Statements of Fact, page 1

| 2. | Comment: Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Please ensure that each such statement is properly characterized and provide us the support for the following: |

| · | each statement attributed to Mr. Liveris, both in the video and in the Facts section of the Site. In this respect, please be sure to provide us full documents to include the entire context of a statement; |

Response:

| a. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “But whatever the world throws at us, we think we are ready. We are, what I call a ‘no excuses company.” Mr. Liveris made this statement on the Company’s January 26, 2006 earnings call for the fourth quarter of 2005. Mr. Liveris’s quote can be found on page 5 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 1]. |

| b. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “This is still a ‘no excuses’ company …” Mr. Liveris made this statement in a letter by Mr. Liveris to the Company’s stockholders contained in the Dow Chemical Company 2007 10-K and Stockholder Summary. Mr. Liveris’s quote can be found on page 3 of such 2007 10-K and Stockholder Summary, supplementally provided to the Staff herewith. [Tab 2]. |

| c. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “And frankly we’ve had world event after world event after world event as you well know, so as a consequence we are a large, global, very integrated company but we’re exposed to a lot of macros…we’ve had to readjust our operating template.” Mr. Liveris made this statement in an interview with CNBC on July 23, 2014. A link to such video is available at the following website: http://video.cnbc.com/gallery/?video=3000295093. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 3

| d. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “Where my competition is state-owned enterprises, you know and they don’t have the same return criteria and they’re certainly not looked at every quarter on Wall Street like I am.” Mr. Liveris made this statement in an interview with CNBC on July 25, 2014. A link to such video is available at the following website: http://video.cnbc.com/gallery/?video=3000184846. |

| e. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “Firstly, three hundred and eighty eight consecutive quarters of never cutting the dividend, I will tell you this, this CEO will never cut the dividend.” Mr. Liveris made this statement in an interview with CNBC. A link to such video is available at the following website: https://www.youtube.com/watch?v=CLJUOlxhVH8. |

| f. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “The bottom line is this is a powerful New Dow as evidenced by how the Rohm & Haas transaction will impact our earnings per share. Without the acquisition of Rohm and Haas and, as I have shown to you before, Dow’s [adjusted] EPS for the next industry trough would have been approximately $3.50. That number jumps closer to $4 with the addition of Rohm and Haas. With our 10% earnings per share growth target, we expect to earn well north of $10 per share.” Mr. Liveris made this statement on a call discussing the acquisition of Rohm & Haas Co. by the Company on July 10, 2008. Mr. Liveris’s quote can be found on page 6 and 7 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 3]. |

| g. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “But as I said this morning, the dividend is safe. This CEO is never going to cut it. I’m not going to be the first.” Mr. Liveris made this statement on the Company’s October 23, 2008 earnings call for the third quarter of 2008. Mr. Liveris’s quote can be found on page 13 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 4]. |

| h. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “But at Dow, we don’t just sit in back rooms and say, oh, woe is me. We actually get moving and implement better, faster, stronger to deliver the economic goals that we promise.” Mr. Liveris made this statement on a call discussing the joint venture agreement between Dow and Petrochemical Industries Company on December 1, 2008. Mr. Liveris’s quote can be found on page 8 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 5]. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 4

| i. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “What’s the earnings power of the new Dow? With all of these elements we have now put in place, we see [adjusted] EPS growing to the $4 to $4.50 range around 2012 and also with earnings power of greater than $10 per share.” Mr. Liveris made this statement on the Company’s November 12, 2009 investor day call. Mr. Liveris’s quote can be found on page 4 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. Please note that the Bloomberg transcript has a typo, in the actual recording of the call Mr. Liveris says 2012, instead of the 2011 which is stated in the transcript. [Tab 6]. |

| j. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “The fundamentals for Ag are as strong as ever… we expect normalized [adjusted] EBITDA margins in this segment in the area of 25%.” Mr. Liveris made this statement on the Company’s November 12, 2009 investor day call. Mr. Liveris’s quote can be found on page 5 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 6]. |

| k. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “You can see we have reached a new level of performance with more than $2 billion of structural enhancements. And we have additional levers we could pull. However, this does mean that we would expect our portfolio to deliver [adjusted] EBITDA north of $8 billion or approximately [adjusted EPS of] $2.50 per share even under the conditions of ‘08, ’09.” Mr. Liveris made this statement on the Company’s October 4, 2011investor day call. Mr. Liveris’s quote can be found on page 3 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 7]. |

| l. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “I am acutely aware that we need to demonstrate that Dow can deliver against its earnings targets and ensure we achieve the minimum of $8 billion [adjusted] EBITDA [in 2012] that we described a year ago. There can and will be no excuses. We are intervening fully to focus, to generate cash and to deliver against these targets.” Mr. Liveris made this statement on the Company’s October 24, 2012 earnings call for the third quarter of 2012. Mr. Liveris’s quote can be found on page 6 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 8]. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 5

