QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to (§) 240.14a-11(c) or (§) 240.14a-12

|

Horizon Organic Holding Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box) |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | 1. | | Title of each class of securities to which transaction applies:

|

| | | 2. | | Aggregate number of securities to which transaction applies:

|

| | | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | 4. | | Proposed maximum aggregate value of transaction:

|

| | | 5. | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | 6. | | Amount Previously Paid:

|

| | | 7. | | Form, Schedule or Registration Statement No.:

|

| | | 8. | | Filing Party:

|

| | | 9. | | Date Filed:

|

HORIZON ORGANIC HOLDING CORPORATION

6311 Horizon Lane

Longmont, Colorado 80503

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14, 2002

To the Stockholders of Horizon Organic Holding Corporation:

Notice Is Hereby Given that the Annual Meeting of Stockholders of Horizon Organic Holding Corporation, a Delaware corporation (the "Company"), will be held on Tuesday May 14, 2002 at 9:30 a.m. local time at the Company's offices at 6311 Horizon Lane, Longmont, Colorado 80503, located North of Boulder, Colorado in the Monarch Office Park off of Highway 52, East of Highway 119, for the following purposes:

- 1.

- To elect three directors to hold office until the 2005 Annual Meeting of Stockholders. The nominees are Mark A. Retzloff, Charles F. Marcy, and G. Irwin Gordon.

- 2.

- To ratify the election of Kathryn A. Paul and Cynthia T. Jamison to the Board of Directors pursuant to which they will serve until the 2004 Annual Meeting of Stockholders.

- 3.

- To ratify and approve the amendment of the Company's 1998 Equity Incentive Plan to increase the number of shares available for issuance under the Plan by 750,000 shares, from the current amount of 1,500,000 to an aggregate of 2,250,000 shares.

- 4.

- To ratify and approve the appointment of KPMG LLP as the Company's independent auditors for the fiscal year ending December 31, 2002.

- 5.

- To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 15, 2002 as the record date for the determination of stockholders entitled to notice of, and to vote at, this Annual Meeting and at any adjournment or postponement thereof.

| | | By Order of the Board of Directors |

|

|

/s/ THOMAS P. BRIGGS

Thomas P. Briggs

Assistant Secretary |

Boulder, Colorado

March 18, 2002

All Stockholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Even if you have given your proxy, you may still vote in person if you attend the meeting and cast your vote.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain from the record holder a proxy issued in your name.

HORIZON ORGANIC HOLDING CORPORATION

6311 Horizon Lane

Longmont, Colorado 80503

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

May 14, 2002

INFORMATION CONCERNING SOLICITATION AND VOTING

General

We are soliciting the enclosed proxy on behalf of our board of directors for use at the Annual Meeting of Stockholders to be held on May 14, 2002, at 9:30 a.m. local time (the "Annual Meeting"), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting.

The Annual Meeting will be held at our offices, 6311 Horizon Lane, Longmont, Colorado 80503, located North of Boulder, Colorado in the Monarch Office Park off of Highway 52, East of Highway 119. On or about April 4, 2002, we intend to mail this proxy statement and accompanying proxy card to all stockholders entitled to vote at the Annual Meeting.

Solicitation

We will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy, and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries, and custodians holding in their names shares of common stock beneficially owned by others, to be forwarded to such beneficial owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by our directors, officers, or other regular employees. No additional compensation will be paid to directors, officers, or other regular employees for such services.

Voting Rights and Outstanding Shares

Only holders of record of our common stock at the close of business on March 15, 2002 will be entitled to notice of, and to vote at, the Annual Meeting. At the close of business on March 15, 2002 we had 10,151,492 shares of common stock outstanding and entitled to vote.

Each holder of record of common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing a written notice of revocation or a duly executed proxy bearing a later date with the our Assistant Secretary at our principal executive office, 6311 Horizon Lane, Longmont, Colorado 80503, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Stockholder Proposals

The deadline for submitting a stockholder proposal for inclusion in our proxy statement and form of proxy for our 2003 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission and our Bylaws is December 2, 2002. Unless a stockholder who wishes to bring a matter before the stockholders at our 2003 annual meeting of stockholders notifies us of such matter prior to February 15, 2003, management will have discretionary authority to vote all shares for which it has proxies in opposition to such matter.

Proposal 1

Election of Directors

Our Amended and Restated Certificate of Incorporation and Bylaws provide that our board of directors shall be divided into three classes, each class consisting of the directors assigned to such class in accordance with a resolution adopted by the board of directors, with each class having a three-year term. Vacancies on the board may be filled only by persons elected by a majority of the remaining directors. A director elected by the board to fill a vacancy (including a vacancy created by an increase in the board) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director's successor is elected and qualified. We have ten board of directors positions, all of which are currently filled.

Mark A. Retzloff, Charles "Chuck" F. Marcy, and G. Irwin Gordon, the nominees for election to this current class, are all currently directors. Our stockholders previously elected Messrs. Retzloff and Gordon. Mr. Marcy was elected in January 2000 by our board of directors to fill a vacancy. If elected at the Annual Meeting, the nominees will serve until the 2005 annual meeting and until their successors are elected and have qualified, or until their earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. In the event that the nominees should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominees as management may propose. The persons nominated for election have agreed to serve if elected, and management has no reason to believe that the nominees will be not be able to serve.

Proxies cannot be voted for a greater number of persons than the number of nominees named below.

Set forth below is biographical information for the each person nominated and each person whose term of office as a director will continue after the Annual Meeting.

Mark A. Retzloff, our co-founder, has served as a director since December 1991. Mr. Retzloff has held several positions with us, including President and Treasurer from December 1991 to May 1995; Vice President, Sales and Marketing and Treasurer from May 1995 to May 1997; Vice President, Sales from May 1997 to January 1999; Senior Vice President Corporate Development from January 1999 to January 2000; and President, International from January 1999 to February 2001. Mr. Retzloff retired as an officer in February 2001. Since July 2001, Mr. Retzloff has served as President and Chief Executive Officer of Rudi's Bakery, Inc., a manufacturer of organic breads. Mr. Retzloff has served on the board of directors of the Organic Trade Association from September 1992 to October 2000 and as its President from September 1996 to September 1999. Mr. Retzloff received a Bachelors degree from the University of Michigan.

Charles "Chuck" F. Marcy joined us as President and Chief Operating Officer in November 1999 and in January 2000 was appointed to the additional position of Chief Executive Officer, at which time he was also appointed as a director. Mr. Marcy previously served as President and Chief Executive Officer of the Sealright Corporation, a manufacturer of dairy packaging and packaging systems from 1995 to 1998. From 1993 to 1995 Mr. Marcy was President of the Golden Grain Company, a subsidiary of Quaker Oats Company and maker of the Near East brand of all-natural grain-based food products. From 1991 to 1993 Mr. Marcy was President of the dairy division of Kraft General Foods. From 1974 to 1991 Mr. Marcy held various senior marketing and strategic planning roles with Sara Lee Corporation and Kraft General Foods, both food manufacturing and marketing companies. Mr. Marcy received his undergraduate degree in mathematics and economics from Washington and Jefferson College and a Masters of Business Administration degree, with a concentration in marketing and general management, from the Harvard Business School. He currently serves as a member of the board of directors of the International Dairy Foods Association and the Community Food Share.

