MADISON FUNDS®

HIGH INCOME FUND

550 Science Drive

Madison, Wisconsin 53711

July 9, 2020

Dear Shareholder:

The Board of Trustees of Madison Funds (the “Trust”) is asking shareholders of the Madison High Income Fund (the “Acquired Fund”), a series of the Trust, to approve the acquisition of the assets and liabilities of the Acquired Fund by the Madison Core Bond Fund (the “Acquiring Fund” which, together with the Acquired Fund, are collectively referred to as the “Funds”), also a series of the Trust, pursuant to the terms and conditions of an agreement and plan of reorganization and liquidation (the “Reorganization”). For this purpose, you are invited to a Special Meeting of Shareholders of the Acquired Fund (the “Meeting”) to be held on September 2, 2020.

The Reorganization is described in more detail in the attached Combined Proxy Statement/Prospectus. You should review the Combined Proxy Statement/Prospectus carefully and retain it for future reference. If the shareholders of the Acquired Fund approve the Reorganization, it is expected to be completed on or about September 14, 2020.

The Reorganization will result in a decrease in the total annual fund operating expenses for Acquired Fund shareholders, because the Acquiring Fund has lower fees. Moreover, the Acquired Fund shareholders will become investors in a fund that is managed similarly, using extensive credit research to find income producing investments, and the Acquiring Fund may invest up to 20% of its assets in high yield securities. In addition, the Acquired Fund has substantial capital loss carryforwards on its books, and reorganizing the Acquired Fund with and into the Acquiring Fund versus liquidating the Acquired Fund allows the capital loss carryforwards to be transferred to the Acquiring Fund. For these and the other reasons discussed more fully in the Combined Proxy Statement/Prospectus, we anticipate that the Reorganization will result in benefits to the shareholders of the Acquired Fund.

The Board of Trustees has given careful consideration to the Reorganization and has concluded that it is in the best interests of the Funds and the interests of shareholders of the Funds will not be diluted as a result of the Reorganization. The Board unanimously recommends that you vote “FOR” the Reorganization.

If the Reorganization is approved by shareholders of the Acquired Fund, each shareholder holding Class A shares of the Acquired Fund will receive Class A shares of the Acquiring Fund, each shareholder holding Class B shares of the Acquired Fund will receive Class B shares of the Acquiring Fund and each shareholder holding Class Y shares of the Acquired Fund will receive Class Y shares of the Acquiring Fund. These shares will have an aggregate net asset value (“NAV”) equal to the aggregate NAV of the shareholder’s

shares of the Acquired Fund. The Acquired Fund would then be liquidated and terminated as a series of the Trust. Shareholders of the Acquired Fund will not be assessed any sales charges or other individual shareholder fees in connection with the Reorganization.

We welcome your attendance at the Meeting. If you are unable to attend, we encourage you to authorize proxies to cast your votes. No matter how many shares you own, your vote is important.

Sincerely,

/s/Patrick F. Ryan

Patrick F. Ryan

President

MADISON FUNDS®

HIGH INCOME FUND

550 Science Drive

Madison, Wisconsin 53711

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

to be held September 2, 2020

To the Shareholders of the High Income Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Meeting”) of the High Income Fund (the “Acquired Fund”), a series of Madison Funds (the “Trust”), is to be held at 10:30 a.m. Central time on September 2, 2020, at the offices of Madison Asset Management, LLC located at 550 Science Drive, Madison, Wisconsin 53711.

At the Meeting you will be asked to consider and approve the following proposals:

| |

| 1. | To approve an Agreement and Plan of Reorganization and Liquidation (the “Plan”) providing for the acquisition of all of the assets and the assumption of all of the liabilities of the Acquired Fund in exchange for shares of beneficial interest of the Core Bond Fund (the “Acquiring Fund”), a series of Madison Funds, followed by the liquidation of the Acquired Fund; and |

| |

| 2. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

Record owners of shares of the Acquired Fund as of the close of business on June 15, 2020, are entitled to vote at the Meeting or any adjournments or postponements thereof. If you attend the Meeting, you may vote your shares in person. If you do not attend the Meeting, you may vote by proxy by completing, signing and returning the enclosed proxy card by mail in the envelope provided, or by following the instructions on the proxy card to vote by telephone or the Internet.

Your vote is important. If you have any questions, please contact the Trust’s proxy agent, Computershare Fund Services toll-free at (866) 956-7277 for additional information.

By order of the Board of Trustees

Sincerely,

/s/ Holly S. Baggot

Holly S. Baggot

Secretary of Madison Funds

July 9, 2020

IMPORTANT -- WE URGE YOU TO SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ADDRESSED ENVELOPE, WHICH REQUIRES NO POSTAGE AND IS INTENDED FOR YOUR CONVENIENCE. YOU ALSO MAY VOTE BY TELEPHONE OR BY INTERNET USING THE INSTRUCTIONS ON YOUR PROXY CARD. YOUR PROMPT VOTE MAY SAVE THE FUND THE NECESSITY OF FURTHER SOLICITATIONS TO ENSURE A QUORUM AT THE MEETING. IF YOU CAN ATTEND THE MEETING AND WISH TO VOTE YOUR SHARES IN PERSON AT THAT TIME, YOU WILL BE ABLE TO DO SO.

(This page intentionally left blank)

MADISON FUNDS®

HIGH INCOME FUND

550 Science Drive

Madison, Wisconsin 53711

QUESTIONS AND ANSWERS

July 9, 2020

The following questions and answers provide an overview of key features of the proposed reorganization and of the information contained in the attached Combined Proxy Statement/Prospectus (the “Proxy Statement/Prospectus”). Please review the full Proxy Statement/Prospectus before casting your vote.

| |

| 1. | What is this document and why was it sent to you? |

The attached Proxy Statement/Prospectus provides you with information about the proposed acquisition of the High Income Fund (the “Acquired Fund”), a series of Madison Funds (the “Trust”), by the Core Bond Fund (the “Acquiring Fund”, and, together with the Acquired Fund, the “Funds”), also a series of Madison Funds (the “Reorganization”). The purposes of the Proxy Statement/Prospectus are to (1) solicit votes from shareholders of the Acquired Fund to approve the Reorganization, as described in the Agreement and Plan of Reorganization and Liquidation, included as Exhibit A hereto (the “Plan”), and (2) provide information regarding the shares of the Acquiring Fund.

The Proxy Statement/Prospectus contains information that shareholders of the Acquired Fund should know before voting on the Reorganization. The Proxy Statement/Prospectus should be retained for future reference.

| |

| 2. | Why is the Reorganization being proposed now? |

Madison Asset Management, LLC (“Madison”), the investment adviser of the Funds, has recently completed a strategic review of the offerings by the Trust and concluded that, in its current state, the Acquired Fund will not likely grow, making it cost prohibitive to continue to operate as a standalone fund. Because the Acquiring Fund is considered by Madison to be the most compatible with the Acquired Fund in terms of the methodology used by both Funds to find income producing investments, and in light of the Acquiring Fund’s lower advisory fee and lower overall expense ratio as well as other factors discussed in the attached Proxy Statement/Prospectus, Madison recommended the Reorganization to the Board of Trustees of the Trust (the “Board”). Madison believes that optimizing its fixed-income fund lineup, while still offering breadth and depth across asset classes, will make it easier for shareholders to differentiate funds and may increase the combined Fund’s prospects for increased sales and economies of scale. In addition, Madison believes that the Reorganization represents the most effective use of investment resources and creates an environment with the best opportunity for successful long-term investing on behalf of shareholders.

| |

| 3. | What is the purpose of the Reorganization? |

The purpose of the Reorganization is to transfer the assets of the Acquired Fund into the Acquiring Fund. As discussed in the Proxy Statement/Prospectus, after carefully considering the recommendation of Madison, the Board concluded that the Acquired

Fund’s participation in the Reorganization would be in the best interests of the Acquired Fund and its shareholders, and approved the submission of the Plan to shareholders of the Acquired Fund for approval. In reaching this conclusion, the Board considered, among other factors, the expectation that the Acquired Fund and its shareholders will not recognize any taxable gain or loss in the Reorganization and that shareholders of the Acquired Fund would benefit from becoming shareholders of the Acquiring Fund, which has:

| |

| • | The same investment discipline utilized by the Acquired Fund; |

| |

| • | Mike Sanders, the Co-Head of Fixed Income at Madison, as one of the co-portfolio managers. Mr. Sanders is also a co-portfolio manager of the Acquired Fund; |

| |

| • | A lower advisory fee and lower overall expenses, on a per class basis, than the Acquired Fund; and |

| |

| • | The same adviser and distributor which are committed to facilitate the future growth of the larger, combined Fund. |

