn, who will serve as Chairman of the combined company. “There are a lot of natural synergies between our two organizations, which made this partnership so attractive. Our institutions share similar cultures, core values and goals,” he said. “We believe our complementary strengths will allow us to better serve our clients and communities, while our expanded footprint will position us favorably for future growth opportunities.” “This partnership is a natural fit,” echoed SmartFinancial’s President and CEO Billy Carroll. “Cornerstone has a solid reputation as one of the leading commercial lenders and most respected financial institutions in the booming Chattanooga market. SmartBank is a rapidly growing bank that has created a sound business model, dynamic culture and exceptional client service,” he said. “Joining the two outstanding organizations will only strengthen both banks’ positions and add greater value to all of our stakeholders.” Under the terms of the agreement, each outstanding share of common stock of SmartFinancial will be converted into 4.20 shares of Cornerstone common stock, subject to adjustment based on an anticipated reverse stock split of Cornerstone’s common stock, which is expected to adjust the ratio to 1.05 shares of Cornerstone common stock for each share of SmartFinancial stock. Additionally, each outstanding share of SmartFinancial preferred stock will be converted into a share of Cornerstone preferred stock with similar rights and preferences. Current holders of Cornerstone’s preferred stock will be asked to vote on an amendment to Cornerstone’s charter to allow Cornerstone to redeem its outstanding preferred stock prior to the completion of the merger. The definitive agreement has been unanimously approved by the boards of directors of SmartFinancial and Cornerstone. The merger is subject to regulatory approvals, approval by both companies’ shareholders, and certain other closing conditions, and is expected to close in the first half of 2015. The surviving company’s board will include the current seven members of the SmartFinancial board and four current members of the Cornerstone board, under the following leadership structure: Miller Welborn, Chairman; Bill Carroll, Vice-Chairman; and Billy Carroll, President and Chief Executive Officer. Advisors in Transaction SmartFinancial was advised by Hovde Financial and the law firm of Butler Snow LLP. Cornerstone was advised by Raymond James & Associates, Inc. and the law firm of Miller & Martin PLLC. About SmartFinancial, Inc. SmartFinancial, Inc. is a single-bank holding company based in Pigeon Forge, Tennessee that operates SmartBank, a full-service commercial bank founded in 2007, with seven branches throughout East Tennessee and the Florida Panhandle. Recruiting the best people, delivering exceptional client service, strategic branching and a conservative and disciplined approach to lending have all given rise to SmartBank’s success. More information about SmartFinancial can be found on its website: www.smartbank.com. (continued >>>) 3

About Cornerstone Bancshares, Inc.Cornerstone Bancshares, Inc. (OTCBB: CSBQ, CSBQP) is a single-bank holding company based in Chattanooga, Tennessee that operates Cornerstone Community Bank, a full-service commercial bank founded in 1996, with five branches throughout the Chattanooga MSA and one loan production office in Dalton, Georgia. Cornerstone specializes in providing customized financial solutions for businesses and consumers, by offering a comprehensive range of products and services designed to help companies and individuals build strong financial foundations. More information about Cornerstone can be found on its website: www.cscbank.com. Important Information for Shareholders This communication shall not constitute an offer to sell, the solicitation of an offer to sell, the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed merger, Cornerstone will file a registration statement on Form S-4 with the Securities and Exchange Commission, which will contain the joint proxy statement/prospectus of SmartFinancial and Cornerstone. Shareholders of Cornerstone and SmartFinancial are encouraged to read the registration statement, including the joint proxy statement/prospectus that will be part of the registration statement, because it will contain important information about the merger, Cornerstone and SmartFinancial. After the registration statement is filed with the SEC, the joint proxy statement/prospectus and other relevant documents will be mailed to all Cornerstone and SmartFinancial shareholders and will be available for free on the SEC’s website (www.sec.gov). The joint proxy statement/prospectus will also be made available for free by contacting the President and CEO of SmartFinancial at (865) 868-0613 or the President and CEO of Cornerstone at (423) 385-3009. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Cornerstone, SmartFinancial and their respective directors, executive officers, and certain other members of management and employees of Cornerstone and SmartFinancial may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information concerning the interests of the persons who may be considered “participants” in the solicitation will be set forth in the joint proxy statement/prospectus relating to the merger and the other relevant documents filed with the SEC when they become available. Information about the directors and executive officers of Cornerstone is also set forth in Cornerstone’s proxy statement for its 2014 annual meeting of shareholders and its Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC. Forward-Looking Statements Certain of the statements made in this release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements, including statements regarding the intent, belief or current expectations of Cornerstone, SmartFinancial and their respective management regarding the companies’ strategic directions, prospects, future results and benefits of the merger, are subject to numerous risks and uncertainties. Certain factors may cause actual results to differ materially from those contained in the forward-looking statements, including economic and other conditions in the markets in which Cornerstone and SmartFinancial operate, governmental regulations, the ability to obtain regulatory and shareholder approval, the possibility that conditions to completion of the merger will not be satisfied, the ability to complete the merger in the expected timeframe, the companies’ competitive environment, cyclical and seasonal fluctuations in their operating results, and other risks. Sources Cornerstone Bancshares, Inc. and SmartFinancial, Inc. Investor Contacts Cornerstone Bancshares, Inc. SmartFinancial, Inc. Frank Hughes Billy Carroll President & CEO President & CEO (423) 385-3009 (865) 868-0613 Media Contacts Charlotte Lindeman Kelley Fowler Vice President, Marketing First Vice President, Public Relations & Marketing Cornerstone Community Bank SmartBank (423) 385-3097 (865) 868-0611 clindeman@cscbank.com kfowler@smartbank.net 4

Dear SmartBank and Cornerstone Teams,December 8, 2014 Today we will announce that effective December 5th, 2014, SmartFinancial, Inc., parent company of SmartBank, entered into a Definitive Agreement with Cornerstone Bancshares, Inc., parent company of Chattanooga, TN-based Cornerstone Community Bank, to merge holding companies. The merger will create a nearly $1 billion entity under the SmartFinancial name. The combined company will apply to list its stock on the NASDAQ Capital Market. The banks will continue to operate independently while we are working on the integration process. Leadership teams from both banks will begin work immediately to determine best practices and to strategize the implementation process. The plan is to merge the banks under the name of SmartBank within 12-18 months. We will communicate with you often as we work through this process, so that you are informed every step of the way. The leadership structure of the combined company, SmartFinancial Inc., will include Miller Welborn as Chairman, Bill Carroll as Vice Chairman and Billy Carroll as President and Chief Executive Officer. At SmartBank, Billy Carroll will remain as President and CEO, and Bill Carroll as Chairman. At Cornerstone Community Bank, Barry Watson will become President, and Miller Welborn will continue as Chairman. This merger is a very important and strategic move for both banks. The regulatory environment has become so financially burdensome along with a very competitive lending market, that banks today need size and scale to compete. This combination provides the opportunity for both banks to achieve a near $1 billion bank, which is critical and also a desirable size in today’s banking world. This merger also provides the combined company an outstanding footprint with locations in two of Tennessee’s most desirable MSA’s in Knoxville and Chattanooga, plus the state’s best tourism market, Sevier County, as well as a growing presence in the Florida Panhandle. The key to our success has been – and will continue to be – you! As we move forward, we ask that you continue to focus on your day-to-day responsibilities, and providing our clients with the exceptional service that you always deliver! As in any transaction of this size, the integration process will take time. We have established a transition planning team, and we will communicate more information to you as quickly as we can with any transition-related plans. In terms of immediate next steps, the transaction is subject to regulatory approvals, customary closing conditions and approval by shareholders of both SmartFinancial, Inc. and Cornerstone Bancshares, Inc. All of that work will take place over the coming months, and we expect the merger to close in the first half of 2015. This announcement will generate lots of questions. To help answer those, we have attached some FAQs and other important information in this packet. We will be making appearances in all markets this week to help answer some of your questions in person. We will also be meeting with the media in all markets and conducting town hall meetings in Pigeon Forge and Chattanooga that will be open to the public. The dates for town hall meetings will be scheduled in January 2015 and we will inform you of those dates after the first of the year. On Friday, we will be in the office and available to follow up with more information and answer any other questions that may not have already been addressed in your packet. Together we will operate a great bank that is profitable and stable in a constantly evolving market, which is a testament to your hard work and dedication. You have helped position our banks to choose this path, and we know you share our excitement about the opportunities ahead. Thank you for all you have done to make this announcement possible. It’s an honor and a privilege to work with each of you. With Sincere Regards, Billy Carroll Miller Welborn President & CEO Chairman SmartBank Cornerstone Bancshares, Inc. (865) 868-0613 (office) (423) 385-3067 (office) (865) 850-5401 (cell) (423) 595-1608 (cell) 5

