NOTICE OF ANNUAL GENERAL MEETING

OF SHAREHOLDERS AND

MANAGEMENT INFORMATION CIRCULAR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON June 4, 2014

All monetary amounts are expressed in United States dollars, the Company’s reporting currency, unless

otherwise noted as being in Canadian dollars (“CAD” or “C$”).

May 1st, 2014

ATNA RESOURCES LTD.

NOTICE OF ANNUAL GENERAL MEETING

to be held on June 4, 2014

TO THE SHAREHOLDERS:

The Annual General Meeting of shareholders of Atna Resources Ltd. (the “Company”) will be held at the offices of Bull, Housser & Tupper LLP, Suite 900 - 900 Howe Street, Vancouver, BC Canada V6Z 2M4, on Wednesday, June 4, 2014 at 10:00 a.m. (Pacific Time) (the “Meeting”) for the following purposes:

| · | To receive the financial statements for the fiscal year ended December 31, 2013, together with the Auditor’s Report thereon. |

| · | To appoint an Auditor for the ensuing year. |

| · | To elect directors for the ensuing year. |

| · | To transact such further or other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

The Board of Directors has fixed the close of business on April 28, 2014 as the record date for determining shareholders who are entitled to receive notice of, and to vote at, the Meeting. Accompanying this Notice of Meeting are the Management Information Circular (the “Information Circular”) and either a form of proxy or a voting instruction form (“VIF”).

The accompanying Information Circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this Notice. Copies of any documents to be considered, approved, ratified and adopted or authorized at the Meeting will be available for inspection at the Company’s legal counsel’s offices at 900 - 900 Howe Street, Vancouver, BC Canada V6Z 2M4, during normal business hours until June 4, 2014, being the date of the Meeting, as well as at the Meeting.

If you are a registered shareholder and are unable to attend the Meeting in person, please read the notes included in the form of proxy enclosed and then complete, date, sign and mail the enclosed form of proxy, or complete the proxy by telephone or the internet, in accordance with the instructions set out in the proxy and in the Information Circular accompanying this Notice. You may also deposit a completed form of proxy at the Company’s head office, 14142 Denver West Parkway, Suite 250, Golden, CO, USA, 80401, not later than 10:00 a.m. (Pacific time) on Monday, June 2, 2014, or if the Meeting is adjourned, not later than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the adjourned meeting.

| If you are a non-registered shareholder of the Company and receive this Notice of Meeting through your broker or through another intermediary, please complete and return the voting instruction form in accordance with the instructions provided to you by your broker or by the other intermediary. Failure to do so may result in your shares not being eligible to be voted at the Meeting. |

Dated at Golden, Colorado, this 1st day of May, 2014.

By order of the Board

(signed)“Valerie Kimball”

Valerie Kimball

Corporate Secretary

INFORMATION CIRCULAR

As at May 1st, 2014, unless otherwise noted

Solicitation of Proxies

This Information Circular and the accompanying documents (the “Meeting Materials”) are furnished in connection with the solicitation of proxies by the management of Atna Resources Ltd. (the “Company”) for use at the Annual General Meeting (the “Meeting”) of the shareholders of the Company to be held on Wednesday, June 4, 2014 and any adjournment thereof at the time and place and for the purposes set forth in the accompanying Notice of Meeting. While it is expected that the solicitation will be primarily carried out by mail, proxies may also be solicited personally or by telephone by the directors, regular employees or contractors of the Company. All costs of solicitation will be borne by the Company.

These Meeting Materials are being sent to both registered and non-registered owners of the securities. If you are a non-registered owner, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary (as defined below) holding on your behalf. By choosing to send these materials to you directly, the Company (and not the intermediary holding on your behalf) has assumed responsibility for: (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions. (For further information relating to non-registered owners, see the discussion below under “INFORMATION FOR NON-REGISTERED (BENEFICIAL) OWNERS OF SHARES”.)

Voting by Proxies

The enclosed form of proxy accompanying this Information Circular when properly completed and delivered and not revoked confers discretionary authority upon the proxy nominee to vote with respect to any amendments or variations to matters identified in the Notice of Meeting and any other matters that may properly come before the Meeting.In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the enclosed form of proxy to vote in accordance with their best judgment on such matters or business. As at the date of this Information Circular, management is not aware of any such amendments or variations, or of other matters to be presented for action at the Meeting.

If the instructions in a proxy given to management are certain, the common shares represented by proxy will be voted or withheld from voting in accordance with the instructions of the shareholder on any poll as specified in the proxy with respect to the matter to be acted on.If a choice is not so specified with respect to any such matter, the common shares represented by a proxy given to management are intended to be voted in favour of the resolutions referred to in the form of proxy accompanying this Information Circular and for the election of the nominees of management for director and for the appointment of the Auditors. The individuals named in the accompanying form of proxy are directors and/or officers of the Company. A SHAREHOLDER HAS THE RIGHT TO APPOINT A PERSON (WHO NEED NOT BE A REGISTERED SHAREHOLDER) TO ATTEND AND ACT FOR HIM AND ON HIS BEHALF AT THE MEETING OTHER THAN THE PERSONS DESIGNATED IN THE FORM OF PROXY AND MAY EXERCISE SUCH RIGHT BY INSERTING THE NAME IN FULL OF THE DESIRED PERSON IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY AND STRIKING OUT THE NAMES NOW DESIGNATED.

To be valid, a proxy must be in writing and executed by the shareholder or its attorney authorized in writing, unless the shareholder chooses to complete the proxy by telephone or the internet as described in the enclosed proxy form. Completed proxies must be received by Computershare Trust Company of Canada, Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, or at the Company’s head office, 14142 Denver West Parkway, Suite 250, Golden, CO, USA, 80401, not later than 10:00 a.m (Pacific Daylight Time) on Monday, June 2, 2014, or if the Meeting is adjourned, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof. The Chairman of the Meeting has the discretion to accept proxies that are deposited after that time.

Revocability of proxies

A shareholder who has given a proxy may revoke it by an instrument in writing executed by the shareholder or by his or her attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered either to the Company’s legal counsel’s offices at Bull, Housser & Tupper LLP, Suite 900 - 900 Howe Street, Vancouver, BC Canada V6Z 2M4, at any time up to and including the last business day preceding the day of the Meeting, or if adjourned, any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or, if adjourned, any reconvening thereof or in any other manner provided by law. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

INFORMATION FOR NON-REGISTERED (BENEFICIAL) OWNERS OF SHARES

The shares owned by many shareholders of the Company are not registered on the records of the Company in the beneficial shareholders’ own names. Rather, such shares are registered in the name of a securities dealer, bank or other intermediary, or in the name of a clearing agency (referred to in this Information Circular as an “intermediary” or “intermediaries”). Shareholders who do not hold their shares in their own names (referred to in this Information Circular as “non-registered owners”) should note thatonly registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. A non-registered owner cannot be recognized at the Meeting for the purpose of voting his shares unless such holder is appointed by the applicable intermediary as a proxyholder.

Non-registered owners who have not objected to their intermediary disclosing certain ownership information about themselves to the Company are referred to as “NOBOs”. Those non-registered owners who have objected to their intermediary disclosing ownership information about themselves to the Company are referred to as “OBOs”.

In accordance with applicable securities regulatory policy, the Company has elected to seek voting instructions directly from NOBOs. The intermediaries (or their service companies) are responsible for forwarding this Information Circular and other Meeting Materials to each OBO, unless the OBO has waived the right to receive them.

Meeting Materials sent to non-registered owners who have not waived the right to receive Meeting Materials are accompanied by a request for voting instructions form (“VIF”). This form is provided instead of a proxy. By returning the VIF in accordance with the instructions noted on it, a non-registered owner is able to instruct the registered shareholder how to vote on behalf of the non-registered owner. VIFs, whether provided by the Company or by an intermediary, should be completed and returned in accordance with the specific instructions noted on the VIF.

In either case, the purpose of this procedure is to permit non-registered owners to direct the voting of the shares which they beneficially own. If a non-registered owner who receives a VIF wishes to attend the Meeting or have someone else attend on his behalf, then the non-registered owner may request a legal proxy as set forth in the VIF, which will grant the non-registered owner or his nominee the right to attend and vote at the Meeting.

