- OKE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ONEOK (OKE) 8-KDeparture of Directors or Certain Officers

Filed: 23 Feb 21, 4:13pm

| Date of report (Date of earliest event reported) | February 17, 2021 | ||||

| Oklahoma | 001-13643 | 73-1520922 | ||||||||||||

| (State or other jurisdiction | (Commission | (IRS Employer | ||||||||||||

| of incorporation) | File Number) | Identification No.) | ||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, par value of $0.01 | OKE | New York Stock Exchange | ||||||

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers | |||||||

2020 SHORT-TERM INCENTIVE AWARDS The purpose of our shareholder approved Annual Officer Incentive Plan (“AOIP”) is to align the named executive officers’ interests with shareholders’ interests by providing them with a financial incentive tied directly to key measures of our financial and operational performance. The 2020 short-term incentive measures, performance goals and weightings under our AOIP were developed and recommended to the Executive Compensation Committee (the “Committee”) by executive management, were reviewed and approved by the Committee, and were then recommended to, and approved by our Board of Directors in February 2020. The same short-term incentive measures, performance goals and weightings are applicable to non-officer employees under our Annual Employee Incentive Plan (“AEIP”) to promote further alignment of interests throughout the Company. As approved in February 2020 under the AOIP, and as applied to the AEIP (collectively the “STIP”), the short-term incentive measures, performance goals and weightings are summarized as follows: | ||||||||

| ONEOK, INC. Corporate Performance Criteria 2020 Fiscal Year | Threshold (Pays 0%) | Target (Pays 100%) | Maximum (Pays 200%) | Weighting | Target Payout | Maximum Payout | ||||||||||||||||||||||||||||||||

| Distributable Cash Flow (DCF) Per Share | $5.17 | $5.78 | $6.38 | 40% | 40% | 80% | ||||||||||||||||||||||||||||||||

| Return On Invested Capital (ROIC) | 11.67% | 12.90% | 14.13% | 40% | 40% | 80% | ||||||||||||||||||||||||||||||||

| Total Recordable Incident Rate (TRIR) | 0.47 | 0.31 | 0.23 | 10% | 10% | 20% | ||||||||||||||||||||||||||||||||

| Agency Reportable Environmental Event Rate (AREER) | 0.89 | 0.71 | 0.53 | 10% | 10% | 20% | ||||||||||||||||||||||||||||||||

| Total | 100% | 200% | ||||||||||||||||||||||||||||||||||||

Distributable cash flow (DCF) per share which measures the quantity of our cash flow. DCF per share is defined as Adjusted EBITDA (as defined below) less interest expense, budgeted maintenance capital expenditures, and equity earnings from investments, adjusted for net cash distributions received from unconsolidated affiliates and certain other items, divided by the weighted-average number of shares of common stock outstanding for the year. Adjusted EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, noncash impaiment charges, income taxes, noncash compensation expense, allowance for equity funds used during construction and other noncash items. DCF per share measures the amount of cash we generate that is available to pay out in the form of dividends to our shareholders. Return on invested capital (ROIC) which measures the quality and efficiency of our earnings and capital investments. ROIC is earnings before interest and taxes (EBIT), divided by invested capital, where invested capital is the daily average for the fiscal year of short-term debt, less cash, long-term debt and equity, excluding accumulated other comprehensive income. ROIC is a critical indicator of how effectively we use our capital invested in our operations and is an important measurement for judging how much value we are creating for our shareholders. DCF per share, Adjusted EBITDA and EBIT exclude the effects of accounting changes, if any. Total Recordable Incident Rate (TRIR). TRIR is the number of Occupational Safety and Health Administration incidents per 200,000 work-hours. The inclusion of this metric is designed to emphasize our commitment to the safe operation of our business and to reward safe behavior throughout our company. Agency Reportable Environmental Event Rate (AREER). AREER is defined as the total number of releases and excess emission events that trigger a federal, state or local environmental reporting requirement (with some exceptions to account for events outside our control, planned maintenance and disparities in reporting requirements across our operations) per 200,000 work-hours. | ||||||||||||||||||||||||||||||||||||||

