Exhibit 99.1 October 30, 2018 Analyst Contact: Megan Patterson 918-561-5325 Media Contact: Stephanie Higgins 918-591-5026 ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance TULSA, Okla. - Oct. 30, 2018 - ONEOK, Inc. (NYSE: OKE) today announced higher third-quarter 2018 financial results, compared with the third quarter 2017, and increased 2018 financial guidance. Higher Third Quarter 2018 Results, Compared With the Third Quarter 2017: • 40 percent increase in operating income to $495.5 million. • 26 percent increase in adjusted EBITDA to $650.2 million. • 1.39 times dividend coverage ratio in the third quarter 2018. • 18 percent increase in natural gas liquids (NGL) volumes gathered. • 15 percent increase in natural gas volumes processed. ONEOK Increases 2018 Financial Guidance: • Net income guidance midpoint increases 9 percent to $1,180 million from $1,085 million. • Adjusted EBITDA guidance midpoint increases 5 percent to $2,470 million from $2,350 million. • Natural gas liquids segment adjusted EBITDA guidance midpoint increases 11 percent to $1,510 million from $1,365 million. “Sustained NGL and natural gas volume growth across our assets continues to result in high-quality earnings growth,” said Terry K. Spencer, ONEOK president and chief executive officer. “Higher volumes in the Williston Basin and the STACK and SCOOP areas, combined with favorable optimization and marketing activities have resulted in another increase to our 2018 financial guidance. “With more than $6 billion of capital-growth projects announced at attractive returns and producer activity remaining strong, our focus remains on serving our customers and completing these projects on time and on budget,” Spencer added. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 2 THIRD-QUARTER 2018 FINANCIAL PERFORMANCE AND HIGHLIGHTS Three Months Ended Nine Months Ended September 30, September 30, 2018 2017 2018 2017 (Millions of dollars, except per share and dividend coverage ratio amounts) Net income attributable to ONEOK (a) $ 313.3 $ 165.7 $ 858.8 $ 324.8 Net income per diluted share (a) $ 0.75 $ 0.43 $ 2.07 $ 1.20 Adjusted EBITDA (b) $ 650.2 $ 517.2 $ 1,822.4 $ 1,439.1 DCF (b) $ 472.1 $ 364.4 $ 1,357.7 $ 1,018.6 DCF in excess of dividends paid $ 132.6 $ 80.9 $ 374.6 $ 204.9 Dividend coverage ratio (b) 1.39 1.29 1.38 1.42 Operating income $ 495.5 $ 354.6 $ 1,363.6 $ 991.2 Operating costs $ 230.4 $ 204.3 $ 670.7 $ 608.6 Depreciation and amortization $ 107.4 $ 102.3 $ 317.9 $ 302.6 Equity in net earnings from investments $ 39.3 $ 40.1 $ 116.1 $ 119.0 Capital expenditures $ 694.3 $ 135.2 $ 1,309.7 $ 330.4 (a) The three- and nine-month periods ending Sept. 30, 2017, include noncash impairment charges of approximately $20.2 million, or 3 cents per diluted share and 5 cents per diluted share, respectively. The nine-month 2017 period also includes nonrecurring pretax cash and noncash charges of approximately $50 million, or 11 cents per diluted share. (b) Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), distributable cash flow (DCF) and dividend coverage ratio are non-GAAP measures. Nine-month 2017 amounts include pretax cash costs associated with the ONEOK and ONEOK Partners merger transaction of approximately $30 million, or 0.05 times dividend coverage. Reconciliations to relevant GAAP measures are included in this news release. ONEOK’s operating income and adjusted EBITDA increased 40 and 26 percent, respectively, in the third quarter 2018, compared with the third quarter 2017. Higher results were driven primarily by natural gas and NGL volume growth in the Williston Basin and STACK and SCOOP areas and increased optimization and marketing activities in the natural gas liquids segment. Results were offset partially by higher employee-related costs in all three segments, higher operating costs associated with the growth of ONEOK’s operations in the natural gas gathering and processing segment, and the timing of routine maintenance projects in the natural gas liquids and natural gas pipelines segments. Operating income for the third quarter 2018 also was impacted by higher depreciation expense due to capital-growth projects placed in service, compared with the third quarter 2017. HIGHLIGHTS: • Declaring in October 2018 a quarterly dividend of 85.5 cents per share, or $3.42 per share on an annualized basis; • DCF in excess of dividends paid of $132.6 million; • Debt-to-EBITDA ratio on an annualized run-rate basis of 3.4 times as of Sept. 30, 2018; -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 3 • Having $84.5 million of cash and cash equivalents and $2.4 billion of borrowing capacity available under its $2.5 billion credit agreement, as of Sept. 30, 2018; • Repaying in August 2018 $425 million of 3.2 percent senior notes due September 2018; • Completing in July 2018 a $1.25 billion public offering of senior notes, consisting of $800 million of 10-year senior notes at a coupon of 4.55 percent and $450 million of 30-year senior notes at a coupon of 5.2 percent, generating net proceeds of $1.23 billion; • Announcing nearly $1.8 billion of additional capital-growth projects since July 2018; and • Completing in July 2018 the acquisition of the remaining 20 percent interest in the West Texas LPG Pipeline Limited Partnership. INCREASED 2018 FINANCIAL GUIDANCE ONEOK’s full-year 2018 net income is expected to be in the range of $1,140 million to $1,220 million, compared with the range of $1,020 million to $1,150 million announced July 31, 2018. ONEOK’s adjusted EBITDA is expected to be in the range of $2,430 million to $2,510 million, compared with its previously announced range of $2,285 million to $2,415 million. The natural gas liquids segment expects full-year 2018 adjusted EBITDA of $1,485 million to $1,535 million, compared with its previously announced range of $1,300 million to $1,430 million. NGLs gathered