UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08243 |

|

Direxion Funds |

(Exact name of registrant as specified in charter) |

|

1301 Avenue of the Americas (6th Ave.), 28th Floor New York, NY | | 10019 |

(Address of principal executive offices) | | (Zip code) |

|

1301 Avenue of the Americas (6th Ave.), 28th Floor New York, NY 10019 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-851-0511 | |

|

Date of fiscal year end: | August 31, 2017 | |

|

Date of reporting period: | August 31, 2017 | |

| | | | | | | | |

Item 1. Report to Stockholders.

ANNUAL REPORT AUGUST 31, 2017

1301 Avenue of the Americas (6th Ave.), 28th Floor New York, New York 10019 www.direxioninvestments.com

1.2X BULL FUND

Direxion Monthly High Yield Bull 1.2X Fund (DXHYX)

| 1.25X BULL FUND | | 1.25X BEAR FUND | |

| Direxion Monthly NASDAQ-100® Bull 1.25X Fund (DXNLX) | | Direxion Monthly NASDAQ-100® Bear 1.25X Fund (DXNSX) | |

| 1.35X BULL FUND | | 1.35X BEAR FUND | |

| Direxion Monthly 25+ Year Treasury Bull 1.35X Fund (DXLTX) | | Direxion Monthly 25+ Year Treasury Bear 1.35X Fund (DXSTX) | |

| (Formerly Direxion Monthly 25+ Year Treasury Bull 1.2X Fund) | | (Formerly Direxion Monthly 25+ Year Treasury Bear 1X Fund) | |

| 2X BULL FUNDS | | 2X BEAR FUNDS | |

| Direxion Monthly NASDAQ-100® Bull 2X Fund (DXQLX) | | | | | |

| Direxion Monthly S&P 500® Bull 2X Fund (DXSLX) | | Direxion Monthly S&P 500® Bear 2X Fund (DXSSX) | |

| Direxion Monthly Small Cap Bull 2X Fund (DXRLX) | | Direxion Monthly Small Cap Bear 2X Fund (DXRSX) | |

| Direxion Monthly 7-10 Year Treasury Bull 2X Fund (DXKLX) | | Direxion Monthly 7-10 Year Treasury Bear 2X Fund (DXKSX) | |

| Direxion Monthly Emerging Markets Bull 2X Fund (DXELX) | | | | | |

Letter to Shareholders (Unaudited) | | | 4 | | |

Performance Summary (Unaudited) | | | 11 | | |

| Expense Example (Unaudited) | | | 24 | | |

| Allocation of Portfolio Holdings (Unaudited) | | | 26 | | |

| Schedules of Investments | | | 27 | | |

| Statements of Assets and Liabilities | | | 40 | | |

| Statements of Operations | | | 44 | | |

| Statements of Changes in Net Assets | | | 48 | | |

| Financial Highlights | | | 55 | | |

| Notes to the Financial Statements | | | 57 | | |

Report of Independent Registered

Public Accounting Firm | | | 74 | | |

| Supplemental Information (Unaudited) | | | 75 | | |

Investment Advisory Agreement

Approval (Unaudited) | | | 76 | | |

| Trustees and Officers | | | 79 | | |

Help Preserve the Environment – Go Green!

Go paperless with Direxion e-Delivery – a service allowing shareholders to reduce clutter with full online access to regulatory documents. Begin the preservation process with e-delivery.

With Direxion e-Delivery you can:

• Receive email notifications when your most recent shareholder communications are available for review.

• Access prospectuses, annual reports and semi-annual reports online.

It's easy to enroll:

1. Visit www.direxioninvestments.com/edelivery

2. Follow the simple enrollment instructions

If you have questions about Direxion e-Delivery services, contact one of our shareholder representatives at 800-851-0511.

Letter to Shareholders (Unaudited)

Dear Shareholders,

This Annual Report for the Direxion Funds (the "Funds") covers the period from September 1, 2016 to August 31, 2017 (the "Annual Period").

Fund Operational Review:

The Funds are leveraged and seek to provide a calendar month return of 120%, 125%, 135%, 200%, -125%, -135% or -200% of the calendar month performance of a particular benchmark. The term "calendar month" refers to the period from the close of the markets on the last business day of a given calendar month, until the close of the markets on the last business day of the subsequent calendar month. The Funds seek calendar month leveraged investment results which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of a calendar month will generally receive more, or less, than the target exposure to the index, depending on the performance of the target index. If a Fund's shares are held through the end of a calendar month or months, the Fund's performance is likely to deviate from the multiple of the benchmark performance for the longer period. Similarly, the return for investors investing for periods less than a calendar month, or for a period different than the calendar month, will likely deviate from the multiple of the benchmark performance for such shorter periods. The Funds are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking calendar month leverage investment results and intend to actively monitor and manage their investments.

The Funds with the word "Bull" in their name attempt to provide investment results that correlate to 120%, 125%, 135% or 200% of the return of an index or benchmark, meaning the Bull Funds attempt to move in the same direction as the target index or benchmark. The Funds with the word "Bear" in their name attempt to provide investment results that correlate to -125%, -135% or -200% of the return of an index or benchmark, meaning that Bear Funds attempt to move in the opposite or inverse direction of the target index or benchmark.

In seeking to achieve each Fund's calendar month investment objective, Rafferty Asset Management ("Rafferty" or the "Adviser") uses statistical and quantitative analysis to determine the investments each Fund makes and the techniques it employs. Rafferty relies upon a pre-determined model to generate orders resulting in repositioning each Fund's investments in accordance with its calendar month investment objective. Using this approach, Rafferty determines the type, quantity and mix of investment positions it believes in combination should produce calendar month returns consistent with a Fund's objective. As a consequence, if a Fund is performing as designed, the return of the index or benchmark will dictate the return for that Fund. Each Fund pursues its investment objective regardless of market conditions and does not take defensive positions.

Each Fund has a clearly articulated goal which requires the Fund to seek economic exposure in excess of its net assets. To meet its objectives, each Fund invests in some combination of financial instruments so it generates economic exposure consistent with the Fund's investment objective. Financial instruments may include exchange traded funds ("ETFs"), stock index futures contracts, options on securities and stock indices and swap agreements. Each Fund invests significantly in swap agreements. Rafferty uses these types of investments to produce economically "leveraged" investment results. Leveraging allows Rafferty to generate a greater positive or negative return than what would be generated on the invested capital without leverage, thus changing small market movements into larger changes in the value of the investments of a Fund.

The Funds may use certain investment techniques, including investments in derivatives, which may be considered aggressive. Investments in derivatives in general are subject to market risks that may cause their prices to fluctuate over time. Additionally, such instruments may experience potentially dramatic price changes (losses) and imperfect correlations between the price of the contract and the underlying security or index which will increase the volatility of the Funds and may involve a small investment of cash relative to the magnitude of the risk assumed. The use of derivatives may expose the Funds to

DIREXION ANNUAL REPORT

4

additional risks that they would not be subject to if they invested directly in the securities underlying those derivatives. The use of derivatives may result in larger losses or smaller gains than otherwise would be the case.

The discussion below relates to the performance of the Funds for their respective period. The Funds seek to provide calendar month returns which are a multiple – positive or negative – of the calendar month performance of a particular benchmark. The performance of the Funds for their respective period is important for understanding whether these Funds meet their investment goals. A Fund meeting its calendar month investment objective should have performance for the period similar to the performance indicated by models based on the calendar month returns of the relevant benchmark for the period. Direxion maintains models indicating the expected performance of each Fund in light of the path of the relevant benchmark. The models, and a description of how they work, are available on the Direxion website (www.direxioninvestments.com) under Tools/Exposure Level. The models do not take into account the size of a Fund, the Fund's expense ratio or any transaction fees associated with creating a Fund's portfolio. A brief comparison of the actual returns versus the expected returns for each of the Funds in this Annual Report follows.

