UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by Registrant | ☒ |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

HELIOS AND MATHESON ANALYTICS INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies: |

2) Aggregate number of securities to which transaction applies: |

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): |

4) Proposed maximum aggregate value of transaction: |

5) Total fee paid: |

☐ Fee paid previously with preliminary materials |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. 1) Amount Previously Paid: |

2) Form, Schedule or Registration Statement No.: |

3) Filing Party: |

4) Date Filed: |

April 27, 2015 |  |

Dear Shareholder:

You are cordially invited to attend the Helios and Matheson Analytics Inc. Annual Meeting of Shareholders on May 29, 2015. The meeting will begin promptly at 10:00 a.m. local time at the Company’s headquarters located at Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York 10118.

The official Notice of Annual Meeting of Shareholders, proxy statement, proxy card and return envelope are included with this letter. Also enclosed is our Annual Report to shareholders for the year ended December 31, 2014. The matters listed in the Notice of the Annual Meeting of Shareholders are described in detail in the proxy statement.

The vote of every shareholder is important. Please review carefully the enclosed materials and then sign, date and promptly mail your proxy. If you sign and return your proxy card without giving any instruction, it will be voted as the Board of Directors recommends.

The Board of Directors and management look forward to greeting those shareholders who are able to attend.

| Sincerely, HELIOS AND MATHESONANALYTICS INC. /s/ Divya Ramachandran Divya Ramachandran,President andChief Executive Officer |

HELIOS AND MATHESONANALYTICS INC.

EMPIRE STATE BUILDING 350 FIFTH AVENUE

NEW YORK, NEW YORK 10118

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 29, 2015

To the Shareholders of HELIOS AND MATHESON ANALYTICS INC.

PLEASE TAKE NOTICE that the Annual Meeting of Shareholders of Helios and Matheson Analytics Inc. (“Helios and Matheson” or the “Company”) will be held at 10:00 a.m. (local time), on May 29, 2015, at the Company’s headquarters located at Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York 10118 for the following purposes:

| | 1. | To elect four Directors to serve until the Annual Meeting of Shareholders in 2016 and until their respective successors are duly elected and qualified; |

| | 2. | To ratify the appointment of Rosenberg Rich Baker Berman & Company as the independent auditor of the Company for the year ending December 31, 2015; |

| | 3. | To approve, on an advisory basis, the compensation of our named executive officers. |

Only shareholders of record at the close of business on April 24, 2015 are entitled to notice of and to vote at this meeting and any adjournment or postponement thereof.

You may vote in person or by proxy. You may cast your vote by dating and signing the enclosed proxy exactly as your name appears thereon and promptly returning such proxy in the envelope provided. If you sign and return your proxy card without giving any instruction, it will be voted as the Board of Directors recommends.

You may revoke your proxy by voting in person at the meeting, by written notice to the Secretary of the Company or by executing and delivering a later-dated proxy by mail, prior to the closing of the polls. Attendance at the meeting does not by itself constitute revocation of a proxy. All shares that are entitled to vote and are represented by properly completed proxies timely received and not revoked will be voted as you direct.

You are cordially invited to attend the meeting. Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy card promptly. This proxy statement and the accompanying form of proxy, together with the Company’s 2014 Annual Report to shareholders, are being mailed to shareholders on or about May 8, 2015. Your cooperation is appreciated since a majority of the outstanding shares entitled to vote must be represented, either in person or by proxy, to constitute a quorum for the purposes of conducting business at the meeting.

| BY ORDER OF THE BOARD OF DIRECTORS By: /s/ Umesh Ahuja Umesh Ahuja Chief Financial Officer and Secretary |

| | |

April 27, 2015 New York, New York | |

TABLE OF CONTENTS

Page

GENERAL INFORMATION | 1 |

| | |

PROPOSAL 1: ELECTION OF DIRECTORS | 2 |

| | |

CORPORATE GOVERNANCE | 5 |

| | |

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 8 |

| | |

PROPOSAL 3: ADVISORY VOTE ON EXECUTIVE COMPENSATION | 10 |

| | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 11 |

| | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 11 |

| | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 11 |

| | |

INTERESTS OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON | 13 |

| | |

DIRECTOR AND EXECUTIVE OFFICER COMPENSATION | 14 |

Executive Officer | 14 |

Summary Compensation Table for 2014 and 2013 | 14 |

Option Exercises for 2014 | 14 |

Outstanding Equity Awards at 2014 Fiscal Year End | 14 |

Employment Agreements and Potential Post-Employment Payments and Benefits | 15 |

Director Compensation | 15 |

| | |

SHAREHOLDER PROPOSALS | 16 |

| | |

OTHER BUSINESS | 16 |

| | |

MULTIPLE SHAREHOLDERS SHARING ONE ADDRESS | 16 |

HELIOS AND MATHESON ANALYTICS INC.

EMPIRE STATE BUILDING, 350 FIFTH AVENUE, STE 7520

NEW YORK, NEW YORK 10118

(212) 979-8228

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

To be Held on May 29, 2015

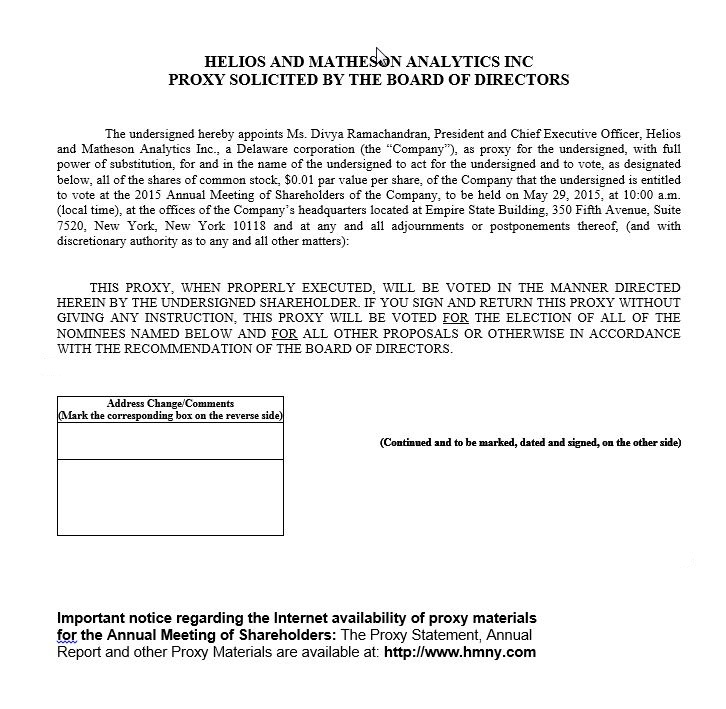

This proxy statement and the accompanying form of proxy are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors”) of Helios and Matheson Analytics Inc., a Delaware corporation (“Helios and Matheson” or the “Company”), to be voted at its Annual Meeting of Shareholders which will be held at 10:00 a.m. (local time), on May 29, 2015 at the Company’s headquarters located at Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York 10118 and at any postponements or adjournments thereof (the “Annual Meeting”).

