As filed with the Securities and Exchange Commission on May 5, 2016

Securities Act File No.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ¨

Post-Effective Amendment No. ¨

VOYA PARTNERS, INC.

(Exact Name of Registrant as Specified in Charter)

7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034

(Address of Principal Executive Offices) (Zip Code)

1-800-262-3862

(Registrant’s Area Code and Telephone Number)

Huey P. Falgout, Jr.

Voya Investment Management

7337 East Doubletree Ranch Road, Ste 100

Scottsdale, AZ 85258-2034

(Name and Address of Agent for Service)

With copies to:

Elizabeth J. Reza

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02199-3600

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on June 10, 2016, pursuant to Rule 488

under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Title of Securities Being Registered: Class ADV and Class S of VY® T. Rowe Price Diversified Mid Cap Growth Portfolio

VY® Fidelity® vip mid cap portfolio

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

1-800-262-3862

June 22, 2016

Dear Shareholder:

On behalf of the Board of Directors (the “Board”) of VY® Fidelity® VIP Mid Cap Portfolio (“Mid Cap Portfolio”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of Mid Cap Portfolio. The Special Meeting is scheduled for 1:00 p.m., Local time, on August 9, 2016, at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting shareholders of Mid Cap Portfolio will be asked to vote on the proposed reorganization (the “Reorganization”) of Mid Cap Portfolio with and into VY® T. Rowe Price Diversified Mid Cap Growth Portfolio (“Diversified Mid Cap Growth Portfolio”) (together with Mid Cap Portfolio, the “Portfolios”). The Portfolios are members of the Voya family of funds.

Shares of Mid Cap Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (collectively, “Qualified Plans”) or, at your direction by your insurance company, through its separate accounts to serve as investment options under your variable annuity contract or variable life insurance policy. If the Reorganization is approved by shareholders, the separate account in which you have an interest or the Qualified Plan in which you are a participant will own shares of Diversified Mid Cap Growth Portfolio instead of shares of Mid Cap Portfolio beginning on the date the Reorganization occurs. The Reorganization would provide the separate account in which you have an interest or the Qualified Plan in which you are a participant with an opportunity to participate in a portfolio that seeks long-term capital appreciation.

Formal notice of the Special Meeting appears on the next page, followed by a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”). The Reorganization is discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. The Board recommends that you vote “FOR” the Reorganization.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than August 8, 2016.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

| | Sincerely, |

| |  |

| | Shaun P. Mathews |

| | President and Chief Executive Officer |

(This page intentionally left blank)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF

VY® Fidelity® vip mid cap portfolio

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

1-800-262-3862

Scheduled for August 9, 2016

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of VY® Fidelity® VIP Mid Cap Portfolio (“Mid Cap Portfolio”) is scheduled for 1:00 p.m., Local time, on August 9, 2016 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting, Mid Cap Portfolio’s shareholders will be asked:

| 1. | To approve an Agreement and Plan of Reorganization by and between Mid Cap Portfolio and VY® T. Rowe Price Diversified Mid Cap Growth Portfolio (“Diversified Mid Cap Growth Portfolio”), providing for the reorganization of Mid Cap Portfolio with and into Diversified Mid Cap Growth Portfolio (the “Reorganization”); and |

| 2. | To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes. |

Please read the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) carefully for information concerning the Reorganization to be placed before the Special Meeting.

The Board of Directors of Mid Cap Portfolio recommends that you vote “FOR” the Reorganization.

Shareholders of record as of the close of business on May 20, 2016 are entitled to notice of, and to vote at, the Special Meeting, and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return the enclosed Proxy Ballot or Voting Instruction Card by August 8, 2016 so that a quorum will be present and a maximum number of shares may be voted. Proxies or voting instructions may be revoked at any time before they are exercised by submitting a revised Proxy Ballot or Voting Instruction Card, by giving written notice of revocation to Mid Cap Portfolio or by voting in person at the Special Meeting.

| | By Order of the Board of Directors |

| |  |

| | Huey P. Falgout, Jr. |

| | Secretary |

| June 22, 2016 | |

(This page intentionally left blank)

PROXY STATEMENT/PROSPECTUS

June 22, 2016

Special Meeting of Shareholders

of VY® Fidelity® VIP Mid Cap Portfolio

Scheduled for August 9, 2016

| ACQUISITION OF THE ASSETS OF: | BY AND IN EXCHANGE FOR SHARES OF: |

VY® Fidelity® VIP Mid Cap Portfolio (A series of Voya Partners, Inc.) 7337 East Doubletree Ranch Road, Suite 100 Scottsdale, Arizona 85258-2034 1-800-262-3862 | VY® T. Rowe Price Diversified Mid Cap Growth Portfolio (A series of Voya Partners, Inc.) 7337 East Doubletree Ranch Road, Suite 100 Scottsdale, Arizona 85258-2034 1-800-262-3862 |

| (each an open-end management investment company) |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on August 9, 2016 |

| This Proxy Statement/Prospectus and Notice of Special Meeting are available at:www.proxyvote.com/voya |

| |

| The Prospectus/Proxy Statement explains concisely what you should know before voting on the matter described herein or investing in VY® T. Rowe Price Diversified Mid Cap Growth Portfolio. Please read it carefully and keep it for future reference. |

| |

| THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. |

TO OBTAIN MORE INFORMATION

To obtain more information about VY® Fidelity® VIP Mid Cap Portfolio (“Mid Cap Portfolio”) and VY® T. Rowe Price Diversified Mid Cap Growth Portfolio (“Diversified Mid Cap Growth Portfolio,”) and together with Mid Cap Portfolio, the “Portfolios”), please write, call, or visit our website for a free copy of the current prospectus, statement of additional information, annual/semi-annual shareholder reports, or other information.

| By Phone: | (800) 992-0180 |

| | |

| By Mail: | Voya Investment Management 7337 East Doubletree Ranch Road, Suite 100 Scottsdale, Arizona 85258-2034 |

| | |

| By Internet: | www.voyainvestments.com/vp/literature |

The following documents containing additional information about the Portfolios, each having been filed with the U.S. Securities and Exchange Commission (“SEC”), are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Statement of Additional Information dated June 22, 2016 relating to this Proxy Statement/Prospectus; |

| 2. | The Prospectus and Statement of Additional Information dated May 1, 2016 for Mid Cap Portfolio; and |

| 3. | The Prospectus and Statement of Additional Information dated May 1, 2016 for Diversified Mid Cap Growth Portfolio. |

The Portfolios are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders, thereunder, and in accordance therewith, file reports and other information including proxy materials with the SEC.

You also may view or obtain these documents from the SEC:

| In Person: | Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (202) 551-8090 |

| | |

| By Mail: | U.S. Securities and Exchange Commission Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (Duplication Fee Required) |

| | |

| By Email: | publicinfo@sec.gov (Duplication Fee Required) |

| | |

| By Internet: | www.sec.gov |

When contacting the SEC, you will want to refer to the Portfolios’ SEC file numbers. The file number for the document listed above as (1) is [File No. generated with N-14 filing]. The file numbers for the documents listed above as (2) and (3) is 333-32575, respectively.

TABLE OF CONTENTS

Introduction

What is happening?

On March 18, 2016, the Board of Directors of VY® Fidelity® VIP Mid Cap Portfolio (“Mid Cap Portfolio”) and VY® T. Rowe Price Diversified Mid Cap Growth Portfolio (“Diversified Mid Cap Growth Portfolio,” and together with Mid Cap Portfolio, the “Portfolios”) approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”), which provides for the reorganization of Mid Cap Portfolio with and into Diversified Mid Cap Growth Portfolio (the “Reorganization”). The Reorganization Agreement requires approval by shareholders of Mid Cap Portfolio, and if approved, is expected to be effective on August 26, 2016, or such other date as the parties may agree (the “Closing Date”).

