UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2003

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14646

(Exact name of Registrant as specified in its charter)

Sinopec Beijing Yanhua Petrochemical Company Limited

(Translation of Registrant’s name into English)

The People’s Republic of China

(Jurisdiction of incorporation or organization)

No. 1 Beice, Yingfeng Erli, Yanshan, Fangshan District, Beijing 102500,

The People’s Republic of China

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of Each Class

| | Name of Each Exchange on which Registered

|

American Depositary Shares | | New York Stock Exchange |

Overseas Listed Foreign Invested Shares, par value RMB1.00 per Share | | The Stock Exchange of Hong Kong Limited |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

NONE

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

NONE

(Title of Classes)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

1,012,000,000 Overseas Listed Foreign Invested Shares

2,362,000,000 Domestic Invested Shares

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 x

Table of Contents

FORWARD-LOOKING STATEMENTS

This Annual Report includes forward-looking statements. All statements, other than statements of historical facts, included in this Annual Report that relates to developments or events that we expect will or may happen in the future are forward-looking statements. The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “believe” “intends to” or similar expressions identify “forward-looking statements” within the meaning of the Private Securities Reform Act of 1995. These forward-looking statements address, among others, issues such as:

| | • | the future price of crude oil; |

| | • | the future price and supply of cracking feedstock; |

| | • | fluctuation in the prices and demand for our products; |

| | • | expansion projects and capital expenditures; |

| | • | China’s regulation of its petrochemical industry; |

| | • | general economic, market and business conditions, including the cyclicality of the petrochemical market; and |

| | • | other risks and factors beyond our control. |

These statements are subject to risks and uncertainties that could cause our actual results to differ materially from historical results and those presently anticipated or projected. You should not place undue reliance on any such forward-looking statements, which speak only as of the date made.

OTHER CONVENTIONS

As used in this Annual Report, unless the context otherwise requires, the following expressions have the following meanings:

“Beijing Yanhua,” “we,” “our” and “us” refer to Sinopec Beijing Yanhua Petrochemical Company Limited, a PRC joint stock limited company, and prior to our formation, relate to the relevant businesses previously carried on by Yanshan Company.

“China” or “PRC” refers to the People’s Republic of China, excluding for the purposes of this Annual Report, Hong Kong, Macau and Taiwan.

“HK dollars” or “HK$” refers to Hong Kong dollars, the legal currency in Hong Kong.

“Industrial Value Added” means the final product, in monetary terms, of production activities of a particular industry throughout a given reporting period.

“Our predecessor” means Yanshan Company, as the operator of the businesses transferred to us in the Restructuring.

“Rated Capacity” is the annual output capacity of a given production unit or, where appropriate, the annual throughput capacity, calculated by estimating the number of days in a year that such a production unit is expected to operate, including downtime for regular maintenance, and multiplying that number by an amount equal to the unit’s optimal daily output or throughput, as the case may be.

1

“Renminbi” or “RMB” refers to Renminbi yuan, the legal currency of the PRC.

“Resins and plastics” include low density polyethylene (“LDPE”), high density polyethylene (“HDPE”), polyester chips, polypropylene and polystyrene. This category of products does not include synthetic fibers such as polyester fibers.

“Restructuring” means the transfer to us, effective as of April 23, 1997, the date of our incorporation, of the principal petrochemical businesses of our predecessor and certain assets and liabilities of our predecessor, together with certain other businesses, assets and liabilities.

“Sinopec”, “our parent” and “our parent company” refer to China Petroleum & Chemical Corporation, a subsidiary controlled by the Sinopec Group and our controlling shareholder since its establishment on February 25, 2000.

“Sinopec Group” means China Petrochemical Corporation, a Chinese state-owned enterprise organized in 1998 and our ultimate parent.

“State Prices” mean the price set by the National Development and Reform Commission (together with its predecessors, the former State Planning Commission and the former State Development and Planning Commission of China, the “NDRC”) and/or the Sinopec Group (the Sinopec Group, in its function of setting State Prices, and the NDRC are collectively referred to as the “State Planning Commission”) of certain products, including light industrial oil, cracking wax oil and hydrogenated raffinate oil.

“Tons” or “tons” refers to metric tons.

“US dollars” or “US$” refers to United States dollars, the legal currency of the United States of America.

“Yanshan Company” means Sinopec Group Beijing Yanshan Petrochemical Company Limited, a subsidiary of Sinopec Group and our controlling shareholder until February 25, 2000.

EXCHANGE RATES

We have translated certain amounts in this Annual Report from Renminbi to US dollars for your convenience. Except as otherwise noted, the translation was made at the exchange rate published by the People’s Bank of China (the “PBOC Rate”) on December 31, 2003 of US$ 1.00 = RMB 8.2767. We do not represent that the Renminbi amounts could have been or could be converted into US dollars at that rate or at any other rate. The noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on December 31, 2003 was US$ 1.00 = RMB 8.2767.

2

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The selected financial data for the years ended December 31, 2001, 2002 and 2003, and as of December 31, 2002 and 2003 were derived from and should be read in conjunction with our Financial Statements included in Item 18. Financial Statements, and the notes thereto, and Item 5. Operating and Financial Review and Prospects. The selected financial data for the years ended December 31, 1999 and 2000, and as of December 31, 1999, 2000 and 2001, were derived from our financial statements which are not included in this Annual Report. Our Financial Statements have been prepared in accordance with IFRS, which differ from US GAAP. For a discussion of the significant differences between IFRS and US GAAP, see Item 18. Financial Statements - Note 27.

3

Selected Financial Data

(in thousands, except per share data)

| | | | | | | | | | | | | |

| | | 1999

| | 2000

| | 2001

| | | 2002

| | 2003

| | 2003

|

| | | (RMB) | | (RMB) | | (RMB) | | | (RMB) | | (RMB) | | (US$)1 |

STATEMENT OF OPERATION DATA | | | | | | | | | | | | | |

IFRS | | | | | | | | | | | | | |

Sales | | 6,489,746 | | 7,852,913 | | 5,975,255 | | | 9,443,061 | | 11,473,928 | | 1,386,292 |

Gross profit | | 1,219,154 | | 1,188,820 | | 315,064 | | | 1,075,032 | | 1,750,366 | | 211,481 |

Operating income/(loss) | | 631,839 | | 623,056 | | (350,644 | ) | | 541,558 | | 1,043,043 | | 126,021 |

Net financing costs | | 98,417 | | 97,893 | | 59,579 | | | 210,830 | | 165,936 | | 20,049 |

Income/(loss) before income tax | | 533,422 | | 525,163 | | (410,223 | ) | | 330,728 | | 877,107 | | 105,972 |

Net income/(loss) | | 357,393 | | 358,731 | | (272,467 | ) | | 209,099 | | 633,885 | | 76,587 |

Basic earnings/(loss) per share(2) | | 0.11 | | 0.11 | | (0.08 | ) | | 0.06 | | 0.19 | | 0.02 |

Basic earnings/(loss) per ADS(2) | | 5.30 | | 5.32 | | (4.04 | ) | | 3.10 | | 9.39 | | 1.13 |

| | | | | | |

US GAAP | | | | | | | | | | | | | |

Gross profit | | 1,325,823 | | 1,244,337 | | 240,730 | | | 1,124,647 | | 1,797,885 | | 217,222 |

Operating income/(loss) | | 734,845 | | 674,909 | | (428,642 | ) | | 587,509 | | 1,086,898 | | 131,320 |

Net financing costs | | 98,417 | | 98,455 | | 60,929 | | | 212,420 | | 167,280 | | 20,211 |

Income/(loss) before income tax | | 636,428 | | 609,630 | | (643,320 | ) | | 379,279 | | 954,411 | | 115,313 |

Net income/(loss) | | 433,471 | | 405,507 | | (440,306 | ) | | 229,864 | | 673,223 | | 81,340 |

Basic earnings/(loss) per share(2) | | 0.13 | | 0.12 | | (0.13 | ) | | 0.07 | | 0.20 | | 0.02 |

