UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under ss. 240.14a-12

PMA Capital Corporation

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

N/A |

| (2) | Aggregate number of securities to which transaction applies: |

N/A |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

N/A |

| (4) | Proposed maximum aggregate value of transaction: |

N/A |

| (5) | Total fee paid: |

N/A |

[ ] Fee paid previously with preliminary materials.

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid: |

2) Form, Schedule or Registration Statement No.: |

3) Filing Party: |

4) Date Filed: |

| 1. | Elect four directors to serve until the 2008 Annual Meeting and until their successors are elected; and |

| 2. | Ratify the appointment of Deloitte & Touche LLP as our independent auditors for 2005. |

| By Order of the Board of Directors, |

| |

| Neal C. Schneider | |

| March 29, 2005 | Chairman of the Board |

| 1. | The election of four directors to serve until the 2008 Annual Meeting and until their successors are elected; and |

| 2. | The ratification of the appointment of our independent auditors for 2005. |

| 1. | In person. Attend the Annual Meeting and vote your shares, or send a personal representative with an appropriate proxy. |

| 2. | By mail. Mark, date, sign and mail the enclosed proxy card in the prepaid envelope. If you return your proxy card but do not mark your voting preference, the individuals named as proxies will vote your shares for each item described in this proxy statement. |

| 1. | In person. You may revoke a previously submitted proxy vote by attending and voting in person or by personal representative with an appropriate proxy card at the Annual Meeting. |

| 2. | In writing.You may give written notice of your revocation to our Corporate Secretary, which must be received before the Annual Meeting begins. Your letter should contain the name in which your shares are registered, the date of the proxy you are revoking, your new voting instructions and your signature. |

| 3. | By proxy. You may revoke your proxy by submitting a later-dated proxy card. We must receive the later-dated proxy card before the Annual Meeting begins. |

If you have invested in the PMA Capital Stock Fund of the PMA Capital Corporation 401(k) Plan, you do not actually own shares of Class A common stock; Vanguard Fiduciary Trust Company, the plan trustee, does. However, you do have “pass through voting rights” based on the amount of money you have invested in the PMA Capital Stock Fund. |

You may exercise your pass through voting rights only by completing the proxy card from the Plan’s trustee mailed with this proxy statement. The proxy card acts as a voting instruction to the Plan’s trustee. The trustee must receive your instructions prior to the Annual Meeting to vote your share equivalents in accordance with your instructions. If your voting instructions are not received by the date that the trustee specifies, the trustee will vote the share equivalents credited to your account in the same proportion that it votes share equivalents for which it did receive timely instructions. |

| We will pay the cost of soliciting proxies. Solicitation will be made by mail and may also be made on our behalf by our officers, directors and employees in person or by telephone. We will reimburse banks, brokers, nominees, custodians and fiduciaries for their reasonable out-of-pocket expenses for sending proxies and proxy materials to beneficial owners. |

Name of Individual or Identity of Group | Class A Common Stock Beneficially Owned | Percent of Class | ||||

| Peter S. Burgess | 17,009 | * | ||||

| Joseph H. Foster | 17,025 | (1) | * | |||

| Charles T. Freeman | -- | * | ||||

| Thomas J. Gallen | 4,346 | (2) | * | |||

| Anne S. Genter | 4,046 | * | ||||

| James C. Hellauer | 12,010 | (3) | * | |||

| Richard Lutenski | 17,009 | * | ||||

| James F. Malone III | 542,300 | 1.7% | ||||

| Edward H. Owlett | 700,230 | (4) | 2.2% | |||

| Roderic H. Ross | 13,396 | * | ||||

| L.J. Rowell, Jr. | 5,347 | (5) | * | |||

| Neal C. Schneider | 53,346 | * | ||||

| Vincent T. Donnelly | 460,854 | (6) | 1.4% | |||

| William E. Hitselberger | 118,720 | (7) | * | |||

| Robert L. Pratter | 132,670 | (8) | * | |||

| Henry O. Schramm II | 96,985 | (9) | * | |||

| John Santulli III | 92,550 | (10) | * | |||

| All executive officers and directors as a group (17 persons) | 2,287,843 | (11) | 7.1% | |||

