UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report __________________

Commission File Number: 000-29336

ATNA RESOURCES LTD.

(Exact name of registrant as specified in its charter)

Not applicable

(Translation of registrant’s name into English)

Province of British Columbia (Canada)

(Jurisdiction of incorporation or organization)

14142 Denver West Parkway, Suite 250

Golden, Colorado 80401

United States

(Address of principal executive offices)

Rod Gloss

Vice President and Chief Financial Officer

14142 Denver West Parkway, Suite 250

Golden, Colorado 80401

United States

Telephone: (303) 278-8464

Fax: (303) 279-3772

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

| Title of Each Class | Issued and Outstanding as at December 31, 2013 |

| | |

| Common Shares without par value | 189,922,144 |

| Preferred Shares without par value | Nil |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.:

¨ Large accelerated filer¨ Accelerated filerx Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ¨ U.S. GAAP | x International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

¨ Item 17¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

¨ Yes x No

TABLE OF CONTENTS

| CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS | | 3 |

| CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF MINERAL RESERVES AND MINERAL RESOURCES | | 5 |

| GLOSSARY OF SELECTED MINING TERMS | | 5 |

| MINERAL RESERVE AND RESOURCE DISCLOSURE | | 7 |

| | | | | |

| PART I | | 8 |

| | ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | | 8 |

| | ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | | 8 |

| | ITEM 3. | KEY INFORMATION | | 8 |

| | ITEM 4. | INFORMATION ON THE COMPANY | | 15 |

| | ITEM 4A. | UNRESOLVED STAFF COMMENTS | | 45 |

| | ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 45 |

| | ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | 56 |

| | ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | 74 |

| | ITEM 8. | FINANCIAL INFORMATION | | 75 |

| | ITEM 9. | THE OFFER AND LISTING | | 76 |

| | ITEM 10. | ADDITIONAL INFORMATION | | 78 |

| | ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 88 |

| | ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | | 91 |

| | | | | |

| PART II | | 92 |

| | ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | | 92 |

| | ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | | 92 |

| | ITEM 15. | CONTROLS AND PROCEDURES | | 92 |

| | ITEM 16. | RESERVED | | 93 |

| | ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | | 93 |

| | ITEM 16B. | CODE OF ETHICS | | 93 |

| | ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | | 94 |

| | ITEM 16D. | EXCEPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | | 94 |

| | ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PERSONS | | 94 |

| | ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | | 95 |

| | ITEM 16G. | CORPORATE GOVERNANCE | | 95 |

| | ITEM 16H. | MINE SAFETY DISCLOSURE | | 95 |

| | | | | |

| PART III | | 95 |

| | ITEM 17. | FINANCIAL STATEMENTS | | 95 |

| | ITEM 18. | FINANCIAL STATEMENTS | | 95 |

| | ITEM 19. | EXHIBITS | | 95 |

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of applicable securities legislation. These “forward-looking statements” are based on projections, expectations and estimates as of the report date or, in the case of documents incorporated by reference herein, as of the date of such documents. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans related to the future. All of the forward-looking statements made in this Annual Report are qualified by these cautionary statements.

Forward-looking statements may include, but are not limited to, statements with respect to the future price of gold and silver, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, anticipated costs of production, estimated capital expenditures, estimated net present values, estimated internal rates of return, estimated development activities, mine development plans, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks or claims, the anticipated use of proceeds from financings, anticipated capital spending and liquidity, the timing of commencement of commercial production, drilling schedules and potential results thereof, granting of permits and approvals, and the timing and potential results of studies and reports. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “is planned”, “expects” or “does not expect”, “is expected”, “is designed”, “budget” or “budgeted”, “scheduled”, “estimates”, “projects”, “forecasts”, “contemplates”, “continue”, “targets”, “targeted”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

In particular, this Annual Report and other documents incorporated by reference herein contain forward-looking statements pertaining to the following:

| · | Any projections of earnings, revenues, synergies, costs and cost savings, cash flows, liquidity, capital spending, and other financial items; |

| · | Any projections of production, recoveries, stripping ratios, conversions of resources to reserves, operational efficiencies and inefficiencies, and other operating items; |

| · | Any projections that new financing can be obtained upon commercially acceptable terms given market and economic conditions at the time; |

| · | Any statement of the plans, strategies, objectives, and goals of management for future operations, including the Briggs mine production, development of the Pinson-underground, Pinson Mag open-pit, Reward, Cecil-R, and Columbia gold mining projects; |

| · | Any statements regarding future economic conditions or performance; |

| · | Any statements of belief or intent; and |

| · | Any assumptions regarding the foregoing. |

The actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and in the sections of thE MD&A entitled “Financial Risk Management”, “Critical Accounting Estimates” and “Risks and Uncertainties” and in the Company’s other filings with Canadian Securities Administrators and the US Securities and Exchange Commission (“SEC”):

| · | Fluctuations in gold and other metals prices; |

| · | Risks relating to the Company’s ability to generate material revenues or obtain adequate financing or its planned exploration and development activities; |

| · | Actual results of current exploration activities; |

| · | Conclusions of economic evaluations; |

| · | Changes in project parameters as plans continue to be refined; |

| · | Possible variations in ore reserves, grade or recovery rates; |

| · | Failure of plant, equipment or processes to operate as anticipated; |

| · | Risks related to fluctuations in the currency market; |

| · | Risks related to the business being subject to environmental laws and regulations which may increase costs of doing business and restrict the Company’s operations; |

| · | Delays in obtaining government approvals or financing or in the completion of development or construction activities; |

| · | Risks related to hedging metal production and key operating inputs; |

| · | Risks related to operating hazards; |

| · | Risks related to the exploration, permitting, development and mining of precious metals; |

| · | Risks related to estimation of reserves and resources; |

| · | Risks related to governmental regulation, including environmental regulation; |

| · | Risks related to competition; |

| · | Risks related to joint ventures; |

| · | Uncertainty of capital costs, operating costs, production, metal recoveries and economic returns; |

| · | Risks related to the uncertainty of the title of assets; |

| · | The need to attract and retain qualified management and technical personnel; |

| · | Risks related to reclamation activities on properties; and |

| · | Other risks described in other documents incorporated by reference herein. |

Forward-looking statements provide information about management’s current expectations and plans relating to anticipated future events and are based on the Company’s current beliefs and assumptions regarding, among other things:

| · | Future gold and other metals prices; |

| · | The overall success of the Company’s ability to generate material revenues and to obtain adequate financing for its planned exploration and development activities; |

| · | Actual results of current exploration activities; |

| · | Conclusions of economic evaluations; |

| · | Changes in project parameters as plans continue to be refined; |

| · | Future variations in ore reserves, grade, or recovery rates; |

| · | Failure of plant, equipment or processes to operate as anticipated; |

| · | Realization of benefits from all capital including deferred stripping costs incurred during development and production; |

| · | The estimated fair value of share-based compensation; |

| · | The estimated fair value of financial instruments and nonmonetary transactions; |

| · | Future profitability affecting deferred tax assets and liabilities; |

| · | The probable outcome of contingencies; |

| · | Fluctuations in the currency market; |

| · | The regulatory frame work governing environmental laws and regulations; |

| · | Possible delays in obtaining governmental approvals or financing or in the completion of development or construction activities; |

| · | Hedging metal production and key operating inputs; |

| · | The exploration, permitting, development and mining of precious metals; |

| · | Estimation of reserves and resources; |

| · | Capital costs, operating costs, production, metal recoveries and economic returns; and |

| · | The Company’s ability to attract and retain qualified management and technical personnel. |