Basic earnings/(loss) per ADS(2) | | 6.42 | | 6.01 | | (6.52 | ) | | 3.41 | | 9.98 | | 1.21 |

| | | | | | |

CASH FLOW DATA | | | | | | | | | | | | | |

IFRS | | | | | | | | | | | | | |

Net cash from operating activities | | 327,462 | | 1,174,930 | | 381,268 | | | 1,037,119 | | 1,616,596 | | 195,319 |

Depreciation | | 636,092 | | 508,282 | | 525,410 | | | 806,124 | | 890,779 | | 107,625 |

Capital expenditures | | 617,113 | | 1,399,580 | | 2,048,217 | | | 722,492 | | 356,334 | | 43,053 |

| | | | | | |

BALANCE SHEET DATA | | | | | | | | | | | | | |

IFRS | | | | | | | | | | | | | |

Current assets | | 2,777,281 | | 2,173,453 | | 1,909,987 | | | 2,028,367 | | 1,823,024 | | 220,260 |

Property, plant and equipment, net | | 5,300,403 | | 6,204,983 | | 8,362,192 | | | 7,900,990 | | 7,388,120 | | 892,641 |

Other non-current assets | | 254,052 | | 271,390 | | 486,017 | | | 330,450 | | 334,167 | | 40,374 |

| | |

| |

| |

|

| |

| |

| |

|

Total assets | | 8,331,736 | | 8,649,826 | | 10,758,196 | | | 10,259,807 | | 9,545,311 | | 1,153,275 |

| | |

| |

| |

|

| |

| |

| |

|

Current liabilities | | 1,602,722 | | 1,786,561 | | 4,755,442 | | | 3,024,160 | | 2,046,927 | | 247,312 |

Long-term bank loans | | 1,235,905 | | 1,388,063 | | 869,811 | | | 1,927,543 | | 1,596,359 | | 192,874 |

Other long-term liabilities | | 429,125 | | 254,927 | | 320,095 | | | 286,157 | | 246,193 | | 29,745 |

Shareholders’ equity | | 5,063,984 | | 5,220,275 | | 4,812,848 | | | 5,021,947 | | 5,655,832 | | 683,344 |

| | |

| |

| |

|

| |

| |

| |

|

Total liabilities and shareholders’ equity | | 8,331,736 | | 8,649,826 | | 10,758,196 | | | 10,259,807 | | 9,545,311 | | 1,153,275 |

| | |

| |

| |

|

| |

| |

| |

|

US GAAP | | | | | | | | | | | | | |

Current assets | | 2,791,936 | | 2,173,453 | | 1,917,315 | | | 2,032,031 | | 1,823,024 | | 220,260 |

Property, plant and equipment, net | | 4,632,464 | | 5,625,737 | | 7,812,191 | | | 7,404,794 | | 6,974,236 | | 842,635 |

Other non-current assets | | 254,052 | | 271,390 | | 486,017 | | | 330,450 | | 334,167 | | 40,374 |

| | |

| |

| |

|

| |

| |

| |

|

Total assets | | 7,678,452 | | 8,070,580 | | 10,215,523 | | | 9,767,275 | | 9,131,427 | | 1,103,269 |

| | |

| |

| |

|

| |

| |

| |

|

Current liabilities | | 1,602,722 | | 1,775,569 | | 4,755,442 | | | 3,024,160 | | 2,046,927 | | 247,312 |

Long-term bank loans | | 1,235,905 | | 1,388,063 | | 869,811 | | | 1,927,543 | | 1,596,359 | | 192,874 |

Other long-term liabilities | | 155,339 | | 19,017 | | 104,291 | | | 98,664 | | 97,110 | | 11,733 |

Shareholders’ equity | | 4,684,486 | | 4,887,931 | | 4,485,979 | | | 4,716,908 | | 5,391,031 | | 651,350 |

| | |

| |

| |

|

| |

| |

| |

|

Total liabilities and shareholders’ equity | | 7,678,452 | | 8,070,580 | | 10,215,523 | | | 9,767,275 | | 9,131,427 | | 1,103,269 |

| | |

| |

| |

|

| |

| |

| |

|

OTHER FINANCIAL DATA | | | | | | | | | | | | | |

IFRS AND US GAAP | | | | | | | | | | | | | |

Dividend declared per share | | 0.06 | | 0.04 | | — | | | — | | 0.05 | | 0.006 |

Number of ordinary shares in (in thousands) | | 3,374,000 | | 3,374,000 | | 3,374,000 | | | 3,374,000 | | 3,374,000 | | 3,374,000 |

| /1/ | Converted into US dollars solely for convenience of readers based on the exchange rate published by the People’s Bank of China on December 31, 2003 of US$ 1.00 = RMB 8.2767. See below for information on exchange rates quoted by the Federal Reserve Bank of New York. |

4

| /2/ | Basic earnings/(loss) per share and per ADS have been computed by dividing net income/(loss) by the weighted average number of ordinary shares in issue. |

Dividends

Our Board of Directors has resolved to recommend the distribution of a dividend, subject to any unpredictable circumstances, at RMB 0.05 per share for the fiscal year ended December 31, 2003. Our Board of Directors intends that such final dividends will be distributed on or before July 2, 2004.

| | |

Dividend Period

| | Dividend per Share

|

January 1, 1999 — December 31, 1999 | | RMB 0.06 (US$ 0.007) |

January 1, 2000 — December 31, 2000 | | RMB 0.04 (US$ 0.005) |

January 1, 2001 — December 31, 2001 | | None |

January 1, 2002 — December 31, 2002 | | None |

January 1, 2003 — December 31, 2003 | | RMB 0.05 (US$ 0.006) |

No other dividends have been paid or declared in the last five years. See Item 18. Financial Statements - Note 20.

Exchange Rate Information

The Chinese government imposes control over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign exchange and through restrictions on foreign trade. See Item 10. Additional Information - Exchange Controls.

The following table sets forth information concerning exchange rates between Renminbi and US dollars for the periods indicated:

| | | | | | | | |

| | | | | Noon Buying Rate

|

Period

| | Period End

| | Average (1)

| | High

| | Low

|

| | | | | (expressed in RMB per US$) |

1999 | | 8.2795 | | 8.2785 | | 8.2800 | | 8.2770 |

2000 | | 8.2774 | | 8.2784 | | 8.2799 | | 8.2768 |

2001 | | 8.2766 | | 8.2772 | | 8.2786 | | 8.2676 |

2002 | | 8.2800 | | 8.2772 | | 8.2800 | | 8.2669 |

2003 | | 8.2767 | | 8.2771 | | 8.2800 | | 8.2766 |

December, 2003 | | 8.2767 | | N/A | | 8.2772 | | 8.2765 |

January, 2004 | | 8.2768 | | N/A | | 8.2772 | | 8.2767 |

February, 2004 | | 8.2769 | | N/A | | 8.2773 | | 8.2769 |

March, 2004 | | 8.2770 | | N/A | | 8.2774 | | 8.2767 |

April, 2004 | | 8.2771 | | N/A | | 8.2772 | | 8.2768 |

May, 2004 | | 8.2771 | | N/A | | 8.2773 | | 8.2768 |

Latest Practicable Date, May 28, 2004 | | 8.2769 | | N/A | | N/A | | N/A |

| Source: | | The Noon Buying Rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. |

| /(1)/ | Determined by averaging the rates on the last day of each month during the respective periods. |

5

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

You should consider carefully all of the information set out in this Annual Report and should, in particular, evaluate the following risks in connection with an investment in us. Certain of these risks are not typically associated with investing in the equity securities of companies from the United States or other economically developed jurisdictions. Our business, financial conditions, and/or operational results could be materially, adversely affected by any of these risks.

Risks Relating to Investments in Beijing Yanhua

Our parent’s (Sinopec’s) inability to supply cracking feedstock and other raw materials may adversely affect our operations.