Fund Performance Review:

The Direxion Monthly High Yield Bull 1.2X Fund seeks to provide 120% of the calendar month return of the Solactive High Yield Beta Index. The Solactive High Yield Beta Index is a rules-based, systematic strategy index that provides exposure to an equal-weighted portfolio of three high-yield ETFs. The allocation to each U.S. High Yield Corporate Bond ETF is adjusted on a monthly basis. The index is calculated and distributed by Solactive AG and is calculated and published in U.S. Dollars. For the Annual Period, the Solactive High Yield Beta Index returned 8.12%. Given the calendar month investment objectives of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of annual performance of the Fund. Direxion Monthly High Yield Bull 1.2X Fund returned 8.08%, while the model indicated an expected return of 9.81%.

The Direxion Monthly NASDAQ-100® Bull 1.25X Fund and the Direxion Monthly NASDAQ-100® Bear 1.25X Fund seek to provide 125% and -125% of the calendar month return of the NASDAQ-100® Index, respectively. The NASDAQ-100® Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market® based on market capitalization. All companies listed on the index have an average daily trading volume of at least 200,000 shares. For the Annual Period, the NASDAQ-100® Index returned 27.00%. Given the calendar month investment objectives of the Funds and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Funds. The Direxion Monthly NASDAQ-100® Bull 1.25X Fund returned 31.77%, while the model indicated an expected return of 34.58%. The Direxion Monthly NASDAQ-100® Bear 1.25X Fund returned -26.91%, while the model indicated an expected return of -26.95%.

From September 1, 2016 through November 30, 2016, the Direxion Monthly 25+ Year Treasury Bull 1.2X Fund and the Direxion Monthly 25+ Year Treasury Bear 1X Fund sought to provide 120% and -100% of the calendar month return of the NYSE 25 Year Plus Treasury Bond Index, respectively. The NYSE 25 Year Plus Treasury Bond Index (AXTWFV) is a multi-security fixed income index that attempts to track U.S. Treasury bonds with a maturity of 25 years or greater. Bonds eligible for inclusion must: be issued by the U.S. Treasury; have a maturity of 25 years or greater at issuance; be denominated in U.S. Dollars; be an either callable or non-callable issue; and have a fixed, non-zero coupon. The Index rebalances monthly, after the close of trading on the last business day of each month. The weighting of the bonds in the Index is reset during the rebalance to represent each issue's market value which is based on the issue's float-adjusted amount outstanding. For the stated period, the NYSE 25 Year Plus Treasury Bond Index returned -14.05%. Given the calendar month investment objectives of the Funds and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Funds. The Direxion Monthly 25+ Year Treasury Bull 1.2X Fund returned -17.13%, while the model indicated an expected return of -16.73%. The Direxion Monthly 25+ Year Treasury Bear 1X Fund returned 14.89%, while the model indicated an expected return of 15.24%.

From December 1, 2016 through August 31, 2017, the Direxion Monthly 25+ Year Treasury Bull 1.35X Fund and the Direxion Monthly 25+ Year Treasury Bear 1.35X Fund sought to provide 135% and -135% of the calendar month return of the

DIREXION ANNUAL REPORT

5

NYSE 25 Year Plus Treasury Bond Index, respectively. The NYSE 25 Year Plus Treasury Bond Index (AXTWFV) is a multi-security fixed income index that attempts to track U.S. Treasury bonds with a maturity of 25 years or greater. Bonds eligible for inclusion must: be issued by the U.S. Treasury; have a maturity of 25 years or greater at issuance; be denominated in U.S. Dollars; be an either callable or non-callable issue; and have a fixed, non-zero coupon. The Index rebalances monthly, after the close of trading on the last business day of each month. The weighting of the bonds in the Index is reset during the rebalance to represent each issue's market value which is based on the issue's float-adjusted amount outstanding. For the stated period, the NYSE 25 Year Plus Treasury Bond Index returned 8.69%. Given the calendar month investment objectives of the Funds and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Funds. The Direxion Monthly 25+ Year Treasury Bull 1.35X Fund returned 9.78%, while the model indicated an expected return of 11.84%. The Direxion Monthly 25+ Year Treasury Bear 1.35X Fund returned -11.42%, while the model indicated an expected return of -10.98%.

The Direxion Monthly NASDAQ-100® Bull 2X Fund seeks to provide 200% of the calendar month return of the NASDAQ-100® Index. The NASDAQ-100® Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market® based on market capitalization. All companies listed on the index have an average daily trading volume of at least 200,000 shares. For the Annual Period, the NASDAQ-100® Index returned 27.00%. Given the calendar month investment objectives of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund. The Direxion Monthly NASDAQ-100® Bull 2X Fund returned 54.55%, while the model indicated an expected return of 59.60%.

The Direxion Monthly S&P 500® Bull 2X Fund and the Direxion Monthly S&P 500® Bear 2X Fund seek to provide 200% and -200% of the calendar month return of the S&P 500® Index, respectively. The S&P 500® Index is a capitalization-weighted index composed of 500 domestic common stocks. Standard & Poor's® selects the stocks comprising the S&P 500® Index on the basis of market capitalization, financial viability of the company and the public float, liquidity and price of a company's shares outstanding. The index is a float-adjusted, market capitalization-weighted index. For the Annual Period, the S&P 500® Index returned 16.23%. Given the calendar month investment objectives of the Funds and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Funds. The Direxion Monthly S&P 500® Bull 2X Fund returned 30.33%, while the model indicated an expected return of 34.44%. The Direxion Monthly S&P 500® Bear 2X Fund returned -26.54%, while the model indicated an expected return of -27.03%.

The Direxion Monthly Small Cap Bull 2X Fund and the Direxion Monthly Small Cap Bear 2X Fund seek to provide 200% and -200% of the calendar month return of the Russell 2000® Index, respectively. The Russell 2000® Index measures the performance of approximately 2,000 small-capitalization companies in the Russell 3000® Index, based on a combination of their market capitalization and current index membership. For the Annual Period, the Russell 2000® Index returned 14.91%. Given the calendar month investment objectives of the Funds and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of annual performance of the Funds. The Direxion Monthly Small Cap Bull 2X Fund returned 26.88%, while the model indicated an expected return of 29.92%. The Direxion Monthly Small Cap Bear 2X Fund returned -29.44%, while the model indicated an expected return of -28.44%.

The Direxion Monthly 7-10 Year Treasury Bull 2X Fund and the Direxion Monthly 7-10 Year Treasury Bear 2X Fund seek to provide 200% and -200% of the calendar month return of the ICE U.S. Treasury 7-10 Year Bond Index, respectively. The ICE U.S. Treasury 7-10 Year Bond Index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years. Eligible securities must be fixed rate, denominated in U.S. dollars, and have $300 million or more of outstanding face value, excluding amounts held by the Federal Reserve. Securities excluded from the index are zero-coupon STRIPS, inflation linked securities, floating rate notes, cash management and Treasury bills, and any government agency debt issued with or without a government guarantee. For Annual Period, the ICE U.S. Treasury 7-10 Year Bond Index returned -1.52%. Given the calendar month investment objectives of the Funds and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Funds. The Direxion Monthly 7-10 Year Treasury Bull 2X Fund returned -5.66%, while the model indicated an expected return of -3.26%. The Direxion Monthly 7-10 Year Treasury Bear 2X Fund returned 1.25%, while the model indicated an expected return of 2.40%.

DIREXION ANNUAL REPORT

6

The Direxion Monthly Emerging Markets Bull 2X Fund seeks to provide 200% of the calendar month return of the MSCI Emerging Markets IndexSM. The MSCI Emerging Market IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. For the Annual Period, the MSCI Emerging Markets IndexSM returned 24.53%. Given the calendar month investment objectives of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund. The Direxion Monthly Emerging Markets Bull 2X Fund returned 49.73%, while the model indicated an expected return of 53.46%.