At the Annual Meeting, the Company’s shareholders will be asked (i) to elect Messrs. Srinivasaiyer Jambunathan, Viraj Patel, Kishan Grama Ananthram and Ms. Divya Ramachandran as directors of the Company to serve until the Annual Meeting of Shareholders in 2016 and until their respective successors are duly elected and qualified (ii) to ratify the appointment of Rosenberg Rich Baker Berman & Company as the Company’s independent auditor for the year ending December 31, 2015; and (iii) to approve, on an advisory basis, the compensation of our named executive officers.

This proxy statement and the accompanying form of proxy, together with the Company’s Annual Report to shareholders, are being mailed to shareholders on or about May 8, 2015.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held onMay 29, 2015:

This proxy statement and the Company’sAnnual Reportto Shareholdersare available for viewing, printing and downloading atwww.hmny.com, under “investor relations”.

Copies of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed with the Securities and Exchange Commission (“SEC”), will be furnished without charge to any shareholder upon written request to Helios and Matheson Analytics Inc., Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York, 10118, Attention: Mr. Umesh Ahuja, Secretary.This proxy statement and the Company’s Annual Reporton Form 10-K for the fiscal year ended December 31, 2014 are also available on the SEC’s website at www.sec.gov.

GENERAL INFORMATION

PROXY SOLICITATION

Proxies may be solicited by mail, personal interview, telephone and facsimile transmission, and by directors, officers and employees of the Company (without special compensation). Since the Company is making this solicitation the expenses for the preparation of proxy materials and the solicitation of proxies for the Annual Meeting will be paid by the Company.

In accordance with the regulations of the Securities and Exchange Commission, the Company will reimburse, upon request, banks, brokers and other institutions, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to the beneficial owners of the Company’s common stock.

REVOKING YOUR PROXY

A shareholder may revoke a proxy at any time before it is exercised in one of the three following ways:

| | ● | By filing with the Secretary of the Company a written revocation to the attention of Mr. Umesh Ahuja, Secretary, Helios and Matheson Analytics Inc., Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York, 10118, Telephone: (212) 979-8228. We must receive your written revocation before the time of the Annual Meeting; |

| | ● | By submitting a duly executed proxy bearing a later date than your original proxy. We must receive such later dated proxy before the closing of the polls; or |

| | ● | By voting in person at the meeting. However, attendance at the Annual Meeting does not by itself constitute revocation of a proxy. A shareholder who holds shares through a broker or other nominee must bring a legal proxy ballot to the meeting if that shareholder desires to vote at the meeting. |

VOTING YOUR SHARES

Shares represented by each properly executed and returned proxy card will be voted (unless earlier revoked) in accordance with the instructions indicated. If no instructions are indicated on the proxy card, all shares represented by valid proxies received pursuant to this solicitation (and not revoked before they are voted) will be voted “FOR” proposals 1, 2 and 3.

Under the Company’s By-Laws, the presence at the Annual Meeting, in person or by duly authorized proxy, of the holders of a majority of the total number of outstanding shares of common stock, voting as a single class, entitled to vote, constitutes a quorum for the transaction of business. Shares of our common stock represented in person or by proxy (regardless of whether the proxy has authority to vote on all matters), as well as abstentions and broker non-votes, will be counted for purposes of determining whether a quorum is present at the meeting.

An "abstention" is the voluntary act of not voting by a shareholder who is present at a meeting and entitled to vote. "Broker non-votes" are shares of voting stock held in record name by brokers and nominees concerning which instructions have not been received from the beneficial owners or persons entitled to vote, and (i) the broker or nominee does not have discretionary voting power under applicable rules or the instrument under which it serves in such capacity or (ii) the record holder has indicated on the proxy or has executed a proxy and otherwise notified us that it does not have authority to vote such shares on that matter.

VOTES REQUIRED FOR APPROVAL

SharesEntitledto Vote.Only holders of record of the Company’s common stock at the close of business on April 24, 2015 (the “Record Date”) are entitled to notice, to attend and to vote at the Annual Meeting with each share entitled to one vote. As of the close of business on the Record Date, the Company had 2,330,438 shares of common stock outstanding.

Votes Required.The votes required on each of the proposals are as follows:

Proposal 1: Election of Directors | | The four nominees for director who receive the most votes will be elected. This is called a “plurality”. If you indicate “withhold authority to vote” for a particular nominee on your proxy card, your vote will not count either for or against the nominee. If you do not provide instructions on how to vote for a particular nominee, your broker will not vote with respect to such director. |

Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm | | The affirmative vote of a majority of the shares of common stock present in person or by proxy which are entitled to vote at the Annual Meeting is required to ratify the Audit Committee's selection of the independent registered public accounting firm. If you abstain from voting, your abstention will count as a vote cast against the proposal. |

Proposal 3: Advisory vote on Executive Compensation | | Proposal 3 is an advisory vote and is non-binding on the Company and the Board. The proposal solicits advice only and therefore, there is no minimum number of votes required with respect to this proposal. |

Controlled Company

Helios and Matheson Information Technology Ltd., an IT services organization with its corporate headquarters in Chennai, India, referred to herein as "Helios and Matheson Parent", owns approximately 75% of the Company’s outstanding common stock.

Helios and Matheson is a “Controlled Company” for purposes of the listing requirements of The NASDAQ Stock Market. A “Controlled Company” is a company of which more than 50% of the voting power for the election of directors is held by an individual, group or another company. Certain NASDAQ requirements do not apply to a “Controlled Company”, including requirements: (i) that a majority of its Board of Directors must be comprised of “independent” directors as defined in NASDAQ’s rules; and (ii) that the compensation of officers and the nomination of directors be determined in accordance with specific rules, generally requiring determinations by committees comprised solely of independent directors or in meetings at which only the independent directors are present.

