UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| |

| | For the fiscal year ended December 29, 2013 |

OR

|

| |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| |

| | For the transition period from to |

Commission file number 000-32369

Popeyes Louisiana Kitchen, Inc.

|

| | |

| Minnesota | | 58-2016606 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 400 Perimeter Center Terrace, Suite 1000 | | 30346 |

| Atlanta, Georgia | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant’s telephone number, including area code:

(404) 459-4450

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. þ

Indicate by check mark whether the registrant has submitted electronically and posted to its web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| | | | | | | |

Large accelerated filer þ | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company o |

| | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act rule 12b-2). Yes ¨ No þ

As of July 12, 2013 (the last business day of the registrant’s second quarter for 2013), the aggregate market value of the registrant’s voting common stock held by non-affiliates of the registrant, based on the closing sale price as reported on the NASDAQ Global Market System, was approximately $900,080,000.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

| Class | | Outstanding at January 24, 2014 |

| Common stock, $0.01 par value per share | | 23,817,393 shares |

Documents incorporated by reference: Portions of our 2013 Proxy Statement are incorporated herein by reference in Part III of this Annual Report.

Popeyes Louisiana Kitchen, Inc.

INDEX TO FORM 10-K

|

| | |

| PART I | |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 4.A | | |

| | |

| PART II | |

| | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| PART III | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | |

| | | |

| Item 15. | | |

PART I.

Item 1. BUSINESS

In January 2014, we changed our name to Popeyes Louisiana Kitchen, Inc. (“Popeyes” or “the Company”) from AFC Enterprises, Inc. Popeyes develops, operates, and franchises quick-service restaurants (“QSRs” or “restaurants”) under the trade names Popeyes® Chicken & Biscuits and Popeyes® Louisiana Kitchen. Within Popeyes, we manage two business segments: franchise operations and company-operated restaurants. Financial information concerning these business segments can be found in Note 20 to our Consolidated Financial Statements included in this Form 10-K.

Popeyes Profile

Popeyes was founded in New Orleans, Louisiana in 1972 and is the world’s second largest quick-service chicken concept based on the number of units. Within the QSR industry, Popeyes distinguishes itself with a unique “Louisiana” style menu that features spicy chicken, chicken tenders, fried shrimp and other seafood, red beans and rice and other regional items. Popeyes is a highly differentiated QSR brand with a passion for its Louisiana heritage and flavorful authentic food.

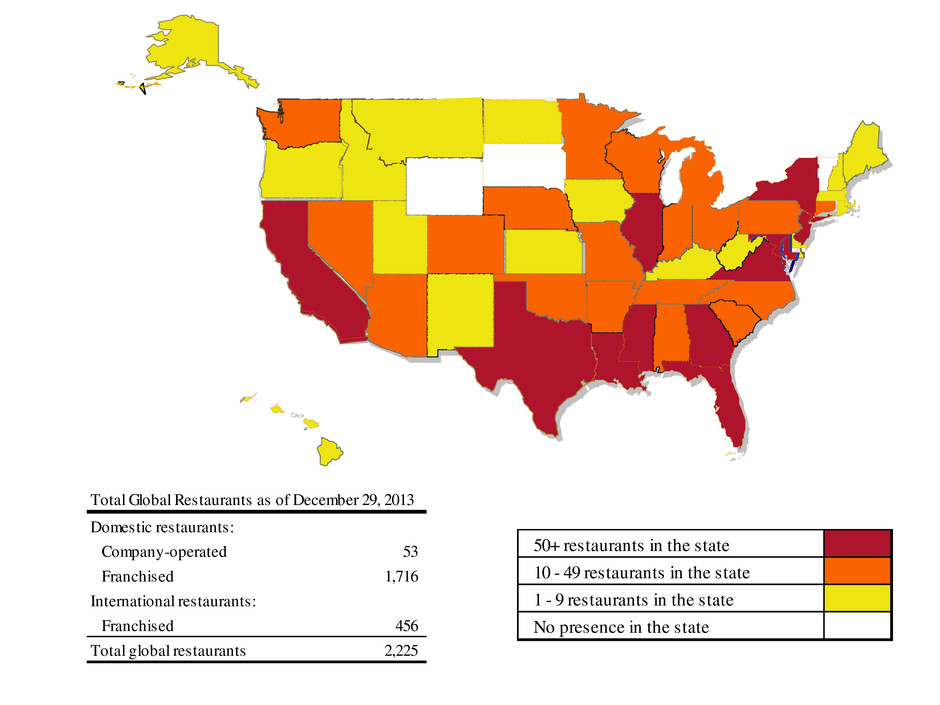

As of December 29, 2013, we operated and franchised 2,225 Popeyes restaurants in 47 states, the District of Columbia, three territories and 28 foreign countries.

As of December 29, 2013, of our 1,716 domestic franchised restaurants, approximately 71% were concentrated in Texas, California, Louisiana, Florida, Illinois, Maryland, New York, Georgia, Virginia, New Jersey, and Mississippi. Of our 456 international franchised restaurants, approximately 59% were located in Korea, Canada, and Turkey. Of our 53 company-operated restaurants, approximately 83% were concentrated in Louisiana, Tennessee, and Indiana.

Financial information concerning our domestic and international operations can be found in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K.

Our Business Strategy

The Company’s Strategic Roadmap, launched in 2008, focuses exclusively on growing the value of our single brand, Popeyes Louisiana Kitchen. There are four organizing pillars to our strategy which we use to select priorities and allocate resources. These pillars are:

| |

| • | Build a Distinctive Brand |

| |

| • | Create Memorable Experiences |

| |

| • | Accelerate Quality Restaurant Openings |

Within each pillar we develop strategies, determine goals and set performance metrics by which we measure our progress.

Our people are critical to this long-term strategy and include our franchisees, restaurant crews and corporate employees. As such, embedded in each of the strategic pillars above, is the principle that we will invest in our people to achieve Popeyes' business goals as well as their individual personal development. Our goal is to create a culture of servant leadership which is ultimately reflected in the experience our guests enjoy in Popeyes Louisiana Kitchen restaurants.

Our Agreements with Popeyes Franchisees

Our strategy places a heavy emphasis on increasing the number of restaurants in the Popeyes system through franchising activities. As of December 29, 2013, we had 338 franchisees operating restaurants within the Popeyes system, and several preparing to become operators. Our largest domestic franchisee operates 142 restaurants and our largest international franchisee operates 101 restaurants. The following discussion describes the standard arrangements we enter into with our Popeyes franchisees.

Domestic Development Agreements. Our domestic franchise development agreements provide for the development of a specified number of Popeyes restaurants within a defined geographic territory. Generally, these agreements call for the development of the restaurants over a specified period of time, usually three to five years, with targeted opening dates for each restaurant. Our Popeyes franchisees currently pay a development fee ranging from $7,500 to $12,500 per restaurant. Typically these development fees are paid when the agreement is executed, and are non-refundable.

International Development Agreements. Our international franchise development agreements are similar to our domestic franchise development agreements, though the development time frames can be longer with development fees of up to $15,000 for each restaurant developed. Depending on the market, limited sub-franchising rights may also be granted.

Domestic Franchise Agreements. Following the execution of a development agreement, we enter into a franchise agreement with our franchisee that conveys the right to operate a specific Popeyes restaurant at a site to be selected by the franchisee and approved by us within 180 days from the execution of the franchise agreement. Our current franchise agreements generally provide for payment of a franchise fee of $35,000 per location. Based on our development incentive programs, in some circumstances the franchise fee could be reduced or eliminated altogether.

These agreements generally require franchisees to pay a 5% royalty on net restaurant sales. In addition, franchisees must contribute to national and local advertising funds. Payments to the advertising funds are generally 4% of net restaurant sales. Some of our institutional and older franchise agreements provide for lower royalties and advertising fund contributions.

International Franchise Agreements. The terms of our international franchise agreements are substantially similar to those included in our domestic franchise agreements, except that these agreements may be modified to reflect the multi-national nature of the transaction and to comply with the requirements of applicable local laws. Our current international franchise agreements generally provide for payment of a franchise fee of up to $30,000 per location. In addition, the effective royalty rates may differ from those included in domestic franchise agreements, and may be lower due to the greater number of restaurants required to be developed by our international franchisees.

