UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549 USA

FORM 20-F /A

(Mark One)

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended November 30, 2007

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report |

For the transition period from _______ _______ to _____________

Commission file number: 000-30194

| |

| Ungava Mines Inc. |

| (Exact name of Registrant as specified in its charter) |

| |

| Not applicable |

| (Translation of Registrant's name into English) |

| |

| Province of Ontario, Canada |

| (Jurisdiction of incorporation or organization) |

| |

| 160 Matheson Boulevard East, Unit 5, Mississauga, Ontario, Canada L4Z 1V4 |

| (Address of principal executive offices) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | |

| Title of each class | | Name of each exchange on which registered |

| None | | Not applicable |

| | | |

| | | |

| | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

| |

| Common Shares Without Par Value |

| (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

92,688,976 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

oYes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

oYes þNo

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þYes oNo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

oLarge accelerated filer oAccelerated filer þNon-accelerated filer

Indicate by check mark which financial statement item the registrant has elected to follow.

oItem 17 þItem 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

oYes þNo

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of Securities under a plan confirmed by a court.

þ Yes oNo

_____________________________________________________________________________________

The information set forth in this Annual Report on Form 20-F is as at November 30, 2007, unless an earlier or later date is indicated.

Financial information is presented in accordance with accounting principles generally accepted in The Unites States of America.

Statements in this Annual Report regarding expected completion dates of feasibility studies, anticipated commencement dates of mining or metal production operations, projected quantities of future metal production and anticipated production rates, operating efficiencies, costs and expenditures are forward-looking statements. Actual results could differ materially depending upon the availability of materials, equipment, required permits or approvals and financing, the occurrence of unusual weather or operating conditions, the accuracy of reserve estimates, lower than expected ore grades or the failure of equipment or processes to operate in accordance with specifications. See "Risk Factors" for other factors that may affect our future financial performance.

_____________________________________________________________________________________

UNGAVA MINES INC.

SECURITIES AND EXCHANGE COMMISSION

FORM 20-F

TABLE OF CONTENTS

| | | PAGE |

| | GLOSSARY OF TERMS | 1 |

| | PART I | 1 |

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 2 |

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 2 |

| ITEM 3 | KEY INFORMATION | 2 |

| 3.A. | Selected Financial Data | 2 |

| 3.B. | Capitalization and Indebtedness | 3 |

| 3.C. | Reasons For The Offer and Use of Proceeds | 3 |

| 3.D. | Risk Factors | 3 |

| ITEM 4 | INFORMATION ON THE COMPANY | 7 |

| 4.A. | History and Development of Our Company | 7 |

| 4.B. | Business Overview | 7 |

| 4.C. | Organizational Structure | 8 |

| 4.D. | Our Property | 8 |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 20 |

| 5.A. | Results of Operations | 20 |

| | Revenues | 20 |

| | Analysis of Expenses | 20 |

| | Summary of Quarterly Results | 21 |

| 5.B. | Liquidity and Capital Resources | 22 |

| 5.C. | Research and Development, Patents and Licenses, etc. | 22 |

| 5.D. | Trend Information | 22 |

| 5.E. | Off-Balance Sheet Arrangements | 22 |

| 5.F. | Disclosure of Contractual Obligations | 22 |

| 5.G. | Safe Harbor | 22 |

| ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 22 |

| 6.A. | Directors and Senior Management | 23 |

| 6.B. | Compensation | 24 |

| | Cash and Non-Cash Compensation - Executive Officers and Directors | 25 |

| | Option Grants in Last Fiscal Year | 25 |

| | Defined Benefit or Actuarial Plan Disclosure | 25 |

| | Termination of Employment, Change in Responsibilities and Employment Contracts | 25 |

| 6.C. | Board Practices | 25 |

| 6.D. | Employees | 25 |

| 6.E. | Share Ownership | 26 |

| ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 26 |

| 7.A. | Major Shareholders | 26 |

| 7.B. | Related Party Transactions | 27 |

| 7.C. | Interests of Experts and Counsel | 27 |

| ITEM 8 | FINANCIAL INFORMATION | 27 |

| 8.A. | Consolidated Statements and Other Financial Information | 27 |

| 8.B. | Significant Changes | 27 |

| ITEM 9 | THE OFFER AND LISTING | 28 |

| 9.A. | Offer and Listing Details | 28 |

| 9.B. | Plan of Distribution | 28 |

| 9.C. | Markets | 28 |

| 9.D. | Selling Shareholders | 28 |

| | | PAGE |

| 9.E. | Dilution | 28 |

| 9.F. | Expenses of the Issue | 28 |

| ITEM 10 | ADDITIONAL INFORMATION | 29 |

| 10.A. | Share Capital | 29 |

| 10.B. | Memorandum and Articles of Association | 29 |

| 10.C. | Material Contracts | 29 |

| 10.D. | Exchange Controls | 29 |

| 10.E. | Taxation | 29 |

| | Material Canadian Federal Income Tax Consequences | 29 |

| 10.F. | Dividends and Paying Agents | 30 |

| 10.G. | Statement by Experts | 30 |

| 10.H. | Documents on Display | 30 |

| 10.I. | Subsidiary Information | 30 |

| ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 30 |

| ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 30 |

| | | |

| | PART II | 31 |

| ITEM 13 | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 31 |

| ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 31 |

| ITEM 15.T. | CONTROLS AND PROCEDURES | 31 |

| ITEM 16 | RESERVED | 31 |

| 16.A. | Audit Committee Financial Expert | 31 |

| 16.B. | Code of Business Conduct and Ethics | 31 |

| 16.C. | Principal Accountant Fees and Services | 33 |

| 16.D. | Exemptions From the Listing Standards for Audit Committees | 33 |

| 16.E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 33 |

| | | |

| | PART III | 34 |

| ITEM 17 | FINANCIAL STATEMENTS | 34 |

| ITEM 18 | FINANCIAL STATEMENTS | 34 |

| ITEM 19 | EXHIBITS | 34 |

| | SIGNATURES | 35 |

Glossary of Terms

“Anomalous” refers to a sample or location that either (i) the concentration of an element(s) or (ii) geophysical measurement is significantly different from the average background values in the area.

“Anorthosite” is a rock comprised of largely feldspar minerals and minor mafic iron-magnesium minerals.

“Assay” is an analysis to determine the quantity of one or more elemental components.

“Au” refers to gold.

“BFS” is an abbreviation for Bankable Feasibility Study

“Byron” refers to Byron Americor Inc.

“Cm” is an abbreviation for centimeters.

“CRI” refers to Canadian Royalties Inc.

“Cu” refers to copper.

“Exploration stage” refers to the stage where a company is engaged in the search for minerals deposits (reserves) which are not in either the development or production stage.

“Fault” is a fracture or break in a rock across which there has been displacement.

“Gabbro” is an intrusive rock comprised of a mixture of mafic minerals and feldspars.

“Grade” is the concentration of an ore metal in a rock sample, given either as weight percent for base metals (ie, Cu, Zu, Pb) or in grams per tonne (g/t) or ounces per short ton (oz/t) for precious or platinum group metals.

“g/t” refers to grams per tonne.

“H” is an abbreviation for hectare.

“Hectare” is an area totaling 10,000 square meters or 100 meters by 100 meters.

“Intrusive” is a rock mass formed below earth’s surface from molten magma, which was intruded into a pre-existing rock mass and cooled to solid.

“Km” is an abbreviation for kilometer.

“M” is an abbreviation for meters.

“mafic” is a rock type consisting of predominantly iron and magnesium silicate minerals with little quartz or feldspar minerals.

“Mineralization” refers to minerals of value occurring in rocks.

“Mt” is an abbreviation for million tonnes.

“Ni” is an abbreviation for nickel.

“NSR” is an abbreviation for Net Smelter Royalty.

“Outcrop” refers to an exposure of rock at the earth’s surface.

“Overburden” is any material covering or obscuring rocks from view.

“PEA” is the “Raglan South Nickel Project, Nunavik, Quebec, Technical Report and Preliminary Economic Assessment on the Mequillon, Mesamax, Expo, and Ivakkak Deposits” prepared for CRI by P&E Mining Consultants and Roche Consulting Group, revised and dated July 24, 2006

“PGE” refers to mineralization containing platinum group elements, i.e. platinum and palladium.

“PGM” refers to platinum group metals, i.e. platinum and palladium.

“Pt” refers to platinum.

“Pyroxenite” refers to a relatively uncommon dark-colored rock consisting chiefly of pyroxene; pyroxene is a type of rock containing sodium, calcium, magnesium, iron, titanium and aluminum combined with oxygen.

