Exhibit 13

Financial Highlights(a)

| | | | | | | | | | | | | | | | | | | |

Years Ended December 31 | | 2006 | | | 2005 | | | 2004 | | 2003 | | | 2002 | |

| (In thousands, except per share and employee data) | | | | | | | | | | | | | | |

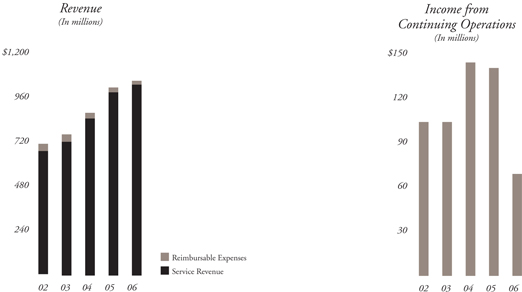

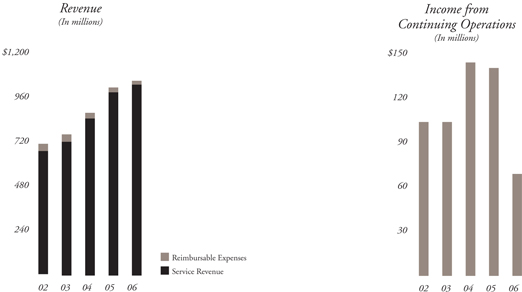

Service revenue | | $ | 1,032,114 | | | $ | 985,702 | | | $ | 847,258 | | $ | 720,657 | | | $ | 669,246 | |

Reimbursable expenses | | | 22,878 | | | | 28,056 | | | | 34,280 | | | 45,395 | | | | 38,520 | |

| | | | | | | | | | | | | | | | | | | |

Total revenue | | | 1,054,992 | | | | 1,013,758 | | | | 881,538 | | | 766,052 | | | | 707,766 | |

Operating income(b) | | | 128,316 | | | | 235,339 | | | | 235,085 | | | 172,157 | | | | 176,533 | |

Stock option expense included in operating income above | | | (15,401 | ) | | | — | | | | — | | | — | | | | — | |

Other charges included in operating income above(b) | | | (123,035 | ) | | | (28,773 | ) | | | — | | | (30,942 | ) | | | (7,342 | ) |

Income from continuing operations | | | 68,775 | | | | 139,524 | | | | 143,809 | | | 104,164 | | | | 103,982 | |

EPS from continuing operations, diluted | | | .81 | | | | 1.52 | | | | 1.58 | | | 1.16 | | | | 1.17 | |

Total assets | | | 1,346,092 | | | | 1,462,976 | | | | 1,287,476 | | | 1,021,284 | | | | 979,010 | |

Debt | | | 415,039 | | | | 130,057 | | | | 50,100 | | | 52,029 | | | | 182,446 | |

Total shareholders’ equity | | | 666,987 | | | | 1,020,874 | | | | 983,659 | | | 790,495 | | | | 622,607 | |

Employees (full-time equivalents) | | | 5,100 | | | | 5,000 | | | | 4,600 | | | 3,700 | | | | 4,400 | |

| | | | | | | | | | | | | | | | | | | |

| (a) | All financial information reflects the stock split paid in the form of a stock dividend effective June 6, 2002 and excludes the following discontinued operations: |

| | 1. | CP Commercial Specialists, sold on February 28, 2003, |

| | 2. | Priority Data Systems, sold on September 29, 2006, |

| | 3. | Bode Labs, EquiSearch and certain businesses in the Financial and Professional Services segment, all of which were held for sale and qualify as discontinued operations at December 31, 2006. |

| (b) | Operating income includes other charges that management excludes in its assessments of operating results. These charges for 2006 consist of approximately $117.6 million recorded for asset impairment charges, expenses related to the fraudulent data access, and severance and lease abandonment charges associated with the centralization of functions and consolidation of certain technology platforms. In addition, other charges include approximately $5.5 million of accelerated depreciation expense. |

ChoicePoint was formed in 1997 as a publicly-held company whose core business was providing support to the insurance industry. Since that time, we have grown steadily by extending the fundamental operating model of our insurance business into other markets. We employ more than 5,100 associates in five business segments: Insurance Services, Screening & Authentication Services, Financial and Professional Services, Government Services and Marketing Services. ChoicePoint is headquartered in the Atlanta suburb of Alpharetta, and its common stock trades on the New York Stock Exchange under the symbol CPS.

FORWARD-LOOKING STATEMENTS

This Annual Report to Shareholders contains forward-looking statements, and actual results could differ materially. Words or phrases such as “we expect,” “we anticipate,” or similar expressions are intended to identify forward-looking statements. Risks that could cause actual results to differ are set forth in the “Risk Factors” section and throughout ChoicePoint’s Annual Report on Form 10-K for the year ended December 31, 2006.

| | | | | | |

| CONTENTS | | | | | | |

Business Segment Overview | | Foldout | | Building Trust Through Transparency | | 17 |

To Our Fellow Shareholders | | 3 | | Board of Directors and Elected Officers | | 20 |

Growth: Building From Within | | 9 | | 2006 Financial Review | | 21 |

Capital Ideas for Shareholder Value | | 13 | | Shareholder Information | | 67 |

Board of Directors and Elected Officers

CHOICEPOINT 2006 ANNUAL REPORT

Left to right: Kenneth G. Langone, John B. McCoy, Dr. John J. Hamre, E. Renae Conley, Ray M. Robinson, Doug C. Curling, Derek V. Smith, M. Anne Szostak, Terrence Murray and Charles I. Story.

| | | | | | |

| Board of Directors | | | | | | |

| Derek V. Smith1* | | Kenneth G. Langone1, 5* | | Charles I. Story1, 2 |

| Chairman and Chief Executive Officer | | Chairman, President, and | | President |

| ChoicePoint Inc. | | Chief Executive Officer | | ECS Group, Inc. |

| Director Since 1997 | | Invemed Associates LLC | | Director Since 1997 |

| | Director Since 2000 | | |

| Doug C. Curling3 | | | | M. Anne Szostak4, 5 |

| President and Chief Operating Officer | | John B. McCoy2*, 4, 5 | | President and Chief Executive Officer |

| ChoicePoint Inc. | | Retired Chairman | | Szostak Partners, LLC |

| Director Since 2000 | | Bank One Corporation | | Director Since 2005 |

| | Director Since 2003 | | | | |

| E. Renae Conley2 | | | | | | |

| President and Chief Executive Officer | | Terrence Murray1, 4*, 5 | | | | |

| Entergy Louisiana, LLC | | Retired Chairman | | Board Committees |

| President and Chief Executive Officer | | FleetBoston | | 1. | | Executive Committee |

| Entergy Gulf States, Inc. – Louisiana | | Financial Corporation | | 2. | | Audit Committee |

| Director Since 2006 | | Director Since 2002 | | 3. | | Privacy & Public |

| | | | | | Responsibility Committee |

| Dr. John J. Hamre3*, 5 | | Ray M. Robinson3 | | 4. | | Management Compensation & |

| President and Chief Executive Officer | | Vice Chairman | | | | Benefits Committee |

| Center for Strategic and | | East Lake Community Foundation | | 5. | | Corporate Governance & |

| International Studies | | President Emeritus | | | | Nominating Committee |

| Director Since 2002 | | East Lake Golf Club | | *Denotes Committee Chairperson |

| | Director Since 2004 | | | | |

| Elected Officers | | | | | | |

| Derek V. Smith | | Steven W. Surbaugh | | Jeffery J. Glazer |

| Chairman and | | Chief Administrative Officer | | Senior Vice President |

| Chief Executive Officer | | Joined Company 2002 | | Joined Company 1997* |

| Joined Company 1997* | | | | | | |

| | David E. Trine | | David W. Davis |

| Doug C. Curling | | Chief Financial Officer | | Corporate Secretary and |

| President and Chief Operating Officer | | Joined Company 1997* | | Senior Vice President – |

| Joined Company 1997* | | | | Government Affairs |

| | Carol A. DiBattiste | | Joined Company 2003 |

| David T. Lee | | General Counsel and Chief Privacy Officer | | |

| Chief Business Officer | | Joined Company 2005 | | John M. Mongelli |

| Joined Company 1997* | | | | Treasurer and Vice President – |

| | | | Investor Relations |

| | | | Joined Company 2000 |

| | |

| | | | * Also member of the ChoicePoint senior management team prior to the Spinoff in 1997. |

