COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes L3’s executive compensation program related to the year ended December 31, 2018 (our 2018 fiscal year). This section details the compensation framework applied by the Compensation Committee of our Board of Directors (the “Committee”) in determining the pay levels and programs available to our named executive officers for whom compensation is disclosed in the compensation tables included in the Tabular Executive Compensation Disclosure section beginning on page 36. Our named executive officers for the 2018 fiscal year were:

| • | Christopher E. Kubasik, Chairman, Chief Executive Officer and President |

| • | Ralph G. D’Ambrosio, Senior Vice President and Chief Financial Officer |

| • | Ann D. Davidson, Senior Vice President and Chief Legal Officer |

| • | Todd W. Gautier, Senior Vice President and President of Electronic Systems Segment |

| • | Jeffrey A. Miller, Senior Vice President and President of ISR Systems Segment |

COMPANY BACKGROUND AND 2018 PERFORMANCE ACHIEVEMENTS

Company Background. L3 is a prime contractor in Intelligence, Surveillance and Reconnaissance (“ISR”) systems, aircraft sustainment (including modifications and fleet management of special mission aircraft), simulation and training, night vision and image intensification equipment, and security and detection systems. L3 is also a leading provider of a broad range of communication, electronic and sensor systems used on military, homeland security and commercial platforms. Approximately 70% of our consolidated net sales for 2018 were made to the U.S. Government (the “USG”), including 66% to the Department of Defense (the “DoD”). The remaining 30% of our sales were made to international and commercial customers.

On June 29, 2018, we completed the sale of our Vertex Aerospace business for a sales price of $540 million, subject to customary closing net working capital adjustments. The divestiture of the Vertex Aerospace business represents a strategic shift by us to exit the logistics solution and maintenance services business for military aircraft where we do not provide complex ISR systems integration and modification. The Vertex Aerospace business generated sales of $0.6 billion in 2018 and $1.4 billion in 2017. The assets and liabilities and results of operations of the Vertex Aerospace business are reported as discontinued operations in our 2018 financial statements and are excluded from the specific financial results set forth in “2018 Performance Achievements” below.

On October 14, 2018, L3 and Harris Corporation (“Harris”) announced an agreement to combine in an all stock merger of equals (the “L3 Harris Merger”). Under the terms of the Agreement and Plan of Merger governing the proposed transaction (the “L3 Harris Merger Agreement”), which was unanimously approved by the boards of directors of both companies, L3 shareholders will receive a fixed exchange ratio of 1.30 shares of Harris common stock for each share of L3 common stock they hold. Upon completion of the L3 Harris Merger, Harris shareholders will own approximately 54% and L3 shareholders will own approximately 46% of the combined company, which will be renamed L3 Harris Technologies, Inc. The L3 Harris Merger was approved by the respective stockholders of L3 and Harris on April 4, 2019, and is expected to close in the middle of 2019 subject to customary closing conditions, including the receipt of regulatory approvals.

2018 Performance Achievements. L3 delivered strong financial performance for 2018, highlighted by the items described below.

| • | Our diluted earnings per share (“EPS”) and free cash flow (“FCF”) achievements significantly exceeded the corporate goals in our annual incentive plan. Our 2018 EPS from continuing operations increased by 6% to $10.05, compared with $9.46 for 2017, and our net cash from operating activities from continuing operations increased by 6% to $1,042 million for 2018, as compared to $985 million from 2017. Our 2018 EPS from continuing operations included certain debt retirement charges, merger and acquisition-related expenses and divestiture gains that are described more fully in “– Reconciliation of Non-GAAP Measures to GAAP Measures” on page 34. Excluding these items, our EPS from continuing operations grew by 14% to $10.75 for 2018, as compared to $9.46 for 2017. Our 2017 EPS from continuing operations also included an estimated tax benefit of $0.99 per diluted share related to the enactment of the U.S. Tax Cuts and Jobs Act in December 2017 (the “2017 Tax Reform Law”). Our FCF from continuing operations increased 8% to $935 million in 2018, as compared to $862 million for 2017. The FCF results discussed in this paragraph are subject to the adjustments set forth in “– Reconciliation of Non-GAAP Measures to GAAP Measures” on page 34. |

| • | Our consolidated organic sales growth (that is, the growth in our net sales excluding the sales impact of business acquisitions and divestitures) (“OSG”) also significantly exceeded our annual incentive plan goal. Our consolidated net sales grew by 7% to $10,244 million for 2018, as compared to $9,573 million for 2017. Our consolidated OSG was 7% for 2018 (with organic sales increasing by $635 million, to $10,138 million for 2018), led by organic growth of 6% for our USG business (including the DoD). Consolidated organic sales exclude $106 million of sales increases related to business acquisitions and $70 million of sales declines related to business divestitures. |

| • | Our segment operating margin was 10.8% for 2018 and was unchanged from 2017. |

| • | Our segment operating income increased by $75 million, or 7%, to $1,106 million for 2018, as compared to $1,031 million for 2017. Favorable contract performance at Electronic Systems was offset by lower manufacturing yields, inventory provisions and unfavorable contract performance for the Traveling Wave Tube business in our Communications & Networked Systems segment and higher research and development costs, primarily at our Intelligence Surveillance and Reconnaissance Systems segment, as described below. |

| • | We undertook significant strategic actions to reshape and strengthen our business portfolio for continued future success. As discussed above, on June 29, 2018, we completed the sale of our Vertex Aerospace business, representing a strategic shift in the scope of our business. We also invested $386 million to acquire five businesses in 2018. Our acquisitions build and strengthen select L3 business areas, including with respect to information security; unmanned surface vessel (USV) and autonomous vessel control systems; aerospace engineering, software development and space situational awareness; robotic solutions for automotive manufacturing; and unmanned aerial systems. We also increased our research and development (R&D) investment by 14%, or $39 million, to $326 million for 2018, as compared to $287 million for 2017. |

| • | As discussed above, on October 14, 2018, we entered into an agreement to combine L3 and Harris in an all stock merger of equals in which L3 shareholders will receive a fixed exchange ratio of 1.30 shares of Harris common stock for each share of L3 common stock they hold and will collectively own approximately 46% of the combined company. |

| • | We returned $576 million of cash to our shareholders in 2018, by repurchasing $322 million of our Common Stock and paying dividends of $254 million following our 14th consecutive annual dividend increase. |

| • | Credit rating agencies S&P, Moody’s and Fitch reaffirmed their stable outlooks and investment-grade credit ratings for L3. We also maintained an efficient capital structure with ample liquidity. We ended 2018 with $3.3 billion of debt, unchanged from 2017 and representing approximately 35% of invested capital, $1,066 million of cash on hand (an increase of approximately 60% as compared to the end of 2017) and an available revolver of $1 billion. |

COMPENSATION PHILOSOPHY, 2018 TARGET PAY AND 2018 INCENTIVE PLAN PAYOUTS

Compensation Philosophy. Our compensation philosophy supports a pay-for-performance culture. We target base salaries and annual and long-term incentive opportunities to approximate market median compensation levels, subject to adjustments based on experience, performance, other individual factors as described in “– Use of Market Data and Competitive Compensation Positioning” beginning on page 18 and as otherwise appropriate. On average, the majority of each executive’s target pay for 2018 was in the form of incentive compensation, which was subject to future performance to have any realized value. See the information in “– Mix of Pay” beginning on page 17.