| (1) | Does not include approximately 11,986 share equivalents, which track the economic performance of the Class A common stock but do not carry voting rights, owned through the Deferred Compensation Plan for Non-Employee Directors and which are payable in cash only. |

| (2) | Does not include approximately 1,605 share equivalents, which track the economic performance of the Class A common stock but do not carry voting rights, owned through the Deferred Compensation Plan for Non-Employee Directors and which are payable in cash only. |

| (3) | Includes 2,000 shares of Class A common stock held in an irrevocable trust for which Mr. Hellauer’s wife serves as trustee. |

| (4) | Includes: (i) 353,700 shares of Class A common stock held in certain Owlett family trusts; (ii) 28,500 shares of Class A common stock held by Mr. Owlett's wife; (iii) 311,230 shares of Class A common stock held jointly by Mr. Owlett and his wife; and (iv) 6,800 shares of Class A common stock held in non-family trusts for which Mr. Owlett serves as trustee. Mr. Owlett disclaims beneficial ownership of the shares held by his wife, of 296,700 shares of Class A common stock held by one of his family trusts and of all the shares held in the non-family trusts. |

| (5) | Does not include approximately 2,054 share equivalents, which track the economic performance of the Class A common stock but do not carry voting rights, owned through the Deferred Compensation Plan for Non-Employee Directors and which are payable in cash only. |

| (6) | Includes options to purchase 381,175 shares of Class A common stock that are currently exercisable or will become exercisable within 60 days of March 1, 2005 under our equity incentive plans. |

| (7) | Includes 150 shares of Class A common stock held in trust for Mr. Hitselberger’s children and options to purchase 98,150 shares of Class A common stock that are currently exercisable or will become exercisable within 60 days of March 1, 2005 under our equity incentive plans. |

| (8) | Includes 3,500 shares of Class A common stock held by Mr. Pratter’s child who resides in his household and to which Mr. Pratter disclaims beneficial ownership, and options to purchase 101,875 shares of Class A common stock that are currently exercisable or will become exercisable within 60 days of March 1, 2005 under our equity incentive plans. |

| (9) | Includes options to purchase 89,660 shares of Class A common stock that are currently exercisable or will become exercisable within 60 days of March 1, 2005 under our equity incentive plans. |

| (10) | Includes options to purchase 85,900 shares of Class A common stock that are currently exercisable or will become exercisable within 60 days of March 1, 2005 under our equity incentive plans. |

| (11) | Includes options to purchase 756,760 shares of Class A common stock that are currently exercisable or will become exercisable within 60 days of March 1, 2005 under our equity incentive plans, but does not include share equivalents under the Deferred Compensation Plan for Non-Employee Directors. |

Name & Address | Class A Common Stock | Percent of Class | ||

NWQ Investment Management Company, LLC(1) 2049 Century Park East Los Angeles, CA 90067-3103 | 2,586,877 | 8.20% | ||

Owl Creek Asset Management, L.P.(2) 410 Park Avenue, Suite 420 New York, New York 10022 | 2,390,037 | 7.51% | ||

Aegis Financial Corporation(3) 1100 North Glebe Road, Ste. 1040 Arlington, VA 22201 | 1,879,651 | 5.90% | ||