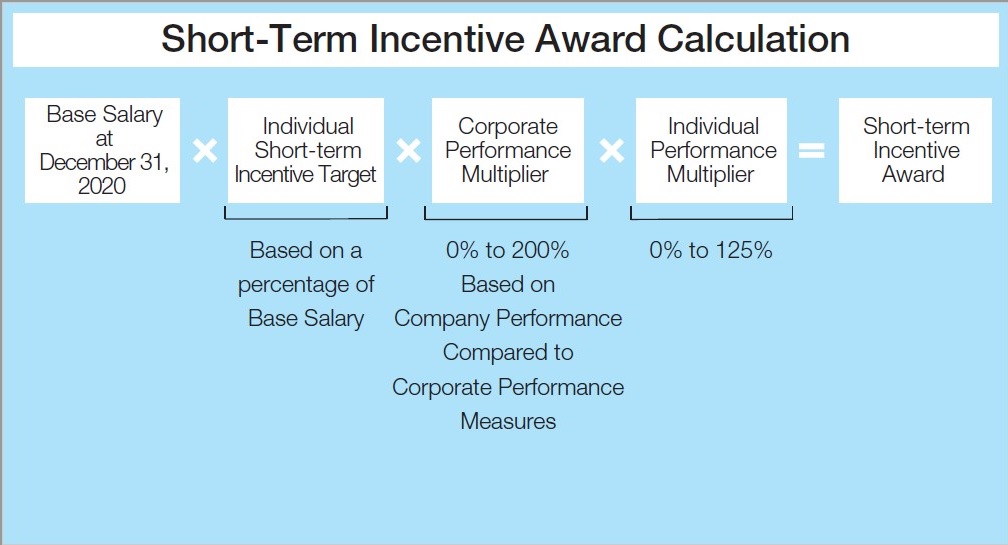

Late in the first quarter 2020, after the approval of our short-term incentive measures, performance goals and weightings, the energy industry experienced historic events that led to a simultaneous demand and supply disruption. The World Health Organization declared COVID-19 a global pandemic and recommended containment and mitigation measures worldwide, which contributed to a massive economic slowdown and decreased demand for crude oil. In addition, Saudi Arabia and Russia increased production of crude oil as the two countries competed for market share. As a result, the global supply of crude oil significantly exceeded demand and led to a collapse in crude oil prices. Crude oil prices and the related impact on crude oil drilling impacts our business due to associated natural gas, which is natural gas produced by oil wells. Associated natural gas contains NGLs. The decline of crude oil prices resulted in crude oil and associated natural gas and NGLs production being curtailed in the second quarter 2020. These events (collectively “COVID-19 related events”), wholly outside of the Company’s control, rendered our 2020 financial performance measures, DCF Per Share and ROIC, unattainable and resulted in 0% being earned toward the corporate performance multiplier for these measures. At year-end, our 2020 TRIR operational performance measure was 0.69, which did not reach the threshold required for a payout. This is partially attributable to an increase in slip, trip and fall injuries for operations employees. As a result, 0% was earned toward the corporate performance multiplier from this measure. Our 2020 AREER operational performance measure was 0.42, which was better than the maximum. As a result, 20% was earned toward the corporate performance multiplier from this measure. As more fully described below, the Committee exercised its discretion, as authorized under the STIP, which resulted in a corresponding recommendation to increase payouts to officers and all employees in the additional amount of 20% guided by a qualitative evaluation of the Company’s 2020 performance in responding to the direct and indirect impacts of COVID-19 related events. Such discretionary payout of 20% plus the AREER payout of 20% resulted in an overall 40% corporate performance multiplier, which was subsequently recommended to, and approved by our Board of Directors. To determine the 2020 short-term incentive awards payable to each of our named executive officers, the 40% corporate performance multiplier was multiplied by the named executive officer’s base salary at December 31, 2020, times the named executive officer’s individual short-term incentive target, times the named executive officer’s individual performance multiplier. An individual performance multiplier may range from zero to 125%. The individual performance multiplier percentage is approved by the Committee annually, taking into consideration management’s recommendation regarding individual performance and contribution. The annual calculation for our named executive officers is shown below: | ||||||||

| 2020 Short-term Incentive Awards | ||||||||||||||||||||||||||||||||

| Name | Base Salary at December 31, 2020 | Individual Short- term Incentive Target | Corporate Performance Multiplier | Individual Performance Multiplier | Short-term Incentive Award1 | |||||||||||||||||||||||||||

| Terry K. Spencer | $850,000 | 125% | 40% | 125% | $531,300 | |||||||||||||||||||||||||||

| Kevin L. Burdick | $500,000 | 90% | 40% | 100% | $180,000 | |||||||||||||||||||||||||||

| Walter S. Hulse III | $500,000 | 90% | 40% | 111% | $200,000 | |||||||||||||||||||||||||||

| Robert F. Martinovich | $500,000 | 80% | 40% | 100% | $160,000 | |||||||||||||||||||||||||||

| Sheridan C. Swords | $500,000 | 75% | 40% | 104% | $156,000 | |||||||||||||||||||||||||||