PROPOSAL 1

ELECTION OF DIRECTORS

We are asking our shareholders to elect four directors at the Annual Meeting. Each director will be elected to serve until the Annual Meeting of Shareholders in 2016 and until their respective successors are duly elected and qualified, unless he/she resigns or is removed before the term expires. Each of the nominees listed below is currently a member of the Board of Directors and each of them has consented to serve as a director if elected. Each of the nominees listed below was recommended by Helios and Matheson Parent. There is detailed information about each of the nominees available in the section of this proxy statement titled “Nominees Standing for Election”.

If any of the nominees cannot serve for any reason, the Board of Directors may designate a substitute nominee or nominees. If a substitute is nominated, we will vote all valid proxies for the election of the substitute nominee or nominees. Alternatively, the Board of Directors may also decide to leave the Board seat or seats open until a suitable candidate or candidates are nominated, or it may decide to reduce the size of the Board.

Nominees Standing for Election

The following nominees are standing for election to serve as directors until the Annual Meeting of Shareholders in 2016:

Name | Age | Position |

Srinivasaiyer Jambunathan | 76 | Chairman and Director |

Kishan Grama Ananthram | 51 | Director |

| Viraj Patel | 52 | Director |

Divya Ramachandran | 35 | Director |

Srinivasaiyer Jambunathan has been a director of the Company since August 22, 2006 and Chairman of the Board since April 1, 2008. Mr. Jambunathan was named Vice Chairman of the Board of Directors on November 8, 2006 and Lead Director on April 25, 2007. Mr. Jambunathan is the Chairman of the Nominating and Corporate Governance Committee and the Executive Committee as well as a member of the Audit Committee and Compensation committee. Mr. Jambunathan is a director for Patel Engineering Company Limited. Since January 2001, Mr. Jambunathan has served as non-executive Chairman of First Policy Insurance Pvt. Ltd. From November 2003 to May 2007, Mr. Jambunathan was a director of JSW Steel Ltd. Mr. Jambunathan served as a director of the Bombay Stock Exchange, and thereafter, the Bombay Stock Exchange Limited, for a total period of six years until 2006. Mr. Jambunathan was also the non-executive Chairman of the Bombay Stock Exchange from March 2003 to August 2005. From March 2005 to August 2005 Mr. Jambunathan also served as non-executive Chairman of Provogue India Ltd., a men’s designer wear and fashion apparel company. Mr. Jambunathan was Chairman of the local Advisory Board, State Bank of Mauritius from 1996 to 2001. Mr. Jambunathan brings to the Company’s Board a wealth of knowledge of organizational and operational management as well as board leadership experience essential to a public company and led us to conclude that he should continue to serve as a director.

Viraj Patel has been a director of the Company since May 2, 2012. Mr. Patel is a seasoned finance executive with over 25 years of multinational experience in technology, life sciences and industrial companies. Mr. Patel began his professional career at Pricewaterhouse, New York and holds a BBA from Pace University, New York. He is a Certified Public Accountant from the State of New York and is a member of the New York State Society of CPAs and a member of the American Institute of Certified Public Accountants. Most recently Mr. Patel served as the CFO of Aspire Public Schools, a leading National K- 12 Charter Management Organization, a position he held from September 2013 to March 2015. Prior to his employment with Aspire, Mr. Patel worked as the CFO of Imergy Power Systems from September 2010 through March 2013. Previously, Mr. Patel served as a CFO of leading technology public companies such as UTStarcom (from November 2005 to February 2010) and Avanti (acquired by Synopsys). Mr. Patel also served as Vice President of Finance at Nektar Therapeutics and Chief Accounting Officer at Pall Corporation. Mr. Patel’s education and experience as a CPA and CFO led us to conclude that he should continue to serve as a director.

Kishan Grama Ananthram has been a director of the Company since August 22, 2006. Mr. Ananthram is the Chairman of the Compensation Committee and a member of the Executive Committee and Audit Committee. Mr. Ananthram has served as the Founder, Chairman and Chief Executive Officer of IonIdea, Inc., a software product and engineering outsourcing company since January 1994. Mr. Ananthram has over 20 years of entrepreneurial, management, sales and technology experience. Prior to founding IonIdea, Inc. Mr. Ananthram held various technical and management positions with NUS, Sprint, GTE, Fannie Mae and Hughes. Mr. Ananthram brings to the Company’s Board over 20 years of entrepreneurial, management, sales and technology experience which led us to the conclusion that he should continue to serve as a director.

Divya Ramachandran has been a director of the Company since August 22, 2006. Ms. Ramachandran is a member of the Executive Committee, the Nominating and Corporate Governance Committee and the Compensation Committee. Since May 2010, Ms. Ramachandran has been President and Chief Executive Officer of the Company. From February 2004 to May 2010, Ms. Ramachandran was employed by Helios and Matheson Information Technology Ltd., the Company’s parent, initially focusing on mergers and acquisitions and later on sales and client relationships. From June 2003 to January 2004, Ms. Ramachandran was Program Director for General Management Programs at the Indian School of Business. From July 2002 to January 2003, Ms. Ramachandran was a Senior Manager, Strategy and Restructuring Cell for Lupin Limited, one of India’s leading pharmaceutical companies. From June 2000 to 2001, Ms. Ramachandran was an associate with Arthur Andersen. Ms. Ramachandran brings to the Company’s Board valuable insight into organizational and operational issues as well as experience in managing complex global information technology companies which led us to the conclusion that she should continue to serve as a director.

Recommendation

The Nominating and Corporate Governance Committee has nominated each of the director nominees set forth in Proposal 1. The Board of Directors recommends that shareholders voteFOR each of the nominees.

CORPORATE GOVERNANCE

Board of Directors Meetings and Committees

During the year ended December 31, 2014, the Board of Directors met seven times. The Board of Directors has an Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, Committee of Independent Directors and an Executive Committee. During 2014, the Audit Committee held four meetings, the Nominating and Corporate Governance Committee held two meetings and the Compensation Committee held two meetings. Each of the committees of the Board of Directors acts pursuant to a separate written charter adopted by the Board of Directors. During 2014, each director, except for Mr. Ananthram, attended at least 75% of the aggregate number of meetings of the Board of Directors and committees on which such directors served. During 2014 Mr. Ananthram attended 67% of the aggregate number of meetings of the Board of Directors and committees on which he served.