are expected to average 910,000 to 940,000 barrels per day (bpd), compared with the previously announced range of 850,000 to 1 million bpd, and NGLs fractionated are expected to average 715,000 to 735,000 bpd in 2018, compared with the previously announced range of 650,000 to 725,000 bpd. The increase in the segment’s financial guidance primarily reflects continued volume growth, primarily in the STACK and SCOOP areas, and higher optimization and marketing activities. The natural gas gathering and processing segment expects full-year adjusted EBITDA of $600 million to $620 million, compared with its previously announced range of $575 million to $625 million. The increase in the segment’s financial guidance midpoint is primarily due to volume growth in the Williston Basin and STACK and SCOOP areas and higher average fee rates. Natural gas processed is expected to average 1,775 to 1,855 million cubic feet per day (MMcf/d), compared with the previously announced range of 1,750 to 1,900 MMcf/d. The natural gas pipelines segment expects full-year 2018 adjusted EBITDA of $350 million to $360 million, compared with the previously announced range of $335 million to $355 million. The increase primarily reflects the expectation for continued fee-based earnings growth from increased interruptible volumes and firm transportation capacity contracted. Growth capital expenditures are expected to range from $1,950 million to $2,300 million. Maintenance capital expenditures are expected to range from $170 million to $180 million. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 4 With $1.6 billion of equity issued in 2017 and January 2018, ONEOK has satisfied its expected equity financing needs for its announced capital-growth projects through the remainder of 2018. ONEOK expects to benefit from increasing cash flows from operations in 2019 and expects any additional equity financing to be considered in the latter part of 2019. This consideration will be based on the timing and amount of capital expenditures. If necessary, ONEOK expects any additional equity financing to be limited to issuances under its existing “at- the-market” equity program. ONEOK expects approximately 75 to 85 percent of its total 2018 dividend payments to be a return of capital. Additional information regarding return of capital distributions is available at ONEOK’s investor relations website, ir.oneok.com, under Stock Information. Additional guidance information can be found in the tables. EARNINGS PRESENTATION AND KEY STATISTICS: Additional financial and operating information that will be discussed on the third-quarter 2018 conference call is accessible on ONEOK’s website, www.oneok.com, or from the links below. > View earnings presentation > View earnings tables BUSINESS-SEGMENT RESULTS: Key financial and operating statistics are listed in the tables. Natural Gas Liquids Segment The natural gas liquids segment’s third-quarter 2018 adjusted EBITDA increased 36 percent, compared with the same period in 2017, due primarily to higher earnings from optimization and marketing activities, and increased volumes gathered and fractionated in the Mid-Continent region, primarily in the STACK and SCOOP areas. Third-quarter 2018 NGLs gathered and fractionated increased 18 and 21 percent, respectively, compared with the same period in 2017. Third-quarter 2017 volumes were impacted by temporary industry disruptions from Hurricane Harvey. ONEOK completed the 110,000 barrel per day (bpd) extension of the West Texas LPG pipeline into the Delaware Basin. The segment also connected two third-party natural gas processing plants to its system in the third quarter 2018, one in the STACK and SCOOP area and -more-

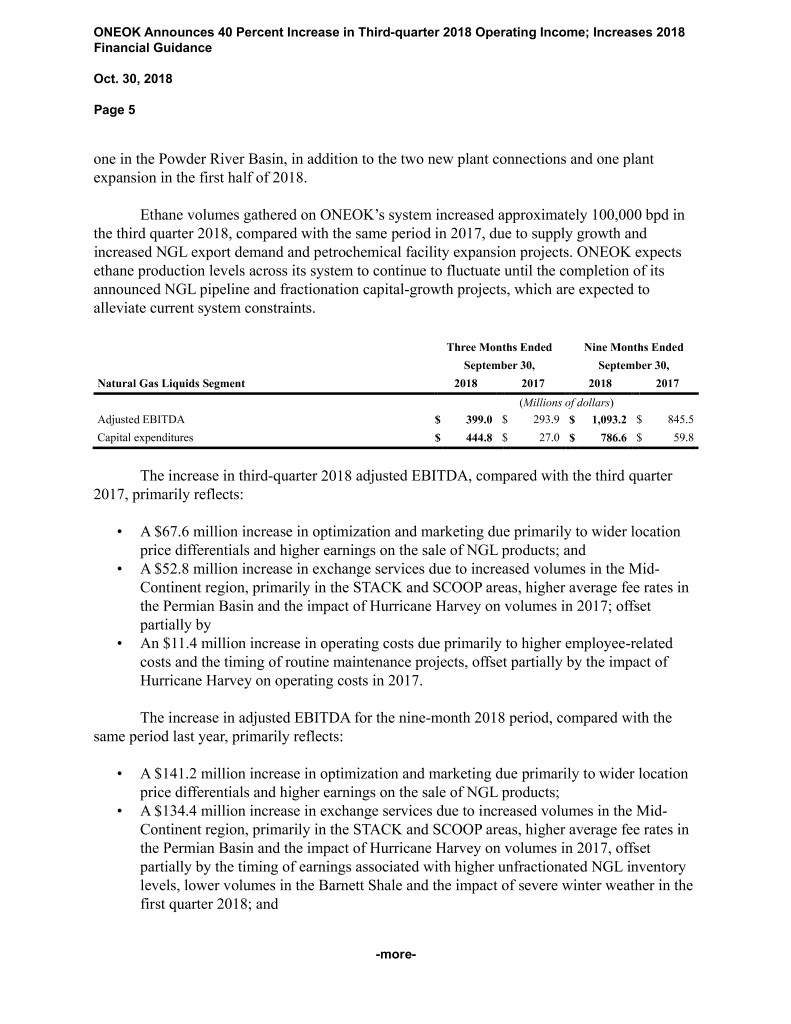

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 5 one in the Powder River Basin, in addition to the two new plant connections and one plant expansion in the first half of 2018. Ethane volumes gathered on ONEOK’s system increased approximately 100,000 bpd in the third quarter 2018, compared with the same period in 2017, due to supply growth and increased NGL export demand and petrochemical facility expansion projects. ONEOK expects ethane production levels across its system to continue to fluctuate until the completion of its announced NGL pipeline and fractionation capital-growth projects, which are expected to alleviate current system constraints. Three Months Ended Nine Months Ended September 30, September 30, Natural Gas Liquids Segment 2018 2017 2018 2017 (Millions of dollars) Adjusted EBITDA $ 399.0 $ 293.9 $ 1,093.2 $ 845.5 Capital expenditures $ 444.8 $ 27.0 $ 786.6 $ 59.8 The increase in third-quarter 2018 adjusted EBITDA, compared with the third quarter 2017, primarily reflects: • A $67.6 million increase in optimization and marketing due primarily to wider location price differentials and higher earnings on the sale of NGL products; and • A $52.8 million increase in exchange services due to increased volumes in the Mid- Continent region, primarily in the STACK and SCOOP areas, higher average fee rates in the Permian Basin and the impact of Hurricane Harvey on volumes in 2017; offset partially by • An $11.4 million increase in operating costs due primarily to higher employee-related costs and the timing of routine maintenance projects, offset partially by the impact of Hurricane Harvey on operating costs in 2017. The increase in adjusted EBITDA for the nine-month 2018 period, compared with the same period last year, primarily reflects: • A $141.2 million increase in optimization and marketing due primarily to wider location price differentials and higher earnings on the sale of NGL products; • A $134.4 million increase in exchange services due to increased volumes in the Mid- Continent region, primarily in the STACK and SCOOP areas, higher average fee rates in the Permian Basin and the