| m. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “You can rest assured that we are driven to intervene and get us to the $8 billion minimum [of adjusted EBITDA] and get us to the $10 billion [of adjusted EBITDA] through the two mechanisms I’ve articulated on this call, which is the interventions, which are substantial [adjusted] EBITDA generators and cash generators next year and the year after, 2013, 2014, and the low-cost drivers embedded in the ethane propane feedstock advantage we have in the United States. Those two things alone will get us to the $10 billion in the next several years.” Mr. Liveris made this statement on the Company’s October 24, 2012 earnings call for the third quarter of 2012. Mr. Liveris’s quote can be found on page 13 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 8]. |

| n. | The 14a-12 Materials provided the following statement attributed to Mr. Liveris: “We have taken a number of consistent aggressive actions since 2006, both in the upstream low-cost assets and the downstream value-add businesses, to reshape and position our company for consistent long-term earnings growth… Throughout this process and with deliberate and strategic moves and full transparency, we have regularly check-pointed with our Board tracking our milestones… This transparency, this accountability demonstrates our commitment to continually challenge all aspects of our operations.” Mr. Liveris made this statement on the Company’s January 29, 2014 earnings call for the fourth quarter of 2013. Mr. Liveris’s quote can be found on page 4 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 9]. |

| o. | The 14a-12 Materials provided the following statement attributed to a Mr. Liveris: “It is honestly impossible to think of Dow as a petrochemical company anymore.” Mr. Liveris made this statement on the Company’s January 29, 2014 earnings call for the fourth quarter of 2013. Mr. Liveris’s quote can be found on page 9 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 9]. |

| · | each statement attributed to the company and to third parties (i.e., media reports); |

Response:

| p. | The 14a-12 Materials provided the following statement attributed to a news person: “Well, Dow recommitted today to its near-term goal, which means essentially in the next couple of years, it’s near-term goal of ten billion dollars in EBITDA” The news person made this statement on a video by Bloomberg on October 4, 2011. A link to such video is available at the following website: https://www.youtube.com/watch?v=dj8I8HrSUJY. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 6

| q. | The 14a-12 Materials provided the following statement attributed to Geoffry Merszei, who, at the time the statement was made, was Dow’s Executive Vice President and Chief Financial Officer: “The focus is clearly on acquisitions that are accretive as soon as possible, that provide a much higher return on capital than the overall returns that we are getting, more in line with many of our specialty businesses.” Mr. Merszei made this statement on the Company’s October 26, 2006 earnings call for third quarter of 2006. Mr. Merszei’s quote can be found on page 14 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 10]. |

| r. | The 14a-12 Materials provided the following statement attributed to Heinz Haller, who, at the time the statement was made, was Dow’s head of Performance Materials, and is currently the Executive Vice President and President of Dow Europe, Middle East & Africa: “Batteries in particular, this is a huge market in the making, and we have taken the decision that we want to participate as the Dow Chemical Company. Why do we do that? I think we are ideally qualified from an electro chemistry standpoint. That’s, after all, what the company is based on – on a huge side. But we have all the technical ingredients to do that.” Mr. Haller made this statement on the Company’s November 12, 2009 investor day call. Mr. Haller’s quote can be found on page 27 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 6]. |

| s. | The 14a-12 Materials provided the following statement attributed to Joseph Harlan, who, at the time the statement was made, was Dow’s head of Performance Materials, and is currently the Chief Commercial Officer and Vice Chairman, Market Business: “We are looking at [being] more market-focused [and] customer-centric. By doing all this, we would expect further to increase our [adjusted] EBITDA margins [in the Performance Materials segment] by 300 basis points over this time period, which will really make sure that our performance is exceeding pre-recessionary levels easy.” Mr. Harlan made this statement on the Company’s October 4, 2011 investor day call. Mr. Harlan’s quote can be found on page 16 of the Bloomberg transcript of such call, supplementally provided to the Staff herewith. [Tab 7]. |

| · | each “Broken Promise” included in the Facts section of the Site; |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 7

Response:

| t. | Third Point included the following statement in the 14a-12 Materials: “In fact, Dow has repeatedly made excuses for missing its targets, blaming everything from China ‘tanking,’ competition from state-owned enterprises, and an ‘uncertain’ economy.” Third Point believes this to be a statement of fact. The Company repeatedly missed its targets, as will be shown in the below responses for the various statements made in the 14a-12 Materials promises with respect to Dow’s missed targets. Mr. Liveris made the above mentioned statements in interviews with CNBC, which are available at CNBC’s website. In the video available at http://video.cnbc.com/gallery/?video=3000240339&play=1, in the first twenty seconds of the video Mr. Liveris blames “China tanking” and an “uncertain economy” for the Company’s performance. In the video available at http://video.cnbc.com/gallery/?video=3000184846&play=1, from 5:17 to 5:53, Mr. Liveris blames competition from “state-owned enterprises” for the Company’s difficulties. |