In addition to those procedures, amendments to National Instrument 54-101 –Communication with Beneficial Owners of Securities of a Reporting Issuer(“NI 54-101”) allow a NOBO to submit to the Company or an applicable intermediary any document in writing that requests that such NOBO or its nominee be appointed as the NOBO’s proxyholder. If such a request is received, the Company or the intermediary, as applicable, must arrange, without expense to the NOBO, to appoint such NOBO or its nominee as a proxyholder and to deposit that proxy within the time specified in this Information Circular, provided that the Company or the intermediary receives such written instructions at least one business day prior to the time at which proxies are to be submitted for use at the Meeting; accordingly, any such request must be received by 10:00 a.m. (Pacific Daylight Time) on May 30, 2014.

The Company does not intend to pay for intermediaries to forward to OBOs under NI 54-101 the proxy-related materials and Form 54-101F7 –Request for Voting Instructions Made by Intermediary, and an OBO will not receive those materials unless the OBO’s intermediary assumes the cost of delivery.

IF YOU ARE A NON-REGISTERED OWNER AND WISH TO VOTE IN PERSON AT THE MEETING, PLEASE REFER TO THE INSTRUCTIONS SET OUT ON THE “REQUEST FOR VOTING INSTRUCTIONS” (VIF) THAT ACCOMPANIES THIS INFORMATION CIRCULAR. |

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Other than as set forth herein, management of the Company is not aware of any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, of any person who has been a director or executive officer of the Company since the commencement of the Company’s last completed financial year, or of any proposed nominee for election as a director of the Company, or of any associate or affiliate of any of such persons, in any manner to be acted upon at the Meeting other than the election of directors or the appointment of auditors.

Voting Shares and Principal Holders Thereof

As at May 1, 2014 there were 190,783,745 outstanding fully paid and non-assessable common shares without par value in the capital of the Company that are entitled to be voted at the Meeting. Holders of the outstanding common shares whose names are entered on the register of shareholders of the Company at the close of business on April 28, 2014, which is the record date, will be entitled to attend in person or appoint a proxy nominee to attend the Meeting and such person will be entitled to vote on a show of hands and, on a poll, will be entitled to one vote for each common share held on that date.

To the knowledge of the directors and executive officers of the Company, and based upon the Company’s review of the records maintained by Computershare Trust Company of Canada, electronic filings with the System for Electronic Document Analysis and Retrieval (“SEDAR”), electronic filings in the U.S. on EDGAR and insider reports filed with System for Electronic Disclosure by Insiders (“SEDI”), as at May 1, 2014, Sprott Asset Management LP was the only known shareholder who beneficially owned, or controlled or directed, directly or indirectly, shares carrying 10% or more of the voting rights attached to all outstanding common shares of the Company. Sprott Asset Management LP reported owning 39,077,588 common shares as at September 30, 2013, which represents 20.48% of the current issued capital of the Company.

Financial Statements

The audited financial statements for the fiscal year ended December 31, 2013 and the report of the Auditor’s thereon will be placed before the Meeting.

MATTERS TO BE VOTED ON AT THE MEETING

Appointment of Auditors

Management of the Company will propose the appointment of EKS&H LLLP of Denver, Colorado as Auditors of the Company to hold office until the next annual general meeting of the Company. EKS&H LLLP were first appointed as the Auditors of the Company on March 31, 2008.

The Audit Committee recommends the appointment of EKS&H LLLP as the Company’s Auditors to hold office until the Company’s next annual general meeting.

Election of Directors

Nominees

The Board of Directors presently consists of seven directors and it is intended to elect seven directors for the ensuing year.

The term of office of each of the present directors expires at the Meeting. Directors of the Company are elected at the annual general meeting to hold office until the next general meeting or until his successor is elected or appointed, unless his office is earlier vacated in accordance with the Articles of the Company, or with the provisions of theBusiness Corporations Act (British Columbia) (the “Act”). In the absence of instructions to the contrary, the enclosed proxy will be voted for the nominees listed below.

MANAGEMENT DOES NOT CONTEMPLATE THAT ANY OF THE NOMINEES WILL BE UNABLE TO SERVE AS A DIRECTOR. IF, PRIOR TO THE MEETING, ANY VACANCIES OCCUR IN THE NOMINEES LISTED BELOW, IT IS INTENDED THAT DISCRETIONARY AUTHORITY WILL BE EXERCISED BY THE PERSON NAMED IN THE PROXY AS NOMINEE TO VOTE THE SHARES REPRESENTED BY PROXY FOR THE ELECTION OF ANY OTHER PERSON OR PERSONS AS DIRECTOR.

The following sets out the names of the nominees for election as directors, the province or state and country in which each is ordinarily resident, all offices of the Company now held by each, their principal occupations, the period of time for which each has been a director of the Company, and the number of voting common shares of the Company or any of its subsidiaries beneficially owned by each, or controlled or directed, directly or indirectly, as at the date hereof.

Management is proud to nominate the following seven directors for election to the Company’s Board. Combined, the nominees have over 246 years of high level mining industry, finance and corporate governance experience. The nominees currently serve on a total of nine different mining company boards, most of which are Canadian companies. All of the directors have been or currently are Chief Executive Officers or Presidents of publicly listed companies. These Board nominees are strongly independent, with only one nominee being from executive management. Six of the nominees are fully independent. The Board unanimously recommends that shareholders vote in favor of these Candidates.

Name, Position,

Province/State and Country of

Residence(1,2) | | Principal Occupation or

Employment(1) | | Director Since | | Voting

Securities

Beneficially

Owned(1,3) |

David H. Watkins(6)

Director and Chairman

British Columbia, Canada | | Chairman of the Company since January 2009 | | March 2000 | | 1,716,953 |

James K. B. Hesketh(7)

Director, President and Chief Executive Officer

Colorado, United States | | President & Chief Executive Officer of the Company since January 2009 | | September 2001 | | 694,045 |

David K. Fagin (4,6)

Director, Colorado, United States | | Investor | | March 2008 | | 468,028 |

Name, Position,

Province/State and Country of

Residence(1,2) | | Principal Occupation or

Employment(1) | | Director Since | | Voting

Securities

Beneficially

Owned(1,3) |

Ronald D. Parker (5,7)

Director, Missouri, United States | | Retired | | March 2008 | | 264,722 |

Glen D. Dickson, (4,5)

Director, British Columbia, Canada | | Retired | | December 2002 | | 143,494 |

Christopher E. Herald (5,7)

Director, Colorado, United States | | President & Chief Executive Officer of Solitario Exploration and Royalty Corp. | | August 2009 | | 289,660 |

Paul H. Zink (4,6)

Director, Colorado, United States | | Senior Vice President and Chief Financial Officer, Rare Element Resources Ltd. | | April 2011 | | 292,535 |

| (1) | The information as to province/state and country of residence, principal occupation and shares beneficially owned is not within the knowledge of the management of the Company and has been furnished by the respective nominees. |

| (2) | None of the proposed nominees for election as a director is to be elected under any arrangement or understanding between the proposed director and any other person or company, except the directors and executive officers of the company acting solely in such capacity. |

| (3) | In aggregate, the directors of the Company beneficially own, or control or direct, directly or indirectly, a total of 3,869,437 common shares of the Company representing approximately 2% of the total number of issued and outstanding common shares of the Company as at May 1, 2014. |

| (4) | Member of the Audit Committee. |

| (5) | Member of the Compensation Committee. |

| (6) | Member of the Nomination and Corporate Governance Committee. |

| (7) | Member of the Health, Safety and Environment Committee |

None of the proposed nominees for election as a director of the Company:

| (a) | is, as at the date of this Information Circular, or has been, within ten years before the date of this Information Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that: |

| (i) | was subject to a cease trade order or similar order or an order that denied the relevant company access to any exemption under securities legislation, which order was in effect for a period of more than 30 consecutive days (an “Order”) that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer, |

| (b) | is, as at the date of this Information Circular, or has been, within ten years before the date of this Information Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | has, within the ten years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director. |

Additional Information Regarding the Directors

David H. Watkins, 69, was appointed Executive Chairman in January 2009 and stepped down as Executive Chairman becoming Chairman on July 1, 2010. Mr. Watkins has over 40 years’ experience in exploration, development, and mining operations. During the early part of his career, he served as exploration geologist for Newmont and Noranda. He later joined Falconbridge Copper Ltd. as an Exploration Geologist and rose to Chief Geologist responsible for exploration in Quebec and mine operations at Lake Dufault and Opemiska. Mr. Watkins was appointed Vice President, Exploration in 1986 and later became President of Minnova Inc., the successor company to Falconbridge Copper. Mr. Watkins served as President of Cyprus Exploration and Development Corporation and Senior Vice President, Exploration for Cyprus Amax Minerals Company for six years prior to joining the Company in 1999. Mr. Watkins served as President and CEO of the Company from 2000 to 2008.