We source, and expect to continue to source, substantially all of our cracking feedstock and significant amounts of other raw materials from Sinopec. In 2003, costs of cracking feedstock from Sinopec accounted for 73.2% of our total raw material costs and 51.2% of our total sales costs. Sinopec, through its own feedstock production capacity, can supply the amounts of feedstock we require at present and is expected to be able to supply the cracking feedstock we require after the completion of our current expansion plans. We have an exclusive right of first refusal to purchase various types of cracking feedstock Sinopec produces. In the past, we have been able to acquire sufficient cracking feedstock from Sinopec and Yanshan Company, our previous parent, for our operations. We cannot assure you, however, that Sinopec will continue to be able to supply us with sufficient amounts of cracking feedstock when we need it in the future.

We will access other viable alternative sources for cracking feedstock in the future, should any alternative sources present better prices or quality, or from time to time when Sinopec is unable to meet our demand. We will incur additional costs associated with transporting the cracking feedstock to the extent we purchase cracking feedstock from sources other than Sinopec. In 2003, we purchased limited amounts of cracking feedstock from third parties, incurring weighted average transportation costs of approximately RMB 122 per ton. We cannot assure you that if we choose or are required to purchase cracking feedstock from third parties in the future, transportation costs will remain at the level stated above.

We use light industrial oil, a type of refined oil, as our principal cracking feedstock. The prices for most types of refined oil sold within China are set at the State Prices. Prior to June 1998, the State Planning Commission determined the State Prices for light industrial oil guided by, among other factors, crude oil prices and prices of similar cracking feedstock products in the international market. The State Planning Commission generally had no fixed schedule for adjusting the State Prices. From June 1998 until October 2001, China implemented a different pricing scheme for oil, including crude oil, light industrial oil and naphtha. Under this pricing scheme, the State Planning Commission established, on a monthly basis, indicative State Prices for all grades of crude oil, light industrial oil and naphtha based on comparable international market prices as set by the Singaporean market. The Sinopec Group and China National Petroleum Corporation (“CNPC”) would then set the prices for different grades of domestic crude oil based on the relevant indicative State Prices. The prices for light industrial oil and naphtha were set by the Sinopec Group based on the indicative State Prices set by the State Planning Commission. However, in the event of significant fluctuations in international cracking feedstock prices, the State Prices may not have accurately reflected the international market prices. Consequently, there may have been periods during which we had to purchase light industrial oil or naphtha at prices that were significantly higher than the then current international market prices. This pricing scheme has been modified since October 2001 to include the New York and Rotterdam refined oil markets. Since this change, the prices for refined oil have been set by the Sinopec Group and CNPC within a range of plus or minus 8% of the weighted average of the refined oil prices in New York, Rotterdam and Singapore, and are subject to non-scheduled adjustments from time to time.

6

We purchase cracking feedstock from the Beijing Yanshan Branch of Sinopec (“Sinopec Yanshan”) and because Sinopec Yanshan’s refining facilities were designed and built to process certain types of crude oil, the origin and contents of the crude oil are important to their operation. In 2003, Daqing Oilfield in Heilongjiang Province supplied approximately 95.6% of Sinopec Yanshan’s crude oil, with the remaining 4.4% obtained through import from Russia. The mix of crude oil available to Sinopec Yanshan has been satisfactory for the production of our products. Additionally, in 2003 Sinopec Yanshan modified the production process at its refining facilities to refine a small portion of crude oil imported from Russia. Any modification of the source of crude oil beyond the capacity of Sinopec Yanshan’s refining facilities could have an adverse effect on Sinopec Yanshan’s ability to meet our cracking feedstock requirements and a corresponding effect on us.

Our business may be adversely affected by China’s entry into the WTO and increased overseas competition.

We compete mainly in China’s domestic market. In 2003, we derived approximately 98.7% of our revenues from sales within China. A substantial portion of China’s domestic market demand for our principal products, however, continues to be met by imported products.

China joined the WTO on December 11, 2001. As a condition to its membership, China has committed to eliminate some tariff and non-tariff barriers to foreign competition in the domestic petrochemical industry that benefited us in the past. In particular, China has committed to

| | • | permit increasing levels of foreign investment in the domestic petrochemical industry, allowing foreign investors to own up to 100% of a domestic petrochemical company by December 11, 2004, and allowing them to engage in the distribution of imported and domestically produced petrochemical products (including ownership of sales networks, distribution channels and storage facilities) by the same date; |

| | • | gradually eliminate import non-tariff barriers such as quotas based on amount and source; |

| | • | reduce tariffs on imported crude oil from 9% to 5% and reduce tariffs on various petrochemical products; |

| | • | gradually relax restrictions on the import of crude and refined oil by non-state companies; |

| | • | grant foreign-invested companies the right to import petrochemical products; and |

| | • | permit foreign companies to engage in wholesale distribution of crude oil, refined oil and chemical fertilizers and remove all restrictions on retail operations by December 11, 2006. |

As a result of these measures, we will likely face increased competition from foreign companies and imports in the near future and longer term. However, we believe that our products have competed and will continue to compete with imported products in China. We already compete with certain major overseas petrochemical competitors from South Korea, Taiwan and Japan, many of which have substantially greater overall financial, technical, marketing and distribution resources than we do. We compete with such companies in different products to various degrees on the basis of price, product quality, customer service, payment terms and distribution capability within China. As imports already constitute substantial portions of PRC domestic consumption for many of our principal products, in most cases we have already been adjusting our product prices taking into consideration international supply conditions, international pricing, tariffs for the relevant products, imports not subject to tariffs (such as imports into special economic zones for processing into products for export) and transportation costs.

7

Market cyclically and our high operational leverage may have a significant effect on our profitability.

Regional and global markets for many of our products are sensitive to changes in industry capacity and output levels, cyclical changes in regional and global economic conditions, the price and availability of substitute products and changes in consumer demand. Changes in these factors from time to time have had a significant impact on product prices in the regional and global markets. In the past, PRC markets for many of our principal products were insulated from many aspects of this cyclicality as a result of tariffs, import quotas, other trade restrictions and the Chinese government’s allocation and pricing control. With China’s entry into the WTO in December 2001, tariffs and other import restrictions are being reduced and the control of product allocation and pricing relaxed. Consequently, the domestic markets for many of our products will become increasingly subject to the cyclicality of regional and global markets. Between 1994 and 2003, the markets for many of our principal products experienced substantial price fluctuations. We cannot assure that future demand for our products will be sufficient to alleviate any existing or future conditions of excess industry capacity, overproduction, or other events.

Similar to other producers in the petrochemical industry and other bulk manufacturing industries, we are highly leveraged operationally. Because a significant portion of our expenses have either been fixed (as in the case of depreciation expense for a given piece of equipment) or have consisted of stable unit costs (as in the case of cracking feedstock), fluctuations in sales, particularly those caused by changes in product prices, have tended to cause disproportionately larger fluctuations in profitability. We expect this leverage and the effect on our profitability will continue for the foreseeable future.

Related party transactions; conflict of interest.

Sinopec owns 70.0% of our issued share capital and therefore is our controlling shareholder. Furthermore, Sinopec is an enterprise whose controlling shareholder is the Sinopec Group and has been authorized by the Sinopec Group to hold a controlling interest in us. Sinopec has controlling interests in many petrochemical enterprises that are our competitors. Sinopec has confirmed in writing that we will be treated no less favorably than the other enterprises directly or indirectly under its control in respect of all transactions between Sinopec and us on the one hand and Sinopec and its other subsidiaries on the other hand. Our articles of association provide that, in addition to any obligation imposed by law, a controlling shareholder shall not exercise its voting rights in a manner prejudicial to the interests of the shareholders generally, including voting with respect to certain enumerated matters of fundamental importance to shareholders. There has not been, however, any published report of judicial enforcement in China of such provisions by minority shareholders. Accordingly, Sinopec could take actions that favor its interests over our interests, and we cannot be sure that we or you have effective legal remedies.

Cost of compliance with PRC environmental protection regulation may adversely affect our business.

We are subject both to PRC national and local environmental protection regulations which currently impose a graduated schedule of fees for the discharge of waste substances, require the payment of fees for pollution and provide for the closure of any facility which fails to comply with orders requiring it to cease or rectify certain behavior causing environmental damage.