The Reorganization will not occur unless the Plan is approved by shareholders of the Acquired Fund. The Board unanimously recommends that you vote “FOR” the Plan.

| |

| 4. | How will the proposed Reorganization work? |

Subject to the approval of the shareholders of the Acquired Fund, the Plan provides for:

| |

| • | The transfer of all of the assets of the Class A, Class B and Class Y shares of the Acquired Fund in exchange for Class A, Class B and Class Y shares of beneficial interest of the Acquiring Fund, respectively, and the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| |

| • | The distribution of the Acquiring Fund shares received by the Acquired Fund from the Acquiring Fund to shareholders of the Acquired Fund; and |

| |

| • | The complete termination and liquidation of the Acquired Fund. |

Upon consummation of the Reorganization, Class A, Class B and Class Y shareholders of the Acquired Fund will become Class A, Class B and Class Y shareholders of the Acquiring Fund, respectively. As a result, each former Class A, Class B and Class Y shareholder of the Acquired Fund will hold Acquiring Fund Class A, Class B and Class Y shares, respectively, with an aggregate net asset value (“NAV”) equal to the aggregate NAV of the shareholder’s Acquired Fund Class A, Class B and Class Y shares, respectively. Please refer to the Proxy Statement/Prospectus for a detailed explanation of the Reorganization. If the Plan is approved by the Acquired Fund’s shareholders at the Special Meeting of Shareholders (the “Meeting”), the Reorganization is expected to occur on or about September 14, 2020 (the “Effective Date”).

| |

| 5. | Who is eligible to vote on the Reorganization? |

Shareholders of record of the Acquired Fund at the close of business on June 15, 2020 (the “Record Date”), are entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof. If you held Acquired Fund shares on the Record Date, you have the right to vote even if you later sold your shares. Each shareholder is entitled to one vote for each dollar of net asset value standing in such shareholder’s name on the books of the Acquired Fund as of the Record Date. As of the Record Date, the Acquired Fund had 3,015,500.927 shares outstanding with an aggregate net asset value of $16,609,629.01. Shares represented by properly executed proxies, unless the proxies are revoked before or at the Meeting, will be voted according to shareholders’ instructions. If you sign and return a proxy but do not fill in a vote, your shares will be voted “FOR” the

Plan. If any other business properly comes before the Meeting, your shares will be voted at the discretion of the persons named as proxies.

| |

| 6. | How will the Reorganization affect me as a shareholder of the Acquired Fund? |

Each Class A shareholder of the Acquired Fund will become a shareholder of Class A shares of the Acquiring Fund, each Class B shareholder of the Acquired Fund will become a shareholder of the Class B shares of the Acquiring Fund and each Class Y shareholder of the Acquired Fund will become a shareholder of the Class Y shares of the Acquiring Fund. The shares of the Acquiring Fund that an Acquired Fund shareholder receives will have a total NAV equal to the total NAV of the shares held by such shareholder in the Acquired Fund as of the Effective Date of the Reorganization.

| |

| 7. | Who manages the Acquiring Fund? |

The investment adviser to the Acquiring Fund is Madison. Madison also serves as investment adviser to the Acquired Fund. Mike Sanders, Allen Olson and Chris Schroeder co-manage the Acquired Fund, and Mike Sanders, Paul Lefurgey and Greg Poplett co-manager the Acquiring Fund.

| |

| 8. | How will the Reorganization affect the advisory fees and expenses? |

The Reorganization will result in a change in the advisory fee rate of the Acquired Fund, as the investment advisory fee of the Acquired Fund, which is an annual rate of 0.55% of the Acquired Fund’s average daily net assets, is higher than the investment advisory fee of the Acquiring Fund, which is an annual rate of 0.50% of the Acquired Fund’s average daily net assets. Moreover, the Acquiring Fund has lower overall expenses than the Acquired Fund on a per class basis, which will benefit Acquired Fund shareholders.

| |

| 9. | What happens if shareholders do not approve the Plan? |

If shareholders do not approve the Plan, the Reorganization will not occur and the Board will consider other options for the Acquired Fund, including liquidation.

| |

| 10. | Is consummation of the Reorganization subject to any conditions (in addition to shareholder approval)? |

In addition to shareholder approval, the Reorganization is subject to a number of customary conditions to close, including the receipt of a tax opinion from counsel to the Funds to the effect that the Reorganization is expected to be tax-free for federal income tax purposes and the effectiveness of the registration statement of which this Proxy Statement/Prospectus is a part.

| |

| 11. | Who is paying for expenses of the Reorganization? |

Madison is paying for the costs and expenses related to the Reorganization, including the repositioning costs and expenses described under the heading “Costs of the Reorganization” below.

| |

| 12. | Who do I call if I have questions about the Meeting or the Reorganization? |

If you have any questions about the Reorganization or the proxy card, please call the Trust’s proxy agent, Computershare Fund Services toll-free at (866) 956-7277.

| |

| 13. | Where may I find additional information regarding the Acquired Fund and the Acquiring Fund? |

Additional information relating to the Acquired Fund and the Acquiring Fund has been filed with the U.S. Securities and Exchange Commission (“SEC”) and can be found in the following documents:

| |

| • | The Statement of Additional Information dated July 9, 2020, that has been filed with the SEC in connection with this Proxy Statement/Prospectus and is incorporated into this Proxy Statement/Prospectus by reference (the “Reorganization SAI”); |

| |

| • | The Annual Report to Shareholders of the Funds, which contains audited financial statements for the fiscal year ended October 31, 2019, which is incorporated into this Proxy Statement/Prospectus by reference; and |

| |

| • | The Semi-Annual Report to Shareholders of the Funds, which contains unaudited financial statements for the six-month period ended April 30, 2020, which is incorporated into this Proxy Statement/Prospectus by reference; |

| |

| • | The Prospectus and Statement of Additional Information (“SAI”) of the Funds, dated June 1, 2020, which are incorporated into this Proxy Statement/Prospectus by reference. |

Copies of the Funds’ Annual Report to Shareholders, Semi-Annual Report to Shareholders and Prospectus and SAI are available, along with the Proxy Statement/Prospectus and Reorganization SAI, upon request, without charge, by writing to the address or calling the telephone number listed below.

By mail Madison Funds, P.O. Box 219083, Kansas City, MO 64121-9083

By phone: (800) 877-6089

All of this additional information is also available in documents filed with the SEC. You may view or obtain these documents from the SEC:

In person: at the SEC’s Public Reference Room located at 100 F Street,

N.E., Washington, DC 20549

By phone: 1-202-551-8090 (for information on the operations of the Public

Reference Room only)

By mail: Public Reference Branch, Officer of Consumer Affairs and

Information Services, Securities and Exchange Commission,

Washington, DC 20549-1520 (duplicating fee required)

By email: publicinfo@sec.gov (duplicating fee required)

By Internet: www.sec.gov

Other Important Things to Note:

| |

| • | You may lose money by investing in the Funds. |

| |

| • | The SEC has not approved or disapproved these securities or passed upon the adequacy of the Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense. |

COMBINED PROXY STATEMENT/PROSPECTUS

RELATING TO THE ACQUISITION OF

MADISON HIGH INCOME FUND,

a series of Madison Funds

BY

MADISON CORE BOND FUND,

a series of Madison Funds

Managed by:

Madison Asset Management, LLC

550 Science Drive

Madison, Wisconsin 53711

1-800-877-6089

July 9, 2020

This Combined Proxy Statement and Prospectus (the “Proxy Statement/Prospectus”) is being sent to you in connection with the solicitation of proxies by the Board of Trustees of Madison Funds (the “Trust”) for use at a Special Meeting of Shareholders (the “Meeting”) of the High Income Fund, a series of the Trust (the “Acquired Fund”), managed by Madison Asset Management, LLC (“Madison”), at the offices of Madison located at 550 Science Drive, Madison, Wisconsin 53711.