All of our franchise agreements require that our franchisees operate restaurants in accordance with our defined operating procedures, adhere to the menu established by us, and meet applicable quality, service, health and cleanliness standards. We may terminate the franchise rights of any franchisee who does not comply with these standards and requirements.

Site Selection

For new domestic restaurants, we assist our franchisees in evaluating sites consistent with the overall market plan for each development area. Domestically, we primarily emphasize freestanding sites with drive-thrus and in limited situations where there is a compelling need in dense areas we may pursue other venues such as “end-cap, in-line” strip-mall sites with ample parking and easy access from high traffic roads.

Each international market has its own factors that lead to venue and site determination. In international markets, we use different venues including freestanding, in-line, food court and other nontraditional venues. Market development strategies are a collaborative process between Popeyes and our franchisees so we can leverage local market knowledge.

Suppliers and Purchasing Cooperative

Suppliers. Our franchisees are required to purchase all ingredients, products, materials, supplies and other items necessary in the operation of their businesses solely from suppliers who have been approved by us. These suppliers are required to meet or exceed strict quality control standards, and they must possess adequate capacity to supply our restaurant system reliably.

Purchasing Cooperative. Supplies are generally provided to our domestic franchised and company-operated restaurants pursuant to supply agreements negotiated by Supply Management Services, Inc. (“SMS”), a not-for-profit purchasing cooperative. We, our Popeyes franchisees and the owners of restaurants of the other participating brand hold membership interests in SMS in proportion to the number of restaurants owned. As of December 29, 2013, we held one of seven seats on the SMS board of directors and our voting interests were approximately 3%. Our Popeyes franchise agreements require that each domestic franchisee join SMS.

Supply Agreements. The principal raw material for a Popeyes restaurant operation is fresh chicken. Company-operated and franchised restaurants purchase their chicken from suppliers who service the Popeyes system. In order to ensure favorable pricing and to secure an adequate supply of fresh chicken, SMS has entered into supply agreements with several chicken suppliers. These contracts, which pertain to the vast majority of our system-wide purchases, are “cost-plus” contracts with prices based partially upon the cost of feed grains plus certain agreed upon non-feed and processing costs.

We have entered into long-term beverage supply arrangements with certain major beverage vendors. These contracts are customary in the QSR industry. Pursuant to the terms of these arrangements, marketing rebates are provided to the owner/operator of Popeyes restaurants based upon the volume of beverage purchases.

We also have a long-term agreement with an exclusive supplier of certain proprietary products for the Popeyes system. This supplier sells these products to our approved distributors, who in turn sell them to our franchised and company-operated Popeyes restaurants.

Marketing and Advertising

Each Popeyes restaurant, company-operated or franchised, contributes to an advertising fund that supports (1) branding and marketing initiatives, including the development of marketing materials that are used throughout our domestic restaurant system and (2) local marketing programs. We act as the agent for the fund and coordinate its activities. We and our Popeyes franchisees made contributions to the advertising fund of approximately $94.2 million in 2013, $85.6 million in 2012, and $73.0 million in 2011.

Fiscal Year and Seasonality

During 2013 and 2011, the fiscal year included 52 weeks and our fiscal year was composed of 13 four-week accounting periods and ends on the last Sunday in December. During 2012, our fourth fiscal quarter was 13 weeks and the fiscal year included 53 weeks. The first quarter of our fiscal year has four periods, or 16 weeks. All other quarters have three periods, or 12 weeks.

Seasonality has little effect on our operations.

Employees

As of January 26, 2014, we had approximately 1,726 hourly employees working in our company-operated restaurants. Additionally, we had approximately 64 employees involved in the management of our company-operated restaurants, composed of restaurant managers, multi-unit managers and field management employees. We also had approximately 216 employees responsible for corporate administration, franchise services and business development.

None of our employees are covered by a collective bargaining agreement. We believe that the dedication of our employees is critical to our success and that our relationship with our employees is good.

Intellectual Property and Other Proprietary Rights

We own a number of trademarks and service marks that have been registered with the U.S. Patent and Trademark Office, or for which we have made application to register, including the “Popeyes,” “Popeyes Chicken & Biscuits,” and the brand logo for Popeyes and Popeyes Louisiana Kitchen. In addition, we have registered, or made application to register, one or more of these marks and others, or their linguistic equivalents, in foreign countries in which we do business, or are contemplating doing business. There is no assurance that we will be able to obtain the registration for the marks in every country where registration has been sought. We consider our intellectual property rights to be important to our business and we actively defend and enforce them.

Formula and Supply Agreements with Former Owner. The Company has a formula licensing agreement with the estate of Alvin C. Copeland, the founder of Popeyes and the primary owner of Diversified Foods and Seasonings, Inc. (“Diversified”). Under this agreement, the Company has the worldwide exclusive rights to the Popeyes fried chicken recipe and certain other ingredients used in Popeyes products. The agreement provides that the Company pay the estate of Mr. Copeland approximately $3.1 million annually until March 2029. During each of 2013, 2012, and 2011, the Company expensed approximately $3.1 million under this agreement. The Company also has a supply agreement with Diversified through which the Company purchases certain proprietary spices and other products made exclusively by Diversified.

International Operations

We continue to expand our international operations through franchising. As of December 29, 2013, we had 456 franchised international restaurants. During 2013, franchise revenues from these operations represented approximately 10.9% of our total franchise revenues. For each of 2013, 2012, and 2011, international revenues represented 6.4%, 6.9% and 7.5% of total revenues, respectively.

Insurance

We carry property, general liability, business interruption, crime, directors and officer’s liability, employment practices liability, environmental and workers’ compensation insurance policies, which we believe are customary for businesses of our size and type. Pursuant to the terms of their franchise agreements, our franchisees are also required to maintain certain types and levels of insurance coverage, including commercial general liability insurance, workers’ compensation insurance, all risk property and automobile insurance.

Competition

The foodservice industry, and particularly the QSR industry, is intensely competitive with respect to price, quality, name recognition, service and location. We compete against other QSRs, including chicken, hamburger, pizza, Mexican and sandwich restaurants, other purveyors of carry-out food and convenience dining establishments, including national restaurant and grocery chains. Many of our competitors possess substantially greater financial, marketing, personnel and other resources than we do.

Government Regulation

We are subject to various federal, state and local laws affecting our business, including various health, sanitation, labor, fire and safety standards. Newly constructed or remodeled restaurants are subject to state and local building code and zoning requirements. In connection with the re-imaging and alteration of our company-operated restaurants, we may be required to expend funds to meet certain federal, state and local regulations, including regulations requiring that remodeled or altered restaurants be accessible to persons with disabilities. Difficulties or failures in obtaining the required licenses or approvals could delay or prevent the opening of new restaurants in particular areas.

We are also subject to the Fair Labor Standards Act and various other laws governing such matters as minimum wage requirements, overtime and other working conditions and citizenship requirements. A significant number of our foodservice personnel are paid at rates related to the federal or state minimum wage, and increases in the minimum wage have increased our labor costs.

Many states and the Federal Trade Commission, as well as certain foreign countries, require franchisors to transmit specified disclosure documents to potential franchisees before granting a franchise. Additionally, some states and certain foreign countries require us to register our franchise disclosure documents before we may offer a franchise.

We have franchise agreements related to the operation of restaurants located on various U.S. military bases which are with certain governmental agencies and are subject to renegotiation of profits or termination at the election of the U.S. government. During 2013, royalty revenues from these restaurants were approximately $2.0 million.

Enterprise Risk Management

The Company has developed and implemented an Enterprise Risk Management program. The purpose of the program is to provide the Company with a systematic approach to identify and evaluate risks to the business, and provide the Company an effective manner of risk management and control. The Enterprise Risk Management program is designed to integrate risk management into the culture and strategic decision making of the Company, and to help the organization more effectively and efficiently drive performance. The Enterprise Risk Management program encompasses all aspects of the Company's business, including, without limitation, financial, operational, reputational, societal, and cyber security risks.

