UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-08231

SPIRIT OF AMERICA INVESTMENT FUND, INC.

(Exact name of registrant as specified in charter)

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Address of principal executive offices) (Zip code)

Mr. David Lerner

David Lerner Associates

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-516-390-5565

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | |

| |

| | |

| ANNUAL REPORT | |

| December 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

| | Spirit of America Real Estate Income and Growth Fund |

| | |

| | Spirit of America Large Cap Value Fund |

| | |

| | Spirit of America Municipal Tax Free Bond Fund |

| | |

| | Spirit of America Income Fund |

| | |

| | Spirit of America Utilities Fund |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We are happy to have this opportunity to share with you, our shareholders, the Annual Report for the Spirit of America Real Estate Income and Growth Fund. This includes a review of our performance in 2023, in addition to a discussion of the economy, and our thoughts on the securities markets.

At Spirit of America Investment Fund, Inc., our team takes a comprehensive approach to investing. We analyze economic trends and evaluate industries that could benefit from those trends. Based upon this analysis, we select investments we believe are positioned to provide the best potential returns. Our portfolio managers and analysts utilize their extensive backgrounds in their respective fields to carefully scrutinize each security in the portfolio on an ongoing basis.

The Spirit of America Real Estate Income and Growth Fund’s investment philosophy continues to seek enduring value in the physical structures of America by investing in real estate companies which own data centers, industrial warehouses, hotels, apartments, and other income producing assets. Our goal is to maximize total return to shareholders by benefitting from the income generated through the rental of these properties, while also participating in potential long term appreciation of asset values.

We thank you for your support, and look forward to your future investment in the Spirit of America Real Estate Income and Growth Fund.

Sincerely,

|

David Lerner President Spirit of America Investment Fund, Inc. |  |

Doug Revello

Portfolio Manager |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final reading of the third quarter 2023 gross domestic product (GDP), to show an increase in the annual growth rate of 4.9%, which was lower than initial projections of 5.2%, mainly because of a decline in consumer spending. At a 4.9% growth rate, the U.S. increased at more than twice the rate of growth in the previous quarter and puts to rest concerns of a recession this year. The solid third-quarter growth came even as the Federal Reserve (Fed) raised interest rates to their highest level in years. The Fed has raised interest rates 11 times since March of last year, pushing the federal funds rates to a 22-year high of 5.25% to 5.5% to slow the economy and lower soaring inflation. Fed Chairman Jerome Powell hinted at the last rate meeting that Fed officials may soon be ready to reverse course on interest rate hikes. “If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026,” Fed Chair Jerome Powell said in a statement. The third quarter growth in the U.S. economy was buoyed by a strong consumer in spite of higher interest rates, ongoing inflation pressures, and a variety of other domestic and global headwinds. The sharp increase came due to contributions from consumer spending, increased inventories, exports, residential investment and government spending. The GDP increase marked the biggest gain since the fourth quarter of 2021. While the U.S. has proven resilient to the various challenges, most economists expect growth to slow considerably in the coming months. However, they generally think the U.S. can skirt a recession absent any other unforeseen shocks.

The U.S labor market closed out 2023 in strong shape as the pace of hiring was even more powerful than expected, the Labor Department reported. December’s job report showed employers added 216,000 positions for the month while the unemployment rate held at 3.7%. Payroll growth showed a sizeable gain from November’s downwardly revised 173,000. October was also revised lower, to 105,000 from 150,000, indicating a slightly less robust picture for growth in the fourth quarter. Economists surveyed by Dow Jones had been looking for payrolls to increase 170,000 and the unemployment rate to nudge higher to 3.8%. The December hiring boost as reflected in the Labor Department report was led by a gain of 52,000 in government jobs and another 38,000 in health-care related fields. The report showed that inflationary pressures, despite receding elsewhere, are still prevalent in the labor market. Average hourly earnings rose 0.4% on the month and were up 4.1% from a year ago, both higher than the respective estimates for 0.3% and 3.9%.

During its December meeting, The Federal Open Market Committee (FOMC) agreed to hold its benchmark rate steady in a range between 5.25% and 5.5%. At the meeting, Federal Reserve officials concluded that interest rate cuts are likely in 2024, though they appeared to provide little in the way of when that might occur, according to the minutes. Members indicated they expect three quarter-percentage point cuts by the end of 2024. Officials noted the progress that has been made in the battle to bring down inflation. They said supply chain factors that contributed substantially to a surge that peaked in mid-2022 appear to have eased. In addition, they cited progress in bringing the labor market better into balance, though that also is a work in progress. The “dot plot” of individual members’ expectations released following the meeting showed that participants expect cuts over the coming three years to bring the overnight borrowing rate back down near the long-run range of 2%. However, the minutes noted an “unusually elevated degree of uncertainty” about the policy path. Several members said it might be necessary to keep the funds rate at an elevated level if inflation doesn’t cooperate, and others noted the potential for additional hikes depending on how conditions evolve. Despite the cautionary tone from Fed officials, markets expect the central bank to cut aggressively in 2024.

Market Commentary

Spurred by the expected end to the Federal Reserve’s cycle of monetary policy tightening, the FTSE Nareit All Equity REITs Index rose 11.4% in 2023. The real turning point for REITs this year took place in the middle of October when the 10-Year Treasury peaked. From October 19th through December 29th, the All Equity REITs index rose 22.1%, while the yield on the 10-Year Treasury dipped from its high of 4.991% on October 19th to ending the year at 3.88%. Data Centers were the number one performing REITs sector this year, returning 30.1% for the year.

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Fund Summary

The Spirit of America Real Estate Income and Growth Fund, SOAAX (the “Fund”), aims to provide high total return through a combination of capital appreciation and dividend income.

As of December 31, 2023, the Fund was invested over 98% in REITs. A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate. REITs provide investors with regular income streams, diversification and long-term capital appreciation. REITs typically pay out all of their taxable income as dividends to shareholders. REITs are tied to almost all aspects of the economy, including apartments, hospitals, hotels, industrial facilities, infrastructure, nursing homes, offices, shopping malls, storage centers, and student housing.

Return Summary

The Fund had a total one year return of 11.22% (no load, gross of fees). This compares to the 13.73% returned by its benchmark, the MSCI US REIT Index, for the same period.

The material factors that affected the Fund were market direction and security selection. The Funds underperformance was due to numerous factors such as sector weightings where the fund was overweight in the Telecom sector by 1.57% which resulted in a (2.88)% total return for the Fund. The Fund was underweight in the Retail sector as compared to its MSCI US REIT benchmark by 4.37% and retail REITs returned over 10% for the year. The Fund did not rely on derivatives or leverage strategies.