20 CHOICEPOINT 2006 ANNUAL REPORT

ChoicePoint 2006 Annual Report

| | |

|

| Management’s Discussion and Analysis 22 |

|

| Management’s Report on Internal Control Over Financial Reporting 36 |

|

| Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting 37 |

|

| Report of Independent Registered Public Accounting Firm 38 |

|

| Consolidated Statements of Income 39 |

|

| Consolidated Balance Sheets 40 |

|

| Consolidated Statements of Shareholders’ Equity 41 |

|

| Consolidated Statements of Cash Flows 42 |

|

| Notes to Consolidated Financial Statements 43 |

| |

| Shareholder Information 67 | | |

ChoicePoint is committed to full disclosure of its accounting policies. Shareholders who have any questions or concerns about corporate policies, governance and/or disclosure are encouraged to contact the Company’s Investor Relations office. ChoicePoint has established a toll-free telephone number to receive complaints about accounting, internal accounting controls, auditing or other legitimate concerns anonymously. The whistleblower hotline number is 800-762-0056.

CHOICEPOINT 2006 ANNUAL REPORT21

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

Overview

During the past nine years, ChoicePoint Inc. (“ChoicePoint,” “we,” “our,” “us” or “the Company”) has transformed from a predominantly manually-driven and customer-focused asset base into the diversified, technology-driven, data-intensive business it is today. This transformation, coupled with focused execution, has enabled the Company to deliver strong growth in revenue, earnings and cash flows. Given our unique data, analytical and distribution capabilities, ChoicePoint is a leading provider of identification and credential verification services for making smarter decisions in a world challenged by increased risks. Serving the needs of business, government, non-profit organizations and individuals, ChoicePoint works to create a safer and more secure society through the responsible use of information while working diligently to protect personal privacy. For more information, visit the Company’s Web site at www.choicepoint.com.

Across our markets, we compete on data, analytics and distribution. A significant majority of our revenue streams are transaction-based, earning revenue each time our databases are accessed and further promoting the scalability of our products and services. The fundamentals that drive revenues are numerous and varied across and within our business segments. Generally, the Company’s primary growth drivers are new customers, increased penetration of new products, expansion into new markets and acquisitions.

On July 10, 2006, the Company announced its intent to divest various businesses, including its forensic DNA (“Bode”) and shareholder services businesses (“EquiSearch”), as a result of a company-wide strategic review. Additionally, on September 29, 2006, the Company announced the sale of Priority Data Systems, a comparative rating software solutions business (“Priority Data”), to the parent company of AMS Services. On October 24, 2006, the Company announced its intent to sell additional non-strategic businesses, later disclosed to be part of its public records operations, specifically the businesses that collect bankruptcy, lien and judgment (“BLJ”) records and provide them on a wholesale, bulk basis. For all periods presented, these businesses are presented as discontinued operations consistent with the Company’s decision to sell these businesses. Consequently, the results of these discontinued operations for such completed fiscal years are reflected in the Company’s Consolidated Statements of Income as discontinued operations. Cash flows related to discontinued operations are stated separately from cash flows related to continuing operations by category in the Consolidated Statements of Cash Flows. The results of Bode, EquiSearch, BLJ and Priority Data in all prior periods presented has been reclassified to conform to the 2006 classification. As a result, and unless specifically stated, all discussions regarding the years ended December 31, 2006, 2005, and 2004 reflect results only from continuing operations.

| | | | | | | | | | | | | | | |

(In thousands) | | 2006 | | Change | | | 2005 | | Change | | | 2004 |

Service revenue | | $ | 1,032,114 | | 5 | % | | $ | 985,702 | | 16 | % | | $ | 847,258 |

Reimbursable expenses per EITF 01-14 | | | 22,878 | | | | | | 28,056 | | | | | | 34,280 |

| | | | | | | | | | | | | | | |

Total revenue | | $ | 1,054,992 | | 4 | % | | $ | 1,013,758 | | 15 | % | | $ | 881,538 |

| | | | | | | | | | | | | | | |

22 CHOICEPOINT 2006 ANNUAL REPORT

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

Comparison of 2006 with 2005 Consolidated Results

Revenue

Total revenue grew 4%, or $41.2 million, to $1.1 billion in 2006. Service revenue, which excludes revenue from reimbursable expenses per EITF 01-14, (see Note 3 to the accompanying consolidated financial statements for the year ended December 31, 2006 (the “Consolidated Financial Statements”)), grew 5%, or $46.4 million, to $1.0 billion in 2006. Revenue growth in 2006 was driven by consistent growth in our Insurance Services products; strong performances in our background screening and vital records businesses in our Screening and Authentication Services segment; and improvements in our market penetration in the Government Services segment. Revenue growth is also attributable to six 2006 acquisitions and the full year impact of three 2005 acquisitions. This revenue growth was offset slightly by declines in our online public filings and real estate-related services in our Financial and Professional Services segment and the lower spending by larger clients in the mortgage industry in our Marketing Services segment. Internal revenue (which excludes $11.9 million of revenue from acquisitions) increased 4% from 2005 to 2006.

Cost of Service Revenue

In 2006, cost of service revenue was $541.9 million, or 53% of service revenue, as compared to $505.9 million, or 51% of service revenue in 2005. The increase in cost of service revenue as a percentage of service revenue is primarily due to the recognition of stock option expense of $4.3 million during 2006 as a result of the adoption of Statement of Financial Accounting Standards (“SFAS”) No. 123(R), Share-Based Payment (“SFAS 123(R)”), on January 1, 2006, and $5.5 million of accelerated depreciation expense recorded in the first quarter of 2006 in connection with the consolidation of certain technology platforms.

Selling, General and Administrative Expenses

Selling, general and administrative expenses (“SG&A”) increased to $244.3 million, or 24% of service revenue in 2006, from $215.6 million, or 22% of service revenue, in 2005. The increase in SG&A expenses as a percentage of service revenue is primarily due to the recognition of $11.1 million of additional stock option expense as a result of the adoption of SFAS 123(R) on January 1, 2006.

Other Operating Charges

Other operating charges include the following:

| | | | | | | | | |

| | | Year Ended December 31, |

(In thousands) | | 2006 | | 2005 | | 2004 |

Net Marketing Services segment impairment | | $ | 99,400 | | $ | — | | $ | — |

Other asset impairments | | | 10,720 | | | — | | | — |

Lease abandonment and severance | | | 3,943 | | | 1,472 | | | — |

Fraudulent data access related expense | | | 3,509 | | | 27,301 | | | — |

| | | | | | | | | |

Total other operating charges | | $ | 117,572 | | $ | 28,773 | | $ | — |

| | | | | | | | | |

Of total other operating charges recorded in 2006, $99.4 million represents the asset impairment charge related to the Company’s Marketing Services segment. In addition, as part of the previously announced strategic review, the Company recorded additional asset impairment, lease abandonment and severance charges totaling $14.7 million primarily related to the centralization of functions and consolidation of certain technology platforms. Also, an additional $3.5 million was recorded for legal fees and other professional fees associated with the fraudulent data access previously disclosed in the Company’s filings with the Securities and Exchange Commission (the “SEC”).

During 2005, the Company recorded other operating charges of $28.8 million that included a pre-tax charge of $8.0 million for the settlement reached with the Federal Trade Commission (“FTC”) in January 2006, $19.3 million for specific legal expenses and other professional fees related to the fraudulent data access and $1.5 million for lease abandonment charges related to the consolidation of two facilities. The terms of the settlement agreement with the FTC required a non-tax deductible civil penalty of $10 million, the establishment of a $5 million fund to be administered by the FTC for consumer redress initiatives, completion of certain one-time and ongoing customer credentialing activities, such as additional site visits, and undertaking additional obligations relating to information security. The settlement also requires ChoicePoint to obtain, every two years for the next 20 years, an assessment from a qualified, independent, third-party professional to ensure that its information security program meets the standards of the order.

