FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2003

Commission File Number: 1-14646

Sinopec Beijing Yanhua Petrochemical Company Limited

(Translation of registrant’s name into English)

No.1 Beice, Yingfeng Erli, Yanshan, Fangshan District, Beijing

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g-2(b):82-Not Applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| | | | | SINOPEC BEIJING YANHUA PETROCHEMICAL COMPANY LIMITED |

|

Dated: May9, 2003 | | | | By: | | /s/ DU GUOSHENG

|

| | | | | | | | | Name: Du Guosheng Title: Chairman of the Board |

Exhibit Index

| A. | | Annual report of the Company for the year ended December 31, 2002 filed with the Hong Kong Stock Exchange on April 30, 2003 and disclosed on the website of the Hong Kong Stock Exchange on May 5, 2003. |

Exhibit A

SINOPEC BEIJING YANHUA PETROCHEMICAL COMPANY LIMITED

ANNUAL REPORT 2002

1

Table of Contents

Company Profile |

Financial Highlights |

Chairman’s Statement |

Management’s Discussion and Analysis |

Report of the Board of Directors |

Report of the Board of Supervisors |

Directors, Supervisors and Senior Management |

Notice of Annual General Meeting |

Auditors’ Report |

Income Statement |

Balance Sheet |

Cash Flow Statement |

Statement of Changes in Equity |

Notes to the Financial Statements |

Supplemental Information for North American Shareholders |

Corporate Information |

Other Information |

2

Company Profile

Sinopec Beijing Yanhua Petrochemical Company Limited (the “Company”), was incorporated as a joint stock limited company in accordance with the Company Law of the People’s Republic of China (the “PRC”) on 23 April 1997 pursuant to the reorganisation of Beijing Yanshan Petrochemical Corporation (the “Predecessor”), which has since been renamed SINOPEC Group Beijing Yanshan Petrochemical Company Limited (“Yanshan Company”). The Predecessor was under the control of the former China National Petrochemical Corporation (“Sinopec”). On 27 July 1998, Sinopec was reorganised into China Petrochemical Corporation (“Sinopec Group”). On 25 February 2000, China Petroleum & Chemical Corporation (“New Sinopec”) was incorporated as a controlling subsidiary of the Sinopec Group and the State-owned shares in the Company representing 70% of the outstanding share capital of the Company held by the Predecessor were transferred to New Sinopec (therefore, “Parent Company” as set forth in this report refers to the Yanshan Company prior to 25 February 2000 and to New Sinopec thereafter.) The Company’s foreign shares (accounting for 30% of the issued share capital) include H Shares (“H Shares”) listed on The Stock Exchange of Hong Kong Limited (“SEHK”) and American Depositary Shares (“ADSs”) (one ADS represents fifty H Shares) listed on the New York Stock Exchange (“NYSE”).

The principal business of the Company is the production and sale of three principal petrochemical product groups, namely: (i) resins and plastics, (ii) synthetic rubber, and (iii) basic organic chemical products. The Company’s principal production facilities include a 710,000 ton ethylene production unit (annual rated capacity), Low Density Polyethylene (“LDPE”) production units, polypropylene production units, a High Density Polyethylene (“HDPE”) production unit, a phenol-acetone unit, a cis-polybutadiene rubber production unit and a butyl rubber production unit. In 2002, the Company derived essentially all of its revenues from domestic sales in the PRC.

[A picture is inserted here]

[A picture is inserted here]

The Company is a subsidiary of New Sinopec, which specialises in the production of petrochemicals. In 2002, the Company was the largest ethylene producer in the PRC, accounting for approximately 13.6% of total ethylene production in the PRC. The sales volume of the Company’s plastics and resins ranked the first among all enterprises in the same industry in the PRC in 2002. The Company also ranked the first or the second in the PRC market share (in terms of sales) for LDPE, polypropylene, cis-polybutadiene rubber, phenol and acetone. Based on comparative production statistics on raw material conversion and energy utilisation compiled by the Sinopec Group, the Company is one of the most efficient petrochemical companies in the PRC in terms of material conversion and energy utilisation.

3

Since the Company’s global public offering and placing of shares (“Global Public Offering”) in June 1997, the Company has implemented effective strategies to reduce costs and enhance the profitability of its business. The Company has been using, and gradually increasing the use of, self-developed cracking feedstock substitutes, such as vacuum gas oil (“VGO”), cracking wax oil and hydrogenated raffinate oil, which are less expensive and similar to light industrial oil, without affecting the efficiency of the Company’s production. In 2001 and 2002, the amount of less expensive substitute cracking feedstock used by the Company accounted for approximately 45.0% and 43.8%, respectively, of the Company’s total consumption of cracking feedstock. The Company’s ethylene expansion project (which includes the ethylene facility, the LDPE facility, the acetonitrile extraction facility and the benzene production facility, collectively known as the “Ethylene Project”) was completed at the end of 2001 and thus the Company’s annual capacity of ethylene production has increased from 450,000 tons to 710,000 tons. The Company believes that improved economies of scale will enable the Company to maintain its position as a leading petrochemical company in the PRC.

Financial Highlights

Income Statement

(Amounts expressed in thousands)

Extracted from the accounts prepared in accordance with International Financial Reporting Standards (“IFRS”)

| | | For the year ended 31 December

| |

| | | 2002

| | | 2002

| | | 2002

| | | 2001

| | | 2002 vs. 2001 Increase (Decrease)

| |

| | | RMB | | | HK$ equivalent | | | US$ equivalent | | | RMB (Restated) | | | | |

Sales | | | | | | | | | | | | | | | |

Resins and Plastics | | 5,514,147 | | | 5,196,633 | | | 666,177 | | | 3,203,189 | | | 72 | % |

Synthetic Rubber | | 1,418,899 | | | 1,337,196 | | | 171,421 | | | 925,512 | | | 53 | % |

Basic Organic Chemical Products | | 2,140,185 | | | 2,016,949 | | | 258,560 | | | 1,373,201 | | | 56 | % |

Other | | 369,830 | | | 348,535 | | | 44,680 | | | 473,353 | | | (22 | %) |

| | |

|

| |

|

| |

|

| |

|

| | | |

Total sales | | 9,443,061 | | | 8,899,313 | | | 1,140,838 | | | 5,975,255 | | | 58 | % |

Cost of sales | | (8,368,029 | ) | | (7,886,183 | ) | | (1,010,961 | ) | | (5,660,191 | ) | | 48 | % |

Gross profit | | 1,075,032 | | | 1,013,130 | | | 129,877 | | | 315,064 | | | 241 | % |

Selling, general and administrative expenses | | (530,571 | ) | | (500,020 | ) | | (64,099 | ) | | (565,412 | ) | | (6 | %) |

4

Other expenses, net | | (2,903 | ) | | (2,736 | ) | | (351 | ) | | (100,296 | ) | | (97 | %) |

Profit/(loss) from operations | | 541,558 | | | 510,374 | | | 65,427 | | | (350,664 | ) | | 254 | % |

Net financing costs | | (210,830 | ) | | (198,690 | ) | | (25,471 | ) | | (59,579 | ) | | 254 | % |

Profit/(loss) from ordinary activities before taxation | | 330,728 | | | 311,684 | | | 39,956 | | | (410,223 | ) | | 181 | % |

Income tax (expense)/ benefit | | (121,629 | ) | | (114,625 | ) | | (14,694 | ) | | 137,756 | | | 188 | % |

| | |

|

| |

|

| |

|

| |

|

| | | |

Profit/(loss) attributable to shareholders | | 209,099 | | | 197,059 | | | 25,262 | | | (272,467 | ) | | 177 | % |

| | |

|

| |

|

| |

|

| |

|

| | | |

| * | | Exchange rates used: Renminbi (“RMB”) 1.00 = 0.9424 Hong Kong Dollar (“HK$”) = 0.1208 United States Dollar (“US$”) based on the exchange rates quoted by the People’s Bank of China at the close of business on 31 December 2002. No representation is made that RMB amounts could have been, or could be, converted into HK$ or US$ at that rate on 31 December 2002, or on any other date. |

5

Chairman’s Statement

[Mr. Du Guosheng’s photo is inserted here]

To all shareholders:

It is my pleasure to present to you the audited annual results of Sinopec Beijing Yanhua Petrochemical Company Limited (the “Company”) for the year ended 31 December 2002.

In 2002, despite the retardation in the development of the overall world economy, the demand for petrochemicals remained strong as the economy of China continued to grow at a high speed. During the reporting period, as a result of China’s accession to the World Trade Organisation (“WTO”), costs of importing petrochemicals into China have been reduced. China’s accession to the WTO also has a huge impact on Chinese enterprises in terms of management mechanisms. Facing the intensified market challenges, the Company, through its calm observation, conscientious thinking and the ability to seize opportunities, was able to cope with the situation serenely and to accomplish the following tasks by adhering to the established development strategies of the Company:

| 1) | | Continue to implement theproduction capacity expansion program. In 2002, the Company made full use of its economies of scale after completion of the rebuilding and expansion of the Ethylene Project, and established a solid foundation for the Company to establish its competitive edge in the domestic market through the high-load smooth operation, which has not only achieved the highest overall efficiency in the production of all major products over the past years, but also reduced unit costs in production. The sales volume of the eight main products of the Company has seen a growth of 81.6% as compared with that of 2001. |

| 2) | | Enhancemanagement and lower costs to improve efficiency. In 2002, the Company made full utilisation of its advantages gained in the technology renovation program in connection with the Ethylene Project, and continued to improve on the cracking feedstock, which has pushed the product yield of ethylene to the highest level in history and further reduced production costs. The Company adopted stricter administrative measures with respect to procurement of naphtha, butadiene, benzene and other materials from outside sources by integration of the supply system, tender, and via the Internet to further lower the procurement costs of the Company. |

| 3) | | Improve product mixactivelyin order to meet market demands. In 2002, the Company seized the opportunity to commence operation of the newly built LDPE units, and made full utilisation of its advantages in terms of quality and variety of resin, plastic and other products. By developing and manufacturing special resins and plastics with a high profit margin, the Company improved the profit margin rate of its products. In 2002, the total output of the new products made of synthetic resin developed by the Company reached approximately 200,000 tons, whilst the sales of the materials used in the production of synthetic resin amounted to 538,900 tons, accounting for 56.7% of the sales of resin and plastic, with an increase of 5.2% compared with that over the same period of 2001. |

6

| 4) | | Strengthen sales and marketing activities. In 2002, facing the challenges brought about by China’s accession to the WTO, the management of the Company further improved the sales mechanism of the Company and greatly strengthened sales activities by formulating flexible marketing strategies. Products were manufactured upon purchase orders placed by customers and taking into account their sales prospects. The sales to production ratio of the principal products of the Company were maintained at a very high rate, thus successfully accomplished the sales target. |

The audited net profit of the Company for the year ended 31 December 2002 amounted to RMB 209 million (2001: audited net loss of RMB272 million). The amount of sales was RMB 9,443 million, with an increase of 58.0% from RMB 5,975 million in 2001. According to the Company’s Articles of Association, the retained earnings available for distribution to shareholders of the Company should be the lower amount determined in accordance with the PRC Accounting Rules and Regulations and the amount determined in accordance with the accounting standards adopted by the place where the Company is listed. At 31 December 2002, the Company has accumulated losses of RMB 91,024,000, being the amount determined in accordance with the PRC Accounting Rules and Regulations. The Board has therefore decided not to declare a dividend for 2002.

Looking forward to 2003, the Board believes that internationalisation will be a more common phenomenon in the domestic market of China as a result of China’s accession to the WTO. The establishment and commencement of production of a number of joint venture petrochemical enterprises will not only intensify market competition, but also exert significant pressure on the production and operation of the petrochemical industry in China. Nevertheless, the Board is confident that the momentum of continuous growth of China’s economy will further stimulate the increase in demand for petrochemical products. The Company will, on the basis of perfecting the reorganisation of its internal business flow, make use of the advantages gained in the completion of the technology renovation program in connection with the Ethylene Project and further improve the operating results of the Company through continuous implementation of its development strategies. These strategies include:

| 1) | | Vigorously carrying forward the technical improvement and technical advancement to guarantee the sustainable development ofthe enterprise.In 2003, the Company intends to fully utilise the increased production capacity of the ethylene units through further eliminating the bottleneck in such ethylene units with a view to attain the business concept of “not for the largest, but for the best” and thereby guarantee the sustainable development of the Company through increasing production capacity and improving quality, as well as reducing consumption of materials and energy. |

| 2) | | Increase production efficiency through prudent operational planning. In 2003, the Company will arrange the shutdown and overhaul of certain units and use its best endeavor to produce marketable, quality products through closely adhering to the optimisation of ethylene materials and balanced use of materials. In addition, the Company intends to improve the efficiency of its production units by improving the |

7

performance of the equipment and extending the operating period of equipment and minimising the occurrence of unscheduled shutdowns.

| 3) | | Increase production of products with high added valueby adopting a market orientated approach.In 2003, the Company will continue to adjust its product mix to improve and strengthen its profitability through its close cooperation with scientific research institutions. Based on a full market research, the Company will be able to develop special-purpose materials with high market demand and high added value, the supply of which in China currently relies mainly on imports. The Company will strive to further increase the sales proportion of special-purpose materials used for producing synthetic resin. |

| 4) | | Adhere tothe policy of integrating production, supply, sales and research, and improve sales and marketing activities. In 2003, the Company will continue to strengthen its sales and marketing activities based on its former experiences. Through close cooperation between the various departments such as supply, production, sales and research, the Company will further harmonise the operations of those departments and strive to adjust its production plans in a timely manner in order to meet market changes and the different needs of different customers. The Company will also reinforce its efforts in conducting market analysis, improving its ability to meet market changes, avoiding market risks and enhancing economic efficiency by continuing to adopt the sales strategies of “follow the market, maintain stable production-sales ratio, and obtain the maximum sales price”. |

With concurrent listings on the SEHK and NYSE, the Company is subject to and is committed to meeting the most stringent disclosure requirements imposed on it. The Company has formulatedinternal controls policies which apply to the Company as a whole and each of its principal operating divisions. These policies are intended to comply with the new rules adopted by the Securities and Exchange Commission of the United States of America that apply to public companies and are reviewed regularly to maintain and improve the Company’s standards for internal management.

Finally, I would like to extend my sincere gratitude to all the Company’s staff who, when faced with difficult circumstances in both production and operations, and challenged with arduous tasks of reform and development, overcame the difficulties with realism, hard work and a keen determination to succeed. It is my belief that the Company is uniquely positioned to achieve further success in its operations and to give satisfactory returns to its shareholders.

On behalf of the Board of Directors

Du Guosheng

Chairman

11 April 2003, Beijing, the PRC

8

Management Discussion and Analysis

[Mr. Xu Hongxing’s photo is inserted here]

General

This discussion should be read in conjunction with the information in the audited financial statements contained in this annual report. The information presented below interprets the Company’s financial statements prepared in accordance with IFRS. For the Company’s financial statements prepared in accordance with the accounting principles generally accepted in the United States of America, please see the Company’s annual report on Form 20-F filed with the Securities and Exchange Commission of the United States of America, a copy of which will be provided to any shareholder upon written request.

The information set out below does not form part of the financial statements audited by KPMG, the auditors of the Company, and is included for information purposes only.

The Company is one of the largest producers of ethylene, resins and plastics in the PRC. The vast majority of the Company’s products fall within three principal product groups: (i) resins and plastics, (ii) synthetic rubber, and (iii) basic organic chemical products. In 2002, the Company accounted for approximately 13.6% of the total ethylene production in the PRC. The Company is a leading producer in the PRC of LDPE, cis-polybutadiene rubber, phenol, acetone, SBS and polypropylene.

The Company’s principal raw material is cracking feedstock, substantially all of which is purchased from the Parent Company. The Company mainly uses light industrial oil as its cracking feedstock. The Company also uses naphtha, and VGO, cracking wax oil, and hydrogenated raffinate oil as substitute of light industrial oil developed and used by the Company on its own. Since the establishment of the Sinopec Group in 1998, prices of light industrial oil and naphtha have been determined by the State Development and Planning Commission (“SDPC”) of the PRC and the Sinopec Group together. During the reporting period, the average State price of light industrial oil fluctuated in line with the crude oil price and such average State price of light industrial oil for 2002 decreased by approximately 7.8%, as compared with the price in 2001.

9

Operating Results

[A picture is inserted here]

For the year ended 31 December 2002, the Company’s total sales increased to RMB 9,443.1 million from RMB 5,975.3 million in 2001, representing an increase of 58.0%. This increase in sales was largely attributable to the increase by large margins in the production and sales volumes of major products upon completion of the expansion of the Ethylene Project. Due to the market conditions, the prices of petrochemical products in China were maintained at a relatively low level in the first half of 2002, which has resulted in a decrease of 7.0% in the weighted average sales price of the eight principle products of the Company (representing 74.0% and 79.1% of the total sales revenue of 2001 and 2002, respectively). However, the sales volume of these eight principal products increased by 81.6% in 2002 as compared with that of 2001, and thus increased the sales revenue by large margins. During the reporting period, the profit of the Company before taxation was RMB 330.7 million, with an increase in the profit in the amount of RMB 740.9 million, as compared with a loss before taxation of RMB 410.2 million in 2001. The Company recorded a net profit of RMB 209.1 million in 2002, with an increase of RMB 481.6 million, as compared with a net loss of RMB 272.5 million in 2001.

The following table sets forth a summary of the income statement for the years of 2002 and 2001:

| | | 2002

| | | 2001

| |

| | | (RMB’000) | | | (RMB’000) (Restated) | |

Turnover | | 9,443,061 | | | 5,975,255 | |

Costs of sales | | (8,368,029 | ) | | (5,660,191 | ) |

| | |

|

| |

|

|

Gross profit | | 1,075,032 | | | 315,064 | |

Selling, general and administrative expenses | | (530,571 | ) | | (565,412 | ) |

Other expenses, net | | (2,903 | ) | | (100,296 | ) |

Profit/(loss) from operation | | 541,558 | | | (350,644 | ) |

Net financing costs | | (210,830 | ) | | (59,579 | ) |

Profit/(loss) from ordinary activities before taxation | | 330,728 | | | (410,223 | ) |

Income tax (expense)/benefit | | (121,629 | ) | | 137,756 | |

| | |

|

| |

|

|

Profit/(loss) attributable to shareholders | | 209,099 | | | (272,467 | ) |

| | |

|

| |

|

|

Basic earnings/(loss) per share | | RMB 0.062 | | | (RMB 0.081 | ) |

| | |

|

| |

|

|

Basic earnings/(loss) per ADS | | RMB 3.100 | | | (RMB 4.038 | ) |

| | |

|

| |

|

|

10

11

The following table sets forth a summary of the financial data of the Company respectively for the past five years:

2002

| | 2001

| | 2000

| | 1999

| | 1998

|

(RMB’000) | | (RMB’000) | | (RMB’000) | | (RMB’000) | | (RMB’000) |

| | | (Restated) | | (Restated) | | (Restated) | | (Restated) |

Total assets | | 10,259,807 | | 10,758,196 | | | 8,649,826 | | 8,534,176 | | 7,965,755 |

Total liabilities | | 5,237,860 | | 5,945,348 | | | 3,429,551 | | 3,470,192 | | 3,195,312 |

| | |

| |

|

| |

| |

| |

|

Net assets | | 5,021,947 | | 4,812,848 | | | 5,220,275 | | 5,063,984 | | 4,770,443 |

| | |

| |

|

| |

| |

| |

|

Turnover | | 9,443,061 | | 5,975,255 | | | 7,852,913 | | 6,489,746 | | 5,413,662 |

| | |

| |

|

| |

| |

| |

|

Profits/(loss) from operations | | 541,558 | | (350,644 | ) | | 623,056 | | 631,839 | | 250,532 |

| | |

| |

|

| |

| |

| |

|

Profits/(loss) attributable to shareholders | | 209,099 | | (272,467 | ) | | 358,731 | | 357,393 | | 126,771 |

| | |

| |

|

| |

| |

| |

|

Dividend attributable to the year | | No dividend declared | | No dividend declared | | | 134,960 | | 202,440 | | 67,480 |

| | |

| |

|

| |

| |

| |

|

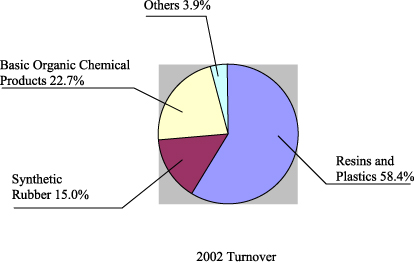

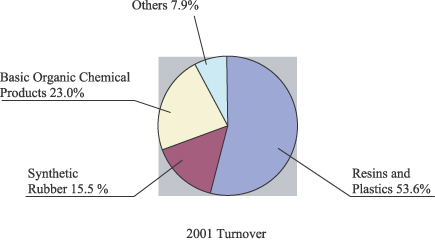

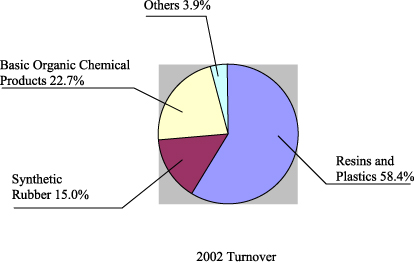

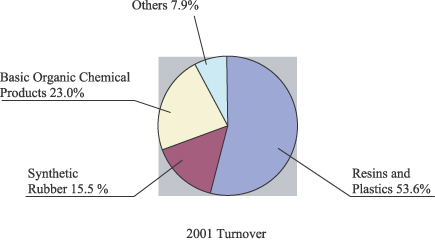

The following table sets forth the Company’s turnover, net of VAT, by principal product groups for the years of 2002 and 2001:

| | | 2002

| | 2001

|

| | | Turnover (RMB ’000) | | Percentage of Turnover | | Turnover (RMB ’000) | | Percentage of Turnover |

Resins and Plastics | | 5,514,147 | | 58.4 | | 3,203,189 | | 53.6 |

Synthetic Rubber | | 1,418,899 | | 15.0 | | 925,512 | | 15.5 |

Basic Organic Chemical Products | | 2,140,185 | | 22.7 | | 1,373,201 | | 23.0 |

Other | | 369,830 | | 3.9 | | 473,353 | | 7.9 |

| | |

| |

| |

| |

|

Total | | 9,443,061 | | 100 | | 5,975,255 | | 100.0 |

| | |

| |

| |

| |

|

12

The following table sets forth the Company’s sales, net of VAT, by geographical analysis for the years of 2002 and 2001:

| | | 2002

| | 2001

|

| | | Turnover (RMB Million) | | Percentage of Turnover | | Turnover (RMB Million) | | Percentage of Turnover |

Northeastern China | | 160.5 | | 1.7 | | 167.3 | | 2.8 |

Northern China | | 5,316.5 | | 56.3 | | 2,886.1 | | 48.3 |

Eastern China | | 2,889.6 | | 30.6 | | 1,864.3 | | 31.2 |

Central-southern China | | 47.2 | | 0.5 | | 657.3 | | 11.0 |

Northwestern China | | 198.3 | | 2.1 | | 41.8 | | 0.7 |

Southwestern China | | 698.8 | | 7.4 | | 191.2 | | 3.2 |

Exports | | 132.2 | | 1.4 | | 167.3 | | 2.8 |

| | |

| |

| |

| |

|

Total | | 9,443.1 | | 100 | | 5,975.3 | | 100.0 |

| | |

| |

| |

| |

|

The following table sets forth the percentages of total turnover of the principal operating expenses associated with the Company’s business:

| | | 2002

| | 2001

| |

| | | (%) | | (%) | |

Turnover | | 100.0 | | 100.0 | |

Less expenditure | | | | | |

Raw materials | | 62.4 | | 67.4 | |

Utility (fuels and power) expenses | | 12.9 | | 13.1 | |

Depreciation | | 8.5 | | 8.8 | |

Wages and bonus | | 2.5 | | 3.5 | |

Other overheads | | 2.9 | | 2.7 | |

Selling, general and administrative expenses | | 5.0 | | 8.7 | |

Other expenses, net | | 0.1 | | 1.7 | |

| | |

| |

|

|

Operating margin/(loss) | | 5.7 | | (5.9 | ) |

| | |

| |

|

|

Raw material expenses were the largest component of the operating expenses. In 2002 and 2001, approximately 52.2% and 52.3%, respectively, of cost of goods sold were expenses relating to purchases of cracking feedstock. In 2002, the total cracking feedstock expense was RMB 4,365.8 million, as compared with RMB 2,959.6 million in 2001, representing an increase of RMB 1,406.2 million, or 47.5%. This increase was largely due to the operation with full load in 2002 with respect to the ethylene units after expansion of the Company, which has resulted in a large increase in the demand for cracking feedstock. Although the price of the light industrial oil was increased from RMB 1,670 per ton at the beginning of 2002 to RMB 2,575 per ton (including 17% VAT)

13

at the end of 2002, which is in line with the fluctuation of the prices of crude oil and domestic finished oil, the average price of the cracking feedstock in 2002 decreased by 8.0% as compared with the price in 2001.

The following table sets forth the changes in the State price of light industrial oil, the principal raw material of the Company, in 2002 and 2001 (including VAT):

RMB per ton

Month

| | 1

| | 2

| | 3

| | 4

| | 5

| | 6

| | 7

| | 8

| | 9

| | 10

| | 11

| | 12

|

Year | | | | | | | | | | | | | | | | | | | | | | | | |

2001 | | 2,430 | | 2,260 | | 2,540 | | 2,465 | | 2,520 | | 2,615 | | 2,575 | | 2,260 | | 2,190 | | 2,250 | | 1,800 | | 1,800 |

2002 | | 1,670 | | 1,795 | | 1,925 | | 2,185 | | 2,325 | | 2,325 | | 2,375 | | 2,375 | | 2,375 | | 2,575 | | 2,575 | | 2,575 |

Since a significant portion of the Company’s expenses has been either fixed (as in the case of depreciation expense for a given piece of equipment) or consisted of stable unit costs (as in the case of cracking feedstock), fluctuations in sales, particularly those principally caused by changes in sales volume or raw material prices, caused fluctuations in profitability. In 2002, due to the large increase in the sales volume of the Company and the decrease in the price of raw materials, the operations margin of the Company increased from -5.9% in 2001 to 5.7% in 2002.

Year ended 31 December 2002 compared with year ended 31 December 2001

Turnover increased to RMB 9,443.1 million in 2002 from RMB 5,975.3 million in 2001, representing an increase of RMB 3,467.8 million or 58.0%, and this was mainly due to the large increase in the production and sales volume of principal products of the Company upon expansion of its production. Due to market conditions, the price of petrochemical products in China was maintained at a low level in the early half of 2002, and the weighted average sales price of the Company’s eight principal products, which accounted for 74.0% and 79.1%, respectively, of total sales revenue of 2001 and 2002, decreased by 7.0% in 2002. However, the sales volume of these eight principal products increased by 81.6% in 2002 as compared with that of 2001, and thus increased the sales revenue by large margins.

Sales of resins and plastics, which accounted for 58.4% of the Company’s total sales, increased by approximately 72.1% from RMB 3,203.2 million in 2001 to RMB 5,514.1 million in 2002. This increase was principally attributable to the fact that the Ethylene Project of the Company was utilised, which enhanced the output of resin and plastic products which increase from 553,000 tons per year to 1,055,000 tons per year. Although the weighted average price of resin and plastic products decreased by 10.1% in 2002, as compared with that of 2001, the large increase in the sales volumes has nevertheless resulted in a large increase in the sales revenue.

14

Sales of synthetic rubber, which accounted for 15.0% of total sales, increased by approximately 53.3% from RMB 925.5 million in 2001 to RMB 1,418.9 million in 2002. The increase was primarily due to an increase in both the sales volume and the sales price of synthetic rubber products in 2002.

Sales of basic organic chemical products, which accounted for 22.7% of total sales, increased by approximately 55.9% from RMB 1,373.2 million in 2001 to RMB 2,140.2 million in 2002, primarily as a result of an increase in the output after renovation of the phenol and acetone units of the Company as well as an increase in the sales price resulting from the restoration of market share.

Sales of other products, which accounted for 3.9% of total sales, decreased by approximately 21.9% to RMB 369.8 million in 2002 from RMB 473.4 million in 2001.

Cost of sales increased to RMB 8,368.0 million in 2002 from RMB 5,660.2 million in 2001. The increase was mainly due to an increase in the output, which has resulted in an increase in the consumption of raw materials and an increase in depreciation of the units newly put into use. The Company’s gross margin increased from RMB 315.1 million in 2001 to 1,075.0 million in 2002, as gross profit mounted up from 5.3% in 2001 to 11.4% in 2002.

Selling, general and administrative expenses decreased by RMB 34.8 million, or 6.2%, to RMB 530.6 million in 2002 from RMB 565.4 million in 2001. This decrease was primarily due to the substantial improvement in marketing efficiency and effectiveness, attained by the reorganisation of the marketing system of the Company.

The Company’s profit from operations in 2002 was RMB 541.6 million, compared with a loss of RMB 350.6 million in 2001. The Company’s operating margin increased to 5.7% in 2002, as compared with –5.9% in 2001. The increase of operating margin has reflected the initial realisation of benefits from the economies of scale upon completion of the expansion of the Company.

Net financing costs have seen a comparatively large increase to RMB 210.8 million in 2002 from RMB 59.6 million in 2001, primarily due to the capitalisation of RMB 153.7 million loan interest during the period of constructions made under the Ethylene Project in 2001.

In 2002, the Company recorded a profit before taxation of RMB 330.7 million, as compared with a loss before taxation of RMB 410.2 million in 2001. The Company’s net profit for 2002 was RMB 209.1 million, yielding a profit margin of 2.2%, as compared with the Company’s net loss of RMB 272.5 million and net profit margin of -4.6% in 2001.

15

Liquidity and Capital Resources

The Company has principally relied on funds from operations and bank loans to finance its capital expenditures and working capital.

The Company’s net cash flow derived from operating activities are generally much higher than its net profit, mainly due to substantial depreciation. In 2002, the Company’s net cash flow from operating activities was RMB 1,037.1 million, representing an increase of RMB 655.8 million from RMB 381.3 million in 2001, primarily due to (i) profit before taxation of RMB 330.7 million and (ii) total depreciation expenses of RMB 806.1 million, which is partly offset by (iii) an increase of inventories in the amount of RMB 247.3 million, and (iv) an increase in trade and bills receivables of RMB 104.0 million.

The Company’s short-term and long-term loans are primarily obtained from PRC financial institutions. In 2002, the Company repaid RMB 4,100 million of its short-term loans and RMB 1,701 million of its long-term loans, and borrowed RMB 4,025 million in short-term loans and RMB 1,442 million in long-term loans. As of 31 December 2002, the Company’s total loans from banks decreased by 8.3% to RMB 3,703.9 million (including RMB 1,575 million of short-term loans, and RMB 201.4 million of long-term loans due within one year) from RMB 4,038.2 million (including RMB 1,650 million of short-term loans, and RMB 1,518.4 million of long-term loans due within one year) as of 31 December 2001.

The Company expects to incur capital expenditures of RMB 300.0 million, RMB 300.0 million and RMB 400.0 million in 2003, 2004 and 2005, respectively. Such capital expenditures will be used mainly for the technical improvement projects of the Company. The Company believes the net cash flow from its operating activities and new bank loans will be sufficient to cover the Company’s expected capital expenditures for the above period.

Gearing Ratio

In 2002 the Company’s gearing ratio was 73.8%, as compared with 83.9% in 2001. The decrease in the gearing ratio was mainly due to the decrease in both the long-term and short-term debts. The gearing ratio is calculated by dividing the total of long-term bank loans and short-term bank loans by the total of shareholders’ equity.

Dividend Policy

Following the establishment of the Company as a joint stock limited company in April 1997, the distribution of the Company’s dividends is considered annually by the Board of Directors and decided by the shareholders in a general meeting. Payment of future dividends will depend upon the revenue, financial conditions, future earnings and other factors of the Company.

16

Contingent Liabilities

As of 31 December 2002, the Company had no significant contingent liabilities.

Purchase, Sale and Investment

Save for the disclosure in this report, during the year 2002, there was no material purchase, sale or investment in connection with the Company’s subsidiaries and associates.

Pledges of Assets

During the year 2002, there was no pledge of assets by the Company.

Exposure to Fluctuations in Exchange Rates and Any Related Hedges

The Company is exposed to foreign currency risk as a result of its foreign currency denominated long-term debt and, to a limited extent, cash and cash equivalents denominated in foreign currencies. The Company had no foreign currency hedging activity in 2002.

US GAAP Reconciliation

The Company prepares a set of financial statements in compliance with IFRS, which differs in certain respects from US GAAP. Please refer to “Supplementary Information for North American Shareholders” for Reference.

17

Report of the Board of Directors

The Board of Directors is pleased to present the Company’s audited financial statements for the year ended 31 December 2002.

Principle Activities and Results

The principal activities of the Company are the production and sale of (i) resins and plastics, (ii) synthetic rubber, and (iii) basic organic chemical products.

The operating results of the Company for the year ended 31 December 2002 and its financial position as at 31 December 2002 set out in the audited income statements and balance sheets prepared in accordance with IFRS.

Dividends and Proposed Profit Appropriations

The Company did not declare any interim dividends for the six months ended 30 June 2002.

According to the Company’s Articles of Association, the retained earnings available for distribution to shareholders of the Company should be the lower of the amount determined in accordance with the PRC Accounting Rules and Regulations and the amount determined in accordance with the accounting standards adopted by the place in which the Company is listed. At 31 December 2002, the Company has accumulated losses of RMB 91,024,000, being the amount determined in accordance with the PRC Accounting Rules and Regulations. The Board has therefore decided not to declare a dividend for 2002.

The Board of Directors resolved on 11 April 2003 to recommend to the shareholders not to declare final dividends for the year ended 31 December 2002. The proposed profit appropriations will be presented to shareholders for approval at the forthcoming annual general meeting to be held on 27 June 2003.

According to the Articles of Association of the Company, the register of members will be temporarily closed for a period of 30 days before the date of the annual general meeting of shareholders, which is from 28 May 2003 to 27 June 2003 (both days inclusive), during which time no share transfer will be effected.

Shares and Shareholders

Highest traded price during the year | | (H Shares) | | 23 June 2002 | | HK$ | 1.25 |

| | | (ADS) | | 30 April 2002 | | US$ | 7.82 |

Lowest traded price during the year | | (H Shares) | | 8 October 2002 | | HK$ | 0.62 |

| | | (ADS) | | 27 September 2002 | | US$ | 4.25 |

18

Total transaction volume for the year | | (H Shares) | | 2,099,326,559 Shares |

| | | (ADS) | | 632,303 ADSs |

As of 31 December 2002, the issued and fully paid share capital of the Company was as follows:

| | | Number of shares

| | Percentage of total

|

| | | (‘000) | | Issued share capital |

Domestic shares held by Parent Company of RMB 1.00 each | | 2,362,000 | | 70.0 |

Foreign shares (in form of H shares) of RMB 1.00 each | | 1,012,000 | | 30.0 |

| | |

| |

|

Total | | 3,374,000 | | 100.0 |

| | |

| |

|

| 3. | | Purchase,Sale orRedemption of the Company’s Listed Securities |

During the year 2002, there was no purchase, sale, redemption or cancellation of any of the Company’s listed securities.

| 4. | | Securities and Transactions in Securities |

During the reporting period, there were no convertible securities, options, warrants or similar rights issued or granted by the Company, nor was there any issuance for cash of equity securities by the Company.

5. Pre-emptive Rights

Under the Articles of Association of the Company and the laws of the PRC, no pre-emptive rights exist that require the Company to offer new shares to existing shareholders in proportion to their shareholding.

6. Substantial Shareholders

As of 31 December 2002, shareholders holding 10% or more of the Company’s issued shares were as follows:

| | | Type of shares

| | Number of shares

| | Percentage of total

|

| | | | | (‘000) | | (%) |

New Sinopec | | Domestic shares | | 2,362,000 | | 70.0 |

19

HKSCC Nominees Limited | | H shares | | 978,161 | | 29.0 |

Other than the information stated above, the Company is not aware of any interests required to be kept by the Company in the share register pursuant to Section 16(1) of the Securities (Disclosure of Interests) Ordinance (Cap 396 of the Laws of Hong Kong) (“SDI Ordinance”) as of 31 December 2002.

Connected Transactions

Amounts involved in connected transactions during the year are set out in note 25 in the financial statements.

As stated in the prospectus of the Company (the “Prospectus”) issued in June 1997 in connection with its global public offering, SEHK has granted conditional waivers to the Company from strict compliance with the Listing Rules in respect of certain connected transactions mentioned in the Prospectus.

The independent non-executive Directors confirm that during the year under review, (i) relevant connected transactions were entered into by the Company in the ordinary and usual course of its business, either on normal commercial terms or on terms that are otherwise fair and reasonable so far as the shareholders of the Company are concerned; and either in accordance with the terms of the agreement governing each such transaction or on terms no less favorable than terms available to/from independent third parties, and (ii) the amount of each category of the connected transaction has not exceeded its relevant cap as stated in the Prospectus.

The auditors of the Company have reviewed the transactions described above and have advised the Directors in writing that:

| (a) | | the transactions described above have been approved by the Board of Directors; and |

| (b) | | the transactions described above have been entered into in accordance with the terms of the agreements governing such transactions, or where there is no such agreement, nothing came to their attention that caused them to believe the transactions described above were not conducted on normal commercial terms (which expression was applied by reference to transactions of a similar nature made by similar entities within the PRC). |

Major Litigation or Arbitration

The Company was not involved in any material litigation or arbitration during the year under review.

20

Major Events

| 1. | | In order for its auditing flow and process to be in conformity with that of its Parent Company, the Company has decided to appoint KPMG and KPMG Huazhen as its international and domestic auditor, respectively, from 2002 onwards. |

| 2. | | The following directors of the Company have ceased to act as the directors of the Company: Mr. Situ Zexiang and Mr. Li Kejun, due to job changes, and Mr. Qi Jiren, executive director of the Company, due to his retirement, have submitted their resignations. Upon nomination at the Board meeting dated 28 March 2002 and approval at the shareholders meeting dated 7 June 2002, Mr. Xiang Hanyin, Mr. Lü Changqin, Mr. Qiao Xianyi and Mr. Mo Zhenglin were appointed as directors of the Company, and Mr. Yang Xuefeng was appointed as independent director of the Company. |

| 3. | | At the meeting of the Board of Directors held on 13 August 2002, Mr. Yang Qingyu was appointed as the Vice Chairman of the Board of the Company, Mr. Xu Hongxing as the General Manager, Mr. Zhao Qichao as the Deputy General Manager, and Mr. Guo Hong as the Chief Financial Officer of the Company. |

| 4. | | The Company has decided at the Board meeting dated 11 April 2003 to appoint Mr. Zhou Quansheng as the Secretary of the Board of Directors of the Company. |

Changes in Directors, Supervisors and Other Executive Officers

| (a) | | According to Article 95 of the Company’s Articles of Association, a director shall serve a term of three years. According to the service contract entered into between each director and the Company, the term of employment of each of the existing Directors is three years commencing from the date of appointment on 5 June 2000 and ending on 4 June 2003. |

| (b) | | The following directors of the Company have ceased to act as the directors of the Company: Mr. Situ Zexiang and Mr. Li Kejun, due to job changes, and Mr. Qi Jiren, executive director of the Company, due to retirement, have submitted their resignations. Upon nomination at the Board meeting dated 28 March 2002 and approval at the shareholders meeting dated 7 June 2002, Mr. Xiang Hanyin, Mr. Lü Changqin, Mr. Qiao Xianyi and Mr. Mo Zhenglin were appointed as directors of the Company, and Mr. Yang Xuefeng was appointed as an independent director of the Company. |

In accordance with Article 116 of the Company’s Articles of Association, a supervisor shall serve a term of three years. According to the service contract entered into between each supervisor and the Company, the term of employment of each of the existin

21

Supervisors is three years commencing from the date of appointment on 5 June 2000 and ending on 4 June 2003. There was no change in Supervisors during the reporting period.

| 3. | | Other executive officers |

At the meeting of the Board of Directors held on 13 August 2002, Mr. Yang Qingyu was appointed as the Vice Chairman of the Board, Mr. Xu Hongxing as the General Manager of the Company, Mr. Zhao Qichao as the Deputy General Manager of the Company, and Mr. Guo Hong as the Chief Financial Officer of the Company.

The Company has decided at the Board meeting dated 11 April 2003 to appoint Mr. Zhou Quansheng as the Secretary of the Board of Directors of the Company.

Details of the current session of the Directors and Supervisors of the Company

Name

| | Position

| | Sex

| | Age

| | Term of Office

| | Annual Emolument and Allowances (in RMB)

|

Du Guosheng | | Chairman | | M | | 46 | | Until June 2003 | | 145,373 |

Yang Qingyu | | Director and Vice Chairman | | M | | 56 | | Until June 2003 | | 142,088 |

Xu Hongxing | | Director and General Manager | | M | | 44 | | Until June 2003 | | 140,568 |

Zhao Qichao | | Director and Deputy General Manager | | M | | 42 | | Until June 2003 | | 119,614 |

*Wang Yuying | | Director | | F | | 56 | | Until June 2003 | | — |

*Wang Yongjian | | Director | | M | | 43 | | Until June 2003 | | — |

*Sun Bingyi | | Director | | M | | 57 | | Until June 2003 | | — |

*Wang Ruihua | | Director | | M | | 55 | | Until June 2003 | | — |

*Wang Caijun | | Director | | M | | 57 | | Until June 2003 | | — |

*Cui Guoqi | | Director | | M | | 49 | | Until June 2003 | | — |

*Lü Changqin | | Director | | M | | 56 | | Until June 2003 | | — |

*Qiao Xianyi | | Director | | M | | 49 | | Until June 2003 | | — |

*Mo Zhenglin | | Director | | M | | 39 | | Until June 2003 | | — |

*Xiang Hanyin | | Director | | M | | 48 | | Until June 2003 | | — |

*Rui Xingwen | | Independent Director | | M | | 76 | | Until June 2003 | | — |

*Zhang Yanning | | Independent Director | | M | | 76 | | Until June 2003 | | — |

*Yang Xuefeng | | Independent Director | | M | | 64 | | Until June 2003 | | — |

22

*Shang Bo | | Chairman of the Board of Supervisors | | M | | 55 | | Until June 2003 | | — |

*Tao Guiying | | Supervisor | | F | | 55 | | Until June 2003 | | — |

*Wang Yihe | | Supervisor | | M | | 54 | | Until June 2003 | | — |

*Wang Shulan | | Supervisor | | F | | 48 | | Until June 2003 | | — |

*Wang Weijun | | Supervisor | | M | | 57 | | Until June 2003 | | — |

Yang Wancheng | | Supervisor | | M | | 57 | | Until June 2003 | | 127,494 |

*Zhang Jinlong | | Supervisor | | M | | 58 | | Until June 2003 | | — |

| * | | Such person has not received any emolument or allowance from the Company. |

Directors’, Supervisors’ and Other Executive Officers’ Interests in Shares

None of the Directors, Supervisors or senior management had, as of 31 December 2002, any interests in any shares or debentures of the Company or any associated corporation (within the meaning of the SDI Ordinance) which are required to be reported to the Company or the SEHK pursuant to section 28 of the SDI Ordinance (including interests which they have taken or are deemed to have under Section 31 or Part I of the Schedule to the SDI Ordinance) or which are required pursuant to Section 29 of the SDI Ordinance to be entered in the register referred to therein, or which are required to be reported to the Company or the SEHK pursuant to the Model Code for Securities Transactions by Directors of Listed Companies or, in the case of Supervisors, which would be required to be reported as described above if they had been Directors.

Directors’ and Supervisors’ Service Contracts

Each of the Directors and Supervisors has entered into a service contract with the Company.

The aggregate amount of cash remuneration paid to the Directors as a group during the year ended 31 December 2002 was RMB 519,285, compared with RMB 154,446 in 2001. The aggregate amount of non-cash remuneration (consisting solely of pension and retirement benefits) paid to the Directors, as a group in 2002, was RMB 28,358, as compared with RMB 15,685 in 2001.

The aggregate amount of cash remuneration paid to the Supervisors as a group during the year ended 31 December 2002 was RMB 116,285, compared with RMB 232,707 in 2001. The aggregate amount of non-cash remuneration (consisting solely of pension and retirement benefits) paid to the Supervisors as a group in 2002 was RMB 11,209, compared with RMB 24,631 in 2001.

No other service contract exists between the Company or any of its subsidiaries and any of the Directors or Supervisors. Subject to the above, no Director or Supervisor has

23

entered into any service contract with the Company that is not terminable by the Company without payment other than statutory compensation.

Directors’ and Supervisors’ Interests in Contracts

Except as disclosed above, there was no contract of significance to which the Company or its subsidiaries was a party subsisting during or at the end of the year under review in which a Director or Supervisor of the Company had a material interest.

Employees’ Benefit, Retirement Scheme and Employee Housing Subsidy

As of 31 December 2002, the Company had 10,366 employees as compared with 10,764 employees in 2001, representing a decrease of 398 employees. In addition, the Company offered its employees the opportunities for education and training based upon its development and actual performance of the employees.

The Company’s employees participated in retirement benefit plans operated by the Company, details of which are set out in note 24 of the financial statements.

Under the relevant laws and regulations of the PRC, the policy for the allocation of housing as welfare benefits has ceased to apply. The Company is considering detailed measures for payment of housing subsidies through increasing wages or making lump sum payments to qualified employees. Once determined, these measures will be reflected in the financial statements of the Company of the next relevant year. As disclosed in the Company’s Prospectus dated 17 June 1997, the Predecessor of the Company is willing to pay such a lump sum payment. For this purpose, the Company is not expecting any cash outflows. Therefore, the Directors believe the implementation of the new government housing reform policy will not have material effect on the Company’s financial position.

Basic Medical Insurance for Employees

According to the Beijing Municipal Government Order (2001) No. 68, and in line with the arrangements of Beijing municipal labor security authority, the Company has implemented the Regulations of Beijing Municipality on Basic Medical Insurance (the “Regulations”) on 1 September 2002. Prior to the implementation of such Regulations, the Company has been carrying out relevant State regulations by drawing 14% of the employees’ total current wages as welfare fees to be used as the medical expenditure for the employees of the Company, whilst relevant welfare fees were set out in the labor costs of the Company for the specific current term. After the implementation of the Regulations, the medical insurance fees to be paid represented 9% of the total wages, and such amount shall be included in the 14% employee welfare fees to be drawn by the Company. As a result, there will be no impact on the income statements and the balance sheets of the Company upon implementation of the Regulations.

24

Major Suppliers and Customers

For the year ended 31 December 2002, 59.5% of purchases (not including the purchase of items which are of a capital nature) were attributable to the Company’s largest supplier, the Parent Company; 12.9% of purchases were attributable to the Company’s five largest suppliers (excluding the Parent Company) in aggregate.

For the year ended 31 December 2002, the aggregate amount of sales attributable to the Company’s five largest customers, excluding Yanshan Company, represented less than 10.9% of the Company’s turnover. The amount of sales attributable to Yanshan Company, the Company’s largest customer, represented 12.4% of the Company’s turnover.

At no time during the year have the Directors and Supervisors, their associates, or any shareholder of the Company (whom to the knowledge of the Directors own more than 5% of the Company’s share capital) had any interests in these major suppliers and customers.

Reserves

Changes in reserves of the Company during the year under review are set out in the statements of changes in equity.

Fixed Assets

Movements in fixed assets of the Company, during the reporting period, are set out in note 11 to the financial statements.

Bank Loans and Other Borrowings

Particulars of bank loans and other borrowings of the Company as of 31 December 2002 are set out in notes 19 and 20 to the financial statements.

Interest Capitalised

Interest capitalised in the Company’s property, plant and equipment during the year amounted to RMB 25.8 million.

Taxation

The Company has been subject to the PRC enterprise income tax of 33% for the year ended 31 December 2002. The Company is not aware of any government policy changes that may affect the Company’s tax rate.

Details of the Company’s taxation are set out in note 7 to the financial statements.

25

Auditors

At the Annual Shareholders Meeting held on 7 June 2002, a resolution was passed for the appointment of KPMG and KPMG Huazhen as the Company’s international and domestic auditors, respectively.

Compliance with the Code of Best Practice

Save as disclosed in announcements, the Company’s Directors are unaware of any circumstance which would indicate that the Company did not comply, or has not complied, with Appendix 14 (the “Code of Best Practice”) of the Rules Governing the Listing of Securities on the SEHK (“Listing Rules”).

During the reporting period, the Board of Directors has established an audit committee. The audit committee is composed of Mr. Rui Xingwen, Mr. Zhang Yanning and Mr. Yang Xuefeng, the independent directors. The audit committee is responsible for the review and supervision of the Company’s financial reporting process and internal controls as set out in the Code of Best Practice. During the reporting period, the audit committee held two meetings. The audit committee, together with the management, has reviewed the accounting policies, principles and methods adopted by the Company, and has discussed about the contents of the auditing, internal controls and the accountants’ report.

Impact of the Recent Economic Development

In the near future, unstable factors will inevitably exist in the international economy, which might bring adverse impact on the production and operation of the Company. Nevertheless, the Company believes that the steady growth of China’s economy will no doubt lead to a further increase in the demands for the products of the Company, whilst the commissioning of the ethylene facilities with 710,000 tons capacity will elaborate the scale merit of the Company. The Company believes that, through the implementation of its various effective operating and development strategies, it will ensure a satisfactory return for the shareholders.

Trust Deposits

As of 31 December 2002, the Company did not have any trust deposits with any financial institutions in the PRC. The Company has not encountered any withdrawal difficulty with respects to its deposits.

By Order of the Board of Directors

Du Guosheng

Chairman

11 April 2003, Beijing, the PRC

26

REPORT OF THE BOARD OF SUPERVISORS

[Mr. Shang Bo’s photo is inserted here]

To all shareholders:

During the reporting period, the Board of Supervisors has complied with the Company Law of the PRC, the regulations associated therewith, and the Company’s Articles of Association and has bona fide performed its duties as set forth in the Company’s Articles of Association, to protect the Company’s interest and the interest of the Company’s shareholders.

In 2002, confronted with more intense fluctuation in the world economy and the market competition after China’s accession to the WTO, the senior management of the Company coped with the realities objectively, based itself upon its own characteristics and implemented corresponding reforming measures and strategies decisively. The Company fully utilised the production capacity advantages upon completion of the Ethylene Project, further enhanced the ability to respond to market conditions through integration of the internal management system, and thereby achieved a satisfactory operation performance. The Board of Supervisors strengthened its supervising and managing efforts by attending the Board of Directors’ meetings and participating in the management’s decision-making process. In addition, the Board of Supervisors implemented supervision on the daily production and operational activities of the Company via overseeing the efficiency and capacity thereof. The Board of Supervisors regularly reviews the Company’s financial statements and accounts and believes that the Company has prepared the financial statements and accounts accurately, comprehensively and on a timely basis. So far as the Board of Supervisors is aware, no irregularity was disclosed in the financial statements and accounts.

The Board of Supervisors supervised the Directors and other Executive Officers in the performance of their duties. The Board of Supervisors believes that all Directors and other Executive Officers have performed their duties in accordance with the principles of honesty and trustworthiness, and acted in the best interests of the Company. So far as the Board of Supervisors is aware and save as disclosed in announcements, the Directors and other Executive Officers have complied with the relevant regulations set out in Appendix 14 of the Listing Rules and relevant regulations of China Securities Regulatory Commission and have not violated any laws, regulations or the Company’s Articles of Association.

The Board of Supervisors has comprehensively analyzed the financial statements of the Company to be presented in the annual shareholders’ meeting. The Board of Supervisors believes that during the reporting period the operating results of the Company reflected the true business position and all expenses and costs were rational. The proposed profit appropriation plan was made in the interests of shareholders and for the future development of the Company, as well as in accordance with the laws and regulations, and the Company’s Articles of Association.

27

The Board of Supervisors has always received strong support in its work from all shareholders, the Board of Directors and the entire staff of the Company. The Board of Supervisors wishes to express its deepest appreciation to all parties concerned.

By Order of the Board of Supervisors

Shang Bo

Chairman of the Board of Supervisors

11 April 2003, Beijing, the PRC

28

Directors, Supervisors and Senior Management

Executive Directors

DU Guosheng,aged 46, is the Chairman of the Board of Directors of the Company. He joined Yanshan Company in 1982 and became the Chairman and General Manager of Yanshan Company in 1999. Mr. Du graduated from Fushun Petroleum Institute and received a master’s degree in management and engineering from Shanghai Tongji University.

YANG Qingyu,aged 56, joined Yanshan Company in 1970 and became the Deputy General Manager of Yanshan Company in 1993. Mr. Yang graduated from Tianjin University.

XU Hongxing, aged 44, is the General Manager of the Company. He joined Yanshan Company in 1982 and has served various capacities including the Deputy Director of the Synthetic Rubber Unit and the Deputy General Manager of Yanshan Company. Mr. Xu graduated from Tianjin University and has an MBA degree from People’s University of China.

ZHAO Qichao, aged 42, is the Deputy General Manager of the Company. He joined Yanshan Company in 1983 and became the Director of Polypropylene Unit of the Company in 1997. Mr. Zhao graduated from the No. 2 Branch School of Beijing Institute of Chemical Engineering.

Non-executive Directors

WANG Yuying, aged 56, joined Yanshan Company in 1970 and has served in various capacities including the Secretary of the Communist Party Committee and Vice Chairman of Yanshan Company. Ms. Wang graduated from People’s University of China with a master’s degree in administration of industrial enterprises.

WANG Yongjian, aged 43, joined Yanshan Company in 1982 and has served various capacities including the Director of Chemical Product Unit and the Deputy General Manager of Yanshan Company. Mr. Wang graduated from the East China Petroleum Institute and has an MBA degree from Dalian University of Science and Technology.

WANG Ruihua,aged 55, joined Yanshan Company in 1969 and became the Chairman of the Trade Union and the Deputy General Manager of Yanshan Company, respectively, in 1996 and 1999. Mr. Wang graduated from Beijing Junior College of Chemical Engineering and Beijing Economics Institute.

WANG Caijun, aged 57, joined Yanshan Company in 1970 and has served various capacities including the Chief Accountant of the Synthetic Rubber Unit and the Chief Accountant of Yanshan Company. Mr. Wang graduated from East China Institute of Chemical Engineering.

29

CUI Guoqi, aged 49, joined Yanshan Company in 1969 and has served various capacities including the Chairman of the Trade Union of Yanshan Company. Mr. Cui graduated from the People’s University of China with an MBA degree.

Lü Changqin,aged 56, joined Yanshan Company in 1974 and has served as the Director of Chemical Works No. 1. He graduated from the Beijing Broadcasting Institute.

QIAO Xianyi,aged 49, joined Yanshan Company in 1970 and has served various capacities including the Deputy Director of the Oil Refining Plant and Deputy General Manager of Yanshan Company. Mr. Qiao graduated from the Beijing University of Chemical Science.

MO Zhenglin, aged 39, joined Yanshan Company in 1986, and has served various capacities including the Deputy Director of the Financial Department of Yanshan Company, Deputy Director of the Financial Department of the Company, and the Dhief Accountant of the Sinopec Yanshan Branch. Mr. Mo graduated from the Zhongnan University of Finance and Economics.

SUN Bingyi,aged 57, joined Yanshan Company in 1970 and became the Deputy General Manager of Yanshan Company in 1989. Mr. Sun graduated from Dalian Heavy Industry Institute.

XIANG Hanyin,aged 48, joined the Yizheng Chemical Fibre Company in 1982, and has served various capacities. In 2000, Mr. Xiang joined the Chemicals Department of New Sinopec as the Deputy Director. Mr. Xiang graduated from Nanjing Chemical Institute.

RUI Xingwen, aged 76, was an economics professor at Shanghai Tongji University and Shandong University and has served in several governmental offices, including Vice Minister respectively of the Ministry of Astronautics Industry and State Planning Commission and Advisor to State Development and Planning Commission. Mr. Rui graduated from People’s University of China.

ZHANG Yanning, aged 76, has served in various governmental offices, holding positions as Vice Minister of the State Economic Commission, Deputy Director of the Production Committee of the State Council, Deputy Chief of the Economic and Trade Office of the State Council, member of the Finance and Economic Affairs Committee of the National People’s Congress, and Chairman of the All China Association of Enterprises. Mr. Zhang graduated from the Dalian Engineering Institute.

YANG Xuefeng,aged 64, joined Sinopec in 1984 and has served various capacities including the Deputy Director of the Department of Production Management and

30

Deputy Director of the Planning Department. Mr. Yang graduated from the Beijing Institute of Chemical Engineering.

Supervisors

SHANG Bo,aged 55, is the Chairman of the Company’s Board of Supervisors. He joined Yanshan Company in 1969 and served in various capacities including a Deputy Secretary of the Communist Party Committee of Yanshan Company. Mr. Shang graduated from Lanzhou Petroleum Institute and Beijing Municipal Management Executive Training School.

TAO Guiying, aged 55, joined Yanshan Company in 1970 and has served in various capacities including positions as a Vice Chairman of the Yanshan Company Trade Union. Ms. Tao graduated from the East China Institute of Chemical Engineering.

WANG Yihe, aged 54, joined Yanshan Company in 1968 and has served in various capacities including a Deputy Secretary of the Disciplinary Committee of Yanshan Company. Mr. Wang graduated from the People’s University of China.

WANG Shulan, aged 48, joined Yanshan Company in 1971 and has served in various capacities including a Deputy Chief of the Accounting Department of the Company. Ms. Wang graduated from the People’s University of China.

WANG Weijun, aged 57, joined Yanshan Company in 1969 and has served in various capacities including the Chairman of the Management Committee of the Chemical Works No. 1 Plant. Mr. Wang graduated from the Beijing Institute of Chemical Engineering.

YANG Wancheng, aged 57, joined Yanshan Company in 1970 and has served in various capacities including the Chairman of the Management Committee of the Synthetic Rubber Unit. He graduated from Tianjin University.

ZHANG Jinlong,aged 58, joined Yanshan Company in 1969 and has served in various capacities including the Chairman of the Trade Union of Polypropylene Business Unit. Mr. Zhang graduated from the China Correspondence University for Calligraphy and Painting.

Other Executive Officers

GUO Hong, aged 39, is the Chief Financial Officer of the Company. Mr. Guo joined Yanshan Company in 1982 and has served various capacities including the Deputy Director of the Financial Department of the Company. Mr. Guo graduated from the Wuhan University of Industry with a Master’s degree.

ZHOU Quansheng,aged 34, is the Secretary of the Board of the Company. Mr. Zhou joined Yanshan Company in 1990, and has served in various capacities including the

31

Head of the Office of the Board Secretary of the Company. Mr. Zhou graduated from Zhejiang University, and obtained an MBA degree from the Dalian Institute of Technology.

32

NOTICE OF ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN that the 2002 Annual General Meeting (“AGM”) of the Company will be held on Monday, 23 June 2003, at No.1 Beice, Yingfeng Erli, Yanshan, Fangshan District, Beijing 102500, the PRC at 9:00 a.m. sharp for the following purposes:

| 1. | | to consider and approve the 2002 report of the Board of Directors of the Company; |

| 2. | | to consider and approve the 2002 report of the Board of Supervisors of the Company; |

| 3. | | to consider and approve the audited financial statements of the Company for the year ended 31 December 2002; |

| 4. | | to consider and approve the proposed profit appropriation plan of the Company for 2002; |

| 5. | | to determine the remuneration of the Directors and Supervisors of the Company for 2003; |

| 6. | | to consider and approve the proposal on the candidates for the new Directors and Supervisors; |

| 7. | | to consider and approve the appointment of KPMG and KPMG Huazhen as the Company’s international and domestic auditors, respectively, for the fiscal year 2003, and to authorise the Directors of the Company to determine their remuneration. |

| 8. | | to transact any further business, if necessary. |

By Order of the Board of Directors

Du Guosheng

Chairman

11 April 2003, Beijing, the PRC

The Registered Office:

No. 1 Beice, Yingfeng Erli,

Yanshan, Fangshan District,

Beijing 102500

The PRC

Notes:

33

| (A) | | Holders of the Company’s overseas listed foreign invested shares (in the form of H Shares) whose names appear on the Register of Members of the Company at close of business on 27 May, 2003 are entitled to attend the AGM upon presentation of their passports or other identity papers and documents of authorisations. |

| (B) | | According to the Company’s Articles of Association, the register of members of the Company will be closed 30 days before the date of the AGM, which is from 28 May 2003 to 27 June 2003 (both days inclusive), during which time no H share transfer will be effected. |

| (C) | | Each shareholder who has the right to attend and vote at the AGM is entitled to appoint one or more proxies, whether they are members or not, to attend and vote on his behalf at the AGM. |

| (D) | | A proxy of a shareholder who has appointed more than one proxy may only vote on a poll. |

| (E) | | The instrument appointing a proxy must be in writing under the hand of the appointer or his attorney. If that instrument is signed by an attorney of the appointer, the power of attorney must be certified with notarisation. To be valid, the notarised certified power of attorney and the form of proxy must be delivered to the registered office of the Company not less than 24 hours before the time appointed for the holding of the AGM. |

| (F) | | Shareholders intending to attend the AGM should return the accompanying reply slip attached in this Annual Report to the Secretary’s Office of the Company before 7 June 2003 personally or by mail, cable or facsimile. Returning the proxy form on the back of the reply slip will not affect shareholders’ rights to attend in person. |

| (G) | | Shareholders attending the AGM are responsible for their own transportation and accommodation expenses. |

| (H) | | The details of the Secretary’s Office of the Company are as follows: |

| | | No. 1 Beice, Yingfeng Erli, |

| | | Yanshan, Fangshan District, |

34

CORPORATE INFORMATION

REGISTERED NAME | [Chinese Name of the Company] |

ENGLISH NAME | Sinopec Beijing Yanhua Petrochemical Company Limited |

LEGAL ADDRESS | No. 1 Beice, Yingfeng Erli, Yanshan |

| | Beijing, People’s Republic of China |

PLACE OF BUSINESS IN HONG | 39/F, Gloucester Tower |

KONG | The Landmark, 11 Pedder Street |

COMPANY SECRETARY | Zhou, Quansheng |

AUTHORIZED REPRESENTATIVES | Xu, Hongxing |

LEGAL ADVISERS

as to Hong Kong law and United | Coudert Brothers |

States law: | 39/F, Gloucester Tower |

| | The Landmark, 11 Pedder Street |

as to PRC law: | Haiwen & Partners |

| | No.2, East Sanhuan Northern Road |

35

PRINCIPAL BANKERS | Industrial and Commercial Bank of China |

| | Beijing, Yanshan Petrochemical Branch |

| | Ying Feng San Li, Fangshan District |

| | Beijing, Yanshan Petrochemical Branch |

| | No.1 Ying FengEr Li, Fangshan District |

| | Bank of China, Beijing Branch |

| | 8 Ya Bao Road, Chao Yang District |

HONG KONG SHARE | Hong Kong Registrars Limited |

DEPOSITARY | The Bank of New York |

| | American Depositary Receipts |

| | 101 Barclay Street, 22nd Floor West |

PLACES OF LISTING | H Shares: |

| | The Stock Exchange of Hong Kong Limited |

| | The New York Stock Exchange, Inc. |

36

OTHER INFORMATION

The Company’s 2002 interim report was published in August 2002. As required by the United States securities laws, the Company will file an annual report in Form 20-F with the Securities and Exchange Commission before 30 June 2003 for inspection. Copies of the interim and annual reports as well as the Form 20-F, once filed, will be available at:

The PRC: | Sinopec Beijing Yanhua Petrochemical Company Limited |

| | Secretariat to the Board of Directors |

| | No. 1 Beice, Yingfeng Erli |

Hong Kong: | Rikes Communications Limited |

| | Rm. 701, Wanchai Central Bldg. |

The USA: | The Bank of New York |

| | New York, NY 10286-1258, USA |

| | Toll Free TEL # for domestic callers: |

37

kpmg

To the shareholders of

Sinopec Beijing Yanhua Petrochemical Company Limited

(Established in the People’s Republic of China with limited liability)

We have audited the financial statements on pages 2 to 36 which have been prepared in accordance with International Financial Reporting Standards promulgated by the International Accounting Standards Board.

RESPECTIVE RESPONSIBILITIES OF DIRECTORS AND AUDITORS

The Company’s directors are responsible for the preparation of the financial statements which give a true and fair view. In preparing the financial statements which give a true and fair view it is fundamental that appropriate accounting policies are selected and applied consistently, that judgements and estimates are made which are prudent and reasonable and that the reasons for any significant departure from applicable accounting standards are stated.

It is our responsibility to form an independent opinion, based on our audit, on those financial statements and to report our opinion to you.

Basis of opinion

We conducted our audit in accordance with Statements of Auditing Standards issued by the Hong Kong Society of Accountants. An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements. It also includes an assessment of the significant estimates and judgements made by the directors in the preparation of the financial statements, and of whether the accounting policies are appropriate to the Company’s circumstances, consistently applied and adequately disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered necessary in order to provide us with sufficient evidence to give reasonable assurance as to whether the financial statements are free from material misstatement. In forming our opinion we also evaluated the overall adequacy of the presentation of information in the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Opinion

In our opinion, the financial statements give a true and fair view of the state of affairs of the Company as at 31 December 2002 and of the Company’s profit and cash flows for the year then ended and have been properly prepared in accordance with International Financial Reporting Standards promulgated by the International Accounting Standards Board and the disclosure requirements of the Hong Kong Companies Ordinance.

KPMG

Certified Public Accountants

Hong Kong, China, 11 April 2003

1

INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2002

(Amounts in thousands, except per share data)

| | | | | 2002

| | | 2001

| |

| | | Note | | RMB | | | RMB | |

| | | | | | | | (Restated) | |

Turnover | | 3 | | 9,443,061 | | | 5,975,255 | |

Cost of sales | | | | (8,368,029 | ) | | (5,660,191 | ) |

| | | | |

|

| |

|

|

Gross profit | | | | 1,075,032 | | | 315,064 | |

Selling, general and administrative expenses | | | | (530,571 | ) | | (565,412 | ) |

Other operating income | | | | 55,979 | | | 30,053 | |

Other operating expenses | | | | (55,687 | ) | | (31,143 | ) |

Net (loss)/ gain on disposal of property, plant and equipment | | 4 | | (3,195 | ) | | 147,737 | |

Employee reduction expenses | | 5 | | — | | | (246,943 | ) |

| | | | |

|

| |

|

|

Profit/(loss) from operations | | | | 541,558 | | | (350,644 | ) |

Net financing costs | | 6 (a) | | (210,830 | ) | | (59,579 | ) |

| | | | |

|

| |

|

|

Profit/(loss) from ordinary activities before taxation | | 6 | | 330,728 | | | (410,223 | ) |

Income tax (expense)/benefit | | 7 | | (121,629 | ) | | 137,756 | |

| | | | |

|

| |

|

|

Profit/(loss) attributable to shareholders | | | | 209,099 | | | (272,467 | ) |

| | | | |

|

| |

|

|

Dividends attributable to the year | | 9 | | — | | | — | |

| | | | |

|

| |

|

|

Basic earnings/(loss) per share | | 10 | | 0.062 | | | (0.081 | ) |

| | | | |

|

| |

|

|

The notes on page 7 to 36 form part of these financial statements.

2

BALANCE SHEET

AT 31 DECEMBER 2002

(Amounts in thousands)

| | | | | 2002

| | | 2001

| |