Statements relating to mineral reserves and resources are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the mineral reserves and resources described exist in the quantities predicted or estimated and can be profitably produced in the future. Estimated values of future net revenue do not represent fair market value. There is no certainty that it will be commercially viable to produce any portion of the resources.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company’s forward-looking statements are based on the beliefs, expectations and opinions of management as of the date the statements are made, and the Company does not assume any obligation to update any forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For reasons set forth above, readers should not place undue reliance on forward-looking statements. Forward-looking statements are made as of the report date and other than as required by applicable securities laws, the Company assumes no obligation to update or revise such forward-looking statements to reflect new events or circumstances.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF MINERAL RESERVES AND MINERAL RESOURCES

We advise U.S. investors that the definitions of the terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” under the Standards on Mineral Resources and Mineral Reserves Definitions and Guidelines adopted by the Canadian Institute of Mining, Metallurgy and Petroleum are different than the definitions adopted by the SEC and applicable to U.S. companies filing reports with the SEC pursuant to SEC Industry Guide 7. It is the view of the SEC’s staff that:

| · | A “final” or “bankable” Feasibility Study is required to meet the requirements to designate reserves under Industry Guide 7. |

| · | A historic three-year average price is to be used in any reserve or cash flow analysis to designate reserves. |

| · | To meet the “legal” part of the reserve definition, the primary environmental analysis or document should have been submitted to governmental authorities. |

Cautionary Note to U.S. Investors – The SEC permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this report, such as “measured,” “indicated,” and “inferred mineral resources” which the SEC guidelines generally prohibit U.S. registered companies from including in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in this Annual Report on Form 20-F.

GLOSSARY OF SELECTED MINING TERMS

Cut-off Grade: The minimum grade of mineralized material used to establish reserves and resources.

Doré: Unrefined gold and silver bullion consisting of approximately 90 percent precious metals that will be further refined to almost pure metal.

Feasibility Study: A Feasibility Study is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of realistically assumed mining, processing, metallurgical, economic, marketing, legal, environmental, social and governmental considerations together with any other relevant operational factors and detailed financial analysis, that are necessary to demonstrate at the time of reporting that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a Pre-Feasibility Study.

Grade: The metal content of sampled material, usually expressed in troy ounces per ton or grams per tonne. In this report we consistently use ounces per ton to describe our grades of reserves or mineralized material. (See “Ounces per Ton” or “Grams per Tonne” below).

Grams per Tonne (“g/t”): Metric units used to describe the grade of sampled material, reserve or resource. It represents the portion of a gram estimated to be contained in a metric ton of rock.

Heap Leaching: A method of recovering gold or other precious metals from a heap of ore placed on an impervious pad, whereby a dilute leaching solution is allowed to percolate through the heap, dissolving the precious metal, which is subsequently captured and recovered.

Net Smelter Return (“NSR”) Royalty: A defined percentage of the gross revenue from a mineral extraction operation, less a proportionate share of transportation, insurance, and processing costs.

Ounces per Ton (“oz/ton”): English units used to describe the grade of ore or other material analyzed, reserve or resource. It represents the portion of an ounce estimated to be contained in a ton of rock.

Patented Mining Claim: A patented mining claim is one for which the federal government has passed its title to the claimant, making it private land. A person may mine and remove minerals from a mining claim without a mineral patent. However, a mineral patent gives the owner exclusive title to the locatable minerals. It also gives the owner title to the surface and other resources.

Preliminary Feasibility Study (or Pre-Feasibility Study): A Preliminary Feasibility Study is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on mining, processing, metallurgical, economic, marketing, legal, environmental, social and governmental considerations and the evaluation of any other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve.

Reclamation: The process of returning land to another use after mining is completed.

Recoverable: That portion of metal contained in ore that can be extracted by processing.

Run-of-Mine: Mined ore of a size that can be processed without further crushing.

Strip Ratio: The ratio between tonnage of waste and ore in an open-pit mine.

Stope:An area developed in an underground mine for the purpose of extracting ore.

Tons or Tonnes: Tons or short tons contain 2,000 pounds and tonnes or metric tons contain 2,204.6 pounds or 1,000 kilograms.

Unpatented Mining Claim: A parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim under the General Mining Law.

Waste: Barren rock or mineralized material that is too low in grade to be economically processed.

MINERAL RESERVE AND RESOURCE DISCLOSURE

Mineral Reserves and Mineral Resources are defined under National Instrument 43-101 (“NI 43-101”) as follows. NI 43-101 technical reports referenced herein can be viewed on SEDAR atwww.sedar.com and on EDGAR atwww.sec.gov.

Mineral Reserve:A Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

Proven Mineral Reserve:A ‘Proven Mineral Reserve’ is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Probable Mineral Reserve:A ‘Probable Mineral Reserve’ is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

Mineral Resource:A Mineral Resource is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

Measured Mineral Resource:A ‘Measured Mineral Resource’ is that part of a Mineral Resourcefor which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

Indicated Mineral Resource:An ‘Indicated Mineral Resource’ is that part of a Mineral Resourcefor which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters and to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Inferred Mineral Resource:An ‘Inferred Mineral Resource’ is that part of a Mineral Resourcefor which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

| A. | Selected Financial Data |

The following tables summarize certain consolidated financial information of the Company. Excerpts from the audited consolidated financial statements for 2009 through 2013 have been prepared in accordance with International Financial Reporting Standards (“IFRS”). The following information should be read in conjunction with the consolidated financial statements and notes thereto, included in Item 18 of this report. Monetary data not labeled herein is stated in United States Dollars (“U.S. Dollars” or “$”). Certain disclosures are reported in Canadian Dollars (“Canadian Dollars” or “C$”). SeeExchange Rates Data in this section.

| Year ended | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Total revenues | | $ | 45,035,100 | | | $ | 59,763,300 | | | $ | 51,755,400 | | | $ | 30,606,900 | | | $ | 8,689,200 | |

| Net (loss) income | | $ | (49,619,600 | ) | | $ | 6,886,000 | | | $ | 15,084,400 | | | $ | (5,891,900 | ) | | $ | (5,779,800 | ) |

| Basic and diluted (loss) income per share | | $ | (0.32 | ) | | $ | 0.05 | | | $ | 0.14 | | | $ | (0.07 | ) | | $ | (0.07 | ) |

| Working capital | | $ | (7,039,800 | ) | | $ | 6,429,000 | | | $ | (4,726,500 | ) | | $ | 11,734,800 | | | $ | 11,365,200 | |

| Total assets | | $ | 112,277,300 | | | $ | 160,184,700 | | | $ | 131,205,300 | | | $ | 83,206,100 | | | $ | 80,037,600 | |

| Total liabilities | | $ | 35,767,300 | | | $ | 42,816,200 | | | $ | 44,413,700 | | | $ | 26,069,500 | | | $ | 25,819,900 | |

| Total shareholders' equity | | $ | 76,510,000 | | | $ | 117,368,500 | | | $ | 86,791,600 | | | $ | 57,136,600 | | | $ | 54,217,700 | |

| Number of shares issued and outstanding | | | 189,922,144 | | | | 144,989,922 | | | | 117,374,643 | | | | 99,002,468 | | | | 83,291,133 | |

Exchange Rate Data

Unless otherwise indicated, all monetary references herein are denominated in U.S. Dollars. The exchange rates used herein were obtained from U. S. Federal Reserve Bank; however, they cannot be guaranteed.