James K. B. Hesketh, 57 became President and Chief Executive Officer in January 2009. Mr. Hesketh has a diverse career in the mining industry, with over 30 years in positions covering mining finance, corporate business development, mine operations, mine engineering, manufacturing and consulting with companies including NM Rothschild & Sons (Denver) Inc., Cyprus Amax Minerals Company, Pincock, Allen & Holt, Inc., and Dresser Industries. Prior to Mr. Hesketh's current role, he was President and CEO of Canyon Resources Corporation ("Canyon”) and served as a Director of the Company. He has been a Director of the Company since 2001.

Glen D. Dickson, 64,has been a Director of the Company since December 2002. Mr. Dickson obtained his B.Sc. (Advanced) degree in Geology in 1974 and has been involved in mineral exploration continuously since then with a variety of Canadian major and junior exploration companies.Mr. Dickson served as Senior Geologist with Asamera Minerals Inc. from 1987 to 1992, and later served as President and Chief Executive Officer of Cumberland Resources Ltd. from 1993 through 2002. Most recently, Mr. Dickson was the Chief Executive Officer and Director of Gold-Ore Resources Ltd., until it merged with Elgin Mining Inc. on April 30, 2012.

Ronald D. Parker, 63, was appointed a director of the Company on March 18, 2008. From 2002 to 2012, Mr. Parker served as President and CEO of Gammill Inc., a manufacturing company. Mr. Parker was a former Director of Canyon and joined the Board through the Canyon Merger. From 1998 to 2002, he served as President and CEO of Apollo Gold Inc. Mr. Parker has held several positions with Homestake Mining Company and its subsidiaries including Vice President of Homestake Mining Company, President of Homestake Canada, Inc., President of Prime Resources Group, Inc. and General Manager of the McLaughlin Mine.

David K. Fagin, 75, was appointed a Director of the Company on March 18, 2008. Mr. Fagin was a former Director of Canyon. From 1992 to 1996, he served as Chairman and CEO of Golden Star Resources Ltd. and then as non-executive Chairman for an additional two years. From 1997 to 2000, he served as Chairman and CEO of Western Exploration and Development Ltd., and later as consultant and Corporate Director. Mr. Fagin has served as President and Director of Homestake Mining Company, Rosario Resources Corporation, and as Vice President of AMAX Inc. Mr Fagin also served for over 20 years on the boards of the T. Rowe Price mutual funds, at one time consisting of over 100 Price boards.

Christopher E. Herald, 60, joined the Board in August 2009. He has over 30 years of experience in the mining industry and has been President and CEO and a Director of Solitario Exploration and Royalty Corporation since 1992. He was instrumental in discovering the 1.5 million ounce high-grade Buckhorn Mountain Gold deposit for Crown Resources and its subsequent sale to Kinross Gold for approximately $240 million in 2006. Chris was also responsible for the initial exploration successes of the 1.5 million ounce Kettle River open pit and underground deposits. During his career, he has held various positions in Anaconda Minerals, Echo Bay Mines, Crown Resources, and as Chairman of The Denver Gold Group.

Paul H. Zink, 59, joined the Company's board in April, 2011. Paul was appointed Chief Financial Officer of Rare Element Resources Ltd. in December 2013. Prior to that he was Chief Executive Officer of Americas Bullion Royalty Corp. Paul served as President of Eurasian Capital, the royalty and merchant banking division of Eurasian Minerals Inc., from July 2010 through January 2013. He has more than 30 years of experience in the financial and extractive industries. He began his career in the metals and mining industry with a 17-year tenure at J.P. Morgan & Co., Inc., where he performed merger and acquisition analysis, banking and project finance advisory work for European mining companies, and sell-side equity research on U.S. mining stocks. His extractive industry experience includes managing Pegasus Gold, Inc.'s acquisition efforts and serving as Chief Financial Officer for Koch Mineral Services, a unit of Koch Industries Inc. From 2008-2010, Mr. Zink served as President and Director of International Royalty Corporation ("IRC") and was a key member of the senior management team that negotiated IRC's successful sale to Royal Gold, Inc. in February, 2010.

Majority Voting for Directors

Under Canadian corporate law, director elections are based on the plurality system, where shareholders vote “for” or “withhold” their votes for a director. Votes withheld are not counted, with the result that, technically, a director could be elected to the board with just one vote in favour. The Board of Directors believes that each of its members should have the confidence and support of the shareholders of the Company. On February 4, 2013, the directors unanimously adopted a majority voting policy (the “Majority Voting Policy”). Each of management’s nominees for election to the Board at the Meeting has agreed, and all future nominees will be required to agree, to abide by it. The Majority Voting Policy states that if in an uncontested election a director nominee has more votes withheld than are voted in favour of him or her, the nominee will be considered by the Board not to have received the support of the shareholders, even though duly elected as a matter of corporate law. Such a nominee will be required forthwith to submit his or her resignation to the Board, effective upon acceptance by the Board. The Board will refer the resignation to the corporate governance committee for consideration and a recommendation. Except in special circumstances that would warrant the continued service of the director on the Board, the corporate governance committee will be expected to recommend that the Board accept the resignation. Within 90 days after the meeting, the Board will make its decision and announce it by press release.

STATEMENT OF EXECUTIVE COMPENSATION

The following table sets forth details of all compensation paid, in the Company’s three most recently completed financial years, in respect of the individuals who were, at the financial year ended December 31, 2013, the Chief Executive Officer, the Chief Financial Officer and the two other most highly compensated executive officers of the Company or its subsidiaries whose total compensation was, individually, more than C$150,000 for the financial year ended December 31, 2013 (the “Named Executive Officers” or “NEOs”).

Summary NEO Compensation Table

Name and principal

position | | Year | | | Salary

($) | | | RSU

awards

($)

(1)(4) | | | Stock Option

awards

($)

(1) | | | Non-equity

incentive plan

compensation

(annual

incentive

plans) ($)

(1,2) | | | Retirement

Contributions

($)

(3) | | | Total

compensation

($) | |

| James K. B. Hesketh – | | | 2013 | | | | 297,000 | | | | 33,000 | | | | 0 | | | | 500 | | | | 11,900 | | | | 342,400 | |

| President, Chief | | | 2012 | | | | 300,774 | | | | 0 | | | | 231,785 | | | | 75,000 | | | | 9,000 | | | | 616,559 | |

| Executive Officer | | | 2011 | | | | 266,108 | | | | 0 | | | | 153,174 | | | | 150,000 | | | | 11,654 | | | | 580,936 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rodney D. Gloss – | | | 2013 | | | | 175,500 | | | | 19,500 | | | | 22,859 | | | | 500 | | | | 7,186 | | | | 225,545 | |

| Vice President, Chief | | | 2012 | | | | 180,671 | | | | 0 | | | | 115,892 | | | | 40,000 | | | | 8,500 | | | | 345,063 | |

| Financial Officer | | | 2011 | | | | 45,000 | | | | 0 | | | | 77,197 | | | | 10,000 | | | | 0 | | | | 132,197 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| William R. Stanley – | | | 2013 | | | | 187,200 | | | | 20,800 | | | | 22,859 | | | | 500 | | | | 7,508 | | | | 238,867 | |

| Vice President, | | | 2012 | | | | 200,774 | | | | 0 | | | | 115,892 | | | | 40,000 | | | | 9,600 | | | | 366,266 | |

| Exploration | | | 2011 | | | | 165,929 | | | | 0 | | | | 91,904 | | | | 80,000 | | | | 9,848 | | | | 347,681 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Daniel Saint Don – Former Vice President, Chief Operating Officer (5) | | | 2013 | | | | 223,249 | | | | 0 | | | | 0 | | | | 20,500 | | | | 4,851 | | | | 248,600 | |

