UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.__)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

PETMED EXPRESS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PETMED EXPRESS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD AT 11:00 A.M. EASTERN TIME ON AUGUST 3, 2023

TO THE OWNERS OF COMMON STOCK OF PETMED EXPRESS, INC.

We cordially invite you to attend the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of PetMed Express, Inc., a Florida corporation (the “Company”), which will be held as a virtual meeting on Thursday, August 3, 2023 at 11:00 a.m., Eastern Time. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/petmeds/2023/htype.asp. After you have registered, you will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. Shareholders will be able to listen, vote and submit questions during the virtual meeting. As always, we encourage you to vote your shares prior to the Annual Meeting.

| | | | | | | | |

| Date: | Time: | Location (virtual): |

| August 3, 2023 | 11:00 a.m. Eastern Time | http://www.viewproxy.com/petmeds/2023/htype.asp |

The purposes of the meeting are:

1.To elect five directors to our Board of Directors;

2.To conduct an advisory vote to approve named executive officer compensation;

3.To conduct an advisory vote to determine the frequency of future advisory votes on named executive officer compensation;

4.To ratify the appointment of RSM US LLP as the independent registered public accounting firm for the Company to serve for the 2024 fiscal year; and

5.To transact any other business as may properly come before the meeting.

These items are described in the accompanying Proxy Statement.

Our Board of Directors has fixed the close of business on June 7, 2023 as the record date for the Annual Meeting (the “Record Date”). Only shareholders of record on June 7, 2023 are entitled to notice of and to vote at the Annual Meeting, or any adjournments or postponements of the Annual Meeting. On June 7, 2023, there were 21,173,327 shares of common stock issued and outstanding.

We would like to extend a personal invitation for you to join us virtually at our Annual Meeting. Your vote is important to us and to our business. We ask that you please cast your vote, as soon as possible. We encourage you to sign and return your proxy card or voting instructions via the Internet or mail prior to the meeting, so that your shares will be represented and voted at the meeting even if you attend the virtual Annual Meeting. For additional instructions on voting by telephone or the internet, please refer to your Notice of Internet Availability of Proxy Materials or proxy card. Returning the proxy does not deprive you of your right to attend the virtual Annual Meeting and to vote your shares at the virtual Annual Meeting.

This Notice of Annual Meeting, and the accompanying Proxy Statement, form of proxy card and our Annual Report on Form 10-K for the year ended March 31, 2023 are first being distributed to shareholders on or about June 20, 2023.

| | | | | |

| By Order of the Board of Directors, /S/ MATHEW N. HULETT MATHEW N. HULETT Chief Executive Officer, President, Director |

Delray Beach, Florida

June 20, 2023

Important Notice Regarding the Availability of Proxy Materials for the virtual Annual Meeting to be Held on August 3, 2023: The Proxy Statement, along with our Annual Report on Form 10-K for the year ended March 31, 2023, is available at: http://www.viewproxy.com/petmeds/2023.

TABLE OF CONTENTS

PETMED EXPRESS, INC.

420 South Congress Avenue

Delray Beach, FL 33445

PROXY STATEMENT

This Proxy Statement contains information relating to the solicitation of proxies by the Board of Directors (“Board of Directors” or "Board”) of PetMed Express, Inc. (the "Company,” "PetMed Express, Inc.,” "we,” "us,” "our”) for use at our 2023 Annual Meeting of Shareholders ("Annual Meeting”). You will be able to virtually attend the Annual Meeting on Thursday, August 3, 2023, at 11:00 a.m., Eastern Time by first registering at http://www.viewproxy.com/petmeds/2023/htype.asp by August 1, 2023 at 11:59 p.m Eastern Time. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date where you will be able to listen to the meeting live, submit questions and vote online. Further information about how to attend the virtual Annual Meeting online, vote your shares online during the virtual Annual Meeting and submit questions during the virtual Annual Meeting is included in this Proxy Statement. Our Board of Directors has fixed the close of business on June 7, 2023 as the record date for the Annual Meeting (the “Record Date”). The Notice of Internet Availability of Proxy Materials containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the year ended March 31, 2023 is first being mailed on or about June 20, 2023 to all shareholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully. Information contained on, or that can be accessed through, our website is not incorporated by reference into this Proxy Statement and references to our website address and the virtual meeting website addresses in this Proxy Statement are inactive textual references only.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS, ANNUAL MEETING, AND VOTING

Why are we holding a virtual Annual Meeting?

Our Annual Meeting will be held solely in a virtual format, which will be conducted via a live video webcast and online shareholder tools. We are using the virtual format to facilitate shareholder attendance and participation by enabling shareholders to participate fully and equally from any location, at no cost. However, you will bear any costs associated with your Internet access, such as usage charges from internet access providers and telephone companies. A virtual Annual Meeting makes it possible for more shareholders (regardless of size, resources or physical location) to have direct access to information more quickly, while saving the Company and our shareholders time and money. We also believe that the online tools we have selected will increase shareholder communication. For example, the virtual format allows shareholders to communicate with us in advance of, and during, the Annual Meeting so they can ask questions of our Board of Directors or management. During the live Q&A session of the Annual Meeting, we may answer questions as they come in and address those asked in advance, to the extent relevant to the business of the Annual Meeting and as time permits.

How do I attend the Annual Meeting virtually?

To virtually attend and participate in the Annual Meeting online, you will need to first register at http://www.viewproxy.com/petmeds/2023/htype.asp by August 1, 2023 at 11:59 p.m. Eastern Time by using the virtual control number included on your Notice of Internet Availability of Proxy Materials or proxy card. After you register, you will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. The Annual Meeting webcast will begin promptly at 11:00 a.m.. Eastern Time. We encourage you to access the meeting prior to the start time. Please be sure to check-in online by 10:45 a.m. Eastern Time on August 3, 2023 (15 minutes prior to the start of the meeting is recommended) and you should allow sufficient time for the check-in procedures. If you encounter any difficulties accessing the virtual meeting during the check-in or course of the Annual Meeting, please call the technical support number at 866-612-8937 (which technical support number will also be posted on the Annual Meeting website log-in page) or email technical support at virtualmeeting@viewproxy.com.

How do I vote at the Annual Meeting virtually?

Both shareholders of record and street name shareholders will be able to attend the Annual Meeting via live video webcast, submit their questions during the meeting and vote their shares electronically at the Annual Meeting.

If you are a registered holder, your virtual control number will be on your Notice of Internet Availability of Proxy Materials or proxy card.

If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the Annual Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the internet, including how to demonstrate proof of stock ownership, are posted at http://www.viewproxy.com/petmeds/2023/htype.asp. On the day of the Annual Meeting, you may only vote during the meeting by e-mailing a copy of your legal proxy to virtualmeeting@viewproxy.com in advance of the meeting.

What am I voting on?

1.The election of five directors to our Board of Directors (Leslie C.G. Campbell, Sandra Y. Campos, Gian M. Fulgoni, Mathew N. Hulett, and Diana Garvis Purcel).

2.The approval of named executive officer compensation (an advisory non-binding vote).

3.The frequency of holding future advisory votes on named executive officer compensation (an advisory non-binding vote).

4.The ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the 2024 fiscal year.

5.Any other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

All director nominees are current Board members who were elected by shareholders at the 2022 Annual Meeting, except for Ms. Campos who was appointed by the Board of Directors as a director on May 17, 2023. Other than the matters set forth in this Proxy Statement and matters incident to the conduct of the Annual Meeting, the Company does not know of any business or proposals to be considered at the Annual Meeting. If any other business is proposed and properly presented at the Annual Meeting, the proxies received from our shareholders give the proxy holders the authority to vote on such matter in their discretion.

What is a proxy?

