- YUM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Yum! Brands (YUM) DEF 14ADefinitive proxy

Filed: 7 Apr 23, 4:21pm

Filed by the Registrant Filed by the Registrant |  Filed by a P Filed by a Part y oth er than the Registrant |

Check the appropriate box: | ||

| Preliminary Proxy Statement | |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material under §240.14a-12 | |

Payment of Filing Fee (Check all boxes that apply): | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

April 7, 2023 Dear Fellow Shareholders:

On behalf of your Board of Directors, we are pleased to invite you to attend the 2023 Annual Meeting of Shareholders of YUM! Brands, Inc. The Annual Meeting will be held Thursday, May 18, 2023, at 9:00 a.m., central time, in the YUM! Brands Center of Restaurant Excellence at 7100 Corporate Drive in Plano, Texas.

We intend to hold our annual meeting in person. However, we continue to monitor the situation regarding COVID-19 closely, taking into account guidance from the Centers for Disease Control and Prevention and the World Health Organization. The health and well-being of our various stakeholders is our top priority. Accordingly, we are planning for the possibility that the annual meeting may be required to be postponed or held solely by webcast in the event we or governmental officials determine that it is not advisable to hold an in-person meeting. In the event the annual meeting is postponed or held solely by webcast, we will announce that fact as promptly as practicable, and details on how to participate will be issued by press release, posted on the Investor Relations section of our website and filed with the U.S. Securities and Exchange Commission as additional proxy material.

| |||||

YUM! Brands, Inc, 1441 Gardiner Lane Louisville Kentucky 40213 | Once again, we encourage you to take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to their shareholders over the Internet. We believe that this e-proxy process expedites shareholders’ receipt of proxy materials, lowers the costs of delivery and helps reduce environmental impact.

Your vote is important. We encourage you to vote promptly whether or not you plan to attend the meeting. You may vote your shares over the Internet or via a toll-free telephone number. If you received a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided. Instructions regarding the three methods of voting prior to the meeting are contained on the notice or proxy card.

If you plan to attend the meeting in person, please bring your notice, admission ticket from your proxy card or proof of your ownership of YUM common stock as of March 20, 2023, as well as valid picture identification. Whether or not you plan to attend, we encourage you to consider the matters presented in the proxy statement and vote as soon as possible.

Sincerely,

| |||||

|

David Gibbs Chief Executive Officer | |||||

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to Be Held on May 18, 2023—this notice and the proxy statement are available at https://investors.yum.com/governance/governance-documents. The Annual Report on Form 10-K is available at https://investors.yum.com/financial-information/annual-reports/.

YUM! Brands, Inc.

1441 Gardiner Lane

Louisville, Kentucky 40213

Notice of Annual Meeting of Shareholders

Thursday, May 18, 2023 9:00 a.m.

YUM! Brands Center of Restaurant Excellence, 7100 Corporate Drive, Plano, Texas 75024.

Items of Business:

| (1) | To elect ten (10) directors to serve until the 2024 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified. |

| (2) | To ratify the selection of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2023. |

| (3) | To consider and hold an advisory vote on executive compensation. |

| (4) | To consider and hold an advisory vote on the frequency of votes on executive compensation. |

| (5) | To consider and vote on five (5) shareholder proposals, if properly presented at the meeting. |

| (6) | To transact such other business as may properly come before the meeting. |

Who Can Vote?:

You can vote if you were a shareholder of record as of the close of business on March 20, 2023.

Annual Report:

A copy of our 2022 Annual Report on Form 10-K is included with this proxy statement.

Website:

You may also read the Company’s Annual Report and this Notice and proxy statement on our website at https://investors.yum.com/financial-information/annual-reports/.

Date of Mailing:

This Notice, the proxy statement and the form of proxy are first being mailed to shareholders on or about April 7, 2023.

By Order of the Board of Directors

Scott A. Catlett

Chief Legal & Franchise Officer & Corporate Secretary

Your Vote is Important

Under securities exchange rules, brokers cannot vote on your behalf for the election of directors or on executive compensation related matters without your instructions. Whether or not you plan to attend the Annual Meeting, please provide your proxy by following the instructions on your Notice or proxy card. On or about April 7, 2023, we mailed to our shareholders a Notice containing instructions on how to access the proxy statement and our Annual Report and vote online.

If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. Instead, you should follow the instructions included in the Notice on how to access and review the proxy statement and Annual Report. The Notice also instructs you on how you may submit your vote by proxy over the Internet.

If you received the proxy statement and Annual Report in the mail, please submit your proxy by marking, dating and signing the proxy card included and returning it promptly in the envelope enclosed. If you are able to attend the Annual Meeting and wish to vote your shares personally, you may do so at any time before the proxy is exercised.

TABLE OF CONTENTS

Table of Contents

| PROXY STATEMENT | 1 | |||

| QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING | 1 | |||

| GOVERNANCE OF THE COMPANY | 7 | |||

| 11 | ||||

| 16 | ||||

| MATTERS REQUIRING SHAREHOLDER ACTION | 26 | |||

ITEM 1 Election of Directors (Item 1 on the Proxy Card) | 26 | |||

ITEM 2 Ratification of Independent Auditors (Item 2 on the Proxy Card) | 27 | |||

ITEM 3 Advisory Vote on Executive Compensation (Item 3 on the Proxy Card) | 28 | |||

ITEM 4 Advisory Vote on the Frequency of Votes on Executive Compensation (Item 4 on the Proxy Card) | 29 | |||

ITEM 5 Shareholder Proposal Regarding Issuance of a Report on Efforts to Reduce Plastics Use (Item 5 on the Proxy Card) | 30 | |||

ITEM 6 Shareholder Proposal Regarding Issuance of Annual Report on Lobbying (Item 6 on the Proxy Card) | 33 | |||

ITEM 7 Shareholder Proposal Regarding Issuance of Civil Rights and Nondiscrimination Audit Report (Item 7 on the Proxy Card) | 35 | |||

ITEM 8 Shareholder Proposal Regarding Disclosure of Share Retention Policies for Named Executive Officers Through Normal Retirement Age (Item 8 on the Proxy Card) | 37 | |||

ITEM 9 Shareholder Proposal Regarding Issuance of Report on Paid Sick Leave (Item 9 on the Proxy Card) | 40 | |||

| STOCK OWNERSHIP INFORMATION | 43 | |||

| DELINQUENT SECTION 16(a) REPORTS | 45 | |||

| EXECUTIVE COMPENSATION | 46 | |||

| 46 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 72 | ||||

| 73 | ||||

| 74 | ||||

| 76 | ||||

| 79 | ||||

| 81 | ||||

| 83 | ||||

| EQUITY COMPENSATION PLAN INFORMATION | 86 | |||

| AUDIT COMMITTEE REPORT | 87 | |||

| ADDITIONAL INFORMATION | 89 | |||

i

PROXY STATEMENT

YUM! Brands, Inc.

1441 Gardiner Lane

Louisville, Kentucky 40213

PROXY STATEMENT

For Annual Meeting of Shareholders To Be Held On

May 18, 2023

The Board of Directors (the “Board of Directors” or the “Board”) of YUM! Brands, Inc., a North Carolina corporation (“YUM” or the “Company”), solicits the enclosed proxy for use at the Annual Meeting of Shareholders of the Company to be held at 9:00 a.m. (Central Time), on Thursday, May 18, 2023, at the YUM! Brands Center of Restaurant Excellence at 7100 Corporate Drive in Plano, Texas.

