Exhibit 99.1

Presenters:

John E. Peck, President / CEO

Billy Duvall, CFO

1

Forward-Looking Statements

Statements herein that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are subject to known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looki ng statements. You should understand that these statements are not guarantees of performance or results and are preliminary in nature. Statements preceded by followed by or that otherwise include the words “believes”, “expects”, “anticipates”, “intends”, “projects”, “estimates”, “plans”, “may result”, “will result”, “may fluctuate” and similar expressions or future or conditional verbs such as “will”, “should”, “would”, “may” and “could” are generally forward-looking in nature and not historical facts.

You should consider the areas or risk described under the heading “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in our periodic reports filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934 in connection with any forward-looking statements that may be made by us and our businesses generally. Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligations to release publicly any updates or revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless required by law.

2

Billy Duvall

Chief Financial Officer

4

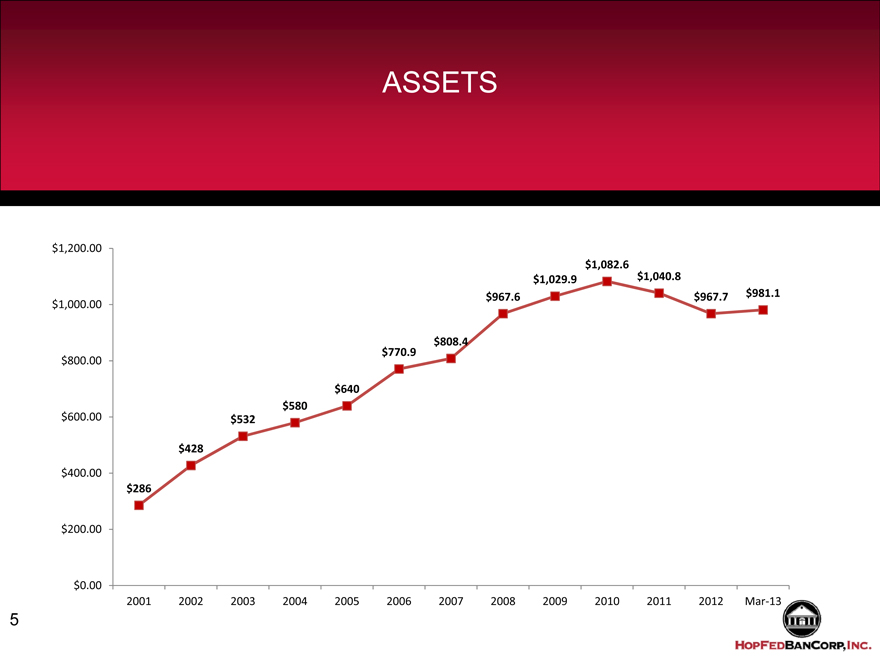

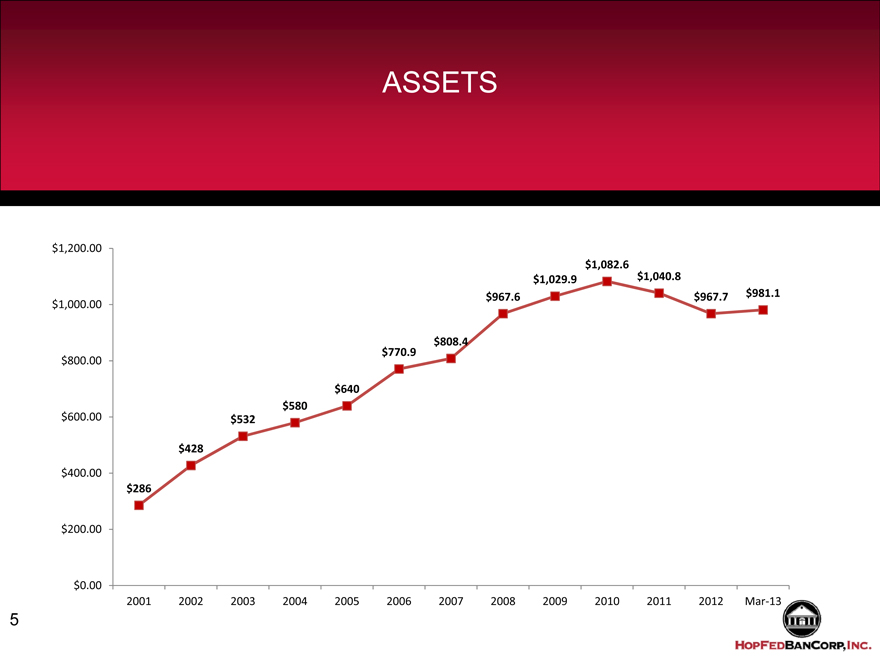

ASSETS

$1,200.00 $1,082.6 $1,029.9 $1,040.8 $967.6 $967.7 $981.1 $1,000.00

$808.4 $770.9 $800.00

$640 $580 $600.00 $532

$428

$400.00 $286

$200.00

$0.00

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Mar-13

5

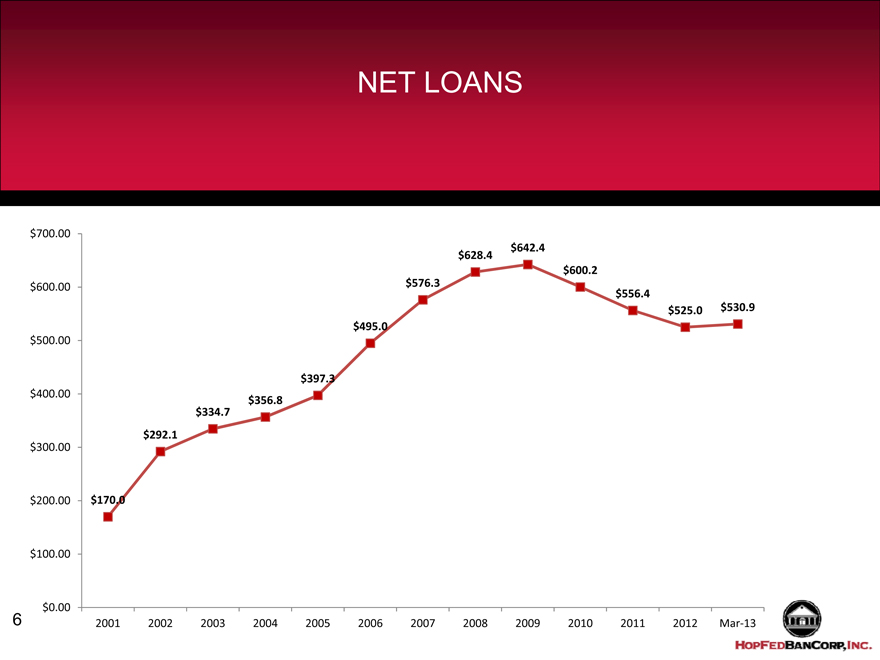

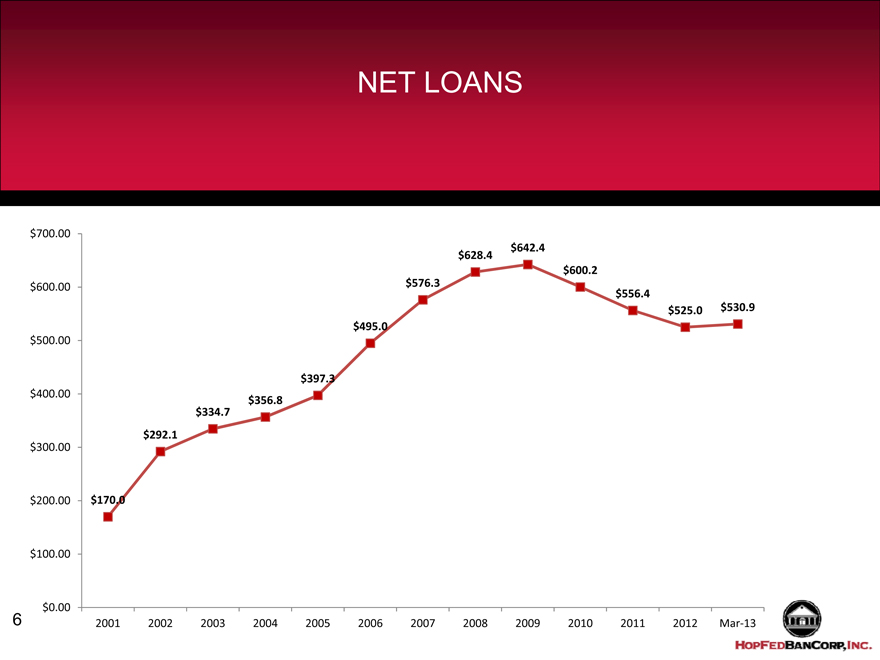

NET LOANS

$700.00 $642.4 $628.4 $600.2 $600.00 $576.3 $556.4 $525.0 $530.9 $495.0 $500.00

$397.3 $400.00 $356.8 $334.7

$292.1 $300.00

$200.00 $170.0

$100.00

$0.00

6 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Mar-13

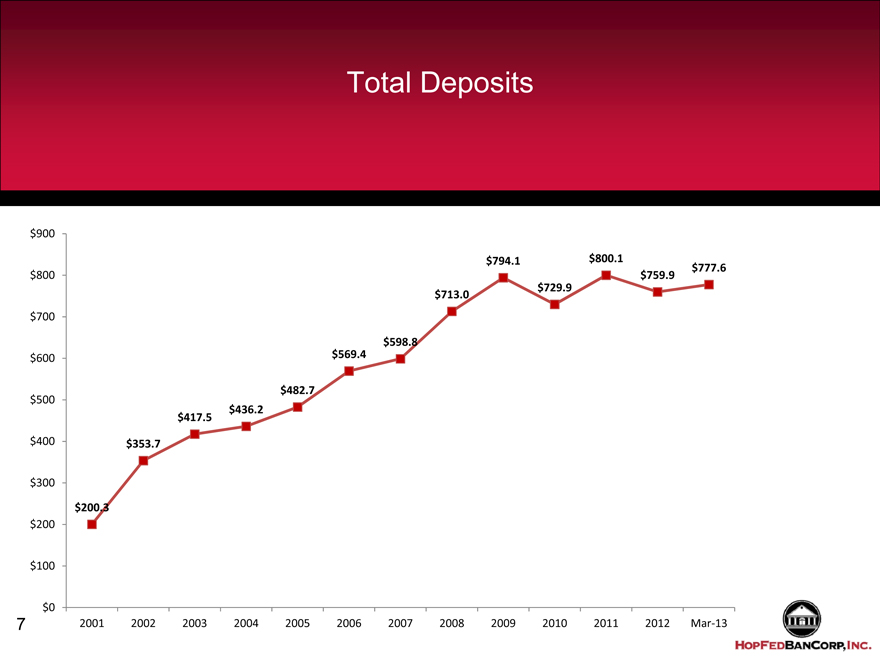

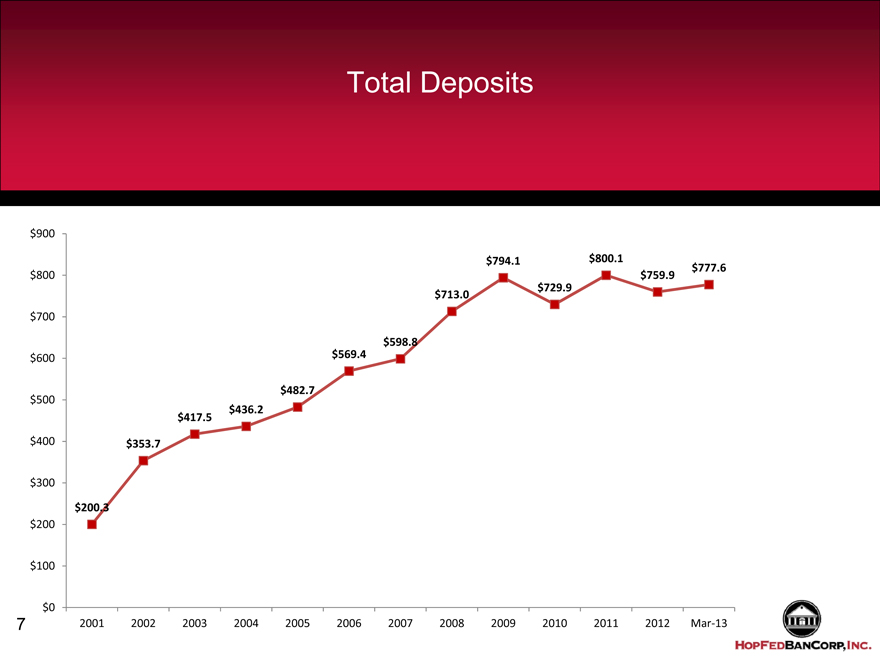

Total Deposits

$900

$794.1 $800.1 $777.6 $800 $759.9 $729.9 $713.0

$700

$598.8 $600 $569.4

$500 $482.7 $436.2 $417.5

$400 $353.7

$300

$200.3 $200

$100

$0

7 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Mar-13

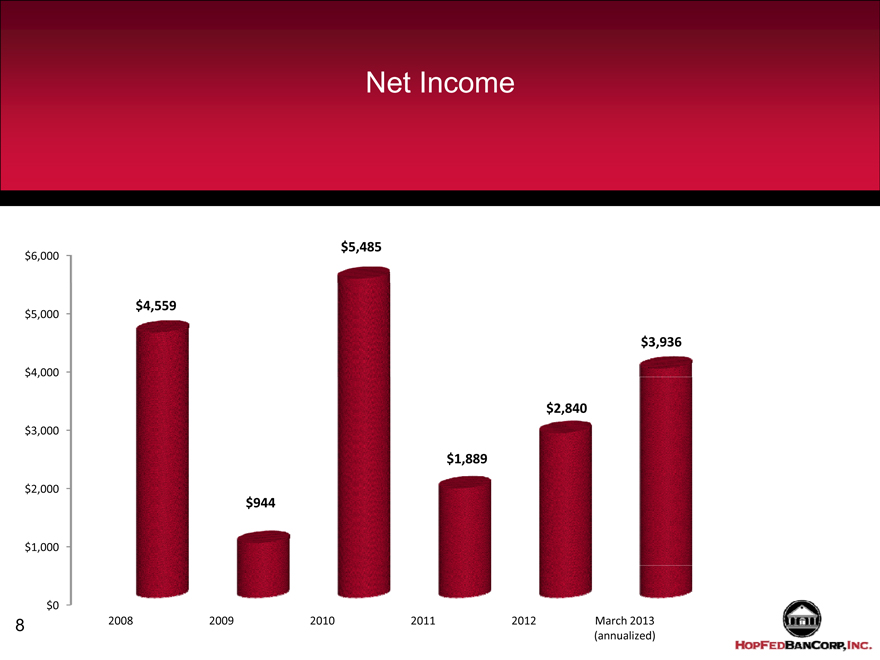

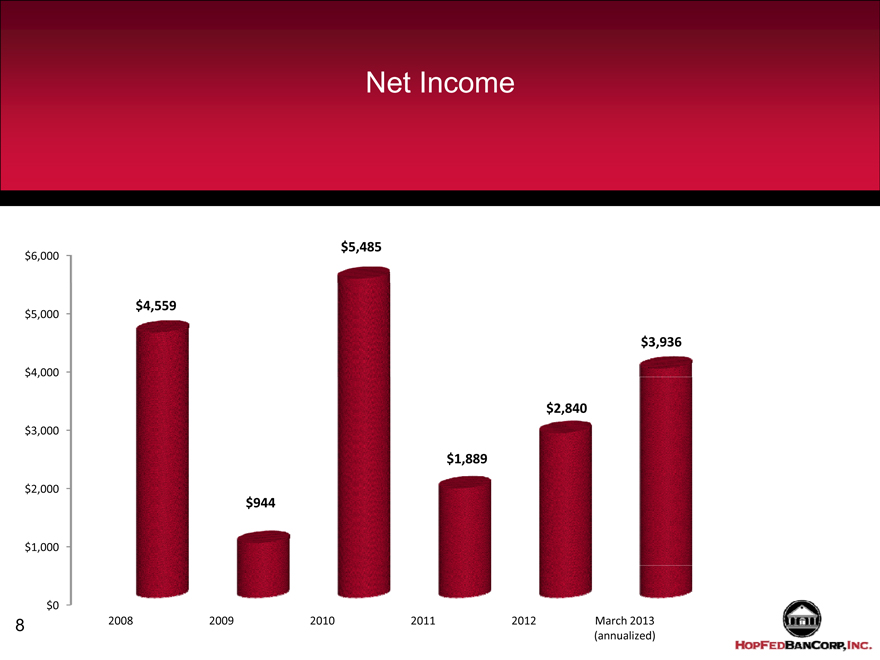

Net Income

$5,485 $6,000

$4,559 $5,000

$3,936

$4,000

$2,840 $3,000

$1,889

$2,000 $944

$1,000

$0

8 2008 2009 2010 2011 2012 March 2013 (annualized)