The $8.0 million charge for the FTC settlement consisted of the $10.0 million civil penalty, the $5.0 million fund for consumer redress initiatives, a $4.0 million charge for additional obligations under the order, offset by the

CHOICEPOINT 2006 ANNUAL REPORT23

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

$11.0 million recovery of these fees received from the Company’s insurance carrier during the first quarter of 2006. A total of $28.7 million, which includes the $19.0 million for the FTC settlement, was recorded as an other current liability in the December 31, 2005 Consolidated Balance Sheet. The $11.0 million insurance receivable related to the FTC settlement was included in other current assets in the December 31, 2005 Consolidated Balance Sheet.

The Company’s management excludes other operating charges in its assessments of operating results.

Operating Income

Operating income decreased 45%, or $107.0 million, from $235.3 million in 2005 to $128.3 million in 2006. The decrease in operating income from 2005 to 2006 is primarily a result of the following:

| | • | | $ 88.8 million increase in other operating charges. See the discussion above in “Other Operating Charges” for additional information on these charges. |

| | • | | $ 15.4 million of stock option expense recognized as a result of the adoption of SFAS 123(R) on January 1, 2006. Of this amount, $4.3 million was recorded as cost of revenue and $11.1 million was recorded as SG&A. |

| | • | | $ 5.5 million of accelerated depreciation recorded in the first quarter of 2006. |

Operating income excluding these charges would have increased 1%. Operating income in our Insurance Services segment improved primarily due to increased revenues and product mix. The improvements in operating income in our Insurance Services segment were offset by decreases in operating income in the Financial and Professional Services segment, Government Services segment and Marketing Services segment. The Company continues to see margin pressures in commodity products in the Financial and Professional Services segment and the Government Services segment. Operating income in our Marketing Services segment decreased as a result of the decrease in revenue. Operating income in the Company’s Screening and Authentication Services segment remained relatively flat as strong margins in the smaller screening businesses were offset by weakened operating leverage in our Workplace Solutions business.

Interest Expense, Net

Interest expense increased $11.4 million to $15.9 million in 2006 from $4.5 million in 2005 due to higher average debt outstanding, primarily associated with the Company’s share buyback program and higher interest rates. Interest payments totaling $15.6 million were made in 2006. Future interest payments will depend on future levels of borrowings.

Income Taxes

ChoicePoint’s 2006 effective tax rate for continuing operations was 38.8%, a decrease from 39.6% in 2005. The higher effective tax rate in 2005 was primarily due to the previously discussed settlement with the FTC. The $10.0 million civil penalty paid to the FTC was non-deductible for federal income tax purposes. Tax payments totaling $75.2 million ($74.1 million net of refunds) were made in 2006. Future tax payments will depend on future operating results.

Discontinued Operations

As previously indicated, ChoicePoint announced plans to divest the Bode Labs, EquiSearch and BLJ businesses as a result of its company-wide strategic review. These businesses are reported as discontinued operations – removing Bode from the Government Services segment and EquiSearch and BLJ from the Financial and Professional Services segment. Additionally, on September 29, 2006, the Company sold Priority Data to the parent company of AMS Services. Consequently, the results of these discontinued operations are reflected in the Company’s Consolidated Statements of Income as discontinued operations. The results of these discontinued operations in prior years have been reclassified to conform to the 2006 classification. The following amounts have been segregated from continuing operations and are reflected as discontinued operations for the years ended December 31, 2006, 2005, and 2004, respectively:

| | | | | | | | | | | | |

(In thousands) | | 2006 | | | 2005 | | | 2004 | |

Total revenue | | $ | 38,183 | | | $ | 44,156 | | | $ | 37,175 | |

| | | |

Income (loss) from discontinued operations before income taxes | | $ | (74,791 | ) | | $ | 1,803 | | | $ | 6,693 | |

Income tax (provision) benefit | | | 22,938 | | | | (671 | ) | | | (2,547 | ) |

| | | | | | | | | | | | |

Income (loss) from discontinued operations, net of tax | | $ | (51,853 | ) | | $ | 1,132 | | | $ | 4,146 | |

| | | | | | | | | | | | |

24 CHOICEPOINT 2006 ANNUAL REPORT

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

During 2006, the Company recorded a non-cash charge of $67.5 million ($47.2 million after tax benefit) in discontinued operations to reduce the carrying value of goodwill and other assets related to these businesses in order to reflect the estimated net proceeds to be realized from selling these three businesses based on indicative bids received to date. Of this amount, $47.0 million related to the BLJ businesses, $10.6 million related to the Bode business and $9.9 million related to the EquiSearch business. Actual proceeds may vary from the estimated net proceeds. In addition, the Company recorded a $5.0 million ($3.1 million net of tax benefit) loss on the sale of Priority Data.

At December 31, 2006, the Company has classified certain assets and liabilities associated with the discontinued operations as assets of businesses held for sale and liabilities of businesses held for sale in the Consolidated Balance Sheets in accordance with the guidance in SFAS No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets(“SFAS No.144”). A total of $31.5 million of assets have been classified as assets of businesses held for sale and $3.2 million of liabilities have been classified as liabilities of businesses held for sale on the December 31, 2006 Consolidated Balance Sheet.

Comparison of 2005 with 2004 Consolidated Results

Revenue

Total revenue grew 15%, or $132.2 million, to $1.0 billion in 2005. Service revenue, which excludes revenue from reimbursable expenses per EITF 01-14 (see Note 3 to the Consolidated Financial Statements), grew 16%, or $138.4 million, to $1.0 billion in 2005. Revenue growth in 2005 was driven by consistent growth in our Insurance Services products and strong performances in our background screening and vital records businesses in our Screening and Authentication Services segment. Revenue growth was also attributable to three 2005 acquisitions and the full year impact of the ten 2004 acquisitions. Internal revenue (which excludes $80.0 million of revenue from acquisitions) increased 6.9% from 2004 to 2005.

Cost of Revenue

In 2005, cost of revenue was $505.9 million, or 51% of service revenue, as compared to $437.1 million, or 52% of service revenue in 2004.

Selling, General and Administrative Expenses

SG&A increased to $215.6 million, or 22% of service revenue, from $175.1 million, or 21% of total revenue, in 2005.

Other Operating Charges

During 2005, the Company recorded other operating charges of $28.8 million. See the “Comparison of 2006 with 2005 Consolidated Results – Other Operating Charges” section for a detailed discussion of these charges. No other operating charges were recorded in 2004.

Operating Income

Operating income increased from $235.1 million in 2004 to $235.3 million in 2005. Included in 2005 operating income are other operating charges totaling $28.8 million related to the fraudulent data access and lease abandonment costs. Excluding these charges, operating income increased 12%. Operating income in our Insurance Services segment and Screening and Authentication Services segment improved primarily due to increased revenues and product mix. These increases were partially offset by decreases in the Financial and Professional Services segment and the Marketing Services segment. The decrease in operating income in the Financial and Professional Services segment was the result of the decision to discontinue the sale of certain of its public filing products in 2005. Marketing Services’ operating income declined as a result of revenue decreases and the change in product mix. Although revenues in Government Services grew as a result of the early 2005 acquisition of i2 Limited (“i2”), a Cambridge, U.K.-based international provider of visualization and link analysis software for intelligence, law enforcement, military and large commercial applications, operating income in Government Services remained relatively flat due to the continued integration efforts in this segment and revenue mix.

Interest Expense, net

Interest expense, net increased $1.6 million to $4.5 million in 2005 from $2.9 million in 2004 due to higher average debt outstanding and higher interest rates.

Income Taxes

ChoicePoint’s 2005 effective tax rate for continuing operations was 39.6%, an increase from 38.0% in 2004. This increase is due to additional tax expense in connection with a settlement with the FTC discussed above in “Other Operating Charges,” partially offset by a $700,000 benefit from a favorable outcome from the completion of a state tax audit during the second quarter of 2005. The additional tax expense associated with the fraudulent data access is a result of the non-deductibility of the $10.0 million civil penalty for federal income tax purposes.