As of December 31, 2013 and March 14, 2014, the noon rate as quoted by Bank of Canada was Canadian Dollar $1.063 and Canadian Dollar $1.109 equals U.S. $1.00, respectively.

The following table sets out the U.S. Dollar to Canadian Dollar high and low exchange rates for each month during the previous six months, expressed as U.S. Dollars per Canadian Dollar.

| | | High for Period | | | Low for Period | |

| February-2014 | | | 1.114 | | | | 1.095 | |

| January-2014 | | | 1.117 | | | | 1.061 | |

| December-2013 | | | 1.069 | | | | 1.057 | |

| November-2013 | | | 1.059 | | | | 1.041 | |

| October-2013 | | | 1.045 | | | | 1.028 | |

| September-2013 | | | 1.053 | | | | 1.023 | |

The following table sets forth the average exchange rates for the past five years, expressed as U.S. Dollars per Canadian Dollar.

| Year | | Average | |

| 2013 | | | 1.029 | |

| 2012 | | | 1.000 | |

| 2011 | | | 0.989 | |

| 2010 | | | 1.030 | |

| 2009 | | | 1.142 | |

| B. | Capitalization and Indebtedness |

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

| C. | Reasons for the Offer and Use of Proceeds |

This Form 20-F is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

The securities of the Company are considered speculative due to the nature of the Company’s business and the present stage of its development. A prospective investor should consider carefully the following factors.

Risk Factors Relating to the Company

The Company was not a Passive Foreign Investment Company, or PFIC, for the year ending December 31, 2013, although we may have been in prior years which could result in adverse U.S. Tax Consequences to U.S. Investors.

Shareholders who are U.S. taxpayers should be aware that Atna is not a passive foreign investment company (“PFIC”) for the current fiscal year, although it may have been a PFIC in prior years and could also be a PFIC in subsequent years. If Atna is a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayer generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a timely and effective qualified electing fund (“QEF”) election or a mark-to-market election with respect to the shares of Atna. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of Atna’s net capital gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amounts to our shareholders. A U.S. taxpayer who makes the mark-to-market election, generally, must include as ordinary income in each year, the excess of the fair market value of the common shares over the taxpayer’s tax basis therein. Refer to additional details under “E. Taxation – U.S. Federal Income Tax Consequences” for more information.

Precious and Base Metal Price Fluctuations

The profitability of the Company’s operations is dependent upon the market price of certain precious and base metals. The markets for gold and other metals are affected by numerous factors, many of which are beyond our control. Such factors include the price of the metal in the marketplace, imports of metals from other nations, demand for metals, the availability of adequate refining and milling facilities, and the market price of competitive metals used in the same industrial applications. The market price of metals is volatile and beyond our control. Gold prices are generally influenced by basic supply/demand fundamentals, inflation, alternative investment markets, and the strength or weakness of the U.S. Dollar. Demand for gold as a safe haven against economic turmoil, currency devaluations and other factors in the financial marketplace often has more of an impact on the price of gold than does the annual production of gold. The market dynamics of supply/demand can be heavily influenced by economic policy; e.g., central banks sales/purchases, political unrest, conflicts between nations, and general perceptions about inflation. Fluctuating metal prices may have a significant impact on our results of operations and operating cash flow. Decreasing mineral prices will adversely affect the market values of our properties and may lead to the recording of asset impairments.

Hedging Risks Related to Precious Metal Production and Key Operating Inputs

The Company may from time to time enter into gold hedge contracts to protect against declines in the price of gold or it may also enter into consumable off-take agreements that may protect against the increasing cost of consumables such as diesel fuel. The Company’s goal is to protect the Company’s cash flows against declining gold prices or increasing diesel prices. The Company’s primary risk mitigation for hedge transactions is its policy to limit net hedge levels to 50 percent of its expected gold production or diesel usage. Although a hedging program is designed to protect cash flow against a decline in the price of gold or rise in the price of diesel fuel, it could also limit the Company’s gold realizations over the term of a hedge contract during periods of increasing gold prices or could increase diesel costs during periods of declining diesel prices.

Operating Hazards and Risks

Mining operations generally involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Hazards such as unusual or unexpected geologic structures and other conditions are involved. Operations in which the Company has a direct or indirect interest will be subject to all of the hazards and risks normally incidental to exploration, development and production of precious and base metals, any of which could result in work stoppages, damage to or destruction of mines and other producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damage. The Company maintains liability insurance in an amount that it considers adequate for its operations; however, the Company may become subject to liabilities due to events of pollution, slope failure, cave-in, flood or other hazards against which it cannot insure or against which it may elect not to insure. The payment of such liabilities may have a material adverse effect on the Company’s financial position.

Exploration and Development

Mineral exploration and development involves a high degree of risk and few properties explored ultimately are developed into producing mines. There is no assurance that Atna’s mineral exploration and development activities will result in any discovery or development of bodies of commercial ore. The long-term profitability of Atna’s operations will be in part directly related to the cost and success of its exploration programs, which may be affected by a number of factors.

Substantial expenditures are required to establish reserves through drilling, to develop metallurgical processes to extract metal from ore and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis.

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond the Company’s control and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and other factors such as government regulations, including regulations relating to royalties, allowable production, importing and exporting minerals and environmental protection.

Calculation of Reserves and Resources and Precious and Base Metal Recovery

There is a degree of uncertainty attributable to the calculation of reserves and resources and corresponding grades being mined or dedicated to future production. Until reserves or resources are actually mined and processed, the quantity of mineralization and grades must be considered as estimates only. In addition, the quantity of reserves and resources may vary depending on metal prices, operating costs, and design parameters. Any material change in quantity of reserves, resources, grade or stripping ratio may affect the economic viability of the Company’s properties. In addition, there can be no assurance that precious or other metal recoveries as determined in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Government Regulation

Operations, development and exploration on the Company’s properties are affected to varying degrees by government regulations and laws relating to matters such as, but not limited to, environmental protection; health, safety and labour; mining law reform; homeland security; restrictions on production; price controls; tax increases; maintenance of claims; tenure; and expropriation of property. There is no assurance that future changes in such regulation, if any, will not adversely affect the Company’s operations.

Environmental Factors

All phases of the Company’s operations are subject to environmental regulation and permitting in the various jurisdictions in which the Company operates. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Company’s operations. Environmental hazards may exist on the Company’s properties unknown to the Company at present, which have been caused by previous or existing owners or operators of the properties.

Competition and Agreements with Other Parties

The mining industry is intensely competitive at all phases, and the Company competes with many companies possessing greater financial and technical resources than those of the Company. Competition in the mining business could adversely affect the Company’s ability to attract qualified mining personnel, competitive financing, or acquire suitable producing properties or prospects for mineral exploration in the future.

The Company may, in the future, be unable to meet its share of costs incurred under agreements to which it is a party and the Company may have its interest in the properties subject to such agreements reduced as a result. Furthermore, if other parties to such agreements do not meet their share of such costs, the Company may be unable to finance the cost required to complete recommended programs.