Non-Interest Deposits

(Millions)

$120

$100

$80

$60

$40

$20

$0

$4

$7

$19

$27

$32

$37

$51

$52

$57

$68

$69

$80

$94

$100

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Q1-2013

9

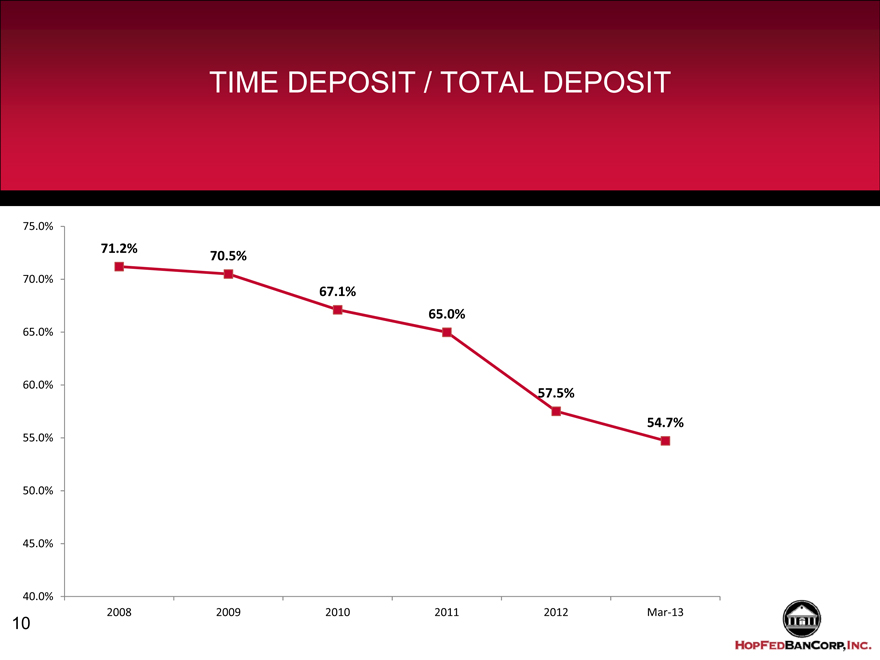

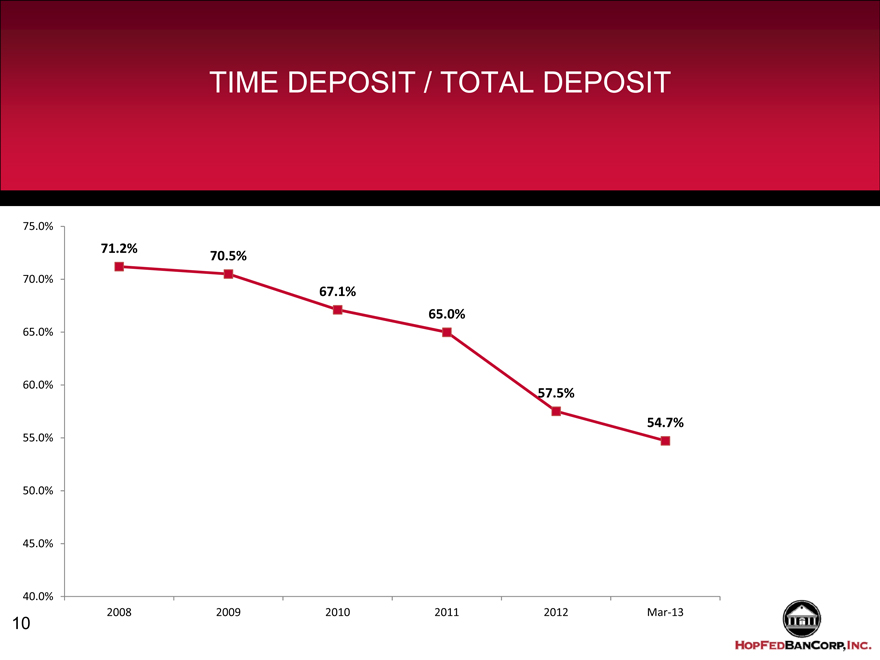

TIME DEPOSIT / TOTAL DEPOSIT

75.0%

71.2%

70.5%

70.0%

67.1%

65.0%

65.0%

60.0%

57.5%

54.7%

55.0%

50.0%

45.0%

40.0%

2008 2009 2010 2011 2012 Mar-13

10

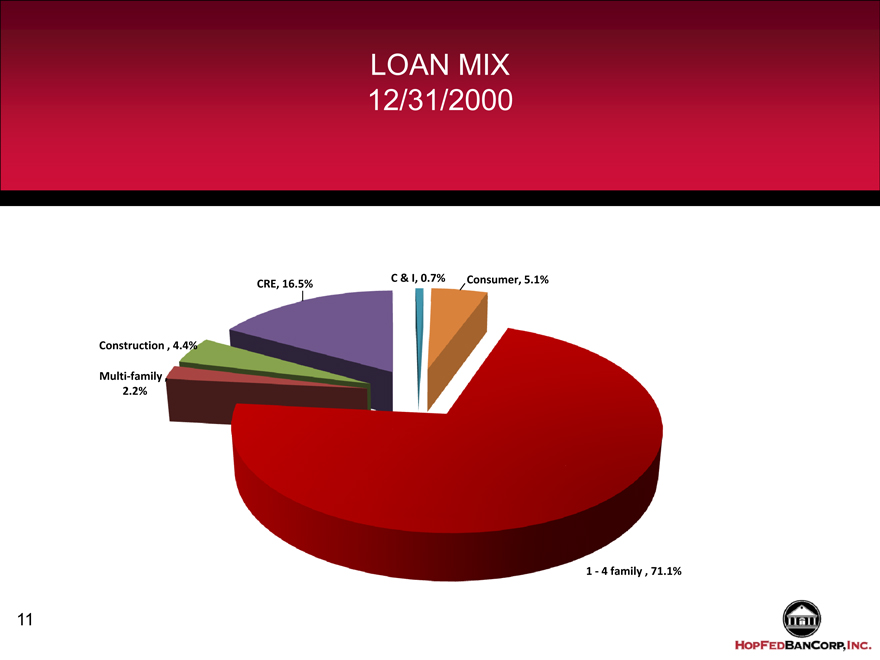

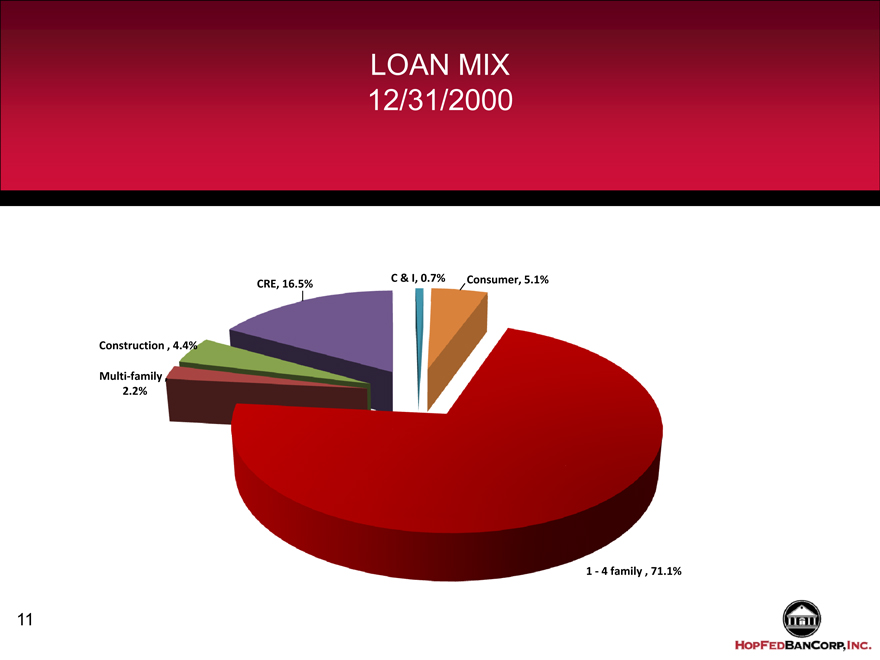

LOAN MIX 12/31/2000

C & I, 0.7% Consumer, 5.1% CRE, 16.5%

Construction , 4.4%

Multi-family ,

2.2%

1—4 family , 71.1%

