-more- November 2, 2021 Analyst Contact: Megan Patterson 918-561-5325 Media Contact: Brad Borror 918-588-7582 ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Increases 2021 Financial Guidance TULSA, Okla. - Nov. 2, 2021 - ONEOK, Inc. (NYSE: OKE) today announced higher third quarter 2021 results and increased 2021 financial guidance. Higher Third Quarter 2021 Results, Compared With Third Quarter 2020: • 26% increase in net income to $392.0 million, resulting in 88 cents per diluted share. • 16% increase in adjusted EBITDA to $865.2 million. • 47% increase in Rocky Mountain region NGL raw feed throughput volumes. • 24% increase in Rocky Mountain region natural gas volumes processed. • 4.0 times annualized run-rate net debt-to-EBITDA ratio. Increased 2021 Guidance: • 10% net income increase to a midpoint of $1.49 billion. • 10% earnings per diluted share increase to a midpoint of $3.33. • 5% adjusted EBITDA increase to a midpoint of $3.375 billion. ONEOK increased 2021 net income guidance to a range of $1.43 billion to $1.55 billion, compared with the previously announced range of $1.20 billion to $1.50 billion. Adjusted EBITDA guidance increased to a range of $3.325 billion to $3.425 billion, compared with ONEOK’s previously announced range of $3.05 billion to $3.35 billion. The increase in financial guidance reflects continued strength in Rocky Mountain region volumes and higher commodity prices in the natural gas gathering and processing segment. NGL volume growth in the Rocky Mountain region and Permian Basin, and higher natural gas sales and firm transportation revenue also contributed to increased 2021 expectations. Exhibit 99.1

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 2 -more- “ONEOK’s strong third quarter results were driven by NGL and natural gas volume growth on our system, contributing higher fee-based earnings,” said Pierce H. Norton II, ONEOK president and chief executive officer. “Increasing producer activity driven by improving market demand resulted in record NGL raw feed throughput volumes on our system. These factors, combined with year-to-date results, contributed to the increase in our 2021 financial guidance, giving us positive momentum going into next year. “The third quarter also marked another milestone in ONEOK’s commitment to environmental responsibility with our announcement of a greenhouse gas emission absolute reduction target,” added Norton. “We continue to evaluate lower-carbon opportunities that will complement our operations and provide long-term stakeholder value.” THIRD QUARTER 2021 FINANCIAL HIGHLIGHTS Three Months Ended Nine Months Ended September 30, September 30, 2021 2020 2021 2020 (Millions of dollars, except per share amounts) Net income (a) $ 392.0 $ 312.3 $ 1,120.3 $ 304.8 Diluted earnings per common share (a) $ 0.88 $ 0.70 $ 2.50 $ 0.71 Adjusted EBITDA (b) (c) $ 865.2 $ 747.0 $ 2,533.1 $ 1,981.7 Operating income (d) $ 667.9 $ 550.4 $ 1,944.1 $ 822.7 Operating costs $ 265.2 $ 205.0 $ 770.9 $ 636.5 Depreciation and amortization $ 154.5 $ 153.2 $ 468.6 $ 426.0 Equity in net earnings from investments $ 28.6 $ 38.0 $ 87.6 $ 108.0 Maintenance capital $ 42.3 $ 31.8 $ 113.5 $ 83.2 Capital expenditures (includes maintenance) $ 166.2 $ 380.0 $ 490.3 $ 1,924.0 (a) Amounts for the three and nine months ended Sept. 30, 2020, include benefits of $2.2 million and $22.2 million, respectively, related to net gains on open market repurchases of debt. Amounts for the nine months ended Sept. 30, 2020, also include noncash charges of $641.8 million, or $1.16 per diluted share after-tax, related primarily to impairments in the natural gas gathering and processing segment and a benefit of $16.9 million, or 3 cents per diluted share after-tax, related to the mark-to-market of ONEOK’s share-based deferred compensation plan. (b) Adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) is a non-GAAP measure. Reconciliation to the relevant GAAP measure is included in this news release. (c) Amounts for the three and nine months ended Sept. 30, 2020, include benefits of $2.2 million and $22.2 million, respectively, related to gains on open market repurchases of debt. (d) Amounts for the nine months ended Sept. 30, 2020, includes noncash impairment charges of $604.0 million. THIRD QUARTER 2021 FINANCIAL PERFORMANCE ONEOK’s third quarter 2021 net income and adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) increased 26% and 16%, respectively, compared with the third quarter 2020, driven by increased natural gas and natural gas liquids (NGL) volumes in the Rocky Mountain region. Results also benefited from the prior year impact of lower realized commodity prices in the third quarter 2020 in the natural gas gathering and processing segment, compared with the third quarter 2021.