G. Irwin Gordon has served as a director since July 1998. Mr. Gordon is the founder and managing partner of The Trion Group, a Dallas, Texas based consulting and interim management firm. Mr. Gordon held the position of President and Chief Executive Officer of Gruma Corporation, a food manufacturing and marketing company, from July 2000 to September 2001. Mr. Gordon served as President and Chief Operating Officer of Suiza Foods Corporation from February 1998 to October 1999. Mr. Gordon joined Suiza Foods Corporation in August 1997 as its Executive Vice President and Chief Marketing Officer. Prior to joining Suiza Foods Corporation, Mr. Gordon served in various capacities for PepsiCo, Inc., most recently as Senior Vice President Global Branding for Frito Lay. Mr. Gordon received an Education degree from the University of British Columbia and a Management Certificate from Stanford University. Mr. Gordon currently serves on the board of directors of the Hestra Corporation, where he serves as the chair of the audit committee and is a member of the governance committee.

The Board Of Directors Recommends That You

Vote In Favor Of The Named Nominees

Paul B. Repetto, our co-founder, has served as our corporate secretary and a director since December 1991. Mr. Repetto was our Vice President, Operations from December 1991 until December 1997; Vice President, Marketing from December 1997 until January 1999; and Senior Vice President, Marketing until January 2000. During 2000, Mr. Repetto retired, but continued to work on special projects for us. Mr. Repetto has served on the Steering Committee of the Organic Foods Alliance and on the board of the Organic Foods Production Association of North America, the predecessor organizations to the Organic Trade Association. Mr. Repetto received a Bachelors degree from the Massachusetts Institute of Technology.

Clark R. Mandigo II has served as a director since July 1996. Since 1991, Mr. Mandigo has been self-employed as a business consultant and investor. He currently serves as chairman of the board for Lone Star Steakhouse & Saloon Inc., a retail restaurant chain, where he is a member of the nominating committee. Mr. Mandigo also serves as a Trustee for Accolade Funds, where he serves on the audit committee, and as a Trustee for U.S. Global Investors Funds, where he also serves on the audit committee. Mr. Mandigo received a Bachelors of Arts degree and a Juris Doctorate degree from the University of Kansas.

Richard L. Robinson has served as a director since July 1996. Mr. Robinson has been the Chairman of Robinson Dairy, Inc., a subsidiary of Dean Foods Company, since 1975 and served as Chief Executive Officer of Robinson Dairy, Inc. from 1975 to July 1999. Mr. Robinson currently serves on the board of directors of U.S. Exploration, Inc. where he is a member of the audit committee. In addition, Mr. Robinson currently serves as a director for HCA Health One and is a member of the Management Committee for Consolidated Container Corp. From 1993 to 1999, Mr. Robinson served as a Director for US Bancorp where he was a member of the compensation and audit committees. From 1986 to 2000, Mr. Robinson served as a director of Asset Investors, Inc., where he served as a member of the audit committee. Mr. Robinson received a Bachelors degree from Colorado State University.

Michelle P. Goolsby has served as a director since November 1999. Ms. Goolsby joined Dean Foods Company in July 1998 as Executive Vice-President, General Counsel and Secretary. In September 1999, she assumed the additional duties of Chief Administrative Officer. From September 1988 until July 1998, she held various positions with the law firm of Winstead Sechrest & Minick. Ms. Goolsby was elected to our board pursuant to Dean Foods Company's stockholder agreement with us under which Dean Foods Company is entitled to certain board representation. Ms. Goolsby received a Juris Doctorate degree and a Bachelors degree from the University of Texas.

Thomas D. McCloskey, Jr. has served as a director since April 1994 and has served as our Chairman of the board of directors from May 1994 until November 1997 and again from May 1999 until the present. Mr. McCloskey has served as Chairman of Cornerstone Holdings, LLC (and predecessor corporation), an investment firm, since 1981. Mr. McCloskey received a bachelors degree from the University of Notre Dame and a Masters of Business Administration from The Wharton School of the University of Pennsylvania.

Kathryn A. Paul has served as a director since June 2001. Ms. Paul joined Delta Dental Plan of Colorado, a dental insurance benefits company, as President in August 2001. Prior to joining Delta Dental Plan of Colorado, Ms. Paul served as President, Western Operations of Kaiser Permanente, a national health care organization. Ms. Paul held various management positions with the Kaiser Permanente organization from 1978 to 2001. Ms. Paul received a Bachelors degree from the University of California, a Master of Public Health degree from the University of California-Berkeley, and an Advanced Management Program certificate from Harvard University. Ms. Paul currently serves on the board of directors for Fischer Imaging Corporation, where she is a member of the audit and compensation committees.

Cynthia T. Jamison has served as a director since March 2002. Ms. Jamison has been a partner with Tatum CFO Partners, LLP, a financial consulting firm, since June 1999. While at Tatum CFO Partners, LLP, Ms. Jamison served as CFO for CultureWorx, Inc., a software manufacturer, from August 2000 to February 2002 and ISCO International, a wireless network equipment manufacturer, from August 1999 to August 2000. Prior to joining Tatum CFO Partners, LLP, Ms. Jamison was the CFO for Chart House Enterprises, Inc., a publicly traded restaurant owner and operator, from June 1998 to April 1999. Ms. Jamison was also the Vice President of Finance for Allied Domecq Retailing USA, the owner of Baskin Robbins and Dunkin Donuts. Ms. Jamison received a Bachelors of Arts degree in economics from Duke University and a Masters of Business Administration from the University of Chicago. Ms. Jamison is also a Certified Public Accountant.

During the fiscal year ended December 31, 2001, our board of directors held four meetings. The board currently has four standing committees, the Audit Committee, the Compensation Committee, the Executive Committee, and the Governance Committee (formerly the Nominating Committee). During the fiscal year ended December 31, 2001, all of our directors attended at least 90% of the meetings held by our board and the committees on which they served.

The Audit Committee makes recommendations to our board regarding the engagement of our independent certified public accountants. It reviews our internal accounting procedures and monitors and reviews the scope and results of our annual audit. The Audit Committee also reviews our annual and quarterly reports that we file with the Securities and Exchange Commission. The Audit Committee is composed of three non-employee directors: Messrs. Gordon, Mandigo, and Robinson. Mr. Gordon is Chairman of the Audit Committee. The Audit Committee met four times during 2001.

The Compensation Committee is responsible for providing guidance, direction, and periodic monitoring for all corporate compensation, benefit, perquisite, and employee equity programs. The Compensation Committee reviews and approves matters involving the following: the compensation, benefits, and perquisites for all corporate officers, other than a corporate officer only holding the title of Secretary; all bonus plans, total bonus payments, and individual awards to all corporate officers; benefit plans, including profit sharing and pension programs; and employment agreements for all corporate officers and for all others with base salaries in excess of $100,000. The Compensation Committee also grants all of our stock option awards. The Compensation Committee is composed of three non-employee directors: Ms. Goolsby and Messrs. Mandigo and Robinson. Mr. Mandigo is Chairman of the Compensation Committee. It met four times during 2001.

The Executive Committee is authorized to do the following: grant stock options to employees and consultants of no more than a total of 30,000 options per year, which right shall not limit the authority of the Compensation Committee; to adopt resolutions that are required in order to authorize the establishment of financial accounts for our company and to permit our company to incur indebtedness; authorize the hiring or termination of employees, other than the positions of chief executive officer and chief financial officer; and to authorize capital expenditures of up to $500,000 in any one single transaction, but no more than two such transactions in any 12 month rolling period. The Executive Committee is composed of Messrs. McCloskey and Marcy. It met informally several times during 2001.

The Governance Committee is authorized to consider and make recommendations to the board concerning corporate governance issues and the composition and performance of the board and its committees. The Governance Committee will not consider nominees for director positions from stockholders. During 2001 the Governance Committee was composed of Messrs. McCloskey, Gordon and Mandigo. Mr. McCloskey was the Chairman of the Governance Committee. It met one time during 2001. In February 2002, the membership of the Governance Committee was reconstituted with Ms. Paul and Messrs. Marcy, McCloskey, and Retzloff as its members. Ms. Paul is the Chairwoman of the Governance Committee.