The value of the Fund and the securities in which the Fund invests may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED)

Summary of Portfolio Holdings (Unaudited)

| As of December 31, 2023 | | | | | | |

| Residential REITs | | | 20.86 | % | | $ | 16,015,382 | |

| Industrial REITs | | | 16.22 | % | | | 12,459,847 | |

| Retail REITs | | | 12.50 | % | | | 9,599,925 | |

| Self-Storage REITs | | | 11.90 | % | | | 9,138,807 | |

| Data Center REITs | | | 11.02 | % | | | 8,465,577 | |

| Gaming REITs | | | 6.10 | % | | | 4,685,618 | |

| Health Care REITs | | | 5.32 | % | | | 4,084,393 | |

| Hotel REITs | | | 4.73 | % | | | 3,629,397 | |

| Office REITs | | | 2.64 | % | | | 2,027,925 | |

| Specialty REITs | | | 2.53 | % | | | 1,942,577 | |

| Multi Asset Class REITs | | | 2.45 | % | | | 1,881,891 | |

| Infrastructure REITs | | | 1.56 | % | | | 1,198,273 | |

| Energy | | | 1.01 | % | | | 778,609 | |

| Mortage Finance | | | 0.82 | % | | | 631,224 | |

| Timber REITs | | | 0.24 | % | | | 184,281 | |

| Midstream - Oil & Gas | | | 0.10 | % | | | 78,150 | |

| Total Investments | | | 100.00 | % | | $ | 76,801,876 | |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED) (CONT.)

Average Annual Returns (Unaudited)

For the periods ended December 31, 2023

| | 1 Year | 5 Year | 10 Year | Expense Ratios4 |

| Class A Shares - with load | 3.73% | 5.07% | 5.52% | 1.54% |

| Class A Shares - no load | 9.53% | 6.22% | 6.09% | 1.54% |

| Class C Shares - with load1 | 7.75% | 5.46% | 5.34% | 2.24% |

| Class C Shares - no load1 | 8.75% | 5.46% | 5.34% | 2.24% |

| Institutional Shares2 | 9.77% | 6.52% | 6.40% | 1.24% |

| MSCI US REIT Index3 | 13.73% | 7.40% | 7.60% | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 5.25% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | The Morgan Stanley Capital International (“MSCI”) US REIT Index is an unmanaged index. The MSCI US REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity Real Estate Investment Trusts (“REITs”) that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2023. Additional information pertaining to the Fund’s expense ratios as of December 31, 2023, can be found in the Financial Highlights tables. |

Fixed Distribution Policy (Unaudited)

The Board of Directors of the Fund has set a fixed distribution policy whereby the Fund will declare semi-annual distributions comprised of income earned, if any, realized long-term capital gains, if any, and to the extent necessary, return of capital, payable as of June 30 and December 31 of each year in the annual aggregate minimum amount of $0.85 per share. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions. The Fund’s total return based on net asset value is presented in the table above as well as in the Financial Highlights tables

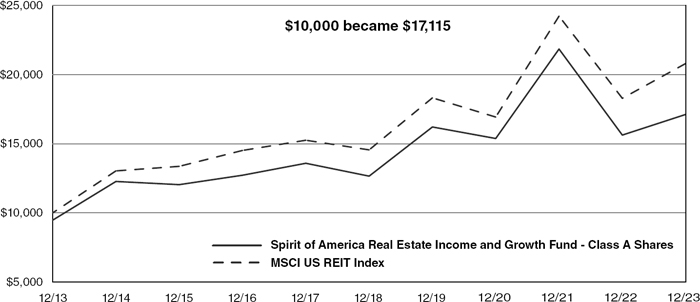

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED) (CONT.)

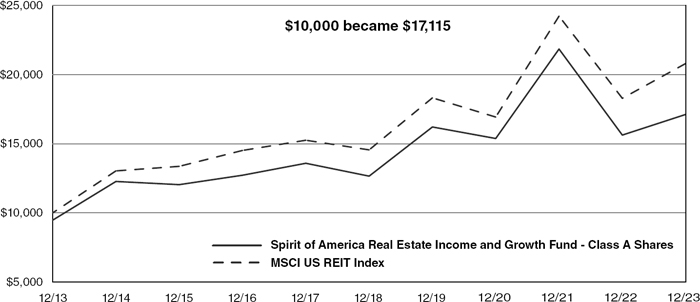

Growth of $10,000 (Unaudited)

(includes one-time 5.25% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund’s Class A Shares over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and future returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We welcome this opportunity to share with you, our investors, the Annual Report for the Spirit of America Large Cap Value Fund along with our thoughts on the market and recent events.

At Spirit of America Investment Fund, Inc., we take a comprehensive approach to investing. Our portfolio managers and analysts use their extensive backgrounds in their respective fields to carefully scrutinize each security in the portfolio on an ongoing basis. We evaluate economic trends, we analyze sectors that could benefit from those trends, and finally, invest in companies that we believe possess strong fundamentals.

We believe that investing in sound companies with attractive valuations will help enhance the long-term returns of the Spirit of America Large Cap Value Fund.

The Spirit of America Large Cap Value Fund’s investment philosophy continues to be to focus on the large cap value segment of the U.S. equity market. Among the valuation factors used to evaluate these stocks are companies with lower debt ratios than their peer group and companies that are undervalued versus the company’s intrinsic worth and future income potential.

We appreciate your continued support and look forward to your future investment in the Spirit of America Large Cap Value Fund.

Sincerely,

|

David Lerner President Spirit of America Investment Fund, Inc. |  |

Doug Revello

Portfolio Manager |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final reading of the third quarter 2023 gross domestic product (GDP), to show an increase in the annual growth rate of 4.9%, which was lower than initial projections of 5.2%, mainly because of a decline in consumer spending. At a 4.9% growth rate, the U.S. increased at more than twice the rate of growth in the previous quarter and puts to rest concerns of a recession this year. The solid third-quarter growth came even as the Federal Reserve (Fed) raised interest rates to their highest level in years. The Fed has raised interest rates 11 times since March of last year, pushing the federal funds rates to a 22-year high of 5.25% to 5.5% to slow the economy and lower soaring inflation. Fed Chairman Jerome Powell hinted at the last rate meeting that Fed officials may soon be ready to reverse course on interest rate hikes. “If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026,” Fed Chair Jerome Powell said in a statement. The third quarter growth in the U.S. economy was buoyed by a strong consumer in spite of higher interest rates, ongoing inflation pressures, and a variety of other domestic and global headwinds. The sharp increase came due to contributions from consumer spending, increased inventories, exports, residential investment and government spending. The GDP increase marked the biggest gain since the fourth quarter of 2021. While the U.S. has proven resilient to the various challenges, most economists expect growth to slow considerably in the coming months. However, they generally think the U.S. can skirt a recession absent any other unforeseen shocks.

The U.S labor market closed out 2023 in strong shape as the pace of hiring was even more powerful than expected, the Labor Department reported. December’s job report showed employers added 216,000 positions for the month while the unemployment rate held at 3.7%. Payroll growth showed a sizeable gain from November’s downwardly revised 173,000. October was also revised lower, to 105,000 from 150,000, indicating a slightly less robust picture for growth in the fourth quarter. Economists surveyed by Dow Jones had been looking for payrolls to increase 170,000 and the unemployment rate to nudge higher to 3.8%. The December hiring boost as reflected in the Labor Department report was led by a gain of 52,000 in government jobs and another 38,000 in health-care related fields. The report showed that inflationary pressures, despite receding elsewhere, are still prevalent in the labor market. Average hourly earnings rose 0.4% on the month and were up 4.1% from a year ago, both higher than the respective estimates for 0.3% and 3.9%.