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 3 -more- Results included higher operating costs from higher employee-related costs, higher materials, supplies and outside services expenses and increased property taxes. HIGHLIGHTS: • Third quarter 2021 net income of $392.0 million, a 26% increase compared with the third quarter 2020. • Third quarter 2021 adjusted EBITDA of $865.2 million, a 16% increase compared with the third quarter 2020. • Completing the 200 million cubic feet per day (MMcf/d) Bear Creek natural gas processing plant expansion and related infrastructure in the Williston Basin. • In September 2021, announcing a 30% absolute greenhouse gas emissions reduction target, or 2.2 million metric tons, of combined Scope 1 and Scope 2 emissions by 2030, compared with 2019 base-year levels. • In October 2021, declaring a quarterly dividend of 93.5 cents per share, or $3.74 per share on an annualized basis. • Redeeming in November 2021 the remaining $536.1 million of 4.25% senior notes due February 2022. • As of Sept. 30, 2021: ◦ 4.0 times annualized run-rate net debt-to-EBITDA ratio. ◦ No borrowings outstanding under ONEOK’s $2.5 billion credit agreement. ◦ $224.3 million of cash and cash equivalents. BUSINESS SEGMENT RESULTS: Natural Gas Liquids Segment Three Months Ended Nine Months Ended September 30, September 30, Natural Gas Liquids Segment 2021 2020 2021 2020 (Millions of dollars) Adjusted EBITDA $ 532.2 $ 451.2 $ 1,448.1 $ 1,199.8 Capital expenditures $ 53.8 $ 298.9 $ 225.8 $ 1,504.9 The increase in third quarter 2021 adjusted EBITDA, compared with the third quarter 2020, primarily reflects: • A $97.8 million increase in exchange services due primarily to $59.6 million in higher volumes primarily in the Rocky Mountain region and Permian Basin, offset partially by

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 4 -more- lower volumes in the Barnett Shale, and $29.5 million related to wider commodity price differentials; and • A $10.3 million increase in optimization and marketing due primarily to wider location and commodity price differentials; offset by • A $25.4 million increase in operating costs due primarily to higher employee-related costs, increased property taxes associated with ONEOK’s completed capital-growth projects and higher outside services expenses. The increase in adjusted EBITDA for the nine-month 2021 period, compared with the same period last year, primarily reflects: • A $299.0 million increase in exchange services (excluding the impact of Winter Storm Uri discussed below) due primarily to: ◦ $249.6 million related to higher volumes in the Rocky Mountain region and lower transportation costs, offset by $11.3 million in lower volumes primarily in the Barnett Shale, ◦ $65.9 million related to wider commodity price differentials, and ◦ $12.9 million related to the recognition of proceeds previously considered a gain contingency, offset by ◦ $15.6 million related to lower earnings on unfractionated NGLs held in inventory due primarily to decreasing inventory levels throughout 2020; and • An $85.1 million increase in optimization and marketing due primarily to wider location and commodity price differentials, increased activities during Winter Storm Uri and higher earnings on purity NGL sales; offset by • A $46.2 million decrease in exchange services related to Winter Storm Uri due primarily to decreased volumes across ONEOK’s operations and higher electricity costs; • A $68.9 million increase in operating costs due primarily to higher employee-related costs, increased property taxes associated with ONEOK’s completed capital-growth projects and higher outside services expenses; and • A $17.0 million decrease in equity in net earnings from investments due primarily to lower volumes on the Overland Pass Pipeline. In the third quarter 2021, the segment connected two third-party natural gas processing plants to its system, including one in the Permian Basin and one in the Rocky Mountain region.

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 5 -more- Natural Gas Gathering and Processing Segment Three Months Ended Nine Months Ended September 30, September 30, Natural Gas Gathering and Processing Segment 2021 2020 2021 2020 (Millions of dollars) Adjusted EBITDA $ 229.7 $ 183.1 $ 663.6 $ 431.5 Capital expenditures $ 80.8 $ 63.0 $ 177.4 $ 362.8 Third quarter 2021 adjusted EBITDA increased, compared with the third quarter 2020, which primarily reflects: • A $36.4 million increase from higher volumes due primarily to increased production in the Rocky Mountain region in 2021 and production curtailments in 2020, offset partially by natural production declines in the Mid-Continent region; • A $26.3 million increase due primarily to lower realized commodity prices in 2020 impacting fee-based contracts with a percent of proceeds (POP) component; and • A $7.3 million increase from a gain on the partial sale of an equity investment; offset by • A $23.9 million increase in operating costs due primarily to higher materials and supplies expenses, employee-related costs and outside services expenses due primarily to the growth of ONEOK’s operations. The increase in adjusted EBITDA for the nine-month 2021 period, compared with the same period last year, primarily reflects: • A $150.5 million increase due primarily to lower realized commodity prices in 2020 impacting fee-based contracts with a POP component; and • A $94.2 million increase from higher volumes due primarily to increased production in the Rocky Mountain region in 2021 and production curtailments in 2020, offset partially by natural production declines in the Mid-Continent region; offset by • A $24.2 million increase in operating costs due primarily to higher materials and supplies expenses, employee-related costs and outside services expenses due primarily to the growth of ONEOK’s operations. Natural Gas Pipelines Segment Three Months Ended Nine Months Ended September 30, September 30, Natural Gas Pipelines Segment 2021 2020 2021 2020 (Millions of dollars) Adjusted EBITDA $ 102.7 $ 109.8 $ 423.6 $ 332.2 Capital expenditures $ 24.6 $ 13.0 $ 73.5 $ 40.5

