Exhibit 99.2

Acquisition of Capstone Bancshares, Inc.

May 22, 2017

Important Information

Important Information for Investors and Shareholders

In connection with the proposed transaction, SmartFinancial, Inc. (“SmartFinancial”) will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 containing a joint proxy statement/prospectus of Capstone Bancshares, Inc. (“Capstone”) and SmartFinancial. A definitive joint proxy statement/prospectus will be mailed to shareholders of both SmartFinancial and Capstone. Shareholders of SmartFinancial and Capstone are urged to read the joint proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Shareholders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SmartFinancial through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by SmartFinancial will also be available free of charge on SmartFinancial’s website at www.smartbank.com or by contacting SmartFinancial’s Investor Relations Department at 423.385.3009.

SmartFinancial, Capstone, their directors and executive officers, and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of SmartFinancial is set forth in SmartFinancial’s proxy statement for its 2017 annual shareholders meeting. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

2

Important Information

Forward Looking Statement Disclosure

This presentation contains forward-looking statements. SmartFinancial cautions you that a number of important factors could cause actual results to differ materially from those currently anticipated in any forward-looking statement. Such factors include, but are not limited to: the businesses of Capstone and SmartFinancial may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and revenue synergies from the merger may not be fully realized within the expected timeframes or at all; disruption from the transaction may make it difficult to maintain relationships with clients or employees; the required governmental approvals for the transaction may not be obtained on the proposed terms and schedules or at all; Capstone’s shareholders and/or SmartFinancial’s shareholders may not approve the transaction; changes in prevailing economic and political conditions, particularly in our market areas, including the areas served by Capstone; credit risk associated with our lending activities; changes in interest rates, loan demand, real estate values and competition; changes in accounting principles, policies, and guidelines; changes in any applicable law, rule, regulation or practice with respect to tax or legal issues; and other economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services and other factors that may be described in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the SEC from time to time. The forward-looking statements are made as of the date of this presentation, and, except as may be required by applicable law or regulation, SmartFinancial assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

3

Opportunity and Rationale

Capstone Branch Map

Transaction Rationale

Continued growth of Southern banking franchise

Pro forma company over $1.6 billion in total assets

Strategic entry into attractive Alabama markets

Financially attractive

Enhanced profitability with +25% EPS accretion

Tangible book value dilution earned back in ~3 years

Pro forma company “well capitalized”

Solid fit

Complementary branch profile fills in existing SmartBank footprint

SMBK management enjoys longstanding ties to the region

Capstone CEO to join SmartBank leadership team

Capstone Bank Financial Highlights(1)

Assets: $511M

Gross Loans: $412M

LTM ROAA: 0.82%

Branches: 8

NPAs/Assets: 0.65%

LTM Effic.: 63.3%

TCE/TA: 10.1%

Deposits: $446M

Source: SNL Financial

Based on bank-level regulatory filings as of 3/31/2017

4

Tuscaloosa Market Highlights

Tuscaloosa Market Overview

SMBK Chairman Miller Welborn was raised in Tuscaloosa and has strong ties to the area

Tuscaloosa, AL is home to the flagship campus of the University of Alabama, one of the largest universities in the country

Over 37,000 students

In 1993, Mercedes-Benz selected Tuscaloosa as the headquarters for its U.S.-based manufacturing operations

Located approximately 20 miles from downtown Tuscaloosa

~3,600 employees

DCH Regional Medical center opened in Tuscaloosa in 1923 and today serves as one of West Alabama’s premier hospitals

+500 bed facility

Over 3,600 employees

Source: SMBK management, University of Alabama, Mercedes-Benz U.S. International, Inc., DCH Health System, BF Goodrich, Hunt Refining Company, Nucor Steel Tuscaloosa, Inc.