11

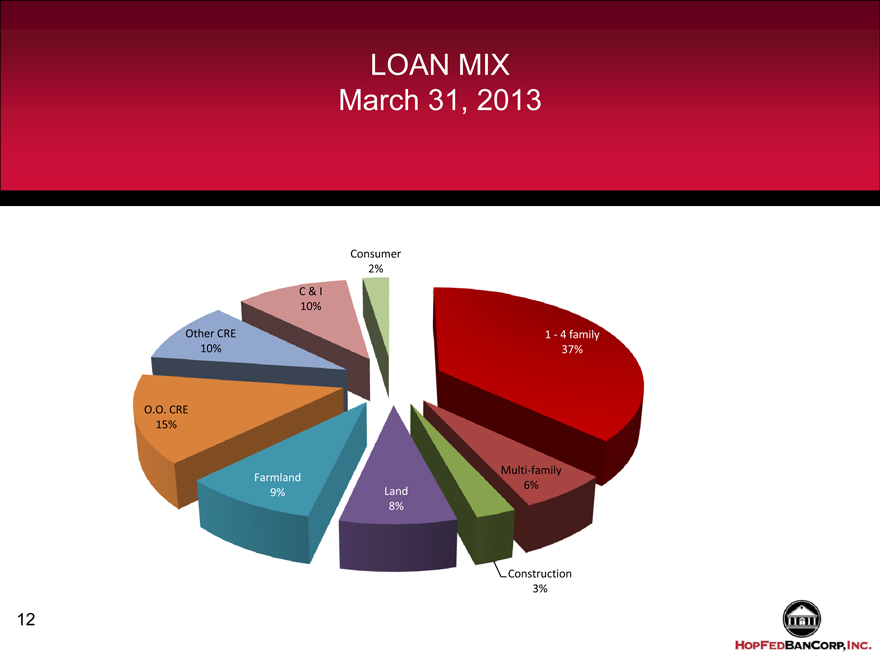

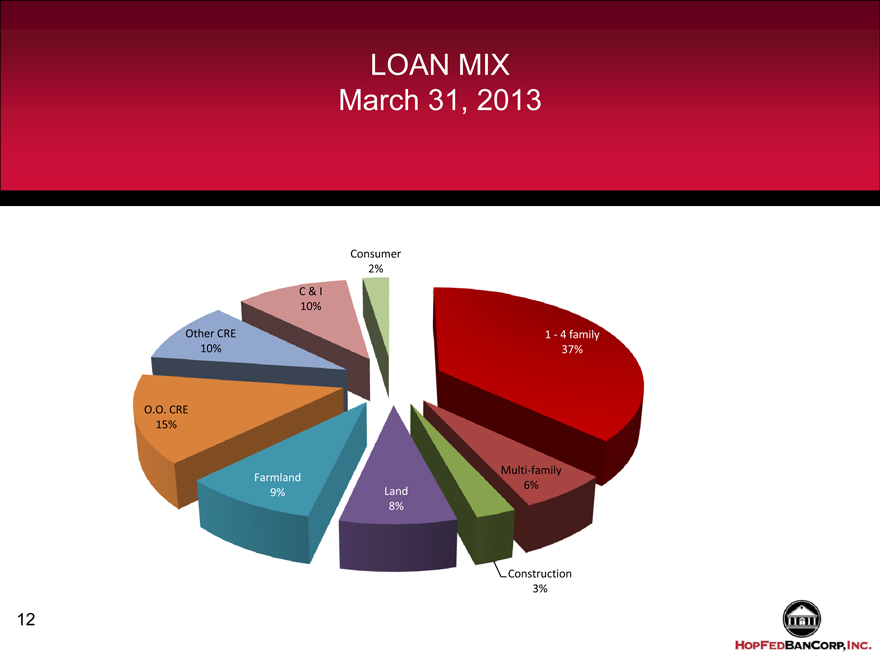

LOAN MIX March 31, 2013

Consumer 2%

C & I 10%

Other CRE 1—4 family 10% 37%

O.O. CRE 15%

Multi-family Farmland 6%

9% Land 8%

Construction 3%

12

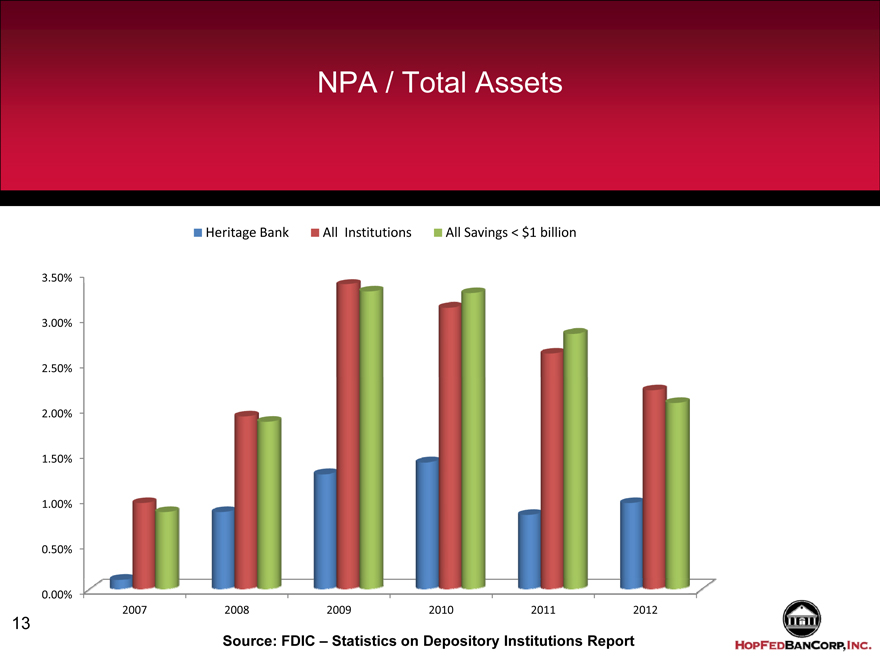

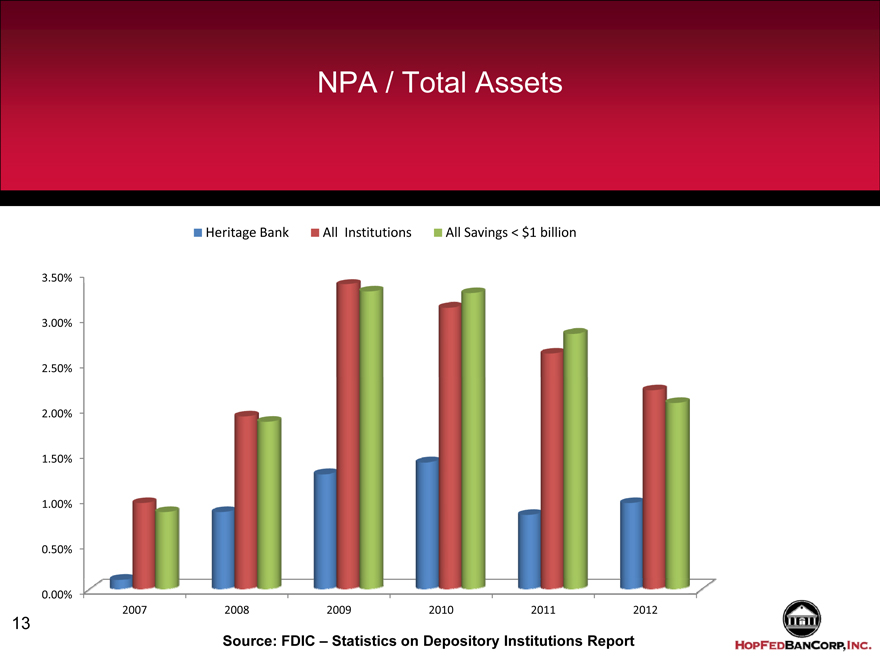

NPA / Total Assets

Heritage Bank All Institutions All Savings < $1 billion

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

13 2007 2008 2009 2010 2011 2012

Source: FDIC – Statistics on Depository Institutions Report

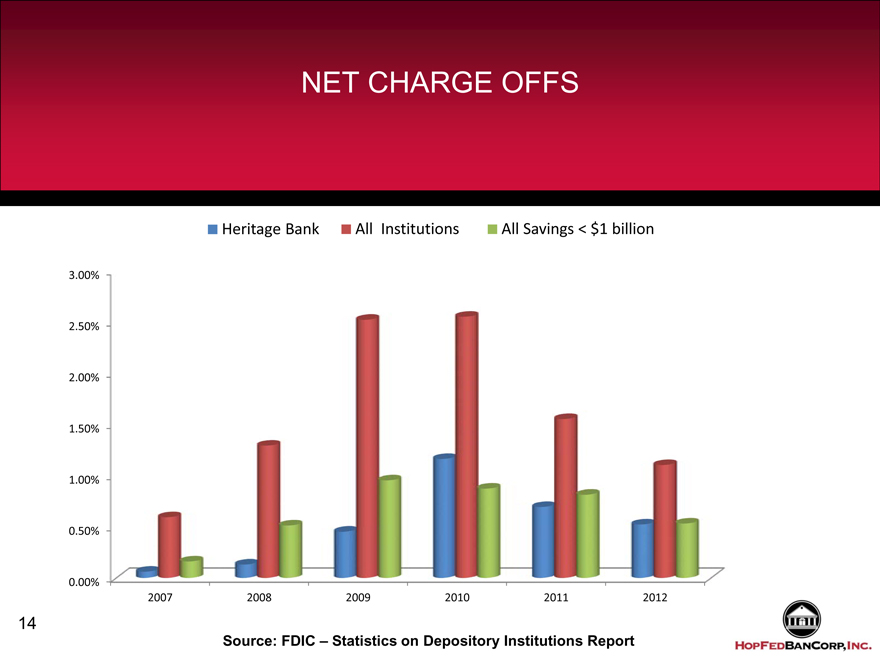

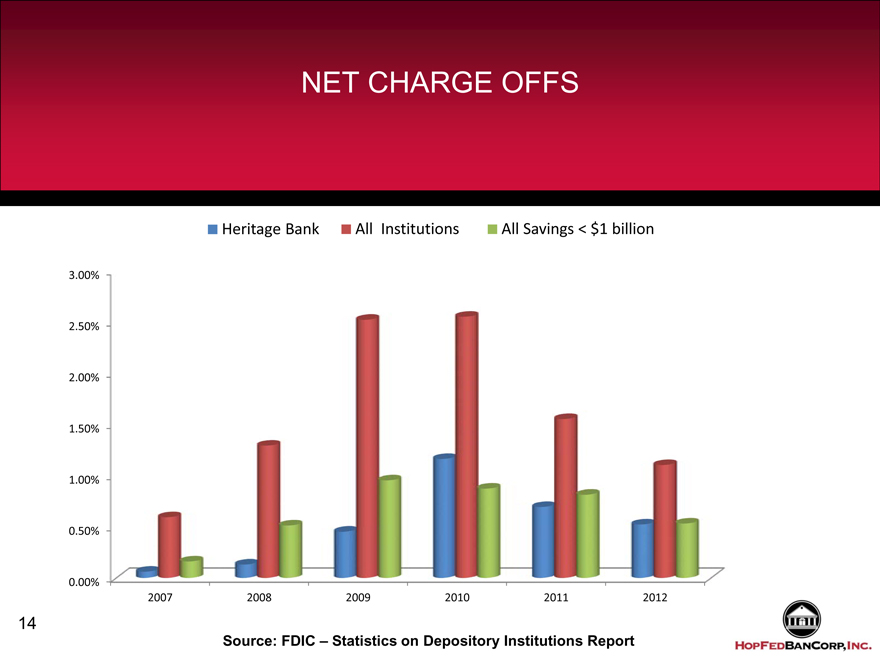

NET CHARGE OFFS