| u. | In the 14a-12 Materials, Third Point made the statement that the combined Return-On-Assets for the Electronics & Functional Materials (“E&FM”) and Coatings & Infrastructure segments in 2013 were each 3.3%, while the entire company had a Return-On-Assets of 5.8%. An analysis of how Third Point calculated such segmented and consolidated return-on-assets has supplementally been provided to the Staff herewith. [Tab 36]. On the basis of such analysis, in its 14a-12 Materials Third Point stated that: “We believe Liveris’s largest acquisition during his tenure as CEO was dilutive to overall return on capital.” An asset would be dilutive to overall return on capital if the Return-On-Assets of such asset were less than the Return-On-Assets for the Company as a whole. As shown in the supplemental materials described above, because the Return-On-Assets for the each of the E&FM and Coatings & Infrastructure segments in 2013 were below the Return-On-Assets of the Company, and such segments are predominately the former Rohm & Haas entities that were acquired, Third Points belief that such acquisition was dilutive to Return-On-Capital is supported by such analysis. |

| v. | In the 14a-12 Materials, Third Point made the statement that “Dow has never come close to achieving its ‘Industry trough’ adjusted EPS target, despite massive unforeseen cost tailwinds from the North American shale revolution”. In July 2008, Mr. Liveris stated that the industry trough adjusted EPS would be $3.50, as discussed in section 2(f) of this response letter. Despite that “industry trough” forecast, since 2008 the closest Dow has come to achieving that forecast was an adjusted EPS of $2.54 in 2011, as can be seen from the chart provided in the 14a-12 Materials with the above referenced statement. The chart shows that Dow’s industry adjusted EPS was $1.97 in 2010, $2.54 in 2011, $1.90 in 2012 and $2.48 in 2013. This chart was based on the figures provided by Dow in various press releases, each of which has been supplementally provided to the Staff herewith. Dow’s 2010 industry adjusted EPS can be found on page 2 of its press release titled Dow Reports Fourth Quarter and Full-Year Results, and dated February 3, 2011. [Tab 11]. Dow’s 2011 industry adjusted EPS can be found on page 2 of its press release titled Dow Reports Fourth Quarter and Full-Year Results, and dated February 2, 2012. [Tab 12]. Dow’s 2012 industry adjusted EPS can be found on page 2 of its press release titled Dow Reports Fourth Quarter and Full-Year Results, and dated January 31, 2013. [Tab 13]. Dow’s 2013 industry adjusted EPS can be found on page 2 of its press release titled Dow Reports Fourth Quarter and Full-Year Results, and dated January 29, 2014. [Tab 14]. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 8

| w. | In the 14a-12 Materials, Third Point stated that Dow’s industry trough adjusted EPS was $0.63 in 2009, which is less than Dow’s target of $4. This statement was based on the adjusted EPS provided by Dow on page 2 of its press release titled Dow Reports Fourth Quarter and Full-Year Results, and dated February 2, 2010, which has been supplementally provided to the Staff herewith. [Tab 15]. |

| x. | In the 14a-12 Materials, Third Point stated that Dow’s dividend was cut by 64% on February 12, 2009. This statement was based on the extensive press coverage of Dow cutting its dividend, including the New York Times article available at the following website: http://www.nytimes.com/2009/02/13/business/13chemical.html?_r=0. |

| y. | Third Point included the following statement in the 14a-12 Materials. “Dow has repeatedly missed its own goals, including segment margin targets, adjusted EBITDA, and adjusted EPS.” Third Point believes this to be a statement of fact that is fully supported by the missed goals and targets described throughout this response letter. |

| z. | In the 14a-12 Materials, Third Point stated that Dow’s adjusted EBITDA margins for the Agricultural Sciences segment peaked in 2011 at 16%. A description of how such margins were calculated by Third Point, and the basis therefor has supplementally been provided to the Staff herewith. [Tab 16]. |

| aa. | Third Point included the following statement in the 14a-12 Materials. “Dow sold the Dow Kokam battery business after taking an impairment in 2012 of $304 million. We believe that Dow clearly did not have the ingredients to make this venture work.” The fact that Dow incurred a $304 million impairment as a result of this acquisition can be found on page 37 of Dow’s Form 10-K for the fiscal year ended December 31, 2012, which has been supplementally provided to the Staff herewith. [Tab 17]. Third Point’s statement that Dow did not have the ingredients to make the Kokam battery business work is supported by the facts that Dow bought the business, incurred a $304 million impairment on the business, and then subsequently sold the business. In the event that Dow had the ingredients to make the venture work, Dow would not have incurred the impairment and subsequently sold the business. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 9

| bb. | Third Point included the following statement in the 14a-12 Materials. “The following year (2012), the Company earned $7.5 billion in adjusted EBITDA and $1.90 in adjusted EPS. One can only imagine how poor results would have been had economic conditions been as weak as they were in 2008-09.” As shown in section 2(k), Mr. Liveris claimed that Dow would have adjusted EBITDA in excess of $8 billion and adjusted EPS of $2.50 per share even under conditions as bad as in 2008 or 2009. In 2012, the Company had an adjusted EBITDA of $7.5 billion and an adjusted EPS or $1.90, which were worse than Dow’s projected lows for a down economy. The Company’s adjusted EBITDA and adjusted EPS can be found on page 2 of Dow’s press release titled Dow Reports Fourth Quarter and Full-Year Results, and dated January 31, 2013, which has supplementally been provided to the Staff herewith. [Tab 13]. |