Proposal 2

Ratification of Directors

Our directors elected Kathryn A. Paul to our board in June 2001 and Cynthia T. Jamison to our board in March 2002. Our board has directed that we submit the elections of Ms. Paul and Ms. Jamison to our stockholders for ratification at the Annual Meeting.

Biographical information for Ms. Paul and Ms. Jamison is contained under Proposal 1. In addition, under Proposal 1, you will find information concerning the other members of our board, the composition of our board, the classes of our board, and other board and committee information. Ms. Paul and Ms. Jamison are members of Class III of our board and will serve until the 2004 Annual Meeting of Stockholders or until their successors are elected and qualified.

There is no requirement that our stockholders ratify the elections of Ms. Paul and Ms. Jamison. However, the board is submitting the elections of Ms. Paul and Ms. Jamison to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the elections, the board will reconsider its election of these two individuals.

The ratification of the elections of Ms. Paul and Ms. Jamison shall be made in accordance with the same procedures for electing directors under Proposal 1 above. Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the ratification of the elections of Ms. Paul and Ms. Jamison.

The Board of Directors Recommends that

You Vote in Favor of Proposal 2

Proposal 3

Approval of Amendment to the 1998 Equity Incentive Plan

Introduction

At the Annual Meeting, our stockholders are being asked to ratify and to approve an amendment to the 1998 Equity Incentive Plan (the "Plan") to increase the number of shares of common stock reserved for issuance under the Plan by 750,000 shares, to an aggregate of 2,250,000 shares. The board has adopted the amendment, subject to stockholder approval at the Annual Meeting.

We believe that long-term equity compensation in the form of stock options is critical to our efforts to attract qualified employees and to retain and provide incentive to current employees, particularly in light of the increasingly competitive environment for talented personnel. As of December 31, 2001 there were approximately 394,976 shares available for future grants under the Plan. The board believes that the number of shares currently available under the Plan is likely to be insufficient in the event of continued growth in our operations, including potential increases in the number of employees. For this reason, the board has determined that it is in our best interest to increase the number of shares available for issuance under the Plan by 750,000 shares. Accordingly, the board recommends that the stockholders vote "FOR" ratification and approval of the amendment of the Plan. Unless otherwise directed therein, the proxies solicited hereby will be voted for ratification and approval of the amendment of the Plan.

Although we are only proposing to amend the number of shares available for issuance under the Plan, set forth below is a summary of the principal features of the Plan. The summary, however, does not purport to be a complete description of all the provisions of the Plan. Any stockholders who wish to obtain a copy of the actual Plan documents may do so upon written request to our Assistant Secretary at our principal offices at 6311 Horizon Lane, Longmont, Colorado 80503. In addition, the Plan documents have previously been filed with the Securities and Exchange Commission as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2000.

General

The purposes of the Plan are for us to obtain the benefits of the incentive inherent in the ownership of our common stock by our employees who are important to our success and growth of our business, to help us retain the services of such persons, and to compensate such persons for their service to us. The number of our employees who are eligible to participate in the Plan is currently 250.

The aggregate number of shares which may be issued, and as to which stock options may be granted under the Plan is currently 1,500,000 shares of Common Stock (excluding any increase by the proposed amendment), subject to proportionate adjustment by reason of merger, consolidation, reorganization, recapitalization, or exchange of shares or by stock dividend, stock split, combination of shares, or other changes in capital structure effected without receipt of consideration. If any stock option granted under the Plan expires, is surrendered in whole or in part, or terminates for any reason without being exercised in full, then the number of shares subject to the stock option will again be available for purposes of the Plan. The shares of common stock which may be issued under the Plan may be either authorized but unissued shares or treasury shares, or both.

An option holder shall have none of the rights of a stockholder with respect to any shares covered by the option until such individual shall have exercised the option, paid the option price, and been issued a stock certificate for the purchased shares. Upon exercise of the option, payment of the option price and issuance of the stock certificate, the option holder shall have all of the rights of a stockholder with respect to such shares including voting and dividend rights, subject only to the provisions of the Plan and other instruments implementing the provisions of the Plan.

Administration

The Plan is to be administered by our board of directors. The board, however, may at any time appoint a committee of two (2) or more non-employee directors and delegate to such committee one or more of the administrative powers allocated to the board under the provisions of the Plan. The board currently delegates its authority under the Plan to the Compensation Committee. The administrative powers under the Plan include, but are not limited to, the following:

- •

- the power to determine the person or persons to be granted options under the Plan;

- •

- the number of shares to be covered by such options;

- •

- whether such options are to be incentive stock options ("Incentive Stock Options") under Section 422A of the Internal Revenue Code of 1986, as amended, nonqualified options ("Nonstatutory Stock Options") not intended to meet the requirements of Section 422A, or stock bonuses and grants of restricted stock (the "Stock Bonuses") (collectively, the "Stock Awards");

- •

- the time or times at which options are to be exercisable; and

- •

- the power to interpret and amend the Plan, subject to further approval by the stockholders for certain amendments required by statute, Securities and Exchange Commission regulations, or NASDAQ rules to be approved by the stockholders.

All questions of interpretation and application of the Plan, or as to stock options granted under the Plan are subject to the determination of the board or the Compensation Committee, which will be final and binding.

Eligibility and Grant of Stock Options

The persons who are eligible to receive options pursuant to the Plan are our employees, Directors, and Consultants, as the last two terms are defined in the Plan, including employees who are also members of the board, as the board or the Compensation Committee shall from time to time select.

The board or the Compensation Committee has the full and absolute authority to determine the number of shares to be covered by granted options, whether options are to be Incentive Stock Options, Nonstatutory Stock Options or Stock Bonuses, as well as the time or times at which options are to be exercisable and such other terms and conditions as may be applicable to such options. However, no option granted under the Plan shall have a term in excess of ten (10) years from the grant date.

The option price per share for Incentive Stock Options and Nonstatutory Stock Options will be fixed by the board or the Compensation Committee, but in no event shall the option price per share for Incentive Stock Options be less than one hundred percent (100%) of the fair market value of a share of common stock on the date of the option grant. The Plan has specific provisions for determining the fair market value of common stock for the purpose of determining the option price.

Transfers

No Incentive Stock Options granted under the Plan shall be transferable by the optionee other than by will or by the laws of descent and distribution. Nonstatutory Stock Options and Stock Bonuses may be transferable to the extent expressly provided in the Option Agreement or Stock Award Agreement.

Adjustment of Shares

If any changes made in the shares subject to the Plan or subject to any option granted under the Plan, either through merger, consolidation, reorganization, recapitalization, stock dividend, split-up, combination of shares, exchange of shares, issuance of rights to subscribe, or change in capital structure, appropriate adjustments or substitutions shall be made by the board or the Compensation Committee in or for such shares, including adjustments in the maximum number of shares subject to the Plan and the number of such shares and price per share subject to the Plan and the number of such shares and price per share subject outstanding options granted under the Plan, as the board or the Compensation Committee, in its sole discretion shall deem equitable to prevent dilution or enlargement of option rights.

In the event of a sale of all or substantially all of our assets or fifty percent (50%) or more of our outstanding voting stock by means of a sale, merger, reorganization or liquidation, the outstanding options shall be assumed by the successor corporation, or parent thereof, or be replaced with a comparable option to purchase shares of the capital stock of the successor corporation, or parent thereof. In the event the surviving or acquiring corporation refuses to assume such options or substitute similar options, then the Stock Awards shall accelerate in vesting and become fully vested prior to the event. Each person holding unexercised options shall be entitled to have such options assumed by the successor corporation, or parent thereof, or replaced with a comparable option, as the case may be. The board will make the determination of option comparability, and its determination shall be final, binding, and conclusive.

