UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

| Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| o | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| ý | Soliciting Material Pursuant to §240.14a-12 | |

ATMI, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

N/A | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

The following is a presentation that was presented to employees of ATMI, Inc. at a town hall meeting on February 4, 2014 regarding the planned acquisition of ATMI, Inc. by Entegris, Inc.

Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. ATMI Town Hall Meeting February 4, 2014

Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. Additional Information About the Acquisition and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed acquisition of ATMI, Inc. (the “Company”) by Entegris, Inc. (the “Acquiror”). A meeting of the stockholders of the Company will be announced to obtain stockholder approval of the proposed transaction. The Company intends to file with the SEC a proxy statement and other relevant documents in connection with the proposed transaction. The definitive proxy statement will be sent or given to the stockholders of the Company and will contain important information about the proposed transaction and related matters. The Company’s stockholders are urged to read the definitive proxy statement and other relevant materials when they become available because they will contain important information about the Company, the Acquiror and the proposed transaction. Investors may obtain a free copy of these materials (when they are available) and other documents filed by the Company with the SEC at the SEC’s website at www.sec.gov, at the Company’s website at www.atmi.com or by sending a written request to the Company at 7 Commerce Drive, Danbury, CT 06810, Attention: Chief Legal Officer. Participants in the Solicitation The Company and its directors, executive officers and certain other members of management and employees may be deemed to be participants in soliciting proxies from the stockholders of the Company in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of the Company’s stockholders in connection with the proposed transaction, and any interest they have in the proposed transaction, will be set forth in the definitive proxy statement when it is filed with the SEC. Additional information regarding these individuals is included in the Company’s Annual Report on Form 10-K filed with the SEC on February 22, 2013 and the proxy statement for the Company’s 2013 Annual Meeting of Stockholders filed with the SEC on April 11, 2013.

Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. * GRPI Goal(s): Provide information on the acquisition of ATMI by Entegris through our interactive Town Hall forum Roles & Responsibilities: Doug: Share information and answer questions from attendees Audience: Active Listening, Question generation Process: Doug to present relevant information Q&A with local sites – Round Robin Style Interpersonal: Inform, Motivate, Inspire, Learn Seize the moment, be courageous, ask and get answers to what’s on your mind

Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. * Transaction overview Entegris to acquire ATMI (excluding the LifeSciences business sold to Pall) Creates strong company built on material science with global manufacturing and technical capabilities Transaction valued at $1.2 billion Expected to close during Q2 2014

Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. * About Entegris Market leader in contamination control and microenvironments to the semiconductor and other industries Annual sales $694M in 2013 2,800 employees worldwide Headquartered in Billerica, MA Manufacturing facilities in U.S., Japan, Malaysia, Korea, and Taiwan Sales and service centers in eight countries Publicly traded on NASDAQ; Symbol: ENTG Executive team: Bertrand Loy – CEO Greg Graves – CFO

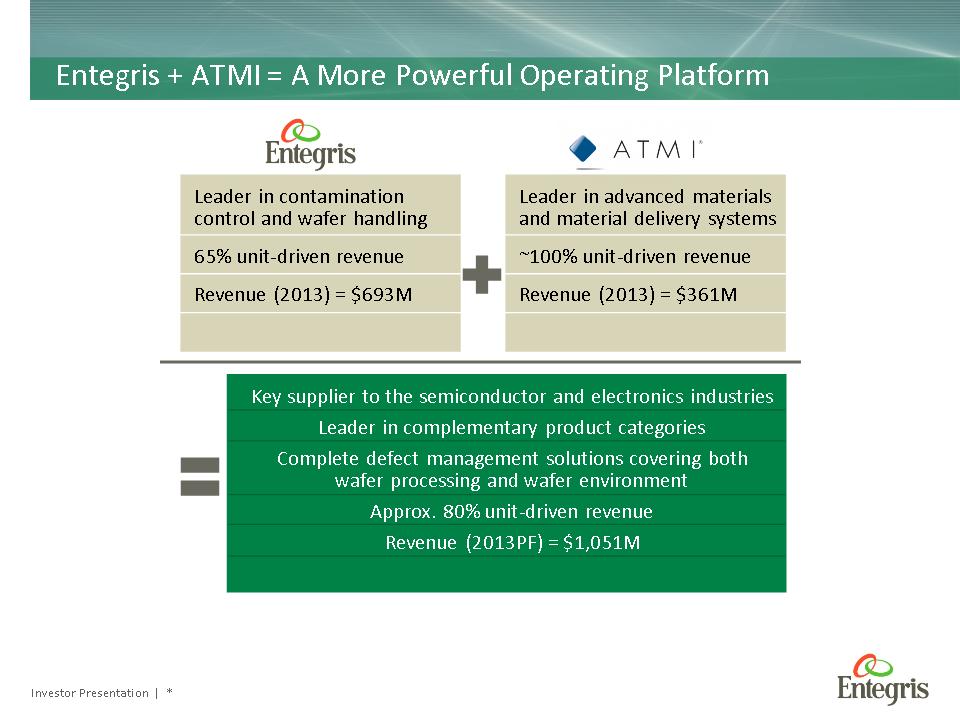

Investor Presentation | * Leader in contamination control and wafer handling 65% unit-driven revenue Revenue (2013) = $693M Entegris + ATMI = A More Powerful Operating Platform Leader in advanced materials and material delivery systems ~100% unit-driven revenue Revenue (2013) = $361M Key supplier to the semiconductor and electronics industries Leader in complementary product categories Complete defect management solutions covering both wafer processing and wafer environment Approx. 80% unit-driven revenue Revenue (2013PF) = $1,051M

Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. * Other important items Impact on ATMI employees Entegris bought ATMI because of our people and our technology As always, we are working to ensure that employees are treated fairly An integration team has been formed and will share important details as they are finalized

Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. Proprietary and Confidential ©2013 ATMI, Inc. All Rights Reserved. ATMI Town Hall Meeting Q & A