2018 Target Pay. The table below details each named executive officer’s 2018 base salary, target annual incentive opportunity (“target bonus”) and grant date target value of long-term incentive awards (collectively, “target pay”).

| | | Salary(1) | | | Target Bonus as % of Salary | | | Target Value of Long-Term Incentives(2) | | | Target Pay(1) | |

| Christopher E. Kubasik | | $ | 1,200,000 | | | | 130% |

| | $ | 9,600,000 | | | $ | 12,360,000 | |

| Ralph G. D’Ambrosio | | | 730,500 | | | | 100% |

| | | 2,700,000 | | | | 4,161,000 | |

| Ann D. Davidson | | | 618,000 | | | | 90% |

| | | 1,000,000 | | | | 2,174,200 | |

| Todd W. Gautier | | | 546,300 | | | | 100% |

| | | 1,300,000 | | | | 2,392,600 | |

| Jeffrey A. Miller | | | 520,550 | | | | 100% |

| | | 1,000,000 | | | | 2,041,100 | |

| (1) | Other than with respect to Messrs. Kubasik and Miller, amounts disclosed in the Salary column represent the annualized base salary established for each named executive officer by the Committee effective February 24, 2018. Mr. Kubasik’s annualized base salary became effective on January 1, 2018 in connection with his promotion to Chief Executive Officer. Mr. Miller’s annualized base salary was initially set at $488,800 effective February 24, 2018 in connection with his then existing role as president of our Sensor Systems segment, and was increased to $565,000 in connection with his promotion to president of our ISR Systems segment effective August 2, 2018. The amounts disclosed in the Salary and Target Pay columns for Mr. Miller reflect his prorated annualized based salary for his service during 2018 in these roles. |

| (2) | The amounts disclosed in this column exclude the value of long-term incentives granted to Messrs. Kubasik and Miller in December 2018, in lieu of being granted in February 2019 as part of their respective 2019 target pay, to mitigate potential excise taxes that may be applicable under Section 280G of the Internal Revenue Code in connection with the L3 Harris Merger. For a further discussion, see “– Summary of 2019 Target Pay” beginning on page 29. |

For 2018, our Chief Executive Officer’s target pay was set by the Committee to approximate market median. The Committee approved target pay increases for Mr. D’Ambrosio and Ms. Davidson that reflected their strong, long-term individual performance. The Committee also approved market-based increases to the target pay of Messrs. Gautier and Miller to bring their pay closer to market median (including, in the case of Mr. Miller, in connection with his promotion to president of our ISR Systems segment in August 2018). Following these pay adjustments, the 2018 target pay of our named executive officers other than our Chief Executive Officer fell, on average, within a competitive range of 85% to 115% of market median. For a further discussion, see “– Use of Market Data and Competitive Compensation Positioning” beginning on page 18.

2018 Incentive Plan Payouts. Payouts under our annual incentive plan and our long-term incentive plan performance awards are subject to the achievement of pre-established targets.

With respect to our annual incentive plan, our overall financial performance was above plan targets, and the applicable functional and personal performance of each of our named executive officers was also assessed as above target. Accordingly, calculated payouts under our annual incentive plan were above target for all of our named executive officers. Notwithstanding the formula-based calculation of these payouts under our annual incentive plan, after considering all aspects of our financial performance for 2018, including the fact that our 2018 segment operating margin fell below management’s internal objectives, Mr. Kubasik recommended and the Committee agreed that calculated payouts for Messrs. Kubasik and D’Ambrosio should be reduced by approximately 10% and for our other named executive officers by approximately 5%. For a further discussion, see “– Elements of 2018 Target Pay – Annual Incentives” beginning on page 20.

For our long-term performance awards that vested on December 31, 2018, our three-year performance achievements exceeded the maximum performance target for EPS and were at the 75th percentile of our peer group for relative total shareholder return. Based on these results, our named executive officers received performance award payouts at 200% of their target awards for each of these performance measures. For a further discussion, see “– Payment of Performance Awards for the 2016-2018 Award Cycle” on page 29.

2018 SHAREHOLDER ADVISORY VOTE ON EXECUTIVE COMPENSATION (“Say-on-Pay”)

At our 2018 annual shareholders meeting, approximately 96% of the votes cast on our Say-on-Pay proposal were voted in favor of the compensation paid to our named executive officers for 2017. We believe that this strong level of shareholder support demonstrates, among other things, the effectiveness of the significant changes made to our compensation program over the past several years in response to shareholder feedback. The Committee considers the outcome of Say-on-Pay votes and other shareholder input in making decisions regarding the executive compensation program.

SOUND PAY PRACTICES

The Committee believes L3’s executive compensation program reinforces its pay-for-performance culture and includes corporate governance practices that are considered by investors to reflect market “best practices.” The table below highlights key features of our executive compensation program.

| Executive Compensation Program Features |

Executive Compensation Program Includes | • Emphasis on long-term, performance-based compensation and meaningful stock ownership guidelines to align executive and shareholder interests • Transparent, formulaic incentive plans designed to promote short- and long-term business success • Performance conditions on the Chief Executive Officer’s stock options • Clawback policy that applies to all incentive compensation, including equity-based awards • Modest perquisites consistent with competitive practices • Double trigger provisions for severance payable in the event of a change in control • Annual compensation risk assessment to ensure program does not encourage excessive risk-taking • Tally sheet analysis to better understand current and accumulated compensation and benefits |

Executive Compensation Program Does Not Include or Prohibits | • Excise tax gross-ups on severance/change in control payments • Repricing of stock options or other equity-based awards without shareholder approval • Pension plan/SERP credit for years not worked with L3 or its predecessor companies • Excessive severance or change in control provisions • Payment of dividends on stock options, or on other equity-based awards prior to vesting • Hedging or pledging of L3 stock by executives, employees and non-employee directors |

PROGRAM OVERVIEW

The table below outlines the principal elements of our executive compensation program. Detailed descriptions of each element of compensation and discussion of how the Committee determined compensation levels for 2018 can be found in the section “– Elements of 2018 Target Pay” beginning on page 19.

Legend: Fixed compensation At-risk compensation Purpose/Objectives lAttract and retain top executives BASE Fixed Cash lSteady income stream SALARY Compensation 2018 Highlights lAnnual "merit" increases eliminated lFuture increases will be based on market benchmarking / positioning CEO, CFO60% Consolidated EPS Purpose/Objectives 80% Financial lLink pay with short-term performance Performance 20% Consolidated FCF lAlign with individual, segment and company performance 20% Individual lFormulaic plan based on pre-established goals Performance 20% Consolidated Organic lPayouts range from 0% to 200% of target Sales Growth lEmphasis on metrics that drive company performance 2018 Highlights Other Corp. Reports60% Consolidated EPS lConsolidated organic sales growth added as a performance measure 60% Financial lIncreased emphasis on financial performance Performance 20% Consolidated FCF lDepartmental performance added as a measure for Corporate ANNUAL20% Departmental Reports (other than CFO) INCENTIVE Performance 20% Consolidated Organic lSegment operating income growth eliminated as a separate 20% Individual Sales Growth performance measure for Segment Presidents Performance 15% Consolidated EPS Segment Presidents 80% Financial 5% Consolidated FCF Performance 20% Individual 20% Consolidated Organic Performance Sales Growth 45% Segment Operating Income 15% Segment FCF 50% Performance Units Purpose/Objectives 40% Performance (Cumulative EPS) lLink pay with long-term performance Awards 50% Performance Cash lPromote stock price appreciation (absolute & relative to peers) (Relative TSR) lAlign executive and shareholder interests lMotivate achievement of long-term business objectives LONG-TERM30% Stock 100% Absolute Stock Price lFacilitate ownership of L3 Common Stock INCENTIVES Options Appreciation lRetention of key employees lPerformance award payouts range from 0% to 200% of target lPerformance vesting conditions imposed on CEO's stock options 30% Restricted CEO Performance Conditions Stock Units 50% Consolidated EPS 2018 Highlights lTSR peer group expanded from 14 to 20 public companies 50% Consolidated FCF

DETERMINING EXECUTIVE COMPENSATION

Role of the Compensation Committee. L3’s executive compensation program is administered by the Committee. The Committee is ultimately responsible for the review and approval of compensation for L3’s Chief Executive Officer and all other executive officers, including the other named executive officers. Key areas of responsibility for the Committee are described in “Committees of the Board of Directors” beginning on page 6.

Role of Management and the Chief Executive Officer. The Company’s human resources, finance and legal departments assist the Committee in the design and development of competitive compensation programs by providing data and analyses to the Committee and Frederic W. Cook (“FW Cook”), the Committee’s independent compensation consultant, in order to ensure that L3’s programs and incentives align with and support the Company’s business strategy. Management also recommends incentive plan metrics, performance targets and other plan objectives to be achieved, based on expected Company performance and subject to Committee approval.

On an annual basis, the Chief Executive Officer reviews the performance of the other executive officers relative to Company performance and their respective functional and/or individual goals, and submits recommendations to the Committee for proposed base salary adjustments, target bonuses and personal ratings under the annual incentive plan, and grant date target values for long-term incentive awards. The Chief Executive Officer further provides the Committee with an annual assessment of his own performance, but otherwise has no role in determining his own compensation. Except as described above, no other executive officer participated in the setting of his or her own compensation or the compensation of any other executive officer.

