UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

POPEYES LOUISIANA KITCHEN, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

PROXY STATEMENT AND NOTICE OF

2014

ANNUAL SHAREHOLDERS MEETING

400 Perimeter Center Terrace, Suite 1000

Atlanta, Georgia 30346

April 22, 2014

To our Shareholders:

It is our pleasure to invite you to attend our 2014 Annual Meeting of Shareholders which will be held on Thursday, May 22, 2014, at the Hilton Garden Inn Atlanta Perimeter, 1501 Lake Hearn Drive, Atlanta, Georgia 30319. The 2014 Annual Meeting will start at 8:30 a.m., local time.

The ballot for the 2014 Annual Meeting, to which this proxy statement relates, includes a proposal for the election of eight directors nominated to serve on our Board of Directors until the 2015 Annual Meeting, a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2014, and a proposal to approve, on an advisory basis, the compensation of the named executive officers as disclosed in the attached proxy statement.

Please note that you will need to show that you are a shareholder of Popeyes Louisiana Kitchen, Inc. to attend the 2014 Annual Meeting. If your shares are registered in your name, your admission card is included with this proxy statement, and you will need to bring that card with you to the meeting, together with valid picture identification. If your shares are held in the name of your broker or another nominee or you received your proxy materials electronically, you will need to bring evidence of your stock ownership, such as your most recent brokerage account statement, and valid picture identification.You will be able to attend the meeting only if you have either an admission card or proof that you own Popeyes Louisiana Kitchen, Inc. stock.

If you will need special assistance at the meeting because of a disability, please contact our Corporate Secretary, Harold M. Cohen, at (404) 459-4650. Whether or not you plan to attend our annual meeting, you can make certain that your shares are represented at the meeting by promptly completing, signing and returning the enclosed proxy card or voting by Internet or telephone.

Thank you for your support.

Sincerely,

John M. Cranor, III

Chairman of the Board

Popeyes Louisiana Kitchen, Inc.

NOTICE OF 2014 ANNUAL MEETING OF SHAREHOLDERS

| | |

Time: | | 8:30 a.m., local time, on Thursday, May 22, 2014 |

| |

Place: | | Hilton Garden Inn Atlanta Perimeter, 1501 Lake Hearn Drive, Atlanta, Georgia 30319 |

| |

Items of Business: | | (1) To elect eight directors nominated by the Board of Directors to our Board of Directors; |

| |

| | (2) To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2014; |

| |

| | (3) To approve, on an advisory basis, the compensation of the named executive officers as disclosed in this proxy statement; and |

| |

| | (4) To transact such other business properly coming before the meeting or any adjournment thereof. |

| |

Who Can Vote: | | You can vote if you were a shareholder of record of our common stock, par value $.01 per share, on April 4, 2014. |

| |

Annual Report: | | A copy of our 2013 Annual Report on Form 10-K is enclosed. |

| |

Date of Mailing: | | This notice and the proxy statement are first being mailed to shareholders on or about April 22, 2014. |

By Order of the Board of Directors

Harold M. Cohen, Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the 2014 Annual Meeting of

Shareholders: The proxy statement and annual report are available at

www.edocumentview.com/PLKI

TABLEOF CONTENTS

What am I voting on?

You will be voting on the following:

| • | | To elect eight directors nominated by the Board of Directors to our Board of Directors; |

| • | | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2014; |

| • | | To approve the compensation, on an advisory basis, of the named executive officers as disclosed in this Proxy Statement; and |

| • | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

No cumulative voting rights are authorized and dissenter’s rights are not applicable to the matters being voted upon.

Who is entitled to vote?

You may vote if you owned our common stock, par value $.01 per share, as of the close of business on April 4, 2014, the record date. Each share of common stock is entitled to one vote. As of April 4, 2014, we had 23,822,927 shares of common stock outstanding.

How do I vote if I do not plan to attend the meeting?

If you are a registered shareholder, meaning that your shares are registered in your name, you have four voting options. You may vote:

| • | | over the Internet at the web address shown on your proxy card (if you have access to the Internet, we encourage you to vote in this manner; Internet voting is available 24 hours a day and will be accessible until 2:00 a.m. Eastern time on May 22, 2014), |

| • | | by telephone through the number shown on your proxy card (telephone voting is available 24 hours a day and will be accessible until 2:00 a.m. Eastern time on May 22, 2014), |

| • | | by signing your proxy card and mailing it in the enclosed prepaid and addressed envelope, or |

| • | | by attending the annual meeting and voting in person. |

If your shares are held in the name of your broker or another nominee, you may be able to grant a proxy to vote via the Internet or telephone. Please see the materials provided by your broker for additional details and voting options available to you.

Please follow the directions on your proxy card carefully.

Can I vote at the meeting?

You may vote your shares at the meeting if you attend in person and the shares are registered in your name. If your shares are held in the name of your broker or another nominee, you may not vote the shares at the meeting unless you obtain a signed proxy from the record holder. Even if you plan to attend the meeting, we encourage you to vote your shares by completing, signing and returning the enclosed proxy card or by Internet or telephone.

Can I change my vote after I return my proxy card or vote by Internet or telephone?

You may change your vote at any time before the polls close at the meeting. You may do this by

(1) submitting a subsequent proxy, by using the Internet, the telephone, or mail,

(2) providing written notice to Harold M. Cohen, Corporate Secretary, revoking your proxy, or

(3) voting in person at the meeting.

Attendance at the meeting will not by itself revoke a proxy.

1

What if I return my proxy card but do not provide voting instructions?

Proxies that are signed and returned but do not contain instructions will be voted “For” the election of the director nominees named on pages 6-8 of this proxy statement, “For” the ratification of the independent registered public accounting firm, and “For” the approval, on an advisory basis, of the compensation of the named executive officers as disclosed in this proxy statement.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts with brokers, other nominees and/or our transfer agent. Please vote all these shares. We recommend that you contact the record holder of your shares and/or our transfer agent to consolidate as many accounts as possible under the same name and address.Our transfer agent is Computershare Investor Services, LLC, which may be reached at 800-962-4284, or by mail at Computershare Trust Company, N.A., P.O. Box 30170 College Station, Texas 77845.

Can I attend the meeting?

The annual meeting is open to all holders of Popeyes Louisiana Kitchen, Inc. (the “Company” or “PLKI”) common stock. To attend the meeting, you will need to bring evidence of your stock ownership. If your shares are registered in your name, your admission card is included with this proxy statement, and you will need to bring it with you to the meeting, together with valid picture identification. If your shares are held in the name of your broker or another nominee or you received your proxy materials electronically, you will need to bring evidence of your stock ownership, such as your most recent brokerage account statement, and valid picture identification.

May shareholders ask questions at the meeting?

Yes. Representatives of PLKI will answer shareholders’ questions of general interest at the end of the meeting. In order to give a greater number of shareholders an opportunity to ask questions, individuals or groups will be allowed to ask only one question and no repetitive or follow-up questions will be permitted.

How many votes must be present to hold the meeting?

Your shares are counted as present at the meeting if you attend the meeting in person, if you properly return the enclosed proxy card or if you grant a proxy to vote via the Internet or telephone, if permitted to do so. In order for us to conduct our meeting, a majority of our outstanding shares of common stock as of April 4, 2014 must be present at the meeting in person or by proxy. This is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

How may I vote for the nominees for director, and how many votes must the nominees receive to be elected?

With respect to the election of nominees for director, you may:

| • | | vote FOR the election of the eight nominees for director; |

| • | | WITHHOLD AUTHORITY to vote for one or more of the nominees and vote FOR the remaining nominees; or |

| • | | WITHHOLD AUTHORITY to vote for the eight nominees. |

The eight nominees receiving the highest number of affirmative votes will be elected as directors. This number is called a plurality.