At the Meeting, you will be asked to consider and approve the following proposals:

| |

| 1. | To approve an Agreement and Plan of Reorganization and Liquidation (the “Plan”) providing for the acquisition of all of the assets and the assumption of all of the liabilities of the Acquired Fund in exchange for shares of beneficial interest of the Madison Core Bond Fund (the “Acquiring Fund” and together with the Acquired Fund, the “Funds”), a series of Madison Funds, followed by the liquidation of the Acquired Fund (the “Reorganization”); and |

| |

| 2. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

Each Fund is a series of the Trust, an open-end management investment company registered with the U.S. Securities and Exchange Commission (the “SEC”) and organized as a Delaware statutory trust. The investment objective of the Acquiring Fund is to seek to generate a high level of current income, consistent with prudent limitation of investment risk. The investment objective of the Acquired Fund is to seek high current income. The Acquired Fund also seeks capital appreciation, but only when consistent with its primary goal.

This Proxy Statement/Prospectus sets forth the basic information you should know before voting on the proposal. You should read it and keep it for future reference. Additional information relating to the Acquiring Fund and this Proxy Statement/Prospectus is set forth in the Statement of Additional Information to this Proxy Statement/Prospectus dated July 9, 2020 (the “Reorganization SAI”), which is incorporated by reference into this Proxy Statement/Prospectus. Additional information about the Acquiring Fund has been filed with the SEC and is available upon request and without charge by writing to the Acquiring Fund or by calling (800) 877-6089. The Acquired Fund expects that this Proxy Statement/Prospectus will be mailed to shareholders on or about July 17, 2020.

THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES NOR HAS IT PASSED ON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

(This page intentionally left blank)

TABLE OF CONTENTS

|

| | | | |

| | Page |

| APPROVAL OF AGREEMENT AND PLAN OF REORGANIZATION AND LIQUIDATION | |

| SUMMARY | |

| INFORMATION ABOUT THE REORGANIZATION | |

| INFORMATION ABOUT THE FUNDS | |

| VOTING INFORMATION | |

| LEGAL MATTERS | |

| FINANCIAL HIGHLIGHTS | |

| INFORMATION FILED WITH THE SEC | |

| | |

| Appendix A | |

| Appendix B | |

APPROVAL OF AGREEMENT AND PLAN OF REORGANIZATION AND LIQUIDATION

On May 21, 2020, the Board of Trustees of the Trust (the “Board”) approved the Plan. Subject to the approval of the shareholders of the Acquired Fund, the Plan provides for:

| |

| • | The transfer of all of the assets of the Class A shares of the Acquired Fund in exchange for shares of beneficial interest of Class A shares of the Acquiring Fund, the transfer of all of the assets of the Class B shares of the Acquired Fund in exchange for shares of beneficial interest of Class B shares of the Acquiring Fund and the transfer of all of the assets of the Class Y shares of the Acquired Fund in exchange for shares of beneficial interest of Class Y shares of the Acquiring Fund, and the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| |

| • | The distribution of the Acquiring Fund shares received by the Acquired Fund from the Acquiring Fund to shareholders of the Acquired Fund; and |

| |

| • | The complete termination and liquidation of the Acquired Fund. |

Class A shareholders of the Acquired Fund will become shareholders of Class A shares of the Acquiring Fund, Class B shareholders of the Acquired Fund will become shareholders of Class B shares of the Acquiring Fund and Class Y shareholders of the Acquired Fund will become shareholders of Class Y shares of the Acquiring Fund. Immediately after the Reorganization, each former Class A shareholder will hold Acquiring Fund Class A shares, each former Class B shareholder will hold Acquiring Fund Class B shares and each former Class Y shareholder will hold Acquiring Fund Class Y shares, with an aggregate net asset value (“NAV”) equal to the aggregate NAV of the shareholder’s Acquired Fund Class A, Class B and Class Y shares, respectively. The Funds expect that shareholders of the Acquired Fund will recognize no gain or loss for federal income tax purposes in connection with the Reorganization. If approved by shareholders of the Acquired Fund, consummation of the Reorganization is expected to occur on or about September 14, 2020 (the “Effective Date”).

The shareholders of the Acquired Fund must approve the Plan in order for the Reorganization to occur. Approval of the Plan requires the affirmative vote of a “majority of the outstanding voting securities” of the Acquired Fund, as that term is defined under the Investment Company Act of 1940, as amended (the “1940 Act”). The Reorganization does not require approval of the shareholders of the Acquiring Fund.

A quorum for the transaction of business by shareholders of the Acquired Fund at the Meeting will consist of the presence in person or by proxy of the holders of at least 20% of the shares of the Acquired Fund outstanding at the close of business on June 15, 2020 (the “Record Date”).

Based on its consideration of, among other factors, the anticipated tax-free nature of the Reorganization and the benefits expected to be received by shareholders of the Acquired Fund in becoming shareholders of the Acquiring Fund, the Board has determined that the Reorganization is in the best interests of the Funds and the interests of shareholders of the Funds will not be diluted as a result of the Reorganization. Accordingly, the Board unanimously recommends that shareholders vote “FOR” the Plan.

For a more complete discussion of the factors considered by the Board in approving the Reorganization, see “Information about the Reorganization-Reasons for the Reorganization.”

SUMMARY

Introduction. The following summary highlights differences between the Funds. This summary is not complete and does not contain all of the information that you should consider before voting on the Plan. This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Proxy Statement/Prospectus and the Plan, a form of which is attached to this Proxy Statement/Prospectus as Appendix A. Shareholders should read this entire Proxy Statement/Prospectus carefully. For more complete information, please read the Funds’ Prospectus. This Proxy Statement/Prospectus, the accompanying Notice of the Special Meeting of Shareholders and the enclosed Proxy Card are being mailed to shareholders of the Acquired Fund on or about July 17, 2020.

Comparison of Investment Advisory Fees. The Funds are party to the same investment advisory agreement with Madison; however, the Funds pay different advisory fees. The Acquired Fund’s annual advisory fee rate is 0.55% of the Acquired Fund’s average daily net assets, and the Acquiring Fund’s annual advisory fee rate is 0.50% of the Acquiring Fund’s average daily net assets, in each case accrued daily and paid monthly. The advisory fee rate for both Funds is reduced by 0.05% when Fund assets reach $500 million and by another 0.05% when Fund assets reach $1 billion.

Comparison of Expenses. The Acquiring Fund has a lower annual advisory fee rate than the Acquired Fund, as well as a lower overall expense ratio than that of the Acquired Fund, as illustrated in the fee table, below.

Fee Table. The purpose of the fee table below is to assist an investor in understanding the various costs and expenses that a shareholder bears directly and indirectly from an investment in the Funds. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below. You may qualify for Class A sales charge discounts if you and your immediate family invest, or agree to invest in the future, at least $25,000 in Madison Funds. More information about these and other discounts is available from your financial professional and can also be found in Appendix B of this Proxy Statement/Prospectus. The fee table shown below is based on actual Fund expenses incurred for the fiscal year ended October 31, 2019. The table also reflects the pro forma combined fees for the Acquiring Fund after giving effect to the Reorganization.

|

| | | | | | | | | |

| | Acquired Fund - High Income Fund1 (Current) | Acquiring Fund - Core Bond Fund (Current) | Acquiring Fund - Core Bond Fund (Pro Forma Combined) |

Shareholder Fees (fees paid directly from your investment) | Class A | Class B | Class Y | Class A | Class B | Class Y | Class A | Class B | Class Y |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 4.50% | None | None | 4.50% | None | None | 4.50% | None | None |

| Maximum deferred sales charge (load) (as a percentage of amount redeemed) | None | 4.50%1 | None | None | 4.50%1 | None | None | 4.50%1 | None |

| Redemption fee within 30 days of purchase (as a percentage of amount redeemed) | None | None | None | None | None | None | None | None | None |

| | | | |

Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment) | Class A | Class B | Class Y | Class A | Class B | Class Y | Class A | Class B | Class Y |

| Management fees | 0.55% | 0.55% | 0.55% | 0.50% | 0.50% | 0.50% | 0.50% | 0.50% | 0.50% |

| Distribution and/or service (12b-1) fees | 0.25% | 1.00% | None | 0.25% | 1.00% | None | 0.25% | 1.00% | None |

| Other expenses | 0.20% | 0.20% | 0.20% | 0.15% | 0.15% | 0.15% | 0.15% | 0.15% | 0.15% |

| Acquired fund fees and expenses | 0.01% | 0.01% | 0.01% | None | None | None | None | None | None |

| Total annual fund operating expenses | 1.01%2 | 1.76%2 | 0.76%2 | 0.90% | 1.65% | 0.65% | 0.90% | 1.65% | 0.65% |

1The CDSC is reduced after 12 months and eliminated after six years following purchase.

