As filed with the Securities and Exchange Commission on April 17, 2008

Securities Act File No.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. o

Post-Effective Amendment No. o

ING PARTNERS, INC.

(Exact Name of Registrant as Specified in Charter)

7337 East Doubletree Ranch Road, Scottsdale, Arizona 85258-2034

(Address of Principal Executive Offices) (Zip Code)

1-800-366-0066

(Registrant’s Area Code and Telephone Number)

Huey P. Falgout, Jr.

ING Investments, LLC

7337 East Doubletree Ranch Road

Scottsdale, Arizona 85258-2034

(Name and Address of Agent for Service)

With copies to:

Jeffrey S. Puretz, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006-2401

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on May 19, 2008

pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

ING VP HIGH YIELD BOND PORTFOLIO

7337 East Doubletree Ranch Road

Scottsdale, Arizona 85258-2034

1-800-992-0180

June 4, 2008

Dear Variable Contract Owner/Plan Participant:

The Board of Trustees (the “Board”) has called a special meeting of shareholders (the “Special Meeting”) of ING VP High Yield Bond Portfolio (“VP High Yield Bond Portfolio”), which is scheduled for 10:00 a.m., Local time, on July 29, 2008, at 7337 East Doubletree Ranch Road, Scottsdale, Arizona 85258-2034.

The Board of VP High Yield Bond Portfolio has reviewed and recommends the proposed reorganization (the “Reorganization”) of VP High Yield Bond Portfolio with and into ING Pioneer High Yield Portfolio (“Pioneer High Yield Portfolio”) (each a “Portfolio” and collectively, the “Portfolios”). The Portfolios are members of the mutual fund group called the “ING Funds.”

Shares of VP High Yield Bond Portfolio have been purchased at your direction by your insurance company (“Insurance Company”) through its separate account to fund benefits payable under your variable annuity contract or variable life insurance policy (each a “Variable Contract”) or at your direction by your qualified pension or retirement plan (“Qualified Plan”). Your Insurance Company and/or Qualified Plan, as the legal owner of that separate account, has been asked to approve the Reorganization. You, as either a participant in a Qualified Plan (“Plan Participant”) or as an owner of a Variable Contract for which VP High Yield Bond Portfolio serves as an investment option, are being asked by your Qualified Plan and/or Insurance Company for instructions as to how to vote the shares of VP High Yield Bond Portfolio to which you have either allocated cash values under your Variable Contract or invested through your Qualified Plan. As such, this letter, the accompanying Notice, combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) and voting instructions card are, therefore, being furnished to Variable Contract owners and Plan Participants entitled to provide voting instructions with regard to the proposals to be considered at the Special Meeting.

If the Reorganization is approved and consummated with respect to each Portfolio, the separate account in which you have an interest or the Qualified Plan in which you are a participant will own shares of Pioneer High Yield Portfolio instead of shares of VP High Yield Bond Portfolio. The Reorganization would provide the separate account in which you have an interest or the Qualified Plan in which you are a participant with an opportunity to participate in a significantly larger portfolio which seeks to maximize total return through income and capital appreciation.

AFTER CAREFUL CONSIDERATION, THE BOARD OF VP HIGH YIELD BOND PORTFOLIO APPROVED THIS PROPOSAL AND RECOMMENDS SHAREHOLDERS VOTE “FOR” THE PROPOSAL.

A Proxy Statement/Prospectus that describes the Reorganization is enclosed. We hope that you can attend the Special Meeting in person; however, we urge you in any event to provide voting instructions by completing and returning the enclosed voting instructions card in the envelope provided at your earliest convenience. Your vote is important regardless of the number of shares attributable to your Variable Contract and/or Qualified Plan. To avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Proxy Statement/Prospectus and provide voting instructions. It is important that your voting instructions be received no later than July 28, 2008.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

| Sincerely, |

| |

|

|

| Shaun P. Mathews, |

| President and Chief Executive Officer |

(This page intentionally left blank)

ING VP HIGH YIELD BOND PORTFOLIO

7337 East Doubletree Ranch Road

Scottsdale, Arizona 85258-2034

1-800-992-0180

Notice of Special Meeting of Shareholders

of ING VP High Yield Bond Portfolio

Scheduled for July 29, 2008

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of shareholders (the “Special Meeting”) of ING VP High Yield Bond Portfolio (“VP High Yield Bond Portfolio”) is scheduled for July 29, 2008, at 10:00 a.m., Local time, at 7337 East Doubletree Ranch Road, Scottsdale, Arizona 85258-2034 for the following purposes:

(1) | | To approve an Agreement and Plan of Reorganization by and between VP High Yield Bond Portfolio and ING Pioneer High Yield Portfolio (“Pioneer High Yield Portfolio”), providing for the reorganization of VP High Yield Bond Portfolio with and into Pioneer High Yield Portfolio; and |

| | |

(2) | | To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournment(s) or postponement(s) thereof, in the discretion of the proxies or their substitutes. |

Shareholders of record as of the close of business on May 1, 2008, are entitled to notice of, and to vote at, the Special Meeting, and are also entitled to vote at any adjournment thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, PLEASE COMPLETE, SIGN AND RETURN PROMPTLY THE ENCLOSED PROXY CARD so that a quorum will be present and a maximum number of shares may be voted. Proxies may be revoked at any time before they are exercised by executing and submitting a revised proxy, by giving written notice of revocation to VP High Yield Bond Portfolio or by voting in person at the Special Meeting.

| By Order of the Board of Trustees |

| |

|

|

| Huey P. Falgout, Jr. |

| Secretary |

June 4, 2008

(This page intentionally left blank)

PROXY STATEMENT/PROSPECTUS

June 4, 2008

TABLE OF CONTENTS

INTRODUCTION | |

| |

SUMMARY | |

The Proposed Reorganization | |

Comparison of Investment Objectives and Principal Investment Strategies | |

Comparison of Portfolio Characteristics | |

Comparison of Investment Techniques and Principal Risks of Investing in the Portfolios | |

Comparison of Portfolio Performance | |

| |

COMPARISON OF FEES AND EXPENSES | |

Management Fees | |

Sub-Adviser Fees | |

Administration Fees | |

Distribution and Service Fees | |

Expense Limitation Arrangements | |

Expense Tables | |

Portfolio Expenses | |

Portfolio Transitioning | |

Key Differences in the Rights of VP High Yield Bond Portfolio’s Shareholders and Pioneer High Yield Portfolio’s Shareholders | |

| |

INFORMATION ABOUT THE REORGANIZATION | |

The Reorganization Agreement | |

Reasons for the Reorganization | |

Board Considerations | |

Tax Considerations | |

Expenses of the Reorganization | |

Future Allocation of Premiums | |

| |

ADDITIONAL INFORMATION ABOUT THE PORTFOLIOS | |

Form of Organization | |

Advisers | |

Distributor | |

Dividends, Distributions and Taxes | |

Capitalization | |

| |

GENERAL INFORMATION ABOUT THE PROXY STATEMENT | |

Solicitation of Proxies | |

Voting Rights | |

Other Matters to Come Before the Special Meeting | |

Shareholder Proposals | |

| |

APPENDICES | |

Appendix A - Form of Agreement and Plan of Reorganization | A-1 |

Appendix B - Additional Information Regarding ING Pioneer High Yield Portfolio | B-1 |

Appendix C - Security Ownership of Certain Beneficial and Record Owners | C-1 |

(This page intentionally left blank)

PROXY STATEMENT/PROSPECTUS

June 4, 2008

PROXY STATEMENT FOR:

ING VP HIGH YIELD BOND PORTFOLIO

(A Series of ING Variable Products Trust)

7337 East Doubletree Ranch Road

Scottsdale, Arizona 85258-2034

1-800-992-0180

PROSPECTUS FOR:

ING PIONEER HIGH YIELD PORTFOLIO

(A Series of ING Partners, Inc.)