2

In the event that a nominee has a greater number of votes “withheld” for his or her election than votes cast “for” his or her election, such nominee will be required under our Majority Voting Policy, contained in our Principles of Corporate Governance, to submit an offering of resignation for consideration by the Board. We have provided more information about our Majority Voting Policy under the heading “Corporate Governance — Majority Voting Policy.”

How may I vote for the ratification of the appointment of our independent registered public accountants, and how many votes must the proposal receive to pass?

With respect to this proposal, you may:

| • | | vote AGAINST the proposal; or |

| • | | ABSTAIN from voting on the proposal. |

The ratification of the appointment of our independent registered public accountants must receive the affirmative vote of a majority of the shares entitled to vote at the annual meeting by the holders who are present in person or by proxy to pass. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal.

How may I vote on the proposal to approve, on an advisory basis, the compensation of the named executive officers as disclosed in this Proxy Statement, and how many votes must the proposal receive to pass?

With respect to this proposal, you may:

| • | | vote FOR the approval, on an advisory basis, of executive compensation; |

| • | | vote AGAINST the approval, on an advisory basis, of executive compensation; or |

| • | | ABSTAIN from voting on the proposal. |

The approval, on an advisory basis, of the compensation of the named executive officers as disclosed in this Proxy Statement must receive the affirmative vote of a majority of the votes entitled to vote at the annual meeting by the holders who are present in person or by proxy to pass. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal.

Will my shares be voted if I do not sign and return my proxy card or vote by Internet or by telephone?

If you are a registered record holder of shares of PLKI and you do not vote by using the Internet, by telephone, or if you received a proxy card by mail, by signing and returning your proxy card, then your shares will not be voted and will not count in deciding the matters presented for shareholder consideration at the annual meeting.

If your shares are held through a brokerage account, your brokerage firm, under certain circumstances, may vote your shares, even if you do not provide voting instructions. Brokerage firms have authority to vote shares for which their customers do not provide voting instructions on certain “routine” matters. The ratification of our independent registered public accounting firm is a routine matter.

The election of directors and the approval, on an advisory basis, of the compensation of the named executive officers as described in this proxy statement are “non-routine” matters and may not be voted on by brokers, banks or other nominees who have not received specific voting instructions from beneficial owners.

If you do not provide voting instructions to your brokerage firm, the brokerage firm may either: (1) vote your shares on routine matters, or (2) leave your shares unvoted (“broker non-votes”). We encourage you to provide instructions to your brokerage firm by signing

3

and returning your proxy. This ensures your shares will be voted at the meeting.

When a brokerage firm votes its customers’ unvoted shares on a routine matter, these shares are counted for purposes of establishing a quorum to conduct business at the meeting and determining the outcome of the vote on the routine matter.

Can my shares be voted on matters other than those described in this proxy statement?

Yes. We have not received proper notice of, and are not aware of, any business to be transacted at the meeting other than as indicated in this proxy statement. If any other item or proposal properly comes before the meeting, the proxies received will be voted on those matters in accordance with the discretion of the proxy holders.

4

| | |

BOARDOF DIRECTORS INFORMATION | | |

What is the makeup of the Board of Directors and how often are members elected?

Our Board of Directors currently has nine members. After nearly eighteen years of distinguished service, Kelvin J. Pennington is retiring from the Board of Directors following the expiration of his current term and will not stand for re-election. We thank Kelvin for his leadership and many valued contributions to PLKI. Given Mr. Pennington’s decision to retire, the Board of Directors is evaluating what it believes the optimal size and composition of the Board should be. We expect the Board of Directors will reduce the size of the Board to eight members on an interim basis and expect that the Board may elect another director over the course of the year. The eight current members of the Board of Directors other than Mr. Pennington will stand for election at the annual meeting.

Our Board of Directors has determined that the following eight directors are independent within the meaning of applicable Nasdaq Global Market rules: Krishnan Anand, Victor Arias, Jr., Carolyn Hogan Byrd, John M. Cranor, III, R. William Ide, III, Joel K. Manby, Kelvin J. Pennington and Martyn R. Redgrave. Cheryl A. Bachelder is currently our CEO and therefore she is not independent within the meaning of applicable Nasdaq Global Market rules.

Each director stands for election each year.

What if a nominee is unwilling or unable to serve?

That is not expected to occur. If it does, proxies voted in favor of the original nominee may be voted for a substitute director nominated by the Board of Directors.

How often did the Board meet in fiscal 2013?

In fiscal 2013, the Board of Directors met five times. Each director attended at least 75% of the meetings of the Board and of the committees of which he or she was a member in fiscal 2013.

Does PLKI have a policy with regard to Board members’ attendance at the annual shareholders meetings?

Our directors are encouraged, but not required, to attend the annual shareholders meeting. All eight directors then serving on our Board attended the 2013 annual shareholders meeting.

5

| | |

| ELECTIONOF DIRECTORSAND DIRECTOR BIOGRAPHIES |

(Item 1 on the proxy card) | | |

Who are this year’s nominees?

There are eight directors nominated by the Board of Directors who are standing for election this year to hold office until the 2015 annual meeting of shareholders and until their successors are elected. Biographical information about our nominees for director and the experience, qualifications, attributes and skills considered by our Corporate Governance and Nominating Committee and Board in determining that the nominee should serve as a director appear below. For additional information about how we identify and evaluate nominees for director, see “Corporate Governance and Nominating Committee”.

Krishnan Anand, age 56, has served as a director since November 2010. Since December 2009, Mr. Anand has served as president of the International Division and Head of Global Strategy/M&A of Molson Coors Brewing Company in Denver, Colorado. Prior to joining Coors, Mr. Anand served from 1997 to 2009 in a number of senior marketing and management positions with The Coca-Cola Company, most recently as President of the Philippines Business Unit in Manila, Philippines. From 1980 to 1997, Mr. Anand served in various managerial positions with Unilever plc in India.

Mr. Anand brings to the Board, among other skills and qualifications, broad management and marketing experience in international business, as well as his track record of judgment and achievement, as demonstrated during a 33 year career in leadership positions at major international companies in the consumer products industry. Mr. Anand’s experience and skills make him valuable to the Board as a member of our People Services (Compensation) Committee and our Corporate Governance and Nominating Committee.

Victor Arias, Jr., age 57, has served as a director since May 2001. Since May 2007,

Mr. Arias has been a senior client partner with Korn Ferry International, an executive search firm. From November 2004 until May 2007, Mr. Arias was a partner with Heidrick & Struggles, an executive search firm. From April 2002 until November 2004, Mr. Arias was an executive search consultant with Spencer Stuart. He is a trustee emeritus of Stanford University.

Mr. Arias brings to the Board, among other skills and qualifications, extensive management and operational expertise, as well as his track record of judgment and achievement, as demonstrated by his leadership positions as a partner at several international executive search firms and a senior executive at several national real estate companies. Mr. Arias’ experience and skills make him valuable to the Board as chair of our People Services (Compensation) Committee and as a member of our Corporate Governance and Nominating Committee.

Cheryl A. Bachelder, age 57, has served as a Director since November 2006. Since November 2007, Ms. Bachelder has served as our Chief Executive Officer. Ms. Bachelder also served as our President from November 2007 until March 2012. Ms. Bachelder currently serves as a member of the Pier 1 Imports, Inc. Board of Directors and she also serves as the chair of its Compensation Committee. Ms. Bachelder serves on the Advisory Board of APFI, the franchising venture of Procter & Gamble. From July 2006 until February 2013, she served as a member of the True Value Company Board of Directors. From May 2009 until December 2012, Ms. Bachelder served as a member of the National Restaurant Association Board of Directors. Ms. Bachelder served as the President and Chief Concept Officer of KFC Corporation from 2001 to 2003. From 1995 to 2000, Ms. Bachelder was Vice President, Marketing and Product Development for Domino’s Pizza, Inc.