2Total annual fund operating expenses for the Acquired Fund for the period ended October 31, 2019 do not match the financial statements because the financial statements do not include acquired fund fees and expenses.

Expense Example. The following example is intended to help you compare the cost of investing in each Fund with the cost of investing in other mutual funds. The example assumes you invest $10,000 in each Fund for the time periods indicated and then redeem your shares at the end of the period. The example also assumes that your investment has a 5% return each year and that each Fund’s total annual fund operating expenses (as set forth above) remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

| | | | | | | | | | |

| | Redemption | No Redemption |

| Fund/Class | Year 1 | Year 3 | Year 5 | Year 10 | Year 1 | Year 3 | Year 5 | Year 10 |

| Acquired Fund/Class A (current) | $548 | $757 | $ | 983 |

| $1,631 | $548 | $757 | $983 | $1,631 |

| Acquiring Fund/Class A (current) | 538 | 724 | 926 |

| 1,508 | 538 | 724 | 926 | 1,508 |

Acquiring Fund/Class A (pro forma) | 538 | 724 | 926 |

| 1,508 | 538 | 724 | 926 | 1,508 |

| | | | | | | | | |

| Acquired Fund/Class B (current) | 629 | 904 | 1,154 |

| 1,875 | 179 | 554 | 954 | 1,875 |

| Acquiring Fund/Class B (current) | 618 | 870 | 1,097 |

| 1,754 | 168 | 520 | 897 | 1,754 |

Acquiring Fund/Class B (pro forma) | 618 | 870 | 1,097 |

| 1,754 | 168 | 520 | 897 | 1,754 |

| | | | | | | | | |

| Acquired Fund/Class Y (current) | 78 | 243 | 422 |

| 942 | 78 | 243 | 422 | 942 |

| Acquiring Fund/Class Y (current) | 68 | 208 | 362 |

| 810 | 66 | 208 | 362 | 810 |

Acquiring Fund/Class Y (pro forma) | 68 | 208 | 362 |

| 810 | 66 | 208 | 362 | 810 |

Comparison of Portfolio Turnover. Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Those costs, which are not reflected in annual fund operating expenses or in the expense example, affect a Fund’s performance. During the fiscal year ended October 31, 2019, each Fund’s portfolio turnover rate was the following percentage of the average value of the Fund’s portfolio:

|

| |

| Fund | Percentage of the Average Value of the Fund’s Portfolio |

| Acquired Fund | 16% |

| Acquiring Fund | 36% |

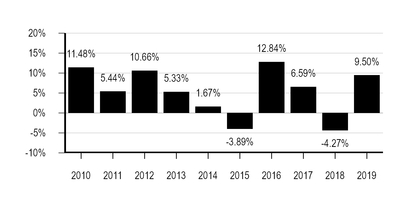

Performance Comparison. The bar chart and table shown below provide some indication of the risks of investing in the Funds. The bar chart shows how each Fund’s performance results have varied from year to year, and the table shows how each Fund’s average annual returns for the one-year, five-year and ten-year periods compare to those of a broad measure of market performance. The Funds’ past performance (before and after taxes) does not necessarily indicate how the Funds will perform in the future. Updated performance information current to the most recent month end is available at no cost by visiting www.madisonfunds.com or by calling 1-800-877-6089.

Acquired Fund - High Income Fund

Calendar Year Total Returns for Class A Shares

(Returns do not reflect sales charges and would be lower if they did.)

|

| | | | |

| | Highest/Lowest quarter end results during this period were: |

| |

| | Highest: | 4Q 2011 | 6.37 | % |

| | Lowest: | 3Q 2015 | -5.36 | % |

Average Annual Total Returns

For periods ended December 31, 2019

|

| | | | | | |

| | 1 Year | 5 Years | 10 Years |

Class A Shares - Return Before Taxes | 4.63 | % | 2.96 | % | 4.89 | % |

| Return After Taxes on Distributions | 2.57 | % | 0.82 | % | 2.29 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | 2.72 | % | 1.28 | % | 2.71 | % |

Class B Shares - Return Before Taxes | 4.26 | % | 2.77 | % | 4.74 | % |

Class Y Shares - Return Before Taxes | 9.69 | % | 4.18 | % | 5.66 | % |

ICE BofA U.S. High Yield Constrained Index (reflects no deduction for sales charges, account fees, expenses or taxes) | 14.41 | % | 6.14 | % | 7.48 | % |

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A shares and will vary for other share classes. Returns after taxes on distributions and sale of Fund shares may be higher than other returns for the same period due to the tax benefit of realizing a capital loss on the sale of Fund shares.

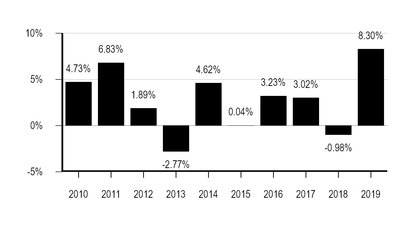

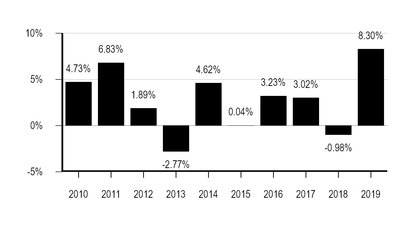

Acquiring Fund - Core Bond Fund

Calendar Year Total Returns for Class A Shares

(Returns do not reflect sales charges and would be lower if they did.)

|

| | | | |

| | Highest/Lowest quarter end results during this period were: |

| |

| | Highest: | 3Q 2011 | 4.05 | % |

| | Lowest: | 4Q 2016 | -2.39 | % |

Average Annual Total Returns

For periods ended December 31, 2019

|

| | | | | | |

| | 1 Year | 5 Years | 10 Years |

Class A Shares - Return Before Taxes | 3.39 | % | 1.73 | % | 2.37 | % |

| Return After Taxes on Distributions | 2.36 | % | 0.68 | % | 1.35 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | 1.99 | % | 0.86 | % | 1.40 | % |

Class B Shares - Return Before Taxes | 3.10 | % | 1.54 | % | 2.22 | % |

Class Y Shares - Return Before Taxes | 8.52 | % | 2.93 | % | 3.09 | % |

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for sales charges, account fees, expenses or taxes) | 8.72 | % | 3.05 | % | 3.75 | % |

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A shares and will vary for other share classes. Returns after taxes on distributions and sale of Fund shares may be higher than other returns for the same period due to the tax benefit of realizing a capital loss on the sale of Fund shares.

The performance history of the Acquiring Fund will survive consummation of the Reorganization. Please remember that past performance (both before and after taxes) is no guarantee of the results the Funds may achieve in the future. Future returns may be higher or lower than the returns achieved in the past.

Comparison of Investment Objectives and Strategies. The investment objective of the Acquired Fund is to seek high current income. The Acquired Fund also seeks capital appreciation, but only when consistent with its primary goal. The investment objective of the Acquiring Fund is to seek to generate a high level of current income, consistent with the prudent limitation of investment risk. While the investment objective of each Fund emphasizes high current income, the Acquired Fund also looks for capital appreciation while the Acquiring Fund does not, preferring instead to attempt to limit investment risk.