Role of Compensation Consultants. The Committee has the sole authority to select, retain, terminate and approve the fees payable to outside consultants to provide it with advice on various aspects of executive compensation design and delivery. The Committee has retained FW Cook to advise the Committee as its independent consultant on executive compensation matters generally. During 2018, FW Cook and its affiliates did not provide any services to the Company or any of the Company’s affiliates other than providing (1) advice on executive officer compensation to the Committee and (2) advice on director compensation to both the Committee and the Nominating and Governance Committee of our Board of Directors.

In the course of conducting its activities for the Committee during 2018, FW Cook attended meetings of the Committee and presented its findings and recommendations to the Committee for discussion. FW Cook also met with management to obtain and validate data and review materials. In March of 2019, the Committee evaluated whether any work performed by FW Cook raised any conflict of interest and determined that it did not.

MIX OF PAY

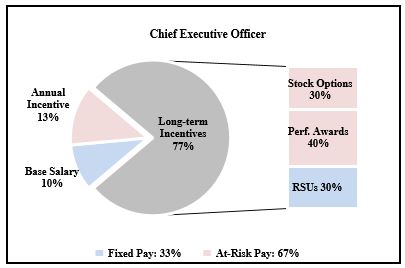

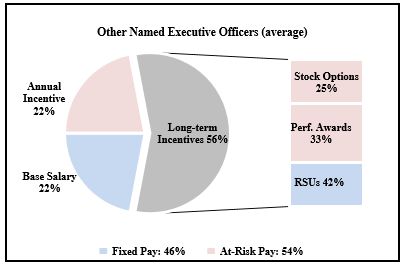

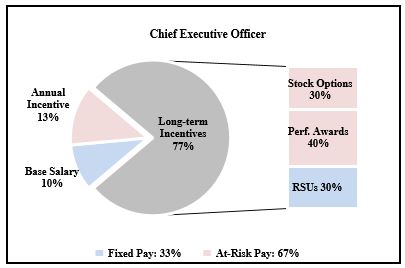

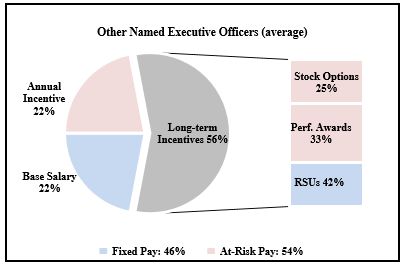

The Committee believes that L3’s pay mix strongly supports the Company’s pay-for-performance culture. In 2018, 67% of the Chief Executive Officer’s 2018 target pay was “at risk” and subject to performance to have any realized value.

Base salary and restricted stock units (“RSUs”) are the only elements of 2018 target pay that are not contingent on future performance to have value (“fixed” pay). However, they both serve to attract and retain top executive talent, and the use of these pay elements is consistent with competitive market practices. As illustrated below, the mix of incentive compensation for our named executive officers is balanced to avoid the risk of emphasizing short-term gains at the expense of long-term performance. The emphasis on long-term incentives demonstrates our strong commitment to the alignment of management and shareholder interests over time.

|  |

Chief Executive OfficerAnnual Incentive 13%Base Salary 10%Long-termIncentives 77%Stock Options 30%Perf. Awards 40%RSUs 30%Fixed Pay: 33%At-Risk Pay: 67%Other Named Executive Officers (average)Annual Incentive 23%Base Salary 24%Long-termIncentives 53%Stock Options 25%Perf. Awards 33%RSUs 42%Fixed Pay: 48%At-Risk Pay: 52% |

USE OF MARKET DATA AND COMPETITIVE COMPENSATION POSITIONING

Compensation Peer Group. The Committee believes that the success of our Company is dependent upon its ability to continue to attract and retain high-performing executives. To ensure the comparability of our executive compensation practices and pay levels, the Committee has historically monitored executive pay at leading defense, aerospace and other industrial companies (the “compensation peer group”) with whom L3 competes for business, executive talent or investor capital. The Committee evaluates each peer company on an annual basis to determine its continued suitability from a pay benchmarking perspective. The selection criteria examined include:

| ▪ | Operational Fit: companies in the same or similar industries with a comparable business mix and client base, and diversified global operations. Due to the limited number of “pure defense” companies of comparable size, the Committee believes that it is appropriate to include other companies in L3’s compensation peer group that are similar in size and compete with L3 for executive talent or investor capital. |

| ▪ | Financial Scope: companies of similar size as measured by annual corporate revenues. At the time this peer group was approved, most of the peers fell within a range of one-third to three times the size of L3. In limited circumstances, the Committee has found it appropriate to include companies with revenues that fall both above and below this range when they are proven competitors for business, executive talent or investor capital. |

The table below shows the composition of our peer group used to benchmark target pay in 2018 and indicates those companies that were added or removed for 2018 as compared to the peer group used to benchmark target pay in 2017.

| 2018 Compensation Peer Group |

Eaton Corporation *

| Leidos Holdings, Inc. | Rockwell Collins, Inc. |

| General Dynamics Corporation | Lockheed Martin Corporation. | Spirit AeroSystems Holdings, Inc. |

| Harris Corporation | Northrop Grumman Corporation | Textron, Inc. |

| Honeywell International, Inc. | Orbital ATK, Inc.** | TransDigm Group Incorporated |

| Huntington Ingalls Industries, Inc. | Parker Hannifin Corporation | |

| Ingersoll-Rand plc | Raytheon Company | |

| * | Removed from the compensation peer group for 2018 |

| ** | Added to the compensation peer group for 2018 |

The peer group used to benchmark target pay in 2018 was established in connection with the Committee’s review of the suitability of the peer group companies conducted in June 2017. At that time, the Committee determined to replace Eaton with Orbital ATK, as Eaton’s aerospace segment was the smallest among its five segments and had declined over time to only 9% of Eaton’s total revenue, while Orbital ATK is an aerospace and defense company that falls within appropriate size parameters and competes with L3 in similar markets.

In June 2018, the Committee conducted its review of the suitability of the peer group companies to be used to benchmark target pay in 2019 and determined not to make any further changes to the peer group at that time.

Use of Market Data. In reviewing competitive compensation levels for 2018, the Committee considered compensation peer group data for all named executive officers other than Ms. Davidson. The Committee did not utilize compensation peer group data for Ms. Davidson (who serves as our Chief Legal Officer) due to the limited number of publicly available benchmarking matches for her position within the compensation peer group. Instead, the Committee used survey data from the Willis Towers Watson Executive Compensation Database General Industry survey (the “General Industry Survey Data”) for this purpose. For Messrs. Gautier and Miller, who serve as segment presidents, the Committee considered competitive compensation levels based on the average of the compensation peer group data and the General Industry Survey Data because it believed that including a broader industry group more accurately reflects the labor market for segment presidents and ensures a meaningful sample size given the revenue of the segments they lead.

Competitive Market Positioning. The Committee’s general practice is to make pay decisions regarding the elements of compensation that compose each named executive officer’s target pay (base salary, target bonus and grant date target value of long-term incentives) in February of each fiscal year. As part of its decision-making process, the Committee compares each named executive officer’s target pay for the fiscal year against the market median; however, the Committee does not use market data in isolation in determining pay. Instead, competitive market data serves as one of many considerations used by the Committee in determining base salary adjustments and target pay opportunities for both annual and long-term incentives. The primary factors considered by the Committee in making its annual pay determinations are shown below.

| Target Pay Determinants |

| • Positioning to competitive market median | • Long-term financial and individual performance | • Role and responsibilities relative to benchmark |

| • Competitive mix of fixed and at-risk pay | • Tenure and experience in role | • Internal pay equity |

| • Competitive mix of cash and equity | • Expected future contributions and market conditions | • Prior year’s compensation levels |

As discussed in “– Compensation Philosophy, 2018 Target Pay and 2018 Incentive Plan Payouts – 2018 Target Pay” beginning on page 13, our Chief Executive Officer’s target pay was set by the Committee at the beginning of 2018 to approximate market median, while the target pay of our other named executive officers for 2018 fell, on average, within a competitive range of 85% to 115% of market median.