7337 East Doubletree Ranch Road

Scottsdale, Arizona 85258-2034

1-800-262-3862

INTRODUCTION

This combined proxy statement and prospectus (“Proxy Statement/Prospectus”) relates to a special meeting of shareholders (the “Special Meeting”) of ING VP High Yield Bond Portfolio (“VP High Yield Bond Portfolio”) to be held on July 29, 2008. As more fully described in this Proxy Statement/Prospectus, the purpose of the Special Meeting is to vote on a proposed reorganization (“Reorganization”) of VP High Yield Bond Portfolio with and into ING Pioneer High Yield Portfolio (“Pioneer High Yield Portfolio”) (each a “Portfolio” and collectively, the “Portfolios”).

Shares of the Portfolios are not offered directly to the public but are sold to qualified pension and retirement plans (each a “Qualified Plan”) and to separate accounts (“Separate Accounts”) of certain participating life insurance companies (“Participating Insurance Companies”) and are used to fund variable annuity and/or variable life contracts (each a “Variable Contract” and collectively, “Variable Contracts”). Participants in a Qualified Plan (“Plan Participants”) or Variable Contract owners who select a Portfolio for investment through a Qualified Plan or Variable Contract, respectively, have a beneficial interest in the Portfolio, but do not invest directly in or hold shares of the Portfolio. The Qualified Plan or Participating Insurance Company that uses a Portfolio as a funding vehicle, is, in most cases, the true shareholder of the Portfolio and, as the legal owner of the Portfolio’s shares, has sole voting and investment power with respect to the shares, but generally will pass through any voting rights to Plan Participants and Variable Contract owners. As such and for ease of reference throughout the Proxy Statement/Prospectus, Plan Participants and Variable Contract owners will be referred to as “shareholders” of the Portfolios.

Because you, as a shareholder of VP High Yield Bond Portfolio, are being asked to approve the Agreement and Plan of Reorganization (the “Reorganization Agreement”) that will result in a transaction in which you will ultimately hold shares of Pioneer High Yield Portfolio, this Proxy Statement also serves as a Prospectus for Pioneer High Yield Portfolio. Pioneer High Yield Portfolio is an open-end management investment company, which seeks to maximize total return through income and capital appreciation.

This Proxy Statement/Prospectus, which should be read and retained for future reference, sets forth concisely the information that a shareholder should know in considering the Reorganization. A Statement of Additional Information (“SAI”) relating to this Proxy Statement, dated June 4, 2008, containing additional information about the Reorganization and the parties thereto, has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated herein by reference. For a more detailed discussion of the investment objectives, strategies and restrictions of the Portfolios, see the Class I prospectus of VP High Yield Bond Portfolio, dated April 28, 2008, which is incorporated by reference (File No: 033-73140); and the Class I prospectus of Pioneer High Yield Portfolio, dated April 28, 2008. Each Portfolio’s SAI, dated April 28, 2008, is also incorporated herein by reference (for VP High Yield Bond Portfolio, File No: 033-73140; for Pioneer High Yield Portfolio, File No: 333-32575). Each Portfolio also provides periodic reports to its shareholders, which highlight certain important information about the Portfolios, including investment results and financial information. The annual report for each Portfolio for the fiscal year ended December 31, 2007 and the semi-annual report for each Portfolio for the fiscal period ended June 30, 2007 (for VP High Yield Bond Portfolio, File No: 811-08220; for Pioneer High Yield Portfolio, File No: 811-08319) are incorporated herein by reference. For a copy of the current prospectus, SAI, annual report, and semi-annual report for each of the Portfolios without charge, or for a copy of the SAI

1

relating to this Proxy Statement/Prospectus, contact the Portfolios at ING Funds, 7337 East Doubletree Ranch Road, Scottsdale, Arizona 85258-2034 or call 1-800-992-0180.

Each Portfolio is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and files reports, proxy materials and other information with the SEC. You can copy and review information about each Portfolio, including the SAI, reports, proxy materials and other information at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the Public Reference Room by calling the SEC at 1-202-551-8090. Such materials are also available in the EDGAR Database on the SEC’s internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing to the SEC’s Public Reference Section, Office of Consumer Affairs and Information, U.S. Securities and Exchange Commission, 100 F. Street N.E., Washington, D.C. 20549.

THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

2

SUMMARY

You should read this entire Proxy Statement/Prospectus carefully. You should also review the Reorganization Agreement, which is attached hereto as Appendix A. Also, you should consult the Class I prospectus, dated April 28, 2008, for more information about Pioneer High Yield Portfolio.

The Proposed Reorganization

At a meeting held on March 27, 2008, the Board of Trustees (the “Board”) of VP High Yield Bond Portfolio approved the Reorganization Agreement. Subject to shareholder approval, the Reorganization Agreement provides for:

· the transfer of all of the assets of VP High Yield Bond Portfolio to Pioneer High Yield Portfolio in exchange for shares of beneficial interest of Pioneer High Yield Portfolio;

· the assumption by Pioneer High Yield Portfolio of the liabilities of VP High Yield Bond Portfolio known as of the Closing Date (as described below);

· the distribution of shares of Pioneer High Yield Portfolio to the shareholders of VP High Yield Bond Portfolio; and

· the complete liquidation of VP High Yield Bond Portfolio.

Shares of Pioneer High Yield Portfolio would be distributed to shareholders of VP High Yield Bond Portfolio so that each shareholder would receive a number of full and fractional shares of Pioneer High Yield Portfolio equal to the aggregate value of shares of VP High Yield Bond Portfolio held by such shareholder.

As a result of the Reorganization, each owner of Class I shares of VP High Yield Bond Portfolio would become a shareholder of Class I shares of Pioneer High Yield Portfolio. The Reorganization is expected to be effective on September 6, 2008, or such other date as the parties may agree (the “Closing Date”).

Each shareholder will hold, immediately after the Closing Date, shares of Pioneer High Yield Portfolio having an aggregate value equal to the aggregate value of the shares of VP High Yield Bond Portfolio held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

· The Portfolios have similar investment objectives;

· VP High Yield Bond Portfolio invests at least 80% of its net assets in high-yield bonds (“junk bonds”), while Pioneer High Yield Portfolio invests at least 80% of its net assets in junk bonds and preferred stocks;

· Pioneer High Yield Portfolio may invest in securities of Canadian issuers to the same extent as securities of U.S. issuers, while VP High Yield Bond Portfolio does not have a similar investment strategy;

· As a principal investment strategy, Pioneer High Yield Portfolio, unlike VP High Yield Bond Portfolio, may invest in equity securities when the sub-adviser believes they offer the potential for capital appreciation or to diversify the Portfolio’s investment portfolio;

· VP High Yield Bond Portfolio may engage in frequent and active trading to achieve its investment objective, while Pioneer High Yield Portfolio does not implement a similar investment strategy;

· VP High Yield Bond Portfolio is advised by ING Investments, LLC (“ING Investments”) and sub-advised by ING Investment Management Co. (“ING IM”), while Pioneer High Yield Portfolio is advised by Directed Services LLC (“DSL”) and sub-advised by Pioneer Investment Management, Inc. (“Pioneer”);

· VP High Yield Bond Portfolio is the smaller Portfolio (approximately $89.7 million in net assets compared to $112.0 million in net assets for Pioneer High Yield Portfolio, as of December 31, 2007);

· VP High Yield Bond Portfolio, which commenced operations on May 6, 1994 (Class I), has a longer track record than Pioneer High Yield Portfolio, which commenced operations on January 3, 2006 (Class I);

3

· As a result of the Reorganization, the gross and net expenses of the disappearing VP High Yield Bond Portfolio are expected to decrease;

· The purchase and redemption of shares of each Portfolio may be made by Separate Accounts of Participating Insurance Companies and by Plan Participants in a Qualified Plan; consequently, Variable Contract owners and Plan Participants should consult the underlying product prospectus or Qualified Plan documents, respectively, with respect to purchases, exchanges and redemption of shares;

· Each Portfolio is distributed by ING Funds Distributor, LLC (“IFD”);

· In connection with the Reorganization, certain holdings of VP High Yield Bond Portfolio may be sold shortly prior to the Closing Date. The sub-adviser to Pioneer High Yield Portfolio may also sell portfolio securities that it acquired from VP High Yield Bond Portfolio after the Closing Date. In addition, both Portfolios may engage in a variety of transition management techniques to facilitate the portfolio transition process. Such sales and purchases would result in increased transaction costs, which are ultimately borne by shareholders, and may result in the realization of taxable gains or losses for either or both Portfolios; and

· The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization; accordingly, pursuant to this treatment, neither VP High Yield Bond Portfolio nor its shareholders, nor Pioneer High Yield Portfolio nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement.