Factors Affecting Direxion Fund Performance:

Benchmark Performance: The calendar month performance of each Fund's benchmark index, and the factors and market conditions implicitly affecting that index, are the primary factors driving Fund performance. Given the calendar month goals, the series of calendar month index returns are most important. The market conditions affecting the benchmark indexes during the past year are described below.

Leverage: Each Fund seeks calendar month investment results (before fees and expenses) of either 120%, 125%, 135% or 200% (for the Bull Funds) or -125%, -135% or -200% (for the Bear Funds) of the performance of its respective underlying index. The use of leverage magnifies a Fund's gains or losses and increases the investment's risk and volatility.

Volatility and Compounding: The goal of leveraged funds is to provide a multiple of the calendar month returns of an underlying index. Over periods longer or shorter than a calendar month, a Fund should not be expected to provide its respective multiple of the return of the underlying index. Due to the effects of compounding – a universal mathematical concept applying to all investments – returns of the Funds over longer periods will differ from the Fund's calendar month stated goal. Periods of high-volatility lacking a clear trend hurt a Fund's performance, while trending low-volatility markets enhance a Fund's performance.

Cost of Financing: In order to attain leveraged exposure, a Bull Fund incurs a cost of LIBOR1 plus or minus a spread, and a Bear Fund receives LIBOR plus or minus a spread as applied to the borrowed portion of the Fund's exposure. Financing costs create a drag on a Bull Fund's performance. Because LIBOR is very low, a Bear Fund receives a negligible amount of financing, or in the case of hard-to-borrow shares, might pay to finance its short position.

Equity Dividends: A Bull Fund's performance is positively impacted by equity and index dividends, as the Funds receive those payments. A Bear Fund's performance is negatively impacted, as they are obligated to pay the dividends.

Fees, Expenses, and Transaction Costs: Fees and expenses are listed in each Fund's prospectus and may be larger than many traditional index funds' fees, causing a greater negative impact on Fund performance. Transactions costs are not included in the expense ratio of the Funds. Transaction costs can be higher due to the Fund's use of leverage, significant purchase and redemption activity by Fund shareholders; or trading securities that are comparatively less liquid.

Market Conditions Affecting Index and Fund Performance:

The unexpected election of Donald Trump as the 45th President of the United States was a dominant theme during the Annual Period. Post-election clarification of the policies of the incoming administration proved to be a global boost to equity markets that would persist largely unimpeded through the end of the Annual Period. Spurred by policies friendly to banks, financial stocks were leaders of the S&P 500® Index into the end of 2016. United States tailwinds led to an improving outlook for global growth, boosting stock performance in Europe and Asia, while the Federal Reserve's move to increase interest rates weighed on some of their currencies as compared to the U.S. Dollar. Into 2017, United States equity markets rallied on positive economic data and a hopeful outlook on topics such as deregulation, infrastructure spending and tax cuts. Favorable monetary policy by global central banks proved a continued boon to global equities during Q1 of 2017.

1 London Inter-Bank Offer Rate. The interest rate that the banks charge each other for loans (usually in Eurodollars). This rate is applicable to the short-term international interbank market, and applies to very large loans borrowed for anywhere from one day to five years.

DIREXION ANNUAL REPORT

7

Through March and April, realization that the U.S. Administration's policy changes would not be instituted as swiftly as originally thought proved to have a sobering effect on equity markets. Investors treated the pullback as a buying opportunity with the prevailing sentiment reverting to speculation that global growth could withstand the political unrest. August 2017 proved to be the opposite of what is typically seen as a quiet month for the market; volatility spiked on the threat of United States war with North Korea, and European stocks were caught in the verbal crossfire, suffering their worst week since November 2016.

The Annual Period saw three Federal Fund rate hikes – December, March and June. The shift away from a zero interest rate policy accelerated as the United States economy continued to show strength. U.S. government bonds saw negative returns during the Annual Period due to a combination of the aforementioned Federal Reserve's monetary tightening and possible fiscal stimulus in the form of infrastructure spending and tax cuts. High Yield bonds did well despite a continued slump in energy names, as the S&P Oil & Gas Exploration and Production Select Industry Index was down significantly for the Annual Period.

Market Volatility Affecting Index and Fund Performance:

During the Annual Period, volatility hit a high on November 4, 2016 and a low July 21, 2017. There were a few small spikes in volatility in September and October 2016 on high trading volume as the results of the Brexit vote and the ensuing uncertainty of its economic implications resonated across the globe. Volatility continued to increase on October 28, 2016 when the FBI sent a letter to congress stating a previously closed Clinton email probe would be reopened. As volatility continued to increase, the November 5, 2016 high can be credited to the final results of the Brexit vote, where the United Kingdom electorate voted to leave the European Union. The subsequent United States presidential election results on November 8, 2016 furthered the short period of heightened volatility. A return to normalcy prevailed into the end of the 2016 year as fear of a Brexit contagion abated, witnessing the largest weekly decline in the history of the VIX Index. A level of lower volatility remained consistent from mid-November through mid-July, where the VIX Index set a record low. April saw a spike in previously protracted lows in volatility on geopolitical concerns and a softening of economic data in the United States. Mid-May saw a pullback in United States equities, and a corresponding jump in volatility, as turmoil from the removal of James Comey as FBI Director spilled over into the markets. Volatility would stay near record lows until August, when President Trump made threatening comments to North Korea. The volatility of each index used as a benchmark for the Funds is below:

| Benchmark | | One-Year Return

Period Ended

August 31, 2017 | | Annualized Volatility | |

NYSE 25 Year Plus Treasury Bond Index1 | | | -14.05 | % | | | 14.27 | % | |

NYSE 25 Year Plus Treasury Bond Index2 | | | 8.69 | % | | | 9.70 | % | |

Solactive High Yield Beta Index | | | 8.12 | % | | | 5.05 | % | |

NASDAQ-100® Index | | | 27.00 | % | | | 11.36 | % | |

S&P 500® Index | | | 16.23 | % | | | 8.34 | % | |

Russell 2000® Index | | | 14.91 | % | | | 14.15 | % | |

ICE U.S. Treasury 7-10 Year Bond Index | | | -1.52 | % | | | 4.69 | % | |

MSCI Emerging Markets IndexSM | | | 24.53 | % | | | 15.65 | % | |

1 September 1, 2016 through November 30, 2016

2 December 1, 2016 through August 31, 2017

DIREXION ANNUAL REPORT

8

As always, we thank you for using the Direxion Funds and we look forward to our mutual success.

Regards,

| |

| |

Eric W. Falkeis | | Patrick Rudnick | |

Principal Executive Officer | | Principal Financial Officer | |

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate and an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. To obtain performance data current to the most recent month-end, please call toll-free, 1.800.851.0511, or visit www.direxioninvestments.com.

An investment in the Funds involves risk, including the possible loss of principal. The Funds are non-diversified and include risks associated with concentration risk which results from the Funds' investments in a particular industry or sector and can increase volatility over time. Active and frequent trading associated with a regular rebalance of the fund can cause the price to fluctuate, therefore impacting its performance compared to other investment vehicles. The Funds are leveraged and include risks associated with being leveraged which include the potential to create a greater negative return had the Fund not employed leverage. For other risks including correlation, compounding, market volatility and specific risks regarding each sector, please read the prospectus. An investment in any of the Direxion Funds is subject to a number of risks that could affect the value of its shares. It is important that investors closely review and understand these risks before making an investment.

An investor should consider the investment objectives, risks, charges and expenses of the Direxion Funds carefully before investing. The prospectus contains this and other information about the Direxion Funds. To obtain a prospectus, please call the Direxion Funds at 1.800.851.0511 or visit www.direxioninvestments.com. The prospectus should be read carefully before investing.