Environmental Matters

We are subject to various federal, state and local laws regulating the discharge of pollutants into the environment. We believe that we conduct our operations in substantial compliance with applicable environmental laws and regulations. Certain of our current and formerly owned and/or leased properties are known or suspected to have been used by prior owners or operators as retail gas stations and a few of these properties may have been used for other environmentally sensitive purposes. Certain of these properties previously contained underground storage tanks (“USTs”) and some of these properties may currently contain abandoned USTs. It is possible that petroleum products and other contaminants may have been released at these properties into the soil or groundwater. Under applicable federal and state environmental laws, we, as the current or former owner or operator of these sites, may be jointly and severally liable for the costs of investigation and remediation of any such contamination, as well as any other environmental conditions at our properties that are unrelated to USTs. We have obtained insurance coverage that we believe is adequate to cover any potential environmental remediation liabilities.

Available Information

We file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports with the Securities and Exchange Commission (the “SEC”). You may obtain copies of these documents by accessing the SEC’s website at http://www.sec.gov. In addition, as soon as reasonably practicable after such materials are filed with, or furnished to, the SEC, we make copies of these documents (except for exhibits) available to the public free of charge through our web site at www.investor.popeyes.com or by contacting our Secretary at our principal offices, which are located at 400 Perimeter Center Terrace, Suite 1000, Atlanta, Georgia 30346, telephone number (404) 459-4450.

Item 1A. RISK FACTORS

Certain statements we make in this filing, and other written or oral statements made by or on our behalf, may constitute “forward-looking statements” within the meaning of the federal securities laws. Words or phrases such as “should result,” “are expected to,” “we anticipate,” “we estimate,” “we project,” “we believe,” or similar expressions are intended to identify forward-looking statements. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. We believe that these forward-looking statements are reasonable; however, you should not place undue reliance on such statements. Such statements speak only as of the date they are made, and we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise. The following risk factors and others that we may add from time to time, are some of the factors that could cause our actual results to differ materially from the expected results described in our forward-looking statements.

If we are unable to compete successfully against other companies in the QSR industry or develop new products that appeal to consumer preferences, we could lose customers and our revenues may decline.

The QSR industry is intensely competitive with respect to price, quality, brand recognition, menu offerings, service and location. If we are unable to compete successfully against other foodservice providers, we could lose customers and our revenues may decline. We compete against other QSRs, including chicken, hamburger, pizza, Mexican and sandwich restaurants, other purveyors of carry out food, convenience dining establishments and other home meal replacement alternatives, including national restaurant and grocery store chains. Many of our competitors possess substantially greater financial, marketing, personnel and other resources than we do. There can be no assurance that consumers will continue to regard our products favorably, that we will be able to develop new products that appeal to consumer preferences, or that we will be able to continue to compete successfully in the QSR industry.

Adverse publicity related to food safety and quality could result in a loss of customers and reduce our revenues.

We and our franchisees are, from time to time, the subject of complaints or litigation from guests alleging illness, injury or other food quality, health or operational concerns. Adverse publicity resulting from these allegations may harm our reputation or our franchisees’ reputation, regardless of whether the allegations are valid or not, whether we are found liable or not, or whether those concerns relate only to a single restaurant or a limited number of restaurants or many restaurants. We are also subject to potentially negative publicity from various sources, including television, social media sites, which are beyond the control of the Company. Additionally, some animal rights organizations have engaged in confrontational demonstrations at certain restaurant companies across the country. As a multi-unit restaurant company, we can be adversely affected by the publicity surrounding allegations involving illness, injury, or other food quality, health or operational concerns. Complaints, litigation or adverse publicity experienced by one or more of our franchisees could also adversely affect our business as a whole. If we have adverse publicity due to any of these concerns, we may lose customers and our revenues may decline.

If our franchisees are unable or unwilling to open a sufficient number of restaurants, our growth strategy could be at risk.

As of December 29, 2013, we franchised 1,716 restaurants domestically and 456 restaurants in Puerto Rico, Guam, the Cayman Islands and 28 foreign countries. Our growth strategy is significantly dependent on increasing the number of our franchised restaurants. If our franchisees are unable to open a sufficient number of restaurants, our growth strategy could be significantly impaired.

Our ability to successfully open additional franchised restaurants will depend on various factors, including the availability of suitable sites, the negotiation of acceptable leases or purchase terms for new locations, permitting and regulatory compliance, the ability to meet construction schedules, the financial and other capabilities of our franchisees, and general economic and business conditions. Many of the foregoing factors are beyond the control of our franchisees. Further, there can be no assurance that our franchisees will successfully develop or operate their restaurants in a manner consistent with our concepts and standards, or will have the business abilities or access to financial resources necessary to open the restaurants required by their agreements. Historically, there have been many instances in which Popeyes franchisees have not fulfilled their obligations under their development agreements to open new restaurants.

If the cost of chicken increases, our cost of sales will increase and our operating results could be adversely affected.

The principal raw material for Popeyes is fresh chicken. Any material increase in the costs of fresh chicken could adversely affect our operating results. Our company-operated and franchised restaurants purchase fresh chicken from various suppliers who service us from various plant locations. These costs are significantly affected by increases in the cost of chicken, which can result from a number of factors, including increases in the cost of grain, disease, declining market supply of fast-food sized chickens

and other factors that affect availability. Because our purchasing agreements for fresh chicken allow the prices that we pay for chicken to fluctuate, a rise in the prices of chicken products could expose us to cost increases. If we fail to anticipate and react to increasing food costs by adjusting our purchasing practices or increasing our sales prices, our cost of sales may increase and our operating results could be adversely affected.

Changes in consumer preferences and demographic trends could result in a loss of customers and reduce our revenues.

Foodservice businesses are often affected by changes in consumer tastes, national, regional and local economic conditions, discretionary spending priorities, demographic trends, traffic patterns and the type, number and location of competing restaurants. In addition, the restaurant industry is currently under heightened legal and legislative scrutiny related to menu labeling and resulting from the perception that the practices of restaurant companies have contributed to nutritional, caloric intake, obesity, or other health concerns of their guests. If we are unable to adapt to changes in consumer preferences and trends, we may lose customers and our revenues may decline.

Because our operating results are closely tied to the success of our franchisees, the failure or loss of one or more franchisees, operating a significant number of restaurants, could adversely affect our operating results.

Our operating results are dependent on our franchisees and, in some cases, on certain franchisees that operate a large number of restaurants. How well our franchisees operate their restaurants and their desire to maintain their franchise relationship with us is outside of our direct control. In addition, economic conditions and the availability of credit may have an adverse impact on our franchisees. Any failure of these franchisees to operate their restaurants successfully or the loss of these franchisees could adversely impact our operating results. As of December 29, 2013, we had 338 franchisees operating restaurants within the Popeyes system and several preparing to become operators. The largest of our domestic franchisees operates 142 Popeyes restaurants; and the largest of our international franchisees operates 101 Popeyes restaurants. Typically, each of our international franchisees is responsible for the development of significantly more restaurants than our domestic franchisees. As a result, our international operations are more closely tied to the success of a smaller number of franchisees than our domestic operations. There can be no assurance that our domestic and international franchisees will operate their franchises successfully or continue to maintain their franchise relationships with us.

Currency, economic, political and other risks associated with our international operations could adversely affect our operating results.

We also face currency, economic, political, and other risks associated with our international operations. As of December 29, 2013, we had 456 franchised restaurants in Puerto Rico, Guam, the Cayman Islands and 28 foreign countries. Business at these operations is conducted in the respective local currency. The amount owed to us is based on a conversion of the royalties and other fees to U.S. dollars using the prevailing exchange rate. In particular, the royalties are based on a percentage of net sales generated by our foreign franchisees’ operations. Consequently, our revenues from international franchisees are exposed to the potentially adverse effects of our franchisees’ operations, currency exchange rates, local economic conditions, political instability and other risks associated with doing business in foreign countries. We expect that our franchise revenues generated from international operations will increase in the future, thus increasing our exposure to changes in foreign economic conditions and currency fluctuations.