Prior to the Closing Date, VP High Yield Bond Portfolio will pay to the Separate Accounts of Participating Insurance Companies and Qualified Plans that own its shares, a cash distribution consisting of any undistributed investment company taxable income and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date.

The unaudited gross and net operating expenses before and after the Reorganization, expressed as an annual percentage of the average daily net asset value per share for shares of each Portfolio as of December 31, 2007, are as follows:

| | Class I | |

Gross Expenses Before the Reorganization: | | | |

VP High Yield Bond Portfolio | | 0.80 | % |

Pioneer High Yield Portfolio | | 0.78 | % |

| | Class I | |

Net Expenses Before the Reorganization (After Fee Waiver): | | | |

VP High Yield Bond Portfolio(1) | | 0.75 | % |

Pioneer High Yield Portfolio(1) | | 0.77 | % |

| | Class I | |

After the Reorganization: Pioneer High Yield Portfolio Pro Forma | | | |

Gross estimated expenses of Pioneer High Yield Portfolio | | 0.77 | % |

Net estimated expenses of Pioneer High Yield Portfolio(1) | | 0.72 | % |

4

(1) For each Portfolio, the investment adviser has entered into an expense limitation agreement with the respective Portfolio, under which it will limit the expenses of such Portfolio, excluding interest, taxes, brokerage and extraordinary expenses (and Acquired Fund Fees and Expenses), subject to possible recoupment by the investment adviser within three years. For each Portfolio, the expense limits will continue through at least May 1, 2009. The expense limitation agreement is contractual and shall renew automatically for one-year terms unless DSL or ING Investments, as applicable, provides written notice of termination of the expense limitation agreement at least 90 days prior to the end of the then current term or upon termination of the management agreement. Net expenses of VP High Yield Bond Portfolio and Pioneer High Yield Portfolio include interest expense of 0.01% and 0.02%, respectively. The interest expense for Pioneer High Yield Portfolio post merger is estimated to be 0.01%. Upon shareholder approval of the merger, the expense limits for Pioneer High Yield Portfolio will be extended to May 1, 2011.

Approval of the Reorganization Agreement requires the affirmative vote of the lesser of (i) 67% or more of the shares present at the meeting, provided that more than 50% of the shares are present in person or represented by proxy at the Special Meeting, or (ii) a majority of the shares entitled to vote. The holders of a majority of outstanding shares present in person or by proxy shall constitute a quorum at the meeting. A majority of the shareholders present in person or by proxy may adjourn the meeting (i) in the absence of a quorum at such meeting or (ii), in the event a quorum is present, for any reason permitted by law, including for the purpose of providing time for the solicitation of additional shareholder votes. In the event a meeting is adjourned, the time and place of such adjourned meeting shall be announced at the meeting and no additional notice shall be given unless after the adjournment a new record date is fixed.

AFTER CAREFUL CONSIDERATION, THE BOARD OF VP HIGH YIELD BOND PORTFOLIO APPROVED THE PROPOSED REORGANIZATION. THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSED REORGANIZATION.

5

Comparison of Investment Objectives and Principal Investment Strategies

The following summarizes the investment objective, principal investment strategies and management differences, if any, between VP High Yield Bond Portfolio and Pioneer High Yield Portfolio:

| | VP High Yield Bond Portfolio | | Pioneer High Yield Portfolio |

Investment Objective | | The Portfolio seeks to provide investors with a high level of current income and total return. The Portfolio’s investment objective is not fundamental and may be changed without a shareholder vote. | | Seeks to maximize total return through income and capital appreciation. The Portfolio’s investment objective is not fundamental and may be changed without a shareholder vote. |

| | | | |

Principal Investment Strategies | | · Under normal market conditions, the Portfolio will invest at least 80% of its net assets (plus borrowings for investment purposes) in a portfolio of high-yield (high-risk) bonds, commonly referred to as “junk bonds.” The Portfolio will provide shareholders with at least 60 days’ prior notice of any change in this investment policy. · High-yield bonds are debt securities that, at the time of purchase, are not rated by a nationally recognized statistical rating organization (“NRSRO”) or are rated below investment grade (for example, rated below BBB- by Standard & Poor’s Rating Corporation or Baa3 by Moody’s Investors Service, Inc.) or have an equivalent rating by a NRSRO. · The Portfolio defines high yield bonds to include: bank loans; payment-in-kind securities; fixed and variable floating rate and deferred interest debt obligations; zero-coupon bonds and debt obligations provided they are unrated or rated below investment grade. In evaluating the quality of a particular high-yield bond for investment by the Portfolio, the sub-adviser does not rely exclusively on ratings assigned by the NRSRO. · The sub-adviser will utilize a security’s credit rating as simply one indication of an issuer’s creditworthiness and will principally rely upon its own analysis of any security. However, the sub-adviser does not have restrictions on the rating level of the securities in the Portfolio’s portfolio and may purchase and hold securities in default. There are no restrictions on the average maturity of the Portfolio or the maturity of any | | · Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in below investment grade (high-yield) debt securities and preferred stocks. The Portfolio will provide shareholders with at least 60 days’ prior written notice of any change in this non-fundamental investment policy. Debt securities rated below investment grade are commonly referred to as “junk bonds” and may be considered speculative. · The Portfolio’s investments may have fixed or variable principal payments and all types of interest rate and dividend payment and reset terms, including fixed-rate, adjustable rate, floating rate, zero-coupon, contingent, deferred, payment in kind and auction rate features. · The Portfolio invests in securities with a broad range of maturities, and its high-yield securities investments may be convertible into equity securities of the issuer. The Portfolio may also invest in event-linked bonds and credit default swaps. · Pioneer uses a value investing approach in managing the Portfolio, seeking securities selling at reasonable prices or substantial discounts to their underlying values. The Portfolio then holds these securities for their incremental yields or until market values reflect their intrinsic values. Pioneer evaluates a security’s potential value, including the attractiveness of its market valuation, based on the company’s assets and prospects for earnings growth. · In determining whether an investment is appropriate for the Portfolio, |

6

| | VP High Yield Bond Portfolio | | Pioneer High Yield Portfolio |

| | single investment. Maturities may vary widely depending on the sub- adviser’s assessment of interest rate trends and other economic or market factors. · Any remaining assets may be invested in investment grade debt securities; common and preferred stocks; U.S. government securities; money market instruments; and debt securities of foreign issuers including securities of companies in emerging markets. · The Portfolio may purchase structured debt obligations and may engage in dollar roll transactions and swap agreements, including credit default swaps. The Portfolio may invest in derivatives and companies of any size. · In choosing investments for the Portfolio, the sub-adviser combines extensive company and industry research with relative value analysis to identify high yield bonds expected to provide above-average returns. Relative value analysis is intended to enhance returns by moving from overvalued to undervalued sectors of the bond market. The sub-adviser’s approach to decision making includes contributions from individual managers responsible for specific industry sectors. · The Portfolio may invest in other investment companies to the extent permitted under the Investment Company Act of 1940, as amended, and the rules and regulations thereunder. · The sub-adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. · The Portfolio may also lend portfolio securities on a short-term or long-term basis, up to 33 1/3% of its assets. | | Pioneer employs due diligence and fundamental research. This includes evaluating issuers based on an issuer’s financial statements and operations and considering a security’s potential to provide income. · From time to time, the Portfolio may invest more than 25% of its assets in the same market segment. · In assessing the appropriate maturity, rating and sector weighting of the Portfolio’s investment portfolio, Pioneer considers a variety of factors that are expected to influence economic activity and interest rates. These factors include fundamental economic indicators, such as the rates of economic growth and inflation; Federal Reserve monetary policy; and the relative value of the U.S. dollar compared to other currencies. Pioneer adjusts sector weightings to reflect its outlook on the market for high-yield securities, rather than using a fixed sector allocation. Pioneer makes these adjustments periodically as part of its ongoing review of the Portfolio’s investment portfolio. · The Portfolio may invest in securities of Canadian issuers to the same extent as securities of U.S. issuers. The Portfolio may invest up to 15% of its total assets in foreign securities (excluding Canadian issuers) including debt and equity securities of corporate issuers and debt securities of government issuers in developed and emerging markets. · The Portfolio may invest in investment grade and below investment grade convertible bonds and preferred stocks that are convertible into the equity securities of the issuer. The Portfolio also may invest in mortgage-backed and asset-backed securities, mortgage derivatives and structured securities. Consistent with its investment objective, the Portfolio invests in equity securities of U.S. and non-U.S. issuers when Pioneer believes they offer the potential for capital appreciation or to diversify the Portfolio’s investment portfolio. |