Ongoing Financing

The business of mineral exploration and extraction involves a high degree of risk with very few properties that are explored ultimately achieving commercial production. As a mining company in the exploration, development and mining stage, the ability of the Company to conduct exploration, development and mining operations is affected principally by its ability to raise adequate amounts of capital through equity financings, debt financings, joint ventures or joint operations of projects, asset sales and other means. In turn, the Company’s ability to obtain funding depends in part upon the market’s perception of its management and properties, the price of gold, the marketability of its securities, the attractiveness of its assets for sale and its creditworthiness with potential lenders. Servicing existing debt, previously incurred to finance projects, may hamper the Company’s ability to invest in new projects and obtain new financing. There is no assurance that the Company will be successful in obtaining required financing.

Cash Flow

Briggs is the Company’s sole operating unit and source of operating cash flow. Any positive cash flow developed from Briggs may be used to fund some or all of the Company’s corporate overhead, exploration and project development costs. The Company has limited financial resources and there is no assurance that additional funding will be available to allow the Company to accomplish its stated goals or to fulfil its obligations with regard to existing debt, development, exploration, and joint venture properties. Failure to obtain additional financing could result in delay or indefinite postponement of further development and/or exploration and the possible, partial or total loss of the Company’s interest in certain properties.

Conflict of Interest

Certain directors and officers of the Company are officers and/or directors of, or are associated with other natural resource companies, that acquire interest in mineral properties. Such associations may give rise to conflicts of interest from time to time. Directors are required by law, however, to act honestly and in good faith with a view to the best interests of the Company and its shareholders and to disclose any personal interest which they may have in any material transactions which are proposed to be entered into with the Company and to abstain from voting as a director for the approval of any such transaction.

Title to Assets

Although the Company has or will receive title opinions for any properties in which it has a material interest in Canada and the U.S., there is no guarantee that title to such properties will not be challenged or impugned. The Company has not conducted surveys of all of the claims in which its holds direct or indirect interests and therefore, the precise area and location of such claims may be in doubt. The majority of the Company’s properties are located in the U.S. where mineral title is held through either patented or unpatented mining claims, fee mineral rights, and as leased mineral interests. Members of the U.S. Congress have repeatedly introduced bills which would supplant or alter the provisions of the Mining Law of 1872. If enacted, such legislation could change the cost of holding unpatented mining claims and could impact our ability to develop mineral resources on unpatented mining claims. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Although it is impossible to predict at this point what any legislated royalties might be, enactment could adversely affect the potential for development of such mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect the Company’s financial performance.

The Company’s Canadian mineral claims may be subject to prior unregistered agreements or transfers or native land claims and title may be affected by undetected defects. Native land claim settlements are more advanced in the Yukon Territory than they are in British Columbia, and to the best of the Company’s knowledge, none of the Company’s properties in the Yukon Territory cover areas where the Federal Crown proposes to transfer mineral rights to the First Nations. However, there is no guarantee that this will not change before settlements are finalized.

Dividends

The Company has not, since the date of its incorporation, declared or paid any dividends on its Common Shares and does not currently intend to pay dividends. For the foreseeable future, earnings, if any, are expected to be retained to finance further growth and development of the business of the Company.

Resale of Shares

The continued operation of the Company will be dependent upon its ability to generate operating revenues and to procure additional financing. There can be no assurance that any such revenues can be generated or that other financing can be obtained. If the Company is unable to generate such revenues or obtain such additional financing, any investment in the Company may be lost. In such event, the probability of resale of the shares purchased would be diminished.

Joint Arrangements

Certain of the properties in which the Company has an interest are operated through joint operations and joint ventures with other mining companies. The existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on the viability of the Company’s interests held through joint arrangements and on the Company’s future cash flows, earnings, results of operations and financial condition: (i) disagreements with joint arrangement partners on how to develop and operate mines efficiently; (ii) inability of joint arrangement partners to meet their obligations to the joint arrangement or third parties; (iii) litigation between joint arrangement partners regarding joint arrangement matters; (iv) the sale of a joint arrangement partner’s interest to a third party; and (v) limited legal rights to influence the direction of project development where Atna is not the operator of the project.

Potential Litigation

From time to time, during the ordinary course of business, the Company and its subsidiaries and affiliates may be threatened with, or may be named as a defendant in various actions, disputes, and legal proceedings, including claims of breach of contract, lost profits or other consequential damage claims. A significant judgment against the Company or any of its subsidiaries or affiliates or a failure to settle any dispute on terms satisfactory to the Company could have a material adverse effect on the Company’s ability to continue operations.

Risk Factors Specific to the Company

Gold Recovery at Briggs

CR Briggs Corporation, a wholly-owned subsidiary of the Company, operates Briggs. Briggs has been producing gold since the second quarter of 2009 and produced approximately 32,800 ounces of gold doré during 2013. Briggs uses a conventional gold heap-leach recovery process. This process involves the application of cyanide solutions by drip irrigation to crushed ore stacked on an impervious pad. As the solution percolates through the heap, gold is dissolved from the ore into solution. This solution is collected and processed with activated carbon that collects the gold from the solution. The gold laden carbon is further processed through pressure stripping the carbon into a more highly concentrated gold bearing solution. The gold bearing solution is further concentrated by an electrowinning circuit, which collects the gold onto electric cathodes which are then melted into gold doré bars. Factors impacting gold recovery include variation in ore grade, crushed ore size, rock type, solution concentration, lime addition, temperature, rainfall, irrigation time, pressure stripping, refining efficiencies, leach pad dynamics and other associated factors.

Production Costs and Risk Factors at Briggs

The cost of gold produced may be impacted by numerous variables including ore grade and gold recovery, stripping ratio, fuel and consumable costs, labor and benefit costs, equipment operating and maintenance costs, and numerous other factors. Production risk factors may include labor strife, slope failure, poor gold recovery, unavailability of skilled labor and management, availability of mining equipment, lack of machine parts, availability of consumables used in mining, mine plan implementation, weather, governmental regulations and other operating factors.

California Legislation and Regulations May Cause the Development of Projects Adjacent To Briggs to Become Uneconomic.

On April 10, 2003, the California State Mining and Geology Board enacted a Backfill Regulation (the “Backfill Regulation”) that requires that all future metal mines, with certain exceptions, be backfilled to the approximate original contour of the landscape subject to certain limitations. Any new open pit developments on our properties outside the existing Briggs plan of operations area may be required to comply with the Backfill Regulation.

Atna Has Significant Obligations At Its Mines, Which May Adversely Impact Liquidity.

Briggs operates under permits granted by various agencies including the U.S. Department of the Interior Bureau of Land Management (the “BLM”), Inyo County, California, the California Department of Conservation, and the Lahontan Regional Water Quality Control Board (“Lahontan”). The Company has posted reclamation bonds with these agencies in the amount of $4.4 million, supported by sureties with the exception of a $30,000 cash bond.

The Company has posted reclamation bonds for Pinson with the BLM and the State of Nevada in the amount of $0.8 million, which is supported by a surety. These agencies will require the posting of additional bonds of $0.9 million in 2014.

The Company has posted an additional $0.9 million of reclamation bonds with the State of Nevada for Reward, which is supported by a surety.

Please refer to the discussion below of the “Kendall, Montana” property and its reclamation requirements. In addition to $2.3 million of cash deposits held as reclamation bonds, the Company has posted an additional $0.2 million of reclamation bonds, supported by a surety, with the Montana Department of Environmental Quality (“MDEQ”).