We intend to hold our annual meeting in person. However, we continue to monitor the situation regarding COVID-19 closely, taking into account guidance from the Centers for Disease Control and Prevention and the World Health Organization. The health and well-being of our various stakeholders is our top priority. Accordingly, we are planning for the possibility that the annual meeting may be required to be postponed or held solely by webcast in the event we or governmental officials determine that it is not advisable to hold an in-person meeting. In the event the annual meeting is postponed or held solely by webcast, we will announce that fact as promptly as practicable, and details on how to participate will be issued by press release, posted on the Investor Relations section of our website and filed with the U.S. Securities and Exchange Commission as additional proxy material.

This proxy statement contains information about the matters to be voted on at the Annual Meeting and the voting process, as well as information about our directors and most highly paid executive officers.

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

What is the purpose of the Annual Meeting?

At our Annual Meeting, shareholders will vote on several important Company matters. In addition, our management will report on the Company’s performance over the last fiscal year and, following the meeting, respond to questions from shareholders.

Why am I receiving these materials?

The Board has made these materials available to you over the internet or has delivered printed versions of these materials to you by mail, in connection with the Board’s solicitation of proxies for use at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”). The Annual Meeting is scheduled to be held on Thursday, May 18, 2023 at 9:00 a.m. Central Time, at 7100 Corporate Drive, Plano, Texas. This solicitation is for proxies for use at the Annual Meeting or at any reconvened meeting after an adjournment or postponement of the Annual Meeting.

1

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

Why did I receive a one-page Notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

As permitted by Securities and Exchange Commission (“SEC”) rules, we are making this proxy statement and our Annual Report available to our shareholders electronically via the Internet. On or about April 7, 2023, we mailed to our shareholders a Notice containing instructions on how to access this proxy statement and our Annual Report and vote online. If you received a Notice by mail you will not receive a printed copy of the proxy materials in the mail unless you request a copy. The Notice instructs you on how to access and review all of the important information contained in the proxy statement and Annual Report. The Notice also instructs you on how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

We encourage you to take advantage of the availability of the proxy materials on the Internet in order to help lower the costs of delivery and reduce the Company’s environmental impact.

Who may attend the Annual Meeting?

The Annual Meeting is open to all shareholders of record as of close of business on March 20, 2023, or their duly appointed proxies.

What do I need to bring to attend the Annual Meeting In-Person?

You will need valid picture identification and either an admission ticket or proof of ownership of YUM’s common stock to enter the Annual Meeting. If you are a registered owner, your Notice will be your admission ticket.

If you received the proxy statement and Annual Report by mail, you will find an admission ticket attached to the proxy card sent to you. If you plan to attend the Annual Meeting in person, please so indicate when you vote and bring the ticket with you to the Annual Meeting. If your shares are held in the name of a bank or broker, you will need to bring your legal proxy from your bank or broker and your admission ticket in order to vote at the meeting. If you do not bring your admission ticket, you will need proof of ownership to be admitted to the Annual Meeting. A recent brokerage statement or letter from a bank or broker is an example of proof of ownership. If you arrive at the Annual Meeting without an admission ticket, we will admit you only if we are able to verify that you are a YUM shareholder. Your admittance to the Annual Meeting will depend upon availability of seating. All shareholders will be required to present valid picture identification prior to admittance. IF YOU DO NOT HAVE VALID PICTURE IDENTIFICATION AND EITHER AN ADMISSION TICKET OR PROOF THAT YOU OWN YUM COMMON STOCK, YOU MAY NOT BE ADMITTED INTO THE ANNUAL MEETING.

Please note that cellular and smart phones/devices, computers, cameras, sound or video recording equipment, and other similar devices, large bags, briefcases and packages will not be allowed in the meeting room. Seating is limited and admission is on a first-come, first-served basis. Seating may be further limited if necessary to comply with applicable COVID-19 safety guidelines.

May shareholders ask questions?

Yes. Representatives of the Company will answer shareholders’ questions of general interest following the Annual Meeting. In order to give a greater number of shareholders an opportunity to ask questions, individuals or groups will be allowed to ask only one question and no repetitive or follow-up questions will be permitted.

Questions will be answered as time allows.

2

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

Who may vote?

You may vote if you owned YUM common stock as of the close of business on the record date, March 20, 2023. Each share of YUM common stock is entitled to one vote. As of March 20, 2023, YUM had approximately 280 million shares of common stock outstanding.

What am I voting on?

You will be voting on the following nine(9) items of business at the Annual Meeting:

| ∎ | The election of ten (10) directors to serve until the next Annual Meeting of Shareholders and until their respective successors are duly elected and qualified; |

| ∎ | The ratification of the selection of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2023; |

| ∎ | An advisory vote on executive compensation; |

| ∎ | An advisory vote on the frequency of votes on executive compensation; and |

| ∎ | Five(5) shareholder proposals. |

We will also consider other business that properly comes before the meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote your shares:

| ∎ | FOR each of the nominees named in this proxy statement for election to the Board; |

| ∎ | FOR the ratification of the selection of KPMG LLP as our independent auditors; |

| ∎ | FOR the proposal regarding an advisory vote on executive compensation; |

| ∎ | ONE YEAR as the frequency for holding of advisory votes on executive compensation; and |

| ∎ | AGAINST the shareholder proposals. |

How do I vote before the Annual Meeting?

There are three ways to vote before the meeting:

| ∎ | By Internet — If you have Internet access, we encourage you to vote on www.proxyvote.com by following instructions on the Notice or proxy card; |

| ∎ | By telephone — by making a toll-free telephone call from the U.S. or Canada to 1(800) 690-6903 (if you have any questions about how to vote over the phone, call 1(888) 298-6986); or |

| ∎ | By mail — If you received your proxy materials by mail, you can vote by completing, signing and returning the enclosed proxy card in the postage-paid envelope provided. |

If you are a participant in the direct stock purchase and dividend reinvestment plan (ComputerShare CIP), as a registered shareholder, you will receive all proxy materials and may vote your shares according to the procedures outlined herein.

If you are a participant in the YUM! Brands 401(k) Plan (“401(k) Plan”), the trustee of the 401(k) Plan will only vote the shares for which it has received directions to vote from you.

Proxies submitted through the Internet or by telephone as described above must be received by 11:59 p.m., Eastern Time, on May 17, 2023. Proxies submitted by mail must be received prior to the meeting. Directions submitted by 401(k) Plan participants must be received by 12:00 p.m., Eastern Time, on May 16, 2023.

3

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

Also, if you hold your shares in the name of a bank or broker, your ability to vote by the Internet or telephone depends on their voting processes. Please follow the directions on your notice carefully. A number of brokerage firms and banks participate in a program provided through Broadridge Financial Solutions, Inc. (“Broadridge”) that offers Internet and telephone voting options. If your shares are held in an account with a brokerage firm or bank participating in the Broadridge program, you may vote those shares through the Internet at Broadridge’s voting website (www.proxyvote.com) or telephonically by calling the telephone number shown on the voting instruction form received from your brokerage firm or bank. Votes submitted through the Internet or by telephone through the Broadridge program must be received by 11:59 p.m., Eastern Time, on May 17, 2023.

Can I vote at the Annual Meeting?

Shares registered directly in your name as the shareholder of record may be voted in person at the Annual Meeting. Shares held through a broker or nominee may be voted in person only if you obtain a legal proxy from the broker or nominee that holds your shares giving you the right to vote the shares.

Even if you plan to attend the Annual Meeting, we encourage you to vote your shares by proxy. You may still vote your shares in person at the meeting even if you have previously voted by proxy.

