Third Point Sends Letter to Shareholders Regarding Campbell’s Record of Putting the Interests of Billionaire, Insider Heirs Ahead of Independent Shareholders

Asserts Shareholders and Employees Have Been Repeatedly Misled About the Consequences of Share Buyback Programs and the Implications of Certain Disastrous Acquisitions

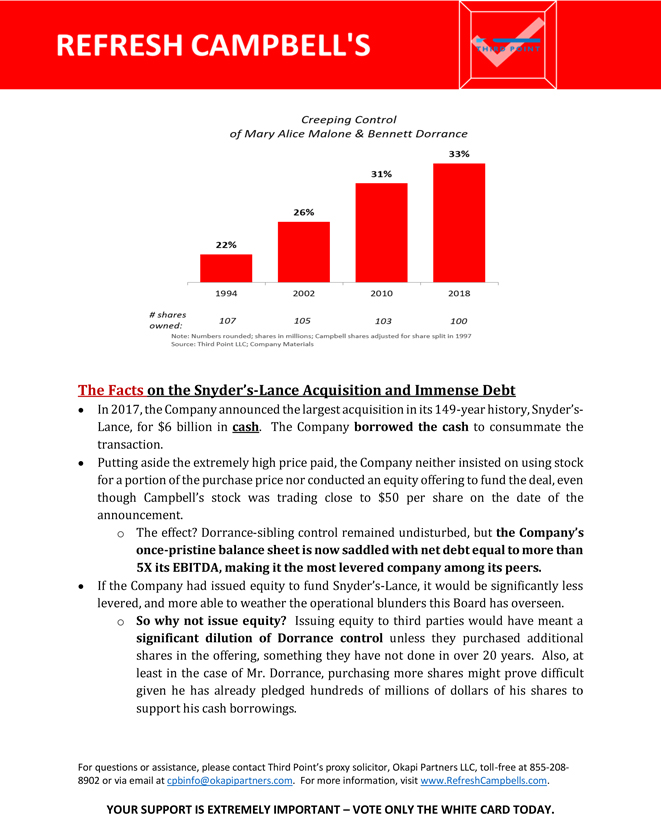

Believes Twenty Years of Buybacks Occurred Without Disclosing That One Result Was to Give the Two Billionaire Dorrance Siblings on the Board Almost Total Control Over the Company’s Direction

Reminds Shareholders that the Entrenched Board’s Legacy of Value Destruction Includes an Approximately 20% Drop in Share Price This Year Alone

After Considering the Current Board’s History of Destroying Your Value, We Urge Shareholders to VOTE THE WHITE CARD to Elect the Independent Slate and End This Reign of Error

NEW YORK—(BUSINESS WIRE)—Third Point LLC (LSE: TPOU) (“Third Point”), a New York-based investment firm managing approximately $17 billion in assets and a holder of approximately 7% of the outstanding common shares of Campbell Soup Company (NYSE: CPB) (“Campbell” or the “Company”), has mailed a detailed letter to shareholders regarding Campbell’s record of putting the interests of billionaire, insider heirs ahead of independent shareholders. Thefull text of the letter can be found here and below.

As a reminder, we encourage all shareholders to also reviewour Case for Change to understand more about why the Independent Slate will respect shareholder voices, end the Entrenched Board’s reign of error, and set Campbell on a new and profitable path. We urge all shareholders toVOTE THE WHITE CARD to elect the Independent Slate.

***

November 5, 2018

Dear Fellow Campbell Soup Company Shareholder:

Campbell’s shareholders and employees have been misled about the consequences of the Company’s share buyback programs and the implications of some of its purchases. Campbell has done twenty years of stock buybacks without disclosing that one result was to give the two billionaire Dorrance siblings on the Board almost total control over the Company and the practical ability to block any important decisions they do not like. The Company’s recentall-cash acquisition ofSnyder’s-Lance has saddled Campbell’s with massive debt that is now heavily weighing on the Company but benefitted the billionaire siblings by allowing them to keep their control that could otherwise have been diluted. We find ourselves asking:

Is this Company run for ALL Shareholders or for the Benefit of Two Billionaire Insiders?