All surety bonds are subject to annual review and adjustment. Surety bonds presently totaling another $0.2 million are outstanding for Clover, Columbia, and other properties.

Development Risks at Pinson and Reward

Mine development is subject to numerous risks. These risks are typically quantified through technical and economic estimates generated in Pre-Feasibility and Feasibility Studies. There is no guarantee that these estimates will be correct or realized once the mine is developed.

The Company commenced development of the Pinson-underground mine in January 2012. In June of 2013, Pinson-underground mine development activities were halted and the mine was placed on care and maintenance pending a combination of engineering activities, improvements in market conditions, and additional financing. Based on experience gained during development activities at Pinson-underground, additional engineering studies, mine design, costing studies, and economic analyses are deemed appropriate. This work-program will be ongoing during 2014.

A Pre-Feasibility Study for the Mag open-pit mine at Pinson is expected to be completed in 2014. This study will be utilized as the basis for the submission of a Mine-Plan-of-Operations to State regulatory authorities to commence the permitting process on this project.

In January 2011, the Company commenced Phase 1 infrastructure development work on Reward. The majority of this construction, which included construction of wildlife exclusion fencing, drilling and completing the production water well, and extending power lines from local grid power sources to the mine site, has been completed. Development of Reward including the construction of leach pad facilities, purchase or lease of a semi-portable crushing plant, the installation of offices, lab and shop facilities and pre-stripping of mine waste will commence when adequate financing becomes available, remaining engineering activities have been completed, and market conditions are supportive.

Montana Regulatory Authorities May Impose Additional Reclamation Requirements On Our Closure Of The Kendall Mining Property

Atna’s wholly-owned subsidiary, CR Kendall Corporation (“CRK”), is reclaiming and closing the Kendall mining property (“Kendall”) located near Lewistown, Montana. In April 2012, Kendall entered into an agreement with the Montana Department of Environmental Quality (“MDEQ”), whereby Atna agreed to provide financial support to complete a final EIS closure study. As part of this agreement, Kendall submitted on July 25, 2012 an application to the MDEQ providing a final closure and reclamation plan for the Kendall mine site. The MDEQ has performed a completeness review of this plan, and Kendall has prepared responses to this review. The EIS will be managed by the MDEQ in consultation with Kendall. Any costs in excess of the EIS project budget will be shared equally between CRK and the MDEQ. No work has commenced on this study.In 2001, CRK deposited with the MDEQ approximately $1.9 million in a fund to accomplish required reclamation work. This fund was never utilized and with accumulated interest now totals approximately $2.3 million. Once a final Record of Decision on the final closure plan has been issued by the MDEQ, as part of the Agreement, CRK will create a trust fund to provide for any future operation, maintenance and replacement of water treatment and closure facilities. Funds remaining in the current funds on deposit with the MDEQ will be utilized in funding this trust.

| ITEM 4. | INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

Atna Resources Ltd. was incorporated under theCompany Act of the Province of British Columbia, Canada, on May 30, 1984, by registration of its Memorandum and Articles under its present name. The Company was extra-territorially registered in the Yukon Territory on April 13, 1995. The Company’s business is to explore, acquire, develop, and mine precious metals, uranium and other mineral properties. The Company’s properties are primarily located in the United States and Canada. The Company is a reporting issuer in British Columbia, Alberta, Ontario and Nova Scotia and a Foreign Private Issuer in the U.S., based on the residency of stockholders as of June 30, 2013. The Company’s common stock is listed on the Toronto Stock Exchange (the “TSX”) under the symbol “ATN” in Canada and on the over-the-counter Bulletin Board (the “OTCQB”) under the symbol “ATNAF” in the U.S.

Atna merged with Canyon Resources Corporation (“Canyon”) on March 18, 2008 (the “Canyon Merger”), at which time Canyon became a wholly-owned subsidiary of the Company. Canyon was incorporated under the General Corporation Laws of the State of Delaware in 1979.

Atna’s headquarters are located at 14142 Denver West Parkway, Suite 250, Golden, Colorado, USA, 80401. The toll free telephone number for the Atna headquarters is 877-692-8182. Bull, Housser & Tupper LLP is the Company’s Canadian legal counsel and registered agent and is located at Suite 900, 900 Howe Street, Vancouver, BC, Canada V6Z 2M4.

The Company’s expenditures have included those primarily for general corporate purposes, capital and development, servicing debt, and the acquisition of a 70 percent interest in Pinson in 2011. General corporate purposes primarily include: profit or loss on sales from mining operations, exploration expense, property maintenance expense, expenditures to build inventories and working capital, spending on asset retirement obligations, and net interest expense. Virtually all of the Company’s investments in the last three years have been in the western U.S.

A summary of the Company’s significant cash flows and expenditures is set forth below, as well as a summary of amounts expended on exploration and property maintenance.

| Net Uses of Cash | | 2013 | | | 2012 | | | 2011 | | | Total | |

| Purchases and development of property and equipment | | $ | 26,410,800 | | | $ | 21,705,700 | | | $ | 9,929,500 | | | | 58,046,000 | |

| Increases in restricted cash / surety deposits | | | N/A | | | | N/A | | | | 686,700 | | | | 686,700 | |

| Pinson purchase price | | | N/A | | | | N/A | | | | 15,000,000 | | | | 15,000,000 | |

| Capitalized loan interest - Pinson | | | 1,185,600 | | | | 2,161,400 | | | | 700,100 | | | | 4,047,100 | |

| Additions of stripping activity assets | | | 3,187,500 | | | | 540,500 | | | | 4,033,900 | | | | 7,761,900 | |

| Repayments of Debt | | | 9,559,500 | | | | 5,573,900 | | | | 5,989,400 | | | | 21,122,800 | |

| Effect of exchange rate changes | | | 167,700 | | | | 6,500 | | | | 23,000 | | | | 197,200 | |

| Total net uses of cash | | $ | 40,511,100 | | | $ | 29,988,000 | | | $ | 36,362,600 | | | | 106,861,700 | |

| | | | | | | | | | | | | | | | | |

| Exploration expense | | $ | 703,900 | | | $ | 1,733,300 | | | $ | 634,900 | | | | 3,072,100 | |

| Property maintenance expense | | $ | 1,132,200 | | | $ | - | | | $ | - | | | | 1,132,200 | |

The Company’s expenditures have been financed primarily by operations, debt financings equity financings, and proceeds from the sale of investments and assets as follows.

| Net Sources of Cash | | 2013 | | | 2012 | | | 2011 | | | Total | |

| Net contribution by Operations | | $ | 8,307,100 | | | $ | 13,590,500 | | | $ | 15,498,700 | | | $ | 37,396,300 | |

| Preproduction gold sales | | | 6,532,400 | | | | 1,353,100 | | | | - | | | $ | 7,885,500 | |

| Proceeds from sale of investments | | | 42,100 | | | | 833,600 | | | | 465,600 | | | $ | 1,341,300 | |

| Proceeds from asset sales | | | 736,600 | | | | 135,800 | | | | 471,500 | | | $ | 1,343,900 | |

| Proceeds from insurance settlement | | | 368,800 | | | | 435,800 | | | | - | | | $ | 804,600 | |

| Decrease in restricted-cash / surety-deposits | | | 645,000 | | | | 391,000 | | | | N/A | | | $ | 1,036,000 | |

| Exercise of stock options | | | 31,400 | | | | 337,400 | | | | 74,900 | | | $ | 443,700 | |

| Exercise of warrants | | | - | | | | 5,960,100 | | | | 122,900 | | | $ | 6,083,000 | |

| Net Proceeds from equity financings | | | 5,294,700 | | | | 16,330,500 | | | | - | | | $ | 21,625,200 | |

| Net Proceeds from debt financings | | | - | | | | - | | | | 20,098,900 | | | $ | 20,098,900 | |

| Total net sources | | $ | 21,958,100 | | | $ | 39,367,800 | | | $ | 36,732,500 | | | $ | 98,058,400 | |