Why did you send me this booklet?

Shares of Mid Cap Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (“Qualified Plans”) or, at your direction, by your insurance company through its separate accounts (“Separate Accounts”) to serve as an investment option under your variable annuity and/or variable life contract (“Variable Contract”).

This booklet includes a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) and a Proxy Ballot or Voting Instruction Card for Mid Cap Portfolio. It provides you with information you should review before providing voting instructions on the matters listed in the Notice of Special Meeting.

The Separate Accounts and Qualified Plans or their trustees, as record owners of Mid Cap Portfolio shares are, in most cases, the true “shareholders” of Mid Cap Portfolio; however, participants in Qualified Plans (“Plan Participants”) or holders of Variable Contracts (“Variable Contract Holders”) may be asked to instruct their Qualified Plan trustee or Separate Accounts, as applicable, as to how they would like the shares attributed to their Qualified Plan or Variable Contract to be voted. For clarity and ease of reading, references to “shareholder” or “you” throughout this Proxy Statement/Prospectus do not refer to the technical shareholder but rather refer to the persons who are being asked to provide voting instructions on the proposals, unless the context indicates otherwise. Similarly, for ease of reading, references to “voting” or “vote” do not refer to the technical vote but rather to the voting instructions provided by Variable Contract Holders or Plan Participants.

Because you are being asked to approve a Reorganization Agreement that will result in a transaction in which you will ultimately hold shares of Diversified Mid Cap Growth Portfolio, this Proxy Statement also serves as a prospectus for Diversified Mid Cap Growth Portfolio. Diversified Mid Cap Growth Portfolio is an open-end management investment company, which seeks long-term capital growth, as described more fully below.

Who is eligible to vote?

Shareholders holding an investment in shares of Mid Cap Portfolio as of the close of business on May 20, 2016 (the “Record Date”) are eligible to vote at the Special Meeting or any adjournments or postponements thereof.

How do I vote?

You may submit your Proxy Ballot or Voting Instruction Card in one of four ways:

| · | By Internet. The web address and instructions for voting can be found on the enclosed Proxy Ballot or Voting Instruction Card. You will be required to provide your control number located on the Proxy Ballot or Voting Instruction Card. |

| · | By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot or Voting Instruction Card. You will be required to provide your control number located on the Proxy Ballot or Voting Instruction Card. |

| · | By Mail. Mark the enclosed Proxy Ballot or Voting Instruction Card, sign and date it, and return it in the postage-paid envelope we provided. Both joint owners must sign the Proxy Ballot or Voting Instruction Card. |

| · | In Person at the Special Meeting. You can vote your shares in person at the Special Meeting. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180. |

To be certain your vote will be counted, a properly executed Proxy Ballot or Voting Instruction Card must be received no later than 5:00 p.m., Local time, on August 8, 2016.

Should shareholders require additional information regarding the Special Meeting, they may contact the Proxy Solicitor toll-free at (877) 283-0324. (See “General Information” for more information on the Proxy Solicitor.)

When and where will the Special Meeting be held?

The Special Meeting is scheduled to be held at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034, on August 9, 2016, at 1:00 p.m., Local time, and if the Special Meeting is adjourned or postponed, any adjournments or postponements of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180.

Summary of the Reorganization

You should read this entire Proxy Statement/Prospectus, and the Reorganization Agreement, which is included in Appendix A. For more information about Diversified Mid Cap Growth Portfolio, please consult Appendix B and Diversified Mid Cap Growth Portfolio’s prospectus dated May 1, 2016.

On March 18, 2016, the Board approved the Reorganization. Subject to shareholder approval, the Reorganization Agreement provides for:

| · | the transfer of all of the assets of Mid Cap Portfolio to Diversified Mid Cap Growth Portfolio in exchange for shares of capital stock of Diversified Mid Cap Growth Portfolio; |

| · | the assumption by Diversified Mid Cap Growth Portfolio of all the liabilities of Mid Cap Portfolio; |

| · | the distribution of shares of Mid Cap Portfolio to the shareholders of Diversified Mid Cap Growth Portfolio; and |

| · | the complete liquidation of Mid Cap Portfolio. |

If shareholders of Mid Cap Portfolio approve the Reorganization, each owner of Class ADV and Class S shares of Mid Cap Portfolio would become a shareholder of the corresponding share class of Diversified Mid Cap Growth Portfolio. The Reorganization is expected to be effective on the Closing Date. Each shareholder of Mid Cap Portfolio will hold, immediately after the close of the Reorganization (the “Closing”), shares of Diversified Mid Cap Growth Portfolio having an aggregate value equal to the aggregate value of the shares of Mid Cap Portfolio held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

| · | The Portfolios have substantially similar investment objectives. Mid Cap Portfolio invests all of its assets in Service Class 2 shares of Fidelity® VIP Mid Cap Portfolio (the “Master Fund”). The Master Fund is an actively managed fund which seeks to provide you with long-term growth of capital. Diversified Mid Cap Growth Portfolio is an actively managed fund which seeks to provide you with long-term capital appreciation. |

| · | The Portfolios have similar investments strategies as both Mid Cap Portfolio, through the Master Fund, and Diversified Mid Cap Growth Portfolio invest primarily in equity securities of mid-capitalization companies. |

| · | Directed Services LLC (“DSL” or “Adviser”) serves as the investment adviser for both Portfolios. Fidelity Management & Research Company (“FMR”) serves as the investment adviser for the Master Fund. |

| · | Each Portfolio is distributed by Voya Investments Distributor, LLC (the “Distributor”). |

| · | The shareholders of Mid Cap Portfolio are expected to benefit from a reduction in total gross expenses as shareholders of Diversified Mid Cap Growth Portfolio. In addition, the shareholders of Mid Cap Portfolio are expected to benefit from an expense limitation agreement between the Adviser and Diversified Mid Cap Growth Portfolio, which contractually obligates the Adviser to limit the expenses of Diversified Mid Cap Growth Portfolio at a rate that is lower than the rate provided in the expense limitation agreement between the Adviser and Mid Cap Portfolio. |

| · | The Reorganization will not affect a shareholder’s right to purchase, redeem, or exchange shares of the Portfolios. In addition, the Reorganization will not affect how shareholders purchase or sell their shares. |

| · | The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither Mid Cap Portfolio nor its shareholders, nor Diversified Mid Cap Growth Portfolio nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the Reorganization. |

Proposal One – Approval of the Reorganization

What is the proposed Reorganization?

Shareholders of Mid Cap Portfolio are being asked to approve a Reorganization Agreement, providing for the reorganization of Mid Cap Portfolio with and into Diversified Mid Cap Growth Portfolio. If the Reorganization is approved, shareholders of Mid Cap Portfolio will become shareholders of Diversified Mid Cap Growth Portfolio as of the Closing.

Why is a Reorganization proposed?

As part of the Board’s annual review of contractual arrangements in November of 2015, the Board directed the Adviser to explore the future viability of Mid Cap Portfolio due to underperformance, asset size, and asset outflows. At the March 2016 Board meeting the Adviser presented the Board with the Reorganization proposal. In support of its proposal, the Adviser noted that in its view, the Reorganization would provide the shareholders of Mid Cap Portfolio with the potential for improved performance and an immediate benefit through lower gross and net expenses.

How do the Investment Objectives compare?

As described in the chart that follows, the Portfolios have similar investment objectives.

| | Mid Cap Portfolio | Diversified Mid Cap Growth Portfolio |

| Investment Objective | The Portfolio seeks long-term growth of capital. | The Portfolios seeks long-term capital appreciation. |

Each Portfolio’s investment objective is non-fundamental and may be changed by a vote of the Board, without shareholder approval. A Portfolio will provide 60 days’ prior written notice of any change in a non-fundamental investment objective.

How do the Annual Portfolio Operating Expenses compare?

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolios. Pro forma fees and expenses, which are the estimated fees and expenses of Diversified Mid Cap Growth Portfolio after giving effect to the Reorganization, assume the Reorganization occurred on December 31, 2015. The table does not reflect fees or expenses that are, or may be, imposed under your Variable Contract or Qualified Plan. For more information on these charges, please refer to the documents governing your Variable Contract or consult your plan administrator.

Annual Portfolio Operating Expenses1 Expenses you pay each year as a % of the value of your investment |

| | Mid Cap Portfolio | Diversified Mid

Cap Growth

Portfolio | Diversified Mid

Cap Growth

Portfolio

Pro Forma |

| Class ADV | | | | |

| Management Fees | % | 0.652 | 0.74 | 0.74 |

| Distribution and/or Shareholder Services (12b-1) Fees | % | 0.50 | 0.50 | 0.50 |

| Shareholder Services Fee | % | 0.253 | N/A | N/A |

| Other Expenses | % | 0.19 | 0.03 | 0.03 |

| Total Annual Portfolio Operating Expenses | % | 1.59 | 1.27 | 1.27 |

| Waivers and Reimbursements | % | (0.16)4 | None5 | None5 |

| Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 1.43 | 1.27 | 1.27 |

| | | | | |

| Class S | | | | |

| Management Fees | % | 0.652 | 0.74 | 0.74 |

| Distribution and/or Shareholder Services (12b-1) Fees | % | 0.25 | 0.25 | 0.25 |

| Shareholder Services Fee | % | 0.253 | N/A | N/A |

| Other Expenses | % | 0.19 | 0.03 | 0.03 |

| Total Annual Portfolio Operating Expenses | % | 1.34 | 1.02 | 1.02 |

| Waivers and Reimbursements | % | (0.16)4 | None5 | None5 |

| Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 1.18 | 1.02 | 1.02 |

| 1. | Expense ratios have been adjusted to reflect current contractual rates. |

| 2. | The management fees include the management fee of Fidelity® VIP Mid Cap Portfolio (“Master Fund”) of 0.55%. |

| 3. | Service Class 2 shareholders of the Master Fund, including Equity-Income Portfolio, pay a shareholder servicing fee of 0.25%. |

| 4. | The adviser is contractually obligated to limit expenses to 0.55% and 0.30% for Class ADV and Class S shares, respectively, through May 1, 2018. The limitation does not extend to interest, taxes, investment-related costs, leverage expenses, Master Fund Fees and Expenses, and extraordinary expenses. This limitation is subject to possible recoupment by the adviser within 36 months of the waiver or reimbursement. Termination or modification of this obligation requires approval by the Portfolio’s board. |

| 5. | The adviser is contractually obligated to limit expenses to 1.30% and 1.05% for Class ADV and Class S shares, respectively, through May 1, 2018. The limitation does not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. This limitation is subject to possible recoupment by the adviser within 36 months of the waiver or reimbursement. Termination or modification of this obligation requires approval by the Portfolio’s board. |

Expense Examples The Examples are intended to help you compare the costs of investing in shares of the Portfolios with the costs of investing in other mutual funds. The Examples do not reflect expenses and charges which are, or may be, imposed under your Variable Contract or Qualified Plan. The Examples assume that you invest $10,000 in the Portfolios for the time periods indicated. The Examples also assume that your investment had a 5% return during each year and that the Portfolios’ operating expenses remain the same. Although your actual costs may be higher or lower based on these assumptions your costs would be: |

| | | Mid Cap

Portfolio | Diversified Mid Cap

Growth Portfolio | Diversified Mid Cap

Growth Portfolio

Pro Forma |

| Class | | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs |

| Class ADV | $ | 146 | 486 | 851 | 1,876 | 129 | 403 | 697 | 1,534 | 129 | 403 | 697 | 1,534 |

| Class S | $ | 120 | 409 | 719 | 1,599 | 104 | 325 | 563 | 1,248 | 104 | 325 | 563 | 1,248 |

The Examples reflect applicable expense limitation agreements and/or waivers in effect, if any, for the one-year period and the first year of the three-, five-, and ten-year periods.

How do the Principal Investment Strategies compare?

As described in more detail in the table that follows, both Portfolios invest primarily in equity securities of mid-capitalization companies. Mid Cap Portfolio seeks to achieve its investment objective by investing all of its assets in Service Class 2 shares of the Master Fund. By contrast, Diversified Mid Cap Growth Portfolio seeks to achieve its investment objective by investing directly in securities. Diversified Mid Cap Growth Portfolio may also use derivatives as a principal investment strategy while Mid Cap Portfolio does not.

| | Mid Cap

Portfolio | Diversified Mid Cap

Growth Portfolio |

| Investment Strategies | The Portfolio invests all of its assets in the Service Class 2 shares of the Master Fund, a series of Variable Insurance Products Fund III, a registered open-end investment company. In turn, the Master Fund normally invests primarily in a portfolio of common stocks. The Master Fund normally invests at least 80% of its net assets (plus borrowings for investment purposes) in securities of companies with medium market capitalizations (which, for the purposes of the Master Fund are defined as those companies with market capitalizations similar to companies in the Russell Midcap® Index or the S&P MidCap 400 Index). As of December 31, 2015 the smallest company in the Russell Midcap® Index had a market capitalization of $383.4 million and the largest had a market capitalization of $30.4 billion. As of December 31, 2015 the smallest company in the S&P MidCap 400 Index had a market capitalization of $661.4 million and the largest had a market capitalization of $12.5 billion. Investments can potentially include companies with smaller or larger market capitalizations. The Master Fund’s Adviser or Sub-Adviser may invest the Master Fund’s assets in securities of foreign issuers in addition to securities of domestic issuers. Additionally, the Master Fund’s Adviser or Sub-Adviser may invest in growth stocks or value stocks or both. For additional information regarding the principal investment strategies of the Master Fund, please refer to the Master Fund prospectus. The principal investment strategies of the Portfolio can be changed without shareholder approval. The Portfolio has the same investment objective and limitations as the Master Fund. Investment of the Portfolio’s assets in the Service Class 2 shares of the | Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in the equity securities of companies having a market capitalization within the range of companies in the Russell Midcap® Growth Index or the S&P MidCap 400 Index (the “Indices”) at the time of purchase. The Portfolio will provide shareholders with at least 60 days’ prior written notice of any change in this non-fundamental investment policy. As of December 31, 2015 the smallest company in the Russell Midcap® Growth Index had a market capitalization of $451.7 million and the largest had a market capitalization of $30.4 billion. As of December 31, 2015 the smallest company in the S&P MidCap 400 Index had a market capitalization of $661.4 million and the largest had a market capitalization of $12.5 billion. The sub-adviser (“Sub-Adviser”) focuses on mid-sized companies whose earnings are expected to grow at a rate faster than the average company. The Portfolio may on occasion purchase a stock whose market capitalization is outside of the capitalization range of mid-sized companies. The market capitalization of the companies in the Portfolio and the Indices will change over time, and the Portfolio will not automatically sell or cease to purchase a stock of a company it already owns just because the company’s market capitalization grows or falls outside of the index ranges. Stock selection is based on a combination of fundamental, bottom-up analysis and top-down quantitative strategies in an effort to identify companies with superior long-term appreciation prospects. The Sub-Adviser generally uses a growth |

| | Mid Cap

Portfolio | Diversified Mid Cap

Growth Portfolio |

| | Master Fund is not a fundamental policy of the Portfolio and a shareholder vote is not required for the Portfolio to withdraw its investment in the Master Fund. Master Fund (as described in its prospectus dated May 1, 2016) · Normally investing primarily in common stocks. · Normally investing at least 80% of assets in securities of companies with medium market capitalizations (which, for purposes of this fund, are those companies with market capitalizations similar to companies in the Russell Midcap® Index or the S&P MidCap 400 ® Index). · Potentially investing in companies with smaller or larger market capitalizations. · Investing in domestic and foreign issuers. · Investing in either “growth” stocks or “value” stocks or both. · Using fundamental analysis of factors such as each issuer's financial condition and industry position, as well as market and economic conditions, to select investments. | approach, looking for companies with one or more of the following characteristics: a demonstrated ability to consistently increase revenues, earnings, and cash flow; capable management; attractive business niches; and a sustainable competitive advantage. Valuation measures, such as a company’s price/earnings ratio relative to the market and its own growth rate, are also considered. Most holdings are expected to have relatively low dividend yields. In pursuing its investment objective, the Sub-Adviser has the discretion to deviate from the Portfolio’s normal investment criteria, as described above, and purchase securities that it believes will provide an opportunity for gain. These special situations might arise when the Sub-Adviser believes a security could increase in value for a variety of reasons, including a change in management, an extraordinary corporate event, a new product introduction or innovation, or a favorable competitive development. While most assets will be invested in U.S. common stocks, to a limited extent, other securities may also be purchased, including foreign stocks, futures, and forward foreign currency exchange contracts, in keeping with the Portfolio’s investment objective. Any investments in futures would typically serve as an efficient means of gaining exposure to certain markets or as a cash management tool to maintain liquidity while being invested in the market. Forward foreign currency exchange contracts would primarily be used to help protect the Portfolio’s foreign holdings from unfavorable changes in foreign currency exchange rates. The Portfolio may also invest, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder (“1940 Act”), in shares of T. Rowe Price Reserve Investment Fund and T. Rowe Price Government Reserve Investment Fund, internally managed money market funds of the Sub-Adviser. In addition, the Portfolio may invest in U.S. and foreign dollar denominated money market securities and U.S. and foreign dollar currencies. The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 33 1⁄3% of its total assets. |

How do the Principal Risks compare?

The following table summarizes and compares the principal risks of investing in the Portfolios.

Risks | Mid Cap

Portfolio | Diversified Mid

Cap Growth

Portfolio |

Bank Instruments: Bank instruments include certificates of deposit, fixed time deposits, bankers’ acceptances, and other debt and deposit-type obligations issued by banks. Changes in economic, regulatory or political conditions, or other events that affect the banking industry may have an adverse effect on bank instruments or banking institutions that serve as counterparties in transactions with the Portfolio. | | ü |

Company: The price of a company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, reduced demand for company goods or services, regulatory fines and judgments, or business challenges. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. | ü | ü |

Currency: To the extent that the Portfolio invests directly in foreign (non-U.S.) currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged by the Portfolio through foreign currency exchange transactions. | ü | ü |

Derivative Instruments: Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in market interest rates and liquidity and volatility risk. The amounts required to purchase certain derivatives may be small relative to the magnitude of exposure assumed by the Portfolio. Therefore, the purchase of certain derivatives may have an economic leveraging effect on the Portfolio and exaggerate any increase or decrease in the net asset value. Derivatives may not perform as expected, so the Portfolio may not realize the intended benefits. When used for hedging purposes, the change in value of a derivative may not correlate as expected with the currency, security or other risk being hedged. When used as an alternative or substitute for direct cash investments, the return provided by the derivative may not provide the same return as direct cash investment. In addition, given their complexity, derivatives expose the Portfolio to the risk of improper valuation. | | ü |

Foreign Investments: Investing in foreign (non-U.S.) securities may result in the Portfolio experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to: smaller markets; differing reporting, accounting, and auditing standards; nationalization, expropriation, or confiscatory taxation; foreign currency fluctuations, currency blockage, or replacement; potential for default on sovereign debt; or political changes or diplomatic developments, which may include the imposition of economic sanctions or other measures by the United States or other governments and supranational organizations. Markets and economies throughout the world are becoming increasingly interconnected, and conditions or events in one market, country or region may adversely impact investments or issuers in another market, country or region. | ü | ü |

Growth Investing: Prices of growth stocks are more sensitive to investor perceptions of the issuing company’s growth potential and may fall quickly and significantly if investors suspect that actual growth may be less than expected. There is a risk that the Portfolio that invests in growth-oriented stocks may underperform other funds that invest more broadly. Growth stocks tend to be more volatile than value stocks, and may Underperform the market as a whole over any given time period. | ü | ü |

Investment Model: A manager’s proprietary model may not adequately allow for existing or unforeseen market factors or the interplay between such factors. Portfolios that are actively managed, in whole or in part, according to a quantitative investment model can perform differently from the market as a whole based on the investment model and the factors used in the analysis, the weight placed on each factor, and changes from the factors’ historical trends. Issues in the construction and implementation of the investment models (including, for example, data problems and/or software issues) may create errors or limitations that might go undetected or are discovered only after the errors or limitations have negatively impacted performance. There is no guarantee that the use of these investment models will result in effective investment decisions for the Portfolio. | | ü |

Risks | Mid Cap

Portfolio | Diversified Mid

Cap Growth

Portfolio |

Liquidity: If a security is illiquid, the Portfolio might be unable to sell the security at a time when the Portfolio’s manager might wish to sell, or at all. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, exposing the Portfolio to the risk that the price at which it sells illiquid securities will be less than the price at which they were valued when held by the Portfolio. The prices of illiquid securities may be more volatile than more liquid investments. The risks associated with illiquid securities may be greater in times of financial stress. The Portfolio could lose money if it cannot sell a security at the time and price that would be most beneficial to the Portfolio. | ü | ü |

Market: Stock prices may be volatile or have reduced liquidity in response to real or perceived impacts of factors including, but not limited to, economic conditions, changes in market interest rates, and political events. Stock markets tend to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to costs and impair the ability of the Portfolio to achieve its investment objectives. | ü | ü |

Mid-Capitalization Company: Investments in mid-capitalization companies may involve greater risk than is customarily associated with larger, more established companies due to the greater business risks of a limited operating history, smaller size, limited markets and financial resources, narrow product lines, less management depth, and more reliance on key personnel. Consequently, the securities of mid-capitalization companies may have limited market stability and may be subject to more abrupt or erratic market movements than securities of larger, more established growth companies or the market averages in general. | ü | ü |

Other Investment Companies: The main risk of investing in other investment companies, including exchange-traded funds (“ETFs”), is the risk that the value of the securities underlying an investment company might decrease. Shares of investment companies that are listed on an exchange may trade at a discount or premium from their net asset value. You will pay a proportionate share of the expenses of those other investment companies (including management fees, administration fees, and custodial fees) in addition to the expenses of the Portfolio. The investment policies of the other investment companies may not be the same as those of the Portfolio; as a result, an investment in the other investment companies may be subject to additional or different risks than those to which the Portfolio is typically subject. | | ü |

Securities Lending: Securities lending involves two primary risks: “investment risk” and “borrower default risk.” When lending securities, the Portfolio will receive cash or U.S. government securities as collateral. Investment risk is the risk that the Portfolio will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that the Portfolio will lose money due to the failure of a borrower to return a borrowed security. Securities lending may result in leverage. The use of leverage may exaggerate any increase or decrease in the net asset value, causing the Portfolio to be more volatile. The use of leverage may increase expenses and increase the impact of the Portfolio’s other risks. | | ü |

Special Situations: A “special situation” arises when, in a manager’s opinion, securities of a particular company will appreciate in value within a reasonable period because of unique circumstances applicable to the company. Special situations often involve much greater risk than is inherent in ordinary investment securities. Investments in special situation companies may not appreciate and the Portfolio’s performance could suffer if an anticipated development does not occur or does not produce the anticipated result. | | ü |

Risks | Mid Cap

Portfolio | Diversified Mid

Cap Growth

Portfolio |

Value Investing: Securities that appear to be undervalued may never appreciate to the extent expected. Further, because the prices of value-oriented securities tend to correlate more closely with economic cycles than growth-oriented securities, they generally are more sensitive to changing economic conditions, such as changes in market interest rates, corporate earnings and industrial production. The manager may be wrong in its assessment of a company’s value and the securities the Portfolio holds may not reach their full values. A particular risk of the Portfolio’s value approach is that some holdings may not recover and provide the capital growth anticipated or a security judged to be undervalued may actually be appropriately priced. The market may not favor value-oriented securities and may not favor equities at all. During those periods, the Portfolio’s relative performance may suffer. There is a risk that the Portfolio that invests in value-oriented stocks may underperform other funds that invest more broadly. | ü | |

How does Mid Cap Portfolio’s performance compare to Diversified Mid Cap Growth Portfolio?

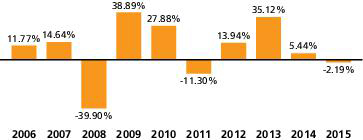

The following information is intended to help you understand the risks of investing in the Portfolios. The following bar charts show the changes in the Portfolios’ performance from year to year, and the tables compare the Portfolios’ performance to the performance of a broad-based securities market index/indices for the same period. The Portfolios’ performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. The bar chart shows the performance of the Portfolios’ Class ADV shares. Other class shares’ performance would be higher than Class ADV shares’ performance because of the higher expenses paid by Class ADV shares. Performance in the Average Annual Total Returns table does not include insurance-related charges imposed under a Variable Contract or expenses related to a Qualified Plan. If these charges or expenses were included, performance would be lower. Thus, you should not compare the Portfolio’s performance directly with the performance information of other investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract or Qualified Plan. The Portfolio’s past performance is no guarantee of future results.

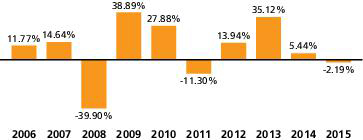

Mid Cap Portfolio - Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 2nd 2009, 19.08% and Worst quarter: 4th 2008, -23.79

The Portfolio’s Class ADV shares’ year-to-date total return as of March 31, 2016: -0.53

Diversified Mid Cap Growth Portfolio - Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 2nd 2009, 19.35% and Worst quarter: 4th 2008, -27.57%

The Portfolio’s Class ADV shares’ year-to-date total return as of March 31, 2016: -0.31

Average Annual Total Returns %

(for the periods ended December 31, 2015) |

| | 1 Year | 5 Years | 10 Years | Since

Inception | Inception Date |

| Mid Cap Portfolio | | | | | | |

| Class ADV | % | -2.19 | 7.09 | 6.78 | N/A | 11/15/04 |

| S&P MidCap 400 Index1 | % | -2.18 | 10.68 | 8.18 | N/A | |

| Class S | % | -1.88 | 7.35 | 7.05 | N/A | 11/15/04 |

| S&P MidCap 400 Index1 | % | -2.18 | 10.68 | 8.18 | N/A | |

| | | | | | | |

| Diversified Mid Cap Growth Portfolio | | | | |

| Class ADV | % | 1.51 | 10.98 | 8.07 | N/A | 12/10/01 |

| S&P MidCap 400 Index1 | % | -2.18 | 10.68 | 8.18 | N/A | |

| Russell Midcap® Growth Index1 | % | -0.20 | 11.54 | 8.16 | N/A | |

| Class S | % | 1.72 | 11.25 | 8.34 | N/A | 12/10/01 |

| S&P MidCap 400 Index1 | % | -2.18 | 10.68 | 8.18 | N/A | |

| Russell Midcap® Growth Index1 | % | -0.20 | 11.54 | 8.16 | N/A | |

1. The index returns do not reflect the deductions for fees, expenses, or taxes.

How does the management of the Portfolios compare?

The following table describes the management of the Portfolios.

| | Mid Cap Portfolio | Diversified Mid Cap Growth Portfolio |

| Investment Adviser | Directed Services LLC (“DSL”) | DSL |

| | | |

Management Fee (as a percentage of average daily net assets) | 0.100% while Series invested in Master Fund; and 0.680% for Standalone Series. | 0.740% on all assets. |

| | | |

| Master Fund Adviser | Fidelity Management & Research Company (“FMR”) | N/A |

Master Fund Management Fee (total paid for the most recently completed fiscal year for which information is publicly available, as a percentage of average daily net assets) | 0.55 | N/A |

| Sub-Adviser | N/A | T. Rowe Price Associates, Inc. (“T. Rowe Price”) |

| | | |

Sub-Advisory Fee (as a percentage of average daily net assets) | N/A | 0.50% on the first $250 million of assets;

0.45% on the next $500 million of assets; and

0.40% on assets over $750 million.1 |

| Portfolio Managers | Portfolio Manager of the Master Fund Tom Allen (since 06/01) | Donald J. Easley (since 05/09) Donald J. Peters (since 11/04) |

| Distributor | Voya Investments Distributor, LLC (the “Distributor”) | Distributor |

| 1. | For purposes of calculating the sub-advisory fees for Diversified Mid Cap Growth Portfolio, its assets are aggregated with those of VY® T. Rowe Price Growth Equity Portfolio (another series of Voya Partners, Inc.), VY® T. Rowe Price Capital Appreciation Portfolio and VY® T. Rowe Price Equity Income Portfolio (each a series of Voya Investors Trust) and the T. Rowe Price managed assets of Voya Multi-Manager International Equity Fund (a series of Voya Mutual Funds). All T. Rowe Price sub-advisory fees are subject to a preferred provider discount. The discount is calculated based on the assets of all T. Rowe Price sub-advised funds as follows: |

Aggregate assets between $750 million and $1.5 billion – 5%

Aggregate assets between $1.5 billion and $3.0 billion – 7.5%

Aggregate assets greater than $3.0 billion – 10%

Adviser to the Portfolios

DSL, a Delaware limited liability company, serves as the investment adviser to the Portfolios. DSL has overall responsibility for the management of the Portfolios. DSL provides or oversees all investment advisory and portfolio management services for the Portfolios and assists in managing and supervising all aspects of the general day-to-day business activities and operations of the Portfolios, including custodial, transfer agency, dividend disbursing, accounting, auditing, compliance and related services. DSL is registered with the SEC as an investment adviser and with Financial Industry Regulatory Authority (“FINRA”) as a broker-dealer.

The Adviser is an indirect, wholly-owned subsidiary of Voya Financial, Inc. Voya Financial, Inc. is a U.S.-based financial institution whose subsidiaries operate in the retirement, investment, and insurance industries.

DSL’s principal office is located at 1475 Dunwoody Drive, West Chester, PA 19380. As of December 31, 2015, DSL managed approximately $37 billion in registered investment company assets.

Adviser to the Master Fund

Mid Cap Portfolio does not have a sub-adviser; instead the Portfolio invests all of its assets in Service Class 2 shares of the Master Fund, a series of Variable Insurance Products Fund III, a registered open-end investment company.

FMR serves as manager to the Master Fund and to other mutual funds, including the Fidelity® Variable Insurance Products family of funds. FMR’s principal office is located at 245 Summer Street, Boston, MA 02210. As of December 31, 2015, FMR had approximately $644.4 million in discretionary assets under management, and approximately $2.04 trillion when combined with all of its affiliates’ assets under management.

The following individual is responsible for the day-to-day management of the Master Fund.

Tom Allen is portfolio manager of Fidelity® VIP Mid Cap Portfolio. Since joining Fidelity Investments in 1995, Mr. Allen has worked as a research analyst and manager.

Sub-Adviser to Diversified Mid Cap Growth Portfolio

The Adviser has engaged a sub-adviser to provide the day-to-day management of Diversified Mid Cap Growth Portfolio’s portfolio.

The Adviser acts as “manager-of-managers” for Diversified Mid Cap Growth Portfolio. The Adviser has ultimate responsibility, subject to the oversight of Diversified Mid Cap Growth Portfolio’s Board, to oversee any sub-advisers and to recommend the hiring, termination, or replacement of sub-advisers. Diversified Mid Cap Growth Portfolio and the Adviser have received exemptive relief from the SEC which permits the Adviser, with the approval of Diversified Mid Cap Growth Portfolio’s Board but without obtaining shareholder approval, to enter into or materially amend a sub-advisory agreement with sub-advisers that are not affiliated with the Adviser (“non-affiliated sub-advisers”) as well as sub-advisers that are indirect or direct, wholly-owned subsidiaries of the Adviser or of another company that, indirectly or directly wholly owns the Adviser (“wholly-owned sub-advisers”).

Consistent with the “manager-of-managers” structure, the Adviser delegates to the sub-adviser of Diversified Mid Cap Growth Portfolio the responsibility for day-to-day investment management subject to the Adviser’s oversight. The Adviser is responsible for, among other things, monitoring the investment program and performance of the sub-adviser of Diversified Mid Cap Growth Portfolio. Pursuant to the exemptive relief, the Adviser, with the approval of Diversified Mid Cap Growth Portfolio’s Board, has the discretion to terminate any sub-adviser (including terminating a non-affiliated sub-adviser and replacing it with a wholly-owned sub-adviser), and to allocate and reallocate Diversified Mid Cap Growth Portfolio’s assets among other sub-advisers. In these instances, the Adviser may have an incentive to select or retain an affiliated sub-adviser. In the event that an Adviser exercises its discretion to replace the sub-adviser of Diversified Mid Cap Growth Portfolio or add a new sub-adviser to Diversified Mid Cap Growth Portfolio, the Portfolio will provide shareholders with information about the new sub-adviser and the new sub-advisory agreement within 90 days. The appointment of a new sub-adviser or the replacement of an existing sub-adviser may be accompanied by a change to the name of Diversified Mid Cap Growth Portfolio and a change to the investment strategies of Diversified Mid Cap Growth Portfolio.

Under the terms of the sub-advisory agreement, the agreement can be terminated by the Adviser, Diversified Mid Cap Growth Portfolio’s Board, or the sub-adviser, provided that the conditions of such termination are met. In the event a sub-advisory agreement is terminated, the sub-adviser may be replaced subject to any regulatory requirements or the Adviser may assume day-to-day investment management of Diversified Mid Cap Growth Portfolio.

T. Rowe Price was founded in 1937 by the late Thomas Rowe Price, Jr. and is a wholly-owned subsidiary of T. Rowe Price Group, Inc., a publicly held financial services holding company. The principal address of T. Rowe Price is 100 East Pratt Street, Baltimore, Maryland 21202. As of December 31, 2015, the firm and its affiliates managed approximately $763.1 billion in assets.

VY® T. Rowe Price Diversified Mid Cap Growth Portfolio is managed by an investment advisory committee. The following co-chairmen are jointly responsible for the day-to-day management of Diversified Mid Cap Growth Portfolio and work with the committee in developing and executing Diversified Mid Cap Growth Portfolio’s investment program.

Donald J. Easley, CFA, Vice President and a Portfolio Manager in the U.S. equity division for the tax-efficient and structured active mid-cap growth strategies, joined T. Rowe Price in 2000. Prior to that, he worked as a credit analyst with the Bank of New York.

Donald J. Peters is a Vice President of T. Rowe Price and has been managing investments since joining T. Rowe Price in 1993. Mr. Peters is a portfolio manager for major institutional relationships at T. Rowe Price with structured active tax-efficient strategies.

Distributor

The Distributor is the principal underwriter and distributor of each Portfolio. It is a Delaware limited liability company with its principal offices at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034. The Distributor is an indirect wholly-owned subsidiary of Voya Financial, Inc., and an affiliate of the Adviser.

The Distributor is a member of FINRA. To obtain information about FINRA member firms and their associated persons, you may contact FINRA at www.finra.org or the Public Disclosure Hotline at 800-289-9999.

Additional Information about the Portfolios

Form of Organization

Both Portfolios are organized as a series of Voya Partners, Inc. (“VPI”), a Maryland corporation. Both Portfolios are governed by a board of directors consisting of the same 12 members. For more information on the history of VPI, see each Portfolio’s Statement of Additional Information dated May 1, 2016.

Dividends and Other Distributions

Each Portfolio declares and pays dividends from net investment income at least annually. Each Portfolio will also pay distributions from net realized capital gains, reduced by available capital losses, at least annually. All dividends and capital gain distributions will be automatically reinvested in additional shares of the Portfolios at the net asset value of such shares on the payment date unless a participating insurance company’s separate account is permitted to hold cash and elects to receive payment in cash. From time to time, a portion of a Portfolio’s distributions may constitute a return of capital.

To comply with federal tax regulations, the Portfolios may also pay an additional capital gains distribution.

Capitalization

The following table shows on an unaudited basis the capitalization of each of the Portfolios as of December 31, 2015 and on a pro forma basis as of December 31, 2015, giving effect to the Reorganization

| | | Mid Cap

Portfolio | Diversified Mid Cap

Growth Portfolio | Adjustments | Diversified Mid Cap

Growth Portfolio

Pro Forma |

| Class ADV | | | | | |

| Net Assets | $ | 521,070 | 27,217,451 | 321 | 27,738,553 |

| Net Asset Value Per Share | $ | 15.19 | 9.83 | - | 9.83 |

| Shares Outstanding | | 34,299 | 2,769,608 | 18,7122 | 2,822,619 |

| | | | | | |

| Class S | | | | | |

| Net Assets | $ | 32,146,190 | 30,613,515 | 1,9681 | 62,761,673 |

| Net Asset Value Per Share | $ | 15.40 | 10.30 | - | 10.30 |

| Shares Outstanding | | 2,087,693 | 2,972,159 | 1,033,4872 | 6,093,339 |

| 1. | Reflects adjustment for estimated one-time consolidation expenses. |

| 2. | Reflects new shares issued, net of retired shares of Mid Cap Portfolio. (Calculation: Net Assets ÷ NAV per share). |

Additional Information about the Reorganization

The Reorganization Agreement

The terms and conditions under which the proposed transaction may be consummated are set forth in the Reorganization Agreement. Significant provisions of the Reorganization Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Reorganization Agreement, a form of which is attached to this Proxy Statement/Prospectus as Appendix A.

The Reorganization Agreement provides for: (i) the transfer, as of the Closing Date, of all of the assets of Mid Cap Portfolio in exchange for shares of capital stock of Diversified Mid Cap Growth Portfolio and the assumption by Diversified Mid Cap Growth Portfolio of all of Mid Cap Portfolio’s liabilities; and (ii) the distribution of shares of Diversified Mid Cap Growth Portfolio to shareholders of Mid Cap Portfolio, as provided for in the Reorganization Agreement. Mid Cap Portfolio will then be liquidated.

Each shareholder of Class ADV and Class S shares of Mid Cap Portfolio will hold, immediately after the Closing, the corresponding share class of Diversified Mid Cap Growth Portfolio having an aggregate value equal to the aggregate value of the shares of Mid Cap Portfolio held by that shareholder as of the close of business on the Closing Date.