It is anticipated that each member of the Board of Directors will attend the Company’s 2015 Annual Meeting of Shareholders. At the Company’s 2014 Annual Meeting of Shareholders, all four directors were in attendance. The Company does not have a formal policy with respect to directors’ attendance at the Annual Meeting of Shareholders.

Board Leadership Structure and Role in Risk Oversight

In accordance with the Company’s Bylaws, the Board of Directors elects the Company’s Chairman and Chief Executive Officer. Each of these positions may be held by the same person or may be held by different people. Currently, these two offices are held by different people. The Board of Directors believes that the Company and its shareholders are best served by having a policy that provides the Board of Directors the ability to select the most qualified and appropriate individual to lead the Board as Chairman. The Board of Directors also believes it is important to remain flexible when allocating responsibilities among these two offices in a way that best serves the needs of the Company. The Board of Directors believes it is appropriate at this time to maintain separate offices of Chairman and Chief Executive Officer as it allows the Company’s Chief Executive Officer to focus primarily on her management responsibilities.

In May 2014, the Board of Directors appointed Mr. Srinivasaiyer Jambunathan as the Company’s Chairman of the Board. Mr. Jambunathan is expected to continue to serve as Chairman of the Board following the Company’s 2015 Annual Meeting.

The Company is exposed to a number of risks that are inherent with every business. Such risks include, but are not limited to, financial and economic risks and legal and regulatory risks. While management is responsible for the day-to-day management of these risks, the Board of Directors, as a whole and through its committees, is responsible for the oversight of risk management. The Board of Directors is responsible for evaluating the adequacy of risk management processes and determining whether such processes are being implemented by management. The Board of Directors has delegated to the Audit Committee the primary role in carrying out risk oversight responsibilities. The Audit Committee’s Charter provides that it will discuss significant risks or exposures and assess the steps management has taken to minimize such risks to the Company. The Board of Directors has also delegated to other committees the oversight of risks within their areas of responsibility and expertise. For example, the Compensation Committee oversees risks associated with the Company’s policies and practices relating to compensation.

Independent Directors

Upon consideration of the criteria and requirements regarding director independence set forth in NASDAQ Rule 5605, the Board of Directors has determined that the following three nominees, Messrs. Jambunathan, Patel and Ananthram, meet NASDAQ’s independence standards.

Audit Committee

Audit Committee. The Audit Committee is authorized to engage the Company’s independent auditors and review with such auditors (i) the scope and timing of their audit services and any other services they are asked to perform, (ii) their report on the Company’s financial statements following completion of their audit and (iii) the Company’s policies and procedures with respect to internal accounting and financial controls. In addition, pursuant to NASDAQ Rules, the Company must have an Audit Committee composed of at least three members, each of whom must satisfy specified independence and qualification criteria. Currently, the Audit Committee is comprised of Messrs. Patel (Chairman), Ananthram and Jambunathan. The Board of Directors has determined that Mr. Patel qualifies as an “audit committee financial expert.” The Board of Directors has determined that each of the members of the Audit Committee is independent (as independence is defined in NASDAQ Rule 5605(a)(2) and in Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended). During the year ended December 31, 2014, the Audit Committee held four meetings. The Audit Committee Charter is posted at the Company’s website, www.hmny.com, under “who we are”. Any person may obtain a copy of the Audit Committee Charter without charge by calling 212-979-8228 or by writing to Helios and Matheson Analytics Inc., Empire State Building, 350 Fifth Avenue, Suite 7520, New York, NY 10118, Attention Mr. Umesh Ahuja, Secretary.

Compensation Committee

CompensationCommittee. The Compensation Committee is authorized and empowered to approve appointments and promotions of executive officers of the Company and fix salaries for such officers, provided that all actions of the Compensation Committee must be ratified by the full Board of Directors within three months of the subject action. The Compensation Committee is also authorized to administer the Company’s 2014 Equity Incentive Plan. Currently, the Compensation Committee is comprised of Messrs. Ananthram (Chairman), Jambunathan and Ms. Ramachandran. The Board of Directors has determined that Mr. Ananthram and Mr. Jambunathan are independent members of the Compensation Committee (as independence is defined in NASDAQ Rule 5605(a)(2)). The Compensation Committee met twice during the year ended December 31, 2014. The Compensation Committee may delegate its authority to subcommittees or the Chairman of the Compensation Committee when it deems it appropriate and in the best interests of the Company. The Compensation Committee Charter is posted at the Company’s website, www.hmny.com, under “who we are”.

Nominatingand Corporate GovernanceCommittee

Nominatingand Corporate GovernanceCommittee. The Nominating and Corporate Governance Committee is authorized to nominate candidates to the Board of Directors. Currently the Nominating and Corporate Governance Committee is comprised of Messrs. Jambunathan and Ananthram and Ms. Ramachandran. The Board of Directors has determined that, with the exception of Ms. Ramachandran, the members of the Nominating and Corporate Governance Committee are independent (as independence is defined in NASDAQ Rule 5605(a)(2)). The Nominating and Corporate Governance Committee Charter is posted at the Company’s website, www.hmny.com, under “who we are”. The Nominating and Corporate Governance Committee met two times during the year ended December 31, 2014.

The Nominating and Corporate Governance Committee receives recommendations for director nominees from a variety of sources, including from shareholders, management and members of the Board of Directors. Shareholders may recommend any person to be a director of the Company by writing to the Company’s Secretary. Each submission must include (i) a brief description of the candidate, (ii) the candidate’s name, age, business address and residence address, (iii) the candidate’s principal occupation and the number of shares of the Company’s capital stock beneficially owned by the candidate and (iv) any other information that would be required under the SEC rules in a proxy statement listing the candidate as a nominee for director. There has been no material change to these procedures.