Heritage Bank All Institutions All Savings < $1 billion

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

14 2007 2008 2009 2010 2011 2012

Source: FDIC – Statistics on Depository Institutions Report

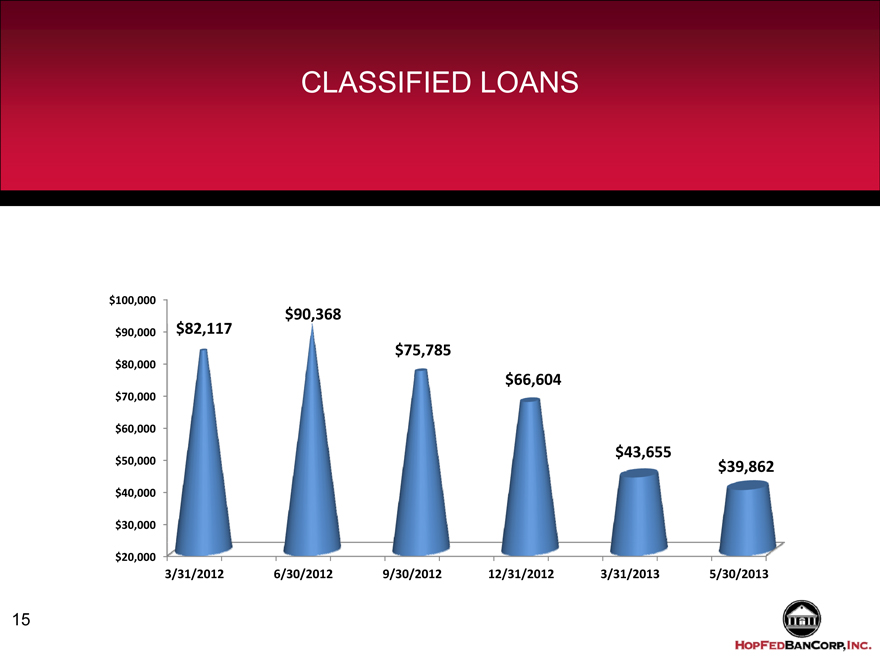

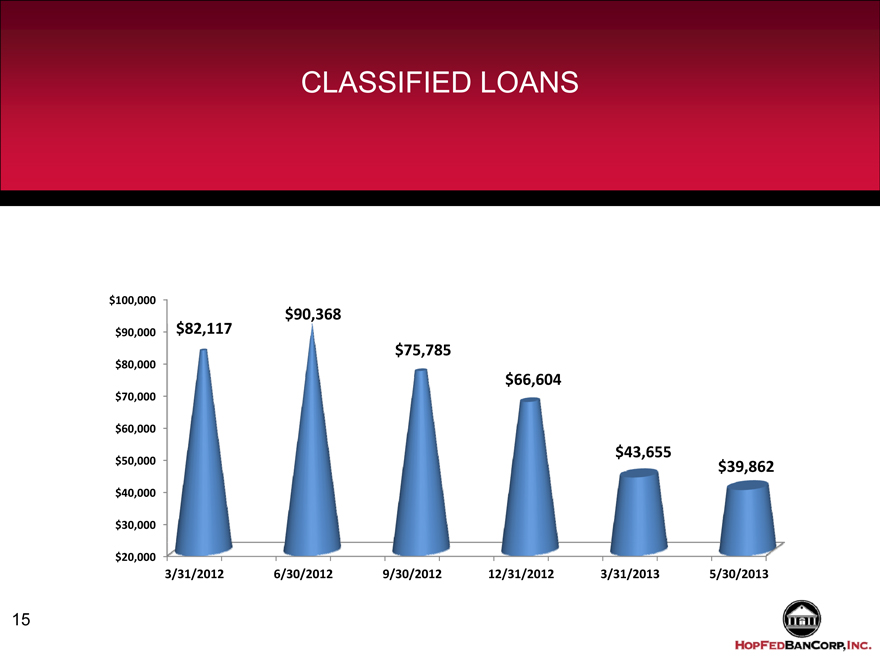

CLASSIFIED LOANS

$100,000

$90,368

$90,000 $82,117

$75,785

$80,000

$66,604

$70,000

$60,000

$43,655

$50,000 $39,862 $40,000

$30,000

$20,000

3/31/2012 6/30/2012 9/30/2012 12/31/2012 3/31/2013 5/30/2013

15

John E. Peck

President / CEO

16

Opportunity

17

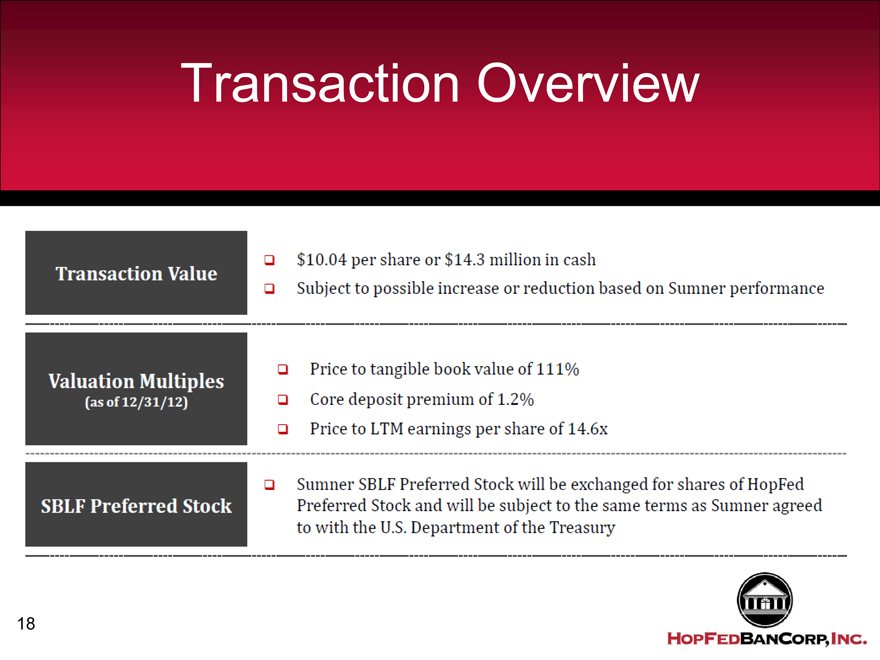

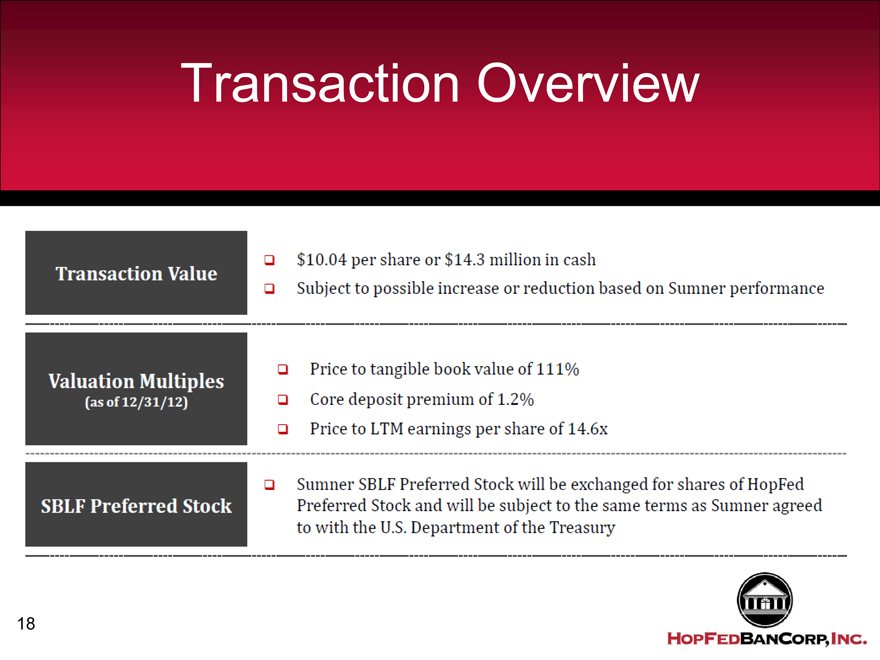

Transaction Overview