| (1) | Dollar amounts provided for option-based awards and restricted-stock-unit (“RSU”) awards reflect fair value on the date of grant. Option-based awards, RSUs, and dollar amounts for annual incentive plans are determined as discussed in the Compensation Discussion and Analysis below. |

| (2) | Amounts represent incentive cash bonuses paid during the year. |

| (3) | Dollar amounts provided represent the employer 401K matching contribution during the year. |

| (4) | All RSUs granted were in lieu of deferred compensation as discussed in Salaries and Bonuses below. |

| (5) | Mr. Saint Don’s employment contract expired on December 31, 2013. |

Additional Information Regarding Officers

Rodney D. Gloss joined the Company in October of 2011 as Vice President and Chief Financial Officer. Mr. Gloss has an extensive background in the global mining and manufacturing sectors with experience in managing all aspects of accounting and finance. He is an experienced and proven leader with the analytical and financial know-how to reduce costs and grow enterprises in a profitable manner. Mr. Gloss has served as Corporate Controller for Alacer Gold; VP, Chief Accounting Officer, and Corporate Controller for Intrepid Potash; and CFO, VP, Controller, and Director of Treasury for Timminco Ltd. Mr. Gloss holds an MBA in Finance and Marketing from the University of California, Los Angeles and a BS in Mathematics from Northern Arizona University. He is a CPA in the State of California.

William R. Stanley was appointedVice President of Exploration in January 2004. Mr. Stanley has over 30 years’ experience as a mineral exploration geologist. While the vast majority of Mr. Stanley’s exploration experience is in the Western United States, he has also developed and led international exploration efforts in Mexico, Chile, and New Zealand. Mr. Stanley holds a Bachelor of Science degree in Geology, from Central Washington University, and a Master of Business Administration from Arizona State University. Prior to joining the Company, Mr. Stanley was an independent mining consultant providing services to both major and junior exploration firms. He has held positions with Cyprus Amax as the U.S. Exploration Manager, and Homestake Mining Company as Senior Exploration Geologist where he was responsible for several gold deposit discoveries, two of which were placed into production.

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth details of all awards outstanding for the Named Executive Officers at the end of the most recently completed financial year, including awards granted to the Named Executive Officers in prior years.

| | | Option-Based Awards | | | Share-Based Awards |

| Name | | No. of

Securities

Underlying

Unexercised

Options

(#) | | | Option

Exercise

Price

(C$) | | | Option

Expiration

Date | | Value of

Unexercised In-

The-Money

Options(1)

(C$) | | | No. of Shares

or Units of

Shares That

Have Not

Vested

(#) | | Market or

Payout Value of

Share-Based

Awards That

Have Not

Vested

(C$) | | Market or

Payout Value

of Vested

Share-Based

Awards Not

Paid Out or

Distributed

(C$) |

| James K. B. | | | 400,000 | | | | 0.71 | | | Dec. 17/14 | | | - | | | Nil | | N/A | | N/A |

| Hesketh | | | 400,000 | | | | 0.60 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 500,000 | | | | 0.90 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 500,000 | | | | 1.13 | | | Dec. 11/16 | | | - | | | | | | | |

| Subtotal | | | 1,800,000 | | | | | | | | | | - | | | | | | | |

| Rodney D. | | | 200,000 | | | | 0.75 | | | Oct. 3/16 | | | - | | | Nil | | N/A | | N/A |

| Gloss | | | 75,000 | | | | 0.90 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 250,000 | | | | 1.13 | | | Dec. 11/16 | | | - | | | | | | | |

| | | | 398,400 | | | | 0.105 | | | Dec. 12/18 | | | 1,992 | | | | | | | |

| Subtotal | | | 923,400 | | | | | | | | | | 1,992 | | | | | | | |

| William R. | | | 200,000 | | | | 0.71 | | | Dec. 17/14 | | | - | | | Nil | | N/A | | N/A |

| Stanley | | | 200,000 | | | | 0.60 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 300,000 | | | | 0.90 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 250,000 | | | | 1.13 | | | Dec. 11/16 | | | - | | | | | | | |

| | | | 398,400 | | | | 0.105 | | | Dec. 12/18 | | | 1,992 | | | | | | | |

| Subtotal | | | 1,348,400 | | | | | | | | | | 1,992 | | | | | | | |

| Daniel Saint Don(2) | | | 300,000 | | | | 1.16 | | | Jan. 31/14 | | | - | | | Nil | | N/A | | N/A |

| Subtotal | | | 300,000 | | | | | | | | | | - | | | | | | | |

| (1) | Based on the Company’s closing share price of C$0.11 on December 31, 2013. |

| (2) | Daniel Saint Don’s employment contract expired on December 31, 2013 and therefore his stock option terminated on January 31, 2014. |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth details of the value vested or earned by the Named Executive Officers for incentive plan awards for the most recently completed financial year. All share-based awards were in lieu of deferred compensation.

| Name | | Option-Based Awards – Value

Vested During the Year

(C$) | | | Share-Based Awards – Value

Vested During the Year

(C$) | |

| James K. B. Hesketh | | | 0 | | | | 19,013.33 | |

| Rodney D. Gloss | | | 996 | | | | 11,390.47 | |

| William R. Stanley | | | 996 | | | | 12,702.99 | |

| Dan Saint Don | | | 13,500 | | | | 0 | |

Stock Option Plan

In 2007, the Company adopted an incentive stock option plan pursuant to the policies of the TSX with the approval of the Company’s shareholders, which plan was amended in 2008, 2009 and 2013 (as amended the “Option Plan”). As of the date of this Information Circular, an aggregate of 11,652,650 common shares are issuable upon the exercise of outstanding options granted under the Option Plan, representing 6.1% of the issued and outstanding common shares of the Company. There are currently 7,425,724 options available to be granted under the Option Plan (provided no further RSUs (as defined below) are granted), representing 3.9% of the issued and outstanding common shares of the Company. A copy of the Option Plan is available upon request from the Corporate Secretary of the Company, 14142 Denver West Parkway, Suite 250, Golden, Colorado, 80401 or on SEDAR (www.sedar.com). Key provisions of the Option Plan include:

| · | persons who are eligible to receive options pursuant to the Option Plan are directors, officers and employees of the Company and its subsidiaries and others providing management or consulting services to the Company or an entity controlled by the Company; |

| · | a restriction that the maximum number of common shares issuable pursuant to options granted under the Option Plan will be a number equal to 10% of the issued and outstanding common shares on a non-diluted basis at any time, less the aggregate total number of shares that are, from time to time, subject to issuance under outstanding rights that have been granted by the Company under any other share compensation arrangement, including outstanding restricted share units issued by the Company under its Restricted Share Unit Plan (as discussed below); |

| · | unless permitted by regulatory approval and, if required by applicable law, shareholder approval is obtained: (i) the aggregate number of shares which may be issuable to insiders of the Company pursuant to options granted under the Option Plan and under any other share compensation arrangement shall not exceed 10% of the total number of issued and outstanding shares at the date of grant on a non-diluted basis; (ii) the aggregate number of shares which may be issued to insiders pursuant to options granted under the Option Plan and under any other share compensation arrangement, within any one-year period, shall not exceed 10% of the total number of issued and outstanding shares at the end of such period on a non-diluted basis; and (iii) the aggregate number of shares which may be reserved for issuance, from time to time, to any one service provider under the Option Plan and under any other share compensation arrangement may not exceed 5% of the total number of issued and outstanding shares at the date of grant on a non-diluted basis; |

| · | the option price per common share is to be determined by the Board provided that such exercise price is not less than the market price on the date of grant of such options or such other minimum price as may be required by the TSX and the options may be priced in Canadian or U.S. Dollars as determined by the Board at the time the option is granted; |

| · | the market price is defined as the average of the daily high and low board lot trading prices of the common shares of the Company for three trading days immediately preceding the time the option is granted; |

| · | the vesting period of all options are determined by the Board; |

| · | options may be exercisable for a period of up to a maximum term of five years, subject to a blackout period allowance, such period to be determined by the Board, and the options are non-transferable; |

| · | options held by individuals who are terminated without cause are subject to an accelerated expiry term for those options which requires that options held by those individuals expire on the earlier of: (a) the original expiry term of such options; (b) 30 days after the Optionee ceases active employment with the Company; or (c) 30 days after the date of delivery of written notice of retirement, resignation or termination; |

| · | options held by an individual who ceases to be employed by the Company for cause or is removed from office or becomes disqualified from being a director will terminate immediately; |

| · | options held by an individual who ceases to be employed by the Company due to death, disability or retirement in accordance with the Company’s retirement policy will terminate on the earlier of: (a) 365 days after the date of death, disability or retirement; and (b) the original expiry term of such options; |

| · | options which expire unexercised or are otherwise cancelled will be returned to the Option Plan and may be made available for future option grant pursuant to the provisions of the Option Plan or may be made subject to issuance under a right granted pursuant to any other share compensation arrangement; |

| · | optionees may, rather than exercise their options, elect to terminate such option, in whole or in part, and receive the number of common shares, which have a value equivalent to the number of options terminated multiplied by the difference between the fair value of a common share and the option price of the options terminated; |

| · | the Board may, without shareholder approval, from time to time, subject to applicable law and the prior approval, if required, of the TSX or any other applicable regulatory body having authority over the Company, the Option Plan or the shareholders of the Company: (i) suspend, terminate, or discontinue the Option Plan, and (ii) amend or revise the terms of the Option Plan or any option granted under the Option Plan and the Option Agreement relating thereto at any time without the consent of the optionee, provided that such amendment does not adversely alter or impair the option previously granted (except as permitted under the adjustment provisions of the Option Plan), including amendments of a typographical, grammatical, clerical or administrative nature, to the vesting provisions of the Option Plan or any option, to change the termination provisions of any option that does not entail an extension beyond the original expiration date of the option and to change the eligible participants under the Option Plan; |

| · | the Board, absent prior approval of the shareholders of the Company and of the TSX or any other regulatory body having authority over the Company, will not be entitled to (i) increase the maximum percentage of shares issuable by the Company pursuant to the Option Plan; (ii) amend an option grant for an option held by an insider of the Company to effectively reduce the exercise price, or to extend the expiry date; (iii) extend the Blackout Expiration Term as provided in the Option Plan; (iv) make a change to the class of eligible participants which would have the potential of broadening or increasing participation by insiders of the Company; (v) add any form of financial assistance; or (vi) add a deferred or restricted share unit or any other provision which results in an eligible participant receiving shares while no cash consideration is received by the Company. Notwithstanding any provision in the Option Plan to the contrary, any revision to the terms of an option granted to a U.S. Participant (as defined in the Option Plan) shall be made only if it complies with, and does not create adverse tax consequences under, Sections 424 and/or 409A of the Code (as defined in the Option Plan), as applicable; and |

| · | options issued to eligible U.S. Participants (as defined in the Option Plan) may qualify as an “incentive stock option” pursuant to Section 422 of the Code. |

During the financial year ended December 31, 2013, the Company amended the Option Plan in order to accommodate the introduction of the Restricted Share Unit Plan as a new component of the Company’s equity-based incentive program. The amendments did not represent a substantive change to the Company’s existing Option Plan. Rather, they were required merely to align certain terms and definitions of the Option Plan with the Company’s newly adopted Restricted Share Unit Plan, as the existing Option Plan was prepared prior to the institution of the RSU Plan. The key amendments (the “Amendments”), which were approved by the shareholders of the Company at the Annual General Meeting held on May 7, 2013, were as follows:

| 1. | to add the definitions of “Applicable Law”, “RSU Plan” and “Share Compensation Arrangement” under section 2.1 of the Option Plan; |

| 2. | to amend section 3.3 of the Option Plan to provide that: |

| (a) | the maximum number of common shares of the Company that may be issuable pursuant to options granted under the Option Plan, which options are outstanding but unexercised and whether or not they are vested, shall be a number equal to 10% of the number of issued and outstanding common shares of the Company on a non-diluted basis at any time, less the aggregate total number of common shares of the Company that are, from time to time, subject to issuance under outstanding rights that have been granted by the Company under any other share compensation arrangement, including outstanding restricted share units issued by the Company under its Restricted Share Unit Plan; and |

| (b) | unless permitted by regulatory approval and, if required by applicable law, shareholder approval is obtained: |

| (i) | the aggregate number of common shares of the Company which may be issuable to insiders pursuant to options granted under the Option Plan and under any other share compensation arrangement shall not exceed 10% of the total number of issued and outstanding common shares of the Company at the date of grant of the option on a non-diluted basis; |

| (ii) | the aggregate number of common shares of the Company which may be issued to insiders pursuant to options granted under the Option Plan and under any other share compensation arrangement, within any one-year period, shall not exceed 10% of the total number of issued and outstanding common shares of the Company at the end of such period on a non-diluted basis; and |

| (iii) | the aggregate number of common shares of the Company which may be reserved for issuance, from time to time to any one service provider under the Option Plan and under any other share compensation arrangement may not exceed 5.0% of the total number of issued and outstanding common shares of the Company at the date of grant of the option on a non-diluted basis; |

| 3. | to amend section 4.9 of the Option Plan to provide that any unissued option shares not acquired by an optionee under an option, which have expired or have been cancelled, may be made the subject of a further option grant pursuant to the provisions of the Option Plan or may be made subject to issuance under a right granted pursuant to any other share compensation arrangement; and |

| 4. | to amend section 6.3(a) of the Option Plan to provide that notwithstanding any other provision of the Option Plan to the contrary, the aggregate number of common shares of the Company available for options granted to citizens of the United States is 6,000,000 subject to: (i) the limitations set out in section 3.3 of the Option Plan, (ii) adjustment pursuant to section 5 of the Option Plan; and (iii) the provisions of sections 422 and 424 of the U.S. Internal Revenue Code of 1986, as amended. |

Restricted Share Unit Plan

Effective May 7, 2013, the Company adopted a restricted share unit plan (the “RSU Plan”), pursuant to which the Board may grant restricted share units (the “RSUs”) to eligible participants. The RSUs are substantially like “phantom” shares, the implied value of which will rise and fall in value based on the underlying market value of the Company’s common shares and are redeemable for common shares on the vesting dates determined by the Board when the RSUs are granted. As of the date of this Information Circular, an aggregate of 260,286 common shares are issuable upon the vesting of outstanding RSUs granted under the RSU Plan, representing approximately 0.14% of the issued and outstanding common shares of the Company. There are currently 7,165,439 RSUs available to be granted under the RSU Plan (provided no further options are granted), representing 3.76% of the issued and outstanding common shares of the Company. A copy of the RSU Plan is available upon request from the Corporate Secretary of the Company, 14142 Denver West Parkway, Suite 250, Golden, Colorado, 80401 or on SEDAR (www.sedar.com). The key features of the RSU Plan are as follows:

| · | the eligible participants are directors, officers, employees and consultants of the Company; |

| · | the maximum number of common shares of the Company which may be made subject to issuance under RSUs granted under the RSU Plan shall be a number equal to 10% of the number of issued and outstanding common shares of the Company on a non-diluted basis at any time, less the aggregate total number of common shares of the Company that are, from time to time, subject to issuance under outstanding rights that have been granted by the Company under any other share compensation arrangement, including outstanding stock options issued by the Company under its Option Plan; |

| · | unless permitted by regulatory approval and, if required by applicable law, shareholder approval is obtained: (i) the aggregate number of common shares of the Company that may be made subject to issuance to insiders pursuant to RSUs granted under the RSU Plan and under any other share compensation arrangement may not exceed 10% of the total number of common shares of the Company outstanding at the date of grant of the RSU (on a non-diluted basis); (ii) the aggregate number of common shares of the Company that may be issued to insiders pursuant to RSUs granted under the RSU Plan and under any other share compensation arrangement, within any one year period, may not exceed 10% of the total number of common shares of the Company outstanding at the end of such period (on a non-diluted basis); and (iii) the aggregate number of common shares of the Company which may be reserved for issuance, from time to time, to any one person or company under the RSU Plan and under any other share compensation arrangement may not exceed 5% of the total number of common shares of the Company outstanding at the date of grant of the RSU (on a non-diluted basis); |

| · | RSUs shall consist of a grant of units, each of which represents the right of the participant to receive one common share of the Company; |

| · | the Board has the discretion to determine the vesting date for each RSU or any other vesting requirements; |

| · | unless otherwise determined by the Board, in its sole discretion, or specified in the applicable RSU agreement: |

| (a) | upon the voluntary resignation or the termination for cause of a participant, all of the participant’s RSUs which remain unvested shall be forfeited without any entitlement to such participant. If the participant has an employment or consulting agreement with the Company, the term “cause” shall have the meaning given to it in the applicable participant’s employment or consulting agreement; |

| (b) | upon the termination without cause or death of a participant, the participant or the participant’s beneficiary, as the case may be, shall have a number of RSUs become vested in a linear manner equal to the sum for each grant of RSUs of the original number of RSUs granted multiplied by the number of completed months of employment since the date of grant divided by the number of months required to achieve the full vesting of such grant of RSUs reduced by the actual number of RSUs that have previously become vested. |

| · | the assignment or transfer of RSUs, or any other benefits under the RSU Plan, are not permitted; |

| · | the Board has the right, in its absolute discretion, subject to any necessary regulatory approvals, to at any time amend, suspend, terminate or discontinue the RSU Plan, or revoke or alter any action taken in connection therewith, except that no general amendment or suspension of the RSU Plan will, without the written consent of all holders of outstanding RSUs, impair the rights and entitlements of any such holder pursuant to then-outstanding RSUs unless such amendment is the result of a change in the rules and policies of the TSX or the US Market (as defined in the RSU Plan), all without shareholder approval or participant approval, except that this discretionary authority will not extend to the directors the authority to increase the Plan Limit (as defined in the RSU Plan) without shareholder approval, excluding, where required by the policies of the TSX or the US Market, the votes attaching to shares held by persons eligible to be participants under the RSU Plan. If the RSU Plan is terminated, the provisions of the RSU Plan and any administrative guidelines, and other rules and regulations adopted by the Board and in force at the time of the RSU Plan shall continue in effect during such time as an RSU or any rights pursuant thereto remain outstanding; |

| · | subject to regulatory approval, the Board may, without shareholder or participant approval, amend or modify in any manner an outstanding RSU to the extent that the Board would have had the authority to initially grant such award as so modified or amended, including without limitation, to change the date or dates as of which an RSU vests, except that no amendment will, without the written consent of all affected participants, alter or impair any RSU previously granted under the RSU Plan unless as a result of a change in applicable law or the Company’s status or classification thereunder; and |

| · | upon the occurrence of a Change of Control (as defined in the RSU Plan), all outstanding RSUs at that time shall automatically and irrevocably vest in full. |

During the financial year ended December 31, 2013, no amendments to the RSU Plan were adopted either with or without shareholder approval.

Performance Graphs

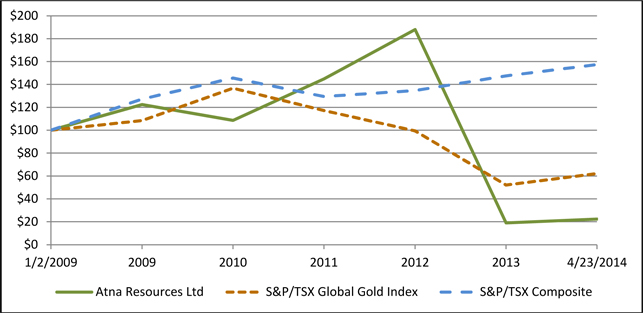

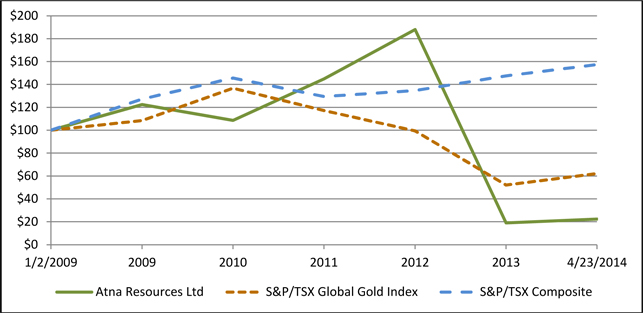

The following graph compares, assuming an initial investment of CAD$100 as of January 1, 2009, the yearly percentage change in cumulative total shareholder return on the common shares of the Company against the cumulative total shareholder return of the S&P Global Gold Index and the S&P/TSX Composite Index for the Company’s five most recently completed financial years.

Atna Resources Ltd. Cumulative Value of a CAD$100 Investment

Comparison of Cumulative Total Return

| | | January | | | December | | | December | | | December | | | December | | | December | | | April, 23 | |

| | | 2009 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

Atna Resources Ltd.

(ATN) | | | 100 | | | | 122 | | | | 109 | | | | 145 | | | | 188 | | | | 19 | | | | 22 | |

| S&P/TSX Global Gold Index (XGD) | | | 100 | | | | 108 | | | | 137 | | | | 117 | | | | 99 | | | | 52 | | | | 62 | |

S&P/TSX Composite

(^TSX) | | | 100 | | | | 127 | | | | 146 | | | | 129 | | | | 135 | | | | 148 | | | | 157 | |

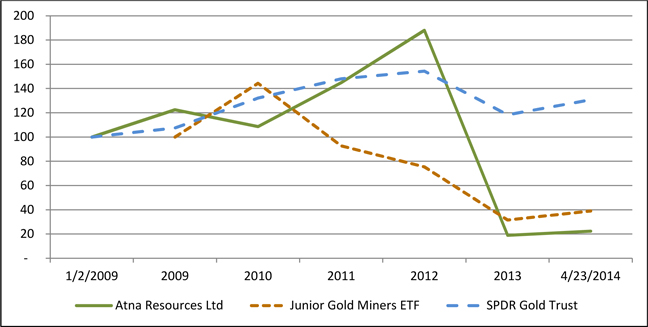

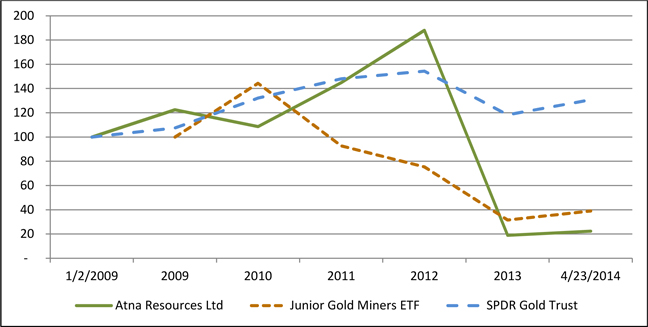

2013 was a challenging year for Atna and the global gold sector. The price of gold began the year at approximately $1,690 per ounce and declined to approximately $1,190 per ounce by the end of the second quarter 2013. This decline is reflected in the S&P/TSX Global Gold Fund and more sharply in the Junior Gold Miner ETF below, as the junior mining sector deteriorated, losing approximately 47% of its value by the end of 2013 vs. 2012.

In light of the gold market, Atna worked hard through the year to conserve cash and to reduce spending. The Pinson underground mine was placed on care and maintenance and a focus on improving productivity was heightened at the Briggs mine to reduce the cost of gold production.

The following graph compares, assuming an initial investment of CAD$100 as of January 1, 2009, the yearly percentage change in cumulative total shareholder return on the common shares of the Company against the cumulative total shareholder return of the SPDR Gold Trust and the Junior Gold Miners ETF for the Company’s five most recently completed financial years.

Atna Resources Ltd. Cumulative Value of a CAD$100 Investment

Comparison of Cumulative Total Return

| | | January | | | December | | | December | | | December | | | December | | | December | | | April, 23 | |

| | | 2009 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

Atna Resources Ltd.

(ATN) | | | 100 | | | | 122 | | | | 109 | | | | 145 | | | | 188 | | | | 19 | | | | 22 | |

| Junior Gold Miner ETF (GDXJ:US)(1) | | | - | | | | 100 | | | | 144 | | | | 93 | | | | 75 | | | | 32 | | | | 39 | |

SPDR Gold Trust ETF

(GLD:US) | | | 100 | | | | 108 | | | | 132 | | | | 148 | | | | 154 | | | | 118 | | | | 131 | |

| (1) | Junior Gold Miner ETF inception date was 11/11/2009. US ETF’s have been converted to CAD. |

Compensation of NEOs during the first three of the five year period was relatively flat except for cost of living increases and reflects the negative trends shown in the value of an investment in the Company during that period. In 2012, compensation increased with increased activity related to development of the Pinson mine. There were no increases in compensation in 2013. Executive Management opted to receive 20% of their compensation in the form of RSU grants.

In 2009, the Company was successful in bringing the Briggs Mine into operation, producing 11,200 ounces of gold that year. In 2010, the Company ramped up production at Briggs producing 25,000 ounces of gold and revenues of $30.6 million. The Company reached a major goal in 2011 by acquiring Barrick’s 70% interest in the Pinson Mine, consolidating its interest to control 100% of the high-grade gold resource. Additionally, the Company produced 32,000 ounces of gold at its Briggs Mine and revenue of $51.7 million in 2011. In 2012, the Company produced nearly 37,000 ounces at its Briggs and Pinson mines, a 13% increase over 2011, generating revenue of $59.8 million, an increase of 15%. 2013 was a difficult year for the Company and many factors impacted stock performance. Namely, declining gold prices affected margins on gold sales, lower production and resultant higher costs than anticipated at the Briggs mine and the ramp up to commercial production at the Pinson underground mine was costly and unsustainable in a declining gold market.

For more details on the Company's projects, please review the Company’s Management Discussion and Analysis and financial filings available on SEDAR and EDGAR or on the Company’s website atwww.atna.com.

COMPENSATION DISCUSSION AND ANALYSIS

Overview of Compensation Policies

Compensation of the Company’s NEOs is determined by the Board. The Compensation Committee is responsible for considering specific and general information and making recommendations to the full Board with respect to compensation matters. The Compensation Committee is comprised of three independent directors. The Committee’s consideration of and recommendations regarding executive compensation are guided by a number of factors described below. The objectives of the Company’s total executive compensation package are to attract and retain the best possible executive talent, to provide an economic framework to motivate the Company’s executives to achieve goals consistent with the Company’s business strategy, to align interests between executives and shareholders through employee compensation plans, and to provide a compensation package that recognizes an executive's individual results and contributions in addition to the Company’s overall business results. The Company’s Option Plan and RSU Plan provide the Compensation Committee with additional tools to compensate management.

Goals, principally those established by the annual budget and those established in individual annual reviews, and subjective measures are used by the Compensation Committee and Board to determine adjustments in compensation. Market conditions including competition within the mining industry for skilled personnel and competitive bench-marking surveys are also considered. The Board exercises discretion and judgment in determining the appropriate compensation. The Board has considered the impact of compensation policies and practices upon risk, and has moderated equity-compensation somewhat as a result. Compensation programs are considered normal within industry. Directors and NEO’s are not allowed to hedge against a change in value of other outstanding positions they have in the Company’s equity.

The gold mining industry was relatively depressed in 2013 with many reductions-in-force having been announced, so competition for skilled personnel diminished, allowing the lesser compensation. As equity compensation includes an incentive to perform in the future and aligns the interests of key employees and stockholders, it was determined that making equity-compensation grants was still important. With the decrease in the Company’s stock price, outstanding options granted in prior years materially decreased in value, effectively negating much of the equity-compensation and equity-incentives previously granted.

The Board reviews management’s future goals and strategies at least yearly to ensure that they are aligned with those of the shareholders and that they provide a sound growth platform that should enhance shareholder value in both the long and short term. In making its recommendations concerning executive compensation, the Compensation Committee reviews individual levels of responsibility, scope and complexity of the executive’s position, and an evaluation of each individual’s role and achievement of goals in advancing the business strategies of the Company. The individual’s and Company’s performance are also compared to the executive salary ranges for other companies of similar size and industry.

The Compensation Committee recommends to the Board compensation levels for the Chief Executive Officer, the Chief Financial Officer and other executive officers of the Company. In reviewing individual performance of executives whose compensation is detailed in this Information Circular, the Committee takes into account the full compensation package of each individual, including past compensation levels, past gains on exercises of stock options, and current intrinsic value of outstanding options. Additionally, the Compensation Committee takes into account the views of James K.B. Hesketh, the Company's Chief Executive Officer, who submits a performance report detailing the successes and failures of the Company and its executive officers compared to goals and strategies during the past year.

The Compensation Committee believes that the Chief Executive Officer, as well as the other officers of the Company, are strongly motivated and dedicated to the growth in shareholder value of the Company. The Committee further believes that the Chief Executive Officer, as well as the other officers of the Company, are receiving salary compensation in the appropriate range of peer-group levels and that their performance incentives are heavily based on their personal shareholding and/or incentive equity holdings in the Company. In 2013, stock options were granted to officers with the view that such awards align their interest directly with that of the shareholders.

Salaries and Cash Bonuses

Salaries for executive officers are determined by evaluating the responsibilities of the position held and the experience of the individual, and by reference to the competitive marketplace for executive talent, including a comparison of salaries for comparable positions at other similar mining companies.

The salary levels of the Chief Executive Officer and other officers of the Company are recommended by the Compensation Committee and approved by the Board of Directors. Specific individual performance, initiative and accomplishments and overall corporate or business segment performance are reviewed in determining the compensation level of each individual officer. In a particular business unit, such unit's financial, operating, cost containment, and productivity results are also considered. The Compensation Committee, where appropriate, also considers other performance measures, productivity, cost control, safety, environmental awareness, and improvements in relations with shareholders, employees, the public, and government regulators.

At the June 19th, 2013 Compensation Committee meeting, members recommended that the Board ask senior executive officers to voluntarily defer 20% of their salaries until the financial health of the Company improves. Executive officers, including the Chief Executive Officer, the Chief Financial Officer and the VP of Exploration, voluntarily opted to continue this deferral into 2014. The amount deferred is to be paid at a later time in the form of RSUs having a market value equal to the amount deferred. Each RSU would vest immediately.

During 2013, NEO’s were not awarded any increases in salaries; were awarded approximately 15% of the intrinsic value of prior year’s equity-compensation; and received cash bonuses of $500 as did all other exempt employees. Throughout the year there were a number of factors and events that the Compensation Committee considered to be important with respect to determining compensation of the NEOs. These events included:

| · | Company-wide cost reductions. |

| · | Debt refinancings during difficult market conditions. |

| · | Full repayment of the Company’s 2009 US$14.5 million gold bonds. |

| · | Cessation of development at the Pinson underground mine. |

| · | Completion of Briggs Goldtooth north and south pit development. |

| · | Poor operating results at the Briggs mine. |

| · | Significant improvement in Briggs safety programs and performance, resulting in 442 days with no lost-time accidents as of May 1, 2014. |

| · | Increase in gold resource base through successful drilling program at the Reward property. |

Stock Option Plan

Methodology Used to Calculate Fair Value for Option-Based Awards

The exercise price of each stock option is based on, and may not be less than, 100% of the fair market value of its common shares on the date of grant. The term of each stock option is fixed by the Board of Directors and may not exceed five years from the date of grant. The Board also determines the vesting requirements of the grant which may be accelerated by the Board of Directors.

The fair value of each option award is estimated on the date of grant using a Black-Scholes-Merton option valuation model that uses the assumptions noted in the following table. Expected market volatility is based on a number of factors including historical volatility of the Company’s common shares, the Company’s market capitalization, current options trading in the marketplace if any, future outlook of the Company, and other fair value related factors. The Company uses historical information in estimating the expected term. Vesting periods during 2013 were two years with 33% vesting immediately and 33 % vesting at each anniversary date. The risk-free rate is based on the yields of Canadian benchmark bonds which approximate the expected life of the option. The Company has never paid a dividend and does not plan to in the future and therefore the expected dividend yield is nil.

The following table summarizes the weighted-average assumptions used in determining fair values during 2013:

| | | 2013 | |

| Expected volatility | | | 87.0 | % |

| Expected option term - years | | | 3.1 | |

| Risk-free interest rate | | | 1.2 | % |

| Forfeiture rate | | | 9.2 | % |

Under the Company's Option Plan, option-based compensation may be granted to the Company's key employees and consultants, including the individuals whose compensation is detailed in this Information Circular. The Compensation Committee recommends the number and form of the option-based compensation considering factors including competitive compensation surveys and analysis, management recommendations, and gains received on past option-based grants.

The use of option-based compensation is intended to align the interests of the executives and other key employees with those of the shareholders. Option-based compensation also serves to increase management ownership in the Company, provides a level of deferred compensation, aids in employee retention and conserves cash. The Compensation Committee believes that stock options with graded vesting periods are the best tools to provide for short-term, mid-term and long-term incentives to motivate the executive officers and key employees of the Company to consistently perform at a high level and in the best interest of shareholders.

Restricted Share Unit Plan

Under the Company’s RSU Plan, share-based compensation in the form of an RSU may be granted to the Company’s directors, officers, employees and consultants, including the individuals whose compensation is detailed in this Information Circular. The Board (or a duly appointed committee of the Board or a senior officer of the Company) may take into account previous RSU grants when considering new grants. The Board may approve such grants or delegate its authority to the Compensation Committee. As described above, RSUs may also be granted by the Board in lieu of deferred compensation. In the case of an RSU grant for deferred compensation, the RSU will have a market value equal to the amount of the deferred compensation, calculated on a 5-day volume weighted average price preceding the grant date.

Employment Contracts

The following summarizes the employment agreements (the “Employment Agreements”) of Messrs. Hesketh, Gloss and Stanley (the “Executives”). The Employment Agreements will terminate annually on December 31, unless sooner terminated in accordance with the provisions of the Employment Agreements, and may be renewed for periods of one year at a time thereafter. If the Company terminates the employment of the Executive without cause, or the Executive terminates employment for good reason (as defined in the Employment Agreements), then the Executive will be entitled to: (i) accrued compensation including a pro rata bonus as defined in the agreement, (ii) a severance payment equal to one year’s salary plus one month’s salary for each year of service to the Company up to a maximum of 18 months’ salary; or if the termination by the Company without cause or by the Executive for good reason occurs upon or within ninety days after a Change of Control, as defined in the Employment Agreements, then the severance payment shall be equal to twenty-four months of the Executive’s annual salary, (iii) the Executive is eligible to receive COBRA continuation coverage paid by the Company for a period of up to twelve months, and (iv) subject to the terms of the Employment Agreements, all equity awards shall vest. The Company is also obligated to pay a tax gross-up payment to cover certain excise tax imposed by Section 4999 of the Code which may be incurred in connection with a severance payment.

The Employment Agreements contain a covenant not to compete with the Company during the term of employment and for a period of one year following termination of employment, including recruitment of any employee away from the Company.

Salary payments related to the above Employment Agreements are based on the current salary at the time of the event. The pro rata bonus payment is based on the average payments received by the Executive in the previous two years. The option-based payment is based on the fair value of options received in the previous year. Assuming that an event triggered a contractual payment at the end of 2013, the following estimated maximum payments would be required.

| Executive Name and Title | | Maximum

Employment

Contract Payments | |

| James K.B. Hesketh, President and Chief Executive Officer | | $ | 718,250 | |

| Rodney D. Gloss, Vice President and Chief Financial Officer | | $ | 475,717 | |

| William R. Stanley, Vice President of Exploration | | $ | 500,574 | |

Director compensation

The following table sets forth details of all amounts of compensation provided to the directors other than the NEOs (the “Other Directors”) for the Company’s most recently completed financial year:

Summary Director Compensation Table

| Name | | Fees

Earned

($) | | | RSU-based

awards(1) (2)

($) | | | Option-based

awards (1)

($) | | | Total

compensation

($) | |

| David H. Watkins, Chairman | | | 6,000 | | | | 26,500 | | | | 11,889 | | | | 44,389 | |

| Glen D. Dickson | | | 5,375 | | | | 24,125 | | | | 11,889 | | | | 41,389 | |

| Name | | Fees

Earned

($) | | | RSU-based

awards(1) (2)

($) | | | Option-based

awards (1)

($) | | | Total

compensation

($) | |

| David K. Fagin | | | 6,000 | | | | 26,000 | | | | 11,889 | | | | 43,889 | |

| Ronald D. Parker | | | 4,500 | | | | 22,500 | | | | 11,889 | | | | 38,889 | |

| Christopher E. Herald | | | 4,250 | | | | 21,750 | | | | 11,889 | | | | 37,889 | |

| Paul H. Zink | | | 5,000 | | | | 22,500 | | | | 11,889 | | | | 39,389 | |

| (1) | Dollar amounts provided for option-based awards and RSU awards reflect fair value on the date of grant. Option-based awards and RSUs are determined as discussed in the Compensation Discussion and Analysis above. |

| (2) | All RSUs were granted in lieu of directors’ fees earned as discussed below. |

Compensation of Directors

At the June 19, 2013 Compensation Committee meeting, members recommended to the Board of Directors that all directors’ fees be paid in equivalent amounts of RSUs that would vest immediately.

At the December 12th, 2013 Compensation Committee meeting, members recommended that no increase in directors’ fees be made in 2014 and it was further recommend that directors’ fees continue to be paid in RSUs in an equivalent amount owed to each Director. Upon granting and immediately vesting of each RSU, common shares would then be issued. In addition to conserving cash, the use of RSUs to pay directors’ fees is intended to increase the alignment of interests with stockholders of the Company. It was previously determined that each director’s compensation was within a competitive range of those paid to directors of similarly sized mining companies.

The 2014 fee schedule is as follows:

An annual retainer fee of $13,000.00 per year plus, as applicable:

| · | a fee of $1,000.00 per meeting of the Board of Directors; |

| · | a fee of $500.00 per committee meeting attended by each member director; |

| · | an annual fee of $5,000.00 to the chairman of the Audit Committee; |

| · | an annual fee of $2,500.00 to the chairman of the Compensation Committee; |

| · | an annual fee of $1,000.00 to the chairman of the Health, Safety and Environment Committee; |

| · | an annual fee of $1,000.00 to the chairman of the Nomination and Corporate Governance Committee; |

| · | an annual fee of $7,000.00 to the Chairman of the Board; and |

| · | an annual option grant at the market price at the date of the grant, with a vesting period of two years and a term not to exceed five years. |

There are no other arrangements in addition to or in lieu of the above-described fee structure under which directors of the Company were compensated by the Company during the most recently completed financial year for their services in the capacity as directors.

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth details of all awards outstanding for the Other Directors at the end of the most recently completed financial year, including awards granted to the Other Directors in prior years.

| | | Option-Based Awards | | | Share-Based Awards |

| Name | | No. of

Securities

Underlying

Unexercised

Options

(#) | | | Option

Exercise

Price

(C$) | | | Option

Expiration Date | | Value of

Unexercised

In-The-Money

Options(1)

(C$) | | | No. of Shares

or Units of

Shares That

Have Not

Vested

(#) | | Market or

Payout Value

of Share-Based

Awards That

Have Not

Vested

(C$) | | Market or

Payout Value

of Vested

Share-Based

Awards Not

Paid Out or

Distributed

(C$) |

| David H. Watkins | | | 120,000 | | | | 0.71 | | | Dec. 17/14 | | | - | | | Nil | | N/A | | N/A |

| | | | 120,000 | | | | 0.60 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 150,000 | | | | 0.90 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 130,000 | | | | 1.13 | | | Dec. 11/16 | | | - | | | | | | | |

| | | | 207,200 | | | | 0.105 | | | Dec. 12/18 | | | 1,036 | | | | | | | |

| Subtotal | | | 727,200 | | | | | | | | | | 1,036 | | | | | | | |

| Glen D. Dickson | | | 120,000 | | | | 0.71 | | | Dec. 17/14 | | | - | | | Nil | | N/A | | N/A |

| | | | 120,000 | | | | 0.60 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 150,000 | | | | 0.90 | | | Dec. 13/15 | | | - | | | | | | | |

| | | | 130,000 | | | | 1.13 | | | Dec. 11/16 | | | - | | | | | | | |

| | | | 207,200 | | | | 0.105 | | | Dec. 12/18 | | | 1,036 | | | | | | | |

| Subtotal | | | 727,200 | | | | | | | | | | 1,036 | | | | | | | |