7

| | VP High Yield Bond Portfolio | | Pioneer High Yield Portfolio |

| | | | Equity securities may include common stocks, depositary receipts, warrants, rights and other equity interests. The Portfolio may also invest in other investment companies, including exchange-traded funds (“ETFs”), and in Real Estate Investment Trusts (“REITs”). · The Portfolio may use futures and options on securities, indices and currencies; forward foreign currency exchange contracts; and other derivatives. The Portfolio generally limits the use of derivatives to hedging against adverse changes in stock market prices, interest rates or currency exchange rates. From time to time the Portfolio may use derivatives as a substitute for purchasing or selling securities or to increase the Portfolio’s return, a non-hedging strategy that may be considered speculative. · Normally, the Portfolio invests substantially all of its assets to meet its investment objective. The Portfolio may invest the remainder of its assets in securities with remaining maturities of less than one year, cash equivalents or may hold cash. · Pioneer may sell securities for a variety of reasons, such as to secure gains, limit losses or redeploy assets into opportunities believed to be more promising, among others. · The Portfolio may also lend portfolio securities on a short-term or long-term basis, up to 33 1/3% of its assets. |

| | | | |

Investment Adviser | | ING Investments | | DSL |

| | | | |

Sub-Adviser | | ING IM | | Pioneer |

| | | | |

Portfolio Manager(s) | | Randall Parrish, CFA | | Andrew Feltus and Tracy Wright |

As you can see from the chart, both Portfolios have similar investment objectives which involve seeking total return. However, there are differences between the Portfolios’ investment strategies. VP High Yield Bond Portfolio invests at least 80% of its assets in junk bonds, while Pioneer High Yield Portfolio invests at least 80% of its assets in junk bonds and preferred stocks. Although VP High Yield Bond Portfolio may also invest in preferred stocks, Pioneer High Yield Portfolio’s 80% policy potentially gives that Portfolio more exposure to the risks and rewards of investing in preferred stocks. VP High Yield Bond Portfolio may engage in frequent and active trading to achieve its investment objective, while

8

Pioneer High Yield Portfolio does not implement a similar principal investment strategy. While Pioneer High Yield Portfolio may invest in securities of Canadian issuers to the same extent as securities of U.S. issuers, VP High Yield Bond Portfolio does not have a similar principal strategy. Furthermore, unlike VP High Yield Bond Portfolio, as a principal strategy Pioneer High Yield Portfolio may invest in equity securities when the sub-adviser believes they offer the potential for capital appreciation or to diversify the Portfolio’s investment portfolio. Please refer to the “Comparison of Portfolio Characteristics” table on the next page for more specific information regarding the characteristics of the Portfolios.

9

Comparison of Portfolio Characteristics

The following table compares certain characteristics of the Portfolios as of December 31, 2007:

| | VP High Yield Bond Portfolio | | Pioneer High Yield Portfolio | |

Net Assets | | $89,661,243 | | $112,021,778 | |

| | | | | | | |

Number of Holdings | | 239 | | | 142 | | |

| | | | | | | |

Portfolio Turnover Rate | | 96 | % | | 68 | % | |

| | | | | | | |

Weighted Average Rating | | B | | | B | | |

| | | | | | | |

Weighted Average Duration | | 3.96 years | | 4.50 years | |

| | | | | | | |

As of Percentage of Assets: | | | | | | | |

AAA | | — | % | | — | % | |

AA | | 0.5 | % | | — | % | |

A | | 0.5 | % | | — | % | |

BBB | | 1.9 | % | | 1.7 | % | |

BB or less | | 88.1 | % | | 83.3 | % | |

Not Rated | | 0.7 | % | | 11.7 | % | |

Cash | | 8.3 | % | | 3.3 | % | |

TOTAL | | 100.0 | % | | 100.0 | % | |

| | | | | |

Top 5 Industries (as % of net assets) | | Diversified Financial Services | | 12.7 | % | Electric | | 9.3 | % |

| | Media | | 9.4 | % | Oil & Gas | | 6.3 | % |

| | Telecommunications | | 7.6 | % | Aerospace/Defense | | 6.2 | % |

| | Oil & Gas | | 6.6 | % | Chemicals | | 6.0 | % |

| | Healthcare - Services | | 5.4 | % | Mining | | 4.6 | % |

| | | | | | | | | |

U.S. Fixed Income Securities (as a % of market value*) | | $75,243,269 | | 84.9 | % | $78,963,816 | | 71.7 | % |

| | | | | | | | | |

U.S. Equity Securities (as a % of market value*) | | $203,085 | | 0.2 | % | $19,390,455 | | 17.6 | % |

| | | | | | | | | |

Foreign Securities (as a % of market value*) | | $6,869,336 | | 7.8 | % | $8,567,940 | | 7.8 | % |

| | | | | | | | | |

Top 10 Holdings (as a % of net assets) | | HCA, Inc., 9.625%, due 11/15/16 | | 1.2 | % | DRS Technologies, Inc., 6.875%, due 11/01/13 | | 3.4 | % |

| | Ford Motor Co., 8.597%, due 11/29/13 | | 1.1 | % | Esterline Technologies Corp., 7.750%, due 06/15/13 | | 2.3 | % |

| | General Motors Corp., 8.375%, due 07/15/33 | | 1.0 | % | Gardner Denver, Inc., 8.000%, due 05/01/13 | | 2.3 | % |

| | Idearc, Inc., 8.000%, due 11/15/16 | | 1.0 | % | Forest City Enterprises, Inc., 6.500%, due 02/01/17 | | 2.2 | % |

| | Rural Cellular Corp., 8.124%, due 06/01/13 | | 1.0 | % | Valeant Pharmaceuticals International, 7.000%, due 12/15/11 | | 2.1 | % |

| | Intelsat Bermuda Ltd., 11.250%, due 06/15/16 | | 1.0 | % | Mueller Industries, Inc., 6.000%, due 11/01/14 | | 2.0 | % |

| | Ford Motor Credit Co., 9.875%, due 08/10/11 | | 1.0 | % | Novelis, Inc., 7.250%, due 02/15/15 | | 1.9 | % |

| | R.H. Donnelley Corp., 6.875%, due 01/15/13 | | 1.0 | % | Baldor Electric Co., 8.625%, due 02/15/17 | | 1.7 | % |

| | Waste Services, Inc., 9.500%, due 04/15/14 | | 0.9 | % | Interpublic Group of Cos., Inc., 7.250%, due 08/15/11 | | 1.7 | % |

| | Freeport-McMoRan Copper & Gold, Inc., 8.375%, due 04/01/17 | | 0.9 | % | CMS Energy Corp., 6.875%, due 12/15/15 | | 1.7 | % |

| | | | | | | | | | | |

* Excluding short-term investments.

10

Comparison of Investment Techniques and Principal Risks of Investing in the Portfolios

Because of the similarities between the investment objectives and strategies of the Portfolios, many of the risks of investing in VP High Yield Bond Portfolio are the same as the risks of investing in Pioneer High Yield Portfolio. The value of each Portfolio’s shares may go up or down, sometimes rapidly and unpredictably. Market conditions, financial conditions of issuers represented in a Portfolio, investment strategies, portfolio management, and other factors affect the volatility of each Portfolio’s shares. The following summarizes and compares the principal investment techniques and risks of investing in the Portfolios, as disclosed in each Portfolio’s prospectus. The fact that a risk is not listed as a principal risk in a Portfolio’s prospectus does not necessarily mean that shareholders of that Portfolio are not subject to that risk. You may lose money on your investment in either Portfolio.