Dear SmartFinancial Shareholder,It gives me great pleasure to announce an exciting partnership that we believe will provide a tremendous growth platform for our company. Effective December 5th, SmartFinancial, Inc., parent company of SmartBank, entered into a Definitive Agreement with Cornerstone Bancshares, Inc., parent company of Chattanooga, TN-based Cornerstone Community Bank, to merge holding companies. The merger will create a nearly $1 billion, entity under the SmartFinancial name. In connection with the merger, we will apply to list the surviving company’s stock on the NASDAQ Capital Market. Completion of the merger is subject to several conditions, including the approval by our shareholders and bank regulators. In the coming months, you will receive more information on the proposed merger, and in the meantime, I have enclosed a press release which explains some of the details of the transaction. About our Partner Cornerstone Bancshares, Inc. is a single-bank holding company based in Chattanooga, Tennessee that operates Cornerstone Community Bank, a full-service commercial bank founded in 1996, with five branches throughout the Chattanooga MSA and one loan production office in Dalton, Georgia. The Chattanooga MSA is one of the Southeast’s best markets boasting accolades from the recent expansion announcements from Volkswagen and Amazon to being named one of the best cities for young entrepreneurs and having the first gigabyte broadband internet service in the United States. More information about Cornerstone Community Bank can be found on its website: www.cscbank.com. Creating Scale & Synergies SmartBank and Cornerstone Community Bank not only are similar in asset size, but also have a similar culture and philosophy of providing exceptional quality products, service and value to each and every one of our clients. We believe our core values are very much in sync and will make this partnership that much stronger. One of the goals for SmartFinancial has been to create a company with enough scale to operate efficiently in today’s banking environment. This moves us toward accomplishing that goal. Board & Management Team The SmartFinancial Board of Directors will include our current seven directors you have serving currently and adding four from Cornerstone’s Board to create an eleven person Board of Directors. We have asked current Cornerstone Chairman, Miller Welborn, to Chair SmartFinancial due to his experience and expertise in leading the board of an SEC registered company. I will serve as Vice Chairman of SmartFinancial, as well as Chairman of SmartBank’s Board of Directors. Billy Carroll will continue to serve as President & CEO of both SmartFinancial and SmartBank. The combined management team will also have vast experience and provide outstanding leadership for our company. Business as Usual… and Even Better Both banks will continue to operate under their same names in their respective markets. However, this strategic partnership will allow us to expand our footprint for greater growth opportunities and to combine our complementary strengths and resources in order to better serve our clients. In fact, we anticipate that this merger will only strengthen both banks and allow us to improve our geographic coverage, product offerings and service. We will begin planning for integration of the Banks, under the SmartBank name, once the holding company merger is completed. I realize you may have some questions related to this new partnership, and I welcome you to contact us. As always, we are here to answer any questions. We also intend to communicate with you often about any new developments related to this merger and will be posting relevant updates on both banks’ websites: www.smartbank.com and www.cscbank.com. In addition, we plan to host a Town Hall Meeting in January. This meeting will be a casual drop-in meeting to help answer any questions you may have related to this merger. I will send you information on that once it is finalized. As always, we appreciate your investment in SmartFinancial and its future, and we look forward to bringing even greater value to all of our stakeholders. With Sincere Regards, William Y. Carroll, Sr. Chairman of the Board SmartFinancial, Inc (865) 868-0612

Dear Cornerstone Shareholder,It gives me great pleasure to announce an exciting partnership. Effective December 5th, Cornerstone Bancshares, Inc., parent company of Cornerstone Community Bank, entered into a Definitive Agreement with SmartFinancial, Inc., parent company of Pigeon Forge, TN-based SmartBank, to merge holding companies. The merger will create a nearly $1 billion entity under the SmartFinancial name. In connection with the merger, we will apply to list the surviving company’s stock on the NASDAQ Capital Market. Completion of the merger is subject to several conditions, including the approval by our shareholders and bank regulators. In the coming months, you will receive more information on the proposed merger, and in the meantime, I have enclosed a press release which explains some of the details of the transaction. About our Partner SmartFinancial, Inc. is a single-bank holding company based in Pigeon Forge, Tennessee that operates SmartBank, a full-service commercial bank founded in 2007, with seven branches throughout East Tennessee and the Florida Panhandle. Recruiting the best people, delivering exceptional client service, strategic branching and a conservative and disciplined approach to lending have all given rise to SmartBank’s success. More information about SmartBank can be found on its website: www.smartbank.com. A Merger of Equals SmartBank not only shares a comparable asset size with Cornerstone, but also a similar culture and philosophy of providing exceptional quality products, service and value to each and every one of our clients. We believe our core values are very much in sync and will make this partnership that much stronger. Business as Usual… or Even Better Both banks will continue to operate seamlessly under their same names in their respective markets. However, this strategic partnership will allow us to expand our footprint and to combine our complementary strengths and resources in order to better serve our customers. We realize you may have some questions related to this new partnership. We intend to communicate with you about any new developments related to this merger and will be posting relevant updates on both banks’ websites: www.cscbank.com and www.smartbank.com. As always, we appreciate your investment in Cornerstone and its future, and we look forward to the future. With Sincere Regards, Miller Welborn, Chairman Cornerstone Bancshares, Inc. (423) 385-3067 7

Dear SmartBank Client,It gives us great pleasure to announce an exciting partnership that we believe will greatly benefit you, our valued SmartBank client. Effective December 5th, our parent company, SmartFinancial, Inc., entered into a Definitive Agreement with Cornerstone Bancshares, Inc., parent company of Chattanooga based Cornerstone Community Bank, to merge holding companies. The merger will create a nearly $1 billion entity under the SmartFinancial name. In connection with the merger, we will apply to list the surviving company’s stock on the NASDAQ Capital Market. Completion of the merger is subject to several conditions, including the approval by our shareholders and bank regulators. In the coming months, you will receive more information on the proposed merger. About our Partner Cornerstone Bancshares, Inc. is a single-bank holding company based in Chattanooga, Tennessee that operates Cornerstone Community Bank, a full-service commercial bank founded in 1996, with five branches throughout the Chattanooga MSA and one loan production office in Dalton, Georgia. The Chattanooga MSA is one of the Southeast’s best markets boasting accolades from the recent expansion announcements from Volkswagen and Amazon to being named one of the best cities for young entrepreneurs and having the first gigabyte broadband internet service in the United States. More information about Cornerstone Community Bank can be found on its website: www.cscbank.com. Creating Scale to make us Stronger SmartBank not only shares a comparable asset size with Cornerstone, but also a similar culture and philosophy of providing exceptional quality products, service and value to each and every one of our clients. We believe our core values are very much in sync and will make this partnership that much stronger. Leadership Team The combined holding company Board will be comprised of directors from both banks. Miller Welborn, Cornerstone’s current Chairman will serve in that capacity for SmartFinancial, based on his expertise in chairing publicly traded companies; Bill Carroll, will serve as Vice Chairman of SmartFinancial and remain as Chairman of SmartBank; and Billy Carroll, will serve as President and CEO of both SmartFinancial and SmartBank. The SmartBank Board of Directors will include Miller Welborn, Bill Carroll, Billy Carroll, Vic Barrett, Greg Davis, Ted Miller, David Ogle, Keith Whaley, and Geoff Wolpert. The combined management team will have tremendous experience and provide outstanding leadership for our bank. Business as Usual… or Even Better Both banks will continue to operate under their same names in their respective markets. However, this strategic partnership will allow us to expand our footprint for greater growth opportunities and to combine our complementary strengths and resources in order to better serve our clients. We will begin planning for integration of the Banks, under the SmartBank name, once the holding company merger is completed. You can be assured that we anticipate no disruption in client service or operations as this partnership develops. It should be business as usual for both organizations. In fact, we believe that this merger will only strengthen both banks and allow us to improve our geographic coverage, product offerings and service. I realize you may have some questions related to this new partnership, and I welcome you to contact us. As always, we are here to answer any questions. We also intend to communicate with you often about any new developments related to this merger and will be posting relevant updates on both banks’ websites: www.smartbank.com and www.cscbank.com. As always, we appreciate the opportunity to earn your business and serve your banking needs. We now look forward to being able to do that even better! With Sincere Regards, Billy Carroll President & CEO SmartBank