Our operating results and same-store sales may fluctuate significantly and could fall below the expectations of securities analysts and investors, which could cause the market price of our common stock to decline.

Our operating results and same-store sales have fluctuated significantly in the past and may fluctuate significantly in the future as a result of a variety of factors, many of which are outside of our control. If our operating results or same-store sales fluctuate or fall below the expectations of securities analysts and investors, the market price of our common stock could decline.

Factors that may cause our results or same-store sales to fluctuate include the following:

| |

| • | the opening of new restaurants by us or our franchisees; |

| |

| • | the closing of restaurants by us or our franchisees; |

| |

| • | increases in the number of restaurant properties leased or sub-leased to franchisees under percentage rent arrangements; |

| |

| • | volatility of gasoline prices; |

| |

| • | increases in labor costs; |

| |

| • | increases in the cost of commodities and paper products; |

| |

| • | inclement weather patterns; and |

| |

| • | economic conditions generally, and in each of the markets in which we, or our franchisees, are located. |

Accordingly, results for any one period are not indicative of the results to be expected for any other period or for the full year, and same-store sales for any future period may decrease.

We are subject to government regulation, and our failure to comply with existing regulations or increased regulations could adversely affect our business and operating results.

We are subject to numerous federal, state, local and foreign government laws and regulations, including those relating to:

| |

| • | the preparation and sale of food; |

| |

| • | employee healthcare legislation; |

| |

| • | building and zoning requirements; |

| |

| • | environmental protection; |

| |

| • | information security and data protection; |

| |

| • | minimum wage, overtime, immigration, unions and other labor issues; |

| |

| • | compliance with the Americans with Disabilities Act; and |

| |

| • | working and safety conditions. |

If we fail to comply with existing or future regulations, we may be subject to governmental or judicial fines or sanctions, or we could suffer business interruption or loss. In addition, our capital expenses could increase due to remediation measures that may be required if we are found to be noncompliant with any of these laws or regulations.

We are also subject to regulation by the Federal Trade Commission and to state and foreign laws that govern the offer, sale and termination of franchises and the refusal to renew franchises. The failure to comply with these regulations in any jurisdiction or to obtain required approvals could result in a ban or temporary suspension on future franchise sales or fines or require us to make a rescission offer to franchisees, any of which could adversely affect our business and operating results.

Disruptions in the financial markets may adversely affect the availability and cost of credit and the slower economy may impact consumer spending patterns.

The ability of our franchisees and prospective franchisees to obtain financing for development of new restaurants or reinvestment in existing restaurants depends in part upon financial and economic conditions which are beyond their control. If our franchisees are unable to obtain financing on acceptable terms to develop new restaurants or reinvest in existing restaurants, our business and financial results could be adversely affected.

Disruptions in the financial markets and the slower economy may also adversely affect consumer spending patterns. There can be no assurances that governmental or other responses to economic challenges will restore or maintain consumer confidence, stabilize the markets or increase or maintain liquidity and the availability of credit. Declines in or displacement of our guests’ discretionary spending could reduce traffic in our system’s restaurants and/or limit our ability to raise prices.

Shortages or interruptions in the supply or delivery of fresh food products could adversely affect our operating results.

We and our franchisees are dependent on frequent deliveries of fresh food products that meet our specifications. Shortages or interruptions in the supply of fresh food products caused by unanticipated demand, natural disasters, problems in production or distribution, declining number of distributors, inclement weather or other conditions could adversely affect the availability, quality and cost of ingredients, which would adversely affect our operating results.

Instances of food-borne illness or avian flu could adversely affect the price and availability of poultry and other foods and create negative publicity which could result in a decline in our sales.

Instances of food-borne illness or avian flu could adversely affect the price and availability of poultry and other foods. As a result, Popeyes restaurants could experience a significant increase in food costs if there are additional instances of avian flu or food-borne illnesses. In addition to losses associated with higher prices and a lower supply of our food ingredients, instances of food-borne illnesses could result in negative publicity for us. This negative publicity, as well as any other negative publicity concerning food products we serve, may reduce demand for our food and could result in a decrease in guest traffic to our restaurants. A decrease in guest traffic to Popeyes restaurants as a result of these health concerns or negative publicity could result in a decline in our sales.

Failure to protect our information systems against cyber attacks or information security breaches, including failure to protect the integrity and security of individually identifiable data of our customers, franchisees and employees, could expose us to litigation, damage our reputation and have a material adverse effect on our business.

We rely on computer systems and information technology to conduct our business. These systems are inherently vulnerable to disruption or failure, as well as internal and external security breaches, denial of service attacks or other disruptive problems caused by hackers. A failure of these systems could cause an interruption in our business which could have a material adverse effect on our results of operations and financial condition.

In addition, we receive and maintain certain personal information about our customers, franchisees and employees. The use of this information by us is regulated by applicable law. If our security and information systems are compromised or our business associates fail to comply with these laws and regulations and this information is obtained by unauthorized persons or used inappropriately, it could adversely affect our reputation, as well as our restaurant operations and results of operations and financial condition. Additionally, we could be subject to litigation or the imposition of penalties. As privacy and information security laws and regulations change, we may incur additional costs to ensure we remain in compliance.

If any member of our senior management left us, our operating results could be adversely affected, and we may not be able to attract and retain additional qualified management personnel.

We are dependent on the experience and industry knowledge of the members of our senior management team. If, for any reason, our senior executives do not continue to be active in management or if we are unable to attract and retain qualified new members of senior management, our operating results could be adversely affected. We cannot guarantee that we will be able to attract and retain additional qualified senior executives as needed. We have employment agreements with certain executives; however, these agreements do not ensure their continued employment with us.

We may not be able to adequately protect our intellectual property, which could harm the value of our Popeyes brand and branded products and adversely affect our business.

We rely on a combination of trademarks, copyrights, service marks, trade secrets and similar intellectual property rights to protect our Popeyes brand and branded products. Our expansion strategy depends on our continued ability to use our intellectual property to increase brand awareness and further develop our branded products in both domestic and international markets. If our efforts to protect our intellectual property are not adequate, or if any third party misappropriates or infringes on our intellectual property, the value of our Popeyes brand may be harmed, which could have a material adverse effect on our business, including the failure of our Popeyes brand and branded products to achieve and/or maintain market acceptance.

Also, certain branding names, phrases, and designs that we use have not been registered in all of the countries in which we do business and may never be registered in all of these countries. In addition, the laws of some foreign countries do not protect intellectual property rights to the same extent as the laws of the U.S. We cannot be certain that we will be able to adequately protect our use of various marks or that their use will not result in liability for trademark infringement, trademark dilution or unfair competition.

As the franchisor of the Popeyes system, we try to ensure that the quality of our Popeyes brand and branded products is maintained by all of our franchisees, but cannot be certain that franchisees or others will not take actions that adversely affect the value of our intellectual property or reputation.

There can be no assurance that all of the steps we have taken to protect our intellectual property in the U.S. and foreign countries will be adequate. Further, through acquisitions of third parties, we may acquire brands and related trademarks that are subject to the same risks as the brand and trademarks we currently own.

Our 2013 Credit Facility may limit our ability to expand our business, and our ability to comply with the repayment requirements, covenants, tests and restrictions contained in the 2013 Credit Facility may be affected by events that are beyond our control.