6

| | |

| ELECTIONOF DIRECTORSAND DIRECTOR BIOGRAPHIES |

(Item 1 on the proxy card) | | |

Ms. Bachelder brings to the Board, among other skills and qualifications, her experience in the leadership position as CEO of our Company, as well as her track record of judgment, achievement and leadership, as demonstrated during a 18 year career in the Quick Service Restaurant industry in leadership positions at major restaurant companies and over 34 years of proven operational and managerial experience in the retail and consumer products industries.

Carolyn Hogan Byrd, age 65, has served as a director since May 2001. Ms. Byrd founded GlobalTech Financial, LLC, a financial services and consulting company headquartered in Atlanta, Georgia, in May 2000 and currently serves as chairman and chief executive officer. From November 1997 to October 2000, Ms. Byrd served as president of The Coca-Cola Financial Corporation. From 1977 to 1997, Ms. Byrd served in a variety of domestic and international positions with The Coca-Cola Company. In addition to serving as chairman of the Board of Directors of Global Tech Financial, LLC, Ms. Byrd currently serves on the Boards of Directors of Federal Home Loan Mortgage Corporation and Regions Financial Corporation. Ms. Byrd previously served on the Boards of Directors of the St. Paul Companies, Inc., Circuit City Stores, Inc., Reliastar Financial, ING Americas and RARE Hospitality, Inc.

Ms. Byrd brings to the Board, among other skills and qualifications, extensive management, financial, and board level expertise, as well as her track record of judgment and achievement, as evidenced by leadership positions as chairman and chief executive officer of a financial services company, and president of the financial division of a global beverage company. Further, her service as a director of other public companies provides her with broad experience as well as skills that make her valuable to the Board as chair of our Corporate Governance and Nominating Committee and a member of our Audit Committee.

John M. Cranor, III, age 67, has served as a director since November 2006 and Chairman of our Board since November 2007. From 2003 until 2008, Mr. Cranor served as the President and Chief Executive Officer of the New College Foundation, affiliated with the New College of Florida in Sarasota. From 2000 to 2003, Mr. Cranor was a managing General Partner of Yearling Fund, LLC, an early stage investment fund. He currently continues to serve as a Limited Partner in the Yearling Fund. From 1996 to 1999, Mr. Cranor served as Chairman, President and Chief Executive Officer of Long John Silver’s Restaurants, Inc. From 1989 to 1994, Mr. Cranor was President and Chief Executive Officer of KFC Corporation.

Mr. Cranor brings to the Board, among other skills and qualifications, broad managerial and operational experience as well as his track record of judgment and achievement, as demonstrated by his leadership positions as president and chief executive officer of major Quick Service Restaurant companies, as well as broad corporate experience and executive skills that make him valuable to the Board as Chairman of the Board and as a member of our Corporate Governance and Nominating Committee.

R. William Ide, III,age 73, has served as a director since August 2001. Mr. Ide currently is a partner with the law firm of McKenna Long Aldridge, a national law firm. Mr. Ide is a former Senior Vice President, Secretary and General Counsel of Monsanto Corporation, former Counselor to the United States Olympic Committee and was president of the American Bar Association. Mr. Ide is a former member of the board of directors of the Albemarle Company. He is currently serving as chairman of the Executive Committee of the board of directors of East-West Institute. Mr. Ide also serves as a trustee of Clark Atlanta University and as chairman of the Conference Board’s Governance Center Advisory Board.

7

| | |

| ELECTIONOF DIRECTORSAND DIRECTOR BIOGRAPHIES |

(Item 1 on the proxy card) | | |

Mr. Ide brings to the Board, among other skills and qualifications, over 42 years of experience in corporate and securities laws, investment banking, and corporate governance matters, as well as his track record of judgment and achievement, as demonstrated by his experience as a leading partner in a national law firm and general counsel of a worldwide chemical company, and as president of the American Bar Association. Further, his service as chairman of the Conference Board’s Governance Center Advisory Board and his service as a director of other public companies make him valuable to the Board as a member of our Corporate Governance and Nominating Committee and as a member of our Audit Committee.

Joel K. Manby, age 54, has served as a director since he was appointed by the Board in September 2013. Mr. Manby is currently President and Chief Executive Officer of Herschend Family Entertainment Corporation (HFE), the largest family-owned attractions company in the U.S. with such brands as the Harlem Globetrotters, Dollywood, Silver Dollar City, Stone Mountain Park, Newport Aquarium, Adventure Aquarium, and Pirate’s Voyage Dinner Theater. He has served in that capacity since 2003. Mr. Manby also currently serves as a member on the National Board of The Salvation Army. Prior to joining HFE, Mr. Manby spent almost 20 years in the auto industry in general management and marketing roles, primarily at General Motors in the Saturn and Saab divisions. Mr. Manby served as CEO of Saab Cars USA from 1996 to 2002. Mr. Manby was recommended for appointment by a search firm.

Mr. Manby brings to the Board, among other skills and qualifications, broad management and

operations experience, as well as his track record of judgment and achievement, as demonstrated during a distinguished career in leadership positions at major companies in the entertainment and automobile industries. Mr. Manby’s varied experience and skills make him valuable to the Board.

Martyn R. Redgrave,age 61, has served as a director since he was appointed by the Board in October 2013. Mr. Redgrave is currently a Senior Advisor to Limited Brands, Inc. From March 2005 until August 2012, Mr. Redgrave served as Executive Vice President and Chief Administrative Officer of Limited Brands, Inc. Mr. Redgrave has been a member of the Board of Directors of Deluxe Corporation since August 2001. Since August 2012, he has served as the Non-Executive Chairman of the Board of Directors of Deluxe Corporation. Mr. Redgrave was recommended for appointment by a search firm.

Mr. Redgrave brings to the Board, among other skills and qualifications, broad managerial and operational experience as well as his track record of judgment and achievement, as demonstrated by his leadership positions as executive vice president and chief administrative officer of a major international retail company, as well as broad corporate experience and established board skills that make him valuable to the Board.

THE BOARD OF DIRECTORS OF

THE COMPANY RECOMMENDS THAT

THE SHAREHOLDERS VOTEFOR THE

ELECTION OF THESE

DIRECTORS

8

| | |

BOARDOF DIRECTORS COMMITTEES | | |

What are the committees of the Board?

Our Board of Directors currently has the following committees and membership:

| | | | | | |

Name of Committee

and Members | | Primary Functions of the Committee | | Number of

Meetings

in

Fiscal 2013 | |

| | |

Executive: | | | | | | |

John M. Cranor, III, Chair Cheryl A. Bachelder R. William Ide, III Kelvin J. Pennington | | • Exercises the authority of the full Board between Board meetings | | | 0 | |

| | |

Audit: | | | | | | |

Kelvin J. Pennington, Chair Carolyn Hogan Byrd R. William Ide, III | | • Oversees the Company’s financial reporting process and systems of internal controls on behalf of the Board of Directors • Selects and oversees independent auditors • Receives, accepts and reviews the report of independent auditors • Oversees performance of the Company’s internal audit function | | | 5 | |

| | |

People Services (Compensation): | | | | | | |

Victor Arias, Jr., Chair Krishnan Anand Kelvin J. Pennington | | • Reviews and recommends compensation of executive officers and directors, and sets the CEO’s annual compensation • Makes grants of stock awards to officers and employees pursuant to stock plans • Oversees the administration of stock and bonus plans | | | 4 | |

| | |

Corporate Governance and Nominating: | | | | | | |

Carolyn Hogan Byrd, Chair Krishnan Anand Victor Arias, Jr. John M. Cranor, III R. William Ide, III | | • Takes a leadership role in shaping the Company’s corporate governance policies • Considers, reviews, evaluates and recommends director-nominees to the Board • Establishes minimum qualifications for director-nominees • Reviews director-nominees submitted by shareholders • Develops and facilitates continuing education program for directors • Makes recommendations to the Board with respect to strategic plans, including potential mergers and acquisitions and financing alternatives | | | 5 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

The charters that have been adopted for each of the Audit, People Services (Compensation) and Corporate Governance and Nominating Committees are available on the Investor Relations page on our website athttp://investor.popeyes.com. Our Board of Directors has determined that all members of the People Services (Compensation) Committee are independent within the meaning of applicable Nasdaq Global Market rules. For additional information about the Compensation Committee’s processes and the role of executive officers and compensation consultants in determining compensation, see “Compensation Discussion and Analysis.”