The obligations of the Portfolios under the Reorganization Agreement are subject to various conditions, including approval of the shareholders of Mid Cap Portfolio and that each Portfolio receives an opinion from the law firm of Ropes & Gray LLP to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. The Reorganization Agreement also requires that each of the Portfolios take, or cause to be taken, all actions, and do or cause to be done, all things

reasonably necessary, proper or advisable to consummate and make effective the transactions contemplated by the Reorganization Agreement. The Reorganization Agreement may be terminated by mutual agreement of the parties or by one party on certain other grounds. Please refer to Appendix A to review the terms and conditions of the Reorganization Agreement.

Expenses of the Reorganization

The expenses of the Reorganization will be paid by the Adviser (or an affiliate). The expenses of the Reorganization include, but are not limited to, the costs associated with the preparation of necessary filings with the SEC, printing and distribution of the Proxy Statement/Prospectus and proxy materials, legal fees, accounting fees, securities registration fees, and expenses of holding the Special Meeting. The expenses of the Reorganization are estimated to be $117,500 and do not include the transition costs described in “Portfolio Transitioning” below.

Portfolio Transitioning

If the Reorganization is approved by shareholders, Mid Cap Portfolio is expected to redeem out of the Master Fund on or about August 26, 2016. The proceeds of such redemption will be delivered to Diversified Mid Cap Growth Portfolio at the Closing.

Costs of portfolio transitions are measured using implementation shortfall, which measures the change between the market value of a portfolio at the close of the market the day before any trading related to the portfolio transition occurs and the actual price at which the trades are executed during the portfolio transition. Implementation shortfall includes both explicit and implicit transition costs. The explicit costs include brokerage commissions, fees, and taxes. The explicit transition costs are estimated to be $5,200 and will be paid by Diversified Mid Cap Growth Portfolio. All the other costs of transitioning the Portfolios are considered implicit costs. These include spread costs, market impact costs, and opportunity costs. Quantifying implicit costs is difficult and involves some degree of subjective determinations. These implicit costs will be borne by the Portfolios.

During the transition period, Mid Cap Portfolio might not be pursuing its investment objective and strategies, and limitations on permissible investments and investment restrictions will not apply. After the Closing, T. Rowe Price, as the sub-adviser to Diversified Mid Cap Growth Portfolio, may also sell portfolio holdings that it acquired from Mid Cap Portfolio, and Diversified Mid Cap Growth Portfolio may not be immediately fully invested in accordance with its stated investment strategies. In addition, each Portfolio may engage in a variety of transition management techniques to facilitate the portfolio transition process, including without limitation, the purchase and sale of baskets of securities and exchange-traded funds, and enter into and close futures contracts or other derivative transactions. Such sales and purchases by the Portfolios during the transition period may be made at a disadvantageous time and could result in potential losses to the Portfolios.

Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368 of the Code. Accordingly, pursuant to this treatment, neither Mid Cap Portfolio nor the Separate Accounts and Qualified Plans as its shareholders, nor Diversified Mid Cap Growth Portfolio nor the Separate Accounts and Qualified Plans as its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement. As a condition to the closing of the Reorganization, the Portfolios will receive an opinion from tax counsel to the effect that, on the basis of existing provisions of the Code, U.S. Treasury Regulations promulgated thereunder, current administrative rules, pronouncements and court decisions, and subject to certain qualifications, the Reorganization will qualify as a tax-free reorganization for federal income tax purposes.

On or prior to the Closing Date, Mid Cap Portfolio will pay to the Separate Accounts of Participating Insurance Companies and Qualified Plans that own its shares, a distribution consisting of any undistributed investment company taxable income, any net tax-exempt income, and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date, including portfolio transitions in connection with the Reorganization and the redemption of Master Fund shares. Variable Contract owners and Plan Participants are not expected to recognize any income or gains for federal income tax purposes from this cash distribution.

Future Allocation of Premiums

Shares of Mid Cap Portfolio have been purchased at the direction of Variable Contract Holders by Participating Insurance Companies through Separate Accounts to fund benefits payable under a Variable Contract. If the Reorganization is approved, Participating Insurance Companies have advised us that all premiums or transfers to Mid Cap Portfolio will be allocated to Diversified Mid Cap Growth Portfolio.

What is the Board’s recommendation?

Based upon its review, the Board, including a majority of the Directors who are not “interested persons,” as defined by the 1940 Act (the “Independent Directors”), determined that the Reorganization would be in the best interests of the Portfolios and their shareholders. In addition, the Board determined that the interests of the shareholders of the Portfolios would not be diluted as a result of the Reorganization.

Accordingly, after consideration of such factors and information it considered relevant, the Board, including a majority of the Independent Directors approved the Reorganization Agreement and voted to recommend to shareholders that they approve the Reorganization Agreement. The Board is therefore recommending that Mid Cap Portfolio’s shareholders vote “FOR” the Reorganization Agreement.

What factors did the Board consider?

The Board considered the Reorganization as part of its overall consideration of what would be in the best interest of Mid Cap Portfolio and its shareholders. The Board determined that Mid Cap Portfolio would benefit from being combined into Diversified Mid Cap Growth Portfolio under the day-to-day management of T. Rowe Price.

The Board, in approving the Reorganization, considered a number of factors, including, but not limited to, the following: the fact that Mid Cap Portfolio does not have a sub-adviser and invests all of its assets in shares of the Master Fund; an analysis of T. Rowe Price as sub-adviser of Diversified Mid Cap Growth Portfolio; a presentation from DSL regarding the Reorganization, intending to, among other things, enhance the efficiency and reduce the complexity of the Voya family of funds; DSL’s analysis of potential alternative Portfolios that could have served as a merger partner for Mid Cap Portfolio other than Diversified Mid Cap Growth Portfolio; the fact that there are concerns with the future viability of Mid Cap Portfolio based on underperformance, asset size and outflows; the superior performance of Diversified Mid Cap Growth Portfolio, as compared to the performance of Mid Cap Portfolio, in the year-to-date, one-year, three-year and five-year time periods; the performance of Mid Cap Portfolio as compared to its Morningstar, Inc. (“Morningstar”) peer group and the performance of Diversified Mid Cap Growth Portfolio as compared to its Morningstar peer group; the lower net expense ratios that current shareholders of Mid Cap Portfolio are expected to experience as a result of the Reorganization; the consideration of representations from the Portfolios’ Chief Investment Risk Officer regarding the consistent performance and superior track record of Diversified Mid Cap Growth Portfolio; the similarities in the investment objectives of each Portfolio; the similarities in the direct and indirect investment strategies of Mid Cap Portfolio, pursued through its investment in the Master Fund, and Diversified Mid Cap Growth Portfolio; the larger combined asset size of the two Portfolios, which would likely result in a reduction in expenses for the benefit of current shareholders of Mid Cap Portfolio and provide greater scale and superior potential to maintain long-term scale benefits for the shareholders of Mid Cap Portfolio; DSL’s representations that direct and indirect costs related to proxy solicitation will not be borne by either Portfolio or their shareholders and that portfolio transition costs will be borne by Diversified Mid Cap Growth Portfolio; the fact that implicit transaction costs are uncertain and will be borne by the Diversified Mid Cap Growth Portfolio; the expected tax consequences of the Reorganization to Mid Cap Portfolio and its shareholders, including that the Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization; and the Board’s determination that the Reorganization will not dilute the interests of the shareholders of Mid Cap Portfolio. Different Board members may have given different weight to different individual factors and related conclusions.

What is the required vote?

Approval of the Reorganization Agreement requires the affirmative vote of the lesser of (i) 67% or more of the voting securities present at the meeting, provided that more than 50% of the voting securities are present in person or represented by proxy at the Special Meeting, or (ii) a majority of the shares entitled to vote.

What happens if shareholders do not approve the Reorganization?

If shareholders of Mid Cap Portfolio do not approve the Reorganization, Mid Cap Portfolio will continue to be managed by DSL as described in the prospectus, and the Board will determine what additional action, if any, should be taken.