Amendment and Termination of the Plan

The board has the power and authority to amend or modify the Plan in any or all respects, whatsoever; provided, however, that no such amendment or modification shall, without the consent of the option holders, adversely affect rights and obligations with respect to options at the time outstanding under the Plan. Furthermore, the board shall, except for amendments relating to adjustments upon changes in the stock, obtain the approval of our stockholders for all such amendments as are required by statute, Securities and Exchange Commission regulation, or Nasdaq rules to be approved by the stockholders.

The Plan, unless sooner terminated, shall terminate at the close of business on April 13, 2008. The board shall have the authority to effect, at any time and from time to time, with the consent of the affected optionee, the cancellation of any or all outstanding options under the Plan and to grant in substitution therefore new options under the Plan covering the same or different numbers of shares of common stock but having an option price per share not less than one hundred percent (100%) of fair market value on the new grant date.

Plan Benefits

We cannot currently determine the number of shares subject to the options that may be granted in the future to executive officers, directors and employees under the Plan. The following table sets forth information with respect to the stock options granted under the Plan during the fiscal year 2001 to the named executive officers, all current named executive officers as a group, all current directors other than the named executive officers as a group, and all employees, including all other officers who are not named executive officers, as a group.

Name

| | Weighted Average

Exercise

Price Per Share

| | Number of Shares Subject to

Options Granted

under the Plan in 2001

|

|---|

| Charles F. Marcy | | 4.94 | | 80,000 |

| Thomas P. Briggs | | 4.94 | | 20,000 |

| Clark F. Driftmeir | | 4.94 | | 20,000 |

| Kevin R. O'Rell | | 4.94 | | 10,000 |

| Stephen J. Jacobson | | 4.94 | | 15,000 |

| Mark A. Retzloff | | 7.00 | | 6,000 |

| All six of the executive officers listed above, as a group | | 5.02 | | 151,000 |

| All of the other eight current directors, not including Messrs. Marcy and Retzloff listed above, as a group | | 6.90 | | 46,000 |

| All employees, not including the six executive officers listed above, as a group | | 11.63 | | 201,000 |

Federal Income Tax Consequences

The following is a brief summary of the principal federal income tax consequences of the grant and exercise of Nonstatutory and Incentive Stock Options under present law.

An optionee will not recognize any taxable income for federal income tax purposes upon receipt of a Nonstatutory Stock Option.

Upon the exercise of a Nonstatutory Stock Option with cash, the amount by which the fair market value of the shares received, determined as of the date of exercise, exceeds the option price is generally treated as compensation received in the year of exercise. If the option price is paid in whole or in part with shares of our common stock, no income, gain or loss is recognized on the receipt of shares equal in value on the date of exercise to the shares delivered in payment of the option price. The fair market value of the remainder of the shares received upon exercise, determined as of the date of exercise, less the amount of cash, if any, paid upon exercise, is generally treated as compensation received on the date of exercise. Individuals are subject to special Federal income tax rules upon the exercise of a Nonstatutory Stock Option (i) if the exercise is within six months of the date of grant, or (ii) in the event the fair market value of the shares acquired is less than the option price on the date of exercise.

In each instance that an amount is treated as compensation received, we are generally entitled to a corresponding deduction in the same amount for compensation paid to the optionee in such taxable year.

The grant of an Incentive Stock Option pursuant to Section 422A of the Internal Revenue Code of 1986, as amended, has no tax consequences to the optionee. Thus, optionees have no income from the receipt of Incentive Stock Options, and we will have no business expense deductions from the grant of the Incentive Stock Options.

When the statutory stock option is exercised, no income is attributed to the optionee to whom stock is transferred. However, to obtain this tax deferred treatment, the individual must maintain the shares he or she acquires through the exercise of the Incentive Stock Option for the required holding period. In short, there must be no disposition of the stock: (i) within two (2) years after the option is granted, or (ii) within one (1) year after the stock is transferred to the optionee. These holding period requirements do not apply to statutory options that are exercised after the employee's death. If an individual fails to hold the stock for the requisite holding period, the tax will be deferred only until the tax year in which the stock is disposed of, and the gain will be treated as ordinary income. On the other hand, when the requisite holding periods are met, an individual will be taxed at the capital gains rate when stock obtained pursuant to the exercise of the Incentive Stock Option is sold.

Vote Required

The affirmative vote of the holders of a majority of our common stock present at the Annual Meeting in person or by proxy and entitled to vote is required to approve the proposed amendment of the Plan. An abstention from voting on a matter by a stockholder present in person or represented by proxy and entitled to vote has the same legal effect as a vote "AGAINST" the proposed amendment. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The Board of Directors Recommends that

You Vote in Favor of Proposal 3

Proposal 4

Ratification of Selection of Independent Auditors

The board has selected KPMG LLP as our certified public accountants for the fiscal year ending December 31, 2002 and has further directed that management submit the selection of KPMG LLP as our independent auditors for ratification by the stockholders at the Annual Meeting. The Audit Committee has also recommended the selection of KPMG LLP as our independent auditors. KPMG LLP has audited our financial statements since December 28, 1996. Representatives of KPMG LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

KPMG LLP billed us an aggregate of $163,038 in fees for professional services rendered for the audit of our consolidated financial statements as of and for the year ended December 31, 2001 included in our annual report on Form 10-K and the reviews of the condensed consolidated financial statements included in our quarterly reports on Forms 10-Q as of and for the three months ended March 31, 2001, as of and for the three and six months ended June 30, 2001 and as of and for the three and nine months ended September 30, 2001.

KPMG LLP did not bill us any fees for professional services rendered for designing and implementing financial information systems for the year ended December 31, 2001.

KPMG billed us an aggregate of $102,808 in fees for professional services rendered for services other than those set forth above under the headings Audit Fees and Financial Information Systems Design and Implementation Fees for the year ended December 31, 2001. These fees were primarily related to tax consultation and preparation.

Stockholder ratification of the selection of KPMG LLP as our independent auditors is not required by our Bylaws or otherwise. However, the board is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the board, in their discretion, may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in our and our stockholders' best interests.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of KPMG LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The Board Of Directors Recommends

That You Vote In Favor Of Proposal 4

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of March 1, 2002 by:

- •

- Each of our directors and executive officers;

- •

- Each person who is known to us to beneficially own more than five percent of the outstanding shares of our common stock; and

- •

- All of our directors and executive officers as a group.

Applicable percentage ownership is based on 10,147,643 shares of common stock outstanding as of March 1, 2002.