“Ultramafic” refers to types of rock containing relatively high proportions of the heavier elements such as magnesium, iron, calcium and sodium; these rocks are usually dark in color and have relatively high specific gravities.

PART 1

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue”, or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States of America, we do not intend to update any of the forward-looking statements to conform these statements to actual results. As used in this annual report, the terms “we”, “us”, “our”, “Company” and “UMI” mean Ungava Mines Inc. and its subsidiaries, unless otherwise indicated.

Unless otherwise indicated, all dollar amounts referred to herein are in Canadian dollars.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

ITEM 3. KEY INFORMATION

3.A. Selected Financial Data

The following tables summarize our selected financial data (stated in Canadian dollars). November 30, 2007 and November 30, 2006 information has been prepared in accordance with United States general accepted accounting principles (“U.S. GAAP”). The information in the tables was extracted from the more detailed financial statements and related notes included with this filing and should be read in conjunction with these financial statements and with the information appearing under the heading "Item 5 – Operating and Financial Review and Prospects". Results for the period ended November 30, 2007, are not necessarily indicative of results for future periods.

| | | November 30, 2007 | | | November 30, 2006 | | | November 30, 2005 | | | November 30, 2004 | | | November 30, 2003 | |

| | $ | - | | | $ | - | | | | - | | | | - | | | | - | |

| | $ | (2,083,220 | | | $ | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | |

Basic and fully diluted loss per share | | $ | (0.08 | | | $ | - | | | | - | | | | - | | | | - | |

| | | 892,182 | | | $ | 1 | | | $ | 17,301 | | | $ | 17,301 | | | $ | 17,301 | |

| | $ | (1,333,472 | | | $ | (1,324,833 | | | $ | (1,307,532 | ) | | $ | (1,307,532 | ) | | $ | (1,307,532 | ) |

| | $ | 3,595,315 | | | $ | 1,520,734 | | | $ | 1,520,734 | | | $ | 1,520,734 | | | $ | 1,520,734 | |

Number of shares outstanding | | | 92,688,976 | | | | 8,281,431 | | | | 8,281,431 | | | | 8,281,431 | | | | 8,281,431 | |

Cash flow from operating activities | | $ | (677,620 | | | $ | (2,845,56 7 | ) | | | - | | | | - | | | | - | |

Cash flow from investing activities | | $ | (727,467 | ) | | $ | - | | | | - | | | | - | | | | - | |

Cash flow from financing activities | | $ | 1,412,551 | | | $ | 2,845,567 | | | | - | | | | - | | | | - | |

| | $ | 7,464 | | | $ | - | | | | - | | | | - | | | | - | |

Weighted average number of shares outstanding | | | 27,346,532 | | | | 8,281,431 | | | | 8,281,431 | | | | 8,281,431 | | | | 8,281,431 | |

In this Annual Report on Form 20-F, unless otherwise specified, all monetary amounts are expressed in Canadian dollars. On February 22, 2008, the exchange rate, based on the noon buying rate published by The Bank of Canada, for the conversion of Canadian dollars into United States dollars (the “Noon Rate of Exchange”) was $0.9846.

The following table sets out the high and low exchange rates for each of the last six months.

| | 2008 | 2007 |

| | January | December | November | October | September | August |

| High for period | .9685 | .9788 | .9992 | .9996 | .9466 | .9298 |

| Low for period | 1.0096 | 1.0220 | 1.0905 | 1.0527 | 1.0069 | .9525 |

The following table sets out the average exchange rates for the most recent financial years calculated by using the average of the Noon Rate of Exchange on the last day of each month during the period.

| | Year Ended November 30 |

| | 2007 | 2006 |

| Average for the period | 1.0748 | 1.1342 |

3.B. Capitalization and Indebtedness

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

3.C. Reasons for The Offer and Use of Proceeds

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

3.D. Risk Factors

The following is a brief discussion of those distinctive or special characteristics of our operations and industry, which may have a material impact on, or constitute risk factors in respect of, our future financial performance.

An investment in our common stock involves a high degree of risk. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed.

This document contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth in the following Risk Factors and elsewhere in this document.

We only have a 30% interest in the Expo Ungava Property and this interest will be further reduced to 20% if Canadian Royalties Inc. (“CRI”) delivers a bankable feasibility study which is accepted by a bank willing to finance the property into production on a non-recourse basis.

Our sole significant asset is a 30% interest in the Expo Ungava Property. Canadian Royalties Inc. (“CRI”) owns the remaining 70% of the interest. Our interest will be further diluted if CRI obtains an 80% in the Expo Ungava Property and we fail to subsequently contribute our pro rata share of joint venture expenses.

We do not have control of the operations at the Expo Ungava Property and CRI may operate the property in a manner which is adverse to our interest and may have a negative impact on our business.

Because of our minority interest in the Expo Ungava Property, we have limited control of the operations on such property and the interest of our joint venture partner in operating the property may be adverse to our interest.

We only have contractual control of parties which may become our future joint venturers regarding ownership and operation of the Expo Ungava Property.

We may enter into one or more joint ventures in the future, in addition to the joint venture with CRI. Any failure of CRI or any other joint venture partner to meet its obligations could have a material adverse affect on such joint ventures. In addition, we may be unable to exert influence over strategic decisions made in respect of other properties subject to such joint ventures.

We are seeking damages in litigation against numerous parties, as well as a defendant in an action prosecuted by Canadian. We may loss all these actions.

There is always risk in litigation. We are currently seeking damages in litigations against numerous parties. On the other hand, we are a defendant in an action prosecuted by Canadian for vexatious prosecution in which about $1,500,000 is claimed as damages. We may lose all these actions. In addition to being liable to those damages, we may be liable to pay the legal costs of the successful parties in the legal actions.

Our auditor has expressed substantial doubt as to our ability to continue as a going concern. If projected ore recoveries from future mining activities on the Property are not achieved, then our financial condition will be adversely affected and we may not be able to pursue operations.

We have a history of losses and expect to incur losses in the foreseeable future, and there is no assurance that we will be able to continue as a going concern.

Our financial statements included with this registration statement for the year ended November 30, 2007 have been prepared assuming that we will continue as a going concern. Our auditors have made reference to the doubt as to our ability to continue as a going concern in their audit report on our audited financial statements for the year ended November 30, 2007. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

Because of the speculative nature of exploration of mineral properties, there is no assurance that any exploration activities in which we have an interest, will result in the discovery of additional commercially exploitable quantities of ore.

The search for valuable minerals as a business is extremely risky. We can provide no assurance that exploration on our properties will establish that additional commercially exploitable reserves of ore exists. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates.

Our Property interest may be subject to title risks.

We have investigated title to our Property and, to the best of our knowledge, title to our Property in which we have an interest is in good standing. However, our Property may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. These defects could adversely affect our title to the Property or delay or increase the cost of the development of such properties.

Our property interest in Canada may also be subject to aboriginal rights that may be claimed on Crown properties or other types of tenure with respect to which mineral rights have been conferred. We are not aware of any aboriginal land claims having been asserted or any legal actions relating to native issues having been instituted with respect to the mineral property in Canada in which we have an interest.

Exploration activities, including test mining and mining activities are inherently hazardous.

Mining operations generally involve a high degree of risk. The operations by CRI are subject to all the hazards and risks normally encountered in the exploration, development and production of ore, including unusual and unexpected geology formations, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. O perations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability. The nature of these risks are such that liabilities might result in us being forced to incur significant costs that could have a material adverse effect on our financial condition and business prospects.

If CRI experiences accidents or other adverse events at the Property, then our financial condition and profitability could be adversely affected.

Exploration activities, including test mining and mining activities at the Property are subject to adverse operating conditions. Exploration accidents or other adverse incidents, such as cave-ins or flooding, could affect the ability to continue mining activities at the Property. A particular concern at the Property is warm temperatures that can reduce the winter season during which underground mining activities can safely be conducted. The occurrence of any of these events could cause a delay in recovery of ore or could reduce the amount of material that we are able to recover, with the result that the ability to achieve recoveries from mineral sales and to sustain operations would be adversely impacted. Adverse operating conditions may also cause operating costs to increase. Exploration accidents or other adverse events could also result in an adverse environmental impact to the land on which operations are located with the result that there may be liabilities for environmental cleanup and remediation.

If we become subject to increased laws and regulation, including environmental laws, operating expenses may increase.

