MANAGEMENT INFORMATION CIRCULAR

As at March 20, 2006

SOLICITATION OF PROXIES

This Information Circular is furnished in connection with the solicitation of proxies by the management of ATNA RESOURCES LTD. (the "Company"), at the time and place and for the purposes set forth in the Notice of Meeting.

Note: | The term "shareholder" as defined in the Business Corporations Act S.B.C. 2002, c.57 (the "Act"), except in section 385, means a person whose name is entered in a securities register of a company as a registered owner of a share of the company or, until such an entry is made for the company: |

| | (a) | in the case of a company incorporated before the coming into force of the Act, a subscriber, or |

| | (b) | in the case of a company incorporated under the Act, an incorporator. |

It is expected that the solicitation will be primarily by mail. Proxies may also be solicited personally or by telephone by directors, officers or employees of the Company at nominal cost. The cost of this solicitation will be borne by the Company.

APPOINTMENT OF PROXYHOLDER

A duly completed form of proxy will constitute the person(s) named in the enclosed form of proxy as the proxyholder for the shareholder (the “Registered Shareholder”). The persons whose names are printed in the enclosed form of proxy for the Meeting are officers or directors of the Company (the “Management Proxyholders”).

A Registered Shareholder has the right to appoint a person other than a Management Proxyholder to represent the Registered Shareholder at the Meeting by striking out the names of the Management Proxyholders and by inserting the desired person's name in the blank space provided or by executing a proxy in a form similar to the enclosed form. A proxyholder need not be a Registered Shareholder.

The persons named in the accompanying Form of Proxy are nominees of the Company's management. A shareholder desiring to appoint some other person (who need not be a shareholder) to represent him at the meeting may do so either by:

| | (a) | STRIKING OUT THE PRINTED NAMES AND INSERTING THE DESIRED PERSON'S NAME IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY; OR |

| | (b) | BY COMPLETING ANOTHER PROPER FORM OF PROXY. |

The completed proxy must be deposited at the office of Pacific Corporate Trust Company, 510 Burrard Street, 2nd Floor, Vancouver, British Columbia, Canada, V6C 3B9 not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the Meeting.

A shareholder who has given a proxy may revoke it by an instrument in writing delivered to the office of Pacific Corporate Trust Company, Corporate Trust Department, or to the registered office of the Company, 1040 - 999 West Hastings Street, Vancouver, British Columbia, Canada, V6C 2W2, at any time up to and including the last business day preceding the day of the meeting, or any adjournment thereof, or to the Chairman of the meeting or any adjournment thereof, or in any other manner provided by law.

VOTING OF PROXIES

If the instructions as to voting indicated in the proxy are certain, the shares represented by the proxy will be voted on any poll and where a choice with respect to any matter to be acted upon has been specified in the proxy, the shares will be voted on any poll in accordance with the specifications so made. IF A CHOICE IS NOT SO SPECIFIED, IT IS INTENDED THAT THE PERSON DESIGNATED BY MANAGEMENT IN THE ACCOMPANYING FORM OF PROXY WILL VOTE THE SHARES REPRESENTED BY THE PROXY IN FAVOUR OF EACH MATTER IDENTIFIED ON THE FORM OF PROXY AND FOR THE NOMINEES OF MANAGEMENT FOR DIRECTORS AND AUDITOR.

The form of proxy accompanying this Information Circular confers discretionary authority upon the named proxyholder with respect to amendments or variations to the matters identified in the accompanying Notice of Meeting and with respect to any other matters which may properly come before the meeting. As of the date of this Information Circular, the management of the Company knows of no such amendment or variation or matters to come before the meeting other than those referred to in the accompanying Notice of Meeting.

NON-REGISTERED HOLDERS

Only Registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of the Company are “non-registered” shareholders because the shares they own are not registered in their own names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the shares. More particularly, a person is not a Registered Shareholder in respect of shares which are held on behalf of that person (the “Non-Registered Holder”) but which are registered either: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees of administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”)), of which the Intermediary is a participant.

Non-Registered Holders who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company are referred to as “NOBOs”. Those Non-Registered Holders who have objected to their Intermediary disclosing ownership information about themselves to the Company are referred to as “OBOs”.

In accordance with the requirements of National Policy 54-101, Communication with Beneficial Owners of Securities of a Reporting Issuer, of the Canadian Securities Administrators, the Company has elected to send the notice of meeting, this information circular and proxy (collectively the “Meeting Materials”) directly to the NOBOs, and indirectly through Intermediaries to the OBOs.

The Intermediaries (or their service companies) are responsible for forwarding the Meeting Materials to each OBO, unless the OBO has waived the right to receive them.

Meeting Materials sent to Non-Registered Holders who have not waived the right to receive Meeting Materials are accompanied by a request for voting instructions (a “VIF”). This form is instead of a proxy. By returning the VIF in accordance with the instructions noted on it a Non-Registered Holder is able to instruct the Registered Shareholder how to vote on behalf of the Non-Registered Shareholder. VIFs, whether provided by the Company or by an Intermediary, should be completed and returned in accordance with the specific instructions noted on the VIF.

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the Shares which they beneficially own. Should a Non-Registered Holder who receives a VIF wish to attend the Meeting or have someone else attend on his/her behalf, the Non-Registered Holder may request a legal proxy as set forth in the VIF, which will grant the Non-Registered Holder or his/her nominee the right to attend and vote at the Meeting. Non-Registered Holders should carefully follow the instructions set out in the VIF including those regarding when and where the VIF is to be delivered.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Other than as disclosed elsewhere herein, none of the following persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon other than the election of directors or the appointment of auditors:

| (a) | any director or executive officer of the Company at any time since the commencement of the Company's last completed financial year; |

| (b) | any proposed nominee for election as a director of the Company; and |

| (c) | any associate or affiliate of any of the foregoing persons. |

FINANCIAL STATEMENTS, DIRECTORS REPORT, MANAGEMENT’S DISCUSSION AND ANALYSIS & ADDITIONAL INFORMATION

The Report of the Directors to Shareholders and the consolidated financial statements of the Company for the year ended December 31, 2005 (the “Financial Statements”), including the accompanying notes and the auditor’s report, will be presented to the shareholders at the Meeting. These documents are being mailed to shareholders with this Information Circular.