| cc. | In the 14a-12 Materials, Third Point made a statement of fact that adjusted EBITDA margins for the Performance Materials segment have contracted, contrary to the prior statement from Mr. Harlan, the head of the division, who stated, as shown in Section 2(s), that margins would expand by 300 bps. Adjusted EBITDA margins for the performance materials segment contracted from the time Mr. Harlan made that statement in 2011 to 2013, contracting from 12.8% in 2010 down to 10.9% in 2013. A description of how such margins were calculated by Third Point has supplementally been provided to the Staff herewith. [Tab 18]. |

| dd. | Third Point included the following statement in the 14a-12 Materials. “In addition, [Joe Harlan] gave ‘near-term’ and ‘earnings power’ adjusted EBITDA targets of $2.5 and $3.4 billion, respectively, compared to 2012 and 2013 actual adjusted EBITDA of $1.6 and $1.5 billion, respectively.” The targets can be found on page 5 of a presentation by Mr. Harlan, dated October 4, 2011, which has supplementally been provided to the Staff herewith. [Tab 19]. The actual adjusted EBITDA for 2012 can be found in Dow’s press release titled Dow Reports Fourth Quarter and Full-Year Results, dated January 31, 2013, on page 11 [Tab 13], and the actual adjusted EBITDA for 2013 can be found in Dow’s press release titled Dow Reports Fourth Quarter and Full-Year Results, dated January 29, 2014, on page 11, each of which have supplementally been provided to the Staff herewith. [Tab 14]. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 10

| ee. | In the 14a-12 Materials, Third Point stated that Dow missed the minimum adjusted EBITDA target of $8 billion for 2012, which target is shown in Section 2(l). In that year, Dow reported an adjusted EBITDA of $7.5 billion. This figure was provided by Dow on page 2 of its press release titled Dow Reports Fourth Quarter and Full-Year Results, and dated January 31, 2013, which has been supplementally provided to the Staff herewith. [Tab 13]. |

| ff. | Third Point included the following statement in the 14a-12 Materials. “Liveris has claimed that Dow would achieve $10 billion of adjusted EBITDA in the ‘near-term’ for 5 consecutive years. ‘Interventions’ (e.g. productivity and cost-cutting) and low cost feedstocks were supposed to get Dow to $10 billion of adjusted EBITDA. Currently, achieving the $10 billion in adjusted EBITDA depends on significant capital expenditures on new projects such as PDH, Sadara and Gulf Coast investments.” Starting in November of 2009, for five consecutive years Dow set a target of $10 billion of adjusted EBITDA in the “near-term”. This can be seen from the materials compiled by Third Point, which such compilation and source materials has supplementally provided to the Staff herewith. [Tab 20]. Such materials contain infographics provided by Dow’s management team in presentations during each of the past five years. In such infographics, Dow originally stated that it would achieve an adjusted EBITDA target of $10 billion through interventions and low cost feedstocks, which is shown in the infographics that were presented by Dow on or prior to December 3, 2012 and was stated by Mr. Liveris on the October 24, 2012 earnings call for the third quarter of 2012 (as shown in Section 2(m) above). Starting with the December 2, 2013 infographic, Dow continued to project an adjusted EBITDA of $10 billion, but required additional projects and growth to reach that $10 billion adjusted EBITDA target. |

| gg. | Third Point included the following statement in the 14a-12 Materials. “We question words such as ‘accountability’ and ‘milestones’ given Liveris’s track record of missing targets, including the ones in the table below. Assuring investors that these decisions were “check-pointed” with the Board (which he chairs) shows a complete lack of personal accountability.” Dow has historically missed many of its own milestones, as shown in the 14a-12 Materials, including the specific missed targets referenced by the above statement. The targets are shown on page 10 of the presentation from the Dow Investor forum by Bill Weidman, CFO, which has supplementally been provided to the Staff herewith. [Tab 37]. A description of how the margins in the table provided in the 14a-12 Materials were calculated has also supplementally been provided to the Staff herewith. [Tab 21]. |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 11

| hh. | In the 14a-12 Materials, Third Point stated that “we question the Board’s ability to ‘check-point’ when Dow’s segment disclosure and selective raw material transfer pricing is so opaque.” Dow’s segment disclosure is opaque because the Company does not disclose any of its petrochemical capacities, which is the amount of product that Dow’s asset base is capable of producing on an annualized basis. A number of Dow’s major competitors disclose capacity information in their respective Annual Reports on Form 10-K. We have supplementally provided to the Staff herewith a copy of the petrochemical capacities for several of Dow’s competitors (Chevron Phillips Chemical, Westlake Chemical, LyondellBasell Industries and Exxon Mobil). [Tab 22]. This capacity information would be important for the Board and investors to analyze the profit potential of the Company, since without such data, assumptions must be made as to the price, volume and cost of Dow’s separate products. |