9

| | |

| AUDIT COMMITTEE REPORTAND | | |

AUDIT FEES | | |

AUDIT COMMITTEE REPORT

Who serves on the Audit Committee of the Board of Directors?

The members of the committee are currently Kelvin J. Pennington (Chair), Carolyn Hogan Byrd, and R. William Ide, III. Our Board of Directors has determined that all of the Audit Committee members are independent within the meaning of the applicable rules of the Securities and Exchange Commission (the “SEC”) and Nasdaq Global Market.

Our Board of Directors has determined that Mr. Pennington is an audit committee financial expert within the meaning of applicable SEC rules.

What document governs the activities of the Audit Committee?

The Audit Committee acts under a written charter adopted by our Board that sets forth the committee’s responsibilities and duties, as well as requirements for the committee’s composition and meetings. The Audit Committee charter is available on our website at http://investor.popeyes.com.

What is the relationship between the Audit Committee, PLKI’s management and the independent registered public accounting firm?

Management is responsible for the financial reporting process, including the system of internal controls, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. PLKI’s independent registered public accounting firm is responsible for auditing those financial statements and expressing an opinion as to their conformity with generally accepted accounting principles, in addition to auditing the effectiveness of our internal controls over

financial reporting. The Audit Committee’s responsibility is to assist the Board of Directors in its oversight of these processes, and also to exercise certain responsibilities which it must undertake as a committee of independent directors. The Audit Committee is not professionally engaged in the practice of accounting or auditing and its members are not necessarily experts in the fields of accounting or auditing, including with respect to auditor independence. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by management and the independent registered public accounting firm.

What has the Audit Committee done with regard to our audited financial statements for fiscal 2013?

The Audit Committee has:

| • | | reviewed and discussed the audited financial statements with PLKI’s management and internal auditors; |

| • | | been provided with management’s representation to the Audit Committee that the PLKI financial statements have been prepared in accordance with generally accepted accounting principles; |

| • | | discussed with PricewaterhouseCoopers LLP, independent registered public accounting firm for PLKI’s fiscal year ending December 29, 2013, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1 AU, Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; and |

| • | | reviewed the Company’s system of internal controls with management and PricewaterhouseCoopers LLP. |

In addition, the Audit Committee has reviewed the Company’s compliance with Sarbanes-Oxley 404 requirements, which requires management

10

| | |

| AUDIT COMMITTEE REPORTAND | | |

AUDIT FEES | | |

to establish and maintain an adequate internal control structure and procedures for financial reporting.

Has the Audit Committee considered the independence of PLKI’s registered public accounting firm?

The Audit Committee has received from PricewaterhouseCoopers LLP the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding PricewaterhouseCoopers LLP’s communications with the Audit Committee concerning independence, and the applicable requirements of the SEC. The Audit Committee has discussed with PricewaterhouseCoopers LLP that firm’s independence.

Has the Audit Committee made a recommendation regarding the audited financial statements for fiscal 2013?

Based upon and in reliance on the representations of and discussions with management, internal auditors and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements for PLKI be included in PLKI’s Annual Report on Form 10-K for the fiscal year ended December 29, 2013 for filing with the SEC.

Has the Audit Committee reviewed the fees paid to the independent auditors?

The Audit Committee has reviewed, discussed and approved the fees paid to PricewaterhouseCoopers LLP during fiscal years 2013 and 2012 for audit and non-audit services, which are set forth below under “Fees Paid to Independent Registered Public Accounting Firm,” and has determined that the provision of the non-audit services are compatible with the firm’s independence.

Is the Audit Committee required to pre-approve all services provided by the independent registered public accounting firm?

Pursuant to its charter, the Audit Committee must pre-approve all audit and non-audit services to be performed by the independent auditors and no such services shall be performed unless permitted by SEC rules.

Who prepared this report?

This report has been furnished by the members of the Audit Committee:

Kelvin J. Pennington, Chair

Carolyn Hogan Byrd

R. William Ide, III

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit Fees

PricewaterhouseCoopers LLP billed us aggregate fees and expenses of $733,600 for the integrated annual audit of our 2013 financial statements, and billed us aggregate fees and expenses of $588,925 for the integrated annual audit of our 2012 financial statements.

Audit-Related Fees

None.

Tax Fees

PricewaterhouseCoopers LLP billed us aggregate fees and expenses of $97,241 and $119,029 for 2013 and 2012, respectively, for assistance with the preparation of our 2012 federal and state tax returns, federal and state income tax examinations, and other tax accounting services.

All Other Fees

PricewaterhouseCoopers LLP billed us $4,500 for non-audit related services in 2013 and $4,500 for non-audit related services in 2012.

11

Our Board has adopted Principles of Corporate Governance. The Principles of Corporate Governance are available on the Investor Relations page of our website at http://investor.popeyes.com. The charters of the Audit Committee, People Services (Compensation) Committee, and Corporate Governance and Nominating Committee are also available on the Investor Relations page of our website. Our Board has adopted the PLKI Honor Code (the “Honor Code”), which applies to all officers and employees. Additionally, our Board has adopted a Code of Conduct for the Board of Directors (the “Directors Code”). The Honor Code and the Directors Code reflect our commitment to conduct our business in accordance with the highest ethical principles. Our Honor Code and our Directors Code are available on the Investor Relations page of our website at http://investor.popeyes.com. Copies of our Principles of Corporate Governance, Directors Code, committee charters and Honor Code are also available upon written request to Popeyes Louisiana Kitchen, Inc., 400 Perimeter Center Terrace, Suite 1000, Atlanta, Georgia 30346, Attention: Corporate Secretary.

Any shareholder or interested party who wishes to communicate directly with our Board, or an individual member of our Board, may do so in writing to Popeyes Louisiana Kitchen, Inc. Board of Directors, c/o Corporate Secretary, 400 Perimeter Center Terrace, Suite 1000, Atlanta, Georgia 30346. At each regular Board meeting, the Corporate Secretary will present a summary of any communications received since the last meeting (excluding any communications that consist of advertising, solicitations or promotions of a product or service) and will make the communications available to the directors upon request.

Incentive-Based Compensation Recoupment (“Clawback”) Policy

Our Board has adopted an incentive-based compensation recovery policy for executive

officers. If we are required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the federal securities laws, we will seek to recover incentive-based compensation (including stock options) from any of our current or former executive officers who (a) received incentive-based compensation during the three-year period preceding the date on which we announce we are required to prepare the accounting restatement and (b) engaged in misconduct or negligent conduct resulting, directly or indirectly, in our being required to prepare the accounting restatement. We will seek to recover the excess of the incentive-based compensation paid to the executive officer based on the erroneous data over the incentive-based compensation that would have been paid to the executive officer if the financial accounting statements had been as presented in the restatement.

Majority Voting Policy

Our Board has adopted a Majority Voting Policy as part of our Principles of Corporate Governance. Under our Majority Voting Policy, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election (a “Majority Withhold Vote”) in an uncontested election of directors must tender to the Board his or her offer of resignation within five days following certification of the shareholder vote. The Corporate Governance and Nominating Committee will promptly consider the resignation offer and make a recommendation to the Board as to whether to accept or reject the tendered offer of resignation. The Board will act on the Corporate Governance and Nominating Committee’s recommendation within 90 days following certification of the shareholder vote. The Board will then promptly disclose its decision regarding whether to accept the director’s resignation offer, including its rationale, in a report furnished to or filed with the SEC.