During its December meeting, The Federal Open Market Committee (FOMC) agreed to hold its benchmark rate steady in a range between 5.25% and 5.5%. At the meeting, Federal Reserve officials concluded that interest rate cuts are likely in 2024, though they appeared to provide little in the way of when that might occur, according to the minutes. Members indicated they expect three quarter-percentage point cuts by the end of 2024. Officials noted the progress that has been made in the battle to bring down inflation. They said supply chain factors that contributed substantially to a surge that peaked in mid-2022 appear to have eased. In addition, they cited progress in bringing the labor market better into balance, though that also is a work in progress. The “dot plot” of individual members’ expectations released following the meeting showed that participants expect cuts over the coming three years to bring the overnight borrowing rate back down near the long-run range of 2%. However, the minutes noted an “unusually elevated degree of uncertainty” about the policy path. Several members said it might be necessary to keep the funds rate at an elevated level if inflation doesn’t cooperate, and others noted the potential for additional hikes depending on how conditions evolve. Despite the cautionary tone from Fed officials, markets expect the central bank to cut aggressively in 2024.

Market Commentary

After a dismal year of stock market returns in 2022, most investors were happy to see the year end and a new year begin. Investors went into 2023 worried about inflation, rising rates, slow economic growth and expecting a recession by the second half of the year. Instead, inflation cooled and the economy remained solid despite numerous early headwinds. The first part of 2023 the market had to endure a regional banking crisis while the Fed raised interest rates four times sparking fears of a credit crunch. The latter half of 2023 saw a market rally driven by speculation that the Fed would cut interest rates. At the FOMC December meeting, officials signaled that no additional increases are expected and they will likely lower rates in the coming year.

2023 marked a much-needed comeback when it came to both stock and bond market performance. Bolstered by the combination of a solid economy, better-than-expected corporate earnings, and an apparent end to the Federal Reserve’s interest rate hikes. Stocks were able to rally over 25% in 2023 led mostly by Technology stocks, more specifically a small group of tech names referred to as the Magnificent Seven. Composed of Apple, Alphabet (Google), Amazon, Meta Platforms

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

(Facebook), Microsoft, Nvidia and Tesla, the group contributed roughly 60% to the S&P 500’s gains in 2023. One of the tailwinds for these stocks is expectations of multiple Fed interest rate cuts in 2024, along with the emerging boom in artificial intelligence technologies.

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Fund Summary

The Spirit of America Large Cap Value Fund, SOAVX (the “Fund”), seeks to provide capital appreciation with a secondary objective of current income. The emphasis of the Fund is focused on investing in a diversified portfolio. We are invested in all 11 sectors on the S&P 500 Index.

The material factors that affected the Fund were market direction, stock selection, and the ongoing Covid-19 pandemic. The value of the Fund and the securities in which the Fund invests may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model. We invest the old-fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on the experience of our dedicated team of professionals.

Return Summary

The Fund had a total return of 27.57% (no load, gross of fees) in 2023. This compares to its benchmark, the S&P 500 Index, which was up 26.29% for the year.

The material factors that affected the Fund’s outperformance of its benchmark, the S&P 500, were market direction and security selection. The Fund continues to invest with a value approach looking for companies with attractive valuations. The Fund outweighed the S&P by 3.49% in the Information Technology sector which was the best performing sector for the year. Another reason for the Fund’s outperformance over the benchmark was the Consumer Staples sector ending the year with a total return down over two percent, and the Fund was two percent less concentrated in that segment than the S&P 500. This was due to the security selection and sector positioning within the Fund.

SPIRIT OF AMERICA LARGE CAP VALUE FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED)

Summary of Portfolio Holdings (Unaudited)

As of December 31, 2023

| Technology | | | 34.72 | % | | $ | 52,393,162 | |

| Health Care | | | 10.66 | % | | | 16,079,811 | |

| Energy | | | 10.19 | % | | | 15,371,171 | |

| Industrials | | | 9.71 | % | | | 14,649,335 | |

| Consumer Staples | | | 8.66 | % | | | 13,059,053 | |

| Financials | | | 7.91 | % | | | 11,926,193 | |

| Consumer Discretionary | | | 6.06 | % | | | 9,135,586 | |

| Communications | | | 6.01 | % | | | 9,065,869 | |

| Utilities | | | 2.57 | % | | | 3,871,952 | |

| Real Estate Investment Trusts (REITs) | | | 1.94 | % | | | 2,927,280 | |

| Materials | | | 1.57 | % | | | 2,366,065 | |

| Total Investments | | | 100.00 | % | | $ | 150,845,477 | |

Average Annual Returns (Unaudited)

For the periods ended December 31, 2023

| | 1 Year | 5 Year | 10 Year | Expense Ratios4 |

| Class A Shares - with load | 19.06% | 13.64% | 9.57% | 1.51% |

| Class A Shares - no load | 25.67% | 14.87% | 10.16% | 1.51% |

| Class C Shares - with load1 | 23.80% | 14.06% | 9.37% | 2.21% |

| Class C Shares - no load1 | 24.80% | 14.06% | 9.37% | 2.21% |

| Institutional Shares2 | 26.05% | 15.22% | 10.49% | 1.21% |

| S&P 500 Index3 | 26.29% | 15.69% | 12.03% | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 5.25% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2023. Additional information pertaining to the Fund’s expense ratios as of December 31, 2023, can be found in the Financial Highlights tables. |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED) (CONT.)

Fixed Distribution Policy (Unaudited)

The Board of Directors of the Fund has set a fixed distribution policy whereby the Fund will declare semi-annual distributions comprised of income earned, if any, realized long-term capital gains, if any, and to the extent necessary, return of capital, payable as of June 30 and December 31 of each year in the annual aggregate minimum amount of $1.40 per share. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions. The Fund’s total return based on net asset value is presented in the table above as well as in the Financial Highlights tables.

SPIRIT OF AMERICA LARGE CAP VALUE FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED) (CONT.)

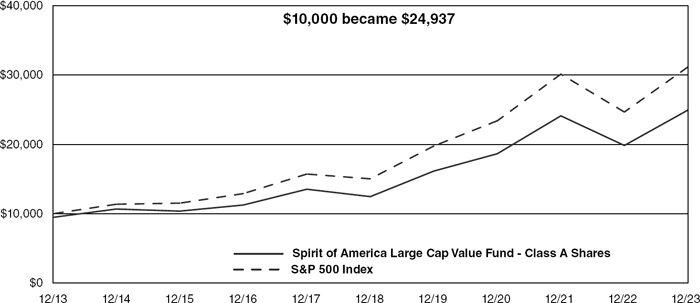

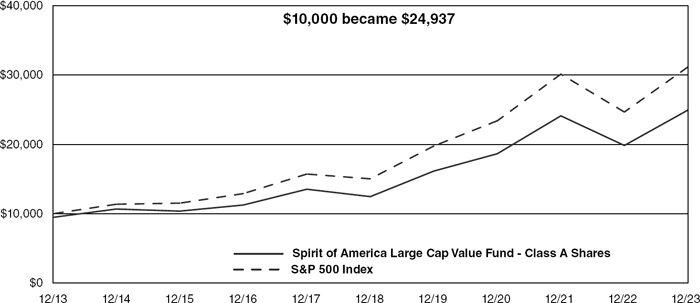

Growth of $10,000 (Unaudited)

(includes one-time 5.25% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund’s Class A Shares over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and future returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We are very pleased to provide the 2023 Annual report for the Spirit of America Municipal Tax Free Bond Fund. We look forward to continued inflows and further development of the Spirit of America Municipal Tax Free Bond Fund.