It is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. We have designated Christine Chambers, our Chief Financial Officer and Corporate Secretary, and Mr. Hulett, our Chief Executive Officer and President, as proxies for the Annual Meeting.

Why did I receive this Proxy Statement?

Our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting because you were a shareholder of record at the close of business on June 7, 2023, the Record Date, and are entitled to vote at the Annual Meeting. The Company has made this Proxy Statement and the Annual Report on Form 10-K for the year ended March 31, 2023 ("2023 Annual Report on Form 10-K”), along with either a proxy card or a voting instruction card, available to you on the Internet or, upon request, has delivered printed versions to you by mail beginning on, or about, June 20, 2023. This Proxy Statement summarizes the information you need to know to vote at the Annual Meeting. You do not need to attend the virtual Annual Meeting to vote your shares.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

As permitted by the rules adopted by the Securities and Exchange Commission ("SEC”), the Company has elected to provide access to its proxy materials over the internet. Accordingly, on or about June 20, 2023, the Company will mail a Notice of Internet Availability of Proxy Materials (the "Notice”) to the Company’s shareholders of record and beneficial owners containing instructions on how to access the proxy materials on the website referred to in the Notice or to request to receive a printed set of the proxy materials. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an

ongoing basis. The Company encourages you to take advantage of the availability of the proxy materials on the internet in order to help reduce the negative environmental impact of the Annual Meeting.

How will my proxy vote my shares?

Your proxy will vote according to your instructions. If you complete your proxy instructions but do not indicate your vote on one or all of the business matters, your proxy will vote "FOR” each of the nominees in item 1, "FOR” item 2, “FOR EVERY YEAR” in item 3, and “FOR” item 4. Also, your proxy is authorized to vote on any other business that properly comes before the Annual Meeting in accordance with the recommendation of our Board of Directors.

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

•view the Company’s proxy materials for the Annual Meeting on the internet; and

•instruct the Company to send future proxy materials to you electronically by email.

The Company’s proxy materials are also available on the Company’s website at: http://www.petmeds.com/annualreports.jsp. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will help reduce any negative impact of the Company’s annual meetings of shareholders on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it. If you did not receive an email, you can reach out to the following email address to make this change, addresschange@continentalstock.com.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered, with respect to those shares, the "shareholder of record.” The Notice of Internet Availability of Proxy Materials or Proxy Statement, 2023 Annual Report on Form 10-K, and proxy card have been sent directly to you by us. If your shares are held in a stock brokerage account by a bank or other nominee, you are considered the "beneficial owner” of shares held in "street name.” The Proxy Statement and 2023 Annual Report on Form 10-K or a notice for electronic access of these materials have been forwarded to you by your broker, bank, or other nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting.

How do I vote?

If your shares are held in street name, through a broker, bank, or other nominee, that institution will send you separate instructions describing the procedure for voting your shares. Shareholders of record can vote as follows:

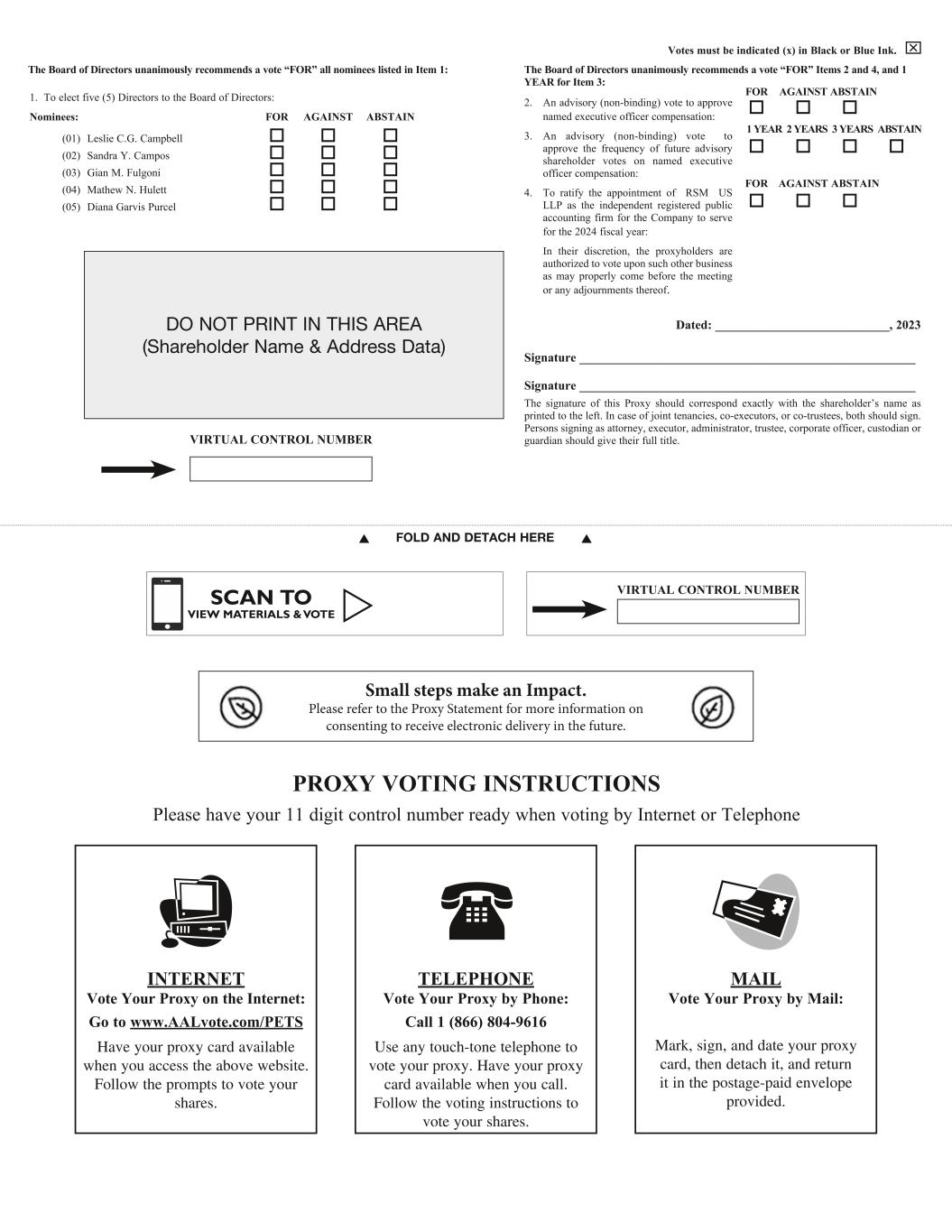

•By Mail: If you, as a shareholder, requested printed copies of the proxy materials by mail, you should sign, date, and return their proxy card(s) in the pre-addressed, postage-paid envelope that is provided.

•By Telephone or Internet: Shareholders may vote by proxy over the telephone at 1-(866) 804-9616, or internet at www.AALvote.com/PETS, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on August 2, 2023. Street name holders, however, may vote by telephone or internet only if their bank or broker makes those methods available, in which case the bank or broker will enclose the instructions with the proxy materials. The telephone and internet voting procedures are designed to authenticate shareholders’ identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded.

•At the Meeting: If you are a shareholder on the Record Date and attend the virtual Annual Meeting, you may vote your shares at the virtual Annual Meeting by visiting www.AALvote.com/PETS, even if you have previously returned a proxy card. If you are a beneficial owner of shares held in street name on the Record Date and wish to vote your shares at the Annual Meeting,you may only vote during the meeting by e-mailing a copy of your legal proxy to virtualmeeting@viewproxy.com.

Who is entitled to vote and how many votes do they have?

Holders of our common stock as of the close of business on June 7, 2023, the Record Date, are entitled to vote at the Annual Meeting. Each issued and outstanding share of our common stock is entitled to one vote. As of the Record Date, 21,173,327 shares of our common stock were issued and outstanding and entitled to vote at the Annual Meeting. However, if you have shares held through a brokerage firm, bank, or other custodian, you may revoke your instructions only by informing the custodian in accordance with any procedures it has established.