The Acquired Fund seeks to achieve its investment objective by investing primarily in lower-rated, higher-yielding income bearing securities, such as “junk” bonds. Because the performance of these securities has historically been strongly influenced by economic conditions, the Acquired Fund may rotate securities selection by business sector according to the economic outlook. Under normal market conditions, the Acquired Fund invests at least 80% of its net assets (including borrowings for investment purposes) in bonds rated lower than investment grade (BBB/Baa) and their unrated equivalents or other high-yielding securities. Types of bonds and other securities include, but are not limited to, domestic and foreign (including emerging market) corporate bonds, debentures, notes, convertible securities, preferred stocks, municipal obligations, government obligations and mortgage-backed securities. Up to 25% of the Acquired Fund’s assets may be invested in the securities of issuers in any one industry, and up to 50% of the Acquired Fund’s assets may be invested in restricted securities (a restricted security is one that has a contractual restriction on resale or cannot be resold publicly until it is registered under the Securities Act of 1933, as amended). The dollar weighted average life of the Acquired Fund as of December 31, 2019 was 1.97 years. In selecting the Acquired Fund’s investments, the portfolio managers employ a multi-faceted, “bottom up” investment approach that utilizes proprietary analytical tools which are integral to assessing the potential risk and relative value of each investment and also assist in identifying companies that are likely to have the ability to meet their interest and principal payments on their debt securities. Investment candidates are analyzed in depth at a variety of risk levels. Investments are not made on the basis of one single factor. Rather, investments are made based on the careful consideration of a variety of factors, including: (i) analyses of business risks (including leverage risk) and macro risks (including interest rate trends, capital market conditions and default rates); (ii) assessment of the industry’s attractiveness and competitiveness; (iii) evaluation of the business, including core strengths and competitive weaknesses; (iv) qualitative evaluation of the management team, including in-person meetings or conference calls with key managers; and (v) quantitative analyses of the company’s financial statements.

Under normal market conditions, the Acquiring Fund seeks to achieve its investment objective by investing at least 80% of its net assets (including borrowings for investment purposes) in bonds. To keep current income relatively stable and to limit share price volatility, the Acquiring Fund emphasizes investment grade securities and maintains an intermediate (typically 3-7 year) average portfolio duration, with the goal of being between 85-115% of the market benchmark duration (for this purpose, the benchmark used is Bloomberg Barclays U.S. Aggregate Bond Index, the duration of which as of December 31, 2019 was 5.79 years). Duration is an approximation of the expected change in a debt security’s price given a 1% move in interest rates, using the following formula: [change in debt security value = (change in interest rates) x (duration) x (-1)]. By way of example, assume XYZ company issues a five year bond which has a duration of 4.5 years. If interest rates were to instantly increase by 1%, the bond would be expected to decrease in value

by approximately 4.5%. The Acquiring Fund is managed so that, under normal market conditions, the weighted average life of the Fund will be 10 years or less. The weighted average life of the Acquiring Fund as of December 31, 2019 was 8.16 years. The Acquiring Fund strives to add incremental return in the portfolio by making strategic decisions relating to credit risk, sector exposure and yield curve positioning. The Acquiring Fund generally holds 150-275 individual securities in its portfolio at any given time and may invest in the following instruments:

| |

| • | Corporate debt securities: securities issued by domestic and foreign (including emerging market) corporations which have a rating within the four highest categories and, to a limited extent (up to 20% of its assets), in securities not rated within the four highest categories (i.e., “junk bonds”). Madison will only invest in lower-grade securities when it believes that the creditworthiness of the issuer is stable or improving, and when the potential return of investing in such securities justifies the higher level of risk; |

| |

| • | U.S. Government debt securities: securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities; |

| |

| • | Foreign government debt securities: securities issued or guaranteed by a foreign (including emerging market) government or its agencies or instrumentalities, payable in U.S. dollars, which have a rating within the four highest categories; |

| |

| • | Non-rated debt securities: securities issued or guaranteed by corporations, financial institutions, and others which, although not rated by a national rating service, are considered by Madison to have an investment quality equivalent to those categories in which the Acquiring Fund is permitted to invest (including up to 20% of the Acquiring Fund’s assets in junk bonds); and |

| |

| • | Asset-backed, mortgage-backed and commercial mortgage-backed securities: securities issued or guaranteed by special purpose corporations and financial institutions that represent direct or indirect participation in, or are collateralized by, an underlying pool of assets. The types of assets that can be “securitized” include, among others, residential or commercial mortgages, credit card receivables, automobile loans, and other assets. |

Madison may alter the composition of the Acquiring Fund with regard to quality and maturity and may sell securities prior to maturity. Madison’s intent when it sells bonds is to “lock in” any gains already achieved by that investment or, alternatively, prevent additional or potential losses that could occur if Madison continued to hold the bond. Turnover may also occur when Madison finds an investment that could generate a higher return than the investment currently held. However, increasing portfolio turnover at a time when Madison’s assessment of market performance is incorrect could lower investment performance. Under normal market conditions, the Acquiring Fund will not engage in active or frequent trading of its bonds. However, it is possible that Madison will determine that market conditions require a significant change to the composition of the Acquiring Fund’s portfolio. For example, if interest rates begin to rise, Madison may attempt to sell bonds in anticipation of further rate increases before they lose more value.

In addition to the foregoing, Madison reserves the right to invest a portion of the Acquiring Fund’s assets in short-term debt securities (i.e., those with maturities of one year or less) and to maintain a portion of the Acquiring Fund’s assets in uninvested cash. However, Madison does not intend to hold more than 35% of the Acquiring Fund’s assets in such investments. Short-term investments may include investment grade certificates of deposit, commercial paper and repurchase agreements. Madison might hold substantial cash reserves in seeking to reduce the Acquiring Fund’s exposure to bond price depreciation during a period of rising interest rates and to maintain desired liquidity while awaiting more attractive investment conditions in the bond market. The investment strategy of the Acquiring Fund reflects Madison’s general “Participate and Protect®”

investment philosophy. Madison’s expectation is that investors in the Acquiring Fund will participate in market appreciation during bull markets and experience something less than full participation during bear markets compared with investors in portfolios holding more speculative and volatile securities; therefore, this investment philosophy is intended to represent a conservative investment strategy. There is no assurance that Madison’s expectations regarding this investment strategy will be realized.

Although each Fund expects to pursue its investment objective utilizing its principal investment strategies regardless of market conditions, each Fund may invest up to 100% in money market instruments. To the extent a Fund engages in this temporary defensive position, the Fund’s ability to achieve its investment objective may be diminished.

In their management of the Acquiring Fund, the portfolio managers of the Acquiring Fund intend to continue to follow the same investment strategies currently utilized in managing the Acquiring Fund, as described above. Mike Sanders, the Co-Head of Fixed Income at Madison, co-manages each Fund.

Comparison of Fundamental and Non-Fundamental Investment Policies.

Fundamental Policies. Fundamental investment policies are policies that, under the 1940 Act, may not be changed without a shareholder vote. The 1940 Act requires a fund to disclose whether it has certain policies relating to, for example, borrowing money or issuing senior securities, and that these policies be fundamental. The Acquiring Fund has the same fundamental policies as the Acquired Fund. In addition to the fundamental policies listed below, the investment objective of both Funds is a fundamental investment policy which cannot be changed without shareholder approval.

|

| |

| Fundamental Policies |

| Acquired Fund | Acquiring Fund |

| The Fund will not, with respect to 75% of its total assets, purchase securities of an issuer (other than the U.S. Government, its agencies or instrumentalities), if (i) such purchase would cause more than 5% of the Fund’s total assets taken at market value to be invested in the securities of such issuer or (ii) such purchase would at the time result in more than 10% of the outstanding voting securities of such issuer being held by the Fund. | Same. |

| The Fund will not invest 25% or more of its total assets in the securities of one or more issuers conducting their principal business activities in the same industry (excluding the U.S. Government or any of its agencies or instrumentalities). | Same. |

| The Fund will not borrow money, except that it may (i) borrow from any lender for temporary purposes in amounts not in excess of 5% of its total assets and (ii) borrow from banks in any amount for any purpose, provided that immediately after borrowing from a bank, the fund’s aggregate borrowings from any source do not exceed 33 1/3% of the Fund’s total assets (including the amount borrowed). If, after borrowing from a bank, the Fund’s aggregate borrowings later exceed 33 1/3% of the Fund’s total assets, the Fund will, within three days after exceeding such limit (not including Sundays or holidays), reduce the amount of its borrowings to meet the limitation. The Fund may make additional investments while it has borrowings outstanding, and the Fund may make other borrowings to the extent permitted by applicable law. | Same. |

|

| |

| Fundamental Policies |

| Acquired Fund | Acquiring Fund |

| The Fund may not make loans, except through (i) the purchase of debt obligations in accordance with the Fund’s investment objective and policies, (ii) repurchase agreements with banks, brokers, dealers and other financial institutions, and (iii) loans of securities as permitted by applicable law. | Same. |

| The Fund may not underwrite securities issued by others, except to the extent that the sale of portfolio securities by the Fund may be deemed to be an underwriting. | Same. |

| The Fund may not purchase, hold or deal in real estate, although it may purchase and sell securities that are secured by real estate or interests therein, securities of real estate investment trusts and mortgage-related securities and may hold and sell real estate acquired by the Fund as a result of the ownership of securities. | Same. |

| The Fund may not invest in commodities or commodity contracts, except that the Fund may invest in currency, and financial instruments and contracts that are commodities or commodity contracts. | Same. |

| The Fund may not issue senior securities to the extent such issuance would violate applicable law. | Same. |