Our many years of experience in the municipal bond market have helped us to pursue a balance between yield and quality. Our goal is to continue seeking current income that is exempt from federal income tax, while employing a relatively conservative approach to investing in the municipal market. Although the mandate of the Spirit of America Municipal Tax Free Bond Fund allows it to invest in lower rated securities, at this time, the focus will continue to be investing in bonds which are investment grade.

We appreciate your support of our fund and look forward to your future investment in the Spirit of America Municipal Tax Free Bond Fund.

Thank you for being a part of the Spirit of America Family of Funds.

Sincerely,

|

David Lerner President Spirit of America Investment Fund, Inc. |  |

Mark Reilly

Portfolio Manager |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final reading of the third quarter 2023 gross domestic product (GDP), to show an increase in the annual growth rate of 4.9%, which was lower than initial projections of 5.2%, mainly because of a decline in consumer spending. At a 4.9% growth rate, the U.S. increased at more than twice the rate of growth in the previous quarter and puts to rest concerns of a recession this year. The solid third-quarter growth came even as the Federal Reserve raised interest rates to their highest level in years. The Fed has raised interest rates 11 times since March of last year, pushing the federal funds rates to a 22-year high of 5.25% to 5.5% to slow the economy and lower soaring inflation. Fed Chairman Jerome Powell hinted at the last rate meeting that Fed officials may soon be ready to reverse course on interest rate hikes. “If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026,” Fed Chair Jerome Powell said in a statement. The third quarter growth in the U.S. economy was buoyed by a strong consumer in spite of higher interest rates, ongoing inflation pressures, and a variety of other domestic and global headwinds. The sharp increase came due to contributions from consumer spending, increased inventories, exports, residential investment and government spending. The GDP increase marked the biggest gain since the fourth quarter of 2021. While the U.S. has proven resilient to the various challenges, most economists expect growth to slow considerably in the coming months. However, they generally think the U.S. can skirt a recession absent any other unforeseen shocks.

The U.S labor market closed out 2023 in strong shape as the pace of hiring was even more powerful than expected, the Labor Department reported. December’s job report showed employers added 216,000 positions for the month while the unemployment rate held at 3.7%. Payroll growth showed a sizeable gain from November’s downwardly revised 173,000. October was also revised lower, to 105,000 from 150,000, indicating a slightly less robust picture for growth in the fourth quarter. Economists surveyed by Dow Jones had been looking for payrolls to increase 170,000 and the unemployment rate to nudge higher to 3.8%. The December hiring boost as reflected in the Labor Department report was led by a gain of 52,000 in government jobs and another 38,000 in health-care related fields. The report showed that inflationary pressures, despite receding elsewhere, are still prevalent in the labor market. Average hourly earnings rose 0.4% on the month and were up 4.1% from a year ago, both higher than the respective estimates for 0.3% and 3.9%.

During its December meeting, The Federal Open Market Committee (FOMC) agreed to hold its benchmark rate steady in a range between 5.25% and 5.5%. At the meeting, Federal Reserve officials concluded that interest rate cuts are likely in 2024, though they appeared to provide little in the way of when that might occur, according to the minutes. Members indicated they expect three quarter-percentage point cuts by the end of 2024. Officials noted the progress that has been made in the battle to bring down inflation. They said supply chain factors that contributed substantially to a surge that peaked in mid-2022 appear to have eased. In addition, they cited progress in bringing the labor market better into balance, though that also is a work in progress. The “dot plot” of individual members’ expectations released following the meeting showed that participants expect cuts over the coming three years to bring the overnight borrowing rate back down near the long-run range of 2%. However, the minutes noted an “unusually elevated degree of uncertainty” about the policy path. Several members said it might be necessary to keep the funds rate at an elevated level if inflation doesn’t cooperate, and others noted the potential for additional hikes depending on how conditions evolve. Despite the cautionary tone from Fed officials, markets expect the central bank to cut aggressively in 2024.

Market Commentary

Total 2023 municipal bond volume fell slightly from 2022 as market volatility, higher interest rates, pandemic aid and slower economic growth kept issuers on the sidelines. However, a robust fourth quarter buoyed issuance for the year, so volume only ticked down 2.8%, much better than previous quarters where issuance was down double digits. The muni market saw $379.992 billion of debt issues in 2023, only $11.076 billion less than the $391.068 billion seen in 2022. This is less severe than last year when issuance fell 19.1% from 2021. Tax-exempt issuance rose 3.3% to $325.840 billion from $315.317 billion in 2022. Taxable issuance dropped 31% to $37.443 billion from $54.279 billion in 2022. Firms were mixed on expectations of total issuance for 2023. Estimates were between $302 billion and $500 billion by the end of 2022, based on factors such as market volatility, a potential recession and its severity, and Fed policy.

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

The 30 Year US Treasury yield moved from a 3.84% on 1/3/23 to a 4.03% on 12/29/23. The MMD Tax-Free 30 Year AAA yield began the year at a 3.57% on 1/3/23 and ended the year at a 3.42% on 12/29/23. The U.S. 10-year Treasury yield finished 2023 at 3.88% in a momentous year for treasury yields as the Federal Reserve continued its aggressive hiking campaign and investors fretted over high inflation and a potential recession. The 10-year yield started the year at 3.74%. The yield hit a high of 4.99% in October.

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Fund Summary

The Spirit of America Municipal Tax Free Bond Fund’s, SOAMX (the “Fund”), seeks to provide high current income that is exempt from federal income tax, including alternative minimum tax. The Fund focuses on quality credits in the municipal market. We are targeting a balance between attractive yield and quality investments.

The Fund can invest in lower rated securities; however we have kept our focus on investing in bonds that are investment grade. Our plan is to continue with this relatively conservative approach to investing in the municipal market.

In keeping with this philosophy, the Fund has been able to maintain attractive yields without venturing into the speculative, below investment grade, segment of the municipal market. As of December 31, 2023, approximately 97.35% of the portfolio was above investment grade, with 97.35% rated “A” or better. The average rating of holdings in the Fund is Aa2/AA.

One of the Fund’s goals has been to diversify with respect to geographic location and sector. As of the end of December 2023, the Fund consists of 150 different positions varied across 31 states and the District of Columbia. The holdings range throughout various sectors, including areas such as: general obligations, healthcare, education, industrial development and other public improvement bonds.

While it certainly has not been a primary goal of the Fund, we have been able to maintain a percentage of bonds in states and territories which have a state tax exemption in New York, New Jersey and Connecticut, where a majority of our clients reside. Additionally, Puerto Rico bonds are exempt from state tax. Due to the struggles Puerto Rico has been facing, the Fund has actively managed its Puerto Rico holdings. As of December 31, 2023, Puerto Rico holdings now represent 0.00% of the portfolio.

Return Summary

The Fund’s Net Asset Value went from $8.47 to $8.64 during 2023. The Fund is currently at $35,072,256 million in net assets with 1,025 shareholder accounts as of December 31, 2023.