Name of Beneficial Owner(1)

| | Number of Shares

Beneficially Owned(2)

| | Percent

Beneficially Owned

|

|---|

Dean Foods Company

2515 McKinney Avenue, Suite 1200

Dallas, Texas 75201 | | 1,338,000 | | 13.19 |

Michelle P. Goolsby(3)

c/o Dean Foods Company

2515 McKinney Avenue, Suite 1200

Dallas, Texas 75201 | | 1,339,656 | | 13.20 |

Thomas D. McCloskey, Jr.(4)

132 W. Main St.

Aspen, Colorado 81611 | | 1,143,140 | | 11.27 |

McCloskey 1998 GRAT

132 W. Main St.

Aspen, Colorado 81611 | | 595,976 | | 5.87 |

Dimensional Fund Advisors, Inc.(5)

1299 Ocean Ave., 11th Floor

Santa Monica, California 90401 | | 535,700 | | 5.28 |

| Paul B. Repetto(6) | | 362,389 | | 3.57 |

| Mark A. Retzloff(7) | | 309,545 | | 3.05 |

| Charles F. Marcy(8) | | 222,032 | | 2.19 |

| Clark R. Mandigo II(9) | | 83,734 | | ** |

| Don J. Gaidano(10) | | 56,101 | | ** |

| Richard L. Robinson(11) | | 54,384 | | ** |

| Kevin R. O'Rell(12) | | 18,398 | | ** |

| Clark F. Driftmier(13) | | 16,394 | | ** |

| Thomas P. Briggs(14) | | 16,000 | | ** |

| G. Irwin Gordon(15) | | 11,925 | | ** |

| Stephen J. Jacobson(16) | | 5,000 | | ** |

| Kathryn A. Paul | | 255 | | ** |

| John M. Haydock | | 0 | | ** |

| Cynthia T. Jamison | | 0 | | ** |

| All executive officers and directors as a group (16 persons)(17) | | 3,638,953 | | 35.86 |

- **

- Less than one percent.

- (1)

- Unless otherwise set forth, all addresses are c/o Horizon Organic Holding Corporation, 6311 Horizon Lane, Longmont, Colorado 80503.

- (2)

- This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the Securities and Exchange Commission. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Share amounts include stock options exercisable within 60 days of March 1, 2002. Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission.

- (3)

- Goolsby: Includes 750 shares subject to stock options exercisable within 60 days of March 1, 2002 and 1,338,000 shares held by Dean Foods Company. Ms. Goolsby is the Chief Administration Officer of Dean Foods Company and disclaims any beneficial ownership of the shares held by Dean Foods Company.

- (4)

- McCloskey: Includes 595,976 shares held by the McCloskey 1998 GRAT, of which Mr. McCloskey's children are the beneficiaries; 132,445 shares held by the Thomas D. McCloskey and Bonnie P. McCloskey Revocable Trust of 1994; 219,600 shares held by the McCloskey Trust, of which Mr. McCloskey is a trustee; and an aggregate of 14,250 shares held in trusts by each of his four children (collectively, the "Trust Shares"); and 155,280 shares held by McCloskey Ventures LLC, of which Mr. McCloskey is a manager (the "LLC Shares"). Mr. McCloskey disclaims any beneficial interest in the Trust Shares and the LLC shares, except to the extent of his pecuniary interest in the LLC shares arising from his role therein. Also includes 26,250 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (5)

- Based on a Schedule 13G filing as of February 12, 2002.

- (6)

- Repetto: Includes 1,980 shares held by his spouse and 30,500 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (7)

- Retzloff: Includes 23,000 shares held by his spouse, an aggregate of 38,000 shares held by spouse as custodian for his three children and 45,375 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (8)

- Marcy: Includes 173,125 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (9)

- Mandigo: Includes 53,730 shares held jointly with his spouse, an aggregate of 23,236 shares held in trust for his four children and 7,500 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (10)

- Gaidano: Includes 37,250 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (11)

- Robinson: Includes 7,500 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (12)

- O'Rell: Includes 15,000 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (13)

- Driftmier: Includes 15,000 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (14)

- Briggs: Includes 10,000 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (15)

- Gordon: Includes 4,500 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (16)

- Jacobson: Includes 5,000 shares subject to stock options exercisable within 60 days of March 1, 2002.

- (17)

- Includes 377,750 shares subject to stock options exercisable within 60 days of March 1, 2002. See Notes 3 through 4 and 6 through 16 above.

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by the Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2001, our directors, officers, and greater than ten percent beneficial owners were in compliance with all Section 16(a) filing requirements applicable to them.

MANAGEMENT

Executive Officers, Directors and Key Employees

Our executive officers, directors and key employees are as follows:

Name

| | Age

| | Position

|

|---|

| Charles F. Marcy(4)(3) | | 51 | | President, Chief Executive Officer, and Director |

Thomas P. Briggs |

|

53 |

|

Senior Vice President, Finance & Administration, Chief Financial Officer, Treasurer and Assistant Secretary |

Clark F. Driftmier |

|

48 |

|

Senior Vice President, Marketing |

Don J. Gaidano |

|

53 |

|

Managing Director, UK |

Stephen J. Jacobson |

|

58 |

|

Vice President, Operations |

John M. Haydock |

|

44 |

|

Vice President, Sales |

Kevin R. O'Rell |

|

50 |

|

Vice President, Quality Assurance and Research and Development |

Thomas D. McCloskey, Jr.(3)(4) |

|

55 |

|

Chairman of the Board of Directors |

Paul B. Repetto |

|

65 |

|

Secretary and Director |

Mark A. Retzloff(3) |

|

53 |

|

Director |

G. Irwin Gordon(1) |

|

51 |

|

Director |

Clark R. Mandigo, II(1)(2) |

|

58 |

|

Director |

Richard L. Robinson(1)(2) |

|

72 |

|

Director |

Michelle P. Goolsby(2) |

|

44 |

|

Director |

Kathryn A. Paul(3) |

|

55 |

|

Director |

Cynthia T. Jamison |

|

42 |

|

Director |

- (1)

- Member of the Audit Committee

- (2)

- Member of the Compensation Committee

- (3)

- Member of the Governance Committee

- (4)

- Member of the Executive Committee

Thomas P. Briggs joined us as Vice President, Finance & Administration, Chief Financial Officer, Treasurer and Assistant Secretary in June 2000. He has served as our Senior Vice President, Finance & Administration, Chief Financial Officer, Treasurer and Assistant Secretary since January 2001. Mr. Briggs has 10 years experience in the dairy foods industry and 30 years experience in finance. From 1990 through 2000, Mr. Briggs served as Vice President of Finance for Leprino Foods Company, the world's largest manufacturer of mozzarella cheese and one of the largest companies in the U.S. dairy industry. Mr. Briggs has both national accounting firm and public company experience. He began his career in 1969 with Price Waterhouse and in the late 1980s was a senior manager with Deloitte & Touche. Mr. Briggs holds a Bachelors of Arts degree in accounting from Duke University, and a Juris Doctorate degree from Georgetown University Law Center.

Clark F. Driftmier joined us as Vice President, Marketing in February 2000. He has served as Senior Vice President, Marketing since January 2001. From September 1994 to February 2000, Mr. Driftmier served at Small Planet Foods LLC, the parent company of Cascadian Farm and Muir Glen, two leading organic brands. His most recent position at Small Planet was Senior Vice President of Marketing. From 1989 to 1994, Mr. Driftmier held various marketing positions at Ralston Purina, including Product Manager of Chex breakfast cereals and other national brands. Mr. Driftmier received a Bachelors degree from Oberlin College, and a Masters of Business Administration degree from Darden Graduate Business School, at the University of Virginia. Mr. Driftmier currently serves on the Marketing Committee of the Organic Trade Association. Previously, he served on the board of directors of the Colorado Nursery Association.

Don J. Gaidano has served as our Managing Director in the UK since February 2001. From June 2000 to January 2001, he served as our Vice-President, Finance in the UK. Prior to that he served as our Vice President, Finance & Administration, Chief Financial Officer, Treasurer and Assistant Secretary from May 1997 to June 2000. From April 1994 until April 1997, Mr. Gaidano worked as a private financial consultant for food manufacturers and distributors. Mr. Gaidano received a Bachelors of Science degree from the University of Santa Clara and is a Certified Public Accountant.