Exploration activities and mining activities are subject to various federal, provincial and local laws governing prospecting, development, production, taxes, labor standards and occupational health, mine safety, toxic substances and other matters. Mining activities are also subject to various federal, provincial and local laws and regulations relating to the protection of the environment. These regulations may impose significant operating costs. No assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail production or development. Amendments to current laws and regulations governing operations and activities of exploration, mining and milling or more stringent implementation thereof could have a substantial adverse impact and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Government approvals and permits are currently, and may in the future be, required in connection with mining operations. To the extent CRI is not able to obtain such approvals; our joint venture partner may be curtailed or prohibited from proceeding with planned exploration or development of mineral properties.

Mining operations require governmental permits and approvals. If our joint venture partner is not able to obtain permits required to conduct operations and comply with the requirements of such permits, they may not be able to complete their exploration activities or commence commercial mining for ore and may be subject to substantial penalties for non-compliance.

Exploration and mining activities are subject to numerous environmental regulations and non-compliance may precipitate significant penalties.

All phases of operations in which we have an interest are subject to environmental regulation. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for noncompliance, more stringent environmental assessments of proposed projects and heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect operations. Environmental hazards may exist on the properties on which we hold interests, which are unknown to us at present, and which have been caused by previous or existing owners or operators of the properties. We may become liable for such environmental hazards caused by previous owners and operators of the properties even where we have attempted to contractually limit our liability.

There is intense competition in the exploration and mining industry. Both CRI and ourselves will have to compete for financing and for qualified managerial and technical employees.

The exploration industry is intensely competitive in all of its phases. Competition includes large established exploration companies with substantial capabilities and with significant financial and technical resources. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. Our joint venture partner has to compete with other exploration and mining companies in the recruitment and retention of qualified managerial and technical employees. If they are unable to successfully compete for financing or for qualified employees, programs may be affected.

Fluctuations in Commodity Prices may affect our revenues, if any, negatively.

The profitability of mining operations is significantly affected by changes in the market price of base metals and platinum group metals. The level of interest rates, the rate of inflation, world supply of base metals and platinum group metal and stability of exchange rates can all cause significant fluctuations in base metal and platinum group metal prices. Such external economic factors are in turn influenced by changes in international investment patterns and monetary systems and political developments. The price of base metals and platinum group metals has fluctuated widely in recent years, and future serious price declines could cause continued commercial production to be impracticable. Depending on the price of base metals and platinum group metals, cash flow from mining operations may not be sufficient. Market fluctuations and the price of base metals and platinum group metals may render reserves uneconomical. Moreover, short term operating factors relating to the reserves, such as the need for orderly development of the ore bodies or the processing of new or differing grades of ore, may cause a mining operation to be unprofitable in any particular accounting period.

Certain of our directors serve as directors of other companies which may have interests which conflict with the interest of our stockholders.

Certain of our directors also serve or may in future serve as directors of or consultants to, other companies involved in natural resource exploration and development and consequently there exists the possibility that such directors are or may come to be in a position of conflict of interest.

There is only a very thin public market for our common stock and there is no assurance that a substantial public market will ever develop. Our stockholders may not be able to resell their shares at or above the purchase price paid by such stockholders, or at all.

Even though our common stock is quoted on the Over-the-Counter Bulletin Board trading system (OTCBB), an investment in our stock may be highly illiquid and subject to significant market volatility. This volatility may be caused by a variety of factors including low trading volume and market conditions.

Stockholders may experience wide fluctuations in the market price of our securities. These fluctuations may have an extremely negative effect on the market price of our securities and may prevent a stockholder from obtaining a market price equal to the purchase price such stockholder paid when the stockholder attempts to sell our securities in the open market. In these situations, the stockholder may be required either to sell our securities at a market price which is lower than the purchase price the stockholder paid, or to hold our securities for a longer period of time than planned. An inactive market may also impair our ability to raise capital by selling shares of capital stock and may impair our ability to acquire other companies by using common stock as consideration or to recruit and retain management with equity-based incentive plans.

Our common stock is considered a “Penny Stock,” which is subject to restrictions on marketability, so you may not be able to sell your shares.

The SEC has adopted regulations that generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. The market price of our common stock is likely to be less than $5.00 per share and therefore may be a “penny stock” according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect the ability of investors hereunder to sell their shares. Investors will find it difficult to obtain accurate quotations of the stock and may experience a lack of buyers to purchase such stock or a lack of market makers to support the stock price.

If we fail to comply in a timely manner with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a negative effect on the trading price of our common stock.

Pursuant to Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we will be required to furnish a report by our management on our internal control over financial reporting. Such report will contain, among other matters, an assessment of the effectiveness of our internal controls over financial reporting as of the end of 2008. Compliance with Section 404 is likely to result in increased general and administrative expenses and may shift management time and attention from revenue-generating activities to compliance activities. There also can be no assurance that our auditors will be able to issue an unqualified opinion on management’s assessment of the effectiveness of our internal control over financial reporting in the future. Failure to achieve and maintain an effective internal control environment or to complete our Section 404 certifications could have a material adverse effect on our stock price. Any failure to complete our assessment of our internal control over financial reporting, to remediate any material weaknesses that we may identify or to implement new or improved controls, or difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock. Due to the limited number of personnel engaged by our Company, we it is not feasible to achieve complete segregation of incompatible duties and we do not have the optimum complement of personnel with all of the knowledge to address all complex and non-routine transactions that may arise. We rely on outside consultants to assist us as required and have identified the skill sets that we require in future employees. We will add to our complement of staff as soon as our working capital situation allows us to add staff.

We have never paid nor do we expect in the near future to pay cash dividends.

We have never paid cash dividends on our capital stock and do not anticipate paying any cash dividends in the immediate future.

ITEM 4. INFORMATION ON OUR COMPANY

4.A. History and Development of Our Company

| 4.A (i) | We are a company that continues as the result of an amalgamation ( see below) of Byron Americor Inc., a shell company listed on the NASDAQ OTC BB market and Ungava Mines Inc. (“UMI”) an Ontario, Canada corporation, organized in February 2007 as a wholly owned subsidiary of Nearctic Nickel Mines Inc. (“NNMI”). In March 2007, NNMI transferred its wholly-owned subsidiary, Ungava Mineral Exploration Inc. (“UMEI”), to UMI on a tax-free rollover basis. As part of the consideration, UMI agreed to pay $500,000 to NNMI and assume all future costs of the litigation related to the mineral property. NNMI remains a party to certain Ontario litigation relating to the mineral property and has a right to receive a portion of any recovery. NNMI has declared a dividend of UMI common shares whereby one share of UMI is to be distributed for each two NNMI shares held. The distribution and date is contingent on certain eventualities which may not occur. |

| 4.A (ii) | On August 22, 2007, through a series of transactions, NNMI acquired control of Byron Americor Inc. (“Byron”) an Ontario company whose common shares trade on the NASDAQ OTC BB market (UGVMF). In one transaction, NNMI acquired 14,131,638 Byron common shares for nominal consideration. In another transaction, NNMI transferred to Byron all the outstanding shares and share purchase warrants of UMI and 5,000,000 NNMI common share purchase warrants exercisable at $0.75 per share for five years, in exchange for 75,868,362 Byron common shares and 10,000,000 Byron common share purchase warrants exercisable at $0.75 per share for five years. After these transactions, there were 92,688,976 common shares of Byron outstanding. Byron had been a shell company with nominal assets and limited liabilities. The transaction is a capital transaction in substance and therefore has been accounted for as a recapitalization of Byron. Because UMI is deemed to be the purchaser for accounting purposes, consolidated financial information and information in this document is presented as a continuation of UMI and its subsidiary UMEI. |

| 4.A (iii) | By Articles of Amalgamation, effective September 21, 2007, UMI amalgamated with Byron Americor Inc. The amalgamated company continues under the name Ungava Mines Inc. |

| 4.A (iv) | The address of our principal place of business is: 160 Matheson Boulevard East, Unit 5, Mississauga, Ontario, Canada, L4Z 1V4. Our telephone number is (905) 568-4573. |

| 4.A (v) | The history of Byron is detailed below: Byron was incorporated under the laws of the Province of British Columbia, Canada, on July 18, 1986 as Castello Resources Ltd. It subsequently changed its name to Castello Business Systems Ltd. on January 21, 1993 before becoming Castello Casino Corp. on October 31, 1995. In 1995, Articles of Continuance provided for Byron's continuance in the Province of Ontario, Canada. Articles of Amendment, granted to Castello, provided for an increase in the authorized capital to 100,000,000 common shares of no par value and the consolidation of the common shares on the basis of four (4) pre-consolidation common shares for one (1) post-consolidation common share. Byron, on April 15, 2003, changed its name to Byron Resources Inc., and the common shares of the company were consolidated on the basis of 1 new share for each 140 shares held, approval having been granted at the Annual and Special Meeting of Shareholders held on December 12, 2002. On July 9, 2004, Byron changed its name to Byron Global Corp, and on August 3, 2004 its common shares were consolidated on the basis of 1 new share for each 10 shares held, approval having been granted at the Annual and Special Meeting of Shareholders held on June 25, 2004. On July 9, 2007, Byron changed its name to Byron Americor Inc. and its common shares were consolidated on the basis of 1 new share for each 10 shares held. |

| On August 22, 2007, through a series of transactions, NNMI acquired control of Byron. (See 4.A (ii) above). |

