December 9, 2020 Transforming our Business and Unlocking Value

2 Forward-Looking Statements This presentation and any oral related statements made by our representatives may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward- looking statements may relate to strategic alternatives, future operations, strategies, plans, partnerships, investments, share buybacks, financial results or other developments, and are subject to assumptions, risks and uncertainties. Statements such as “guidance”, “expect”, “strong”, “anticipate”, “believe”, “intend”, “goal”, “objective”, “target”, “potential”, “will”, “may”, “would”, “should”, “can”, “deliver”, “accelerate”, “enable”, “estimate”, “projects”, “outlook”, “opportunity”, “position” or similar words, as well as specific projections of future events or results qualify as forward-looking statements. Forward-looking statements, by their nature, are subject to a variety of inherent risks and uncertainties that could cause actual results to differ materially from the results projected. Many of these risks and uncertainties cannot be controlled by American Equity Investment Life Holding Company (“AEL”) and include the possibility that the proposed transaction may not be completed. Factors that may cause our actual decisions or results to differ materially from those contemplated by these forward-looking statements can be found in AEL’s Form 10-K and Form 10-Q filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement was made and AEL undertakes no obligation to update such forward-looking statements. There can be no assurance that other factors not currently disclosed or anticipated by AEL will not materially adversely affect our results of operations or plans. Investors are cautioned not to place undue reliance on any forward-looking statements made by us or on our behalf.

3 What is AEL and where is it going? American Equity is a leader in general account annuities, especially fixed index annuities (FIAs) Simple client promise underlies product offerings, specifically providing policyholders the dignity of a paycheck for life by providing secure retirement income and principal protected accumulation. Stayed away from complex insurance tail risk exposures. At scale player with over $50 billion in policyholder funds under management and proven ability to originate and change with the times, demonstrated by consistently being top #3-5 player in the independent agent channel. Tail-wind of retail market investing thru ETFs and indices is a positive for the fixed index annuity market Highly rated and liquid asset portfolio with significant unrealized gains that are not reflected in insurance book value accounting, allows for repositioning assets to monetize illiquidity benefits of liabilities without re-risking into high beta credit sectors or increasing asset leverage . Track record of consistent growth and robust ROEs, repositioning to continue to deliver strong double digits ROEs even with low UST rates Scarcity value: At scale origination franchise for general account annuity liabilities, provides significant asset investing opportunity

4 AEL 2.0 Transformation Capitalizing on AEL heritage and building a differentiated asset origination & management platform to significantly grow shareholder value with tangible return metrics along the way Re-establish leading position in independent agent channel and grow additional sources of origination (Eagle Life, inorganic partnerships) Diversify investment portfolio to monetize illiquidity value in funding with stable cash flow, long term assets, i.e. alpha-producing assets Optimize capital structure efficiency with reinsurance vehicles to raise third party capital and build multiple, stable earning streams compared to primarily investment grade, core fixed income assets based spread income (under AEL 1.0)

5 Maximizing Shareholder Value Creation with AEL 2.0 Business Plan Go-to-Market (raise & service funds) IMO model, traditional customer service Investment management (invest funds) Core Plus fixed income (FI) investing 2018 Priorities: Evolve Capabilities • Investment enhancement • Actuarial modeling • Strategic Partner(s) To …. “AEL 2.0 differentiators (2H, 2020 onwards)” Investment management Core FI & Alpha assets proprietary sourcing & insurer specific structuring Foundational capabilities Analytics, Technology, Talent Capital structure Optimize asset- leverage, diversify Sources of risk bearing capital & Reinsurance SPVsGo-to-Market Multi-channel dominance (Independent agent, financial institutions & inorganic). Product Innovation & Service differentiation From .…“AEL 1.0 differentiators (Pre-2020)” Industry evolution Emergence of PE backed annuity competitors Investing in a low interest rate environment Digital engagement model as an expedited reality (post-COVID)

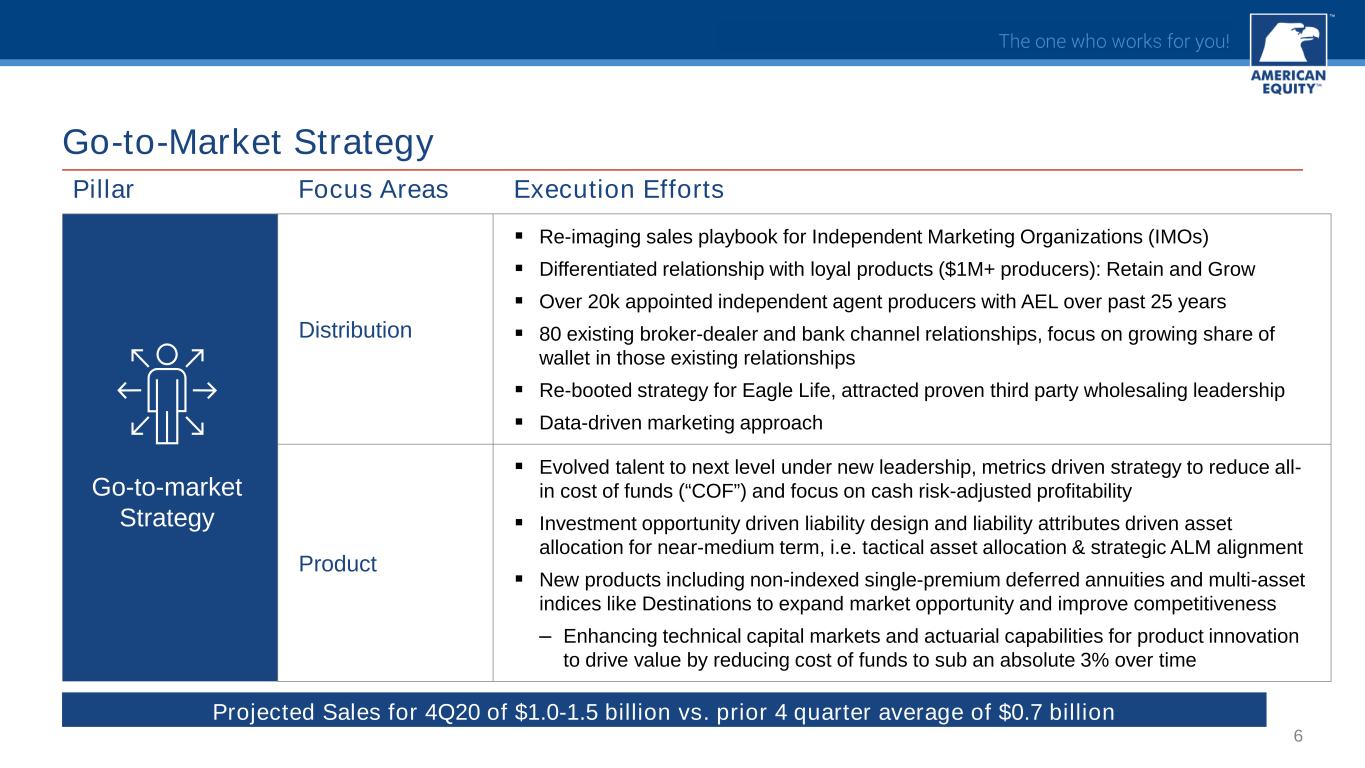

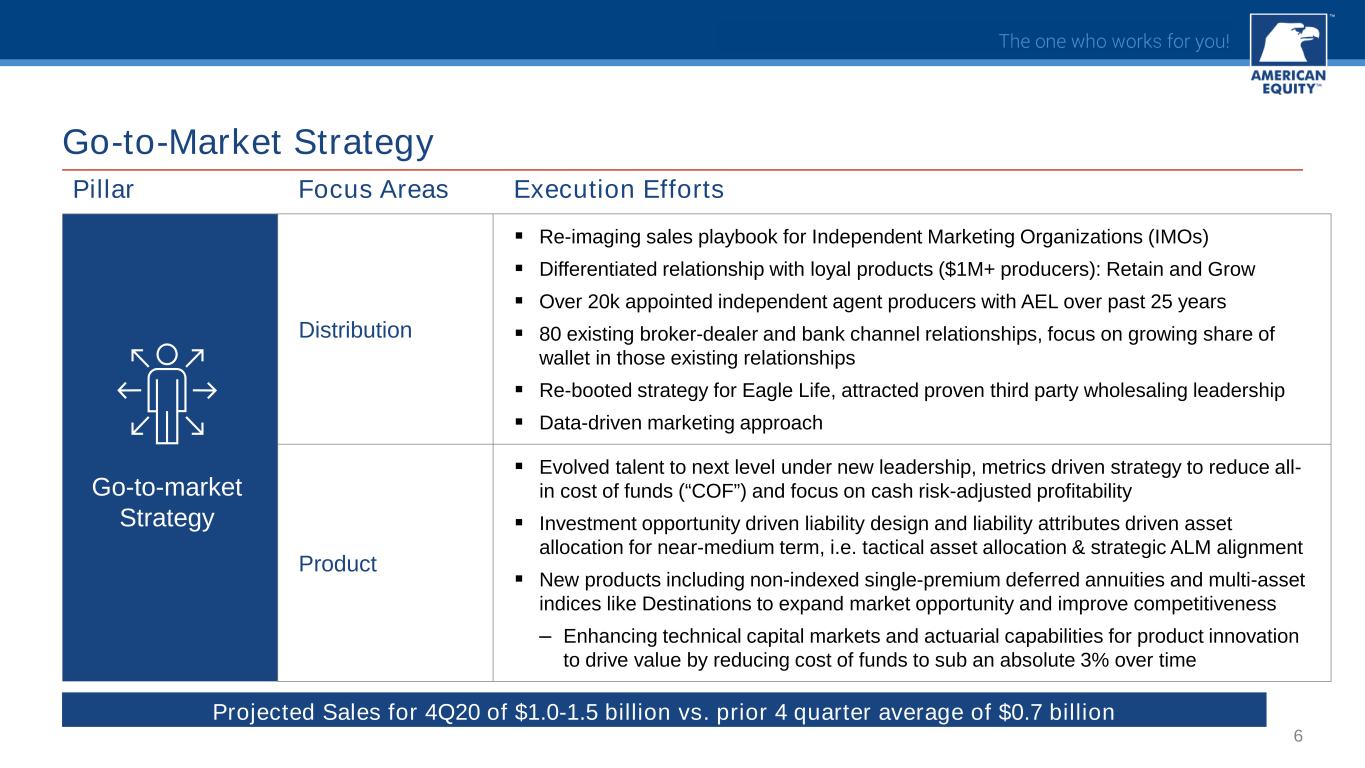

6 Pillar Focus Areas Execution Efforts Distribution Re-imaging sales playbook for Independent Marketing Organizations (IMOs) Differentiated relationship with loyal products ($1M+ producers): Retain and Grow Over 20k appointed independent agent producers with AEL over past 25 years 80 existing broker-dealer and bank channel relationships, focus on growing share of wallet in those existing relationships Re-booted strategy for Eagle Life, attracted proven third party wholesaling leadership Data-driven marketing approach Product Evolved talent to next level under new leadership, metrics driven strategy to reduce all- in cost of funds (“COF”) and focus on cash risk-adjusted profitability Investment opportunity driven liability design and liability attributes driven asset allocation for near-medium term, i.e. tactical asset allocation & strategic ALM alignment New products including non-indexed single-premium deferred annuities and multi-asset indices like Destinations to expand market opportunity and improve competitiveness ‒ Enhancing technical capital markets and actuarial capabilities for product innovation to drive value by reducing cost of funds to sub an absolute 3% over time Go-to-Market Strategy Projected Sales for 4Q20 of $1.0-1.5 billion vs. prior 4 quarter average of $0.7 billion Go-to-market Strategy

7 Pillar Focus Areas Execution Efforts Insurance Asset Manager Re-tooling investment management platform (BlackRock Aladdin Solutions) Expanding underwriting and risk capital allocation lens for additional asset sectors Building internal securitization or structuring skills for risk capital efficiency while entering new sectors. Strategic & Tactical Asset Allocation (SAA & TAA) processes Started de-risking portfolio in 2020, accelerate migration to alpha assets in 2021 Sourcing Partnerships with aligned economics to benefit AEL owners Proprietary sourcing pipeline with specialty asset managers or proven operators in industry sub-sectors. AEL becomes funding provider of choice for platforms Identifying potential revenue sharing or minority stakes to earn share of overall asset manager FCF, participate in valuation growth and drive alignment in interests Investment Management Drive 4%+ absolute investment yield by YE ‘21 and reduce correlation with publicly traded core fixed income Investment Management For both ceded liabilities and AEL retained portfolio: Real estate and infrastructure For AEL portfolio: Residential Real estate (whole loans) and landlord (single family rental – SFR) For third party reinsurance platform and ceded liabilities only: Corporate credit, real estate, mortgages, private equity, and direct lending

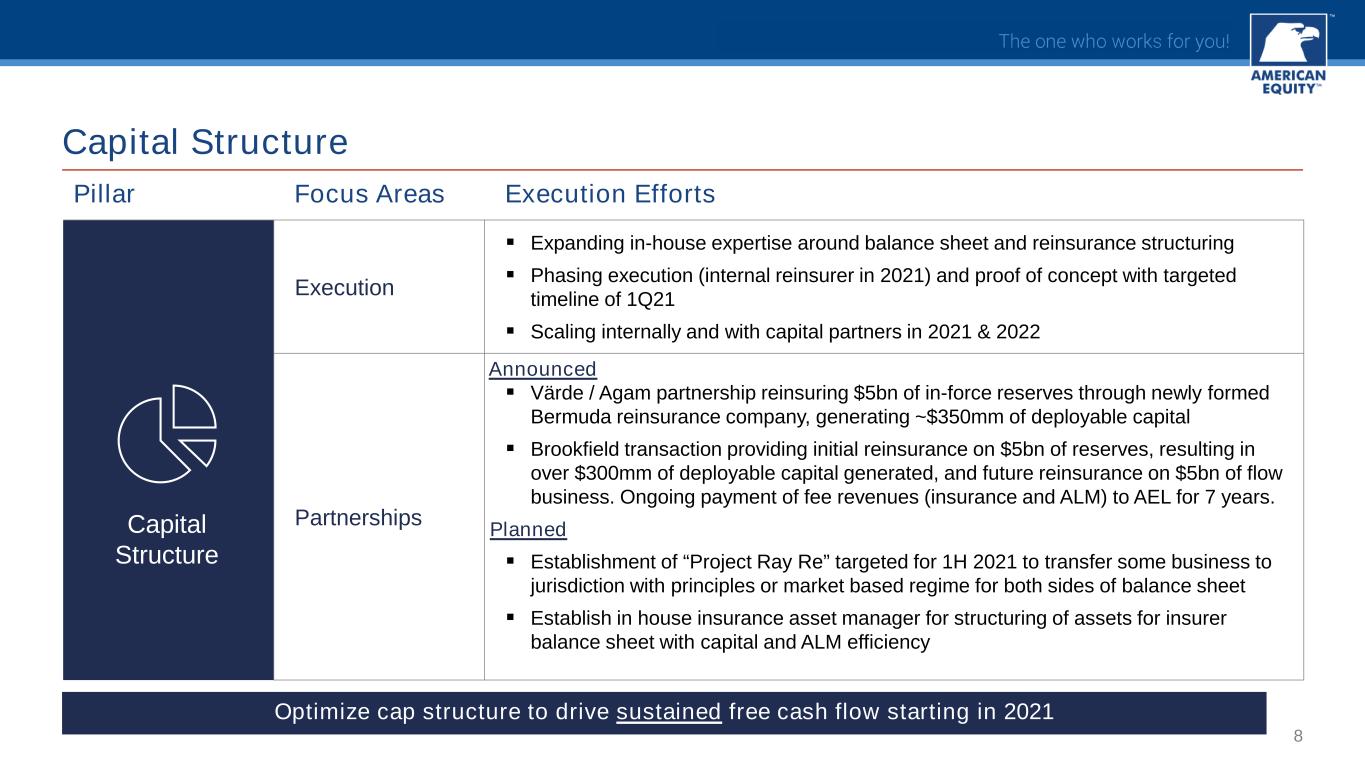

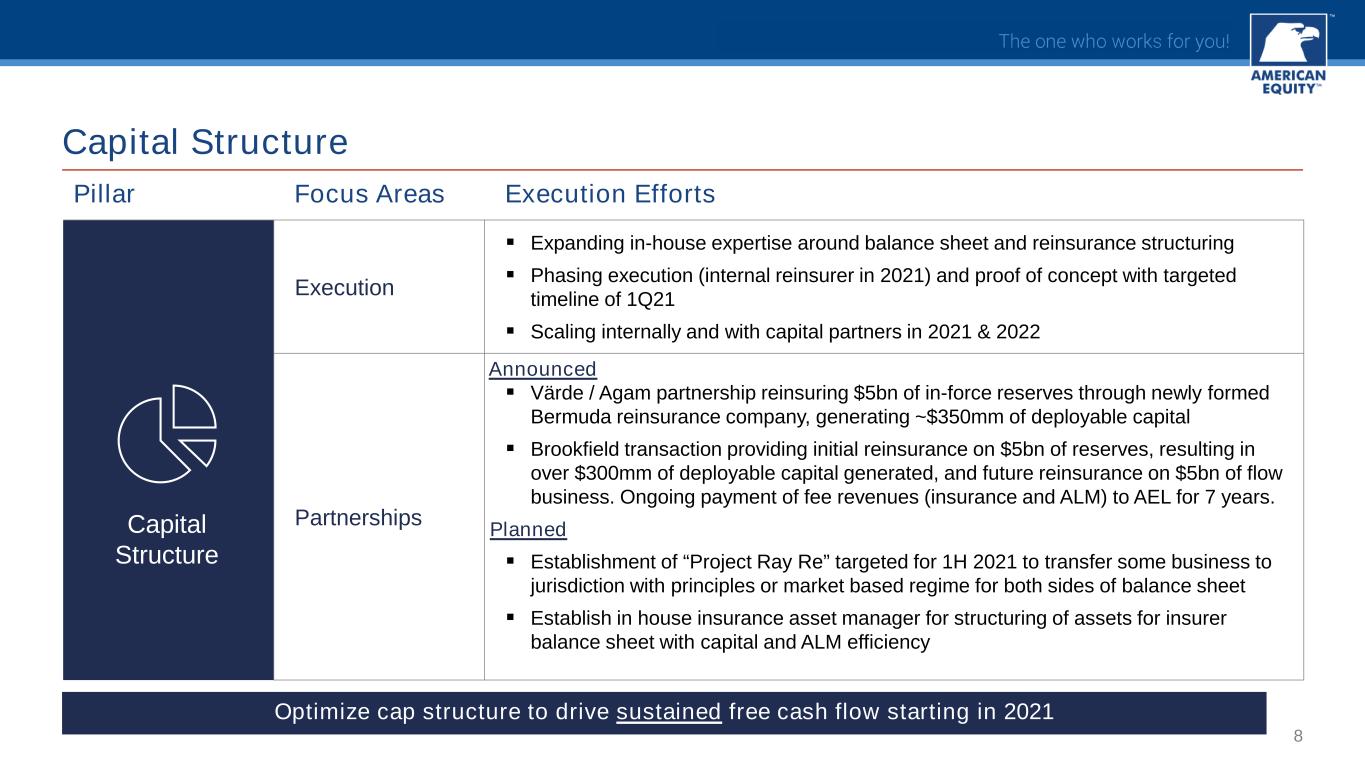

8 Pillar Focus Areas Execution Efforts Execution Expanding in-house expertise around balance sheet and reinsurance structuring Phasing execution (internal reinsurer in 2021) and proof of concept with targeted timeline of 1Q21 Scaling internally and with capital partners in 2021 & 2022 Partnerships Värde / Agam partnership reinsuring $5bn of in-force reserves through newly formed Bermuda reinsurance company, generating ~$350mm of deployable capital Brookfield transaction providing initial reinsurance on $5bn of reserves, resulting in over $300mm of deployable capital generated, and future reinsurance on $5bn of flow business. Ongoing payment of fee revenues (insurance and ALM) to AEL for 7 years. Establishment of “Project Ray Re” targeted for 1H 2021 to transfer some business to jurisdiction with principles or market based regime for both sides of balance sheet Establish in house insurance asset manager for structuring of assets for insurer balance sheet with capital and ALM efficiency Capital Structure Optimize cap structure to drive sustained free cash flow starting in 2021 Capital Structure Announced Planned

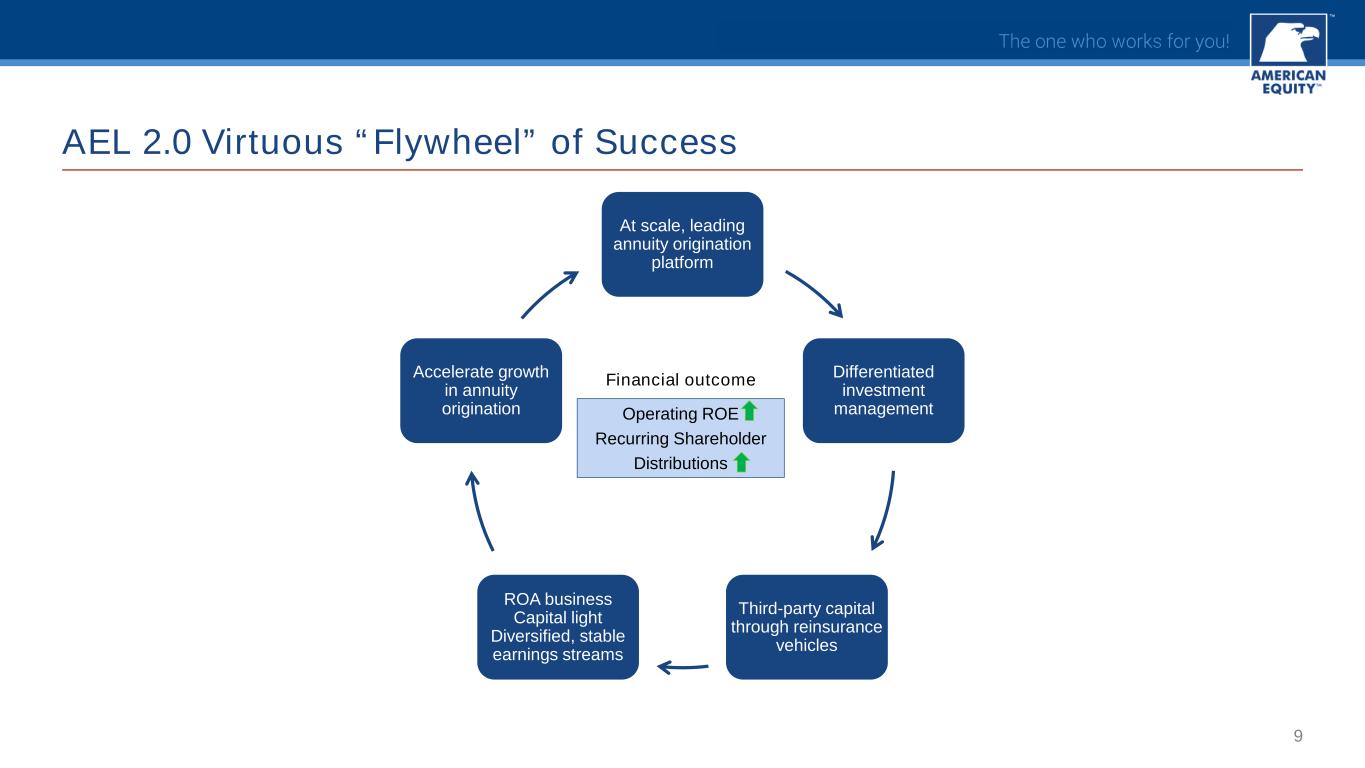

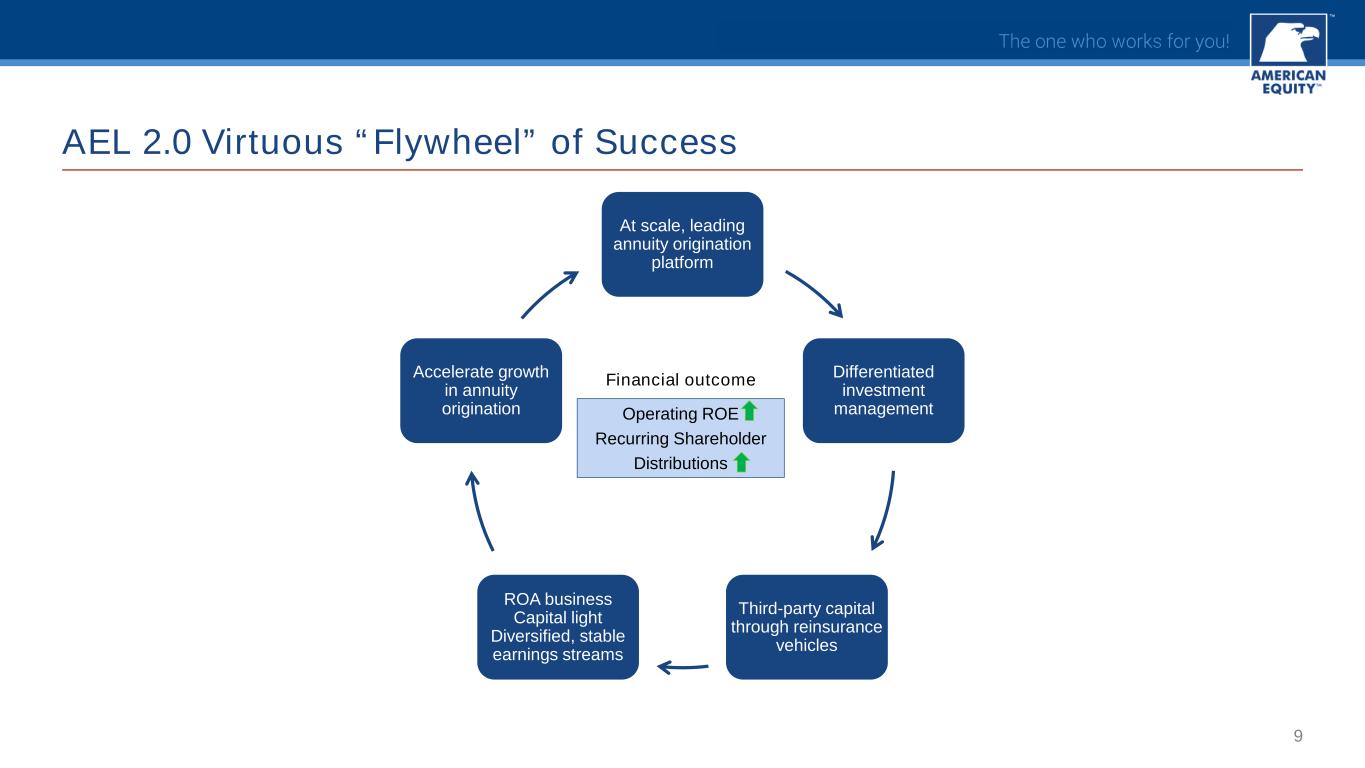

9 AEL 2.0 Virtuous “Flywheel” of Success At scale, leading annuity origination platform Differentiated investment management Third-party capital through reinsurance vehicles ROA business Capital light Diversified, stable earnings streams Accelerate growth in annuity origination Financial outcome Operating ROE Recurring Shareholder Distributions

10 Executing on AEL 2.0 Investment Management & Capital Structure Pillars Overview of Dialogues Investment management Capital structure September 28th Agreement in principle for a strategic partnership with Värde Partners and Agam Capital Management, LLC October 18th Strategic partnership with Brookfield-up to $10bn reinsurance arrangement and up to 19.9% equity investment - closed initial 9.9% stake on November 30th October 29th 12-14% economic interest for AEL and potential to originate $1.0bn to $2.25bn of assets N.A. November 30th Completed $50mm open market share repurchase and commenced $115mm ASR as initial components of returning $500mm capital to shareholders in the near term N.A. Establishment of AEL’s Offshore Reinsurer Convert $0.5-1B of unrealized capital gains to support increasing alpha producing assets Transfer ~20% of business in 2021 to optimize returns for shareholders thru AEL 2.0 pillars Likely jurisdiction in Bermuda (internally christened as “Project Ray Re”) Start Investment portfolio re- positioning Entry into middle market private credit and scaling real estate specialty subsector investments (“lender plus landlord”) model. Internal securitization for capital efficiency A nn ou nc ed E xe cu tio n E ff or ts Since early 2020, AEL has been engaged in third-party dialogues to build the pillars of investment management and capital structure Active dialogue with several asset managers involving potential investment management agreements with differential economic arrangements to benefit AEL shareholders through either varied means including performance fees linked to AEL capital appreciation, revenue participation or general partner equity stakes. H 1, 2 02 1 E xp ec te d

11 AEL 2.0 Partnerships Network: Illustrative Map Reinsurance arrangement Investment Mgmt (IM) arrangement Economic or control arrangement AEL Reinsurance Partnerships In-house Reinsurer (Bermuda) Project Ray Re AEILIC (Iowa Insurer) Co-insurance (Solely with AEILIC) AEL HoldCo Reinsurer SPVs (Side-cars) (Bermuda) Expect in 2022+ AE Insurance Asset Mgr. Third Party Equity Investors IM Agreement 75-100% interest Varde-Agam Reinsurer (Bermuda) NorthEnd Re Brookfield Reinsurer (Cayman) Pretium (AEL focus on residential: loans & single family rental) AEL with minority interest (economic and/or voting) MM Private Credit Manager (Expect 1H, 2021) Real Estate Equity Sub-sector(s) (Expect 2021) AEL 2.0 Asset Management Partnerships Co-insurance (AEILIC only) IM Sub-advisory agreements Varde Insurance Asset Mgr. (Expect 1H, 2021) 7 year ALM fee Co-insurance 7 Year insurance fee payment IM Agreement AEL 20% interest IM A gr ee m en ts Co-insurance [5-10] Year insurance fee payment 100% interest 100% interest 100% interest

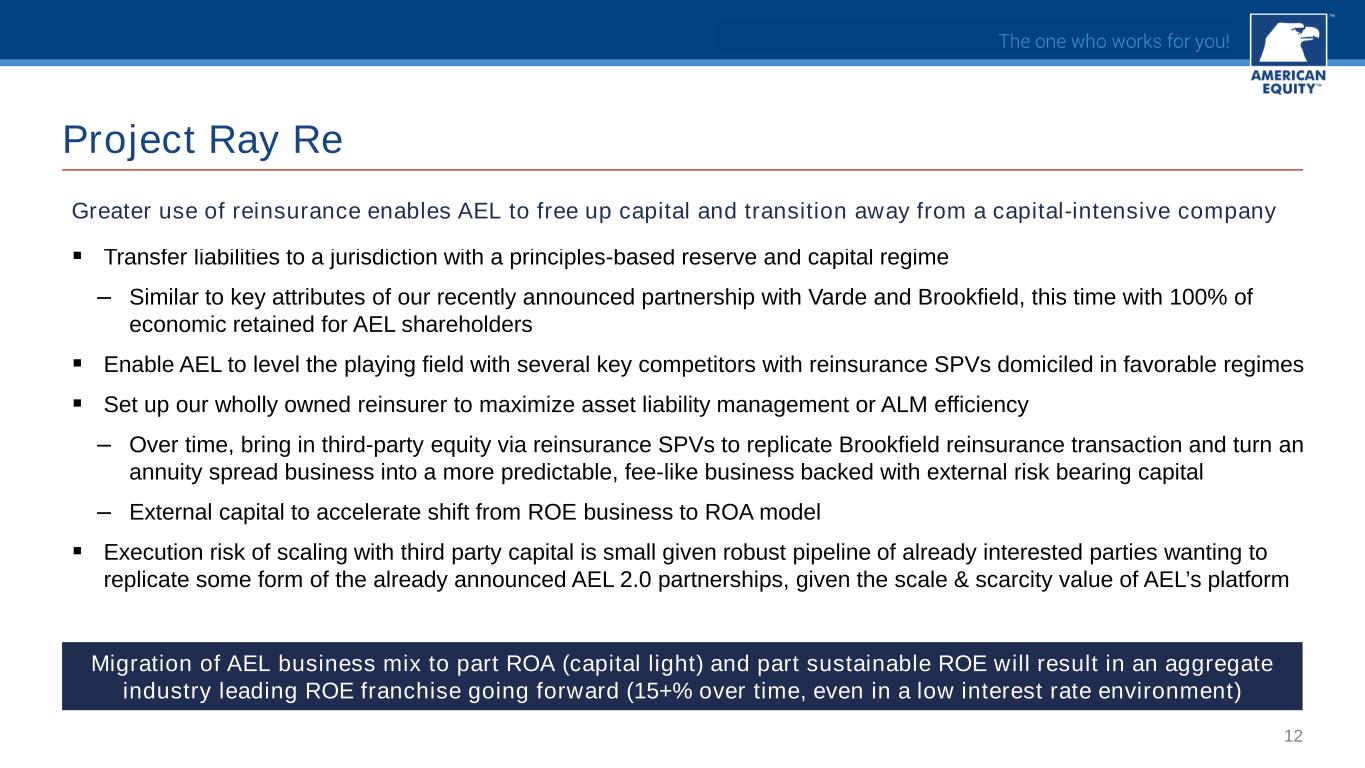

12 Project Ray Re Migration of AEL business mix to part ROA (capital light) and part sustainable ROE will result in an aggregate industry leading ROE franchise going forward (15+% over time, even in a low interest rate environment) Transfer liabilities to a jurisdiction with a principles-based reserve and capital regime ‒ Similar to key attributes of our recently announced partnership with Varde and Brookfield, this time with 100% of economic retained for AEL shareholders Enable AEL to level the playing field with several key competitors with reinsurance SPVs domiciled in favorable regimes Set up our wholly owned reinsurer to maximize asset liability management or ALM efficiency ‒ Over time, bring in third-party equity via reinsurance SPVs to replicate Brookfield reinsurance transaction and turn an annuity spread business into a more predictable, fee-like business backed with external risk bearing capital ‒ External capital to accelerate shift from ROE business to ROA model Execution risk of scaling with third party capital is small given robust pipeline of already interested parties wanting to replicate some form of the already announced AEL 2.0 partnerships, given the scale & scarcity value of AEL’s platform Greater use of reinsurance enables AEL to free up capital and transition away from a capital-intensive company

13 Expect to Return Significant Amount of Capital to Shareholders ~10% of current market cap. each year starting in 2021 5 quarter plan: 4Q 2020 through 4Q 2021 ~$250-300mm Annual ongoing free cash flow from operations Share holder return of capital to be sustained by operational performance Intention to fully offset dilution from Brookfield equity investments (tranche I: 9.1mm shares, tranche II in 2021 after Form A insurance regulatory approval, up to 20% stake) In past 50 days, repurchased 5.4mm shares (5+% of shares) ‒ Completed $50mm open market repurchase of 1.9mm shares ‒ Authorized $115mm ASR with 3.5mm shares already delivered, rest expected in 1Q 2021. Return at least $250mm in additional capital to shareholders in 2021, after repurchases to offset Brookfield dilution Turning a historically capital constrained organization into a high topline and bottom line growth business

14 AEL 1.0 AEL 2.0 Revenue Streams Traditional spread-based business model Increased fee-based revenue and enhanced, sustainable profitability on spread-based earnings Capital Intensity Retained earnings required to support earnings generating insurance liabilities, minimal free cash flow Historically, serially raised capital to support policyholder funds under management growth Shift to “return on assets” model Ability to return $250-300mm of capital to shareholders through operating cash flow Partnerships with highly supportive third-party capital providers Interest Rate Sensitivity Business performance highly correlated with interest rates and publicly traded fixed income Fee-based and contractual income streams lessen correlation to rate environment AEL 2.0 – Transformed Earnings

15 AEL 2.0 Strategic Goals and Measures of Success Focus Areas Goals Expected Outcomes Insurance Liability Origination Franchise High growth with attractive cost of funding Achieve first quartile cost of funds relative to peer insurers in target channels (sub 3% over time) on new products No longer capital constraint to grow policyholder funds under management or repositioning of asset portfolio Financial Profile Sustainably EPS growth and industry leading ROE Achieve 11-14% ROE over the next few years and long-term goal of 15%+ even in a low rate environment Robust ongoing operating EPS growth from 2022, 2021 as reset year with portfolio migration & execution of reinsurance transactions Increase share of fee-based revenue (ROA model) and expand profitability on spread-driven earnings (ROE model) Unlocking Shareholder Value Return of capital and ongoing free cash flow generation Unlock economic value trapped in assets and reserves, redeploy freed up capital for sustained EPS and ROE growth Continue rapid progress on path to annualized free cash flow of $250-300mm starting in 2021, look for ways to grow in future years

December 9, 2020 APPENDIX – Additional Details on AEL 2.0 Announced Partnerships (2H, 2020)

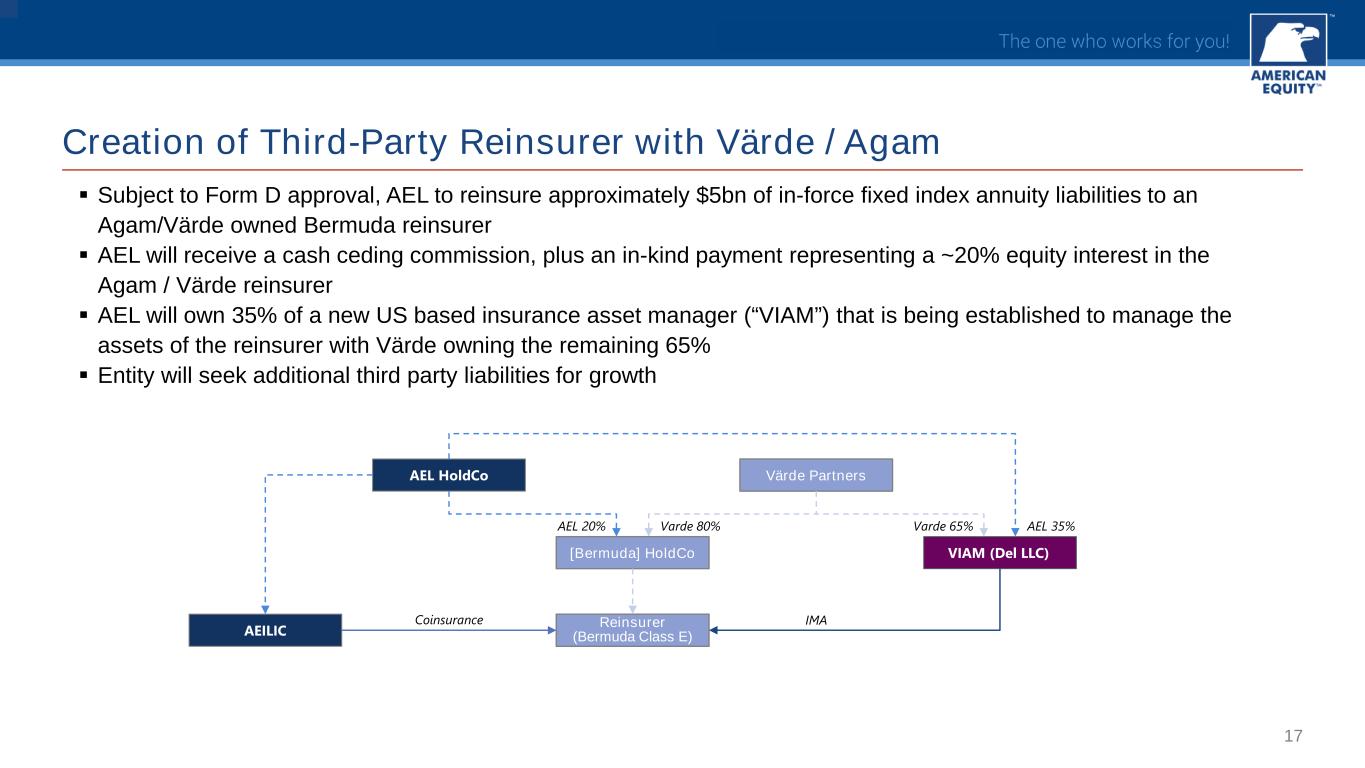

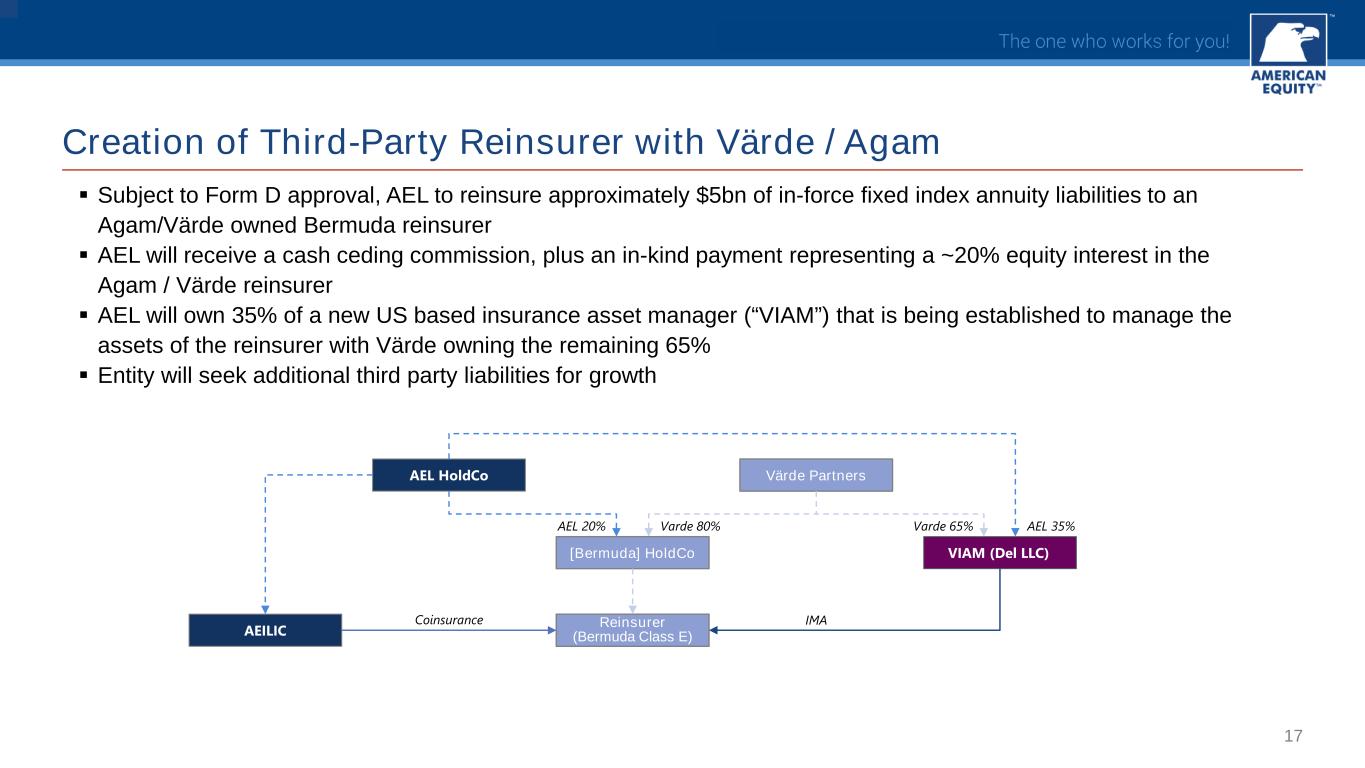

17 Subject to Form D approval, AEL to reinsure approximately $5bn of in-force fixed index annuity liabilities to an Agam/Värde owned Bermuda reinsurer AEL will receive a cash ceding commission, plus an in-kind payment representing a ~20% equity interest in the Agam / Värde reinsurer AEL will own 35% of a new US based insurance asset manager (“VIAM”) that is being established to manage the assets of the reinsurer with Värde owning the remaining 65% Entity will seek additional third party liabilities for growth Creation of Third-Party Reinsurer with Värde / Agam Reinsurer (Bermuda Class E) VIAM (Del LLC) AEILIC Coinsurance Värde PartnersAEL HoldCo [Bermuda] HoldCo AEL 20% Varde 80% Varde 65% AEL 35% IMA

18 Overview of Brookfield Transaction Release over $300mm of capital from $5bn in-force reinsurance transaction Generate stable, recurring “fee-like” income Establishes Brookfield as a long-term shareholder with strong alignment at a floor price of $37 per share Positions AEL for conversion into an “ROA” business model and accelerating growth of annuity origination Unique investment opportunities in assets with long-term, contractual cash flows Completed initial investment of 9.9% at $37 per share on November 30th Subsequent, up to 10% investment at greater of adjusted book value1 or $37 per share Equity Investment Initial $5bn of reserves Follow-on $5bn of future flow business2 Reinsurance Agreement 1 Excluding AOCI and the net impact of fair value accounting for derivatives and embedded derivatives 2 Certain reinsurance terms referenced remain subject to finalization Access to Brookfield’s attractive alternative asset strategies providing sustained returns in a low interest rate environment Asset Management Relationship

19 Overview of Brookfield Transaction Economics Return on Equity (“ROE”) Model 1 Spread, cede and fee parameters shown on after-tax basis (21% tax rate) 2 Fee-earning assets equal to initial statutory cash surrender value % $mm Insurance Cede1 0.51% $24 Asset Mgmt. Fee1 0.20% $9 Total1 0.71% $33 Required Capital 0% $0. Manufacture $33mm of earnings for 7 years plus significant capital release up front % $mm Spread Earnings1 0.7-0.8% $35-40 Required Capital 6.0-7.0% $320-350 Return on Equity (%)2 10-12% $5.0bn of FA Statutory Liabilities $320-350mm $4.7bn of Fee Earning Assets2 In-force $5 Billion Only Return on Assets (“ROA”) Model Flow arrangement provides capital for additional earnings growth

20 Overview of Pretium Pretium focuses on identifying potential cyclical and secular catalysts that produce opportunities with asymmetrical return profiles AEL has previously sourced non-qualified mortgages from Pretium, enabling the company to offer attractive single premium deferred annuities ‒ AEL expects to originate between $1bn to $2.25bn of assets through Pretium over the next year or two AEL ownership of 12% expected to increase to 13.9%1 ‒ Investment will allow for AEL to participate in valuation growth as Pretium scales its platform over time $5.7 $7.8 $10.3 $12.5 $14.6 $15.9 2015 2016 2017 2018 2019 1H 2020 PillarPretium AUM ($bn) Targeted Sectors Mortgage Finance Corporate and Structured Credit Residential 1 Ownership will increase to 13.9% once assets originated reaches $2.25bn