What is a quorum of shareholders?

A quorum is necessary to hold a valid meeting. Shares representing the majority of the total outstanding common stock of the Company entitled to vote at the Annual Meeting, virtually present or represented by proxy, constitute a quorum for the conduct of business at the meeting. If you vote or return a proxy card, your shares will be considered part of the quorum.

What vote is required for approval of the proposals?

Assuming a quorum is established:

•In an uncontested director election, as is occurring this year, directors must be elected by the affirmative vote of a majority of the votes cast at the Annual Meeting. Only votes cast "FOR” or "AGAINST” will affect the outcome of this proposal. Failure to receive the affirmative vote of a majority of the votes cast will trigger certain post-election resignation procedures (described below on page 17). (In the case of any contested director election, directors are elected by a plurality of the votes cast.)

•The advisory vote to approve named executive officer compensation requires the affirmative vote of a majority of the shares virtually present or represented by proxy at the Annual Meeting and entitled to vote on the matter. The vote is advisory and therefore not binding on our Board; however, the Board and the Compensation Committee of the Board will consider the result of the vote when making future decisions regarding our named executive officer compensation policies and practices.

•The advisory vote to determine the frequency of future advisory votes on named executive officer compensation requests shareholders to select a preferred voting frequency by selecting the option of every year, every two years, or every three years (or abstain), and the frequency receiving the greatest number of votes will be considered the frequency preferred by shareholders.. The vote is advisory and therefore not binding on our Board; however, the Board and the Compensation Committee of the Board will consider the result of the vote when making the decision regarding the frequency of future advisory votes on named executive officer compensation.

•The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter.

How does the Board recommend I vote on the proposals?

The Board recommends that you vote:

•FOR each of the nominees for director set forth on page 7;

•FOR the approval of named executive officer compensation set forth on page 7;

•FOR the option of once "every year" as the preferred frequency for advisory votes on named executive officer compensation set forth on page 8; and

•FOR the ratification of the appointment of our independent registered public accounting firm set forth on page 8.

May I change or revoke my vote after I return my proxy card?

Yes, you may change your vote at any time before your shares are voted at the Annual Meeting by:

•Notifying our Corporate Secretary, in writing at PetMed Express, Inc., 420 South Congress Avenue, Delray Beach, FL 33445 that you are revoking your proxy;

•Executing and delivering a later dated proxy card; or

•Attending and voting at the virtual Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

Who will count the votes and where can I find the voting results of the Annual Meeting?

A representative of Alliance Advisors LLC, a company contracted by us to assist the Company in the tabulation of proxies, will tabulate the votes and our Corporate Secretary will act as inspector of election. The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by the inspector of election and will be published in a Current Report on Form 8-K that will be filed with the SEC within 4 business days following the Annual Meeting.

How are abstentions and broker non-votes counted?

Abstentions are considered shares present at the Annual Meeting in person or by proxy and will be counted for purposes of determining whether a quorum is present. Broker non-votes refer to the Company’s shares held in street name by a brokerage firm or nominee organization (such as Cede & Co.) under circumstances where the beneficial owner has not instructed the broker or nominee as to how the shares should be voted. Broker non-votes are considered present by proxy for purposes of determining whether a quorum is present at the meeting.

If your shares are held in street name, the broker or nominee organization in whose name your shares are held is permitted to vote your shares on matters deemed "routine” at the Annual Meeting, even if you have not provided specific direction on how your shares should be voted. Under Florida law, abstentions and broker non-votes are not treated as votes "cast” and thus have no effect on the proposals at the Annual Meeting.

The only routine matter to be presented at the Annual Meeting is Item 4 (Ratification of the Appointment of Independent Registered Public Accounting Firm). If the broker firm or nominee organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote.”

Where can I find a list of shareholders entitled to vote as of the Record Date at the Annual Meeting?

A list of registered shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder for any purpose germane to the Annual Meeting during the Annual Meeting upon request via the chat function during the duration of the virtual Annual Meeting, and for ten days prior to the Annual Meeting, during normal business hours, at the Company’s principal place of business at 420 South Congress Avenue, Delray Beach, FL 33445.

How may I communicate with the Company’s Board, a committee of the Board or the non-management directors on the Company’s Board?

You may contact any of our directors by writing to them c/o PetMed Express, Inc., 420 South Congress Avenue, Delray Beach, FL 33445. Each communication should specify the applicable director or directors to be contacted as well as the general topic of the communication. Concerns about accounting or auditing matters or communications intended for non-management directors should be sent to the attention of the Chair of the Audit Committee at the address above. Our directors may at any time review a log of all correspondence received by the Company that is addressed to the independent members of the Board and request copies of any such correspondence.

When are shareholder proposals, including director nominations, due for the 2024 annual meeting of shareholders?

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended ("Exchange Act”) shareholders may present proper proposals for inclusion in the Company’s 2024 proxy statement and for consideration at the 2024 annual meeting of shareholders by submitting their proposals to the Company, not less than 120 calendar days prior to the anniversary date of our Proxy Statement distributed to our shareholder in connection with our Annual Meeting. Therefore, proposals that shareholders wish to be included in next year’s proxy statement for the annual meeting of shareholders to be held in 2024 must be received at the Company’s principal place of business at 420 South Congress Avenue, Delray Beach, FL 33445, addressed to the Corporate

Secretary’s attention, no later than the close of business on February 20, 2024. Upon receipt of any proposal, we will determine whether to include such proposal in accordance with our Bylaws (defined below), and regulations governing the solicitation of proxies.

Pursuant to our Second Amended and Restated Bylaws ("Bylaws”), a shareholder, or group of up to 20 shareholders, that has owned continuously for at least three years shares of the Company’s stock representing an aggregate of at least 3% of our outstanding shares, may nominate and include in the Company’s proxy materials director nominees constituting up to the greater of 2 or 20% of the Company’s Board, provided that the shareholder(s) and nominee(s) satisfy the requirements in the Company’s Bylaws. Notice of proxy access director nominees must be received not less than 120 days nor more than 150 days prior to the anniversary date of our Proxy Statement distributed to our shareholders in connection with our Annual Meeting. Therefore, notice of such nominees must be received at the Company’s principal place of business at 420 South Congress Avenue, Delray Beach, FL 33445, addressed to the Corporate Secretary’s attention, no earlier than the close of business on January 21, 2024 and no later than the close of business on February 20, 2024.

Pursuant to our Bylaws, the Company must receive advance notice of any shareholder proposal, including the nomination of any shareholder candidates for the Board, to be submitted at the 2024 annual meeting of shareholders. We must receive such notice not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, in advance of the anniversary of the previous year’s annual meeting if such meeting is to be held on a day which is not more than 30 days in advance of the anniversary of the previous year’s annual meeting or not later than 60 days after the anniversary of the previous year’s annual meeting. Therefore, notice of such proposals must be received at the Company’s principal place of business at 420 South Congress Avenue, Delray Beach, FL 33445, addressed to the Corporate Secretary’s attention, no earlier than the close of business on April 5, 2024 and no later than the close of business on May 5, 2024. Our Bylaws set forth the information that is required in a written notice of a shareholder proposal.

Who is soliciting my proxy and who pays the cost?