Dear Cornerstone Community Bank Customer:It gives me great pleasure to announce an exciting partnership that we believe will greatly benefit you, our valued Cornerstone Community Bank customer. Effective December 5th, our parent company, Cornerstone Bancshares, Inc., entered into a Definitive Agreement with SmartFinancial, Inc., parent company of SmartBank, to merge holding companies. The merger will create a nearly $1 billion entity under the SmartFinancial name. In connection with the merger, we will apply to list the surviving company’s stock on the NASDAQ Capital Market. Completion of the merger is subject to several conditions, including the approval by our shareholders and bank regulators. In the coming months, you will receive more information on the proposed merger. About our Partner SmartFinancial, Inc. is a single-bank holding company based in Pigeon Forge, Tennessee that operates SmartBank, a full-service commercial bank founded in 2007, with seven branches throughout East Tennessee and the Florida Panhandle. Recruiting the best people, delivering exceptional client service, strategic branching and a conservative and disciplined approach to lending have all given rise to SmartBank’s success. More information about SmartBank can be found on its website: www.smartbank.com. A Merger of Equals SmartBank not only shares a comparable asset size with Cornerstone, but also a similar culture and philosophy of providing exceptional quality products, service and value to each and every one of our clients. We believe our core values are very much in sync and will make this partnership that much stronger. Leadership Team The combined holding company Board will be comprised of directors and management team members of both banks, with the following leadership structure: Miller Welborn, Chairman; Bill Carroll, Vice Chairman; and Billy Carroll, President and CEO. I have been part of the management team at Cornerstone for 12 years, most recently as Executive Vice President and Senior Loan Administrator. I now have the privilege of serving as President of Cornerstone Community Bank. Former President and CEO Frank Hughes will continue to serve with our organization, by working with institutional investors at the holding company level. Other Cornerstone Community Bank management team members will continue to serve in their current roles and capacities. What This Means to You Both banks will continue to operate seamlessly under their same names in their respective markets. However, this strategic partnership will allow us to expand our footprint in the Southeast for greater growth opportunities and to combine our complementary strengths and resources in order to better serve our customers. Business as Usual… or Even Better You can be assured that there will be no disruption in customer service or operations as this partnership develops. It should be business as usual for both Cornerstone Community Bank and SmartBank. In fact, we anticipate that this merger of holding companies will only strengthen both banks and allow us to improve our geographic coverage, product offerings and service. We realize you may have some questions related to this new partnership, and we welcome you to contact either of us directly at the numbers listed below. We also intend to communicate with you often about any new developments related to this merger and will be posting relevant updates on both banks’ websites: www.cscbank.com and www.smartbank.com In addition, we will host a public Town Hall meeting in January. This meeting will be a casual drop-in meeting to help answer any questions you may have related to this merger. I will send you information on that once it is finalized. As always, we appreciate the opportunity to earn your business and serve your banking needs. We now look forward to being able to do that even better! With Sincere Regards, Barry Watson President Cornerstone Community Bank (423) 385-3057 9

THE TRANSACTION – SEE PRESS RELEASECORPORATE 1. Who are SmartFinancial and SmartBank? SmartFinancial, Inc. is a single-bank holding company based in Pigeon Forge, Tennessee that operates SmartBank, a full-service commercial bank founded in 2007, with over $500 million in assets and seven offices throughout East Tennessee (Pigeon Forge, Sevierville, Gatlinburg, and Knoxville) and the Florida Panhandle (Destin, Pensacola, and a Panama City LPO). 2. Who are Cornerstone Bancshares and Cornerstone Community Bank? Cornerstone Bancshares, Inc. is a $425 million single-bank holding company of Cornerstone Community Bank, one of Chattanooga’s oldest and most well-respected community banks. Founded in 1996, Cornerstone has built a solid reputation as one of the leading commercial lenders and financial institutions in the booming Chattanooga market, with five full-service branches serving Hamilton County and contiguous counties. 3. Why are we merging? Merging gives both companies the best opportunity to thrive and provide the best return for our shareholders. In today’s banking environment, having sufficient size to compete for loans and to cover the expense for new regulatory reform is key to drive needed returns for our shareholders. Mergers make sense when the cultures fit and management and board of directors have a common vision. This combination fits all the criteria for a successful merger. 4. Who will lead the combined company? The Banks? Billy Carroll will be the President & Chief Executive Officer for the combined company, SmartFinancial. Miller Welborn will be the Chairman and Bill Carroll will be Vice Chairman. At SmartBank, there is no change with Billy Carroll remaining as President & CEO and Bill Carroll as Chairman. At Cornerstone Community Bank, Barry Watson will become President and Miller Welborn will continue as Chairman. Frank Hughes will continue as President & CEO of Cornerstone’s holding company, and will assume an Investment Officer role working with Billy for SmartFinancial, post-merger, focusing on the combined company investment portfolio and institutional investor relations. All other Executive Team members will remain in their same roles and capacities. 5. Where will the company’s headquarters be? The Banks? We will move the holding company’s SmartFinancial headquarters to Knoxville – centrally located between Pigeon Forge and Chattanooga. Each Bank’s main offices will continue to be in Pigeon Forge and Chattanooga. 6. Who will the directors be? Directors at both banks will remain the same with adding Miller Welborn to the SmartBank Board and adding Billy Carroll to the Cornerstone Community Bank Board. The SmartFinancial Board will consist of Miller Welborn, Chair; Bill Carroll, Vice Chair; Monique Berke; Doyce Payne; Frank McDonald; Vic Barrett; Billy Carroll; Ted Miller; David Ogle; Keith Whaley; and Geoff Wolpert. 7. How will this affect our shareholders? Cornerstone Bancshares will issue shares of stock to SmartFinancial shareholders based on a predetermined exchange ratio, and the company, going forward, will carry the SmartFinancial name. Cornerstone shareholders will see no change, other than the new corporate name. SmartFinancial shareholders will receive additional shares of stock, based on the exchange ratio. 8. Will we be a publicly traded company? Cornerstone will file a registration statement on Form S-4 with the Securities and Exchange Commission to issue its common stock to SmartFinancial shareholders. Cornerstone’s common stock is currently thinly traded on the over-the-counter market under the symbol “CSBQ.” In connection with the merger, Cornerstone will apply to list its common stock – including the common stock to be issued to SmartFinancial shareholders – on the NASDAQ Capital Market. This may give our shareholders more flexibility to buy and sell their common stock after the merger than they have today. MERGERS: EMPLOYEE QUESTIONS 1. Will I still have a job? Yes – we do not anticipate staff reductions. Over the coming year we will be working on an integration plan as we look to combine the banks and start gaining needed efficiencies. 2. Will my compensation change? We do not anticipate any changes in compensation. Of course, if you are asked to take on a new role that requires more responsibility, we will make necessary adjustments to ensure our associates are fairly compensated. 10

FAQ [CONT.]3. Will my benefits change? Since we are not immediately merging the banks, we will not change benefit plans. As part of our integration planning over the coming year, we will be reviewing benefits at both banks and making the determination on the appropriate benefits for our combined company. There will be changes, but we assure you that we will provide a very sound benefits package. Our goal is to provide the best benefits package possible to our team members in order to recruit and retain the best talent. 4. Who will I report to? Most of our associates will have no change in their reporting structure. There will be a few changes in the organization at the senior level and that may affect a few folks. As we look to integrate, we will see some reporting changes over the coming year and we will communicate those as we go. 5. Will my title or job responsibilities change? We anticipate very few changes initially and most of those will be at our senior corporate level. Again, over the coming year we will be working on an integration plan as we look to combine the banks and start gaining needed efficiencies. 6. Will our culture change? Culture is one of the most critical pieces of this partnership, and yes, you will see some changes. Any changes will be for the betterment and unity of our combined team and our company’s brand identity. 7. Will our work processes change? As we look to combine, we will be looking to adopt the “best practices” for both banks to create an efficient process in all areas. 8. Will any locations close because of the merger? We are committed to all markets where the banks currently operate and we would hope that additional markets arise for expansion opportunities given our larger footprint. 9. How are clients being notified about the merger? A press release is prepared and will be distributed nationally in the morning. Clients will be notified through our website, regular mail and email where applicable. Shareholders will be notified through email and regular mail. 10. What do I say to clients who call with concerns as a result of the merger? Refer them to the appropriate relationship manager, and if they have further questions, we will direct them to the appropriate management team member. 11. How will the merger impact clients? What differences will they see? None. We anticipate integrating many of SmartBank’s new technology areas including iPad apps and mobile check capture as soon as feasible. We will continue to deliver the outstanding client service that both banks are known for, and that’s the real key. 12. What will our company name be? SmartFinancial will be the name of the combined company. Initially, both banks will continue to operate under their existing names; and once combined, the bank name will be SmartBank. 13. How should we answer the phone? Starting when? No changes on phone answering at this time. 14. How long will the integration take? A few corporate areas will be done immediately once the merger is complete, but the bank integration will take approximately12-18 months. 15. Who should we contact if we have questions? Any member of the executive management team should be able to answer questions; however, please do not hesitate to call Miller, Bill or Billy directly with questions. 16. What should I do if someone from the media calls to ask about the merger? In Chattanooga, direct the call to Charlotte Lindeman, and in Sevier County, Knox County or Florida, contact Kelley Fowler. Kelley and Charlotte will be able to coordinate with Billy, Bill or Miller as needed. 17. Will we have career opportunities at other locations now? We will look to post job opportunities in all of our markets. 11