12

The Corporate Governance and Nominating Committee in making its recommendation, and the Board in making its decision, will each consider the best interests of the Company and our shareholders and may each consider any other factors or other information that it considers appropriate and relevant, including but not limited to:

| • | | the stated reasons, if any, why shareholders withheld their votes; |

| • | | possible alternatives for curing the underlying cause of the withheld votes; |

| • | | the director’s qualifications; |

| • | | the director’s past and expected future contributions to the Company; and |

| • | | the overall composition of the Board and its committees, including whether, if the offer of resignation is accepted, the Company will no longer be in compliance with any applicable law, rule, regulation or governing document. |

Any director who tenders his or her offer of resignation under our Majority Voting Policy will not participate in the Corporate Governance and Nominating Committee deliberation or recommendation or Board deliberation or action

regarding whether to accept the resignation offer. If a majority of the Corporate Governance and Nominating Committee received a Majority Withhold Vote in the same election, then the independent directors (other than those who received a Majority Withhold Vote in that election) will instead appoint a committee among themselves to consider the resignation offers and recommend to the Board whether to accept them. If, however, the independent directors who did not receive a Majority Withhold Vote constitute two or fewer directors, all independent directors may participate in the action regarding whether to accept the resignation offers, except that each director who has tendered his or her offer of resignation will recuse himself or herself from the deliberations and voting with respect to his or her individual offer to resign.

If a director’s resignation offer is not accepted by the Board, that director will continue to serve for the term for which he or she was elected and until his or her successor is duly elected, or his or her earlier resignation or removal. If a director’s resignation offer is accepted by the Board, then the Board, in its sole discretion, in accordance with our bylaws, may fill any resulting vacancy or may decrease the size of the Board.

13

| | |

BOARD LEADERSHIP STRUCTURE | | |

Since 2007, one of our independent directors, Mr. Cranor, has served as the independent Chairman of our Board. We believe this board leadership structure, with an independent director serving as chairman, is currently best for our Company and our shareholders.

We believe that the Chief Executive Officer is responsible for the day-to-day leadership and management of the Company, and that the Chairman’s responsibility is to provide oversight, direction and leadership of the Board. As directors continue to have more oversight responsibilities, we believe it is beneficial to have an independent Chairman whose primary responsibility is leading the Board. Pursuant to our Principles of Corporate Governance and our Bylaws, the independent Chairman will establish the agenda for each Board meeting, determine

the length of the meetings, chair the Board meetings and executive sessions of the Board, and in consultation with the Chief Executive Officer determine appropriate ways to facilitate interaction between the directors and management. By delineating the role of the Chairman position and separating it from the role of the Chief Executive Officer, we attempt to ensure there is no duplication of effort between the Chief Executive Officer and the Chairman. We believe this provides the most effective leadership of our Board, while positioning our Chief Executive Officer as the leader of the Company to our shareholders, franchisees, employees, business partners, and other stakeholders.

14

| | |

BOARD’S ROLEIN RISK OVERSIGHT | | |

Our Board is responsible for overseeing the Company’s risk management function. The Board delegates some of its risk oversight role to the Audit Committee, the People Services (Compensation) Committee, and to the Corporate Governance and Nominating Committee. Under its charter, the Audit Committee is responsible for oversight of our risk assessment programs and risk management strategies, including our corporate compliance programs and internal audit. Under its charter, the People Services (Compensation) Committee sets the overall compensation strategy and compensation policies for the Company’s senior executives, including the mitigation of pay practices that could encourage excessive risk taking. Under its charter, the Corporate Governance and Nominating Committee is responsible for reviewing and monitoring the business risks to the Company’s strategies, communicating to management the views of the Board with respect to the types and level of risks

to be undertaken by the Company, and overseeing the risk management undertaken by the Company. In addition to the activities of the Audit Committee, the People Services (Compensation) Committee and the Corporate Governance and Nominating Committee, the full Board regularly engages in discussions of the most significant risks that the Company is facing and how these risks are being managed. The Board receives reports on enterprise risk management from senior officers of the Company and from the Chairs of the Audit Committee and the Corporate Governance and Nominating Committee, as well as from outside advisors. The Board believes that the enterprise risk management process in place enables the Board to effectively oversee the Company’s risk management function. The full Board and the People Services (Compensation) Committee are also involved in activities related to CEO and management succession.

15

| | |

| CORPORATE GOVERNANCEAND | | |

NOMINATING COMMITTEE | | |

Carolyn Hogan Byrd is the chair and Krishnan Anand, Victor Arias, Jr., John M. Cranor, III, and R. William Ide, III are members of our Corporate Governance and Nominating Committee. We have posted the Corporate Governance and Nominating Committee’s charter in the Investor Relations sections on our website at http://investor.popeyes.com. Our Board of Directors has determined that all members of the Corporate Governance and Nominating Committee are independent within the meaning of the applicable Nasdaq Global Market rules. The purpose of the Corporate Governance and Nominating Committee is (1) to identify individuals qualified to become members of our Board of Directors and to recommend to the Board of Directors nominees for election in connection with our annual meeting of shareholders, (2) to develop and recommend to the Board of Directors our Principles of Corporate Governance and to take a leadership role in shaping our corporate governance policies, (3) to make recommendations to the Board of Directors with respect to our strategic plans and (4) such other responsibilities and duties as may, from time to time, be delegated to the Committee by the Board of Directors.

One responsibility of the Corporate Governance and Nominating Committee is to establish criteria for evaluating persons to be nominated for election to our Board of Directors and its committees. Under the Corporate Governance and Nominating Committee Charter, these criteria include, at a minimum, the depth of a candidate’s experience and availability, the balance of his or her business interests and experience and the need for any required expertise on our Board of Directors or one of its committees. Furthermore, the Principles of Corporate Governance adopted by our Board of Directors provide that independent directors should be persons with broad training, knowledge and experience in business, finance,

education, government or other professions or vocations who have earned distinction in their chosen fields, and those Principles of Corporate Governance also provide that the composition of our Board of Directors should reflect ethnic and gender diversity, as well as diversity of expertise in areas that will foster our business success. The Corporate Governance and Nominating Committee considers all of these criteria in selecting nominees and in the future may establish additional minimum criteria for nominees.

The Corporate Governance and Nominating Committee has not adopted a specific policy regarding the consideration of shareholder director nominees, but its general policy is to welcome prospective nominees recommended by shareholders. Shareholders who wish to recommend individuals for consideration by the Corporate Governance and Nominating Committee to become nominees for election to our Board of Directors may do so by submitting a written recommendation to Popeyes Louisiana Kitchen, Inc., Attention: Corporate Secretary, 400 Perimeter Center Terrace, Suite 1000, Atlanta, Georgia 30346. Submissions must include sufficient biographical information concerning the recommended individual, including age, five year employment history with employer names and a description of the employer’s business, whether such individual can read and understand financial statements, accompanying footnotes and public filings, and Board memberships (if any) for the Committee to consider as well as any other requirements under our bylaws. The Corporate Governance and Nominating Committee will evaluate all prospective nominees in the same manner, whether or not the nominee was recommended by a shareholder.

The Corporate Governance and Nominating Committee’s process for selecting nominees begins with an evaluation of the performance of

16

| | |

| CORPORATE GOVERNANCEAND | | |

NOMINATING COMMITTEE | | |

incumbent directors and a determination of whether our Board of Directors or its committees have specific unfulfilled needs. The Corporate Governance and Nominating Committee then considers prospective nominees identified by the Committee, other directors, our executive officers and shareholders, and in some cases, a third party search firm engaged by the Committee to assist in identifying candidates. Evaluations of prospective candidates typically include a review of the candidate’s background and qualifications, interviews with several board members, and discussions of the Committee and the full board. This consideration includes determining whether a candidate qualifies as “independent” under the various standards applicable to the Board of Directors and its committees.