The Company and its Board of Directors are soliciting your proxy. Our directors, officers, and employees may solicit proxies by email, telephone, mail, and personal contact. They will not receive any additional compensation for these activities. Additionally, we entered into an agreement with Okapi Partners LLC for advisory and solicitation services in connection with this solicitation, for which Okapi Partners will receive an estimated fee of $17,500, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Okapi Partners will solicit proxies from individuals, brokers, banks and other institutional holders.The Company will also reimburse brokerage firms, banks, and other custodians for their reasonable out-of-pocket expenses for forwarding these proxy materials to you. Alliance Advisors LLC is a company contracted by us to assist the Company in the tabulation of proxies and we may also use their proxy solicitation services for the Annual Meeting, if needed. The Company will bear all fees and costs for proxy solicitation.

Can different shareholders sharing the same address receive only one Annual Report on Form 10-K and Proxy Statement?

Yes. The SEC permits companies and intermediaries, such as a brokerage firm or a bank, to satisfy the delivery requirements for annual reports and proxy statements with respect to two or more security holders sharing the same address by delivering only one annual report and proxy statement to that address. This process which is commonly referred to as "householding” can effectively reduce our printing and postage costs. Under householding, each shareholder would continue to receive a separate proxy card or voting instruction card. Certain of our shareholders whose shares are held in street name and who have consented to householding will receive only one set of our Annual Meeting materials per household this year. If your household received a single set of our Annual Meeting materials this year, you may request to receive additional copies of these materials by calling or writing your broker, bank, or other nominee. If you own your shares in street name, you can request householding by calling or writing your broker, bank, or other nominee.

ITEM 1 - ELECTION OF DIRECTORS

The Board of Directors unanimously recommends a vote "FOR” the election of the following nominees for director:

Leslie C.G. Campbell, Sandra Y. Campos, Gian M. Fulgoni, Mathew N. Hulett, and Diana Garvis Purcel.

The Company’s Bylaws provide that the Board of Directors of the Company shall consist of not less than three or more than eleven individuals. Our Board of Directors, upon the recommendation of the Corporate Governance and Nominating Committee, has nominated the five persons listed under "Nominees For Directors of PetMed Express, Inc.” for election as directors. Each of the nominees for director was elected by our shareholders at the annual meeting of shareholders in 2022 except for Ms. Campos who was appointed as a director by the Board on May 17, 2023. Contingent upon the election of the current slate of director nominees, the Board approved to reduce the size of the Board to five persons effective upon the close of the Annual Meeting.

Each of the nominated directors has agreed to serve if elected. If elected, the directors will serve until the next annual meeting of shareholders or until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal. However, if for some reason one or more of them is unable to accept nomination, or election, the Board may decrease the size of the Board, leave a vacancy unfilled or may designate a substitute nominee(s), and the proxies will be voted for the election of any such substitute nominee(s) designated by our Board of Directors. Biographical information for each nominee for director is presented below under "Nominees for Directors of PetMed Express, Inc.”

The Board of Directors and the Corporate Governance and Nominating Committee believe that each of the director nominees possesses important experience and skills that provide the Board of Directors with an optimal balance of leadership, competencies, qualifications, and diversity in areas that are important to the Company, and that each of the director nominees has high ethical standards, acts with integrity and exercises careful, mature judgment. Each director nominee is committed to employing his or her skills and abilities to aid the long-term interests of our shareholders. In addition, our director nominees are knowledgeable and experienced in one or more business, governmental, or academic endeavors, which further qualifies them for service as members of the Board of Directors.

ITEM 2 - ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

The Board of Directors unanimously recommends a vote "FOR” the approval of the named executive officer compensation described in this Proxy Statement.

In accordance with the requirements of Regulation 14A of the Exchange Act and the related rules of the SEC, we are asking our shareholders to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the SEC (a "say-on-pay”). This vote is advisory, which means that the vote on named executive officer compensation is not binding on the Company, the Company’s Board of Directors or the Compensation Committee of the Board of Directors. However, the Compensation Committee and the Board value the opinions expressed by shareholders in their votes on this proposal and will consider the outcome of the vote when making future compensation decisions regarding named executive officers. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of the Company’s named executive officers, as described in this Proxy Statement in accordance with the compensation disclosure rules of the SEC. We currently conduct annual shareholder advisory votes on named executive officer compensation. At our 2022 annual meeting of shareholders, our named executive officer compensation program was approved, on an advisory basis, by more than 84% of the votes cast. Our Compensation Committee believes that this level of approval is indicative of our shareholders’ general support of our compensation philosophy and goals. We encourage shareholders to read the Compensation Discussion and Analysis, the Fiscal 2023 Summary Compensation Table and the other related tables and disclosure, beginning on page 28 of this Proxy Statement, which describe the details of our named executive officer compensation program and the decisions made by the Compensation Committee.

Accordingly, we ask the Company’s shareholders to vote on the following resolution at the Annual Meeting: "RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the named

executive officers, as disclosed in the Company’s Proxy Statement for the 2023 Annual Meeting pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Fiscal 2023 Summary Compensation Table and the other related tables and disclosure.”

ITEM 3 - ADVISORY VOTE TO DETERMINE THE FREQUENCY OF SHAREHOLDER ADVISORY

VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION

The Board of Directors unanimously recommends that you vote for the option of "every year" as the preferred frequency for shareholder advisory votes on named executive officer compensation.

In accordance with the requirements of Regulation 14A of the Exchange Act and the related rules of the SEC, this Item 3 affords the Company’s shareholders with the opportunity to vote, on a non-binding advisory basis, for their preference as to how frequently the Company should include an advisory vote on named executive officer compensation in its proxy materials for future annual shareholder meetings. Shareholders may indicate whether they would prefer that we conduct future shareholder advisory votes on named executive officer compensation every year, every two years, or every three years. Shareholders also may abstain from casting a vote on this Item 3.

The Board of Directors has determined that an annual shareholder advisory vote on named executive officer compensation is the most appropriate alternative for the Company and therefore the Board of Directors recommends that you vote for a one-year interval for the advisory vote on named executive officer compensation. In determining to recommend that shareholders vote for a frequency of once every year, the Board of Directors considered how an advisory vote at this frequency will allow the Company’s shareholders to evaluate the effectiveness of the Company’s overall compensation philosophy, policies and practices in the context of the Company’s business results for the corresponding period. An advisory vote occurring once every year will permit the Company’s shareholders to observe and evaluate the impact of any changes to the Company’s executive compensation policies and practices which have occurred since the last advisory vote on named executive officer compensation, including changes made in response to the outcome of a prior advisory vote on named executive officer compensation. At our 2017 annual meeting of shareholders, approximately 87% of the votes cast, on an advisory basis, were in favor of holding the vote on named executive officer compensation once every year.

This vote is advisory, which means that the vote on how frequently to hold a shareholder vote on named executive officer compensation is not binding on the Company, the Board of Directors or the Compensation Committee of the Board of Directors. Shareholders may cast a vote in response to the resolution set forth below on the preferred voting frequency by choosing among four options (holding the vote every year, every two years or every three years, or abstain from voting) and, therefore, shareholders will not be voting to approve or disapprove the recommendation of the Board of Directors.

“RESOLVED, that the option of every year, every two years, or every three years that receives the highest number of votes cast for this resolution will be determined to be, on an advisory basis, the shareholder’s preferred frequency with which the Company is to hold a shareholder vote to approve the compensation of the named executive officers as disclosed pursuant to the Securities and Exchange Commission’s compensation disclosure rules.”

ITEM 4 - RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors unanimously recommends a vote "FOR” the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2024.

The Audit Committee of our Board of Directors has approved and re-appointed RSM US LLP to audit our fiscal year 2024 consolidated financial statements. RSM US LLP has served us in this capacity since March 2001. Representatives of the firm are expected to be present at the virtual Annual Meeting, will have an opportunity to make a statement, if they desire to do so, and will be available to respond to questions.