Dimensional Fund Advisors, Inc.(4) 1299 Ocean Ave., 11th Floor Santa Monica, CA 90401 | 1,682,075 | 5.31% |

| (1) | Based solely on a Schedule 13G/A, dated February 11, 2005, NWQ Investment Management Company, LLC (“NWQ”) has sole voting power over 2,428,947 shares of Class A common stock and sole dispositive power over 2,586,877 shares of Class A common stock. Due to the dispositive power over the shares of Class A common stock, NWQ may be deemed to beneficially own such shares, which are owned by clients of NWQ. The percentage of class beneficially owned is as reported in such Schedule 13G/A and is as of December 31, 2004. |

| (2) | Based solely on a Schedule 13D/A, dated March 21, 2005, Owl Creek Asset Management, L.P. (“Owl Creek”) shares voting and dispositive power over 1,387,910 shares of Class A common stock with the entities and person listed below. The following entities and person share voting and dispositive power with Owl Creek over the number of shares of Class A common stock listed below: |

| · | Owl Creek I, L.P.; 128,387 shares; |

| · | Owl Creek II, L.P.; 873,740 shares; |

| · | Owl Creek Advisors, LLC; 1,002,127 shares; and |

| · | Jeffrey A. Altman; 2,390,037 shares. |

| Due to the voting and dispositive power over the shares of Class A common stock, Owl Creek may be deemed to beneficially own such shares. The percentage of class beneficially owned is as reported in such Schedule 13D/A and is as of March 21, 2005. |

| (3) | Based solely on a Schedule 13G, dated February 14, 2005, Aegis Financial Corporation (“AFC”) has sole voting and dispositive power over 1,879,651 shares of Class A common stock. Additionally, the following individuals have shared voting and dispositive power and/or sole voting and dispositive power over the shares of Class A common stock listed below: |

| § | Paul Gambel; 1,881,651 (shared); 10,000 (sole); |

| § | Scott L. Barbee; 1,879,651 (shared); 23,213 (sole); and |

| § | William S. Berno; 1,879,651 (shared). |

| (4) | Based solely on a Schedule 13G, dated February 9, 2005, Dimensional Fund Advisors, Inc. (“DFA”) has sole voting and dispositive power over 1,682,075 shares of Class A common stock. Due to the dispositive power over the shares of Class A common stock, DFA may be deemed to beneficially own such shares, which are owned by certain investment companies and certain commingled group trusts and separate accounts for which DFA serves as investment advisor or investment manager. DFA disclaims beneficial ownership of such shares. The percentage of class beneficially owned is as reported in such Schedule 13G and is as of December 31, 2004. |

Peter S. Burgess, age 63 | Director since 2004 |

Charles T. Freeman, age 61 | Nominee for Director |

James C. Hellauer, age 66 | Director sinceFebruary 2005 |

Roderic H. Ross, age 74 | Director since 1981 |

Vincent T. Donnelly, age 52 | Director since2004 |

Joseph H. Foster, age 76 | Director since 1982 |

James F. Malone III, age 61 | Director since 1974 |

L. J. Rowell, Jr., age 72 | Director since 1992 |

Thomas J. Gallen, age 64 | Director since 2000 |

Richard Lutenski, age 54 | Director since 2004 |

Edward H. Owlett, age 78 | Director since 1964 |

Neal C. Schneider, age 60 | Director since 2003 |

| · | Reviewing with our management and independent auditors the audited annual financial statements and the unaudited quarterly financial statements; |

| · | In consultation with the independent auditors, management and the internal auditor, reviewing the integrity of our financial reporting processes as well as the adequacy of internal controls with respect to those processes; |

| · | Reviewing any material changes to our accounting principles and practices; |

| · | Selecting, evaluating and, where appropriate, replacing our independent auditors, and approving the independent auditors’ fees; |

| · | Reviewing with our independent auditors the written statement regarding their independence; and |

| · | Pre-approving all audit and permitted non-audit services, which pre-approval may be delegated to one or more Committee members. |

| · | Nominating candidates to stand for election to the Board of Directors at the Annual Meeting; |

| · | Nominating candidates to fill vacancies on the Board of Directors between meetings of shareholders; |

| · | Establishing the criteria and qualifications for directors; |

| · | Developing and recommending to the Board corporate governance guidelines; |

| · | Reviewing the Board’s committee structures and recommending committee members; |

| · | Reviewing with the Compensation Committee and Chairman of the Board the job performance of the Company’s senior executives; and |

| · | Establishing procedures for shareholder recommendations of nominees to the Board. |

| · | Have relevant business management, financial, investment and/or professional experience, industry knowledge, and strategic planning capabilities; |

| · | Have a demonstrated history of integrity and ethics in his/her personal and professional life and an established record of professional accomplishment in his/her chosen field; |

| · | Not have a conflict of interest that impedes the proper performance of the responsibilities of a director; |

| · | Be willing to serve on the Board for a period of no less than two three-year terms; |

| · | Be prepared to participate fully in board activities, including active membership on at least one board committee and attendance at, and active participation in, meetings of the board and the committees of which he/she is a member, and not have other personal or professional commitments that would, in the Committee’s judgment, interfere with or limit his or her ability to do so; and |

| · | Be willing to make, and be financially capable of making, a reasonable investment in the Company’s stock given the candidate’s financial circumstances. |

| · | The nominee’s full name and current address; |

| · | All information required to be disclosed in solicitation of proxies for election of directors, or that is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934; |

| · | The nominee’s written consent to serve as a director, if elected; |

| · | The name of the nominating shareholder, and the beneficial owner, if different; |

| · | The number of shares which are owned of record or beneficially by the nominating shareholder; and |

| · | A description of all arrangements and understandings between the nominating shareholder and any beneficial owner and any other person or persons pursuant to which the nomination is made. |

| · | Reviewing and recommending cash compensation plans; |

| · | Reviewing and approving the cash compensation of our executive officers, including our Chief Executive Officer; |

| · | Establishing performance goals for executive officer incentive-based cash compensation and certifying whether the performance goals have been met; |

| · | Approving the grant of awards under, and determining participants in, our equity incentive plans; and |

| · | Establishing performance goals for awards under our equity incentive plans. |

| · | Overseeing Investment Policy and Guidelines for the operating companies; |

| · | Reviewing the performance of the investment portfolio relative to compliance with the Company’s Investment Policy and Guidelines; |

| · | Overseeing the development of operational metrics, including performance targets, objectives or benchmarks; |

| · | Overseeing the development and assessment of the Company’s business strategy; and |

| · | Overseeing the development and review of the Company’s annual business plan. |

| The Audit Committee: | |

| Peter S. Burgess (Chair) | |

| Edward H. Owlett | |

| L. J. Rowell, Jr. | |

| Neal C. Schneider | |

Board of Directors | ||||

| Chairman’s Annual Retainer | $ | 200,000 | ||

Member Annual Retainer | $ | 32,000 | ||

Meeting Fee | $ | 2,000 | ||

Executive Committee | ||||

Chair Annual Retainer | $ | 5,000 | ||

Member Annual Retainer | $ | 2,500 | ||

Meeting Fee | $ | 1,000 | ||

Audit and Compensation Committees | ||||

Chair Annual Retainer | $ | 10,000 | ||

Member Annual Retainer | $ | 5,000 | ||

Meeting Fee | $ | 1,500 | ||

Nominating and Corporate Governance Committee | ||||

Meeting Fee | $ | 1,000 | ||

Strategy and Operations Committee | ||||

Meeting Fee | $ | 1,000 | ||

| Annual Compensation | Long-Term Compensation Awards | ||||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | Other Annual Compensation ($) | Restricted Stock Awards(1)($) | Securities Underlying Options (#) | All Other Compensation ($) | ||||

Vincent T. Donnelly President and Chief Executive Officer | 2004 | 652,499 | 301,500 | 417 | (2) | 387,810 | 405,350 | 17,215 | (3) | ||

| 2003 | 593,750 | 90,000 | 49,960 | -- | 67,000 | 44,547 | |||||

| 2002 | 429,166 | 350,000 | -- | -- | 25,000 | 26,798 | |||||

William E. Hitselberger Executive Vice President and Chief Financial Officer | 2004 | 399,999 | 106,250 | -- | 123,015 | 128,500 | 16,023 | (4) | |||

| 2003 | 339,582 | 35,000 | 575 | -- | 23,600 | 27,804 | |||||

| 2002 | 246,354 | 21,000 | 330 | -- | 20,000 | 16,042 | |||||

Robert L. Pratter Senior Vice President and General Counsel | 2004 | 367,500 | 62,560 | 476 | (2) | 72,280 | 75,750 | 35,445 | (5) | ||

| 2003 | 367,500 | 36,800 | 702 | -- | 25,000 | 36,994 | |||||

| 2002 | 363,854 | 5,000 | 4,107 | -- | 25,000 | 28,937 | |||||

Henry O. Schramm II Senior Vice President and Chief Underwriter, The PMA Insurance Group | 2004 | 279,999 | 25,200 | -- | 44,667 | 35,700 | 16,648 | (6) | |||

| 2003 | 277,082 | 93,900 | -- | -- | -- | 20,310 | |||||

| 2002 | 267,082 | 63,550 | -- | -- | 5,000 | 20,406 | |||||

John Santulli III Senior Vice President Marketing and Field Operations, The PMA Insurance Group | 2004 | 239,998 | 21,600 | -- | 38,286 | 30,600 | 28,212 | (7) | |||

| 2003 | 237,812 | 79,850 | -- | -- | -- | 16,455 | |||||

| 2002 | 228,854 | 46,050 | -- | -- | 6,000 | 15,995 | |||||

| (1) | Each of the Named Executive Officers held as of December 31, 2004, all shares of restricted stock originally granted to them. Mr. Donnelly held 55,800 shares with an aggregate value of $577,530; Mr. Hitselberger held 17,700 shares with an aggregate value of $183,195; Mr. Pratter held 10,400 shares with an aggregate value of $107,640; Mr. Schramm held 6,300 shares with an aggregate value of $65,205; and Mr. Santulli held 5,400 shares with an aggregate value of $55,890. The restrictions on shares of restricted stock held by Messrs. Donnelly, Hitselberger and Pratter, lapse 50% on March 15, 2005 and 50% on March 15, 2006. The restrictions on shares of restricted stock held by Messrs. Schramm and Santulli, lapsed 100% on March 15, 2005. To the extent we declare any dividends on our Class A common stock, dividends will be paid in respect of the shares of restricted stock. |

| (2) | Amounts represent tax payment reimbursements for certain benefits. |

| (3) | Amount represents Company matching contributions to its 401(k) plan of $10,250, $5,136 of life insurance premiums paid by the Company and $1,829 in earnings on investments not paid during 2004 under the Company’s Deferred Compensation Plan other than those offered under the Company’s 401(k) plan. |

| (4) | Amount represents Company matching contributions to its 401(k) plan of $10,250, $4,711 of life insurance premiums paid by the Company and $1,062 in earnings on investments not paid during 2004 under the Company’s Deferred Compensation Plan other than those offered under the Company’s 401(k) plan. |

| (5) | Amount represents Company contributions to its non-qualified 401(k) excess plan of $8,125, Company matching contributions to its 401(k) plan of $10,250, and $11,004 of life insurance premiums paid by the Company and $6,066 in earnings on investments not paid during 2004 under the Company’s Deferred Compensation Plan other than those offered under the Company’s 401(k) plan. |

| (6) | Amount represents Company matching contributions to its 401(k) plan of $10,250, $5,966 of life insurance premiums paid by the Company and $432 in earnings on investments not paid during 2004 under the Company’s Deferred Compensation Plan other than those offered under the Company’s 401(k) plan. |

| (7) | Amount represents Company contributions to its non-qualified 401(k) excess plan of $1,750, Company matching contributions to its 401(k) plan of $10,250, $4,746 of life insurance premiums paid by the Company and $11,466 in earnings on investments not paid during 2004 under the Company’s Deferred Compensation Plan other than those offered under the Company’s 401(k) plan. |

| Individual Grants | ||||||||||

Name | Number of Securities Underlying Options/SARs Granted (#)(1) | % of Total Options/SARs Granted to Employees in Fiscal Year | Exercise Price ($/Share) | Expiration Date | Grant Date Present Value ($) | |||||

| Vincent T. Donnelly | 405,350(2) | 30.0% | 7.02 | 5/06/14 | 1,558,571(4) | |||||

| William E. Hitselberger | 128,500(2) | 9.5% | 7.02 | 5/06/14 | 494,083(4) | |||||

| Robert L. Pratter | 75,750(2) | 5.6% | 7.02 | 5/06/14 | 291,259(4) | |||||

| Henry O. Schramm II | 35,700(3) | 2.6% | 5.78 | 3/10/14 | 109,885(5) | |||||

| John Santulli III | 30,600(3) | 2.3% | 5.78 | 3/10/14 | 94,187(5) | |||||

| (1) | These options include a reload feature, which means that a new option is automatically granted for each share of stock that an employee uses to pay the exercise price of an option. Reload options become exercisable six months after their grant date and terminate on the expiration of the option to which they relate. The exercise price of a reload option is equal to the fair market value of our Class A common stock on the date the reload option is granted. Because reload options replace shares used to exercise an option, they maintain, but do not increase, an employee’s total ownership of our Class A common stock. |

| (2) | These options became or will become exercisable 50% on 12/01/04 and 50% on 3/15/06. |

| (3) | The options became fully exercisable on 3/15/05. |

| (4) | This is based on a binomial option-pricing model adapted for use in valuing executive stock options. Calculations of grant date present values for all options assume an option life of 5 years, a dividend yield of 0%, an expected price volatility of Class A common stock of 60.3% and a risk-free interest rate of 2.7%. The approach used in developing the foregoing assumptions is consistent with the requirements of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation.” The actual value, if any, an executive may realize will depend on the excess of the stock price on the date the option is exercised over the exercise price, so there is no assurance the value realized by an executive will be at or near the value estimated by the binomial option-pricing model. We believe that no model accurately predicts the future price of the Class A common stock or places an accurate present value on stock options. |

| (5) | This is based on a binomial option-pricing model adapted for use in valuing executive stock options. Calculations of grant date present values for all options assume an option life of 5 years, a dividend yield of 0%, an expected price volatility of Class A common stock of 60.8% and a risk-free interest rate of 3.7%. The approach used in developing the foregoing assumptions is consistent with the requirements of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation.” The actual value, if any, an executive may realize will depend on the excess of the stock price on the date the option is exercised over the exercise price, so there is no assurance the value realized by an executive will be at or near the value estimated by the binomial option-pricing model. We believe that no model accurately predicts the future price of the Class A common stock or places an accurate present value on stock options. |

Shares Acquired | Number of Securities Underlying Unexercised Options | Value of Unexercised In-the-Money Options at | ||||||||||

on | Value | at Fiscal Year-End | Fiscal Year-End | |||||||||

Name | Exercise (#) | Realized ($) | Exercisable (#) | Unexercisable (#) | Exercisable ($) | Unexercisable ($) | ||||||

| Vincent T. Donnelly | -- | -- | 364,425 | 294,925 | 674,908 | 755,978 | ||||||

| William E. Hitselberger | -- | -- | 96,500 | 104,600 | 213,953 | 242,509 | ||||||

| Robert L. Pratter | -- | -- | 89,375 | 88,875 | 126,124 | 156,374 | ||||||

| Henry O. Schramm II | -- | -- | 51,980 | 39,720 | -- | 163,149 | ||||||

| John Santulli III | -- | -- | 53,650 | 33,950 | -- | 139,842 | ||||||

| · | Pay base salaries to executive officers that are reasonably competitive with base salaries paid by United States insurance companies (the "Peer Companies") for comparable executive positions. |

| · | Reward executive officers through the potential award of incentive cash bonuses based on pre-established, objective performance criteria related to the financial results of the Company and the business segment under each executive officer's direct management and also taking into account the executive officer's individual leadership, strategic management and contribution to the Company's success. |

| · | Provide additional long-term incentives to executive officers and align their interests with the shareholders' interests through the granting of stock-based compensation. |

| · | Compensate executive officers on an equitable basis taking into consideration each individual's degree of responsibility and contribution to the achievement of the Company's overall objectives. |

| Compensation Committee | |

| Thomas J. Gallen | |

| Edward H. Owlett | |

| L. J. Rowell, Jr. (Chair) |

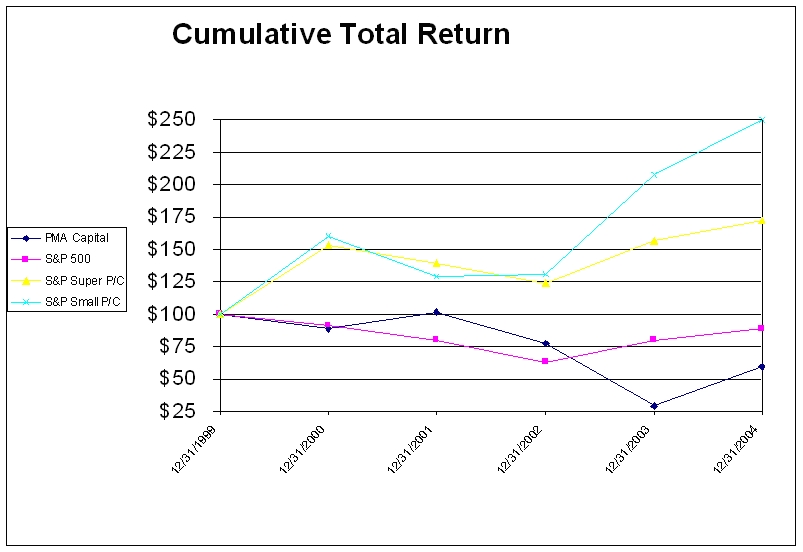

12/31/1999 | 12/31/2000 | 12/31/2001 | 12/31/2002 | 12/31/2003 | 12/31/2004 | |

PMA Capital | $100 | $ 88.75 | $101.46 | $ 77.54 | $ 29.41 | $ 59.45 |

S&P 500 | 100 | 90.97 | 80.19 | 62.57 | 80.32 | 88.94 |

S&P Super P/C | 100 | 153.10 | 139.24 | 124.41 | 156.48 | 172.46 |

S&P Small P/C | 100 | 160.06 | 129.10 | 131.20 | 207.74 | 249.85 |

2003 | 2004 | |

Audit Fees | $2,077,100 | $2,923,173 |

Audit-Related Fees | $195,600 | $99,320 |

Tax Fees | $43,378 | $105,140 |

All Other Fees | $150,020 | $289,896 |

Total | $2,466,098 | $3,417,529 |

| By Order of the Board of Directors, | ||

| ||

| March 29, 2005 | Neal C. Schneider | |

| Chairman of the Board |

(Please sign, date and return this proxy in the enclosed postage prepaid envelope.) [X] Votes must be indicated (x) in Black or Blue ink. The Board of Directors recommends a vote FOR Items 1 and 2. Item 1. Election of Directors | FOR AGAINST ABSTAIN Item 2. Ratification of Deloitte & Touche LLP [ ] [ ] [ ] as independent auditors for 2005. |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee mark the “Exceptions” box and strike a line through the nominee’s name.) FOR [] WITHHOLD [ ] [ ] ALL FOR ALL EXCEPTIONS Nominees: Peter S. Burgess James C. Hellauer Roderic H. Ross Charles T. Freeman | In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting and any adjournments thereof. To change your address, please mark this box. [ ] To include any comments, please mark this box. [ ] |

| NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. | Date Share Owner sign here Co-owner sign here |