The Fund had a total one year return of 5.44% (no load, gross of fees) for 2023. This compares to the 6.40% return of its benchmark, the Bloomberg Municipal Bond Index, for the same period. That result does not take the Fund’s sales charge and expense ratio into account. The Fund’s slight underperformance relative to the benchmark was largely due to the Fund’s shorter duration and average maturity as compared to the (BBMBI). Longer maturing bonds, in general, experience greater price appreciation than bonds with shorter maturities, when interest rates are falling.

The material factors that affected the Fund were the drop in municipal bond interest rates in 2023 and the continued investment in high quality securities. As a result of the Fund’s focus on quality, it had zero exposure to Puerto Rico whose challenges have been well documented. The Fund does not rely on derivatives or leverage strategies. The value of the Fund and the securities may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Including the sales charge and expenses, as of December 31, 2023, the Fund’s one year return was (0.48%). The Fund had an annualized five year return of (0.09%) and an annualized return since inception of 2.47%. Our plan is to proceed with the same strategy that we have utilized since the Fund’s inception. We will continue to seek out municipal bonds that provide a balance between credit risk and the potential to offer high current income and consistently attractive yields.

Ratings are provided by Moody’s Investor Services and Standard & Poor’s. The Moody’s ratings in the following ratings explanations are in parenthesis.

AAA (Aaa) - The highest rating assigned by Moody’s and S&P. Capacity to pay interest and repay principal is extremely strong. AA (Aa) - Debt has a very strong capacity to pay interest and repay principal and differs from the highest rated issues only in a small degree.

A - Debt rated “A” has a strong capacity to pay interest and repay principal, although it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher-rated categories.

BBB (Baa) - Debt is regarded as having an adequate capacity to pay interest and repay principal. These ratings by Moody’s and S&P are the “cut-off” for a bond to be considered investment grade. Whereas debt normally exhibits adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal in this category than in higher-rated categories.

BB (Bb), B, CCC (Ccc), CC (Cc), C - Debt rated in these categories is regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. “BB” indicates the least degree of speculation and

“C” the highest. While such debt will likely have some quality and protective characteristics, these are outweighed by large uncertainties or market exposure to adverse conditions and are not considered to be investment grade.

D - Debt rated “D” is in payment default. This rating category is used when interest payments or principal payments are not made on the date due, even if the applicable grace period has not expired, unless S&P believes that such payments will be made during such grace period.

Ratings are subject to change.

Ratings apply to the bonds in the portfolio. They do not remove market risk associated with the fund.

Ratings are based on Moody’s and S&P, as applicable. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. If securities are rated differently by the rating agencies, the higher of the two rating is applied thus improving the overall evaluation of the portfolio.

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED)

Summary of Portfolio Holdings (Unaudited)

As of December 31, 2023

| New York | | | 17.70 | % | | $ | 6,155,444 | | | Arizona | | | 1.52 | % | | $ | 529,605 | |

| Florida | | | 10.03 | % | | | 3,488,044 | | | Colorado | | | 1.45 | % | | | 504,229 | |

| Pennsylvania | | | 9.18 | % | | | 3,192,723 | | | Money Market Funds | | | 1.11 | % | | | 387,013 | |

| Texas | | | 7.56 | % | | | 2,628,252 | | | Tennessee | | | 1.01 | % | | | 351,849 | |

| California | | | 6.60 | % | | | 2,296,357 | | | North Carolina | | | 0.93 | % | | | 321,893 | |

| Connecticut | | | 6.18 | % | | | 2,148,936 | | | South Dakota | | | 0.81 | % | | | 283,236 | |

| Massachusetts | | | 6.05 | % | | | 2,103,511 | | | Rhode Island | | | 0.76 | % | | | 265,798 | |

| Illinois | | | 4.04 | % | | | 1,405,307 | | | Iowa | | | 0.76 | % | | | 263,399 | |

| New Jersey | | | 3.49 | % | | | 1,212,909 | | | New Mexico | | | 0.73 | % | | | 255,363 | |

| Nevada | | | 2.77 | % | | | 964,598 | | | Virginia | | | 0.73 | % | | | 254,966 | |

| Georgia | | | 2.44 | % | | | 848,203 | | | Washington | | | 0.73 | % | | | 254,194 | |

| District of Columbia | | | 2.30 | % | | | 799,887 | | | Delaware | | | 0.66 | % | | | 228,053 | |

| Michigan | | | 2.10 | % | | | 728,774 | | | Indiana | | | 0.52 | % | | | 180,609 | |

| Maine | | | 1.78 | % | | | 618,005 | | | Vermont | | | 0.45 | % | | | 155,048 | |

| Nebraska | | | 1.74 | % | | | 605,531 | | | North Dakota | | | 0.29 | % | | | 100,229 | |

| Missouri | | | 1.70 | % | | | 591,300 | | | Wisconsin | | | 0.21 | % | | | 71,340 | |

| Minnesota | | | 1.67 | % | | | 581,375 | | | Total Investments | | | 100.00 | % | | $ | 34,775,980 | |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED) (CONT.)

Average Annual Returns (Unaudited)

For the periods ended December 31, 2023

| | | | | Expense Ratios4 |

| | | | | | With Applicable |

| | 1 Year | 5 Year | 10 Year | Gross | Waivers |

| Class A Shares - with load | (0.48)% | (0.09)% | 2.06% | 1.19% | 0.92% |

| Class A Shares - no load | 4.48% | 0.89% | 2.56% | 1.19% | 0.92% |

| Class C Shares - with load1 | 2.49% | 0.03% | 1.65% | 2.04% | 1.77% |

| Class C Shares - no load1 | 3.49% | 0.03% | 1.65% | 2.04% | 1.77% |

| Institutional Shares2 | 4.64% | 1.04% | 2.71% | 1.04% | 0.77% |

| Bloomberg Municipal Bond Index3 | 6.40% | 2.25% | 3.03% | | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 4.75% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | The Bloomberg Municipal Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2023. Spirit of America Management Corp. (the “Adviser”) has contractually agreed to waive advisory fees and/or reimburse expenses under an Operating Expenses Agreement so that the total operating expenses will not exceed 0.90%, 1.75% and 0.75% of the Class A Shares, Class C Shares and Institutional Shares average daily net assets, respectively, through May 1, 2024. The waiver does not include front end or contingent deferred loads, taxes, interest, dividend expenses, brokerage commissions or expenses incurred in connection with any merger, reorganization, or extraordinary expenses such as litigation. Any amounts waived or reimbursed by the Adviser are subject to reimbursement by the Fund within the following three years, provided the Fund is able to make such reimbursement and remain in compliance with the expense limitations stated above. The Operating Expense Agreement may be terminated at any time, by the Board of Directors, on behalf of the Fund, upon sixty days written notice to the Adviser. Additional information pertaining to the Fund’s expense ratios as of December 31, 2023, can be found in the Financial Highlights tables. |

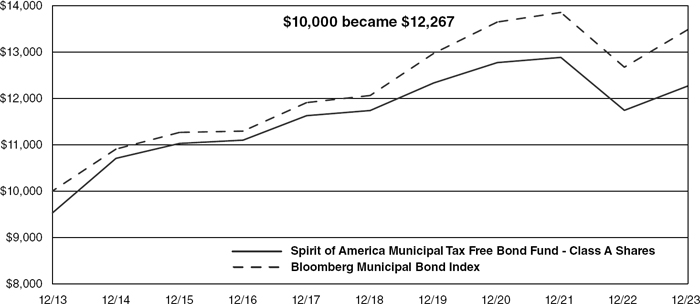

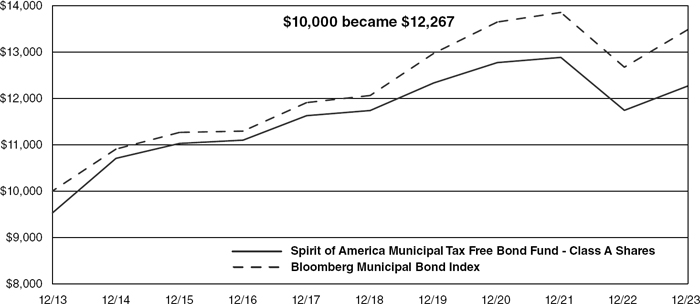

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED) (CONT.)