Stephen J. Jacobson joined us as Director of Operations in January 2000. He has served as Vice President, Operations since December 2000. From 1997 to 2000, Mr. Jacobson served as Director of Finance and Budgeting for Recycling Industries, Inc., a scrap metal company. From 1995 to 1997 he served as Regional Distribution Director for Meadow Gold Dairies, a national milk processing, marketing and distribution company. From 1993 to 1995 he served as a consultant with the Denver Management Group, consultants for the dairy and beverage industry. Mr. Jacobson received a Bachelors of Arts degree in Finance and Economics from Hofstra University.

John M. Haydock has served as our Vice President, Sales since June 2001. Prior to joining us, he served as Vice President, Sales for Vlasic Foods International, a food manufacturing and marketing company. From 1994 to 1998 he served in various sales and marketing roles for Good Humor-Breyers, a national dairy products processing, marketing and distribution company, including National Sales Director and Director of Grocery Sales. Prior to joining Good Humor-Breyers, Mr. Haydock served in various sales roles for Kraft General Foods. Mr. Haydock has over fourteen years experience in dairy industry sales positions. Mr. Haydock earned a Bachelors degree in marketing from Indiana University and a Masters of Business Administration degree from Keller Graduate School.

Kevin O'Rell has served as Vice President, Research & Development/Quality Assurance since May 1999. From 1987 to 1999, Mr. O'Rell was president of Brotech, a food and dairy consulting firm. Prior to 1987 Mr. O'Rell held various technical positions at Beatrice Foods, Crest Foods and Dannon, all consumer food product manufacturers. Mr. O'Rell received his bachelors degree in food science from the University of Illinois.

See "Proposal 1—Election of Directors" for Mr. Marcy's biography.

Officers are elected by the board of directors and serve at the discretion of the board. There are no family relationships among any of our directors or officers.

EXECUTIVE COMPENSATION

Each non-employee director receives $1,000 for each board meeting they attend and $500 for each committee meeting they attend if the committee meeting is held on a date other than the date of a board meeting. These fees are paid in grants of shares of our common stock. The number of shares granted is calculated by dividing the fee amount by the closing per-share price of our common stock as reported on the Nasdaq National Market on the date of such meeting. Directors are also reimbursed for certain expenses in connection with attendance at board and committee meetings. We also pay Mr. McCloskey, our Chairman, quarterly payments of $6,250 as compensation for additional time he spends in relation to us. Mr. McCloskey is also reimbursed for his expenses incurred relating to these activities. In the fiscal year ended December 31, 2001, we paid our non-employee directors a total of $24,000 in the form of common stock grants and a total of $12,500 in the form of direct compensation.

In addition, each year we grant each non-employee director a stock option grant to purchase 6,000 shares of our common stock. These options are made pursuant to our 1998 Equity Incentive Plan and are granted at each annual meeting of stockholders. The exercise price for these options is the closing per-share price of our common stock as reported on the Nasdaq National Market on the date of such annual meeting. Additionally, each non-employee director receives a stock option grant to purchase 4,000 shares of our common stock on the date such director is elected to our board. The exercise price for these options is the closing per-share price of our common stock as reported on the Nasdaq National Market on the date the individual becomes a director.

In the fiscal year ended December 31, 2001, we granted options to Ms. Goolsby and Messrs. Mandigo, Gordon, McCloskey and Robinson for 6,000 shares each of our common stock at an exercise price of $7.00 per share and we granted options to Ms. Paul for 10,000 shares of our common stock at an exercise price of $6.55.

During 2001, Messrs. Mandigo, McCloskey, and Robinson exercised options under the Plan. The following table identifies the number of shares acquired and the value realized for each stock option exercised during 2001 by these three individuals. Market price is based on the closing price of our common stock on the dates of exercise as reported on the Nasdaq National Market.

Name

| | Date

| | Shares Acquired on

Exercise

| | Option Price

| | Market Price

| | Net Value Realized

|

|---|

| Clark R. Mandigo, II | | 6/29/01 | | 5,000 | | $ | 3.22 | | $ | 9.55 | | $ | 31,650 |

| Thomas D. McCloskey, Jr. | | 7/5/01 | | 5,000 | | $ | 3.22 | | $ | 9.67 | | $ | 32,250 |

| Richard L. Robinson | | 6/18/01 | | 5,000 | | $ | 3.22 | | $ | 8.25 | | $ | 25,150 |

Compensation of Executive Officers

The following table shows the compensation paid to or earned by our Chief Executive Officer and our other five most highly compensated executive officers for the fiscal years ended December 31, 2001, 2000, and 1999:

Summary Compensation Table

| | Annual Compensation

| | Long Term Compensation

|

|---|

Name and Principal Position

| | Fiscal Year

| | Salary ($)(1)

| | Bonus ($)(1)

| | Securities

Underlying

Options (#)

| | All Other

Compensation ($)(2)

|

|---|

| Charles F. Marcy, President and Chief Executive Officer | | 2001

2000

1999 | | 300,913

267,377

19,284 | | 132,401

54,208

- -0- | | 80,000

50,000

200,000 | | 9,616

57,100

- -0- |

Thomas P. Briggs, Senior Vice President—Finance & Administration, Chief Financial Officer, and Treasurer(3) |

|

2001

2000 |

|

176,144

85,943 |

|

45,028

12,775 |

|

20,000

20,000 |

|

5,675

27,878 |

Clark F. Driftmier Senior Vice President—Marketing(4) |

|

2001

2000 |

|

172,786

119,166 |

|

39,938

17,591 |

|

20,000

30,000 |

|

6,320

3,240 |

Kevin R. O'Rell Vice President—QA/R&D(5) |

|

2001

2000

1999 |

|

146,951

128,909

89,096 |

|

38,292

21,156

14,450 |

|

10,000

10,000

20,000 |

|

6,056

4,150

6,804 |

Stephen J. Jacobson Vice President—Operations(6) |

|

2001

2000 |

|

135,122

77,917 |

|

30,979

7,040 |

|

15,000

5,000 |

|

5,361

- -0- |

Mark A. Retzloff Former President—International(7) |

|

2001

2000

1999 |

|

30,000

150,000

150,000 |

|

54,099

24,636

18,000 |

|

6,000

20,000

8,000 |

|

160,790

12,579

4,771 |

- (1)

- Includes amounts, if any, deferred pursuant to Section 401(k) of the Internal Revenue Code of 1986, as amended.

- (2)

- Includes matching contributions made by us to the 401(k) Plan, premiums for health, long-term disability and life insurance paid by us, severance pay and relocation costs reimbursed by us.

- (3)

- Mr. Briggs joined us in June 2000.

- (4)

- Mr. Driftmier joined us in February 2000.

- (5)

- Mr. O'Rell joined us in April 1999.

- (6)

- Mr. Jacobson joined us in May 2000.

- (7)

- Mr. Retzloff retired in February 2001 and received the remainder of his 2001 annual salary as severance pay.

STOCK OPTION GRANTS AND EXERCISES

We grant options to our executive officers under the 1998 Equity Incentive Plan. As of December 31, 2001, there were granted options to purchase a total of 1,017,226 shares under the 1998 Equity Incentive Plan and options to purchase a total of 394,976 shares remaining available for grants.