8

Utilizing our own and Yanshan Company’s environmental protection units, we have established a system to treat wastewater and materials in order to prevent pollution to the environment. Yanshan Company’s environmental protection units consist of an environmental compliance division and a number of facilities to treat wastewater, solid waste and waste gas. We use the wastewater treatment facilities that are part of our production facilities to conduct preliminary water treatment. Thereafter, we send the wastewater to Yanshan Company’s wastewater treatment plant for further treatment. The treated water is stored in Sinopec’s reservoir for further biochemical treatment. Yanshan Company charges us treatment fees based on its costs for the amount of wastewater and the quantity of polluted contents in the wastewater. We believe that the wastewater treatment facilities in our production plants have adequate capacity to conduct preliminary water treatment, and that Yanshan Company’s water treatment plant has sufficient capacity to treat all wastewater generated by Yanshan Company and us. All solid waste materials are either buried in a sealed disposal site or burned in a furnace, both of which are operated by Yanshan Company. We believe that the disposal site and the waste burning furnace comply with both the national and local environmental laws regarding the discharge or disposal of solid waste. However, we cannot assure you that Chinese national or local authorities will not impose additional regulations that would require additional expenditures on environmental matters in the future.

Our insurance coverage may not be sufficient to cover risks related to industry-related accidents.

Due to the nature of our business, we handle many highly flammable and explosive materials and operate many facilities under high pressure and high temperatures. As a result, similar to other companies in the petrochemical industry, we have experienced accidents that have caused property damage and personal injuries. We have implemented strict safety measures for the operation and maintenance procedures of our production facilities. Our operational results may nevertheless be adversely affected by losses incurred by or payments required of us for which we are not fully insured. See Item 4. Information on the Company - Business Overview - Insurance.

Our business may be adversely affected if we are unable to refinance our current short-term indebtedness with an equally favorable financing arrangement.

As of December 31, 2003, we had current liabilities of approximately RMB 2,047 million, including short-term bank loans of approximately RMB 1,070 million and current portion of long-term bank loans amounting to approximately RMB 18.4 million. As of the same date, we had long-term bank loans, net of current portion, of approximately RMB 1,596 million. We have found short-term loans to be an attractive source of funding relative to long-term loans because of, among other reasons, their easy accessibility and lower cost in China. We have been able to refinance our short-term loans in the past and believe that we will be able to do so in the future. However, no assurance can be given that it will not become more difficult for us to refinance our short-term loans or that such loans will remain attractive as compared to long-term loans. In addition, if the terms of such loans become less attractive, we may not be able to replace them with more attractive long-term financing. See Item 5. Operating and Financial Review and Prospects - Liquidity and Capital Resources.

Risks Relating to China

Currently, substantially all of our assets are located in China and our revenue is primarily derived from our operations in China. Accordingly, our financial condition and results of operations are subject to a significant degree to economic, political and legal developments in China.

Political and economic policies in China could affect our business in unpredictable ways.

The economy of China differs from the economies of most countries belonging to the Organization for Economic Co-operation and Development (“OECD”) in a number of respects, including:

9

| | • | level of government involvement; |

| | • | level of capital reinvestment; |

| | • | control of foreign exchange; and |

| | • | allocation of resources. |

Before its adoption of reform and open-door policies beginning in 1978, China was primarily a planned economy. Since that time, the Chinese government has been reforming the Chinese economic system, and has also begun reforming the government structure. These reforms have resulted in significant economic growth and social progress. Although the Chinese government still owns a significant portion of the productive assets in China, economic reform policies since the late 1970s have emphasized autonomous enterprises and the utilization of market mechanisms. We currently expect that the Chinese government will continue these reforms, further reduce government intervention and rely more heavily on market mechanisms to allocate resources. Although we believe these reforms will have a positive effect on our overall and long-term development, we cannot predict whether changes to China’s political, economic and social conditions, laws, regulations and policies will have any adverse effect on our current or future business or operational results.

If the Chinese government changed the current regulations that allow us to make payments in foreign currencies, we could have trouble making our foreign exchange payments.

The Renminbi currently is not a freely convertible currency. We receive most of our revenue in Renminbi. A portion of our Renminbi revenue must be converted into other currencies to meet our foreign currency obligations. We usually have substantial requirements for foreign currency, including debt service costs on foreign currency-denominated debt and payment of any dividends declared in respect of the H shares. We estimate that debt service costs on foreign currency-denominated debt will be approximately RMB 18.4 million (US$ 2.2 million) for the fiscal year 2004.

Under the existing foreign exchange regulations in China, we may undertake current account foreign exchange transactions, including the payment of dividends, without prior approval from the State Administration of Foreign Exchange by producing commercial documents evidencing the foreign exchange transactions, provided that they are processed through Chinese banks licensed to engage in foreign exchange transactions. The Chinese government has stated publicly that it intends to make the Renminbi freely convertible in the future. However, uncertainty exists as to whether the Chinese government may restrict access to foreign currency for current account transactions if foreign currency becomes scarce in China.

Foreign exchange transactions under the capital account (international revenues and expenditures that increase or decrease debt or equity, including principal payments on foreign currency-denominated obligations) continue to be subject to limitations and require the prior approval of the State Administration of Foreign Exchange. These limitations could affect our ability to obtain foreign exchange through debt financing, or to make capital expenditures in foreign currencies.

If the Chinese government restricts our ability to make payments in foreign exchange, we could have trouble making our foreign exchange payments and could even default on our obligations. See Item 10. Addition Information - Exchange Controls.

10

Fluctuation of the Renminbi could reduce our profits or our dividends.

Although the official exchange rate for the conversion of Renminbi to US dollars has been relatively stable since 1994, we cannot assure you of its future stability. The exchange rate of the Renminbi may become volatile against the US dollar or other currencies in the future.

Substantially all of our revenues and operating expenses are denominated in Renminbi, while some of our equipment purchases and debt repayment are denominated in foreign currencies. Accordingly, any future Renminbi devaluations could increase our cost in meeting these obligations, harming our profitability. In addition, any devaluation of the Renminbi may lower the amount of dividends payable on our H shares and ADSs in foreign currency terms.

Interpretation and enforcement of Chinese laws and regulations is uncertain.

The Chinese legal system is based on statutory law. Under this system, prior court decisions may be cited as persuasive authority, but do not have the binding effect of precedents. Since 1979, the Chinese government has been developing a comprehensive system of commercial laws and considerable progress has been made in the promulgation of laws and regulations dealing with economic matters, such as corporate organization and governance, foreign investment, commerce, taxation and trade. As these laws, regulations and legal requirements are relatively new, and because of the limited volume of published case law and judicial interpretations and the non-binding nature of prior court decisions, the interpretation and enforcement of these laws, regulations and legal requirements involve greater uncertainty than expected in more developed countries.

You may not enjoy shareholders’ protections that you would be entitled to in other jurisdictions.

Chinese legal provisions for the protection of shareholders’ rights and access to information, in particular, are different and less developed than those applicable to companies formed in the United States, Hong Kong, the United Kingdom and other developed countries or regions. You may not enjoy shareholders’ protections under Chinese law that you would be entitled to in other jurisdictions.

Chinese securities laws and regulations are still at an early stage of development and may not provide the legal protections you would be entitled to in other countries.

The regulatory framework for the securities market in China is still at an early stage of development. The China Securities Regulatory Commission is responsible for drafting regulations for, administering and regulating the national securities markets. The Chinese Company Law, the rules and regulations recently promulgated thereunder and laws relating to Chinese companies whose shares are offered overseas provide, to a limited extent, a legal framework governing the corporate behavior of companies such as ours, and their directors and shareholders. The Chinese Securities Law, which became effective on July 1, 1999, is the fundamental law comprehensively regulating the securities markets in China and applies to the issuance and trading of shares, company bonds and other securities in China designated by the State Council. However, these laws, rules, regulations and measures are still at an early stage of development and may not provide investors with the same extent of protection they may expect in the developed countries and regions.

You may have to pay Chinese tax on dividends and capital gains tax in the future.