DIRECTOR QUALIFICATIONS AND DIVERSITY

There are certain minimum qualifications for Board membership that director candidates should possess, including strong values and discipline, high ethical standards, a commitment to full participation on the Board and its committees, and relevant experience. "Diversity of race, ethnicity, gender and age are important factors in evaluating candidates for Board membership” as set forth in the Corporate Governance and Nominating Committee Charter ("Charter”). The Charter further provides that “To reflect the Company’s commitment to diversity, the initial list of candidates from which new independent director nominees are chosen by the Board will include qualified candidates who reflect diverse backgrounds, including, but not limited to, diversity of race, ethnicity, national origin, gender and sexual orientation.” For the avoidance of doubt, the Company uses the definition of diverse as adopted by NASDAQ, namely an individual who self-identifies as Female, as an Underrepresented Minority or as LGBTQ+. The Corporate Governance and Nominating Committee and the full Board of Directors implement and assess the effectiveness of these guidelines and the commitment to diversity by referring to the Charter in the review and discussion of Board candidates when assessing the composition of the Board. On an annual basis, the Corporate Governance and Nominating Committee reviews its own performance, leads the Board in its annual review of the Board's performance, and reviews the Board structure to determine whether there is a need for an addition or other changes to the Board. Annually, and in fiscal 2023, the Corporate Governance and Nominating Committee reviewed the Company’s Board attributes matrix, in order to identify the current Board’s attributes and determine additional desirable skills to consider adding to the Board. As part of its authority and responsibilities as specified in its Charter, the Corporate Governance and Nominating Committee seeks individuals qualified to become Board members for recommendation to the Board, including evaluating persons suggested by shareholders or others.

Criteria contemplated when considering the need for Board recruitment or refreshment includes, but is not limited to, the current composition of the Board, the range of talents, experiences, contributions and skills that would best serve the Company’s strategy and complement those already represented on the Board, the balance of management and independent directors, the need for financial or other specialized expertise, and diversity. The assessment of candidates includes these criteria, along with a consideration of the nominee's judgment, experience, independence, possible conflicts of interest, understanding of the Company's or other related industries, a willingness and ability to devote adequate time to our Board’s duties, and such other factors as the Corporate Governance and Nominating Committee concludes are pertinent in light of the current needs of the Board. The Corporate Governance and Nominating Committee then conducts appropriate inquiries into the backgrounds and qualifications of possible nominees in an effort to determine each proposed nominee's qualifications for service on the Board. With the foregoing director qualifications and commitment to diversity in mind, on May 17, 2023, the Board of Directors appointed Ms. Campos as a director.

| | | | | | | | |

| Board Diversity Matrix of Current Directors (as of June 7, 2023) |

| Total Number of Directors | 7 |

| Female | Male |

| Part I: Gender Identity |

| Independent Directors | 4 | 2 |

| CEO, non-independent Director | | 1 |

Part II: Demographic

Background |

| White | 3 | 3 |

| Hispanic/Latinx | 1 | |

The Company notes that, currently, a majority of the independent Directors on its Board of Directors are women. Contingent upon the election of the current slate of director nominees, the board size will be 5 directors, of which three of the independent directors are women, and one director, Ms. Campos, is ethnically diverse. The Company values diversity on its Board of Directors, and diverse characteristics continue to be key criteria in considering future board candidates.

Skills, Experience and Qualifications of Director Nominees

The Corporate Governance and Nominating Committee and the Board believe that the qualifications and attributes set forth in this Proxy Statement for the nominees support the conclusion that these individuals are qualified to serve as directors of the Company and collectively bring a balance of relevant skills, professional experience, and diversity of backgrounds allowing them to effectively oversee the Company’s business.

Board Qualifications of Director Nominees (as of June 7, 2023)

| | | | | |

| Animal Health/Welfare | g g c c c |

| Retail/Ecommerce | g g g g c |

| Technology: | g g g g c |

| Marketing/Media: | g g g c c |

| Operations/Management: | g g g g c |

| Public Boards: | g g g g c |

| Risk Management | g g g c c |

| Strategy/M&A: | g g g g g |

| Supply Chain: | g g c c c |

NOMINEES FOR DIRECTORS OF PETMED EXPRESS, INC.

The biographies of each of the director nominees, below, support the conclusion that these individuals are dedicated, ethical, highly regarded, and qualified to serve as directors of the Company. They collectively possess a variety of skills, professional experience, and diversity of backgrounds allowing them to effectively oversee the Company’s business, and if elected, would constitute a balanced and multi-disciplinary Board composed of qualified and diverse individuals. The biographies each contain information regarding the person’s service as a director, business, educational, and other professional experience, director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, during the last ten years or beyond if material, and the experiences, qualifications, attributes or skills that caused the Board to determine that the person should serve as a director for the Company. The Company believes that the backgrounds and qualifications of the director nominees considered as a group should provide diverse business and professional capabilities, along with the experience, knowledge and other abilities that will allow the Board to fulfill its responsibilities.

Contingent upon the election of the current slate of director nominees, the Board approved to reduce the size of the Board to five persons effective upon the close of the Annual Meeting. In addition, contingent upon the election of the current slate of director nominees, the Board approved that, upon the close of the Annual Meeting, (i) Ms. Campbell (the current Chair of the Corporate Governance and Nominating Committee) will serve as Chair of the Board’s Compensation Committee to fill the Chair vacancy left by Ms. Watson, the current Chair of the Board’s Compensation Committee, at which time Ms. Campbell will step down as Chair of the Corporate Governance and Nominating Committee, and (ii) Dr. Fulgoni (the Company’s Chair of the Board) will serve as Chair of the Board’s Corporate Governance and Nominating Committee (in addition to his position as Chair of the Board) to replace the Chair vacancy left by Ms. Campbell, the current Chair of the Board’s Corporate Governance and Nominating Committee.

LESLIE C.G. CAMPBELL, Independent Director, Chair of the Corporate Governance and Nominating Committee

| | | | | |

| Age: | 64 |

| Director Since: | 2018 |

| Director Status: | Independent Director |

| Committees: | Audit (F), Compensation, Corporate Governance and Nominating (C) |

| Current Public Boards: | Shapeways (NYSE:SHPW), LiveVox Holdings, Inc. (NASDAQ: LVOX) |

(C): Chair (F): Financial Expert

Ms. Campbell has served as a member of our Board of Directors, and the Chair of the Corporate Governance and Nominating Committee, and a member of the Audit and Compensation committees since July 2018, and is considered to be an "audit committee financial expert” within the meaning of Item 407(d) (5) of Regulation S-K. Ms. Campbell is an experienced public board director and former international executive with multi-disciplinary expertise, a history of global leadership, and success in formulating strategies that optimize the performance of enterprises from start up to multi-billion dollar market caps.

A frequent and sought-after speaker and panelist on corporate governance matters, Ms. Campbell was named to Women Inc. Magazine’s list of Most Influential Corporate Board Directors and is NACD Director Certified®. She is particularly recognized for strategic planning, for her international and technology experience, for demonstrating deep customer and product understanding, for her supply chain expertise, and for creating high performance, cross-cultural teams that deliver measurable results.

Since October 2021, Ms. Campbell has served as a member of the board of directors and chair of the compensation and human capital committee of Shapeways (NYSE:SHPW), and since June 2021, Ms. Campbell has been a member of the board of directors and chair of the audit committee of LiveVox Holdings, Inc. (NASDAQ: LVOX). From May 2016 to May 2022, Ms. Campbell served as a member of the board of directors of Coupa Software, Inc. (NASDAQ: COUP) , where she was the chair of the nominating and corporate governance committee and served on the audit committee. In 2023, Ms. Campbell joined the board and became chair of the audit committee of privately held PointClickCare, a healthcare software company based in Toronto, Canada. In 2019 she joined the advisory board of privately held Riley, Inc. (formerly Grapevine Solutions), a commercial relationship insights platform. In 2017, Ms. Campbell joined the Growth Advisory Board of Diligent, the privately held creator of Diligent Boards, the widely used board portal. From 2013 to 2019, she was a member of the board of directors of Bideawee, Inc., one of America’s first no-kill animal rescues, and served there as vice chairman and a member of the executive committee, as well as on the finance, audit and compensation committees. In 2023 she rejoined the board of directors of Bideawee, Inc.