FAQ [CONT.]MERGERS: COMMON CLIENT QUESTIONS 1. How will this merger impact me? No change. Each bank system will continue to operate just as they are today. Going forward, Cornerstone clients may see some positive upgrades with new technology such as mobile check deposit. MERGERS: COMMON VENDOR / SUPPLIER QUESTIONS 1. How will the changes in ownership affect my company? No changes are anticipated immediately. Vendor relationships will be evaluated during our integration planning. 2. What is the legal name of the new organization? SmartFinancial, Inc. will be the company name. Both banks’ names remain the same. 3. Where and to whom should invoices be sent now? Same – no change. 4. Are the contracts/purchase orders we have in place still valid? If so, for how long? Yes. Any changes will be communicated. 5. Will policies regarding how you select vendors/suppliers change? Not at this time but will be evaluated during our integration planning. 6. Will we be required to ship materials to a different location? No. 7. Will we still be dealing with the same purchasing agent(s)? Yes. MERGERS: COMMON COMMUNITY QUESTIONS 1. Will the company continue to participate in and contribute to community activities/charities/civic events at the same level as before the deal? Yes. We will remain committed to the communities we serve. 2. Will the banks continue to play an active role in community activities? Yes. A critical component to both banks’ mission is involvement in community. 3. Will the merger create new jobs for our community? Will there be job losses? As a result of this merger and with a growing $1 billion bank, we foresee a growing associate base with greater employment opportunities in the future. 4. How will the community benefit from the deal? A company the size of SmartFinancial will have greater ability to lend, more robust technology, greater employment opportunities and room for growth for our existing associates, and a greater ability to impact the communities we serve through our community stewardship. 12

SmartBank emerged in January 2006, when long-time executive bankers Bill Carroll and Billy Carroll decided to start the process of organizing a bank with the image, values and service level that would become incomparable to any other bank in the market. SmartBank opened its first office in January 2007 in Pigeon Forge, Tennessee. Today, SmartBank has 7 branches serving clients in East Tennessee and the Florida Panhandle. Recruiting the best people, delivering exceptional client service, strategic branching and a conservative and disciplined approach to lending have all given rise to SmartBank’s success. At SmartBank, we are committed to creating a better bank, and will continue to work hard and capitalize on opportunities that build value for our shareholders, clients and associates. Some key highlights in the history of SmartBank: • In 2007 SmartBank opened the corporate headquarters in Pigeon Forge, TN. Since then, it has expanded with 7 full-service branches, a lending production office and an additional corporate office in Knoxville,TN. • SmartBank quickly grew to $100 million in assets in its first six months of business. • By, 2009 SmartBank reached $250 million in assets and expanded its presence into the Knoxville market with a full-service branch. • In 2012, SmartBank acquired substantially all of the assets and liabilities of GulfSouth Private Bank, adding 4 new offices in the Florida Panhandle. • In 2013, SmartBank opened the Panama City loan production office and relocated the Pensacola office to a thriving downtown market. In November, SmartBank opened its newly designed branch in Knoxville, TN making it the second location in this market. • Branches/Locations: 7 full-service branches in Pigeon Forge, Sevierville, Gatlinburg, Knoxville (2), Destin & Pensacola. SmartBank also has a Lending Production Office in Panama City and a Corporate Office in Knoxville. • Associates: 118; in 2013 SmartBank Associates logged 4,786 volunteer hours for local charitable organizations and area schools, and attended 1,707 events to support our community. • $72,500 donated to our local National Park through client signature-based debit card transactions. SmartBank Associates are proud of the culture they are creating, and together believe in the company’s 8 Core Values, known as The SmartBank Way: • We NEVER COMPROMISE INTEGRITY - we will always act with integrity. Period. • We are PASSIONATE - “enthusiasm,” “energy,” and “determination” all describe the way we act and how we work within our company. • We are NOT AFRAID TO TRY NEW IDEAS - and realize that some will fail. If they do, we will learn from them. We understand that we don’t have all the answers but we must explore new areas of business, even when it is uncomfortable. • We are ACCOUNTABLE - to each other, our clients and shareholders. • We DELIVER THE EXCEPTIONAL - create “WOW” for our clients. We look for opportunities to create experiences that people talk about. • We EMBRACE CHANGE - we are curious and seek continuous improvement without the boundary of “that’s the way we’ve always done it.” • We PURSUE BREAKTHROUGH STRATEGIES - we explore innovation and anticipate both the future opportunities and the future obsolescence in how banking is done. • We COMMUNICATE - in an open, honest and respectful way. Vision: Our vision is to build exceptional value for our brand and for our CLIENTS, COMMUNITIES, ASSOCIATES, and SHAREHOLDERS by delivering more than they think possible. Mission: • We build exceptional value for our CLIENTS by demonstrating incomparable care for their needs and increasing their financial wealth. • We build exceptional value in our COMMUNITIES by providing lasting solutions to their problems and protecting their greatest assets. • We build exceptional value for our ASSOCIATES by fostering a more fulfilling environment that respects individual needs, establishes high expectations and recognizes achievement. • We build exceptional value for our SHAREHOLDERS by managing growth and maximizing profitability, return on investment, stock value, dividends, and liquidity. • We’ve achieved this through the integrity and innovation of our associates and directors – it’s The SmartBank Way 13

Cornerstone Community Bank was founded in 1996 by a group of veteran bankers who recognized the need for a bank that specialized in financial services for local businesses in the Chattanooga area. Cornerstone opened its first corporate office in Hixson, Tennessee on February 20, 1996. Today, Cornerstone has 5 full-service branch locations serving both business and consumer clients throughout the Chattanooga MSA, including Hamilton and contiguous counties; as well as a Loan Production Office in Dalton, Georgia. Now one of Chattanooga’s oldest, largest and most well-respected community banks, Cornerstone stands today as a leading commercial lender and premier financial institution in the rapidly expanding Chattanooga market. Cornerstone team’s in-depth knowledge and breadth of expertise, combined with an unwavering commitment to exceptional client service, is what sets Cornerstone apart from other banks. This has proven to be a winning formula for Cornerstone through history and what will help create greater value and growth opportunities for the future. Some key highlights in the history of Cornerstone Community Bank: • In 1996, Cornerstone opened its first office in Hixson, Tennessee as a bank primarily dedicated to supporting local businesses in Chattanooga. • In 1997, the first branch was opened at Fountain Square in downtown Chattanooga.“Premier” • In September of 1997, Cornerstone completed the acquisition of the Bank of East Ridge, chartered in 1983, which tripled Cornerstone’s asset size.Bank Traits: • Cornerstone has since expanded to 5 full-service branches located in key areas throughout Chattanooga and a loan production office in Dalton, GA. • While Cornerstone remains the banking choice of local businesses, we have also expanded our markets with a P Performance-driven comprehensive range of customized financial solutions for individuals. • Through the years, Cornerstone quickly grew to become one of the fastest-growing community banks in the booming Chattanooga market. • In November of 2006, Cornerstone moved its headquarters and downtown branch into the One Central Plaza R Results-oriented building, where it continues to operate today. • In 2007, Cornerstone was named a “Top 20 Community Bank in America,” based on asset size, by the Independent Community Bank Association’s “Independent Banker” national magazine. • Throughout the years, Cornerstone has been a leading SBA Preferred Lender in the Chattanooga market, and E Excellence is our has been named “SBA Lender of the Year” for Tennessee multiple years.guiding standard • Cornerstone established the Cornerstone Bancshares Foundation in 2006 as a means of furthering its reach and support to worthy causes in the local community. • Through the Foundation and the bank, Cornerstone remains committed to giving back to the community we serve, through our time, talents and financial resources.M Mission-minded • During the Great Recession, Cornerstone successfully raised $15 million in capital to solidify its capital foundations. • Cornerstone has achieved 15 consecutive quarters of positive earnings and has a solid earnings footprint for greater growth and profitability. • With the recent investments of major businesses in Chattanooga, including Volkswagen and Amazon, Cornerstone I Integrity-based is ideally positioned to take advantage of the economic opportunities ahead. • Associates: 108 Cornerstone’s core values and corporate culture can best be summarized in the following statements, which are E Earning the respect not just words on paper but a philosophy we embrace and endeavor to live by each and every day:of our community OUR MISSION Cornerstone Community Bank is Chattanooga’s PREMIER community bank, building our markets one customer at a time. R Rewarding to all of our stakeholders OUR VISION To earn the distinction of being Chattanooga’s premier community bank, by delivering exceptional products, service and value to our customers; by fostering an environment that promotes teamwork, success and development of our people; and by focusing our time, talents and resources on building relationships and serving our community. 14