Under current Chinese tax laws, regulations and rulings, dividends we pay to holders of H shares who are foreign individuals but not residents in China or which are foreign enterprises with no permanent establishment in China are not subject to Chinese withholding tax. In addition, gains realized by individuals or enterprises upon the sale or other disposition of H shares are not currently subject to Chinese capital gains tax. We cannot assure you, however, that withholding or capital gains taxes imposed by Chinese authorities will not become applicable to such dividends or gains in the future. Holders of H shares could, in the future, become subject to a withholding tax on dividends, which is currently imposed at the rate of 20% for individual and 10% for enterprises respectively unless reduced or eliminated by an applicable taxation treaty between China and the country in which the foreign individual or enterprise resides.

11

Our articles of association require you to submit your disputes with us and other persons to arbitration. You will have no legal right to a court proceeding.

Our articles of association require a holder of H shares and ADSs having a claim against, or a dispute with, us, our directors, supervisors, executive officers or a holder of our domestic shares relating to any rights or obligations conferred or imposed by our articles of association, the Chinese Company Law or any other Chinese laws or regulations and relating to our affairs, to submit the dispute or claim to the China International Economic and Trade Arbitration Commission or to the Hong Kong International Arbitration Center for arbitration. Our articles of association further provide that the arbitrator’s award shall be final and binding on all parties.

It may be difficult to effect service of process upon us or our directors, supervisors or executive officers who live in China or to enforce against them inside China any judgments obtained from non-Chinese courts.

We are a joint stock company incorporated in China with limited liability. All of our directors, supervisors and executive officers reside in China, and our assets and the assets of those persons are located inside China. Therefore, you may not be able to effect service of process upon us or those persons outside China or to enforce against them outside China any judgments obtained from non-Chinese courts. China does not have treaties or arrangements providing for the recognition and enforcement of judgments of the courts of the United States, the United Kingdom or most other Western countries. Therefore, recognition and enforcement in China of judgments obtained in these jurisdictions may be impossible.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

History

We were established in the People’s Republic of China as a joint stock limited company under the Chinese Company Law on April 23, 1997 as Beijing Yanhua Petrochemical Company Limited. On December 8, 2000, we changed our name to Sinopec Beijing Yanhua Petrochemical Company Limited.

We are one of the largest producers of resins and plastics in China. We are also one of the largest producers of ethylene in China. In 2003, we accounted for approximately 11.8 % of China’s total ethylene production. See B. Business Overview – Completion. We use substantially all of the ethylene we produce to manufacture a broad range of downstream petrochemical products. We are a leading producer in China of

| | • | cis-polybutadiene rubber; |

12

Our executive offices are located at No. 1 Beice, Yingfeng Erli, Yanshan, Fangshan District, Beijing 102500, PRC. Our telephone number is (86) (10) 6934-5924.

Yanshan Company, our predecessor, was established in 1967 by the China Ministry of Petroleum. In 1969, our predecessor completed the construction of three principal refining facilities. Thereafter, between 1969 and 1973, our predecessor completed more than 25 petrochemical production facilities, including a cis-polybutadiene rubber facility, the technology for which was internally developed. In 1973, with technology from ABB Lummus Global Inc. of the United States (“ABB Lummus”), our predecessor began the construction of its ethylene facility, with an annual production capacity of 300,000 tons, as well as a number of other production facilities that would utilize products from the ethylene facility as their raw materials. In 1976, the ethylene facility began operating, establishing itself as the first facility in China with annual ethylene production capacity of 300,000 tons. In 1983, our predecessor came under the control of China National Petrochemical Corporation (“China Petrochemical”).

Our predecessor replaced and modified its production facilities from time to time in order to maintain its facilities in as advanced and efficient state as possible. As a result of these improvements, current production capacities of most of our major production facilities, including the ethylene facility, exceed their original design Rated Capacities.

In 1994, our predecessor expanded the Rated Capacity of its ethylene facility to 450,000 tons with technology from ABB Lummus, constructed its HDPE facility and expanded its polypropylene facilities. The renovated ethylene facility produced approximately 473,000 tons of ethylene in 1995, exceeding the design Rated Capacity of this facility. The successful expansion of the ethylene facility enabled our predecessor to achieve a substantial increase in its sales and profitability from 1994 to 1995.

In 2001, we continued the introduction of the technology from ABB Lummus, expanded the Rated Capacity of our ethylene facilities to 710,000 tons, and constructed a new LDPE facility with an expected annual production capacity of 200,000 tons. The expanded ethylene facility produced approximately 744,000 tons of ethylene in 2002 and 722,000 tons in 2003. Both figures exceeded the design Rated Capacity of this facility. The successful re-expansion of the ethylene facility enabled us to achieve substantial increases in 2002 and 2003 over the factory’s sales and profitability figures for 2001.

In the Restructuring, our predecessor, in return for transferring its petrochemical operations to us, received 100% of the equity interest in us in the form of domestic invested shares, par value RMB 1.00 per share (each a “Domestic Share” and, collectively, the “Domestic Shares”), becoming our controlling shareholder at that time. The Restructuring was carried out in preparation of an initial public offering of our securities that was completed in June 1997.

On February 25, 2000, as part of the reorganization of the Sinopec Group, Yanshan Company transferred to Sinopec all of its ownership interest in us, represented by 2,362,000,000 Domestic Shares constituting 70% of our entire issued capital stock, making Sinopec our controlling shareholder. On October 19, 2000, Sinopec completed an initial public offering of securities which are currently traded on the New York Stock Exchange, the Hong Kong Stock Exchange, and the London Stock Exchange. On July 16, 2001, Sinopec completed a public offering of 280,000,000 “A” shares, which are currently traded on the Shanghai Stock Exchange. Sinopec Group and Sinopec have confirmed that they will treat us no less favorably than the other enterprises directly or indirectly under their respective control.

13

Principal Capital Expenditures and Divestitures

China’s rapid growth in consumption of petrochemical products, driven by the broad-based expansion of China’s consumer, industrial and transportation sectors, presents us with a number of attractive market opportunities. From 2000 to 2003, we accelerated our capital expansion program to take advantage of these opportunities and maximize our long-term earnings growth. During this period, we invested approximately RMB 4,563 million in capital expansion programs, used mainly for technical renovation for expanding the Ethylene Rated Capacity to 710,000 tons and eliminating relevant production bottlenecks. The investment made in 2003 was approximately RMB 291 million and was mainly used for technical renovation for expanding the capacity of phenol-acetone and ethylene glycol. We have targeted selected products for future expansion for which we generally believe (i) our existing market position for such products or related products is strong and will be enhanced by such an expansion, (ii) China’s consumption is growing at a rapid rate, and (iii) China’s consumption will continue to outstrip domestic production capacity for the foreseeable future. Our capital expansion plans have been formulated in concert with those of Yanshan Company, our former parent, which in 1998 completed an expansion of its crude oil refining capacity that substantially increased its ability to supply us with cracking feedstock, propylene and isobutene.

The table below sets forth selected information on our major construction and expansion projects that have been completed between 2001 and 2003. We have no such projects in progress.

| | | | | | |

Projects

| | Original

Rated Capacity

| | New/expanded

Rated Capacity

| | Construction period

|

| | | (’000 tons) | | (’000 tons) | | |

Ethylene | | 450 | | 710 | | 1998-2001/ Completed |

LDPE | | 180 | | 380 | | 1998-2001/ Completed |

Acetonitrile extraction | | 35 | | 65 | | 1998-2001/ Completed |

Benzene production | | 70 | | 100 | | 1998-2001/ Completed |

Phenol-acetone | | 180 | | 240 | | 2003 / Completed |

Ethylene and LDPE Facilities

China’s ninth five-year plan for 1996-2000 called for substantial investment in the construction or expansion of six ethylene facilities in China and targeted the total production volume of ethylene in China to reach 4.2 million tons by the end of 2000, a 75.0% increase from that in 1995. Our ethylene expansion project (the “Ethylene Project”) was one of the six projects contemplated by this ninth five-year plan. After delays caused by the State Council’s temporary suspension of all ethylene and LDPE projects in China, we began work on the Ethylene Project in 1999 and completed it in November 2001, increasing our annual ethylene production Rated Capacity to 710,000 tons from 450,000 tons. As an integral part of the Ethylene Project, our LDPE facilities were also expanded, increasing their annual Rated Capacity from 180,000 tons to 380,000 tons. The expanded LDPE facility uses the ethylene produced by the expanded ethylene facility to produce LDPE, a high value-added resin and plastic product with a broad range of applications. Although China’s annual ethylene production had reached 6.11 million tons by the end of 2003, the Chinese government anticipates a continuation of a significant shortage of ethylene in China in the near term. As of December 31, 2003, the total actual investment in the Ethylene Project was RMB 3.16 billion, including RMB 1.01 billion in self-funded investment and RMB 2.15 billion in loans.

14

Polypropylene Facility

Our polypropylene facility was completed within our Polypropylene Unit in 1998. This 200,000-ton polypropylene project, with an estimated investment of RMB 1.39 billion, has an actual investment of RMB 772 million, all of which was self-funded. With the completion of the polypropylene facility and expansion of the ethylene facility, we increased the volume and variety of our polypropylene and also improved its quality. Based on our market study, we believe that in the year 2004 China will continue to experience a shortage of polypropylene, a product with a broad range of applications. We are a leading producer of polypropylene in China, both in terms of aggregate sales and production volume. In November 2001, to accelerate the pace of our technology renovation programs and to increase the overall efficiency of our production, we sold our oldest and the first polypropylene production unit to Yanshan Company on condition that Yanshan Company would not compete with us in its business. See Item 7.B. Major Shareholders and Related Party Transactions - Related Party Transactions.

Butyl Rubber Facility

In the last quarter of 1999, we completed the construction of the butyl rubber facility and commenced commercial production at the site. Only a limited number of butyl rubber producers exist worldwide and we are the first to produce the material in China. Butyl rubber is a high-performance product sought for its air-tight sealing capacity and resistance to oxidation under high temperature. We believe we can secure a domestic market share for butyl rubber. This project, with estimated investment of RMB 1.48 billion, currently has an actual investment of RMB 950 million, of which RMB 468 million is self-funded and RMB 482 million are loans.

Phenol-acetone

From September to November of 2003, we conducted and completed the upgrade and increase of the annual production capacity of the No. 1 phenol-acetone production unit from 100,000 tons to 160,000 tons, and our production volume of phenol-acetone was accordingly increased from 180,000 tons to 240,000 tons, strengthening our position as one of the largest producers of this type of product in China. While the products of phenol and acetone are widely used in China and the demand of such products is growing year by year, there is a great shortage of such products in China. We believe that the completion of the upgrade and capacity increase of the phenol-acetone facilities will aid in further increasing our performance. This project, which had an estimated investment of RMB 150 million, had an actual investment of RMB 110 million.

Other Facilities

As part of our continuing efforts to renew and remodel all of our production facilities to improve efficiency, in 1999 we began expanding and upgrading our styrene, acetonitrile extraction and benzene production facilities, and completed construction of the acetonitrile extraction and benzene production facilities as scheduled in 2001.Expansion and renovation of our styrene production facilities were suspended after they commenced in light of the subsequent change of our focus. There is no timetable for us to resume such expansion and renovation. In addition, after completing technical renovations of our PTA and PX facilities in 1999, we also began to produce PIA and MX. We believe that continuing expansion of these facilities will allow us to produce a greater number of higher-margin products with high market demand.

These projects have been partially funded by the proceeds from our June 1997 global initial public offering and partially from bank borrowings and funds generated by our operations. We believe sufficient additional funds will be available to complete these projects from Sinopec Group and various domestic and international banks.

15

B. Business Overview

We believe that we are one of China’s most efficient petrochemical producers in terms of raw material conversion and energy utilization, based on comparative production statistics compiled by the Sinopec Group. Many of our production facilities have been built or renovated with technologies imported from overseas companies. In 2001, we completed expansion of our ethylene production capacity and have constructed and expanded selected downstream production facilities to meet the growth of demand in China for petrochemical products.

In 2003, we had sales of approximately RMB 11,473.9 million (US$ 1,386.3 million) and a net profit of approximately RMB 633.9 million (US$ 76.6 million). In 2003, 98.7% of our sales were derived from PRC domestic sales. Of our 2003 sales, 55.2% consisted of resins and plastics, 23.5% consisted of basic organic chemical products, 16.8% consisted of synthetic rubber and the remaining 4.5% consisted of other petrochemical products and sales of other goods.

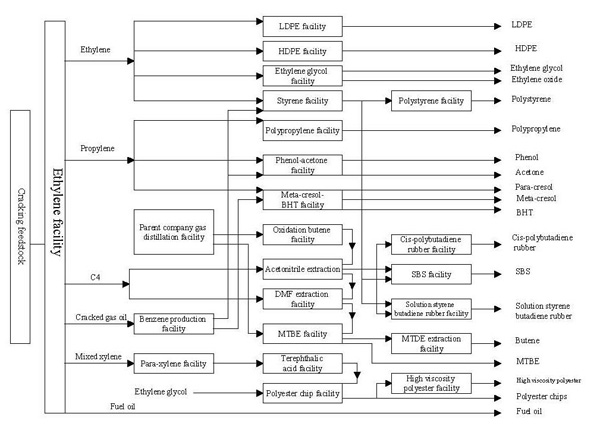

We are located in the Fangshan District, 50 kilometers southwest of downtown Beijing. Our facilities comprise five production units:

| | (i) | Chemical Works No. 1, which includes the ethylene facility, a number of facilities primarily utilizing ethylene as their raw material and other ancillary facilities; |

| | (ii) | Polypropylene Unit (formerly Chemical Works No. 2), comprising a number of facilities primarily utilizing propylene as their raw material and other ancillary facilities; |

| | (iii) | Chemical Product Unit, which includes a phenol-acetone and other ancillary facilities; |

| | (iv) | Synthetic Rubber Unit, comprising a number of synthetic rubber facilities, Butyl Rubber facilities and ancillary facilities; and |

| | (v) | Polyester Unit, which includes a number of polyester-production facilities and ancillary facilities. |

In addition, we own the Resin Application Research Unit, comprising research and development facilities, pilot facilities for developing new products and other ancillary facilities.

Our overseas listed foreign invested shares, par value RMB 1.00 per share (each an “H Share” and, collectively, the “H Shares”), are listed and traded on the Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”). Our American Depositary Shares (“ADSs”), each ADS representing 50 H Shares held by the depositary, The Bank of New York (the “Depositary”), are listed and traded on the New York Stock Exchange under the symbol “BYH.” Sinopec is our controlling shareholder and holds 70.0% of our issued share capital.

Industry Background and Relevant Markets

The petrochemical industry in China is a basic industrial sector, and has been a major focus for development by the Chinese government. In 2003, the Industrial Value Added figure for China’s petrochemical industry (including petroleum processing and production of organic chemicals, resins and plastics, synthetic rubber, synthetic fibers and chemical fertilizers) amounted to approximately RMB 570.38 billion, accounting for approximately 13.9 % of China’s aggregate Industrial Value Added.

We believe that the growth of China’s economy has been the driving force for significant increase in demand for many consumer products that use our products as raw materials. In spite of this growth, per capita consumption of petrochemical products in China remains significantly lower than that in major OECD countries. We believe that as China’s economy undergoes further industrialization and its consumer markets further develop, demand for petrochemical products will continue to grow at a relatively high rate.

16

Industry Structure and Regulatory Environment

In the early 1970s, the Chinese government established a number of petroleum refining and petrochemical production and processing facilities in large complexes to permit integrated production of petroleum products, basic organic chemical products, resins and plastics, synthetic fibers and synthetic rubber. During this period, as part of the Chinese government’s policy to develop the raw material base for the petrochemical industry, the Chinese government purchased from overseas the first 300,000-ton Rated Capacity ethylene facility in China, which was installed in our Chemical Works No. 1.

Since the late 1980s, the Chinese government has implemented various economic liberalization measures which have materially affected China’s petrochemical industry in areas such as cost and allocation of raw materials, product pricing and marketing and distribution of products. Nevertheless, a portion of China’s petrochemical industry and certain of our products remain under the control of the Chinese government.

Central government agencies and their local or provincial level counterparts do not own or directly control production facilities. However, they exercise significant control over the petrochemical industry in areas such as pricing, quality standards, allocation of raw materials and selected finished products, allocation of foreign and domestic loans and allocation of Renminbi loans for capital construction projects, as well as setting national five-year state plans and ten-year development plans. We believe that China’s petrochemical industry will continue to evolve at a measured and gradual pace away from its history of state control. We expect, and are preparing for, liberalization measures to continue and a more competitive environment to develop.

China Petrochemical was established as a corporate entity by the Chinese government in 1983 and was authorized by the Chinese government to invest and hold controlling interests in a majority of the petrochemical enterprises in China. Following the Restructuring, until July 1998, Yanshan Company was a wholly-owned subsidiary of China Petrochemical.

In the first half of 1998, the Chinese government restructured and consolidated many of the then existing governmental agencies in the chemical and petrochemical industries in accordance with a plan approved by the State Council (the “Industry Restructuring”). Prior to the Industry Restructuring, various governmental agencies had responsibilities for administrative oversight of the chemical and petrochemical industries, including China’s Ministry of Chemical Industries (“MCI”), China Petrochemical, and China National Oil and Gas Corporation (“CNOGC”). Pursuant to the Industry Restructuring, the Chinese government created the State Oil and Chemical Industry Bureau (“SOCIB”) and transferred to SOCIB most of the responsibilities for national-level oversight then held by MCI, China Petrochemical and CNOGC. In July 1998, the Chinese government created from CNOGC and China Petrochemical, respectively, CNPC and the Sinopec Group, and our parent became a wholly-owned subsidiary of the Sinopec Group, a state owned entity authorized to conduct business in the petrochemical industry in the southern and eastern regions of China, including Beijing. On February 25, 2000, the Sinopec Group completed a restructuring and eventually established Sinopec, our current parent. In February 2001, SOCIB was dissolved upon the approval of the State Council and its responsibilities were transferred to the State Economic and Trade Commission (“SETC”). From February 2001 to March 2003, the SETC served as the supervising authority of China’s petrochemical and chemical industry. In March 2003, the State Council restructured certain governmental agencies. Accordingly, the State Assets Regulatory and Management Commission, the NDRC and the Ministry of Commerce each took over some of the SETC’s functions. We therefore currently are subject to industrial oversight of the three newly established governmental agencies in different spheres. Through our parent company, we are owned by the Sinopec Group.

17

Crude Oil and Cracking Feedstock

Our principal raw material, cracking feedstock, is derived from crude oil and supplied primarily by one of Sinopec’s refineries. Therefore, the supply and price of crude oil are key factors in determining the availability and pricing of cracking feedstock. The allocation and pricing of domestic onshore crude oil in China has generally been subject to state control. Prior to June 1998, the State Planning Commission established State Prices for domestic onshore crude oil which, except for some recent periods, have historically been below international market prices, and determined annual allocations of crude oil among all PRC crude oil refining enterprises. China Petrochemical then re-allocated crude oil allocated to it to enterprises under its control. In June 1998, as part of the Industry Restructuring, the Chinese government implemented a new pricing scheme to allow the prices of domestically produced crude oil to generally reflect and to fluctuate with the prevalent international market prices. In October 2001, this pricing scheme was modified to reflect a broader range of international market prices and to allow for more timely adjustments of PRC domestic prices. The Sinopec Group oversees the allocation of cracking feedstock among the enterprises under its control. Imports of cracking feedstock are subject to restrictions, including import quota controls and import/export licensing requirements. See “Raw Materials, Water and Energy Supply—Cracking Feedstock.”

Resins and Plastics

Resins and plastics have very broad applications. The level of demand in China for resins and plastics is significantly related to the development of the agricultural, industrial, construction-related and automobile industries and the consumption of consumer products such as housewares, household electric appliances, toys and packaging materials. Each of these industries utilizes specific types of resins and plastics based on the particular requirements of its products and depending on the hardness, plasticity, heat resistance, abrasion performance, elongation, cost and other characteristics of each type of resins and plastics. Beginning in 2002, resins and plastics were no longer subject to the Chinese government allocation and pricing controls in China.

Synthetic Rubber

The level of demand for synthetic rubber is significantly related to the development of the tire industry, as well as other industries such as housewares, shoes, toys and mining. Each of these industries utilizes specific types of synthetic rubber based on the particular requirements of its products and depending on the hardness, plasticity, heat resistance, abrasion performance, elongation and other characteristics of each type of synthetic rubber. Synthetic rubber in China is not subject to Chinese government allocation and pricing control.

Basic Organic Chemical Products

Ethylene is one of the most important petrochemical raw materials used in the production of downstream petrochemical products. The production of ethylene is a significant indicator of the development level of a country’s petrochemical industry. The Chinese government’s five-year plan for 2001-2005 identified ethylene as a priority product for further development and targeted annual domestic production of ethylene to increase to approximately 8.3 million tons by 2005. In 2002 and 2003, the actual PRC domestic ethylene production reached approximately 5.43 million tons and 6.11 million tons, respectively. This was achieved through development of large-scale ethylene facilities such as our Ethylene Project, completed in 2001. From 1996 through 2003, the production of ethylene derivatives, as well as co-products such as propylene, butadiene, toluene and xylene, also increased correspondingly. We use most of the ethylene we produce for the production of downstream products. From 2002, none of the ethylene produced by us was sold to third parties pursuant to Chinese government allocation and pricing controls.

18

Business Strategy

In view of the developments associated with China’s entry into the WTO, we intend to build on our position as one of the leading PRC petrochemical enterprises in order to develop our business to match the rapid rate of economic progress in China and achieve long-term earnings growth. We have refocused and adjusted our strategy along the following elements:

Expand Production Capacity

We will continue to expand our production capacity with respect to products for which we believe

| | (i) | our existing market position is strong and will be enhanced by such an expansion; |

| | (ii) | PRC consumption is growing at a rapid rate; and |

| | (iii) | PRC consumption will continue to outstrip domestic production capacity for the foreseeable future. |

In 1998, we upgraded and increased the Rated Capacity of our HDPE production facility from 140,000 tons to 160,000 tons, upgraded and increased the Rated Capacity of our ethylene glycol production facility from 60,000 tons to 80,000 tons, and upgraded and increased the Rated Capacity of our phenol-acetone production facility from 80,000 tons to 100,000 tons. Our existing SBS and solution styrene butadiene rubber production facilities were also upgraded, increasing each of their Rated Capacities from 10,000 tons to 30,000 tons. In addition, in 1998, we completed our third polypropylene facility with a Rated Capacity of 200,000 tons. In the last quarter of 1999, we completed construction of our principal butyl rubber facility with a Rated Capacity of 30,000 tons, and commenced commercial production at the site. In 2000, we accelerated the pace of our technology renovation program and completed certain technology improvement and capacity expansion projects as previously planned. This involved construction of two new cracking furnaces, each with an annual capacity of 100,000 tons, and the renovation of two existing cracking furnaces, each with a capacity of 60,000 tons. These facilities successfully began operation at the same time, laying a foundation for the completion of the Ethylene Project. To support the expansion of the production capacity of such products, in November 2001 we completed the Ethylene Project, thereby increasing our annual ethylene production from its previous Rated Capacity of 450,000 tons to 710,000 tons. In consideration of the market demand and the product economic benefits, in 2001 we turned our cresol and BHT facilities into the No.2 phenol-acetone unit, with a Rated Capacity of 80,000 tons. From September to November of 2003, we upgraded and increased the annual production capacity of the No. 1 phenol-acetone production facility from 100,000 tons to 160,000 tons, and our production volume of phenol-acetone was accordingly increased from 180,000 tons to 240,000 tons, strengthening our position as one of the largest producers of this type of product in China. We believe that the greater economies of scale achieved by completion of our capital expansion program will further strengthen our competitive position. We may also consider expansion through the acquisition of other PRC chemical enterprises should attractive opportunities arise.

Enhance Operating Efficiency

We will continue to focus on further enhancing our operating efficiency, which we believe is already one of the highest among PRC petrochemical producers in terms of raw material conversion and energy utilization. We have increased the cracking feedstock conversion rates of our ethylene facility in the past six years and continue to explore ways to improve use of feedstock and other raw materials. We have developed an ability to use vacuum gas oil (“VGO”), cracking wax oil and hydrogenated raffinate oil as alternative lower-cost cracking feedstock to light industrial oil. We have been using an increasing proportion of such alternative cracking feedstock in the past six years and intend to continue increasing its use to reduce costs in the future. We will continue to pursue measures to increase energy efficiency and equipment use. These measures include

| | (i) | importing and internally developing methods to improve production techniques, |

19

| | (ii) | upgrading certain of our cracking furnaces to permit the use of a wider variety of cracking feedstock, and |

| | (iii) | extending the period between scheduled maintenance shutdowns from the current two years to a longer period. |

Improve Product Mix

We will continue to gradually shift our product mix from general purpose petrochemicals toward more specialized products we produce. We believe that continuing to emphasize more specialized, higher margin petrochemical products will enhance our profitability and improve our competitive position. In line with this strategy, our research and development department will continue to work with our customers to develop new products and improve and customize to better meet our customers’ needs.

As part of this strategy, in 1999 we began to produce butyl rubber, MX and PIA. In the past several years, we have increased the sales of special resins and plastics, thus increasing the proportion of products with high profit margins within the resin and plastic product group. We intend to continue to target new products we believe are more technologically advanced, have more specialized applications and will carry higher profit margins than many of our current products. Our capital expansion program reflects this strategy. We have acquired the technology for such products and are considering acquisitions and strategic alliance inside and outside of China.

Strengthen Sales and Marketing Activities

As China increasingly evolves into a market driven economy, our sales and marketing efforts are focused on reinforcing our relationships with existing customers and gaining new customers. To achieve this, we intend to continue to expand our direct sales force in order to develop more direct sales to industrial customers and to reduce sales through intermediaries. In 2003, direct sales to industrial customers constituted 40.1% of our total sales. Sales to trading companies and sales made through Yanshan Company constituted 49.6% and 9.0% of our total sales, respectively. We will continue to strive to meet our customers’ needs by improving the marketing and customer support activities that we have developed over the past several years. These activities include conducting industry studies, surveys of potential applications for existing and new products and analyses of competitors’ product offerings, and expanding our after-sale customer services, including technical support and technology assistance. We are also making efforts to develop e-commerce as one of our methods to initiate sales activities. In 2003, we sold 353,300 tons of our products initiated through the Internet resulting in the revenue of approximately RMB 2.270 billion.

20

PRINCIPAL PRODUCTS

We produce over 40 types of products. Our production processes are highly integrated, and many of our products are consumed internally as feedstock for the production of our other products. The following table sets forth our principal products based on sales volume and sales in 2001, 2002 and 2003.

| | | | | | | | | | | | | | | | | | |

| | | 2001

| | 2002

| | 2003

|

Principal products

| | Sales

volume

| | Sales

| | Percentage

of sales

| | Sales

volume

| | Sales

| | Percentage

of sales

| | Sales

volume

| | Sales

| | Percentage

of sales

|

| | | (’000 tons) | | (RMB

millions) | | (%) | | (’000 tons) | | (RMB

millions) | | (%) | | (’000 tons) | | (RMB

millions) | | (%) |

| Resins and plastics | | | | | | | | | | | | | | | | | | |

LDPE | | 153.6 | | 969.4 | | 16.2 | | 413.4 | | 2,195.7 | | 23.3 | | 410.0 | | 2,658.5 | | 23.2 |

Polypropylene | | 205.2 | | 1,136.1 | | 18.8 | | 402.7 | | 2,133.0 | | 22.6 | | 366.4 | | 2,388.2 | | 20.8 |

HDPE | | 122.5 | | 719.8 | | 12.0 | | 164.4 | | 853.7 | | 9.0 | | 157.9 | | 949.2 | | 8.3 |

Polyester chips | | 38.9 | | 213.5 | | 3.6 | | 5.2 | | 31.6 | | 0.3 | | 0.3 | | 2.2 | | 0.0 |

Polystyrene | | 21.6 | | 164.4 | | 3.0 | | 51.9 | | 300.2 | | 3.2 | | 48.9 | | 334.2 | | 2.9 |

Sub-total | | 541.8 | | 3,203.2 | | 53.6 | | 1,037.6 | | 5,514.2 | | 58.4 | | 983.5 | | 6,332.3 | | 55.2 |

| Synthetic rubber | | | | | | | | | | | | | | | | | | |

Butyl rubber | | 8.2 | | 65.7 | | 1.1 | | 24.0 | | 289.2 | | 3.1 | | 29.5 | | 391.3 | | 3.4 |

Cis-polybutadiene | | 92.7 | | 529.3 | | 8.9 | | 118.0 | | 683.2 | | 7.2 | | 123.0 | | 1,028.5 | | 9.0 |

SBS | | 40.8 | | 330.5 | | 5.5 | | 60.3 | | 446.5 | | 4.7 | | 64.2 | | 504.0 | | 4.4 |

Sub-total | | 141.7 | | 925.5 | | 15.5 | | 202.3 | | 1,418.9 | | 15.0 | | 216.7 | | 1,923.8 | | 16.8 |

Basic organic chemical products | | | | | | | | | | | | | | | | | | |

Phenol | | 75.8 | | 375.6 | | 6.3 | | 120.4 | | 564.3 | | 6.0 | | 108.9 | | 712.9 | | 6.2 |

Ethylene glycol | | 50.5 | | 209.4 | | 3.5 | | 79.6 | | 301.9 | | 3.2 | | 76.8 | | 434.2 | | 3.8 |

Ethylene | | 30.7 | | 119.1 | | 2.0 | | 41.1 | | 140.7 | | 1.5 | | 51.4 | | 188.9 | | 1.6 |

Acetone | | 47.4 | | 167.8 | | 2.8 | | 73.4 | | 293.5 | | 3.1 | | 67.0 | | 347.4 | | 3.0 |

Others(1) | | N/A | | 501.3 | | 8.4 | | N/A | | 839.8 | | 8.9 | | N/A | | 1,016.6 | | 8.9 |

Sub-total | | N/A | | 1,373.2 | | 23.0 | | N/A | | 2,140.2 | | 22.7 | | N/A | | 2,700.0 | | 23.5 |

Others(1) | | N/A | | 473.4 | | 7.9 | | N/A | | 369.8 | | 3.9 | | N/A | | 517.8 | | 4.5 |

Total | | N/A | | 5,975.3 | | 100.0 | | N/A | | 9,443.1 | | 100.0 | | N/A | | 11,473.9 | | 100.0 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| /(1)/ | No single chemical product in these categories comprised more than 2.0% of total sales. |

| N/A: | Information is not available. |

Product Pricing

We currently make pricing decisions for all of our products with reference to prices in the major chemical commodities markets in China. Prices for some of our products have experienced substantial fluctuations over the last few years primarily due to fluctuations in international prices for these products, especially in the Southeast Asian market. Because imports constitute a substantial portion of PRC domestic consumption for many of our principal products, prices for these products in China’s domestic markets fluctuate substantially in concert with international prices. We adjust our product prices by taking into consideration international supply conditions, international pricing, tariffs for the relevant products, imports not subject to tariffs (such as imports into special economic zones for processing into products for export) and transportation costs. Our sales and marketing department has access to domestic and international market information through our computerized data center, enabling us to closely monitor pricing developments in major international commodity markets, particularly in Southeast Asia. Due to brand recognition, reliability in supply and generally high and consistent product quality, we believe that we can implement a flexible pricing scheme for many of our products. See Item 5. Operating and Financial Review and Prospects.

21

All of our products are currently sold at prices set by the market. Until 2001, of the major products we produce, a limited amounts of ethylene was subject to a certain degree of state pricing control within a fixed range. Starting from 2002, ethylene was no longer subject to state pricing control.

Sales and Marketing