The 2013 Credit Facility contains financial and other covenants, including covenants which require us to maintain various financial ratios, limit our ability to incur additional indebtedness, restrict the amount of capital expenditures that may be incurred, restrict the payment of cash dividends and limit the amount of debt which can be loaned to our franchisees or guaranteed on their behalf. This facility also limits our ability to engage in mergers or acquisitions, sell certain assets, repurchase our stock and enter into certain lease transactions. The 2013 Credit Facility includes customary events of default, including, but not limited to, the failure to maintain the financial ratios described above, the failure to pay any interest, principal or fees when due, the failure to perform certain covenant agreements, inaccurate or false representations or warranties, insolvency or bankruptcy, change of control,

the occurrence of certain ERISA events and judgment defaults. The restrictive covenants in our 2013 Credit Facility may limit our ability to expand our business, and our ability to comply with these provisions may be impacted by events beyond our control. A failure to comply with any of the financial and operating covenants included in the 2013 Credit Facility would result in an event of default, permitting the lenders to accelerate the maturity of outstanding indebtedness. This acceleration could also result in the acceleration of other indebtedness that we may have outstanding at that time. Were we to default on the terms and conditions of the 2013 Credit Facility and the debt were accelerated by the facility’s lenders, such developments would have a material adverse impact on our financial condition and our liquidity.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 2. PROPERTIES

We own, lease or sublease the land and buildings for our company-operated restaurants. In addition, we own, lease or sublease land and buildings which we lease or sublease to our franchisees and third parties.

We typically lease our restaurants under triple net leases that require us to pay minimum rent, real estate taxes, maintenance costs and insurance premiums and, in some cases, percentage rent based on sales in excess of specified amounts. Generally, our leases have initial terms of 20 years, with options to renew for one or more additional periods, although the terms of our leases vary depending on the facility.

The following table sets forth the locations by state of our company-operated restaurants as of December 29, 2013:

|

| | | | | | | | |

| | Land and Buildings Owned | | Land and/or Buildings Leased | | Total |

| Louisiana | 5 |

| | 21 |

| | 26 |

|

| Tennessee | 2 |

| | 8 |

| | 10 |

|

| Indiana | 5 |

| | 3 |

| | 8 |

|

| Mississippi | 1 |

| | 3 |

| | 4 |

|

| North Carolina | — |

| | 3 |

| | 3 |

|

| Arkansas | — |

| | 1 |

| | 1 |

|

| South Carolina | 1 |

| | — |

| | 1 |

|

| Total | 14 |

| | 39 |

| | 53 |

|

Within our franchise operations segment, our typical restaurant leases to franchisees are triple net to the franchisee, requiring them to pay minimum rent (based upon prevailing market rental rates) or percentage rent based on sales in excess of specified amounts or both minimum rent and percentage rent plus real estate taxes, maintenance costs and insurance premiums. These leases are typically cross-defaulted with the corresponding franchise agreement for that site.

The following table sets forth the locations by state of land and buildings which we lease or sublease to our franchisees as of December 29, 2013:

|

| | | | | |

| | Land and Buildings Owned | | Land and/or Buildings Leased | | Total |

| Texas | 7 | | 21 | | 28 |

| Georgia | 0 | | 16 | | 16 |

| California | 9 | | 4 | | 13 |

| Minnesota | 9 | | 4 | | 13 |

| Tennessee | 1 | | 3 | | 4 |

| Colorado | 1 | | 1 | | 2 |

| Pennsylvania | 2 | | 0 | | 2 |

| Total | 29 | | 49 | | 78 |

Additionally, we had three properties subleased or available to sublease to unrelated third parties and one owned parcel of land.

We lease office space in a facility located in Atlanta, Georgia that is the headquarters for the Company. The lease for the office space expires on November 30, 2022. There are two 5 year renewal options which can be executed to extend the lease an additional 10 years at a market rate to be determined at the time of renewal.

We believe our leased and owned facilities provide sufficient space to support our corporate and operational needs.

Item 3. LEGAL PROCEEDINGS

We are a defendant in various legal proceedings arising in the ordinary course of business, including claims resulting from “slip and fall” accidents, employment-related claims, claims from guests or employees alleging illness, injury or other food quality, health or operational concerns and claims related to franchise matters. We have established adequate reserves to provide for the defense and settlement of such matters, and we believe their ultimate resolution will not have a material adverse effect on our financial condition or our results of operations.

Item 4. MINE SAFETY DISCLOSURES

None.

Item 4A. EXECUTIVE OFFICERS

The following table sets forth the name, age (as of the date of this filing) and position of our current executive officers:

|

| | | | | |

| Name | | Age | | Position |

| Cheryl A. Bachelder | | 57 |

| | Chief Executive Officer |

| Ralph W. Bower | | 51 |

| | President-U.S. |

| H. Melville Hope, III | | 52 |

| | Senior Vice President and Chief Financial Officer |

| Richard H. Lynch | | 59 |

| | Chief Brand Experience Officer |

| Harold M. Cohen | | 50 |

| | Senior Vice President, General Counsel, Chief Administrative Officer and Corporate Secretary |

| Andrew Skehan | | 53 |

| | Chief Operating Officer-International |

Cheryl A. Bachelder, age 57, has served as our Chief Executive Officer since November 2007. She has served as a member of the Board of Directors since November 2006 and also serves on the Procter & Gamble APFI Advisory Board, since 2009, as well as the Board of Directors for Pier 1 Imports, since November 2012. She also served on the True Value Corporation Board of Directors, from 2006 – 2013 and the National Restaurant Association Board, May 2009 – December 2012. Ms. Bachelder served as the President and Chief Concept Officer of KFC Corporation in Louisville, Kentucky from January 2001 to September 2003.

Ralph W. Bower, age 51, has served as our President – U.S. since March of 2012. Mr. Bower served as our Chief Operating Officer U.S. From March 2009 to February 2012. From February 2008 to March 2009, Mr. Bower served as our Chief Operations Officer. From 2006 to 2008, Mr. Bower was the KFC operations leader responsible for more than 1,300 KFC franchised restaurants in the western United States. Prior to this position, he led KFC company operations in Pennsylvania, New Jersey and Delaware. From 2002 to 2003 Mr. Bower directed the guest satisfaction function for KFC. Before joining KFC, Mr. Bower was employed by Western Ohio Pizza, a franchisee of Domino’s Pizza, overseeing operations in Dayton, OH, and Indianapolis, IN. Mr. Bower began his restaurant career with the second largest Domino’s franchise organization, Team Washington, where he was a regional director.

H. Melville Hope, III, age 52, has served as our Chief Financial Officer since December 2005. From February 2004 until December 2005, Mr. Hope served as our Senior Vice President, Finance and Chief Accounting Officer. From April 2003 to February 2004, Mr. Hope was our Vice President of Finance. Prior to joining the Company, he was Chief Financial Officer for First Cambridge HCI Acquisitions, LLC, a real estate investment firm, located in Birmingham, Alabama. From 1984 to 2002, Mr. Hope was an accounting, auditing and business advisory professional for PricewaterhouseCoopers, LLP in Atlanta, Georgia, in Savannah, Georgia and in Houston, Texas where he was admitted to the partnership in 1998.

Richard H. Lynch, age 59, was appointed as Chief Brand Experience Officer in January 2014. From January 2012 to January 2014, Mr. Lynch served as Chief Global Brand Officer. From March 2008 to January 2012, Mr. Lynch served as our Chief Marketing Officer following his consultancy as interim CMO. Mr. Lynch served as Principal of Go LLC, a marketing consulting firm specializing in restaurant and food retail from July 2003 to February 2008, where he developed brand strategy and innovation plans for concepts including Burger King, Ruby Tuesday, and Buffalo Wild Wings. From November 1982 to June 2003, Mr. Lynch

served as Executive Vice President at Campbell Mithun Advertising where he led the development of strategy and positioning for brands such as Domino’s Pizza, Martha Stewart Everyday and Betty Crocker.

Harold M. Cohen, age 50, has served as our Senior Vice President of Legal Affairs, Corporate Secretary and General Counsel since September 2005. Mr. Cohen has served as our Chief Administrative Officer since May 2008. Mr. Cohen has been General Counsel of Popeyes, formerly a division of AFC Enterprises, Inc., since January 2005. He also has served as Vice President of the Company since July 2000. From April 2001 to December 2004, he served as Deputy General Counsel of the Company. From August 1995 to June 2000, he was Corporate Counsel for the Company.