Growth of $10,000 (Unaudited)

(includes one-time 4.75% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund’s Class A Shares over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and future returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

SPIRIT OF AMERICA INCOME FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We are pleased to send you the 2023 Annual Report for the Spirit of America Income Fund. The Spirit of America Income Fund began operations on December 31, 2008.

As 2023 has come to an end, we could not be more proud and excited about the progress of this fund. Our goal is to continue seeking current income while investing in quality fixed income securities.

We firmly maintain our philosophy that striving for the optimal balance between yield and quality will continue to position us to achieve long term success. Our dedication to providing our investors with a fund that will merit their long term commitment and satisfaction has never been stronger. Now is an excellent time to team up with your Investment Counselor to evaluate your portfolio and make sure you are properly positioned to achieve your investment goals.

Your support is sincerely appreciated and we look forward to your continued confidence in the Spirit of America Income Fund.

Sincerely,

|

David Lerner President Spirit of America Investment Fund, Inc. |  |

Mark Reilly

Portfolio Manager |

SPIRIT OF AMERICA INCOME FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final reading of the third quarter 2023 gross domestic product (GDP), to show an increase in the annual growth rate of 4.9%, which was lower than initial projections of 5.2%, mainly because of a decline in consumer spending. At a 4.9% growth rate, the U.S. increased at more than twice the rate of growth in the previous quarter and puts to rest concerns of a recession this year. The solid third-quarter growth came even as the Federal Reserve raised interest rates to their highest level in years. The Fed has raised interest rates 11 times since March of last year, pushing the federal funds rates to a 22-year high of 5.25% to 5.5% to slow the economy and lower soaring inflation. Fed Chairman Jerome Powell hinted at the last rate meeting that Fed officials may soon be ready to reverse course on interest rate hikes. “If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026,” Fed Chair Jerome Powell said in a statement. The third quarter growth in the U.S. economy was buoyed by a strong consumer in spite of higher interest rates, ongoing inflation pressures, and a variety of other domestic and global headwinds. The sharp increase came due to contributions from consumer spending, increased inventories, exports, residential investment and government spending. The GDP increase marked the biggest gain since the fourth quarter of 2021. While the U.S. has proven resilient to the various challenges, most economists expect growth to slow considerably in the coming months. However, they generally think the U.S. can skirt a recession absent any other unforeseen shocks.

The U.S labor market closed out 2023 in strong shape as the pace of hiring was even more powerful than expected, the Labor Department reported. December’s job report showed employers added 216,000 positions for the month while the unemployment rate held at 3.7%. Payroll growth showed a sizeable gain from November’s downwardly revised 173,000. October was also revised lower, to 105,000 from 150,000, indicating a slightly less robust picture for growth in the fourth quarter. Economists surveyed by Dow Jones had been looking for payrolls to increase 170,000 and the unemployment rate to nudge higher to 3.8%. The December hiring boost as reflected in the Labor Department report was led by a gain of 52,000 in government jobs and another 38,000 in health-care related fields. The report showed that inflationary pressures, despite receding elsewhere, are still prevalent in the labor market. Average hourly earnings rose 0.4% on the month and were up 4.1% from a year ago, both higher than the respective estimates for 0.3% and 3.9%.

During its December meeting, The Federal Open Market Committee (FOMC) agreed to hold its benchmark rate steady in a range between 5.25% and 5.5%. At the meeting, Federal Reserve officials concluded that interest rate cuts are likely in 2024, though they appeared to provide little in the way of when that might occur, according to the minutes. Members indicated they expect three quarter-percentage point cuts by the end of 2024. Officials noted the progress that has been made in the battle to bring down inflation. They said supply chain factors that contributed substantially to a surge that peaked in mid-2022 appear to have eased. In addition, they cited progress in bringing the labor market better into balance, though that also is a work in progress. The “dot plot” of individual members’ expectations released following the meeting showed that participants expect cuts over the coming three years to bring the overnight borrowing rate back down near the long-run range of 2%. However, the minutes noted an “unusually elevated degree of uncertainty” about the policy path. Several members said it might be necessary to keep the funds rate at an elevated level if inflation doesn’t cooperate, and others noted the potential for additional hikes depending on how conditions evolve. Despite the cautionary tone from Fed officials, markets expect the central bank to cut aggressively in 2024.

Market Commentary

Following a brutal 2022, Investors went into 2023 worried about inflation and expecting a recession by the second half of the year. Instead, inflation has cooled and the economy remained solid despite numerous early headwinds. We had the regional banking crisis, which sparked fears of a credit crunch and while the Fed raised interest rates four times over the year, at their December meeting, officials signaled that no additional increases are expected and they will likely lower rates in the coming year.

2023 marked a much-needed comeback when it came to both stock and bond market performance. Bolstered by the combination of a solid economy, better-than-expected corporate earnings, and an apparent end to the Federal Reserve’s interest rate hikes. Stocks were able to rally over 25% in 2023 led mostly by Technology stocks, more specifically a small group of tech names referred to as the Magnificent Seven. Composed of Apple, Alphabet (Google), Amazon, Meta Platforms (Facebook), Microsoft, Nvidia and Tesla, the group contributed roughly 60% to the S&P 500’s gains in 2023. The main tailwind’s for these stocks was due to expectations of multiple Fed rate cuts in 2024, along with the emerging boom in artificial intelligence technologies.

SPIRIT OF AMERICA INCOME FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Total 2023 municipal bond volume fell slightly from 2022 as market volatility, higher interest rates, pandemic aid and slower economic growth kept issuers on the sidelines. However, a robust fourth quarter buoyed issuance for the year, so volume only ticked down 2.8%, much better than previous quarters where issuance was down double digits. The muni market saw $379.992 billion of debt issues in 2023, only $11.076 billion less than the $391.068 billion seen in 2022. This is less severe than last year when issuance fell 19.1% from 2021. Tax-exempt issuance rose 3.3% to $325.840 billion from $315.317 billion in 2022. Taxable issuance dropped 31% to $37.443 billion from $54.279 billion in 2022. Firms were mixed on expectations of total issuance for 2023. Estimates were between $302 billion and $500 billion by the end of 2022, based on factors such as market volatility, a potential recession and its severity, and Fed policy.