Additional information relating to the Company may be found on SEDAR at www.sedar.com. A securityholder may contact the Company to request copies of the Company’s financial statements and Management’s Discussion and Analysis (“MD&A”). Financial information is provided in the Company’s comparative financial statements and MD&A for its most recently completed financial year.

APPOINTMENT AND REMUNERATION OF AUDITOR

The management of the Company will recommend to the Meeting to appoint De Visser Gray, of 401 - 905 West Pender Street, Vancouver, British Columbia, Canada, V6C 1L6, as auditor of the Company to hold office until the close of the next Annual General Meeting of shareholders. It is proposed that the remuneration to be paid to the auditor be fixed by the directors.

De Visser Gray was first appointed auditor of the Company on February 1, 1994.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Company is authorized to issue an unlimited number of common shares without par value (the "Common Shares") and an unlimited number of Preferred Shares without par value. As of March 20, 2006, 63,558,637 Common Shares and no Preferred Shares are issued and outstanding.

Only the holders of Common Shares are entitled to vote at the Meeting and the holders of Common Shares are entitled to one vote for each Common Share held. The directors of the Company fixed March 16, 2006 as the record date for the determination of the shareholders entitled to vote at the Meeting.

To the knowledge of the directors and senior officers of the Company, there is no person beneficially owning, directly or indirectly, or exercising control or direction over, voting securities carrying more than 10% of the voting rights attached to any class of voting securities of the Company.

ELECTION OF DIRECTORS

The Company's Board of Directors presently has five members. At the Meeting, two directors are to be elected, to hold office for the term expiring at the Annual General Meeting in 2009 or until their successors are duly elected or appointed, unless such offices are earlier vacated in accordance with the Articles of the Company or the director becomes disqualified to act as a director. In the absence of instructions to the contrary, the enclosed Proxy will be voted for such two directors, whose terms of office expire at the Meeting.

The terms of office of the other three directors who are not nominees for election expire at the Annual General Meetings in 2007 and 2008, respectively.

MANAGEMENT DOES NOT CONTEMPLATE THAT EITHER NOMINEE WILL BE UNABLE TO SERVE AS A DIRECTOR. IN THE EVENT THAT, PRIOR TO THE MEETING, ANY VACANCIES OCCUR IN THE SLATE OF NOMINEES HEREIN LISTED, IT IS INTENDED THAT DISCRETIONARY AUTHORITY BE EXERCISED BY MANAGEMENT TO VOTE THE PROXY FOR THE ELECTION OF ANY OTHER PERSON(S) AS DIRECTOR(S).

The following information concerning the directors has been furnished by the respective directors:

Name, Province/State and Country of Ordinary Residence | Present principal occupation, business or employment and, if not elected a director by a vote of security holders, principal occupation, business or employment during the past five years(2) | Term of service as a director of the Company and Proposed Expiry Date and First and Last Position in the Company | Approx. no. of voting securities beneficially owned, directly or indirectly or over which direction or control is exercised(3) |

Nominees for Election - Directors whose term of office will expire at the Annual General Meeting in 2009 |

Glen D. Dickson(4) (5) British Columbia, Canada | Geologist; Chairman and Chief Executive Officer, Gold-Ore Resources Ltd., Nov./2002 to date | Chairman and Director, Dec.05/2002 to date | 195,000 |

Wilson J. Barbour(4) Ontario, Canada | Independent Financial Consultant | Director, May 20/2003 to date | 100,000 |

Directors whose terms of office will expire at the Annual General Meeting in 2008 |

William J. Coulter(4) (5) British Columbia, Canada | Chairman and Chief Executive Officer, Commander Resources Ltd., Feb./2004 to date; President, Major General Resources Ltd., August 1999 to Feb./2004 | Director, Jun.01/1984 to date | 130,000(6) |

James K.B. Hesketh(4) (5) Colorado, United States | President & CEO, Canyon Resources Corporation, Mar./2005 to date; President, Kalex Inc. (Strategic and Management Consulting), Jun./1994 - Feb./2005; VP & Principal Mining Engineer, NM Rothschild & Sons (Denver) Inc., Feb./2000 - Jan./2004 | Director, Sep.20/2001 to date | 75,000 |

Director whose term of office will expire at the Annual General Meeting in 2007 |

David H. Watkins British Columbia, Canada | President, Chief Executive Officer and Director of the Company | President and Chief Executive Officer, Mar.22/2000 to date | 723,880 |

(1) For the purposes of disclosing positions held in the Company, "Company" shall include the Company and/or a parent or subsidiary thereof.

(2) Unless otherwise stated above, each of the above-named nominees has held the principal occupation or employment indicated for at least five years.

(3) Securities beneficially owned by directors is based on information furnished to the Company by the nominees.

(4) Member of Audit Committee.

(5) Member of the Compensation Committee

(6) 54,500 of these shares are registered in the name of Binjas Holdings Ltd. and 22,000 of these shares are registered in the name of Jay Willy Trading Co. Ltd., both non-reporting companies, controlled by William J. Coulter.

STATEMENT OF EXECUTIVE COMPENSATION

Reference is made to Schedule "A" attached hereto and forming a part hereof.

INCENTIVE STOCK OPTIONS

Summary of General Requirements

At the Company's Annual General Meeting held on April 14, 2005, the shareholders approved an amendment to the Company’s Employee Incentive Stock Option Plan (the “Plan”) so that up to a total of 5,000,000 common shares may be allocated and reserved for option. As of the date hereof, 4,925,500 common shares have been granted under the Existing Plan so that 74,500 common shares are available for option under the Existing Plan.

The objective of the Plan is to provide for and encourage ownership of common shares of the Company by its directors, officers and key employees and those of any subsidiary companies so that such persons may increase their stake in the Company and benefit from increases in the value of the common shares. The Plan is designed to be competitive with the benefit programs of other companies in the natural resource industry. It is the view of management that the Plan is a significant incentive for the directors, officers and key employees to continue and to increase their efforts in promoting the Company's operations to the mutual benefit of both the Company and such individuals.

Amended and Restated Incentive Stock Option Plan

The Company wishes to increase the number of shares that have been allocated and reserved for use in the Company’s Existing Plan from 5,000,000 to 6,355,864 shares, and to bring the Plan into compliance with the Toronto Stock Exchange’s current rules and policies. As of the date hereof, 4,925,500 common shares have been granted under the Existing Plan so that 1,430,364 common shares would be available for option under the new plan.