Atna expects that cash requirements over the next 12 months can be met through a combination of a debt refinancing that occurred in January 2014; cash flow from the Briggs operations; equipment financing; asset sales; and existing cash. If required, supplemental financing may be generated from the issuance of debt, convertible bonds, or equity; new lines of credit; asset sales; or combinations thereof. As of December 31, 2013, the Company had a net working capital (current assets less current liabilities) deficit of $7.0 million; however $22.0 million of working capital was subsequently drawn in January of 2014 through a long-term note obligation to refinance current obligations. Current assets as of December 31, 2013 included recoverable, gold inventories of approximately 18,100 ounces at Briggs.

As a result of the debt refinancing in January of 2014, whereby payment of $22.0 million of obligations was deferred until January of 2016, the principal use of funds anticipated within the next 12 months is the accumulation of cash to fund repayment of this debt in two years and to fund the future development of several existing properties. The 2009 Gold Bond obligation was repaid in full in 2013. The debt with Sprott Resource Lending Partnership (“Sprott”) was pre-paid in January 2014 via the referenced refinancing. Development of several existing properties is on hold pending additional engineering, improvements in the gold market, and the availability of additional financing.

The Company is involved in all phases of the mining business including exploration, preparation of Pre-Feasibility and Feasibility studies, permitting, construction and development, operation, and final closure of mining properties. Atna’s ongoing exploration and development efforts are focused primarily on precious metals in the western United States. The Company conducts a portion of its mineral exploration and development activities through joint arrangements with other companies.

Atna’s business model is principally one of adding value through the development and operation of precious-metal mines in the United States. The Company seeks to produce positive cash flow principally from the mining and production of gold and to maximize the return on cash invested. The Company believes that unlocking the value of its portfolio of gold properties, either through direct development and production or through the sale of assets, to which value has been added, provides the greatest opportunity to add value for its shareholders.

The Company’s primary focus for 2014 is to increase productivity and reduce costs at the Briggs Mine with the goal of reaching targeted production rates of 40,000 to 45,000 gold ounces in 2014. Key development activities planned for 2014 include completion of a Pre-Feasibility Study for the Mag open pit mine at Pinson, modifying the underground mine plan at Pinson based on experience gained in 2013, and completing detailed engineering for Reward to make that project ready for construction. The Company believes these activities will provide a long term pipeline of development opportunities. Additionally, the Company will engage in reserve-expansion-studies at Briggs to endeavor to extend mine life, inclusive of pit-expansion through cost reductions and through exploration of the potential of underground mining.

Production at Briggs during 2013 included the mining of 2.1 million tons of gold ore containing 41,000 ounces of gold at a strip ratio of 4.4 tons of waste per ton of ore to produce 32,800 ounces of gold in doré. Approximately 31,700 ounces of gold were sold by Briggs at an average gold price of $1,412 per ounce. Estimated mined recoverable gold inventory at year-end was 18,100 contained ounces in all stages of processing.

The Company’s financial results are not significantly impacted by seasonality. Quarterly expenses and income vary depending on the tons of ore mined and processed; ore grades; stripping ratios; labor, diesel, chemical, tire, and maintenance costs; realized and unrealized gains and losses on derivatives; gains or losses on the sale of investments and disposals of properties; and other factors. Significant operating costs include: labor and benefits, fuel, maintenance and supplies, chemicals, explosives, and outside services. Competition for experienced mining staff continues to be an issue and has been a factor in increasing the costs of doing business. Fuel cost is a significant cost factor at Briggs. In 2013 and 2012, diesel fuel represented approximately 22 percent and 21 percent of “Cost of sales, excluding depreciation”, respectively. The prices of consumable materials used in the production and processing of gold ores stabilized in 2013 after rapid price increases over the prior three years.

Atna’s 2008 sale of its royalty portfolio provided approximately $20 million of net proceeds, which was sufficient to re-start and operate the Briggs mine without additional financing until October 2009 when Atna closed C$1.5 million in convertible debentures. In December 2009, the Company closed the Gold Bond Financing of $14.5 million using the funds for general corporate purposes and the continued development of Briggs. These 2009 Gold Bonds were repaid in full, as scheduled, in December 2013. In December 2010, the Company closed a $9.2 million bought-deal equity offering. Briggs began operations in 2009 and has provided net positive operating cash flows since the fourth quarter of 2010.

In September 2011, the Company closed a C$20 million debt facility to fund the acquisition of the remaining 70 percent interest in the Pinson mine as further described under “D. Property, Plant and Equipment – Production Property – Pinson Mine Property, Nevada” and to provide initial development capital for that project. The term of this debt facility (“Sprott Loan”) was extended in February 2012, C$2.5 million was repaid in February 2013, and in March 2013 and October 2013, the term of the remaining C$17.5 million was amended to be payable at later dates in 2014. In January of 2014, the Sprott Loan was refinanced and rolled into a $22 million 2-year term-loan with Waterton Precious Metals Fund II Cayman, L.P. (“Waterton Loan”) (Also see descriptions of the Waterton Loan in “Item 5, B. Liquidity and Capital Resources, Debt” and “Item 10, C. Material Contracts”.). The exercise of options and warrants during 2012 resulted in net proceeds to the Company of $6.3 million. In September 2012, the Company closed a $17.25 million stock offering, netting $16.3 million in proceeds, principally used for development of Pinson-underground. In September 2013, the Company closed a C$5.8 million bought-deal private placement of equity netting $5.3 million in proceeds, principally used for strengthening working capital, paying for Pinson-underground development, and general corporate purposes.

When conditions permit, the Company’s business model also calls for the acquisition of mineral prospects under what are judged to be favorable terms. Our principal acquisition objective is to acquire mining prospects in a later stage of exploration that provide a reasonable return on capital upon completion of exploration activities and development. These opportunities may include properties that were closed due to lack of capital. The Company continually reviews acquisition opportunities that could provide potential long term value through further investment. The Company targets acquisitions that have the potential to provide positive cash flow over a significant operating reserve life and annually produce over 100,000 ounces of gold. The target property would need to be located in a setting where positive community relations may exist, where development of that property would not create long term environmental issues, and where there is a reasonable chance of obtaining the required permits.