The Corporate Governance and Nominating Committee or a subcommittee of its members then selects nominees to recommend to our Board of Directors, which considers and makes the final selection of director nominees and directors to serve on its committees.

The Corporate Governance and Nominating Committee’s responsibilities also include:

| • | | Considering suggestions by our Chairman of the Board of Directors for directors to serve on Board committees, including the chair of each committee, and recommending to the Board of Directors the members and chair of all standing committees; |

| • | | Annually developing and overseeing an evaluation of our full Board of Directors and individual members of our Board of Directors; |

| • | | Overseeing the implementation of the Company’s strategic plans approved by the Board, and reviewing and monitoring the business risks to our strategies; |

| • | | Communicating to management the views of the Board with respect to the types and levels of risks to be undertaken by the Company, and overseeing the risk management undertaken by the Company; |

| • | | Reviewing director compliance with stock ownership policies and guidelines; |

| • | | Assisting our Board of Directors with development of responsibilities of directors; |

| • | | Establishing and maintaining a director orientation program for new directors, and developing, or making available, a continuing education program conducted for all directors; |

| • | | Assisting our Board of Directors with its responsibilities for oversight of our Honor Code, and reviewing the Company’s evaluation of compliance with our Honor Code; |

| • | | Reviewing any conflicts of interest involving our officers or members of our Board of Directors; |

| • | | Assisting our Board of Directors with oversight of the Company’s policies; |

| • | | Periodically reviewing the Company’s report on significant litigation; |

| • | | Reviewing the independence of each of our directors; |

| • | | Reviewing the continued appropriateness of Board membership when one of our directors changes the position he or she held when elected or appointed to the Board; and |

| • | | Reviewing and discussing with appropriate members of management the development of the Company’s strategic plans, and making recommendations to our Board of Directors with respect to our strategic plans, including potential mergers, acquisitions and divestitures, as well as financing alternatives. |

17

The following table sets forth information known to us regarding the beneficial ownership of our common stock as of January 31, 2014 by:

| • | | each shareholder known by us to own beneficially more than 5% of our common stock; |

| • | | each of our named executive officers; and |

| • | | all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage of ownership held by that person, shares of common stock subject to options held by that person that are currently exercisable or will become exercisable within 60 days after January 31, 2014, and restricted stock units and restricted stock that vests within 60 days after January 31, 2014, are deemed outstanding, while these shares are not deemed outstanding for computing percentage ownership of any other person. Unless otherwise indicated in the footnotes below, the persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws where applicable. The address for those individuals for which an address is not otherwise indicated is: c/o Popeyes Louisiana Kitchen, Inc., 400 Perimeter Center Terrace, Suite 1000, Atlanta, Georgia 30346.

The percentages of common stock beneficially owned are based on 24,050,172 shares of common stock outstanding as of January 31, 2014.

| | | | | | | | |

Name | | Shares

Beneficially

Owned | | | Percentage

of Class | |

Directors and Named Executive Officers: | | | | | | | | |

Cheryl A. Bachelder | | | 345,437 | | | | 1.4 | % |

Ralph Bower | | | 68,283 | | | | * | |

H. Melville Hope, III | | | 43,100 | | | | * | |

Richard H. Lynch | | | 91,418 | | | | * | |

Harold M. Cohen | | | 9,420 | | | | * | |

Andrew G. Skehan | | | 1,977 | | | | * | |

Krishnan Anand(1) | | | 10,231 | | | | * | |

Victor Arias, Jr.(2) | | | 33,163 | | | | * | |

Carolyn Hogan Byrd(3) | | | 33,163 | | | | * | |

John M. Cranor, III(4) | | | 31,280 | | | | * | |

R. William Ide, III(5) | | | 33,163 | | | | * | |

Joel K. Manby(6) | | | 0 | | | | * | |

Kelvin J. Pennington(7) | | | 33,163 | | | | * | |

Martyn R. Redgrave(8) | | | 0 | | | | * | |

| | |

All directors and executive officers as a group (14 persons)(9) | | | 733,798 | | | | 3.1 | % |

| | |

Five Percent Shareholders: | | | | | | | | |

BlackRock, Inc.(10) | | | 1,587,350 | | | | 6.60 | % |

Columbia Wanger Asset Management, LLC(11) | | | 2,050,000 | | | | 8.52 | % |

The Vanguard Group, Inc.(12) | | | 1,406,087 | | | | 5.85 | % |

Renaissance Technologies LLC(13) | | | 1,350,644 | | | | 5.62 | % |

18

| * | Less than 1% of the outstanding shares of common stock. |

| (1) | Mr. Anand’s business address is Molson Coors Brewing Company, 1225 17th Street, Suite 3200, Denver, Colorado 80202. |

| (2) | Mr. Arias’ business address is Korn Ferry International, 2100 McKinney, Suite 1800, Dallas, Texas 75201. |

| (3) | Ms. Byrd’s business address is GlobalTech Financial, LLP, 2839 Paces Ferry Road, Suite 810, Atlanta, Georgia 30339. |

| (4) | Mr. Cranor’s business address is 400 Perimeter Center Terrace, NE, Suite 1000, Atlanta, Georgia 30346. |

| (5) | Mr. Ide’s business address is McKenna Long & Aldridge, LLP, 303 Peachtree Street NE, Suite 5300, Atlanta, Georgia 30308. |

| (6) | Mr. Manby’s business address is Herschend Family Entertainment, 5445 Triangle Parkway, Suite 200, Norcross, Georgia 30092. |

| (7) | Mr. Pennington’s business address is PENMAN Partners, 30 North LaSalle Street, Suite 1402, Chicago, Illinois 60602. |

| (8) | Mr. Redgrave’s business address is 400 Perimeter Center Terrace, NE, Suite 1000, Atlanta, Georgia 30346. |

| (9) | There are no shares of restricted stock units that will vest within 60 days of January 31, 2014 included in the calculation of shares owned by directors and executive officers as a group. |

| (10) | Represents shares of common stock beneficially owned by BlackRock, Inc. (“BlackRock”). BlackRock has sole voting power with respect to 1,501,536 shares and sole dispositive power with respect to 1,587,350 shares. This information is included in reliance upon a Schedule 13G/A filed with the SEC on January 28, 2014. The address of BlackRock is 40 East 52nd Street, New York, NY 10022. |

| (11) | Represents shares of common stock beneficially owned by Columbia Wanger Asset Management, LLC (“Columbia”). Columbia has sole voting power with respect to 2,000,000 shares and sole dispositive power with respect to 2,050,000 shares. The number of shares beneficially owned includes shares held by Columbia Acorn Fund, a Massachusetts business trust that is managed by Columbia. This information is included in reliance upon a Schedule 13G/A filed with the SEC on February 6, 2014. The address of each of Columbia and Columbia Acorn Fund is 227 West Monroe Street, Suite 3000, Chicago, IL 60606. |

| (12) | Represents shares of common stock beneficially owned by The Vanguard Group, Inc. (“Vanguard”). Vanguard has sole voting power with respect to 33,527 shares, sole dispositive power with respect to 1,374,260 shares, and shared dispositive power with respect to 31,827 shares. This information is included in reliance upon a Schedule 13G/A filed with the SEC on February 10, 2014. The address of Vanguard is 100 Vanguard Blvd., Malvern, PA 19355. |

| (13) | Represents shares of common stock beneficially owned by Renaissance Technologies LLC (“Renaissance”). Renaissance has sole voting power with respect to 1,196,814 shares, sole dispositive power with respect to 1,284,744 shares and shared dispositive power with respect to 65,900 shares. This information is included in reliance upon Schedule 13G filed with the SEC on February 13, 2014. The address of Renaissance is 800 Third Avenue, New York, New York 10022. |