At the Meeting, the shareholders will be asked to consider, and the directors, believing it to be in the best interests of the Company, recommend the shareholders approve, a resolution whereunder the Company’s Existing Plan be deleted in its entirety and a new Incentive Stock Option Plan (the “Amended and Restated Plan”) in form as attached hereto as Schedule “B” be adopted in its place and stead. Reference should be made thereto for a complete statement of the terms and conditions of the Amended and Restated Plan. If the new Plan is approved by the Company’s shareholders, the number of shares available for the granting of options under the Amended and Restated Plan, 6,355,864, will represent 10% of the number of shares of the Company that are issued and outstanding as of the record date for the Meeting.

All outstanding incentive stock options will automatically be subject to the terms and conditions of the Amended and Restated Plan.

INSIDERS TO WHOM SHARES MAY BE ISSUED UNDER THE PLAN, AND THEIR RESPECTIVE ASSOCIATES AND AFFILIATES, WILL ABSTAIN FROM VOTING ON THE FOREGOING RESOLUTION. THE APPROVAL OF A MAJORITY OF DISINTERESTED SHAREHOLDERS OF THE COMPANY IS THEREFORE SOUGHT.

As a result, at the Meeting, the votes attaching to the 1,223,880 shares held by insiders and their associates will not be counted.

Granting of Options

During the most recently completed financial year (January 1, 2005 to December 31, 2005) (the "Financial Period"), the Company granted the following incentive stock options to its directors and other insiders:

Name of Optionee | Date of Grant | No. of Shares | Consideration received for Options | Exercise Price Per Share | Expiry Date |

| G. Ross McDonald | Feb. 8, 2005 | 50,000 | Nominal | $0.59 | Feb. 8, 2008 |

Terry Owen(1) | Feb. 8, 2005 | 100,000 | Nominal | $0.59 | Feb. 8, 2008 |

| Bonnie Whelan | Feb. 8, 2005 | 100,000 | Nominal | $0.59 | Feb. 8, 2008 |

| Wilson J. Barbour | Apr. 18, 2005 | 75,000 | Nominal | $0.70 | Apr. 18, 2008 |

| William J. Coulter | Apr. 18, 2005 | 75,000 | Nominal | $0.70 | Apr. 18, 2008 |

| Glen D. Dickson | Apr. 18, 2005 | 100,000 | Nominal | $0.70 | Apr. 18, 2008 |

| James K.B. Hesketh | Apr. 18, 2005 | 75,000 | Nominal | $0.70 | Apr. 18, 2008 |

| William R. Stanley | Apr. 18, 2005 | 150,000 | Nominal | $0.70 | Apr. 18, 2008 |

| David H. Watkins | Apr. 18, 2005 | 300,000 | Nominal | $0.70 | Apr. 18, 2008 |

(1) Terry Owen resigned as the Vice-President, Operations, effective June 10, 2005, at which time 50,000 options were cancelled. The balance of 50,000 options remain in full force and effect until the end of their term.

Reference is made to the section captioned "Election of Directors" for further details with respect to the present positions of certain of the aforesaid persons and number of shares held in the Company.

Exercise of Options

The following are particulars of incentive stock options exercised by the directors and other insiders of the Company during the Financial Period:

No. of Shares | Exercise Price Per Share | Date of Exercise | Closing Price per Share on Exercise Date | Aggregate Net Value(1) |

| 25,000 | $0.23 | Feb. 3, 2005 | $0.57 | $8,500 |

| 225,000 | $0.22 | Mar. 10, 2005 | $0.84 | $139,500 |

| 50,000 | $0.23 | Sep. 1, 2005 | $0.90 | $33,500 |

| 100,000 | $0.25 | Sep. 20, 2005 | $1.07 | $82,000 |

| 50,000 | $0.325 | Sep. 21, 2005 | $1.10 | $38,750 |

| 50,000 | $0.22 | Sep. 22, 2005 | $1.09 | 43,500 |

| 10,000 | $0.225 | Nov. 30, 2005 | $1.52 | 12,650 |

| 200,000 | $0.25 | Dec. 7, 2005 | $1.95 | 340,000 |

| 105,000 | $0.25 | Dec. 30, 2005 | $1.95 | 178,500 |

| 25,000 | $0.325 | Dec. 30, 2005 | $1.95 | 40,625 |

(1) Aggregate net value represents the market value at exercise less the exercise price at the date of exercise.

Summary of Number of Securities under Option

In summary:

| (i) | incentive stock options to purchase a total of 1,050,000 common shares without par value were granted during the Financial Period, of which options to purchase up to a total of 1,025,000 common shares were granted to insiders. |

as at the date hereof, incentive stock options to purchase up to a total of 2,755,000 common shares are outstanding, of which options to purchase up to a total of 2,220,000 shares pertain to insiders.

INDEBTEDNESS TO COMPANY OF DIRECTORS AND EXECUTIVE OFFICERS

None of the directors, executive officers and senior officers of the Company or its subsidiary proposed nominees for election or associates of such persons is or has been indebted to the Company (other than routine indebtedness) in excess of $50,000 at any time for any reason whatsoever, including the purchase of securities of the Company or any of its subsidiaries.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Since the commencement of the Company's last completed financial year, other than as disclosed elsewhere herein, no informed person of the Company, any proposed director of the Company or any associate or affiliate of any informed person or proposed director has any material interest, direct or indirect, in any transaction or in any proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries. The term “informed person” as defined in National Instrument 51-102, Continuous Disclosure Obligations, means:

| (a) | a director or executive officer of a reporting issuer; |

| (b) | a director or executive officer of a person or company that is itself an informed person or subsidiary of a reporting issuer; |

| (c) | any person or company who beneficially owns, directly or indirectly, voting securities of a reporting issuer or who exercises control or direction over voting securities of a reporting issuer or a combination of both carrying more than 10 percent of the voting rights attached to all outstanding voting securities of the reporting issuer other than voting securities held by the person or company as underwriter in the course of a distribution; and |

| (d) | a reporting issuer that has purchased, redeemed or otherwise acquired any of its securities, for so long as it holds any of its securities. |

MANAGEMENT CONTRACTS

There are no management functions of the Company or its subsidiary which are to any substantial degree performed by a person other than a director or executive officer of the Company or its subsidiary. The Company has no employment contracts.

PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

It is not known that any other matters will come before the meeting other than as set forth above and in the Notice of Meeting accompanying this Information Circular, but if such should occur the persons named in the accompanying Form of Proxy intend to vote on them in accordance with their best judgement, exercising discretionary authority with respect to amendments or variations of matters identified in the Notice of Meeting and other matters which may properly come before the meeting or any adjournment thereof.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Company is required to report annually to its shareholders on its corporate governance practices and policies with reference to National Policy 58-201, Corporate Governance Guidelines (the “Policy”), and National Instrument 58-101, Disclosure of Corporate Governance Practices, as adopted by the Canadian Securities Administrators, and effective June 30, 2005.

Mandate and Responsibility of the Board

The Board of Directors is responsible for supervising management in carrying on the business and affairs of the Company. Directors are required to act and exercise their powers with reasonable prudence in the best interests of the Company. The Board agrees with and confirms its responsibility for overseeing management's performance in the following particular areas: the strategic planning process of the Company; identification and management of the principal risks associated with the business of the Company; planning for succession of management; the Company's policies regarding communications with its shareholders and others; and the integrity of the internal controls and management information systems of the Company.

In carrying out its mandate, the Board relies primarily on management to provide it with regular detailed reports on the operations of the Company and its financial position. The Board reviews and assesses these reports and other information provided to it at meetings of the full Board and of its committees. The Company’s President and CEO is a member of the Board, giving the Board direct access to information on all areas of responsibility. Other management personnel regularly attend Board meetings to provide information and answer questions. Directors also consult from time to time with management and visit the operations of the Company. The reports and information provided to the Board include details concerning the monitoring and management of the risks associated with the Company's operations, such as compliance with safety standards and legal requirements, environmental issues and the financial position and liquidity of the Company. At least annually, the Board reviews management's report on its business and strategic plan and any changes with respect to risk management and succession planning.

Composition of the Board

The Board consists of five Directors, of which four directors are “independent” in the context of the Policy. David H. Watkins is not independent, because he is the President and Chief Executive Officer of the Company. Directors Dickson, Coulter and Hesketh, each of whom is independent with respect to the Company, are also directors of other reporting issuers. Reference is made to the narrative under the heading “Election of Directors” for the names of these other reporting issuers.

The independent directors do not hold separate meetings at which members of management are absent. However, during the course of a Directors’ meeting, if a matter is more effectively dealt with without the presence of members of management, the independent Directors ask members of management to leave the meeting, and the independent Directors then meet in camera.

Glen D. Dickson, an independent director in terms of the Policy, is the current Chairman, and as been appointed to that position since December 5, 2002. The Chairman assists the Board to function independently of management.

The Board considers its size to be appropriate and effective for the carrying out of its responsibilities.

Description of Board Committees

The Board has established two full-time committees, an Audit Committee and a Compensation Committee. Consistent with the Policy, these committees are comprised entirely of independent directors. The Board has adopted a charter with respect to its Audit and Compensation Committees and a Code of Ethics for Officers, as more fully set forth below:

Audit Committee Charter

Purpose

The Committee serves as the representative of the Board for the general oversight of the Company’s affairs relating to: (a) the internal controls and management information systems of the Company; the quality and integrity of the Company’s financial statements; the Company’s compliance with legal and regulatory requirements; the auditor’s qualifications and independence; and the performance of the Company’s internal audit function and auditors; (b) through its activities, the Committee facilitates open communication among directors, auditors and management by meeting in private sessions regularly with these parties; and (c) the Committee also provides oversight regarding significant financial matters, including borrowing, currency exposure, dividends, share issuance and repurchases, and the financial aspects of the Company’s benefit plans.

Committee Membership

The Audit Committee of the Board of Directors (the “Board”) shall consist of at least three directors. Each member of the Audit Committee shall meet the standards stipulated in Multilateral Instrument 52-110 Audit Committees, adopted by the Canadian Securities Administrators and all other applicable regulatory authorities. Under the Sarbanes-Oxley Act, at least one member of the Committee must be a “financial expert”, whose qualifications include financial literacy, independence and accounting or related financial expertise. The Audit Committee shall report to the Board. A majority of the members of the Committee shall constitute a quorum. The members of the Audit Committee shall be appointed and replaced by the Board.

Meetings and Procedures

The Audit Committee shall convene at least four times a year; and it shall endeavour to determine that auditing procedures and controls are adequate to safeguard Company assets and to assess compliance with Company policies and legal requirements.

Responsibilities

The Audit Committee shall: have the sole authority to select, compensate, oversee, evaluate and, where appropriate, replace the auditor; annually review the management arrangements for the Company; annually review and approve the proposed scope of each fiscal year’s internal and outside audit at the beginning of each new fiscal year; review and approve any audit and non-audit services and fees to be provided by the Company’s auditor; at, or shortly after the end of each fiscal year, review with the auditor and management, the audited financial statements and related opinion and costs of the audit of that year; review funding and investment policies, implementation of funding policies and investment performance of the Company’s benefit plans; provide any recommendations, certifications and reports that may be required by the Exchange or applicable regulatory authorities including the report of the Audit Committee that must be included in the Company’s annual proxy statement; review and discuss the annual audited financial statements and quarterly financial statements with management and the auditor; have the authority to engage independent counsel and other advisers as it determines necessary to carryout its duties. The company shall provide for appropriate funding, as determined by the Audit Committee, in its capacity as a committee of the Board, for payment of compensation to any advisers employed by the Audit committee and to the auditor employed by the Company for the purpose of rendering or issuing an audit report; discuss with management and the auditor the Company’s policies with respect to risk assessment and risk management; meet separately, periodically, with management and the auditor; in consultation with the auditor and management, review the integrity of the Company’s financial reporting process; review periodically the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the Company; review with the auditor: (a)any audit problems or other difficulties encountered by the auditor in the course of the audit process, including any restrictions on the scope of the auditor’s activities or on access to requested information, and any significant disagreements with management, and (b) management’s responses to such matters; review and discuss with the auditor the responsibility, budget and staffing of the Company’s internal audit function; report regularly to the Board. Such report to the Board may take the form of an oral report by the Chairman or any other member of the Audit Committee designated by the Audit Committee to make such report; and perform a review and evaluation, at least annually, of the performance of the Audit committee. In addition, the Audit Committee shall review and reassess, at least annually, the adequacy of this Charter and recommend to the Board any improvements to this Charter that the Audit Committee considers necessary or valuable. The Audit Committee shall conduct such evaluations and reviews in such manner as it deems appropriate.