General Information about the Proxy Statement/Prospectus

Who is asking for my vote?

The Board is soliciting your vote for a special meeting of Mid Cap Portfolio’s shareholders.

How is my proxy being solicited?

Mid Cap Portfolio has retained D. F. King Co., Inc. (the “Solicitor”) to assist in the solicitation of proxies, at an estimated cost of $6,400 which will be paid by the Adviser. As the date of the Special Meeting approaches, certain shareholders may receive a telephone call from a representative of the Solicitor if their votes have not yet been received. Authorization to permit the Solicitor to execute proxies may be obtained by telephonic instructions from shareholders of the Portfolio. Proxies that are obtained telephonically will be recorded in accordance with certain procedures, as explained further below. The Board believes that these procedures are reasonably designed to ensure that both the identity of the shareholder casting the vote and the voting instructions of the shareholder are accurately determined and recorded.

In situations where a telephonic proxy is solicited, the Solicitor’s representative is required to ask for each shareholder’s full name, address, title (if the shareholder is authorized to act on behalf of an entity, such as a corporation), and to confirm that the shareholder has received the proxy materials in the mail. The Solicitor’s representative will explain the process, read the proposals on the Proxy Ballot, and ask for the shareholder’s instructions on the proposals. Although the Solicitor’s representative is permitted to answer questions about the process, he or she is not permitted to recommend to the shareholder how to vote, other than reading any recommendation set forth in the Proxy Statement. The Solicitor’s representative will record the shareholder’s instructions on the Proxy Ballot. Within approximately 72 hours of soliciting telephonic voting instructions, the shareholder will be sent a letter or mailgram to confirm his or her vote and asking the shareholder to call the Solicitor immediately if his or her instructions are not correctly reflected in the confirmation.

Should you require additional information regarding the Special Meeting, you may contact the Solicitor toll-free at (877) 283-0324. In addition to solicitation by mail, certain officers and representatives of the Portfolios, officers and employees of the Adviser or its affiliates, and certain financial services firms and their representatives, who will receive no extra compensation for their services, may solicit votes by telephone, telegram, facsimile, or other communication.

What happens to my proxy once I submit it?

The Board has named Huey P. Falgout, Jr., Secretary, Theresa K. Kelety, Assistant Secretary, and Todd Modic, Assistant Secretary, or one or more substitutes designated by them, as proxies who are authorized to vote Portfolio shares as directed by shareholders.

Can I revoke my proxy after I submit it?

A shareholder may revoke the accompanying proxy at any time prior to its use by filing with the Portfolio a written revocation or a duly executed proxy bearing a later date. In addition, any shareholder who attends the Special Meeting in person may vote by ballot at the Special Meeting, thereby canceling any proxy or voting instruction previously given.

How will my shares be voted?

If you follow the voting instructions, your proxies will vote your shares as you have directed. If you submit your Proxy Ballot or Voting Instruction Card but do not vote on the proposals, your proxies will vote on the proposals as recommended by the Board. If any other matter is properly presented at the Special Meeting, your proxies will vote in their discretion in accordance with their best judgment, including on any proposal to adjourn the meeting. At the time this Proxy Statement/Prospectus was printed, the Board knew of no matter that needed to be acted upon at the Special Meeting other than the proposals discussed in this Proxy Statement/Prospectus.

Quorum and Tabulation

Each shareholder of Mid Cap Portfolio is entitled to one vote for each share held as to any matter on which such shareholder is entitled to vote and for each fractional share that is owned, the shareholder shall be entitled to a proportionate fractional vote. Fifty percent (50%) of the outstanding shares present in person or by proxy shall constitute a quorum.

Adjournments

If a quorum is not present at the Special Meeting, if there are insufficient votes to approve any proposal, or for any other reason deemed appropriate by your proxies, your proxies may propose one or more adjournments of the Special Meeting to permit additional time for the solicitation of proxies, in accordance with the organizational documents of VPI and applicable law. Solicitation of votes may continue to be made without any obligation to provide any additional notice of the adjournment. The persons named as proxies will vote in favor of such adjournments in their discretion.

Broker Non-Votes and Abstentions

If a shareholder abstains from voting as to any matter, or if a broker returns a “non-vote” proxy, indicating a lack of authority to vote on a matter, then the shares represented by such abstention or non-vote will be treated as shares that are present at the Special Meeting for purposes of determining the existence of a quorum. However, abstentions and broker non-votes will be disregarded in determining the “votes cast” on a proposal.

Additional Voting Information

The Separate Accounts and Qualified Plans are the record owners of the shares of the Portfolios. The Qualified Plans and Separate Accounts will vote Mid Cap Portfolio’s shares at the Special Meeting in accordance with the timely instructions received from persons entitled to give voting instructions under the Variable Contracts or Qualified Plans. Mid Cap Portfolio does not impose any requirement that a minimum percentage of voting instructions be received, before counting the Separate Accounts and Qualified Plans as Mid Cap Portfolio’s shareholders in determining whether a quorum is present.

Where Variable Contract Holders and Plan Participants fail to give instructions as to how to vote their shares, the Qualified Plans and Separate Accounts will use proportional voting and vote those shares in proportion to the instructions given by other Variable Contract Holders and Plan Participants who voted. The effect of proportional voting is that if a large number of Variable Contract Holders and Plan Participants fail to give voting instructions, a small number of Variable Contract Holders and Plan Participants may determine the outcome of the vote. Because a significant percentage of shares are held by Separate Accounts, which use proportional voting, the presence of such Separate Accounts at the Special Meeting shall be sufficient to constitute a quorum for the transaction of business at the Special Meeting.

How many shares are outstanding?

As of the Record Date, the following shares of capital stock of Mid Cap Portfolio were outstanding and entitled to vote:

| Class | Shares Outstanding |

| ADV | |

| S | |

| Total | |

Shares have no preemptive or subscription rights. [To the knowledge of the Adviser, as of the Record Date, no current Director owns 1% or more of the outstanding shares of any class of the Portfolio, and the officers and Directors own, as a group, less than 1% of the shares of any class of the Portfolio.]

Appendix C hereto lists the persons that, as of the Record Date owned beneficially or of record 5% or more of the outstanding shares of any class of Mid Cap Portfolio or Diversified Mid Cap Growth Portfolio.

Can shareholders submit proposals for a future shareholder meeting?

The Portfolio is not required to hold annual meetings and currently does not intend to hold such meetings unless shareholder action is required by law. A shareholder proposal to be considered for inclusion in a proxy statement at any subsequent meeting of shareholders must be submitted in a reasonable time before a proxy statement for that meeting is printed and mailed. Whether a proposal is included in a proxy statement will be determined in accordance with applicable federal and state laws.

Why did my household only receive one copy of this Proxy Statement/Prospectus?

Only one copy of this Proxy Statement/Prospectus may be mailed to each household, even if more than one person in the household is a Portfolio shareholder of record, unless the Portfolio has received contrary instructions from one or more of the household’s shareholders. If you need an additional copy of this Proxy Statement, please contact Shareholder Services at (800) 992-0180. If in the future, you do not wish to combine or wish to recombine the mailing of a proxy statement with household members, please inform the Portfolio in writing at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona, 85258-2034 or via telephone at (800) 992-0180.

In order that the presence of a quorum at the Special Meeting may be assured, prompt execution and return of the enclosed Proxy Ballot or Voting Instruction Card is requested. A self-addressed postage paid envelope is enclosed for your convenience. You also may vote via telephone or via the Internet. Please follow the voting instructions as outlined on your Proxy Ballot or Voting Instruction Card.

| |  |

| | Huey P. Falgout, Jr. |

| | Secretary |

June 22, 2016

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

Appendix A: Form of Agreement and Plan of Reorganization