CHOICEPOINT 2006 ANNUAL REPORT25

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

Financial Results by Segment

| | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2006 | | | Year Ended December 31, 2005 | | | Year Ended

December 31, 2004 | |

(In thousands) | | Revenue | | Operating

Income | | | Revenue | | Operating

Income | | | Revenue | | Operating

Income | |

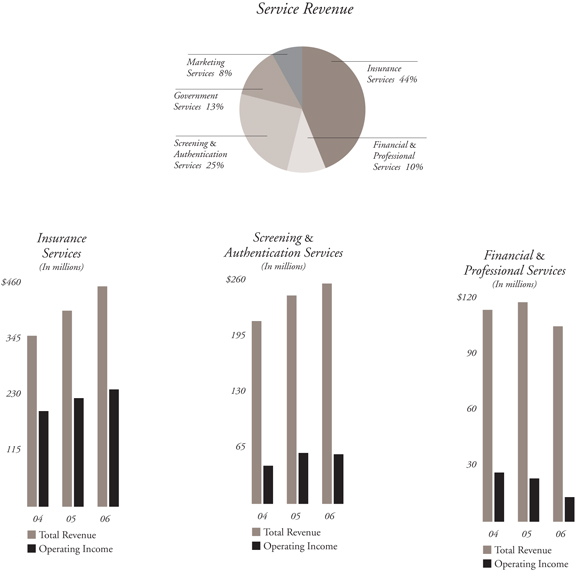

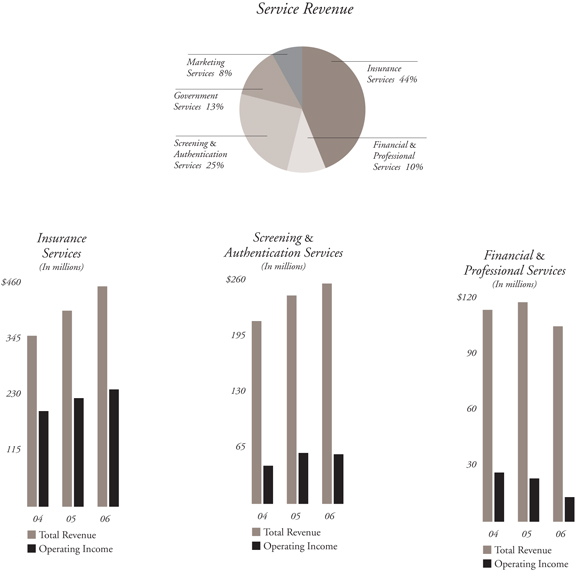

Insurance Services | | $ | 454,458 | | $ | 239,843 | | | $ | 402,853 | | $ | 221,670 | | | $ | 352,368 | | $ | 195,851 | |

Screening & Authentication Services | | | 257,088 | | | 57,096 | | | | 242,054 | | | 58,980 | | | | 212,706 | | | 43,715 | |

Financial & Professional Services | | | 105,041 | | | 12,998 | | | | 117,510 | | | 22,738 | | | | 113,768 | | | 26,338 | |

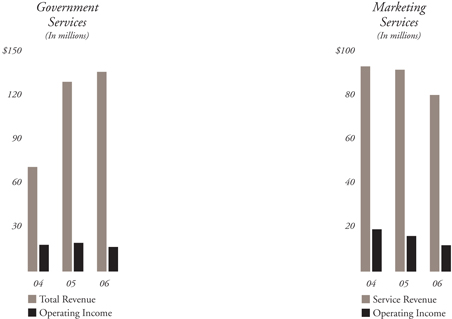

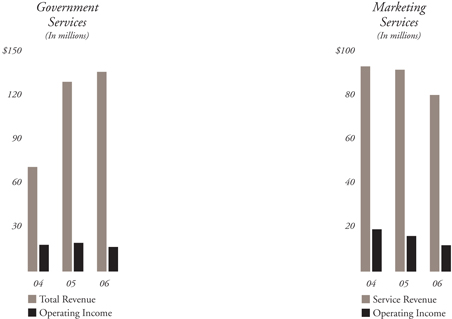

Government Services | | | 135,813 | | | 15,656 | | | | 129,358 | | | 19,326 | | | | 70,523 | | | 18,020 | |

Marketing Services | | | | | | | | | | | | | | | | | | | | | |

Marketing Services service revenue | | | 79,714 | | | 12,446 | | | | 91,529 | | | 15,899 | | | | 93,389 | | | 18,651 | |

Reimbursable expenses | | | 22,878 | | | — | | | | 28,056 | | | — | | | | 34,280 | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Marketing Services | | | 102,592 | | | 12,446 | | | | 119,585 | | | 15,899 | | | | 127,669 | | | 18,651 | |

Royalty | | | — | | | — | | | | 2,398 | | | 1,722 | | | | 4,504 | | | 2,062 | |

Corporate and shared | | | — | | | (71,287 | ) | | | — | | | (76,223 | ) | | | — | | | (69,552 | ) |

Accelerated depreciation | | | — | | | (5,463 | ) | | | — | | | — | | | | — | | | — | |

Stock option expense | | | — | | | (15,401 | ) | | | — | | | — | | | | — | | | — | |

Other operating charges | | | — | | | (117,572 | ) | | | — | | | (28,773 | ) | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Totals from continuing operations | | $ | 1,054,992 | | $ | 128,316 | | | $ | 1,013,758 | | $ | 235,339 | | | $ | 881,538 | | $ | 235,085 | |

| | | | | | | | | | | | | | | | | | | | | |

26 CHOICEPOINT 2006 ANNUAL REPORT

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

Insurance Services

Our Insurance Services segment, which provides data, analytics, software and business outsourcing services to property and casualty (“P&C”) insurance carriers, posted strong annual results, achieving 13% total revenue growth over 2005. For the past nine consecutive years, Insurance Services has provided the Company with double-digit revenue growth. In 2006, internal revenue growth, excluding $8.8 million of incremental acquisition revenue, was 11%, as we continued to grow our already strong base personal lines and underwriting business with recent product offerings such as Current Carrier® and motor vehicle record activity files, further addressing the needs of our customers by providing analytics to enhance their ability to underwrite policies and mitigate risk. Our claims products also produced strong growth, as we benefited from customer wins and the increased revenue from new product offerings. Our Insurity operations also had a strong year, as we continued to expand our service offerings and to help our customers solve complex business challenges and better focus on managing their businesses around their core competencies with industry-leading software solutions and business process outsourcing services offerings. Revenue growth at Insurity was led by a combination of customer wins and increased penetration of our outsourcing services. Operating income for Insurance Services in 2006 increased $18.2 million, or 8%, from 2005 due to increased revenue, offset slightly by the continued high level of investments in new product initiatives. Operating margins remained strong at 52.8% for 2006 compared to 55.0% for 2005.

Screening & Authentication Services

During 2006, the Screening & Authentication Services segment experienced growth in its background screenings and vital records businesses. This growth was diluted by the relatively flat revenue in our tenant screening and drug testing business. The segment delivered 6% total revenue growth and 5% internal revenue growth for the year ended December 31, 2006, compared to the year ended December 31, 2005, which excludes $1.9 million of incremental revenue from 2006 acquisitions and the full year impact of 2005 acquisitions. Businesses in this segment facilitated more than ten million screenings for our customers, including over half of the largest U.S.-based employers, identifying over 750,000 individuals with criminal records. These background screenings include approximately 1.5 million ChoicePoint-subsidized transactions for many of our nation’s leading non-profit organizations under our VolunteerSelectSM screening product. In addition to the WorkPlace Solutions business, the VitalChek® business delivered strong growth driven by the demand from businesses and not-for-profit organizations for authenticated birth certificates, the implementation of new database software services and a favorable travel environment. Screening & Authentication Services’ 2006 operating income decreased $1.9 million, or 3%, from 2005 due to certain fixed costs incurred by our Workplace Solutions business in order to service anticipated customer hiring activity that failed to materialize. Operating margins declined to 22.2% for 2006, compared to 24.4% for 2005 due to lower revenue growth in our higher margin automated products and lower retail hiring levels than anticipated late in 2006.