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 6 -more- The decrease in third quarter 2021 adjusted EBITDA, compared with the third quarter 2020, primarily reflects: • A $7.4 million decrease from lower equity in net earnings from investments due primarily to decreased firm transportation revenues on Northern Border Pipeline; and • A $5.8 million increase in operating costs due primarily to higher employee-related costs and higher supplies expenses; offset by • A $4.9 million increase in transportation and storage services due primarily to higher storage and firm transportation rates. The increase in adjusted EBITDA for the nine-month 2021 period, compared with the same period last year, primarily reflects: • A $106.8 million increase due primarily to higher average natural gas prices on 5.2 billion cubic feet (Bcf) of natural gas sales in the first quarter 2021 of volumes previously held in inventory, compared with 1.2 Bcf in the first quarter 2020; and • A $7.0 million increase in transportation services due primarily to higher park-and-loan activity and higher interruptible transportation revenue in the first quarter 2021, offset partially by a favorable $13.5 million contract settlement in the second quarter 2020; offset by • A $16.4 million increase in operating costs due primarily to higher employee-related costs and higher supplies expenses; and • A $7.4 million decrease from lower equity in net earnings from investments due primarily to decreased firm transportation revenues on Northern Border Pipeline. EARNINGS CONFERENCE CALL AND WEBCAST: ONEOK executive management will conduct a conference call at 11 a.m. Eastern Daylight Time (10 a.m. Central Daylight Time) on Nov. 3, 2021. The call also will be carried live on ONEOK’s website. To participate in the telephone conference call, dial 800-367-2403, pass code 2571760, or log on to www.oneok.com. If you are unable to participate in the conference call or the webcast, the replay will be available on ONEOK’s website, www.oneok.com, for 90 days. A recording will be available by phone for seven days. The playback call may be accessed at 888-203-1112, pass code 2571760.

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 7 -more- LINK TO EARNINGS TABLES AND PRESENTATION: https://ir.oneok.com/financial-information/financial-reports/2021 NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL MEASURES: ONEOK has disclosed in this news release adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA), which is a non-GAAP financial metric, used to measure the company’s financial performance. Adjusted EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, noncash impairment charges, income taxes, noncash compensation expense, allowance for equity funds used during construction (equity AFUDC), and other noncash items. Adjusted EBITDA is useful to investors because it, and similar measures, is used by many companies in the industry as a measure of financial performance and is commonly employed by financial analysts and others to evaluate ONEOK’s financial performance and to compare the company’s financial performance with the performance of other companies within the industry. Adjusted EBITDA should not be considered in isolation or as a substitute for net income or any other measure of financial performance presented in accordance with GAAP. This non-GAAP financial measure excludes some, but not all, items that affect net income. Additionally, this calculation may not be comparable with similarly titled measures of other companies. A reconciliation of net income to adjusted EBITDA is included in the tables. ONEOK, Inc. (pronounced ONE-OAK) (NYSE: OKE) is a leading midstream service provider and owner of one of the nation's premier natural gas liquids (NGL) systems, connecting NGL supply in the Rocky Mountain, Mid-Continent and Permian regions with key market centers and an extensive network of natural gas gathering, processing, storage and transportation assets. ONEOK is a FORTUNE 500 company and is included in S&P 500. For information about ONEOK, visit the website: www.oneok.com. For the latest news about ONEOK, find us on LinkedIn, Instagram, Facebook and Twitter. This news release contains certain "forward-looking statements" within the meaning of federal securities laws. Words such as “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “target,” “guidance,” “intends,” “may,” “might,” “outlook,” “plans,” “potential,” “projects,” “scheduled,” “should,” “will,” “would,” and similar expressions may be used to identify forward-looking statements. Forward-looking statements are not statements of historical fact and reflect our current views about future events. Such forward-looking statements include, but are not limited to, statements about the benefits of the transaction involving us, including future financial and operating results, our plans, objectives, expectations and intentions, and other statements that are not historical facts, including future results of operations, projected cash flow and liquidity, business strategy, expected synergies or cost savings, and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained in this news release will occur as projected and actual results may differ materially from those projected.