Ms. Campbell previously served as the chief procurement officer for Reed Elsevier, Inc., a world leading provider of professional information solutions in the science, medical, legal, risk, and business sectors, from September 2007 to December 2012. From March 1998 to September 2007, Ms. Campbell held a number of senior positions at Dell, Inc., most recently as the vice president of Worldwide Procurement, and previously as the vice president and general manager, Global Segment EMEA. Ms. Campbell held a number of positions at Oracle Corporation from May 1990 to January 1998. From August 1982 to May 1990, she held a number of positions at KPMG Peat Marwick LLP, a member firm of KPMG International, most recently as a senior manager. Ms. Campbell holds a B.A. in Business Administration from the University of Washington.

Ms. Campbell’s extensive and high-level experience in the financial services and technology industries, as well as her board experience with other private and public corporations, enables her to make very significant contributions to the Board’s decision-making processes, especially in strategy, corporate governance, operational, financial, technology and supply chain matters.

SANDRA Y. CAMPOS, Independent Director

| | | | | |

| Age: | 56 |

| Director Since: | 2023 |

| Director Status: | Independent Director |

| Committees: | Audit, Compensation, Corporate Governance and Nominating |

| Current Public Boards: | Big Lots (NYSE:BIG) |

(C): Chair (F): Financial Expert

Ms. Campos has served as a member of our Board of Directors, and a member of the Audit, Compensation, and Corporate Governance and Nominating committees since May 17, 2023. Ms. Campos served as the chief executive officer of DVF (Diane von Furstenberg) (a luxury fashion brand) from April 2018 to November 2020. Prior to joining DVF, Ms. Campos was the co-president, Women’s Apparel, of Global Brands Group Holding Limited (a branded apparel, footwear and brand management company) from 2015 to April 2018, which included the Juicy Couture, Bebe, Buffalo, Tretorn, BCBG and Herve Leger brands. Ms. Campos also has held leadership roles prior thereto with apparel companies Polo Ralph Lauren and Nautica International. Ms. Campos also founded Fashion Launchpad (a continuing education platform for retail and fashion professionals) in June 2020, and created Dream out Loud in partnership with Selena Gomez (the first teen celebrity brand management company) which was established in 2009, and launched at retail in 2010. After her departure from DVF, Ms. Campos served as the chief executive officer of Project Verte Inc. (a retail technology and supply chain solutions provider) from November 2020 until November 2021. A receivership proceeding was filed against Project Verte Inc. in August 2022 in the Delaware Court of Chancery. The receiver subsequently filed a bankruptcy proceeding under Chapter 7 of the U.S. Bankruptcy Code with respect to Project Verte Inc. in January 2023 in the U.S. Bankruptcy Court for the District of Delaware.

Ms. Campos has been a member of the board of directors of Big Lots (NYSE:BIG), and a member of its audit committee and capital allocation planning committee since May 2021; an operating advisor of ShoulderUp Technology Acquisition Corp (SPAC) since October 2021; a member of the board of directors of Fabric (a modular and headless commerce solution) since August 2022, and; a member of the board of directors of PureRED, an advertising services company, since March 2023.

Ms Campos’ experience as a chief executive officer along with her extensive experience in retail, brand management and marketing allows her to bring current and relevant perspective to the Board. Along with her public and private board experience, Ms. Campos’ background allows her to make very significant contributions to the Board’s decision-making processes especially in consumer facing activities like marketing, brand management and social media.

DR. GIAN M. FULGONI, Independent Director, Chair of the Board of Directors

| | | | | |

| Age: | 75 |

| Director Since: | 2002 |

| Director Status: | Independent Chair of the Board |

| Committees: | Audit, Compensation, Corporate Governance and Nominating |

| Current Public Boards: | None |

(C): Chair (F): Financial Expert

Dr. Fulgoni has served as a member of our Board of Directors since November 2002, contributing extensive marketing and advertising knowledge to the Board. Dr. Fulgoni has been the Chair of the Board since February 2021. Dr. Fulgoni has also served as a member of the Compensation, Audit and Corporate Governance and Nominating committees since 2002.

Dr. Fulgoni had previously been a member of our Board of Directors from August 1999 through November 2000, but left to devote his time to comScore, Inc., (at that time, ComScore Networks, Inc.), (NASDAQ: SCOR), a digital data and analytics company that he had co-founded, and which is now a recognized global leader in measuring the cross-platform world. Dr. Fulgoni served on the comScore board of directors from 1999 until April 2018. Dr. Fulgoni served as comScore’s executive chairman from 1999 to March 2014, chairman emeritus from March 2014 to August 2016, and chief executive officer from August 2016 to November 2017.

From 1981 until 1998, Dr. Fulgoni served as president and chief executive officer of Information Resources, Inc. (IRI), (then: NASDAQ: IRIC), a leading global supplier of retail scanner data and software services to the Consumer Packaged Goods (CPG) industry, where he grew the company’s revenues at an annual rate of 40% to more than $500 million annually and its market value to $1.5 billion. In 1996, IRI was recognized by Advertising Age magazine as the largest U.S. market research firm.

Additionally, by the time Dr. Fulgoni joined the Company’s Board of Directors, he had already been involved in the growth of other successful public companies. From 1991 until 1999, Dr. Fulgoni served as a member of the board of Platinum Technology, Inc., during which time the company grew from $80 million to more than $1 billion

in annual revenues and established itself as a global leader in the software services industry. In 1999, Platinum Technology was acquired by Computer Associates in an all-cash transaction valued at $4.0 billion -- at the time the largest-ever acquisition in the software industry.

Dr. Fulgoni had also served on the board of U.S. Robotics from 1991 to 1994, prior to its acquisition in 1997 by 3 Com in a transaction valued at $8 billion, and in 1999, Dr. Fulgoni served on the board of yesMail.com, a leading supplier of permission-based e-mail services. In March 2000, yesMail.com was acquired by CMGI for approximately $700 million. Beginning in November 2013, Dr. Fulgoni served on the board of Cord Blood Registry (owned by GTCR, the leading private equity company) until its sale to AMAG Pharmaceuticals (NASDAQ: AMAG) in August 2015.

Dr. Fulgoni has repeatedly been recognized for his entrepreneurial skills. In 1991 and again in 2004, Dr. Fulgoni was named Illinois Entrepreneur of the Year, the only person to have twice received that honor. In 1992, Dr. Fulgoni received the Wall Street Transcript Award for outstanding contributions as chief executive officer in enhancing the overall value of IRI to the benefit of its stockholders. In 2008, Dr. Fulgoni was inducted into the Chicago Entrepreneurship Hall of Fame and was also an Ernst & Young® Entrepreneur of the Year award winner in the services category and was a national finalist. In 2014, the Advertising Research Foundation (ARF) conferred on him a Lifetime Achievement Award for outstanding contributions to the ARF board and support of the ARF community. In 2018, Dr. Fulgoni received a Lifetime Achievement Award from CableFax and the Erwin Ephron Demystification Award from the Advertising Research Foundation. In 2019, Dr. Fulgoni was inducted into the U.S. Market Research Hall of Fame.