impact of Hurricane Harvey on volumes in 2017, offset partially by the timing of earnings associated with higher unfractionated NGL inventory levels, lower volumes in the Barnett Shale and the impact of severe winter weather in the first quarter 2018; and -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 6 • A $5.4 million increase in equity in net earnings from investments due primarily to higher volumes delivered to the Overland Pass Pipeline; offset partially by • A $23.6 million increase in operating costs due primarily to higher employee-related costs, the timing of routine maintenance projects and higher property taxes, offset partially by the impact of Hurricane Harvey on operating costs in 2017; and • A $7.6 million decrease in transportation and storage services due primarily to lower storage capacity contracted with third parties in the Mid-Continent region. Natural Gas Gathering and Processing Segment The natural gas gathering and processing segment’s third-quarter 2018 adjusted EBITDA increased 12 percent, compared with the same period in 2017, due to continued volume growth across ONEOK’s operating basins. Natural gas volumes processed in the third quarter 2018 increased 15 percent, compared with the same period in 2017, due to volume growth in the Williston Basin and STACK and SCOOP areas. The segment also continues to benefit from higher fee-based earnings, with an average fee rate of 92 cents per Million British thermal units (MMBtu) in the third quarter 2018, compared with 86 cents per MMBtu in the third quarter 2017. Three Months Ended Nine Months Ended September 30, September 30, Natural Gas Gathering and Processing Segment 2018 2017 2018 2017 (Millions of dollars) Adjusted EBITDA $ 159.6 $ 142.0 $ 457.0 $ 374.2 Capital expenditures $ 213.0 $ 85.5 $ 433.6 $ 185.7 Third-quarter 2018 adjusted EBITDA increased, compared with the third quarter 2017, which primarily reflects: • A $31.8 million increase due primarily to natural gas volume growth in the Williston Basin and the STACK and SCOOP areas, offset partially by natural production declines; and • A $7.9 million increase due primarily to higher realized NGL and condensate prices; offset partially by • An $11.4 million increase in operating costs due primarily to the growth of ONEOK’s operations and higher employee-related costs; • A $6.7 million decrease due to contract settlements; and • A $3.4 million decrease due primarily to lower equity in net earnings from investments in the dry natural gas area of the Powder River Basin. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 7 The increase in adjusted EBITDA for the nine-month 2018 period, compared with the same period last year, primarily reflects: • A $120.8 million increase due primarily to natural gas volume growth in the Williston Basin and the STACK and SCOOP areas, offset partially by natural production declines; and • A $14.2 million increase due primarily to higher realized NGL and condensate prices, offset partially by lower realized natural gas prices; offset partially by • A $41.9 million increase in operating costs due primarily to the growth of ONEOK’s operations and higher employee-related costs; and • An $8.9 million decrease due primarily to lower equity in net earnings from investments in the dry natural gas area of the Powder River Basin. Natural Gas Pipelines Segment The natural gas pipelines segment’s adjusted EBITDA increased 3 percent in the third quarter 2018, compared with the same period in 2017, due primarily to increased interruptible volumes and firm transportation capacity contracted. Three Months Ended Nine Months Ended September 30, September 30, Natural Gas Pipelines Segment 2018 2017 2018 2017 (Millions of dollars) Adjusted EBITDA $ 90.1 $ 87.5 $ 269.1 $ 251.1 Capital expenditures $ 31.5 $ 18.8 $ 71.9 $ 70.7 The increase in adjusted EBITDA for the third quarter 2018, compared with the third quarter 2017, primarily reflects: • A $9.9 million increase from higher transportation services due primarily to increased interruptible volumes and firm transportation capacity contracted; and • A $1.5 million increase from equity in net earnings due primarily to higher firm transportation revenues on Roadrunner Gas Transmission Pipeline; offset partially by • A $7.0 million increase in operating costs due primarily to higher employee-related costs and the timing of routine maintenance projects; and • A $2.6 million decrease from net retained fuel due primarily to lower equity gas sales related to transportation and storage services. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 8 The increase in adjusted EBITDA for the nine-month 2018 period, compared with the same period last year, primarily reflects: • A $21.4 million increase from higher transportation services due primarily to increased interruptible volumes and firm transportation capacity contracted; and • A $6.3 million increase from natural gas storage services; offset partially by • A $9.6 million increase in operating costs due primarily to higher employee-related costs and the timing of routine maintenance projects. CAPITAL-GROWTH ACTIVITIES: Since June 2017, ONEOK has announced more than $6 billion of organic capital-growth projects to support increasing production across ONEOK’s operating footprint. These projects are backed by a combination of long-term fee-based contracts, volume commitments or acreage dedications. The natural gas liquids and natural gas gathering and processing projects are expected to generate adjusted EBITDA multiples of four to six times. ONEOK’s MB-5 fractionator project also includes system expansions that provide infrastructure capacity to support additional assets as ONEOK continues to evaluate opportunities for fractionation, storage and export facilities to meet the supply and demand needs for NGLs. Since June 2017, the natural gas liquids segment