Andrew Skehan, age 53, was appointed our Chief Operating Officer – International in August 2011. From October 2009 until August 2011, Mr. Skehan was Chief Operating Officer – International for Wendy’s/Arby’s Group in Atlanta, Georgia. From April 2007 until December 2008, he was President – Europe, Africa and Middle East for Quiznos Restaurants in Denver, Colorado. From April 1999 until December 2006, Mr. Skehan served as Chief Marketing Officer and subsequently Chief Operating Officer for Churchill Downs Inc. in Louisville, Kentucky.

PART II.

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock currently trades on the NASDAQ Global Market under the symbol “PLKI.”

The following table sets forth the high and low per share sales prices of our common stock, by quarter, for fiscal years 2013 and 2012.

|

| | | | | | | | | | | | | | | |

| 2013 | | 2012 |

| (Dollars per share) | High | | Low | | High | | Low |

| First Quarter | $ | 36.77 |

| | $ | 25.68 |

| | $ | 17.77 |

| | $ | 13.68 |

|

| Second Quarter | $ | 38.59 |

| | $ | 31.13 |

| | $ | 24.49 |

| | $ | 15.99 |

|

| Third Quarter | $ | 44.45 |

| | $ | 35.78 |

| | $ | 26.79 |

| | $ | 20.74 |

|

| Fourth Quarter | $ | 45.22 |

| | $ | 37.01 |

| | $ | 27.89 |

| | $ | 24.36 |

|

Share Repurchases

A share repurchase program approved by the Board of Directors is presently in place. As of February 26, 2014, the remaining dollar amount of shares that may be repurchased under the program was approximately $31.5 million. See Note 12 to our Consolidated Financial Statements included in this Form 10-K.

During 2013, we repurchased and retired 504,295 shares of common stock for approximately $19.9 million. During 2012, we repurchased and retired 741,228 shares of common stock for approximately $15.2 million. During 2011, we repurchased and retired 1,465,436 shares of common stock for approximately $22.3 million.

During the fourth quarter of 2013, we repurchased 114,577 of our common shares as scheduled below:

|

| | | | | | | | | | | | | | |

| Period | | Number of Shares Repurchased | | Average Price Paid Per Share | | Total Number of Shares Repurchased as Part of a Publicly Announced Plan | | Maximum Value of Shares that May Yet Be Repurchased Under the Plan |

| Period 11 (10/07/13 to 11/03/13) | | — |

| | $ | — |

| | — |

| | $ | 36,476,042 |

|

| Period 12 (11/04/13 to 12/01/13) | | 114,577 |

| | $ | 43.18 |

| | 114,577 |

| | $ | 31,528,485 |

|

| Period 13 (12/02/13 to 12/29/13) | | — |

| | $ | — |

| | — |

| | $ | 31,528,485 |

|

| Total | | 114,577 |

| | $ | 43.18 |

| | 114,577 |

| | $ | 31,528,485 |

|

Shareholders of Record

As of January 31, 2014, we had 122 shareholders of record of our common stock.

Dividend Policy

We anticipate that we will retain any future earnings to support operations and to finance the growth and development of our business, and we do not expect to pay cash dividends in the foreseeable future. Any future determination relating to our dividend policy will be made at the discretion of our Board of Directors and will depend on a number of factors, including future earnings, capital requirements, financial conditions, plans for share repurchases, future prospects and other factors that the Board of Directors may deem relevant. Other than a special cash dividend, we have never declared or paid cash dividends on our common stock.

Stock Performance Graph

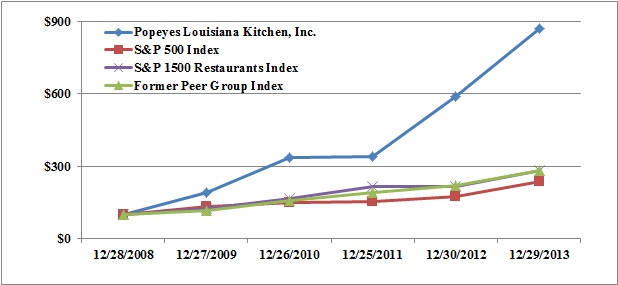

The following stock performance graph compares the performance of our common stock to the Standard & Poor’s 500 Stock Index (“S&P 500 Index”), the S&P 1500 Restaurants Index (the “peer group index”) and a peer group index composed of the following quick service restaurant companies: Domino’s Pizza Inc., Jack In the Box Inc., Papa Johns International Inc., Sonic Corp., Wendy’s International Inc. and YUM! Brands Inc. (collectively the “former peer group”). Management believes that the companies included in the S&P 1500 Restaurants Index better reflect the scope of the Company’s operations and match the competitive market in which the Company operates than its former peer group. The former peer group companies are included in the S&P 1500 Restaurants Index. Stock performance is compared for the five fiscal year period ended December 29, 2013. The cumulative total return computations set forth in the performance graph assume the investment in the Company’s common stock and in each index was $100 at the end of fiscal 2008, and, with respect to the indices, that all dividends were reinvested.

|

| | | | | | | | | | | | |

| Comparison of Cumulative Five Year Total Return |

| | | | | | | | | | | | | |

| Company Name / Index | | 12/28/2008 | | 12/27/2009 | | 12/26/2010 | | 12/25/2011 | | 12/30/2012 | | 12/29/2013 |

| Popeyes Louisiana Kitchen, Inc. | | 100 | | 192 | | 338 | | 341 | | 587 | | 869 |

| S&P 500 Index | | 100 | | 132 | | 150 | | 155 | | 175 | | 235 |

| S&P 1500 Restaurants Index | | 100 | | 124 | | 167 | | 215 | | 216 | | 281 |

| Former Peer Group Index | | 100 | | 116 | | 158 | | 193 | | 219 | | 282 |

Item 6. SELECTED FINANCIAL DATA

The following data was derived from our Consolidated Financial Statements. Such data should be read in conjunction with our Consolidated Financial Statements and the notes thereto and our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” at Item 7 of this Annual Report.

|

| | | | | | | | | | | | | | | | | | | |

| (In millions, except per share data) | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| Summary of Operations: | | | | | | | | | |