CHOICEPOINT 2006 ANNUAL REPORT27

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

Financial & Professional Services

The Financial & Professional Services segment, which provides public information to the banking, mortgage and professional services markets, posted a revenue decline of $12.5 million from $117.5 million in 2005 to $105.0 million in 2006. Total revenue and internal revenue decreased 11% from 2005. The decline in revenue is primarily attributable to the downturn in the mortgage services market and the impact of our 2005 decision to exit certain revenue markets to reduce our risk and strengthen the level of protection around the data we hold. Financial & Professional Services’ 2006 operating income decreased $9.7 million, primarily as a result of this decision. Operating margins decreased to 12.4% for 2006, compared to 19.3% for 2005, primarily due to revenue declines in our higher-margin products.

Government Services

In 2006, Government Services’ total revenue grew 5% from 2005 as the strong performance of our U.S. and international software business was tempered by a decline in our data business. Our early 2005 acquisition of i2, together with the 2005 acquisition of EzGov, Inc. and the 2004 acquisitions of The Templar Corporation and iMapData.com, Inc. (“iMap”), complements our strategy to grow this business to better serve our base law enforcement and government customers and to fuel future growth in new markets. The combination of our public filings data, iMap’s infrastructure data and mapping software and i2’s analytic platform enables us to offer end-to-end solutions to meet our customers’ needs. Excluding the 2006 incremental impact from 2005 acquisitions, which contributed $1.2 million of revenue in 2006, our internal revenue for Government Services increased 4% from 2005. Operating income decreased $3.7 million, or 19%, from 2005 to 2006 and operating margins decreased to 11.5% for 2006, compared to 14.9% for 2005, in each case primarily due to margin pressures in our data products and investments in new product initiatives.

Marketing Services

Marketing Services saw a continuation of negative revenue trends in 2006. In July 2006, we announced that we intended to divest the Marketing Services business and reclassified the results of the business as discontinued operations in the third quarter of 2006. After thoroughly evaluating our strategic opportunities, we decided to retain Marketing Services and reclassified its results as continuing operations in the fourth quarter of 2006. We continue to face a tough discretionary spending environment, particularly with some of our larger mortgage and consumer finance customers. For 2006, Marketing Services’ service revenue declined 13% from 2005 and total revenue (service revenue plus reimbursable expenses) declined 14% from the prior year. Due to the high fixed costs in the marketing business, full year operating income decreased $3.5 million, or 22%, from 2005 to 2006. Operating margin (as a percentage of service revenue) also declined to 15.6% for 2006 compared to 17.4% for 2005 (12.1% and 13.3% of total revenue, respectively) as a result of the aforementioned revenue decrease and high fixed costs.

Royalty

Royalty revenue from laser technology patents held by the Company was $2.4 million in 2005. There was no royalty revenue in 2006 due to the expiration of the patents underlying this revenue in May 2005.

Corporate Costs

Corporate and shared expenses totaled $71.3 million, or 6.9% of service revenue, for the year ended December 31, 2006, compared to $76.2 million, or 7.7% of service revenue in 2005. Corporate and shared expenses in 2005 included an expense of approximately $2.4 million for a specific litigation matter. The decrease in corporate costs as a percentage of service revenue in 2006 over 2005 is a result of lower incentive accruals and cost controls.

Cash Flow and Liquidity Review

Liquidity and Capital Resources

The Company’s sources of capital include, but are not limited to, cash and cash equivalents, cash from continuing operations, amounts available under the Credit Facility and the Receivables Facility (see Note 6 to the Consolidated Financial Statements), the issuance of equity securities and other external sources of funds. ChoicePoint’s short-term and long-term liquidity depends primarily upon its level of net income, working capital management (accounts receivable, accounts payable and accrued expenses) and bank borrowings. We believe that available short-term and long-term capital resources are sufficient to fund capital expenditures, working capital requirements, share repurchases under our stock buyback program (see Note 9 to the Consolidated Financial Statements), scheduled debt payments, and interest and tax obligations for the next twelve months. We currently estimate 2007 capital expenditures will be approximately $55 – $65 million for continuing operations. Any material variance of operating results could require us to obtain additional equity or debt financing. In addition, investments in business, products, or technologies could require us to obtain additional equity or debt financing. There can be no assurance that such financing will be available to us on favorable terms.

The Company uses cash generated to invest in growing the business, to fund acquisitions and operations, and to repurchase its common stock (See Note 9 to the Consolidated Financial Statements). Therefore, no cash dividends

28 CHOICEPOINT 2006 ANNUAL REPORT

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

have been paid, and we do not anticipate paying any cash dividends on our common stock in the near future. The Company may desire to obtain additional long-term financing for other strategic reasons. We anticipate no difficulty in obtaining long-term financing based on favorable experiences in the debt market in the recent past and the Company’s consistent high level of cash flow. ChoicePoint may also utilize an existing line of credit for overnight borrowings; however, no such borrowings were outstanding at either December 31, 2006 or 2005.

Net free cash flow (net cash provided by operating activities of continuing operations of $234.5 million less capital expenditures of $58.4 million) was $176.1 million for the year ended December 31, 2006. Excluding cash paid during 2006 related to the fraudulent data access of $10.2 million, net free cash flow would have been $186.3 million for the year ended December 31, 2006. Net free cash flow is not defined under generally accepted accounting principles in the United States (“GAAP”). Therefore, it should not be considered a substitute for income or cash flow data prepared in accordance with GAAP and may not be comparable to similarly titled measures used by other companies. It should not be inferred that the entire net free cash flow amount is available for discretionary expenditures. The Company believes net free cash flow is a useful measure of performance and its ability to generate cash.

On October 25, 2006, the Company entered into a $600 million unsecured credit facility (the “Credit Facility”) with a group of banks, which is expandable to $750 million, to refinance its existing facility, fund share repurchases and for general corporate purposes. At December 31, 2006, there was $315.0 million outstanding under the Credit Facility. In addition, approximately $10.0 million of the remaining availability under the Credit Facility was utilized for outstanding letters of credit. The average interest rate based on the terms of the Credit Facility was 5.8% at December 31, 2006. The Company had a $400.0 million unsecured multicurrency revolving credit facility (the “Former Credit Facility”) with a group of banks that was terminated effective October 25, 2006.

The Credit Facility contains covenants customary for facilities of this type. Such covenants include limitations, in certain circumstances, on the ability of the Company and its subsidiaries to (i) effect a change of control of the Company, (ii) incur certain types of liens, and (iii) transfer or sell assets. The Credit Facility also requires compliance with financial covenants, including (i) maximum funded debt to EBITDA and (ii) minimum interest coverage. We have maintained compliance with these financial covenants.

At December 31, 2005, there was $80.0 million outstanding under the Former Credit Facility.

In July 2001, to obtain an additional source of financing, the Company and certain of its subsidiaries entered into an agreement (the “Receivables Facility”) with a financial institution whereby it may sell on a continuous basis an undivided interest in all eligible trade accounts receivable subject to limitations up to $100 million. On December 1, 2006, the Receivables Facility was amended to increase the available borrowing capacity to $125.0 million. Net proceeds from the Receivables Facility were $100.0 million at December 31, 2006, and $50.0 million at December 31, 2005. The average interest rate based on the terms of the Receivables Facility was 5.6% at December 31, 2006.

At December 31, 2006, we had $300.0 million of available capacity under the above facilities.

Net debt (total debt of $415.0 million less cash of $26.6 million) was $388.4 million at December 31, 2006. Net debt to total capitalization (net debt of $388.4 million

CHOICEPOINT 2006 ANNUAL REPORT29

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

plus total shareholders’ equity of $667.0 million) was 36.8% at December 31, 2006. Net debt is not defined under GAAP. Management believes that net debt provides useful information regarding the level of the Company’s indebtedness by reflecting cash and investments that could be used to repay debt. It should not be considered a substitute for total debt data prepared in accordance with GAAP and may not be comparable to similarly titled measures used by other companies.

