Exhibit 99.1

Non-GAAP Disclaimer

Certain financial data included in this exhibit consists of non-GAAP financial measures. These non-GAAP financial measures may not be comparable to similarly titled measures presented by other entities, nor should they be construed as an alternative to other financial measures determined in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Although American National Group Inc. believes these non-GAAP financial measures provide useful information to users in measuring the financial performance and condition of its business, users are cautioned not to place undue reliance on any non-GAAP financial measures included in this exhibit. A reconciliation of the non-GAAP financial measures to the most directly comparable U.S. GAAP financial measure is available in this exhibit.

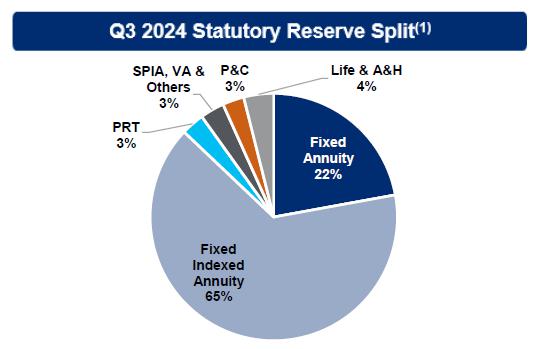

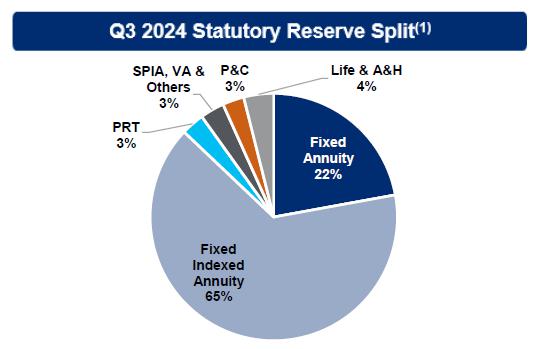

Reserve Profile

(1) Q3 2024 statutory reserve split include results from the affiliates of ANAT and AEL