Transaction Value

$10.04 per share or $14.3 million in cash

Subject to possible increase or reduction based on Sumner performance

Valuation Multiples (as of 12/31/12)

Price to tangible book value of 111%

Core deposit premium of 1.2%

Price to LTM earnings per share of 14.6x

SBLF Preferred Stock

Sumner SBLF Preferred Stock will be exchanged for shares of HopFed Preferred Stock and will be subject to the same terms as Sumner agreed to with the U.S. Department of the Treasury

18

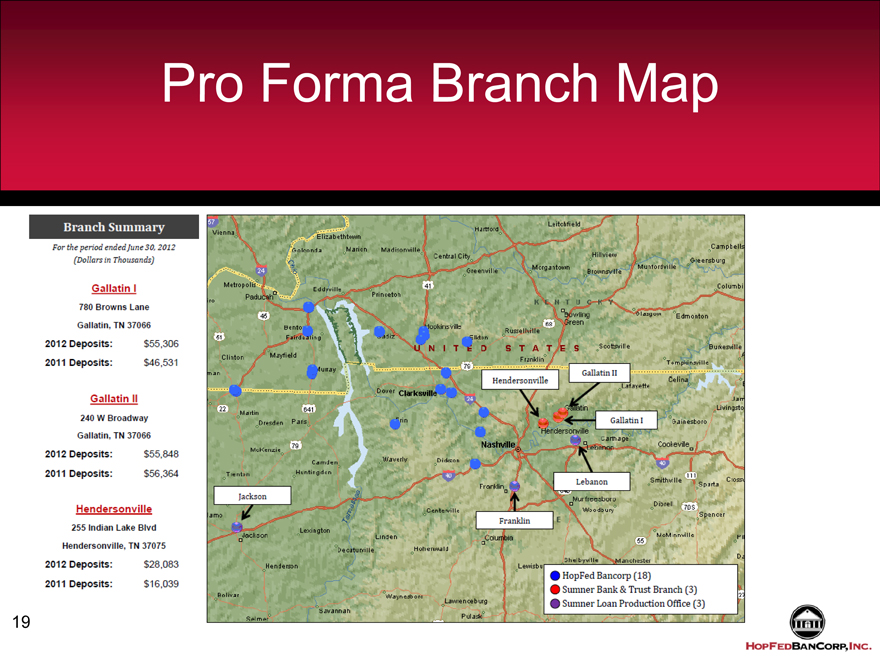

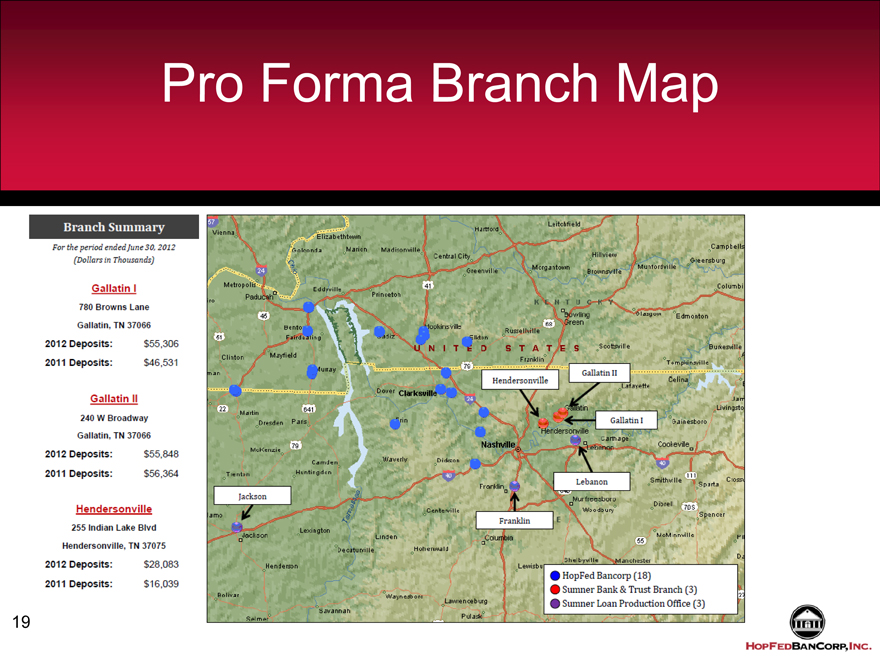

Pro Forma Branch Map

Branch Summary

For the period ended June 30, 2012

(Dollars in Thousands)

Gallatin I

780 Browns Lane

Gallatin, TN 37066

2012 Deposits: $55,306

2011 Deposits: $46,531

Gallatin II

240 W Broadway

Gallatin, TN 37066

2012 Deposits: $55,848

2011 Deposits: $56,364

Hendersonville

255 Indian Lake Blvd

Hendersonville, TN 37075

2012 Deposits: $28,083

2011 Deposits: $16,039

19

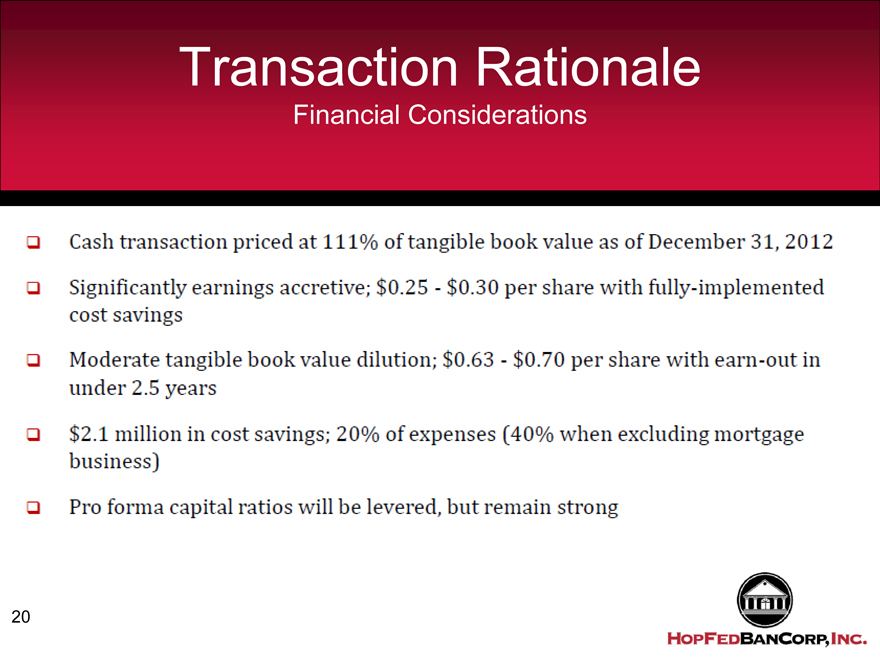

Transaction Rationale

Financial Considerations

20

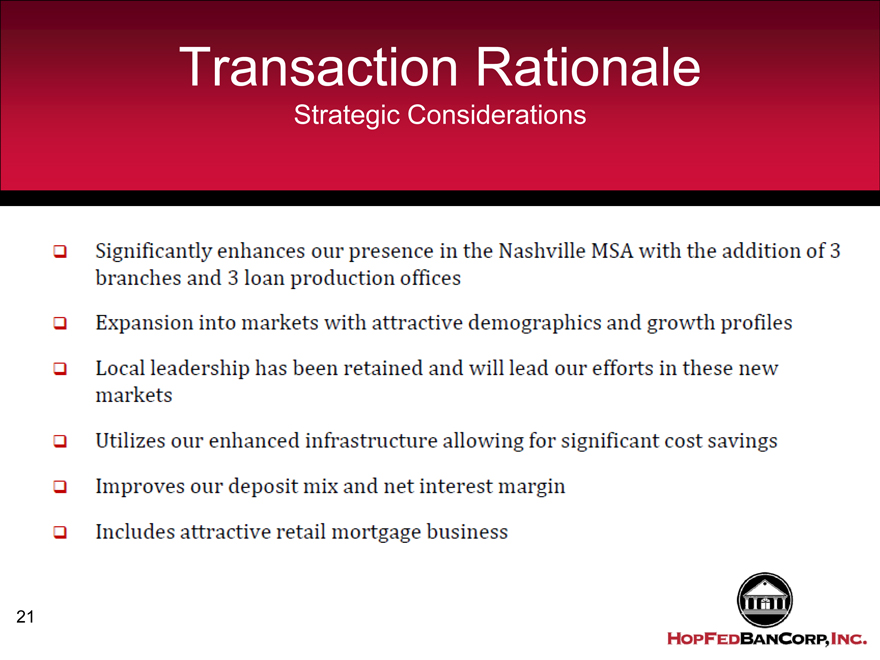

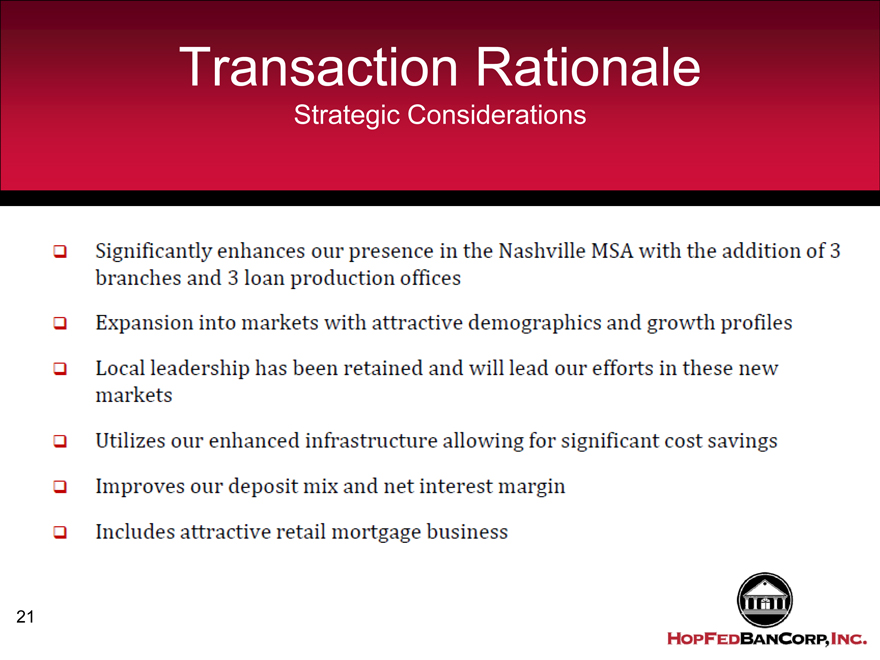

Transaction Rationale

Strategic Considerations

Significantly enhances our presence in the Nashville MSA with the addition of 3 branches and 3 loan production offices

Expansion into markets with attractive demographics and growth profiles

Local leadership has been retained and will lead our efforts in these new markets

Utilizes our enhanced infrastructure allowing for significant cost savings

Improves our deposit mix and net interest margin

Includes attractive retail mortgage business

21

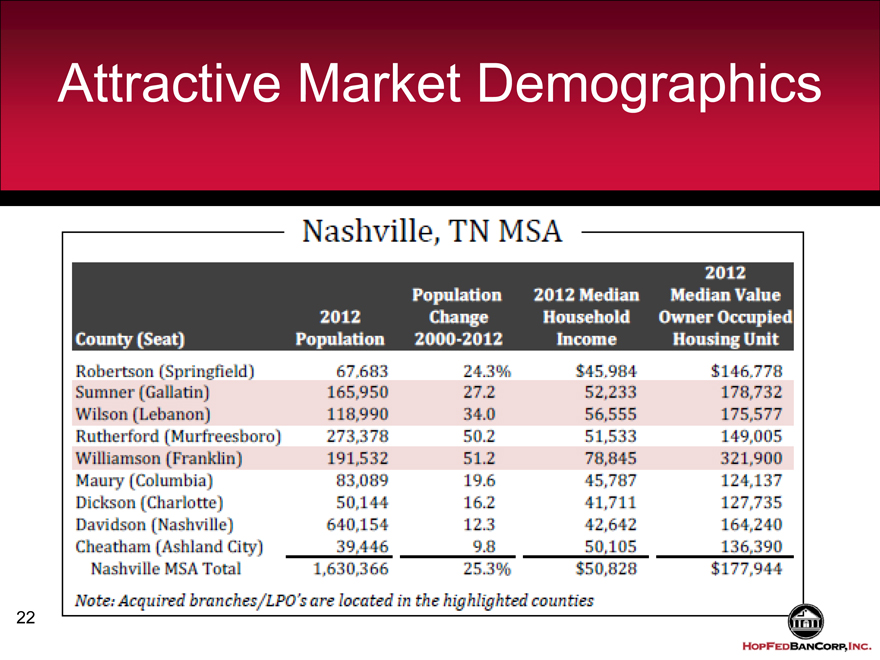

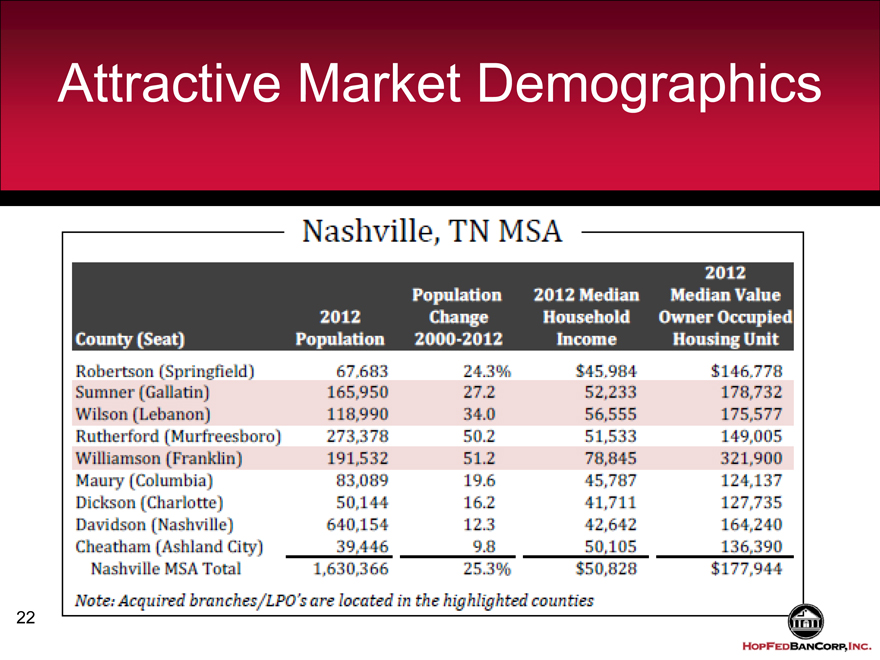

Attractive Market Demographics

Nashville, TN MSA

County (Seat) 2012 Population Population Change 2012 Median 2012 Median Value

2000-2012 Household Owner Occupied

Income Housing Unit

Robertson

(Springfield) 67.683 24.3% $45,984 $146,778

Sumner

(Gallatin) 165,950 27.2 52,233 178,732

Wilson

(Lebanon) 118,990 34.0 56,555 175,577

Rutherford(Murfreesboro) 273,378 50.2 51,533 149,005

Williamson (Franklin) 191,532 51.2 78,845 321,900

Maury (Columbia) 83,089 19.6 45,787 124,137

Dickson (Charlotte) 50,144 16.2 41,711 127,735

Davidson (Nashville) 640,154 12.3 42,642 164,240

Cheatham (Ashland City) 39,446 9.8 50,105 136,390

Nashville MSA Total 1,630,366 25.3% $50,828 $177,944

Note: Acquired branches/LPO’s are located in the highlighted counties.

22

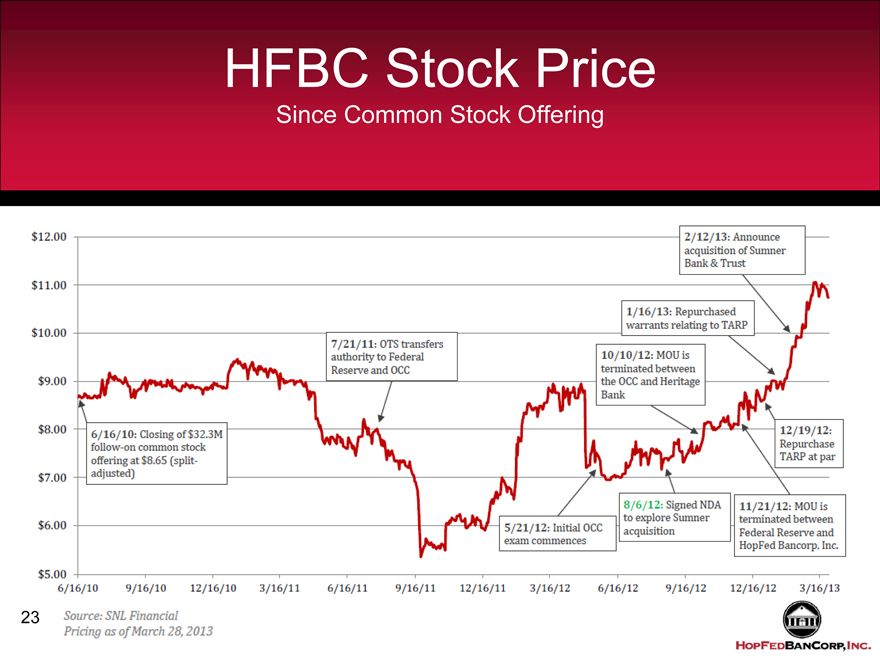

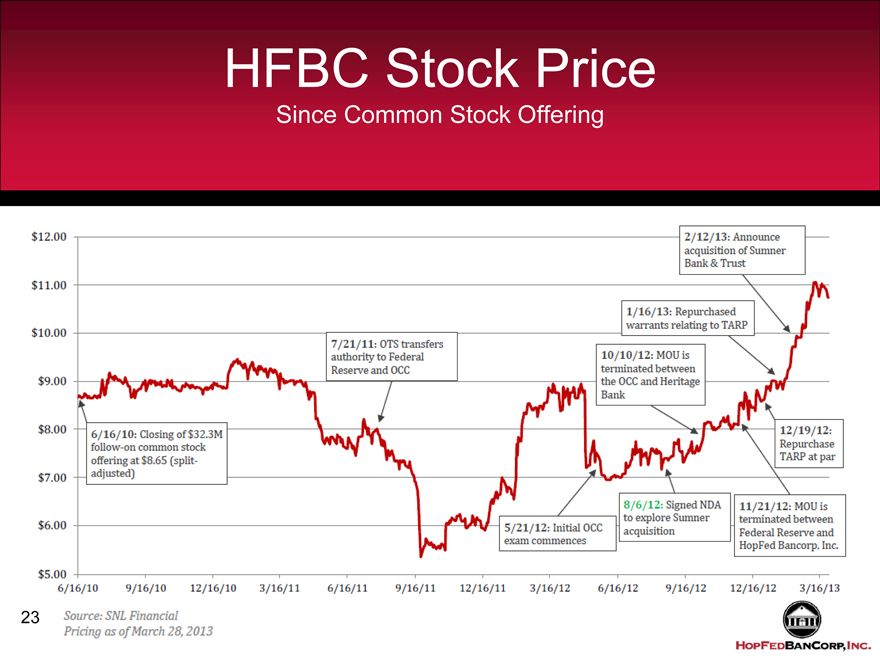

HFBC Stock Price

Since Common Stock Offering

$12.00 2/12/13: Announce acquisition of Sumner Bank & Trust

$11.00 1/16/13: Repurchased warrants relating to TARP

$10.00 7/21/11: OTS transfers authority to Federal Reserve and OCC

$9.00 10/10/12: MOU is terminated between the OCC and Heritage Bank

$8.00 6/16/10: Closing of $32.3M follow-on common stock offering at $8.65 (split-adjusted) 12/19/12: Repurchase TARP at par

$7.00 5/21/12: Initial OCC exam commences 8/6/12: Signed NDA to explore Sumner acquisition 11/21/12: MOU is terminated between Federal Reserve and HopFed Bancorp, Inc.

$6.00

$5.00

6/16/10

9/16/10

12/16/10

3/16/11

6/16/11

9/16/11

12/16/11

3/16/12

6/16/12

9/16/12

12/16/12

3/16/13

Source: SNL Financial

Pricing as of March 28, 2013

23

23

Presenters:

John E. Peck, President / CEO

Billy Duvall, CFO

24 www.bankwithheritage.com