Regulatory agencies, both state, county, and federal, having authority over the Company’s exploration, development and mining are numerous and include, but are not limited to, Mine Safety and Health Administration (“MSHA”), U.S. Department of Occupational Safety and Health (“OSHA”) Department of the Interior, Bureau of Land Management (“BLM”), U.S. Forest Service (“USFS”) U.S. Department of Alcohol Tobacco and Firearms (“BATF”), U.S. Department of Homeland Security, U.S. Environmental Protection Agency (“EPA”), U.S. Corp of Engineers on the Federal level. On the State level the Company is subject to regulation by the California Department of Occupational Safety and Health (“CAL-OSHA”), California Air Resources Board (“CARB”), Great Basin Unified Air Pollution Control District, California Regional Water Quality Control Board, California Department of Fish and Game, California Environmental Protection Agency (“CEPA”), Nevada Division of Environmental Protection (“NDEP”) and the Montana Department of Environmental Protection ("MDEP").

Numerous factors affect the marketing of metals, many of which are beyond our control. Products are dictated by the ore reserves located, developed, and mined. Metals are widely traded on international markets, so the sale of products does not require significant marketing except to the extent milling and refining capacities become a limitation. Metal prices are determined by volatile international market factors beyond the Company’s control. Such factors include marketplace speculation as to gold’s value as a safe haven, basic supply/demand fundamentals, inflation, conditions in alternative investment markets, the strength or weakness of the U.S. Dollar, governmental economic policies, central banks’ sales and purchases, political unrest, and other factors noted under Item 3. “D. Risk Factors”. Fluctuating metal prices may have a significant impact on our results of operations and operating cash flow. Decreasing mineral prices will adversely affect the market values of our properties and may lead to the recording of asset impairments.

The decision to put a mine into production and the commitment of the funds necessary for that purpose must be made long before the first revenues from production will be received. Over the last five years, between 2009 and 2013, the average annual London PM Fix price per ounce of gold steadily increased from $810 in January 2009 to $1,895 in September 2011, varied between $1,531 in December 2011 and $1,792 in October 2012, and steadily declined from that $1,792 price in October 2012 to bounce off bottoms of $1,192 in June 2013 and $1,195 in December 2013. The economics of a gold mine change over time due to gold price fluctuations during the project’s life. Although it is possible in certain circumstances to protect against price fluctuations by hedging, at a cost, the volatility of mineral prices represents a substantial risk to the realization of adequate returns.

Exploration, development, and production programs conducted in the U.S. are subject to local, state, and federal regulations regarding environmental protection. A significant amount of the mining and exploration activities are conducted on public lands. The BLM regulations cover mining operations carried out on most public lands. Exploration for or the production of minerals are subject to existing laws and regulations relating to exploration procedures, safety precautions, employee health and safety, air quality standards, pollution of water sources, waste materials, odor, noise, dust and other environmental protection requirements adopted by federal, state and local governmental authorities. As a result, environmental assessment or environmental impact studies are generally required before any proposed exploration work or production activities can be commenced. The requirements imposed by such authorities may be costly, time consuming, and may delay or restrict the conduct of exploration, development, and mining operations. Future legislation and regulations designed to protect the environment, as well as future interpretations of existing laws and regulations, may require substantial increases in equipment and operating costs and delays, interruptions, or a termination of operations. We cannot accurately predict or estimate the impact of any such future laws or regulations, or future interpretations of existing laws and regulations, on our operations.

The U.S. has an extensive framework of environmental legislation that undergoes constant revision. We participate in the legislative process through independent contact with legislators and through trade organizations to assist legislative bodies in making informed decisions.

Historic mining activities have occurred on certain of the Company’s properties. In the event that such historic activities have resulted in releases or threatened releases of regulated substances into the environment, there exists the potential for liability under federal or state remediation statutes. Except as discussed in the Company’s periodic public reports, the Company is not aware of any pending claims under these statutes at this time, and cannot predict whether any such claims will be asserted in the future.

Environmental regulations add to the cost and time needed to bring new mines into production and add to operating and closure costs for mines already in operation. As mines are placed into production, the costs associated with regulatory compliance can be expected to increase. Such costs are a normal cost of doing business in the mining industry, and may require significant capital and operating expenditures in the future. The Company believes that it is currently in material compliance with all applicable environmental regulations and there are no material enforcement procedures currently ongoing.

| C. | Organizational Structure |

The Company owns all of the issued and outstanding shares of the common stock of Canyon. The organizational chart below reflects the Company’s legal ownership of its significant subsidiaries and ownership interests in various gold properties as of the date of this Annual Report on Form 20-F. Properties are routinely acquired, sold, subjected to a joint-venture, or abandoned in the ordinary course of business.

| D. | Property, Plant and Equipment |

Summary of Mineral Reserves and Resources

The mineral reserve and resource figures below are estimates, subject to forward-looking-statement limitations. The reader is urged to review the sections of this Annual Report entitled “Cautionary Information About Forward Looking Statements” and “Risk Factors”. All reserve and resource figures are considered current as indicated in the footnotes to the tables. The scientific and technical information about the Company’s mineral properties contained in this Report has been prepared under the supervision of, reviewed by and approved by William Stanley, a Registered Member of the Society for Mining, Metallurgy and Exploration, a Licensed Geologist, the Company's Vice President Exploration, a “qualified person” as that term is defined in NI 43-101.

The mineral resources reported below, other than those declared as proven and probable mineral reserves, have no demonstrated economic viability at this time. The quantity and grade of reported Inferred Mineral Resources in these estimations are based on limited information and should be considered conceptual in nature. It is uncertain if further exploration will result in discovery of a Measured or Indicated Mineral Resource within those areas classified as Inferred Resources.

Underground reserves at Pinson were disclosed in May 2012 after completion of an NI 43-101 Technical Report and Pre-Feasibility Study on the Pinson property titled “NI43-101 Technical Report Pinson Project Humbolt, County Nevada” dated May 30, 2012 with an effective date May 18, 2012 (filed on SEDAR in May2012) (the “Pinson Technical Report”), endorsed by William J. Crowl, R.G., MMSA SME-RM and Donald E. Hulse, P.E. of Gustavson Associates, LLC. The Company is currently reviewing the mine planning, costing, and engineering of the underground mine and believes additional engineering studies, mine design, costing, and economic analysis are appropriate.

Gold Mineral Reserves - Proven and Probable(1, 2, 3)