Non-Fundamental Policies. Non-fundamental investment policies may be changed by the Board of Trustees of the Funds without a shareholder vote. The Acquiring Fund has substantially similar non-fundamental policies as the Acquired Fund.

|

| |

| Non-Fundamental Policies |

| Acquired Fund | Acquiring Fund |

| The Fund will not sell securities short or maintain a short position, except for short sales against the box. | Same. |

| The Fund will not purchase illiquid securities if more than 15% of the total assets of the Fund, taken at market value, would be invested in such securities. | Same. |

| No similar policy. | The Fund will not invest more than 5% of the value of its total assets (determined as of the date of purchase) in the securities of any one issuer (other than securities issued or guaranteed by the United States Government or any of its agencies or instrumentalities and excluding bank deposits), and Madison will not purchase, on behalf of the Fund, any securities when, as a result, more than 10% of the voting securities of the issuer would be held by the Fund. For purposes of these restrictions, the issuer is deemed to be the specific legal entity having ultimate responsibility for payment of the obligations evidenced by the security and whose assets and revenues principally back the security. |

| No similar policy. | At least 65% of the Fund’s assets must be invested in investment grade securities. |

Comparison of Principal Risks. The principal risks of the Acquiring Fund are substantially the same as those of the Acquired Fund. A description of each of these risks is provided below.

|

| |

| Principal Risks |

| Acquired Fund | Acquiring Fund |

Non-Investment Grade Security Risk. Issuers of non-investment grade securities (i.e., “junk” bonds) are typically in weak financial health and, compared to issuers of investment-grade bonds, they are more likely to encounter financial difficulties and to be materially affected by these difficulties when they do encounter them. Because the Fund invests a significant portion of its assets in these securities, the Fund may be subject to greater levels of credit and liquidity risk than a fund that does not invest in such securities. These securities are considered predominately speculative with respect to the issuer's continuing ability to make principal and interest payments. An economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund's ability to sell these securities. If the issuer of a security is in default with respect to interest or principal payments, the Fund may lose its entire investment. Because of the risks involved in investing in non-investment grade securities, an investment in a fund that invests in such securities should be considered speculative. | Similar, but only to the extent the Fund invests in non-investment grade securities (subject to a limitation of no more than 20% of the Fund’s assets). |

Interest Rate/Credit Risks. The Fund is subject to interest rate risk and above-average credit risk, which are risks that the value of your investment will fluctuate in response to changes in interest rates or an issuer will not honor a financial obligation. Investors should expect greater fluctuations in share price, yield and total return compared to bond funds holding bonds and other income bearing securities with higher credit ratings and/or shorter maturities. These fluctuations, whether positive or negative, may be sharp and unanticipated. | Similar. The Fund, like most income funds, is subject to interest rate risk as well as average (as opposed to above-average) credit risk. |

|

| |

| Principal Risks |

| Acquired Fund | Acquiring Fund |

Liquidity Risk. The Fund is also subject to liquidity risk, which means there may be little or no trading activity for the debt securities in which the Fund invests, and that may make it difficult for the Fund to value accurately and/or sell those securities. In addition, liquid debt securities in which the Fund invests are subject to the risk that during certain periods their liquidity will shrink or disappear suddenly and without warning as a result of adverse economic, regulatory or market conditions, or adverse investor perceptions. If the Fund experiences rapid, large redemptions during a period in which a substantial portion of its debt securities are illiquid, the Fund may be forced to sell those securities at a discount, which could result in significant fund and shareholder losses. Liquidity risk may be higher for the Fund than those of income funds that hold U.S. government securities as part of their portfolios because the liquidity of U.S. government securities has historically continued in times of recent market stress. The Fund normally holds few or no U.S. government securities. | Similar. The Fund has liquidity risk, but because the Fund may hold U.S. government securities in its portfolio, to the extent such securities are held, the Fund’s liquidity risk is mitigated. |

Prepayment/Extension Risk. The Fund may also invest in mortgage-backed securities that are subject to prepayment/extension risks, which is the chance that a fall/rise in interest rates will reduce/extend the life of a mortgage-backed security by increasing/decreasing mortgage prepayments, typically reducing the fund’s return. | Same. |

| No similar risk. | Call Risk. If a bond issuer “calls” a bond held by the Fund (i.e., pays it off at a specified price before it matures), the Fund could have to reinvest the proceeds at a lower interest rate. It may also experience a loss if the bond is called at a price lower than what the Fund paid for the bond. |

| Similar to “Non-Investment Grade Security Risk,” discussed above. | Risk of Default. Although Madison monitors the condition of bond issuers, it is still possible that unexpected events could cause the issuer to be unable to pay either principal or interest on its bond. This could cause the bond to go into default and lose value. Some federal agency securities are not backed by the full faith and credit of the United States, so in the event of default, the Fund would have to look to the agency issuing the bond for ultimate repayment. |

|

| |

| Principal Risks |

| Acquired Fund | Acquiring Fund |

| Similar to “Prepayment/Extension Risk,” discussed above. | Mortgage-Backed Securities Risk. The Fund may own obligations backed by mortgages issued by a government agency or through a government-sponsored program. If the mortgage holders prepay principal during a period of falling interest rates, the Fund could be exposed to prepayment risk. In that case, the Fund would have to reinvest the proceeds at a lower interest rate. The security itself may not increase in value with the corresponding drop in rates since the prepayment acts to shorten the maturity of the security. |

Federal Income Tax Consequences. The Funds expect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), with substantially the following results: no gain or loss will be recognized by the Acquired Fund or its shareholders as a result of the Reorganization. The aggregate tax basis of the shares of the Acquiring Fund received by a shareholder of the Acquired Fund (including any fractional shares to which the shareholder may be entitled) will be the same as the aggregate tax basis of the shareholder’s shares of the Acquired Fund. The holding period of the shares of the Acquiring Fund received by a shareholder of the Acquired Fund (including any fractional share to which the shareholder may be entitled) will include the holding period of the shares of the Acquired Fund held by the shareholder, provided that such shares are held as capital assets by the shareholder of the Acquired Fund at the time of the Reorganization. The holding period and tax basis of each asset of the Acquired Fund in the hands of the Acquiring Fund as a result of the Reorganization will generally be the same as the holding period and tax basis of each such asset in the hands of the Acquired Fund prior to the Reorganization. It is a condition to the closing of the Reorganization that both the Acquired Fund and Acquiring Fund receive an opinion of Godfrey & Kahn, S.C. confirming these consequences, as further discussed below under “Information About the Reorganization-Federal Income Tax Consequences.” An opinion of counsel is not binding on the Internal Revenue Service.

Additional tax considerations are discussed under the section on “Information about the Reorganization-Federal Income Tax Consequences.”

Distributor; Rule 12b-1 Service Plan. MFD Distributor, LLC (“MFD”) is the Funds’ distributor. MFD’s principal business address is 550 Science Drive, Madison, Wisconsin 53711. MFD is a wholly-owned subsidiary of MIH and an affiliate of Madison. The Board of Trustees has adopted a Rule 12b-1 plan with respect to each Fund’s Class A and Class B shares pursuant to which the Funds pay for shareholder services at an aggregate annual rate of 0.25% of each Fund’s daily net assets attributable to the Class A and Class B shares. In addition, the Board has adopted a separate Rule 12b-1 plan with respect to each Fund’s Class B shares pursuant to which the Funds pay for distribution-related expenses at an aggregate annual rate of 0.75% of each Fund’s daily net assets attributable to the Class B shares. For more information, please see Appendix B.