In conducting a search for director candidates, the Nominating and Corporate Governance Committee may use its network of contacts to compile a list of potential candidates, but it may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee generally reviews all recommended candidates at the same time and subjects all candidates to appropriate review criteria. Members of the Board of Directors should be qualified, dedicated, ethical and have experience relevant to the Company’s operations and understand the complexities of the Company’s business environment. The Nominating and Corporate Governance Committee evaluates candidates in the context of the current composition of the Board of Directors, and these recommendations are submitted to the Board of Directors for review and approval. As part of this assessment, the Nominating and Corporate Governance Committee considers diversity of age, skills and such other factors as it deems appropriate, given the current needs of the Board of Directors and its committees. The Nominating and Corporate Governance Committee is also responsible for providing a leadership role in shaping and monitoring the corporate governance practices of the Company.

Executive Committee

Executive Committee. The Executive Committee has all the powers of the Board of Directors except for the matters that have been explicitly delegated by the Board of Directors to the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The objectives of the Executive Committee include: (i) focusing on business development, (ii) assisting in formulating business strategies, (iii) monitoring the Company’s progress on a monthly basis (actual vs. planned performance), (iv) controlling expenditures, (v) when necessary, taking appropriate corrective action, (vi) formulating plans for the future, (vii) helping management improve performance and sanctioning actions by management to do so, (viii) periodically reviewing in consultation with the Company’s Chief Executive Officer the Company’s management succession planning and (ix) other actions consistent with applicable law and the Company’s governing documents that the Executive Committee or the Board deems appropriate. Pursuant to Delaware General Corporate Law, the Executive Committee may not approve, adopt or recommend to shareholders any action or matter other than the election or removal of directors expressly required to be submitted to shareholders for approval or the adoption, amendment or repeal of any bylaw of the Company. Currently the Executive Committee is comprised of Messrs. Jambunathan (Chairman) and Ananthram and Ms. Ramachandran. During the year ended December 31, 2014, the Executive Committee did not meet.

Committee of Independent Directors

Committee of Independent Directors. We have a Committee of Independent Directors that is comprised of Messrs. Jambunathan (Chairman), Patel and Ananthram. The Committee of Independent Directors is scheduled to meet twice during each year. The Committee of Independent Directors met twice during the year ended December 31, 2014 and all members attended the meetings except Mr. Ananthram who attended one of the two meetings.

Other Committees

The Board of Directors may establish additional standing or ad hoc committees from time to time.

Shareholder Communications with the Board

Shareholders may communicate with the Board of Directors by written correspondence. Correspondence from the Company’s shareholders to the Board of Directors or any individual directors or officers should be sent to the Company’s Secretary. Correspondence addressed to either the Board of Directors as a body, or to any director individually, will be forwarded by the Company’s Secretary to the Chairman of the Nominating and Corporate Governance Committee or to the individual director, as applicable. The Company’s Secretary will regularly provide to the Board of Directors a summary of all shareholder correspondence that the Secretary receives. This process has been approved by the Company’s Board of Directors.

All correspondence should be sent to Helios and Matheson Analytics Inc., Empire State Building, 350 Fifth Avenue, Suite 7520, New York, NY 10118, Attention: Mr. Umesh Ahuja, Secretary. The Secretary will screen all communications for product inquiries, new product suggestions, resumes, job inquiries, surveys, business solicitations and advertisements, as well as unduly hostile, threatening, illegal, unsuitable, frivolous, patently offensive or otherwise inappropriate material before forwarding the correspondence to the Board.

Compensation Committee Interlocks and Insider Participation

As noted above, currently, the Compensation Committee is comprised of Messrs. Ananthram (Chairman), Jambunathan and Ms. Ramachandran. Since May 2010, Ms. Ramanchandran has been the President and Chief Executive Officer of the Company. None of the other members of the Compensation Committee has ever been an officer or employee of the Company.

Kishan Grama Ananthram, a member of the Company’s Board of Directors, is the Chief Executive Officer of IonIdea and Mr. Ananthram and his spouse own all of the outstanding capital stock of IonIdea. The Company currently uses professional services and equipment provided by IonIdea. For additional information, please see “Certain Relationships and Related Transactions”.

Code of Business Conduct and Ethics

The Board of Directors has adopted a code of ethics designed, in part, to deter wrongdoing and to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with or submits to the Securities and Exchange Commission and in the Company’s other public communications, compliance with applicable governmental laws, rules and regulations, the prompt internal reporting of violations of the code to an appropriate person or persons, as identified in the code, and accountability for adherence to the code. The code of ethics applies to all directors, executive officers and employees of the Company. The Company will provide a copy of the code to any person without charge, upon request to Ms. Jeannie Lovastik, Human Resources Generalist by calling (212) 979-8228 or by writing to Helios and Matheson Analytics Inc., Empire State Building, 350 Fifth Avenue, Suite 7520, New York, NY 10118, Attention: Ms. Jeannie Lovastik.

The Company intends to disclose any amendments to or waivers of its code of ethics as it applies to directors or executive officers by filing them on Form 8-K.

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On January 6, 2015, Mercadien, P.C., Certified Public Accountants (“Mercadien”) notified the Company of its intention to not stand for reelection as the Company’s independent registered public accounting firm following the completion of the audit of the Company’s financial statements for the year ended December 31, 2014. Mercadien was unable to continue as the Company’s auditor for the 2015 fiscal year because it cannot meet the requirement of Section 10A of the Securities Exchange Act of 1934, as amended (“Section 10A”). If the lead (or coordinating) audit partner (having primary responsibility for the audit), or the audit partner responsible for reviewing the audit has performed audit services for an issuer in each of the 5 previous fiscal years, Section 10A prohibits the registered public accounting firm from continuing to provide audit services to that issuer. The audit of the Company as of and for the year ended December 31, 2014 will mark completion of the fifth consecutive audit for both the lead and concurring review partner, and Mercadien is unable to rotate a suitable lead and concurring review partner for the 2015 periods.

The reports of Mercadien on the Company’s consolidated financial statements for the fiscal years ended December 31, 2014 and December 31, 2013 did not contain any adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s fiscal years ended December 31, 2014 and December 31, 2013 and through the date of Mercadien’s resignation, there were no disagreements with Mercadien on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Mercadien, would have caused it to make reference thereto in its reports on the Company’s financial statements for such periods.

During the Company’s fiscal years ended December 2014 and 2013 and through the date of Mercadien’s resignation, there were no “reportable events” as described in Item 304(a)(1)(v) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended.