Credit Risk. Both Portfolios are subject to credit risk. Each Portfolio could lose money if a bond issuer (debtor) fails to repay interest and principal in a timely manner or if it goes bankrupt. This is especially true during periods of economic uncertainty or economic downturns. High-yield/high-risk bonds are especially subject to credit risk and are considered to be mostly speculative in nature.

Derivatives Risk. Both Portfolios are subject to derivatives risk. Each Portfolio may use futures, options, swaps and other derivative instruments to hedge or protect the Portfolio from adverse movements in underlying securities prices and interest rates or as an investment strategy to help attain the Portfolio’s investment objective. Each Portfolio may also use a variety of currency hedging techniques, including foreign currency contracts, to attempt to hedge exchange rate risk or to gain exposure to a particular currency. The Portfolio’s use of derivatives could reduce returns, may not be liquid and may not correlate precisely to the underlying securities or index. Derivative securities are subject to market risk, which could be significant for those derivatives that have a leveraging effect that could increase the volatility of the Portfolio and may reduce returns for the Portfolio. Derivatives are also subject to credit risks related to the counterparty’s ability to perform, and any deterioration in the counterparty’s creditworthiness could adversely affect the instrument. A risk of using derivatives is that the sub-adviser might imperfectly judge the market’s direction, which could render a hedging strategy ineffective or have an adverse effect on the value of the derivatives.

Emerging Markets Risk. Both Portfolios are subject to emerging markets risk. Emerging market countries are generally defined as countries in the initial stage of their industrialization cycles with low per capita income. Investments in emerging market countries present risks in a greater degree than, and in addition to, those presented by investments in foreign issuers in general as these countries may be less politically and economically stable than other countries. A number of emerging market countries restrict, to varying degrees, foreign investment in stocks. Repatriation of investment income, capital and proceeds of sales by foreign investors may require governmental registration and/or approval in some emerging market countries. A number of the currencies of developing countries have experienced significant declines against the U.S. dollar from time to time, and devaluation may occur after investments in those currencies by a Portfolio. Inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries. It may be more difficult to buy and sell securities in emerging market countries as many of the emerging securities markets are relatively small, have low trading volumes, suffer periods of relative illiquidity and are characterized by significant price volatility. There is a risk in emerging market countries that a future economic or political crisis could lead to: price controls; forced mergers of companies; expropriation or confiscatory taxation; seizure; nationalization; foreign exchange controls that restrict the transfer of currency from a given country; or creation of government monopolies.

Foreign Investment Risk. Both Portfolios are subject to foreign investment risk. Foreign investments may be riskier than U.S. investments for many reasons, including changes in currency exchange rates; unstable political, social and economic conditions; possible security illiquidity; a lack of adequate or accurate company information; differences in the way securities markets operate; less secure foreign banks or securities depositaries than those in the United States; less standardization of accounting standards and market regulations in certain foreign countries; foreign taxation issues; and varying foreign controls on investments. Foreign investments may also be affected by administrative difficulties, such as delays in clearing and settling transactions. In addition, securities of foreign companies may be denominated in foreign currencies and the costs of buying, selling and holding foreign securities, including brokerage, tax and custody costs, may be higher than those involved in domestic transactions. American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”), and Global Depositary Receipts (“GDRs”) are subject to risks of foreign investments, and they may not always track the price of the underlying foreign security. These factors may make foreign investments more volatile and potentially less liquid than U.S. investments.

High Yield, Lower-Grade Debt Securities Risk. Both Portfolios are subject to high yield, lower-grade debt securities risk. High-yield debt securities (commonly referred to as “junk bonds”) generally present greater credit risk that

11

an issuer cannot make timely payment of interest or principal than an issuer of a higher quality debt security, and typically have greater potential price volatility and principal and income risk. Changes in interest rates, the market’s perception of the issuers and the credit worthiness of the issuers may significantly affect the value of these bonds. High-yield bonds are not considered investment grade, and are regarded as predominantly speculative with respect to the issuing company’s continuing ability to meet principal and interest payments. The secondary market in which high-yield securities are traded may be less liquid than the market for higher grade bonds. It may be more difficult to value less liquid high-yield securities, and determination of their value may involve elements of judgment.

Interest Rate Risk. Both Portfolios are subject to interest rate risk. The value of debt securities and short-term money market instruments generally tend to move in the opposite direction to interest rates. When interest rates are rising, the prices of debt securities tend to fall. When interest rates are falling, the prices of debt securities tend to rise. Bonds with longer durations tend to be more sensitive to changes in interest rates, making them more volatile than bonds with shorter durations or money market instruments. Further, economic and market conditions may cause issuers to default or go bankrupt.

Other Investment Companies Risk. Both Portfolios are subject to other investment companies risk. The Portfolios may invest in other investment companies to the extent permitted by the 1940 Act and the rules & regulations thereunder. These may include exchange-traded funds (“ETFs”) and Holding Company Depositary Receipts (“HOLDRs”), among others. ETFs are exchange-traded investment companies that are designed to provide investment results corresponding to an equity index and include, among others, Standard & Poor’s Depositary Receipts (“SPDRs”), PowerShares QQQTM (“QQQQ”), Dow Jones Industrial Average Tracking Stocks (“Diamonds”) and iShares exchange-traded funds (“iShares”). The main risk of investing in other investment companies (including ETFs) is that the value of the underlying securities held by the investment company might decrease. The value of the underlying securities can fluctuate in response to activities of individual companies or in response to general market and/or economic conditions. Because a Portfolio may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company (including management fees, administration fees and custodial fees) in addition to the expenses of the Portfolio. Additional risks of investments in ETFs include: (i) an active trading market for an ETF’s shares may not develop or be maintained or (ii) trading may be halted if the listing exchange’s officials deem such action appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts trading generally. Because HOLDRs concentrate in the stocks of a particular industry, trends in that industry may have a dramatic impact on their value.

Securities Lending Risk. Both Portfolios are subject to securities lending risk. Each Portfolio may lend securities to financial institutions that provide cash or securities issued or guaranteed by the U.S. government as collateral. Securities lending involves the risk that the borrower may fail to return the securities in a timely manner or at all. As a result, a Portfolio may lose money and there may be a delay in recovering the loaned securities. A Portfolio could also lose money if it does not recover the securities and/or the value of the collateral falls, including the value of investments made with cash collateral. These events could trigger adverse tax consequences to the Portfolio. Engaging in securities lending could have a leveraging effect, which may intensify the market risk, credit risk and other risks associated with investments in the Portfolio. When a Portfolio lends its securities, it is responsible for investing the cash collateral it receives from the borrower of the securities, and the Portfolio could incur losses in connection with the investment of such cash collateral.

Corporate Debt Securities Risk. VP High Yield Bond Portfolio is subject to corporate debt securities risk. Corporate debt securities are subject to the risk of the issuer’s inability to meet principal and interest payments on the obligation and may also be subject to price volatility due to such factors as interest rate sensitivity, market perception of the credit worthiness of the issuer and general market liquidity. When interest rates decline, the value of the Portfolio’s debt securities can be expected to rise, and when interest rates rise, the value of those securities can be expected to decline. Debt securities with longer maturities tend to be more sensitive to interest rate movements than those with shorter maturities.

One measure of risk for fixed-income securities is duration. Duration is one of the tools used by a portfolio manager in the selection of fixed-income securities. Historically, the maturity of a bond was used as a proxy for the sensitivity of a bond’s price to changes in interest rates, otherwise known as a bond’s interest rate risk or volatility. According to this measure, the longer the maturity of a bond, the more its price will change for a given change in market interest rates. However, this method ignores the amount and timing of all cash flows from the bond prior to final maturity. Duration is a measure of average life of a bond on a present value basis, which was developed to incorporate a bond’s yield, coupons, final maturity and call features into one measure. For point of reference, the duration of a non-callable 7% coupon bond with a remaining maturity of 5 years is approximately 4.5 years, and the duration of a non-callable 7% coupon bond with a remaining maturity of 10 years is approximately 8 years. Material changes in interest rates may impact the duration calculation.