Companies with Presence in Western Alabama

5

Capstone Leaders Joining SMBK

Robert Kuhn Capstone CEO

Mr. Kuhn was born and raised in Tuscaloosa, Alabama. He graduated from Tuscaloosa High School, Alexander City Junior College, and from The University of Alabama in Birmingham with a degree in corporate finance and investment management. Mr. Kuhn has been in the banking business for over 34 years with experience in key areas of banking, including collections, operations, retail lending, credit analysis and commercial lending. For 15 years he was a member of the corporate banking team at Regions Bank in Birmingham, Alabama. In 2000, Mr. Kuhn returned home to Tuscaloosa as President and CEO of Security Bank. In 2005 he rejoined to Regions as President and CEO of the Tuscaloosa Bank, and joined Capstone Bank in late 2008 as President and CEO.

Steven Tucker Capstone Chairman

Chairman Tucker graduated from the University of Alabama with dual degrees in finance and accounting as well as an MBA. After serving as an officer in the US Army, he joined the national accounting firm of Arthur Anderson and completed the requirements to become a Certified Public Accountant. Mr. Tucker worked for 20 years in the field of public accounting, and then became a principal in Barnett Transportation, a liquid bulk transporter headquartered in Tuscaloosa, Alabama. Tucker has served many years as Treasurer and later President of the Children’s Hands On Museum as well as serving on the board of the Alabama Trucking Association Worker’s Compensation Fund. Mr. Tucker joined the board of directors of Capstone Bank in 2008 and has served on the loan, audit and compensation committees and currently is Chairman of the Board.

J. Beau Wicks Capstone Director

Mr. Wicks, 56, is a lifelong resident of Tuscaloosa. He is a 1983 graduate of The University of Alabama, with a degree in Accounting. He spent eight years as a controller for Randall Publishing Company, and six years as CFO for Cummings Trucking Company. In 1998, Mr. Wicks started Southeast Logistics, a regional trucking company serving the building products industry (roofing, steel, lumber, pipe). The company has grown to operate approximately 300 trucks with four offices in three states. Mr. Wicks is a member of the Alabama Trucking Association, and has served on the board of directors of the ATA Workers Compensation Self Insurance Fund for twelve years, including two years as chairman. Mr. Wicks joined The Board of Directors of Capstone Bank in 2008, and has served on the loan, budget and audit committees, including five years as Audit Chairman. Prior to joining Capstone, Mr. Wicks also served three years on the Board of Directors of First Federal Bank. Over the years, Mr. Wicks has served numerous civic and philanthropic organizations within his community.

6

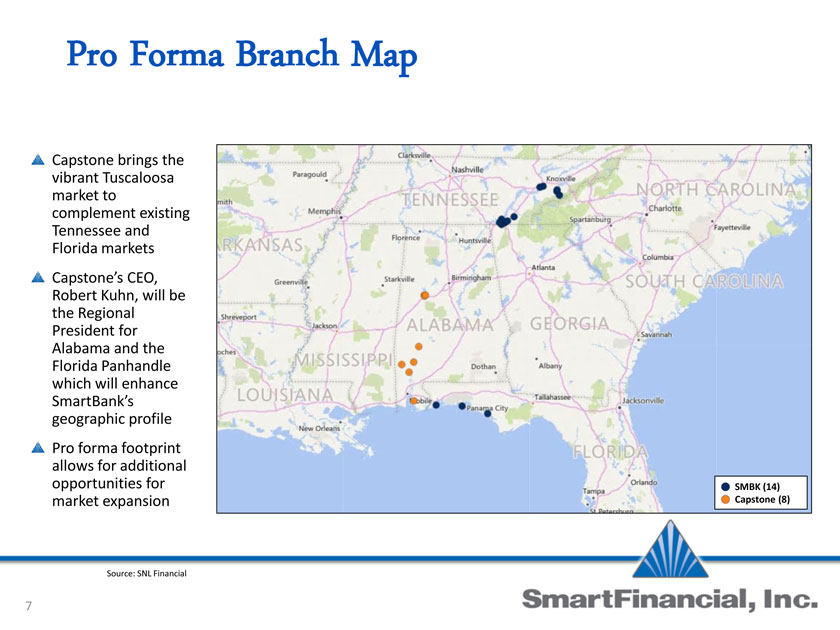

Pro Forma Branch Map

Capstone brings the vibrant Tuscaloosa market to complement existing Tennessee and Florida markets

