SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by the Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

HOPFED BANCORP, INC

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount previously paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

HOPFED BANCORP, INC.

4155 Lafayette Road

Hopkinsville, Kentucky 42240

April 17, 2007

Dear Stockholder:

We invite you to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of HopFed Bancorp, Inc. (the “Company”) to be held at the Heritage Bank, 4155 Lafayette Road, Hopkinsville, Kentucky on Wednesday, May 16, 2007 at 3:00 p.m., local time.

The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the Annual Meeting.

As an integral part of the Annual Meeting, we will report on the operations of the Company. Directors and officers of the Company as well as representatives of Rayburn, Bates & Fitzgerald, P.C., the Company’s independent auditors, will be present to respond to any questions that our stockholders may have. Detailed information concerning our activities and operating performance is contained in our Annual Report which also is enclosed.

YOUR VOTE IS IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. On behalf of the Board of Directors, we urge you to please sign, date and return the enclosed proxy card in the enclosed postage-prepaid envelope as soon as possible even if you currently plan to attend the Annual Meeting. This will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the Annual Meeting.

| Sincerely, |

| John E. Peck |

| President and Chief Executive Officer |

HOPFED BANCORP, INC.

4155 Lafayette Road

Hopkinsville, Kentucky 42240

(270) 887-2999

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 16, 2007

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of HopFed Bancorp, Inc. (the “Company”) will be held at Heritage Bank, 4155 Lafayette Road, Hopkinsville, Kentucky on Wednesday, May 16, 2007 at 3:00 p.m., local time.

The Annual Meeting is for the following purposes, which are more completely described in the accompanying Proxy Statement:

| 1. | The election of three directors of the Company. |

| 2. | Such other matters as may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors is not aware of any other business to come before the Annual Meeting.

Any action may be taken on any one of the foregoing proposals at the Annual Meeting or any adjournments thereof. Stockholders of record at the close of business on March 30, 2007, are the stockholders entitled to vote at the Annual Meeting and any adjournment thereof.

You are requested to fill in and sign the enclosed proxy which is solicited by the Board of Directors and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend and vote at the Annual Meeting in person.

| BY ORDER OF THE BOARD OF DIRECTORS |

| BOYD M. CLARK |

| SECRETARY |

Hopkinsville, Kentucky

April 17, 2007

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF A FURTHER REQUEST FOR PROXIES IN ORDER TO INSURE A QUORUM. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES.

PROXY STATEMENT

HOPFED BANCORP, INC.

4155 Lafayette Road

Hopkinsville, Kentucky 42240

(270) 887-2999

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

May 16, 2007

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of HopFed Bancorp, Inc. (the “Company”) for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at Heritage Bank, 4155 Lafayette Road, Hopkinsville, Kentucky on Wednesday, May 16, 2007, at 3:00 p.m., local time. The accompanying Notice of Annual Meeting and this Proxy Statement, together with the enclosed form of proxy, are first being mailed to stockholders on or about April 17, 2007.

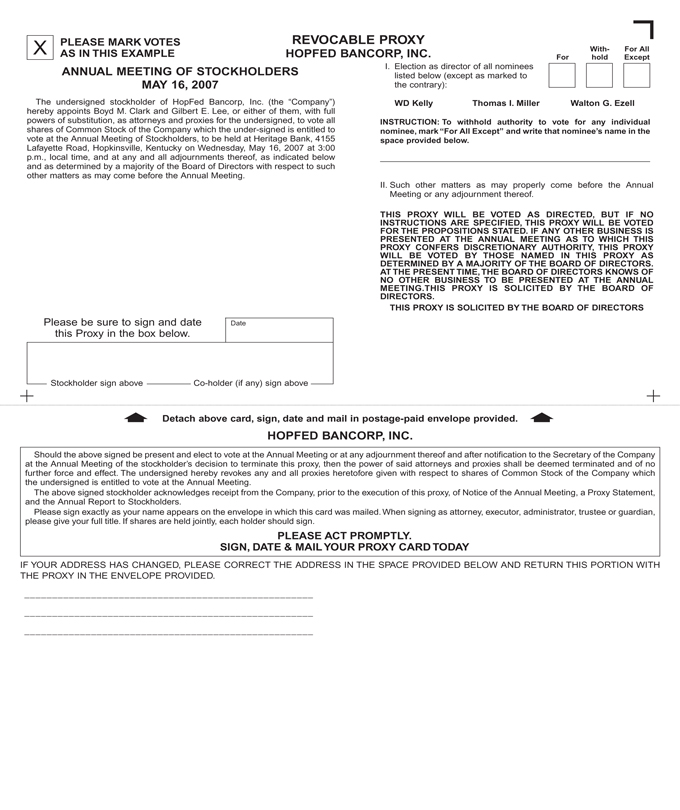

VOTING AND REVOCATION OF PROXIES

Proxies solicited by the Board of Directors of the Company will be voted in accordance with the directions given therein.Properly executed but unmarked proxies will be voted FOR Proposal I to elect three nominees of the Nominating and Corporate Governance Committee of the Board of Directors as directors of the Company. If any other matters are properly brought before the Annual Meeting as to which proxies in the accompanying form confer discretionary authority, the persons named in the accompanying proxies will vote the shares represented thereby on such matters as determined by a majority of the Board of Directors. The proxies solicited by the Board of Directors confer discretionary authority on the persons named therein to vote with respect to the election of any person as a director where the nominee is unable to serve or for good cause will not serve, with respect to matters incident to the conduct of the Annual Meeting and with respect to any other matter presented to the Annual Meeting if notice of such matter has not been delivered to the Company in accordance with the Certificate of Incorporation and Bylaws. Proxies marked as abstentions will not be counted as votes cast. In addition, shares held in street name which have been designated by brokers on proxy cards as not voted (“broker non-votes”) will not be counted as votes cast. Proxies marked as abstentions or as broker non-votes, however, will be treated as shares present for purposes of determining whether a quorum is present.

Stockholders who execute the form of proxy enclosed herewith retain the right to revoke such proxies at any time prior to exercise. Unless so revoked, the shares represented by properly executed proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies may be revoked at any time prior to exercise by written notice to the Secretary of the Company or by the filing of a properly executed, later-dated proxy. A proxy will not be voted if a stockholder attends the Annual Meeting and votes in person. The presence of a stockholder at the Annual Meeting alone will not revoke such stockholder’s proxy.

VOTING SECURITIES

The securities which can be voted at the Annual Meeting consist of shares of the Company’s common stock, $.01 par value per share (the “Common Stock”). Stockholders of record as of the close of business on March 30, 2007 (the “Record Date”) are entitled to one vote for each share of Common Stock then held on all matters. As of the Record Date, 3,617,601 shares of the Common Stock were issued and outstanding. The presence, in person or by proxy, of at least one-third of the total number of shares of Common Stock outstanding and entitled to vote will be necessary to constitute a quorum at the Annual Meeting.

Persons and groups owning in excess of 5% of Common Stock are required to file certain reports regarding such ownership with the Company and the Securities and Exchange Commission (“SEC”) pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As of the Record Date, management was aware of the persons listed below who beneficially owned more than 5% of the outstanding shares of Common Stock. This information is based on the most recent report filed by such persons.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Shares of Common Stock Outstanding | ||||

Jeffrey L. Gendell Tontine Management, L.L.C. Tontine Financial Partners, L.P. 55 Railroad Avenue Greenwich, CT 06830 | 245,128 | (1) | 6.8 | % |

| (1) | Mr. Gendell serves as the managing member of Tontine Management, L.L.C., a Delaware limited liability company (“TM”), which is the general partner of Tontine Financial Partners, L.P., a Delaware limited partnership (“TFP”). TM has the power to direct the affairs of TFP, including decisions respecting the disposition of the proceeds from the sale of the shares. Mr. Gendell directs TM’s operations. |

PROPOSAL I — ELECTION OF DIRECTORS

The Company’s Certificate of Incorporation requires that directors be divided into three classes, as nearly equal in number as possible, the members of each class to serve for a term of three years and until their successors are elected and qualified. The Nominating and Corporate Governance Committee of the Board of Directors has nominated WD Kelley, Thomas I. Miller and Walton G. Ezell to serve for a three-year term and until their successors are elected and qualified. Delaware law and the Company’s Bylaws provide that directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the election of directors.