1 The “Non-Equity Incentive Plan Compensation” and “Bonus” columns of the Summary Compensation Table for Fiscal 2020 within ONEOK’s 2021 Notice of Annual Meeting and Proxy Statement, together, will reflect the annual short-term incentive awards under the AOIP earned by each of the named executive officers for 2020 and paid in 2021. | ||||||||||||||||||||||||||||||||

Exercise of Discretion as Authorized Under the STIP Under the STIP, the Committee has express authority to make discretionary adjustments and interpretations as it determines to be appropriate, including the modification of goals and performance measures. The exercise of such discretion may result in a corresponding recommendation to change payouts under the STIP. Considering COVID-19 related events, the Committee continued throughout the year to monitor the STIP, with the assistance of, and through communications with, its independent compensation consultant and management. At the Committee’s July 2020 meeting, management reported that a payout under the STIP’s financial performance measures was unlikely. Nevertheless, management reported that the Company had prioritized the safe operation of its assets and the health and safety of its employees; maintained high levels of productivity despite the pandemic and related challenges; stated the Company had no employee layoffs or furloughs and did not anticipate any; had not reduced the dividend payable to shareholders and did not anticipate doing so; and had taken a number of proactive measures to improve its financial flexibility and strengthen its balance sheet by refinancing debt, issuing equity and curtailing a significant portion of planned capital expenditures. At that time, in consultation with the Committee’s independent compensation consultant, the Committee began discussing potential alternatives for addressing the financial performance measures that were unlikely to payout under the STIP, which reflect 80% of the weighting, in order to continue to retain and motivate employees as they helped navigate a challenging year. Such alternatives included, but were not limited to, taking no action; modifying or replacing existing performance measures to reflect updated market conditions; setting a new “second-half” plan for the period from July to December; and considering the potential exercise of discretion with a corresponding recommendation to increase payouts to officers and all employees after year-end to reflect the Company’s performance and take into account the impact of COVID-19 related events. The Committee and its independent compensation consultant also discussed the Company’s compensation philosophy, the financial impacts of an adjustment to 2020 short-term incentive payouts on shareholders and how the exercise or non-exercise of discretion might be viewed by employees, shareholders and other key stakeholders. The Committee then identified a preferred approach for further consideration, the replacement of the financial performance measures that were unlikely to payout. With this approach, the Committee would then consider the potential exercise of discretion with a corresponding recommendation to increase payouts to officers and all employees, but with a maximum payout well below the target, guided by a qualitative evaluation of the Company’s 2020 performance. The Committee requested that management provide qualitative measurement categories for review at the next meeting. | ||||||||

Thereafter, and at the Committee’s November 2020 meeting, it continued to engage in discussion on the potential exercise of discretion. At that meeting, the Committee reviewed and discussed two qualitative measurement categories for evaluating the Company’s 2020 performance. Such categories are summarized as follows: Response to Direct Impacts of COVID-19 Related Events •Crisis management and communication •Employee health and safety •Facility and operational impacts Response to Indirect Impacts of COVID-19 Related Events •Financial stability •Stakeholder interactions •Operation of assets •Completion of special projects •Workforce impacts •Technology and infrastructure At a January 2021 special meeting, the Committee continued to monitor the STIP and engage in further discussion about the potential exercise of discretion. At its February 2021 meeting, in consultation with its independent compensation consultant, the Committee determined that it would exercise its discretion and make a corresponding recommendation to increase payouts to officers and all employees in the STIP in recognition of the Company’s 2020 performance in responding to the direct and indirect impacts of COVID-19 related events, as referenced above. The Committee then determined it would recommend to our Board of Directors the approval of an overall corporate performance multiplier of 40%, which included a 20% payout under the AREER operational performance measure and an additional 20% payout based on a qualitative evaluation of the Company’s 2020 performance. The Committee believed this was a measured and appropriate response to recognize the Company’s collective performance in 2020. Further, the Committee believed these actions to be consistent with ONEOK’s compensation philosophy of paying for performance and that these actions were aligned with the interests of shareholders by fostering the retention, motivation and engagement of employees. At its February 2021 meeting, the Board of Directors reviewed and approved the payment of 2020 short-term incentive awards based on the overall corporate performance multiplier recommended by the Committee and approved the Committee’s exercise of discretion, as described above. | ||||||||

| ONEOK, Inc. | |||||||||||

| Date: | February 23, 2021 | By: | /s/ Walter S. Hulse III | ||||||||

| Walter S. Hulse III Chief Financial Officer, Treasurer and Executive Vice President, Strategy and Corporate Affairs | |||||||||||