There is no guarantee the Funds will achieve their objective. Investing in funds that track an index may be more volatile than investing in broadly diversified funds. The use of leverage by a Fund means the Funds are riskier than alternatives which do not use leverage.

The views in this report were those of the Adviser as of August 31, 2017 and may not reflect their views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Fund in understanding their investments in the Fund and do not constitute investment advice.

The total annual fund operating expense ratios of the Direxion Monthly 25+ Year Treasury Bull 1.35X Fund, Direxion Monthly 25+ Year Treasury Bear 1.35X Fund, Direxion Monthly High Yield Bull 1.2X Fund, Direxion Monthly NASDAQ-100® Bull 1.25X Fund, Direxion Monthly NASDAQ-100® Bear 1.25X Fund, Direxion Monthly NASDAQ-100® Bull 2X Fund, Direxion Monthly S&P 500® Bull 2X Fund, Direxion Monthly S&P 500® Bear 2X Fund, Direxion Monthly Small Cap Bull 2X Fund, Direxion Monthly Small Cap Bear 2X Fund, Direxion Monthly 7-10 Year Treasury Bull 2X Fund, Direxion Monthly 7-10 Year Treasury Bear 2X and Direxion Monthly Emerging Markets

DIREXION ANNUAL REPORT

9

Bull 2X Fund are 1.24%, 1.23%, 1.76%, 1.32%, 1.28%, 1.50%, 1.49%, 1.51%, 1.51%, 1.52%, 1.51%, 1.50% and 1.50%, respectively.*

Distributed by: Rafferty Capital Markets, LLC

* The total annual fund operating expense ratios of the Direxion Monthly 25+ Year Treasury Bull 1.35X Fund, Direxion Monthly 25+ Year Treasury Bear 1.35X Fund, Direxion Monthly High Yield Bull 1.2X Fund, Direxion Monthly NASDAQ-100® Bull 1.25X Fund, Direxion Monthly NASDAQ-100® Bear 1.25X Fund, Direxion Monthly NASDAQ-100® Bull 2X Fund, Direxion Monthly S&P 500® Bull 2X Fund, Direxion Monthly S&P 500® Bear 2X Fund, Direxion Monthly Small Cap Bull 2X Fund, Direxion Monthly Small Cap Bear 2X Fund, Direxion Monthly 7-10 Year Treasury Bull 2X Fund, Direxion Monthly 7-10 Year Treasury Bear 2X and Direxion Monthly Emerging Markets Bull 2X Fund includes Acquired Fund Fees and Expenses, indirect fees and expenses that the Fund incurs that are required to be disclosed. Without Acquired Fund Fees and Expenses, total annual fund operating expense ratios of the Direxion Monthly 25+ Year Treasury Bull 1.35X Fund and Direxion Monthly 25+ Year Treasury Bear 1.35X Fund, would be 1.10%, respectively. Total annual fund operating expense ratios of the Direxion Monthly NASDAQ-100® Bull 1.25X Fund and Direxion Monthly NASDAQ-100® Bear 1.25X Fund, would be 1.15%, respectively. The total annual fund operating expenses ratios of all other Funds would be 1.35%, respectively.

DIREXION ANNUAL REPORT

10

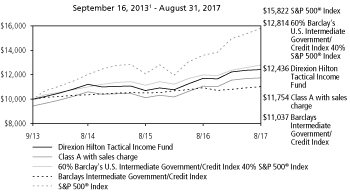

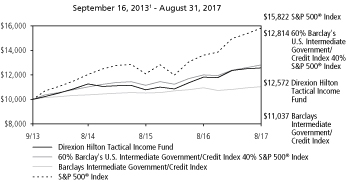

Direxion Monthly High Yield Bull 1.2X Fund

Performance Summary (Unaudited)

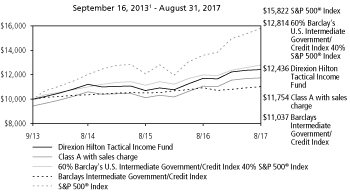

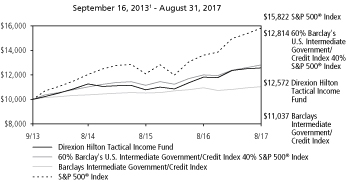

February 17, 20161 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 120% of the price performance of the Solactive High Yield Beta Index.

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Direxion Monthly

High Yield Bull 1.2X Fund | | | 8.08 | % | | | 17.34 | % | |

Solactive High Yield Beta Index | | | 8.12 | % | | | 15.70 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than 120% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund's inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the Solactive High Yield Beta Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure2

Investment Type | | Percent of

Net Assets | |

Investment Companies | | | 79.6 | % | |

Swap Contracts | | | 39.8 | % | |

Total Exposure | | | 119.4 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 Commencement of operations.

2 As of August 31, 2017.

DIREXION ANNUAL REPORT

11

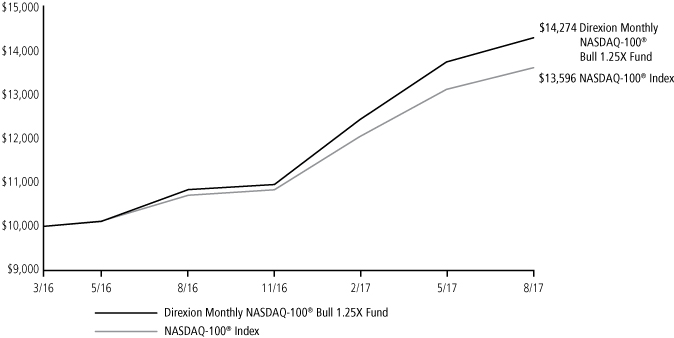

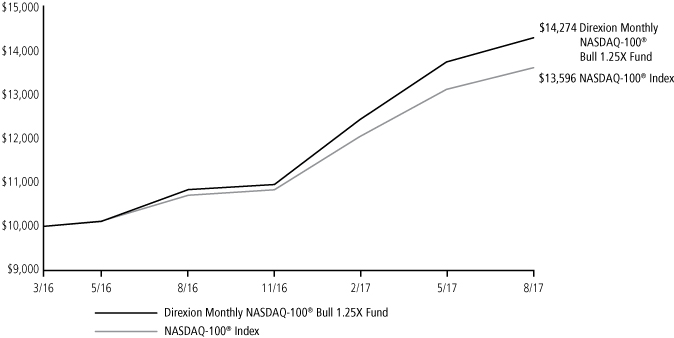

Direxion Monthly NASDAQ-100® Bull 1.25X Fund

Performance Summary (Unaudited)

March 31, 20161 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 125% of the price performance of the NASDAQ-100® Index.

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Direxion Monthly NASDAQ-100®

Bull 1.25X Fund | | | 31.77 | % | | | 28.50 | % | |

NASDAQ-100® Index | | | 27.00 | % | | | 24.16 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of a calendar month will generally receive more, or less, than 125% exposure to the target index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made at the Fund's inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the NASDAQ-100® Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities. During the period shown, Rafferty Asset Management, LLC waived and/or reimbursed fees for various expenses. Had these waivers and/or reimbursements not been in effect, performance would have been lower.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure2

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | 124.7 | % | |

Total Exposure | | | 124.7 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 Commencement of operations.

2 As of August 31, 2017.

DIREXION ANNUAL REPORT

12

Direxion Monthly NASDAQ-100® Bear 1.25X Fund

Performance Summary (Unaudited)

March 31, 20161 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 125% of the inverse of the price performance of the NASDAQ-100® Index.

