Filed by L3 Technologies, Inc.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: L3 Technologies, Inc.

Commission File No. 001-37975

February 19, 2019

L3’s Andy Zogg (ISR) and Harris’ Charlie Roberts on Being Customers’ First Choice IMO Leadership Profile

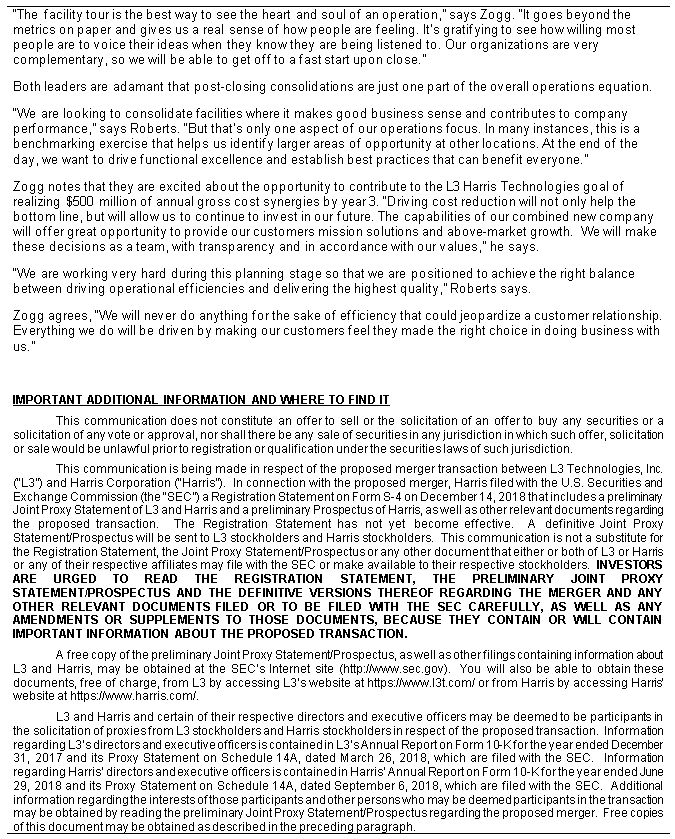

How do you combine the talent and assets of more than 400 locations in over 100 countries and still manage to stay agile and meet or exceed customer expectations every day? That is the challenge – and opportunity – that Integration Management Office (IMO) Operations Leads Andy Zogg (pictured at left) and Charlie Roberts (right) are tackling as they plan to integrate the L3 Harris operations team. “When the merger closes, we want our customers to be confident that this merger integration was done with their best interests in mind,” agree Zogg and Roberts, both of whom are defense industry veterans with extensive integration experience. Zogg is Senior Vice President and COO of L3’s ISR Systems segment; Roberts is Vice President of Operations at Harris. They both strive to facilitate strong execution after the merger closes by delivering operational efficiencies that will help L3 Harris Technologies provide best-in-class solutions across space, air, land, sea, and cyber domains. This will include becoming more innovative and affordable, which will allow a combined L3 Harris additional investment in technology and drive down costs. Their strategic approach in planning for the merger is three-pronged: (1) Geography – planning for the integration of certain operations that are in close proximity where it makes good business sense; (2) Business alignment – Preparing to align solutions around areas of expertise that support the business segments and customer needs; and (3) Functional excellence – Driving optimal performance across locations doing similar work. “So far, the process and policy commonalities we’ve identified outweigh the differences in how our two companies have operated up to now,” says Roberts. “Our site visits continue to reveal areas of excellence to establish new best practices across our segments post-close.” Zogg and Roberts have visited about 15 sites and plan to travel to more in the coming months. During these visits they work closely with the facilities leads Mark Peterson (ES) and Tina Zinger (Harris) to coordinate operational priorities within real estate and facility parameters. In addition to meeting with site managers, the visits allow a deep dive into supply chain, engineering, manufacturing, quality and other functions to ensure alignment in the future. Across the board, site leaders and teams have been most helpful in educating us as to the key elements of the business.

“The facility tour is the best way to see the heart and soul of an operation,” says Zogg. “It goes beyond the metrics on paper and gives us a real sense of how people are feeling. It’s gratifying to see how willing most people are to voice their ideas when they know they are being listened to. Our organizations are very complementary, so we will be able to get off to a fast start upon close.” Both leaders are adamant that post-closing consolidations are just one part of the overall operations equation. “We are looking to consolidate facilities where it makes good business sense and contributes to company performance,” says Roberts. “But that’s only one aspect of our operations focus. In many instances, this is a benchmarking exercise that helps us identify larger areas of opportunity at other locations. At the end of the day, we want to drive functional excellence and establish best practices that can benefit everyone.” Zogg notes that they are excited about the opportunity to contribute to the L3 Harris Technologies goal of realizing $500 million of annual gross cost synergies by year 3. “Driving cost reduction will not only help the bottom line, but will allow us to continue to invest in our future. The capabilities of our combined new company will offer great opportunity to provide our customers mission solutions and above-market growth. We will make these decisions as a team, with transparency and in accordance with our values,” he says. “We are working very hard during this planning stage so that we are positioned to achieve the right balance between driving operational efficiencies and delivering the highest quality,” Roberts says. Zogg agrees, “We will never do anything for the sake of efficiency that could jeopardize a customer relationship. Everything we do will be driven by making our customers feel they made the right choice in doing business with us.” IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. This communication is being made in respect of the proposed merger transaction between L3 Technologies, Inc. (“L3”) and Harris Corporation (“Harris”). In connection with the proposed merger, Harris filed with the U.S. Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 on December 14, 2018 that includes a preliminary Joint Proxy Statement of L3 and Harris and a preliminary Prospectus of Harris, as well as other relevant documents regarding the proposed transaction. The Registration Statement has not yet become effective. A definitive Joint Proxy Statement/Prospectus will be sent to L3 stockholders and Harris stockholders. This communication is not a substitute for the Registration Statement, the Joint Proxy Statement/Prospectus or any other document that either or both of L3 or Harris or any of their respective affiliates may file with the SEC or make available to their respective stockholders. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT, THE PRELIMINARY JOINT PROXY STATEMENT/PROSPECTUS AND THE DEFINITIVE VERSIONS THEREOF REGARDING THE MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. A free copy of the preliminary Joint Proxy Statement/Prospectus, as well as other filings containing information about L3 and Harris, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from L3 by accessing L3’s website at https://www.l3t.com/ or from Harris by accessing Harris’ website at https://www.harris.com/. L3 and Harris and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from L3 stockholders and Harris stockholders in respect of the proposed transaction. Information regarding L3’s directors and executive officers is contained in L3’s Annual Report on Form 10-K for the year ended December 31, 2017 and its Proxy Statement on Schedule 14A, dated March 26, 2018, which are filed with the SEC. Information regarding Harris’ directors and executive officers is contained in Harris’ Annual Report on Form 10-K for the year ended June 29, 2018 and its Proxy Statement on Schedule 14A, dated September 6, 2018, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the preliminary Joint Proxy Statement/Prospectus regarding the proposed merger. Free copies of this document may be obtained as described in the preceding paragraph.

FORWARD-LOOKING STATEMENTS Certain of the matters discussed in this communication are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than historical facts may be forward-looking statements; words such as “may,” “will,” “should,” “likely,” “projects,” “financial guidance,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” and similar expressions are used to identify forward-looking statements. L3 and Harris caution investors that these statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond L3’s and Harris’ control, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. In addition to factors previously disclosed in L3’s and Harris’ reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of L3 and Harris to terminate the definitive merger agreement between L3 and Harris; the outcome of any legal proceedings that may be instituted against L3, Harris or their respective directors; the risk that the stockholder approvals of L3 or Harris may not be obtained on the expected schedule or at all; the ability to obtain regulatory approvals and satisfy other closing conditions to the merger in a timely manner or at all, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating the L3 and Harris businesses or fully realizing anticipated cost savings and other benefits; business disruptions from the proposed merger that may harm L3’s or Harris’ businesses, including current plans and operations; any announcement relating to the proposed transaction could have adverse effects on the ability of L3 or Harris to retain and hire key personnel or maintain relationships with suppliers and customers, including the U.S. government and other governments, or on L3’s or Harris’ operating results and businesses generally; the risk that the announcement of the proposed transaction could have adverse effects on the market price of the common stock of either or both of L3’s and Harris’ common stock and the uncertainty as to the long-term value of the common stock of the combined company following the merger; certain restrictions during the pendency of the merger that may impact L3’s or Harris’ ability to pursue certain business opportunities or strategic transactions; the business, economic and political conditions in the markets in which L3 and Harris operate; and events beyond L3’s and Harris’ control, such as acts of terrorism. These forward-looking statements speak only as of the date of this communication or as of the date they were made, and neither L3 nor Harris undertakes any obligation to update forward-looking statements. For a more detailed discussion of these factors, also see the information under the captions “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in L3’s and Harris’ Preliminary Joint Proxy Statement/Prospectus that forms part of the Registration Statement on Form S-4 filed by Harris and the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in L3’s and Harris’ most recent reports on Form 10-K for the years ended December 31, 2017 and June 29, 2018, respectively, and any material updates to these factors contained in any of L3’s and Harris’ subsequent and future filings. As for the forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainties of estimates, forecasts and projections and may be better or worse than projected and such differences could be material. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Given these uncertainties, you should not place any reliance on these forward-looking statements.