Compensation Committee Charter

Purpose

The Compensation Committee is appointed by the Board to discharge the Board’s responsibilities relating to compensation to the Company’s executive. The Compensation Committee has overall responsibility for approving and evaluating the management, the compensation plans, policies and programs of the Company. The Compensation Committee is also responsible for producing an annual report on executive compensation for inclusion in the Company’s proxy statement, in accordance with applicable rules and regulations.

Committee Membership

The Compensation Committee shall consist of no fewer than three members, each of whom shall be a director of the Company. Each member of the Compensation Committee shall meet the standards relating to independence set out in the Policy and all other applicable regulatory authorities. The Compensation Committee shall report to the Board. A majority of the members of the Compensation Committee shall constitute a quorum. The members of the Compensation Committee shall be appointed and replaced by the Board.

Committee Authority and Responsibilities

The Compensation Committee shall: annually review and approve corporate goals and objectives relevant to compensation, evaluate management’s performance in light of those goals and objectives, and determine management’s compensation levels based on this evaluation. In determining the long-term incentive component of management compensation, the Compensation Committee will consider the Company’s performance and relative shareholder return, the value of similar incentive awards to management at comparable companies, the awards given to management in past years, and other factors it deems appropriate; the Compensation Committee shall have the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of management compensation and shall have sole authority to approve the consultant’s fees and other retention terms, all at the Company’s expense; the Compensation Committee shall annually review and determine the compensation of management, including incentive-compensation plans and equity-based plans; the Compensation Committee shall annually review and approve, for management of the Company: (a) the annual base salary level, (b) the annual incentive opportunity level, (c) the long-term incentive opportunity level, (d) the terms of any employment agreements, severance arrangements, and change in control agreements/provisions, in each case as, when and if appropriate, and (e) any special or supplemental benefits; the terms of any employment agreements or contracts, including those for new hire, temporary employees or consultants, should be reviewed and approved by the Compensation Committee; the Compensation Committee may form and delegate authority to subcommittees, when appropriate; the Compensation Committee shall make regular reports to the Board; the Compensation Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval; the Compensation Committee shall annually evaluate its own performance; and the Compensation Committee, and each member of the Compensation Committee in his or her capacity as such, shall be entitled to rely, in good faith, on information, opinions, reports or statements, or other information prepared or presented to them by: (a) officers and other employees of the Company, whom such member believes to be reliable and competent in the matters presented, and (b) counsel, public accountants or other persons as to matters which the member believes to be within the professional competence of such person.

Summary of Attendance of Directors

The following table sets out the attendance of the directors at Board meetings and meetings of the committees of the Board of which they members during the year ended December 31, 2005:

| Director | Board | Audit | Compensation |

| | 8 Meetings | 4 Meetings | 1 Meeting |

Glen D. Dickson | 7 | 2 | 1 |

David H. Watkins | 8 | n/a | n/a |

Wilson J. Barbour | 7 | 4 | n/a |

William J. Coulter | 8 | 4 | 1 |

James K.B. Hesketh | 7 | 4 | 1 |

Code of Ethics for Officers

It is the policy of the Company that all officers, including the Chief Executive Officer and the Chief Financial Officer, adhere to and advocate the following principles governing their professional and ethical conduct in the fulfillment of their responsibilities: act with honesty and integrity, avoiding actual or apparent conflicts between his or her personal, private interest and the interest of the Company, including receiving improper personal benefits as a result of his or her position; provide stakeholders with information that is accurate, complete, objective, relevant, timely and understandable; comply with the laws of federal, provincial and local governments applicable to the Company, and the rules and regulations of private and public regulatory agencies having jurisdiction over the Company; act in good faith, responsibly, with due care and diligence, without misrepresenting or omitting material facts or allowing independent judgment to be compromised; respect the confidentiality of information acquired in the course of the performance of his or her responsibilities except when authorized or otherwise legally obligated to disclose. Do not use confidential information, acquired in the course of the performance of his or her responsibilities, for personal advantage. Do not compete directly or indirectly with the Company; proactively promote ethical behaviour among subordinates and peers; use corporate assets and resources employed or entrusted in a responsible manner; and advance the Company’s legitimate interest and proactively promote high integrity as a responsible member of his or her business team and/or in his or her work environment.

The Company’s corporate governance practices substantially comply with the Policy.

Board Approvals and Review

No formal description has yet been established of the types of decisions by the Company which will require prior Board approval. To date, all substantive decisions involving acquisitions, major financings, major asset sales, budgets and major business initiatives have been referred to the Board. As and when the Company’s activities evolve beyond the early stages of exploration and development for mineral interests, review and approval criteria will be further considered and specific dollar capital amounts established.

Board Independent of Management

It is the responsibility of the Chairman to ensure that the Board operates independently of management. The Board reviews at least annually the existence of any relationships between each director and the Company to ensure that the majority of directors are independent of the Company. The Chairman has the discretion to meet with independent directors, as and when the circumstances warrant.

Position Descriptions

The Board of directors has not developed written position descriptions for the Chairman, the chairman of Board Committees, or the Chief Executive Officer. The Board is of the view that given the size of the Company, the relatively frequent discussions between Board members and the CEO, and the experience of the individual members of the Board, the responsibilities of such individuals are known and understood without position descriptions being reduced to writing. The Board will evaluate this position from time to time, and if written position descriptions appear to be justified, they will be prepared.

Orientation and Continuing Education

The Board does not have a formal policy relating to the orientation of new directors and continuing education for directors. The appointment of a new director is a relatively infrequent event in the Company’s affairs, and each situation is addressed on its merits on a case by case basis. The Company has a relatively restricted scope of operations, and most candidates for Board positions will likely have past experience in the mining business; they will likely be familiar therefore with the operations of a resource company of the size and complexity of the Company. The Board, with the assistance of counsel, keeps itself apprised of changes in the duties and responsibilities of directors and deals with material changes of those duties and responsibilities as and when the circumstances warrant. The Board will evaluate these positions, and if changes appear to be justified, formal policies will be developed and followed.