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Direxion Monthly NASDAQ-100®

Bear 1.25X Fund | | | (26.91 | )% | | | (25.32 | )% | |

NASDAQ-100® Index | | | 27.00 | % | | | 24.16 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of a calendar month will generally receive more, or less, than -125% exposure to the target index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made at the Fund's inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the NASDAQ-100® Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure2

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | (126.2 | )% | |

Total Exposure | | | (126.2 | )% | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 Commencement of operations.

2 As of August 31, 2017.

DIREXION ANNUAL REPORT

13

Direxion Monthly 25+ Year Treasury Bull 1.35X Fund

Performance Summary (Unaudited)

November 2, 20151 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 135% of the price performance of the NYSE 25 Year Plus Treasury Bond Index.

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Direxion Monthly 25+ Year Treasury

Bull 1.35X Fund | | | (9.03 | )% | | | 4.27 | % | |

NYSE 25 Year Plus Treasury Bond Index | | | (6.59 | )% | | | 5.18 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than 135% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund's inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the NYSE 25 Year Plus Treasury Bond Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities. During the period shown, Rafferty Asset Management, LLC waived and/or reimbursed fees for various expenses. Had these waivers and/or reimbursements not been in effect, performance would have been lower.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure2

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | 99.2 | % | |

Futures Contracts | | | 35.8 | % | |

Total Exposure | | | 135.0 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 Commencement of operations.

2 As of August 31, 2017.

DIREXION ANNUAL REPORT

14

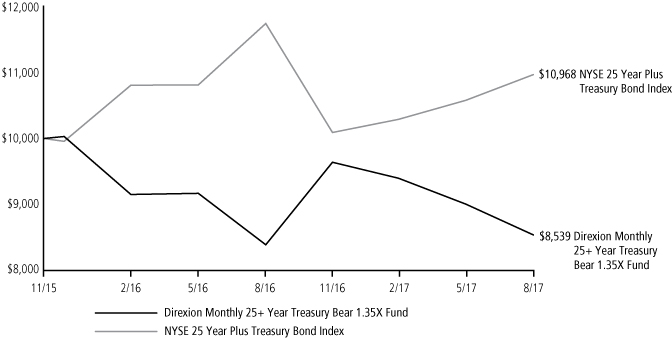

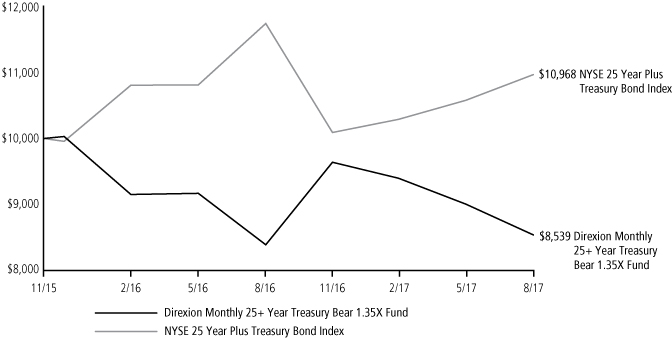

Direxion Monthly 25+ Year Treasury Bear 1.35X Fund

Performance Summary (Unaudited)

November 2, 20151 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 135% of the inverse of the price performance of the NYSE 25 Year Plus Treasury Bond Index.

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Direxion Monthly 25+ Year Treasury

Bear 1.35X Fund | | | 1.77 | % | | | (8.27 | )% | |

NYSE 25 Year Plus Treasury Bond Index | | | (6.59 | )% | | | 5.18 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than -135% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund's inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the NYSE 25 Year Plus Treasury Bond Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities. During the period shown, Rafferty Asset Management, LLC waived and/or reimbursed fees for various expenses. Had these waivers and/or reimbursements not been in effect, performance would have been lower.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure2

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | (135.1 | )% | |

Total Exposure | | | (135.1 | )% | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 Commencement of operations.

2 As of August 31, 2017.

DIREXION ANNUAL REPORT

15

Direxion Monthly NASDAQ-100® Bull 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 200% of the price performance of the NASDAQ-100® Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly NASDAQ-100®

Bull 2X Fund | | | 54.55 | % | | | 26.24 | % | | | 33.96 | % | | | 14.43 | % | |

NASDAQ-100® Index | | | 27.00 | % | | | 15.02 | % | | | 18.18 | % | | | 12.82 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of a calendar month will generally receive more, or less, than 200% exposure to the target index, depending on the performance of the target index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the NASDAQ-100® Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | 200.0 | % | |

Total Exposure | | | 200.0 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

16

Direxion Monthly S&P 500® Bull 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 200% of the price performance of the S&P 500® Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly S&P 500®

Bull 2X Fund | | | 30.33 | % | | | 15.59 | % | | | 26.22 | % | | | 4.02 | % | |

S&P 500® Index | | | 16.23 | % | | | 9.54 | % | | | 14.34 | % | | | 7.61 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of a calendar month will generally receive more, or less, than 200% exposure to the target index, depending on the performance of the target index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the S&P 500® Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fee. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | 200.0 | % | |

Total Exposure | | | 200.0 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

17

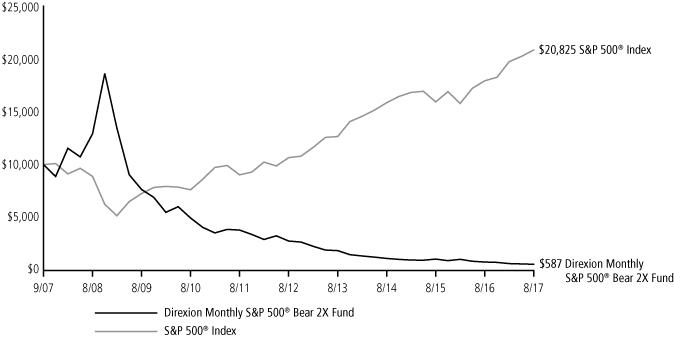

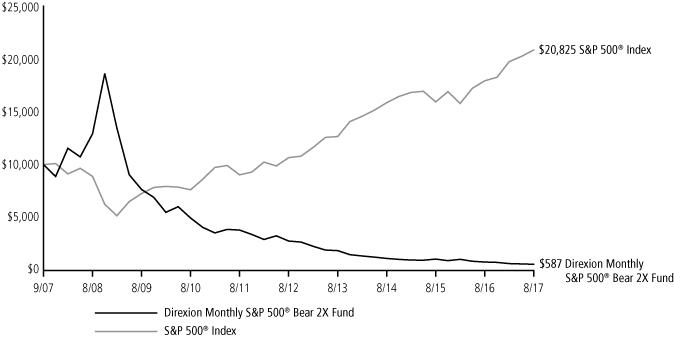

Direxion Monthly S&P 500® Bear 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 200% of the inverse of the price performance of the S&P 500® Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly S&P 500®

Bear 2X Fund | | | (26.54 | )% | | | (19.83 | )% | | | (26.72 | )% | | | (24.68 | )% | |

S&P 500® Index | | | 16.23 | % | | | 9.54 | % | | | 14.34 | % | | | 7.61 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of a calendar month will generally receive more, or less, than -200% exposure to the target index, depending on the performance of the target index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the S&P 500® Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | (200.3 | )% | |

Total Exposure | | | (200.3 | )% | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