4.B Business Overview

Pursuant to an Agreement of January 20, 1995, we acquired a 100% working interest in mineral rights to approximately 170 square kilometers of land located in the Ungava area of Ruperts Land, Quebec, Canada (the “Property”), subject to two 1% Net Smelter Return royalties. We entered into an Agreement with Canadian Royalties Inc. (“CRI”) dated January 12, 2001, under which CRI could earn up to an 80% interest in the Property. To date, CRI has been vested with a 70% interest in the Property. Under the Agreement, CRI will earn a further 10% interest by producing a bankable feasibility study (“BFS”) relating to the construction of a mine on the Property, which is accepted by a banker willing to provide the funding to put the Property into production on a non-recourse basis.

In June 2007, CRI published the highlights of a purported BFS regarding the Property and on June 29, 2007 CRI published a Technical Report relating to its purported BFS and indicated that it is proceeding with permitting applications, and an environmental and social impact analysis. The purported BFS proposes that the Property be put into production and mined in conjunction with a deposit owned by CRI. CRI has also announced that the BFS will be “updated” to include production from the Mequillon deposit on the Property. After Canadian has earned its 80% interest, the companies will enter into a joint venture to own, operate and further explore and develop the Property. Our interest will be subject to dilution for non-contribution to the joint venture. If reduced to a 10% joint venture interest, our interest will be automatically converted to a 1% net smelter returns royalty, which CRI can purchase for $1,500,000.

4.C Organizational Structure

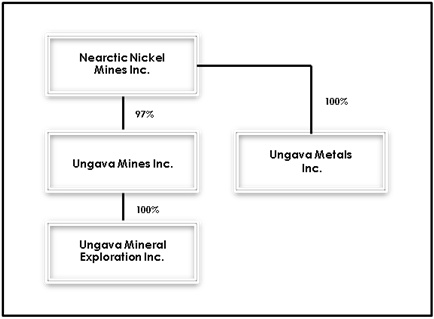

Our organization structure is outlined in the chart below.

Nearctic Nickel Mines Inc. is federally incorporated in Canada, is listed on the Pink Sheets, symbol UGVAF and is a reporting issuer in the Canadian provinces of Alberta, Ontario, Quebec and Nova Scotia.

The 2,688,976 shares of our company not held by NNMI, represent the float in the market.

UMEI is incorporated in Quebec, Canada and Ungava Metals Corp., is an inactive subsidiary incorporated federally in Canada.

4.D Our Property

We are an exploration stage company. Our property is owned by our wholly owned subsidiary, UMEI, and comprises an area of approximately 170 square kilometers. CRI has undertaken all exploration activities on the Property since 2001.

The Property description that follows has been derived largely from the technical reports and to a lesser extent the CRI website and CRI Annual Reports

Location, Access, Infrastructure, Climate, and Physiography

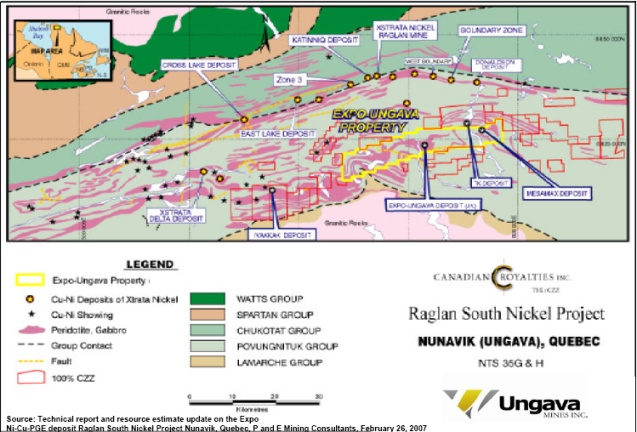

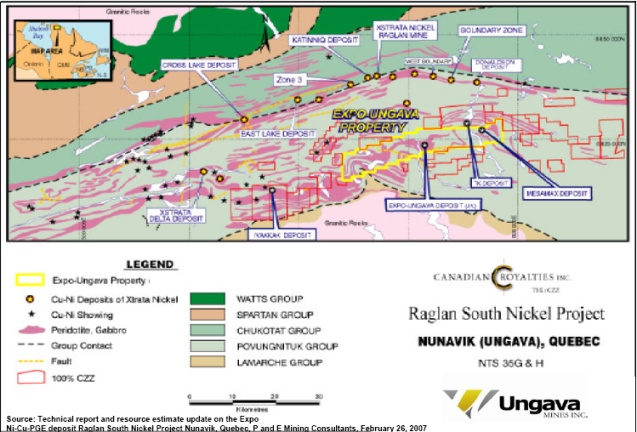

The Property is located in the northern Quebec region of Nunavik approximately 90 kilometers west of the village of Kangiqsujuaq (also known as Wakeham Bay) and approximately 15 kilometers south of Raglan, a Ni-Cu-PGE mining operation owned by Xstrata Nickel a division of Xstrata plc (formerly the Falconbridge Raglan Mines) (see figures 1 and 2). The center of the Property is located at approximately latitude 61o33’N and longitude 73 o 28’W and is within Canadian National Topographic Map Sheet 35H.

Figure 1.

The commercial airlines Air Inuit and First Air have daily air service from Montreal and Val-d’Or to the coastal communities of Salluit and Kangiqsujuaq. Air service from Salluit also connects to the community of Radisson in the James Bay hydroelectric development area. The Property can be accessed by helicopter from the airports at Kangiqsujuaq and Salluit.

CRI maintains a fleet of heavy all terrain haulage equipment to facilitate logistics and road construction In 2005, CRI constructed an access road from the Deception Bay-Katinniq-Donaldson-Douglas Harbour road network south to the Mesamax Deposit. The road network is used for re-supply and the delivery of heavy equipment to the site from sea-lift via Douglas Harbour. Typical re-supply to support on-going exploration activities includes fuel, drilling supplies, nom-perishable food, and other equipment. The on land movement of supplies is supported by helicopter. The infrastructure in place on the property consists of exploration camps. The main camp is located near the south margin of the Expo deposit and includes first aid, office, kitchen, core logging and sampling facilities, sleeping, and dry facilities as well as a mechanical shop comprised of permanent buildings and tents. A smaller stand alone camp has been built at Mequillon which includes core logging facilities, a satellite communications system, office, and kitchen and sleeping facilities. Power is supplies to the camps with diesel generators. Snow machines and all terrain vehicles are use for exploration and logistics activities. Water is readily abundant and is pumped to required points of use.

The Property is located on the northern Canadian tundra. The climate is harsh with summer temperatures ranging typically from 0 Cº to 20 Cº and winter temperatures ranging from 0 Cº to -50 Cº. The Property is located on a broad plateau with gentle relief. Vegetation consists of sparse shrubs, plants, and grasses, which generally grow to less than 25 centimeters in height.

Figure 2.