Contractual Obligations and the Related Future Payments

| | | | | | | | | | | | | | | |

| | | Payments Due During Period |

(In thousands) | | Total | | 2007 | | 2008–2009 | | 2010–2011 | | 2012 & after |

Long-term debt obligations | | $ | 415,000 | | $ | 100,000 | | $ | — | | $ | 315,000 | | $ | — |

Capital lease obligations | | | 39 | | | 11 | | | 28 | | | — | | | — |

Purchase obligations | | | 42,240 | | | 13,050 | | | 15,220 | | | 13,970 | | | — |

Postretirement benefit obligations(a) | | | 23,396 | | | 2,578 | | | 4,928 | | | 4,812 | | | 11,078 |

Operating lease obligations | | | 91,459 | | | 18,736 | | | 32,855 | | | 27,921 | | | 11,947 |

| | | | | | | | | | | | | | | |

Total contractual cash obligations | | $ | 572,134 | | $ | 134,375 | | $ | 53,031 | | $ | 361,703 | | $ | 23,025 |

| | | | | | | | | | | | | | | |

(a) | We made postretirement benefit payments of $2.2 million in 2006. For additional information regarding our postretirement benefit obligations, see Note 10 to the Consolidated Financial Statements. |

We have not included obligations under our deferred compensation plan in the contractual obligations table. Our deferred compensation plan is not required to be funded in advance, but rather is generally funded as benefits become payable to participants. We made deferred compensation payments of $1.0 million in 2006.

Off-Balance Sheet Arrangements

Synthetic Leases

During the second quarter of 2006, the Company entered into a $12.5 million synthetic lease agreement for a new property. Under this synthetic lease agreement, a third-party lessor purchased the property and paid for the build-out of the property completed in December 2006. The $12.5 million synthetic lease expires in 2012. On December 8, 2006, the Company entered into a $25.2 million synthetic lease agreement for our headquarters building and a $46.2 million synthetic lease agreement for our data center facility. These agreements replaced the existing agreements that were due to expire in 2007 and 2008. The new lease agreements expire in 2012, at which time we have the following options for each lease: renew the lease for an additional five years, purchase the building for the original cost or sell the property ourselves (remarket). If we elect to remarket the property, ChoicePoint must guarantee the lessor 80% to 85% of the original cost.

The Company has accounted for the synthetic leases as operating leases and has recorded rent expense. If the Company had elected to purchase the properties instead of entering into the synthetic leases, total assets and debt would have increased by $83.5 million at December 31, 2006 and $71.0 million at December 31, 2005 and we would have recorded additional depreciation expense related to the synthetic leases of approximately $2.7 million ($1.7 million after tax) for 2006, $2.4 million ($1.5 million after tax) for 2005, and $2.2 million ($1.4 million after tax) for 2004.

Derivatives

Derivative financial instruments at December 31, 2006 consist of four interest rate swap agreements entered into to reduce the impact of changes in a benchmark interest rate (LIBOR) on the Company’s LIBOR-based payments on the Company’s synthetic leases. These swap agreements, with a total notional amount of $67 million at December 31, 2006, involve the receipt of a variable rate and payment by ChoicePoint of fixed rates between 4.0% and 6.5%. ChoicePoint has designated all of these swaps as cash flow hedges of the variability in expected future interest payments on $67 million of the Company’s LIBOR-based payments under the synthetic leases discussed previously. Amounts currently due to or from interest rate swap counterparties are recorded as expense in the period in which they accrue. The Company does not enter into derivative financial instruments for trading or speculative purposes. As of December 31, 2006, the fair value of the outstanding interest rate swap agreements was an asset of $0.4 million, which has been recorded net of taxes in accumulated other comprehensive (loss) in accordance with SFAS No. 133,Accounting for Derivative Instruments and Hedging Activities, as amended by SFAS No. 138 (see Notes 3 and 6 to the Consolidated Financial Statements).

Interest Rate Risk Management

The Company is exposed to market risk from changes in interest rates. The information below summarizes the Company’s market risk associated with its debt obligations as of December 31, 2006. The information below should

30 CHOICEPOINT 2006 ANNUAL REPORT

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

be read in conjunction with Note 6 to the Consolidated Financial Statements.

At December 31, 2006, borrowings outstanding under the Credit Facility were $315.0 million and borrowings outstanding under the Receivables Facility were $100.0 million. These facilities bear interest at variable rates based on LIBOR plus applicable margins. At December 31, 2006, the Company’s interest rate was 5.8% under the Credit Facility and 5.6% under the Receivables Facility. At December 31, 2006, $83.5 million was outstanding under the Company’s synthetic lease agreements. The previously discussed swap agreements involve the exchange of variable rates for fixed rate payments and effectively fix the Company’s benchmark interest rate on $67 million of its synthetic leases at approximately 5.4% through August 2007, the expiration date of the swap agreements.

Based on the Company’s overall interest rate exposure at December 31, 2006, a one percent change in interest rates would result in a change in annual pretax interest expense of approximately $4.3 million based on the Company’s current level of borrowings.

Foreign Currency Exchange Rate Risk

The majority of the Company’s revenue, expense and capital expenditure activities are transacted in U.S. dollars. However, the Company does transact business in other currencies, primarily the British pound. The Company’s operations in the United Kingdom and other foreign countries represented an aggregate of approximately 4% of its consolidated revenues from continuing operations during the year ended December 31, 2006, and approximately 9% of consolidated long-lived assets at December 31, 2006.

The Company is required to translate, or express in U.S. dollars, the assets and liabilities of its foreign subsidiaries that are denominated or measured in foreign currencies at the applicable year-end rate of exchange on the Company’s Consolidated Balance Sheets. The Company records the resulting translation adjustment, and gains and losses resulting from the translation of intercompany balances of a long-term investment nature, as components of its shareholders’ equity. Other immaterial foreign currency transaction gains and losses are recorded in the Company’s Consolidated Statements of Income. The Company has not hedged translational foreign currency exposure.

For the year ended December 31, 2006, a 10% fluctuation in the exchange rate between the U.S. dollar and the British pound would result in a change in revenues of $3.2 million, and a change in net income of $0.7 million.

Summary of Cash Activities

Net cash provided by operating activities of continuing operations for the year ended December 31, was $234.6 million for 2006, $247.6 million for 2005 and $240.2 million for 2004. Net cash used in investing activities of continuing operations for the year ended December 31, was $99.4 million for 2006, $184.6 million for 2005 and $281.0 million for 2004. Net cash used in financing activities of continuing operations for the year ended December 31, was $123.8 million for 2006 and $36.3 million for 2005 and net cash provided by financing activities of continuing operations for the year ended December 31, 2004 was $21.4 million.

2006 vs. 2005

The net change in operating assets and liabilities was a decrease of $62.5 million for the year ended December 31, 2006, as compared to the impact for the year ended December 31, 2005, primarily as a result of increases in deferred taxes offset partially by increased accounts receivable in 2006 as compared to 2005. Our accounts receivable increased by $24.7 million from December 31, 2005 to December 31, 2006, while total revenue increased 4%, from the year ended December 31, 2005 to the year ended December 31, 2006. Net cash provided by operating activities for the year ended December 31, 2005 includes the $15.9 million tax benefit of stock options exercised. Effective January 1, 2006, the tax benefit of stock options exercised is included in financing activities under SFAS 123(R). Net cash provided by operating activities of discontinued operations was $3.9 million and $4.3 million for the years ended December 31, 2006 and 2005, respectively.

Net cash used in investing activities of $99.4 million in 2006 and $184.6 million in 2005 includes the acquisition of six entities in 2006 and the acquisition of three entities and a minority investment in 2005 to further capitalize on investment opportunities to build our business model, to expand our offerings to new markets and to develop new products (see Note 4 to the Consolidated Financial Statements). Cash used for investing activities included capital expenditures of $58.4 million and $61.2 million for the years ended December 31, 2006 and 2005, respectively. Net cash used in investing activities by the discontinued operations totaled $10.7 million and $10.5 million for the years ended December 31, 2006 and 2005, respectively. Net cash used in financing activities includes $427.2 million and $125.6 million of share repurchases under the stock buyback program (see Note 9 to the Consolidated Financial Statements) during the years ended December 31, 2006 and 2005, respectively. Net cash used in financing activities also includes $285.0 million

CHOICEPOINT 2006 ANNUAL REPORT31

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

and $80.0 million of net borrowings to fund the share repurchases and aforementioned acquisitions during the years ended December 31, 2006 and 2005, respectively. Net cash used in financing activities for the year ended December 31, 2006, includes $3.2 million of cash provided from the tax benefit from stock options exercised. For 2005, the tax benefit from stock option exercises is classified as a cash flow from operating activities in the Consolidated Statements of Cash Flows.