In addition, Dow’s selective raw material transfer pricing is opaque because Dow inconsistently prices the transfer of internally generated raw materials. Based on conversations with Dow’s management, Third Point came to understand that (i) Dow does not have an explicit policy for internal raw material transfer pricing, (ii) Dow transfers ethylene at cost and propylene at market price and (iii) Dow is not willing to discuss transfer pricing of other internally generated raw materials (e.g. chlorine, caustic soda, propylene oxide, ethylene oxide, acrylic acid, acrylic esters and acrylates). In contrast, after discussion with industry participants, Third Point learned that many of Dow’s competitors in petrochemicals and downstream petrochemical derivatives, generally transfer all internally generated raw materials at market price. Without an understanding of how internally generated raw materials are transferred within Dow, it is hard to believe that the Board, or Dow’s stockholders, could “checkpoint” Dow’s capital allocation decisions. Since internally generated raw materials are transferred at cost, profits and revenue can be transferred to Dow’s different segments. Because this transfer pricing is opaque, it is difficult for the Board to determine whether it would be more beneficial for Dow in certain instances to sell internally generated chemicals to others at market prices, and forego its downstream activities.

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 12

| ii. | In the 14a-12 Materials, Third Point stated that Dow is North America’s largest ethylene producer. Support for this statement can be found on page 18 of the presentation delivered by Phillips 66 at the 2014 Bank of America Merrill Lynch Refining Conference, supplementally provided to the Staff herewith. [Tab 23]. The chart contained in such presentation shows that Dow’s ethylene capacity in the North American region is over 10 billion pounds, while the other large producers all have ethylene capacity in such region under 10 billion pounds and Third Point has no reason to believe this chart is inaccurate. |

| jj. | In the 14a-12 Materials, Third Point stated that “[t]he majority of Dow’s profits are generated from ethylene cracking.” In 2013, Dow’s adjusted EBITDA was $8.4 billion, as provided on page 2 of Dow’s press release titled Dow Reports Fourth Quarter and Full-Year Results, dated January 29, 2014. [Tab 14]. In order for a majority of Dow’s profits to be generated from ethylene cracking, its adjusted EBITDA generated from ethylene cracking would need to be greater than $4.2 billion. Based on Third Point’s calculations of Dow’s EBITDA derived from ethylene cracking, Third Point believes that Dow generates greater than $4.2 billion of its adjusted EBITDA from ethylene cracking. A table showing Third Point’s estimates, along with an explanation of the sources and calculations, has been supplementally provided to the Staff herewith. [Tab 24]. |

| kk. | In the 14a-12 Materials, Third Point stated that “[i]t is nonsensical to suggest that Dow is not a petrochemical company.” The above statement is self evident given the fact that ethylene is a petrochemical, and that Dow is the largest ethylene producer in North America. |

| · | your belief in the “Fourth Quarter 2013 Investor Letter” that the goal of the company’s petrochemical operational strategy was “supposedly to earn higher margins”; |

Response: The full quote from the referenced investor letter states that “Dow’s petrochemical operational strategy has been to migrate downstream, supposedly to earn higher margins, to become more “specialty,” and to increase the number of customer-facing products.” Within Dow’s petrochemical businesses, Dow produces basic building block chemicals. Dow then converts these building blocks into intermediate chemicals, which can then be either sold generally, or converted into specialty products. In general, the intermediate chemicals can be sold as a global commodity on the open market, whereas, if the intermediate chemicals are further converted into specialty products, they would be sold to a specific customer to achieve a specific purpose (e.g., if Dow made a plastic component for a car manufacturer). In general, Third Point believes that it is only beneficial to create specialty components if a business can achieve a higher margin in making those specialty components than a business could have by selling the intermediate chemicals on the open market. Thus, Third Point reasonably views Dow’s migration downstream as an attempt to earn higher margins by creating more specialty and customer-facing products.

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 13

Over the past few years, Dow has promoted to investors this shift downstream to attempt to capture the higher margins of specialty products. In a presentation made in 2009, Mr. Liveris stated that “[n]ow earlier this year, we completed an enterprise-wide strategic review, looking away in our path towards being a mostly downstream specialty company. And confirm that we not only had the right strategy, but we were totally equipped to grow this new Dow portfolio”. That same day Mr. Liveris also stated “[t]he Dow today operates three integrated business models with more high growth, high margin, technology-rich businesses than we've ever had. These new additions to our portfolio are high customer touch businesses with excellent geographic spreads. This enhanced portfolio is much more market driven and it's quite literally moving our earnings up and to the right”. These quotes can be found on the Bloomberg transcript from Dow’s 2009 investor day, on pages 3 and 4. [Tab 6]. On investor day in 2011, Mr. Liveris continued to promote the shift downstream to capture the higher margins of specialty products. Mr. Liveris stated that “these global, flexible and cost advantage assets are a central component of our competitive advantage and our growth in downstream specialty businesses”. James R. Fitterling, president of Dow’s feedstock and energy division, also stated that “we have right-sized this portfolio and reduced the number of underperforming assets and sized it to fit a downstream specialty integration play”. Mr. Fitterling also stated “so that's a lot of transformation for a company as Andrew mentioned. And Feedstocks and Energy provides the basis for that downstream growth.” These quotes can be found on the Bloomberg transcript from Investor Day 2011, on pages 6, 19 and 21, respectively. [Tab 7]. On investor day in 2012, Mr. Liveris continued to promote this downstream approach, stating that “Our job is to execute the downstream.” This quote can be found on the Bloomberg transcript from the Investor Forum on December 3, 2012 on page 23, which has been supplementally provided herewith. [Tab 25].