CRI has completed (commissioned) a number of National Instrument 43-101 (Canada) compliant reports (all of which are viewable and downloadable at CRI’s website on the SEDAR disclosure site, www.sedar.com) which are summarized as follows:

| DATE | REPORT | | ENGINNERING FIRM/CONSULTING GROUP | | AUTHOR(S) |

| 30-May-08 | TECHNICAL REPORT AND RESOURCE ESTIMATE ON THE ALLAMMAQ Ni-Cu-PGE DEPOSIT NUNAVIK NICKEL PROJECT, NUNAVIK, QUEBEC | | P&E Mining Consultants | | Ms. Tracy Armstrong, P.Geo., Mr. Eugene Puritch, P.Eng, Mr. Antoine Yassa, P.Geo |

| 20-Mar-08 | TECHNICAL REPORT AND PRELIMINARY ECONOMIC ASSESSMENT OF THE MEQUILON Ni-Cu-PGE DEPOSIT NUNAVIK NICKEL PROJECT, NUNAVIK, QUEBEC | | P&E Mining Consultants | | Ms. Tracy Armstrong, P.Geo., Mr. Eugene Puritch, P.Eng, MR. David Orava, P.Eng, Mr. Antoine Yassa, P.Geo, Mr. Stephane Rivard, ing. |

| 25-Oct-07 | TECHNICAL REPORT AND UPDATED RESOURCE ESTIMATE ON THEMEQUILLON Ni-Cu-PGE DEPOSIT NUNAVIK NICKEL PROJECT NUNAVIK, QUEBEC | | P&E Mining Consultants | | Ms. Tracy Armstrong, P.Geo., Mr. Eugene Puritch, P.Eng, Mr. Antoine Yassa, P.Geo |

| 20-Jul-07 | RAGLAN SOUTH NICKEL PROJECT TECHNICAL REPORT | | SNC Lavalin | | Mining and Metallurgy Group |

| 22-Mar-07 | TECHNICAL REPORT (2007) AND RESOURCE ESTIMATE UPDATE ON THE IVAKKAK Ni-Cu-PGE DEPOSIT SOUTH TREND PROPERTY, RAGLAN SOUTH NICKEL PROJECT | | G.A. Harron & Associates Inc. and P&E Mining Consultants | | G.A. Harron, P.Eng., Eugene Puritch, P.Eng., Dr. Wayne D. Ewert, P.Geo, Tracy Armstrong, P.Geo |

| 26-Feb-07 | TECHNICAL REPORT AND RESOURCE ESTIMATE UPDATE ON THE EXPO Ni-Cu-PGE DEPOSIT RAGLAN SOUTH NICKEL PROJECT, NUNAVIK, QUEBEC | | P&E Mining Consultants | | Ms. Tracy Armstrong, P.Geo., Mr. Eugene Puritch, P.Eng, Mr. Antoine Yassa, P.Geo |

| 24-Jul-06 | RAGLAN SOUTH NICKEL PROJECT, NUNAVIK, QUEBEC TECHNICAL REPORT AND PRELIMINARY ECONOMIC ASSESSMENT ON THE MEQUILLON, MESAMAX, EXPO AND IVAKKAK DEPOSITS FOR CANADIAN ROYALTIES INC. | | P&E Mining Consultants and Roche Ltd., Consulting Group | | Eugene J. Puritch, P.Eng. Mining Engineer, Alfred S. Hayden, P.Eng. Metallurgist, Michael J. Davie, P.Eng. Mining Enginee, Bruce Brady, P.Eng. OIQ, Mining Enginee, Dr. Wayne Ewert, P.Geo. Geologist, Serge Tourangeau, Biol. M.Sc., Sylvain Boucher, Eng., M.Sc. |

| 31-Mar-06 | TECHNICAL REPORT ON THE IVAKKAK DEPOSIT, SOUTH TREND PROPERTY (NTS 35G/08) NUNAVIK, QUEBEC | | G.A. Harron & Associates Inc. and P&E Mining Consultants | | G.A. Harron, P.Eng., Eugene Puritch, P.Eng., Dr. Wayne D. Ewert, P.Geo, Tracy Armstrong, P.Geo |

| 08-Aug-05 | TECHNICAL REPORT ON THE MINERAL RESOURCE ESTIMATE EXPO NICKEL-COPPER DEPOSIT NUNAVIK, QUEBEC FOR CANADIAN ROYALTIES INC. | | Todd Keast Geological Services Inc. and Strathcona Mineral Services Limited | | Todd Keast, P. Geo. Henrik Thalenhorst, P. Geo |

| 30-May-05 | TECHNICAL REPORT ON THE UPDATED MINERAL RESOURCE ESTIMATE MEQUILLON NICKEL-COPPER DEPOSIT NUNAVIK, QUEBEC | | Todd Keast Geological Services Inc. and Strathcona Mineral Services Limited | | Todd Keast, P. Geo. Henrik Thalenhorst, P. Geo |

| 18-Oct-04 | TECHNICAL REPORT ON THE INITIAL MINERAL RESOURCE ESTIMATE MEQUILLON NICKEL-COPPER DEPOSIT NUNAVIK, QUEBEC FOR CANADIAN ROYALTIES INC. | | Strathcona Mineral Services Limited | | Henrik Thalenhorst, P. Geo |

| 29-May-03 | TECHNICAL REPORT ON THE SOUTH TREND GROUP OF PROPERTIES NUNAVIK QUEBEC FOR CANADIAN ROYALTIES INC. | | Strathcona Mineral Services Limited and Todd Keast Geological Services Inc. | | Henrik Thalenhorst, P. Geo. Todd Keast, P. Geo |

Previous exploration programs and the exploration program funded and completed by CRI have successfully discovered and delineated bodies of Ni-Cu-PGE sulphide mineralization on the property. CRI has estimated and stated reserves for the Expo Ungava property pursuant to Canadian regulations for reserve estimation and reporting. CRI is currently in the process of establishing a commercially viable mining project for the property. CRI to date has spent CDN$140 Million in building the mine and CRI expects to have spent CDN$200 Million by September 2008 when it intends to borrow CDN$250 Million from the Bank of Montreal to finish paying for the mine. CRI has said that it expects the mine to be in production in Q1 2010. As such, the Expo Ungava property is nevertheless deemed to be in the exploration state.

Description and Status of Mining Claims

Mining and mineral exploration rights and permits is administered in Canada by the provinces. Mineral rights are acquired either through ground staking or map staking. Ground staking requires that an individual licensed in the jurisdiction physically erect corner posts and mark the adjoining lines to define a claim on the ground which is subsequently registered with the recording office. Claims in the Nunavik region of Quebec are acquired by map staking and can be accomplished on-line. The registration of the claims requires payment of a registration fee and maintenance of the claims requires payment of renewal fees, and work expenditures where the work expenditures are evidenced by a work report. The Expo Ungava property consists of 500 Quebec provincial mining claims (Map Designated Units or “MDU’s). The total area of the Property is approximately 206 square kilometers (50,828 acres or 20,569 hectares). The renewal date for the MDU’s is February 7, 2009 and the expiry date is April 9, 2009. Maintenance of the claims requires payment of a renewal fee, currently at CDN$92.00 per MDU, payable to the Ministère des Resources Naturelles du Quebec and work expenditures currently at a rate of CDN$1,200 per MDU. Total renewal fees required for the Property are CDN$43,792.00 and total work expenditures required is CDN$571,200.00. The Property MDU’s currently have a total of CDN$6,085,232.62 in excess work expenditure credits which can be distributed upon renewal. Title of the MDU’s is registered to “Exploration Minerale Ungava Inc (13920) 30 %” and “Canadian Royalties Inc (18783) 70 % (responsible)”

Exploration History

The general area of Ni-Cu-PGE deposits in northern Nunavik covering the Raglan Trend and the South Trend encompassing the Expo Ungava property has been explored since the mid 1950's. A brief overview of the exploration history is provided here. For a comprehensive account of previous exploration, the reader is referred to the Thalenhorst and Keast (2003) Technical Report. Initial field work consisting of ground geophysics and surface sampling was undertaken by New Quebec Mining and Exploration in 1957 and indicated the possible importance of the Expo and Mesamax areas. There is no recorded work in the area from 1958 until 1967, when Expo Ungava Mines Ltd. staked the areas identified as having potential in 1957. After completing a magnetometer survey, eight holes were drilled that discovered the Expo deposit. A more ambitious drilling program was conducted by Expo Ungava Mines Ltd. in 1968 that consisted of 35 surface drill holes and essentially outlined the deposit over a strike length of 600 meters.

Amax Exploration Inc. (Amax), as optionee, became manager of the Expo project in 1969 and drilled a further 32 holes designed to test possible extensions of the deposit but were generally unsuccessful. Amax also carried out a preliminary feasibility study at that time, including preliminary metallurgical test work and open-pit mining studies. Although Amax remained active in the general area in 1970, there is no record of further work on Expo in that year, and it appears that the deposit lay dormant again afterwards.

On January 20, 1995, the Company’s, subsidiary Ungava Mineral Exploration Inc. (“UMEI”), acquired a 100% working interest in the Expo Ungava property subject to two 1% NSR royalties.

In 1997 High North Resources Inc. and Ungava Minerals Corp. undertook a confirmatory drill program consisting of five diamond drill holes into the Expo deposit.

On January 12, 2001 the Company’s wholly owned subsidiary, UMEI, entered into the Option and JV Agreement with CRI as described above.

History – Exploration work Completed by CRI

CRI has conducted and continues to implement a systematic and comprehensive exploration program for the discovery and delineation of Ni-Cu-PGE mineralization on the Expo Ungava property. The exploration programs have been executed and supervised by industry professionals, Qualified Persons as defined by National Instrument 43-101, and have been completed to industry standards as per best practice guidelines for mineral exploration and resource estimation as set out by the Canadian Institute of Mining and Metallurgy.

The primary exploration techniques and procedures employed by CRI on the Property have been airborne geophysical surveys, ground geophysical surveys, and diamond drilling. The exploration programs/diamond drilling have successfully expanded and delineated known mineralization (Expo and Mequillon) and have discovered new zones of mineralization (Mesamax and Allammaq) and support resource estimation and project development. The total meterage and number of holes completed on the main zones of mineralization on the Expo Ungava property are summarized in the table below.

| Year | Company | No. of Holes | Total Metreage |

| Expo | 1967 | Expo Ungava | 8 | 731 |

| Expo | 1968 | Expo Ungava | 35 | 3281 |

| Expo | 1969 | Amax | 34 | 5439 |

| Expo | 1997 | High North | 6 | 1023 |

| Expo | 2003 | CR I | 67 | 6747 |

| Expo | 2004 | CR I | 43 | 4825 |

| Expo | 2005 | CR I | 31 | 6153 |

| Expo | 2006 | CR I | 44 | 4578 |

| Total Expo | | | 268 | 32777 |

| | | | | |

| Mequillon | 1958 | C. M de L'Ungava | 5 | 699 |

| Mequillon | 2002 | CR I | 6 | 573 |

| Mequillon | 2003 | CR I | 12 | 1670 |

| Mequillon | 2004 | CR I | 77 | 11757 |

| Mequillon | 2005 | CR I | 19 | 5081 |

| Mequillon | 2006 | CR I | 9 | 2827 |

| Total Mequillon | | | 128 | 22607 |

| | | | | |

| Mesamax | 2001 - 2003 | CR I | 76 | 7400 |

| Mesamax | 2004 | CR I | 41 | 3540 |

| Mesamax | 2005 | CR I | 63 | 33 tonnes |

| Mesamax | 2006 | CR I | 21 | 3438 |

| Total Mesamax | | | 201 | 16676 |

| | | | | |

| Allammaq | 2007 | CR I | 32 | 5736 |

| Total Allammaq | | | 32 | 5736 |

| | | | | |

Source: Technical reports: 1) Raglan South Nickel Project Technical Report, SNC Lavalin, July 20, 2007 and 2) Technical Report and Resource Estimate for the Allammmaq Ni-Cu-PGE Deposit Nunavik Nickel Project, Nunavik Quebec, P&E Mining Consultants, May 30, 2008.

Sampling, Analyses, and QA/QC

Drill core sampling forms the basis of the analytical database. Drill core is logged for geological and geotechnical purposes and sample intervals defined by the geologist based on defined project parameters. The core is split by mechanical methods with ½ the core being returned to the core box for archiving purposes and ½ the core bagged for shipment to the analytical laboratory. The samples are shipped to the ALS Chemex sample preparation facility in Val-d’Or, Quebec. Sample preparation includes crushing the samples to 90% passing 2 millimeters and a 1 kg split pulverized to 85% passing a 75 micron screen. Base metal concentrations are determined using ALS Chemex method ME-ICP81 and precious metals are determined using the ALS Chemex procedures PGM-ICP27 (ICP-AES). ALS Chemex is an internationally recognized and certified laboratory. The sampling, chain of custody, and analytical procedures have been reviewed by independent Qualified Persons on behalf of CRI and as required by National Instrument 43-101.

Data integrity is maintained through the insertion of standard samples in the stream of core samples. In addition, the sampling and analytical data has been verified by sampling and data validation completed by independent Qualified Persons on behalf of CRI.

Exploration and Related Expenditures by CRI

To the end of its fiscal year 2007, CRI has incurred an aggregate expense of CDN$28,917,512 on the Expo Ungava property. Yearly exploration and related expenditures on the Expo Ungava property are summarized in the table below.

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 |

| Acquisition and claims maintenance | 51,699 | 3,232 | 41,378 | 42,446 | 633 | 44,000 | |

| Property/ Option Payments | 20,000 | 30,000 | | | | | |

| Communication | 7,210 | 17,645 | 22,307 | 43,094 | 56,236 | 33,598 | 110,417 |

| Program management and consultants | 34,639 | 18,959 | 152,558 | 302,800 | 394,474 | 2,518,352 | 2,162,932 |

| Drilling, excavation and related costs | 37,038 | 356,772 | 1,473,095 | 1,849,852 | 2,380,676 | 1,937,223 | 3,245,595 |

| Ground geophysics | | | 114,506 | 162,625 | 151,918 | 101,205 | 281,978 |

| Airborne geophysics | | | 122,023 | 2,554 | 112,262 | | 645,927 |

| Technical and field staff | 189,550 | 196,592 | 424,527 | 747,973 | 653,897 | 1,087,677 | 2,018,435 |

| Sampling and testing | 46,477 | 41,264 | 232,731 | 365,342 | 216,214 | 205,899 | 207,374 |

| Metallurgical testing | | | | 162,746 | 233,130 | 672,612 | 127,371 |

| Travel and transport including helicopter and camps | 298,888 | 446,111 | 1,386,285 | 2,781,796 | 2,900,854 | 3,161,041 | 3,778,291 |

| Amortization, insurance and other expenses | 40,844 | 3,710 | 8,634 | 13,295 | 43,591 | 314,689 | 543,022 |

| Professional Fees | 32,742 | 815 | 285 | 2,346 | | | |

| Government assistance | | -75,000 | -461,263 | -2,000,000 | -1,125,000 | -3,115,668 | -6,996,820 |

| Net expenses incurred during the year | 759,087 | 1,040,100 | 3,517,066 | 4,476,869 | 6,018,885 | 6,960,628 | 6,124,522 |

| Balance beginning of year | 20,355 | 779,442 | 1,819,542 | 5,336,608 | 9,813,477 | 15,832,362 | 22,792,990 |

| Balance End of Year | 779,442 | 1,819,542 | 5,336,608 | 9,813,477 | 15,832,362 | 22,792,990 | 28,917,512 |

| | | | | | | | |

Source: CRI Annual reports

Geology and Mineralization

The Property occurs in a succession of dominantly volcanic and sedimentary rocks referred to as the Cape Smith Belt. The volcanic and sedimentary rocks are approximately 2.0 – 1.9 billion years old and the Cape Smith Belt is correlated with the Thompson Nickel Belt in Manitoba.

The Cape Smith Belt hosts two approximately parallel belts of ultramafic rocks. The Raglan trend in the north and the South Trend are separated by a distance of approximately 15 to 20 kilometers. Both belts host a number Ni-Cu-PGE sulphide deposits developed in the ultramafic rocks and spatially associated mafic rocks. The deposits along the Raglan Trend include Donaldson, Boundary, West Boundary, 13-14, 5-8, Katiniq, East Lake, 2-3 Zone and Cross Lake and are collectively owned and exploited by Xstrata Nickel. Deposits on the south trend include Expo, Mesamax, Allammaq, and Mequillon (see figure 2). All of the deposits in the Cape Smith Belt belong to a broad class of mineral deposits referred to as Magmatic Sulphide Deposits or Ni-Cu Magmatic Sulphide Deposits. Deposits of this type are (and have been) major sources of nickel and copper including the deposits at Sudbury, Thompson, Voiseys Bay, and Kambalda (Western Australia) among others. The primary nickel sulphide mineral in these deposits, as a class of deposits and in the case of the Expo Ungava property deposits, is Pentlandite and similarly the primary mineral of copper is chalcopyrite. The platinum group element minerals include various PGE bearing antimony, tellurium, and arsenic minerals.

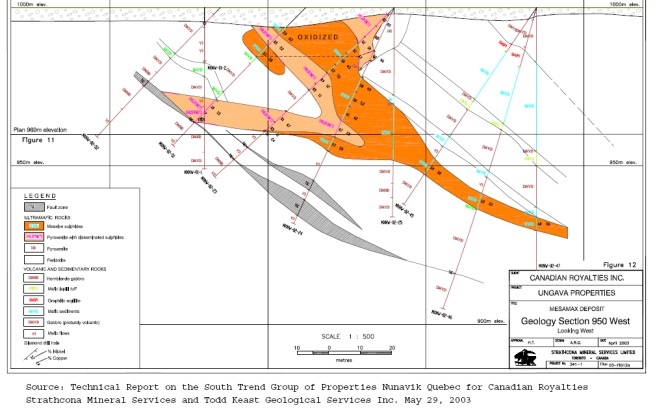

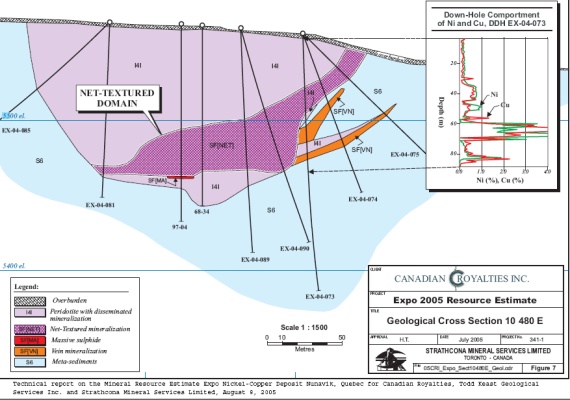

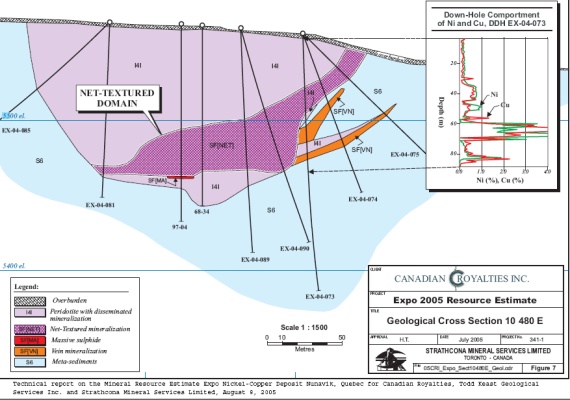

The deposits on the Expo Ungava property occur within ultramafic intrusive rocks which are in turn hosted by the sequence of dominantly volcanic and sedimentary rocks. Geological interpretation of the deposits include the definition of the major rock types and mineralization types including the distinction of massive sulphide, oxidized massive sulphide, and net textured sulphide. Representative sections of mineralization are included in figures 3 and 4.

Figure 4.

Resources and Reserves

Mineral resources and reserves have been estimated and reported for the Expo Ungava property compliant with Canadian regulation National Instrument 43-101. Reserves have been estimated for the Expo and Ungava deposits while resources only have been estimated for Allammaq and Mequillon deposits. The property hosts only “indicated” and “inferred” resources which are not recognized as reserves in filings to the United States Securities Commission. The property does not currently host reserves in the “proven” category.

Resources

General Methodology and Cutoff Grade: The resources for the Allammaq and Mequillon deposits were estimated using a conventional block model method where the resource blocks are constrained by a geologically interpreted 3-dimensional volume. Metal grades of Ni, Cu, Co, Pt, Pd, and Au are estimated for each block as well block volume and block density. Based on grade, a block $ value or “NSR” value (i.e. $/tonne) is then determined for each block using metal prices, exchange rates, factors for metal recovery and payable metal, refining charges, concentrate shipping charges, smelter treatment charges, and shipping costs. The block model is then evaluated against a cutoff “grade” value where the value is based on estimated operating costs. Blocks with an NSR value above the cutoff value are resource and those below cutoff value are not resource. The distinction of resource and waste is also based on an inspection of the block model for continuity of resource blocks. The factors used to establish the block NSR are:

| NSR Cut Off Grade Calc. Components | Allammaq | Mequillon |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Net Textured Ni Concentrate | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Net Textured Cu Concentrate: | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Massive Sulphide & Vein Ni Concentrate | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Massive Sulphide & Vein Cu Concentrate | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Ni Smelter Treatment Charges | | |

Cu Smelter Treatment Charges | | |

| | |

| | |

Source: Technical reports: 1) Technical report and resource estimate on the Allammaq N-Cu-PGE deposit Nunavik Nickel Project, Nunavik, Quebec, , P&E Mining Consultants, May 30, 2008. and 2) Technical report and preliminary economic assessment of the Mequillon Ni-C-PGE deposit, Nunavik Nickel Project, Nunavik, Quebec, P&E Mining Consultants, March 20, 2008

Estimated operating costs for the Mequillon and Allammaq deposits and therefore the resource cut off NSR value are:

| Deposit and Mining Method | | $CDN per tonne |

| Estimated Operating Costs Mequillon Underground | | $43 |

| Estimated Operating Costs Mequillon Open Pit | | $75 |

| Estimated Operating Costs Allammaq Underground | | $115 |

Source: Technical reports: 1) Technical report and resource estimate on the Allammaq N-Cu-PGE deposit Nunavik Nickel Project, Nunavik, Quebec, , P&E Mining Consultants, May 30, 2008. and 2) Technical report and preliminary economic assessment of the Mequillon Ni-C-PGE deposit, Nunavik Nickel Project, Nunavik, Quebec, P&E Mining Consultants, March 20, 2008

Indicated Resources

Cautionary Note to U.S. Investors concerning estimates of Indicated Resources. This section uses the term "indicated resources."

We advise U.S. investors that these terms are not recognized by the U.S. Securities and Exchange Commission. The estimation of measured resources and indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that mineral resources in these categories will ever be converted into reserves.

The indicated resources for the Allammaq and Mequillon deposits are tabulated below:

| Deposit | Tonnes | Ni(%) | Cu(%) | Co(%) | Au(g/t) | Pt(g/t) | Pd(g/t) |

| Indicated | Mequillon | 5,374,000 | 0.74 | 1.07 | 0.04 | 0.23 | 0.70 | 2.65 |

| Indicated | Allammaq | 2,065,000 | 1.30 | 1.52 | 0.05 | 0.13 | 0.73 | 3.14 |

| Total indicated | 7,439,000 | 0.90 | 1.19 | 0.04 | 0.20 | 0.71 | 2.79 |

Source: Technical reports: 1) Technical report and resource estimate on the Allammaq N-Cu-PGE deposit Nunavik Nickel Project, Nunavik, Quebec, , P&E Mining Consultants, May 30, 2008. and 2) Technical report and preliminary economic assessment of the Mequillon Ni-C-PGE deposit, Nunavik Nickel Project, Nunavik, Quebec, P&E Mining Consultants, March 20, 2008

Inferred Resources

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources. This section uses the term "inferred resources." We advise U.S. investors that this term is not recognized by the U.S. Securities and Exchange Commission. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources.

The inferred resources are tabulated below:

| Deposit | Tonnes | Ni(%) | Cu(%) | Co(%) | Au(g/t) | Pt(g/t) | Pd(g/t) |

| Inferred | Mequillon | 3,085,000 | 0.82 | 1.12 | 0.04 | 0.18 | 0.65 | 2.57 |

| Inferred | Allammaq | 461,000 | 1.97 | 1.84 | 0.08 | 0.13 | 0.81 | 2.67 |

| Total inferred | 3,546,000 | 0.97 | 1.21 | 0.05 | 0.17 | 0.67 | 2.58 |

Source: Technical reports: 1) Technical report and resource estimate on the Allammaq N-Cu-PGE deposit Nunavik Nickel Project, Nunavik, Quebec, , P&E Mining Consultants, May 30, 2008. and 2) Technical report and preliminary economic assessment of the Mequillon Ni-C-PGE deposit, Nunavik Nickel Project, Nunavik, Quebec, P&E Mining Consultants, March 20, 2008.

Reserves

General Methodology: Reserves have been estimated for the Expo and Mesamax deposits in accordance with Canadian National Instrument 43-101. The reserves for both deposits are based on open pit mine designs. The reserve estimation procedure consists of evaluation of the resource block model utilizing pit optimization software to compute, based on block NSR, the cost, revenue, and net income for each block. Probable reserves have been estimated only. No proven reserves have been established for the property. The parameters for the estimation of block value for the potential reserve blocks (NSR) are:

| NSR Cut Off Grade Calculation Components |

$C/$US (Exchange Rate Ni Price Cu Price Co Price Au Price Pt Price Pd Price | | | | $0.89 US $6 00/lb US $1 50/lb - - US $900/oz US $300/oz |

Product Recoveries to Nickel Concentrate | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Product Recoveries to Copper Concentrate | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Payable Quantities in Nickel Concentrate | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Payable Quantities in Copper Concentrate | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| |

| |

| |

| |

| |

| |

Ni Smelter Treatment Charges | |

Cu Smelter Treatment Charges | |

| |

Source:Technical reports: 1) Raglan South Nickel Project Technical Report, SNC Lavalin, July 20, 2007 and 2) Raglan South Nickel Project, Nunavik Quebec Technical Report and Preliminary Economic Assessment on the Mequillon, Mesamax, Expo, and Ivakkak deposits for Canadian Royalties Inc., P and E Mining Consultants and Roche Ltd. Consulting Group, July 24, 2006.

The estimated operating costs for the reserve estimation are:

| Cost (CDN $/ tonne) |

| Deposit | Mining | Ore Transport to Mill | Processing Review | G&A | Total Operating Cost |

| Mesamax | $419 | $1 94 | $29.52 | $22.66 | $4.12 |

| Expo | $3.36 | | $24.97 | $17.36 | $42.33 |

| |

Source: Raglan South Nickel Project Technical Report, SNC Lavalin, July 20, 2007

The probable reserve tonnage and grades, including waste tonnes and stripping ratio from the pit designs are:

| | Ore Tonnes | Ni (%) | Cu(%) | Co(%) | Au (g/t) | Pt (g/t) | Pd (g/t) | Waste Tonnes | Stripping Ratio Waste(t)/Ore(t) |

| Mesamax | 2,077,000 | 1.85 | 2.49 | 0.07 | 0.19 | 0.95 | 3.46 | 5,704,000 | 2.75 |

| Expo | 7,843,000 | 0.68 | 0.69 | 0.04 | 0.07 | 0.29 | 1.25 | 29,834,000 | 3.80 |

| |

Source: Raglan South Nickel Project Technical Report, SNC Lavalin, July 20, 2007

We are involved in the following legal actions which involve our subsidiary company, UMEI and our Property:

| (i) | UMEI, is a plaintiff in two actions, commenced against various parties, which are pending. The action in Ontario is for breach of contract and relates to the study of a rock sample collection gathered on UMEI's Property. In the course of this action, UMEI learned that defendants had formed a collaboration with others who obtained samples from the Property obtained by trespass. UMEI is currently seeking to have these others joined as co-defendants in the action as well as a third party which trespassed and facilitated trespass by other parties. The action in Quebec is against parties who UMEI alleges, trespassed onto UMEI's property in 1998, wrote a false and misleading Assessment Report about a discovery made as a result and produced a falsified version of a geologist Report during the 2002 arbitration proceeding with CRI and also against parties who are alleged to have given false testimony at the 2002 arbitration. |

| (ii) | UMEI and certain past and present officers and directors have been named in a Quebec legal action filed by CRI and two directors of CRI. Damages in the amount of $1,550,000 and reimbursement of fees, disbursements and taxes in the amount of $741,933 for multiplicity of proceedings instituted against them by the Company, are sought, as well as other relief. UMEI intends to defend itself and its directors in this action. No liability has been recorded in the financial statements. Any loss which might occur as a result of this action would be charged against earnings in the year incurred. |

| (iii) | UMEI had been named in a Quebec legal action whereby 582556 Alberta Inc. ("582556") sought the cancellation of the conveyance by which it transferred its 1% net smelter returns royalty in the Ungava Property to CRI. The conveyance occurred at the same time that an 80% interest in the Property was optioned to CRI. No damages were, however, claimed against UMEI. |

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

5.A. Results of Operations

5.A. (i) Revenues

CRI has produced a purported Bankable Feasibility Study and has, through various press releases, indicated its intention to proceed with the development of the Property. Until CRI completes the development of the Property, it is not anticipated that the Company will have any material revenue. No revenues (other than interest earned of $9,765, 2006 -$nil) have been reported for the years ended November 30, 2007and 2006.

5.A. (ii) Analysis of Expenses

| | | Three Months Ended | | | % of | | | Three Months Ended | | | % | |

| | | November 30, 2007 | | | Total | | | November 30, 2006 | | | Change | |

| | | | | | | | | | | | | |

| Stock-based compensation | | $ | 1,222,200 | | | | 75 | % | | $ | - | | | | 100 | % |

| Professional fees | | | 257,213 | | | | 16 | % | | | - | | | | 100 | % |

| Consulting & management fees –related party | | | 42,469 | | | | 3 | % | | | | | | | 100 | % |

| Consulting & management fees | | | 68,682 | | | | 4 | % | | | - | | | | 100 | % |

| Office and general | | | 17,019 | | | | 1 | % | | | - | | | | 100 | % |

| Travel | | | 15,051 | | | | 1 | % | | | - | | | | 100 | % |

| | | $ | 1,622,634 | | | | 100 | % | | $ | - | | | | | |

| | | Year Ended | | | % of | | | Year Ended | | | % | |

| | | November 30, 2007 | | | Total | | | November 30, 2006 | | | Change | |

| | | | | | | | | | | | | |

| Stock-based compensation | | $ | 1,222,200 | | | | 58 | % | | $ | - | | | | 100 | % |

| Professional fees | | | 623,595 | | | | 30 | % | | | - | | | | 100 | % |

| Consulting & management fees –related party | | | 112,080 | | | | 5 | % | | | | | | | 100 | % |

| Consulting & management fees | | | 68,682 | | | | 3 | % | | | - | | | | 100 | % |

| Office and general | | | 35,135 | | | | 2 | % | | | - | | | | 100 | % |

| Travel | | | 31,293 | | | | 2 | % | | | - | | | | 100 | % |

| | | $ | 2,092,985 | | | | 100 | % | | $ | - | | | | | |

As indicated in 4.a.(ii) above, financial information in this document is presented as a continuation of UMI and its subsidiary UMEI. UMI was organized in February 2007 and UMEI is not an operating company, it is the company which owns the working interest in the mineral rights to the Property. Accordingly, there are no comparative figures for the previous year. During the year ended November 30, 2007 expenses were $2,092,985. Our major expenses for the year are comprised of the following:

Stock-based compensation

Stock based compensation for the year ended November 30, 2007 was $1,222,200 as a result of the directors of the Company authoriz ing the issue of the following common share stock options during the year:

| a) | On October 3, 2007, 6,200,000 stock options exercisable at $0.60 with an expiry date of September 30, 2012, were granted to the directors and certain consultants of the Company. |

| b) | On October 3, 2007, 400,000 stock options exercisable at $0.60 with an expiry date of September 30, 2008, were granted to certain consultants of the Company. |

| c) | On October 18, 2007, 2,400,000 stock options exercisable at $0.60 with an expiry date of September 30, 2012, were granted to the directors and certain consultants of the Company. |

The weighted average fair value of the stock options granted was estimated at $0.23 per option using the Black-Scholes model for pricing options. The following weighted average assumptions were used:

| Risk free interest rate | 4.29 % |

| Dividend yield | NIL |

| Expected stock volatility | 100 % |

| Expected life | 5 Years |

Professional fees

During the period, the Company incurred legal fees in the amount of $554,933 in connection with the legal actions which are detailed in 4.D. above. Also i ncluded in professional fees are legal expenses in the amount of $26,534in connection with corporate matters and audit fees of $41,845.

Consulting and management fees

Consulting and management fees represent amounts paid for corporate management services as well as expenses incurred in developing investor presentations, development of a website for the company and amounts paid for administrative and accounting services. During the second quarter, the Company retained a new Chief Financial Officer whose fees are included in this category.

Office and general expenses

Includes expenses incurred for stationary, telephone and communications, travel, entertainment and office supplies.

5.A. (iii) Summary of Quarterly Results

| | | QTR | | | QTR | | | QTR | | | QTR | | | QTR | | | QTR | | | QTR | | | QTR | |

| | | | 4 | | | | 3 | | | | 2 | | | | 1 | | | | 4 | | | | 3 | | | | 2 | | | | 1 | |

| | | 2007 | | | 2007 | | | 2007 | | | 2007 | | | 2006 | | | 2006 | | | 2006 | | | 2006 | |

| Net Loss | | $ | (1,615,167 | ) | | $ | (290,532 | ) | | $ | (177,521 | ) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Loss per share basic and fully diluted | | $ | (0.02 | ) | | $ | (0.03 | ) | | $ | (0.01 | ) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

5.B. Liquidity and Capital Resources

In our management's view, given the nature of our activities, the most meaningful and material financial information concerning us relates to our current liquidity and capital resources. We do not currently own or have an interest in any mineral producing properties and have not derived any revenues from the sale of minerals.