BOARDS OF DIRECTORS

BOARD OF DIRECTORSWesley M. Welborn Miller Welborn has served as Chairman of the Board of Directors of the Company and the Bank since November 2009. Mr. Welborn is a Partner with the Lamp Post Group, a Chattanooga based small business incubator. Mr. Welborn also has served as President of Welborn & Associates, Inc., a Chattanooga based consulting firm specializing in transportation logistics, for more than ten years. He has been a director of the Company since September 2005. Mr. Welborn has served on the boards of numerous trucking companies and associations. In addition, he served on the board of a publicly traded bank for many years and for two terms as a director of the Federal Reserve Bank of Atlanta’s Birmingham Branch. He also serves on the boards of several non-profit organizations. Monique P. Berke Monique Berke is Vice President, Investment Operations of Unum Group, a global provider of financial protection benefits. She previously served as Vice President, Human Resources, Global Services for Unum. Prior to 2009, she owned and operated Berke Coaching & Consulting, providing consulting services to Fortune 500 companies. Ms. Berke has extensive experience in the financial services industry with specializations in human resources and operational effectiveness. Her corporate and consulting backgrounds add extensive experience to the Board in matters concerning human resources, process and change management and strategic planning. She has served on several community non-profit boards and committees and is the recipient of many professional awards. B. Kenneth Driver Ken Driver is Vice Chairman and Co-CEO of Fillauer Companies, Inc., a Chattanooga based prosthetic manufacturer since 1914. He previously served as President and Chief Operations Officer of Fillauer Companies, Inc. from 1994 to 2007. Since 2007 he has served as the Vice Chairman and Vice CEO of the Fillauer Companies. He has been a director of the Company since 1997. Mr. Driver has extensive experience in matters involved in running a large public company, has served in several capacities from CFO to President and has expertise in finance and accounting, corporate governance, employee matters, and mergers and acquisitions. 16

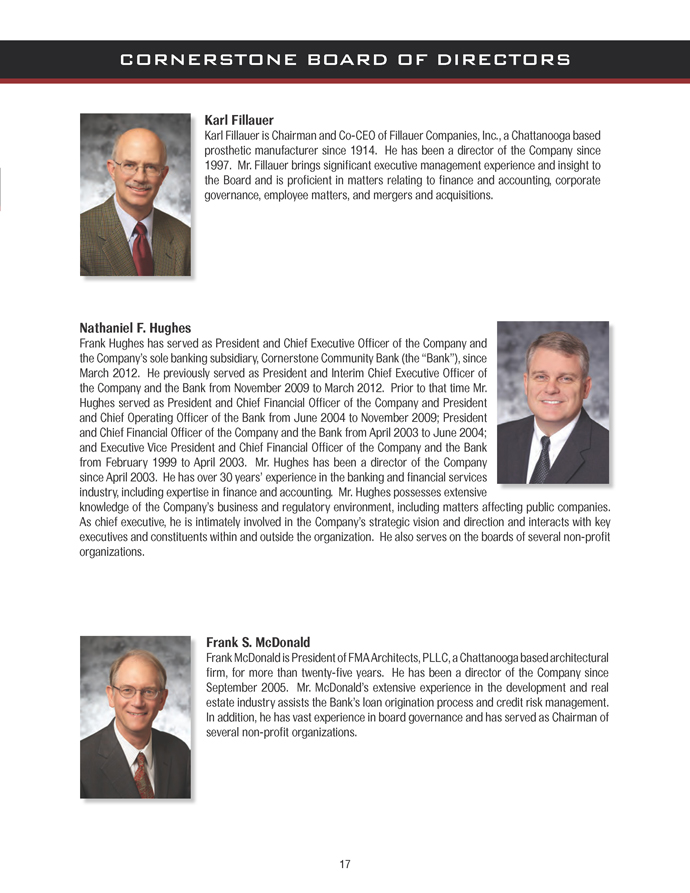

CORNERSTONE BOARD OF DIRECTORSKarl Fillauer Karl Fillauer is Chairman and Co-CEO of Fillauer Companies, Inc., a Chattanooga based prosthetic manufacturer since 1914. He has been a director of the Company since 1997. Mr. Fillauer brings significant executive management experience and insight to the Board and is proficient in matters relating to finance and accounting, corporate governance, employee matters, and mergers and acquisitions. Nathaniel F. Hughes Frank Hughes has served as President and Chief Executive Officer of the Company and the Company’s sole banking subsidiary, Cornerstone Community Bank (the “Bank”), since March 2012. He previously served as President and Interim Chief Executive Officer of the Company and the Bank from November 2009 to March 2012. Prior to that time Mr. Hughes served as President and Chief Financial Officer of the Company and President and Chief Operating Officer of the Bank from June 2004 to November 2009; President and Chief Financial Officer of the Company and the Bank from April 2003 to June 2004; and Executive Vice President and Chief Financial Officer of the Company and the Bank from February 1999 to April 2003. Mr. Hughes has been a director of the Company since April 2003. He has over 30 years’ experience in the banking and financial services industry, including expertise in finance and accounting. Mr. Hughes possesses extensive knowledge of the Company’s business and regulatory environment, including matters affecting public companies. As chief executive, he is intimately involved in the Company’s strategic vision and direction and interacts with key executives and constituents within and outside the organization. He also serves on the boards of several non-profit organizations. Frank S. McDonald Frank McDonald is President of FMA Architects, PLLC, a Chattanooga based architectural firm, for more than twenty-five years. He has been a director of the Company since September 2005. Mr. McDonald’s extensive experience in the development and real estate industry assists the Bank’s loan origination process and credit risk management. In addition, he has vast experience in board governance and has served as Chairman of several non-profit organizations. 17

CORNERSTONE BOARD OF DIRECTORSDoyce G. Payne, M.D. Dr. Doyce Payne practiced obstetrics and gynecology in the Chattanooga area for more than twenty years prior to his redirecting his practice to International Medical Missions in 2004. He has been a director of the Company since 1997. As a resident of Chattanooga, his knowledge of the Chattanooga market fits well with the Company’s strategy of focusing on its core banking franchise in Hamilton County. He also serves on the boards of several non-profit organizations. Billy O. Wiggins Billy Wiggins is President of Checks, Inc., a Chattanooga based specialty check printing company, for more than twenty years. He has been a director of the Company since 1997. Mr. Wiggins has expertise in retailing and wholesaling and extensive experience in the matters involved in running a large company, including finance and accounting, corporate governance, employee matters, and mergers and acquisitions. Marsha Yessick Marsha Yessick is Owner of Yessick’s Design Center, a Chattanooga based interior design company, for more than thirty years and a current member of the American Society of Interior Designers. She has been a director of the Company since 1997. As the founder and operator of several businesses, Ms. Yessick has developed significant experience in managing and operating businesses of varying sizes. In addition, her background assists the Company in human resources management. 18