Other Service Providers. Deloitte & Touche LLP serves as the Funds’ independent registered accounting firm; State Street Bank & Trust Company services as the Funds’ sub-administrator, fund accountant, custodian and securities lending agent; and DST Asset Manager Solutions, Inc. serves as the Funds’ transfer agent.

Comparison of Purchase, Exchange and Redemption Procedures. The purchase, exchange redemption procedures of the Acquired Fund and the Acquiring Fund are exactly the same. Class A shares of both Funds are subject to a front-end sales load, Class B shares of both Funds are subject to a contingent deferred sale charge (“CDSC”) that is eliminated over time, and Class Y shares of both Funds are not subject to either a front-end load or a CDSC. In addition, shares of both Funds are redeemed at a price equal to the NAV next determined after the redemption request is accepted in good order by the Funds (subject to the CDSC for Class B shares, as applicable). The Funds do not impose any redemption fees. For more information, please see Appendix B.

INFORMATION ABOUT THE REORGANIZATION

Introduction. This Proxy Statement/Prospectus is provided to you to solicit your proxy for exercise at the Meeting to approve the Reorganization of the assets and assumption of the liabilities of the Acquired Fund by the Acquiring Fund and the subsequent liquidation and dissolution of the Acquired Fund. The Meeting will be held at 550 Science Drive, Madison, Wisconsin 53711, at 10:30 a.m. Central time on September 2, 2020. This Proxy Statement/Prospectus, the accompanying Notice of Special Meeting of Shareholders and the enclosed Proxy Card are being mailed to shareholders of the Acquired Fund on or about July 17, 2020.

Description of the Plan. The Reorganization is expected to be consummated as of the Effective Date. Under the Plan, the Acquired Fund will transfer all of its assets to the Acquiring Fund and, in exchange, the Acquiring Fund will assume all the Acquired Fund’s liabilities and will issue Class A, Class B and Class Y shares of the Acquiring Fund (the “Reorganization Shares”) to the Acquired Fund. The value of the Acquired Fund’s assets, as well as the number of Reorganization Shares to be issued to the Acquired Fund, will be determined in accordance with the Plan. The Reorganization Shares to be issued will have an aggregate NAV equal to the aggregate value of the assets received from the Acquired Fund, less the aggregate liabilities assumed by the Acquiring Fund in the Reorganization. The Reorganization Shares will immediately be distributed to Acquired Fund shareholders in proportion to their holdings of Class A, Class B and Class Y shares of the Acquired Fund, in liquidation of the Acquired Fund. As a result, Class A shareholders of the Acquired Fund will become Class A shareholders of the Acquiring Fund, Class B shareholders of the Acquired Fund will become Class B shareholders of the Acquiring Fund and Class Y shareholders of the Acquired Fund will become Class Y shareholders of the Acquiring Fund. The NAV of the Funds will be computed as of the close of regular trading on the New York Stock Exchange on the day prior to the Effective Date (the “Valuation Time”).

Following the distribution of the Reorganization Shares of the Acquiring Fund in full liquidation of the Acquired Fund, the Acquired Fund will wind up its affairs, cease operations and dissolve as soon as is reasonably practicable after the Reorganization. If the shareholders do not approve the Plan, the Board will consider alternative options for the Acquired Fund, including liquidation.

The projected expenses of the Reorganization, including printing and proxy solicitation expenses, legal and accounting costs, are estimated to be approximately $47,935. All such costs and expenses will be borne by Madison, not the Funds. The Acquired Fund plans to sell approximately 20 securities representing 24% of the Acquired Fund’s portfolio prior to consummation of the Reorganization. In this regard, Madison expects to sell CCC-rated bonds, B3 rated bonds, ETFs, non-rated bonds and any positions with a par value of $100,000 or less. The positions sold will help move the overall quality of the Acquired Fund’s portfolio slightly higher to be more in line with the Acquiring Fund’s portfolio and to manage position sizes towards par values that are easier to trade. Minimal gains are expected to be realized from the trades and no capital gain distribution will be

required prior to consummation of the Reorganization given the large capital losses currently held in the Acquired Fund. Madison expects that the Acquired Fund will have a small amount of net investment income to distribute (approximately $18,000). Given that the securities will be sold at the market bid, the Acquired Fund will not incur any portfolio repositioning costs in connection with the Reorganization.

If the Plan is approved, the Reorganization will be consummated on the Effective Date and is conditioned upon satisfying the terms of the Plan. Under applicable legal and regulatory requirements, none of the Acquired Fund’s shareholders will be entitled to exercise objecting shareholders' appraisal rights (i.e., to demand the fair value of their shares in connection with the Reorganization). Therefore, shareholders will be bound by the terms of the Plan. However, any shareholder of the Acquired Fund may redeem his or her shares prior to the Effective Date.

Completion of the Reorganization is subject to certain conditions set forth in the Plan. The Plan may be amended by the Board, and may also be terminated by the Board if circumstances should develop that, in the opinion of the Board, make proceeding with the Reorganization inadvisable. The form of the Plan is attached as Appendix A.

Reasons for the Reorganization. At a meeting of the Board held on May 21, 2020 (the “Board Meeting”), Madison recommended that the Board approve and recommend to Acquired Fund shareholders for their approval the proposed Plan. At the Board Meeting, the Board reviewed detailed information provided by Madison, and considered, among other things, the factors discussed below, in light of their fiduciary duties under federal and state law. After careful consideration, the Board, including all trustees who are not “interested persons” of the Funds, with the advice and assistance of independent counsel, approved the Plan and the Reorganization, and recommended that the shareholders of the Acquired Fund vote in favor of the Reorganization by approving the Plan.

In approving and recommending the proposed Plan, the Board considered, among other things:

| |

| • | The terms of the Reorganization, including the anticipated tax-free nature of the transaction for the Acquired Fund and its shareholders; |

| |

| • | That, despite each Fund having a different focus (i.e. for the Acquired Fund, investing primarily in non-investment grade securities, and for the Acquiring Fund, investing primarily in investment grade securities), the Acquired Fund shareholders will become investors in a fund that is managed using the same investment discipline which relies on extensive credit research to find income producing investments; |

| |

| • | That Mike Sanders, the Co-Head of Fixed Income at Madison, is on the portfolio management team for both Funds; |

| |

| • | That the advisory fee for the Acquiring Fund is lower than that of the Acquired Fund, and the overall expense ratios for the Acquiring Fund’s Class A, Class B and Class Y shares are lower than those of the Acquired Fund’s Class A, Class B and Class Y shares, respectively; |

| |

| • | That the Acquired Fund has substantial capital loss carryforwards on its books, and reorganizing the Acquired Fund with and into the Acquiring Fund versus liquidating the Acquired Fund allows the capital loss carryforwards to be transferred to the Acquiring Fund; |

| |

| • | That despite having a better performance track record than the Acquiring Fund, the Acquired Fund’s prospects for future growth are limited and combining the Acquired Fund with the larger Acquiring Fund results in synergies described above which Madison and the distributor of the Madison Funds believe will help facilitate the future growth of the combined Fund; |

| |

| • | That the Reorganization will not result in the dilution of shareholders’ interests; |

| |

| • | That the Funds will not bear the costs of the Reorganization; and |

| |

| • | Other alternatives to the Reorganization, including liquidation (which would impose transaction and other costs and would not be tax-free). |

Based on the foregoing and additional information presented at the Board Meeting, the Board determined that the Reorganization and the Plan would be in the best interests of the Funds and the interests of shareholders of the Funds will not be diluted as a result of the Reorganization. The Board concluded that the advantages associated with proceeding with the Reorganization outweighed any disadvantages that they identified as part of their review (e.g., combining a Fund with a better performance track record (Acquired Fund) with a lower performing Fund (Acquiring Fund)). The Board approved the Plan, subject to approval by shareholders of the Acquired Fund, and the solicitation of the shareholders of the Acquired Fund to vote “FOR” the approval of the Plan.

Description of the Securities to be Issued. The Declaration of Trust of the Trust permits the Board of Trustees to issue an unlimited number of shares of beneficial interest of each series within the Trust with no par value per share. Each Fund is a series of the Trust which offers three share classes: Class A, Class B and Class Y. Under the Plan, the Acquiring Fund will issue Class A, Class B and Class Y shares for distribution to the Acquired Fund shareholders in exchange for their Class A, Class B and Class Y shares, respectively. The Class A, Class B and Class Y shares of the Acquiring Fund are identical in all respects to the Class A, Class B and Class Y shares of the Acquired Fund.