| Category | | Tons (x1,000) | | | Au (oz/ton) | | | Contained Ounces | |

| Briggs (1)- 100% Atna | | | | | | | | | | | | |

| Proven | | | 3,380 | | | | 0.020 | | | | 69,013 | |

| Probable | | | 3,582 | | | | 0.021 | | | | 75,264 | |

| | | | | | | | | | | | | |

| Briggs reserves | | | 6,962 | | | | 0.021 | | | | 144,277 | |

| | | | | | | | | | | | | |

| Reward(2) - 100% Atna | | | | | | | | | | | | |

| Proven | | | 3,293 | | | | 0.025 | | | | 83,049 | |

| Probable | | | 7,438 | | | | 0.022 | | | | 166,466 | |

| | | | | | | | | | | | | |

| Reward reserves | | | 10,731 | | | | 0.023 | | | | 249,516 | |

| | | | | | | | | | | | | |

| Pinson Underground(3) - 100% Atna | | | | | | | | | | | | |

| Proven | | | 989 | | | | 0.362 | | | | 358,176 | |

| Probable | | | 736 | | | | 0.373 | | | | 274,453 | |

| | | | | | | | | | | | | |

| Pinson Underground reserves | | | 1,724 | | | | 0.367 | | | | 632,629 | |

| | | | | | | | | | | | | |

| Total reserves | | | 19,417 | | | | 0.053 | | | | 1,026,422 | |

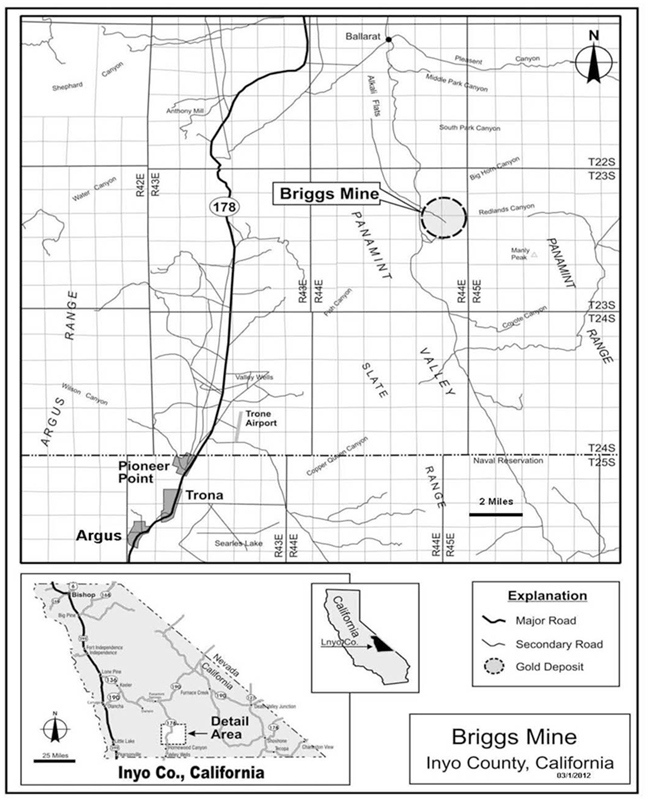

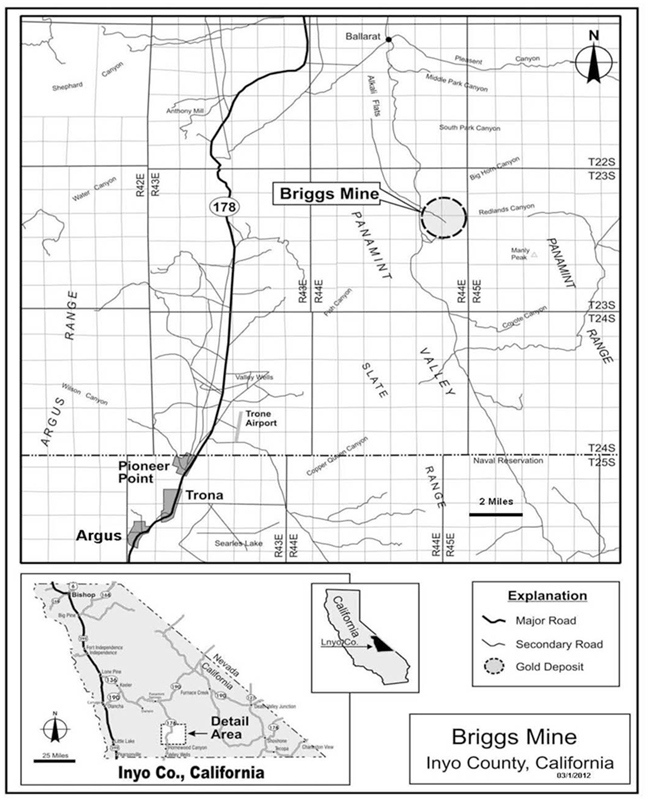

| (1) | Briggs mineral reserve summary is based on a 0.0069 oz/ton gold incremental leach cut-off grade calculated using $1,300 per ounce gold supported by the report titled “2012 NI 43-101 Technical Report on the Briggs Mine, Inyo County, California” dated May 29, 2012 with an effective date of March 26, 2012 (the “Briggs Report”) prepared by Alan C. Noble, P.E. of Ore Reserves Engineering, Michael J. Read, SME-RM of Chlumsky, Armbrust & Meyer LLC, William R. Stanley, SME-RM, V.P. Exploration of the Company, and Douglas E. Stewart, P.E., former V.P. and COO of the Company. Messrs. Noble and Read are independent qualified persons in accordance with NI 43-101 and Messrs. Stanley and Stewart are non-independent qualified persons in accordance with NI 43-101. The Briggs Report was filed on SEDAR on May 22, 2012. The mineral reserve has been updated and reconciled by Mr. Read for mine production in 2013 and is current as of December 31, 2013. |

| (2) | Reward mineral reserve is current as of December 31, 2013, using a >$0.01 net incremental value and $1,300 per ounce gold price, and is supported by the Reward Report (as defined below) filed on SEDAR on July 9, 2012. The reserves have been updated using the 12/31/2013 block model by Michael J. Read, SME-RM of Chlumsky, Armbrust & Meyer LLC. |

| (3) | The Pinson Underground Reserve is supported by the Pinson Technical Report filed on SEDAR on May 30, 2012 and has been reconciled for underground development and test mining completed through 12/31/2013. |

Gold Mineral Resources - Measured, Indicated and Inferred(1, 2, 3, 4, 5, and 6)

| Category | | Tons (x1,000) | | | Au (oz/ton) | | | Contained Ounces | |

| Measured | | | | | | | | | | | | |

| Briggs - 100%(1) | | | 10,208 | | | | 0.021 | | | | 217,100 | |

| Reward - 100%(2) | | | 4,819 | | | | 0.022 | | | | 105,500 | |

| Pinson - Underground 100% (3,4) | | | 1,596 | | | | 0.352 | | | | 562,700 | |

| Pinson - Open pit 100%(3,4) | | | 21,159 | | | | 0.035 | | | | 732,000 | |

| Columbia - 100%(5) | | | 5,370 | | | | 0.047 | | | | 254,400 | |

| Cecil-R - 100%(6) | | | 858 | | | | 0.024 | | | | 20,800 | |

| | | | | | | | | | | | | |

| Total measured | | | 44,010 | | | | 0.043 | | | | 1,892,500 | |

| | | | | | | | | | | | | |

| Indicated | | | | | | | | | | | | |

| Briggs - 100%(1) | | | 17,546 | | | | 0.019 | | | | 336,600 | |

| Reward - 100%(2) | | | 15,474 | | | | 0.018 | | | | 282,400 | |

| Pinson - Underground 100%(3,4) | | | 1,301 | | | | 0.383 | | | | 498,000 | |

| Pinson Open pit 100%(3,4) | | | 4,307 | | | | 0.058 | | | | 249,600 | |

| Columbia - 100%(5) | | | 11,294 | | | | 0.043 | | | | 487,300 | |

| Cecil-R - 100%(6) | | | 2,382 | | | | 0.022 | | | | 52,700 | |

| | | | | | | | | | | | | |

| Total indicated | | | 52,304 | | | | 0.036 | | | | 1,906,600 | |

| | | | | | | | | | | | | |

| Measured & indicated | | | | | | | | | | | | |

| Briggs - 100%(1) | | | 27,754 | | | | 0.020 | | | | 553,700 | |

| Reward - 100%(2) | | | 20,294 | | | | 0.019 | | | | 387,900 | |

| Pinson - Underground 100% (3,4) | | | 2,897 | | | | 0.366 | | | | 1,060,700 | |