ELEMENTS OF 2018 TARGET PAY

Base Salary

Base salary serves as the foundation of an executive’s compensation and is an important component in L3’s ability to attract and retain executive talent. The Committee considers each executive’s role and responsibilities, experience, tenure, business results and individual performance, competitive market pay levels, and internal pay equity in making base salary adjustments. In the first quarter of 2018, the Committee increased Mr. Kubasik’s base salary in connection with his promotion to Chief Executive Officer and increased the base salaries of Messrs. Gautier and Miller to bring their pay closer to market median. The Committee further increased Mr. Miller’s pay in August 2018 in connection with his promotion to president of our ISR Systems segment. No base salary changes were made during 2018 for Mr. D’Ambrosio or Ms. Davidson.

| | | 2018 Salary(1) (in thousands) | |

| Christopher E. Kubasik | | $ | 1,200 | |

| Ralph G. D’Ambrosio | | | 731 | |

| Ann D. Davidson | | | 618 | |

| Todd W. Gautier | | | 546 | |

| Jeffrey A. Miller | | | 521 | |

| (1) | Other than with respect to Messrs. Kubasik and Miller, amounts disclosed in the 2018 Salary column represent the 2018 annualized base salary established for each named executive officer by the Committee effective February 24, 2018. Mr. Kubasik’s annualized base salary became effective on January 1, 2018. Mr. Miller’s annualized base salary was initially set at $488,800 effective February 24, 2018 in connection with his then existing role as president of our Sensor Systems segment, and was increased to $565,000 in connection with his promotion to president of our ISR Systems segment effective August 2, 2018. The amounts disclosed in the 2018 Salary column for Mr. Miller reflect his prorated annualized based salary for his service during 2018 in these roles. |

Annual Incentives

The annual incentive plan provides senior executives with the opportunity to earn annual cash incentive awards based on corporate, segment, functional and individual performance relative to pre-established internal targets.

| Award Determination under Annual Incentive Plan |

| • Performance criteria defined at the beginning of the performance period |

| • Performance compared to pre-established goals |

| • For corporate named executive officers, financial performance is based on consolidated EPS, FCF and OSG results |

| • For segment presidents, financial performance is primarily based on the operating income (“OI”) and FCF results for their respective segments, with additional consideration given to consolidated EPS, FCF and OSG results |

| • Functional and individual performance measured based on pre-established goals and assigned specific weightings |

| • Payouts can range from 0% to 200% of target bonus based on performance |

The Committee established the overall design of the annual incentive plan for 2018 in February 2018. The 2018 plan design is similar to the 2017 design, except for the following changes:

| Changes to Annual Incentive Plan Design for 2018 |

| • Consolidated OSG was added as a performance measure for all participants |

| • For all corporate participants other than the CEO and CFO, functional performance was added as a performance measure |

| • The weighting of financial performance in determining overall plan payouts was increased |

| • The maximum payout for segment presidents was reduced to 200%, by eliminating a separate opportunity for an additional 25% payout based solely on segment organic income growth |

The Committee established the 2018 consolidated and segment financial targets under the annual incentive plan in February 2018. The consolidated financial targets were based on management’s most recent consolidated internal financial plan presented to L3’s Board of Directors (the “2018 Plan”), which formed the basis for L3’s financial guidance disclosed to investors in January 2018. The segment financial targets for OI and FCF were based on internal segment financial plans that were consistent with the 2018 Plan.

Based on L3’s actual 2018 financial performance relative to plan and the Committee’s assessment of the named executive officers’ functional and individual performance for 2018, the Committee approved 2018 annual incentive payouts for the named executive officers as detailed in the steps below.

STEP 1. Determine target bonus at beginning of fiscal year

Annual incentive plan (“AIP”) target bonuses are set as a percentage of base salary in connection with the determination of target pay for each named executive officer. For 2018, the Committee increased Mr. Kubasik’s target bonus percentage in connection with his promotion to Chief Executive Officer effective January 1, 2018. The Committee also approved increases in the target bonus percentages for Mr. D’Ambrosio and Ms. Davidson that reflected their strong, long-term individual performance. The 2018 target bonus percentage for each of Messrs. Gautier and Miller was held constant at 2017 levels.

| | | 2018 Salary(1) (in thousands) | | | 2018 AIP Target Bonus (%) | | | 2018 AIP Target Bonus (in thousands) | |

| Christopher E. Kubasik | | $ | 1,200 | | | | 130% |

| | $ | 1,560 | |

| Ralph G. D’Ambrosio | | | 731 | | | | 100% |

| | | 731 | |

| Ann D. Davidson | | | 618 | | | | 90% |

| | | 556 | |

| Todd W. Gautier | | | 546 | | | | 100% |

| | | 546 | |

| Jeffrey A. Miller | | | 521 | | | | 100% |

| | | 521 | |

| (1) | Represents each named executive officer’s annualized base salary that was established as part of their 2018 target pay. For a further discussion, see “– Base Salary” beginning on page 19. |

STEP 2. Determine the financial rating based on performance for the fiscal year

Financial ratings are based on a weighted-average calculation of L3’s consolidated performance (or, for segment presidents, both L3’s and their respective segment’s performance) relative to pre-established targets for key financial measures.

For corporate named executive officers, our annual incentive plan is focused on L3’s consolidated EPS, FCF and OSG performance because we believe that these metrics constitute three of the most important financial measures that create shareholder value.

For segment presidents, our plan emphasizes the respective segment’s OI and FCF performance because we consider those to be important financial measures that segment presidents can directly influence in order to increase L3’s consolidated EPS, FCF and OSG. Our plan also takes into account L3’s consolidated EPS, FCF and OSG results in evaluating segment presidents’ financial ratings in order to align segment presidents’ plan payouts with L3’s overall performance.

The table below provides the relative weightings of these performance measures as utilized in evaluating each named executive officer’s financial rating. We believe that the weightings appropriately reflect the importance of these measures to our overall financial success.

| Corporate Executives | | Segment Presidents | |

| Financial Measure | | Weight | | Financial Measure | | Weight | |

| Consolidated EPS | | | 60% |

| Consolidated EPS | | | 15% |

|

| Consolidated FCF | | | 20% |

| Consolidated FCF | | | 5% |

|

| Consolidated OSG | | | 20% |

| Consolidated OSG | | | 20% |

|

| | | | |

| Segment OI | | | 45% |

|

| | | | |

| Segment FCF | | | 15% |

|

| | | | |

| | | | |

|

| Total | | | 100% |

| Total | | | 100% |

|

Pay-for-Performance: A financial rating of 100% indicates weighted-average performance at target levels (that is, at plan). For each of EPS, FCF and OI, performance that exceeds plan by 15% (or by 25% for segment-level measures) results in a maximum financial rating of 200% for that measure, while performance that is below plan by 15% (or by 25% for segment-level measures) results in a threshold financial rating of 50% for that measure. For OSG, performance that exceeds plan by 50% results in a maximum financial rating of 200% for that measure, while performance that is below plan by 50% results in a threshold financial rating of 50% for that measure. If performance on any measure is below threshold, this results in a financial rating of zero for that measure. The financial rating for each measure is interpolated between these points. The combined financial rating is calculated by adding up each measure’s financial rating multiplied by each measure’s respective weight.

| Performance Level | | Consolidated EPS & FCF (% of Plan Performance) | | | Consolidated OSG (% of Plan Performance) | | | Segment OI & FCF (% of Plan Performance) | | | Financial Rating | |

| Maximum | |

| ≥ 115% | |

| |

| ≥ 150% | |

| |

| ≥ 125% | |

| | | 200% | |

|

| Target | | | 100% | |

| | | 100% | |

| | | 100% | |

| | | 100% | |

|

| Threshold | | | 85% | |

| | | 50% | |

| | | 75% | |

| | | 50% | |

|

| Below Threshold | |

| < 85% | |

| |

| < 50% | |

| |

| < 75% | |

| | | 0% | |

|

In February 2018, the Committee determined that for purposes of calculating actual financial results under the annual incentive plan, the effects of the following pre-established categories of items are not reflective of operating performance, and should be excluded:

| L3 Consolidated EPS Adjustments | | L3 Consolidated FCF Adjustments | | L3 Consolidated OSG Adjustments |

• Impairment losses on goodwill and other intangible assets, or on debt or equity investments • Gains or losses on retirement of debt, or on asset dispositions that are not contemplated under L3’s 2018 plan • Extraordinary gains and losses under U.S. generally accepted accounting principles (“GAAP”) • Non-cash gains or losses on discontinued operations • New accounting standards required to be adopted under GAAP or SEC rules • Gains or losses on litigation matters at or exceeding $5 million individually or $25 million in the aggregate • Gains or losses related to the resolution of income tax contingencies for business acquisitions that existed at the date of acquisition | | • Discretionary contributions to pension plans that exceed the amount forecasted in L3’s plan established in February of the fiscal year • Premiums and other payments in excess of principal and interest associated with the retirement of debt, including income taxes incurred in connection with the debt retirement • Tax payments or benefits associated with gains or losses on business divestitures in determining net cash from operating activities | | • New accounting standards required to be adopted under GAAP or SEC rules |

The Committee subsequently determined to also exclude merger and integration expenses incurred in contemplation of the L3 Harris Merger for purposes of calculating consolidated EPS and FCF under the annual incentive plan for 2018.