It is intended that the persons named in the proxies solicited by the Board of Directors will vote for the election of the named nominee. Stockholders are not entitled to cumulate their votes for the election of directors. If the nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute director as the Nominating and Corporate Governance Committee of the Board of Directors may recommend, or the Board of Directors may reduce the number of directors to eliminate the vacancy.

The following table sets forth for the nominees and for each director and named executive officer such person’s name, age, and the year such person first became a director, and the number of shares and percentage of Common Stock beneficially owned.

2

The Board of Directors recommends a vote “FOR” the nominees named below as directors of the Company.

NAME | AGE(1) | YEAR FIRST ELECTED DIRECTOR (2) | PRESENT TERM TO EXPIRE | SHARES OF COMMON STOCK BENEFICIALLY OWNED (3)(4) | PERCENT OF CLASS | |||||||

| BOARD NOMINEES FOR TERM TO EXPIRE IN 2010 | ||||||||||||

WD Kelley | 86 | 1972 | 2007 | 53,364 | 1.5 | % | ||||||

Thomas I. Miller | 62 | 2001 | 2007 | 6,647 | * | |||||||

Walton G. Ezell | 70 | 1965 | 2007 | 57,433 | 1.6 | % | ||||||

| DIRECTORS CONTINUING IN OFFICE | ||||||||||||

Boyd M. Clark | 61 | 1990 | 2008 | 94,081 | (5) | 2.6 | % | |||||

Harry J. Dempsey | 49 | 1999 | 2008 | 40,900 | 1.1 | % | ||||||

Gilbert E. Lee | 63 | 1999 | 2008 | 49,453 | 1.3 | % | ||||||

Kerry B. Harvey | 49 | 2001 | 2009 | 11,900 | * | |||||||

John E. Peck | 42 | 2000 | 2009 | 63,305 | (6) | 1.7 | % | |||||

Other Named Executive Officers | ||||||||||||

Michael L. Woolfolk | 53 | — | — | 28,101 | (7) | * | ||||||

Billy C. Duvall | 41 | — | — | 25,436 | (7) | * | ||||||

Michael F. Stalls | 55 | — | — | 12,509 | (8) | * | ||||||

Keith Bennett | 45 | — | — | 3,252 | * | |||||||

Robert Burrow | 52 | — | — | 10,700 | (9) | * | ||||||

All Executive Officers and Directors as a Group (13 persons) | 457,081 | (10) | 11.9 | %(11) | ||||||||

| * | Less than 1% of the outstanding Common Stock. |

| (1) | At December 31, 2006. |

| (2) | Includes term of office as director of Heritage Bank (the “Bank”) prior to formation of the Company as the holding company for the Bank. Each director of the Company is also a director of the Bank. |

| (3) | At the Record Date. In accordance with Rule 13d-3 under the Exchange Act, a person is considered to “beneficially own” any shares of Common Stock (a) over which he has or shares voting or investment power, or (b) as to which he has the right to acquire beneficial ownership at any time within 60 days of the Record Date. As used herein, “voting power” is the power to vote or direct the vote of shares, and “investment power” is the power to dispose or direct the disposition of shares. Includes shares owned directly by the named individuals, shares held by their spouses, minor children and trusts over which they have or share voting or investment power. Does not include shares held or beneficially owned by other relatives as to which the named individuals disclaim beneficial ownership. Also includes options to purchase Common Stock which are exercisable within 60 days of the Record Date. See “— Directors’ Compensation — 1999 Stock Option Plan.” |

| (4) | Includes unvested shares held in the Company’s 2004 Long-Term Incentive Plan (the “2004 Plan”) that may be voted by the following persons: 675 shares by each non-employee director; 4,402 shares by Mr. Peck; 2,222 shares by Mr. Clark; 3,463 shares by Mr. Woolfolk; 2,474 shares by Mr. Duvall, 2,215 shares by Mr. Stalls, 1,962 shares by Mr. Bennett and 350 shares by Mr. Burrow. |

| (5) | Includes 10,772 shares of Common Stock pledged as security for a loan from an unaffiliated party. |

(Footnotes continued on next page)

3

| (6) | Includes options to purchase 50,000 shares of Common Stock which are exercisable within 60 days of the Record Date. |

| (7) | Includes options to purchase 20,000 shares of Common Stock which are exercisable within 60 days of the Record Date. |

| (8) | Includes options to purchase 10,000 shares of Common Stock which are exercisable within 60 days of the Record Date. Excludes options to purchase 10,000 shares which are not exercisable within 60 days of the Record Date. Such options would become fully exercisable upon a change in control of the Company as defined in the option plans. |

| (9) | Includes options to purchase 10,000 shares of Common Stock which are exercisable within 60 days of the Record Date. |

| (10) | Includes options to purchase 215,704 shares of Common Stock which are exercisable within 60 days of the Record Date. Excludes options to purchase 10,000 shares which are not exercisable within 60 days of the Record Date. Such options would become fully exercisable upon a change in control of the Company as defined in the option plans. |

| (11) | Includes 3,617,601 of the Company’s Common Stock outstanding as of the record date plus options to purchase 215,704 shares of Common Stock which are exercisable within 60 days of the Record Date. Excludes options to purchase 10,000 shares which are not exercisable within 60 days of the Record Date. Such options would become fully exercisable upon a change in control of the Company as defined in the option plans. |

Listed below is certain information about the principal occupations of the Board nominees and the other directors of the Company. Unless otherwise noted, all such persons have held these positions for at least five years.

WD Kelley. Prior to his retirement in 1980, Mr. Kelley served as Superintendent of Schools for Christian County, Kentucky. Mr. Kelley currently serves as Chairman of the Board of Directors of the Bank, a position he has held since 1995. He also serves as Chairman of the Board of Directors of the Company.

Thomas I. Miller, PHD, CPA. Dr. Miller has served as a professor of accounting at Murray State University in Murray, Kentucky for 33 years. Since 1980, Dr. Miller has also been a partner in the independent accounting firm of Miller and Wilson in Murray, Kentucky.

Walton G. Ezell. Mr. Ezell is a self-employed farmer engaged in the production of grain in Christian County, Kentucky.

Boyd M. Clark. Mr. Clark has served as Senior Vice President — Loan Administrator of the Bank since 1995. Prior to his current position, Mr. Clark served as First Vice President of the Bank. He has been an employee of the Bank since 1973. Mr. Clark also serves as Vice President and Secretary of the Company. From May-July 2000, Mr. Clark served as Acting President of both the Company and the Bank.

Harry J. Dempsey. Dr. Dempsey has served as an anesthesiologist with Christian County Anesthesia in Hopkinsville, Kentucky, since 1985.

Gilbert E. Lee. Mr. Lee is co-owner of C&L Rentals, LLC, a residential and commercial real estate rental company.

Kerry B. Harvey. Mr. Harvey is a partner in the law firm of Owen, Harvey and Carter.

John E. Peck. Mr. Peck has served as President and Chief Executive Officer of both the Company and the Bank since July 2000. Prior to that, Mr. Peck was President and Chief Executive Officer of United Commonwealth Bank and President of Firstar Bank-Calloway County.

Other Named Executive Officers

Michael L. Woolfolk. Mr. Woolfolk has served as Executive Vice President and Chief Operations Officer of the Bank since August 2000. Prior to that, he was President of Firststar Bank-Marshall County, President and Chief Executive Officer of Bank of Marshall County and President of Mercantile Bank.

Billy C. Duvall. Mr. Duvall has served as Vice President, Chief Financial Officer and Treasurer of the Company and the Bank since June 1, 2001. Prior to that, he was an Auditor with Rayburn, Betts & Bates, P.C., independent public accountants and a Principal Examiner with the National Credit Union Administration.

Michael F. Stalls. Mr. Stalls has served as Vice President, Chief Credit Officer of the Bank since May 28, 2004. Prior to that, he was Senior Vice President and Chief Credit Officer for the southern Tennessee markets of Regions Bank.