On March 27, 2015, upon approval of the Audit Committee of the Company’s Board of Directors, the Company engaged Rosenberg Rich Baker Berman & Company, Certified Public Accountants, to audit the Company’s financial statements and to perform reviews of interim financial statements. During the Company’s fiscal years ended December 31, 2014 and December 31, 2013, and through the date of Rosenberg Rich Baker Berman & Company was retained by the Company, neither the Company nor anyone acting on its behalf consulted with Rosenberg Rich Baker Berman & Company regarding either (i) the application of accounting principles to a specific completed or contemplated transaction, the type of audit opinion that might be rendered regarding the Company’s financial statements, or other information provided that was an important factor considered by the Company in reaching a decision as to an accounting, auditing, or financial reporting issue or (ii) any of the matters or events set forth in Item 304(a)(2)(i) or Item 304(a)(2)(ii) of Regulation S-K.

The Audit Committee of the Board of Directors has recommended to the Board of Directors of the Company the selection of Rosenberg Rich Baker Berman & Company to be the independent auditor of the Company for the year ending December 31, 2015.

Rosenberg Rich Baker Berman & Company has been appointed as the Principal Accountant on March 27, 2015 by the Board of Directors.

Audit Fees

For the year ended December 31, 2014 and 2013, the aggregate fee paid or expected to be paid to Mercadien, P.C. for the audit of the Company’s financial statements for such years and the reviews of Company’s interim financial statements were $90,000 and $80,000 respectively.

Audit-Related Fees

During the years ended December 31, 2014 and 2013, there were no fees paid to Mercadien, P.C. for audit-related services.

Tax Fees

During the years ended December 31, 2014 and 2013, there were no fees paid to Mercadien, P.C. for tax advice and tax planning services.

All Other Fees

During the years ended December 31, 2014 and 2013, Mercadien, P.C. was paid $0 and $4,000 respectively for professional services other than audit and tax services.

Audit Committee Policies and Procedures

The Audit Committee reviews the independence of the Company’s auditors on an annual basis and has determined that Mercadien P.C., Certified Public Accountants and Rosenberg Rich Baker Berman & Company are independent. In addition, the Audit Committee pre-approves all fees and work which is performed by the Company’s independent auditor.

Report of the Audit Committee of the Board of Directors

The following is the report of the Audit Committee with respect to the Company’s audited financial statements for the fiscal year ended December 31, 2014. The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

REVIEW WITH MANAGEMENT. The Audit Committee has reviewed and discussed the Company’s audited financial statements with management.

REVIEW AND DISCUSSIONS WITH INDEPENDENT ACCOUNTANTS. The Audit Committee has discussed with Mercadien P.C., the Company’s independent accountants for the fiscal year ended December 31, 2014, the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380),as adopted by the Public Company Accounting Oversight Board in Rule 3200T, that includes, among other items, matters related to the conduct of the audit of the Company’s financial statements. The Audit Committee has received from Mercadien P.C. the required written communication, as required by the Public Company Accounting Oversight Board regarding the independent accountant’s communication with the audit committee concerning independence and has discussed with the independent audit firm, that firm’s independence.

CONCLUSION. Based on the review and discussions with management and Mercadien P.C. referred to above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

AUDIT COMMITTEE:

Mr. Viraj Patel, Chairman

Mr. Kishan Ananthram

Mr. S. Jambunathan

Auditors’ Attendance at the Annual Meeting

A representative of Mercadien, P.C., the independent auditor of the Company for the year ending December 31, 2014, is expected to be present at the Annual Meeting. A representative of Rosenberg Rich Baker Berman & Company is also expected to be present at the Annual Meeting. The representatives will be given the opportunity to make a statement at the Annual Meeting and is expected to be available to respond to appropriate questions.

Recommendation

The Board of Directors recommends that the shareholdersRATIFY the selection of Rosenberg Rich Baker Berman & Company to be the independent auditor of the Company for the year ending December 31, 2015.

PROPOSAL 3

APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED

EXECUTIVE OFFICERS

In recent years, good corporate governance commentators and advisors have advocated and, increasingly, governmental regulatory authorities, including the SEC, are mandating that public companies initiate procedures to ensure that our stockholders have input on our compensation programs for our named executive officers. This is commonly known as “Say-on-Pay”.

Our Board values and encourages constructive dialogue on executive compensation and other important governance topics with our stockholders, to whom it is ultimately accountable. We urge you to read this Proxy Statement for additional details on the Company’s executive compensation.

Our Say-on-Pay Proposal is designed to provide our stockholders with the opportunity to consider and vote upon the compensation paid to our named executive officers, as disclosed in this Proxy Statement pursuant to Item 402 of SEC Regulation S-K, including the compensation table and narrative discussion. Although the vote is advisory and non-binding on the Company or the Board, our Board and the Compensation Committee will review the voting results. To the extent there is any significant lack of support for the compensation of our named executive officers, we would expect to initiate procedures designed to help us better understand stockholder concerns.

Marking the Proxy Card “For” indicates support for the compensation of our named executive officers; marking the Proxy Card “Against” indicates lack of support for the compensation of our named executive officers. You may abstain by marking the “Abstain” box on the Proxy Card.

Vote and Recommendation

This is an advisory vote and does not require a minimum number of votes.However, our Board of Directors recommends that stockholders vote"FOR" the approval of the compensation paid to our named executive officers.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of common stock beneficially owned as of April 24, 2015 by each person known by the Company to own beneficially more than 5% of the common stock. None of the Company’s directors or executive officers named in the Summary Compensation Table own shares of the Company’s common stock or have the right to acquire shares of the Company’s common stock. As of April 24, 2015, 2,330,438 shares of the Company’s common stock were outstanding. Unless otherwise indicated in the table below, the address of each shareholder is c/o Helios and Matheson Analytics Inc., Empire State Building, 350 Fifth Avenue, Suite # 7520, New York, New York 10118.

| | Common stock beneficially owned(1) |

Name | Number of Shares | | Percentage of Ownership |

Helios and Matheson Information Technology Ltd | 1,743,040 | (2) | 74.80% |

Navneet Chugh S | 230,000 | (3) | 9.9% |

(1) | As used in the tables above, “beneficial ownership” means the sole or shared power to vote or direct the voting or to dispose or direct the disposition of any security. A person is deemed to have "beneficial ownership" of any security that such person has a right to acquire within 60 days of April 24, 2015. Any security that any person named above has the right to acquire within 60 days is deemed to be outstanding for purposes of calculating the ownership of such person but is not deemed to be outstanding for purposes of calculating the ownership percentage of any other person. Unless otherwise noted, the Company believes each person listed has the sole power to vote, or direct the voting of, and power to dispose, or direct the disposition of, all such shares. The table is based upon information supplied by officers, directors and principal shareholders and Schedules 13D and 13G, if any, filed with the Securities and Exchange Commission. |

(2) | Helios and Matheson Information Technology Ltd.’s principal executive offices are located at Crest No 04-01, Ascendas International Tech Park, Taramani, Chennai 600 113 India. |

(3) | Address of Navneet Chugh is 15925 Carmenita Road, Cerritos CA 90703 – 2206 |

SECTION 16(a)BENEFICIALOWNERSHIPREPORTINGCOMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors, executive officers and certain beneficial owners of the Company's equity securities (the "Section 16 Reporting Persons") to file with the SEC reports regarding their ownership and changes in ownership of the Company’s equity securities. The Company believes that, during fiscal year 2014, its Section 16 Reporting Persons complied with all Section 16(a) filing requirements.

CERTAINRELATIONSHIPS ANDRELATEDTRANSACTIONS, AND DIRECTOR INDEPENDENCE

Transactions with Related Persons, Promoters and Certain Control Persons

The following describes all transactions since January 1, 2013 and all proposed transactions in which the Company is, or it will be, a participant and the amount involved exceeds $120,000 or 1% of the average of the Company’s total assets at year end for the last 2 completed fiscal years; and in which any related person had or will have a direct or indirect material interest.

Effective August 1, 2013, the Company renewed a Statement Of Work dated August 1, 2012 (expired on July 31, 2013) with IonIdea, Inc. to provide certain professional services, workstation facilities and communication equipment to the Company and its wholly-owned subsidiary Helios and Matheson Global Services Private Limited. The Statement of Work commenced on August 1, 2008, and continues through July 31, 2014 and thereafter renewed automatically for one year unless terminated by either party in accordance with the provisions of the original agreement. Prior to September 4, 2008, the Company had been using the same professional services, workstation facilities and communication equipment from IonIdea without a contract since July 1, 2007. Kishan Grama Ananthram, a member of the Company’s Board of Directors, is the Chief Executive Officer of IonIdea and Mr. Ananthram and his spouse own all of the outstanding capital stock of IonIdea. The total amount paid to IonIdea is based upon the number of Company employees using workstation facilities and communication equipment. From January 1, 2013 through December 31, 2013 and January 1, 2014 through the date of this proxy statement, the amounts paid to IonIdea were $44,700 and $56,140 respectively.

In September 2010, the Company entered into a Memorandum of Understanding with Helios and Matheson Parent (the “HMIT MOU”) pursuant to which Helios and Matheson Parent has agreed to make available to the Company facilities of dedicated Off-shore Development Centers (“ODCs”) and also render services by way of support in technology, client engagement, management and in operating the ODCs for the Company. The Company has furnished Helios and Matheson Parent a security deposit of $2 million, classified as a non-current asset on the balance sheet, to cover any expenses, claims or damages that Helios and Matheson Parent may incur while discharging its obligation under the HMIT MOU and also to cover the Company’s payable to Helios and Matheson Parent. Helios and Matheson Parent has been providing recruitment services to Helios and Matheson Analytics Inc. and has not charged a fee for these services. For the purpose of strengthening our client relationships, Helios and Matheson Parent also provides knowledge transition free of cost to clients and volume/business commitment based discounts. The investment made by Helios and Matheson Parent in this regard during the twelve months ended December 31, 2014 is approximately $105,483. The amount payable to Helios and Matheson Parent for services rendered under the HMIT MOU was $8,736 and $392,808 for the twelve months ended December 31, 2014 and 2013, respectively and is included as a component of cost of revenue. All payments to Helios and Matheson Parent under the MOU are made after collections are received from clients. The amount paid to Helios and Matheson Parent for services rendered under the HMIT MOU was $0 and $283,645 for the twelve months ended December 31, 2014 and 2013, respectively. As of December 31, 2014, the Company has a receivable from Helios and Matheson Parent in the amount of $182,626 which represents amounts paid on behalf of Helios and Matheson Parent. As of December 31, 2014, the amount paid on behalf of Helios and Matheson Parent is reported as an offset to accounts payable to Helios and Matheson Parent.

In August 2014, the Company entered into a Professional Service Agreement with Helios and Matheson Parent (the “HMIT PSA”), which documented ongoing services provided by Helios and Matheson Parent from February 24, 2014. Pursuant to the HMIT PSA Helios and Matheson Parent hires employees in India and provides infrastructure services for those employees to facilitate the operations of those of the Company’s clients who need offshore support for their business. For the services the Company pays the cost incurred by Helios and Matheson Parent for the employee it hires to provide the services and a fixed fee for infrastructure support. Beginning October 2014, all employees were transferred to the payroll of the Company’s subsidiary, Helios and Matheson Global Services Pvt. Ltd., and Helios and Matheson Parent was paid only for the infrastructure support it is providing. For the twelve months ended December 31, 2014 and 2013, the Company’s revenue from services provided with offshore support was approximately $909,000 and $0 respectively. Amounts payable to Helios and Matheson Parent for services rendered under the HMIT PSA was $322,000 for the twelve months ended December 31, 2014 and is included as a component of cost of revenue. The amount paid to Helios and Matheson Parent for services rendered under the HMIT PSA for the twelve months ended December 31, 2014 was $321,000.

Our Board of Directors has not adopted specific policies or guidelines relating to the approval of related party transactions. In approving transactions with directors and officers, our Board of Directors follows Section 144 of the Delaware General Corporation Law. Section 144 requires the following:

(1) The material facts as to the director's or officer's relationship or interest and as to the contract or transaction are disclosed or are known to the board of directors or the committee, and the board or committee in good faith authorizes the contract or transaction by the affirmative votes of a majority of the disinterested directors, even though the disinterested directors be less than a quorum; or

(2) The material facts as to the director's or officer's relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders; or

(3) The contract or transaction is fair as to the corporation as of the time it is authorized, approved or ratified, by the board of directors, a committee or the stockholders.

In approving the transactions with IonIdea and Helios and Matheson Parent disclosed above, the disinterested members of the Board determined that the consideration to be paid for the services and equipment provided by IonIdea and Helios and Matheson Parent was comparable to the consideration that would have been paid to an independent party for similar services and equipment and was, therefore, fair to the Company.

In approving transactions with other related parties, our Board of Directors acts in accordance with their fiduciary duties as directors.

INTERESTS OF CERTAINPERSONS IN MATTERSTO BE ACTED UPON

As the holder of approximately 75% of the Company’s outstanding voting securities, Helios and Matheson Parent will have significant influence on matters requiring shareholder approval, and will control matters which require only majority shareholder approval.

DIRECTOR AND EXECUTIVE OFFICER COMPENSATION

Executive Officers

The following table sets forth the names, ages and offices of the Company’s current executive officers.

Name | Age | Title |

| Divya Ramachandran | 35 | President and Chief Executive Officer |

Umesh Ahuja | 41 | Chief Financial Officer and Secretary |

Divya Ramachandran. Please see the biographical information included in the discussion of Proposal 1.

Umesh Ahuja has been the Company’s Chief Financial Officer and Secretary since November 11, 2010. Mr. Ahuja is a CMA (India) and has passed the CPA exam in the United States but has not sought certification in any state. Mr. Ahuja has 18 years of corporate experience. Since June 2009, he has been Vice President of Helios and Matheson Global Services, a wholly owned subsidiary of the Company located in Bangalore, India. From 1998 to 2009, Mr. Ahuja served as Assistant Vice President of Genpact India, a global leader in business process and technology management services.

There is no family relationships between any director, executive officer, or person nominated to become a director or executive officer.

Summary Compensation Table for 2014 and 2013

The following table sets forth certain information regarding all compensation awarded to, earned by or paid to our principal executive officer (the "named executive officer") for services rendered in all capacities during the years ended December 31, 2014 and 2013. During the last two fiscal years, no one other than the named executive officer received compensation in an amount in excess of $100,000.

| Summary Compensation table | | |

Name and Principal position | Year | Salary | Options Awards | Performance Bonus | All Other Compensation (1) | Total |

| | | | | | | |

Divya Ramachandran | 2014 | 250,000 | - | - | 75,600 | 325,600 |

President and Chief Executive Officer | 2013 | 250,000 | - | - | 69,600 | 319,600 |

| | | | | | | |

| | (1) | All Other Compensation is comprised of monthly rent reimbursed to Ms. Ramachandran during the period. |

Option Exercises for 2014

No options were exercised by the named executive officer of the Company during 2014.

Outstanding Equity Awards at2014Fiscal Year End

The named executive officer did not hold equity compensation awards as of December 31, 2014.

Employment Agreements

There are currently no employment agreements with the Company’s named executive officer.

Director Compensation

The following table sets forth certain information regarding compensation for services rendered by the Company’s directors during the fiscal year ended December 31, 2014. During the fiscal year ended December 31, 2014, there were no equity awards granted to directors.

Name | | Fees Earned or Paid in Cash(a) | | |

Srinivasaiyer Jambunathan | | $ | 30,000 | | |

Kishan Grama Ananthram | | $ | 30,000 | | |

Viraj Patel | | $ | 30,000 | | |

Divya Ramachandran | | $ | - | | |

| | (a) | Non-employeedirectors received non-employee directors’ compensation of $7,500 per quarter during 2014. Each director is reimbursed for travel and other reasonable expenses incurred as related to the business of the Company. |

SHAREHOLDER PROPOSALS

Pursuant to Rule 14a-8 under the Exchange Act, proposals by shareholders that are intended for inclusion in our proxy statement and proxy card and to be presented at our next annual meeting must be received by us no later than the close of business on December 31, 2015 in order to be considered for inclusion in our proxy materials relating to the next annual meeting. Such proposals shall be addressed to our Secretary at our corporate headquarters and may be included in next year's annual meeting proxy materials if they comply with rules and regulations of the Securities and Exchange Commission (“SEC”) governing shareholder proposals.

Recommendations from shareholders which are received after the deadline likely will not be considered timely for consideration by the Board for next year’s Annual Meeting.

OTHER BUSINESS

The Board of Directors of the Company is not aware of any other matters to come before the Annual Meeting. If any other matter should come before the meeting, the persons named in the enclosed proxy intend to vote the proxy according to their best judgment.

MULTIPLE SHAREHOLDERS SHARING ONE ADDRESS

In accordance with Rule 14a-3(e)(1) under the Exchange Act, one proxy statement will be delivered to two or more shareholders who share an address, unless we have received contrary instructions from one or more of the shareholders. We will deliver promptly upon written or oral request a separate copy of the proxy statement to a shareholder at a shared address to which a single copy of the proxy statement was delivered. Requests for additional copies of the proxy statement, and requests that in the future separate proxy statements be sent to shareholders who share an address, should be directed to Helios and Matheson Analytics Inc., Attn: Mr. Umesh Ahuja, Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York 10118, (212) 979-8228. In addition, shareholders who share a single address but receive multiple copies of the proxy statement may request that in the future they receive a single copy by contacting us at the address and phone number set forth in the prior sentence.

A copy of the 2014 Annual Report to SHAREHOLDERS accompanies this Proxy Statement.COPIES OF THE COMPANY’S FORM 10-K REPORT FOR FISCAL YEAR 2014, INCLUDING EXHIBITS, CONTAINING INFORMATION ON OPERATIONS AND THE COMPANY’S FINANCIAL STATEMENTS AND THE FINANCIAL STATEMENT SCHEDULES FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ARE AVAILABLE UPON WRITTEN REQUEST WITHOUT CHARGE FOR REQUESTORS WHO INCLUDE IN THEIR WRITTEN REQUEST A GOOD FAITH REPRESENTATION THAT, AS OFAPRIL 24, 2015, SUCH REQUESTOR WAS A BENEFICIAL OWNER OF THE COMPANY’S COMMON STOCK. PLEASE WRITE TO:

HELIOS AND MATHESONANALYTICS INC.

EMPIRE STATE BUILDING

350 FIFTH AVENUE

SUITE 7520

NEW YORK, NY 10118

ATTENTION: UMESH AHUJA, SECRETARY

Copies may also be obtained without charge through the SEC’s World Wide Web site athttp://www.sec.gov

19