The following table sets forth for the named executive officers certain information regarding options granted to them for the fiscal year ended December 31, 2001:

Option Grants in Fiscal 2001

| |

| |

| |

| |

| | Potential Realizable Value At

Assumed Annual Rates of Stock price

Appreciation for Option Terms ($)(3)

|

|---|

| | Number of Shares

Underlying

Options

Granted(1)

| | Percent of Total

Options Granted to

Employees in

Fiscal Year(2)

| |

| |

|

|---|

Name

| | Exercise

Price

($/Share)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Charles F. Marcy | | 80,000 | | 22.73 | % | 4.94 | | 1/31/06 | | 504,386 | | 636,473 |

| Thomas P. Briggs | | 20,000 | | 5.68 | % | 4.94 | | 1/31/06 | | 126,096 | | 159,118 |

| Clark F. Driftmier | | 20,000 | | 5.68 | % | 4.94 | | 1/31/06 | | 126,096 | | 159,118 |

| Stephen J. Jacobson | | 15,000 | | 4.26 | % | 4.94 | | 1/31/06 | | 94,500 | | 119,400 |

| Kevin R. O'Rell | | 10,000 | | 2.84 | % | 4.94 | | 1/31/06 | | 63,048 | | 79,559 |

| Mark A. Retzloff | | 6,000 | | 1.70 | % | 7.00 | | 5/16/06 | | 53,603 | | 67,641 |

- (1)

- 25% of the options vest and will become exercisable upon the first anniversary of the grant date and will become exercisable as to the remainder of the grant in three equal annual installments thereafter.

- (2)

- Based on total options to purchase 352,000 shares of common stock granted in 2001.

- (3)

- The potential realizable value is calculated assuming that the fair market value of common stock on the date of the grant as determined by the board appreciates at the indicated annual rate compounded annually for the entire term of the option and that the option is exercised and the common stock received therefore is sold on the last day of the term of the option for the appreciated price. The 5% and 10% rates of appreciation are mandated by the rules of the Securities and Exchange Commission and do not represent our estimate or projection of future increases in the price of our common stock.

The following table identifies the number of shares acquired and value realized for each stock option exercised by the named executive officers during 2001. In addition, this table identifies the number and value of unexercised options for the named executive officers at the end of 2001.

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized

($)

| | Number of Securities Underlying

Unexercised Options at 12/31/01

Exercisable/Unexercisable (#)(1)

| | Value of Unexercised In-the-Money Options at 12/31/01

Exercisable/Unexercisable ($)(2)

|

|---|

| Charles F. Marcy | | — | | — | | 137,500/192,500 | | 1,209,913/1,889,788 |

| Thomas P. Briggs | | — | | — | | 5,000/35,000 | | 32,600/329,400 |

| Clark F. Driftmier | | — | | — | | 7,500/42,500 | | 53,900/393,300 |

| Stephen J. Jacobson | | — | | — | | 1,250/18,750 | | 8,463/199,088 |

| Kevin R. O'Rell | | — | | — | | 12,500/27,500 | | 52,435/203,335 |

| Mark A. Retzloff | | 10,000 | | 72,180 | | 43,375/28,125 | | 474,788/193,733 |

- (1)

- Includes both "in-the-money" and "out-of-the-money" options. "In-the-money" options are options with exercise prices below the market price of our common stock as of December 31, 2001.

- (2)

- Based on the fair market value of our common stock as of December 31, 2001 of $16.52 per share, minus the per share exercise price of "in-the-money" unexercised options, multiplied by the number of shares represented by such options.

EMPLOYMENT AGREEMENTS

We have entered into employment agreements with the following named executive officers:

- •

- Charles F. Marcy

- •

- Thomas P. Briggs

- •

- Clark F. Driftmier

- •

- Kevin R. O'Rell

- •

- Stephen J. Jacobson

- •

- Mark A. Retzloff

Messrs. Marcy, Briggs, Driftmier, Jacobson, and O'Rell's employment agreements provide that they are eligible for the following benefits:

- •

- Incentive bonus in Mr. Marcy's case of up to 110% of his base salary and in the cases of Messrs. Briggs, Driftmier, O'Rell and Jacobson up to 70% of their base salaries

- •

- 27 days paid time off

- •

- Participation in any employee benefit plans that are available to our other employees and payment of the premiums or costs incurred by the executive officer associated with participation in such employee benefit plans

- •

- Life insurance

- •

- Disability insurance

- •

- Reimbursement of reasonable business expenses

Messrs. Marcy, Briggs, Driftmier, Jacobson, and O'Rell's employment agreements provide that if they were terminated without cause or as a result in a change in the control of our company, we would be obligated to pay them their base salaries for a period of 24 months from the date of termination in Mr. Marcy's case and 12 months in the case of Messrs. Briggs, Driftmier, Jacobson, and O'Rell. This severance pay would require that they execute a release and an agreement not to compete with us in the organic products industry for the period of time that we pay them their base salaries.

Mr. Retzloff entered into an Amended Executive Employment Agreements effective as of January 1, 1998. Mr. Retzloff's employment agreement provided that he would receive an annual salary of $120,000, which was adjustable as determined by the Compensation Committee. Mr. Retzloff retired as an operating officer in February 2001 and received his annual salary for the remainder of 2001 as severance pay and has provided consulting services to us, as we have requested, from time to time.

REPORT OF THE COMPENSATION COMMITTEE1

- 1

- Notwithstanding anything to the contrary set forth in any of the Company's filings under the Securities Act of 1933, as amended (the "Securities Act") or the Exchange Act that might incorporate future filings by reference, including this Proxy Statement, in whole or in part, the following Report of the Compensation Committee and the Performance Graph shall not be incorporated by reference into any such filings, and shall not be deemed soliciting material under the Securities Act or the Exchange Act.

The Compensation Committee is composed of three non-employee directors elected by the board. In 2001, the Compensation Committee members were Clark R. Mandigo, II, Richard L. Robinson, and Michelle Goolsby. The Compensation Committee is responsible for providing guidance, direction, and periodic monitoring for all corporate compensation, benefit, perquisite, and employee equity programs. The Compensation Committee specifically reviews and approves the following matters within the following limitations:

- (i)

- compensation, benefit, and perquisites for all corporate officers, except a corporate officer only holding the office of secretary;

- (ii)

- all bonus plans, total bonus payments, and individual awards to all corporate officers;

- (iii)

- benefit plans including profit sharing and pension programs;

- (iv)

- perquisite programs and perquisites for corporate officers;

- (v)

- employment agreements for all corporate officers and for all others with base salaries in excess of $100,000; and

- (vi)

- option grants under the 1998 Equity Incentive Plan.

Base Salary

The Compensation Committee annually reviews each executive officer's base salary. When reviewing base salaries, the Compensation Committee considers individual and corporate performance, levels of responsibility, prior experience, breadth of knowledge, and competitive pay practices.

Bonuses

In 2001, our Chief Executive Officer and our five other highest paid executive officers earned bonuses in amounts ranging from $30,979 to $132,401. The bonuses were paid out in 2002. Such bonuses were based on the extent to which the corporate goals were achieved. The bonuses represented approximately 22% to 44% of such officer's base salary.

Stock-Based Incentive Compensation

We adopted the 1998 Equity Incentive Plan in order to provide equity based performance incentives to our employees. The Plan authorizes us to award our officers and other employees incentive stock options and nonqualified stock options to purchase our common stock. The purpose of the Plan is to attract, retain and motivate officers and employees. Stock options may be exercised at a purchase price as determined by the Compensation Committee, provided that:

- •

- The exercise price per share under the Plan must be at least 100% of the fair market value on the date of grant for incentive stock options and at least 85% of the fair market value on the date of grant for nonqualified stock options.

- •

- Incentive stock options to employees who beneficially own 10% or more of our outstanding shares may be granted at an exercise price per share of at least 110% of fair market value.