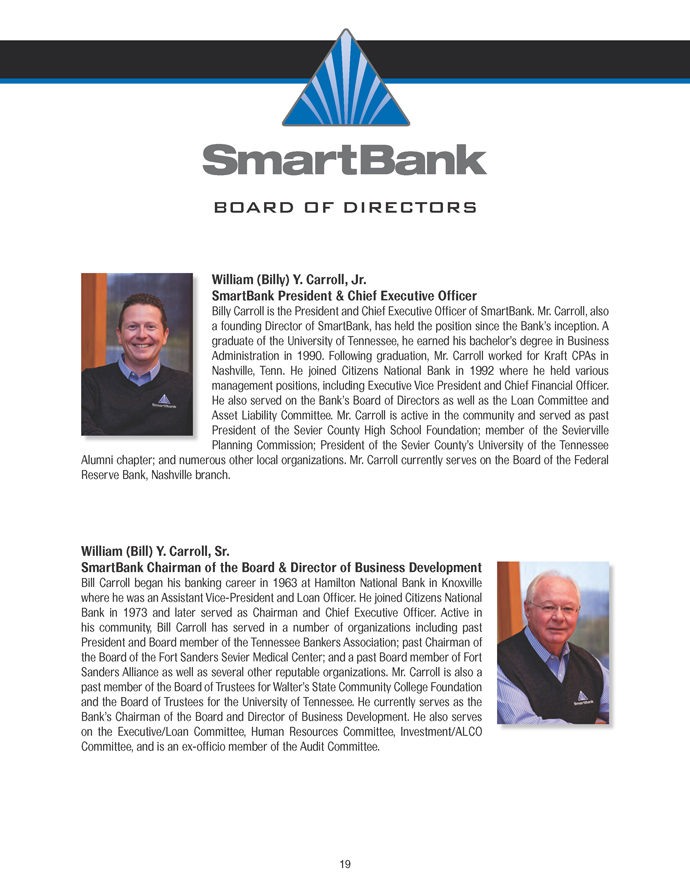

BOARD OF DIRECTORSWilliam (Billy) Y. Carroll, Jr. SmartBank President & Chief Executive Officer Billy Carroll is the President and Chief Executive Officer of SmartBank. Mr. Carroll, also a founding Director of SmartBank, has held the position since the Bank’s inception. A graduate of the University of Tennessee, he earned his bachelor’s degree in Business Administration in 1990. Following graduation, Mr. Carroll worked for Kraft CPAs in Nashville, Tenn. He joined Citizens National Bank in 1992 where he held various management positions, including Executive Vice President and Chief Financial Officer. He also served on the Bank’s Board of Directors as well as the Loan Committee and Asset Liability Committee. Mr. Carroll is active in the community and served as past President of the Sevier County High School Foundation; member of the Sevierville Planning Commission; President of the Sevier County’s University of the Tennessee Alumni chapter; and numerous other local organizations. Mr. Carroll currently serves on the Board of the Federal Reserve Bank, Nashville branch. William (Bill) Y. Carroll, Sr. SmartBank Chairman of the Board & Director of Business Development Bill Carroll began his banking career in 1963 at Hamilton National Bank in Knoxville where he was an Assistant Vice-President and Loan Officer. He joined Citizens National Bank in 1973 and later served as Chairman and Chief Executive Officer. Active in his community, Bill Carroll has served in a number of organizations including past President and Board member of the Tennessee Bankers Association; past Chairman of the Board of the Fort Sanders Sevier Medical Center; and a past Board member of Fort Sanders Alliance as well as several other reputable organizations. Mr. Carroll is also a past member of the Board of Trustees for Walter’s State Community College Foundation and the Board of Trustees for the University of Tennessee. He currently serves as the Bank’s Chairman of the Board and Director of Business Development. He also serves on the Executive/Loan Committee, Human Resources Committee, Investment/ALCO Committee, and is an ex-officio member of the Audit Committee. 19

SMARTBANK BOARD OF DIRECTORSGregory L. Davis SmartBank Executive Vice President, Chief Lending Officer Greg Davis graduated from the University of Tennessee with a BS with Honors degree in Finance. He began his career as an examiner for the Tennessee Department of Financial Institutions. In 1998 he joined BB&T as its Vice President and Commercial Lender. He earned the bank’s “Sterling Performer for 2002 BB&T East Tennessee Region” as the company’s top commercial lender for the region. He became Senior Vice President and the City Executive for BB&T in Sevier County and was responsible for coordinating documentation, credit analysis, and loan reviews for commercial lending as well as prospecting, deposit gathering, product sales, and officer training and coaching. Davis serves on the Board of Directors for the Areawide Development Corporation and is a member of the Loan Approval Committee and ALCO Committee. Davis was elected to SmartBank’s Board of Directors in August, 2010. Victor L. Barrett Co-Founder & Partner of The Track Recreation Center Vic Barrett, a Texas native, earned his Bachelor of Business Administration degree in Accounting from The University of Texas at El Paso. He became a licensed CPA in Texas and Tennessee. Barrett worked in accounting and finance at various oil related companies in Houston before moving to Pigeon Forge, where he co-founded The Track Recreation Center family entertainment business. The Track Recreation Centers have since expanded to Destin, FL and to Gulf Shores, AL. Barrett is currently a partner, stockholder and executive in those businesses. Mr. Barrett serves as a member of the bank’s Investment/ALCO and Human Resources committees as well as the Chairman of the Audit Committee. Ted C. Miller Business Manager & Partner of Dolly Parton Productions Ted Charles Miller is the Business Manager and Partner of Dolly Parton Productions. He has over fifty years of experience in tourism, recreation, development, and marketing of themed attractions. He serves as Vice Chair of The Dollywood Foundation and The Imagination Library. In 1995, Mr. Miller was appointed by the Governor of Tennessee to serve on the Film, Entertainment and Music Commission. In 1998, he was the tourism leader of the year from the Hotel, Motel and Lodging Association. Mr. Miller was appointed to the “Knights of the Roundtable” by the Tennessee State Tourism Industry in 2000. He currently serves on an executive committee overseeing the State Tourism Department at the pleasure of Governor Bill Haslam. Mr. Miller also serves on the bank’s Executive/Loan Committee and the Audit Committee. 20

SMARTBANK BOARD OF DIRECTORSDavid A. Ogle President and Co-Founder of Five Oaks Development Group David Austin Ogle is a real estate developer. He earned his B.B.A. from East Tennessee State University and has his Master’s degree in Construction Science and Management from Clemson University. He’s completed additional studies at Cornell University in Hotel Development. He is a partner and co-founder of Five Oaks Development Group, founder and sole stockholder in Five Oaks/Ogle, Inc., Co-Founder and President of Oaktenn, Inc., and also Co-Founder and Officer in Five Oaks Outlet Centers, Inc. Active in the community, Mr. Ogle is past Chairman of the Tennessee Real Estate Commission and past Chairman of the Board of Trustees of Carson Newman College. In December 2010, the Trustees of Carson Newman College conferred an Honorary Doctorate of Business Administration to Ogle. He was recognized by Business Tennessee magazine as being one of the Top Commercial Real Estate persons in Tennessee. Mr. Ogle serves on the bank’s Executive/Loan and Human Resources committees. Keith E. Whaley, O.D. Founder of Whaley Family EyeCare Keith E. Whaley, O.D., is the founder of the Whaley Family EyeCare in Pigeon Forge, Tenn. He studied at the University of Tennessee, Chattanooga and the University of Tennessee. He earned his Bachelor of Science in Biology and Doctor of Optometry from the Southern College of Optometry. Dr. Whaley holds memberships in the American Optometric Association, the TN Association of Optometric Physicians (TAOP) and the East TN Society of Optometric Physicians (ETSOP). He served on the TAOP Board of Trustees from 2001-2010. Dr. Whaley is a past member and Board of Directors member of the Pigeon Forge Rotary Club, where he served as President from 2003 – 2004 and past President of the Business Network International Sevier County Chapter. He also served as Mayor of the City of Pigeon Forge from 2007-2011. He currently serves as a commissioner on the Sevier County Board of Commissioners. Dr. Whaley serves on the bank’s Investment/ALCO and Audit committees, as well as serving as Secretary to the Board of Directors. Geoffrey A. Wolpert Owner of The Park Grill & The Peddler Restaurants Geoff Wolpert is the owner of The Park Grill and The Peddler restaurants in Gatlinburg. After graduating from the University of South Carolina with a degree in business management, he began management training at The Peddler Steak House in Gatlinburg. Since then, he has managed The Peddler and become majority stockholder in the restaurant’s parent company. In 1988, he sold all The Peddler Steak Houses except the renamed one in Gatlinburg, and in 1995 he opened The Park Grill. Wolpert was recognized as the 2000 Volunteer of the Year by the Gatlinburg Chamber of Commerce and received the 2004 Leadership Award from the United Way of Sevier County. Mr. Wolpert is the founding President of the Gatlinburg Gateway Foundation, and is currently serving as the President on the Board of Governors of Arrowmont School of Arts & Crafts and as Chairman of the Development Committee. Mr. Wolpert serves on the bank’s Audit and Human Resources Committee. 21

EXECUTIVE MANAGEMENT TEAMS

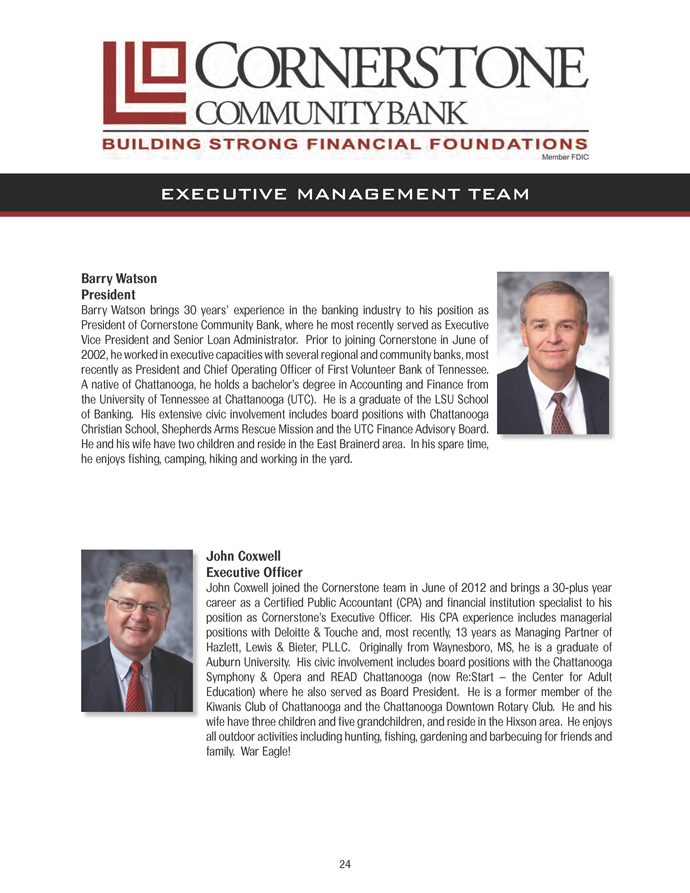

EXECUTIVE MANAGEMENT TEAMBarry Watson President Barry Watson brings 30 years’ experience in the banking industry to his position as President of Cornerstone Community Bank, where he most recently served as Executive Vice President and Senior Loan Administrator. Prior to joining Cornerstone in June of 2002, he worked in executive capacities with several regional and community banks, most recently as President and Chief Operating Officer of First Volunteer Bank of Tennessee. A native of Chattanooga, he holds a bachelor’s degree in Accounting and Finance from the University of Tennessee at Chattanooga (UTC). He is a graduate of the LSU School of Banking. His extensive civic involvement includes board positions with Chattanooga Christian School, Shepherds Arms Rescue Mission and the UTC Finance Advisory Board. He and his wife have two children and reside in the East Brainerd area. In his spare time, he enjoys fishing, camping, hiking and working in the yard. John Coxwell Executive Officer John Coxwell joined the Cornerstone team in June of 2012 and brings a 30-plus year career as a Certified Public Accountant (CPA) and financial institution specialist to his position as Cornerstone’s Executive Officer. His CPA experience includes managerial positions with Deloitte & Touche and, most recently, 13 years as Managing Partner of Hazlett, Lewis & Bieter, PLLC. Originally from Waynesboro, MS, he is a graduate of Auburn University. His civic involvement includes board positions with the Chattanooga Symphony & Opera and READ Chattanooga (now Re:Start – the Center for Adult Education) where he also served as Board President. He is a former member of the Kiwanis Club of Chattanooga and the Chattanooga Downtown Rotary Club. He and his wife have three children and five grandchildren, and reside in the Hixson area. He enjoys all outdoor activities including hunting, fishing, gardening and barbecuing for friends and family. War Eagle! 24

CORNERSTONE EXECUTIVE MANAGEMENT TEAMFelicia Barbee Chief Financial Officer Prior to joining Cornerstone in October of 2012, Felicia Barbee was Chief Financial Officer at a community bank in North Georgia for nine years. Before that, she was employed at Hazlett, Lewis & Bieter, PLLC. She graduated Magna Cum Laude from the University of Tennessee at Chattanooga with a bachelor’s degree in Accounting and earned her Certified Public Accountant designation. She is a member of the American Institute of Certified Public Accountants and the Georgia Society of CPAs. She is very active in her church where she also serves in the Music/Worship Ministry and various outreach ministries such as feeding the homeless. She resides in Chickamauga, GA with her husband and son. Her interests include singing, songwriting and watching her son play sports. Gary Petty Chief Operating Officer Gary Petty started with Cornerstone in January of 2000 and has nearly 20 years’ experience in the banking industry. He received his undergraduate degree in Economics from the University of Georgia and a Master of Accountancy degree from the University of Tennessee at Chattanooga. He and his wife live in Ringgold, GA. In his spare time, he enjoys jogging with his wife and participating in marathons and Ironman Competitions. Bob Vercoe Chief Credit Officer Bob Vercoe joined Cornerstone in November of 2010 as a 30-year veteran of the banking industry, having served in executive positions with banks in Charlotte, NC; Nashville, TN; and Chattanooga, TN. Originally from Raleigh, NC, he holds a bachelor’s degree in U.S. History and an MBA in finance from the University of North Carolina at Chapel Hill. He has lived in Chattanooga for the past 20 years. He and his wife have four grown children and reside on Signal Mountain. His passion is watching Tar Heels basketball. 25

EXECUTIVE MANAGEMENT TEAMWilliam (Billy) Y. Carroll, Jr. President & Chief Executive Officer Billy Carroll is the President and Chief Executive Officer of SmartBank. Mr. Carroll, also a founding Director of SmartBank, has held the position since the Bank’s inception. A graduate of the University of Tennessee, he earned his bachelor’s degree in Business Administration in 1990. Following graduation, Mr. Carroll worked for Kraft CPAs in Nashville, Tenn. He joined Citizens National Bank in 1992 where he held various management positions, including Executive Vice President and Chief Financial Officer. He also served on the Bank’s Board of Directors as well as the Loan Committee and Asset Liability Committee. Mr. Carroll is active in the community and served as past President of the Sevier County High School Foundation; member of the Sevierville Planning Commission; President of the Sevier County’s University of the Tennessee Alumni chapter; and numerous other local organizations. Mr. Carroll currently serves on the Board of the Federal Reserve Bank, Nashville branch. Greg Davis Executive Vice President, Chief Lending Officer Greg Davis graduated from the University of Tennessee with a BS with Honors degree in Finance. He began his career as an examiner for the Tennessee Department of Financial Institutions. In 1998 he joined BB&T as its Vice President and Commercial Lender. He earned the bank’s “Sterling Performer for 2002 BB&T East Tennessee Region” as the company’s top commercial lender for the region. He became Senior Vice President and the City Executive for BB&T in Sevier County and was responsible for coordinating documentation, credit analysis, and loan reviews for commercial lending as well as prospecting, deposit gathering, product sales, and officer training and coaching. Davis serves on the Board of Directors for the Areawide Development Corporation and is a member of the Loan Approval Committee and ALCO Committee. Davis was elected to SmartBank’s Board of Directors in August, 2010. 26

SMARTBANK EXECUTIVE MANAGEMENT TEAMC. Bryan Johnson Executive Vice President & Chief Financial Officer Bryan Johnson is a 1991 graduate of the United States Military Academy at West Point with a BS in Economics, Mathematical. After college, he attended Officer Basic Training and Airborne School before serving as an Artillery Officer with the First Armored Division in Europe. Following a deployment to Bosnia as the Battalion Intelligence officer Johnson left the Army as a Captain. In 2000 Johnson received his J.D. and MBA in Finance from the University of Tennessee. Also in 2000 Johnson received the Chartered Financial Analyst Designation. Following graduate school, he joined Moon Capital Management, a registered investment advisor. There he was responsible for the research of investments on behalf of individual and institutional clients. Johnson also worked as an Adjunct Professor for the University of Tennessee teaching Security Analysis and Financial Statement Analysis courses from 2002 - 2009. He is the Treasurer of the CFA Society of East Tennessee and a member of the West Point Society of East Tennessee. Johnson joined SmartBank in February 2010 as Vice President and Controller. Rhett Jordan Executive Vice President & Chief Credit Officer Rhett Jordan is a highly-skilled professional with a wide array of knowledge and experience. Prior to joining the SmartBank team, Rhett served as the Senior Vice President & East Tennessee Credit Officer for Regions Bank in Knoxville. He also served as the Chief Credit Officer for BankEast in Knoxville. Rhett attended Samford University where he received his Bachelor of Science degree in Business Administration with a Management concentration. Later, he received his MBA from Spring Hill College in Mobile, Alabama. Rhett is currently a member of the Risk Management Association. He is a past member of the Association of Financial Professionals, United Way of East Tennessee Funds Allocation Committee and the American Cancer Society Leadership Council. Bill Lloyd Regional President of Florida Bill Lloyd began his banking career in 1990 and has held a variety of leadership positions in the Florida Panhandle since 1997. Prior to joining SmartBank, Bill most recently served as Executive Vice President, Senior Loan Officer for Vision Bank. Bill carries a wealth of knowledge and expertise in the financial industry. He is responsible for overseeing all areas of business within SmartBank’s Florida Market. Bill received his Bachelor of Science degree in Finance from Florida State University and holds a Chartered Financial Analyst designation. He is also a board member of World Choice Investments LLC and operates a private scholarship program. 27

SMARTBANK EXECUTIVE MANAGEMENT TEAMDiane Short Executive Vice President & Human Resources Officer Diane Short is a skilled Human Resource professional and consultant with over 20 years of experience. She brings a wealth of knowledge from working with leading organizations in various industries including hospitality, finance, retail and transportation. Prior to joining SmartBank, she served as Vice President – Employee Relations, Talent Management and Recruiting of Gaylord Entertainment Corporation, where she focused on developing and managing cooperative team environments while exceeding performance benchmarks. Diane attended Georgia State University where she received a degree in Psychology. Diane is a member of the Society of Human Resources Management and is a past member of the Advisory Board at Trevecca College in Nashville, Tennessee. 28

OUR MARKETS KNOXVILLE, TN SEVIER COUNTY, TN CHATTANOOGA, TN PANAMA CITY, fl DESTIN, fl PENSACOLA, fl

KNOXVILLE, TNWith its heritage of innovative science and technology breakthroughs and solid, business-friendly values, Knoxville-Oak Ridge Innovation Valley region is a prime business location in the Southeast. Beyond science and technology, Innovation Valley is just an all around great place to live. Knoxville’s roots run deep and strong. The city has served as the hub of the region since its founding in 1791. The best of its Appalachian heritage remains today - a strong work ethic, a family-centered community, and an intense respect for the natural beauty that envelops the region. http://www. knoxvillechamber.com/relocation Knoxville is home to cable TV’s HGTV, which is one of the fastest growing networks in cable history with nearly 84 million households in less than nine years. http://www.cityofknoxville.org/about/funfacts.asp Knoxville is home to the Knoxville News Sentinel which is one of the top 100 Daily newspapers in the United States. Source: Audit Bureau of Circulations figures for six-month period ending 9/30/08 Knoxville is home to Pat Summitt, UT Lady Vols former women’s basketball coach who is the all-time winningest coach in NCAA basketball history of either a men’s or women’s team in any division. http:// www.cityofknoxville.org/about/funfacts.asp The only museum devoted to women’s basketball (Women’s Basketball Hall of Fame) is located in Knoxville, Tennessee. http://www.cityofknoxville.org/about/funfacts.asp Knoxville has birthed several celebrities such as Johnny Knoxville, Quentin Tarantino, and actors Patricia Neal & David Keith. http://www.cityofknoxville.org/about/funfacts.asp One of the country’s five national labs sits in Knoxville’s backyard in Oak Ridge. The main campus of the University of Tennessee is home to nationally acclaimed schools of engineering, business and law. Seventeen additional colleges and training programs in the region produce a ready supply of trained workers. All these organizations feed the strong, entrepreneurial spirit found in Knoxville. Three of the nation’s major interstates - I-40, I-75, I-81 - intersect in Knoxville. http://www.knoxvillechamber.com/relocation Of more than 150 hospitals in Tennessee, in 2013 U.S. News & World report released its annual list of “America’s Best Hospitals,” naming three Knoxville area Covenant Health hospitals - Fort Sanders Regional Medical Center, Methodist Medical Center, and Parkwest Medical Center in Tennessee’s Top 10 for metro areas. http://health.usnews.com/best-hospitals/area/tn In 2012, Knoxville was ranked 2nd in “Cities with the Happiest Workers” by careerbliss.com http://www. careerbliss.com/advice/happiest-and-unhappiest-cities-for-workers/ Knoxville boasts something for everyone. Newly-renovated Knoxville Museum of Art, historic Tennessee Theater, University of Tennessee’s 20 NCAA Division 1 athletic teams, Southern Professional Hockey League team – the Ice Bears, Knoxville Zoo (53 acres & 750+ animals), Ijams Nature Center, and the 85-acre Fort Dickerson Park featuring Quarry Lake. Annual Labor Day festival, Boomsday (with over 400,000 in attendance at the 26th annual event in 2013), was named one of the “Top 20 Events in the Southeast” by the Southeast Tourism Society. http://www.knoxvillechamber.com/Flashbook/knox_fbook.html http://www.southeasttourism.org/Programs/STSTop20-Winners With the region branding itself as Innovation Valley, Knoxville is home to the Knoxville Entrepreneur Center, assisting those who see the promise of starting a business in the area. http://www. knoxvillechamber.com/Flashbook/knox_fbook.html Knoxville is home to numerous corporate headquarters, with operations like Pilot Flying J, Bush Brothers and Company, Scripps Networks Interactive, Regal Entertainment and Clayton Homes, all based out of the region. In 2012, Rivr Media, a Knoxville-based television production company launched Nest Features Film Studio. The facility has plans to produce four feature-length films, positioning Knoxville to be the new Hollywood of the South. http://www.knoxvillechamber.com/Flashbook/ knox_fbook.html Additional resources: http://www.visitknoxville.com/media/about-knoxville#rankings 30

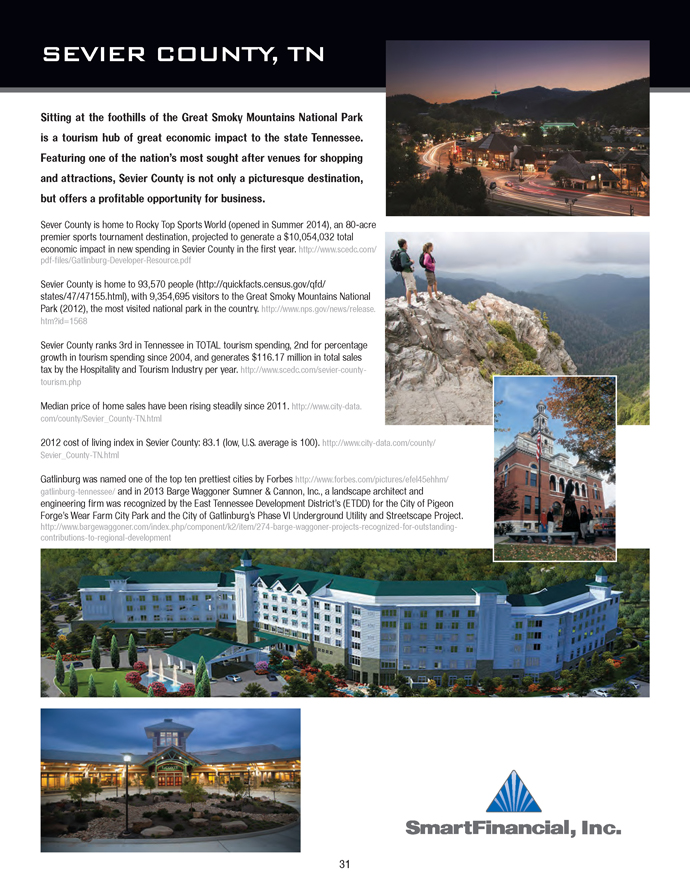

SEVIER COUNTY, TNSitting at the foothills of the Great Smoky Mountains National Park is a tourism hub of great economic impact to the state Tennessee. Featuring one of the nation’s most sought after venues for shopping and attractions, Sevier County is not only a picturesque destination, but offers a profitable opportunity for business. Sever County is home to Rocky Top Sports World (opened in Summer 2014), an 80-acre premier sports tournament destination, projected to generate a $10,054,032 total economic impact in new spending in Sevier County in the first year. http://www.scedc.com/ pdf-files/Gatlinburg-Developer-Resource.pdf Sevier County is home to 93,570 people (http://quickfacts.census.gov/qfd/ states/47/47155.html), with 9,354,695 visitors to the Great Smoky Mountains National Park (2012), the most visited national park in the country. http://www.nps.gov/news/release. htm?id=1568 Sevier County ranks 3rd in Tennessee in TOTAL tourism spending, 2nd for percentage growth in tourism spending since 2004, and generates $116.17 million in total sales tax by the Hospitality and Tourism Industry per year. http://www.scedc.com/sevier-county-tourism.php Median price of home sales have been rising steadily since 2011. http://www.city-data. com/county/Sevier_County-TN.html 2012 cost of living index in Sevier County: 83.1 (low, U.S. average is 100). http://www.city-data.com/county/ Sevier_County-TN.html Gatlinburg was named one of the top ten prettiest cities by Forbes http://www.forbes.com/pictures/efel45ehhm/ gatlinburg-tennessee/ and in 2013 Barge Waggoner Sumner & Cannon, Inc., a landscape architect and engineering firm was recognized by the East Tennessee Development District’s (ETDD) for the City of Pigeon Forge’s Wear Farm City Park and the City of Gatlinburg’s Phase VI Underground Utility and Streetscape Project. http://www.bargewaggoner.com/index.php/component/k2/item/274-barge-waggoner-projects-recognized-for-outstanding-contributions-to-regional-development 31