The 30 Year US Treasury yield moved from a 3.84% on 1/3/23 to a 4.03% on 12/29/23. The MMD Taxable 30 Year AAA yield began the year at a 5.29% on 1/3/23 and ended the year at a 5.16% on 12/29/23. The U.S.10-year Treasury yield finished 2023 at 3.88% in a momentous year for treasury yields as the Federal Reserve continued its aggressive hiking campaign and investors fretted over high inflation and a potential recession. The 10-year yield started the year at 3.74%. The yield hit a high of 4.99% in October.

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Fund Summary

The Spirit of America Income Fund’s, SOAIX (the “Fund”) objective is to seek high current income. The emphasis of the Fund is focused on investing in a diversified portfolio of taxable municipal bonds, income producing equity securities, preferred stocks, collateralized mortgage obligations, and master limited partnerships (MLPs).

At the end of 2023, the Fund had over 59% of its assets in taxable municipal bonds, more than 20% in preferred stock, over 10% in corporate bonds and more than 8% in common stock securities. We remain diligent in our approach to the market. Here at Spirit of America each and every credit goes through rigorous credit analysis.

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model.

We invest the old-fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on the experience of our dedicated team of professionals. When we began the Fund, we felt the environment was favorable to start an income fund and while past performance is no guarantee of future results; our results continue to validate that belief.

Return Summary

The Fund’s Net Asset Value went from $10.08 to $10.09 during 2023. The Fund is currently at $71,839,917 million in net assets with 3,612 shareholder accounts as of December 31, 2023.

The Fund had a total return of 8.14% (gross of fees) for fiscal year ended December 31, 2023. This compares to the 5.53% returned by its benchmark, the Bloomberg U.S. Aggregate Index, for the same period.

The material factors that affected the Fund were market direction and security selection. The Fund’s outperformance relative to its benchmark was principally due to the performance of the preferred stock holdings within the portfolio, which are not prevalent in the benchmark. The preferred stock holdings within the Fund had a total return of approximately 10% for 2023. The Fund does not rely on derivatives or leverage strategies. The value of the Fund and the securities may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

Including the sales charge and expenses, as of December 31, 2023, the Fund’s one year return was 1.86%. The Fund, which began operations in January 2009, had an annualized five year return of 1.93% and an annualized return since inception of 5.40%.

We plan to proceed with the same game plan we have employed since the Fund began: pursuing a balance between yield and risk with a focus on quality.

SPIRIT OF AMERICA INCOME FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED)

Summary of Portfolio Holdings (Unaudited)

As of December 31, 2023

| Municipal Bonds | | | 59.86 | % | | $ | 42,813,944 | |

| Preferred Stocks | | | 20.16 | % | | | 14,425,995 | |

| Corporate Bonds | | | 10.90 | % | | | 7,799,789 | |

| Common Stocks | | | 9.01 | % | | | 6,448,908 | |

| Collateralized Mortgage Obligations | | | 0.07 | % | | | 52,341 | |

| Total Investments | | | 100.00 | % | | $ | 71,540,977 | |

Average Annual Returns (Unaudited)

For the periods ended December 31, 2023

| | | | | Expense Ratios4 |

| | | | | | With Applicable |

| | 1 Year | 5 Year | 10 Year | Gross | Waivers |

| Class A Shares - with load | 1.86% | 1.93% | 3.50% | 1.18% | 1.12% |

| Class A Shares - no load | 6.94% | 2.92% | 4.00% | 1.18% | 1.12% |

| Class C Shares - with load1 | 5.25% | 2.16% | 3.22% | 1.93% | 1.87% |

| Class C Shares - no load1 | 6.25% | 2.16% | 3.22% | 1.93% | 1.87% |

| Institutional Shares2 | 7.30% | 3.18% | 4.26% | 0.93% | 0.87% |

| Bloomberg U.S. Aggregate Bond Index3 | 5.53% | 1.10% | 1.81% | | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 4.75% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | The Bloomberg U.S. Aggregate Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2023. Spirit of America Management Corp. (the “Adviser”) has contractually agreed to waive advisory fees and/or reimburse expenses under an Operating Expenses Agreement so that the total operating expenses will not exceed 1.10%, 1.85% and 0.85% of the Class A Shares, Class C Shares and Institutional Shares average daily net assets, respectively, through May 1, 2024. The waiver does not include front end or contingent deferred loads, taxes, interest, dividend expenses, brokerage commissions or expenses incurred in connection with any merger, reorganization, or extraordinary expenses such as litigation. Any amounts waived or reimbursed by the Adviser are subject to reimbursement by the Fund within the following three years, provided the Fund is able to make such reimbursement and remain in compliance with the expense limitations stated above. The Operating Expense Agreement may be terminated at any time, by the Board of Directors, on behalf of the Fund, upon sixty days written notice to the Adviser. Additional information pertaining to the Fund’s expense ratios as of December 31, 2023, can be found in the Financial Highlights tables. |

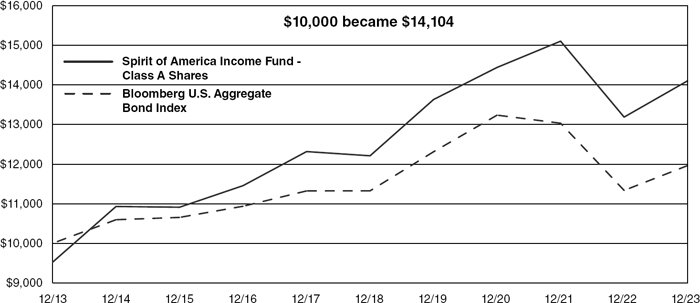

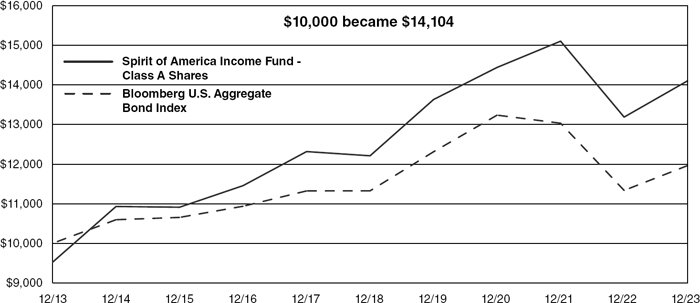

SPIRIT OF AMERICA INCOME FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED) (CONT.)

Growth of $10,000 (Unaudited)

(includes one-time 4.75% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund’s Class A Shares over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and future returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

SPIRIT OF AMERICA UTILITIES FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We welcome this opportunity to share with you, our investors, the Annual Report for the Spirit of America Utilities Fund. The Spirit of America Utilities Fund began operations on January 31, 2023.

At Spirit of America Investment Fund, Inc., we take a comprehensive approach to investing. Our portfolio managers and analysts use their extensive backgrounds in their respective fields to carefully scrutinize each security in the portfolio on an ongoing basis.

We believe that investing in sound companies with attractive valuations will help enhance the long-term returns of the Spirit of America Utilities Fund.

The Spirit of America Utilities Fund’s investment philosophy is to focus on U.S. based companies within the utility sector that are principally engaged in operations such as providing electricity, natural gas, water and communication services to the public.