| · | your statement in the “Fourth Quarter 2013 Investor Letter” that “[p]erhaps unsurprisingly, our analysis suggests that Dow’s downstream migration within petrochemicals has not yielded material benefits so far and instead may be a significant drag on profitability. . . . Our work suggests that upside from both cost-cutting and operating optimization could amount to several billion dollars in annual EBITDA. We suspect that Dow’s push downstream has led the company to use its upstream assets to subsidize certain downstream derivatives either by sacrificing operation efficiency or making poor capital allocation decisions, or both. Poor segment disclosure combined with Dow’s opaque and inconsistent transfer pricing methodology for internally sourced raw materials…”; |

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 14

Response: As discussed elsewhere in this response letter, Dow can sell chemicals and products at various places in the supply chain. Dow can sell chemicals upstream as a commodity on the general market and receive the market rate of price times the volume sold for that specific chemical, or Dow can migrate the product downstream, adding value and profit based on the downstream transformation. Using analyst and consultant data for the price, cost and volume of the chemicals that Dow produces, Third Point’s calculations show that Dow may be able to make more profit by selling chemicals on the open market rather than using its current strategy of attempting to further refine such chemicals into customer specific products. By cutting the costs of further refining its chemicals into downstream, customer specific products, Third Point believes that Dow would optimize its profit potential, significantly increasing adjusted EBITDA. Third Point believes that because of Dow’s poor segment disclosure and transfer pricing methodology, Dow has made what Third Point believes are poor capital allocation decisions, and its Board cannot fully understand that the push downstream sacrifices operational efficiency resulting in a drag on the Company’s profit.

The goal of Third Point’s analysis was to compare estimates of the profit that Dow could achieve by selling its chemicals on the commodities market, using price and volume to determinate the amount of profit that Dow could achieve in this manner, with the actual reported adjusted EBITDA that Dow generates. A table showing Third Point’s estimates, along with an explanation of such estimates, has been supplementally provided to the Staff herewith. [Tab 26]. Based on Third Point’s calculations, Third Point believes that Dow could make significantly more profit by selling its chemicals on the open market, and that Dow’s shift downstream does not create an incremental profit.

| · | your similar statement also in the “Fourth Quarter 2013 Investor Letter” that the “optimization of Dow Petchem . . . could translate into future EBITDA well in excess of $9 billion on a stand-alone basis”; |

Response: The full quote from the investor letter states “[t]he optimization of Dow Petchem Co. combined with the significant step-up in earnings from organic growth initiatives already put in place by management – the PDH plant, the Sadara JV, and the U.S. Gulf Coast greenfield ethylene cracker – could translate into future EBITDA well in excess of $9 billion on a stand-alone basis.” As shown in the table below, adding Dow’s actual adjusted EBITDA for 2013 for the petrochemical segments, which include feedstocks & energy, performance plastics and performance materials, to Dow’s estimates for adjusted EBITDA associated with its expansion projects, sums to a number in excess of $9 billion of adjusted EBITDA, as shown in the table below. Third Point believes that the optimization of Dow could provide an even larger adjusted EBITDA; however, it is not necessary to discuss such optimizations since, based solely on Third Point’s reliance upon Dow’s own estimates, Third Point has sufficient basis for its above statement to be true. The source material for the below table has been supplementally provided herewith. [Tab 14]. The Dow Presentation is a presentation by Mr. Liveris titled Separation of Commodity Chemicals Business. [Tab 27].

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 15

| | Bridge to $9B of Dow Petchem EBITDA ($ in millions) | | | Source | |

| | Feedstock and Energy Adj. EBITDA 2013A | $837 | | Dow Q4 2013 Press Release – Page 11 | |

| | Performance Plastics Adj. EBITDA 2013A | 4,092 | | Dow Q4 2013 Press Release – Page 11 |

| | Performance Materials Adj. EBITDA 2013A | 1,459 | | Dow Q4 2013 Press Release – Page 11 |

| | Total Dow Petchem Adj. EBITDA 2013A | $6,388 | | |

| | | | | |

| | St. Charles Ethylene Restart | $75 | | Dow Presentation Dec 3, 2013 – Page 10 |

| | PDH Plant EBITDA | 450 | | Dow Presentation Dec 3, 2013 – Page 10 |

| | Louisiana Ethane Flexibility | 250 | | Dow Presentation Dec 3, 2013 – Page 10 |

| | Sadara | 500 | | Dow Presentation Dec 3, 2013 – Page 10 |

| | Texas Ethylene and USGC Derivatives | 1,500 | | Dow Presentation Dec 3, 2013 – Page 10 |

| | Total Adj. EBITDA | $9,163 | | |

| · | your statements in the “Fourth Quarter 2013 Investor Letter” that “. . . the market remains unconvinced” and that the market is “skeptical of Dow’s divisional margin targets given the lack of clarity around how they were derived and the lack of progress toward achieving them”; |