Nomination of Directors

The Board has neither a formal policy for identifying new candidates for Board nomination nor a permanent nominating committee. If and when the Board determines that its size should be increased or if a director needs to be replaced, a nomination committee comprising entirely of independent directors will be struck. The terms of reference of such a committee will be determined when it is created, but are expected to include the determination of the independence of the candidate, his or her experience in the mining business and compatability with the other directors.

Assessments

The Board has no formal process for the assessment of the effectiveness and contribution of the individual directors. Each director has extensive public company experience and is familiar with what is required of him. Frequency of attendance at Board meetings and the quality of participation in such meetings are two of the criteria by which the performance of a director will be assessed.

Shareholder Feedback and Liaison

The Company has an Investor Relations Manager for direct communication with investors, to maintain a current website (www.atna.com) and to respond to toll-free calls (1-800-789-2862) and e-mails at (info@atna.com) and filings via SEDAR (www.sedar.com).

BOARD APPROVAL

The contents of this Information Circular, including the schedules thereto, and the sending thereof to shareholders entitled to receive notice of the Meeting, to each director, to the auditors of the Company and to the appropriate governmental agencies, have been approved in substance by the directors of the Company pursuant to resolutions passed as of March 20, 2006.

CERTIFICATE

The foregoing contains no untrue statement of a material fact and does not omit to state a material fact that is required to be stated or that is necessary to make a statement not misleading in the light of the circumstances in which it was made.

BY ORDER OF THE BOARD

ATNA RESOURCES LTD.

“David H. Watkins”

David H. Watkins, President

Schedule "A" to the Information Circular of

ATNA RESOURCES LTD. (the "Company")

STATEMENT OF EXECUTIVE COMPENSATION

For the purposes of this Information Circular:

| (a) | "Chief Executive Officer” or “CEO" means each individual who served as chief executive officer of the Company or acted in a similar capacity during the most recently completed financial year; |

| (b) | "Chief Financial Officer" or “CFO” means each individual who served as chief financial officer of the Company or acted in a similar capacity during the most recently completed financial year; |

| (c) | “long-term incentive plan” or “LTIP” means a plan providing compensation intended to motivate performance over a period greater than one financial year. LTIPs do not include option or SAR plans or plans for compensation through shares or units that are subject to restrictions on resale; |

| (d) | “measurement period” means the period beginning at the “measurement point” which is established by the market close on the last trading day before the beginning of the Company’s fifth preceding financial year, through and including the end of the company’s most recently completed financial year. If the class or series of securities has been publicly traded for a shorter period of time, the period covered by the comparison may correspond to that time period; |

| (e) | "Named Executive Officers" or “NEOs” means the following individuals: |

| | (iii) | each of the Company's three most highly compensated executive officers, other than the CEO and CFO, who were serving as executive officers at the end of the most recently completed financial year and whose total salary and bonus exceeds $150,000; and |

| | (iv) | any additional individuals for whom disclosure would have been provided under (iii) but for the fact that the individual was not serving as an executive officer of the Company at the end of the most recently completed financial year end. |

| (f) | “normal retirement age” means normal retirement age as defined in a pension plan or, if not defined, the earliest time at which a plan participant may retire without any benefit reduction due to age; |

| (g) | “options” includes all options, share purchase warrants and rights granted by a company or its subsidiaries as compensation for employment services or office. An extension of an option or replacement grant is a grant of a new option. Also, options includes any grants made to an NEO by a third party or a non-subsidiary affiliate of the Company in respect of services to the Company or a subsidiary of the Company. |

| (h) | “plan” includes, but is not limited to, any arrangement, whether or not set forth in any formal document and whether or not applicable to only one individual, under which cash, securities, options, SARs, phantom stock, warrants, convertible securities, shares or units that are subject to restriction on resale, performance units and performance shares, or similar instruments may be received or purchased. It excludes the Canada Pension Plan, similar government plans and group life, health, hospitalization, medical reimbursement and relocation plans that are available generally to all salaried employees (for example, does not discriminate in scope, terms or operation in favour of executive officers or directors); |

| (i) | “replacement grant” means the grant of an option or SAR reasonably related to any prior or potential cancellation of an option or SAR; |

| (j) | “repricing” of an option or SAR means the adjustment or amendment of the exercise of base price of a previously awarded option or SAR. Any repricing occurring through the operation of a formula or mechanism in, or applicable to, the previously awarded option or SAR equally affecting all holders of the class of securities underlying the option or SAR is excluded; and |

| (k) | “stock appreciation right” or “SAR” means a right, granted by the Company or any of its subsidiaries as compensation for employment services or office to receive cash or an issue or transfer of securities based wholly or in part on changes in the trading price of public traded securities. |

A. Executive Compensation

During the fiscal year ended December 31, 2005, the Company had three named executive officers (for the purposes of applicable securities legislation), namely David H. Watkins, the President and Chief Executive Officer, G. Ross McDonald, Chief Financial Officer, and William R. Stanley, Vice-President, Exploration (collectively the “Named Executive Officers”).

The following table sets forth, for the periods indicated, the compensation of the Named Executive Officers:

| | | Annual Compensation | Long Term Compensation | |

| | | | | | Awards | Payouts | |

NEO Name and Principal Position | Year (1) | Salary ($) | Bonus ($) | Other Annual Compen- sation ($)(3) | Securities Under Options/ SARs granted (#) | Shares or Units subject to Resale Restrictions ($)(2) | LTIP payouts ($) | All Other Compen- sation ($)(4) |

David H. Watkins President and Chief Executive Officer | 2003 2004 2005 | 138,333 168,000 160,000 | n/a 33,000(6) n/a | Nil Nil Nil | 500,000 100,000 300,000 | Nil Nil Nil | Nil Nil Nil | 56,427(5) n/a n/a |

William R. Stanley Vice-President, Exploration | 2004 2005 | 112,996 139,920 | n/a 15,900(7) | Nil Nil | 300,000 150,000 | Nil Nil | Nil Nil | n/a n/a |

G. Ross McDonald Chief Financial Officer | 2005 | 27,500 | n/a | Nil | 50,000 | Nil | Nil | n/a |

(1) Financial year for the period January 1 to December 31.