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 8 -more- Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties, many of which are beyond our control, and are not guarantees of future results. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. These risks and uncertainties include, without limitation, the following: • the length, severity and reemergence of a pandemic or other health crisis, such as the COVID-19 pandemic and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities implement to address it, which may (as with COVID-19) precipitate or exacerbate one or more of the factors herein, reduce the demand for natural gas, NGLs and crude oil and significantly disrupt or prevent us and our customers and counterparties from operating in the ordinary course for an extended period and increase the cost of operating our business; • operational challenges relating to the COVID-19 pandemic and efforts to mitigate the spread of the virus, including logistical challenges, protecting the health and well-being of our employees, remote work arrangements, performance of contracts and supply chain disruption; • the impact on drilling and production by factors beyond our control, including the demand for natural gas and crude oil; producers' desire and ability to drill and obtain necessary permits; regulatory compliance; reserve performance; and capacity constraints and/or shutdowns on the pipelines that transport crude oil, natural gas and NGLs from producing areas and our facilities; • risks associated with adequate supply to our gathering, processing, fractionation and pipeline facilities, including production declines that outpace new drilling, the shutting-in of production by producers, actions taken by federal, state or local governments to require producers to prorate or to cut their production levels as a way to address any excess market supply situations or extended periods of ethane rejection; • demand for our services and products in the proximity of our facilities; • economic climate and growth in the geographic areas in which we operate; • the risk of a slowdown in growth or decline in the United States or international economies, including liquidity risks in United States or foreign credit markets; • performance of contractual obligations by our customers, service providers, contractors and shippers; • the effects of changes in governmental policies and regulatory actions, including changes with respect to income and other taxes, pipeline safety, environmental compliance, cybersecurity, climate change initiatives, emissions credits, carbon offsets, carbon pricing, production limits and authorized rates of recovery of natural gas and natural gas transportation costs; • changes in demand for the use of natural gas, NGLs and crude oil because of the development of new technologies or other market conditions caused by concerns about climate change; • the transition to a lower-carbon economy, including the timing and extent of the transition, as well as the expected role of different energy sources in such a transition; • the pace of technological advancements and industry innovation, including those focused on reducing greenhouse gas emissions and advancing other climate-related initiatives, and our ability to take advantage of those innovations and developments; • the effectiveness of our risk management strategies, including mitigating climate-related risks; • our ability to identify and execute opportunities, and the economic viability of those opportunities, including those relating to renewable natural gas, carbon capture, use and storage, other renewable energy sources such as solar and wind and alternative low carbon fuel sources such as hydrogen; • the ability of our existing assets and our ability to apply and continue to develop our expertise to support the growth of, and transition to, various renewable and alternative energy opportunities, including through the positioning and optimization of our assets; • our ability to efficiently reduce the carbon intensity of our operations (both Scope 1 and 2 emissions), including through the use of lower carbon power alternatives, management practices and system optimizations; • the necessity to direct our focus on maintaining and enhancing our existing assets instead of efforts to reduce our greenhouse gas emissions; • the effects of weather and other natural phenomena, including climate change, on our operations, demand for our services and energy prices; • acts of nature, sabotage, terrorism or other similar acts that cause damage to our facilities or our suppliers', customers’ or shippers' facilities;

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 9 -more- • the possibility of future terrorist attacks or the possibility or occurrence of an outbreak of, or changes in, hostilities or changes in the political conditions throughout the world; • the risk of increased costs for insurance premiums, security or other items as a consequence of terrorist attacks; • the timing and extent of changes in energy commodity prices, including changes due to production decisions by other countries, such as the failure of countries to abide by agreements to reduce production volumes; • competition from other United States and foreign energy suppliers and transporters, as well as alternative forms of energy, including, but not limited to, solar power, wind power, geothermal energy and biofuels such as ethanol and biodiesel; • the ability to market pipeline capacity on favorable terms, including the effects of: – future demand for and prices of natural gas, NGLs and crude oil; – competitive conditions in the overall energy market; – availability of supplies of United States natural gas and crude oil; and – availability of additional storage capacity; • the efficiency of our plants in processing natural gas and extracting and fractionating NGLs; • the composition and quality of the natural gas and NGLs we gather and process in our plants and transport on our pipelines; • risks of marketing, trading and hedging activities, including the risks of changes in energy prices or the financial condition of our counterparties; • our ability to control operating costs and make cost-saving changes; • the risk inherent in the use of information systems in our respective businesses and those of our counterparties and service providers, including cyber-attacks, which, according to experts, have increased in volume and sophistication since the beginning of the COVID-19 pandemic; implementation of new software and hardware; and the impact on the timeliness of information for financial reporting; • the timely receipt of approval by applicable governmental entities for construction and operation of our pipeline and other projects and required regulatory clearances; • the ability to recover operating costs and amounts equivalent to income taxes, costs of property, plant and equipment and regulatory assets in our state and Federal Energy Regulatory Commission (FERC)-regulated rates; • the results of governmental actions, administrative proceedings and litigation, regulatory actions, executive orders, rule changes and receipt of expected clearances involving any local, state or federal regulatory body, including the FERC, the National Transportation Safety Board, the Department of Homeland Security, the Pipeline and Hazardous Materials Safety Administration (PHMSA), the U.S. Environmental Protection Agency (EPA) and the U.S. Commodity Futures Trading Commission (CFTC); • the mechanical integrity of facilities and pipelines operated; • the capital-intensive nature of our businesses; • the impact of unforeseen changes in interest rates, debt and equity markets, inflation rates, economic recession and other external factors over which we have no control, including the effect on pension and postretirement expense and funding resulting from changes in equity and bond market returns; • actions by rating agencies concerning our credit; • our indebtedness and guarantee obligations could make us vulnerable to general adverse economic and industry conditions, limit our ability to borrow additional funds and/or place us at competitive disadvantages compared with our competitors that have less debt or have other adverse consequences; • our ability to access capital at competitive rates or on terms acceptable to us; • our ability to acquire all necessary permits, consents or other approvals in a timely manner, to promptly obtain all necessary materials and supplies required for construction, and to construct gathering, processing, storage, fractionation and transportation facilities without labor or contractor problems; • our ability to control construction costs and completion schedules of our pipelines and other projects; • difficulties or delays experienced by trucks, railroads or pipelines in delivering products to or from our terminals or pipelines; • the uncertainty of estimates, including accruals and costs of environmental remediation; • the impact of uncontracted capacity in our assets being greater or less than expected; • the impact of potential impairment charges; • the profitability of assets or businesses acquired or constructed by us;