has announced approximately $5 billion of capital-growth projects, which include the following: Approximate Cost Expected Project Scope (Millions of dollars) Completion West Texas LPG 120-mile pipeline lateral extension with 110,000 bpd of (WTLPG) Pipeline capacity in the Delaware Basin $200 (a) Complete expansion 60,000 bpd pipeline expansion from the Mid-Continent to Fourth quarter Sterling III expansion the Gulf Coast, which increases capacity to 250,000 bpd $130 2018 Elk Creek Pipeline 900-mile pipeline from the Williston Basin to the Mid- $1,400 Fourth quarter project Continent with initial capacity up to 240,000 bpd 2019 (b) 530-mile pipeline from the Mid-Continent to the Gulf First quarter Arbuckle II Pipeline Coast with initial capacity of 400,000 bpd $1,360 2020 125,000 bpd fractionator and related infrastructure in Mont First quarter MB-4 fractionator Belvieu, Texas $575 2020 WTLPG pipeline 80,000 bpd mainline expansion with additional pump First quarter expansion and Arbuckle facilities and pipeline looping, and connection to Arbuckle $295 2020 II connection II Pipeline MB-5 fractionator 125,000 bpd fractionator and related infrastructure in Mont $750 First quarter Belvieu, Texas 2021 Arbuckle II Pipeline Extension of pipeline further north into the STACK area First quarter extension and additional NGL gathering infrastructure $240 2021 Arbuckle II Pipeline 100,000 bpd pipeline expansion, which increases capacity First quarter expansion to 500,000 bpd $60 2021 (a) Reflects total project cost. On July 31, 2018, ONEOK acquired the remaining 20 percent interest in the West Texas LPG Pipeline Limited Partnership. (b) ONEOK expects the southern section of the pipeline to be in service as early as the third quarter 2019. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 9 Since June 2017, the natural gas gathering and processing segment has announced approximately $1 billion of capital-growth projects, which include the following: Approximate Cost Expected Project Scope (Millions of dollars) Completion 200 million cubic feet per day (MMcf/d) processing Additional STACK $40 Complete processing capacity capacity through a long-term processing services agreement with a third party Canadian Valley 200 MMcf/d processing plant expansion in the STACK, expansion which increases capacity to more than 400 MMcf/d $160 Complete Demicks Lake I plant 200 MMcf/d processing plant and related infrastructure in $400 Fourth quarter and infrastructure the core of the Williston Basin 2019 Demicks Lake II plant 200 MMcf/d processing plant and related infrastructure in First quarter and infrastructure the core of the Williston Basin $410 2020 In June 2018, the natural gas pipelines segment announced the following projects: Expected Project Scope Completion ONEOK Gas Transportation 100 MMcf/d westbound expansion from the STACK area to multiple Fourth quarter (OGT) westbound expansion western Oklahoma interstate pipeline delivery points 2018 150 MMcf/d eastbound expansion from the STACK and SCOOP areas to First quarter OGT eastbound expansion an eastern Oklahoma interstate pipeline delivery point 2019 ONEOK WesTex Transmission 300 MMcf/d expansion from the Permian Basin to interstate pipeline First quarter expansion delivery points in the Texas Panhandle 2019 Roadrunner Gas Transmission Approximately 1 Bcf/d of eastbound transportation capacity from the First quarter bidirectional project (50 percent owned) Delaware Basin to the Waha area 2019 EARNINGS CONFERENCE CALL AND WEBCAST: ONEOK executive management will conduct a conference call at 11 a.m. Eastern Daylight Time (10 a.m. Central Daylight Time) on Oct. 31, 2018. The call also will be carried live on ONEOK’s website. To participate in the telephone conference call, dial 877-260-1479, pass code 7455940, or log on to www.oneok.com. If you are unable to participate in the conference call or the webcast, the replay will be available on ONEOK’s website, www.oneok.com, for 30 days. A recording will be available by phone for seven days. The playback call may be accessed at 888-203-1112, pass code 7455940. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 10 LINKS TO EARNINGS TABLES AND PRESENTATION: Tables: http://ir.oneok.com/~/media/Files/O/OneOK-IR/financial-reports/2018/q3-2018-earnings-results-financial-news.pdf Presentation: http://ir.oneok.com/~/media/Files/O/OneOK-IR/financial-reports/2018/q3-2018-earnings-results-presentation.pdf NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL MEASURES: ONEOK has disclosed in this news release adjusted EBITDA, distributable cash flow, dividend coverage ratio and projected adjusted EBITDA multiples, which are non-GAAP financial metrics, used to measure the company’s financial performance and are defined as follows: • Adjusted EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, noncash impairment charges, income taxes, noncash compensation expense, allowance for equity funds used during construction (equity AFUDC), and other noncash items; • Distributable cash flow is defined as adjusted EBITDA, computed as described above, less interest expense, maintenance capital expenditures and equity earnings from investments, excluding noncash impairment charges, adjusted for cash distributions received from unconsolidated affiliates and certain other items; • Dividend coverage ratio is defined as ONEOK’s distributable cash flow to ONEOK shareholders divided by the dividends paid for the period; and • Adjusted EBITDA multiples for the announced capital-growth projects reflect the expected adjusted EBITDA to be generated by the projects relative to the capital investment being made. These non-GAAP financial measures described above are useful to investors because they, and similar measures, are used by many companies in the industry as a measure of financial performance and are commonly employed by financial analysts and others to evaluate ONEOK’s financial performance and to compare ONEOK’s financial performance with the performance of other companies within ONEOK’s industry. Adjusted EBITDA, distributable cash flow and dividend coverage ratio should not be considered in isolation or as a substitute for net income, earnings per share or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures exclude some, but not all, items that affect net income. Additionally, these calculations may not be comparable with similarly titled measures of other companies. Reconciliations of net income to adjusted EBITDA, distributable cash flow and dividend coverage ratio are included in the tables. A reconciliation of estimated adjusted EBITDA multiples to GAAP net income is not provided because the GAAP net income generated by the projects is not available without unreasonable efforts. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 11 ONEOK, Inc. (pronounced ONE-OAK) (NYSE: OKE) is a leading midstream service provider and owner of one of the nation's premier natural gas liquids (NGL) systems, connecting NGL supply in the Mid-Continent, Permian and Rocky Mountain regions with key market centers and an extensive network of natural gas gathering, processing, storage and transportation assets. ONEOK is a FORTUNE 500 company and is included in the S&P 500 Index. For information about ONEOK, visit the website: www.oneok.com. For the latest news about ONEOK, find us on LinkedIn, Instagram, Facebook and Twitter. Some of the statements contained and incorporated in this news release are forward-looking statements as defined under federal securities laws. The forward-looking statements relate to ONEOK’s anticipated financial performance (including projected operating income, net income, capital expenditures, cash flows and projected levels of dividends), liquidity, management’s plans and objectives for ONEOK’s future capital-growth projects and other future operations (including plans to construct additional natural gas and natural gas liquids pipelines and processing facilities and related cost estimates), ONEOK’s business prospects, the outcome of regulatory and legal proceedings, market conditions and other matters. ONEOK makes these forward-looking statements in reliance on the safe harbor protections provided under federal securities legislation and other applicable laws. The following discussion is intended to identify important factors that could cause future outcomes to differ materially from those set forth in the forward-looking statements. Forward-looking statements include the items identified in the preceding paragraph, the information concerning possible or assumed future results of ONEOK’s operations and other statements contained or incorporated in this news release identified by words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “should,” “goal,” “forecast,” “guidance,” “could,” “may,” “continue,” “might,” “potential,” “scheduled” and other words and terms of similar meaning. One should not place undue reliance on forward-looking statements. Known and unknown risks, uncertainties and other factors may cause ONEOK’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements. Those factors may affect ONEOK’s operations, markets, products, services and prices. In addition to any assumptions and other factors referred to specifically in connection with the forward-looking statements, factors that could cause ONEOK’s actual results to differ materially from those contemplated in any forward-looking statement include, among others, the following: • the effects of weather and other natural phenomena, including climate change, on ONEOK’s operations, demand for ONEOK’s services and energy prices; • competition from other United States and foreign energy suppliers and transporters, as well as alternative forms of energy, including, but not limited to, solar power, wind power, geothermal energy and biofuels such as ethanol and biodiesel; • the capital intensive nature of ONEOK’s businesses; • the profitability of assets or businesses acquired or constructed by us; • ONEOK’s ability to make cost-saving changes in operations; • risks of marketing, trading and hedging activities, including the risks of changes in energy prices or the financial condition of ONEOK’s counterparties; • the uncertainty of estimates, including accruals and costs of environmental remediation; • the timing and extent of changes in energy commodity prices; • the effects of changes in governmental policies and regulatory actions, including changes with respect to income and other taxes, pipeline safety, environmental compliance, climate change initiatives and authorized rates of recovery of natural gas and natural gas transportation costs; • the impact on drilling and production by factors beyond ONEOK’s control, including the demand for natural gas and crude oil; producers' desire and ability to obtain necessary permits; reserve performance; and capacity constraints on the pipelines that transport crude oil, natural gas and NGLs from producing areas and ONEOK’s facilities; • difficulties or delays experienced by trucks, railroads or pipelines in delivering products to or from ONEOK’s terminals or pipelines; -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 12 • changes in demand for the use of natural gas, NGLs and crude oil because of market conditions caused by concerns about climate change; • the impact of unforeseen changes in interest rates, debt and equity markets, inflation rates, economic recession and other external factors over which we have no control, including the effect on pension and postretirement expense and funding resulting from changes in equity and bond market returns; • ONEOK’s indebtedness and guarantee obligations could make us vulnerable to general adverse economic and industry conditions, limit ONEOK’s