The segment OI and FCF performance targets are subject to adjustment based on acquisitions or dispositions that occur during the fiscal year, or to account for internal realignments that result in business units being transferred from one segment to another segment during the fiscal year. In addition, the segment OI and FCF results reflect adjustments to account for the impact of non-operational items that were not anticipated at the time the segment performance targets were established; however, we do not make adjustments for program or operational shortfalls.

2018 Financial Performance Achieved Relative to Plan

Our 2018 performance targets under the annual incentive plan for consolidated EPS, FCF and OSG were $9.40, $900 million and 3.5%, respectively. Based on the methodology set forth above, our weighted-average performance for 2018 resulted in a financial rating of 181% for our corporate named executive officers.

As described above, the 2018 financial performance of our segment named executive officers, Messrs. Gautier and Miller, was measured primarily based on the financial results of their respective segments. During the third quarter of 2018, we realigned the scope of the business units that fell within their respective segments (and, in the case of Mr. Miller, renamed his segment as the ISR Systems segment). To account for these changes, the Committee approved new full-year financial performance targets for the realigned segments, which were calculated consistent with our 2018 Plan as if the realignments had occurred at the beginning of 2018, and measured the full-year financial performance of the original and realigned segments as compared to their original and realigned performance targets, respectively. The financial ratings for Messrs. Gautier and Miller were calculated based on the original and realigned performance achievements of the respective segments they led, which were weighted to account for the portions of 2018 during which they were in effect.

Through September 2018, Mr. Gautier was president of the Electronic Systems segment, which had original, full-year performance targets of $436 million for OI and $432 million for FCF. For the remaining part of the year, Mr. Gautier was president of the realigned Electronic Systems segment, which had realigned, full-year performance targets of $354 million for OI and $359 million for FCF. Based on the methodology set forth above, the overall 2018 financial rating for Mr. Gautier, taking into account both the segment financial results and the corporate financial results above, was 133%.

Through July 2018, Mr. Miller was president of the Sensor Systems segment, which had original, full-year performance targets of $211 million for OI and $218 million for FCF. For the remaining part of the year, Mr. Miller was president of the newly created ISR Systems segment, which had realigned, full-year performance targets of $440 million for OI and $354 million for FCF. Based on the methodology set forth above, the overall 2018 financial rating for Mr. Miller, taking into account both the segment financial results and the corporate financial results above, was 162%.

STEP 3. Determine personal and functional ratings

Personal ratings are based on the assessment of an executive’s performance relative to pre-determined individual goals. The personal rating can range from 0% to 200% of target. For 2018, the Chief Executive Officer provided individual performance assessments and recommended personal ratings for the Committee’s consideration for the other named executive officers based on the factors in the table below. The Chief Executive Officer also submitted a self-assessment addressing his factors listed below, but made no recommendation to the Committee as to his own personal rating. For 2018, each of our named executive officers received a personal rating that was above target (that is, above 100%).

Christopher E. Kubasik (Chairman, Chief Executive Officer and President) | Ralph G. D’Ambrosio (Senior Vice President and Chief Financial Officer) | Ann D. Davidson (Senior Vice President and Chief Legal Officer) | Todd W. Gautier (Senior Vice President and President of Electronic Systems Segment) | Jeffrey A. Miller (Senior Vice President and President of ISR Systems Segment) |

• Leadership

• Strategic planning

• External relations

• Communication / branding

• Optimize operations

• Internal collaboration

• Talent management

• Financial performance

• Risk management

• Board relations / corporate governance | • Financial reporting and forecasting

• Management of capital structure and liquidity

• Internal controls over financial reporting

• Enterprise risk management

• Company-wide cost savings

• Tax planning and strategies

• Expand scope of company-wide shared services

• Talent management | • Strategic advice on legal, regulatory and transactional matters

• Legal risk management

• Corporate and organizational governance

• Contract management and regulatory compliance

• Oversight of ethics and business conduct program

• Legal and compliance-related cost savings | • Winning re- competitions and new business

• Program performance

• Optimize operations / cost savings

• Developing adjacent markets / international expansion

• Internal collaboration

• Talent management

• Identify acquisition targets and integrate acquired businesses

• Continuous process improvements | • Winning re- competitions and new business

• Program performance

• Optimize operations / cost savings

• Developing adjacent markets / international expansion

• Internal collaboration

• Talent management

• Identify acquisition targets and integrate acquired businesses

• Continuous process improvements |

Ms. Davidson also received a functional rating based on the performance of the Company’s legal function relative to pre-determined functional goals, including with respect to talent management, internal reporting, collaboration initiatives, cost savings and efficiency initiatives, strategic advice, leadership, corporate governance, executive compensation, ethics and compliance, contracts and program management and law department operations. The functional rating can range from 0% to 200% of target. For 2018, the Chief Executive Officer assessed the performance of the Company’s legal function and recommended a functional rating for the Committee’s consideration based on this assessment. Following this assessment, Ms. Davidson received a functional rating that was above target (that is, above 100%).

STEP 4. Determine total rating

Each executive’s total rating determines the potential payout under the annual incentive plan and is equal to the weight- adjusted sum of the financial and individual ratings.

| | | Corporate Executives | | | Segment Presidents | |

| | | CEO and CFO (weight) | | | Chief Legal Officer (weight) | | | (weight) | |

| | | | | | | | | | |

| Financial Rating | | | 80% |

| | | 60% |

| | | 80% |

|

| Functional Rating | | | — |

| | | 20% |

| | | — |

|

| Personal Rating | | | 20% |

| | | 20% |

| | | 20% |

|

| Total Rating | | | 100% |

| | | 100% |

| | | 100% |

|

| | | | | | | | | | | |

| |

| | |

Annual Incentive Plan Payout Formula | Total Rating = [Financial Rating x Weight] + [Functional Rating x Weight] + [Personal Rating x Weight] Potential Annual Incentive Plan Payout ($) = Target Bonus ($) x Total Rating |

| | |

STEP 5. Discretionary adjustment

Notwithstanding the performance criteria described above, the Committee has the authority to apply negative discretion to reduce awards that would otherwise be considered “earned” based on the formulaic plan design. For 2018, management and the Committee believed that the calculated payouts under the annual incentive plan did not sufficiently reflect all aspects of the Company’s financial performance for 2018, including the fact that our 2018 segment operating margin fell below management’s internal objectives. Therefore, prior to the Committee’s determination of the awards to be approved under the annual incentive plan for the named executive officers, Mr. Kubasik recommended and the Committee agreed that calculated payouts for Messrs. Kubasik and D’Ambrosio should be reduced by approximately 10% and for our other named executive officers by approximately 5%.