Capstone’s CEO, Robert Kuhn, will be the Regional President for Alabama and the Florida Panhandle which will enhance SmartBank’s geographic profile

Pro forma footprint allows for additional opportunities for market expansion

Source: SNL Financial

7

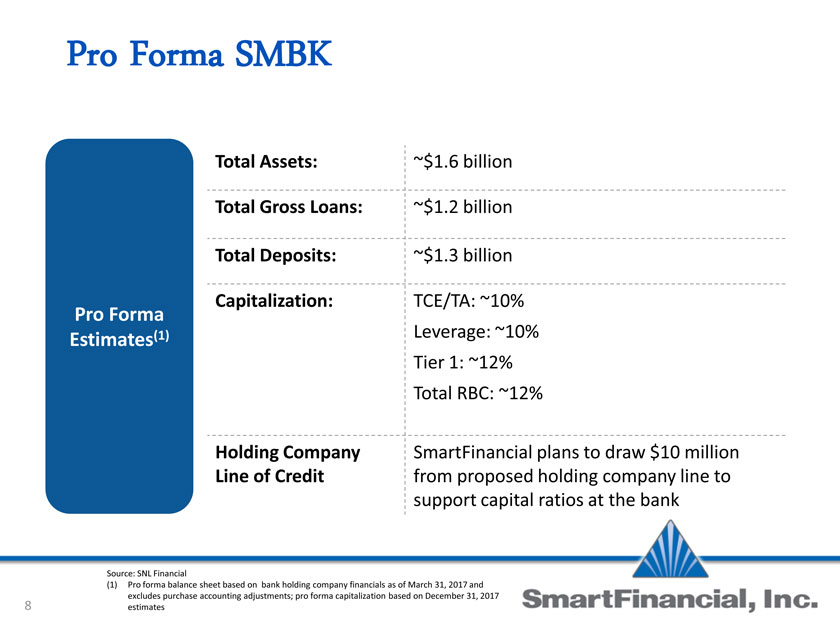

Pro Forma SMBK

Pro Forma Estimates(1)

Total Assets: ~$1.6 billion

Total Gross Loans: ~$1.2 billion

Total Deposits: ~$1.3 billion

Capitalization: TCE/TA: ~10% Leverage: ~10% Tier 1: ~12% Total RBC: ~12%

Holding Company Line of Credit SmartFinancial plans to draw $10 million from proposed holding company line to support capital ratios at the bank

Source: SNL Financial

(1) Pro forma balance sheet based on bank holding company financials as of March 31, 2017 and excludes purchase accounting adjustments; pro forma capitalization based on December 31, 2017 estimates

8

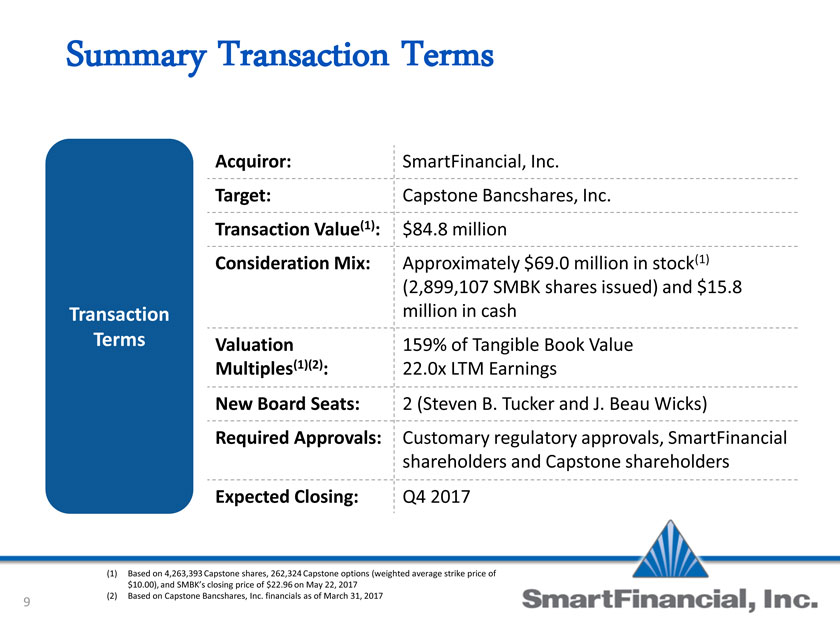

Summary Transaction Terms

Transaction Terms

Acquiror: SmartFinancial, Inc.