18

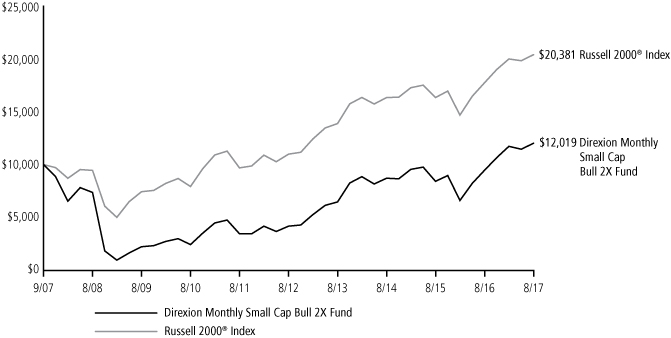

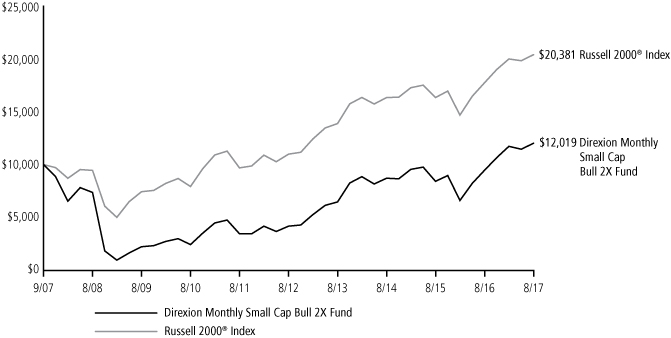

Direxion Monthly Small Cap Bull 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 200% of the price performance of the Russell 2000® Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly Small Cap

Bull 2X Fund | | | 26.88 | % | | | 11.32 | % | | | 23.48 | % | | | 1.86 | % | |

Russell 2000® Index | | | 14.91 | % | | | 7.67 | % | | | 13.15 | % | | | 7.38 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than 200% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the Russell 2000® Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | 202.9 | % | |

Total Exposure | | | 202.9 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

19

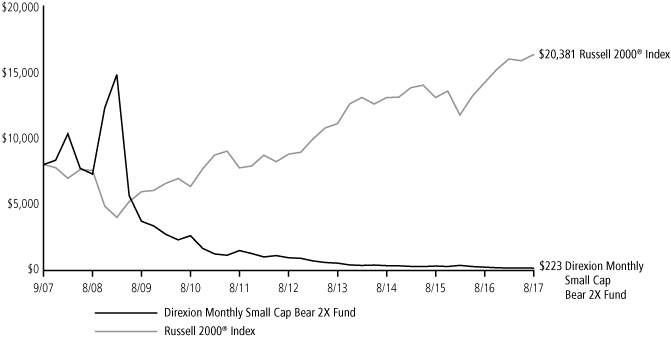

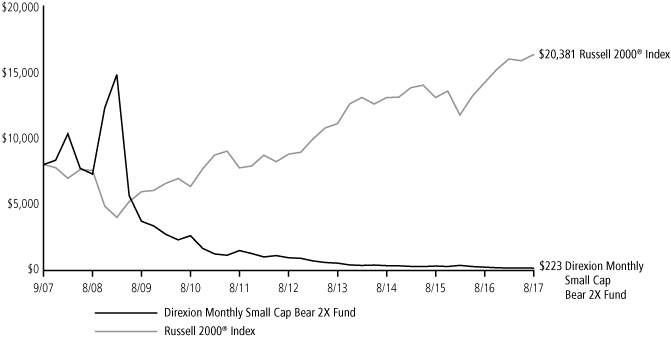

Direxion Monthly Small Cap Bear 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 200% of the inverse of the price performance of the Russell 2000® Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly Small Cap

Bear 2X Fund | | | (29.44 | )% | | | (21.29 | )% | | | (28.62 | )% | | | (31.63 | )% | |

Russell 2000® Index | | | 14.91 | % | | | 7.67 | % | | | 13.15 | % | | | 7.38 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than -200% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the Russell 2000® Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | (200.1 | )% | |

Total Exposure | | | (200.1 | )% | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

20

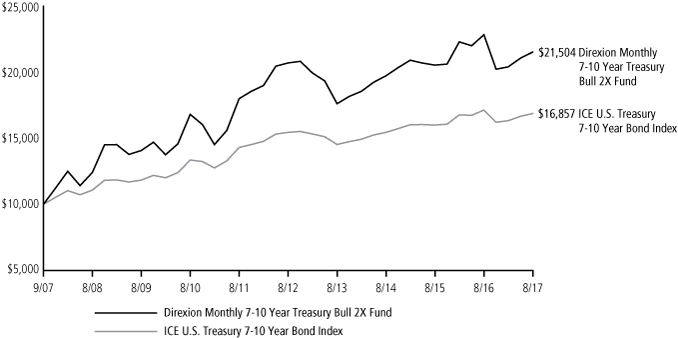

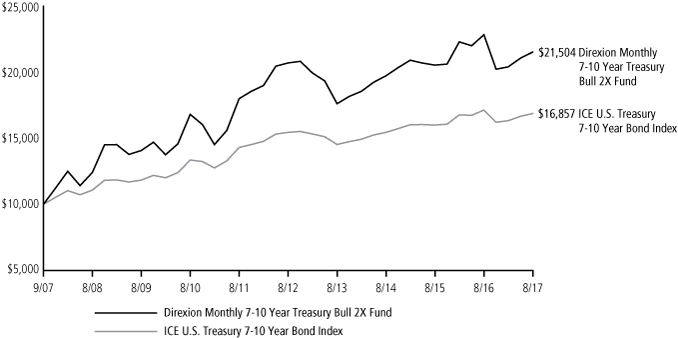

Direxion Monthly 7-10 Year Treasury Bull 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: The Direxion Monthly 7-10 Year Treasury Bull 2X Fund seeks monthly investment results, before fees and expenses, of 200% of the calendar month performance of the ICE U.S. Treasury 7-10 Year Bond Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly 7-10 Year Treasury Bull 2X Fund | | | (5.66 | )% | | | 2.95 | % | | | 0.79 | % | | | 7.96 | % | |

ICE U.S. Treasury 7-10 Year Bond Index | | | (1.52 | )% | | | 2.98 | % | | | 1.78 | % | | | 5.36 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than 200% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the ICE U.S. Treasury 7-10 Year Bond Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | 200.0 | % | |

Total Exposure | | | 200.0 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

21

Direxion Monthly 7-10 Year Treasury Bear 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: The Direxion Monthly 7-10 Year Treasury Bear 2X Fund seeks monthly investment results, before fees and expenses, of 200% of the inverse of the calendar month performance of the ICE U.S. Treasury 7-10 Year Bond Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly 7-10 Year Treasury Bear 2X Fund | | | 1.25 | % | | | (8.22 | )% | | | (6.18 | )% | | | (13.56 | )% | |

ICE U.S. Treasury 7-10 Year Bond Index | | | (1.52 | )% | | | 2.98 | % | | | 1.78 | % | | | 5.36 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than -200% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the ICE U.S. Treasury 7-10 Year Bond Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

| | | Percent of | |

Investment Type | | Net Assets | |

Swap Contracts | | | (200.3 | )% | |

Total Exposure | | | (200.3 | )% | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

22

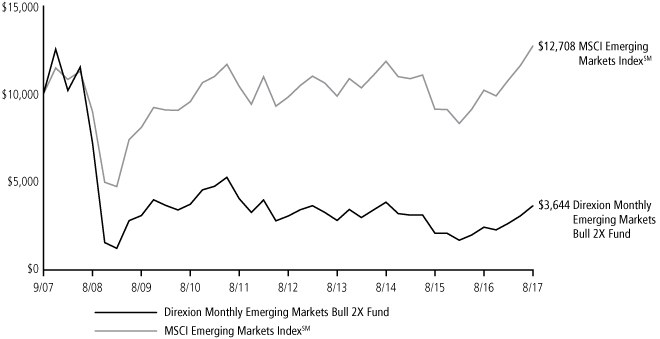

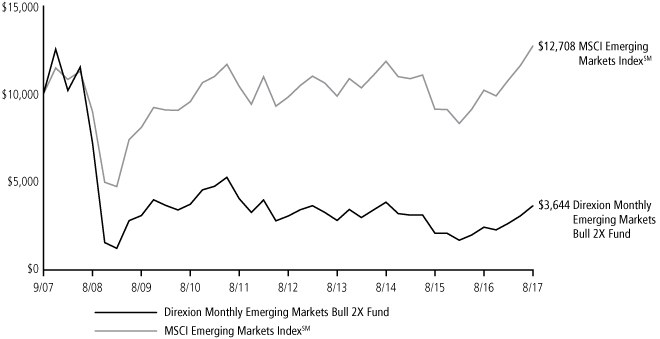

Direxion Monthly Emerging Markets Bull 2X Fund

Performance Summary (Unaudited)