2018 Annual Incentive Plan Payouts. The table below lists the final 2018 annual incentive plan payments to the named executive officers that were approved by the Committee.

| 2018 Annual Incentive Plan Payouts | |

| | | 2018 AIP Target | | | Total Rating | | | Formulaic Payout | | | Discretionary Adjustment | | | 2018 AIP Payout | |

| Named Executive Officer | | [Step 1] | | | [Steps 2-4] | | | [Subtotal] | | | [Step 5] | | | [Total] | |

| Christopher E. Kubasik | | $ | 1,560,000 | | | | 185% |

| | $ | 2,882,880 | | | $ | (287,880 | ) | | $ | 2,595,000 | |

| Ralph G. D’Ambrosio | | | 730,500 | | | | 182% |

| | | 1,328,049 | | | | (133,049 | ) | | | 1,195,000 | |

| Ann D. Davidson | | | 556,200 | | | | 183% |

| | | 1,015,621 | | | | (50,621 | ) | | | 965,000 | |

| Todd W. Gautier | | | 546,300 | | | | 135% |

| | | 739,690 | | | | (36,690 | ) | | | 703,000 | |

| Jeffrey A. Miller | | | 520,550 | | | | 165% |

| | | 857,787 | | | | (42,787 | ) | | | 815,000 | |

Long-Term Incentives

Long-term incentives are intended to align the interests of the named executive officers with shareholders by linking a meaningful portion of executive pay to shareholder value creation over a multi-year period. Long-term incentives are also provided to drive the performance of our long-term business strategy, engage and retain our key executives and facilitate ownership of our Common Stock. The table below details the long-term incentive vehicles granted to our named executive officers in February 2018 as part of their 2018 target pay, and the respective weights of these vehicles as a percentage of the total grant date target value of the long-term incentives awarded. Except for Ms. Davidson, who received 100% of her long-term incentive award in RSUs, the forms and weightings of the long-term incentives awarded to the named executive officers as part of their 2018 target pay are substantially identical to those awarded in 2017.

| Long-term Incentive | | Weight(1) | | Rationale | | Performance Criteria & Other Features |

| Stock Options | | 30% | | • Stock price appreciation | | • Ultimate value dependent on stock price appreciation |

| | | | | • Stock ownership and capital accumulation | | • Vest in equal annual increments over three years with a 10-year term |

| | | | | | | • Exercise price equal to the closing price of our Common Stock on the date of grant |

| | | | | | | • Grants to the Chief Executive Officer include additional performance vesting conditions as described below under “Stock Options” |

| | | | | | | |

| RSUs | | 30% | | • Retention | | • Ultimate value dependent on stock price |

| | | | | • Stock ownership and capital accumulation | | • Vest at the end of three years |

| | | | | | | |

| Performance Awards | | 40% | | • Stock price appreciation | | • 50% Performance Cash Awards: vest at the end of a three-year period based on TSR relative to performance peer group and are paid in cash |

| | | | | • Stock ownership and capital accumulation for performance units | | • 50% Performance Units: vest at the end of a three-year period based on EPS performance and are paid in shares of Common Stock (together with accrued cash dividends on shares of Common Stock earned) |

| | | | | • Motivates achievement of long- term business strategy | | • The actual percentages of the awards that vest range from 0 to 200% of target, based on performance |

| | | | |

| |

|

| | | | | | |

|

| (1) | Ms. Davidson received 100% of her 2018 long-term incentive awards in the form of RSUs. |

For purposes of allocating the total grant date target value of long-term incentives approved by the Committee in accordance with the weightings listed above, stock options are valued based on their grant date fair value for financial reporting purposes, RSUs are valued based on the total number of units awarded multiplied by the closing price of our Common Stock on the grant date, performance cash awards are valued based on the target dollar value at the time the award is made, and performance units are valued based on the target number of units awarded multiplied by the closing price of our Common Stock on the grant date.

2018 Grant Date Target Values for Long-Term Incentive Awards. In connection with determining the total grant date target value of the long-term incentives awarded to each named executive officer as part of their 2018 target pay, the Committee primarily considered the following factors:

| • | Competitive market median pay levels in the context of target pay as described in the section “Use of Market Data and Competitive Compensation Positioning” beginning on page 18; |

| • | The scope of responsibility of the named executive officer relative to the other participants in the long-term incentive program and the relative importance of the named executive officer to the Company’s long term success; |

| • | In the case of the named executive officers other than Mr. Kubasik, the long-term incentive award recommendation of Mr. Kubasik; and |

| • | The grant date target value of the prior year’s long-term incentive awards and the long-term performance of the named executive officer. |

| | | 2018 Grant Date Target Value(1) (in thousands) | |

| Christopher E. Kubasik | | $ | 9,600 | |

| Ralph G. D’Ambrosio | | | 2,700 | |

| Ann D. Davidson | | | 1,000 | |

| Todd W. Gautier | | | 1,300 | |

| Jeffrey A. Miller | | | 1,000 | |

| (1) | The amounts disclosed exclude the value of long-term incentives granted to Messrs. Kubasik and Miller in December 2018, in lieu of being granted in February 2019 as part of their 2019 target pay, to mitigate potential excise taxes that may be applicable under Section 280G of the Internal Revenue Code in connection with the L3 Harris Merger. For a further discussion, see “– Summary of 2019 Target Pay” beginning on page 29. |

Stock Options. Stock options are a regular component of our long-term incentive program. Stock options directly align the long-term interests of our executives with those of shareholders because they provide value only if the price of our Common Stock increases after the options are granted. Stock options are granted with an exercise price equal to the closing price of our Common Stock on the date of grant, generally vest in equal annual increments over a three-year period and expire ten years from the grant date.

Consistent with prior years, the Committee continued to include performance-based vesting conditions on the stock options granted to our Chief Executive Officer in 2018 in order to strengthen the performance-based orientation of our executive compensation programs. As a result,

| • | 50% of these stock options would vest only if L3’s consolidated EPS for the fiscal year ended December 31, 2018 is at least $7.99; and |

| • | 50% of these stock options would vest only if L3’s consolidated FCF for the fiscal year ended December 31, 2018 is at least $765 million. |

In the event that one or both of the performance conditions were not satisfied, the stock options that failed to vest would be forfeited.

Consistent with the terms of last year’s CEO stock option grant, the performance-based vesting requirements for EPS and FCF under the CEO stock options granted in 2018 represent a 15% reduction from the 2018 consolidated financial targets for these measures established by the Committee in February 2018 under the annual incentive plan.

For purposes of evaluating whether the performance conditions have been satisfied, L3’s consolidated EPS and FCF results for 2018 are required to be calculated on the same basis as the methodology established by the Committee in February 2018 used to determine performance for these measures under L3’s annual incentive plan. In February 2019, the Committee determined that both the EPS and FCF performance conditions of the stock options granted to Mr. Kubasik in 2018 were satisfied.

Performance Awards. The performance awards granted by the Committee in 2018 were equally weighted between performance cash awards earned on the basis of relative TSR and performance units earned on the basis of cumulative EPS results, in each case for the three-year period ending December 31, 2020. The payout ultimately earned can range from zero to 200% of the target amount of cash or stock, in each case based on actual performance relative to the pre-determined goals. The Committee chose relative TSR and cumulative EPS because it believes that they are aligned with shareholder value creation, both directly (relative TSR) and indirectly (EPS).

Performance Cash Awards: Relative TSR (50% weighting; denominated and paid in cash) | | | Performance Units: EPS (50% weighting; denominated and paid in stock) |

| Level | Relative TSR

| Payout* | | | Level

| EPS | Payout* |

Maximum

| ≥ 75th Percentile

| 200% | | | Maximum

| ≥ $33.28 | 200% |

| Target | 50th Percentile | 100% | | |

| $31.76 | 150% |

| Threshold | 25th Percentile | 25% | | | Target | $30.25 | 100% |

Below Threshold

| < 25th Percentile

| 0% | | | | $28.74 | 75% |

| | | | | | Threshold

| $27.23 | 50% |

| | | Below Threshold | < $27.23 | 0% |

| | | | | | |

*Interim points are interpolated. | | | *Interim points are interpolated. |

While the Committee has elected to use EPS as a performance measure for both the annual incentive plan and the long-term performance awards, the performance requirements under these plans are designed so that the resulting payouts under the plans reflect different and important aspects of Company performance that are not duplicative. Payouts under the annual incentive plan take into account EPS performance for a single fiscal year, while payouts under the long-term performance awards require EPS performance to be sustained and measured over a three-year period. The Committee believes it is appropriate to separately reward annual and long-term EPS performance achievements because of the importance of EPS in creating shareholder value.

The target performance goal set by the Committee for the 2018 EPS-based performance unit awards reflects a three-year forecast presented by management to the Committee in February 2018. The Committee set the threshold and maximum EPS performance goals under the 2018 performance unit awards based on a range of ±10% of the target three-year goal, which was consistent with the performance range used for the 2017 EPS-based performance awards.

For purposes of calculating actual financial results for the performance unit awards, EPS is required to be calculated on the same basis as the methodology established by the Committee in February 2018 used to determine EPS performance under L3’s annual incentive plan.

Relative Benchmark for the TSR-Based Performance Awards. The Company’s relative TSR performance for its long-term performance awards is assessed over a three-year period using a custom peer group (the “performance peer group”) of companies with a sales mix that is heavily weighted towards sales to the DoD and the defense industry, and which include the primary U.S. public company competitors for each of L3’s reporting segments. For the 2018 awards, the Committee elected to add six companies to the performance peer group that were not included in the performance peer group utilized for the 2017 awards in order to ensure that an appropriate sample size of peer companies remained following pending consolidations among them. The companies included in the 2018 performance peer group at the time of grant are listed below.

| | Performance Peer Group | |

| Aerojet Rocketdyne Holdings, Inc.* | FLIR Systems, Inc. | Northrop Grumman Corporation |

| BAE Systems | General Dynamics Corporation | Orbital ATK, Inc. |

| BWX Technologies, Inc.* | Harris Corporation | Raytheon Company |

| CAE Inc.* | Huntington Ingalls Industries, Inc. | Rockwell Collins, Inc. |

| Cubic Corporation | Leidos Holdings, Inc.* | Teledyne Technologies Inc. |

| Curtiss-Wright Corporation* | Lockheed Martin Corporation | Textron Inc. |

| Esterline Technologies Corporation | Moog Inc.* | |

| * | Added to the performance peer group for 2018 |

RSUs. RSUs are a regular component of our long-term incentive program. The Committee believes that RSUs enhance retention of L3’s senior executives. The Committee may also make these awards to recognize increased responsibilities or special contributions, attract new executives, retain executives or recognize other special circumstances. RSU grants generally have the following characteristics:

| • | automatically convert into shares of our Common Stock on the vesting date; |

| • | vest three years from the grant date; and |

| • | accumulate cash dividend equivalents payable in a lump sum contingent upon vesting. |

PAYMENT OF PERFORMANCE AWARDS FOR THE 2016-2018 AWARD CYCLE

In February 2019, the Committee reviewed and certified the results for the performance awards granted to named executive officers in 2016. Payouts under the 2016 performance awards were contingent upon L3’s cumulative EPS and relative TSR achievements over the three-year performance period ending December 31, 2018. The Company’s cumulative EPS achievement exceeded the maximum EPS performance target, and, as a result, the named executive officers earned 200% of the target number of EPS-based performance units originally awarded in 2016 (which were settled in shares of our Common Stock). With respect to the performance cash awards based on relative TSR performance, L3’s TSR was at the 75th percentile of the peer group used to measure our performance under these awards, and, as a result, 200% of the target dollar value originally awarded in 2016 was earned with respect to these awards.

SATISFACTION OF PERFORMANCE-BASED VESTING CONDITIONS FOR 2017 RSU AWARDS

On December 20, 2017, the Committee awarded special, one-time grants of RSUs to Mr. Kubasik and Ms. Davidson which were subject to partial or complete forfeiture if the respective grant date fair values of the RSUs awarded to them on that date exceeded 1.0% (in the case of Mr. Kubasik) or 0.5% (in the case of Ms. Davidson) of our 2018 FCF, calculated on the same basis as the methodology established by the Committee in February 2018 to determine FCF performance under L3’s annual incentive plan. In February 2019, in the Committee reviewed and certified that our 2018 FCF performance was sufficient to avoid any forfeiture of these awards.

SUMMARY OF 2019 TARGET PAY

For 2019, the Committee made the following changes to the target pay levels of our named executive officers:

| • | base salary increases of 3% for each named executive officer other than Mr. Miller (who received a base salary increase effective August 2, 2018 in connection with his prior promotion to president of our ISR Systems segment); |

| • | a market-based increase in the target value of long-term incentives for Mr. Kubasik; |

| • | an increase in the target value of long-term incentives for Mr. Miller in connection with his prior promotion to president of our ISR Systems segment. |

Following these pay adjustments, the 2019 target pay of our named executive officers as detailed below fell, on average, within a competitive range of 85% to 115% of market median.

| | | Salary(1) | | | Target Bonus as % of Salary | | | Target Value of Long-Term Incentives(2) | | | Target Pay | |

| Christopher E. Kubasik | | $ | 1,236,000 | | | 130% |

| | $ | 10,000,000 | | | $ | 12,842,800 | |

| Ralph G. D’Ambrosio | | | 752,415 | | | 100% |

| | | 2,700,000 | | | | 4,204,830 | |

| Ann D. Davidson | | | 636,540 | | | 90% |

| | | 1,000,000 | | | | 2,209,426 | |

| Todd W. Gautier | | | 562,689 | | | 100% |

| | | 1,300,000 | | | | 2,425,378 | |

| Jeffrey A. Miller | | | 565,000 | | | 100% |

| | | 1,300,000 | | | | 2,430,000 | |

| (1) | Amounts disclosed in this column represent the annualized base salary established for each named executive officer by the Committee effective February 23, 2019. |

| (2) | The amounts disclosed in this column include the value of long-term incentives granted to Messrs. Kubasik and Miller in December 2018 as further described below. |

The long-term incentives awarded to Messrs. D’Ambrosio and Gautier and Ms. Davidson as part of their 2019 target pay were granted in February 2019 and were entirely in the form of RSUs. The long-term incentives awarded to Messrs. Kubasik and Miller as part of their 2019 target pay were granted in December 2018, instead of February 2019, in order to mitigate potential excise taxes that may be applicable under Section 280G of the Internal Revenue Code in connection with the L3 Harris Merger. As a result, these awards are reflected in the “Summary Compensation Table” beginning on page 36 as part of the stock awards granted to Messrs. Kubasik and Miller in 2018. The December 2018 grants were made entirely in the form of restricted stock awards (“RSAs”) under which Messrs. Kubasik and Miller were required to make elections under Section 83(b) of the Internal Revenue Code to be taxed on the value of such awards in 2018. The taxes payable by Messrs. Kubasik and Miller in connection with their Section 83(b) elections were satisfied through withholding from the shares subject to their awards.

The long-term incentive awards granted to the named executive officers in December 2018 and February 2019 have terms and conditions that are similar to the terms and conditions of the RSUs previously granted to them as part of their 2018 target pay, except that they are subject to “double trigger” vesting in the event of a change in control of the Company. Accordingly, a change in control of the Company as a result of the L3 Harris Merger or otherwise would not result in accelerated vesting for these awards unless a qualified termination of the named executive officer’s employment occurs within two years following the change in control.

EXECUTIVE BENEFITS AND PERQUISITES

Retirement Plans. L3 provides retirement benefits as part of a competitive compensation package to retain key employees. Messrs. D’Ambrosio and Gautier participate in the L3 Technologies, Inc. Pension Plan (the “Corporate Pension Plan”) and the L3 Link Simulation and Training Retirement Plan (the “Link Pension Plan”), respectively, each of which is a tax-qualified defined benefit plan. Messrs. D’Ambrosio and Gautier also participate in a nonqualified supplemental executive retirement plan (the “SERP”) that restores benefits that are not accrued under the defined benefit plans in which they participate due to limits imposed by the Internal Revenue Code. Messrs. Kubasik and Miller and Ms. Davidson do not participate in any of our defined benefit plans, which were generally closed to new participants hired on or after January 1, 2007. See “2018 Pension Benefits” beginning on page 45 for additional details.

The amounts relating to our defined benefit plans that are reported in the Summary Compensation Table on page 36 under the heading “Change in Pension Value and Nonqualified Deferred Compensation Earnings” are substantially affected by changes in actuarial assumptions made since 2015 that are required under GAAP, and are not the result of any arrangements entered into between the Company and any named executive officer that modify any of our pension plans or enhance any benefits accrued or to be accrued thereunder. For a further discussion of the actuarial assumptions upon which the values reported for 2018 are based, see Note 20 to our audited consolidated financial statements included in the Initial Form 10-K.

It is the Committee’s practice to periodically review the plan design and benefit levels of our retirement plans to ensure that they are consistent with the pay practices of our compensation peer group. The Committee most recently performed this review in 2017. Subsequent to this review, the Company determined to reduce future benefit accruals under substantially all of its salaried defined benefit plans, including the Corporate Pension Plan, the Link Pension Plan and the related portions of the SERP, effective January 1, 2019.

Deferred Compensation Plans. L3 sponsors two nonqualified deferred compensation plans, the L3 Technologies, Inc. Deferred Compensation Plan II (the “DCP II”) and the L3 Technologies, Inc. Supplemental Savings Plan II (the “SSP II”), for a select group of highly compensated executives, including our named executive officers, as a competitive practice.