Response: Based on discussions with analysts, and a review of analysts reports and questions, Third Point believes that that the market generally views Dow’s targets, including margin targets, with skepticism. As discussed throughout this letter, including in Section 2(hh) above, Dow’s margin targets are troublesome because Dow transfers certain products at cost, and certain products at market prices. This transfer pricing may move profits or margins from one segment into another. Mark Connelly, on page 2 of a CLSA research report titled “Transparency but Not Clarity,” dated November 25, 2014, which has supplementally been provided herewith, agreed with this assessment, when he stated that “Dow is ending a multi-decade reporting fiction that made Dow’s various segments look far more profitable than they really were. We have often wondered whether anyone inside Dow (or on its Board) actually had any idea where, when, or why the company made money - as they made critically important capital allocation decisions.” [Tab 28].

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 16

For the above reasons, analysts have been skeptical of Dow’s targets, and what those targets actually mean. Kevin McCarthy, on page 1 of a research report by Bank of America titled “Belt Tightens Further at Investor Day” on December 3, 2012, which has been supplementally provided herewith, wrote that “Dow’s [adjusted] EBITDA, goal of $10 bn and segment margin and growth targets remain intact, although we do not consider these especially meaningful without specific time frames attached. Please see tables 1-4 herein for financial goals.” [Tab 29]. Not only did Dow miss many of its adjusted EBITDA and margin targets in the tables provided, but Mr. McCarthy shows that the market is unconvinced by Dow’s targets, especially in light of the fact that Dow does not state when the targets would be achieved. Mark Connelly on page 2 of the CLSA report discussed above also stated that “for many years, Dow has had stretch goals for returns above the cost of capital, and has shown little success achieving them except at cyclical peaks. Lots of companies do that, particularly in basic materials, where the record of actually achieving return on capital targets across a cycle is so weak.” Not only was a research report with “Not Clarity” in the title discussing Dow’s margin goals with skepticism, the article also states that Dow has shown “little success” at achieving such goals except at cyclical peaks. Bob Koort, a Goldman Sachs Analyst, asked on the Q4 2012 Earning Call, a Bloomberg transcript of which has supplementally been provided herewith, “Andrew, I was wondering if I could ask maybe a broader question around your Performance Materials business and propylene derivatives businesses. It seems like it's been quite some time since they performed up to par. And I'm wondering if you can assess is this a Dow-specific issue, or is there something structurally about those end markets and businesses that just make it a tough slog or how do you compare when you benchmark?” [Tab 30]. This quote from Mr. Koort shows another instance of where analysts are unconvinced by Dow’s performance, and are trying to find understanding from management as to why the business is underperforming.

| · | your statement in the “Fourth Quarter 2013 Investor Letter” that “The South American soybean opportunity alone for ENLIST could increase divisional EBITDA by 30-40% once fully penetrated”; |

Response: ENLIST is a crop trait being developed by Dow for both corn and soy, and will be available for sale in both South America and North America. ENLIST is currently in the EPA approval process. Based on analysis by Third Point, Third Point believes that ENLIST could increase the divisional adjusted EBITDA for Dow’s agricultural sciences division by 30-40% once fully penetrated. An analysis showing Third Point’s calculations in support of this belief has supplementally been provided to the Staff herewith. [Tab 31].

| · | your statement in the “Fourth Quarter 2013 Investor Letter” that in the Electronics & Functional Materials segment you see certain developments “leading to above-GDP growth rates and sustainably robust returns on invested capital”; |

Response: This statement refers to two different claims. First, Third Point claimed that Third Point could see certain developments in E&FM leading to above-GDP growth rates. In making this claim, Third Point relied on Dow’s forecasts from its 2012 databook, which has been supplementally provided herewith. [Tab 32]. On page 15 of the 2012 databook, Dow set a normalized revenue growth target of 2X GDP. Third Point believes that this target is achievable since Dow’s E&FM division provides products for semiconductor technologies, circuit boards and display technologies, the main components of smart phones and flat screen televisions. This is an attractive end-market that could likely allow for growth at a rate of twice the GDP, as forecasted by Dow.

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 17

Second, Third Point claimed that Third Point could see certain developments in the E&FM segment resulting in sustainably robust returns on invested capital. In Dow’s 2012 databook mentioned in the above paragraph, Dow targeted a margin of about 25% for its E&FM segment. In making this statement, Third Point relied both on Dow’s target, and Dow’s recent E&FM margins, which, as shown in the chart below, in recent years have been in the 22.7% to 23.6% range. Third Point believes that Dow’s target could be reasonable for this segment due to the structure of the E&FM market. The market allows for higher returns for a number of reasons. First, in electronics production, Dow’s products are often contracted into a product platform. Thus, if Dow wins a bid to provide components for a certain phone, Dow would provide such components for the entire life of that phone. In addition, there are only a handful of large chemical companies that could provide such products, and the barriers to entry into the market are high. Lastly, electronics manufacturers are more likely to trust the larger, established chemical companies rather than smaller, newer companies that may not have the capability or credibility to fulfill large contracts.