September 1, 2007 - August 31, 2017

Investment Objective: Seeks monthly investment results, before fees and expenses, of 200% of the price performance of the MSCI Emerging Markets Index.

| | | Average Annual Total Return1 | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | |

Direxion Monthly Emerging

Markets Bull 2X Fund | | | 49.73 | % | | | (1.83 | )% | | | 3.50 | % | | | (9.60 | )% | |

MSCI Emerging Markets IndexSM | | | 24.53 | % | | | 2.38 | % | | | 5.30 | % | | | 2.43 | % | |

The Fund seeks calendar month leveraged investment results, which should not be equated with seeking a leveraged goal for shorter than a calendar month. An investor who purchases shares on a day other than the last business day of the calendar month will generally receive more, or less, than 200% exposure to its index. Other factors such as fees and expenses, high portfolio turnover, transaction costs, significant purchases and redemption activity by Fund shareholders and/or a temporary lack of liquidity in the markets for the securities held by the Fund may also cause the Fund's investment results to vary from its stated objective.

This chart illustrates the performance of a hypothetical $10,000 investment made ten years ago, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the MSCI Emerging Markets IndexSM does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure1

Investment Type | | Percent of

Net Assets | |

Swap Contracts | | | 201.8 | % | |

Total Exposure | | | 201.8 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 As of August 31, 2017.

DIREXION ANNUAL REPORT

23

Expense Example (Unaudited)

August 31, 2017

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (March 1, 2017 – August 31, 2017).

Actual Expenses

The first line under each Fund in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as wire transfers, returned checks or stop payment orders. Therefore, the second line under each Fund in the table is useful in comparing ongoing Fund costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

DIREXION ANNUAL REPORT

24

Expense Example (Unaudited)

August 31, 2017

| | | Annualized

Expense

Ratio | | Beginning

Account Value

March 1, 2017 | | Ending

Account Value

August 31, 2017 | | Expenses

Paid During

Period* | |

Direxion Monthly High Yield Bull 1.2X Fund | |

Based on actual fund return | | | 1.35 | % | | $ | 1,000.00 | | | $ | 1,026.50 | | | $ | 6.90 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly NASDAQ-100® Bull 1.25X Fund | |

Based on actual fund return | | | 1.15 | % | | | 1,000.00 | | | | 1,149.90 | | | | 6.23 | | |

Based on hypothetical 5% return | | | 1.15 | % | | | 1,000.00 | | | | 1,019.41 | | | | 5.85 | | |

Direxion Monthly NASDAQ-100® Bear 1.25X Fund | |

Based on actual fund return | | | 1.15 | % | | | 1,000.00 | | | | 854.90 | | | | 5.38 | | |

Based on hypothetical 5% return | | | 1.15 | % | | | 1,000.00 | | | | 1,019.41 | | | | 5.85 | | |

Direxion Monthly 25+ Year Treasury Bull 1.35X Fund | |

Based on actual fund return | | | 1.08 | % | | | 1,000.00 | | | | 1,071.70 | | | | 5.64 | | |

Based on hypothetical 5% return | | | 1.08 | % | | | 1,000.00 | | | | 1,019.76 | | | | 5.50 | | |

Direxion Monthly 25+ Year Treasury Bear 1.35X Fund | |

Based on actual fund return | | | 1.10 | % | | | 1,000.00 | | | | 908.60 | | | | 5.29 | | |

Based on hypothetical 5% return | | | 1.10 | % | | | 1,000.00 | | | | 1,019.66 | | | | 5.60 | | |

Direxion Monthly NASDAQ-100® Bull 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 1,247.40 | | | | 7.65 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly S&P 500® Bull 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 1,095.90 | | | | 7.13 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly S&P 500® Bear 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 900.60 | | | | 6.47 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly Small Cap Bull 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 1,025.20 | | | | 6.89 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly Small Cap Bear 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 953.40 | | | | 6.65 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly 7-10 Year Treasury Bull 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 1,055.10 | | | | 6.99 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly 7-10 Year Treasury Bear 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 932.90 | | | | 6.58 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

Direxion Monthly Emerging Markets Bull 2X Fund | |

Based on actual fund return | | | 1.35 | % | | | 1,000.00 | | | | 1,377.10 | | | | 8.09 | | |

Based on hypothetical 5% return | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | | |

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 days (the number of days in the period of March 1, 2017 to August 31, 2017), then divided by 365.

DIREXION ANNUAL REPORT

25

Allocation of Portfolio Holdings (Unaudited)

August 31, 2017

| | | Cash* | | Investment

Companies | | Futures | | Swaps | | Total | |

Direxion Monthly High Yield Bull 1.2X Fund | | | 20 | % | | | 80 | % | | | — | | | | 0 | %** | | | 100 | % | |

Direxion Monthly NASDAQ-100® Bull 1.25X Fund | | | 98 | % | | | — | | | | — | | | | 2 | % | | | 100 | % | |

Direxion Monthly NASDAQ-100® Bear 1.25X Fund | | | 104 | % | | | — | | | | — | | | | (4 | )% | | | 100 | % | |

Direxion Monthly 25+ Year Treasury Bull 1.35X Fund | | | 98 | % | | | — | | | | 0 | %** | | | 2 | % | | | 100 | % | |

Direxion Monthly 25+ Year Treasury Bear 1.35X Fund | | | 103 | % | | | — | | | | — | | | | (3 | )% | | | 100 | % | |

Direxion Monthly NASDAQ-100® Bull 2X Fund | | | 94 | % | | | — | | | | — | | | | 6 | % | | | 100 | % | |

Direxion Monthly S&P 500® Bull 2X Fund | | | 98 | % | | | — | | | | — | | | | 2 | % | | | 100 | % | |

Direxion Monthly S&P 500® Bear 2X Fund | | | 105 | % | | | — | | | | — | | | | (5 | )% | | | 100 | % | |

Direxion Monthly Small Cap Bull 2X Fund | | | 100 | % | | | — | | | | — | | | | 0 | %** | | | 100 | % | |

Direxion Monthly Small Cap Bear 2X Fund | | | 102 | % | | | — | | | | — | | | | (2 | )% | | | 100 | % | |

Direxion Monthly 7-10 Year Treasury Bull 2X Fund | | | 98 | % | | | — | | | | — | | | | 2 | % | | | 100 | % | |

Direxion Monthly 7-10 Year Treasury Bear 2X Fund | | | 102 | % | | | — | | | | — | | | | (2 | )% | | | 100 | % | |

Direxion Monthly Emerging Markets Bull 2X Fund | | | 98 | % | | | — | | | | — | | | | 2 | % | | | 100 | % | |

Allocation of Portfolio Holdings reflects percentages of net assets.

* Cash and other assets less liabilities.