The DCP II allows for voluntary deferrals by executives, including the named executive officers, of up to 50% of base salary and 100% of annual incentive payouts into an unfunded, nonqualified account. There are no company contributions under this plan, and deferred amounts earn interest at the prime rate.

The SSP II allows for voluntary deferrals by executives, including the named executive officers, of up to 10% of the portion of the executive’s eligible compensation (generally, base salary and annual incentive payouts) that exceeds certain Internal Revenue Code limits into an unfunded, nonqualified account. The Company matches up to the first 4% of eligible compensation that was contributed by a participant during the prior calendar year and makes supplemental contributions of 1% of eligible compensation for participants who do not participate in any defined benefit plan maintained by the Company. Earnings on amounts credited to a participant’s SSP II account are based on participant elections among investment choices, which generally mirror those available to participants in the L3 Technologies Master Savings Plan, which is our tax-qualified, 401(k) defined contribution plan.

Employment, Severance and Change in Control Arrangements. Except as described in “2017 Offer Letter with Christopher E. Kubasik” below and “2018 Letter Agreement with Christopher E. Kubasik” on page 32, L3 does not have any employment agreements with its named executive officers. L3’s named executive officers are covered under both the L3 Technologies, Inc. Executive Severance Plan (the “Executive Severance Plan”), which provides for specified severance benefits in the event of termination by the Company without cause outside of a change of control, and the L3 Technologies, Inc. Change in Control Severance Plan (the “Change in Control Severance Plan”), which provides for specified severance benefits in the event of termination by the Company without cause or by the employee for good reason following a change of control. The purpose of these arrangements is to preserve morale and productivity and encourage retention. Severance benefits under the Executive Severance Plan and the Change in Control Severance Plan are designed to be market competitive and do not provide tax gross-ups. See “Potential Payments Upon Change in Control or Termination of Employment” beginning on page 49 for additional details.

Perquisites. L3 provides the named executive officers with modest perquisites consistent with competitive practices. In 2018, the named executive officers were eligible for an annual executive physical, financial planning services, supplemental life insurance and participation in our executive medical plan. We also provide our Chief Executive Officer with a car and security driver and access to L3’s fractionally-owned aircraft for occasional personal use. Our corporate aircraft policy requires that our Chief Executive Officer reimburse the Company for the incremental costs incurred in connection with his personal use of the aircraft. We also maintain a key employee relocation policy applicable to management employees generally. While Mr. Kubasik completed the relocation of his personal residence to New York in 2017, the final reimbursement to Mr. Kubasik under this policy was made in 2018. For a further discussion, see Note 6 to the “Summary Compensation Table” beginning on page 36.

2017 OFFER LETTER WITH CHRISTOPHER E. KUBASIK

On October 31, 2017, the Company entered into an offer letter with Mr. Kubasik in respect of his pending promotion to Chief Executive Officer effective January 1, 2018. The offer letter provides that Mr. Kubasik’s 2018 target pay would be $12.36 million effective January 1, 2018, composed of an annual base salary of $1.2 million, a target bonus opportunity of 130% of base salary and long-term incentive compensation having a grant date value of $9.6 million.

2018 LETTER AGREEMENT WITH CHRISTOPHER E. KUBASIK

In connection with the execution of the L3 Harris Merger Agreement, the Company entered into a letter agreement with Mr. Kubasik (the “Letter Agreement”) to confirm the terms of the changes to his roles and compensation arrangements in anticipation of, in connection with, and following the contemplated L3 Harris Merger. The Letter Agreement provides that from the closing of the L3 Harris Merger, Mr. Kubasik will serve as the Vice-Chairman, President and Chief Operating Officer of the combined company through the second anniversary of the closing of the L3 Harris Merger or, if earlier, until William M. Brown ceases to serve as the Chief Executive Officer of the combined company, at which point Mr. Kubasik will become the Chief Executive Officer of the combined company. On the third anniversary of the closing of the L3 Harris Merger, Mr. Kubasik will become Chairman of the combined company. Beginning at the closing of the L3 Harris Merger, Mr. Kubasik’s annual target pay would be $14.2 million, composed of an annual base salary of $1.45 million, a target bonus opportunity of $2.5 million and long-term incentive compensation having a grant date value of $10.25 million. Prior to the closing of the L3 Harris Merger, the elements of Mr. Kubasik’s annual target pay may not exceed the levels set forth in the preceding sentence. In all cases, the compensation elements provided to Mr. Kubasik following the closing of the L3 Harris Merger will be no less than the corresponding amounts provided to Mr. Brown. After the closing of the L3 Harris Merger, Mr. Kubasik will also receive a one-time integration award of performance stock units and performance-based stock options with grant date fair values of $2.5 million and $5 million, respectively. Mr. Kubasik will also receive up to $1.25 million for relocation-related expenses, with a tax gross-up of any amounts taxed as ordinary income. The protection period under which Mr. Kubasik will be covered by L3’s Change in Control Severance Plan will be extended until the fourth anniversary after the closing of the L3 Harris Merger, and the definitions of “cause” and “good reason” applicable to Mr. Kubasik thereunder will be modified in certain respects. In the event Mr. Kubasik is terminated following the L3 Harris Merger without “cause” or he terminates his employment for “good reason” (under the modified definitions referred to in the prior sentence), his then outstanding long-term incentive awards (including the one-time integration awards referred to above) will be subject to accelerated vesting and/or remain outstanding and eligible for further vesting in whole or in part. The description of the material terms of Mr. Kubasik’s Letter Agreement set forth above is qualified in its entirety by the description of such terms included in our Form 8-K filed with the SEC on October 15, 2018, which is hereby incorporated by reference.

STOCK OWNERSHIP GUIDELINES AND RETENTION REQUIREMENTS

L3’s stock ownership guidelines reflect the Committee’s belief that executives should accumulate a meaningful level of ownership in Company stock to align their interests with those of our shareholders. The Chief Executive Officer’s ownership guideline is equivalent in value to six times his base salary. Ownership guidelines for senior executives, other than the Chief Executive Officer, range from one and a half to three times base salary depending on roles and organizational levels. The Committee reviews progress toward guideline achievement annually. Each executive subject to stock ownership guidelines is required to retain 50% of net shares (after payment of fees, taxes and exercise prices, if applicable) acquired upon the vesting of stock awards or the exercise of stock options until the guideline multiple of base salary is met.

The stock ownership of our named executive officers as of December 31, 2018, as compared to our guideline and retention requirements is as follows:

| | | Stock Guideline (multiple of salary) | | | Stock Ownership (in dollars) | | | Stock Ownership (multiple of salary) | | Subject to Retention Ratio |

| Christopher E. Kubasik | | | 6.0 | | | $ | 10,311,983 | | | | 8.6 | | No |

| Ralph G. D’Ambrosio | | | 3.0 | | | | 9,791,089 | | | | 13.4 | | No |

Ann D. Davidson(1) | | | 3.0 | | | | 1,558,217 | | | | 2.5 | | Yes |

Todd W. Gautier(1) | | | 3.0 | | | | 1,401,439 | | | | 2.6 | | Yes |

| Jeffrey A. Miller | | | 3.0 | | | | 2,014,110 | | | | 3.6 | | No |

| (1) | Ms. Davidson and Mr. Gautier achieved stock ownership in excess of their respective guidelines in February 2019. |

“Stock ownership” is defined to include shares of Common Stock held outright, shares and share equivalents held in benefit plans, and unvested RSUs and RSAs. Unvested performance units and unexercised stock options are not included in this calculation.

COMPENSATION CLAWBACK POLICY

Under L3’s clawback policy, the Company may recoup and/or cancel any incentive-based compensation, including equity- based compensation, awarded to executives who are subject to the policy, under the following circumstances:

| • | The award was predicated upon the achievement of financial results that were subsequently the subject of a material restatement of L3’s financial statements; |

| • | The executive’s fraud or willful misconduct was a significant contributing cause to the need for the restatement; and |

| • | A smaller award would have been earned under the restated financial results. |

Subject to the discretion and approval of the Board of Directors, the Company will, to the extent permitted by law, seek to recover the amount of incentive compensation paid or payable to the executive in excess of the amount that would have been paid based on the financial restatement.

ANTI-HEDGING AND ANTI-PLEDGING POLICIES

Our policies prohibit the hedging or pledging of our Common Stock by all executives, employees and non-employee directors.

COMPENSATION RISK ASSESSMENT