Target: Capstone Bancshares, Inc.

Transaction Value(1): $84.8 million

Consideration Mix: Approximately $69.0 million in stock(1) (2,899,107 SMBK shares issued) and $15.8 million in cash

Valuation Multiples(1)(2): 159% of Tangible Book Value

22.0x LTM Earnings

New Board Seats: 2 (Steven B. Tucker and J. Beau Wicks)

Required Approvals: Customary regulatory approvals, SmartFinancial shareholders and Capstone shareholders

Expected Closing: Q4 2017

(1) Based on 4,263,393 Capstone shares, 262,324 Capstone options (weighted average strike price of $10.00), and SMBK’s closing price of $22.96 on May 22, 2017

(2) Based on Capstone Bancshares, Inc. financials as of March 31, 2017

9

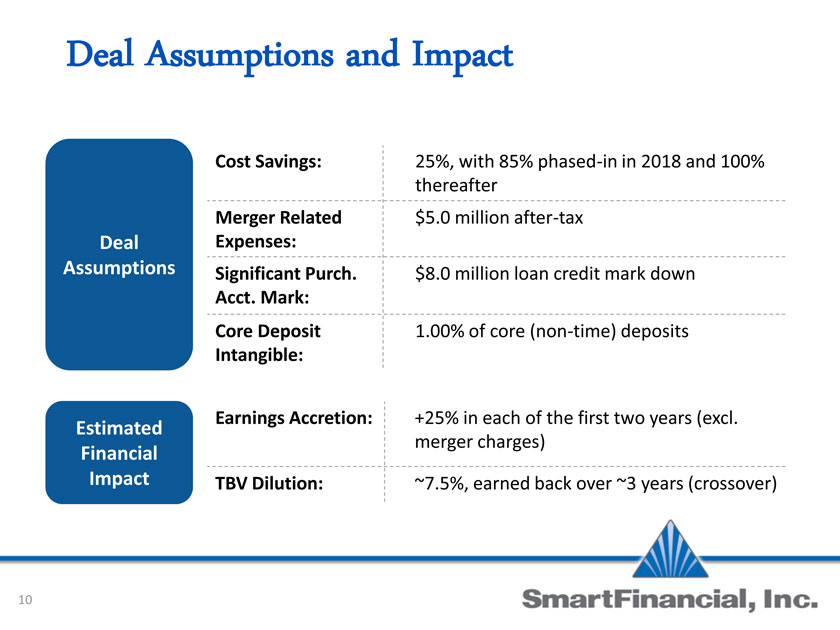

Deal Assumptions and Impact

Deal Assumptions

Cost Savings: 25%, with 85% phased-in in 2018 and 100% thereafter

Merger Related Expenses: $5.0 million after-tax

Significant Purch. Acct. Mark: $8.0 million loan credit mark down

Core Deposit Intangible: 1.00% of core (non-time) deposits

Estimated Financial Impact

Earnings Accretion: +25% in each of the first two years (excl. merger charges)

TBV Dilution: ~7.5%, earned back over ~3 years (crossover)