(2) Includes the dollar value (net of consideration paid by the NEO) calculated by multiplying the closing market price of the Company’s free trading shares on the date of grant by the number of stock or stock units awarded.

(3) Perquisites and other personal benefits, securities or property for the three most recently completed financial years do not exceed the lesser of $50,000 and 10% of the total annual salary and bonus.

(4) Including, but not limited to, amount paid, payable or accrued upon resignation, retirement or other termination of employment or change in control and insurance premiums with respect to term life insurance.

(5) The parties agreed to terminate an employment agreement between the Company and Mr. Watkins by paying one-third of the severance payment set out in the agreement. The payment was term life insurance in the amount of $910 and 241,380 shares at $0.23 per share.

(6) The Company granted to David H. Watkins a special bonus in recognition of his achievements in 2003.

(7) The Company granted to William R. Stanley a special bonus in recognition of his achievements in 2004.

B. Options and Stock Appreciation Rights ("SARs")

The following table sets forth details of incentive stock options granted to each of the Named Executive Officers during the most recently completed financial year (January 1, 2005 to December 31, 2005) (the "Financial Period"):

Name | Securities under Options/SARs granted (#) | Percent of Total Options/SARs granted to Employees in Financial Period(1) | Exercise or Base Price ($/Security) | Market Value of Securities underlying Options/SARs on the Date of Grant ($/Security) | Expiration Date |

| David H. Watkins | 300,000 | 28.6% | $0.70 per share | $0.70 per share | Apr.18 2008 |

| William R. Stanley | 150,000 | 14.3% | $0.70 per share | $0.70 per share | Apr. 18, 2008 |

| G. Ross McDonald | 50,000 | 0.05% | $0.59 per share | $0.59 per share | Feb. 8, 2008 |

(1) Reflected as a percentage of the total number of options to purchase common shares granted (1,050,000) during the Financial Period.

The following table sets forth information concerning the exercise of options under the Plan during the Financial Period and the value at December 31, 2005 of unexercised in-the-money options under the Plan held by each of the NEOs.

Name | Securities Acquired on Exercise | Aggregate Realized Value ($) | Unexercised Options at Financial Year End Exercisable/Unexercisable | Value of Unexercised in-the-Money Options at Financial Year End Exercisable/Unexercisable |

| David H. Watkins | 300,000 | 422,000 | 450,000/150,000 | 187,500/105,000 |

| William R. Stanley | n/a | n/a | 225,000/100,000 | 220,625/151,875 |

| G. Ross McDonald | n/a | n/a | 60,000/10,000 | 49,600/20,100 |

C. Pension Plan

The Named Executive Officers do not participate in any defined benefit or actuarial plan.

D. | Termination of Employment, Change in Responsibilities and Employment Contracts |

During the Financial Period, there were no employment contracts between the Company and any of its subsidiaries and the Named Executive Officers and there were no compensatory plans or arrangements, including payments to be received from the Company or any of its subsidiaries, with respect to the Named Executive Officers.

E. | Composition of Compensation Committee |

The Board of Directors upon the advice of the Compensation Committee determines executive compensation for the Company. The Compensation Committee is comprised of Glen D. Dickson, William J. Coulter and James K.B. Hesketh.

F. | Report on Executive Compensation |

The Compensation Committee meets as required, but at least annually. The Committee reviews management compensation policies and benefits, monitors management succession planning and conducts an annual review of the overall condition and quality of the Company's human resources. In addition, the Committee has the specific mandate to review and approve executive compensation. In carrying out its mandate, the Committee assesses on an annual basis the performance of the Chief Executive Officer against established objectives. It also reviews performance reports submitted for other executive officers.

Compensation Philosophy and Process

The Compensation Committee reviews the compensation of the directors on an annual basis, taking into account such matters as time commitment, responsibility and compensation provided by comparable companies, and makes a recommendation to the Board for approval annually.

Chief Executive Officer Compensation Summary

For the period ended December 31, 2005, the Chief Executive Officer was compensated in the amount of $27,500 and received an incentive stock option to purchase up to 50,000 shares of the Company exercisable at a price of $0.59 per share at any time up to February 8, 2008.

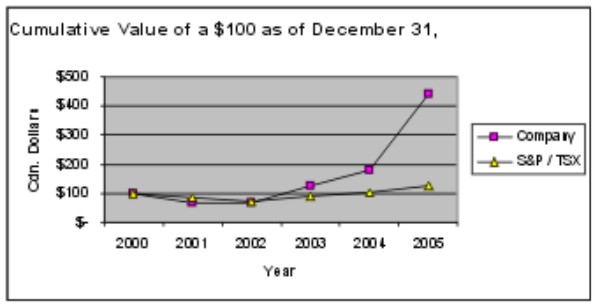

The graph below compares the yearly percentage change in the cumulative total shareholder return on the Company's common shares against the cumulative total shareholder return of the TSX 300 Composite Index for the five-year period commencing December 31, 2000 and ending December 31, 2005.

The Company did not pay any dividends during the subject period.

FIVE YEAR CUMULATIVE TOTAL RETURN ON $100 INVESTMENT ASSUMING DIVIDENDS ARE REINVESTED

(December 31, 2000 - December 31, 2005)

The common shares of the Company are posted and listed for trading on The Toronto Stock Exchange.

H. Compensation of Directors

During the Financial Period, no compensation was paid or is payable by the Company to the directors of the Company, other than the Chief Executive Officer (the “Other Directors”), or the Company’s subsidiaries, if any, for their services:

| | (a) | in their capacity as directors, including any amounts payable for committee participation or special assignments pursuant to any standard or other arrangements; or |

| | (b) | as consultants or experts. |

save and except as otherwise herein disclosed.

The Company has no pension plan or other arrangement for non-cash compensation to the Other Directors, except incentive stock options. During the Financial Period, on April 18, 2005, the Other Directors were granted incentive stock options to purchase up to 325,000 common shares of the Company exercisable for a term of three years from the date of grant at $0.70 per share.