Educated in the United Kingdom, Dr. Fulgoni holds a M.A. degree in Marketing from Lancaster University and a BSc. degree in Physics from the University of Manchester. In 2012, Dr. Fulgoni was awarded an Honorary Fellowship by the University of Glamorgan in Wales in recognition of his entrepreneurial skills and achievements in market research. In 2016, Dr. Fulgoni was awarded a Doctor of Science (honoris causa) degree by Lancaster University to mark his outstanding contribution to the field of global market research. In addition to serving on the Company’s Board of Directors, Dr. Fulgoni also currently serves on the board of directors of Prophet, a brand and marketing consulting company, since 2010; Fluree, a company that has pioneered a revolutionary data-first technology approach with its data management platform, since 2019; Varcode, a next-generation cold chain temperature management solution since 2019; QualSights, an immersive consumer insights platform since 2018; the North American Foundation for the University of Manchester (NAFUM), since 1998; and the senior advisory board for the Journal of Advertising Research, since 2013. Dr. Fulgoni is also a venture partner at 4490 Ventures, a Midwest venture capital fund, since 2017.

Dr. Fulgoni’s extensive and high-level experience in strategic and marketing industry trends allows him to bring an informed perspective and thoughtful insights and guidance to how the Company addresses strategic and marketing industry issues. This, as well as his executive and board involvement with other businesses and organizations, enables Dr. Fulgoni to make very significant contributions to the Board’s decision-making processes especially in evaluating marketing opportunities for the Company.

MATHEW N. HULETT, Chief Executive Officer, President, and Director

| | | | | |

| Age: | 53 |

| Director Since: | 2021 |

| Director Status: | Chief Executive Officer and Director |

| Committees: | None |

| Current Public Boards: | None |

(C): Chair (F): Financial Expert

Mr. Hulett has served as a member of our Board of Directors, and Chief Executive Officer and President of the Company since August 2021.

Prior to joining the Company, Mr. Hulett served as the co-president of Rosetta Stone from January 2019 to July 2021 and was the president of Language at Rosetta Stone from August 2017 to July 2021. Rosetta Stone was previously a publicly held company (NYSE: RST) until taken private in October 2020. Mr. Hulett's duties at Rosetta Stone included leading all the entire business operations and strategic direction for the company's language business.

Prior to that, from October 2015 to March 2018, Mr. Hulett served as entrepreneur in residence at Voyager Capital, an information technology venture capital firm. From December 2015 to April 2017, Mr. Hulett served as the chief product officer at TINYpulse, a privately held SaaS- based Human Resources technology provider, where he was responsible for driving product strategy, design, and development.

From May 2013 to September 2015, Mr. Hulett served as the chief executive officer of Click Sales, Inc. (dba ClickBank), a privately held, top-100 internet retailer that provides digital lifestyle products to customers in 190 countries. Prior to ClickBank, Mr. Hulett served as senior vice president of RealNetwork’s games division from August 2010 to May 2013, where he led the right-sizing effort of the traditional gaming business and led the business’ turnaround strategy pivot into social and mobile gaming. He has also held the chief executive office role at AdXpose and was president of the corporate travel division of Expedia. He received his Bachelor of Arts degree in Marketing and Information Systems from the University of Washington.

DIANA GARVIS PURCEL, Independent Director, Chair of the Audit Committee

| | | | | |

| Age: | 57 |

| Director Since: | 2022 |

| Director Status: | Independent Director |

| Committees: | Audit (C)(F), Compensation, Corporate Governance and Nominating |

| Current Public Boards: | Ocean Power Technologies, Inc. (NYSE: OPTT) |

(C): Chair (F): Financial Expert

Ms. Purcel has served as a member of our Board of Directors, and a member of the Audit, Compensation, and Corporate Governance and Nominating committees since April 2022, and Chair of the Audit Committee since July 2022. As an emerging voice on corporate governance and strategy, Ms. Purcel was named as a Director to Watch by Directors & Boards magazine and is NACD Director Certified®. Ms. Purcel has 20 years of experience as a chief financial officer, including 17 years with small cap publicly traded companies. Ms. Purcel has served on the board of directors of Ocean Power Technologies, Inc. (NYSE: OPTT) since December 2020, and on the board of directors, and as a member of the executive committee and chair of the finance committee, for the Animal Humane Society since December 2017. From March 2019 to June 2021 (when the company was sold), Ms. Purcel served on the board of directors for Now Boarding. From 2005 to 2008, Ms. Purcel served on the board of directors for Multicultural Foodservice and Hospitality Alliance, as the chair of its audit committee.

From April 2018 until May 2019, Ms. Purcel served as executive vice president and chief financial officer for Evine Live, Inc. (NASDAQ: EVLV), now known as iMedia Brands, Inc. (NASDAQ: IMBI), an interactive video and digital commerce company. From September 2014 until June 2017, Ms. Purcel served as the chief financial officer for Cooper’s Hawk Winery & Restaurants, LLC, which operated restaurants, manufactured private-label wines, and managed the largest wine club in the world.

From 2003 until 2014, Ms. Purcel served as chief financial officer and corporate secretary for Famous Dave’s of America, Inc. (at the time, NASDAQ: DAVE), which franchised and operated a casual dining restaurant chain of almost 200 locations in over 35 states. From September 2002 to June 2003, Ms. Purcel served as chief financial officer, and from April 1999 to September 2002, as vice president, controller and chief accounting officer of Paper Warehouse, Inc. (OTC: PWHS), a party-goods retailer and franchisor in 10 states.

Ms. Purcel has also worked with Arthur Andersen & Co, from 1988 to 1993 as a certified public accountant and senior auditor, and with other companies including Target Corporation (from 1994 to 1998 as a senior analyst). Ms. Purcel holds a Master’s in Business Administration from the University of St. Thomas, a Bachelor of Science in Management, with a concentration in Accounting, from Tulane University, and is a certified public accountant (inactive).

Ms Purcel’s 30 years of experience in finance, accounting, corporate strategy, governance, mergers and acquisitions, information technology, and overall general management, coupled with her experience as a chief financial officer in numerous public and private entities over a 20 year period, enables her to make significant contributions to the Board, Ms. Purcel brings significant financial experience and expertise, and is considered to be an “audit committee financial expert” within the meaning of Item 407(d) (5) of Regulation S-K. .

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth information with respect to our executive officers as of the date of this Proxy Statement:

| | | | | | | | |

| Name | Age | Position(s) |

| Mathew N. Hulett | 53 | Chief Executive Officer, President and Director |

| Christine Chambers | 46 | Chief Financial Officer, Treasurer and Secretary |

A description of the business experience of Mr. Hulett is provided above under the section named “Nominees for Directors of PetMed Express, Inc.”

CHRISTINE CHAMBERS, 46, Chief Financial Officer, Treasurer and Secretary

Ms. Chambers has served as the Company’s Chief Financial Officer since August 2022, the Company’s Treasurer since October 2022, and the Company’s Secretary since May 17, 2023. Ms. Chamber served as Senior Vice President, Chief Financial Officer and Treasurer of RealNetworks, Inc. (NASDAQ: RNWK) from March 2021 to July 2022. Prior to that, Ms. Chambers served as Vice President, Finance for Rosetta Stone Inc., from June 2018 to March 2021. Rosetta Stone was previously a publicly held company (NYSE: RST) until taken private in October 2020. From May 2016 to June 2018, Ms. Chambers served as RealNetworks’ Vice President, Finance. Previously, she served as an independent finance consultant, beginning 2015, and as Deputy Director Budget and Planning at the Bill & Melinda Gates Foundation, from 2013 to 2015. From 2005 to 2013, Ms. Chambers held several positions within the finance department of RealNetworks. Ms. Chambers holds a bachelor’s degree in finance from Loughborough University in the UK and an MBA from the University of Washington. Ms. Chambers is an Associate member of the Chartered Global Management Accountants (CGMA).

There are no family relationships between any of the executive officers and directors.

CORPORATE GOVERNANCE

The business and affairs of PetMed Express, Inc. are managed by or under the direction of our Board of Directors which is the Company’s ultimate decision-making body except with respect to those matters reserved to our shareholders. Our Board includes a majority of independent directors. Our Board reaffirms its accountability to shareholders through the shareholder election process. Our Board reviews and ratifies executive officer selection and compensation and monitors overall corporate performance and the integrity of our financial controls. Our Board also oversees our strategic and business planning processes.

Shareholder Communications with the Board

The Company provides an informal process for shareholders to send communications to our Board of Directors or specified individual directors or committees of the Board. Shareholders, who wish to communicate directly with our Board of Directors, or specified individual directors or committees of the Board, may do so in writing addressed to the Board of Directors, individual director or the committee of the Board c/o PetMed Express, Inc., 420 South Congress Avenue, Delray Beach, FL 33445. Correspondence directed to an individual Board member is referred to that member. Correspondence not directed to a particular Board member or committee of the Board is referred to the Chair of the Corporate Governance and Nominating Committee.

Shareholder Outreach and Engagement

We value regular engagement with and feedback from a wide variety of stakeholders, including customers, employees, suppliers, and communities. We also recognize the value of listening to the views of our shareholders about our business and corporate governance matters, and we consider the relationship with our shareholders as an integral part of our corporate governance practices. We conduct shareholder outreach throughout the year to ensure that management and the Board understands and considers the issues of importance to our shareholders, so we are able to address them appropriately.

During fiscal 2023, we reached out by email and telephone to our top 15 institutional investors representing 57% of shares outstanding to request meetings to discuss any current issues or concerns they may have had. Four shareholders representing nearly 28% of our outstanding shares engaged with us about topics of importance to them, including our newly appointed Chief Executive Officer and the Company’s transformation. Other areas of interest were related to our corporate governance policies, our commitment to environmental, social, and governance matters, and executive compensation. These topics of interest are summarized below:

| | | | | | | | |

| Topic | What We Heard From Shareholders | Responses We Provided |

| Company’s ongoing transformation | Shareholders requested an update on the Company’s transformation | The Company’s CEO provided an overview of both the new Company strategy and the progress toward key milestones for the Company's transformation, including:

-An executive summary of the new "Pet Health Expert" strategy which focuses on leveraging the Company's deep understanding of pet health and wellness to provide exceptional customer service and support.

-Progress on the transformation including increased focus on recurring revenue (e.g., AutoShip & Save), catalog expansion to include non-medication items such as pet food, as well as the introduction of unique and differentiated services like insurance and pet telemedicine.

-Additionally, the discussion covered the deployment of capital, examining both inorganic and organic strategies to accelerate the pace of the transformation. |

| Board Composition | Shareholders requested additional clarification about Board composition, diversity, and refreshment | The Company reiterated the Board’s commitment to diversity, Board composition and refreshment, and governance processes. The Board is currently comprised of directors with diverse backgrounds, experiences, and perspectives. We evaluate our overall Board composition, including diversity, at least annually during the formal Board and committee evaluation process. In May 2023, the Board welcomed Sandra Y. Campos to the Board of Directors, and Ms. Campos serves on the Audit, Compensation and Corporate Governance and Nominating committees. The Company notes that should all of the 2023 Director nominees be approved, our Board will be comprised of directors not only with diverse skills and backgrounds, but also who represent diversity of gender and ethnicity. In the future as the Board continues to evaluate Board composition and contemplate Board refreshment, our Corporate Governance and Nominating Committee will continue to include gender, underrepresented minority and LGBTQ+ diversity among the factors reviewed and considered in the Director nomination process. For more information see Director Qualifications and Diversity on page 9. |

Environmental, Social, and Governance ("ESG”) | Shareholders requested further details on our Board’s commitment to ESG | The Company is committed to doing more for the broader environment, society and humanity, and this year we further defined our ESG strategy. Although we are still in the early stages of implementing our ESG strategy, we have committed to a 23% emissions reduction target by 2030 through the Science Based Target Initiative (SBTi). As part of our strategy, we will continue to build out our social programs that support pets, pet parents, and the veterinary community. We are committed to fostering, cultivating, and preserving a culture of diversity, equity, and inclusion. Additionally, we will publish our first introductory Sustainability Report this year. For more information see Environmental, Social, and Governance Matters on page 21. |

| | | | | | | | |

| Equity Grants | Shareholders requested information regarding to what extent equity was offered to employees throughout the Company, and information regarding the award of restricted stock or restricted stock units (RSUs) | We have included a table in this year’s Proxy Statement to detail the distribution of equity grants throughout the Company, and amended and restated the Company’s employee equity restricted stock plan and outside director equity restricted stock plan to allow for the granting of restricted stock units (RSUs) and, in the case of the employee plan, performance restricted stock units (PSUs), as well as restricted stock and restricted performance stock. |

| Short term and Long term compensation strategy | Shareholders were interested in executive compensation which included both long term and short term goals and incentives | For fiscal year 2024, the Company introduced an Annual Incentive Plan (AIP) for named executive officers which rewards the achievement of specific annual objectives. For fiscal year 2024 the AIP objectives are adjusted EBITDA and Revenue. For more information on the AIP, see page 31. |

Director Resignation Policy for Uncontested Election of Directors

The Company's Bylaws currently provide for election of directors by a majority voting standard, under which each director nominee in an uncontested election must receive more "FOR" votes cast than "AGAINST" votes cast to be elected. Conversely, a director nominee in an uncontested election who does not receive more "FOR" votes cast than "AGAINST" votes cast would not be elected. Votes withheld, abstentions and broker non-votes will continue to have no effect on the outcome of an election. In the event that an incumbent director does not receive the requisite majority of votes cast in an uncontested election, the Company would follow a certain post-election resignation procedure (described below). In all contested director elections, in which a shareholder has duly nominated (and not withdrawn by a certain date) an individual for election to the Board, a plurality voting standard would apply. Under the post-election resignation procedure, any incumbent director who fails to receive the requisite number of votes for reelection in an uncontested election will be required to promptly tender his or her resignation to the Board. The Corporate Governance and Nominating Committee will then make a recommendation to the Board on whether to accept or reject the resignation, and the Board will make the ultimate decision as to whether to accept or reject the resignation by considering factors it deems relevant, such as the percentage of outstanding shares represented by the votes cast at the meeting, the director nominee's past and expected future contributions to the Company, the overall composition of the Board and committees of the Board, and whether accepting the tendered resignation would cause the Company to fail to meet any applicable rule or regulation (including the listing standards of The NASDAQ Stock Market LLC ("NASDAQ”) and the requirements of the federal securities laws). The Board will act on the resignation within 90 days following certification of the shareholder vote for the meeting and will promptly disclose its decision and rationale in a Current Report on Form 8-K filed with the SEC.

Policy with Regard to the Consideration of Director Candidate Recommendations by our Shareholders

The Corporate Governance and Nominating Committee has a policy pursuant to which it considers director candidates recommended by our shareholders. All director candidates recommended by our shareholders are considered for selection to the Board on the same basis as if such candidates were recommended by one or more of our directors or other sources. To recommend a director candidate for consideration by our Corporate Governance and Nominating Committee, a shareholder must submit the recommendation in writing to our Corporate Secretary not later than one hundred twenty (120) calendar days prior to the anniversary date of our proxy statement distributed to our shareholders in connection with our most recent annual meeting. The director candidate recommendation must provide the following information: (i) the name of the shareholder making the recommendation, (ii) the name of the candidate, (iii) the candidate’s resume or a listing of his or her qualifications to be a director, (iv) the proposed candidate’s written consent to being named as a nominee and to serving as one of our directors if elected, and (v) a description of all relationships, arrangements or understandings, if any, between the proposed candidate and the recommending shareholder and between the proposed candidate and us so that the candidate’s independence may be assessed. The shareholder or the director candidate also must provide any additional information requested by our Corporate Governance and Nominating Committee to assist