10

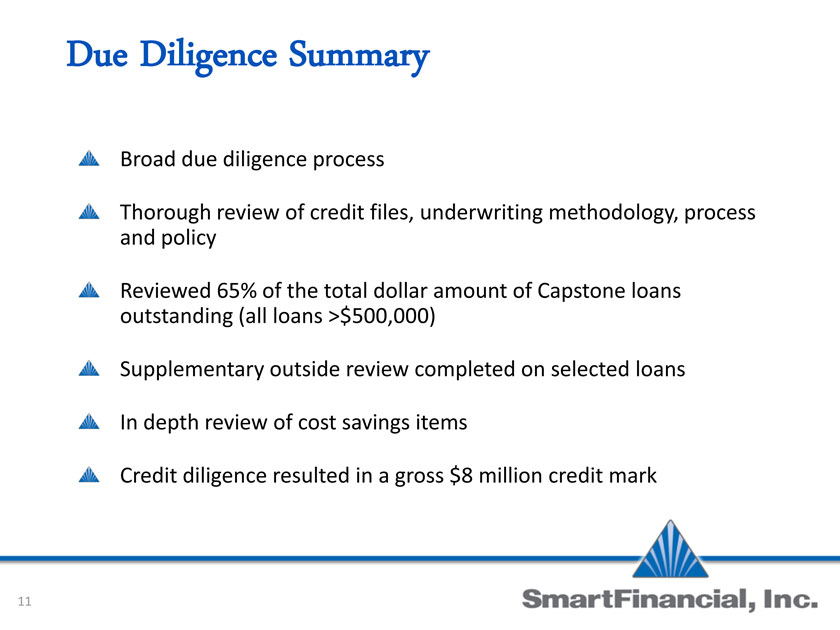

Due Diligence Summary

Broad due diligence process

Thorough review of credit files, underwriting methodology, process and policy

Reviewed 65% of the total dollar amount of Capstone loans outstanding (all loans >$500,000)

Supplementary outside review completed on selected loans

In depth review of cost savings items

Credit diligence resulted in a gross $8 million credit mark

11

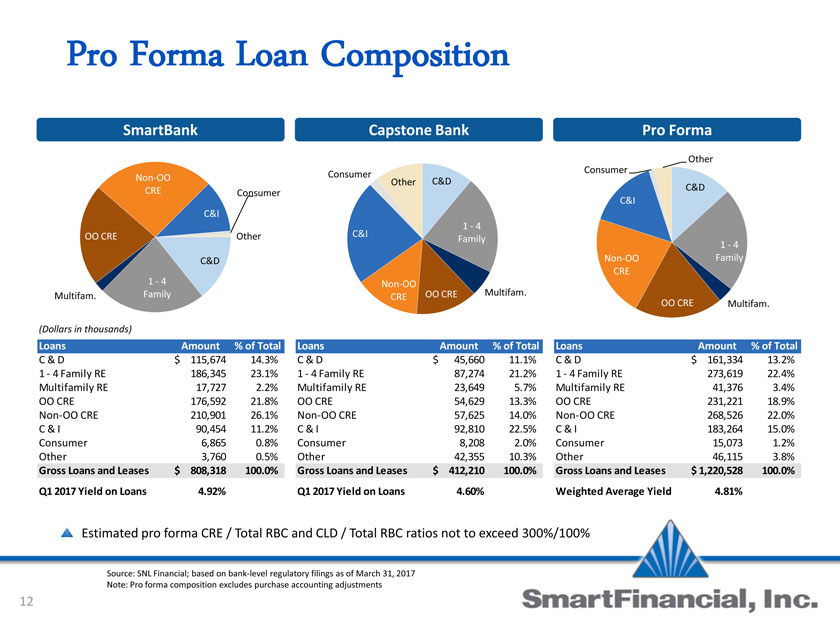

Pro Forma Loan Composition

SmartBank Non-OO CRE OO CRE C&I Consumer Other C&D 1 - 4 Family Multifam.

(Dollars in thousands)

Loans Amount % of Total

C & D $ 115,674 14.3%

1 - 4 Family RE 186,345 23.1%

Multifamily RE 17,727 2.2%

OO CRE 176,592 21.8%

Non-OO CRE 210,901 26.1% C & I 90,454 11.2% Consumer 6,865 0.8% Other 3,760 0.5% Gross Loans and Leases $ 808,318 100.0%