Schedule "B" to the Information Circular of

ATNA RESOURCES LTD. (the "Company")

EMPLOYEE INCENTIVE STOCK OPTION PLAN

(as adopted at the Annual General Meeting held on April 12, 1996,

as amended at the Annual General Meeting held on June 16, 2000, the

Annual and Extraordinary General Meeting held on June 8, 2001,

the Annual and Extraordinary General Meeting held on May 20, 2003, the Annual and Extraordinary General Meeting held on April 14, 2005

and the Annual and Special Meeting held on April 20, 2006)

1. Purpose

The purpose of the Employee Incentive Stock Option Plan (the "Plan") is to promote the profitability and growth of ATNA RESOURCES LTD. (the "Company") by facilitating the efforts of the Company and its subsidiaries to obtain and retain key individuals. The Plan provides an incentive for and encourages ownership of the Company's shares by its key individuals so that they may increase their stake in the Company and benefit from increases in the value of the Company's shares.

2. Administration

The Plan will be administered by a compensation committee (the "Committee") of the Company's Board of Directors (the "Board").

The Committee will be authorized, subject to the provisions of the Plan, to adopt such rules and regulations which it deems consistent with the Plan's provisions and, in its sole discretion, to designate options ("Options") to purchase shares of the Company pursuant to the Plan. The Committee may authorize one or more individuals of the Company to execute, deliver and receive documents on behalf of the Committee.

3. Eligibility

All directors and officers and employees of the Company and its subsidiaries will be eligible to receive Options. The term "subsidiaries" for the purpose of the Plan will include ATNA RESOURCES, INC., which definition may be varied by the Committee to conform with the changing interests of the Company.

Nothing in the Plan or in any Option shall confer any right on any individual to continue in the employ of or association with the Company or its subsidiaries or will interfere in any way with the right of the Company or subsidiaries to terminate at any time the employment of a person who is an optionee ("Optionee") under an Option.

4. Shares Subject to Option

The shares to be optioned under the Plan will be authorized but unissued Common Shares without par value ("Shares") of the Company.

At no time will more than 6,355,864 shares be under option pursuant to the Plan. The number of Shares under Option at any specific time to any one Optionee shall not exceed 5% of the issued and outstanding common share capital of the Company, subject to adjustment under Section 12 below.

Shares subject to and not delivered under an Option which expires or terminates shall again be available for option under the Plan.

5. Granting of Options

The Committee may from time to time at its discretion, subject to the provisions of the Plan, determine those eligible individuals to whom Options will be granted, the number of Shares subject to such Options, the dates on which such Options are to be granted and the expiration of such Options.

The Committee may, at its discretion, with respect to any Option, impose additional terms and conditions which are more restrictive on the Optionee than those provided for in the Plan.

Each Option will be evidenced by a written agreement between, and executed by, the Company and the individual containing terms and conditions established by the Committee with respect to such Option and will be consistent with the provisions of the Plan.

6. Option Price

The price per Share at which Shares may be purchased upon the exercise of an Option (the "Option Price") will not be lower than the "market price" of the Shares on The Toronto Stock Exchange (the "Exchange") at the time of grant. In the context of the Plan, "market price" means the volume weighted average trading price (“VWAP”) of the Company's shares on the Exchange for the five trading days prior to the date of the grant. The VWAP is the trading price of the Company’s shares, calculated by dividing the total value by the total volume of the Company’s shares over the said five trading days.

7. Term of Option

The maximum term of any Option will be 10 years.

The Option Price will be paid in full at the time of exercise of the Option and no Shares will be delivered until full payment is made.

An Optionee will not be deemed the holder of any Shares subject to his Option until the Shares are delivered to him.

8. Transferability of Options

An Option may not be assigned. During the lifetime of an Optionee, the Option may be exercised only by the Optionee.

9. Termination of Employment

Upon termination of employment for any reason except death or retirement or failure of re-election as a director or failure to be re-appointed an officer of the Company, an Optionee may, unless expressly provided to the contrary in the agreement granting the Option, at any time within 30 days after the date of termination but not later than the date of expiration of the Option, exercise the Option to the extent the Optionee was entitled to do so on the date of termination. Any Option or portions of Options of terminated individuals not so exercised will terminate and will again be available for future Options under the Plan. A change of position will not be considered a termination so long as the Optionee continues to be employed by the Company or its subsidiaries.

10. Death

Notwithstanding any other provision of this Plan other than the maximum of 10 years provided for in Section 7, if any Optionee shall die holding an Option which has not been fully exercised, his personal representative, heir or legatee may, at any time within 60 days of grant of probate of the will or letters of administration of the estate of the decedent or within one year after the date of such death, whichever is the lesser time, exercise the Option with respect to the unexercised balance of the Shares subject to the Option.

11. Retirement

Notwithstanding any other provision of this Plan, if any Optionee shall retire or terminate his employment with the consent of the Board under circumstances equating retirement, while holding an Option which has not been fully exercised, such Optionee may exercise the Option at any time during the unexpired term of the Option.

12. Changes in Shares

In the event the authorized common share capital of the Company as presently constituted is consolidated into a lesser number of Shares or subdivided into a greater number of Shares, the number of Shares for which Options are outstanding will be decreased or increased proportionately as the case may be and the Option Price will be adjusted accordingly and the Optionees will have the benefit of any stock dividend declared during the period within which the said Optionee held his Option. Should the Company amalgamate or merge with any other company or companies (the right to do so being hereby expressly reserved) whether by way of arrangement, sale of assets and undertakings or otherwise, then and in each such case the number of shares of the resulting corporation to which an Option relates will be determined as if the Option had been fully exercised prior to the effective date of the amalgamation or merger and the Option Price will be correspondingly increased or decreased, as applicable.

13. Cancellation and Re-granting of Options

The Committee may, with the consent of the Optionee, cancel an existing Option, and re-grant the Option at an Option Price determined in the same manner as provided in Section 6 hereof, subject to the prior approval of the Exchange.

14. Amendment or Discontinuance

The Board may alter, suspend or discontinue the Plan, but may not, without the approval of the shareholders of the Company and the Exchange, make any alteration which would (a) increase the aggregate number of Shares subject to Option under the Plan except as provided in Section 12 or (b) decrease the Option Price except as provided in Section 12. Notwithstanding the foregoing, the terms of an existing Option may not be altered, suspended or discontinued without the consent in writing of the Optionee.

15. Interpretation

The Plan will be construed according to the laws of the Province of British Columbia.

16. Liability

No member of the Committee or any director, officer or employee of the Company will be personally liable for any act taken or omitted in good faith in connection with the Plan.