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 10 -more- • risks associated with pending or possible acquisitions and dispositions, including our ability to finance or integrate any such acquisitions and any regulatory delay or conditions imposed by regulatory bodies in connection with any such acquisitions and dispositions; • the risk that material weaknesses or significant deficiencies in our internal controls over financial reporting could emerge or that minor problems could become significant; • the impact and outcome of pending and future litigation; • the impact of recently issued and future accounting updates and other changes in accounting policies; and • the risk factors listed in the reports ONEOK has filed and may file with the Securities and Exchange Commission (the "SEC"), which are incorporated by reference. These reports are also available from the sources described below. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. ONEOK undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or changes in circumstances, expectations or otherwise. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in the most recent reports on Form 10-K and Form 10-Q and other documents of ONEOK on file with the SEC. ONEOK's SEC filings are available publicly on the SEC's website at www.sec.gov. ###

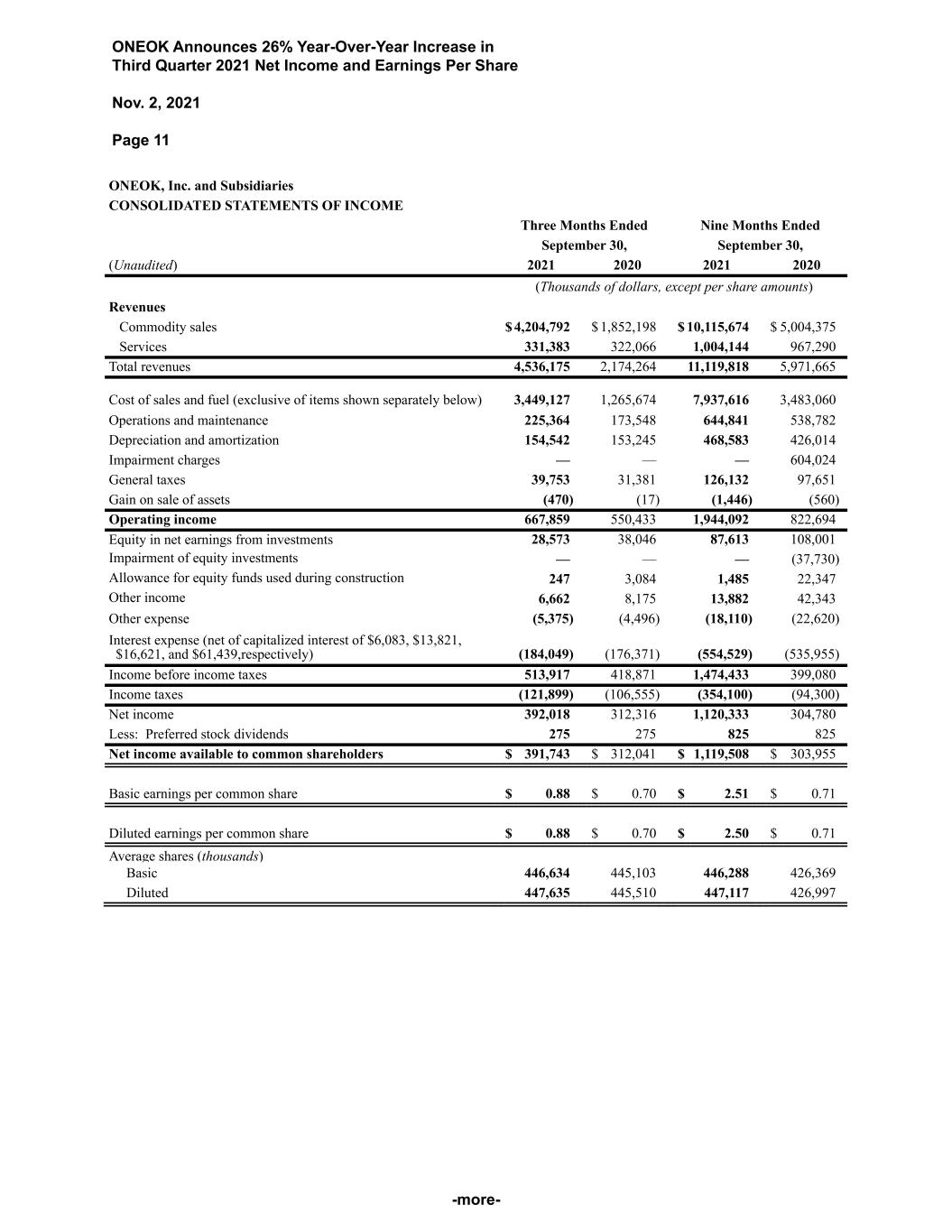

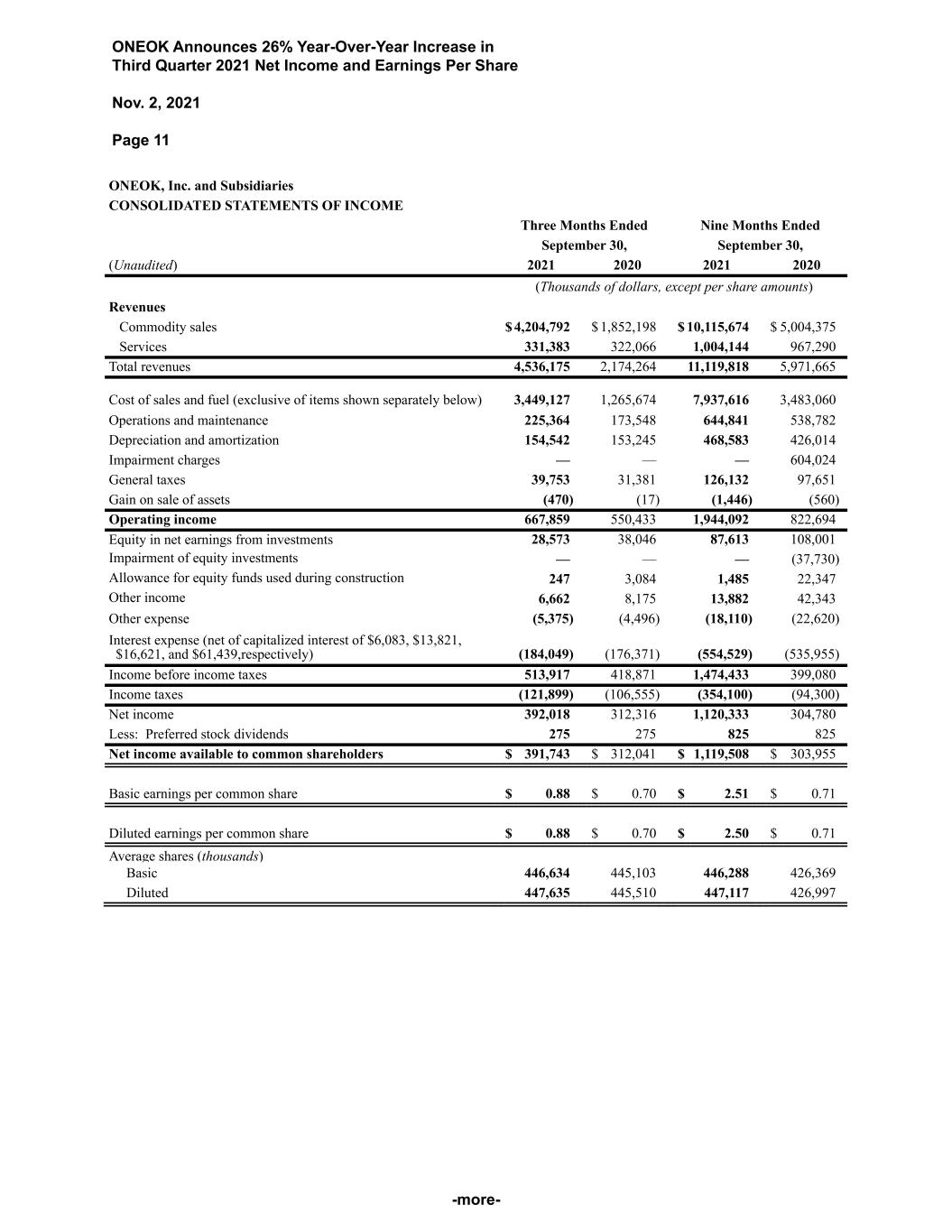

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 11 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF INCOME Three Months Ended Nine Months Ended September 30, September 30, (Unaudited) 2021 2020 2021 2020 (Thousands of dollars, except per share amounts) Revenues Commodity sales $ 4,204,792 $ 1,852,198 $ 10,115,674 $ 5,004,375 Services 331,383 322,066 1,004,144 967,290 Total revenues 4,536,175 2,174,264 11,119,818 5,971,665 Cost of sales and fuel (exclusive of items shown separately below) 3,449,127 1,265,674 7,937,616 3,483,060 Operations and maintenance 225,364 173,548 644,841 538,782 Depreciation and amortization 154,542 153,245 468,583 426,014 Impairment charges — — — 604,024 General taxes 39,753 31,381 126,132 97,651 Gain on sale of assets (470) (17) (1,446) (560) Operating income 667,859 550,433 1,944,092 822,694 Equity in net earnings from investments 28,573 38,046 87,613 108,001 Impairment of equity investments — — — (37,730) Allowance for equity funds used during construction 247 3,084 1,485 22,347 Other income 6,662 8,175 13,882 42,343 Other expense (5,375) (4,496) (18,110) (22,620) Interest expense (net of capitalized interest of $6,083, $13,821, $16,621, and $61,439,respectively) (184,049) (176,371) (554,529) (535,955) Income before income taxes 513,917 418,871 1,474,433 399,080 Income taxes (121,899) (106,555) (354,100) (94,300) Net income 392,018 312,316 1,120,333 304,780 Less: Preferred stock dividends 275 275 825 825 Net income available to common shareholders $ 391,743 $ 312,041 $ 1,119,508 $ 303,955 Basic earnings per common share $ 0.88 $ 0.70 $ 2.51 $ 0.71 Diluted earnings per common share $ 0.88 $ 0.70 $ 2.50 $ 0.71 Average shares (thousands) Basic 446,634 445,103 446,288 426,369 Diluted 447,635 445,510 447,117 426,997

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 12 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS September 30, December 31, (Unaudited) 2021 2020 Assets (Thousands of dollars) Current assets Cash and cash equivalents $ 224,337 $ 524,496 Accounts receivable, net 1,497,549 829,796 Materials and supplies 147,800 143,178 NGLs and natural gas in storage 628,110 227,810 Commodity imbalances 22,396 11,959 Other current assets 146,669 132,536 Total current assets 2,666,861 1,869,775 Property, plant and equipment Property, plant and equipment 23,580,308 23,072,935 Accumulated depreciation and amortization 4,358,361 3,918,007 Net property, plant and equipment 19,221,947 19,154,928 Investments and other assets Investments in unconsolidated affiliates 797,233 805,032 Goodwill and net intangible assets 765,902 773,723 Other assets 420,388 475,296 Total investments and other assets 1,983,523 2,054,051 Total assets $ 23,872,331 $ 23,078,754

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 13 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (Continued) September 30, December 31, (Unaudited) 2021 2020 Liabilities and equity (Thousands of dollars) Current liabilities Current maturities of long-term debt $ 536,107 $ 7,650 Accounts payable 1,442,984 719,302 Commodity imbalances 316,270 186,372 Accrued taxes 121,228 89,428 Accrued interest 140,689 245,153 Operating lease liability 14,378 13,610 Other current liabilities 231,214 83,032 Total current liabilities 2,802,870 1,344,547 Long-term debt, excluding current maturities 13,640,467 14,228,421 Deferred credits and other liabilities Deferred income taxes 981,823 669,697 Operating lease liability 78,497 87,610 Other deferred credits 527,799 706,081 Total deferred credits and other liabilities 1,588,119 1,463,388 Commitments and contingencies Equity ONEOK shareholders’ equity: Preferred stock, $0.01 par value: authorized and issued 20,000 shares at September 30, 2021, and at December 31, 2020 — — Common stock, $0.01 par value: authorized 1,200,000,000 shares; issued 474,916,234 shares and outstanding 445,933,921 shares at September 30, 2021; issued 474,916,234 shares and outstanding 444,872,383 shares at December 31, 2020 4,749 4,749 Paid-in capital 7,235,255 7,353,396 Accumulated other comprehensive loss (661,836) (551,449) Retained earnings — — Treasury stock, at cost: 28,982,313 shares at September 30, 2021, and 30,043,851 shares at December 31, 2020 (737,293) (764,298) Total equity 5,840,875 6,042,398 Total liabilities and equity $ 23,872,331 $ 23,078,754

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 14 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS Nine Months Ended September 30, (Unaudited) 2021 2020 (Thousands of dollars) Operating activities Net income $ 1,120,333 $ 304,780 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 468,583 426,014 Impairment charges — 641,754 Equity in net earnings from investments (87,613) (108,001) Distributions received from unconsolidated affiliates 88,389 109,595 Deferred income tax expense 344,808 93,174 Other, net 57,479 (17,599) Changes in assets and liabilities: Accounts receivable (687,031) 111,629 NGLs and natural gas in storage (400,300) 4,349 Accounts payable 756,072 (198,809) Risk-management assets and liabilities (254,163) (136,543) Other assets and liabilities 84,605 (127,215) Cash provided by operating activities 1,491,162 1,103,128 Investing activities Capital expenditures (less allowance for equity funds used during construction) (490,329) (1,924,003) Distributions received from unconsolidated affiliates in excess of cumulative earnings 19,188 22,280 Other, net (4,286) (80,148) Cash used in investing activities (475,427) (1,981,871) Financing activities Dividends paid (1,250,204) (1,189,575) Repayment of short-term borrowings, net — (220,000) Issuance of long-term debt, net of discounts — 3,244,777 Repayment of long-term debt (68,787) (1,433,480) Issuance of common stock 21,871 959,653 Other (18,774) (56,461) Cash provided by (used in) financing activities (1,315,894) 1,304,914 Change in cash and cash equivalents (300,159) 426,171 Cash and cash equivalents at beginning of period 524,496 20,958 Cash and cash equivalents at end of period $ 224,337 $ 447,129

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 15 -more- ONEOK, Inc. and Subsidiaries INFORMATION AT A GLANCE Three Months Ended Nine Months Ended September 30, September 30, (Unaudited) 2021 2020 2021 2020 (Millions of dollars, except as noted) Natural Gas Liquids Operating costs, excluding noncash compensation adjustments $ 122.4 $ 97.0 $ 359.5 $ 290.6 Depreciation and amortization $ 75.0 $ 71.5 $ 223.7 $ 198.4 Equity in net earnings from investments $ 5.4 $ 8.0 $ 14.1 $ 31.1 Adjusted EBITDA $ 532.2 $ 451.2 $ 1,448.1 $ 1,199.8 Raw feed throughput (MBbl/d) (a) 1,275 1,162 1,174 1,088 Average Conway-to-Mont Belvieu OPIS price differential - ethane in ethane/propane mix ($/gallon) $ — $ 0.03 $ (0.01) $ 0.01 Capital expenditures $ 53.8 $ 298.9 $ 225.8 $ 1,504.9 (a) - Represents physical raw feed volumes on which ONEOK charges a fee for transportation and/or fractionation services. Natural Gas Gathering and Processing Operating costs, excluding noncash compensation adjustments $ 91.3 $ 67.4 $ 254.0 $ 229.8 Depreciation and amortization $ 63.8 $ 66.5 $ 198.1 $ 180.6 Equity in net earnings (loss) from investments $ 0.5 $ — $ 2.7 $ (1.4) Adjusted EBITDA $ 229.7 $ 183.1 $ 663.6 $ 431.5 Natural gas gathered (BBtu/d) (a) 2,757 2,514 2,693 2,503 Natural gas processed (BBtu/d) (a) (b) 2,549 2,345 2,471 2,327 Average fee rate ($/MMBtu) (a) $ 1.02 $ 0.94 $ 1.04 $ 0.84 Capital expenditures $ 80.8 $ 63.0 $ 177.4 $ 362.8 (a) - Includes volumes for consolidated entities only. (b) - Includes volumes ONEOK processed at company-owned and third-party facilities. Natural Gas Pipelines Operating costs, excluding noncash compensation adjustments $ 39.2 $ 33.4 $ 115.4 $ 99.0 Depreciation and amortization $ 14.8 $ 14.2 $ 43.8 $ 43.9 Equity in net earnings from investments $ 22.7 $ 30.1 $ 70.9 $ 78.3 Adjusted EBITDA $ 102.7 $ 109.8 $ 423.6 $ 332.2 Natural gas transportation capacity contracted (MDth/d) (a) 7,335 7,349 7,353 7,485 Transportation capacity contracted (a) 94 % 94 % 94 % 96 % Capital expenditures $ 24.6 $ 13.0 $ 73.5 $ 40.5 (a) - Includes volumes for consolidated entities only.

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 16 -more- ONEOK, Inc. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Three Months Ended Nine Months Ended September 30, September 30, (Unaudited) 2021 2020 2021 2020 (Thousands of dollars) Reconciliation of net income to adjusted EBITDA Net income $ 392,018 $ 312,316 $ 1,120,333 $ 304,780 Interest expense, net of capitalized interest 184,049 176,371 554,529 535,955 Depreciation and amortization 154,542 153,245 468,583 426,014 Income tax expense 121,899 106,555 354,100 94,300 Impairment charges — — — 641,754 Noncash compensation expense (a) 12,978 1,606 37,086 1,261 Equity AFUDC and other noncash items (246) (3,084) (1,485) (22,346) Adjusted EBITDA (b) 865,240 747,009 2,533,146 1,981,718 (a) Amounts for the nine months ended Sept. 30, 2021 and 2020, include a loss of $6.9 million and a benefit of $16.9 million, respectively, related to the mark-to-market of ONEOK’s share-based deferred compensation plan. (b) Amounts for the three and nine months ended Sept. 30, 2020, include corporate gains of $2.2 million and $22.2 million, respectively, related to gains on open market repurchases of debt.

ONEOK Announces 26% Year-Over-Year Increase in Third Quarter 2021 Net Income and Earnings Per Share Nov. 2, 2021 Page 17 ONEOK, Inc. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Updated 2021 Guidance Range (Unaudited) (Millions of dollars) Reconciliation of net income to adjusted EBITDA Net income $ 1,430 - $ 1,550 Interest expense, net of capitalized interest 750 - 730 Depreciation and amortization 630 - 620 Income tax expense 455 - 495 Noncash compensation expense 55 - 35 Equity AFUDC and other noncash items 5 - (5) Adjusted EBITDA $ 3,325 - $ 3,425