4

Keith Bennett. Mr. Bennett has served as Montgomery County, Tennessee Market President for the Bank since November 2005. Prior to that, Mr. Bennett was Vice President of Commercial Lending for Farmers and Merchants Bank and First Federal Savings and Loan, both of Clarksville, Tennessee.

Robert Burrow. Mr. Burrow has served as Fulton County, Kentucky Market President for the Bank since September 2002. From 1992 to 2002, Mr. Burrow held the same position in for Old National Bank of Evansville, Indiana.

CORPORATE GOVERNANCE AND OTHER MATTERS

Board of Director and Stockholder Meetings

The Board of Directors met 12 times during the fiscal year ended December 31, 2006. All directors attended at least 75% of the Board of Directors meetings and assigned committee meetings in 2006. The Company encourages director’s attendance at its annual stockholder meetings and requests that directors make reasonable efforts to attend such meetings. All of the members of the Board of Directors with the exception of Dr. Miller attended the 2006 Annual Meeting of Stockholders.

Board of Director Independence

Each year, the Board of Directors reviews the relationships that each director has with the Company and with other parties. Only those directors who do not have any of the categorical relationships that preclude them from being independent within the meaning of applicable NASDAQ rules and who the Board of Directors affirmatively determines have no relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director are considered to be “independent directors.” The Board of Directors has reviewed a number of factors to evaluate the independence of each of its members. These factors include its members’ relationships with the Company and its competitors, suppliers and customers; their relationships with management and other directors; the relationships their current and former employers have with the Company; and the relationships between the Company and other companies of which the Company’s Board members are directors or executive officers. After evaluating these factors, the Board of Directors has determined that Messrs. Kelley, Miller, Ezell, Dempsey, Lee and Harvey, are independent directors of the Company within the meaning of applicable NASDAQ listing standards.

Independent members of the Board of Directors of the Company meet in executive session without management present and are scheduled to do so at least two times per year. During the fiscal year ended December 31, 2006, the independent members of the Board of Directors met two times in executive session without management present.

Stockholder Communications

Stockholders may communicate directly with members of the Board of Directors or the individual chairman of standing Board of Directors committees by writing directly to those individuals at the following address: P.O. Box 537, Hopkinsville, Kentucky 42241. The Company’s general policy is to forward, and not to intentionally screen, any mail received at the Company’s corporate office that is sent directly to an individual, unless the Company believes the communication may pose a security risk. The Board of Directors reserves the right to revise this policy in the event it is abused, becomes unworkable or otherwise does not efficiently serve the policy’s purpose.

Code of Ethics

The Board of Directors has adopted a Code of Ethics that applies to all officers, other employees and directors. A link to the Code of Ethics is on the Investor Relations portion of the Company’s website at:http://www.bankwithheritage.com. Any waiver or substantive amendments of the Code of Ethics applicable to the Company’s directors and executive officers also will be disclosed on the Company’s website.

5

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors has a standing Audit Committee, Compensation Committee, and Nominating Corporate Governance Committee. The Board of Directors has determined that all of the directors who serve on these committees are independent within the meaning of applicable Securities and Exchange Commission (“SEC”) rules and NASDAQ listing standards. The Board of Directors has adopted a charter for each of the three standing committees. Links to these committee charters are on the “Investor Relations” portion of the Company’s website at:http://www.bankwithheritage.com. The Board of Directors of each of the Company and the Bank also has an Executive Committee.

Audit Committee

The current members of the Audit Committee are Dr. Dempsey, who serves as the chairman, Mr. Kelley, Mr. Lee and Dr. Miller. Each of the members of the committee is independent within the meaning of applicable NASDAQ rules. The Board of Directors has determined that Dr. Miller is an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K.

The Audit Committee has oversight responsibility for the quality and integrity of the Company’s financial statements. The Audit Committee meets privately with the independent auditors, has the sole authority to retain and dismiss the independent auditors and reviews their performance and independence from management. The independent auditors have unrestricted access and report directly to the committee. The Audit Committee met six times during 2006. The primary functions of the Audit Committee are to oversee: (i) the audit of the financial statements of the Company provided to the SEC, the shareholders and the general public; (ii) the Company’s internal financial and accounting processes; and (iii) the independent audit process. Additionally, the Audit Committee has responsibilities relating to: (i) registered public accounting firms; (ii) complaints relating to accounting, internal accounting controls or auditing matters; (iii) authority to engage advisors; and (iv) funding as determined by the audit committee. These and other aspects of the Audit Committee’s authority are more particularly described in the Audit Committee Charter adopted by the Board of Directors, available on the “Investor Relations” portion of the Company’s website at:http://www.bankwithheritage.com.

The Audit Committee has adopted a formal policy concerning approval of audit and non-audit services to be provided to the Company by its independent auditor. The policy requires that all services to be provided by the independent auditor, including audit services and permitted audit-related and non-audit services, must be pre-approved by the Audit Committee. The Audit Committee approved all audit and non-audit services provided during 2006.

Compensation Committee

The members of the Compensation Committee are Mr. Lee, who serves as the Chairman, and Messrs. Ezell, Kelley, Harvey and Miller, each of whom is a non-employee director and is also independent within the meaning of NASDAQ listing standards. The Compensation Committee met two times during 2006. The functions of the Compensation Committee include making recommendations to the Board of Directors concerning compensation, including incentive compensation, of the executive officers and directors. The Compensation Committee also administers our stock incentive plans. A link to the Compensation Committee Charter is on the “Investor Relations” portion of our website at:http://www.bankwithheritage.com.

Nominating and Corporate Governance Committee

The independent members of the Board of Directors serve as the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for evaluating and recommending individuals for election or re-election to the Board of Directors, including those recommendations submitted by stockholders, the evaluation of the performance of the Board of Directors and its committees, and the evaluation and recommendation of corporate governance policies. In 2006, the Nominating and Corporate Governance Committee held one meeting

6

It is a policy of the Nominating and Corporate Governance Committee that candidates for director possess the highest personal and professional integrity, have demonstrated exceptional ability and judgment and have skills and expertise appropriate for the Company and serving the long-term interests of the Company’s shareholders. The committee’s process for identifying and evaluating nominees is as follows: (1) in the case of incumbent directors whose terms of office are set to expire, the committee reviews such directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance, and any related party transactions with the Company during the applicable time period (incumbent directors whose terms are to expire do not participate in such review); and (2) in the case of new director candidates, the committee first conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors.

The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications, including whether the nominee is independent within the meaning of NASDAQ rules, and then selects a candidate for recommendation to the Board of Directors by majority vote. In seeking potential nominees, the Nominating and Corporate Governance Committee uses its and management’s network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates, nor has the committee rejected a timely director nominee from a stockholder(s) holding more than 5% of the Company’s voting stock.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders, provided the stockholders follow the procedures set forth in the Company’s Certificate of Incorporation. The committee does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether the candidate was recommended by a stockholder or otherwise.

The Company’s Certificate of Incorporation provides that, to be timely, a stockholder’s notice of nomination must be delivered or mailed to the Secretary of the Company not less than 30 days nor more than 60 days prior to an annual meeting; provided, however, that in the event that less than 40 days’ notice of the meeting is given or made to stockholders, notice by the stockholder, to be timely, must be not later than close of business on the 10th day following the date on which notice is mailed. A stockholder’s notice of nomination must also set forth as to each person who the stockholder proposes to nominate for election as a director, (a) the name, age, business address and, if known, residence address of such person, (b) the principal occupation or employment of such person, (c) the class and number of shares of the Company which are beneficially owned by such person, and (d) any other information reasonably requested by the Company. At the request of the Board of Directors, any person nominated by the Board of Directors for election as a director shall furnish to the Secretary of the Company that information required to be set forth in a stockholder’s notice of nomination which pertains to the nominee. Stockholder nominations may be proposed by any shareholder eligible to vote at an annual meeting provided the notice is timely and complies with the informational requirements of the Certificate of Incorporation. See “Date for Submission of Stockholder Proposals.”