2005 vs. 2004

The net change in operating assets and liabilities was a decrease of $5.9 million in 2005, as compared to the impact for the year ended December 31, 2004, primarily as a result of increases in our current liabilities, offset partially by increased accounts receivable in 2005 as compared to 2004. Our increase in current liabilities was due primarily to the settlement with the FTC (see Note 12 to the Consolidated Financial Statements) and related costs, additional reserves on specific litigation matters, increased operational costs related to increased revenues and changes in income taxes payable due to timing of estimated tax payments. Our accounts receivable increased by $9.7 million, from December 31, 2004 to December 31, 2005, while revenue increased $132.2 million, or 15%, from the year ended December 31, 2004 to the year ended December 31, 2005.

Net cash provided by operating activities of discontinued operations was $4.3 million and $8.4 million for the years ended December 31, 2005 and 2004, respectively. Net cash used in investing activities by the discontinued operations totaled $10.5 million and $10.8 million for the years ended December 31, 2005 and 2004, respectively.

Net cash used in investing activities of $184.6 million in 2005 and $281.0 million in 2004 includes the acquisition of three entities and a minority investment in 2005 and ten entities in 2004. Cash used for investing activities included capital expenditures of $61.2 million and $55.3 million for the years ended December 31, 2005 and 2004, respectively. Net cash used in investing activities for the year ended December 31, 2004 includes $3.5 million of proceeds from the sale of CPCS.

Net cash used in financing activities for the year ended December 31, 2005, includes $125.6 million of share repurchases under the stock buyback program (see Note 9 to the Consolidated Financial Statements). Net cash used in financing activities in 2005 also includes $80.0 million of net borrowings to fund the share repurchases and aforementioned acquisitions.

New Accounting Pronouncements

The Company adopted SFAS 123(R) effective January 1, 2006 using the modified prospective transition method. Under this transition method, compensation cost was recognized after adoption for all share-based payments granted prior to, but not yet vested as of January 1, 2006, and all share-based payments granted subsequent to January 1, 2006. As a result of adopting SFAS 123(R), the Company’s income before income taxes and net income (loss) for the year ended December 31, 2006, were $15.4 million and $12.3 million lower, respectively, than if the Company had continued to account for share-based compensation under Accounting Principles Board Opinion No. 25. SFAS 123(R) also requires that the benefits of tax deductions in excess of recognized compensation cost be reported as a financing cash flow, rather than as an operating cash flow as required under prior guidance. This requirement reduced net operating cash flows in the amount of $3.2 million for the year ended December 31, 2006. See Note 8 to the Consolidated Financial Statements for additional information on the adoption of SFAS 123(R).

In September 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and 132(R)” (“SFAS 158”), which requires recognition in the Statements of Financial Position of the over- or under-funded status of defined pension and other postretirement plans, measured as the difference between the fair value of plan assets and the accumulated benefit obligation for other postretirement benefit plans, with a corresponding adjustment to accumulated other comprehensive income, net of tax. The Company adopted the recognition and disclosure provisions of SFAS 158 as of December 31, 2006. The adjustment to accumulated other comprehensive income at adoption of $5.5 million ($3.4 million net of tax) represents the net unrecognized actuarial gains and unrecognized prior service credit. There was no impact on results of operations or cash flows. In addition, SFAS 158 did not have an effect on the Company’s consolidated financial condition at December 31, 2005 or 2004. See Note 10 to the Consolidated Financial Statements for additional information on the adoption of SFAS 158.

In September 2006, the SEC issued Staff Accounting Bulletin No. 108,Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements (“SAB 108”). SAB 108 provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a current year misstatement.

32 CHOICEPOINT 2006 ANNUAL REPORT

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

The SEC staff believes that registrants should quantify errors using both the balance sheet and income statement approach when quantifying a misstatement. The guidance provides for a one-time cumulative effect adjustment to correct for misstatements for errors that were not deemed material under a company’s prior approach but are material under the SAB 108 approach. SAB 108 is effective for the Company’s fiscal year ending December 31, 2006. The adoption of SAB 108 had no effect on the results of operations or financial position of the Company.

In July 2006, the FASB issued FASB Interpretation No. 48,Accounting for Uncertainty in Income Taxes (“FIN 48”). The interpretation clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements in accordance with SFAS No. 109,Accounting for Income Taxes. Specifically, the pronouncement prescribes a recognition threshold and a measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The interpretation also provides guidance on the related derecognition, classification, interest and penalties, accounting for interim periods, disclosure and transition of uncertain tax positions. This interpretation was effective for the Company on January 1, 2007. The Company is currently evaluating the impact this new standard will have on its future results of operations and financial position.

In September 2006, the FASB issued SFAS No. 157,Fair Value Measurements (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value in accordance with GAAP, and expands disclosures about fair value measurements. SFAS 157 applies where other accounting pronouncements require or permit fair value measurements; it does not require any new fair value measurements under GAAP. SFAS 157 is effective for the Company on January 1, 2007. The effects of adoption will be determined by the types of instruments carried at fair value in the Company’s financial statements at the time of adoption as well as the method utilized to determine their fair values prior to adoption. Based on the Company’s current use of fair value measurements, SFAS 157 is not expected to have a material effect on the results of operations or financial position of the Company.

Critical Accounting Policies

The Consolidated Financial Statements are prepared in accordance with GAAP, which require the Company to make estimates and assumptions which may be revised over time as new information and regulations become available. The Company believes that of its significant accounting policies (see Note 3 to the Consolidated Financial Statements), the following may involve a higher degree of judgment and complexity:

Purchase Price Allocation

Over its history, the Company’s growth has been partly driven by acquisitions. The application of the purchase method of accounting requires companies to assign values to acquired assets and liabilities, including intangible assets acquired based on their fair value. The determination of fair value for acquired assets, particularly intangible assets, requires a high degree of judgment, and estimates often involve significant subjectivity due to the lack of transparent market data or listed market prices. The Company generally uses internal evaluations in determining the fair value of assets acquired and liabilities assumed; however, the use of different valuation models or assumptions could result in different amounts of goodwill and other acquisition intangible assets and different lives for amortizable intangible assets. As of December 31, 2006, certain of our 2006 purchase price allocations were based on preliminary estimates which may be revised in future periods as estimates and assumptions are finalized (see Note 4 to the Consolidated Financial Statements). The Company does not anticipate that these revisions would be significant to the financial statements taken as a whole.

Impairment Charges

SFAS No. 142,Goodwill and Other Intangible Assets, requires the testing of intangible assets with indefinite lives and goodwill for impairment at least annually (see Note 3 to the Consolidated Financial Statements). In assessing the recoverability of these intangible assets, the Company must make assumptions regarding the estimated discounted future cash flows to determine the estimated fair value of the respective assets. These assumptions may change in the future due to economic conditions or in connection with the sale or integration of the Company’s business units, at which time ChoicePoint may be required to record impairment charges for these assets. The Company completed its last annual goodwill impairment review as of October 31, 2006 and no additional impairment was indicated as a result of this review. Assuming a 10% reduction in estimated annual cash flows in the 2006 annual impairment tests, the Company would have recorded impairment charges of approximately $6 million.

