example of participating executives having a like age and service profile), the benefits provided under the retirement plans in which he participates were determined to exceed market median levels based on the potential length of service until retirement (attaining age 65), together with recent actions taken by certain of the companies within the compensation peer group to reduce future benefit accruals under their respective defined benefit plans. Subsequent to the Committee’s October 2017 review, the Company determined to reduce future benefit accruals under substantially all of its salaried defined benefit plans, including the Corporate Pension Plan, the IS Pension Plan and the related portions of the SERP effective January 1, 2019.

Deferred Compensation Plan. L3 sponsors a nonqualified deferred compensation plan, the L3 Technologies, Inc. Deferred Compensation Plan II, for a select group of highly compensated executives, including our named executive officers, as a competitive practice. This plan allows for voluntary deferrals by executives, including the named executive officers, of up to 50% of base salary and 100% of annual incentive payouts into an unfunded, nonqualified account. There are no company contributions under this plan, and deferred amounts earn interest at the prime rate.

Employment, Severance and Change in Control Arrangements. Except as described in “Offer Letter with Christopher E. Kubasik” on page 60 and “Retirement Agreement with Michael T. Strianese” on page 60, L3 does not have any employment agreements or severance arrangements with its named executive officers other than in connection with a change in control. L3’s named executive officers are covered under the L3 Technologies, Inc. Change in Control Severance Plan (the “Change in Control Severance Plan”), which provides for specified severance benefits in the event of termination by the Company without cause or by the employee for good reason following a change of control. The purpose of these arrangements is to preserve morale and productivity, and encourage retention, in the face of the disruptive impact of a change in control. Severance benefits under the Change in Control Severance Plan are market competitive and do not provide tax gross-ups. See “Potential Payments Upon Change in Control or Termination of Employment” beginning on page 76 for additional details.

Perquisites. L3 provides the named executive officers with modest perquisites consistent with competitive practices. In 2017, the named executive officers were eligible for an annual executive physical, financial planning services, supplemental life insurance and participation in an executive medical plan. We also provide our Chief Executive Officer with a car and security driver, and access to L3’s fractionally-owned aircraft for occasional personal use. Our corporate aircraft policy requires that our Chief Executive Officer reimburse the Company for the incremental costs incurred in connection with his personal use of the aircraft. We also maintain a key employee relocation policy applicable to management employees generally. In 2017, Mr. Kubasik and Ms. Davidson completed the relocation of their respective personal residences, and their relocation expenses were paid and/or reimbursed under this policy. For a further discussion, see Note 6 to the “Summary Compensation Table” beginning on page 67.

OFFER LETTER WITH CHRISTOPHER E. KUBASIK

On July 20, 2017, the Company announced that Mr. Kubasik would succeed Mr. Strianese as L3’s Chief Executive Officer effective January 1, 2018. On October 31, 2017, the Company entered into an offer letter with Mr. Kubasik in respect of his pending promotion to his new role. The offer letter provides that Mr. Kubasik’s annual target compensation would be $12.36 million effective January 1, 2018, composed of an annual base salary of $1.2 million, a target bonus opportunity for fiscal 2018 of 130% of base salary (or $1.56 million) and long-term incentive compensation having a grant date value of $9.6 million. In addition, pursuant to the offer letter, on December 20, 2017, Mr. Kubasik received a one-time grant of stock options and restricted stock units with grant date fair values of $2.8 million and $1.2 million, respectively. The offer letter provides that these one-time awards are subject to three-year “cliff” vesting, which automatically accelerates in the event Mr. Kubasik’s employment is terminated by L3 without “cause” or he terminates his employment for “good reason,” in each case as defined in L3’s Change in Control Severance Plan.

RETIREMENT AGREEMENT WITH MICHAEL T. STRIANESE

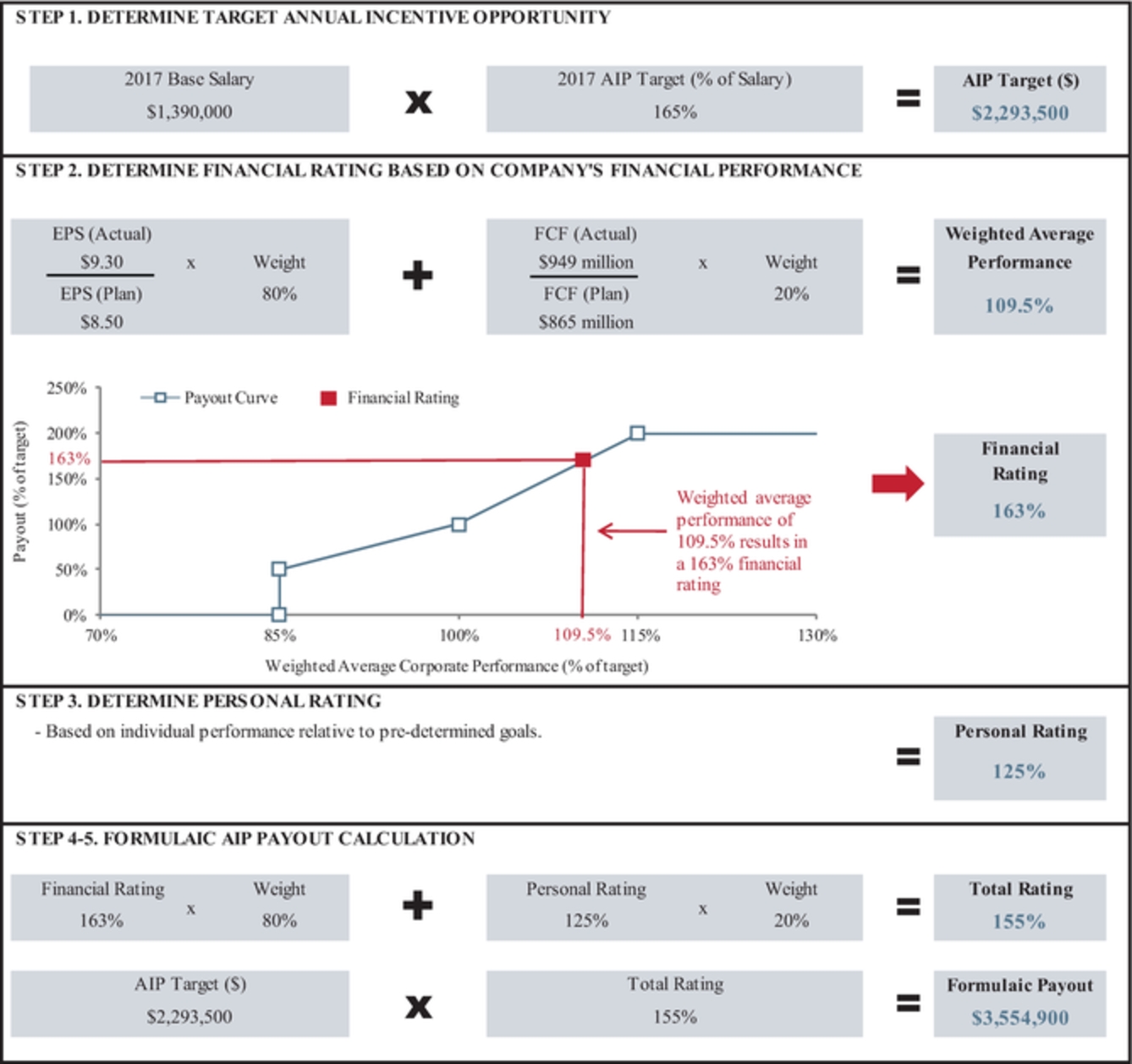

On November 8, 2017, the Company entered into a Retirement Agreement and General Release with Mr. Strianese, pursuant to which Mr. Strianese would: (1) continue to serve as Chairman and Chief Executive Officer at his then current salary of $1.39 million per annum through December 31, 2017, at which time he would retire from his position as Chief Executive Officer, and (2) serve as Executive Chairman at a base salary of $695,000 per annum from January 1, 2018 through the conclusion of the Annual Meeting, at which time his term of office as a director and his employment with the Company would cease. The agreement further provides that Mr. Strianese would remain eligible to participate in the Company’s annual incentive plan: (a) for fiscal 2017 based on his existing target bonus opportunity of 165% of base salary (or $2,293,500) and

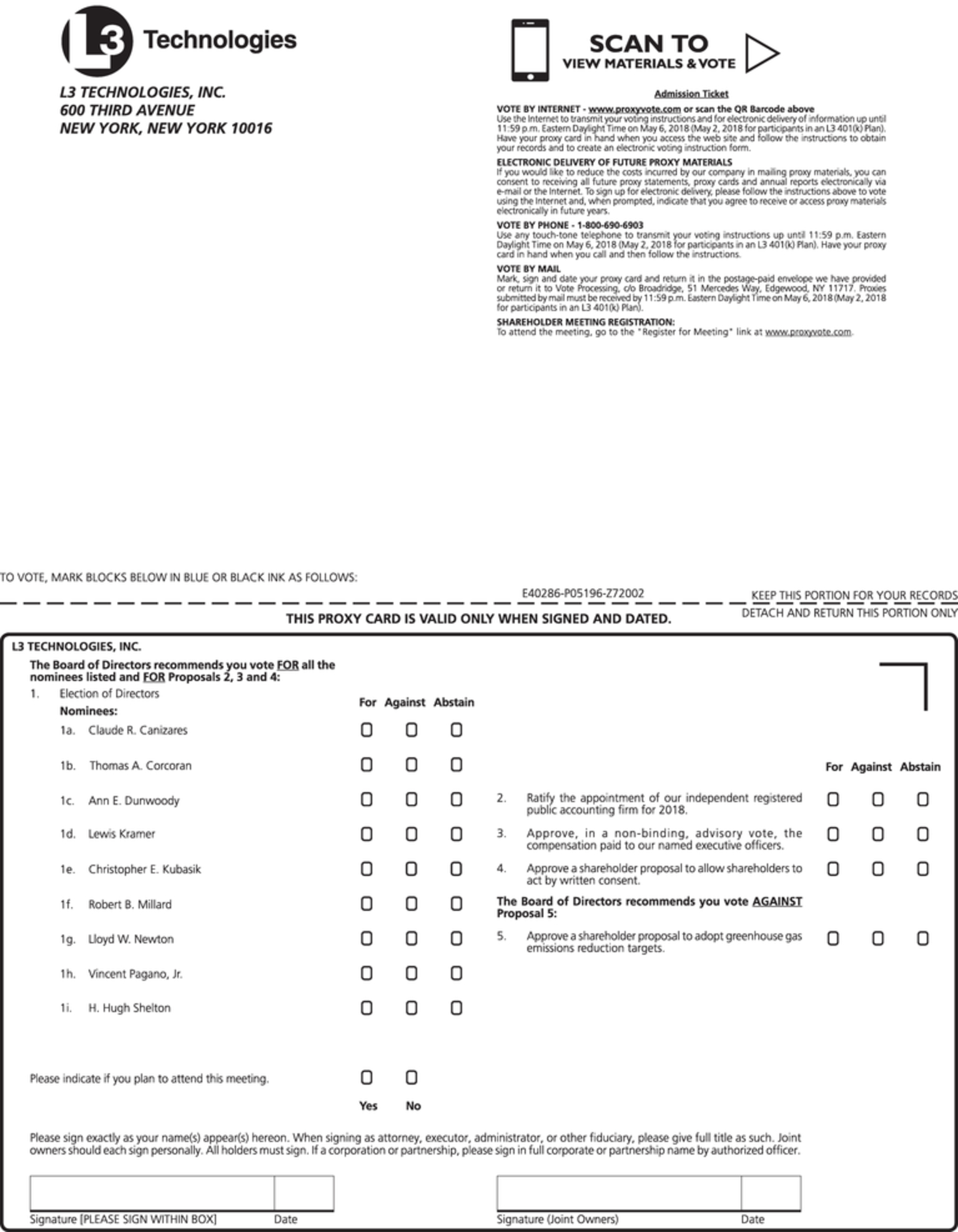

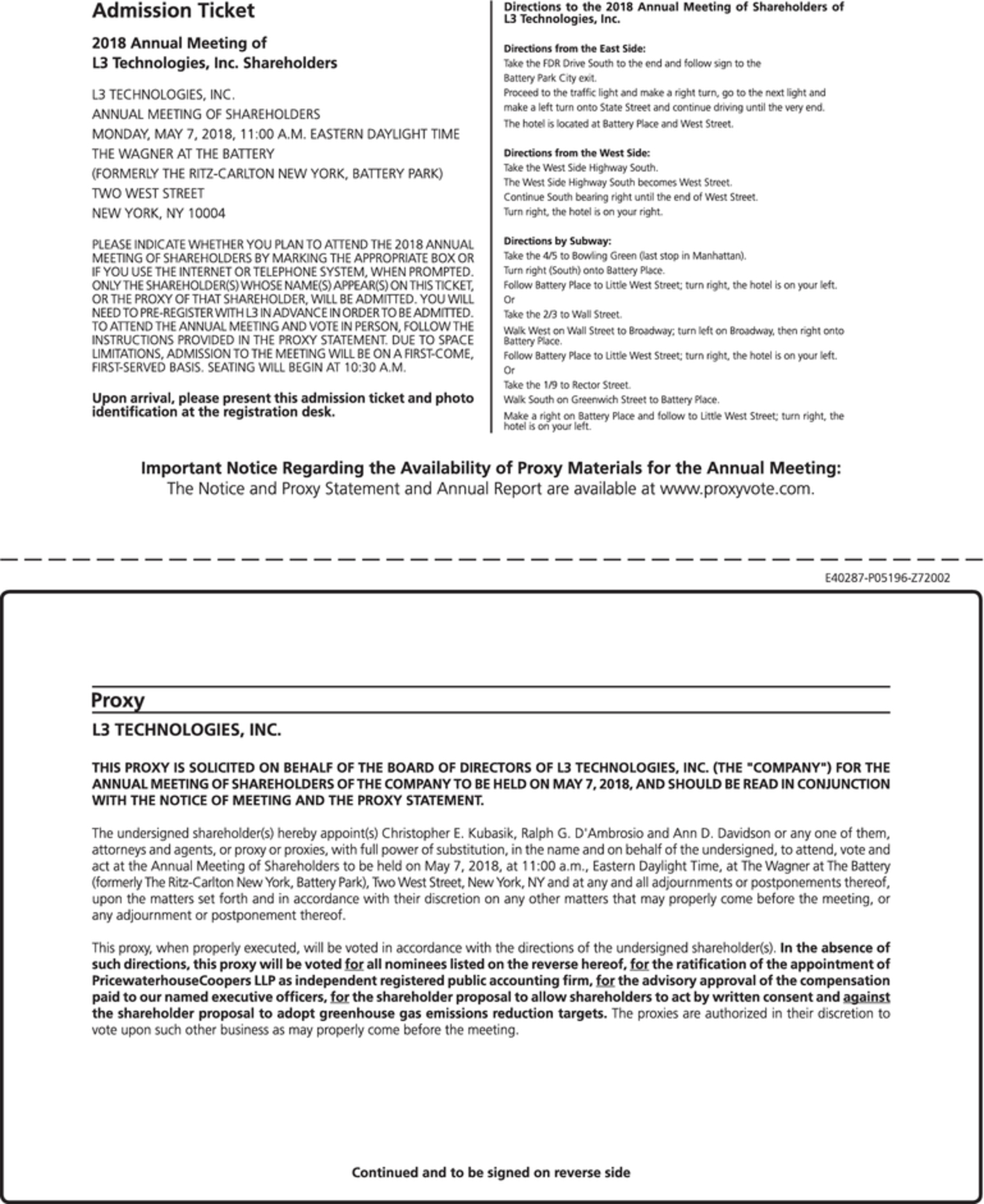

On behalf of the Board of Directors, I cordially invite you to attend the Annual Meeting of Shareholders of L3 Technologies, Inc., to be held at 11:00 a.m., Eastern Daylight Time, on Monday, May 7, 2018, at The Wagner at The Battery (formerly The Ritz-Carlton New York, Battery Park), located at Two West Street, New York, New York 10004. The notice and proxy statement for the Annual Meeting are attached to this letter and describe the business to be conducted at the Annual Meeting.

On behalf of the Board of Directors, I cordially invite you to attend the Annual Meeting of Shareholders of L3 Technologies, Inc., to be held at 11:00 a.m., Eastern Daylight Time, on Monday, May 7, 2018, at The Wagner at The Battery (formerly The Ritz-Carlton New York, Battery Park), located at Two West Street, New York, New York 10004. The notice and proxy statement for the Annual Meeting are attached to this letter and describe the business to be conducted at the Annual Meeting.