Revenues:(1) | | | | | | | | | |

Sales by company-operated restaurants(2) | $ | 78.7 |

| | $ | 64.0 |

| | $ | 54.6 |

| | $ | 52.7 |

| | $ | 57.4 |

|

Franchise royalties and fees(3) | 121.9 |

| | 110.5 |

| | 95.0 |

| | 89.4 |

| | 86.0 |

|

Rent from franchised restaurants(4) | 5.4 |

| | 4.3 |

| | 4.2 |

| | 4.3 |

| | 4.6 |

|

| Total revenues | 206.0 |

| | 178.8 |

| | 153.8 |

| | 146.4 |

| | 148.0 |

|

| Expenses: | | | | | | | | | |

| Restaurant food, beverages and packaging | 26.1 |

| | 21.7 |

| | 18.3 |

| | 16.8 |

| | 18.9 |

|

| Restaurant employee, occupancy and other expenses | 37.9 |

| | 31.2 |

| | 26.1 |

| | 25.8 |

| | 29.5 |

|

| General and administrative expenses | 73.4 |

| | 67.6 |

| | 61.3 |

| | 56.4 |

| | 56.0 |

|

| Occupancy expenses - franchise restaurants | 3.4 |

| | 2.9 |

| | 2.7 |

| | 2.1 |

| | 2.6 |

|

| Depreciation and amortization | 6.7 |

| | 4.6 |

| | 4.2 |

| | 3.9 |

| | 4.4 |

|

Other expenses (income), net(5) | 0.3 |

| | (0.5 | ) | | 0.5 |

| | 0.2 |

| | (2.1 | ) |

| Total expenses | 147.8 |

| | 127.5 |

| | 113.1 |

| | 105.2 |

| | 109.3 |

|

| Operating profit | 58.2 |

| | 51.3 |

| | 40.7 |

| | 41.2 |

| | 38.7 |

|

Interest expense, net(6) | 3.7 |

| | 3.6 |

| | 3.7 |

| | 8.0 |

| | 8.4 |

|

| Income before income taxes | 54.5 |

| | 47.7 |

| | 37.0 |

| | 33.2 |

| | 30.3 |

|

| Income tax expense | 20.4 |

| | 17.3 |

| | 12.8 |

| | 10.3 |

| | 11.5 |

|

| Net income | $ | 34.1 |

| | $ | 30.4 |

| | $ | 24.2 |

| | $ | 22.9 |

| | $ | 18.8 |

|

| | | | | | | | | | |

| Earnings per common share, basic | $ | 1.44 |

| | $ | 1.27 |

| | $ | 0.99 |

| | $ | 0.91 |

| | $ | 0.74 |

|

| Earnings per common share, diluted | $ | 1.41 |

| | $ | 1.24 |

| | $ | 0.97 |

| | $ | 0.90 |

| | $ | 0.74 |

|

| | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | |

| Basic | 23.6 |

| | 23.9 |

| | 24.5 |

| | 25.3 |

| | 25.3 |

|

| Diluted | 24.1 |

| | 24.5 |

| | 25.0 |

| | 25.5 |

| | 25.4 |

|

| | | | | | | | | | |

| Summary of cash flow data: | | | | | | | | | |

| Share repurchases | $ | 19.9 |

| | $ | 15.2 |

| | $ | 22.3 |

| | $ | — |

| | $ | — |

|

| | | | | | | | | | |

| Year-end balance sheet data: | | | | | | | | | |

| Total assets | $ | 200.5 |

| | $ | 172.4 |

| | $ | 135.6 |

| | $ | 123.9 |

| | $ | 116.6 |

|

| Total debt | 67.2 |

| | 72.8 |

| | 64.0 |

| | 66.0 |

| | 82.6 |

|

| |

| (1) | Factors that impact the comparability of revenues for the years presented include: |

| |

| (a) | The effects of restaurant openings, closings, unit conversions, franchisee sales and same-store sales (see “Summary of System-Wide Data” later in this Item 6). |

| |

| (b) | The Company’s fiscal year ends on the last Sunday in December. The 2012 fiscal year consisted of 53 weeks. All other fiscal years presented consisted of 52 weeks each. The 53rd week in 2012 increased sales by company-operated restaurants by approximately $1.2 million and increased franchise revenues by approximately $1.7 million. The net impact of the 53rd week earnings per share was approximately $0.01 per diluted share. |

| |

| (2) | Factors that impact the comparability of sales by Company-operated restaurants for the years presented include: |

| |

| (a) | The Company opened nine, five and two company restaurants in 2013, 2012 and 2011, respectively. The impact of new restaurant openings net of one closure in 2013 was an increase in company-operated sales of $14.9 million in 2013 compared to 2012, $5.5 million in 2012 compared to 2011, and $1.3 million in 2011 compared to 2010. |

| |

| (b) | In 2009, the Company completed the re-franchising of 16 company-operated restaurants in its Nashville, Tennessee and Atlanta, Georgia markets resulting in a decrease in 2010 revenues of $6.5 million as compared to 2009 (net of franchise royalties earned). |

| |

| (3) | Factors that impact franchise royalties and fees include: |

| |

| (a) | Franchise revenues are principally composed of royalty payments from franchisees that are are generally 5% of franchise net restaurant sales. While franchise sales are not recorded as revenue by the Company, management believes they are important in understanding the Company’s financial performance because these sales are indicative of the Company’s health, given the Company’s strategic focus on growing its overall business through franchising. Total franchisee sales were $2.358 billion in 2013, $2.189 billion in 2012, $1.932 billion in 2011, $1.811 billion in 2010, and $1.716 billion in 2009. |

| |

| (b) | In 2012, the Company completed an acquisition of twenty-seven restaurants in Minnesota and California. The restaurants were in the trade image of another quick service restaurant concept. Twenty-six of the acquired restaurants were converted into the Popeyes Louisiana Kitchen image and leased to Popeyes franchisees to operate under our standard franchise agreement. The remaining restaurant property was sold in 2013. Non-recurring franchise fees associated with twenty-four conversions completed in 2013 were $5.5 million compared to $0.5 million for two conversions completed in 2012. |

| |

| (4) | Rent from franchised restaurants are composed of rents and percentage rents associated with properties leased or sub-leased to franchisees. Percentage rents earned from twenty-six restaurant properties converted and franchised in Minnesota and California increased rent from franchised restaurants $1.9 million in 2013 compared to 2012. The assignment of leases to franchisees and lease terminations in 2013 and 2012 reduced rent from franchised restaurants by $0.6 million in 2013 compared to 2012. |

| |

| (5) | Factors that impact the comparability of other expenses (income), net for the years presented include: |

| |

| (a) | During 2012, other income includes a $0.3 million gain on the sale of real estate to a franchisee and the recognition of $0.5 million in deferred gains related to seven properties formerly leased to a franchisee. |

| |

| (b) | During 2011, the Company sold two properties to a franchisee for approximately $0.7 million and recognized a gain of $0.5 million. |

| |

| (c) | The Company recognized $0.8 million in expense for the corporate support center relocation in 2011. |

| |

| (d) | During 2009, the Company sold ten real estate properties for a gain of approximately $3.6 million. |

| |

| (e) | During 2013, 2012, 2011, 2010, and 2009 disposals of fixed assets were approximately $0.4 million, $0.3 million, $0.5 million, $0.7 million, and $0.6 million, respectively. |

| |

| (6) | Factors that impact the comparability of interest expense, net for the years presented include: |

| |

| (a) | During 2013 we expensed $0.4 million as a component of interest expense, net in connection with the re-financing of our 2013 Credit Facility. See Note 9 to our Consolidated Financial Statements included in this Form 10-K for details on the 2013 Credit Facility. |

| |

| (b) | In 2011, interest from term loans decreased $3.2 million compared to 2010 primarily due to lower interest rates from the Credit Facility refinanced in 2010. See Note 9 to our Consolidated Financial Statements included in this Form 10-K for details on the 2010 Credit Facility. |

| |

| (c) | During 2010 we expensed $0.6 million as a component of Interest expense, net in connection with the extinguishment of the 2005 Credit Facility term loan. |

| |

| (d) | During 2009 we expensed $1.9 million as a component of Interest expense, net in connection with the third amendment and restatement of the 2005 Credit Facility. |

Summary of System-Wide Data

The following table presents financial and operating data for the Popeyes restaurants we operate and those that we franchise. The data presented is unaudited. Data for franchised restaurants is derived from information provided by our franchisees. We present this data because it includes important operational measures relevant to the QSR industry.

|

| | | | | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

Global system-wide sales increase (1) | 8.2 | % | | 13.5 | % | | 6.6 | % | | 5.1 | % | | 1.8 | % |

| Company-operated restaurants same-store sales increase (decrease) | 2.3 | % | | 5.3 | % | | 1.1 | % | | 4.0 | % | | (0.8 | )% |

| Domestic franchised restaurants same-store sales increase | 3.6 | % | | 7.5 | % | | 3.1 | % | | 2.5 | % | | 0.7 | % |

| Total domestic same-store sales increase | 3.6 | % | | 7.5 | % | | 3.0 | % | | 2.5 | % | | 0.6 | % |

| International franchised restaurants same-store sales increase | 4.7 | % | | 2.6 | % | | 3.3 | % | | 3.1 | % | | 1.9 | % |