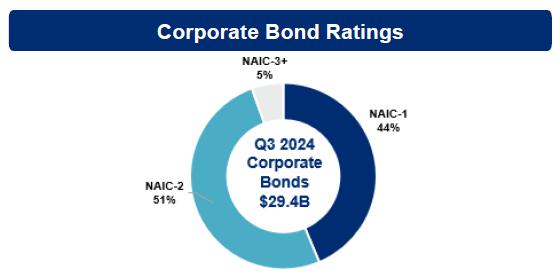

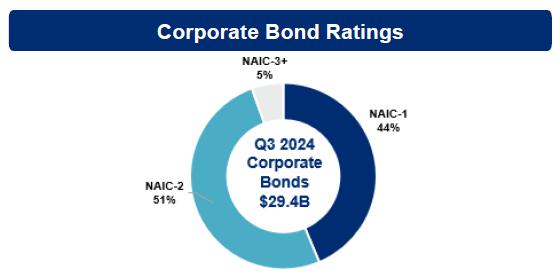

Investment Portfolio Overview

| · | Portfolio average credit rating: “A” |

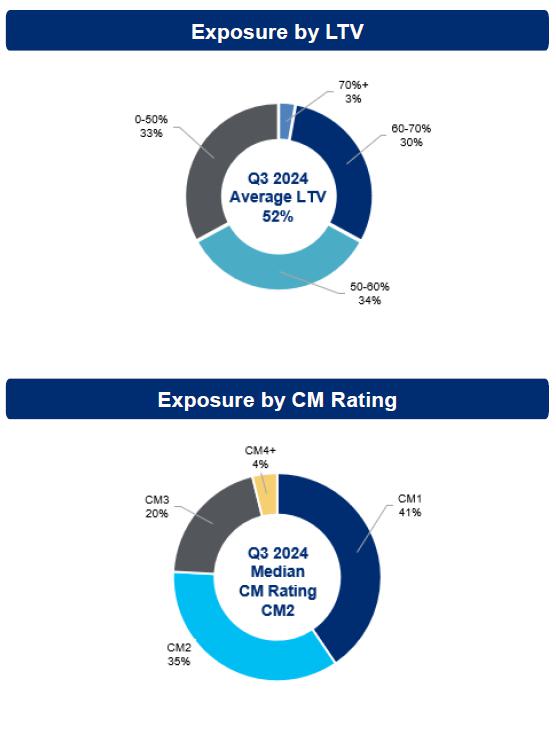

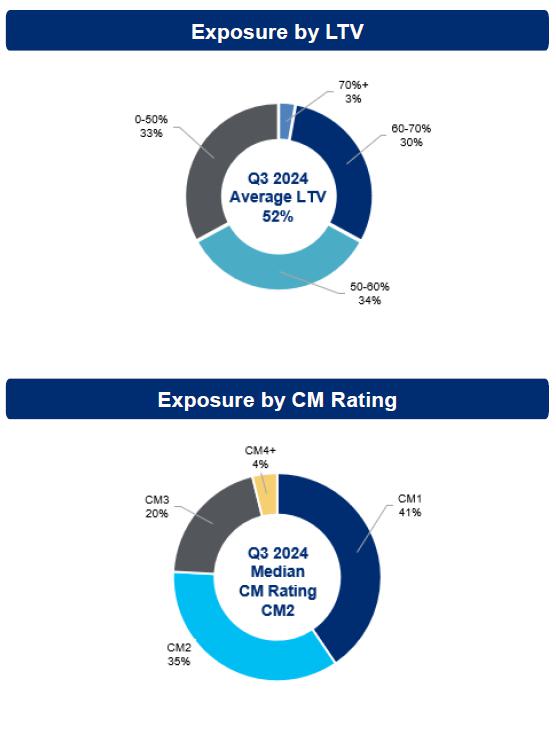

Commercial Mortgage Loan

Structured Credit

Distributable Operating Earnings Reconciliation

| | | 2022 | | | 2023 | | | 2024 | |

| ($ in millions) | | Q4 | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Q1 | | | Q2 | | | Q3 | |

| Net Income (loss) attributable to ANGI / American National | | $ | 132 | | | $ | 8 | | | $ | 101 | | | $ | 54 | | | $ | 229 | | | $ | 113 | | | $ | 244 | | | $ | (299 | ) |

| Net invest. gains & losses, incl. reinsurance funds withheld(2) | | | (25 | ) | | | 52 | | | | 44 | | | | 200 | | | | (87 | ) | | | (4 | ) | | | (361 | ) | | | (128 | ) |

| Mark-to-market on insurance contracts and other net assets(3,4) | | | 31 | | | | 90 | | | | (6 | ) | | | (114 | ) | | | - | | | | 55 | | | | 577 | | | | 835 | |

| Deferred income tax expense (recovery) | | | 31 | | | | (8 | ) | | | 14 | | | | (10 | ) | | | 25 | | | | 28 | | | | (355 | ) | | | (105 | ) |

| Depreciation | | | 18 | | | | 5 | | | | 5 | | | | 5 | | | | 4 | | | | 6 | | | | 17 | | | | 25 | |

| Transaction costs | | | 1 | | | | 2 | | | | - | | | | 5 | | | | 5 | | | | 1 | | | | 131 | | | | 32 | |

| Distributable Operating Earnings | | $ | 188 | | | $ | 149 | | | $ | 158 | | | $ | 140 | | | $ | 176 | | | $ | 199 | | | $ | 253 | | | $ | 360 | |

(1) Distributable operating earnings (“DOE”) is a non-GAAP measure used by management to assess operating results and the performance of the business.

(2) “Net investment gains and losses, including reinsurance funds withheld” represents mark-to-market gains (losses) on our invested assets and reinsurance funds withheld. Mark-to-market gains (losses) on our invested assets are presented as “Investment related gains (losses)” on the statements of operations. Mark-to-market gains (losses) on reinsurance funds withheld are included in “Net investment results from reinsurance funds withheld” and represent the change in fair value of the embedded derivative during the period.

(3) “Mark-to-market on insurance contracts and other net assets” principally represents the mark-to-market effect on insurance-related liabilities, net of reinsurance, due to changes in market risks (e.g., interest rates, equity markets and equity index volatility) and includes depreciation expenses on investment real estate. These mark-to-market effects are primarily included in “Net investment income”, “Interest sensitive contract benefits”, “Change in fair value of insurance-related derivatives and embedded derivatives” and “Change in fair value of market risk benefits” on the statements of operations.

(4) Included in “Mark-to-market on insurance contracts and other net assets” are “returns on equity invested in certain variable interest entities” and “our share of adjusted earnings from our investments in certain associates”. “Returns on equity invested in certain variable interest entities” primarily represent equity-accounted income from our investments in real estate partnerships and investment funds and are included in “Net investment income” on the statements of operations. Additionally, “our share of adjusted earnings from our investments in certain associates” represent our share of DOE from AEL following the announcement of our acquisition in the third quarter of 2023.