12

Price Volatility Risk. VP High Yield Bond Portfolio is subject to price volatility risk. The value of the Portfolio changes as the prices of its investments go up or down. Debt and equity securities face market, issuer and other risks, and their values may fluctuate, sometimes rapidly and unpredictably. Market risk is the risk that securities may decline in value due to factors affecting securities markets generally or particular industries. Issuer risk is the risk that the value of a security may decline for reasons relating to the issuer such as changes in the financial condition of the issuer. The Portfolio may invest in equity securities of larger companies, which sometimes have more stable prices than smaller companies. However, the Portfolio may invest in securities of small- and midsized companies, which may be more susceptible to greater price volatility than larger companies because they typically have fewer financial resources, more limited product and market diversification and may be dependent on a few key managers. Small- and mid- sized companies tend to be more volatile and less liquid than stocks of larger companies.

Inability to Sell Securities Risk. VP High Yield Bond Portfolio is subject to inability to sell securities risk. High-yield securities may be less liquid than other investments and higher quality investments. The Portfolio could lose money if it cannot sell a security at the time and price that would be most beneficial to the Portfolio. A security in the lowest rating categories, that is unrated, or whose credit rating has been lowered may be particularly difficult to sell. Valuing less liquid securities involves greater exercise of judgment and may be more subjective than valuing securities using market quotes.

Small- and Mid- Capitalization Companies Risk. VP High Yield Bond Portfolio is subject to small- and mid- capitalization companies risk. Investments in small- and mid-capitalization companies involve greater risk than is customarily associated with larger, more established companies due to the greater business risks of smaller size, limited markets and financial resources, narrow product lines and the frequent lack of depth of management. The securities of smaller companies are often traded over-the-counter and may not be traded in volumes typical on a national securities exchange. Consequently, the securities of smaller companies may have limited market stability and may be subject to more abrupt or erratic market movements than securities of larger, more established companies or the market averages in general.

Portfolio Turnover Risk. VP High Yield Bond Portfolio is subject to portfolio turnover risk. The Portfolio is generally expected to engage in frequent and active trading of portfolio securities to achieve their investment objectives. A high portfolio turnover rate involves greater expenses to the Portfolios, including brokerage commissions and other transaction costs, which may have an adverse effect on the performance of the Portfolio.

Convertible Securities Risk. Pioneer High Yield Portfolio is subject to convertible securities risk. The value of convertible securities may fall when interest rates rise and increase when interest rates fall. Convertible securities with longer maturities tend to be more sensitive to changes in interest rates, usually making them more volatile than convertible securities with shorter maturities. Their value also tends to change whenever the market value of the underlying common or preferred stock fluctuates. The Portfolio could lose money if the issuer of a convertible security is unable to meet its financial obligations or goes bankrupt.

Credit Derivatives Risk. Pioneer High Yield Portfolio is subject to credit derivatives risk. The Portfolio may enter into credit default swaps, both directly and indirectly in the form of a swap embedded within a structured note, to protect against the risk that a security will default. The Portfolio pays a fee to enter into the trade and receives a fixed payment during the life of the swap. If there is a credit event, the Portfolio either delivers the defaulted bond (if the Portfolio has taken the short position in the credit default swap) or pays the par amount of the defaulted bond (if the Portfolio has taken the long position in the credit default swap note). Risks of credit default swaps include the cost of paying for credit protection if there are no credit events.

Debt Securities Risk. Pioneer High Yield Portfolio is subject to debt securities risk. The value of debt securities may fall when interest rates rise. Debt securities with longer maturities tend to be more sensitive to changes in interest rates, usually making them more volatile than debt securities with shorter maturities. In addition, debt securities, such as bonds, involve credit risk as described above. These securities are also subject to interest rate risk. This is the risk that the value of the security may fall when interest rates rise. In general, the market price of debt securities with longer maturities tends to be more volatile in response to changes in interest rates than the market price of shorter-term securities.

Depositary Receipts Risk. Pioneer High Yield Portfolio is subject to depositary receipts risk. The Portfolio may invest in depositary receipts, including unsponsored depositary receipts. Unsponsored depositary receipts may not provide as much information about the underlying issuer and may not carry the same voting privileges as sponsored depositary receipts. Investments in depositary receipts involve risks similar to those accompanying direct investments in foreign securities.

13

Equity Securities Risk. Pioneer High Yield Portfolio is subject to equity securities risk. Equity securities include common, preferred and convertible preferred stocks and securities with values that are tied to the price of stocks, such as rights, warrants and convertible debt securities. Common and preferred stocks represent equity ownership in a company. Stock markets are volatile. The price of equity securities will fluctuate and can decline and reduce the value of an investment in equities. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. The value of equity securities purchased by the Portfolio could decline if the financial condition of the companies decline or if overall market and economic conditions deteriorate. Even investment in high quality or “blue chip” equity securities or securities of established companies with large market capitalizations (which generally have strong financial characteristics) can be negatively impacted by poor overall market and economic conditions. Companies with large market capitalizations may also have less growth potential than smaller companies and may be able to react less quickly to change in the marketplace.

Leveraging Risk. Pioneer High Yield Portfolio is subject to leveraging risk. Certain transactions may give rise to a form of leverage. Such transactions may include, among others, reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions. The use of derivatives may also create leveraging risk. To mitigate leveraging risk, the Portfolio will segregate liquid assets or otherwise cover the transactions that may give rise to such risk. The use of leverage may cause the Portfolio to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Leverage, including borrowing, may cause the Portfolio to be more volatile than if the Portfolio had not been leveraged. This is because leverage tends to exaggerate the effect of any increase or decrease in the value of the Portfolio’s assets.

Liquidity Risk. Pioneer High Yield Portfolio is subject to liquidity risk. Liquidity risk exists when particular investments are difficult to purchase or sell. the Portfolio’s investments in illiquid securities may reduce the returns of the Portfolio because it may be unable to sell the illiquid securities at an advantageous time or price. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the Portfolio could realize upon disposition. Portfolios with principal investment strategies that involve foreign securities, small companies, derivatives, or securities with substantial market and credit risk tend to have greater exposure to liquidity risk.

Manager Risk. Pioneer High Yield Portfolio is subject to manager risk. The sub-adviser will apply investment techniques and risk analyses in making investment decisions for the Portfolio, but there can be no assurance that these will achieve the Portfolio’s objective. The sub-adviser could do a poor job in executing an investment strategy. The sub-adviser may use the investment techniques or invest in securities that are not part of the Portfolio’s principal investment strategy. Individuals primarily responsible for managing the Portfolio may leave their firm or be replaced. Many sub-advisers of equity portfolios employ styles that are characterized as “value” or “growth.” However, these terms can have different application by different managers. One sub-adviser’s value approach may be different from another, and one sub-adviser’s growth approach may be different from another. For example, some value managers employ a style in which they seek to identify companies that they believe are valued at a more substantial or “deeper discount” to a company’s net worth than other value managers. Therefore, a portfolio that is characterized as growth or value can have greater volatility than other portfolios managed by other managers in a growth or value style.

Market and Company Risk. Pioneer High Yield Portfolio is subject to market and company risk. The price of a security held by the Portfolio may fall due to changing economic, political or market conditions or disappointing earnings or losses. Stock prices in general may decline over short or even extended periods. The stock market tends to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Further, even though the stock market is cyclical in nature, returns from a particular stock market segment in which the Portfolio invests may still trail returns from the overall stock market.

Mortgage-Related Securities Risk. Pioneer High Yield Portfolio is subject to mortgage-related securities risk. Rising interest rates tend to extend the duration of mortgage-related securities, making them more sensitive to changes in interest rates. As a result, in a period of rising interest rates, if the Portfolio holds mortgage-related securities, it may exhibit additional volatility. This is known as extension risk. In addition, mortgage-related securities are subject to prepayment risk. When interest rates decline, borrowers may pay off their mortgage sooner than expected. This can reduce the returns of the Portfolio because it will have to reinvest that money at the lower prevailing interest rates.

Prepayment or Call Risk. Pioneer High Yield Portfolio is subject to prepayment or call risk. Mortgage-backed and other debt securities are subject to prepayment risk, which is the risk that the issuer of a security can prepay the principal prior to the security’s expected maturity. The prices and yields of mortgage-related securities are determined, in part, by assumptions about the cash flows from the rate of payments of the underlying mortgages. Changes in interest rates may cause the rate of expected prepayments of those mortgages to change. In general, prepayments increase when general

14

interest rates fall and decrease when general interest rates rise. This can reduce the returns of the Portfolio because it will have to reinvest that money at the lower prevailing interest rates. Securities subject to prepayment risk, including the mortgage-related securities that the Portfolio buys, have greater potential for losses when interest rates rise than other types of debt securities. The impact of prepayments on the price of a security may be difficult to predict and may increase the volatility of the price. Interest-only and principal-only “stripped” securities can be particularly volatile when interest rates change. If the Portfolio buys mortgage-related securities at a premium, accelerated prepayments on those securities could cause the Portfolio to lose a portion of its principal investment represented by the premium the Portfolio paid.

Real Estate Investment Trusts Risk. Pioneer High Yield Portfolio is subject to real estate investment trusts risk. Investing in REITs may subject the Portfolio to risks similar to those associated with the direct ownership of real estate including terrorist attacks, war or other acts that destroy real property (in addition to securities market risks). Some REITs may invest in a limited number of properties, in a narrow geographic area, or in a single property type, which increases the risk that the Portfolio could be unfavorably affected by the poor performance of a single investment or investment type. These companies are also sensitive to factors such as changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand and the management skill and creditworthiness of the issuer. Borrowers could default on or sell investments the REIT holds, which could reduce the cash flow needed to make distributions to investors. In addition, REITs may also be affected by tax and regulatory requirements in that a REIT may not qualify for preferential tax treatments or exemptions. REITs require specialized management and pay management expenses.

Sector Risk. Pioneer High Yield Portfolio is subject to sector risk. A sector is a group of selected industries, such as technology. The Portfolio may, at times, invest significant assets in securities of issuers in one or more sectors of the economy or stock market, such as technology. To the extent the Portfolio’s assets are concentrated in a single market sector, volatility in that sector will have a greater impact on the Portfolio than it would on a portfolio that has securities representing a broader range of investments.

Value Investing Risk. Pioneer High Yield Portfolio is subject to value investing risk. The Portfolio may invest in “value” stocks. The sub-adviser may be wrong in its assessment of a company’s value and the stocks the Portfolio holds may not reach what the sub-adviser believes are their full values. A particular risk of the Portfolio’s value approach is that some holdings may not recover and provide the capital growth anticipated or a stock judged to be undervalued may actually be appropriately priced. Further, because the prices of value-oriented securities tend to correlate more closely with economic cycles than growth-oriented securities, they generally are more sensitive to changing economic conditions, such as changes in interest rates, corporate earnings and industrial production. The market may not favor value-oriented stocks and may not favor equities at all. During these periods, the Portfolio’s relative performance may suffer.

Zero-Coupon Risk. Pioneer High Yield Portfolio is subject to zero-coupon risk. Zero-coupon and stripped securities are subject to greater fluctuations in price from interest rate changes than conventional interest-bearing securities. The Portfolio may have to pay out the imputed income on zero-coupon securities without receiving the actual cash currently. The values of interest-only and principal-only mortgage-related securities also are subject to prepayment risk and interest rate risk.

15

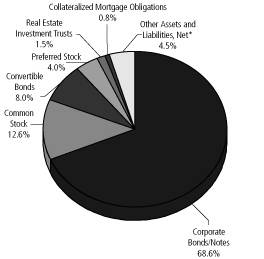

Comparison of Portfolio Performance

Set forth below is the performance information for each Portfolio. The bar charts and table below provide some indication of the risks of investing in each Portfolio by showing changes in the performance of each Portfolio from year to year and by comparing each Portfolio’s performance to that of a broad measure of market performance for the same period.

The bar chart shows the performance of VP High Yield Bond Portfolio’s Class I for each year since inception. The performance information does not include insurance-related charges which are, or may be imposed, under a Variable Contract or expenses related to a Qualified Plan. Any charges will reduce your return. Thus, you should not compare VP High Yield Bond Portfolio’s performance directly with the performance information of other products without taking into account all insurance-related charges and expenses payable under your Variable Contract or direct expenses of your Qualified Plan. Past performance is not necessarily an indication of how the Portfolio will perform in the future.

VP High Yield Bond Portfolio

Calendar Year-by-Year Returns(1)(2)

(1) These figures are for the year ended December 31 of each year. They do not reflect expenses or changes which are, or may be, imposed under your Variable Contract or Qualified Plan, and would be lower if they did.

(2) During the period shown in the chart, the Portfolio’s best quarterly performance was 5.97% for the 4th quarter of 2001, and the Portfolio’s worst quarterly performance was (7.97)% for the 3rd quarter of 1998.

16

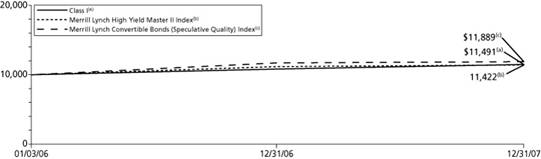

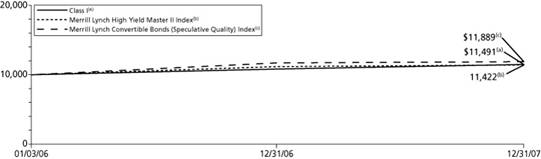

Comparison of Portfolio Performance

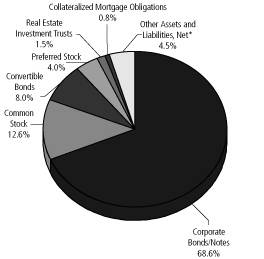

The bar chart shows the performance of Pioneer High Yield Portfolio’s Class I for the first full calendar year of operations. The performance information does not include insurance-related charges which are, or may be imposed, under a Variable Contract or expenses related to a Qualified Plan. Any charges will reduce your return. Thus, you should not compare Pioneer High Yield Portfolio’s performance directly with the performance information of other products without taking into account all insurance-related charges and expenses payable under your Variable Contract or direct expenses of your Qualified Plan. Past performance is not necessarily an indication of how the Portfolio will perform in the future.

Pioneer High Yield Portfolio

Calendar Year-by-Year Returns(%)(1)(2)(3)

(1) These figures are for the year ended December 31. They do not reflect expenses or changes which are, or may be, imposed under your Variable Contract or Qualified Plan, and would be lower if they did.

(2) Class I shares commenced operations on January 3, 2006.

(3) During the period shown in the chart, the Portfolio’s best quarterly performance was 4.05% for the 1st quarter of 2007, and the Portfolio’s worst quarterly performance was (0.58)% for the 4th quarter of 2007.

17

Average Annual Total Return

(For the periods ended December 31, 2007)

| | 1 Year | | 5 Years

(Or life of Class) | | 10 Years

(Or life of Class) | |

VP High Yield Bond Portfolio(1) | | | | | | | |

Class I | | 2.19 | % | 7.55 | % | 2.13 | % |

Lehman Brothers® High Yield Bond Index (reflects no deduction for fees or expenses) (2) | | 1.87 | % | 10.90 | % | 5.51 | % |

Lehman Brothers® High Yield Bond —2% Issuer Constrained Composite Index (reflects no deduction for fees, expenses or taxes) (3) | | 2.26 | % | 10.75 | % | 5.59 | % |

Pioneer High Yield Portfolio | | | | | | | |

Class I | | 6.15 | % | 7.22 | %(4) | N/A | |

Merrill Lynch High Yield Master II Index(5) | | 2.19 | % | 6.87 | %(6) | N/A | |

Merrill Lynch Convertible Bonds (Speculative Quality) Index(7) | | 1.54 | % | 9.05 | %(6) | N/A | |

(1) No performance information for ADV Class and Class S of VP High Yield Bond Portfolio is shown because these classes were dissolved on March 31, 2008.