Total global same-store sales increase (2) | 3.7 | % | | 6.9 | % | | 3.1 | % | | 2.6 | % | | 0.7 | % |

| | | | | | | | | | |

| Company-operated restaurants (all domestic) | | | | | | | | | |

| Restaurants at beginning of year | 45 |

| | 40 |

| | 38 |

| | 37 |

| | 55 |

|

| New restaurant openings | 9 |

| | 5 |

| | 2 |

| | 1 |

| | — |

|

Restaurant conversions, net (3) | — |

| | — |

| | — |

| | — |

| | (16 | ) |

| Permanent closings | (1 | ) | | — |

| | — |

| | — |

| | (2 | ) |

| Restaurants at end of year | 53 |

| | 45 |

| | 40 |

| | 38 |

| | 37 |

|

| | | | | | | | | | |

| Franchised restaurants (domestic and international) | | | | | | | | | |

| Restaurants at beginning of year | 2,059 |

| | 1,995 |

| | 1,939 |

| | 1,906 |

| | 1,867 |

|

| New restaurant openings | 185 |

| | 136 |

| | 138 |

| | 105 |

| | 95 |

|

Restaurant conversions, net (3) | — |

| | — |

| | — |

| | — |

| | 16 |

|

| Permanent closings | (67 | ) | | (75 | ) | | (75 | ) | | (67 | ) | | (79 | ) |

Temporary (closings)/re-openings, net (4) | (5 | ) | | 3 |

| | (7 | ) | | (5 | ) | | 7 |

|

| Restaurants at end of year | 2,172 |

| | 2,059 |

| | 1,995 |

| | 1,939 |

| | 1,906 |

|

| Total system restaurants | 2,225 |

| | 2,104 |

| | 2,035 |

| | 1,977 |

| | 1,943 |

|

| | | | | | | | | | |

| New franchised restaurant openings | | | | | | | | | |

| Domestic | 115 |

| | 79 |

| | 71 |

| | 44 |

| | 39 |

|

| International | 70 |

| | 57 |

| | 67 |

| | 61 |

| | 56 |

|

| Total new franchised restaurant openings | 185 |

| | 136 |

| | 138 |

| | 105 |

| | 95 |

|

| | | | | | | | | | |

| Franchised restaurants | | | | | | | | | |

| Domestic | 1,716 |

| | 1,634 |

| | 1,587 |

| | 1,542 |

| | 1,539 |

|

| International | 456 |

| | 425 |

| | 408 |

| | 397 |

| | 367 |

|

| Restaurants at end of year | 2,172 |

| | 2,059 |

| | 1,995 |

| | 1,939 |

| | 1,906 |

|

| |

| (1) | Fiscal year 2012 consisted of 53 weeks. All other fiscal years presented consisted of 52 weeks. The 53rd week in 2012 contributed approximately 2.0% to global system-wide sales growth. Excluding the impact of the 53rd week in 2012, global system-wide sales growth in 2013 was approximately 9.9%. |

| |

| (2) | New restaurants are included in the computation of same-store sales after they have been open 65 weeks. Unit conversions are included immediately upon conversion. Temporary closings are excluded from same store sales for the period they are closed. |

| |

| (3) | Unit conversions include the sale or purchase of Company-operated restaurants to/from a franchisee. |

| |

| (4) | Temporary closings are presented net of re-openings. Most temporary closings arise due to the re-imaging or the rebuilding of older restaurants. |

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our Selected Financial Data, our Consolidated Financial Statements and our Risk Factors that are included elsewhere in this filing.

Our discussion contains forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements, as a result of a number of factors including those factors set forth in Item 1A. of this Annual Report and other factors presented throughout this filing.

Nature of Business

Popeyes develops, operates, and franchises quick-service restaurants under the trade names Popeyes® Chicken & Biscuits and Popeyes® Louisiana Kitchen (collectively “Popeyes”) in 47 states, the District of Columbia, Puerto Rico, Guam, the Cayman Islands, and 28 foreign countries. Popeyes has two reportable business segments: franchise operations and company-operated restaurants. Financial information concerning these business segments can be found at Note 20 to our Consolidated Financial Statements.

2013 Overview

We accomplished the following results in 2013 as a result of disciplined execution against our strategic plan:

| |

| • | Reported net income was $34.1 million, or $1.41 per diluted share, compared to $30.4 million, or $1.24 per diluted share, in 2012. Adjusted earnings per diluted share were $1.43 compared to $1.24 in 2012, an increase of approximately 15%. Adjusted earnings per diluted share is a supplemental non-GAAP measure of performance. See the heading entitled “Management’s Use of Non-GAAP Financial Measures.” |

| |

| • | Global same-store sales increased 3.7%, compared to a 6.9% increase last year, for a two-year growth of 10.6%. |

| |

| • | Global system-wide sales increased approximately 9.9%, for a two-year growth rate of over 21%, after adjusting for the 53rd week of operations in fiscal 2012. |

| |

| • | The Popeyes system opened 194 restaurants, compared to 141 last year, and permanently closed 68 restaurants, resulting in 126 net openings, compared to 66 in 2012. The Popeyes system opened more new restaurants in fiscal 2013 than in any single year in the last 15 years. |

| |

| • | Popeyes expanded its strategic investment in company-operated restaurants by adding six new restaurants in our two new markets, Indianapolis and Charlotte, and three in our heritage markets, New Orleans and Memphis. We expect that this strategy will allow the Company to demonstrate its dominant real estate approach and our investment in our employee and guest experiences. In addition, the profitability of our restaurants represents a good long-term investment of capital and fuels our investment in our franchise system as a whole. |

| |

| • | Approximately 550 domestic restaurants were remodeled bringing the total to over 1,100 restaurants, or 60% of the domestic system, in the new Popeyes Louisiana Kitchen image. |

| |

| • | General and administrative expenses were $73.4 million, at 3.0% of system-wide sales compared to $67.6 million at 3.0% of system-wide sales in 2012. |

| |

| • | Operating EBITDA of $65.2 million was 31.7% of total revenues, compared to $55.9 million, at 31.3% of total revenues last year. Operating EBITDA is a supplemental non-GAAP measure of performance. See the heading entitled “Management’s Use of Non-GAAP Financial Measures.” |

| |

| • | Free cash flow was $42.0 million, compared to $36.7 million in 2012. Free cash flow is a supplemental non-GAAP measure of performance. See the heading entitled “Management’s Use of Non-GAAP Financial Measures.” |

| |

| • | The Company recorded $5.5 million in non-recurring franchise revenues related to the conversions of restaurants acquired in Minnesota and California. These revenues, net of occupancy and other expenses, contributed approximately $0.12 to adjusted earnings per share in 2013. |

| |

| • | The Company repurchased approximately 504,000 shares of its common stock for approximately $19.9 million. |

2013 Same-Store Sales

Global same-store sales increased 3.7%, compared to a 6.9% increase in 2012.

Total domestic same-store sales increased 3.6%, compared to a 7.5% increase last year. For five consecutive years, our domestic same-store sales have outpaced the chicken-QSR and the entire QSR category, according to independent data. This positive sales growth reflects Popeyes continued menu innovation, supported by expanded relevant advertising and strengthened restaurant execution which has led to an increase in Popeyes market share of the chicken-QSR category to 20.8% for 2013.

Company-operated restaurant same-store sales increased 2.3%, compared to 5.3% in 2012. Same-store sales in 2013 were comprised of 3.4% in our heritage markets, New Orleans and Memphis, offset by negative same-store sales for the single Indianapolis restaurant included in the computation of same-store sales. The Company expects that in the near-term, same-store sales in its new company-operated markets of both Indianapolis and Charlotte will be impacted as new restaurants are developed in those emerging markets and rollover high first year sales volumes.

International same-store sales increased 4.7%, compared to a 2.6% increase last year, the seventh consecutive year of positive same-store sales.

2014 Operating and Financial Outlook

Globally, in 2014, the Company expects:

| |

| • | Same-store sales growth in the range of 2.0% to 3.0%. |

| |

| • | New restaurant openings in the range of 180 to 200 and net restaurant openings in the range of 100 to 130, for a net unit growth rate of approximately 5%. During 2014, the Company expects to open 10 to 15 new company-operated restaurants. |

| |

| • | General and administrative expenses are expected to be approximately 3% of system-wide sales maintaining the investment rate for sustainable long term growth. |

| |

| • | Capital expenditures for the year are expected to be $30 to $35 million, including approximately $25 million for company-operated restaurant development. |

| |

| • | Adjusted earnings per diluted share in the range of $1.57 to $1.62. This guidance reflects a two year average growth of approximately 13% to 14%. |

| |

| • | In 2014, the Company plans to repurchase $20 to $30 million in outstanding shares, compared to $19.9 million in 2013. |

| |

| • | The Company’s effective income tax rate in 2014 is expected to be approximately 38%, compared to 37.4% in 2013. |