The Nominating and Corporate Governance Committee may reject any nomination by a stockholder not made in accordance with the requirements of the Company’s Certificate of Incorporation. Notwithstanding the foregoing procedures, if neither the Board of Directors nor such committee makes a determination as to the validity of any nominations by a shareholder, the chairman of the annual meeting shall, if the facts warrant, determine at the annual meeting whether the nomination was made in accordance with the terms of the Certificate of Incorporation.

Executive Committees

The Board of Directors of each of the Company and the Bank has established an Executive Committee which, when the Board of the Company or the Bank is not in session, may exercise all of the authority of the Board except to the extent that such authority is limited by law or Board resolution. Members of the Executive Committee of each of the Company and the Bank are Messrs. Kelley, Lee, Peck and Ezell. During 2006, the Executive Committee of the Company and the Bank each conducted three meetings.

7

COMPENSATION DISCUSSION AND ANALYSIS

Overview of Compensation Program

The Compensation Committee of the Board of Directors (the “Committee”), comprised entirely of independent directors, has responsibility for establishing, implementing and monitoring adherence with the Company’s compensation program. The role of the Committee is to oversee, on behalf of the Board and for the benefit of the Company and its shareholders, the Company’s compensation and benefit plans and policies, administer its stock plans (including reviewing and approving equity grants to directors and executive officers) and review and approve annually all compensation decisions relating to the CEO and the other executive officers of the Company. The Committee meets a minimum of two times annually to review executive compensation programs, approve compensation levels and performance targets, review management performance, and approve final executive bonus distributions.

The Committee operates in accordance with a charter, most recently revised in January 2007, which sets forth its rights and responsibilities. The Committee and the Board annually review the charter.

Introduction

In this section, we discuss certain aspects of our compensation program as it pertains to our President and Chief Executive Officer, our Chief Financial Officer, and our other most highly-compensated executive officers listed in the Summary Compensation Table. We refer to these seven persons throughout as the “named executive officers.” Our discussion focuses on compensation and practices relating to our most recently completed fiscal year.

We believe that the performance of each of the named executive officers has the potential to impact both our short-term and long-term profitability. Therefore, we place considerable importance on the design and administration of the executive compensation plans, policies and benefit programs.

Compensation Philosophy and Objectives

The Company and the Committee believe that the compensation paid to executive officers should be closely aligned with the performance of the Company, that such compensation must be competitive with similar institutions in the region, and that such compensation should assist the Company in attracting and retaining key executives critical to the Company’s long-term success. The Committee utilizes both salary and equity compensation as a tool to attract and retain key executive officers. The Committee believes that compensation based on short term performance goals may not always be in the best interest of stockholders. The Committee believes that compensation should be structured to ensure that a portion of the executive’s compensation opportunities will be directly related to Company achieving its longer term goals established in its Three Year Business Plan. Execution of the Company’s Business Plan may not result in immediate improvement in the Company’s stock price since the Company’s current focus is on expansion into higher growth markets. This expansion may result in higher operating expenses and lower earnings in the near term. However, the Board of Directors is committed to the long term growth opportunities and enhanced shareholder value that this expansion provides.

The Board of Directors remains committed to shareholder value by achieving a higher stock price in the future, with most operational and financial goals set within a five year time frame. The Committee recognizes that the Company’s stock is thinly traded and daily prices can fluctuate widely based on small trade volumes, making it difficult to measure the short-term performance of the Company’s stock. For the Company’s most senior executive officers, including the executive officers named in this proxy statement, the equity compensation is designed to reward Company-wide performance of the business goals set out by the Company’s Board of Directors. In last three years, the Company has chosen to utilize equity compensation in the form of restricted stock awards in addition to a base salary as a means to attract and retain key executive officers.

8

Role of Executive Officers and Compensation Consultant

The Committee makes all compensation decisions for the CEO and all other executive officers of the Company. The CEO annually reviews the performance of each other executive officer. The conclusions reached and recommendations based on these reviews, including with respect to salary adjustments and annual award amounts, are presented to the Committee. The Committee considers the CEO’s recommendation when making its final compensation decision for all executives other than the CEO.

The Committee utilizes the Human Resource Department and also has the authority under its charter to engage the services of outside consultants to assist the Committee. In accordance with this authority, the Committee in 2006 utilized the 2005 Financial Institutions Compensation Survey Report (the “Survey”), prepared for the Kentucky Bankers Association (“KBA”) by Crowe Chizek, to compare and benchmark the total compensation program for the CEO and other executive officers. The Survey collects data from over 94 financial institutions and reports data on more than 8,800 bank employee salaries. The Company participates in this Survey annually.

Setting Executive Compensation

The Company intends to continue its strategy of compensating its executives through programs that emphasize performance-based incentive compensation. The Company has structured cash and equity compensation to motivate executives to achieve the business goals set by the Company and rewards the executives for achieving such goals. For the executive officers, including the named executive officers in the Summary Compensation Table, the current compensation package includes a base salary, grants of stock options and/or awards of restricted stock. Executives with lending responsibilities may also receive cash bonuses based on incentives including production, asset quality and margin enhancement. The executive’s base salary is intended to provide a certain level of income commensurate with an executive’s position, responsibilities, and contributions to the Company. The Committee believes the combined value of base salary plus annual incentive is competitive with the salary and bonus provided to similarly situated executives as reflected in the salary report from the Kentucky Banker’s Association.

Base Salary

Base salary ranges are established based on a number of factors, including the KBA Survey of similar asset sized financial institutions as well as other market data. The KBA Survey illustrates the market rate for select executive positions expressed as a percentage of the median paid by the respondent companies. Executive positions are individually benchmarked against these survey sources annually to establish a competitive salary range for each position, which is typically targeted to be at or slightly above the median of the survey results.

The actual base salary of each executive officer relative to the target established above is determined by the executive’s performance, which is evaluated annually by the CEO and reviewed and approved by the Committee. In the case of the CEO, the Committee also considers the performance of the Company, and the anticipated level of difficulty of replacing the CEO with someone of comparable experience and skill. Based on these factors, the Committee established the CEO’s base salary at $230,000 per year in June 2006. Salaries for the named executive officers are set forth on the Summary Compensation Table.

The Committee adjusted the salaries of Mr. Bennett to $135,000 and Mr. Burrow to $121,200 effective January 1, 2007. The Committee will adjust the salaries for the remaining name executives in June 2007, with any changes in base salary effective as of July 1, 2007.

9

Long Term Incentive Compensation

In 2006, the Committee made grants of restricted stock to certain executive officers, including the CEO, under the Company’s stock plans. The purpose of these equity incentives is to encourage stock ownership, offer long-term performance incentive and to more closely align the executive’s compensation with the return received by the Company’s shareholders. In 2006, the Committee made restricted stock grants to the CEO and executive officers as outlined in the table titledGrant of Plan – Based Awards included in this document. Grants of stock options and restricted stock are typically made on an annual basis at the Committee’s June meeting following the public release of the Company’s fiscal year-end results. Stock options, when awarded, have an exercise price equal to 100% of the fair market value of the Company’s common stock on the date of grant. Restricted stock grants vest equally over a four year period but vesting may be accelerated due to the a change in control of the Company, an exercise of options by the award recipient and the death or termination without cause of the award recipient. In 2007, the Committee has not approved any stock option grants or restricted stock awards.

Retirement Plans

Defined Contribution Plan

The Company has one defined contribution retirement plan in which certain of the named executive officers currently participate.

401(k) Plan

The Company’s 401(k) Plan is a tax-qualified plan that covers all eligible salaried and hourly employees. Currently the Company makes matching contributions of 100% up to the 4% elective deferral rate. Elective deferrals of greater than 4% are not matched by the Company. In addition, the Company provides an additional contribution for all eligible employees equal to 4% of their base salary. The 401(k) Plan is a defined contribution plan and as such the ultimate benefit is a derivative of the contributions made and the performance of the underlying investments. Each participant self directs their respective investments from an approved master list of qualifying investment funds. No Company issued securities are held in the 401(k) plan. For the year ended December 31, 2006, all named executive officers with the exception of Mr. Bennett participated in the 401(k) Plan. Mr. Bennett’s participation in the Company’s 401(k) Plan began on January 1, 2007. For the year ended December 31, 2006, the Company’s total expense related to its 401(k) Plan was $334,000.

Perquisites and Other Personal Benefits

The Company does not provide the named executive officers with perquisites or other personal benefits such as Company vehicles, club memberships, financial planning assistance, tax preparation, or other benefits not described above. The only exception is that the Company provides Mr. Peck and Mr. Bennett with reimbursement for country club dues. Mr. Peck also has the use of a company owned vehicle. The value of these benefit are disclosed in the Summary Compensation Table.

Employment and Other Agreements

The Company has employment agreements with Messrs Peck, Woolfolk, and Bennett.

The employment agreement with Mr. Peck is a three year agreement that automatically extends each July 3rd to provide for a continuous 36 month term unless either party gives notice to the other of its’ election to terminate this automatic renewal provision. The agreement provides for a base salary and certain perquisites as noted above. In addition, the agreement provides certain payments to Mr. Peck in the event his employment is terminated as a result of a change of control of the Company or his termination without cause. In either event, Mr. Peck is entitled to receive an amount equal to two times Mr. Peck’s base salary plus the continuation of other employee benefits through the unexpired term of the contract.

10

The employment agreement with Mr. Woolfolk is a three year agreement that automatically extends each August 15th to provide for a continuous 36 month term unless either party gives notice to the other of its’ election to terminate this automatic renewal provision. The agreement provides for a base salary as noted above. In addition, the agreement provides certain payments to Mr. Woolfolk in the event his employment is terminated as a result of a change of control of the Company or his termination without cause. In either event, Mr. Woolfolk is entitled to receive an amount equal to two times Mr. Woolfolk’s base salary plus the continuation of other employee benefits through the unexpired term of the contract.

The employment agreement with Mr. Bennett is a four year agreement beginning November 2, 2005. The agreement provides for a base salary of $135,000 for 2007. In addition, the agreement provides certain payments to Mr. Bennett in the event of his termination of employment without cause. In the event of termination of employment without cause, Mr. Bennett is entitled to receive an amount equal to his base salary plus the continuation of other employee benefits through the term of the contract

Except for these agreements, and our broad-based severance policy, none of our named executive officers has an agreement which requires us to pay their salaries for any period of time. We entered into these agreements because the banking industry has been consolidating for a number of years, and we do not want our executives distracted by a rumored or actual change in control. Further, if a change in control should occur, we want our executives to be focused on the business of the organization and the interests of shareholders. In addition, we think it is important that our executives can react neutrally to a potential change in control and not be influenced by personal financial concerns. We believe these agreements are consistent with market practice and assist us in retaining our executive talent.

The Company has a Supplemental Executive Retirement Plan (“SERP”) for Mr. Robert Burrow. The SERP provides for monthly payments to the covered executive in amounts indexed to an underlying life insurance policy. The benefit takes the form of two components: the pre-retirement benefit and the post-retirement benefit. The respective benefits are accrued annually as an expense to the Company and recorded as a liability payable to the covered executive at the normal retirement age of 65. The pre-retirement component is paid in a lump sum and is payable to a named beneficiary in the event of the covered executive’s death prior to the beginning of post retirement payments. The post-retirement benefit is payable monthly for 180 months. At December 31, 2006, the accrued liability for Mr. Burrow was $99,732. The cash surrender value of the underlying life insurance policy of which the Company is the owner and beneficiary was $132,880 at December 31, 2006.

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code limits the deductibility for federal income tax purposes of executive compensation paid to the CEO and the four other most highly compensated officers of a public company to $1,000,000 per year, but contains an exception for certain performance-based compensation. Base salary, by its nature, does not qualify as performance-based compensation under Section 162(m). The Company’s grants of stock options and restricted stock under its stock award plans qualify as performance-based compensation under Section 162(m).

11

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors hereby furnishes this report to the stockholders of the Company in accordance with rules adopted by the Securities and Exchange Commission. The Compensation Committee has reviewed and discussed with management the Company’s Compensation Discussion and Analysis contained in this proxy statement. Based upon this review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement. This report is submitted on behalf of the members of the Compensation Committee.

Respectfully submitted on March 30, 2007.

| Gilbert E. Lee, Chairman |

| Kerry Harvey |

| Walton G. Ezell |

| Thomas I. Miller |

| WD Kelley |

Additional Information with Respect to Compensation Committee Interlocks and Insider Participation in Compensation Decisions

None of the members of the Compensation Committee was an officer or employee of HopFed Bancorp, Inc. or any of our subsidiaries during 2006 or is a former officer of HopFed Bancorp, Inc. or any of our subsidiaries.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth compensation information for the Company’s CEO, CFO, and the five other most highly compensated executive officers for the fiscal year ended December 31, 2006.

Name and Principal Position | Year | Salary | Bonus(1) | Stock Awards(2) | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other | Total | ||||||||||||||||

John E. Peck President & CEO | 2006 | $ | 213,175 | — | $ | 14,627 | N/A | N/A | N/A | $ | 31,520 | $ | 259,322 | ||||||||||||

Billy C. Duvall Treasurer & CFO | 2006 | $ | 119,952 | — | $ | 8,437 | N/A | N/A | N/A | $ | 10,002 | $ | 138,391 | ||||||||||||

Michael L. Woolfolk COO | 2006 | $ | 167,519 | — | $ | 12,038 | N/A | N/A | N/A | $ | 14,275 | $ | 193,832 | ||||||||||||

Boyd M. Clark Secretary | 2006 | $ | 106,480 | $ | 454 | $ | 7,725 | N/A | N/A | N/A | $ | 10,626 | $ | 125,285 | |||||||||||

Michael F. Stalls Chief Credit Officer | 2006 | $ | 131,618 | $ | 6,251 | $ | 4,804 | N/A | N/A | N/A | $ | 12,572 | $ | 155,245 | |||||||||||

Keith Bennett Montgomery Co. Market President | 2006 | $ | 130,000 | $ | 175,008 | $ | 4,785 | N/A | N/A | N/A | $ | 3,965 | $ | 313,758 | |||||||||||

Robert Burrow Fulton Co. Market President | 2006 | $ | 120,176 | — | $ | 3,002 | N/A | N/A | $ | 4,295 | (3) | $ | 10,456 | $ | 137,929 | ||||||||||

(Footnotes on next page)

12

| (1) | Represents cash bonus paid for loan production and yield goals for the year ended December 31, 2006. The Bank offers cash incentives for loan officers who meet certain measured goals and objectives. Pursuant to his employment agreement, Mr. Bennett received a $120,130 bonus for meeting certain goals for loan growth and credit quality. |

| (2) | Represents restricted stock awards approved by the Compensation Committee that vest over a four-year period at a rate of 25% per year. Vesting is accelerated upon a change in control, the exercise of eligible options, and the death or termination without cause of the award recipient. The dollar amounts in this column represent restricted stock awards in 2004 and 2005 that partially vested during 2006. Messrs. Peck, Duvall, Woolfolk, Clark and Stalls received restricted stock awards that partially vested on June 15, 2006. Messrs. Peck, Duvall, Woolfolk and Clark received restricted stock awards that partially vested on June 14, 2006. Mr. Burrow received a restricted stock award that partially vested on August 18, 2006. The market price of the Common Stock on each of June 14 and June 15, 2006, was $16.22 per share, and the market price of the Common Stock on August 18, 2006 was $16.10 per share. Mr. Bennett’s restricted stock award vested on November 2, 2006. On that date the market price of the Common Stock was $16.50 per share. All compensation amounts include unpaid quarterly dividends on vested shares at $0.12 per share, plus interest on unpaid dividends at a rate of 5% per year. |

| (3) | Mr. Burrow was awarded a Supplemental Executive Retirement Plan (“SERP”) in 1985 by his former employer, the assets and liabilities of which were acquired and assumed by the Company in 2002. The SERP is fully vested. The Company accrues interest on a monthly basis to fund the SERP. See “— Nonqualified Deferred Compensation” below. |

| (4) | Includes Company matching contributions under our 401(k) plan of up to 4% of base salary of $17,111, $9,629, $13,448, $8,652, $11,029, and $9,629 for Messrs. Peck, Duvall, Woolfolk, Clark, Stalls, and Burrow, respectively. Also included in this column are amounts for a life insurance policy provided to all full time employees equal to three times the employee’s base compensation and payments on Mr. Peck’s behalf of $3,600 and Mr. Bennett’s behalf of $3,424 for local country club memberships. Other expenses also includes the lease payment of $10,416 on an automobile provided to Mr. Peck. |

Grant of Plan - Based Awards

The following table sets forth the plan-based grants made during the fiscal year ended December 31, 2006.

Name | Grant Date(1) | Estimated future payouts under Non-Equity Incentive Plan Awards | Estimated future payouts under Equity Incentive Plan Awards | All Other Stock Awards: Number of Shares of Stock(2) | All Other Option Awards: Number of Securities Underlying Options | Exercise or Base Price of Option Awards(3) | Grant Date Fair Value of Stock and Option Awards(3) | |||||||||

John E. Peck | 6/20/2006 | N/A | N/A | 2,226 | N/A | $ | 15.50 | $ | 34,503 | |||||||

Billy C. Duvall | 6/20/2006 | N/A | N/A | 1,216 | N/A | $ | 15.50 | $ | 18,848 | |||||||

Michael L. Woolfolk | 6/20/2006 | N/A | N/A | 1,677 | N/A | $ | 15.50 | $ | 25,994 | |||||||

Boyd M. Clark | 6/20/2006 | N/A | N/A | 1,079 | N/A | $ | 15.50 | $ | 16,725 | |||||||

Michael F. Stalls | 6/20/2006 | N/A | N/A | 1,334 | N/A | $ | 15.50 | $ | 20,677 | |||||||

Keith Bennett | 11/2/2006 | N/A | N/A | 1,091 | N/A | $ | 16.50 | $ | 18,002 | |||||||

| (1) | The Compensation Committee granted Messrs. Peck, Duvall, Woolfolk, Clark and Stalls restricted stock awards on June 20, 2006. The terms and conditions of Mr. Bennett’s employment contract, approved by the Compensation Committee on November 2, 2005, provide that Mr. Bennett will receive restricted stock awards equal to $18,000 on November 2, 2005, November 2, 2006 and November 2, 2007, subject to Mr. Bennett’s continued employment with the Company. |

| (2) | All restricted stock awards approved by the Compensation Committee vest over a four year period at a rate of 25% per year. Vesting is accelerated upon a change in control, the exercise of eligible options, the death or termination without cause of the grant recipient. |

| (3) | The grant date fair value of the awards shown in the above table was computed in accordance with FAS 123(R) and represents the total projected expense to the Company of awards made in 2006. |

13

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth the outstanding equity awards as of December 31, 2006.

| Option Awards | Stock Awards | |||||||||||||||

Name | Number of Shares Underlying Unexercised Options Exercisable | Number of Underlying | Option Price | Option Expiration Date | Number of Shares that have not Vested | Market Value of Shares that have not Vested(1) | ||||||||||

John E. Peck 2000 Stock Option Plan 1999 Stock Option Plan | 40,000 10,000 | N/A N/A | | $ $ | 10.00 12.33 | 5/30/2010 6/1/2011 | — — | | | — — | ||||||

2004 Restricted Stock Award | — | — | — | — | 795 | (2) | $ | 12,800 | ||||||||

2005 Restricted Stock Award | — | — | — | — | 1,381 | (3) | $ | 22,234 | ||||||||

2006 Restricted Stock Award | — | — | — | — | 2,226 | (4) | $ | 35,839 | ||||||||

Billy C. Duvall | ||||||||||||||||

1999 Stock Option Plan | 20,000 | N/A | $ | 12.33 | 6/1/2011 | — | ||||||||||

2004 Restricted Stock Award | — | — | — | — | 455 | (2) | $ | 7,326 | ||||||||

2005 Restricted Stock Award | — | — | — | — | 803 | (3) | $ | 12,928 | ||||||||

2006 Restricted Stock Award | — | — | — | — | 1,216 | (4) | $ | 19,578 | ||||||||

Michael L. Woolfolk | ||||||||||||||||

1999 Stock Option Plan | 20,000 | N/A | $ | 12.33 | 6/1/2001 | — | — | |||||||||

2004 Restricted Stock Award | — | — | — | — | 664 | (2) | 10,690 | |||||||||

2005 Restricted Stock Award | — | — | — | — | 1,122 | (3) | 18,064 | |||||||||

2006 Restricted Stock Award | — | — | — | — | 1,677 | (4) | 27,000 | |||||||||

Boyd M. Clark | ||||||||||||||||

1999 Stock Option Plan | 57,656 | N/A | $ | 17.42 | 4/24/2009 | — | — | |||||||||

2004 Restricted Stock Award | — | — | — | — | 430 | (2) | $ | 6,923 | ||||||||

2005 Restricted Stock Award | — | — | — | — | 713 | (3) | $ | 11,479 | ||||||||

2006 Restricted Stock Award | — | — | — | — | 1,079 | (4) | $ | 17,372 | ||||||||

Michael F. Stalls | ||||||||||||||||

1999 Stock Option Plan | 10,000 | 10,000 | (7) | $ | 17.34 | 6/1/2014 | — | — | ||||||||

2005 Restricted Stock Award | — | — | — | — | 881 | (3) | $ | 14,184 | ||||||||

2006 Restricted Stock Award | — | — | — | — | 1,334 | (4) | $ | 21,477 | ||||||||

Keith Bennett | ||||||||||||||||

2005 Restricted Stock Award | — | — | — | — | 871 | (5) | $ | 14,023 | ||||||||

2006 Restricted Stock Award | — | — | — | — | 1,091 | (6) | $ | 17,565 | ||||||||

Robert Burrow | ||||||||||||||||

1999 Stock Option Plan | 10,000 | N/A | $ | 12.33 | 9/6/2012 | — | — | |||||||||

2004 Restricted Stock Award | — | — | — | — | 350 | (2) | $ | 5,635 | ||||||||

| (1) | The fair market value of the Company’s common stock price at the end of the fiscal year was $16.10 per share. |

| (2) | Remaining unvested shares that will vest 50% on June 14, 2007 and 50% on June 14, 2008. |

| (3) | Remaining unvested shares that will vest 33.3% on June 15, 2007, 33.3% on June 15, 2008 and 33.3% on June 15, 2009. |

| (4) | Remaining unvested shares that will vest 25% on June 20, 2007, 25% on June 20, 2008, 25% on June 20, 2009 and 25% on June 20, 2010. |

| (5) | Remaining unvested shares that will vest 33.3% on November 2, 2007, 33.3% on November 2, 2008 and 33.3% on November 2, 2009. |

| (6) | Remaining unvested shares that will vest 25% on November 2, 2007, 25% on November 2, 2008, 25% on November 2, 2009 and 25% on November 2, 2010. |

| (7) | Remaining unexercisable options that will vest 50% on June 1, 2007 and 50% on June 1, 2008. |

14

Option Exercises and Stock Vested

The following table sets forth exercised options and vested awards for the fiscal year ended December 31, 2006.

| Option Awards | Stock Awards | ||||||||

Name | Number of Shares Acquired on Exercise(1) | Value Realized on Exercise | Number of Shares Acquired on Vesting(2) | Value Realized on Vesting(3) | |||||

John E. Peck | N/A | N/A | 858 | $ | 14,189 | ||||

Billy C. Duvall | N/A | N/A | 495 | $ | 8,185 | ||||

Michael L. Woolfolk | N/A | N/A | 706 | $ | 11,677 | ||||

Boyd M. Clark | N/A | N/A | 453 | $ | 7,494 | ||||

Michael F. Stalls | N/A | N/A | 294 | $ | 4,804 | ||||

Keith Bennett | N/A | N/A | 290 | $ | 4,931 | ||||

Robert Burrow | N/A | N/A | 175 | $ | 3,002 | ||||

| (1) | In 2006, the Compensation Committee did not grant any options, nor were any options exercised. |

| (2) | Represents the number of shares of restricted stock vested in 2006. |

| (3) | For Messrs. Peck, Duvall, Woolfolk, Clark and Stalls, the dollar value realized on vesting shares was computed using the closing price of the Company’s common stock at June 15, 2006 of $15.71 per share, plus unpaid dividends of $0.12 per share per quarter and interest on unpaid dividends of 5% per year. Mr. Bennett’s award vested on November 2, 2006, and the value realized on vesting shares was computed using the closing price of the Company’s common stock on that date of $16.50 per share, plus unpaid dividends of $0.12 per quarter and interest on unpaid dividends of 5% per year. Mr. Burrow’s award vested on August 18, 2006. The value realized on vesting shares was computed using the closing price of the Company’s common stock on that date of $16.10 per share, plus unpaid dividends of $0.12 per quarter and interest on unpaid dividends of 5% per year. |

Nonqualified Deferred Compensation

Name | Executive in the Last FY | Registrant Contributions in Last FY | Aggregate Earnings in Last FY | Aggregate Withdrawals/ Distributions | Aggregate Balance at Last FYE | |||||||||

John E. Peck | N/A | N/A | N/A | N/A | N/A | |||||||||

Billy C. Duvall | N/A | N/A | N/A | N/A | N/A | |||||||||

Michael L. Woolfolk | N/A | N/A | N/A | N/A | N/A | |||||||||

Boyd M. Clark | N/A | N/A | N/A | N/A | N/A | |||||||||

Michael F. Stalls | N/A | N/A | N/A | N/A | N/A | |||||||||

Keith Bennett | N/A | N/A | N/A | N/A | N/A | |||||||||

Robert Burrow | N/A | $ | 4,295 | (1) | N/A | N/A | $ | 99,732 | (2) | |||||

| (1) | In September 2002, the Company purchased assets and assumed liabilities of Old National Bank of Evansville that were assigned to its retail banking and insurance offices located in Fulton, Kentucky. These liabilities included a Supplemental Executive Retirement Plan (“SERP”) between Mr. Burrow and his former employer. The SERP became fully vested in 1992. The SERP has a pre-retirement death benefit payable to the Mr. Burrow’s beneficiaries. The SERP has a post-retirement benefit of 15 annual payments of $7,832 per year payable to Mr. Burrow or his beneficiaries. |

| (2) | The Company accrued interest expense annually related to the funding of Mr. Burrow’s SERP. The cost of the SERP is funded by a Bank Owned Life Insurance Policy on Mr. Burrow. At December 31, 2006, the cash surrender value of the underlying life insurance policy, of which the Company is the owner and beneficiary, was $132,880. If the Company surrenders the life insurance policy prior to the death of Mr. Burrow, federal income taxes would be due on the accumulated earnings of the policy. |

15

Equity Compensation Plans

The following table provides information as of December 31, 2006 with respect to the shares of Common Stock that may be issued under the Company’s existing equity compensation plans.

Plan Category | Number of Securities to be issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (3) | ||||

Equity Compensation Plans Approved by Stockholders(1) | 680,475 | $ | 16.10 | 415,713 | |||

Equity Compensation Plans Not Approved by Stockholders(2) | 40,000 | $ | 10.00 | — | |||

| 720,475 | $ | 15.30 | 415,713 | ||||

| (1) | Consists of the 1999 Plan and the 2004 Plan. |

| (2) | Consists of the 2000 Plan which was adopted by the Board of Directors in connection with the employment of John E. Peck as President and Chief Executive Officer of the Company and the Bank. Pursuant to such Plan and his employment agreement, Mr. Peck was granted options to purchase 40,000 shares of Common Stock at an exercise price of $10.00 per share. |

| (3) | Includes shares available for future issuance under the 1999 Plan and the 2004 Plan. In addition, any shares of Common Stock subject to an option which remains unissued after the cancellation, expiration or exchange of such option shall again become available for grant under the 1999 Plan and the 2004 Plan. There will be no further grants of options under the 2000 Plan. |

DIRECTOR COMPENSATION

The following table sets forth the compensation received by the Company’s non-employee directors.

Name(1) | Fees Earned or Paid in Cash(2) | Stock Awards(3) | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other (4) Compensation | Total(5) | ||||||||||

WD Kelley | $ | 18,075 | $ | 3,076 | N/A | N/A | N/A | N/A | $ | 21,151 | |||||||

Thomas I. Miller | $ | 11,950 | $ | 3,076 | N/A | N/A | N/A | 4,200 | $ | 19,226 | |||||||

Walton G. Ezell | $ | 13,300 | $ | 3,076 | N/A | N/A | N/A | N/A | $ | 16,376 | |||||||

Harry J. Dempsey | $ | 13,300 | $ | 3,076 | N/A | N/A | N/A | N/A | $ | 16,376 | |||||||

Gilbert E. Lee | $ | 14,950 | $ | 3,076 | N/A | N/A | N/A | N/A | $ | 18,026 | |||||||

Kerry B. Harvey | $ | 12,350 | $ | 3,076 | N/A | N/A | N/A | 4,200 | $ | 19,626 | |||||||

| (1) | Members of the Board of Directors of the Company do not receive fees in their capacity as such. Directors who are employed by the Company and the Bank (i.e., Messrs. Peck and Clark) receive no additional compensation for their service as directors. |

| (2) | Includes a $250 monthly retainer and, with the exception of Board Chairman Kelley, an additional $550 per month for each Bank board meeting attended. The Chairman of the Board receives $650 per month for each Bank board meeting attended. In addition, each non-employee board member receives $275 for committee meetings attended. Messers. Miller and Harvey also serve as community board members for the Bank. Community board members serve on non-voting advisory boards in their local communities of residence or influence. Each community board member receives a monthly retainer of $350. |

(Footnotes continued on next page)

16

| (3) | Represents the amount of compensation expense recognized under FAS 123R with respect to restricted stock awards granted in 2006 and prior years. In 2004, 2005 and 2006, the Compensation Committee awarded 300 shares of restricted stock to each non-employee director of the Bank. The shares vest over a four-year period, but vesting may be accelerated based on factors outlined in the HopFed Bancorp, Inc. 2004 Long Term Incentive Plan. |

| (4) | Cash payments to Directors of the Company for the participation in local Community Boards. |

| (5) | Each non-employee director has a total of 675 restricted shares that have not vested. The total compensation reported as result of the scheduled vesting will be determined by the closing price of the Company’s common stock on the date of vesting. The vesting schedule is as follows: |

| June 2007 | 225 shares | |||

| June 2008 | 225 shares | |||

| June 2009 | 150 shares | |||

| June 2010 | 75 shares |

During the year ended December 31, 2006, the Bank’s non-employee directors’ fees totaled $96,275, which included payments of $12,350 to one Director of the Bank who is not a Director of the Company. The Compensation Committee annually reviews and makes recommendations regarding director compensation. These recommendations are based upon, among other things, the Committee’s consideration of compensation paid to directors of comparable financial institutions.

1999 Stock Option Plan. Pursuant to the 1999 Stock Option Plan (the “1999 Plan”) which was approved at the 1999 Annual Meeting of Stockholders, directors and employees of the Company and the Bank are eligible to receive options to acquire shares of Common Stock and stock appreciation rights. Upon stockholders’ approval, each director of the Company (other than Messrs. Dempsey, Lee, Harvey, Peck and Miller who were subsequently elected to the Board of Directors) received an option to acquire shares of Common Stock. As of the Record Date, no stock options granted under the 1999 Plan had been exercised, and no stock appreciation rights had been granted. As of the Record Date, non-employee directors Kelley and Ezell each held an option under the 1999 Plan for 24,024 shares of Common Stock, and Mr. Clark held an option under the 1999 Plan for 57,656 shares. The exercise price of all such options is $17.42 per share. As of Record Date all such options were exercisable. In addition, as of the Record Date, Mr. Peck held options under the 1999 Plan and the 2000 Stock Option Plan (the “2000 Plan”) for 50,000 shares which were exercisable. As of the Record Date, the fair market value of the Common Stock was $16.00 per share.

2004 Long-Term Incentive Plan. Pursuant to the 2004 Plan, which was approved at the 2004 Annual Meeting of Stockholders, 200,000 shares of Common Stock (subject to adjustment as provided for in the 2004 Plan) are available for issuance pursuant to a variety of awards, including options, share appreciation rights, restricted shares, restricted share units, deferred share units, and performance-based awards. The purpose of the 2004 Plan is to attract, retain and motivate select employees, officers, directors, advisors and consultants of the Company and its affiliates and to provide incentives and rewards for superior performance. In 2006, each non-employee director received 300 shares of restricted Common Stock at a value of $15.50 per share on the date of the award.

Other Benefits. Our Bylaws require us to indemnify our directors and officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection with their service to the Company. We also provide our directors with customary directors and officers liability insurance.

17

Potential Payments Upon a Change In Control or Termination

The following table quantifies the estimated change in control payment that would have been payable to each named executive officer assuming a change in control or involuntary termination without cause had occurred on December 31, 2006, and other requirements for payment had been met. The Company is not required to make any payments to executive officers upon their voluntary termination or termination with cause.

Name | Cash Severance | Stock Option Acceleration (1) | Restricted Stock Acceleration (2) | Benefits (3) | Tax Payments (4) | Total | ||||||

John E. Peck Change of control Involuntary termination without cause | 460,000 575,000 | — — | 70,873 70,873 | 49,053 61,316 | — — | 579,926 707,189 | ||||||

Billy C. Duvall Change of control or involuntary termination | — | — | 39,832 | — | — | 39,832 | ||||||

Michael L. Woolfolk Change of control Involuntary termination without cause | 351,000 453,375 | — — | 55,754 55,754 | 40,176 51,894 | — — | 446,930 561,023 | ||||||

Boyd M. Clark Change of control or Involuntary termination without cause | — | — | 35,774 | — | — | 35,774 | ||||||

Michael F. Stalls Change of control or Involuntary termination without cause | — | — | 35,661 | — | — | 35,661 | ||||||

Keith Bennett Change of control Involuntary termination without cause | — 270,000 | — — | 31,588 31,588 | — — | — — | 31,588 301,588 | ||||||

Robert Burrow Change of control or Involuntary termination without cause | — | — | 5,635 | — | — | 5,635 |

| (1) | Assumes the immediate vesting of all unvested in-the-money stock options and the associated cash proceeds resulting from a same day sale exercise of only those previously unvested stock options using the fair market value of our Common Stock at December 31, 2006, of $ 16.10. At December 31, 2006, Mr. Stalls is the only named executive officer with unvested stock options. Those options have an exercise of $17.34, above the market prices of the Company’s common stock at December 31, 2006. |

| (2) | Assumes the immediate vesting of all unvested restricted stock upon a change in control using the fair market value of our Common Stock at December 31, 2006, of $16.10. |

| (3) | Represents the cost to continue medical insurance, dental and life insurance, 401(k) matching of the employee’s base salary and other benefits for a period of 24 months following termination. |

| (4) | Represents taxes associated with “excess parachute payments.” These taxes include any excise tax imposed under Section 4999 of the Internal Revenue Code as well as any federal, state or local tax resulting from the excise tax payment. |

18

CERTAIN TRANSACTIONS

The Bank offers loans to its directors and officers. These loans currently are made in the ordinary course of business with the same collateral, interest rates and underwriting criteria as those of comparable transactions prevailing at the time and do not involve more than the normal risk of collectibility or present other unfavorable features. Under current law, the Bank’s loans to directors and executive officers are required to be made on substantially the same terms, including interest rates, as those prevailing for comparable transactions and must not involve more than the normal risk of repayment or present other unfavorable features. No loans to directors and officers have terms more favorable than might be otherwise offered to customers.

Kerry B. Harvey, a director of the Company and the Bank, is a partner in the firm of Owen, Harvey and Carter, which renders legal services to the Company and the Bank. In 2006, the Company and its subsidiaries paid $76,859 in fees to Owen, Harvey and Carter for legal services rendered.

REPORT OF THE AUDIT COMMITTEE

In accordance with its written charter, as adopted by the Board of Directors, the Audit Committee (the “Committee”) assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. During the fiscal year ended December 31, 2006, the Committee met six times, and the Committee discussed the interim financial information contained in each quarterly earnings announcement with the Chief Financial Officer and independent auditors prior to the public release.

In discharging its oversight responsibility as to the audit process, the Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” discussed with the auditors any relationships that may impact their objectivity and independence and satisfied itself as to the auditors’ independence.The Committee also discussed with management and the independent auditors the quality and adequacy of the Company’s internal controls and the internal audit function within the organization, responsibilities, budget and staffing. The Committee reviewed with the independent auditors their audit plans, audit scope, and identification of audit risks.

The Committee reviewed and discussed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, “Communication with Audit Committees”, as amended, and with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements.

The Audit Committee received reports throughout the year on the progress of the review of the Company’s internal controls for compliance with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and rules promulgated thereunder. The Committee will continue to obtain updates by management on the process and will review management’s and the independent auditors’ evaluation of the Company’s system of internal controls

The Audit Committee, or its Chairman, met with, or held telephonic discussions with, the independent auditors and management prior to release of Company quarterly and annual financial information or the filing of any such information with the Securities and Exchange Commission. The Committee also reviewed and discussed the audited financial statements of the Company as of and for the fiscal year ended December 31, 2006, with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements, and the independent auditors have the responsibility for the examination of those statements.

19

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2006, for filing with the Securities and Exchange Commission.The Committee intends to recommend the reappointment of Rayburn, Bates & Fitzgerald, P.C. as the independent auditors for the Company.

The Audit Committee annually reviews its charter, reports to the Board of Directors on its performance and conducts a Committee self-assessment process.

Respectfully submitted on March 30, 2007.

Harry J. Dempsey, Chairman WD Kelley Thomas I. Miller Gilbert E. Lee |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% stockholders are required to furnish the Company with copies of all such reports. Based solely on its review of copies of such reports received by it, or written representations from certain reporting persons that no annual report of change in beneficial ownership is required, the Company believes that during the year ended December 31, 2006 all such filing requirements were complied with in a timely manner.

INDEPENDENT AUDITORS

Rayburn, Bates & Fitzgerald, P.C., served as the Company’s independent auditors for the year ended December 31, 2006. The Audit Committee presently intends to renew the Company’s arrangement with Rayburn, Bates & Fitzgerald, P.C. to serve as the Company’s independent auditors for the fiscal year ending December 31, 2007. A representative of Rayburn, Bates & Fitzgerald, P.C. is expected to be present at the Annual Meeting to respond to appropriate questions and will have the opportunity to make a statement if he so desires.

20

Audit Fees and Other Matters

Rayburn, Bates & Fitzgerald, P.C. provided audit services to the Company consisting of the annual audit of the Company’s 2006 and 2005 consolidated financial statements contained in the Company’s Annual Reports on Form 10-K and reviews of the financial statements contained in the Company’s Quarterly Reports on Form 10-Q for 2006 and 2005.

Fee Category | Fiscal Year 2006 | % of Total | Fiscal Year 2005 | % of Total | ||||||||

Audit Fees | $ | 173,000 | 88.5 | % | $ | 154,000 | 91.4 | % | ||||

Audit-Related Fees | $ | 5,000 | 2.6 | % | $ | — | — | % | ||||

Tax Fees | $ | 17,500 | 8.9 | % | $ | 14,500 | 8.6 | % | ||||

All Other Fees | $ | — | — | % | $ | — | — | % | ||||

Total Fees | $ | 195,500 | 100.0 | % | $ | 168,500 | 100.0 | % | ||||

The Audit Committee approved all services provided by Rayburn, Bates & Fitzgerald, P.C. during 2006 and 2005. Additional details describing the services provided in the categories in the above table are as follows:

Rayburn, Bates & Fitzgerald, P.C. did not provide any services related to the financial information systems design and implementation of the Company during 2006 and 2005.