The Company is required to asses the other acquired intangible assets, such as purchased software, customer relationships and non-compete agreements, and tangible long-lived assets, such as property, plant and equipment, for impairment whenever indicators of impairment exist in accordance with SFAS No. 144. Management uses

CHOICEPOINT 2006 ANNUAL REPORT33

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

measurable operating performance criteria as well as qualitative measures to determine whether an indicator of impairment exists. If an indicator of impairment exists, the Company reviews and reevaluates the assumptions used, which are primarily identified from the Company’s budget and longer-term strategic plan, for assessing the recoverability of such assets. If the carrying amount of an asset is not recoverable, based upon the expected undiscounted future cash flows of the asset, an impairment loss equal to the excess of the carrying amount over the estimated fair value of the asset is recorded. Also, in connection with selling and integrating certain business operations, the Company has historically recorded asset impairment charges for property, equipment, data and software assets that will no longer be used. Inherent in the assumptions used in impairment analyses are certain significant management judgments and estimates, such as future revenue growth, future operating margins, and future undiscounted cash flows. The Company periodically reviews and reevaluates these assumptions and adjusts them as necessary.

In 2006, the Company recorded other operating charges of $110.1 million ($66.7 million net of taxes) to recognize asset impairments related to continuing operations (see Note 12 to the Consolidated Financial Statements). The Company recorded other operating charges of $67.5 million ($47.2 million net of taxes) related to discontinued operations (see Note 5 to the Consolidated Financial Statements) to reduce the carrying value of goodwill and other assets to reflect the estimated net proceeds which may be realized from selling these businesses.

Software and Databases Developed for Internal Use

As discussed in Note 3 to the Consolidated Financial Statements, the Company capitalizes certain direct costs incurred in the development of internal use software and databases. Amortization of such costs as cost of service revenue is computed on a straight-line basis generally over three to five years. The Company evaluates the recoverability of capitalized costs periodically or as changes in circumstances suggest a possible impairment may exist in accordance with SFAS No. 144. Primarily in connection with the centralization of functions and consolidation of certain technology platforms, capitalized costs, including data purchases, were written down by $8.2 million in 2006 and are included in the impairment charges of $110.1 million in 2006 discussed above. Amortization of capitalized software and database costs, including hardware and data purchases, amounted to $17.8 million in 2006, $13.9 million in 2005, and $14.1 million in 2004.

Postretirement Benefit Obligations

In connection with developing the Company’s projected liabilities for postretirement benefits, management is required to make estimates and assumptions that affect the reported amounts of the liability as of the date of the financial statements and the amount of expense recognized during the period. The liability is developed based on currently available information, estimates of future trends and actuarial assumptions including a discount rate of 5.71% and 5.50% and an initial health care cost trend rate of approximately 9.33% and 10.33% as of December 31, 2006 and 2005, respectively. A 0.25% decrease or increase in the discount rate (to 5.46% or 5.96%) would result in a change in the liability of approximately $400,000. Actual results could differ from these estimates. See Note 10 to the Consolidated Financial Statements for a discussion of the impact of changes in health care cost trend rates.

Revenue Recognition

Certain of the Company’s revenues are accounted for under the percentage of completion method and some of its software revenues are allocated to each element of a transaction based upon its fair value as determined by vendor specific objective evidence. The Company estimates the percentage of completion on contracts and determines the software revenue allocation method based on assumptions and estimates that require judgment. Changes in estimates to complete and revisions to the fair value used in the allocation of software revenue elements could result in a change in the timing of revenue recognition. Management believes its method and related assumptions, which have been consistently applied, to be reasonable (see Note 3 to the Consolidated Financial Statements).

Stock-Based Compensation

Effective January 1, 2006, the Company adopted SFAS 123(R)’s fair value method of measurement for all share-based payment transactions with employees using its modified prospective transition method. Under this transition method, compensation cost was recognized after adoption for all share-based payments granted prior to, but not yet vested as of January 1, 2006, and all share-based payments granted subsequent to January 1, 2006. As a result of adopting SFAS 123(R) on January 1, 2006, the Company’s income before income taxes and net income (loss) for the

34 CHOICEPOINT 2006 ANNUAL REPORT

Management’s Discussion and Analysis

CHOICEPOINT 2006 ANNUAL REPORT

year ended December 31, 2006, were $15.4 million and $12.3 million lower, respectively, than if the Company had continued to account for share-based compensation under Accounting Principles Board Opinion No. 25. Basic and diluted earnings per share from continuing operations for the year ended December 31, 2006 would have been $0.35 and $0.34, respectively, if the Company had not adopted SFAS 123(R), compared to reported basic and diluted earnings per share from continuing operations of $0.21 and $0.20, respectively. As of December 31, 2006, there was approximately $6.7 million in total unrecognized compensation cost related to nonvested stock, $9.2 million related to deferred shares, and $2.1 million related to share equivalent units. That cost is expected to be recognized over a weighted average period of 2.0 years for nonvested stock, 3.3 years for deferred shares, and 1.8 years for share equivalent units. SFAS 123(R) also requires that the benefits of tax deductions in excess of recognized compensation cost be reported as a financing cash flow, rather than as an operating cash flow as required under prior guidance. This requirement reduced net operating cash flows in the amount of $3.2 million for the year ended December 31, 2006. Management judgments and assumptions related to volatility, the expected term and the forfeiture rate are made in connection with the calculation of stock compensation expense. The Company periodically reviews all assumptions used in its stock option pricing model. Changes in these assumptions for future grants could have a significant impact on the amount of stock-based compensation expense.

Forward-Looking Statements

Certain written and oral statements made by or on behalf of the Company may constitute “forward-looking statements” as defined under the Private Securities Litigation Reform Act of 1995. Words or phrases such as “should result,” “are expected to,” “we anticipate,” “we estimate,” “we project,” or similar expressions are intended to identify forward-looking statements. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed in any forward-looking statements. These risks and uncertainties include, but are not limited to, the following important factors: the results of our ongoing review of fraudulent data access and other events, the impact of our decision to discontinue certain services, the results of our re-credentialing of customer accounts, the results of any litigation or government proceedings, the implementation of plans to divest various businesses resulting from our company-wide strategic review including unanticipated losses realized in connection with any such sales, demand for the Company’s services, product development, maintaining acceptable margins, maintaining our data supply, maintaining secure systems including personal privacy systems, ability to minimize system interruptions, ability to control costs, the impact of federal, state and local regulatory requirements on the Company’s business, specifically the direct marketing and public filings markets, privacy matters and any federal or state legislative responses to identify theft concerns, the impact of competition and customer consolidations, ability to continue our long-term business strategy including growth through acquisition, ability to attract and retain qualified personnel, and the uncertainty of economic conditions in general. Additional information concerning these and other risks and uncertainties is contained in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on forward-looking statements, since the statements speak only as of the date that they are made, and the Company undertakes no obligation to publicly update these statements based on events that may occur after the date of this report.

CHOICEPOINT 2006 ANNUAL REPORT35

Management’s Report on Internal Control Over Financial Reporting

CHOICEPOINT 2006 ANNUAL REPORT

The management of ChoicePoint Inc. (the “Company”) is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed under the supervision of the Company’s principal executive and principal financial officers to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external reporting purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting is supported by written policies and guidelines, a program of internal audits, a written Code of Conduct applicable to all Company directors and all officers and employees of the Company, and quarterly written representations obtained from business unit leaders and key financial associates.

Because of the inherent limitations of internal control over financial reporting, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The Company’s management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2006. In making this assessment, the Company’s management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) inInternal Control – Integrated Framework. Based on this assessment, management believes that, as of December 31, 2006, the Company’s internal control over financial reporting is effective.

The Company’s independent registered public accounting firm has audited management’s assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2006, as stated in their report, which expresses unqualified opinions on management’s assessment and on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2006.

|

Derek V. Smith |

| Chief Executive Officer |

|

Steven W. Surbaugh |

Chief Administrative Officer |

|

Doug C. Curling |

| Chief Operating Officer |

|

David E. Trine |

| Chief Financial Officer |

36 CHOICEPOINT 2006 ANNUAL REPORT

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting

CHOICEPOINT 2006 ANNUAL REPORT

To the Board of Directors and Shareholders of ChoicePoint Inc.:

We have audited management’s assessment, included in the accompanying Management’s Report on Internal Control over Financial Reporting, that ChoicePoint Inc. and subsidiaries (the “Company”) maintained effective internal control over financial reporting as of December 31, 2006, based on criteria established inInternal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express an opinion on management’s assessment and an opinion on the effectiveness of the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, evaluating management’s assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, the company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the company’s board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.