On any matter submitted to a vote of the shareholders, each shareholder shall be entitled to one vote for each dollar of net asset value standing in such shareholder’s name on the books of each Fund and class of which such shareholder owns shares which are entitled to vote on the matter. Each share of beneficial interest of each Fund shares equally in dividends and distributions when and if declared by the Fund and in the Fund’s net assets upon liquidation. All shares, when issued, are fully paid and nonassessable. The shares do not entitle the holder thereof to preference, preemptive, appraisal, conversion or exchange rights, except as the Board of Trustees may determine. Shareholders of each Fund vote, as a series of the Trust, to change, among other things, a fundamental policy of the Fund and to approve the Fund’s investment advisory contract. The Funds are not required to hold annual meetings of shareholders but will hold special meetings of shareholders when, in the judgment of the Board of Trustees, it is necessary or desirable to submit matters for a shareholder vote.

Dividends and Other Distributions. On or before the Valuation Time, the Acquired Fund may make one or distributions to shareholders. Such distributions generally will be taxable as ordinary income or capital gains to shareholders that hold their shares of the Acquired Fund in a taxable account.

Share Certificates. The Acquiring Fund will not issue certificates representing Acquiring Fund shares generally or in connection with the Reorganization. Instead, ownership of the Acquiring Fund’s shares will be shown on the books of the Acquiring Fund's transfer agent. If you currently hold certificates representing shares of the Acquired Fund, it is not necessary to surrender the certificates.

Federal Income Tax Consequences. The Reorganization is expected to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Code, and thus is not expected to result in the recognition of gain or loss by either the Acquired Fund or its shareholders. As a condition to the closing of the Reorganization, subject to certain stated assumptions contained therein, the Acquired Fund and the Acquiring Fund will receive an opinion from Godfrey & Kahn, S.C. substantially to the effect that, for United States federal income tax purposes:

| |

| • | The transfer of all of the assets and liabilities of the Acquired Fund to the Acquiring Fund in exchange for Reorganization Shares and the distribution to the Acquired Fund shareholders of the Reorganization Shares will constitute a “reorganization” within the meaning of Section 368(a) of the Code, and the Acquired Fund and the Acquiring Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code; No gain or loss will be recognized by the Acquiring Fund upon its receipt of the assets of the Acquired Fund solely in exchange for the Reorganization Shares and the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| |

| • | No gain or loss will be recognized by the Acquired Fund upon the transfer of all of its assets to the Acquiring Fund solely in exchange for the Reorganization Shares and the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| |

| • | No gain or loss will be recognized by the Acquired Fund upon the distribution of the Reorganization Shares to the Acquired Fund shareholders in exchange for their shares of the Acquired Fund in complete liquidation of the Acquired Fund; |

| |

| • | No gain or loss will be recognized by the shareholders of the Acquired Fund upon the receipt of the Reorganization Shares solely in exchange for their shares of the Acquired Fund as part of the Reorganization; |

| |

| • | The aggregate adjusted tax basis of the Reorganization Shares received by a shareholder of the Acquired Fund will be the same as the aggregate adjusted tax basis of the shares of the Acquired Fund exchanged therefor by such shareholder; |

| |

| • | The holding period of the Reorganization Shares received by a shareholder of the Acquired Fund will include the holding period during which the shares of the Acquired Fund exchanged therefor were held by such shareholder, provided that at the time of the exchange, the shares of the Acquired Fund were held as a capital asset in the hands of such Acquired Fund shareholder; |

| |

| • | The aggregate tax basis of the assets of the Acquired Fund in the hands of the Acquiring Fund will be the same as the aggregate tax basis of such assets immediately prior to the transfer thereof; |

| |

| • | The holding period of each asset of the Acquired Fund in the hands of the Acquiring Fund will include the respective holding period of such assets in the hands of the Acquired Fund immediately prior to the transfer thereof; and |

| |

| • | The Acquiring Fund will succeed to and take into account the items of the Acquired Fund described in Section 381(c) of the Code, subject to any applicable conditions and limitations specified in Sections 381, 382, 383, and 384 of the Code and the regulations thereunder. |

This opinion may contain limitations that Godfrey & Kahn, S.C. deems appropriate and will be based on customary assumptions and representations that Godfrey & Kahn, S.C. reasonably requests. This opinion of counsel will not be binding on the Internal Revenue Service or a court and there is no assurance that the Internal Revenue Service or a court will not take a view contrary to those expressed in the opinion.

The ability of the Acquiring Fund to use the capital loss carryforwards of the Acquired Fund to offset future gains will be limited as a direct result of the Reorganization, in accordance with Section 382 of the Code. However, all losses carried over will become available to use in subsequent years. The Code requires a calculation which allows a certain amount of losses to become available for use each subsequent year until all such losses become available.

Shareholders of the Acquired Fund are encouraged to consult their tax advisers regarding the effect, if any, of the Reorganization in light of their individual circumstances. Because the foregoing only relates to the federal income tax consequences of the Reorganization, those shareholders also should consult their tax advisers as to state and local tax consequences, if any, of the Reorganization.

Capitalization Information. The following table shows the capitalization of each of the Funds as of April 30, 2020, and on a pro forma combined basis, giving effect to the acquisition of the assets and liabilities of the Acquired Fund by the Acquiring Fund at net asset value as of April 30, 2020:

|

| | | | | | | | | | | |

| Share Class | Acquired Fund | Acquiring Fund | Pro Forma Adjustments | Acquired Fund Pro Forma Combined |

| Class A: | | | | |

| Net Assets | $ | 14,550,833 |

| $ | 29,667,862 |

| — |

| $ | 44,218,695 |

|

Shares Outstanding1 | 2,794,505 |

| 2,797,524 |

| (1,423,079 | ) | 4,168,950 |

|

| Net Asset Value per Share | $ | 5.21 |

| $ | 10.61 |

| — |

| $ | 10.61 |

|

| | | | | |

| Class B: | | | | |

| Net Assets | $ | 755,243 |

| $ | 1,032,851 |

| — |

| $ | 1,788,094 |

|

Shares Outstanding1 | 140,574 |

| 97,368 |

| (69,392 | ) | 168,550 |

|

| Net Asset Value per Share | $ | 5.37 |

| $ | 10.61 |

| — |

| $ | 10.61 |

|

| | | | | |

| Class Y: | | | | |

| Net Assets | $ | 724,422 |

| $ | 87,154,778 |

| — |

| $ | 87,879,200 |

|

Shares Outstanding1 | 142,511 |

| 8,268,623 |

| (73,780 | ) | 8,337,354 |

|

| Net Asset Value per Share | $ | 5.08 |

| $ | 10.54 |

| — |

| $ | 10.54 |

|

1The correlating Acquired Fund share classes will be exchanged for the Acquiring Fund share classes at the Acquiring Fund’s ending NAV calculated as of the Valuation Time.

Costs of the Reorganization. Reorganization costs, estimated at approximately $47,935, will be borne by Madison, not the Funds. Such costs include printing and proxy solicitation expenses, legal and accounting costs, and the costs of terminating the Acquired Fund following the Reorganization. It is expected that there will be no portfolio repositioning costs incurred in connection with the Reorganization.

INFORMATION ABOUT THE FUNDS

Shareholder Rights. Each Fund is a series of the Trust, an open-end management investment company organized as a Delaware statutory trust, which is overseen by the same Board of Trustees. Moreover, each Fund is a diversified investment company registered under the 1940 Act. Because both Funds are separate series of the same Trust, shareholders of each Fund have identical rights. Accordingly, the rights of shareholders of the Acquired Fund will not change as a result of the Reorganization.

Investment Advisor; Advisory Agreements and Fees. The investment adviser for both Funds is Madison, which is located at 550 Science Drive, Madison, Wisconsin 53711. Madison is a wholly-owned subsidiary of Madison Investment Holdings, Inc. (“MIH”). As of December 31, 2019, MIH, which was founded in 1974, and its affiliate organizations, including Madison, managed approximately $17.9 billion in assets, including open-end mutual funds, closed-end funds, separately managed accounts and wrap accounts.