The grants are designed to align the interests of the optionee with those of our stockholders and provide each individual with a significant incentive to manage our company from the perspective of an owner with an equity stake in the business. Moreover, the long-term vesting schedule of five years encourages optionees to attain a long-term commitment. The size of the option grant to each optionee is set at a level that the Compensation Committee deems appropriate in light of competitive pay practices to create a meaningful opportunity for stock ownership based upon the individual's current position, but also takes into account the individual's potential for future responsibility and promotion over the option vesting period, and the individual's performance in recent periods. The Compensation Committee periodically reviews the number of shares owned by, or subject to options held by, each executive officer, and additional awards are considered based upon past performance of the executive officer.

Chief Executive Officer Compensation

For the fiscal year ended December 31, 2001, Charles F. Marcy, our President and Chief Executive Officer received total cash payments of $300,913 in salary and earned $132,401 as a bonus. Mr. Marcy's base salary was set at an annual rate of $250,000 in 1999 for services rendered by Mr. Marcy as our President and Chief Operating Officer. That base salary was increased to an annual rate of $275,000 at the time Mr. Marcy became our President and Chief Executive Officer. His current salary is set at $302,500 per year. Mr. Marcy's salary is based largely on review of publicly available information about salaries of executives with similar responsibilities in companies of comparable size in our industry, his responsibilities within our company, and the subjective evaluation of his overall performance and contribution to our company.

Limitation on Deduction of Compensation Paid to Certain Executive Officers

Section 162(m) of the Internal Revenue Code limits our ability to a deduct, for federal income tax purposes, no more than $1 million of compensation paid to certain named executive officers in any one taxable year.

Compensation above $1 million may be deducted if it is "performance-based compensation" within the meaning of the Internal Revenue Code. The statute containing this law and the applicable proposed Treasury regulations offer a number of transitional exceptions to this deduction limit for pre-existing compensation plans, arrangements and binding contracts. As a result, the Compensation Committee believes that at the present time it is quite unlikely that the compensation paid to any named executive officer in a taxable year that is subject to the deduction limit will exceed $1 million. Therefore, the Compensation Committee has not yet established a policy for determining which forms of incentive compensation awarded to our named executive officers shall be designed to qualify as "performance-based compensation." The Compensation Committee intends to continue to evaluate the effects of the statute and any final Treasury regulations and to comply with Section 162(m) of the Internal Revenue Code in the future to the extent consistent with our best interests.

Conclusion

The Compensation Committee believes that our compensation programs and the administration of those programs well serve our stockholders' interests. These programs allow us to attract, retain and motivate exceptional management talent and to compensate executives in a manner that reflects their contributions to both our short and long-term performance. We intend to continue to emphasize programs that we believe will positively affect stockholder value.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee have served as our executive officers. See "Certain Relationships and Related Transactions" for a description of certain transactions with these board members. None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board or Compensation Committee.

PERFORMANCE MEASUREMENT COMPARISON

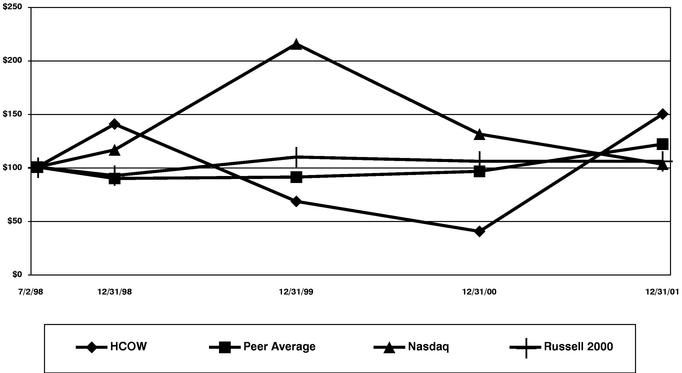

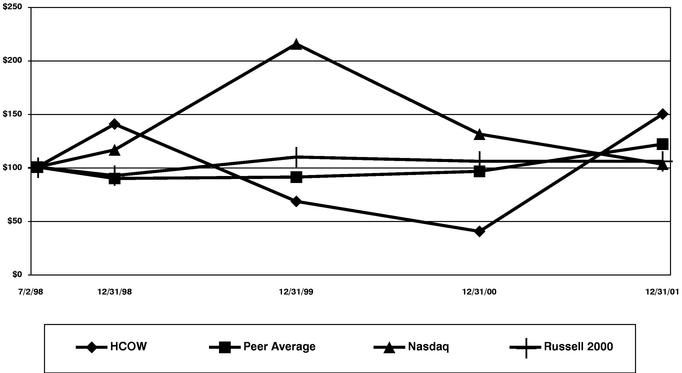

The following graph shows the total stockholder return on our common stock from July 2, 1998, the date we became a public company, until December 31, 2001, for (i) our common stock, (ii) a peer group selected by management that we intend to use in this and future proxy statements, consisting of the following five companies: Hain Celestial Group, Inc. formerly known as Hain Food Group, Gaiam, Inc., United Natural Foods, Inc., Whole Foods Market, Inc., and Wild Oats Markets, Inc., (iii) the NASDAQ Stock Market index, and (iv) the Russell 2000 Equity Index. The graph assumes the investment of $100 in our common stock and in each of the indexes on July 2, 1998 and reinvestment of all dividends, if any. The initial public offering price of our common stock was $11.00 per share.

We have decided that as a result of a number of acquisitions of members of our old peer group, we have changed our peer group for this and all future proxy statements. We originally included the following six companies in our peer group: Gardenburger, Hain Food Group, Hansen Natural Corporation, Odwalla, Ben & Jerry's Homemade, and Celestial Seasonings. All six of these companies sell healthy, natural, or organic products and were publicly traded at the time we created this peer group in our 1999 Proxy Statement. In our 2000 Proxy Statement, the peer group selected by management consisted of these six companies. However, during 2000, Ben & Jerry's Homemade and Celestial Seasonings were acquired and information regarding their stock prices was not available as of December 31, 2000. As a result, our 2001 Proxy Statement included only the four remaining companies from this original peer group. During 2001, Odwalla was acquired and information regarding its stock price was not available as of December 31, 2001 and therefore the original peer group listed above now only includes Gardenburger, Hain Food Group, and Hansen Natural Corporation. Due to the changes in the original peer group, management has determined that it is appropriate to create a new peer group for this and future Proxy Statements. The new peer group will consist of: Hain Celestial Group, Inc. formerly known as Hain Food Group, Gaiam, Inc., United Natural Foods, Inc., Whole Foods Market, Inc., and Wild Oats Markets, Inc. For comparison purposes, the total return over the period of July 2, 1998 to December 31, 2002 of a $100 investment in our stock was $150.18 compared to $122.10 for the new peer group and $74.47 for the old peer group.

AUDIT COMMITTEE AND REPORT2

We have adopted a written Audit Committee Charter, a copy of which was filed as Appendix A to our 2001 Proxy Statement. The members of the Audit Committee are independent directors as that term is defined in Rule 4200(a)(14) of the Nasdaq listing standards. The Audit Committee is composed of three non-employee directors: Messrs. Gordon, Mandigo, and Robinson.

- 2

- Notwithstanding anything to the contrary set forth in any of the Company's filings under the Securities Act of 1933, as amended (the "Securities Act") or the Exchange Act that might incorporate future filings by reference, including this Proxy Statement, in whole or in part, the following Report of the Audit Committee shall not be incorporated by reference into any such filings, and shall not be deemed soliciting material under the Securities Act or the Exchange Act.

The purposes of our Audit Committee are set forth in the Audit Committee Charter. The purposes include assisting the board of directors in its oversight of our financial reporting process and internal controls, our financial statements and the selection of our independent auditors. Management, however, is responsible for the preparation, presentation and integrity of our financial statements, and the independent auditors are responsible for planning and carrying out proper audits and reviews.

The Audit Committee reports as follows:

- 1)