Q2 2020 Financial Results and Business Update August 10, 2020 1

Call Participants Russell Ellison, M.D., M.Sc. President and Chief Executive Officer Tim Chole Vice President of Marketing Paul McGarry VP, Corporate Controller and Principal Accounting Officer Marc Hoffman, M.D. Chief Medical Officer 2

Forward-Looking Statements Certain statements in this press release may constitute “forward-looking statements” within the meaning of the federal securities laws, including, but not limited to, the impact of COVID-19 on Rockwell Medical’s business and operations, the commercialization of Triferic Dialysate, the launch of Triferic AVNU, the selection of and plans for Rockwell Medical’s FPC pipeline candidates, the initiation of a clinical trial in China, the timeline for receipt of a target action date in Canada and the Company’s expected research and development expenses. Words such as, “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “could,” “can,” “would,” “develop,” “plan,” “potential,” “predict,” “forecast,” “project,” “intend” or the negative of these terms, and similar expressions, or statements regarding intent, belief, or current expectations, are forward looking statements. While Rockwell Medical believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties (including, without limitation, those set forth in Rockwell Medical’s SEC filings), many of which are beyond our control and subject to change. Actual results could be materially different. Risks and uncertainties include, but are not limited to: the impact of the COVID-19 pandemic (including, applicable federal state or local orders) on business and operating results, including our supply chain, dialysis concentrates business and the commercial launch of Triferic AVNU; the challenges inherent in new product development and other indications and therapeutics areas for our products; the success of our commercialization strategy; the success and timing of our commercialization of Triferic Dialysate; the success and timing of international clinical trials for Triferic Dialysate; the success and timing of our evaluation program for Triferic AVNU and our commercial launch of Triferic AVNU in the United States; the success and timing of the development of our FPB pipeline candidates, the risk that topline clinical data and real world results may not be predictive of future results; the anticipated number of future clinics with which we may contract for use of Triferic Dialysate; the expected number of annualized treatments for Triferic Dialysate; anticipated research and development expenses, expected financial performance, including cash flows, revenues, growth, margins, funding, liquidity and capital resources; and those risks more fully discussed in the “Risk Factors” section of our Quarterly Report on Form 10-Q for the period ended June 30, 2020 and of our Annual Report on Form 10-K for the year ended December 31, 2019, as such description may be amended or updated in any future reports we file with the SEC. Rockwell Medical expressly disclaims any obligation to update our forward-looking statements, except as may be required by law. Triferic® is a registered trademark of Rockwell Medical, Inc. Triferic AVNU is pending with the U.S. Patent and Trademark Office. All other product names, logos, and brands are property of their respective owners in the United States and/or other countries. All company, product and service names used on this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. 3

Today’s Call 1 Our Commitment to Hemodialysis 2 Triferic® Dialysate 3 Triferic® AVNUTM 4 New Indication Opportunities 5 Q2 Financial Update 6 Q&A 4

Our Mission and Vision Mission: Transform the treatment of iron deficiency and anemia around the world to improve outcomes for patients Continue to develop into a more medically- and scientifically-driven company Vision: Drive next phase of growth by leveraging the attributes of our ferric pyrophosphate citrate (FPC) technology: • Triferic®: drive adoption and product revenue for two FDA-approved Triferic products in hemodialysis • FPC Platform: strategically identify and pursue applications in other disease states 5

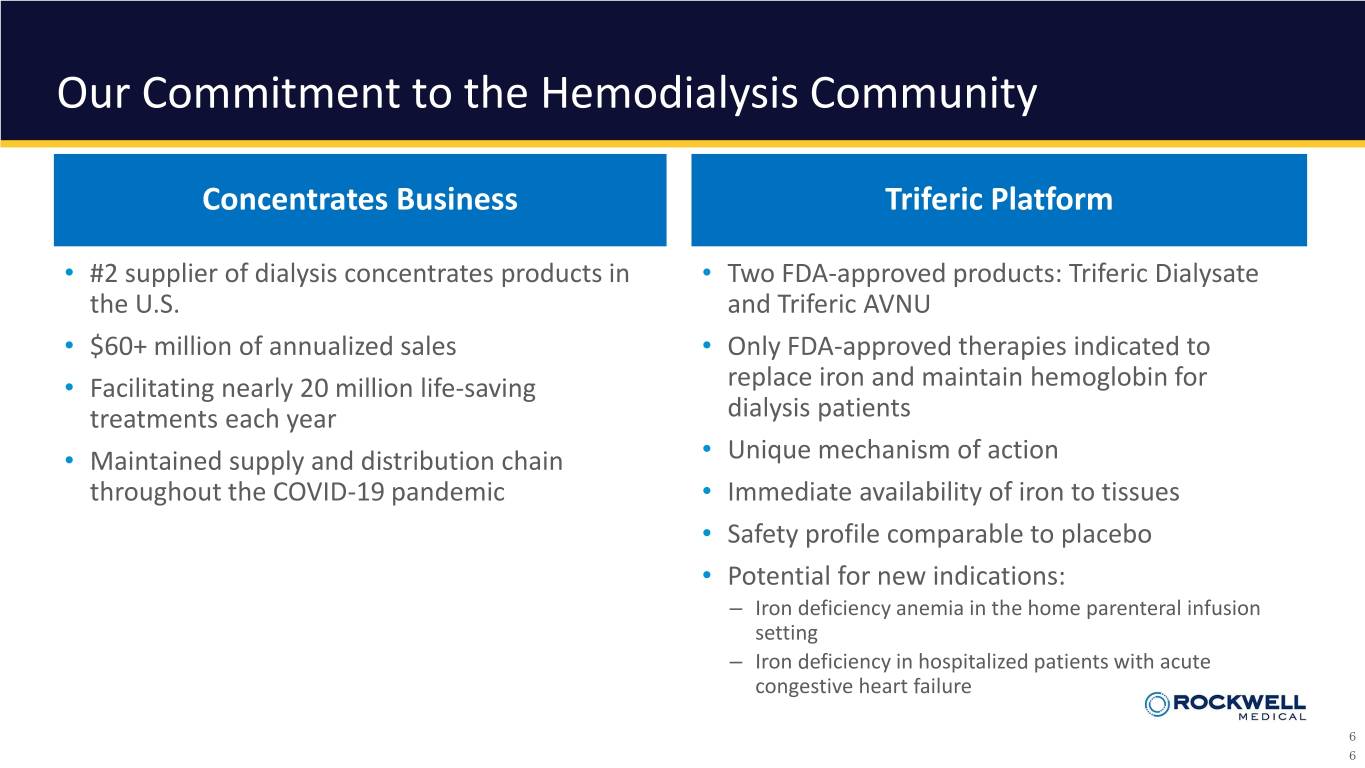

Our Commitment to the Hemodialysis Community Concentrates Business Triferic Platform • #2 supplier of dialysis concentrates products in • Two FDA-approved products: Triferic Dialysate the U.S. and Triferic AVNU • $60+ million of annualized sales • Only FDA-approved therapies indicated to • Facilitating nearly 20 million life-saving replace iron and maintain hemoglobin for treatments each year dialysis patients • Maintained supply and distribution chain • Unique mechanism of action throughout the COVID-19 pandemic • Immediate availability of iron to tissues • Safety profile comparable to placebo • Potential for new indications: – Iron deficiency anemia in the home parenteral infusion setting – Iron deficiency in hospitalized patients with acute congestive heart failure 6 6

COVID-19 Commentary • COVID-19 has had a unique impact on the dialysis community in the U.S. • Rockwell Medical stands with the dialysis community and we continue our efforts to maintain our high level of service – Employee safety initiatives – Enhanced sanitization protocols in manufacturing facilities – Close coordination with customers • Impact to Rockwell Medical: – No material impact on supply chain for concentrates or Triferic to date – Limitations have affected our Triferic field employees, although certain U.S. geographies have started to re-open – Continue to monitor potential impact of the pandemic on international clinical trial and regulatory timelines 7

Q2 2020 Highlights 8

Q2 2020 Highlights • Net sales were $15.9 million • Triferic net sales were $0.2 million and $0.5 million for the three and six months ended June 30, 2020 • Nearly 2,800 contracted patients on therapy for Triferic Dialysate, representing >400,000 annualized treatments • Signed contracts with 12 additional clinics, a 44% increase in contracted clinics compared to March 31, 2020 – Additional eight clinics affiliated with an MDO were trained and approved for adoption as of June 30, 2020 – Substantially all clinics contracted during Q2 converted in June • Active or committed Evaluation Programs with independent dialysis clinics and small dialysis chains representing 26 clinics and nearly 1,500 patients • Enrolled additional clinics in our Real World Data program • Appointed Dr. Allen Nissenson to the Board of Directors • NDS accepted by Health Canada for Triferic AVNU • Received regulatory approval for Dialysate Triferic in Chile in June 2020 9

Triferic® Dialysate Commercial Metrics 10

Summary of Key Metrics Metric 9/30/19 12/31/19 3/31/20 6/30/20 Contracted Patients on Therapy 1,000+ 1,650+ ~2,000 ~2,800 Contracted Annualized Treatment 150,000+ 250,000+ ~300,000 >400,000 U.S. Market Introduction Volume Evaluation Program Patients 1,300+ 600+ 2,250+ ~1,500 Evaluation Program Conversion Rate 75%+ 75% 75% ~75% Centers of Excellence 1 1 1 1 Medical Platform Centers Collecting and Reporting Data 7 8 12 14 KOL Advisory Relationships 10 10 11 13 11

Triferic: U.S. Market Introduction Contracted Clinics Evaluation Program Clinics 50 40 47 36 45 35 40 30 26 35 39 25 30 27 20 25 23 15 20 10 10 15 10 5 5 0 12/31/2019 3/31/2020 6/30/2020 0 12/31/2019 3/31/2020 6/30/2020 COVID-19 Impact* * Includes four clinics that were trained for administration and another four that were scheduled for administration training in March. 12

Triferic® AVNU 13

Triferic AVNU Quarterly Overview Expands U.S. access and provides more access to global markets heavily reliant on on-line bicarb generation • Triferic AVNU received FDA Approval on March 27, 2020 – Triferic AVNU joins Triferic Dialysate as the only FDA-approved products indicated to replace iron and maintain hemoglobin in adult patients with hemodialysis-dependent chronic kidney disease – Provides access to clinics utilizing dry bicarbonate systems: infused over 3hrs, or divided bolus dose, I.V. • Initiating customer outreach to increase awareness of Triferic AVNU – Reaching out to target customers using dry bicarbonate that have expressed interest in Triferic – Engaging with dialysis organizations that have existing purchase agreements in place for Triferic Dialysate – Preparing the promotional, communications, and education programs for the commercial launch • Currently manufacturing sample and commercial supply • Company expects to launch evaluation programs during Q3 2020 – Leverage success of the Triferic Dialysate Evaluation Program – Triferic AVNU commercial availability expected in the fourth quarter of 2020 following the completion of the initial evaluation programs 14

Real-World Data Update 15

Real-World Data: Overall Clinical Impact Additional data from USRDS on single clinic shows meaningful outcomes: Rates for all cause and infection-related hospitalization, and mortality for HHD patients, 2016-17* Infectious Deaths Year # of patient- Hospitalizations Inpatient days hospitalizations Infectious inpatient per 1,000 years (PY) at risk PPY PPY PPY days PPY PY Facility using Triferic on 1/1/2017 2016 49 2.85 21.7 0.49 3.86 101 2017 48 1.41 9.25 0.13 0.71 42.0 All Other US Dialysis Facilities 2016 427057 2.12 16.0 0.35 3.05 164 2017 436247 2.12 16.1 0.33 2.96 165 • A reduction of 17.7% and 45.5% in missed treatments for 5th and 6th quarters following Triferic introduction • Mortality rates reduced 58% • Infectious hospital admission reduced 73%; infection-related hospital days reduced 82% *Abstract submitted and under consideration for inclusion in ASN 2020 annual congress. 16

Preview of FPC New Indication Opportunities 17

1st priority: Home Infusion - Overview • Opportunity: I.V. administration of specialty drugs or nutrients in the home setting • Home and specialty infusion marketplace is experiencing explosive growth • Many patients treated with home infusion therapies suffer from iron deficiency anemia • Traditional I.V. iron is rarely administered at home due to safety concerns • FPC is uniquely suited for home infusion due to its excellent safety and tolerability profile and administration….and the clinical program could be rapid and relatively low cost Comparison of Home Infusion Therapy by Total Patients Served: U.S. patients undergoing the following daily home infusion therapies are known to have a high incidence of iron deficiency and/or iron deficiency 2010: 2019: anemia (30 – 60%): 829,000 3,224,427 Parenteral Nutrition 113,000 patients Hydration 160,000 patients Chemotherapy 132,000 patients Inotropic agents 86,000 patients 18

Home Infusion: 1st priority Favorable Market Access and Rapid, Low Cost Clinical Program Market access conditions for FPC as a home infusion therapy are favorable: • Almost 50% of home infusion therapy is reimbursed by commercial payers using a well-established universal approach • Medicare provides favorable coverage for specific eligible drugs through the Part B home infusion benefit* • Payers are increasingly motivated to reimburse home infusion therapy to limit in-office visits and hospitalizations and to reduce costs Clinical Program could be rapid and low cost: • Type C meeting with FDA in 2020 • Phase II studies, 2021: • Total cost: $1.5m-$2.5m • Estimated completion in 13-18 months • Phase III: $5m-$8m, approx. 2 years *Part B Durable Medical Equipment, Prosthetic, Orthotics, and Supplies Benefit 19

Under Consideration: Acute Heart Failure - Overview • Opportunity: Heart failure in the U.S. is a large and growing patient population • Prevalence of heart failure grew 6-fold from 2010 – 2018 (now 6.5m patients)1,2 • A significant number of patients are hospitalized each year with acute heart failure • 1.2m patients are hospitalized annually in the U.S. with acute systolic heart failure3 • Cost of 1-day hospitalization for AHF patient = $2,4444 • Re-admission within 30 days costs a hospital $13,4004 • Iron deficiency, independent of anemia, is a recognized complication that decreases cardiac performance • 55-85% of AHF patients are iron deficient5 • Multiple studies with traditional I.V. iron in heart failure outpatients show important clinical benefits • Utility of traditional I.V. iron therapy is limited for hospitalized patients due to safety concerns and delayed availability of iron • FPC may be uniquely suited for treatment of iron deficiency in hospitalized AHF patients • Phase II POC : cardiac bioenergetics study can be completed in 20-24 months: • Objective: Establish mechanistic proof of concept – FPC impact on heart energetics and function 1. https://www.cdc.gov/nchs/products/databriefs/db108.htm 2. https://www.cdc.gov/heartdisease/heart_failure.htm 3. MEDPAR & HCUP 4. www.hcupnet.ahrg.gov – HCUP National Inpatient Sample, 2016 Agency for Healthcare Research and Quality (AHRQ) 5. Enjuanes et al, Okonko et al, Cohen-Solal et al, Nunez et al, Van Aelst et al, multiple peer-reviewed publications on file (2011-2017) 20 20

Q2 2020 Financial Results 21

Q2 2020: Selected Balance Sheet and Cash Flow Metrics As of As of ($ in millions) 6/30/2020 12/31/2019 Cash, Cash Equivalents & Investments $ 40.0 $ 26.0 Long-Term Debt, net 20.8 - Working Capital 40.0 24.5 Q2 Q2 2020 2019 Cash Flow from Operations - YTD $ (16.2) $ (10.3) Total Change in Cash & Investments (8.9) 7.4 22

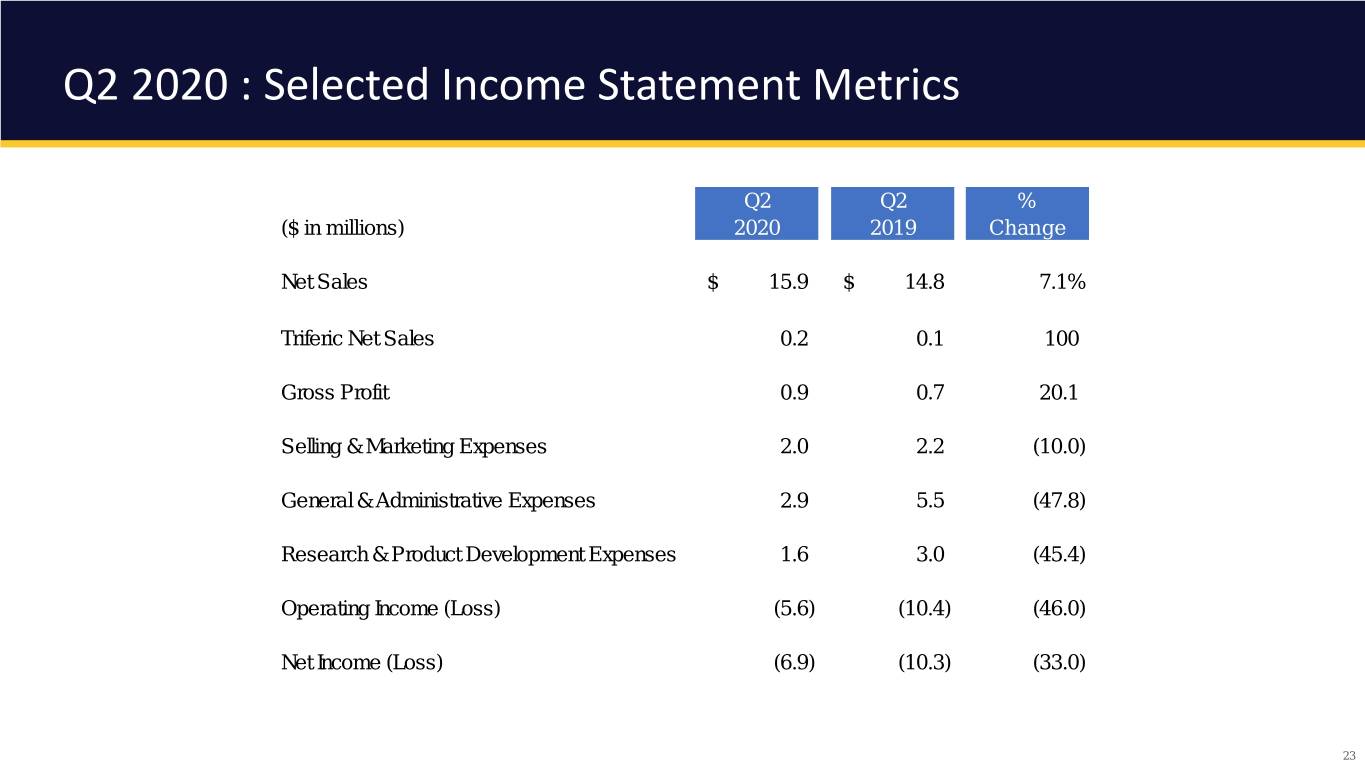

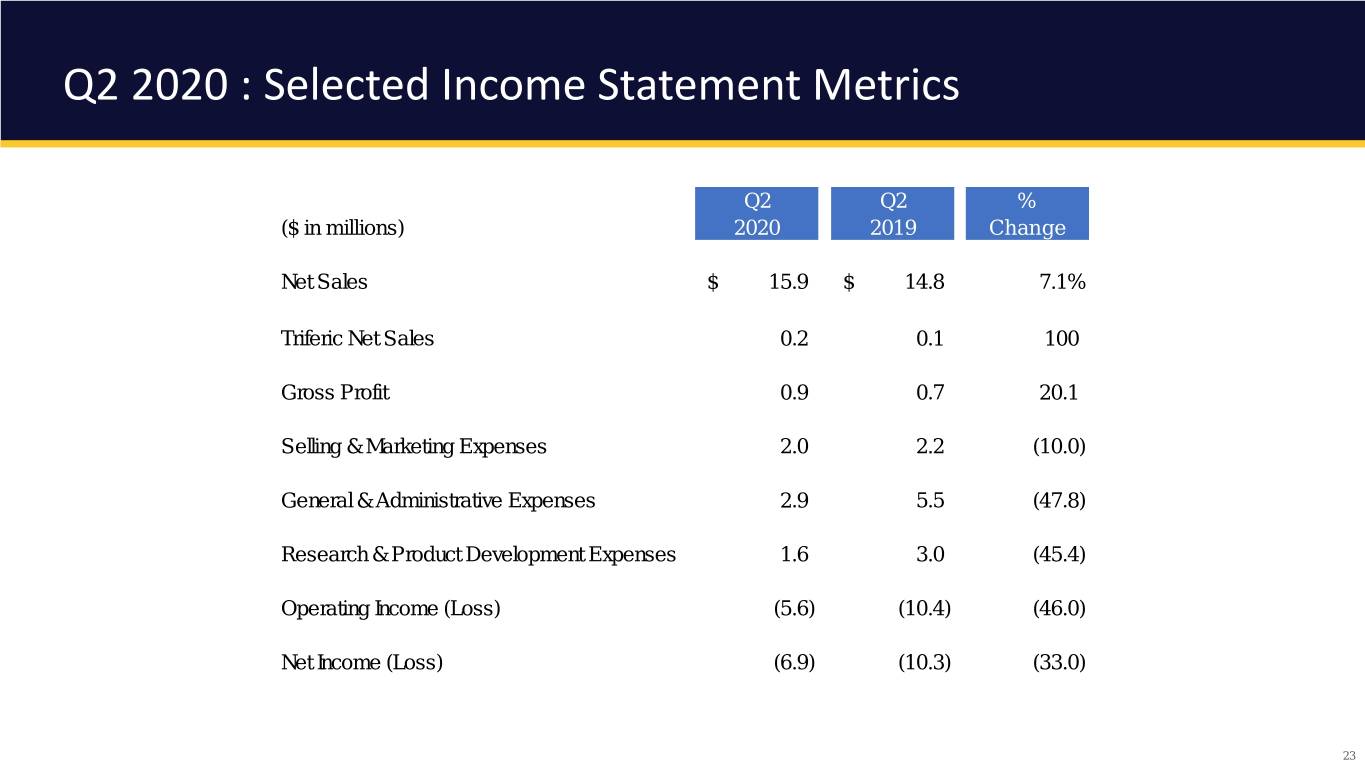

Q2 2020 : Selected Income Statement Metrics Q2 Q2 % ($ in millions) 2020 2019 Change Net Sales $ 15.9 $ 14.8 7.1% Triferic Net Sales 0.2 0.1 100 Gross Profit 0.9 0.7 20.1 Selling & Marketing Expenses 2.0 2.2 (10.0) General & Administrative Expenses 2.9 5.5 (47.8) Research & Product Development Expenses 1.6 3.0 (45.4) Operating Income (Loss) (5.6) (10.4) (46.0) Net Income (Loss) (6.9) (10.3) (33.0) 23

Triferic International Updates 24

Q&A 25