Can I change my mind after I vote?

You may change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| ∎ | Signing another proxy card with a later date and returning it to us prior to the Annual Meeting; |

| ∎ | Voting again through the Internet or by telephone prior to 11:59 p.m., Eastern Time, on May 17, 2023; |

| ∎ | Giving written notice to the Corporate Secretary of the Company prior to the Annual Meeting; or |

| ∎ | Voting again at the Annual Meeting. |

Your attendance at the Annual Meeting will not have the effect of revoking a proxy unless you notify our Corporate Secretary in writing before the polls close that you wish to revoke a previous proxy.

Who will count the votes?

Representatives of Computershare, Inc. will count the votes and will serve as the independent inspector of election.

What if I return my proxy card but do not provide voting instructions?

If you vote by proxy card, your shares will be voted as you instruct by the individuals named on the proxy card. If you sign and return a proxy card but do not specify how your shares are to be voted, the persons named as proxies on the proxy card will vote your shares in accordance with the recommendations of the Board. These recommendations are:

| ∎ | FOR the election of the ten (10) nominees for director named in this proxy statement (Item 1); |

| ∎ | FOR the ratification of the selection of KPMG LLP as our independent auditors for the fiscal year 2023 (Item 2); |

| ∎ | FOR the proposal regarding an advisory vote on executive compensation (Item 3); |

| ∎ | ONE YEAR for the proposal regarding the frequency for holding of advisory votes on executive compensation (Item 4); and |

| ∎ | AGAINST the shareholder proposals (Items 5-9). |

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts with brokers and/or our transfer agent. Please vote all of these shares. We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Computershare, Inc., which may be reached at 1 (888) 439-4986 and internationally at 1 (781) 575-2879.

4

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

Will my shares be voted if I do not provide my proxy?

Your shares may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under the New York Stock Exchange rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters.

The proposal to ratify the selection of KPMG LLP as our independent auditors for fiscal year 2023 is considered a routine matter for which brokerage firms may vote shares for which they have not received voting instructions. The other proposals to be voted on at our Annual Meeting are not considered “routine” under applicable rules. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.”

How many votes must be present to hold the Annual Meeting?

Your shares are counted as present at the Annual Meeting if you attend the Annual Meeting in person or if you properly return a proxy by Internet, telephone or mail. In order for us to conduct our Annual Meeting, a majority of the outstanding shares of YUM common stock, as of March 20, 2023, must be present or represented by proxy at the Annual Meeting. This is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the Annual Meeting.

How many votes are needed to elect directors?

You may vote “FOR” each nominee or “AGAINST” each nominee, or “ABSTAIN” from voting on one or more nominees. Unless you mark “AGAINST” or “ABSTAIN” with respect to a particular nominee or nominees, your proxy will be voted “FOR” each of the director nominees named in this proxy statement. In an uncontested election, a nominee will be elected as a director if the number of “FOR” votes exceeds the number of “AGAINST” votes. Abstentions will be counted as present but not voted. Abstentions and broker non-votes will not affect the outcome of the vote on directors. Full details of the Company’s majority voting policy are set out in our Corporate Governance Principles at https://investors.yum.com/governance/governance-documents/ and at page 19 under “What other significant Board practices does the Company have? — Majority Voting Policy.”

How many votes are needed to approve the other proposals?

In order to be approved, the ratification of the selection of KPMG LLP as our independent auditor, the approval of the advisory vote on executive compensation and the approval of the shareholder proposals must receive the “FOR” vote of a majority of the shares, present in person or represented by proxy, and entitled to vote at the Annual Meeting. For each of these items, you may vote “FOR”, “AGAINST” or “ABSTAIN.” Abstentions will be counted as shares present and entitled to vote at the Annual Meeting. Accordingly, abstentions will have the same effect as a vote “AGAINST” the proposals. Broker non-votes will not be counted as shares present and entitled to vote with respect to the particular matter on which the broker has not voted. Thus, broker non-votes will not affect the outcome of any of these proposals. With respect to the advisory vote on the frequency of advisory votes on executive compensation, you may vote “ONE YEAR”, “TWO YEARS” or “THREE YEARS”, or you may abstain from voting. The frequency of the advisory vote on executive compensation receiving the greatest number of votes — “ONE YEAR”, “TWO YEARS” OR “THREE YEARS” — will be considered the frequency recommended by shareholders. Abstentions and broker non-votes will therefore not affect the outcome of this proposal.

When will the Company announce the voting results?

The Company will announce the voting results of the Annual Meeting on a Current Report on Form 8-K filed within four business days of the Annual Meeting.

5

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

What if other matters are presented for consideration at the Annual Meeting?

The Company knows of no other matters to be submitted to the shareholders at the Annual Meeting, other than the proposals referred to in this Proxy Statement. If any other matters properly come before the shareholders at the Annual Meeting, it is the intention of the persons named on the proxy to vote the shares represented thereby on such matters in accordance with their best judgment.

6

GOVERNANCE OF THE COMPANY

GOVERNANCE OF THE COMPANY

The business and affairs of YUM are managed under the direction of the Board of Directors. The Board believes that good corporate governance is a critical factor in achieving business success and in fulfilling the Board’s responsibilities to shareholders. The Board believes that its practices align management and shareholder interests.

The corporate governance section of the Company website makes available the Company’s corporate governance materials, including the Corporate Governance Principles (the “Governance Principles”), the Company’s Articles of Incorporation and Bylaws, the charters for each Board committee, the Company’s Global Code of Conduct, the Company’s Political Contributions and U.S. Government Advocacy Policy, and information about how to report concerns about the Company. To access these documents on the Company’s website, please visit, https://investors.yum.com/governance/governance-documents/.

7

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

What is the composition of the Board of Directors and how often are members elected?

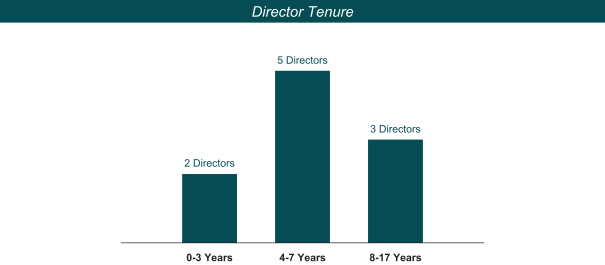

Our Board of Directors presently consists of 10 directors whose terms expire at this Annual Meeting. Our directors are elected annually. The average director tenure is 7 years, with our longest- and shortest-tenured directors having served for 17 years (Mr. Nelson) and for 3 years (Mr. Barr and Ms. Young-Scrivner), respectively.

As discussed in more detail later in this section, the Board has determined that 9 of the 10 individuals standing for election are independent under the rules of the New York Stock Exchange (“NYSE”). The director tenure of the 10 individuals standing for election is reflected in the following chart:

How often did the Board meet in 2022?

The Board of Directors met 5 times during 2022. Each of the directors who served in 2022 attended at least 75% of the meetings of the Board and the committees of which he or she was a member and that were held during the period he or she served as a director.

What is the Board’s policy regarding director attendance at the Annual Meeting of Shareholders?

The Board of Directors’ policy is that all directors should attend the Annual Meeting and all persons then serving as directors attended the 2022 Annual Meeting.

How does the Board select nominees for the Board?

The Nominating and Governance Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders. The Committee’s charter provides that it may retain a third-party executive search firm to identify candidates from time to time.

In accordance with the Governance Principles, our Board seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. Directors should have experience in positions with a high degree of responsibility, be leaders in the companies or institutions with which they are affiliated and are selected based upon contributions they can make to the Board and management. The Committee’s assessment of a proposed candidate will include a review of the person’s judgment, experience, independence, understanding of the Company’s business or other related industries and such other factors as the Nominating and Governance Committee

8

GOVERNANCE OF THE COMPANY

determines are relevant in light of the needs of the Board of Directors. The Committee believes that its nominees should reflect a diversity of experience, gender, race, ethnicity and age. The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees, if any.

In connection with this evaluation, it is expected that each member of the Nominating and Governance Committee will interview the prospective nominee before the prospective nominee is presented to the full Board for consideration. After completing this evaluation and interview process, the Committee will make a recommendation to the full Board as to the person(s) who should be nominated by the Board, and the Board determines the nominee(s) after considering the recommendation and report of the Committee.

The Company’s strategic vision is grounded in our “Recipe for Good Growth.” Our Recipe for Good Growth focuses on four growth drivers intended to accelerate same-store sales growth and net-new restaurant development at KFC, Pizza Hut and Taco Bell around the world. The Company remains focused on building the world’s most loved, trusted and fastest growing restaurant brands by:

| ∎ | Growing Unrivaled Culture and Talent to leverage our culture and people capability to fuel brand performance and franchise success; |

| ∎ | Developing Unmatched Operating Capability, by recruiting and equipping the best restaurant operators in the world to deliver great customer experiences; |

| ∎ | Building Relevant, Easy and Distinctive Brands, by innovating and elevating iconic restaurant brands people trust and champion; and |

| ∎ | Achieving Bold Restaurant Development by driving market and franchise expansion with strong economics and value. |

We look for director candidates who have the skills and experience necessary to help us achieve success with respect to the four growth drivers and the Company’s implementation of its “Recipe for Good Growth,” including our continued focus on our People, Food and Planet strategy. As a result, the skills that our directors possess are thoroughly considered to ensure that they align with the Company’s goals.

The following table describes key characteristics of the Company’s “Recipe for Good Growth” and indicates how the skills our Board collectively possesses positively impacts the growth drivers:

9

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

Our “Recipe for Good Growth” also provides a roadmap for social responsibility, risk management and sustainable stewardship of People, Food and Planet. This allows us to elevate the importance of people and continue building an equitable and inclusive culture that, in turn, helps us better serve our customers and the communities where we operate. Guided by this Recipe, we will strive to unlock potential in people and communities, grow sustainably and continue to serve delicious food that people trust.

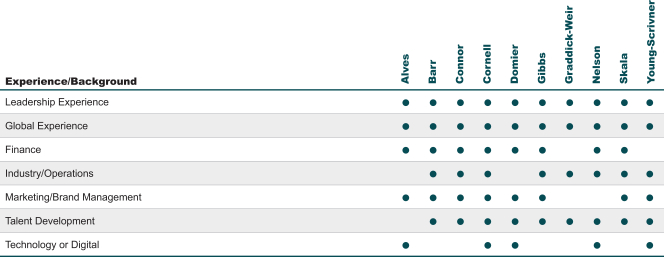

We believe that each of our directors has met the guidelines set forth in the Governance Principles. As noted in the director biographies that follow in this section, our directors have experience, qualifications and skills across a wide range of public and private companies, possessing a broad spectrum of experience both individually and collectively. In addition to the information provided in the director biographies, our director nominees’ qualifications, experiences and skills are summarized in the following matrix. This matrix is intended to provide a summary of our directors’ qualifications and should not be considered to be a complete list of each nominee’s strengths and contributions to the Board.

For a shareholder to submit a candidate for consideration by the Nominating and Governance Committee, a shareholder must notify YUM’s Corporate Secretary, at YUM! Brands, Inc., 1441 Gardiner Lane, Louisville, Kentucky 40213. The recommendation must contain the information described on page 90.

10

GOVERNANCE OF THE COMPANY

Director Biographies

| Paget L. Alves | Director Since 2016

| |||||

Background

Paget L. Alves served as Chief Sales Officer of Sprint Corporation, a wireless and wireline communications services provider, from January 2012 to September 2013 after serving as President of that company’s Business Markets Group beginning in 2009. Mr. Alves currently serves on the boards of directors of Assurant, Inc. and Synchrony Financial. He is also Chairman of the Board of Sorenson Communications, LLC and serves as a member of the Board of Managers of Ariel Alternatives. Mr. Alves has previously served as a Director of International Game Technology PLC.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operating, finance and management experience, including as Chief Sales Officer of a wireless and wireline communications company

∎ Global sales experience

∎ Public company directorship and committee experience

|

Other Public Companies ∎ Assurant, Inc. ∎ Synchrony Financial

Committees ∎ Audit, Chair | |||||

| Keith Barr | Director Since 2020

| |||||

Background

Keith Barr is the Chief Executive Officer of InterContinental Hotels Group plc (IHG), a predominately franchised, global organization that includes brands such as InterContinental Hotels & Resorts, Holiday Inn Family and Crowne Plaza Hotels & Resorts. He has served in this role since July 2017. He served as Chief Commercial Officer of IHG from 2013 to July 2017 and prior to that, as Chief Executive Officer of IHG’s Greater China business. Prior to this position, Mr. Barr served IHG in a number of senior positions in IHG’s Americas and Asia, Middle East and Africa (AMEA) regions.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operating and management experience, including as Chief Executive Officer of a franchised, global company

∎ Expertise in strategic planning, branding and corporate leadership

|

Companies Other Public ∎ None

Committees ∎ Management Planning and Development | |||||

11

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

| Christopher M. Connor | Director Since 2017

| |||||

Background

Christopher M. Connor served as Chairman and Chief Executive Officer of The Sherwin-Williams Company, a global manufacturer of paint, architectural coatings, industrial finishes and associated supplies, until 2016. Mr. Connor held a number of executive positions at Sherwin-Williams beginning in 1983. He served as Chief Executive Officer from 1999 to 2015 and Chairman from 2000 to 2016. He currently serves on the board of International Paper Company. Mr. Connor previously served as a Director of Eaton Corporation plc.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operating and management experience, including as Chairman and CEO of a Fortune 500 company

∎ Expertise in marketing, human resources, talent development, public company executive compensation, planning and operational and financial processes

∎ Public company directorship and committee experience

|

Companies Other Public ∎ International Paper Company

Committees ∎ Management Planning and Development, Chair | |||||

| Brian C. Cornell | Director Since 2015

| |||||

Background

Brian C. Cornell joined the Yum! Brands Board in 2015 and has served as Non-Executive Chairman since November 2018. Mr. Cornell is Chairperson and Chief Executive Officer of Target Corporation, a general merchandise retailer. He has held this position since August 2014. Mr. Cornell served as the Chief Executive Officer of PepsiCo Americas Foods, a division of PepsiCo, Inc. from March 2012 to July 2014. From April 2009 to January 2012, Mr. Cornell served as the Chief Executive Officer and President of Sam’s Club, a division of Wal-Mart Stores, Inc. and as an Executive Vice President of Wal-Mart Stores, Inc. He has been a Director of Target Corporation since 2014. He has previously served as a Director of Home Depot, OfficeMax, Polaris Industries Inc., Centerplate, Inc. and Kirin-Tropicana, Inc.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operating and management experience, including as Chairman and Chief Executive Officer of a merchandise retailer

∎ Expertise in strategic planning, retail business, branding and corporate leadership

∎ Public company directorship experience and committee experience

|

Companies Other Public ∎ Target Corporation

Committees ∎ Management Planning and Development ∎ Nominating and Governance | |||||

12

GOVERNANCE OF THE COMPANY

| Tanya L. Domier | Director Since 2018

| |||||

Background

Tanya L. Domier retired as Chief Executive Officer of Advantage Solutions, Inc., a North American provider of outsourced sales, marketing and business solutions in 2022. Prior to serving as Advantage Solutions’ CEO, Ms. Domier served as its President and Chief Operating Officer from 2010 to 2013. Ms. Domier joined Advantage Solutions in 1990 from the J.M. Smucker Company and has held a number of executive level roles in sales, marketing and promotions. Ms. Domier served as Board Chairperson of Advantage Solutions, a position she held since 2006, until April 1, 2023 and previously served as a director of Nordstrom, Inc.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operating and management experience as Chief Executive Officer

∎ Expertise in strategic planning, finance, global commerce and corporate leadership

∎ Public company directorship and committee experience

|

Companies Other Public ∎ None

Committees ∎ Audit | |||||

| David W. Gibbs | Director Since 2019

| |||||

Background

David W. Gibbs is the current Chief Executive Officer of YUM. He has served in that position since January 2020. Prior to that, he served as President and Chief Operating Officer from August 2019 to December 2019, as President, Chief Operating Officer and Chief Financial Officer from January 2019 to August 2019 and as President and Chief Financial Officer from May 2016 to December 2018. Previously, Mr. Gibbs served as the Chief Executive Officer of the Company’s Pizza Hut Division from January 2015 until April 2016 and was its President from January 2014 through December 2014. Mr. Gibbs served as a director of Sally Beauty Holdings from March 2016 until January 2020. Mr. Gibbs has served as a director of Under Armour since September 2021.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operational and global management experience, including as Chief Executive Officer, Chief Operating Officer and Chief Financial Officer of the Company

∎ Expertise in finance, strategic planning, global branding, franchising and corporate leadership

∎ Public company directorship and committee experience

|

Companies Other Public ∎ Under Armour

Committees ∎ None | |||||

13

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

| Mirian M. Graddick-Weir | Director Since 2012

| |||||

Background

Mirian M. Graddick-Weir retired as Executive Vice President of Human Resources for Merck & Co., Inc., a pharmaceutical company, in November 2018. She had held that position since 2008. From 2006 until 2008, she was Senior Vice President of Human Resources of Merck & Co., Inc. Prior to this position, she served as Executive Vice President of Human Resources of AT&T Corp. from 2001 to 2006. Ms. Graddick-Weir has served as a director of Booking Holdings, Inc. since June 2018.

Specific Qualifications, Experience, Skills and Expertise:

∎ Management experience, including as Executive Vice President of human resources for a pharmaceutical company

∎ Expertise in global human resources, corporate governance and public company compensation

∎ Public company directorship and committee experience

|

Companies Other Public ∎ Booking Holdings, Inc.

Committees ∎ Management Planning and Development

∎ Nominating and Governance, Chair | |||||

| Thomas C. Nelson | Director Since 2006

| |||||

Background

Thomas C. Nelson is President and Chief Executive Officer of National Gypsum Company, a building products manufacturer. He has held this position since 1999 and was elected Chairman of the Board in January 2005. From 1995 to 1999, Mr. Nelson served as the Vice Chairman and Chief Financial Officer of National Gypsum. Mr. Nelson previously worked for Morgan Stanley & Co. and in the United States Defense Department as Assistant to the Secretary and was a White House Fellow. He serves as a director of Atrium Health and previously served as a director for the Federal Reserve Bank of Richmond.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operational and management experience, including as President and Chief Executive Officer of a building products manufacturer

∎ Senior government experience as Assistant to the Secretary of the United States Defense Department and as a White House Fellow

∎ Expertise in finance, strategic planning, business development and retail business

∎ Public company directorship and committee experience

|

Companies Other Public ∎ None

Committees ∎ Management Planning and Development

∎ Nominating and Governance | |||||

14

GOVERNANCE OF THE COMPANY

| P. Justin Skala | Director Since 2016

| |||||

Background

P.Justin Skala is the Executive Chairman of Standard Building Solutions and has held that role since his appointment in February 2023. Prior to that he was Chief Executive Officer of BMI Group, the largest manufacturer of flat and pitched roofing and waterproofing solutions throughout Europe. He served in that role beginning September 1, 2019. Prior to joining BMI Group, Mr. Skala served as Executive Vice President, Chief Growth and Strategy Officer for the Colgate-Palmolive Company, from July 2018 until July 2019. From 2016 until 2018 he served as Chief Operating Officer, North America, Europe, Africa/Eurasia and Global Sustainability for Colgate-Palmolive Company. From 2013 to 2016 he was President of Colgate-North America and Global Sustainability for Colgate-Palmolive Company. From 2010 to 2013 he was the President of Colgate – Latin America. From 2007 to 2010, he was President of Colgate – Asia.

Specific Qualifications, Experience, Skills and Expertise:

∎ Global operating and management experience, including as Chief Executive Officer at a large international manufacturer and as President of major divisions of a consumer products company

∎ Expertise in branding, marketing, finance, sales, strategic planning and international business development

|

Companies Other Public ∎ None

Committees ∎ Audit | |||||

| Annie Young-Scrivner | Director Since 2020

| |||||

Background

Annie Young-Scrivner has served as the Chief Executive Officer of Wella Company, the parent of beauty brands, including Clairol and OPI, since 2020. Prior to this role, Ms. Young-Scrivner was Chief Executive Officer of Godiva Chocolatier, Inc., a manufacturer of Belgian chocolates. Prior to joining Godiva in August 2017, Ms. Young- Scrivner was Executive Vice President, Global Digital & Loyalty Development with Starbucks Corporation from 2015 until her departure in April 2017. At Starbucks, Ms. Young-Scrivner also served as President, Teavana & Executive Vice President of Global Tea from 2014 to 2015, Global Chief Marketing Officer & President of Tazo Tea from 2009 to 2012, and President of Starbucks Canada from 2012 to 2014. Prior to joining Starbucks, Ms. Young-Scrivner held senior leadership positions at PepsiCo, Inc. in sales, marketing and general management, including her role as Region President of PepsiCo Foods Greater China from 2006 to 2008. She previously served as a director of Tiffany & Co. and Macy’s, Inc.

Specific Qualifications, Experience, Skills and Expertise:

∎ Operating and management experience, including as Chief Executive Officer of consumer goods company

∎ Public company directorship and committee experience

|

Companies Other Public ∎ None

Committees ∎ Audit | |||||

If elected, we expect that all of the aforementioned nominees will serve as directors and hold office until the 2024 Annual Meeting of Shareholders and until their respective successors have been elected and qualified.

15

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

Director Compensation

How are directors compensated?

Employee Directors |

Employee directors do not receive additional compensation for serving on the Board of Directors. | |

Non-Employee Directors Annual Compensation |

The annual compensation for each non-employee Director is summarized in the table below. For 2022, each non-employee Director received an annual stock grant retainer with a fair market value of $260,000. Directors may request to receive up to one-half of their stock retainer in cash. The request must be submitted to the Chair of the Management Planning and Development Committee. Directors may also defer payment of their retainers pursuant to the Directors Deferred Compensation Plan. Deferrals are invested in phantom Company stock and paid out in shares of Company stock. Deferrals may not be made for less than two years. | |

Chairperson of the Board and Committee Chairperson Retainers

|

In recognition of their added duties, the Chairperson of the Board (Mr. Cornell in 2022) receives an additional $170,000 stock retainer annually and the Chairs of the Audit Committee (Mr. Alves in 2022), Management Planning and Development Committee (Mr. Connor in 2022) and the Nominating and Governance Committee (Ms. Graddick-Weir in 2022) each receive an additional $25,000, $20,000 and $20,000 annual stock retainer, respectively. These committee chairperson retainers were paid in February of 2022. | |

Initial Stock Grant upon Joining Board |

Non-employee directors also receive a one-time stock grant with a fair market value of $25,000 on the date of grant upon joining the Board, distribution of which is deferred until termination from the Board. | |

Matching Gifts |

To further YUM’s support for charities, non-employee directors are able to participate in the YUM! Brands, Inc. Matching Gifts Program on the same terms as members of YUM’s executive team. Under this program, the YUM! Brands Foundation will match up to $10,000 a year in contributions by the director to a charitable institution approved by the YUM! Brands Foundation. At its discretion, the Foundation may match director contributions exceeding $10,000. | |

Insurance |

We also pay the premiums on directors’ and officers’ liability and business travel accident insurance policies. The annual cost of this coverage was approximately $2 million. This is not included in the tables below as it is not considered compensation to the directors. |

In setting director compensation, the Company considers the significant amount of time that directors expend in fulfilling their duties to the Company as well as the skill level required by the Company of members of the Board. The Board reviews each element of director compensation at least every two years.

In November 2022, the Management Planning and Development Committee of the Board (“Committee”) benchmarked the Company’s director compensation against director compensation from the Company’s Executive Peer Group discussed at page 64. Data for this review was prepared for the Committee by its independent consultant, Meridian Compensation Partners LLC. This data revealed that the Company’s total director compensation was below market median measured against this benchmark, that the retainer paid to our Non-Executive Chairperson is at market median and that the retainers paid to the Chairpersons of the Management Planning and Development Committee and Nominating and Governance Committee were generally consistent with market practice, while the Audit Committee chair retainer was approximately $5,000 below market median. Based on this data, the Committee recommended a $20,000 increase to the annual amount paid to the Directors, raising their retainer to $280,000 annually. The Audit Committee Chair’s retainer was also increased by $5,000 (to $30,000 annually), to better align with market practice. The retainers paid to the Non-Executive Chairperson and the chairs of the Management Planning and Development and Nominating and Governance Committees were not increased.

16

GOVERNANCE OF THE COMPANY

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option/SAR Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | |||||||||||||||

(a) | (b) | (c) | (d) | (e) | (f) | |||||||||||||||

Alves, Paget |

| – |

|

| 285,000 |

|

| – |

|

| 10,000 |

|

| 295,000 |

| |||||

Barr, Keith |

| – |

|

| 260,000 |

|

| – |

|

| 10,000 |

|

| 270,000 |

| |||||

Connor, Christopher |

| – |

|

| 280,000 |

|

| – |

|

| – |

|

| 280,000 |

| |||||

Cornell, Brian |

| – |

|

| 430,000 |

|

| – |

|

| – |

|

| 430,000 |

| |||||

Domier, Tanya |

| – |

|

| 260,000 |

|

| – |

|

| – |

|

| 260,000 |

| |||||

Graddick-Weir, Mirian |

| – |

|

| 280,000 |

|

| – |

|

| 602 |

|

| 280,602 |

| |||||

Hobart, Lauren |

| – |

|

| 260,000 |

|

| – |

|

| – |

|

| 260,000 |

| |||||

Nelson, Thomas |

| – |

|

| 260,000 |

|

| – |

|

| – |

|

| 260,000 |

| |||||

Skala, Justin |

| – |

|

| 260,000 |

|

| – |

|

| – |

|

| 260,000 |

| |||||

Stock, Elane |

| – |

|

| 260,000 |

|

| – |

|

| – |

|

| 260,000 |

| |||||

Young-Scrivner, Annie |

| – |

|

| 260,000 |

|

| – |

|

| 10,000 |

|

| 270,000 |

| |||||

(1) Amounts in column (c) represent the grant date fair value for annual stock retainer awards, Committee Chairperson retainer awards, and Non-Executive Chairperson awards granted to directors in 2022. Retainer awards for new directors are pro-rated for partial years of service.

(2) At December 31, 2022, the aggregate number of stock appreciation rights (“SARs”) awards outstanding for each non-employee director was:

Name | SARs | |||

Alves, Paget |

| – |

| |

Barr, Keith |

| – |

| |

Connor, Christopher |

| – |

| |

Cornell, Brian |

| 6,491 |

| |

Domier, Tanya |

| – |

| |

Hobart, Lauren |

| – |

| |

Graddick-Weir, Mirian |

| 14,622 |

| |

Nelson, Thomas |

| 14,622 |

| |

Skala, Justin |

| 4,646 |

| |

Stock, Elane |

| 10,003 |

| |

Young-Scrivner, Annie |

| – |

| |

(3) Amounts in this column represent charitable matching gifts except for with respect to Ms. Graddick-Weir, for whom these amounts represent personal use of corporate aircraft.

What are the Company’s policies and procedures with respect to related person transactions?

Under the Company’s policies and procedures for the review of related person transactions the Nominating and Governance Committee reviews related person transactions in which we are or will be a participant to determine if they are in the best interests of our shareholders and the Company. Transactions, arrangements, or relationships or any series of similar transactions, arrangements or relationships in which a related person had or will have a material interest and that exceed $100,000 are subject to the Nominating and Governance Committee’s review. Any member of the Nominating and Governance Committee who is a related person with respect to a transaction under review may not participate in the deliberation or vote respecting approval or ratification of the transaction.

17

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

Related persons are directors, director nominees, executive officers, holders of 5% or more of our voting stock and their immediate family members. Immediate family members are spouses, parents, stepparents, children, stepchildren, siblings, daughters-in-law, sons-in-law and any person, other than a tenant or domestic employee, who resides in the household of a director, director nominee, executive officer or holder of 5% or more of our voting stock.

After its review, the Nominating and Governance Committee may approve the transaction. The related person transaction policies and procedures provide that certain transactions are deemed to be pre-approved, even though they exceed $100,000. Pre-approved transactions include employment of executive officers, director compensation, and transactions with other companies if the aggregate amount of the transaction does not exceed the greater of $1 million or 2% of that other company’s total revenues and the related person is not an executive officer of that other company.

Does the Company require stock ownership by directors?

The Board believes that the number of shares of the Company’s common stock owned by each non-management director is a personal decision; however, the Board strongly supports the position that non-management directors should own a meaningful number of shares in the Company and expects that each non-management director will (i) own Company common shares with a value of at least five times the annual Board retainer; (ii) accumulate those shares during the first five years of the director’s service on the Board; and (iii) hold these shares at least until the director departs the Board. Each director may sell enough shares to pay taxes in connection with the receipt of his or her retainer or the exercise of stock appreciation rights and the ownership guideline will be adjusted to reflect the sale to pay taxes.

How much YUM stock do the directors own?

Stock ownership information for each director is shown in the table on page 44.

Does the Company have stock ownership guidelines for executives and senior management?

The Committee has adopted formal stock ownership guidelines that set minimum expectations for executive and senior management ownership. These guidelines are discussed on page 66.

The Company has maintained an ownership culture among its executive and senior managers since its formation. Substantially all executive officers and members of senior management hold stock well in excess of the guidelines.

How Can Shareholders Nominate for the Board?

Director nominations for inclusion in YUM’s proxy materials (Proxy Access). Our bylaws permit a shareholder, or group of up to 20 shareholders, owning continuously for at least three years shares of YUM stock representing an aggregate of at least 3% of our outstanding shares, to nominate and include in YUM’s proxy materials director nominees constituting up to 20% of YUM’s Board, provided that the shareholder(s) and nominee(s) satisfy the requirements in YUM’s bylaws. Notice of proxy access director nominees for the 2024 Annual Meeting of Shareholders must be received by us no earlier than November 9, 2023, and no later than December 9, 2023.

Director nominations to be brought before the 2024 Annual Meeting of Shareholders. Director nominations that a shareholder intends to present at the 2024 Annual Meeting of Shareholders, other than through the proxy access procedures described above, must have been received no later than February 18, 2024. These nominations must be submitted by a shareholder in accordance with the requirements specified in YUM’s bylaws.

Where to send director nominations for the 2024 Annual Meeting of Shareholders. Director nominations brought by shareholders must be delivered to YUM’s Corporate Secretary by mail at YUM! Brands, Inc., 1441 Gardiner Lane, Louisville, Kentucky 40213 and received by YUM’s Corporate Secretary by the dates set forth above.

18

GOVERNANCE OF THE COMPANY

What is the Board’s leadership structure?

In November 2018, Brian C. Cornell assumed the position of Non-Executive Chairperson of the Board. Applying our Corporate Governance Principles, the Board determined that based on Mr. Cornell’s independence, it would not appoint a Lead Director when Mr. Cornell became Non-Executive Chairperson.

The Nominating and Governance Committee annually reviews the Board’s leadership structure and evaluates the performance and effectiveness of the Board of Directors. The Board retains the authority to modify its leadership structure in order to stay current with our Company’s circumstances and advance the best interests of the Company and its shareholders as and when appropriate. The Board’s annual self-evaluation includes questions regarding the Board’s opportunities for open communication and the effectiveness of executive sessions.

The Company’s Governance Principles provide that the Chief Executive Officer (“CEO”) may serve as Chairperson of the Board. These Principles also provide for an independent Lead Director when the CEO is serving as Chairperson. During 2022, our CEO did not serve as Chairperson. Our Board believes that Board independence and oversight of management are effectively maintained through a strong independent Chairperson or Lead Director and through the Board’s composition, committee system and policy of having regular executive sessions of non-employee directors, all of which are discussed below. As Non-Executive Chairperson, Mr. Cornell is responsible for supporting the CEO on corporate strategy along with leadership development. Mr. Cornell also works with the CEO in setting the agenda and schedule for meetings of the Board, in addition to performing the duties that would otherwise be performed by a Lead Director, as described below.

As CEO, Mr. Gibbs is responsible for leading the Company’s strategies, organization design, people development and culture, and for providing the day-to-day leadership over operations.

To ensure effective independent oversight, the Board has adopted a number of governance practices discussed below.

What are the Company’s governance policies and ethical guidelines?

| ∎ | Board Committee Charters. The Audit, Management Planning and Development, and Nominating and Governance Committees of the YUM Board of Directors operate pursuant to written charters. These charters were approved by the Board of Directors and reflect certain best practices in corporate governance. These charters comply with the requirements of the NYSE. Each charter is available on the Company’s website at https://investors.YUM.com/governance/committee-composition-and-charters/. |

| ∎ | Governance Principles. The Board of Directors has documented its corporate governance guidelines in the YUM! Brands, Inc. Corporate Governance Principles. These guidelines are available on the Company’s website at https://investors.YUM.com/governance/governance-documents/. |

| ∎ | Ethical Guidelines. YUM’s Global Code of Conduct was adopted to emphasize the Company’s commitment to the highest standards of business conduct. The Code of Conduct also sets forth information and procedures for employees to report misconduct, ethical or accounting concerns, or other violations of the Code of Conduct in a confidential manner. The Code of Conduct applies to the Board of Directors and all employees of the Company, including the principal executive officer, the principal financial officer and the principal accounting officer. Our directors and the senior-most employees in the Company are required to regularly complete a conflicts of interest questionnaire and certify in writing that they have read and understand the Code of Conduct. The Code of Conduct is available on the Company’s website at https://investors.YUM.com/governance/governance-documents/. The Company intends to post amendments to or waivers from its Code (to the extent applicable to the Board of Directors or executive officers) on this website. |

What other significant Board practices does the Company have?

| ∎ | Private Executive Sessions. Our non-management directors meet in executive session at each regular Board meeting. The executive sessions are attended only by the non-management directors and are presided over by the Lead Director or our Non-Executive Chairperson, as applicable. Our independent directors meet in executive session at least once per year. |

| ∎ | Role of Lead Director. Our Governance Principles require the election, by the independent directors, of a Lead Director when the CEO is also serving as Chairperson. |

19

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

The Board currently does not have a Lead Director, and the duties of the Lead Director are fulfilled by Mr. Cornell as Non-Executive Chairperson. Since Mr. Cornell is independent, the Board determined that it would not appoint a separate Lead Director upon Mr. Cornell’s appointment as Non-Executive Chairperson.

The Lead Director position is structured so that one independent Board member is empowered with sufficient authority to ensure independent oversight of the Company and its management. The Lead Director position has no term limit and is subject only to annual approval by the independent members of the Board. Based upon the recommendation of the Nominating and Governance Committee, the Board has determined that the Lead Director, when appointed, is responsible for:

| (a) | Presiding at all executive sessions of the Board and any other meeting of the Board at which the Chairperson is not present, and advising the Chairperson and CEO of any decisions reached or suggestions made at any executive session, |

| (b) | Approving in advance agendas and schedules for Board meetings and the information that is provided to directors, |

| (c) | If requested by major shareholders, being available for consultations and direct communication, |

| (d) | Serving as a liaison between the Chairperson and the independent directors, and |

| (e) | Calling special meetings of the independent directors. |

| ∎ | Advance Materials. Information and data important to the directors’ understanding of the business or matters to be considered at a Board or Board committee meeting are, to the extent practical, distributed to the directors sufficiently in advance of the meeting to allow careful review prior to the meeting. |

| ∎ | Board and Committees’ Evaluations. The Board has an annual self-evaluation process that is led by the Nominating and Governance Committee. This assessment focuses on the Board’s contribution to the Company and emphasizes those areas in which the Board believes a better contribution could be made. As a part of this process, the Chairperson of the Board or the Chairperson of the Nominating and Governance Committee conduct personal interviews with each member of the Board, the results of which are summarized and discussed in an executive session. In addition, the Audit, Management Planning and Development and Nominating and Governance Committees also each conduct similar annual self-evaluations. |

| ∎ | Majority Voting Policy. Our Articles of Incorporation require majority voting for the election of directors in uncontested elections. This means that director nominees in an uncontested election for directors must receive a number of votes “for” his or her election in excess of the number of votes “against.” The Company’s Governance Principles further provide that any incumbent director who does not receive a majority of “for” votes will promptly tender to the Board his or her resignation from the Board. The resignation will specify that it is effective upon the Board’s acceptance of the resignation. The Board will, through a process managed by the Nominating and Governance Committee and excluding the nominee in question, accept or reject the resignation within 90 days after the Board receives the resignation. If the Board rejects the resignation, the reason for the Board’s decision will be publicly disclosed. |

What access do the Board and Board committees have to management and to outside advisors?

| ∎ | Access to Management and Employees. Directors have full and unrestricted access to the management and employees of the Company. Additionally, key members of management attend Board meetings to present information about the results, plans and operations of the business within their areas of responsibility. |

| ∎ | Access to Outside Advisors. The Board and its committees may retain counsel or consultants without obtaining the approval of any officer of the Company in advance or otherwise. The Audit Committee has the sole authority to retain and terminate the independent auditor. The Nominating and Governance Committee has the sole authority to retain search firms to be used to identify director candidates. The Management Planning and Development Committee has the sole authority to retain compensation consultants for advice on executive compensation matters. |

20

GOVERNANCE OF THE COMPANY

What is the Board’s role in risk oversight?

The Board maintains overall responsibility for overseeing the Company’s risk management, including succession planning, food safety and digital/information security. In furtherance of its responsibility, the Board has delegated specific risk-related responsibilities to the Audit Committee and to the Management Planning and Development Committee.

The Audit Committee engages in substantive discussions of enterprise risk management and processes at all of its regular committee meetings held during the year. At these meetings, it receives functional risk review reports covering significant areas of risk from the employees responsible for these functional areas, as well as receiving reports from the Chief Legal Officer and the Vice President, Internal Audit. Our Vice President, Internal Audit reports directly to the Chairperson of the Audit Committee and our Chief Financial Officer (“CFO”). Additionally, the Company has instituted an enterprise risk management process that is followed at both the parent and brand level. The Audit Committee receives an update from a business unit or brand at each regular meeting where the presenting business unit or brand provides an update on their risk register and key risk mitigation plans. The Audit Committee also receives reports at each regular meeting regarding legal and regulatory risks from management and meets in separate executive sessions with our independent auditors and our Vice President, Internal Audit. The Audit Committee provides a summary to the full Board at each regular Board meeting of the risk area reviewed together with any other risk related subjects discussed at the Audit Committee meeting.

In addition, our Management Planning and Development Committee considers the risks that may be implicated by our compensation programs through a risk assessment conducted by management and reports its conclusions to the full Board.

What is the Board’s role in information security?

Information security and privacy has been and remains of the utmost importance to the Company in light of the value we place on maintaining the trust and confidence of our consumers, employees and other stakeholders. Accordingly, our Chief Information Security Officer and Chief Digital and Technology Officer advise the Audit Committee (at least four times per year) and the full Board of Directors regularly on our program for managing information security risks, including data privacy and data protection risks. We internally follow the NIST Cybersecurity Framework to assess the maturity of our cybersecurity programs. Additionally, we have in place a formal data privacy group made up of privacy professionals, operational experts and specialist legal counsel. The Audit Committee receives periodic updates on data privacy from the data privacy group in addition to the existing updates from our Chief Information Security Officer. Other aspects of our comprehensive information security program include:

| ∎ | Information security and privacy modules included in our mandatory onboarding and annual compliance training for restaurant support center employees, as well as targeted specialized training for any employees that routinely have access to personal data; |

| ∎ | Regular testing, both by internal and external resources, of our information security defenses; |

| ∎ | Periodic phishing drills with all restaurant support center employees; |

| ∎ | Global security and privacy policies; and |

| ∎ | Table-top exercises with senior leaders covering ransomware and other third-party data security threats. |

In addition, the Company maintains an information security risk insurance policy that provides coverage for data security breaches.

What is the Board’s role in the Company’s global sustainability initiatives?

The Company has an integrated, Board and executive-level governance structure to oversee its global sustainability initiatives. Oversight for environmental, social and governance issues (“ESG”) ultimately resides with the Board of Directors. The Board receives regular updates on these matters from management through the Audit, Management Planning and Development and Nominating and Governance Committees. The committees have initial board-level oversight responsibilities for ESG-related items which fall within the purview of each of their designated areas of responsibility. In early 2023, the Committees’ charters were each amended to clarify the areas of the Company’s ESG strategy and initiatives for which each committee has initial oversight responsibility. At the operational level, the Chief Corporate Affairs Officer is

21

YUM! BRANDS, INC.

|  | 2023 PROXY STATEMENT

|

responsible for overseeing the global reputation of YUM Brands and is responsible for shaping the Citizenship and Sustainability Strategy, as approved by the Board, with the Chief Sustainability Officer and Vice President of Government Affairs.

Has the Company conducted a risk assessment of its compensation policies and practices?

As stated in the Compensation Discussion and Analysis at page 46, the philosophy of our compensation programs is to reward performance by designing pay programs that incorporate team and individual performance, and shareholder return; emphasize long-term incentives; drive ownership mentality; and require executives to personally invest in Company stock.

In early 2023, the Committee examined our compensation programs for all employees to determine whether they encourage unnecessary or excessive risk taking. In conducting this review, each of our compensation practices and programs was reviewed against the key risks facing the Company in the conduct of its business. Based on this review, the Committee concluded our compensation policies and practices do not encourage our employees to take unreasonable or excessive risks.

As part of this assessment, the Committee concluded the following policies and practices of the Company’s cash and equity incentive programs serve to reduce the likelihood of excessive risk taking:

| ∎ | Our Compensation system is balanced, rewarding both short-term and long-term performance; |

| ∎ | Long-term Company performance is emphasized. The majority of incentive compensation for the top-level employees is associated with the long-term performance of the Company; |

| ∎ | Strong stock ownership guidelines in place for approximately 210 senior employees are enforced; |

| ∎ | The annual incentive and performance share plans both cap the level of performance over which no additional rewards are paid, thereby mitigating any incentive to take unreasonable risk; |

| ∎ | The annual incentive target setting process is closely linked to the annual financial planning process and supports the Company’s overall strategic plan, which is reviewed and approved by the Board; |

| ∎ | Compensation performance measures in our annual incentive plans are transparent and tied to multiple measurable factors, none of which exceed a 50% weighting; measures are both apparent to shareholders and drivers of returns; |

| ∎ | The performance which determines employee rewards is closely monitored by the Audit Committee and the full Board; and |

| ∎ | The Company has a recoupment (clawback) policy. |

How does the Board determine which directors are considered independent?

The Company’s Governance Principles, adopted by the Board, require that we meet the listing standards of the NYSE. The full text of the Governance Principles can be found on the Company’s website (https://investors.YUM.com/governance/governance-documents/).

Pursuant to the Governance Principles, the Board undertook its annual review of director independence. During this review, the Board considered transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates. As provided in the Governance Principles, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As a result of this review, the Board affirmatively determined that all of the directors are independent of the Company and its management under NYSE rules, with the exception of David Gibbs, who is not considered independent because of his employment by the Company.

22

GOVERNANCE OF THE COMPANY

In determining that the other directors did not have a material relationship with the Company, the Board determined that Messrs. Alves, Barr, Connor, Nelson, Skala and Mmes. Domier, Graddick-Weir, Hobart, Stock and Young-Scrivner had no other relationship with the Company other than their relationship as a director. The Board did note as discussed in the next paragraph that Target Corporation, which employs Mr. Cornell, has a business relationship with the Company; however, as noted below, the Board determined that this relationship was not material to Mr. Cornell or Target Corporation, and therefore determined that Mr. Cornell was independent.

Brian C. Cornell is the Chairman and Chief Executive Officer of Target Corporation. During 2022, the Company received approximately $6 million in license fees from Target Corporation in the normal course of business. Divisions of the Company paid Target Corporation approximately $1 million in rebates in 2022. The Board determined that these payments did not create a material relationship between the Company and Mr. Cornell or the Company and Target Corporation as the payments represent less than 2% of Target Corporation’s revenues. Furthermore, the licensing relationship between the Company and Target Corporation was initially entered into before Mr. Cornell joined the Board or became employed by Target Corporation.

How do shareholders communicate with the Board?