(2) The Lehman Brothers® High Yield Bond Index is an unmanaged index that measures the performance of fixed-income securities generally representative of corporate bonds rated below investment-grade. The index does not reflect fees, brokerage commissions, taxes or other expenses of investing. It is not possible to invest directly in the index.

(3) The Lehman Brothers® High Yield Bond — 2% Issuer Constrained Composite Index is an unmanaged index that measures the performance of fixed-income securities. The Composite Index more closely tracks the types of securities in which the Portfolio invests than the Lehman Brothers® High Yield Bond Index. The index does not reflect fees, brokerage commissions, taxes or other expenses of investing. It is not possible to invest directly in the index.

(4) Class I shares commenced operations January 3, 2006.

(5) The Merrill Lynch High Yield Master II Index is a broad-based index consisting of all U.S. dollar-denominated high-yield bonds with a minimum outstanding amount of $100 million and with a maturity of greater than one year. The index does not reflect fees, brokerage commissions, taxes or other expenses of investing. It is not possible to invest directly in the index.

(6) The index returns are for the period beginning January 1, 2006.

(7) The Merrill Lynch Convertible Bonds (Speculative Quality) Index is a market-capitalization weighted index including mandatory and non-mandatory domestic corporate convertible securities. The index does not reflect fees, brokerage commissions, taxes or other expenses of investing. It is not possible to invest directly in the index.

Additional information regarding Pioneer High Yield Portfolio is included in Appendix B to this Proxy Statement/ Prospectus.

18

COMPARISON OF FEES AND EXPENSES

The following discussion describes and compares the fees and expenses of the Portfolios. For further information on the fees and expenses of Pioneer High Yield Portfolio, see “Appendix B: Additional Information Regarding ING Pioneer High Yield Portfolio.”

Management Fees

VP High Yield Bond Portfolio pays ING Investments, and Pioneer High Yield Portfolio pays DSL, a management fee, payable monthly, based on the average daily net assets of the respective Portfolio. The following table shows the aggregate annual management fee paid by each Portfolio as a percentage of that Portfolio’s average daily net assets:

Portfolio | | Management Fees

(as a % of Net Assets) |

VP High Yield Bond Portfolio(1) | | 0.58% on the first $200 million of the Portfolio’s average daily net assets;

0.55% on the next $300 million of the Portfolio’s average daily net assets;

0.50% on the next $500 million of the Portfolio’s average daily net assets; and

0.45% of the Portfolio’s average daily net assets in excess of $1 billion. |

| | |

Pioneer High Yield Portfolio | | 0.60% of the first $5 billion of the Portfolio’s average daily net assets;

0.50% of the next $2 billion of the Portfolio’s average daily net assets;

0.40% of the next $2 billion of the Portfolio’s average daily net assets; and

0.30% of the Portfolio’s average daily net assets in excess of $9 billion. |

(1) To seek to achieve a return on uninvested cash or for other reasons, the Portfolio may invest its assets in ING Institutional Prime Money Market Fund and/or one or more other money market funds advised by ING affiliates (“ING Money Market Funds”). The Portfolio’s purchase of shares of an ING Money Market Fund will result in the Portfolio paying a proportionate share of the expenses of the ING Money Market Fund. The Portfolio’s sub-adviser will waive its fee in an amount equal to the advisory fee received by the adviser of the ING Money Market Fund in which the Portfolio invests resulting from the Portfolio’s investment into the ING Money Market Fund.

If the Reorganization is approved by shareholders, Pioneer High Yield Portfolio will continue to pay the same management fee currently in place. For more information regarding the management fees for each Portfolio, please see the SAI of each Portfolio, dated April 28, 2008.

Sub-Adviser Fees

ING Investments pays ING IM and DSL pays Pioneer, the sub-adviser to VP High Yield Bond Portfolio and Pioneer High Yield Portfolio, respectively, a sub-advisory fee, payable monthly, based on the average daily net assets of each respective Portfolio. The following table shows the aggregate annual sub-advisory fee paid by each adviser to the sub-adviser, as a percentage of each respective Portfolio’s average daily net assets:

Portfolio | | Sub-Adviser Fees

(as a % of Net Assets) |

VP High Yield Bond Portfolio | | 0.2610% of the first $200 million of assets

0.2475% of the next $300 million of assets

0.2250% on the next $500 million of assets

0.2025% of the assets in excess of $1 billion. |

| | |

Pioneer High Yield Portfolio | | 0.35% on the first $250 million in assets; and

0.30% thereafter. |

19

If the Reorganization is approved by shareholders, DSL will continue to pay Pioneer, the sub-adviser to Pioneer High Yield Portfolio, a sub-advisory fee, payable monthly, based on the average daily net assets of the Portfolio pursuant to the following fee schedule:

Portfolio | | Sub-Adviser Fees

(as a % of Net Assets) |

| | |

Pioneer High Yield Portfolio | | 0.30% on the first $500 million in assets; and

0.25% thereafter. |

Administration Fees

Pursuant to an administrative services agreement between ING Variable Products Trust (“IVPT”), on behalf of VP High Yield Bond Portfolio, and ING Funds Services, LLC (“IFS”), IFS provides all administrative services in support of the Portfolio and is responsible for the supervision of the Portfolio’s other service providers. As compensation for its services, IFS receives a monthly fee from the Portfolio. The fee is computed daily and payable monthly, at an annual rate of 0.10% of the Portfolio’s average daily net assets.

Pursuant to an administrative services agreement between ING Partners, Inc. (“IPI”), on behalf of Pioneer High Yield Portfolio, and IFS, IFS provides all administrative services in support of the Portfolio and is responsible for the supervision of the Portfolio���s other service providers. As compensation for its services, IFS receives a monthly fee from the Portfolio at an annual rate of 0.10% of the Portfolio’s average daily net assets.

If the Reorganization is approved by shareholders, Pioneer High Yield Portfolio will continue to pay the current fee for administrative services.

Distribution and Service Fees

The Class I shares of each Portfolio are not subject to distribution (12b-1) and/or service fees.

Expense Limitation Arrangements

ING Investments has entered into a written expense limitation agreement with IVPT, on behalf of VP High Yield Bond Portfolio, under which ING Investments will limit the expenses of the Portfolio, excluding interest expenses, taxes, brokerage commissions, extraordinary expenses and acquired fund fees and expenses, if applicable, subject to possible recoupment by ING Investments within three years. The expense limitation agreement will continue through at least May 1, 2009. The expense limitation agreement is contractual and shall renew automatically for one-year terms, unless ING Investments provides written notice of termination of the expense limitation agreement at least 90 days prior to the end of the then current term or upon termination of the management agreement.

DSL has entered into a written expense limitation agreement with IPI, on behalf of Pioneer High Yield Portfolio, under which DSL will limit the expenses of the Portfolio, excluding interest expenses, taxes, brokerage commissions, extraordinary expenses and acquired fund fees and expenses, if applicable, subject to possible recoupment by DSL within three years. The expense limitation agreement will continue through at least May 1, 2009. The expense limitation agreement is contractual and shall renew automatically for one-year terms, unless DSL provides written notice of termination of the expense limitation agreement at least 90 days prior to the end of the then current term or upon termination of the management agreement.

In connection with the Reorganization, pending shareholder approval, DSL will extend the written expense limitation agreement with respect to Pioneer High Yield Portfolio through May 1, 2011. There is no guarantee that the expense limit will continue after this date.

Expense Tables

As shown in the table below, shares of the Portfolios are not subject to sales charges or shareholder transaction fees. The table below does not reflect surrender charges and other charges assessed by your Insurance Company under your Variable Contract or under your Qualified Plan.

20

Transaction Fees on New Investments

(fees paid directly from your investment)

| | VP High Yield Bond

Portfolio | | Pioneer High Yield Portfolio | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | N/A | | N/A | |

| | | | | |

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or redemption proceeds) | | N/A | | N/A | |

Neither VP High Yield Bond Portfolio nor Pioneer High Yield Portfolio has any redemption fees, exchange fees or sales charges on reinvested dividends.

21

Portfolio Expenses