19

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The following Compensation Discussion and Analysis, or CD&A, describes our 2013 executive compensation program. It summarizes our executive compensation structure, including design enhancements following our 2013 Say-on-Pay vote, and our shareholder outreach efforts. This CD&A is intended to be read in conjunction with the tables beginning on page 37, which provide detailed historical compensation information for our following named executive officers, or NEOs.

| | |

Name | | Title |

Cheryl A. Bachelder | | Chief Executive Officer |

Ralph Bower | | President — U.S. |

H. Melville Hope, III | | Chief Financial Officer |

Richard H. Lynch | | Chief Brand Experience Officer |

Harold M. Cohen | | General Counsel, Chief Administrative Officer & Corporate Secretary |

2013 Business Performance Highlights

For five years running, our strategic roadmap has been the foundation for our consistent industry-leading results. It encompasses the four things that a great chain restaurant company must do to be successful:

| | • | | Build a Distinctive Brand; |

| | • | | Create Memorable Experiences; |

| | • | | Grow Restaurant Profits; and |

| | • | | Accelerate Quality Restaurant Openings. |

By remaining focused on these four pillars, we continue to deliver exceptional results. It’s this discipline that has allowed us to continue to grow, take market share from our competition and drive continuous improvements in our guest experience.

Our 2013 results speak to the success of our team and our franchise owners.

| | • | | Domestic same-store sales grew for the fifth consecutive year and international same-store sales grew for the seventh consecutive year. |

| | • | | We added 126 net restaurants to our global footprint for a total of 2,225 and a system growth rate of approximately 6%. |

| | • | | In 2013, Popeyes’ system-wide sales increased 8.2%, driven largely by global same-store sales performance and the sales in our new restaurants. Global same-store sales increased 3.7%, compared to 6.9% last year. Domestic same-store sales were up 3.6% on top of a 7.5% increase last year. |

| | • | | We reported net income of $34.1 million, or $1.41 per diluted share. Our adjusted earnings per diluted share were $1.43 compared to $1.24 in 2012.1 |

| 1 | See the heading entitled “Management’s Use of Non-GAAP Financial Measures” contained in Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2013 Annual Report on Form 10-K. |

20

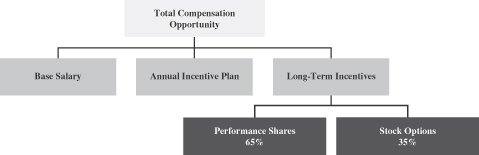

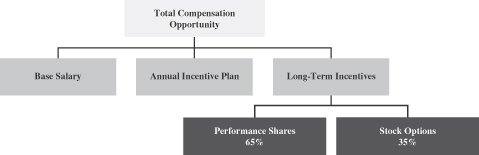

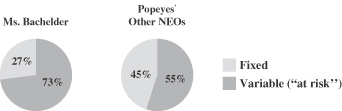

Our executive compensation structure consists of three primary components: base salary, annual cash incentive awards, and long-term equity incentives. Within the long-term incentive component, we utilize a balanced portfolio approach of performance shares (65% weight — based on three-year performance criteria) and stock options (35% weight).

Executive Summary

21

Executive Summary

2013 Say-on-Pay Vote — Our Response

At the 2013 Annual Meeting of Shareholders, the advisory vote to approve the executive compensation program for our NEOs received strong support (95.2% of votes on that issue). Management and the People Services (Compensation) Committee (the “Committee”) considered this strong support of the current pay structure in their compensation program discussions throughout 2013. The Committee is dedicated to continuous improvement to the executive pay program, consistent with its overall compensation strategy, and will continue to review and evaluate market trends and best practices in designing and implementing elements to our compensation program.

2013 Corporate Governance Highlights

| | |

What We Do (Best Practice) | | What We Don’t Do / Don’t Allow |

| |

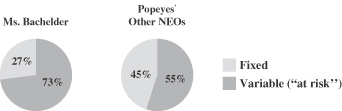

ü Separate the roles of Chairman and Chief Executive Officer ü Enforce strict insider trading policies, an incentive plan clawback policy, and blackout periods for executives and directors ü Set stock ownership guidelines for executives and directors ü Review tally sheets for executives ü Target total compensation at the size-adjusted 50th percentile ü Disclose performance goals for 2013 incentive payments ü Set maximum payout caps on our annual and long-term incentives ü Pay for performance with 73% of our Chief Executive Officer’s total pay opportunity being performance-based “at risk” compensation ü For our performance share plan, we use a combination of financial measures and total shareholder return, and set target value at 65% of our total long-term incentive opportunity ü Limit perquisites and other benefits, and do not include tax gross-ups (other than grandfathered agreements) ü Incorporate general severance and change-in-control provisions that are consistent with market practice, including double-trigger requirements for change-in-control protection ü Perform an annual compensation risk assessment ü Hire an independent consultant reporting directly to the Committee | | ü No hedging or pledging of company stock by executives or directors ü No dividends are paid on unearned performance shares ü No single-trigger or modified single-trigger change-in-control arrangements ü No change-in-control severance multiple in excess of three times salary and target bonus ü No future excise tax gross-ups upon a change in control (except for current grandfathered arrangements) ü No re-pricing or cash buyout of underwater stock options is allowed ü No enhanced retirement formulas ü No guaranteed compensation ü No market timing with granting of equity awards |

22

2013 NEO Compensation Highlights —Target Compensation

| | |

Pay Component | | Summary |

Base Salary | | • At the February 2013 meeting, the Committee reviewed competitive market data and individual performance evaluations. The Committee approved base salary increases for Ms. Bachelder (3.7%), Mr. Cohen (2.3%), and Mr. Lynch (2.4%). Base salaries for Mr. Bower and Mr. Hope were not changed. • At the November 2013 meeting, the Committee reviewed competitive market data and approved a 9.5% increase for Mr. Lynch to account for enhanced strategic planning responsibilities. |

| |

Target Annual Cash Incentive | | • NEO target annual cash incentive awards (as a percent of salary) did not change in 2013. • Our 2013 Annual Incentive Plan design did not change. |

| |

Long-Term Incentives (“LTI”) | | • Our 2013 LTI value mix did not change: 65% performance shares and 35% stock options • At the February 2013 meeting, the Committee reviewed competitive market data to determine 50th percentile values. Except for Ms. Bachelder, modest adjustments were made to each of our NEOs’ target values to maintain a competitive standing for total compensation opportunity. • Ms. Bachelder: Target LTI value changed from $1.1M to $1.2M. |

| |

Total Compensation | | Targeted total compensation opportunity is the size-adjusted 50th percentile of our compensation peer group. |

2013 NEO Compensation Highlights —Actual Compensation

The Committee approved the following compensation items in 2013:

Actual Annual Incentive Awards: At the start of each fiscal year, the Committee approves annual incentive compensation targets (as a % of base salary), based on a review of competitive market data, management’s recommendations, and other relevant factors. The 2013 annual incentive targets for our NEOs are as follows:

| | |

Name | | Target |

Cheryl A. Bachelder | | 100% of Base Salary |

Ralph Bower | | 60% of Base Salary |

H. Melville Hope, III | | 60% of Base Salary |

Harold M. Cohen | | 60% of Base Salary |

Richard H. Lynch | | 60% of Base Salary |

23

The following summarizes the 2013 annual incentive awards earned based on actual performance, as compared to the target opportunity for each NEO:

| | | | | | | | | | | | |

Name | | Actual Incentive

Award

($) | | | Target Incentive

Award

($) | | | Percent of

Target

Incentive Award | |

Cheryl A. Bachelder | | $ | 729,400 | | | $ | 700,000 | | | | 104 | % |

Ralph Bower | | $ | 217,944 | | | $ | 216,000 | | | | 101 | % |

H. Melville Hope, III | | $ | 206,316 | | | $ | 198,000 | | | | 104 | % |

Richard H. Lynch | | $ | 210,101 | | | $ | 202,800 | | | | 104 | % |

Harold M. Cohen | | $ | 195,062 | | | $ | 187,000 | | | | 104 | % |

| | |

Long-Term Incentives (“LTI”) | | • 2013 LTI grant values: The Committee approved a 2013 grant value for Ms. Bachelder that was 9% above the prior year to recognize superior individual and Company performance. • Earned amounts — performance share grant (previous program): Our previous performance share program was replaced starting in 2012. The previous program divided grants into three annual tranches. The 2013 tranche of the 2011-2013 performance cycle was the final grant under that program, with vesting subject to 2013 earnings before interest, taxes, depreciation and amortization, and other expenses (income), net (EBITDA) performance. The 2013 EBITDA performance target was $63.8M. We achieved EBITDA of $65.2M, or 102% of target. Based on the funding scale approved by the Committee for 2013, 106% of the targeted performance shares for the 2013 tranche were earned. All shares earned for the 2011-2013 grant tranches are vested because the full three-year performance period has ended. • Earned amounts — performance share grant (current program): Our current program commenced in 2012 and covers three-year cumulative EBITDA performance and three-year total shareholder return (TSR) performance against a broad group of restaurant industry companies. The first grant under the current program covered 2012-2014. The first potential payout from this program will be at the end of 2014. |

24

Compensation Decision Process

Objectives for NEO Compensation

Our executive compensation program is intended to attract, motivate, and retain executive officers and to align the interests of our executive officers with shareholders’ interests. The Committee’s objectives for our program include, but are not limited to, the following:

| | • | | Enhancing shareholder value by focusing management on the metrics that drive value; |

| | • | | Targeting total compensation opportunities near the size-adjusted 50th percentile of our compensation peer group, based on the Company’s system-wide sales (see “Role of Peer Companies and Competitive Market Data”); |

| | • | | Attracting, motivating, and retaining executive talent willing to commit to long-term shareholder value creation; |

| | • | | Aligning executive decision making with our business strategy; and |

| | • | | Reflecting industry standards, offering competitive total compensation opportunities, and balancing the need for talent with reasonable compensation expense. |

For our NEOs and select other senior executives, the Committee employs a “pay-for-performance” philosophy that ties a significant portion of incentive compensation opportunity to our Company-wide performance — primarily EBITDA, existing restaurant sales growth, new restaurant development, and TSR against the restaurant industry.

Role of Management and the Committee

The Committee approves all compensation for executive officers. For NEOs other than the CEO and the Chief People Experience Officer, our CEO and Chief People Experience Officer make compensation recommendations to the Committee. In making these recommendations, the CEO and Chief People Experience Officer consider peer group market data, individual experience and performance, and financial impact to the Company. For the Chief People Experience Officer, our CEO makes separate compensation recommendations to the Committee, without the Chief People Experience Officer being present. The Committee reviews and discusses all recommendations prior to approval.

The Committee is solely responsible for the review of the performance and compensation for the CEO. Management does not make compensation-related recommendations for the CEO. In executive session, without management present, the Committee reviews CEO compensation in conjunction with its compensation consultant, Aon Hewitt, competitive market data, and individual performance assessments.

Role of the Independent Compensation Consultant

The Committee retained an independent compensation consultant, Aon Hewitt, in accordance with the Committee’s charter. The consultant reports directly to the Committee. The Committee retains sole authority to hire or terminate Aon Hewitt, approve its compensation, determine the nature and scope of services, and evaluate performance. A representative of Aon Hewitt attends Committee meetings, as requested, and communicates with the Committee Chair between meetings. The Committee makes all final decisions. Other than Aon Hewitt’s roles and services listed below with respect to compensation consulting, it performs no other services for the company.

25

Aon Hewitt’s specific compensation consultation roles include, but are not limited to, the following:

| | • | | Advise the Committee on executive compensation trends and regulatory developments. |

| | • | | Provide a total compensation study for executives against the companies in our peer group and recommendations for executive pay. |

| | • | | Provide advice to the Committee on governance best practices, as well as any other areas of concern or risk. |

| | • | | Serve as a resource to the Committee Chair for meeting agendas and supporting materials in advance of each meeting. |

| | • | | Review and comment on proxy disclosure items, including the “Compensation Discussion & Analysis.” |

| | • | | Advise the Committee on management’s pay recommendations. |

The Compensation Committee has considered and assessed all relevant factors, including but not limited to those set forth in Rule 10C-1(b)(4)(i) through (vi) under the Exchange Act, as well as the requirements of Nasdaq, that impact independence and could give rise to a potential conflict of interest with respect to Aon Hewitt. Based on this review, the Committee determined that Aon Hewitt is independent and that there are no conflicts of interest raised by the work performed by Aon Hewitt.

Role of Peer Companies and Competitive Market Data

The Committee reviews competitive market data annually for the CEO and at least biennially for the other NEOs, as developed and presented by Aon Hewitt. In February 2013, the Committee reviewed competitive market data for the CEO, and in November 2013 the Committee reviewed competitive market data for all NEO positions.

How Do We Determine Peer Companies?

We develop a peer group for compensation purposes according to multiple selection criteria:

| | • | | GICS code sub-industry: Restaurant companies |

| | • | | Highly-franchised: Restaurants with franchised sales representing approximately 50% or more of system-wide sales/units |

| | • | | Annual system-wide sales: Approximately 1/3x to 3x Popeyes’ annual system-wide sales |

| | • | | Market capitalization: Approximately 0.2x to 5x Popeyes’ market capitalization |

| | • | | Direct competitors: For business and management talent |

26

In November 2012, the Committee performed a rigorous review of the selection criteria and approved the following peer companies:

| | | | | | | | |

Peer Company | | 2011

System-Wide

Sales | | | Franchise %

By Sales | |

Brinker International, Inc. | | $ | 4,365 | | | | 37 | % |

Buffalo Wild Wings, Inc. | | $ | 2,044 | | | | 65 | % |

Denny’s Corporation | | $ | 2,416 | | | | 83 | % |

DineEquity, Inc. | | $ | 7,081 | | | | 93 | % |

Domino’s Pizza, Inc. | | $ | 6,956 | | | | 95 | % |

Einstein Noah Restaurant Group | | $ | 673 | | | | 44 | % |

Famous Dave’s of America, Inc. | | $ | 492 | | | | 72 | % |

Jack in the Box, Inc. | | $ | 3,824 | | | | 64 | % |

Krispy Kreme Doughnuts, Inc. | | $ | 915 | | | | 71 | % |

Panera Bread Company | | $ | 3,421 | | | | 53 | % |

Papa John’s International, Inc. | | $ | 2,556 | | | | 79 | % |

Sonic Corp. | | $ | 3,689 | | | | 89 | % |

| | |

Median | | $ | 2,989 | | | | 72 | % |

Median, excl. DineEquity and Dominos | | $ | 2,486 | | | | 68 | % |

| | |

Popeyes (2011 actual) | | $ | 1,987 | | | | 97 | % |

Popeyes (2012 actual) | | $ | 2,253 | | | | 97 | % |

(sales dollars in billions) | | | | | | | | |

How Do We Determine Competitive Market Values?

We develop competitive market values based on regression analysis, a statistical technique that estimates the 50th percentile based on our system-wide sales size within the peer group. Regression analysis plots peer group system-wide sales on one axis and peer group pay on the other axis. A “line of best fit” is drawn through the peer group data to estimate Popeyes’ market value based on our system-wide sales relationship to the peer companies. We do not utilize a straight median or average because outliers may impact results. We develop regression-based size-adjusted market values to minimize the impact of outliers and allow for more consistent year-over-year comparisons.