ability to borrow additional funds and/or place us at competitive disadvantages compared with ONEOK’s competitors that have less debt, or have other adverse consequences; • actions by rating agencies concerning ONEOK’s credit; • the results of administrative proceedings and litigation, regulatory actions, rule changes and receipt of expected clearances involving any local, state or federal regulatory body, including the Federal Energy Regulatory Commission (FERC), the National Transportation Safety Board, the Pipeline and Hazardous Materials Safety Administration (PHMSA), the U.S. Environmental Protection Agency (EPA) and the U.S. Commodity Futures Trading Commission (CFTC); • ONEOK’s ability to access capital at competitive rates or on terms acceptable to us; • risks associated with adequate supply to ONEOK’s gathering, processing, fractionation and pipeline facilities, including production declines that outpace new drilling or extended periods of ethane rejection; • the risk that material weaknesses or significant deficiencies in ONEOK’s internal controls over financial reporting could emerge or that minor problems could become significant; • the impact and outcome of pending and future litigation; • the ability to market pipeline capacity on favorable terms, including the effects of: – future demand for and prices of natural gas, NGLs and crude oil; – competitive conditions in the overall energy market; – availability of supplies of Canadian and United States natural gas and crude oil; and – availability of additional storage capacity; • performance of contractual obligations by ONEOK’s customers, service providers, contractors and shippers; • the timely receipt of approval by applicable governmental entities for construction and operation of ONEOK’s pipeline and other projects and required regulatory clearances; • ONEOK’s ability to acquire all necessary permits, consents or other approvals in a timely manner, to promptly obtain all necessary materials and supplies required for construction, and to construct gathering, processing, storage, fractionation and transportation facilities without labor or contractor problems; • the mechanical integrity of facilities operated; • demand for ONEOK’s services in the proximity of ONEOK’s facilities; • ONEOK’s ability to control operating costs; • acts of nature, sabotage, terrorism or other similar acts that cause damage to ONEOK’s facilities or ONEOK’s suppliers' or shippers' facilities; • economic climate and growth in the geographic areas in which we do business; • the risk of a prolonged slowdown in growth or decline in the United States or international economies, including liquidity risks in United States or foreign credit markets; • the impact of recently issued and future accounting updates and other changes in accounting policies; • the possibility of future terrorist attacks or the possibility or occurrence of an outbreak of, or changes in, hostilities or changes in the political conditions throughout the world; • the risk of increased costs for insurance premiums, security or other items as a consequence of terrorist attacks; • risks associated with pending or possible acquisitions and dispositions, including ONEOK’s ability to finance or integrate any such acquisitions and any regulatory delay or conditions imposed by regulatory bodies in connection with any such acquisitions and dispositions; • the impact of uncontracted capacity in ONEOK’s assets being greater or less than expected; • the ability to recover operating costs and amounts equivalent to income taxes, costs of property, plant and equipment and regulatory assets in ONEOK’s state and FERC-regulated rates; • the composition and quality of the natural gas and NGLs we gather and process in ONEOK’s plants and transport on ONEOK’s pipelines; -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 13 • the efficiency of ONEOK’s plants in processing natural gas and extracting and fractionating NGLs; • the impact of potential impairment charges; • the risk inherent in the use of information systems in ONEOK’s respective businesses, implementation of new software and hardware, and the impact on the timeliness of information for financial reporting; • ONEOK’s ability to control construction costs and completion schedules of ONEOK’s pipelines and other projects; and • the risk factors listed in the reports ONEOK has filed and may file with the Securities and Exchange Commission (the "SEC"), which are incorporated by reference. These reports are also available from the sources described below. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. ONEOK undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or changes in circumstances, expectations or otherwise. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in the most recent reports on Form 10-K and Form 10-Q and other documents of ONEOK on file with the SEC. ONEOK's SEC filings are available publicly on the SEC's website at www.sec.gov. ### -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 14 ONEOK, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF INCOME Three Months Ended Nine Months Ended September 30, September 30, (Unaudited) 2018 2017 2018 2017 (Thousands of dollars, except per share amounts) Revenues Commodity sales $ 3,083,625 $ 2,322,534 $ 8,578,891 $ 6,700,260 Services 310,265 583,832 877,605 1,681,489 Total revenues 3,393,890 2,906,366 9,456,496 8,381,749 Cost of sales and fuel (exclusive of items shown separately below) 2,560,765 2,229,416 7,104,609 6,464,281 Operations and maintenance 206,247 179,693 589,465 532,529 Depreciation and amortization 107,383 102,298 317,908 302,566 Impairment of long-lived assets — 15,970 — 15,970 General taxes 24,124 24,641 81,263 76,098 Gain on sale of assets (163 ) (274 ) (348 ) (904 ) Operating income 495,534 354,622 1,363,599 991,209 Equity in net earnings from investments 39,313 40,058 116,070 118,985 Impairment of equity investments — (4,270 ) — (4,270 ) Allowance for equity funds used during construction 2,294 40 3,328 75 Other income 5,072 3,296 7,667 11,670 Other expense (3,404 ) (3,554 ) (11,104 ) (31,581 ) Interest expense (net of capitalized interest of $8,326, $1,068, $15,498, and $4,254, respectively) (121,910 ) (126,533 ) (351,131 ) (361,468 ) Income before income taxes 416,899 263,659 1,128,429 724,620 Income taxes (102,983 ) (97,128 ) (266,285 ) (195,913 ) Net income 313,916 166,531 862,144 528,707 Less: Net income attributable to noncontrolling interests 657 789 3,329 203,911 Net income attributable to ONEOK 313,259 165,742 858,815 324,796 Less: Preferred stock dividends 275 276 825 493 Net income available to common shareholders $ 312,984 $ 165,466 $ 857,990 $ 324,303 Basic earnings per common share $ 0.76 $ 0.43 $ 2.09 $ 1.21 Diluted earnings per common share $ 0.75 $ 0.43 $ 2.07 $ 1.20 Average shares (thousands) Basic 412,117 380,907 411,400 268,108 Diluted 414,847 383,419 414,035 270,349 Dividends declared per share of common stock $ 0.825 $ 0.745 $ 2.390 $ 1.975 -more-

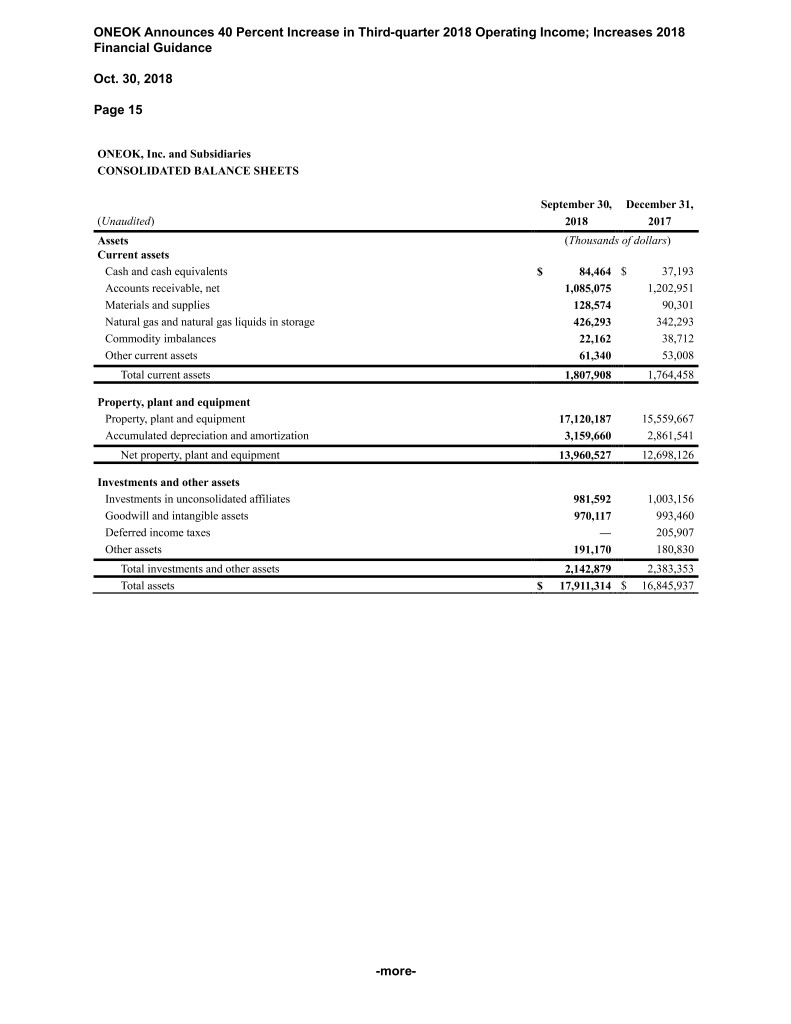

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 15 ONEOK, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS September 30, December 31, (Unaudited) 2018 2017 Assets (Thousands of dollars) Current assets Cash and cash equivalents $ 84,464 $ 37,193 Accounts receivable, net 1,085,075 1,202,951 Materials and supplies 128,574 90,301 Natural gas and natural gas liquids in storage 426,293 342,293 Commodity imbalances 22,162 38,712 Other current assets 61,340 53,008 Total current assets 1,807,908 1,764,458 Property, plant and equipment Property, plant and equipment 17,120,187 15,559,667 Accumulated depreciation and amortization 3,159,660 2,861,541 Net property, plant and equipment 13,960,527 12,698,126 Investments and other assets Investments in unconsolidated affiliates 981,592 1,003,156 Goodwill and intangible assets 970,117 993,460 Deferred income taxes — 205,907 Other assets 191,170 180,830 Total investments and other assets 2,142,879 2,383,353 Total assets $ 17,911,314 $ 16,845,937 -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 16 ONEOK, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (Continued) September 30, December 31, (Unaudited) 2018 2017 Liabilities and equity (Thousands of dollars) Current liabilities Current maturities of long-term debt $ 507,650 $ 432,650 Short-term borrowings 120,000 614,673 Accounts payable 1,339,507 1,140,571 Commodity imbalances 162,990 164,161 Accrued interest 111,747 135,309 Other current liabilities 208,312 179,971 Total current liabilities 2,450,206 2,667,335 Long-term debt, excluding current maturities 8,325,708 8,091,629 Deferred credits and other liabilities Deferred income taxes 132,242 52,697 Other deferred credits 350,400 348,924 Total deferred credits and other liabilities 482,642 401,621 Commitments and contingencies Equity ONEOK shareholders’ equity: Preferred stock, $0.01 par value: issued 20,000 shares at September 30, 2018, and December 31, 2017 — — Common stock, $0.01 par value: authorized 1,200,000,000 shares, issued 445,016,234 shares and outstanding 411,358,838 shares at September 30, 2018; issued 423,166,234 shares and outstanding 388,703,543 shares at December 31, 2017 4,450 4,232 Paid-in capital 7,662,673 6,588,878 Accumulated other comprehensive loss (158,138 ) (188,530 ) Retained earnings — — Treasury stock, at cost: 33,657,396 shares at September 30, 2018, and 34,462,691 shares at December 31, 2017 (856,227 ) (876,713 ) Total ONEOK shareholders’ equity 6,652,758 5,527,867 Noncontrolling interests in consolidated subsidiaries — 157,485 Total equity 6,652,758 5,685,352 Total liabilities and equity $ 16,845,937 $ 17,911,314 -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 17 ONEOK, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS Nine Months Ended September 30, (Unaudited) 2018 2017 (Thousands of dollars) Operating activities Net income $ 862,144 $ 528,707 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 317,908 302,566 Impairment charges — 20,240 Noncash contribution of preferred stock, net of tax — 12,600 Equity in net earnings from investments (116,070 ) (118,985 ) Distributions received from unconsolidated affiliates 125,824 124,517 Deferred income taxes 264,509 186,584 Share-based compensation expense 23,963 19,688 Pension and postretirement benefit expense, net of contributions (2,902 ) 818 Allowance for equity funds used during construction (3,328 ) (75 ) Gain on sale of assets (348 ) (904 ) Changes in assets and liabilities: Accounts receivable 117,876 (33,224 ) Natural gas and natural gas liquids in storage (91,170 ) (174,232 ) Accounts payable (41,837 ) 82,174 Commodity imbalances, net 15,379 (4,004 ) Risk-management assets and liabilities 66,966 34,534 Other assets and liabilities, net (22,464 ) (45,008 ) Cash provided by operating activities 1,516,450 935,996 Investing activities Capital expenditures (less allowance for equity funds used during construction) (1,309,655 ) (330,431 ) Cash paid for acquisition (195,000 ) — Contributions to unconsolidated affiliates (831 ) (87,653 ) Distributions received from unconsolidated affiliates in excess of cumulative earnings 19,613 21,577 Proceeds from sale of assets 1,053 1,910 Cash used in investing activities (1,484,820 ) (394,597 ) Financing activities Dividends paid (983,068 ) (543,445 ) Distributions to noncontrolling interests (3,500 ) (275,060 ) Borrowing (repayment) of short-term borrowings, net (494,673 ) (178,027 ) Issuance of long-term debt, net of discounts 1,245,773 1,190,067 Debt financing costs (11,301 ) (11,340 ) Repayment of long-term debt (930,738 ) (992,864 ) Issuance of common stock 1,195,128 45,849 Other, net (1,980 ) (13,778 ) Cash provided by (used in) financing activities 15,641 (778,598 ) Change in cash and cash equivalents 47,271 (237,199 ) Cash and cash equivalents at beginning of period 37,193 248,875 Cash and cash equivalents at end of period $ 84,464 $ 11,676 -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 18 ONEOK, Inc. and Subsidiaries INFORMATION AT A GLANCE Three Months Ended Nine Months Ended September 30, September 30, (Unaudited) 2018 2017 2018 2017 (Millions of dollars, except as noted) Natural Gas Liquids Operating costs, excluding noncash compensation adjustments $ 97.5 $ 86.1 $ 275.2 $ 251.6 Depreciation and amortization $ 43.7 $ 41.9 $ 129.0 $ 124.5 Equity in net earnings from investments $ 16.5 $ 15.3 $ 49.5 $ 44.1 Adjusted EBITDA $ 399.0 $ 293.9 $ 1,093.2 $ 845.5 NGLs transported-gathering lines (MBbl/d) (a) 956 812 905 794 NGLs fractionated (MBbl/d) (b) 732 605 707 600 NGLs transported-distribution lines (MBbl/d) (a) 544 569 564 559 Average Conway-to-Mont Belvieu OPIS price differential - ethane in ethane/propane mix ($/gallon) $ 0.24 $ 0.05 $ 0.16 $ 0.04 Capital expenditures $ 444.8 $ 27.0 $ 786.6 $ 59.8 (a) - Includes volumes for consolidated entities only. (b) - Includes volumes at company-owned and third-party facilities. Natural Gas Gathering and Processing Operating costs, excluding noncash compensation adjustments $ 88.4 $ 77.0 $ 262.9 $ 221.0 Depreciation and amortization $ 49.2 $ 46.8 $ 145.1 $ 137.8 Equity in net earnings from investments; excluding noncash impairment charges $ — $ 3.4 $ 0.9 $ 9.8 Adjusted EBITDA $ 159.6 $ 142.0 $ 457.0 $ 374.2 Natural gas gathered (BBtu/d) (a) 2,582 2,278 2,516 2,147 Natural gas processed (BBtu/d) (a) (b) 2,447 2,128 2,366 1,995 NGL sales (MBbl/d) (a) 195 193 195 184 Residue natural gas sales (BBtu/d) (a) 1,145 955 1,046 869 Average contractual fee rate ($/MMBtu) (a) $ 0.92 $ 0.86 $ 0.90 $ 0.86 Capital expenditures $ 213.0 $ 85.5 $ 433.6 $ 185.7 (a) - Includes volumes for consolidated entities only. (b) - Includes volumes at company-owned and third-party facilities. Natural Gas Pipelines Operating costs, excluding noncash compensation adjustments $ 35.4 $ 28.4 $ 100.2 $ 90.6 Depreciation and amortization $ 13.6 $ 12.8 $ 41.3 $ 37.9 Equity in net earnings from investments $ 22.8 $ 21.3 $ 65.7 $ 65.1 Adjusted EBITDA $ 90.1 $ 87.5 $ 269.1 $ 251.1 Natural gas transportation capacity contracted (MDth/d) (a) 6,812 6,593 6,747 6,600 Transportation capacity subscribed (a) 96 % 94 % 95 % 94 % Capital expenditures $ 31.5 $ 18.8 $ 71.9 $ 70.7 (a) - Includes volumes for consolidated entities only. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 19 ONEOK, Inc. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Three Months Ended Nine Months Ended September 30, September 30, (Unaudited) 2018 2017 2018 2017 (Thousands of dollars, except per share amounts) Reconciliation of net income to adjusted EBITDA and distributable cash flow Net income $ 313,916 $ 166,531 $ 862,144 $ 528,707 Interest expense, net of capitalized interest 121,910 126,533 351,131 361,468 Depreciation and amortization 107,383 102,298 317,908 302,566 Income taxes 102,983 97,128 266,285 195,913 Impairment charges — 20,240 — 20,240 Noncash compensation expense 5,829 4,883 27,195 9,790 Other noncash items and equity AFUDC (a) (1,834 ) (420 ) (2,305 ) 20,450 Adjusted EBITDA 650,187 517,193 1,822,358 1,439,134 Interest expense, net of capitalized interest (121,910 ) (126,533 ) (351,131 ) (361,468 ) Maintenance capital (63,284 ) (32,514 ) (137,312 ) (79,973 ) Equity in net earnings from investments (39,313 ) (40,058 ) (116,070 ) (118,985 ) Distributions received from unconsolidated affiliates 47,197 49,414 145,437 146,094 Other (739 ) (3,089 ) (5,624 ) (6,155 ) Distributable cash flow $ 472,138 $ 364,413 $ 1,357,658 $ 1,018,647 Dividends paid to preferred shareholders (275 ) (352 ) (825 ) (352 ) Distributions paid to public limited partners — — — (270,959 ) Distributable cash flow to shareholders $ 471,863 $ 364,061 $ 1,356,833 $ 747,336 Dividends paid $ (339,300 ) $ (283,114 ) $ (982,243 ) $ (542,396 ) Distributable cash flow in excess of dividends paid $ 132,563 $ 80,947 $ 374,590 $ 204,940 Dividends paid per share $ 0.825 $ 0.745 $ 2.390 $ 1.975 Dividend coverage ratio 1.39 1.29 1.38 1.42 Number of shares used in computation (thousands) 411,273 380,019 410,980 267,205 (a) Nine-month 2017 totals include ONEOK’s April 2017 contribution to the ONEOK Foundation of 20,000 shares of Series E Preferred Stock, with an aggregate value of $20 million. -more-

ONEOK Announces 40 Percent Increase in Third-quarter 2018 Operating Income; Increases 2018 Financial Guidance Oct. 30, 2018 Page 20 ONEOK, Inc. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES 2018 Updated 2018 Guidance Range (a) Guidance Range (Unaudited) (Millions of dollars) Reconciliation of net income to adjusted EBITDA and distributable cash flow Net income $ 1,020 - $ 1,150 $ 1,140 - $ 1,220 Interest expense, net of capitalized interest 485 - 465 480 - 470 Depreciation and amortization 425 435 425 - 435 Income taxes 315 - 335 355 - 365 Noncash compensation expense 40 - 30 40 - 30 Other noncash items and equity AFUDC - - - (10) - (10) Adjusted EBITDA $ 2,285 - $ 2,415 $ 2,430 - $ 2,510 Interest expense, net of capitalized interest (485 ) - (465 ) (480) - (470) Maintenance capital (160 ) - (180 ) (170) - (180) Equity in net earnings from investments (140 ) - (160 ) (150) - (160) Distributions received from unconsolidated affiliates 175 - 205 185 - 205 Other - - (10 ) - - (10) Distributable cash flow $ 1,675 - $ 1,805 $ 1,815 - $ 1,895 (a) Guidance issued July 31, 2018. Updated 2018 (Unaudited) Guidance Range (Millions of dollars) Reconciliation of segment adjusted EBITDA to adjusted EBITDA Segment adjusted EBITDA: Natural Gas Liquids $ 1,485 - $ 1,535 Natural Gas Gathering and Processing 600 - 620 Natural Gas Pipelines 350 - 360 Other (5) - (5 ) Adjusted EBITDA $ 2,430 - $ 2,510