Q1 2017 Yield on Loans 4.92%

Capstone Bank Consumer Other C&D 1 - 4 Family OO CRE Non-OO CRE C&I Multifam. Loans Amount % of Total C & D $ 45,660 11.1% 1 - 4 Family RE 87,274 21.2% Multifamily RE 23,649 5.7% OO CRE 54,629 13.3% Non-OO CRE 57,625 14.0% C & I 92,810 22.5% Consumer 8,208 2.0% Other 42,355 10.3% Gross Loans and Leases $ 412,210 100.0% Q1 2017 Yield on Loans 4.60% Pro Forma Multifam. C& I OO CRE Non-OO CRE C&D Other Consumer Loans Amount % of Total C & D $ 161,334 13.2% 1 - 4 Family RE 273,619 22.4% Multifamily RE 41,376 3.4% OO CRE 231,221 18.9% Non-OO CRE 268,526 22.0% C & I 183,264 15.0% Consumer 15,073 1.2% Other 46,115 3.8% Gross Loans and Leases $ 1,220,528 100.0% Weighted Average Yield 4.81% Estimated pro forma CRE / Total RBC and CLD / Total RBC ratios not to exceed 300%/100% Source: SNL Financial; based on bank level regulatory filings as of March 31, 2017 Note: Pro forma composition excludes purchase accounting adjustments

12

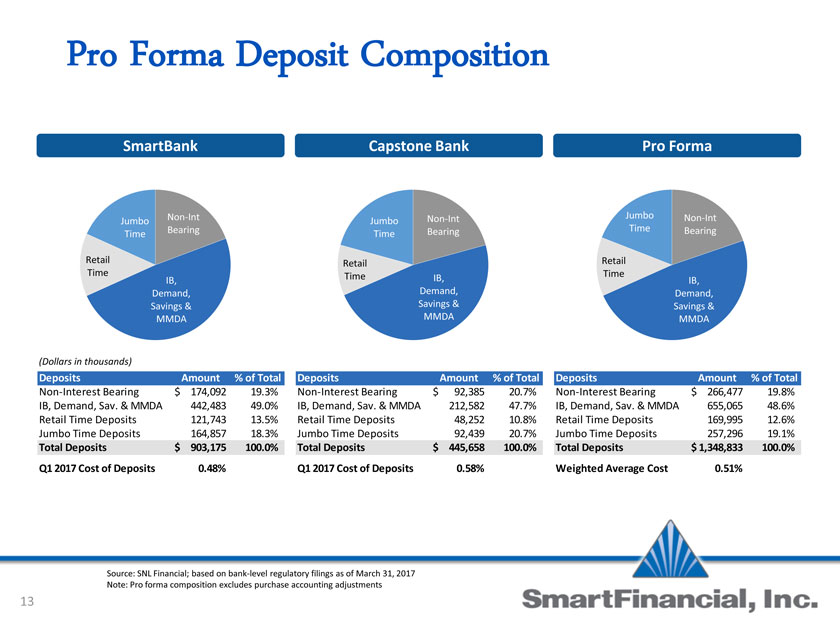

Pro Forma Deposit Composition

SmartBank

Jumbo Time Non-Int Bearing Retail Time IB, Demand, Savings & MMDA

(Dollars in thousands)

Deposits Amount % of Total Non-Interest Bearing $ 174,092 19.3% IB, Demand, Sav. & MMDA 442,483 49.0% Retail Time Deposits 121,743 13.5% Jumbo Time Deposits 164,857 18.3% Total Deposits $ 903,175 100.0%

Q1 2017 Cost of Deposits 0.48% Capstone Bank Jumbo Time Non-Int Bearing IB, Demand, Savings & MMDA Retail Time Deposits Amount % of Total Non-Interest Bearing $ 92,385 20.7% IB, Demand, Sav. & MMDA 212,582 47.7% Retail Time Deposits 48,252 10.8% Jumbo Time Deposits 92,439 20.7% Total Deposits $ 445,658 100.0% Q1 2017 Cost of Deposits 0.58% Pro Forma Jumbo Time Non-Int Bearing IB, Demand, Savings & MMDA Retail Time Deposits Amount % of Total Non-Interest Bearing $ 266,477 19.8% IB, Demand, Sav. & MMDA 655,065 48.6% Retail Time Deposits 169,995 12.6%

Jumbo Time Deposits 257,296 19.1%

Total Deposits $ 1,348,833 100.0%

Weighted Average Cost 0.51%

Source: SNL Financial; based on bank-level regulatory filings as of March 31, 2017

Note: Pro forma composition excludes purchase accounting adjustments

13