We appreciate your continued support and look forward to your future investment in the Spirit of America Utilities Fund.

Sincerely,

|

David Lerner President Spirit of America Investment Fund, Inc. |  |

Mark Reilly

Portfolio Manager |

SPIRIT OF AMERICA UTILITIES FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final reading of the third quarter 2023 gross domestic product (GDP), to show an increase in the annual growth rate of 4.9%, which was lower than initial projections of 5.2%, mainly because of a decline in consumer spending. At a 4.9% growth rate, the U.S. increased at more than twice the rate of growth in the previous quarter and puts to rest concerns of a recession this year. The solid third-quarter growth came even as the Federal Reserve raised interest rates to their highest level in years. The Fed has raised interest rates 11 times since March of last year, pushing the federal funds rates to a 22-year high of 5.25% to 5.5% to slow the economy and lower soaring inflation. Fed Chairman Jerome Powell hinted at the last rate meeting that Fed officials may soon be ready to reverse course on interest rate hikes. “If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026,” Fed Chair Jerome Powell said in a statement. The third quarter growth in the U.S. economy was buoyed by a strong consumer in spite of higher interest rates, ongoing inflation pressures, and a variety of other domestic and global headwinds. The sharp increase came due to contributions from consumer spending, increased inventories, exports, residential investment and government spending. The GDP increase marked the biggest gain since the fourth quarter of 2021. While the U.S. has proven resilient to the various challenges, most economists expect growth to slow considerably in the coming months. However, they generally think the U.S. can skirt a recession absent any other unforeseen shocks.

The U.S labor market closed out 2023 in strong shape as the pace of hiring was even more powerful than expected, the Labor Department reported. December’s job report showed employers added 216,000 positions for the month while the unemployment rate held at 3.7%. Payroll growth showed a sizeable gain from November’s downwardly revised 173,000. October was also revised lower, to 105,000 from 150,000, indicating a slightly less robust picture for growth in the fourth quarter. Economists surveyed by Dow Jones had been looking for payrolls to increase 170,000 and the unemployment rate to nudge higher to 3.8%. The December hiring boost as reflected in the Labor Department report was led by a gain of 52,000 in government jobs and another 38,000 in health-care related fields. The report showed that inflationary pressures, despite receding elsewhere, are still prevalent in the labor market. Average hourly earnings rose 0.4% on the month and were up 4.1% from a year ago, both higher than the respective estimates for 0.3% and 3.9%.

During its December meeting, The Federal Open Market Committee (FOMC) agreed to hold its benchmark rate steady in a range between 5.25% and 5.5%. At the meeting, Federal Reserve officials concluded that interest rate cuts are likely in 2024, though they appeared to provide little in the way of when that might occur, according to the minutes. Members indicated they expect three quarter-percentage point cuts by the end of 2024. Officials noted the progress that has been made in the battle to bring down inflation. They said supply chain factors that contributed substantially to a surge that peaked in mid-2022 appear to have eased. In addition, they cited progress in bringing the labor market better into balance, though that also is a work in progress. The “dot plot” of individual members’ expectations released following the meeting showed that participants expect cuts over the coming three years to bring the overnight borrowing rate back down near the long-run range of 2%. However, the minutes noted an “unusually elevated degree of uncertainty” about the policy path. Several members said it might be necessary to keep the funds rate at an elevated level if inflation doesn’t cooperate, and others noted the potential for additional hikes depending on how conditions evolve. Despite the cautionary tone from Fed officials, markets expect the central bank to cut aggressively in 2024.

Market Commentary

Following a brutal 2022, Investors went into 2023 worried about inflation and expecting a recession by the second half of the year. Instead, inflation has cooled and the economy remained solid despite numerous early headwinds. We had the regional banking crisis, which sparked fears of a credit crunch and while the Fed raised interest rates four times over the year, at their December meeting, officials signaled that no additional increases are expected and they will likely lower rates in the coming year.

The utilities sector pulled back in 2023 as investors shifted their favor away from defensive stocks (which shined in 2022) and toward mega-cap growth companies. Gains in the S&P 500 were largely driven by a handful of companies in the technology and communication sectors. But past performance is never a guarantee of future results, and investors should remember that the upside of poor performance is often lower valuations. By late 2023, valuations among utilities stocks had fallen significantly lower and the sector was trading at one of its largest discounts to the S&P in the past 20 years.

SPIRIT OF AMERICA UTILITIES FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Fund Summary

The Spirit of America Utilities Fund’s, SOAUX (the “Fund”) objective is to maximize total return while providing investors a combination of current income and capital appreciation by investing in a diversified portfolio of securities of U.S based utility and utility related companies.

At the end of 2023, the majority of the Fund’s investments are in the electric utility sector engaged in providing electricity to homes and businesses. The Fund also invested a percentage in multi-utility companies, independent power producers, water utilities, gas utilities, renewable electric companies, oil & gas storage & transportation companies as well as environmental & facilities services.

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model.

We invest the old-fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on the experience of our dedicated team of professionals.

Return Summary

The Fund’s Net Asset Value went from $20.00 to $17.48 during 2023. The Fund is currently at $14,468,545 million in net assets with 310 shareholder accounts as of December 31, 2023.

The Fund had a total return of (2.80%) (gross of fees) since inception of January 31, 2023 for year ended December 31, 2023. This compares to the (5.19%) returned by its benchmark, the S&P 500 Utilities Index, for the same period.

The material factors that affected the Fund were market direction and security selection. The Fund’s outperformance relative to its benchmark was principally due to individual stock selection and the management of the Fund’s cash position. When equity markets experience downward pressure, cash positions can act as a buffer against those market trends. The Fund does not rely on derivatives or leverage strategies. The value of the Fund and the securities may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

Including the sales charge and expenses, as of December 31, 2023, the Fund had a return of (9.67%) since inception.

We plan to proceed with the same game plan we have employed since the Fund began: Seeking out quality U.S. based utility companies with strong fundamentals and attractive valuations while providing investors a combination of current income and capital appreciation.

SPIRIT OF AMERICA UTILITIES FUND

ILLUSTRATION OF INVESTMENTS (UNAUDITED)

Summary of Portfolio Holdings (Unaudited)

As of December 31, 2023

| Utilities | | | 92.92 | % | | $ | 13,417,619 | |

| Money Market Funds | | | 6.29 | % | | | 907,907 | |

| Energy | | | 0.48 | % | | | 69,660 | |

| Industrials | | | 0.31 | % | | | 44,775 | |

| Total Investments | | | 100.00 | % | | $ | 14,439,961 | |

Average Annual Returns (Unaudited)

For the periods ended December 31, 2023

| | | Expense Ratios2 |

| | Since | | |

| | Inception | | |

| | (January 31, | | With Applicable |

| | 2023) | Gross | Waivers |

| Class A Shares - with load | (9.67)% | 2.19% | 1.53% |

| Class A Shares - no load | (4.16)% | 2.19% | 1.53% |

| Class C Shares - with load | (5.74)% | 2.94% | 2.28% |

| Class C Shares - no load | (4.85)% | 2.94% | 2.28% |

| Institutional Shares | (4.00)% | 1.94% | 1.28% |

| S&P 500 Utilities Index1 | (5.19)% | | |