** Percentage is less than 0.5%.

DIREXION ANNUAL REPORT

26

Direxion Monthly High Yield Bull 1.2X Fund

Schedule of Investments

August 31, 2017

Shares | | | | Fair Value | |

INVESTMENT COMPANIES - 79.6% | | | |

| | 1,212,277 | | | iShares iBoxx $ High Yield

Corporate Bond ETF | | $ | 107,407,742 | | |

| | 704,973 | | | PIMCO 0-5 Year High Yield

Corporate Bond Index ETF | | | 71,674,605 | | |

| | 2,883,403 | | | SPDR® Barclays High Yield

Bond ETF | | | 107,435,596 | | |

| | | | | TOTAL INVESTMENT COMPANIES

(Cost $279,709,910) | | $ | 286,517,943 | | |

SHORT TERM INVESTMENTS - 4.4% | | | |

Money Market Funds - 4.4% | | | |

| | 15,710,000 | | | Fidelity Investments Money

Market Government

Portfolio, 0.93% (a)(b) | | $ | 15,710,000 | | |

| | | | | TOTAL SHORT TERM

INVESTMENTS

(Cost $15,710,000) | | $ | 15,710,000 | | |

| | | | | TOTAL INVESTMENTS

(Cost $295,419,910) - 84.0% | | $ | 302,227,943 | | |

| | | | | Other Assets in Excess of

Liabilities - 16.0% | | | 57,448,748 | | |

| | | | | TOTAL NET ASSETS - 100.0% | | $ | 359,676,691 | | |

Percentages are stated as a percent of net assets.

(a) Represents annualized seven-day yield at August 31, 2017.

(b) All or a portion of this security has been segregated as collateral for swap contracts. Total value of amount segregated is $15,710,000.

Long Total Return Swap Contracts

August 31, 2017

Terms of Payments

to be Received at

Termination | | Terms of Payments

to be Paid (Received) at

Termination | | Counterparty | | Termination

Date | | Contracts | | Notional

Amount | | Unrealized

Appreciation

(Depreciation) | |

Total return of iShares

iBoxx $ High Yield

Corporate Bond ETF | | (0.2217)% representing

1 month LIBOR rate + spread | | Credit Suisse

International | | 9/21/2018 | | | 404,094 | | | $ | 35,635,065 | | | $ | 193,313 | | |

Total return of PIMCO

0-5 Year High Yield

Corporate Bond Index ETF | | 1.6783% representing

1 month LIBOR rate + spread | | Credit Suisse

International | | 9/21/2018 | | | 704,973 | | | | 71,396,446 | | | | 255,889 | | |

Total return of SPDR®

Barclays High Yield

Bond ETF | | 0.9383% representing

1 month LIBOR rate + spread | | Credit Suisse

International | | 9/21/2018 | | | 961,167 | | | | 35,657,546 | | | | 160,027 | | |

| | | | | | | | | | | $ | 142,689,057 | | | $ | 609,229 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

27

Direxion Monthly NASDAQ-100® Bull 1.25X Fund

Schedule of Investments

August 31, 2017

Shares | | | | Fair Value | |

SHORT TERM INVESTMENTS - 25.3% | |

Money Market Funds - 25.3% | |

| | 8,640,000 | | | Fidelity Investments Money

Market Government

Portfolio, 0.93% (a)(b) | | $ | 8,640,000 | | |

| | | TOTAL SHORT TERM

INVESTMENTS

(Cost $8,640,000) | | $ | 8,640,000 | | |

| | | TOTAL INVESTMENTS

(Cost $8,640,000) - 25.3% | | $ | 8,640,000 | | |

| | | Other Assets in Excess of

Liabilities - 74.7% | | | 25,552,731 | | |

| | | TOTAL NET ASSETS - 100.0% | | $ | 34,192,731 | | |

Percentages are stated as a percent of net assets.

(a) Represents annualized seven-day yield at August 31, 2017.

(b) All or a portion of this security has been segregated as collateral for swap contracts. Total value of amount segregated is $8,640,000.

Long Total Return Swap Contracts

August 31, 2017

Terms of Payments

to be Received at

Termination | | Terms of Payments

to be Paid at

Termination | | Counterparty | | Termination

Date | | Contracts | | Notional

Amount | | Unrealized

Appreciation

(Depreciation) | |

Total return of

NASDAQ-100® Index | | 1.6306% - 1.6389% representing

1 month LIBOR rate + spread | | Bank of America

Merrill Lynch | | 9/25/2018 | | | 5,899 | | | $ | 34,549,701 | | | $ | 770,459 | | |

Total return of

NASDAQ-100® Index | | 1.6317% representing

1 month LIBOR rate + spread | | Bank of America

Merrill Lynch | | 10/26/2018 | | | 45 | | | | 267,007 | | | | 2,468 | | |

Total return of

NASDAQ-100® Index | | 1.6317% representing

1 month LIBOR rate + spread | | Bank of America

Merrill Lynch | | 10/26/2018 | | | 1,178 | | | | 7,055,281 | | | | (706 | ) | |

| | | | | | | | | | | $ | 41,871,989 | | | $ | 772,221 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

28

Direxion Monthly NASDAQ-100® Bear 1.25X Fund

Schedule of Investments

August 31, 2017

| | | | | Fair Value | |

No reportable investments. | |

| | | | | TOTAL INVESTMENTS

(Cost $—) - 0.0% | | $ | — | | |

| | | Other Assets in Excess of

Liabilities - 100.0% | | | 175,695 | | |

| | | TOTAL NET ASSETS - 100.0% | | $ | 175,695 | | |

Percentages are stated as a percent of net assets.

Short Total Return Swap Contracts

August 31, 2017

Terms of Payments

to be Received at

Termination | | Terms of Payments

to be Paid at

Termination | | Counterparty | | Termination

Date | | Contracts | | Notional

Amount | | Unrealized

Appreciation

(Depreciation) | |

1.0806% representing

1 month LIBOR rate + spread | | Total return of

NASDAQ-100® Index | | Bank of America

Merrill Lynch | | 8/28/2018 | | | 24 | | | $ | 138,262 | | | $ | (5,542 | ) | |

1.0806% representing

1 month LIBOR rate + spread | | Total return of

NASDAQ-100® Index | | Bank of America

Merrill Lynch | | 9/25/2018 | | | 10 | | | | 58,970 | | | | (949 | ) | |

1.0806% representing

1 month LIBOR rate + spread | | Total return of

NASDAQ-100® Index | | Bank of America

Merrill Lynch | | 10/26/2018 | | | 3 | | | | 17,585 | | | | (380 | ) | |

| | | | | | | | | | | | | $ | 214,817 | | | $ | (6,871 | ) | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

29

Direxion Monthly 25+ Year Treasury Bull 1.35X Fund

Schedule of Investments

August 31, 2017

Shares | | | | Fair Value | |

SHORT TERM INVESTMENTS - 15.1% | |

Money Market Funds - 15.1% | |

| | 2,990,000 | | | Fidelity Investments

Money Market

Government

Portfolio, 0.93% (a)(b) | | $ | 2,990,000 | | |

| | | TOTAL SHORT TERM

INVESTMENTS

(Cost $2,990,000) | | $ | 2,990,000 | | |

| | | TOTAL INVESTMENTS

(Cost $2,990,000) - 15.1% | | $ | 2,990,000 | | |

| | | Other Assets in Excess of

Liabilities - 84.9% | | | 16,849,141 | | |

| | | TOTAL NET ASSETS - 100.0% | | $ | 19,839,141 | | |

Percentages are stated as a percent of net assets.

(a) Represents annualized seven-day yield at August 31, 2017.

(b) All or a portion of this security has been segregated as collateral for swap contracts. Total value of amount segregated is $2,990,000.

Long Futures Contracts

August 31, 2017

| Reference Entity | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) | |

Ultra U.S. Treasury Bond | | 12/19/2017 | | | 42 | | | $ | 7,100,625 | | | $ | — | | | $ | (158 | ) | |

Long Total Return Swap Contracts

August 31, 2017

Terms of Payments

to be Received at

Termination | | Terms of Payments

to be Paid at

Termination | | Counterparty | | Termination

Date | | Contracts | | Notional

Amount | | Unrealized

Appreciation

(Depreciation) | |

Total return of

iShares 20+ Year

Treasury Bond ETF | | 0.8483% representing

1 month LIBOR rate + spread | | Credit Suisse