| | Historical E&FM EBITDA Margins | | | |

| | | 2011 | 2012 | 2013 | |

| | Sales | $4,599 | $4,481 | $4,591 | |

| | Sales Growth | 9.4% | -2.6% | 2.5% | |

| | Adj. EBITDA | $1,084 | $1,031 | $1,040 | |

| | Margin | 23.6% | 23.0% | 22.7% | |

| · | your statement in the “First Quarter 2014 Investor Letter” that “Shareholders have long called for the company to increase disclosure, improve the clarity of their reporting, and clearly identify underlying business drivers” and that “All shareholders eagerly anticipate progress on these important initiatives”; |

Response: Third Point believes based on discussions analysts and research into reports delivered by analysts, that stockholders and the market in general desire for Dow to increase clarity in its disclosures so that Dow’s sources of profitability can be better determined. As discussed above, because of Dow’s segment disclosure, selective transfer pricing and inclusion of joint venture income in its segment disclosure, it is difficult for stockholders to determine whether Dow’s management makes effective capital allocation decisions, and to compare Dow’s segments to the corresponding segments of Dow’s competitors. As early as March 16, 2006, Jeffrey Zekauskas, on page 1 of a research note by JP Morgan titled “Dow Seeks Steadier Growth; Investors Seek Transparency”, which has been supplementally provided to the Staff herewith, stated that “Investors sought a shift to market-based transfer pricing for reporting purposes to identify the sources of operating profitability.” [Tab 33]. In addition, Mark Connelly reiterated this desire on page 1 of a CLSA research report titled 1Q14 Just the Outlook, dated April 23, 2014, in which he stated that “Dow passed through all of the profits from hydrocarbons to the downstream businesses – but not the revenues. That made downstream margins look far better than they really were, and may have led to some poor portfolio decisions. Under Liveris, hydrocarbons and feedstocks are together, reducing the distortion somewhat, but the transfer is still relatively the same. Further efforts to improve transparency could help investors with the question they ask the most – where in the chain is the value really created?” [Tab 34]. On the basis of the above, Third Point believes that Dow should improve its disclosure with respect to these aspects, and that other stockholders have this same belief.

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 18

| · | your statement in the “First Quarter 2014 Investor Letter” that you do not believe that “this lost ECU margin is clawed back further downs; |

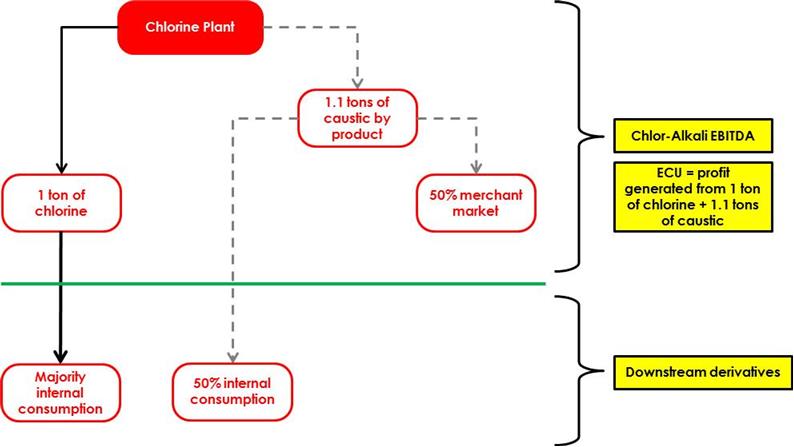

Response: As shown in the figure below, when Dow makes chlorine, Dow actually produces 1 ton of chlorine, and ends up with an additional 1.1 tons of by-product of the process, called caustic, which Dow can use in its own products or sell on the general market. ECU margin is thus defined as the revenue from the sale 1 ton of chlorine and 1.1 tons of caustic by-product of chlorine, less the cost it takes to produce such products. Based on Third Point’s discussions with analysts, Dow and other Chlor-Alkali producers, Third Point believes that almost all chlorine producers sell their caustic by-product into the market, whereas based on Third Point’s discussions with Dow, it consumes about 50% of its caustic by-product internally in its propylene oxide units, part of Dow’s Performance Materials Segment. By consuming the caustic by-product internally, Dow is foregoing the profit it could receive from its caustic by-product on the open market. The above statement by Third Point is based on Third Point’s reasonable belief that this foregone profit is not re-captured by Dow in the downstream products that consume the caustic by-product. An analysis of Third Point’s calculations, which support Third Point’s belief, has been supplementally provided to the Staff herewith. [Tab 35].

Daniel F. Duchovny, Special Counsel

Securities and Exchange Commission

Office of Mergers and Acquisitions

April 10, 2015

Page 19

Please be advised that, in connection with the Comment Letter and Third Point’s responses hereto, on behalf of Third Point and the other participants, we hereby acknowledge the Staff’s position that:

| · | Third Point and the other participants are responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | Third Point and the other participants may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |