| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

|

| Filed by the registrant [ x ] |

| Filed by a party other than the registrant [ ] |

|

|

| Check the appropriate box: |

| [ ] | Preliminary proxy statement |

| [ x ] | Definitive proxy statement |

| [ ] | Definitive additional materials |

| [ ] | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

|

|

OREGON TRAIL FINANCIAL CORP.

|

(Name of Registrant as Specified in Its Charter) |

|

OREGON TRAIL FINANCIAL CORP.

|

(Name of Person(s) Filing Proxy Statement) |

|

| Payment of filing fee (Check the appropriate box): |

| [ x ] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| (1) | Title of each class of securities to which transaction applies: |

N/A

|

| (2) | Aggregate number of securities to which transactions applies: |

N/A

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| 0-11: |

N/A

|

| (4) | Proposed maximum aggregate value of transaction: |

N/A

|

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and |

| identify the filing for which the offsetting fee was paid previously. Identify the previous filing by |

| registration statement number, or the form or schedule and the date of its filing. |

|

| (1) | Amount previously paid: |

N/A

|

| (2) | Form, schedule or registration statement no.: |

N/A

|

| (3) | Filing party: |

N/A

|

| (4) | Date filed: |

N/A

|

|

<PAGE>July 26, 2002Dear Stockholder: You are cordially invited to attend the Annual Meeting of Stockholders of Oregon Trail Financial Corp. The meeting will be held at the Sunridge Inn and Conference Center, One Sunridge Lane, Baker City, Oregon, on Wednesday, August 28, 2002 at 10:00 a.m., local time.

The Notice of Annual Meeting of Stockholders and Proxy Statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of Deloitte & Touche LLP, the Company's independent auditors, will be present to respond to appropriate questions of shareholders.

For the reasons set forth in the proxy statement, the Board unanimously recommends a vote "FOR" each of the nominees as directors specified under Proposal I and "FOR" the ratification of auditors under Proposal II .

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

Sincerely,

/s/Stephen R. Whittemore /s/Berniel L. Maughan Stephen R. Whittemore Berniel L. Maughan Chairman of the Board President and Chief Executive Officer<PAGE>

OREGON TRAIL FINANCIAL CORP.

2055 FIRST STREET

BAKER CITY, OREGON 97814

(541) 523-6327

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On August 28, 2002

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Oregon Trail Financial Corp. ("Company") will be held at the Sunridge Inn and Conference Center, One Sunridge Lane, Baker City, Oregon, on Wednesday, August 28, 2002 at 10:00 a.m., Pacific Daylight Time, for the following purposes:

| (1) | To elect two directors of the Company; |

|

| (2) | To approve the appointment of Deloitte & Touche LLP as the Company's independent auditors for the fiscal year ending March 31, 2003; and |

|

| (3) | To consider and act upon such other matters as may properly come before the meeting or any adjournments thereof. |

NOTE: The Board of Directors is not aware of any other business to come before the meeting.

Any action may be taken on the foregoing proposals at the meeting on the date specified above or on any date or dates to which, by original or later adjournment, the meeting may be adjourned. Stockholders of record at the close of business on July 12, 2002 are entitled to notice of and to vote at the meeting and any adjournments or postponements thereof.

You are requested to complete and sign the enclosed form of proxy, which is solicited by the Board of Directors, and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Zane F. Lockwood ZANE F. LOCKWOOD CORPORATE SECRETARYBaker City, OregonJuly 26, 2002

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES IN ORDER TO ENSURE A QUORUM. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

<PAGE>

PROXY STATEMENT

OF

OREGON TRAIL FINANCIAL CORP.

2055 FIRST STREET

BAKER CITY, OREGON 97814

(541) 523-6327

ANNUAL MEETING OF STOCKHOLDERS

AUGUST 28, 2002

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Oregon Trail Financial Corp. ("Company") to be used at the Annual Meeting of Stockholders of the Company ("Meeting"). The Company is the holding company for Pioneer Bank, A Federal Savings Bank ("Savings Bank"). The Meeting will be held at the Sunridge Inn and Conference Center, One Sunridge Lane, Baker City, Oregon, on Wednesday, August 28, 2002 at 10:00 a.m., Pacific Daylight Time. This Proxy Statement and the enclosed proxy card are being first mailed to shareholders on or about July 26, 2002.

VOTING AND PROXY PROCEDURE

Shareholders Entitled to Vote. Stockholders of record as of the close of business on July 12, 2002 ("Voting Record Date") are entitled to one vote for each share of common stock ("Common Stock") of the Company then held. At the close of business on the Voting Record Date, the Company had 3,089,250 shares of Common Stock entitled to vote.

As provided in the Company's Articles of Incorporation, record holders of the Company's Common Stock who beneficially own, either directly or indirectly, in excess of 10% of the Company's outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit.

If you are a beneficial owner of Company Common Stock held by a broker, bank or other nominee (i.e., in "street name"), you will need proof of ownership to be admitted to the Meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Company Common Stock held in street name in person at the meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Quorum. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Meeting. Abstentions and broker non-votes will be counted as shares present and entitled to vote at the Meeting for purposes of determining the existence of a quorum.

Proxies; Proxy Revocation Procedures. The Board of Directors solicits proxies so that each shareholder has the opportunity to vote on the proposals to be considered at the Meeting. When the proxy card is returned properly signed and dated, the shares represented thereby will be voted in accordance with the instructions on the proxy card. Where no instructions are indicated, proxies will be voted FOR the nominees for directors set forth below and FOR the approval of the appointment of Deloitte & Touche LLP as independent auditors. If a shareholder attends the Meeting, he or she may vote by ballot.

Stockholders who execute proxies retain the right to revoke them at any time. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company or by filing a later dated proxy prior to a vote being taken on a particular proposal at the Meeting. Attendance at the Meeting will not automatically revoke a proxy, but a shareholder in attendance may request a ballot and vote in person, thereby revoking a prior granted proxy.

<PAGE>

If your Company Common Stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. If you wish to change your voting instructions after you have returned your voting instruction form to your broker or bank, you must contact your broker or bank.

Participants in thePioneer Bank, A Federal Savings Bank ESOP. If a stockholder is a participant in thePioneer Bank, A Federal Savings Bank Employee Stock Ownership Plan ("ESOP"), the proxy card represents a voting instruction to the trustees of the ESOP as to the number of shares in the participant's plan account. Each participant in the ESOP may instruct the trustees as to the manner in which shares of Common Stock allocated to the participant's plan account are to be voted. The instructions are confidential and will not be disclosed to the Company. Unallocated shares of Common Stock held by the ESOPand allocated shares for which no voting instructions are received will be voted by the trustees in the same proportion as shares for which the trustees have received voting instructions. The deadline for returning your voting instructions to the trustees is August 20, 2002.

Vote Required. Abstentions and "broker non-votes" (which occur if a broker or other nominee does not have discretionary authority and has not received voting instructions from the beneficial owner with respect to the particular item) are counted for purposes of determining the presence or absence of a quorum for the transaction of business.

The directors to be elected at the Meeting will be elected by a plurality of the votes cast by shareholders present in person or by proxy and entitled to vote. Votes may be cast for or withheld from each nominee for election as director. Votes that are withheld and broker non-votes will have no effect on the outcome of the election because directors will be elected by a plurality of the votes cast. The Company's Articles of Incorporation prohibits stockholders from cumulating their votes for the election of directors.

Approval of the appointment of independent auditors requires the affirmative vote of a majority of the outstanding shares of Common Stock present in person or by proxy and entitled to vote at the Meeting. In determining whether such proposal has received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposal; broker non-votes will be disregarded and will have no effect on the outcome of the vote.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Persons and groups who beneficially own in excess of 5% of the Company's Common Stock are required to file certain reports with the Securities and Exchange Commission ("SEC"), and provide a copy to the Company, disclosing such ownership pursuant to the Securities Exchange Act of 1934, as amended ("Exchange Act"). Based on such reports, the following table sets forth, at the close of business on the Voting Record Date, certain information as to those persons who were beneficial owners of more than 5% of the outstanding shares of Common Stock. Management knows of no persons other than those set forth below who beneficially owned more than 5% of the outstanding shares of Common Stock at the close of business on the Voting Record Date. The table also sets forth, as of the close of business on the Voting Record Date, certain information as to shares of Common Stock beneficially owned by the Company's directors, "named executive officers," and all directors and executive officers as a group.

2

<PAGE>

| Number of Shares | Percent of Shares |

Name

| Beneficially Owned (1)

| Outstanding

|

|

| Beneficial Owners of More Than 5% | | |

|

| Pioneer Bank, A Federal Savings Bank(2) | 354,224 | 11.47% |

| Employee Stock Ownership Plan Trust | | |

|

| Joseph Stilwell(3) | 283,476 | 9.18 |

| 26 Broadway, 23rd Floor | | |

| New York, NY 10004 | | |

|

| Westport Asset Management, Inc.(4) | 181,000 | 5.86 |

| 253 Riverside Avenue | | |

| Westport, Connecticut 06880 | | |

|

| Directors (5) |

| |

| John Gentry | 67,950 | 2.20 |

| Albert H. Durgan | 57,467 | 1.86 |

| Edward H. Elms | 77,019 | 2.49 |

| Stephen R. Whittemore | 73,406 | 2.38 |

| Charles H. Rouse | 72,950 | 2.36 |

| Kevin D. Padrick | 25,000 | * |

| John A. Lienkaemper (6) | 68,175 | 2.21 |

| |

| Named Executive Officers (7) | | |

|

| Berniel L. Maughan | 20,000 | * |

| Zane F. Lockwood (5) | 44,542 | 1.44 |

| Jonathan P. McCreary (5) | 6,524 | * |

| All Executive Officers and | | |

| Directors as a Group (ten persons) | 513,033 | 16.61% |

___________________

| * | Less than 1 percent of shares outstanding. |

| (1) | In accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of Common Stock if he or she has voting and/or investment power with respect to such security. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table may possess voting and/or investment power. The table includes exercisable stock options under the Company's 1998 Stock Option Plan ("Option Plan") in the amounts of 33,833 each for Messrs. Gentry, Durgan, Elms, Whittemore, Rouse and Lienkaemper and 5,000 for Mr. Padrick. The table also includes exercisable stock options under the Option Plan in the amounts of 20,000, 28,168 and 2,524 for Messrs. Maughan, Lockwood and McCreary, respectively. |

(footnotes continued on following page)

3

<PAGE>

| (2) | Under the terms of the ESOP, the trustees will vote unallocated shares and allocated shares for which no voting instructions are received in the same proportion as shares for which the trustees have received voting instructions from participants. As of the Voting Record Date, 205,632 shares have been allocated to participants' accounts. The trustees of the ESOP are William H. Winegar, Michelle Kaseburg, Anne Raffetto and Jonathan P. McCreary. |

| (3) | Based on a SEC Schedule 13D, dated March 18, 2002, that discloses shared voting and dispositive power as to 283,476 shares. |

| (4) | Based on a SEC Schedule 13G, dated February 14, 2002, that discloses shared voting and dispositive power as to 181,000 shares. |

| (5) | Includes unvested shares in the Company's Management Recognition and Development Plan ("MRDP"). Participants in the MRDP exercise all rights incidental to ownership, including voting rights. |

| (6) | Mr. Lienkaemper is a Director for Pioneer Bank, A Federal Savings Bank, a wholly owned subsidiary of the Company and is not a Director of the Company. |

| (7) | SEC regulations define the term "named executive officers" to include all individuals serving as chief executive officer during the most recently completed fiscal year, regardless of compensation level, and the four most highly compensated executive officers, other than the chief executive officer, whose total annual salary and bonus for the last completed fiscal year exceeded $100,000. Messrs. Maughan, Lockwood and McCreary were the Company's only "named executive officers" during the fiscal year ended March 31, 2002. |

PROPOSAL I -- ELECTION OF DIRECTORS

The Company's Board of Directors consists of six members. In accordance with the Company's Articles of Incorporation, the Board is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. The Board of Directors has nominated Albert H. Durgan and Edward H. Elms for election as directors, each to serve for a three-year period or until their respective successors have been duly elected and qualified. Messrs. Durgan and Elms are both current members of the Board of Directors of the Company and each has consented to being named in this Proxy Statement and to serving as a director on the Board if elected.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the above named nominees. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend or the Board of Directors may adopt a resolution to amend the Bylaws and reduce the size of the Board. At this time the Board of Directors knows of no reason why any nominee might be unavailable to serve.

The Board of Directors recommends a vote "FOR" the election of Messrs. Durgan and Elms.

The following table sets forth certain information regarding the nominees for election at the Meeting, as well as information regarding those directors continuing in office after the Meeting.

| | Year First Elected or | Term to |

Name

| Age(1)

| Appointed Director (2)

| Expire

|

|

NOMINEES |

|

| Albert H. Durgan | 71 | 1985 | 2002(3) |

| Edward H. Elms | 54 | 1986 | 2002(3) |

| | | |

(table continued on following page) |

4

<PAGE>

| | Year First Elected or | Term to |

Name

| Age(1)

| Appointed Director (2)

| Expire

|

|

| CONTINUING DIRECTORS |

|

| Stephen R. Whittemore | 52 | 1983 | 2003 |

| Charles H. Rouse | 56 | 1991 | 2003 |

| John Gentry | 54 | 1992 | 2004 |

| Kevin D. Padrick | 47 | 2001 | 2004 |

_______________| (1) | As of March 31, 2002. |

| (2) | Includes prior service on the Board of Directors of the Savings Bank. Each member of the Board of Directors of the Company, except Kevin D. Padrick, is also a member of the Board of Directors of the Savings Bank. |

| (3) | Each nominee has been nominated to serve for a three-year period or until their respective successors have been duly elected and qualified. |

The present principal occupation and other business experience during the last five years of each nominee for election and each director continuing in office is set forth below:

Albert H. Durgan is retired from the Savings Bank after 34 years of service. He served as President of the Savings Bank from 1986 to 1992. Prior to being President, he held the position of Executive Vice President for seven years, Branch Manager for 18 years, and also served in other front-line and back office positions. Mr. Durgan has a Bachelor of Science degree in Real Estate and Finance from the University of Oregon.

Edward H. Elms has been the owner of P&E Distributing Company, a beverage distributor, located in Baker City, Oregon, for 30 years. He also owns and manages commercial and residential rental properties in the Baker City area. Mr. Elms was the co-owner of Heritage Chevrolet, a car dealership located in Baker City, Oregon, from 1996 to 1999. Mr. Elms has a degree in Diesel Technology from the Oregon Institute of Technology.

Stephen R. Whittemore is currently a private investor. Mr. Whittemore was the owner of BesTruss, an engineered roof systems company from 1996 to 2001. He was a partner in Wallowa Lake Tram, Inc. from 1983 to 2001, and was the owner of La Grande Lumber Company, a distributor of building materials, from 1971 to 1996. Mr. Whittemore has a Bachelor of Science degree in Economics from Oregon State University.

Charles H. Rouse has been employed by Norris Beggs & Simpson Realtors as Vice President, Corporate Services, since January of 2001. Prior to 2001, Mr. Rouse was an authorized Sears dealer in Baker City, Oregon, and a property developer and manager since 1995. He was the owner of Rouse's Home Furnishings, Baker City, Oregon, from 1985 to 1995. He has been a Director of the Oregon Tourism Commission and the Western Building Materials Association. Mr. Rouse has a Bachelor of Science degree in Biology and a Masters of Business Administration from Oregon State University.

John Gentry has been President and General Manager of Gentry Ford Sales, Inc., an automobile dealership located in Ontario, Oregon, since 1985. He served as Vice President of that company between 1972 and 1985. Mr. Gentry has a Bachelor of Science degree in Business/Journalism from the University of Oregon. He has been a Director and President of the Ontario, Oregon, Chamber of Commerce, a Director of the City of Ontario, Oregon, Budget Board, a Director and President of the Oregon Automobile Dealers Association, and a Director of the Western States Ford Dealer Advertising Association.

Kevin D. Padrick, an attorney, is a consultant for businesses in need of an individual with a background in both business and law. Most recently, in September 1998, Mr. Padrick was hired as a consultant by Southern Pacific Funding

5

<PAGE>

Corporation and from October 1998 to 1999 Mr. Padrick served as Executive Vice President and later as President of Southern Pacific Funding Corporation. Mr. Padrick has a Bachelor of Science degree from the University of Santa Clara, a Masters of Business Administration from the University of Santa Clara Business School and a Juris Doctor from the University of Santa Clara Law School.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Boards of Directors of the Company and the Savings Bank conduct their business through meetings of the Boards and through their committees. During the fiscal year ended March 31, 2002, the Board of Directors of the Company held eight special meetings and five regularly scheduled meetings, and the Board of Directors of the Savings Bank held no special meetings and 13 regularly scheduled meetings. No director of the Company or the Savings Bank attended fewer than 75% of the total meetings of the Boards and committees on which such person served during this period.

Committees of the Company's Board. The Company's Board of Directors has established Audit and Nominating Committees.

The Audit Committee consists of Directors Elms (Chairman), Gentry, Durgan and Padrick. It receives and reviews all reports prepared by the Company's external and internal auditors. The internal auditor reports monthly to the Audit Committee. The Audit Committee met five times during the fiscal year ended March 31, 2002.

The full Board of Directors acts as a Nominating Committee for the annual selection of management's nominees for election as directors of the Company. The full Board of Directors met once in its capacity as Nominating Committee on June 18, 2002.

Committees of the Savings Bank's Board. The Savings Bank's Board of Directors has established Personnel and Compensation, Audit and Nominating Committees, among others.

The Personnel and Compensation Committee, consisting of Directors Rouse (Chairman), Elms and John Lienkaemper, is responsible for all personnel issues, including recommending compensation levels for all employees and senior management of the Company and the Savings Bank to their respective Board of Directors. The Personnel and Compensation Committee meets at least twice a year and met three times during the year ended March 31, 2002.

The Audit Committee, consisting of Directors Elms (Chairman), Gentry and Durgan, receives and reviews all reports prepared by the Savings Bank's external auditor and the internal audit function. The Audit Committee met five times during the year ended March 31, 2002.

The full Board of Directors of the Savings Bank acts as a Nominating Committee for the annual selection of its nominees for election as directors. The full Board of Directors met once in its capacity as Nominating Committee on June 18, 2002.

DIRECTORS' COMPENSATION

Fees

The Company and the Savings Bank each pay fees to its directors. Each director of the Company receives a quarterly fee of $1,000, except that the Chairman of the Board receives a quarterly fee of $1,250. Each director of the Savings Bank, other than the Chairman of the Board, receives a monthly fee of $1,075. The Chairman of the Board of the Savings Bank receives a monthly fee of $1,125. Each director receives an additional $125 per month for service

6

<PAGE>

on the Board of Directors of Pioneer Development Corporation, a wholly-owned subsidiary of the Savings Bank. The Company and the Savings Bank paid total fees to directors of $166,000 for the fiscal year ended March 31, 2002.

Directors Emeritus Plan

The Savings Bank maintains the Pioneer Bank Director's Plan which confers director emeritus status on a director who retires at or after attaining age 70 with 10 or more years of service. Under the Director's Plan, a director emeritus receives a fee equal to the greater of $800 or 65% of the fee payable to regular Board members for attendance at monthly Board meetings. The fee is payable for the life of the director emeritus. As a condition of receipt of benefits under the Director's Plan, a director emeritus is expected to be available to advise and consult with management of the Savings Bank, represent and promote the interests of the Savings Bank in its primary market area, and refrain from business activities that are competitive with or contrary to the interests of the Savings Bank. An additional feature of the Director's Plan provides that, in the event of a change in control of the Company or the Savings Bank (as defined in the Director's Plan), each active director would be treated as a director emeritus on the effective date of the change of control. Within 30 days of such date, each director would receive a payment equal to the present value of seven times the annual fees payable to the director at the effective time of the change in control. The present value calculation is based on the applicable federal rate as published by the Internal Revenue Service. Assuming a change in control had occurred at March 31, 2002, the aggregate amount payable under the Director's Plan to all current directors would be approximately $525,000.

Other

Pursuant to the Company's Option Plan, 16,228 stock options were granted to each of Messrs. Gentry, Durgan, Elms, Whittemore, Rouse and Lienkaemper, and 5,000 stock options were granted to Mr. Padrick, on October 23, 2001, the grant date. The options were granted at an exercise price of $16.625 and vested immediately on the grant date. Pursuant to the Company's MRDP, 9,727 shares of restricted Common Stock were awarded to each of Messrs. Gentry, Durgan, Elms, Whittemore, Rouse and Lienkaemper on October 23, 2001. These shares vest pro rata over a three-year period with the first vesting on October 23, 2003 and subsequent vesting on October 23, 2004 and October 23, 2005 so long as the recipient continues service as a director of the Company or any of its subsidiaries.

7

<PAGE>

EXECUTIVE COMPENSATION

Summary Compensation Table

The following information is provided for Messrs. Maughan, Lockwood and McCreary. No other executive officer's total annual salary and bonus for the last completed fiscal year exceeded $100,000.

| | | | Long-term Compensation | |

| | Annual Compensation (1)

| Awards

| |

| | | | Restricted | Number | All |

| Name and | | | | Stock | of | Other Annual |

Position

| Year

| Salary ($)

| Bonus

| Awards ($)(2)

| Options (3)

| Compensation (4)

|

| | | | | | |

| Berniel L. Maughan | 2002 | $165,385 | $75,000 | $ -- | -- | $76,820 |

| President and Chief | 2001 | 124,039 | 25,000 | -- | 50,000 | 3,000 |

| Executive Officer |

| |

| Zane F. Lockwood | 2002 | 104,423 | -- | -- | -- | 34,527 |

| Executive Vice President | 2001 | 96,000 | -- | -- | -- | 27,758 |

| and Corporate Secretary | 2000 | 84,224 | -- | -- | -- | 19,661 |

| | | | | | | |

| Jonathan P. McCreary | 2002 | 98,609 | 27,000 | 62,200 | 10,000 | 16,084 |

| Senior Vice President and | 2001 | 64,039 | -- | -- | 5,047 | 4,500 |

| Chief Financial Officer | 2000 | | | | | |

_______________

| (1) | Does not include certain benefits, the aggregate amounts of which do not exceed 10% of total annual salary and bonus. |

| (2) | Pursuant to the MRDP, 18,779 shares of restricted Common Stock were awarded to Mr. Lockwood on October 8, 1998, the award date, which had a value of $209,386. For Mr. McCreary, represents the value of restricted stock awards at September 18, 2001, the award date, pursuant to the MRDP. The MRDP was approved by stockholders at the 1998 Annual Meeting of Stockholders and provides for the award of Common Stock in the form of restricted stock awards to directors, officers and key employees. Dividends are paid on such awards if and when declared and paid by the Company on the Common Stock.At March 31, 2002, the value of the unvested awards for Mr. Lockwood (which vest pro rata over a five-year period at a rate of 20%) was $139,873 (7,512 shares at $18.62 per share) and the value of Mr. McCreary's unvested awards (which vest pro rata over a three-year period at a rate of 33.33% beginning on September 18, 2002) was $74,480 (4,000 shares at $18.62 per share). |

| (3) | Pursuant to the Option Plan, Mr. Maughan was granted 50,000 options on May 22, 2000, Mr. Lockwood was granted 46,948 options on October 8, 1998 and Mr. McCreary was granted 5,047 options on July 19, 2000 and 10,000 options on September 18, 2001. The options for Messrs. Maughan and Lockwood vest at a rate of 20% per year over a five year period. The options for Mr. McCreary awarded July 19, 2000 vest at a rate of 25% per year over a four year period and the options awarded September 18, 2001 vest at a rate of 33.33% per year over a three year period. |

| (4) | Consists of employer 401(k) plan contributions, ESOP shares allocated but not necessarily vested and life insurance premium benefit. ESOP shares allocated are valued at the Company's Common Stock share price on the close of business on March 31, 2002 ($18.62). Mr. Maughan received a $26,400 auto allowance for the two-year period ended March 31, 2002. |

Option Grants in Last Fiscal Year. The Company maintains the Option Plan, which provides discretionary awards of options to purchase Common Stock to officers, directors and employees as determined by the Board of Directors. The Option Plan was approved by stockholders at the 1998 Annual Meeting of Stockholders. The following table lists all grants of options under the Option Plan to Mr. McCreary for the year ended March 31, 2002 and contains certain information about the potential value of the options based upon certain assumptions as to the appreciation of the Company's Common Stock over the life of the option. No options were granted to Messrs. Maughan and Lockwood during the year ended March 31, 2002.

8

<PAGE>

| | | | | Potential Realizable |

| Number of | Percent of | | | Value at Assumed |

| Securities | Total Options | | | Annual Rates of Stock Price |

| Underlying

Option | Granted to

Employees in | Exercise | Expiration | Appreciation for Option Term (2)

|

Name

| Granted (1)

| Fiscal Year

| Price

| Date

| 5%($)

| 10%($)

|

| | | | | |

| Jonathan P. McCreary | 10,000 | 8.29% | 15.550 | 09/18/11 | $143,100 | $322,500 |

____________________| (1) | Mr. McCreary's options vest at the rate of 33.33% per annum. Options will become immediately exercisable in the event of a change in control of the Company. |

| (2) | The dollar gains under these columns result from calculations required by the SEC's rules and are not intended to forecast future price appreciation of the Common Stock of the Company. It is important to note that options have value to the listed executive only if the stock price increases above the exercise price shown in the table during the effective option period. In order for the listed executives to realize the potential values set forth in the 5% and 10% columns in the table, the price per share of the Company's Common Stock would be approximately $29.86 and $47.80, respectively, as of the expiration of the options granted on September 18, 2001. |

Option Exercise/Value Table. The following table sets forth certain information about outstanding options under the Option Plan held by Messrs. Maughan, Lockwood and McCreary.

| | | Number of | |

| | | Securities Underlying | Value of Unexercised |

| | | Unexercised Options | In-the-Money Options |

| Shares

Acquired on | Value | at Fiscal Year End(#)

| at Fiscal Year End($)(1)

|

Name

| Exercise(#)

| Realized($)

| Exercisable

| Unexercisable

| Exercisable

| Unexercisable

|

| | | | | | |

| Berniel L. Maughan | -- | $-- | 10,000 | 40,000 | $ 94,950 | $379,800 |

| Zane F. Lockwood | -- | -- | 28,168 | 18,779 | 210,415 | 140,279 |

| Jonathan P. McCreary | -- | -- | 1,262 | 13,785 | 9,930 | 70,420 |

_______________

| (1) | Value of unexercised in-the-money options equals market value of shares covered by in-the-money options on March 31, 2002 less the option exercise price. Options are in-the-money if the market value of the shares covered by the options is greater than the option exercise price. |

Employment Agreements. The Company (the "Employer") entered into employment agreements ("Employment Agreement") with Messrs. Maughan, Lockwood and McCreary (individually, the "Executive") on May 22, 2000, April 1, 2000 and September 18, 2001, respectively. Messrs. Maughan's and Lockwood's Employment Agreements were subsequently amended on February 12, 2001 to provide the benefits to the Executive intended when the Board of Directors adopted the initial Employment Agreements.

Mr. Maughan's Employment Agreement has an initial four-year term, which may be extended annually for an additional year at the discretion of the Board of Directors of the Company. Mr. Lockwood's Employment Agreement was for an initial term of 20 months until June 1, 2001, and may be extended annually for an additional year at the discretion of the Board of Directors of the Company. Mr. McCreary's Employment Agreement is for an initial term of 20 months until August 1, 2002, and may be extended annually for an additional year at the discretion of the Board of Directors of the Company. The Employment Agreements provide that the Executive's base salary is subject to annual review by the Board of Directors. The current base salaries for Messrs. Maughan, Lockwood and McCreary are $175,000, $108,000 and $102,000, respectively. The Employment Agreements are terminable by the Employer at any time, by the Executive if the Executive is assigned duties inconsistent with his initial position, duties, responsibilities and status, or upon the occurrence of certain events specified by federal regulations.

The Employment Agreements provide for liquidated damages in the event of involuntary termination, not involving a change in control. Under this provision, Mr. Maughan would receive the lesser of three years' base salary

9

<PAGE>

or the base salary for the remaining term of his Employment Agreement, plus the average bonus paid over the last two fiscal years, all payable monthly. Messrs. Lockwood and McCreary would receive the lesser of 18 month's base salary or the base salary for the remaining term of each of their respective Employment Agreements, payable monthly. The Executives would also be entitled to health and other insurance coverage as currently provided. All of these payments would be reduced, dollar for dollar, by any earnings or insurance the Executive receives over this same time period from any other employment.

The Employment Agreements also provide for severance payments and other benefits in the event of involuntary termination of employment in connection with any change in control of the Employer. Severance payments also will be provided on a similar basis in connection with a voluntary termination of employment where, subsequent to a change in control, the Executive is assigned duties inconsistent with his position, duties, responsibilities and status immediately prior to such change in control. The term "change in control" is defined in the agreement as having occurred when, among other things, (a) a person other than the Company purchases shares of Common Stock pursuant to a tender or exchange offer for such shares, (b) any person (as such term is used in Sections 13(d) and 14(d)(2) of the Exchange Act) is or becomes the beneficial owner, directly or indirectly, of securities of the Company representing 25% or more of the combined voting power of the Company's then outstanding securities, (c) a majority of the membership of the Board of Directors changes as the result of a contested election, or (d) shareholders of the Company approve a merger, consolidation, sale or disposition of all or substantially all of the Company's assets, or a plan of partial or complete liquidation.

In the event of the Executive's termination six months preceding, at the time of, or within 24 months following a change of control, the Executives would be entitled to receive the liquidated damages described above and a lump sum cash payment equal to 2.99 times the Executive's base amount of compensation, minus the acceleration and lapse value of any unvested stock options. Assuming that a change in control had occurred at March 31, 2002 and that the Executives received a lump sum cash payment under the change in control provisions of the Employment Agreements, Messrs. Maughan, Lockwood and McCreary would have been entitled to a payment of approximately $541,000 $299,000 and $374,000, respectively. Section 280G of the Code provides that severance payments that equal or exceed three times the individual's base amount are deemed to "excess parachute payments" if they are contingent upon a change in control. Individuals receiving excess parachute payments are subject to a 20% excise tax on the amount of such excess payments. The Employment Agreements provide that in the event any payments or benefits provided to the Executives constitute excess parachute payments, the Employer will pay the Executive in cash any additional amounts equal to the amount needed to ensure that the amount of such payment and the value of such benefits received by the Executive, net of any taxes, equals the amount of such payments and value of such benefits as the Executive would receive in the absence of any excise taxes.

The Employment Agreements restrict the Executive's right to compete against the Employers for a period of one year from the date of termination of the Employment Agreement if the Executive voluntarily terminates employment, except in the event of a change in control.

AUDIT COMMITTEE MATTERS

Audit Committee Charter

The Audit Committee operates pursuant to a Charter approved by the Company's Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Company. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the Committee, as well as the relationship of the Audit Committee to the independent accountants, the internal audit department, and management of the Company.

10

<PAGE>

Report of the Audit Committee

In connection with the specific activities performed by the Committee in its oversight role, it has issued the following report:

| (1) | The Audit Committee has reviewed and discussed the audited financial statements as of and for the year ended March 31, 2002 with management of the Company. |

| |

| (2) | The Audit Committee has discussed with the independent auditors the matters required to be discussed by SAS 61 and SAS 90. |

| |

| (3) | The Audit Committee has received from the independent accountants, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committee, (i) a written disclosure, indicating all relationships, if any, between the independent auditor and its related entities and the Company and its related entities which, in the auditor's professional judgment, reasonably may be thought to bear on the auditor's independence, and (ii) a letter from the independent auditor confirming that, in its professional judgment, it is independent of the Company; and the Audit Committee has discussed with the auditor the auditor's independence from the Company. |

Based on the review and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors that the audited financial statements should be included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2002, for filing with the SEC.

The Audit Committee:

Edward H. Elms (Chairman)

John Gentry

Albert H. Durgan

Kevin D. Padrick

Independence and Other Matters

Each member of the Audit Committee is "independent," as defined under the Nasdaq Stock Market Rules. The Audit Committee members do not have any relationship to the Company that may interfere with the exercise of their independence from management and the Company. None of the Audit Committee members are current officers or employees of the Company or its affiliates.

COMPENSATION COMMITTEE MATTERS

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Report of the Compensation Committee and Performance Graph shall not be incorporated by reference into any such filings.

Report of the Compensation Committee. Under rules established by the SEC, the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company's Chief Executive Officer and other executive officers. The disclosure requirements for the Chief Executive Officer and other executive officers include the use of tables and a report explaining the rationale and considerations that led to the fundamental executive compensation decisions affecting those individuals.

11

<PAGE>

The Personnel and Compensation Committee ("Committee") of the Savings Bank's Board of Directors sets and administers all policies, as defined by the SEC, that govern the total compensation, including long-term compensation of the Company's Chief Executive Officer and other executive officers. None of the members of the Committee is an employee of the Company. The Committee's policy is to offer executive officers competitive compensation and benefits that will permit the Company to attract and retain highly qualified individuals and to motivate such individuals by rewarding them based on the Company's performance.

Currently, the Company's executive compensation package consists primarily of base salary and bonus awards. Individual executive salaries are established based on the individual's subjective performance evaluation, the Company's performance, and market parity. The Committee uses compensation and bonus survey data from the Oregon Banker's Association, America's Community Bankers, and the Washington Financial Industry for its market comparison. The data compares the Company's executive officers to those similarly situated in other similarly sized financial institutions in the region. The compensation of Mr. Maughan, the Company's President and Chief Executive Officer, is determined in the same manner as other executive officers as described above. Therefore, Mr. Maughan's compensation is largely dependent upon his individual performance, the Company's overall performance, and market comparison.

Bonuses may be awarded to executive and other officers of the Company based on their performance and that of the Company. The Committee determines the appropriate level of bonuses using the Committee's assessment of each executive officer's contributions to the Company's success. More specifically, the Company's return on average assets, return on equity, corporate management, and staffing controls all are used in this assessment.

The Company has implemented a Stock Option Plan and MRDP as part of its overall compensation to executive officers.

The Company provides benefits to its executive officers that are generally available to other Company officers and employees. This includes a 401(k) profit sharing plan, an employee stock ownership plan, and a non-qualified deferred compensation plan for key executives. A committee appointed by the Board of Directors administers the plans. Mr. Maughan participates in the 401(k) profit sharing plan and the employee stock ownership plan.

The Committee has recognized that the efforts of key Company executives are, and will continue to be, paramount to its success. Therefore, the Board of Directors approved, based upon the Committee's recommendation, the adoption of an employment agreement with Mr. Maughan, which is designed to retain him and allow him a concerted focus on Company operations. The terms of Mr. Maughan's employment agreement is discussed under "Executive Compensation -- Employment Agreements."

The Committee has reviewed the total compensation of all executive officers during fiscal year 2002 and has concluded that their compensation is reasonable and consistent with the Company's compensation philosophy and industry practice.

PERSONNEL AND COMPENSATION COMMITTEE

/s/ Charles H. Rouse (Chairman)

/s/John Lienkaemper

/s/ Edward H. Elms

Compensation Committee Interlocks and Insider Participation. No executive officer of the Company or the Savings Bank has served as a member of the compensation committee of another entity, one of whose executive officers served on the Personnel Committee. No executive officer of the Company or the Savings Bank has served as a director of another entity, one of whose executive officers served on the Personnel Committee. No executive officer of the Company or the Savings Bank has served as a member of the compensation committee of another entity, one of whose executive officers served as a director of the Company or the Savings Bank.

12

<PAGE>

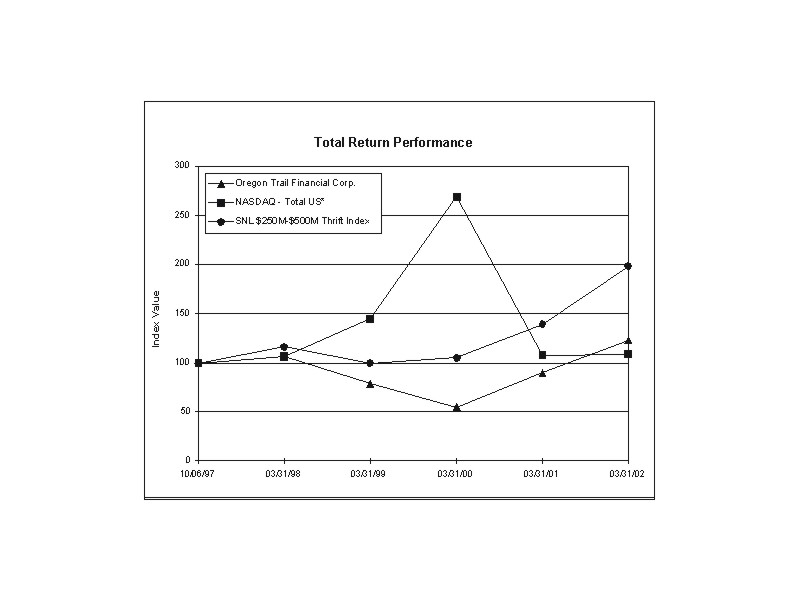

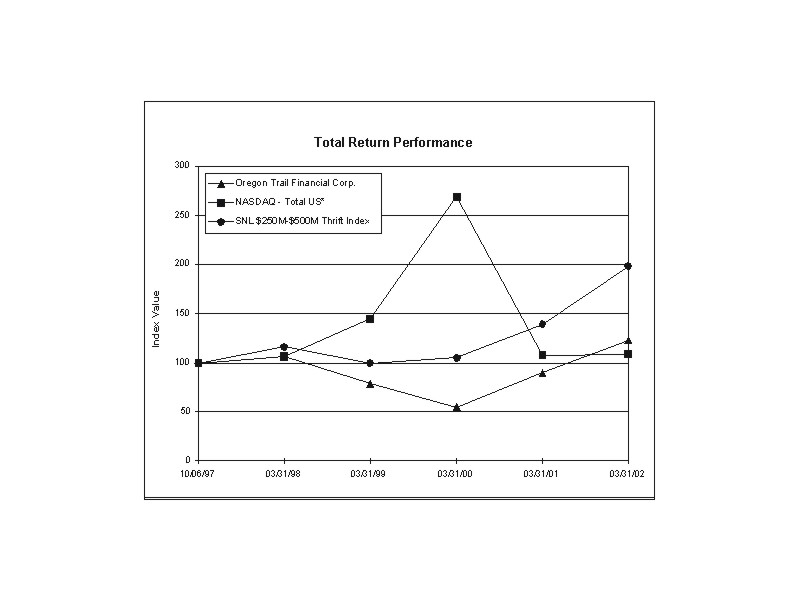

Performance Graph. The following graph compares the cumulative total shareholder return on the Company's Common Stock with the cumulative total return on the Nasdaq U.S. Companies Index and a peer group of the SNL Securities, Inc. $250 Million to $500 Million Asset Thrift Index. Total return assumes (i) the reinvestment of all dividends and (ii) the value of the investment in the Company's Common Stock and each index was $100 at the close of trading on October 6, 1997, the date on which the Company's Common Stock began trading on the Nasdaq National Market.

| Period Ended

|

Index

| 10-06-97

| 03/31/98

| 03/31/99

| 03/31/00

| 03/31/01

| 03/31/02

|

| Oregon Trail Financial Corp. | $100.00 | 106.26 | 78.26 | 54.99 | 90.29 | 122.44 |

| NASDAQ - Total U.S.* | 100.00 | 107.16 | 144.76 | 268.88 | 107.54 | 108.29 |

| SNL $250MM to $500MM Thrift Index | 100.00 | 116.82 | 99.50 | 104.63 | 139.58 | 198.44 |

*Source: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago, 2001. Used with permission. All rights reserved. crsp.com

13

<PAGE>

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than 10% of any registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms it has received and written representations provided to the Company by the above referenced persons, the Company believes that during the fiscal year ended March 31, 2002 all filing requirements applicable to its reporting officers, directors and greater than 10% shareholders were properly and timely complied with, except for the amendment of Form 4s for each of the Company's directors that were initially filed on October 10, 2001 and amended on December 19, 2001. The stock holdings of the Company's directors and officers were further amended with the filing of Forms 5 for each individual on May 14, 2002. Additionally, it was discovered that an Initial Statement of Beneficial Ownership on Form 3 had not been filed for Mr. Jonathan P. McCreary, the Chief Financial Officer of the Company, in July 2000, which was subsequently filed on May 14, 2002.

TRANSACTIONS WITH MANAGEMENT

Federal regulations require that all loans or extensions of credit to executive officers and directors of insured financial institutions must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, except for loans made pursuant to programs generally available to all employees, and must not involve more than the normal risk of repayment or present other unfavorable features. The Company's subsidiary financial institution is therefore prohibited from making any new loans or extensions of credit to executive officers and directors at different rates or terms than those offered to the general public, except for loans made pursuant to programs generally available to all employees, and has adopted a policy to this effect. In addition, loans made to a director or executive officer in an amount that, when aggregated with the amount of all other loans to such person and his or her related interests, are in excess of the greater of $25,000 or 5% of the Savings Bank's capital and surplus (up to a maximum of $500,000) must be approved in advance by a majority of the disinterested members of the Board of Directors. At March 31, 2002, loans to directors and executive officers totalled approximately $1.6 million.

PROPOSAL II -- APPROVAL OF APPOINTMENT OF INDEPENDENT AUDITORS

Deloitte & Touche LLP served as the Company's independent auditors for the calendar year ended March 31, 2002. The Board of Directors has appointed Deloitte & Touche LLP as independent auditors for the fiscal year ending March 31, 2003, subject to approval by stockholders. A representative of Deloitte & Touche LLP is expected to be present at the Meeting to respond to stockholders' questions and will have the opportunity to make a statement if he or she so desires.

Audit Fees

The aggregate fees billed to the Company by Deloitte & Touche LLP for professional services rendered for the audit of the Company's financial statements for fiscal 2002 and the reviews of the financial statements included in the Company Forms 10-Q for that year, including travel expenses, were $89,786.

14

<PAGE>

Financial Information Systems Design and Implementation Fees

Deloitte & Touche LLP performed no financial information system design or implementation work for the Company during the fiscal year ended March 31, 2002.

All Other Fees

Other than audit fees, the aggregate fees billed to the Company by Deloitte & Touche LLP for fiscal 2002, none of which were financial information systems design and implementation fees, were approximately $12,164. The Audit Committee of the Board of Directors determined that the services performed by Deloitte & Touche LLP other than audit services are not incompatible with Deloitte & Touche LLP maintaining its independence.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE APPROVAL OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS OF THE COMPANY FOR THE FISCAL YEAR ENDING MARCH 31, 2003.

OTHER MATTERS

The Board of Directors is not aware of any business to come before the Meeting other than those matters described above in this Proxy Statement. However, if any other matters should properly come before the Meeting, it is intended that the persons named as proxies on the enclosed green proxy card will have discretionary voting authority regarding any such matters. The persons voting these proxies may exercise discretionary authority only as to matters unknown to the Company a reasonable time before this proxy solicitation.

MISCELLANEOUS

The cost of solicitation of proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of common stock. In addition to solicitations by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone without additional compensation.

The Company's Annual Report to Stockholders has been mailed to stockholders as of the close of business on the Voting Record Date. Any stockholder who has not received a copy of such Annual Report may obtain a copy by writing to the Secretary of the Company. The Annual Report is not to be treated as part of the proxy solicitation material or as having been incorporated herein by reference.

STOCKHOLDER PROPOSALS

In order to be eligible for inclusion in the Company's proxy solicitation materials for next year's Meeting of Stockholders, any stockholder proposal to take action at such meeting must be received at the Company's main office at 2055 First Street, Baker City, Oregon, no later than March 31, 2003. Any such proposals shall be subject to the requirements of the proxy solicitation rules adopted under the Exchange Act.

The Company's Articles of Incorporation generally provide that shareholders will have the opportunity to nominate directors of the Company if such nominations are made in writing and are delivered to the Secretary of the Company not less than 30 days nor more than 60 days before the annual meeting of shareholders; provided, however, if less than 31 days notice of the annual meeting is given, such notice shall be delivered to the Secretary of the Company no later than the close of the tenth day following the date on which notice of the meeting was mailed to shareholders.

15

<PAGE>

The notice must set forth (i) the name, age, business address and, if known, residence address of each nominee for election as a director, (ii) the principal occupation or employment of each nominee, (iii) the number of shares of stock of the Company which are beneficially owned by each such nominee, (iv) such other information as would be required to be included in a proxy statement soliciting proxies for the election of the proposed nominee pursuant to the Exchange Act, including, without limitation, such person's written consent to being named in the proxy statement as a nominee and to serving as a director, if elected, and (v) as to the shareholder giving such notice (a) his or her name and address as they appear on the Company's books and (b) the class and number of shares of the Company which are beneficially owned by such shareholder.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Zane F. Lockwood ZANE F. LOCKWOOD CORPORATE SECRETARYBaker City, OregonJuly 26, 2002

FORM 10-K

A copy of the Company's Form 10-K for the fiscal year ended March 31, 2002, as filed with the SEC will be furnished without charge to stockholders as of the close of business on the Voting Record Date upon written request to Zane F. Lockwood, Corporate Secretary, Oregon Trail Financial Corp., 2055 First Street, Baker City, Oregon 97814.

16

<PAGE>

REVOCABLE PROXY

OREGON TRAIL FINANCIAL CORP.

ANNUAL MEETING OF STOCKHOLDERS

AUGUST 28, 2002

I hereby appoint Stephen R. Whittemore and Berniel L. Maughan with full powers of substitution, as my attorneys and proxies to vote all shares of common stock of Oregon Trail Financial Corp. that I am entitled to vote at the Annual Meeting of Stockholders, to be held at the Sunridge Inn and Conference Center, One Sunridge Lane, Baker City, Oregon, on Wednesday, August 28, 2002 at 10:00 a.m., Pacific Daylight Time, and at any and all adjournments thereof, with respect to the following.

| | | | FOR ALL |

| | FOR

| WITHHOLD

| EXCEPT

|

|

| 1. | The election as directors of all nominees | [ ] | [ ] | [ ] |

| listed (except as marked to the contrary below). |

|

| Albert H. Durgan | | | |

| Edward H. Elms | | | |

|

| INSTRUCTION: To withhold authority to vote for any |

| individual nominee, mark "For All Except" and write |

| that nominee's name on the space provided below. |

|

| __________________________________________ |

|

| 2. | The approval of the appointment of Deloitte & | FOR

| AGAINST

| ABSTAIN

|

| Touche LLP as independent auditors for the |

| fiscal year ending March 31, 2003. | [ ] | [ ] | [ ] |

|

| 3. | In their discretion, upon such other matters |

| as may properly come before the meeting. |

|

| The Board of Directors recommends a vote "FOR" the above proposals. |

THE NAMED PROXIES WILL VOTE YOUR SHARES AS YOU INSTRUCT, BUT IF YOU DO NOT SPECIFY HOW YOU WANT TO VOTE YOUR SHARES, THE NAMED PROXIES WILL VOTE YOUR SHARES FOR THE BOARD OF DIRECTORS' NOMINEES IN THE ELECTION OF DIRECTORS AND FOR THE APPROVAL OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS. THE NAMED PROXIES WILL VOTE YOUR SHARES IN THEIR BEST JUDGMENT ON ANY OTHER MATTERS PRESENTED AT THE MEETING. THE NAMED PROXIES VOTING THESE PROXIES MAY EXERCISE DISCRETIONARY AUTHORITY ONLY AS TO MATTERS UNKNOWN TO THE COMPANY A REASONABLE TIME BEFORE THE PROXY SOLICITATION. THE BOARD OF DIRECTORS DOES NOT KNOW OF ANY OTHER MATTERS TO BE PRESENTED AT THE MEETING.

<PAGE>

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

Should the stockholder(s) be present and elect to vote at the Meeting or at any adjournment thereof and after notification to the Secretary of the Company at the Meeting of the stockholder's decision to terminate this proxy, then the power of said attorneys and proxies shall be deemed terminated and of no further force and effect. This proxy revokes all prior proxies given by the stockholder(s).

The undersigned stockholder acknowledges receipt from the Company prior to the execution of this proxy of the Notice of Annual Meeting of Stockholders, a Proxy Statement for the Annual Meeting of Stockholders, and the 2002 Annual Report to Stockholders.

| Dated:______________, 2002 |

|

| |

|

| PRINT NAME OF SHAREHOLDER | | PRINT NAME OF SHAREHOLDER |

| | |

| |

|

| SIGNATURE OF SHAREHOLDER | | SIGNATURE OF SHAREHOLDER |

Please sign exactly as your name appears on the enclosed card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, only one signature is required, but each holder should sign, if possible.

PLEASE COMPLETE, DATE, SIGN AND MAIL THIS PROXY PROMPTLY IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE.